f6f6c3d35a1173e6ddda883344d39bae.ppt

- Количество слайдов: 17

11 September 2009 European. Issuers Securities Reference Data Utility An outline of the concept Francis Gross DG Statistics, External Statistics Division

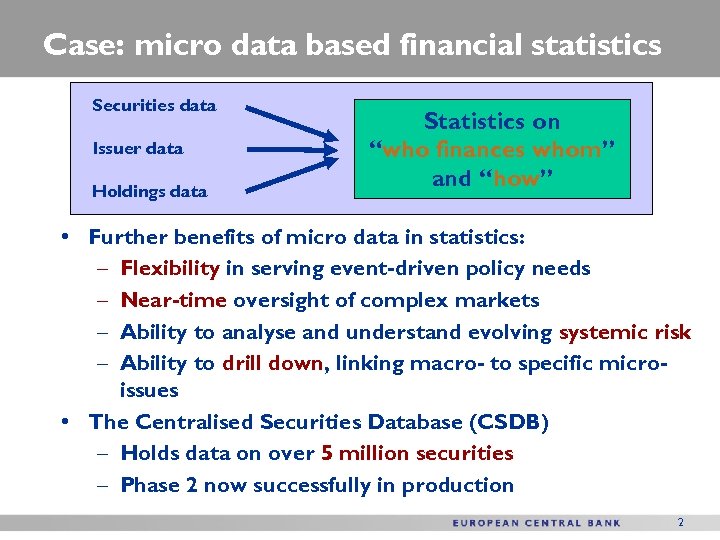

Case: micro data based financial statistics Securities data Issuer data Holdings data Statistics on “who finances whom” and “how” • Further benefits of micro data in statistics: – Flexibility in serving event-driven policy needs – Near-time oversight of complex markets – Ability to analyse and understand evolving systemic risk – Ability to drill down, linking macro- to specific microissues • The Centralised Securities Database (CSDB) – Holds data on over 5 million securities – Phase 2 now successfully in production 2

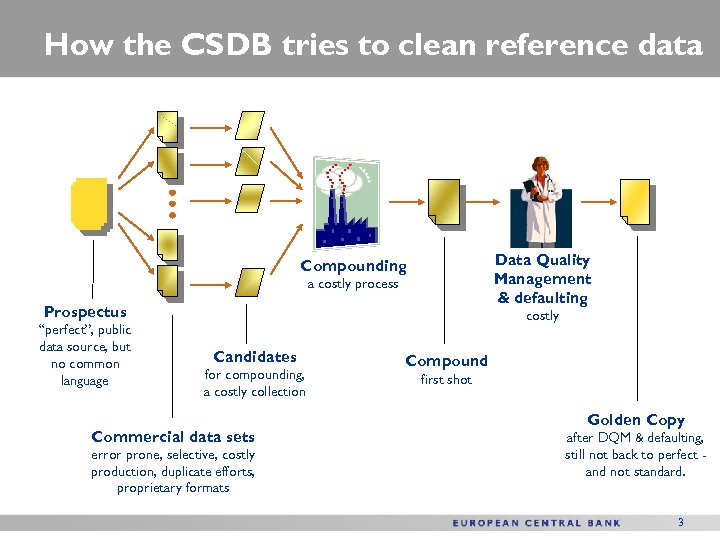

How the CSDB tries to clean reference data Data Quality Management & defaulting Compounding a costly process Prospectus “perfect”, public data source, but no common language costly Candidates for compounding, a costly collection Commercial data sets error prone, selective, costly production, duplicate efforts, proprietary formats Compound first shot Golden Copy after DQM & defaulting, still not back to perfect and not standard. 3

The broader context 4

The broader context: • A tale of progress in politics, education, technology; but • Complexity, volume & speed hit human limitations; thus • Automation must be trusted ever more. • Data from ever more independent sources is a limiting factor, • As each source speaks its own “data dialect”; • Differences can be subtle, but sufficient to defeat automation. • More “data dialects” might end up defeating all known fixes. Are we re-building the Tower of Babel, but this time with data? 5

Weak data harbour key risk in two ways… • Weak data limits essential functions such as automation, market transparency, regulation and systemic risk diagnosis; • Weak data certainly worsened the current crisis. • Data is taken for granted, thus not a board issue; therefore • Data-induced risks grow largely unnoticed by the board. • With evolving markets and IT, weak data act as a slow poison. • Moreover, a single organisation can’t solve it, hence inaction, • even when data weakness is recognised by the board as a risk. Double risk in weak data: (i) a danger growing unnoticed, (ii) met with inaction. 6

… that standardisation can solve. • Data will be good for all users or for none. • Good data ? standards, discipline and rigour; not more IT ! • Diversity in “data dialects” is toxic for systems and processes • There must be less diversity in “data dialects” • Especially in reference data and identifiers. • That the backbone of data is a shared strategic resource. • Top down action is needed, therefore: • We must help leaders understand how critical good data is. Data standards must be driven from the top. Technicians must convey the case to the top! 7

So, what can be done? 8

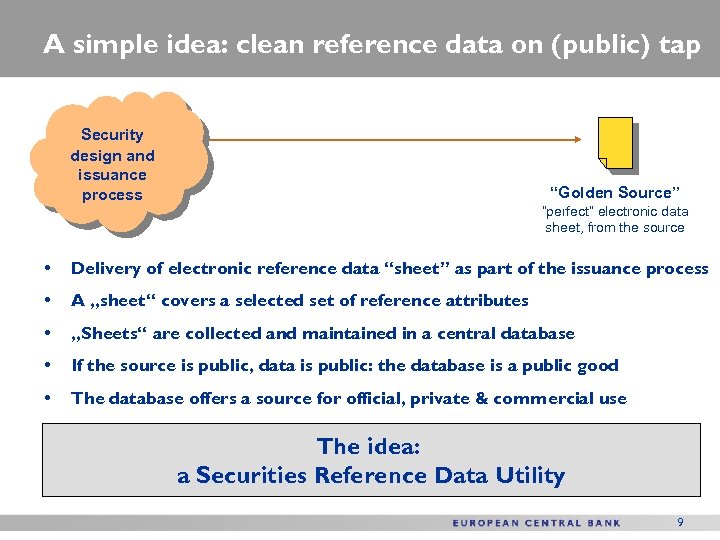

A simple idea: clean reference data on (public) tap Security design and issuance process “Golden Source” “perfect” electronic data sheet, from the source • Delivery of electronic reference data “sheet” as part of the issuance process • A „sheet“ covers a selected set of reference attributes • „Sheets“ are collected and maintained in a central database • If the source is public, data is public: the database is a public good • The database offers a source for official, private & commercial use The idea: a Securities Reference Data Utility 9

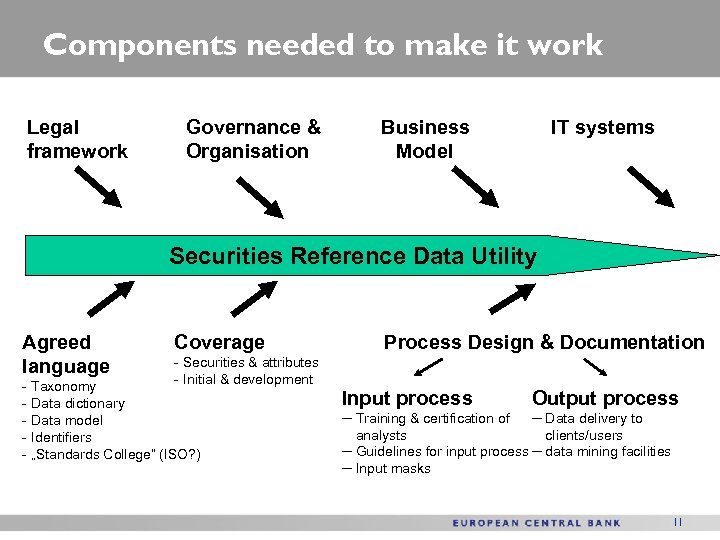

Components needed to make it work Legal framework Governance & Organisation Business Model IT systems Securities Reference Data Utility Agreed language Coverage - Securities & attributes - Initial & development - Taxonomy - Data dictionary - Data model - Identifiers - „Standards College“ (ISO? ) Process Design & Documentation Input process Output process ─ Training & certification of ─ Data delivery to analysts clients/users ─ Guidelines for input process ─ data mining facilities ─ Input masks 11

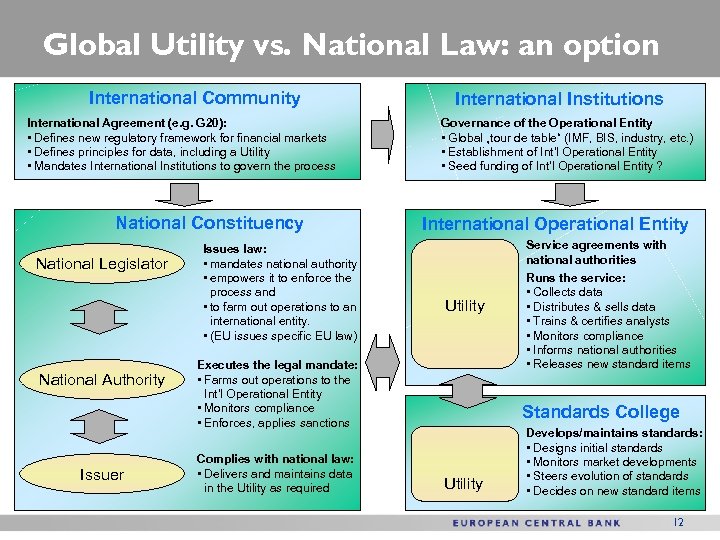

Global Utility vs. National Law: an option International Community International Agreement (e. g. G 20): • Defines new regulatory framework for financial markets • Defines principles for data, including a Utility • Mandates International Institutions to govern the process National Constituency National Legislator National Authority Issuer Issues law: • mandates national authority • empowers it to enforce the process and • to farm out operations to an international entity. • (EU issues specific EU law) International Institutions Governance of the Operational Entity • Global „tour de table“ (IMF, BIS, industry, etc. ) • Establishment of Int’l Operational Entity • Seed funding of Int’l Operational Entity ? International Operational Entity Service agreements with national authorities Utility Executes the legal mandate: • Farms out operations to the Int’l Operational Entity • Monitors compliance • Enforces, applies sanctions Complies with national law: • Delivers and maintains data in the Utility as required Runs the service: • Collects data • Distributes & sells data • Trains & certifies analysts • Monitors compliance • Informs national authorities • Releases new standard items Standards College Utility Develops/maintains standards: • Designs initial standards • Monitors market developments • Steers evolution of standards • Decides on new standard items 12

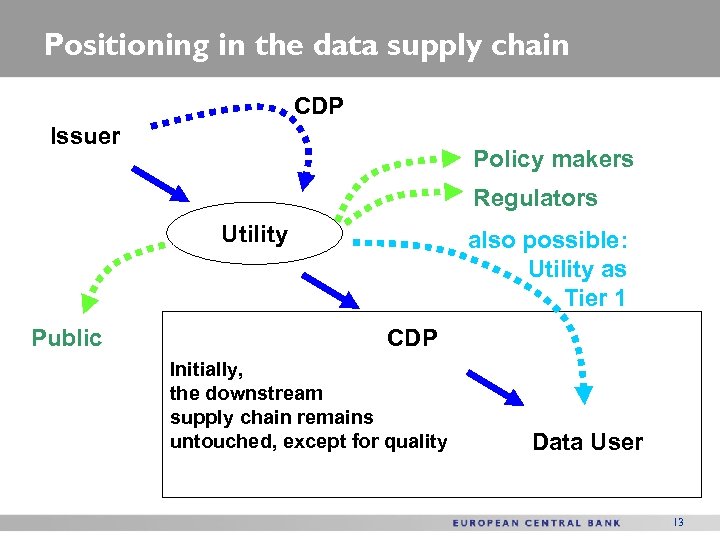

Positioning in the data supply chain CDP Issuer Policy makers Regulators Utility Public also possible: Utility as Tier 1 CDP Initially, the downstream supply chain remains untouched, except for quality Data User 13

Alternative: Multilateral Self-Organisation • Indispensable for agreeing on high-level principles and initiatives • Hard to insulate from the competitive game • Less well suited for converging rapidly on technical solutions 14

Evolution of the Utility Faced with the thick woods of the securities world… 15

Evolution of the Utility … brave explorers started pushing narrow paths through the wild: ISIN, MDDL, etc. 16

Evolution of the Utility The Utility widens these paths. The share of good data grows with time. New issues added, Main old ones too; Others shrink with redemption. 17

Evolution of the Utility Coverage expands to More types of Securities, More Markets, More Attributes. 18

f6f6c3d35a1173e6ddda883344d39bae.ppt