cd27cf854a107ceb7e4dfcb082834abc.ppt

- Количество слайдов: 131

11. 90%

11. 90%

3. Compute Cost of Common Equity

3. Compute Cost of Common Equity

Learning Objectives

Learning Objectives

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Payback Decision Rule

Payback Decision Rule

Capital Budgeting Methods Net Present Value

Capital Budgeting Methods Net Present Value

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Capital Budgeting Methods

Financial Calculator:

Financial Calculator:

Financial Calculator:

Financial Calculator:

Financial Calculator:

Financial Calculator:

Financial Calculator:

Financial Calculator:

NPV Decision Rule Accept

NPV Decision Rule Accept

IRR Decision Rule

IRR Decision Rule

What is capital rationing?

What is capital rationing?

Measurement of Project Risk

Measurement of Project Risk

Measurement of Project Risk

Measurement of Project Risk

Non-simple Projects

Non-simple Projects

Non-simple projects

Non-simple projects

Replacement Chain Approach

Replacement Chain Approach

Replacement Chain Approach

Replacement Chain Approach

Replacement Chain Approach

Replacement Chain Approach

Equivalent Annual Annuity

Equivalent Annual Annuity

Equivalent Annual Annuity

Equivalent Annual Annuity

Learning Objectives

Learning Objectives

General Valuation Model

General Valuation Model

Bond Valuation Model

Bond Valuation Model

Bond Valuation Model

Bond Valuation Model

Bond Valuation Model

Bond Valuation Model

Most Bonds Pay Interest Semi-Annually:

Most Bonds Pay Interest Semi-Annually:

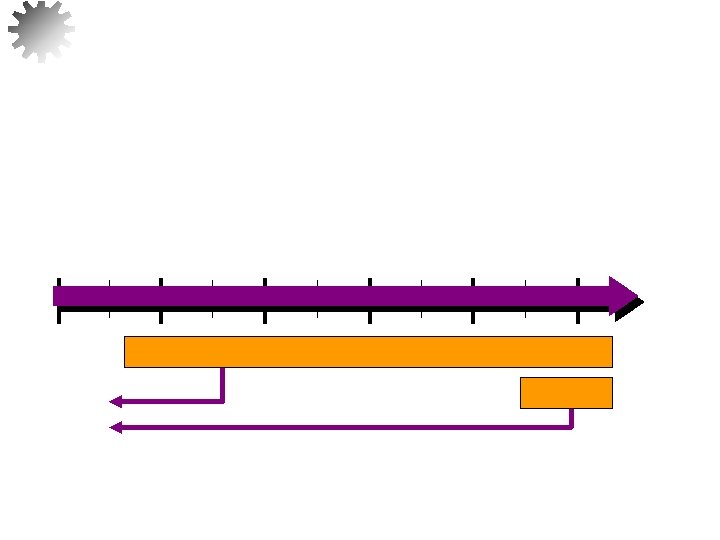

Yield to Maturity

Yield to Maturity

Yield to Maturity

Yield to Maturity

Yield to Maturity

Yield to Maturity

Interest Rate Risk

Interest Rate Risk

Interest Rate Risk

Interest Rate Risk

Valuing Preferred Stock

Valuing Preferred Stock

Valuing Preferred Stock

Valuing Preferred Stock

Valuing Preferred Stock

Valuing Preferred Stock

Constant Growth Dividend Model

Constant Growth Dividend Model

Constant Growth Dividend Model

Constant Growth Dividend Model

Constant Growth Dividend Model

Constant Growth Dividend Model

Valuing Total Stockholders’ Equity

Valuing Total Stockholders’ Equity