e2f1cef75b500480600bb7a8be0bee2f.ppt

- Количество слайдов: 24

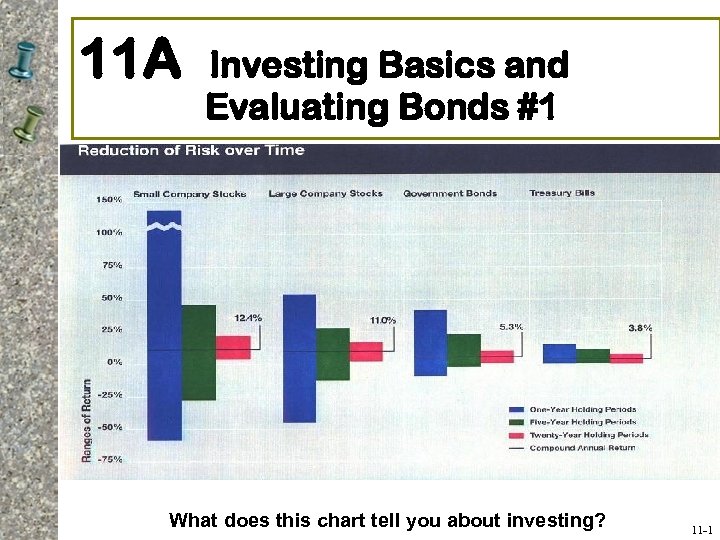

11 A Investing Basics and Evaluating Bonds #1 What does this chart tell you about investing? 11 -1

Saving and Investing: What’s the Same and What’s Different? Saving Both Investing 2

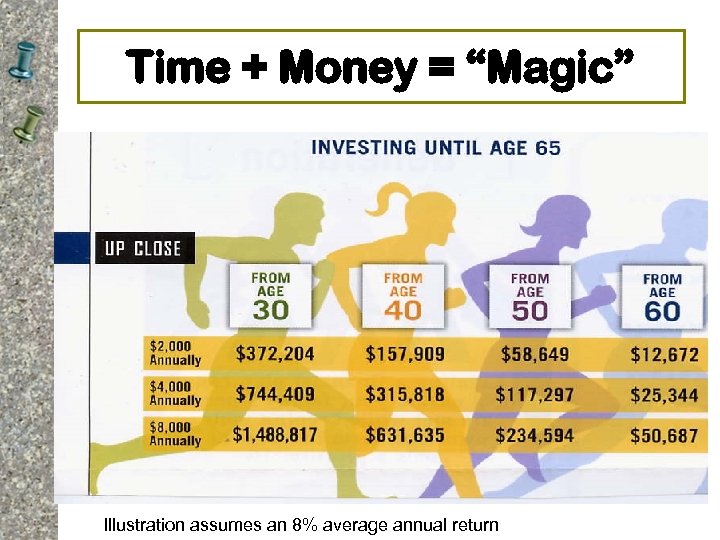

Time + Money = “Magic” Illustration assumes an 8% average annual return

Invest for Long-Term Goals http: //njaes. rutgers. edu/money/pdfs/goalsettingworksheet. pdf Source: Garman/Forgue, PERSONAL FINANCE, Fifth Edition

Why People Invest • To achieve financial goals, such as the purchase of a new car, a down payment on a home, or paying for a child’s education. • To increase current income. • To gain wealth and a feeling of financial security. • To have funds available during retirement years.

Objective 1 Explain Why You Should Establish an Investment Program Establishing Investment Goals • Financial goals should be: – Specific – Measurable – Tailored to your financial needs – Aimed at what you want to accomplish • Financial goals should be the driving force behind your investment plan 11 -6

Investment Pre-requisites • Adequate emergency fund • Adequate insurance • No or low consumer debt balance • Written financial SMART goals • An “investor’s mindset” 7

Getting the Money Needed to Start an Investing Program • Pay yourself first • Take advantage of employer- sponsored retirement programs • Participate in elective savings programs • Make a special savings effort one or two months each year (e. g. , tax refund) • Take advantage of gifts, inheritances, and windfalls 11 -8

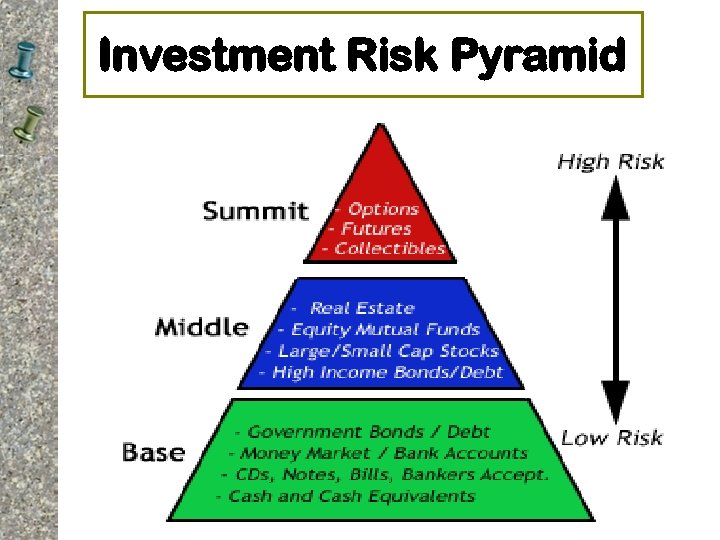

Objective 2 Describe How Safety, Risk, Income, Growth, and Liquidity Affect Your Investment Decisions Factors Affecting the Choice of Investments Safety and Risk – Risk = uncertainty about the outcome – Investment Safety = minimal risk of loss – Risk-Return Trade-Off • The potential return on any investment should be directly related to the risk the investor assumes – Speculative investments are high risk, made by those seeking a large profit in a short time 11 -9

Investment Risk Pyramid

Types of Investment Risk • Inflation Risk during periods of high inflation, your investment return may not keep pace with inflation; lose purchasing power • Interest Rate Risk the value of bonds or preferred stock may increase or decrease with changes in interest rates • Business Failure Risk affects stocks and corporate bonds (when business is not profitable) • Market Risk the risk of being in the market versus in a risk-free asset (stocks follow market cycle) 11 -11

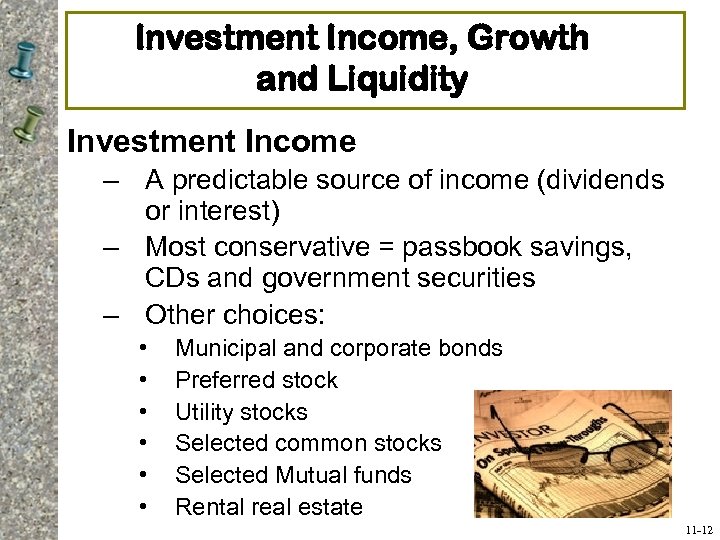

Investment Income, Growth and Liquidity Investment Income – A predictable source of income (dividends or interest) – Most conservative = passbook savings, CDs and government securities – Other choices: • • • Municipal and corporate bonds Preferred stock Utility stocks Selected common stocks Selected Mutual funds Rental real estate 11 -12

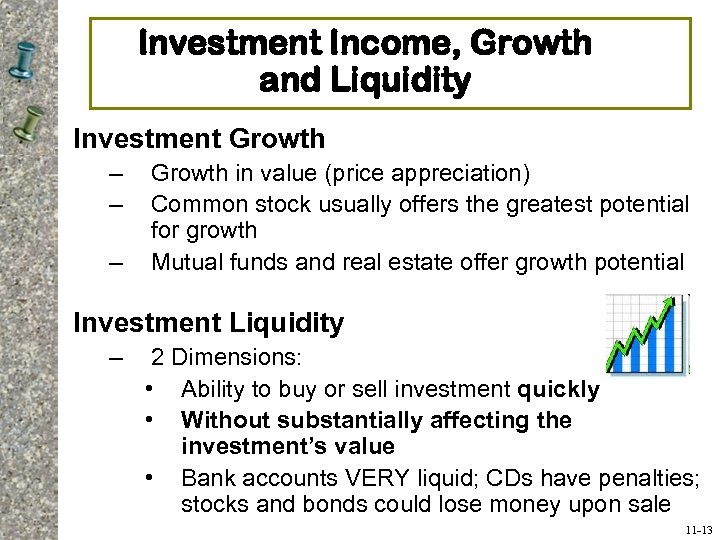

Investment Income, Growth and Liquidity Investment Growth – – – Growth in value (price appreciation) Common stock usually offers the greatest potential for growth Mutual funds and real estate offer growth potential Investment Liquidity – 2 Dimensions: • Ability to buy or sell investment quickly • Without substantially affecting the investment’s value • Bank accounts VERY liquid; CDs have penalties; stocks and bonds could lose money upon sale 11 -13

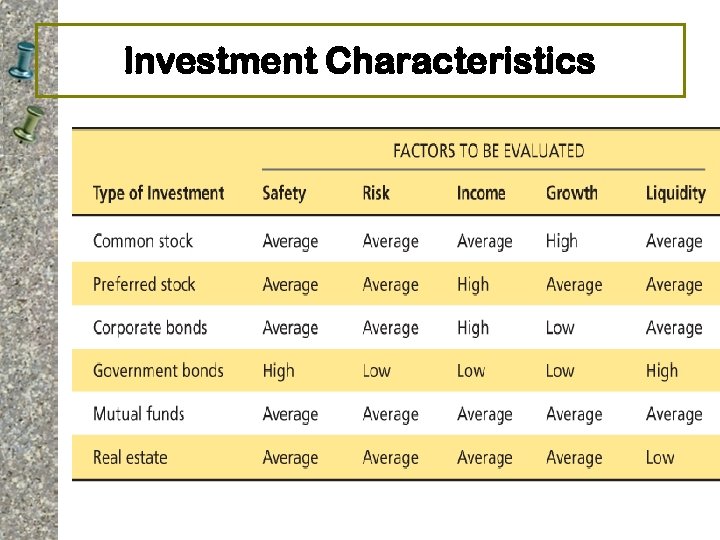

Investment Characteristics

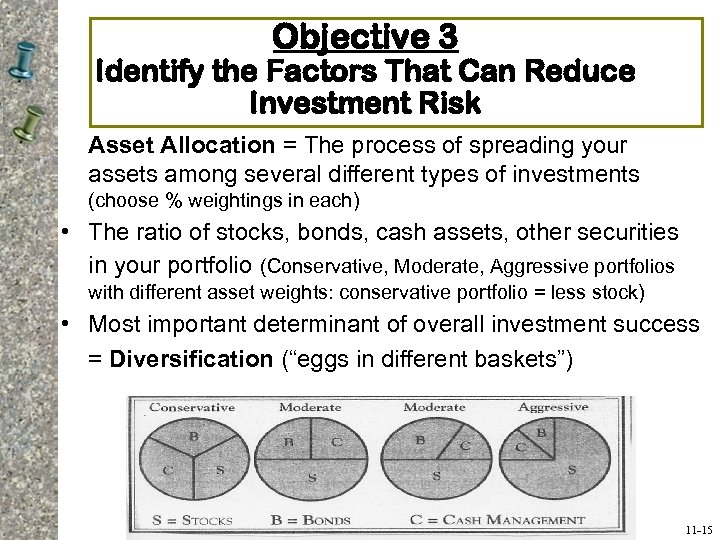

Objective 3 Identify the Factors That Can Reduce Investment Risk Asset Allocation = The process of spreading your assets among several different types of investments (choose % weightings in each) • The ratio of stocks, bonds, cash assets, other securities in your portfolio (Conservative, Moderate, Aggressive portfolios with different asset weights: conservative portfolio = less stock) • Most important determinant of overall investment success = Diversification (“eggs in different baskets”) 11 -15

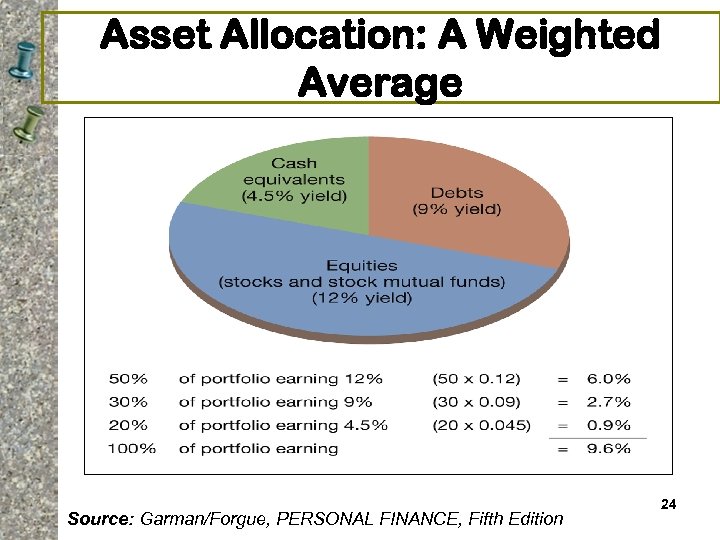

Asset Allocation: A Weighted Average Source: Garman/Forgue, PERSONAL FINANCE, Fifth Edition 24

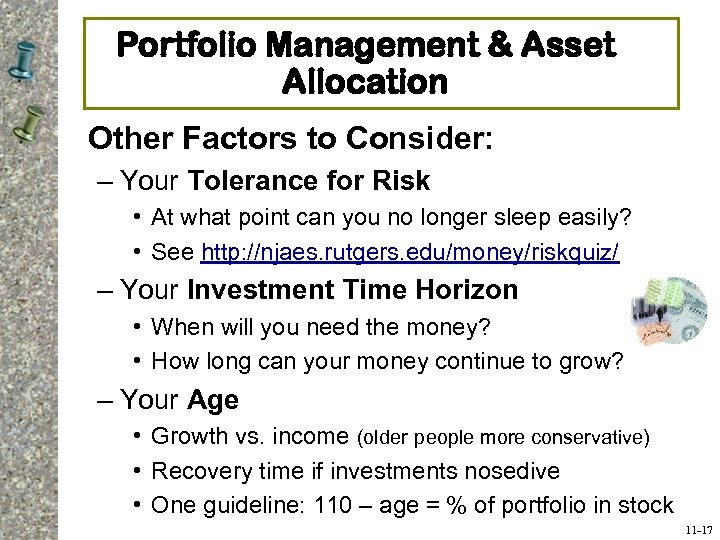

Portfolio Management & Asset Allocation Other Factors to Consider: – Your Tolerance for Risk • At what point can you no longer sleep easily? • See http: //njaes. rutgers. edu/money/riskquiz/ – Your Investment Time Horizon • When will you need the money? • How long can your money continue to grow? – Your Age • Growth vs. income (older people more conservative) • Recovery time if investments nosedive • One guideline: 110 – age = % of portfolio in stock 11 -17

Bond Investing Video https: //www. youtube. com/watch ? v=tu. BDGj. Sh 7 ms

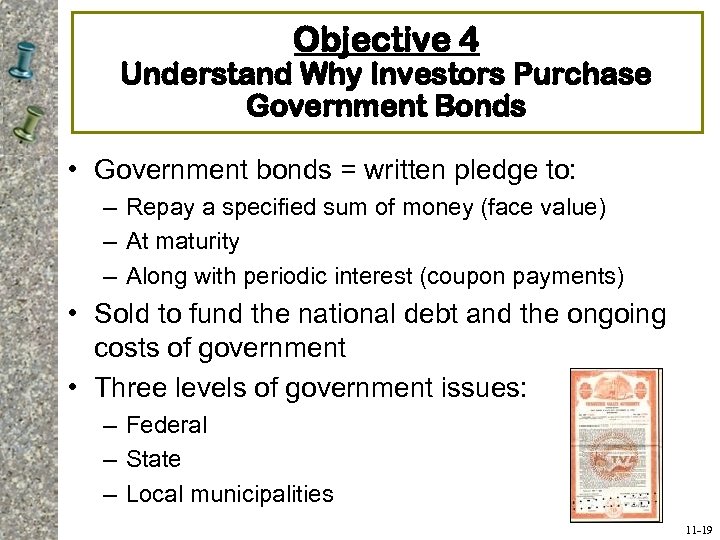

Objective 4 Understand Why Investors Purchase Government Bonds • Government bonds = written pledge to: – Repay a specified sum of money (face value) – At maturity – Along with periodic interest (coupon payments) • Sold to fund the national debt and the ongoing costs of government • Three levels of government issues: – Federal – State – Local municipalities 11 -19

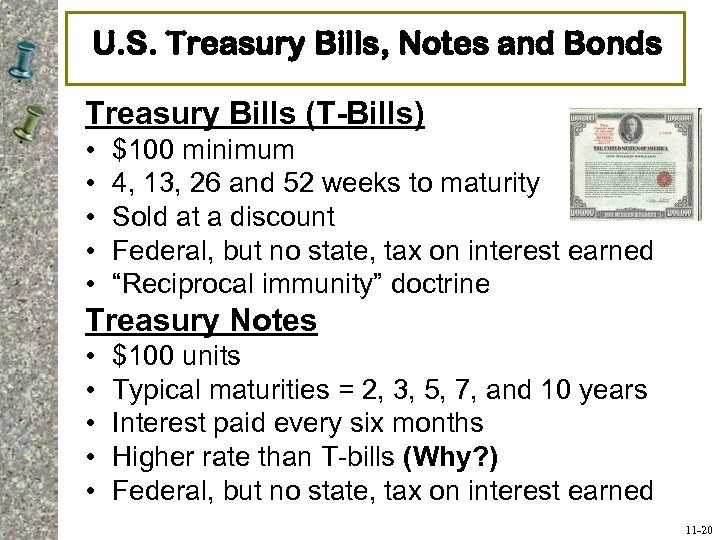

U. S. Treasury Bills, Notes and Bonds Treasury Bills (T-Bills) • • • $100 minimum 4, 13, 26 and 52 weeks to maturity Sold at a discount Federal, but no state, tax on interest earned “Reciprocal immunity” doctrine Treasury Notes • • • $100 units Typical maturities = 2, 3, 5, 7, and 10 years Interest paid every six months Higher rate than T-bills (Why? ) Federal, but no state, tax on interest earned 11 -20

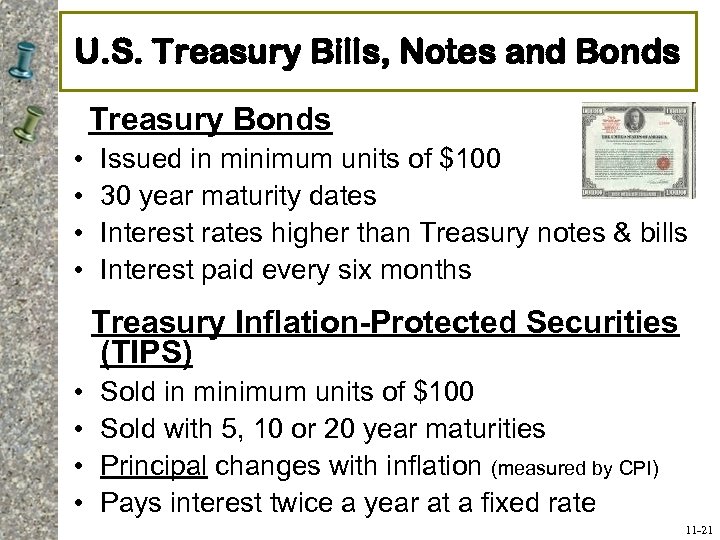

U. S. Treasury Bills, Notes and Bonds Treasury Bonds • • Issued in minimum units of $100 30 year maturity dates Interest rates higher than Treasury notes & bills Interest paid every six months Treasury Inflation-Protected Securities (TIPS) • • Sold in minimum units of $100 Sold with 5, 10 or 20 year maturities Principal changes with inflation (measured by CPI) Pays interest twice a year at a fixed rate 11 -21

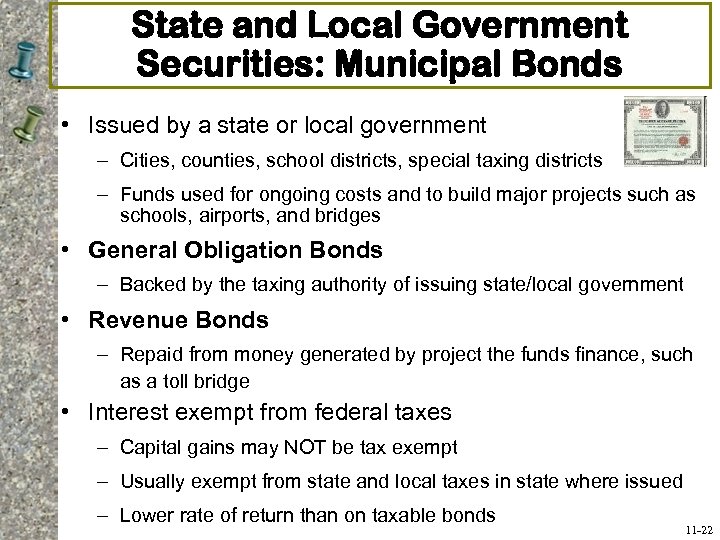

State and Local Government Securities: Municipal Bonds • Issued by a state or local government – Cities, counties, school districts, special taxing districts – Funds used for ongoing costs and to build major projects such as schools, airports, and bridges • General Obligation Bonds – Backed by the taxing authority of issuing state/local government • Revenue Bonds – Repaid from money generated by project the funds finance, such as a toll bridge • Interest exempt from federal taxes – Capital gains may NOT be tax exempt – Usually exempt from state and local taxes in state where issued – Lower rate of return than on taxable bonds 11 -22

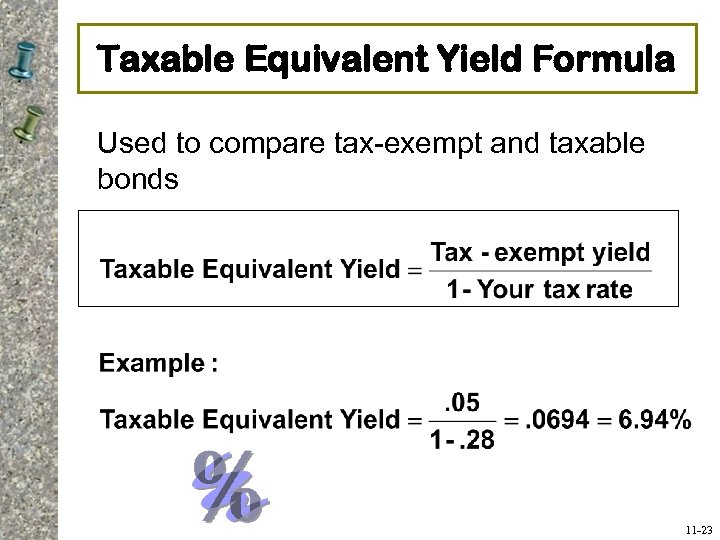

Taxable Equivalent Yield Formula Used to compare tax-exempt and taxable bonds 11 -23

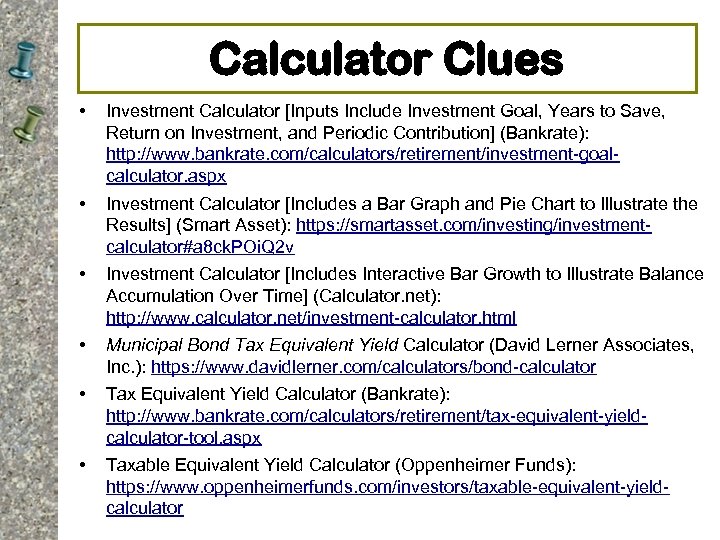

Calculator Clues • Investment Calculator [Inputs Include Investment Goal, Years to Save, Return on Investment, and Periodic Contribution] (Bankrate): http: //www. bankrate. com/calculators/retirement/investment-goalcalculator. aspx • Investment Calculator [Includes a Bar Graph and Pie Chart to Illustrate the Results] (Smart Asset): https: //smartasset. com/investing/investmentcalculator#a 8 ck. POi. Q 2 v • Investment Calculator [Includes Interactive Bar Growth to Illustrate Balance Accumulation Over Time] (Calculator. net): http: //www. calculator. net/investment-calculator. html • Municipal Bond Tax Equivalent Yield Calculator (David Lerner Associates, Inc. ): https: //www. davidlerner. com/calculators/bond-calculator • Tax Equivalent Yield Calculator (Bankrate): http: //www. bankrate. com/calculators/retirement/tax-equivalent-yieldcalculator-tool. aspx • Taxable Equivalent Yield Calculator (Oppenheimer Funds): https: //www. oppenheimerfunds. com/investors/taxable-equivalent-yieldcalculator

e2f1cef75b500480600bb7a8be0bee2f.ppt