a5071422a1bdf6222e76a32ed58c61fc.ppt

- Количество слайдов: 26

11 A Possible Regional - Global Cooperation GME and Ital. Energy role Giorgio Szegö Bucharest th May, 2005 27 -1 -

22 Contents § GME and the Italian Power Exchange (IPEX) § Italian Power Exchange: electricity markets § Next stage: BIPEX (Block Italian Power Exchange) § Italian Power Exchange: Enviromental Markets § Green Certificates Market § Energy Efficiency Certificates § Carbon Emissions Market § A working hypothesis…. § Cooperation and GME role § § Ital. Energy’s goal Ital. Energy role Joint Venture -2 -

33 GME and the Italian Power Exchange (IPEX) GME is responsible for organisation and management of the Italian Power Exchange (IPEX), i. e. of the market for the trading of electricity. IPEX is a fundamental instrument for the creation of a competitive electricity market in Italy. It was created with the purpose of favouring the formation of efficient clearing prices, enabling producers and consumers to buy and sell electricity on the basis of cost-effectiveness -3 criteria.

44 Italian Power Exchange (IPEX) Italian Power Exchange is an electronic marketplace (all transactions take place through the Internet) where demand supply meet, defining the quantities and prices of the electricity to be traded. IPEX is also a real physical market where the schedules of electricity injections (generation) and withdrawals (load) into and from the grid are defined. -4 -

55 Italian Power Exchange: electricity markets The Power Exchange is organised into 3 markets: Day-Ahead Market (MGP) MGP is the venue for the trading of electricity supply offers and demand bids for each hour of the next day Adjustment Market (MA) MA is the venue where electricity supply offers (sale offers) and demand bids (purchase offers) are submitted for revising the injection and withdrawal schedules resulting from the Day. Ahead Market and where such Offers/Bids are traded for each hour of the next day Ancillary Services Market (MSD) MSD is the venue for the trading of supply offers and demand bids in respect of ancillary services. GRTN (Italian Independent Transmission System Operator) uses this market to acquire resources for relieving intrazonal congestion, procuring Reserve Capacity and balancing injections and withdrawals in real time. -5 -

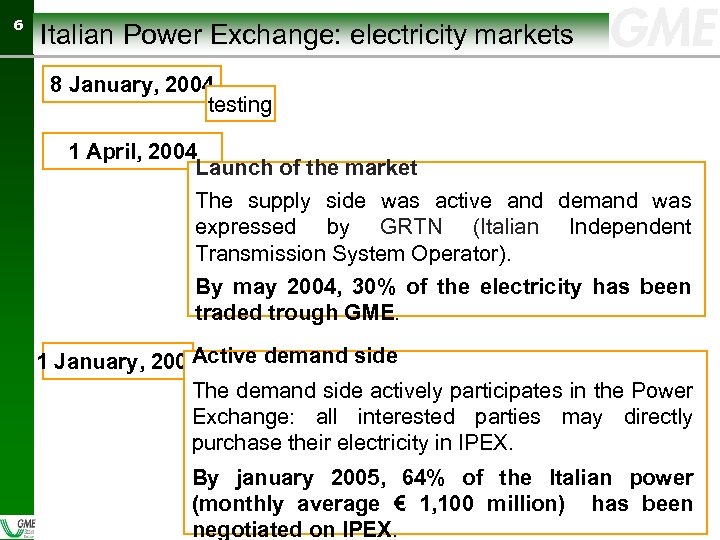

66 Italian Power Exchange: electricity markets 8 January, 2004 testing 1 April, 2004 Launch of the market The supply side was active and demand was expressed by GRTN (Italian Independent Transmission System Operator). By may 2004, 30% of the electricity has been traded trough GME. Active demand side 1 January, 2005 The demand side actively participates in the Power Exchange: all interested parties may directly purchase their electricity in IPEX. By january 2005, 64% of the Italian power (monthly average € 1, 100 million) has been -6 negotiated on IPEX.

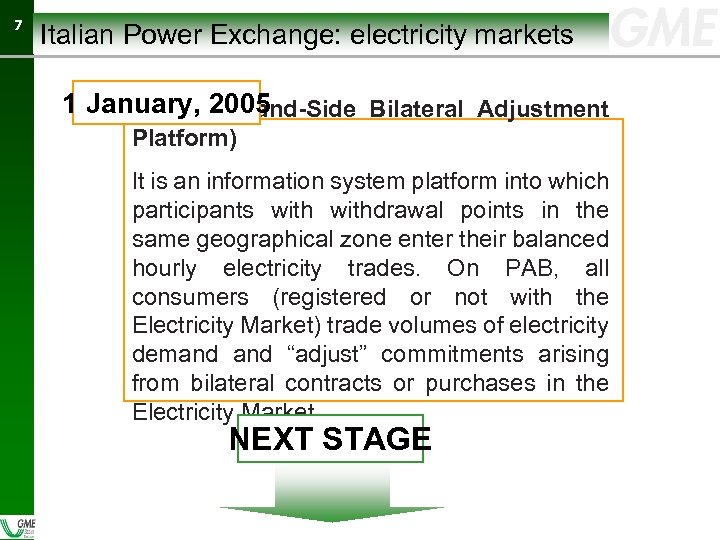

77 Italian Power Exchange: electricity markets 1 January, 2005 PAB (Demand-Side Bilateral Adjustment Platform) It is an information system platform into which participants withdrawal points in the same geographical zone enter their balanced hourly electricity trades. On PAB, all consumers (registered or not with the Electricity Market) trade volumes of electricity demand “adjust” commitments arising from bilateral contracts or purchases in the Electricity Market. NEXT STAGE -7 -

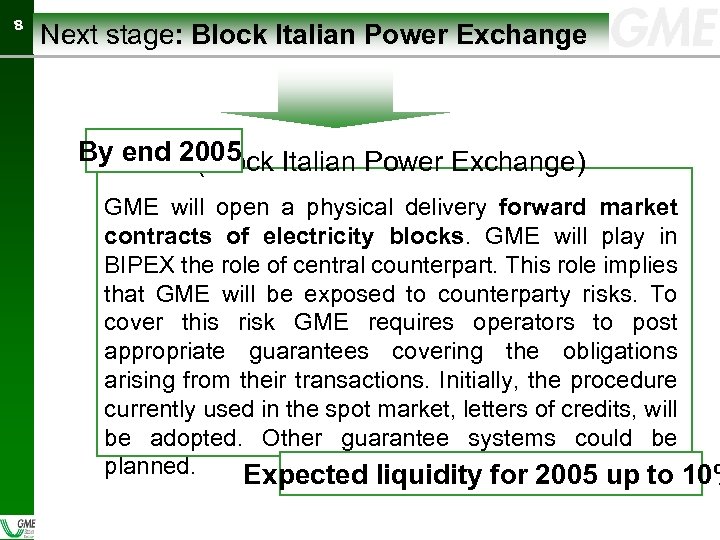

88 Next stage: Block Italian Power Exchange By end 2005 BIPEX (Block Italian Power Exchange) GME will open a physical delivery forward market contracts of electricity blocks. GME will play in BIPEX the role of central counterpart. This role implies that GME will be exposed to counterparty risks. To cover this risk GME requires operators to post appropriate guarantees covering the obligations arising from their transactions. Initially, the procedure currently used in the spot market, letters of credits, will be adopted. Other guarantee systems could be planned. Expected liquidity for 2005 up to 10% -8 -

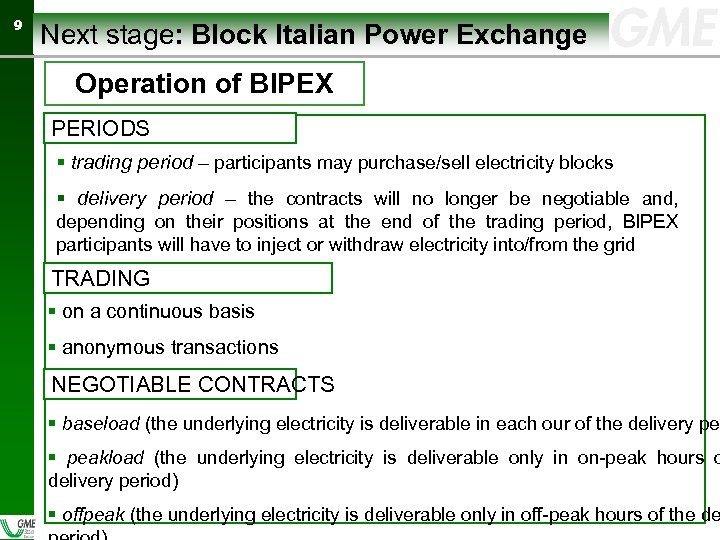

99 Next stage: Block Italian Power Exchange Operation of BIPEX PERIODS § trading period – participants may purchase/sell electricity blocks § delivery period – the contracts will no longer be negotiable and, depending on their positions at the end of the trading period, BIPEX participants will have to inject or withdraw electricity into/from the grid TRADING § on a continuous basis § anonymous transactions NEGOTIABLE CONTRACTS § baseload (the underlying electricity is deliverable in each our of the delivery per § peakload (the underlying electricity is deliverable only in on-peak hours o delivery period) § offpeak (the underlying electricity is deliverable only in off-peak hours of the de -9 -

10 10 Next stage: Block Italian Power Exchange Advantage s A system for trading electricity blocks has the following advantages: § access to the market by a larger number of producers, final customers and traders § during the trading period market participants trade with reference to virtual units, selling and buying electricity blocks without taking account the specific physical units available § higher flexibility in power plant planning § offsetting of the various positions taken on the market, with the option for each participant to open, close, increase or reduce its own exposure depending on market results - 10 -

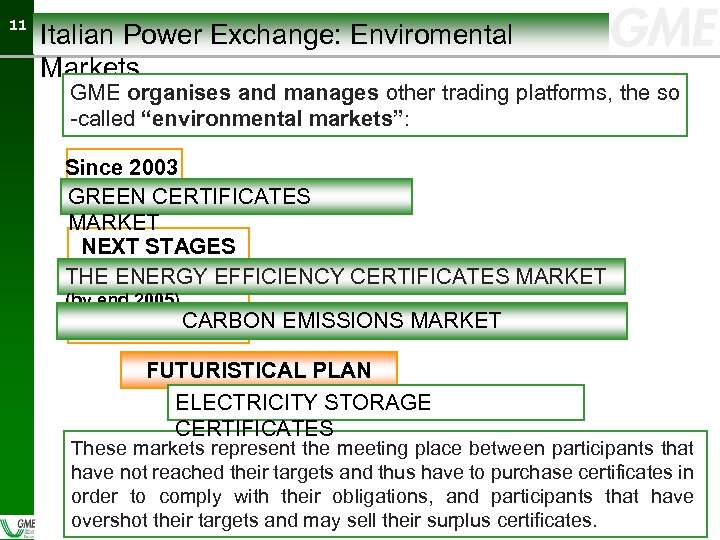

11 11 Italian Power Exchange: Enviromental Markets GME organises and manages other trading platforms, the so -called “environmental markets”: Since 2003 GREEN CERTIFICATES MARKET NEXT STAGES THE ENERGY EFFICIENCY CERTIFICATES MARKET (by end 2005) CARBON EMISSIONS MARKET FUTURISTICAL PLAN ELECTRICITY STORAGE CERTIFICATES These markets represent the meeting place between participants that have not reached their targets and thus have to purchase certificates in order to comply with their obligations, and participants that have overshot their targets and may sell their surplus certificates. - 11 -

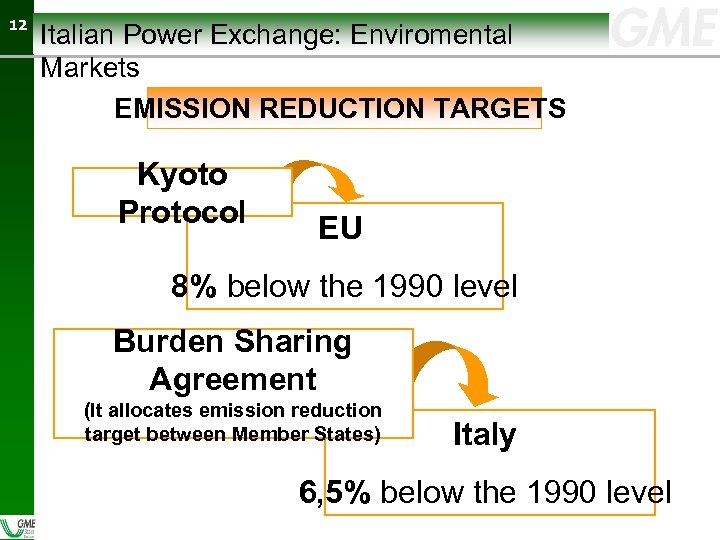

12 12 Italian Power Exchange: Enviromental Markets EMISSION REDUCTION TARGETS Kyoto Protocol EU 8% below the 1990 level Burden Sharing Agreement (It allocates emission reduction target between Member States) Italy 6, 5% below the 1990 level - 12 -

13 13 Italian Power Exchange: Enviromental Markets European Union Greenhouse Gas Emission Trading Scheme (Directive 2003/87/EC) It’s a scheme for trading emission allowances of carbon dioxide (CO 2) and its goal is to help the EU to meet its Kyoto target - 13 -

14 14 Enviromental markets: Green Certificates Market 2002 producers and importers of electricity from non. From renewable sources must inject into the grid a given proportion of electricity from renewables (each year 2% of the electricity generated or imported in the previous year exceeding 100 GWh, from 2004 through 2006 this minimum proportion will be increased by 0. 35% per year). GRTN (Italian Independent Transmission System Operator) issues Green Certificates (CV) to electricity producers. The CV certify electricity generation by power plants that are fed by renewable sources. The Green Certificates may be used to comply with the yearly obligation to generate electricity from renewables. - 14 -

15 15 Enviromental markets: Green Certificates Market GME organises and manages the Green Certificates Market Operation of Green Certificates Market The sessions of this market are held at least once a month with a predefined schedule. The trading is continuous. The participants are: electricity producers, importers, GRTN, wholesale customers and associations registered with the Green Certificates Market (over 100 participants in total). The Green Certificates Market ensures: § LIQUIDITY § TRANSPARENCY § RELIABILITY - 15 -

16 16 Enviromental markets: Energy Efficiency Certificates The Decrees of the Ministry of Productive Activities of 20 July 2004, defined national quantitative targets of energy efficiency enhancement. Electricity distributors and natural gas distributors (serving at least 100, 000 final customers as of 31 December 2001) must reach the set through by increasing energy efficiency in end uses. The TEE certify the reduction of primary energy consumption that has been achieved through energy-saving measures. - 16 -

17 17 Enviromental markets: Energy Efficiency Certificates GME organises a market for the trading of Energy Efficiency Certificates GME issues Energy Efficiency Certificates (TEE) to electricity and gas distributors and to companies operating in the energy services sector (ESCOs). Electricity distributors and natural gas distributors may meet their energy efficiency targets also by purchasing the related - 17 -

18 18 Enviromental markets: Carbon Emissions Market Operation of One ETS allowance represents the right to emit one tonne of CO 2. Member States have drawn up national allocation plans for 2005– 07 which give each installation in the scheme permission to emit an amount of CO 2 that corresponds to the number of allowances received. Companies that keep their emissions below the level of their allowances are able to sell their excess allowances at a price determined by supply and demand at that time. Those facing difficulty in remaining within their emissions limit can buy the extra allowances they need at the market rate. The price of allowances is determined by supply and demand. - 18 -

19 19 Enviromental markets: Carbon Emissions Market GME is organizing a market for trading emission allowances of carbon dioxide This market will help companies to partecipate to EU ETS. The Carbon Emission Market will ensure: § LIQUIDITY § TRANSPARENCY § RELIABILITY - 19 -

20 20 A working hypothesis…. Electricity is not usually stored ELECTRIC POWER STORAGE: IS IT POSSIBLE? NOW… § rising spread in electric power prices between different days of the week and hours § growing interest in discontinuous renewable energy sources (sun, wind, etc. ) THEN…. § “Nuclear renaissance” on the way DEVELOPMENT OF ELECTRICITY STORAGE TECNOLOGIES AND OF A STORAGE CERTIFICATES MARKET. - 20 -

21 21 Cooperation and GME role IPEX GME can implement new electricity markets through its “server farm” so operating and overseeing other trading systems on behalf of foreign countries Minimise the investments needed to launch an electricity market in countries that are now starting with liberalisation - 21 -

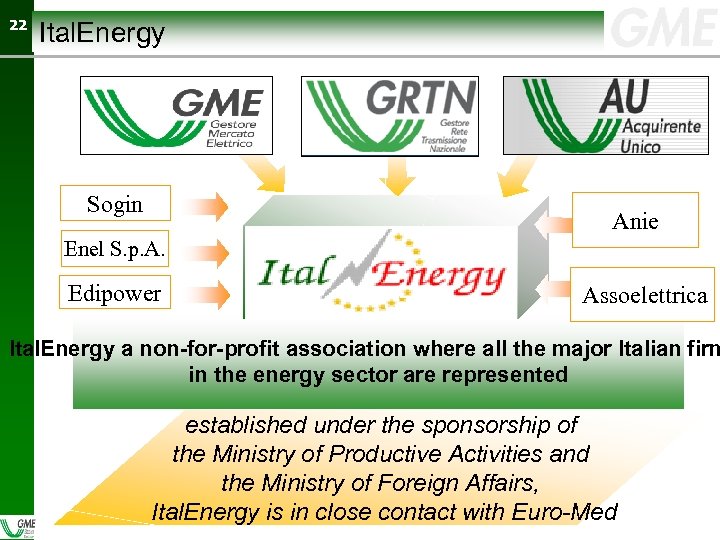

22 22 Ital. Energy Sogin Anie Enel S. p. A. Edipower Assoelettrica Ital. Energy a non-for-profit association where all the major Italian firm in the energy sector are represented established under the sponsorship of the Ministry of Productive Activities and the Ministry of Foreign Affairs, Ital. Energy is in close contact with Euro-Med - 22 -

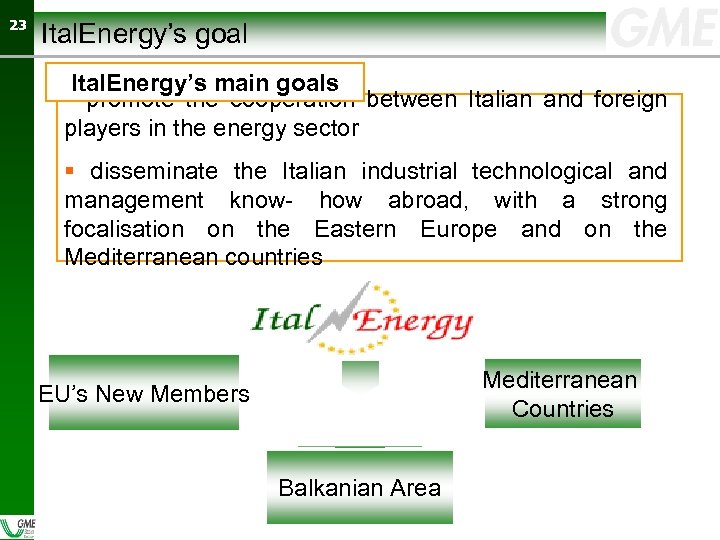

23 23 Ital. Energy’s goal Ital. Energy’s main goals § promote the cooperation between Italian and foreign players in the energy sector § disseminate the Italian industrial technological and management know- how abroad, with a strong focalisation on the Eastern Europe and on the Mediterranean countries Mediterranean Countries EU’s New Members Balkanian Area - 23 -

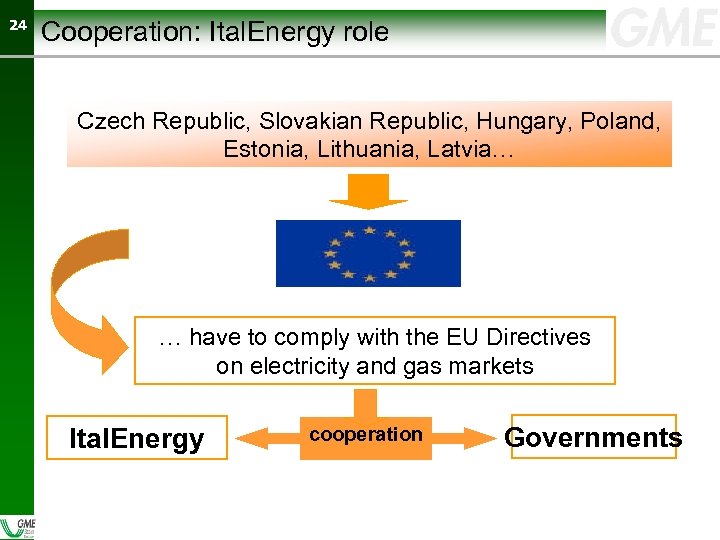

24 24 Cooperation: Ital. Energy role Czech Republic, Slovakian Republic, Hungary, Poland, Estonia, Lithuania, Latvia… … have to comply with the EU Directives on electricity and gas markets Ital. Energy cooperation - 24 - Governments

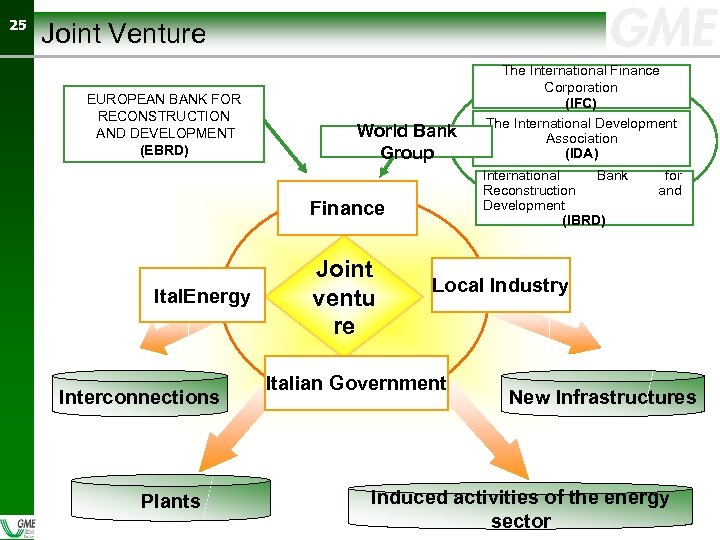

25 25 Joint Venture EUROPEAN BANK FOR RECONSTRUCTION AND DEVELOPMENT (EBRD) World Bank Group International Bank Reconstruction Development (IBRD) Finance Ital. Energy Interconnections Plants Joint ventu re The International Finance Corporation (IFC) The International Development Association (IDA) for and Local Industry Italian Government New Infrastructures Induced activities of the energy sector - 25 -

26 26 www. mercatoelettrico. org Gestore del Mercato Elettrico Sp. A Viale Maresciallo Pilsudski, 92 - 00197 Roma- Italia tel. + 39 (0)6 8012. 1 fax +39 (0)6 8012. 4519 info@mercatoelettrico. org - 26 -

a5071422a1bdf6222e76a32ed58c61fc.ppt