c2974ea2276a1c6b0f6bf32100000e55.ppt

- Количество слайдов: 38

11/9/2001 Lecture Mergers and Acquisitions, M&A 1

11/9/2001 Lecture Mergers and Acquisitions, M&A 1

Topics Types of Merger/ M&A Activity Good/Bad Economic Motives Economic Gains and Distribution of Gains ~ Cash Offer/ Share Offer Financing of Mergers and Defence Tactics Who Benefits/Loses: Empirics Self Study: Regulation of Mergers: UK 2

Topics Types of Merger/ M&A Activity Good/Bad Economic Motives Economic Gains and Distribution of Gains ~ Cash Offer/ Share Offer Financing of Mergers and Defence Tactics Who Benefits/Loses: Empirics Self Study: Regulation of Mergers: UK 2

3 Types of Merger/ M&A Activity

3 Types of Merger/ M&A Activity

Types of Merger Combining of two business under common ownership (over 95% are friendly, 5% hostile takeovers) Horizontal Banks and Building Societies Glaxo-Welcome, Nestle-Rowntree, Granada. Forte(1996) Vertical Oil drilling, refinery and petrol stations Car manufacturer and retail AOL (America Online) and Time Warner (2000), Yahoo and others(1996 -) Conglomerate: Hanson Trust 4

Types of Merger Combining of two business under common ownership (over 95% are friendly, 5% hostile takeovers) Horizontal Banks and Building Societies Glaxo-Welcome, Nestle-Rowntree, Granada. Forte(1996) Vertical Oil drilling, refinery and petrol stations Car manufacturer and retail AOL (America Online) and Time Warner (2000), Yahoo and others(1996 -) Conglomerate: Hanson Trust 4

Types of Merger Disbursement/Disinvestment/Downsizing - we will not discuss this Strategic Alliances - BA, Quantas, Air Liberte etc 5

Types of Merger Disbursement/Disinvestment/Downsizing - we will not discuss this Strategic Alliances - BA, Quantas, Air Liberte etc 5

M&A Activity end 1960’s -conglomerate mergers (then broken up in 1980’s and 1990’s) 1970’s- vertical integration (now ‘outsourcing’ !) 1980 s - leveraged buyouts (USA) - RJR Nabisco 1990’s- horizontal mergers (eg. banks)/cross-border (eg. in Europe) UK ‘waves’ 71 -72, 87 -89, 97 -2000 6

M&A Activity end 1960’s -conglomerate mergers (then broken up in 1980’s and 1990’s) 1970’s- vertical integration (now ‘outsourcing’ !) 1980 s - leveraged buyouts (USA) - RJR Nabisco 1990’s- horizontal mergers (eg. banks)/cross-border (eg. in Europe) UK ‘waves’ 71 -72, 87 -89, 97 -2000 6

M&A Activity 1997 -2000 British Petroleum acquires Amoco ($48 bn) Exxon acquires Mobil ($80 bn) Daimler-Benz acquires Chrysler ($38 bn) Travellers Group acquires Citicorp ($83 bn) Deutsche Bank acquires Bankers Trust ($10 bn) AOL-Time Warner ($190 bn) Lloyds - Abbey National ? 7

M&A Activity 1997 -2000 British Petroleum acquires Amoco ($48 bn) Exxon acquires Mobil ($80 bn) Daimler-Benz acquires Chrysler ($38 bn) Travellers Group acquires Citicorp ($83 bn) Deutsche Bank acquires Bankers Trust ($10 bn) AOL-Time Warner ($190 bn) Lloyds - Abbey National ? 7

8 Good/Bad Economic Motives

8 Good/Bad Economic Motives

Good Economic Motives More Efficient Use of Resources Better management in merged firm (e. g. Marriott takeover of Renaissance hotel grp, Dec 1996) Cost savings (e. g. close bank branches) Additional revenue generation (e. g. AOL-Time Warner) Technology transfer/know-how (e. g. Glaxo-Welcome) Strategic objectives (‘option’ to do something in the future e. g. AOL-Time Warner) 9

Good Economic Motives More Efficient Use of Resources Better management in merged firm (e. g. Marriott takeover of Renaissance hotel grp, Dec 1996) Cost savings (e. g. close bank branches) Additional revenue generation (e. g. AOL-Time Warner) Technology transfer/know-how (e. g. Glaxo-Welcome) Strategic objectives (‘option’ to do something in the future e. g. AOL-Time Warner) 9

Bad Economic Motives Tax Advantages - loss ‘carry forwards’ used by ‘profitable’ bidder (merely a redistribution of income from tax payers to shareholders) Increase Market Power / Reduce Competition-Regulation ‘Using up’ Free Cash Flow after undertaking all NPV>0 projects - Empire Building ~ funds should be paid out to shareholders who then decide the best use for the cash (eg. to invest in other firms). Hubris (=Overconfidence) - Guinness-Distillers Generate fees for Corporate Bankers/Lawyers ! 10

Bad Economic Motives Tax Advantages - loss ‘carry forwards’ used by ‘profitable’ bidder (merely a redistribution of income from tax payers to shareholders) Increase Market Power / Reduce Competition-Regulation ‘Using up’ Free Cash Flow after undertaking all NPV>0 projects - Empire Building ~ funds should be paid out to shareholders who then decide the best use for the cash (eg. to invest in other firms). Hubris (=Overconfidence) - Guinness-Distillers Generate fees for Corporate Bankers/Lawyers ! 10

11 Economic Gains and Distribution of Gains

11 Economic Gains and Distribution of Gains

Economic Gains and Distribution of Gains 1) Economic Gains 2) Distribution of Gains - cash offer and underpriced 3) Distribution of Gains - share offer 12

Economic Gains and Distribution of Gains 1) Economic Gains 2) Distribution of Gains - cash offer and underpriced 3) Distribution of Gains - share offer 12

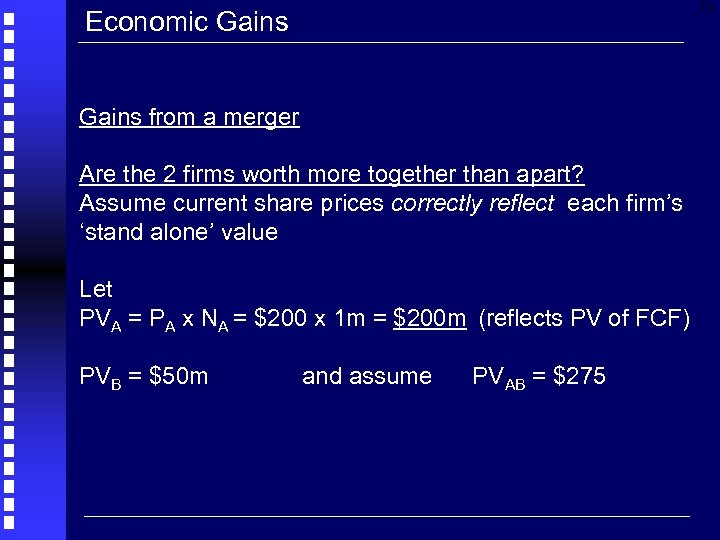

13 Economic Gains from a merger Are the 2 firms worth more together than apart? Assume current share prices correctly reflect each firm’s ‘stand alone’ value Let PVA = PA x NA = $200 x 1 m = $200 m (reflects PV of FCF) PVB = $50 m and assume PVAB = $275

13 Economic Gains from a merger Are the 2 firms worth more together than apart? Assume current share prices correctly reflect each firm’s ‘stand alone’ value Let PVA = PA x NA = $200 x 1 m = $200 m (reflects PV of FCF) PVB = $50 m and assume PVAB = $275

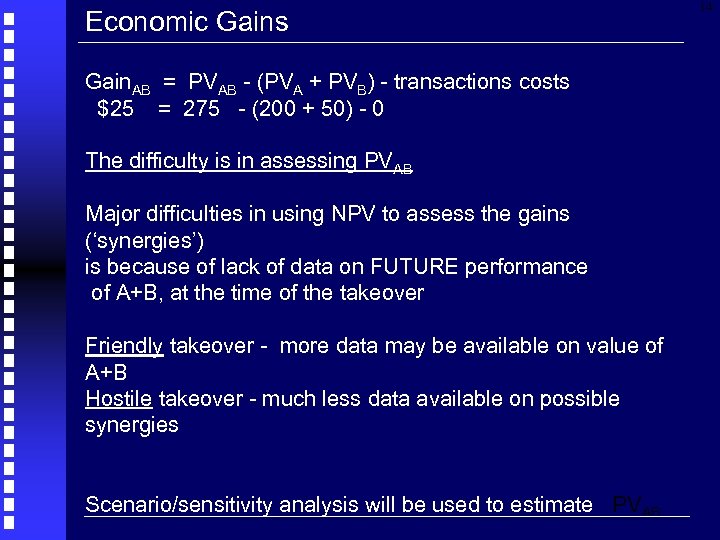

Economic Gains Gain. AB = PVAB - (PVA + PVB) - transactions costs $25 = 275 - (200 + 50) - 0 The difficulty is in assessing PVAB Major difficulties in using NPV to assess the gains (‘synergies’) is because of lack of data on FUTURE performance of A+B, at the time of the takeover Friendly takeover - more data may be available on value of A+B Hostile takeover - much less data available on possible synergies Scenario/sensitivity analysis will be used to estimate PVAB 14

Economic Gains Gain. AB = PVAB - (PVA + PVB) - transactions costs $25 = 275 - (200 + 50) - 0 The difficulty is in assessing PVAB Major difficulties in using NPV to assess the gains (‘synergies’) is because of lack of data on FUTURE performance of A+B, at the time of the takeover Friendly takeover - more data may be available on value of A+B Hostile takeover - much less data available on possible synergies Scenario/sensitivity analysis will be used to estimate PVAB 14

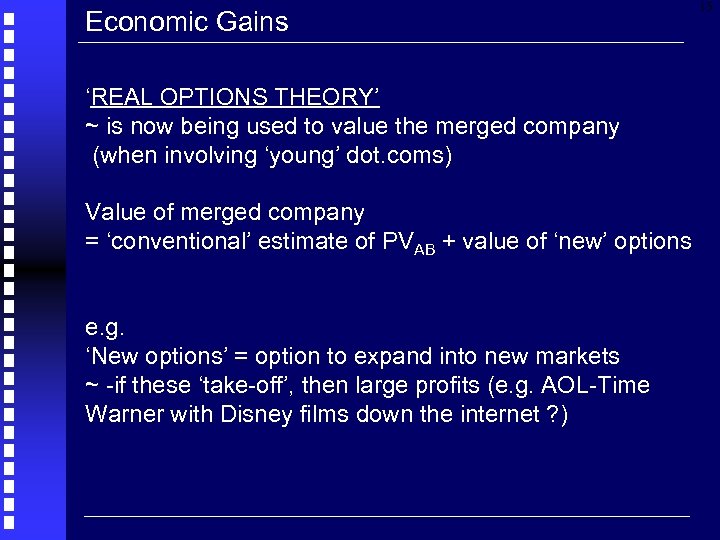

Economic Gains ‘REAL OPTIONS THEORY’ ~ is now being used to value the merged company (when involving ‘young’ dot. coms) Value of merged company = ‘conventional’ estimate of PVAB + value of ‘new’ options e. g. ‘New options’ = option to expand into new markets ~ -if these ‘take-off’, then large profits (e. g. AOL-Time Warner with Disney films down the internet ? ) 15

Economic Gains ‘REAL OPTIONS THEORY’ ~ is now being used to value the merged company (when involving ‘young’ dot. coms) Value of merged company = ‘conventional’ estimate of PVAB + value of ‘new’ options e. g. ‘New options’ = option to expand into new markets ~ -if these ‘take-off’, then large profits (e. g. AOL-Time Warner with Disney films down the internet ? ) 15

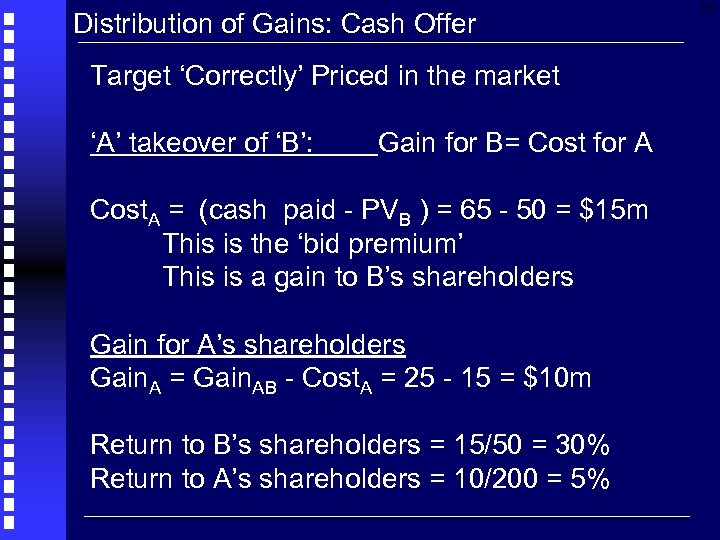

Distribution of Gains: Cash Offer Target ‘Correctly’ Priced in the market ‘A’ takeover of ‘B’: Gain for B= Cost for A Cost. A = (cash paid - PVB ) = 65 - 50 = $15 m This is the ‘bid premium’ This is a gain to B’s shareholders Gain for A’s shareholders Gain. A = Gain. AB - Cost. A = 25 - 15 = $10 m Return to B’s shareholders = 15/50 = 30% Return to A’s shareholders = 10/200 = 5% 16

Distribution of Gains: Cash Offer Target ‘Correctly’ Priced in the market ‘A’ takeover of ‘B’: Gain for B= Cost for A Cost. A = (cash paid - PVB ) = 65 - 50 = $15 m This is the ‘bid premium’ This is a gain to B’s shareholders Gain for A’s shareholders Gain. A = Gain. AB - Cost. A = 25 - 15 = $10 m Return to B’s shareholders = 15/50 = 30% Return to A’s shareholders = 10/200 = 5% 16

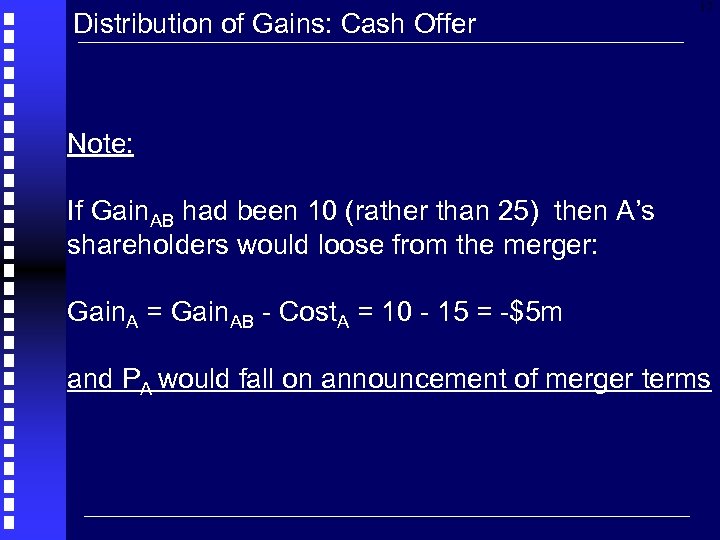

Distribution of Gains: Cash Offer 17 Note: If Gain. AB had been 10 (rather than 25) then A’s shareholders would loose from the merger: Gain. A = Gain. AB - Cost. A = 10 - 15 = -$5 m and PA would fall on announcement of merger terms

Distribution of Gains: Cash Offer 17 Note: If Gain. AB had been 10 (rather than 25) then A’s shareholders would loose from the merger: Gain. A = Gain. AB - Cost. A = 10 - 15 = -$5 m and PA would fall on announcement of merger terms

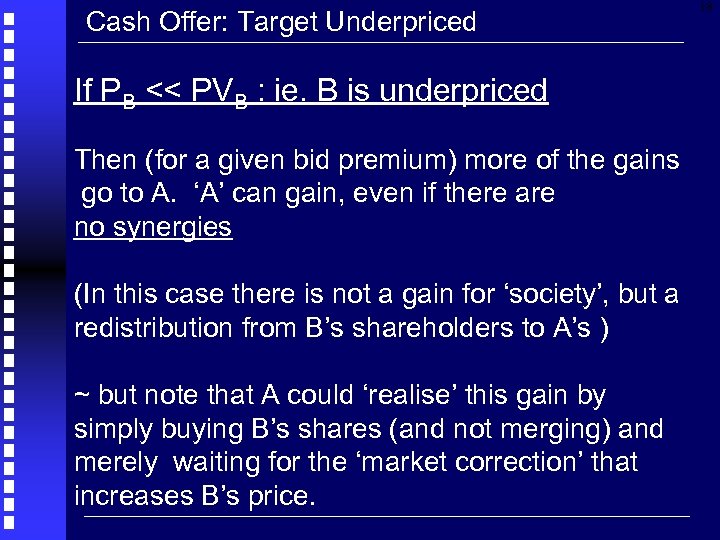

Cash Offer: Target Underpriced If PB << PVB : ie. B is underpriced Then (for a given bid premium) more of the gains go to A. ‘A’ can gain, even if there are no synergies (In this case there is not a gain for ‘society’, but a redistribution from B’s shareholders to A’s ) ~ but note that A could ‘realise’ this gain by simply buying B’s shares (and not merging) and merely waiting for the ‘market correction’ that increases B’s price. 18

Cash Offer: Target Underpriced If PB << PVB : ie. B is underpriced Then (for a given bid premium) more of the gains go to A. ‘A’ can gain, even if there are no synergies (In this case there is not a gain for ‘society’, but a redistribution from B’s shareholders to A’s ) ~ but note that A could ‘realise’ this gain by simply buying B’s shares (and not merging) and merely waiting for the ‘market correction’ that increases B’s price. 18

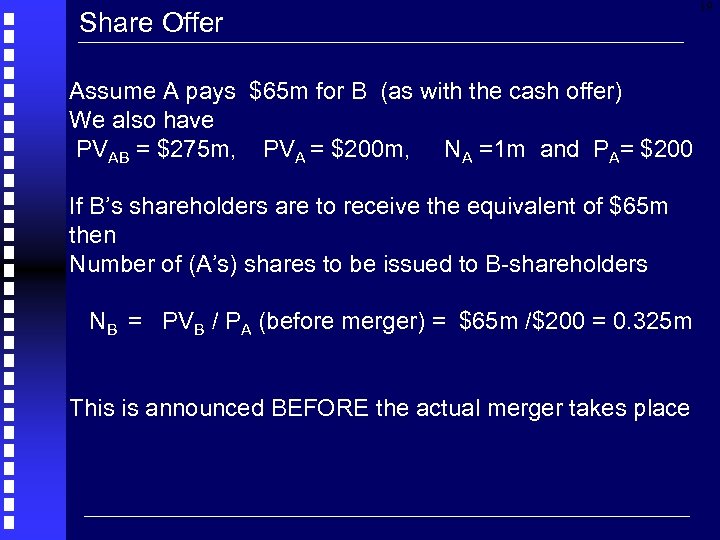

Share Offer Assume A pays $65 m for B (as with the cash offer) We also have PVAB = $275 m, PVA = $200 m, NA =1 m and PA= $200 If B’s shareholders are to receive the equivalent of $65 m then Number of (A’s) shares to be issued to B-shareholders NB = PVB / PA (before merger) = $65 m /$200 = 0. 325 m This is announced BEFORE the actual merger takes place 19

Share Offer Assume A pays $65 m for B (as with the cash offer) We also have PVAB = $275 m, PVA = $200 m, NA =1 m and PA= $200 If B’s shareholders are to receive the equivalent of $65 m then Number of (A’s) shares to be issued to B-shareholders NB = PVB / PA (before merger) = $65 m /$200 = 0. 325 m This is announced BEFORE the actual merger takes place 19

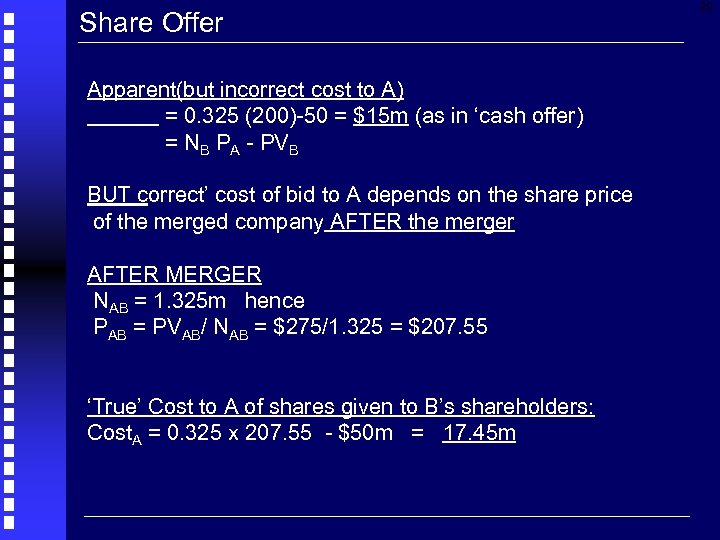

Share Offer Apparent(but incorrect cost to A) = 0. 325 (200)-50 = $15 m (as in ‘cash offer) = NB PA - PVB BUT correct’ cost of bid to A depends on the share price of the merged company AFTER the merger AFTER MERGER NAB = 1. 325 m hence PAB = PVAB/ NAB = $275/1. 325 = $207. 55 ‘True’ Cost to A of shares given to B’s shareholders: Cost. A = 0. 325 x 207. 55 - $50 m = 17. 45 m 20

Share Offer Apparent(but incorrect cost to A) = 0. 325 (200)-50 = $15 m (as in ‘cash offer) = NB PA - PVB BUT correct’ cost of bid to A depends on the share price of the merged company AFTER the merger AFTER MERGER NAB = 1. 325 m hence PAB = PVAB/ NAB = $275/1. 325 = $207. 55 ‘True’ Cost to A of shares given to B’s shareholders: Cost. A = 0. 325 x 207. 55 - $50 m = 17. 45 m 20

Cash versus Share Offer 21 CASH: cost to A of the merger is unaffected by the post-merger gains. SHARES Cost to A depends on the merger gains PVAB , which show up in the post merger price, PAB

Cash versus Share Offer 21 CASH: cost to A of the merger is unaffected by the post-merger gains. SHARES Cost to A depends on the merger gains PVAB , which show up in the post merger price, PAB

22 Financing of Mergers and Defence Tactics

22 Financing of Mergers and Defence Tactics

Financing of Mergers 23 CASH (TENDER) OFFER Source of cash can be provided by the acquirer undertaking a ‘rights issue’ or, by bank borrowing or, issuing debt (e. g. LBO) or by using retained profits (‘free cash flows’) - advantage to target shareholders is ‘precision’, and free to re-invest the cash in any other company - disadvantage is cash paid out may be treated as realised capital gain and taxed. - advantage for acquirer is that it retains total control of the new merged firm (ie no ‘dilution’ for its shareholders

Financing of Mergers 23 CASH (TENDER) OFFER Source of cash can be provided by the acquirer undertaking a ‘rights issue’ or, by bank borrowing or, issuing debt (e. g. LBO) or by using retained profits (‘free cash flows’) - advantage to target shareholders is ‘precision’, and free to re-invest the cash in any other company - disadvantage is cash paid out may be treated as realised capital gain and taxed. - advantage for acquirer is that it retains total control of the new merged firm (ie no ‘dilution’ for its shareholders

Financing of Mergers SHARE OFFER - advantage to target shareholders is that any capital gain on ‘new’ shares are not realised and hence not subject to immediate capital gains tax - advantage is target shareholder have (voting) shares in the new company -disadvantage to acquirer, if target (B) is overvalued by stock market or bid premium is ‘too high’ MIXED OFFERs ARE ALSO USED: Cash, shares, preference shares, share options 24

Financing of Mergers SHARE OFFER - advantage to target shareholders is that any capital gain on ‘new’ shares are not realised and hence not subject to immediate capital gains tax - advantage is target shareholder have (voting) shares in the new company -disadvantage to acquirer, if target (B) is overvalued by stock market or bid premium is ‘too high’ MIXED OFFERs ARE ALSO USED: Cash, shares, preference shares, share options 24

Defence Tactics PAC MAN - mount a counter bid against the predator WHITE KNIGHT - arrange another bid from a friendly company POISON PILL - make bid costly (e. g. your shareholders can buy shares of new company at v. large discount. Rights issue to dilute predators holdings ) POISON PUT (in bond covenants) - bondholders of target can demand immediate repayment in full, if there is a change in ownership CROWN JEWELS - sell off bits the acquirer is most interested in 25

Defence Tactics PAC MAN - mount a counter bid against the predator WHITE KNIGHT - arrange another bid from a friendly company POISON PILL - make bid costly (e. g. your shareholders can buy shares of new company at v. large discount. Rights issue to dilute predators holdings ) POISON PUT (in bond covenants) - bondholders of target can demand immediate repayment in full, if there is a change in ownership CROWN JEWELS - sell off bits the acquirer is most interested in 25

Defence Tactics GOLDEN PARACHUTES - managers get massive payoff if they are taken over GREENMAIL - bribe your shareholders with promise of large future dividend payouts if they don’t sell their shares. - buy-up shares promised to the predator, at a premium. SHARK REPELLANTS - supermajority (80%) to approve merger - restricted voting rights (for shareholders who own more than x% of stock) 26

Defence Tactics GOLDEN PARACHUTES - managers get massive payoff if they are taken over GREENMAIL - bribe your shareholders with promise of large future dividend payouts if they don’t sell their shares. - buy-up shares promised to the predator, at a premium. SHARK REPELLANTS - supermajority (80%) to approve merger - restricted voting rights (for shareholders who own more than x% of stock) 26

27 Who Benefits/Loses: Empirics

27 Who Benefits/Loses: Empirics

Who Benefits/Loses: Empirics MANAGEMENT - acquiring management gain control and $’s - 4 directors of RBS shared £ 2. 5 for successful takeover of Nat West - Vodaphone CE Chris Gent £ 10 m for takeover of Mannesmann - acquired managers(‘golden parachutes’ or redundancy) EMPLOYEES - usually redundancies for some employees of target 28

Who Benefits/Loses: Empirics MANAGEMENT - acquiring management gain control and $’s - 4 directors of RBS shared £ 2. 5 for successful takeover of Nat West - Vodaphone CE Chris Gent £ 10 m for takeover of Mannesmann - acquired managers(‘golden parachutes’ or redundancy) EMPLOYEES - usually redundancies for some employees of target 28

Who Benefits/Loses: Empirics 29 SHAREHOLDERS - TARGET SHAREHOLDERS gain - ACQUIRING SHAREHOLDERS - lose or break even, THE ECONOMY - v. mixed (see CAR and Post merger performance - below)

Who Benefits/Loses: Empirics 29 SHAREHOLDERS - TARGET SHAREHOLDERS gain - ACQUIRING SHAREHOLDERS - lose or break even, THE ECONOMY - v. mixed (see CAR and Post merger performance - below)

Who Benefits/Loses: Empirics 30 The markets reaction/interpretation - Abnormal Return and Cumulative Abnormal Return 1) Use data from -70 days to -10 days before announcement Normal Return = a + (beta) Rm 2) Data -10 days to +10 days after announcement AR = Actual R - Normal Return CAR = sum of AR (from -10 to +10 or longer) Markets are forward looking so change in price reflects the PV of all future prospects/profits

Who Benefits/Loses: Empirics 30 The markets reaction/interpretation - Abnormal Return and Cumulative Abnormal Return 1) Use data from -70 days to -10 days before announcement Normal Return = a + (beta) Rm 2) Data -10 days to +10 days after announcement AR = Actual R - Normal Return CAR = sum of AR (from -10 to +10 or longer) Markets are forward looking so change in price reflects the PV of all future prospects/profits

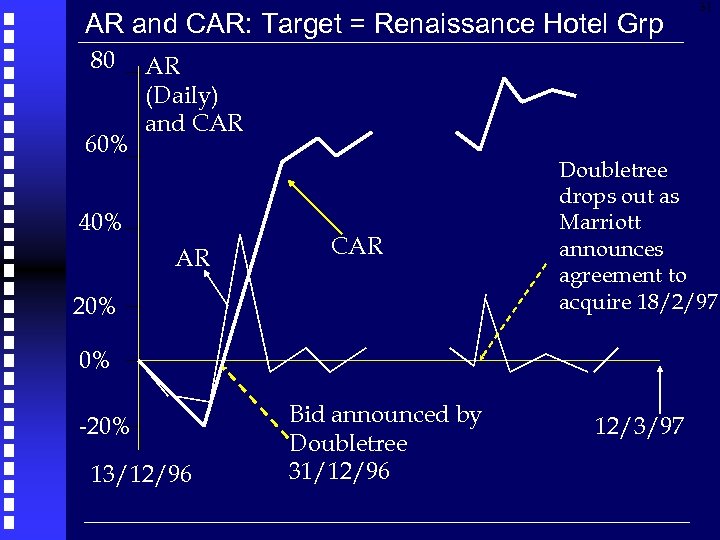

AR and CAR: Target = Renaissance Hotel Grp 80 60% 31 AR (Daily) and CAR 40% AR CAR 20% Doubletree drops out as Marriott announces agreement to acquire 18/2/97 0% -20% 13/12/96 Bid announced by Doubletree 31/12/96 12/3/97

AR and CAR: Target = Renaissance Hotel Grp 80 60% 31 AR (Daily) and CAR 40% AR CAR 20% Doubletree drops out as Marriott announces agreement to acquire 18/2/97 0% -20% 13/12/96 Bid announced by Doubletree 31/12/96 12/3/97

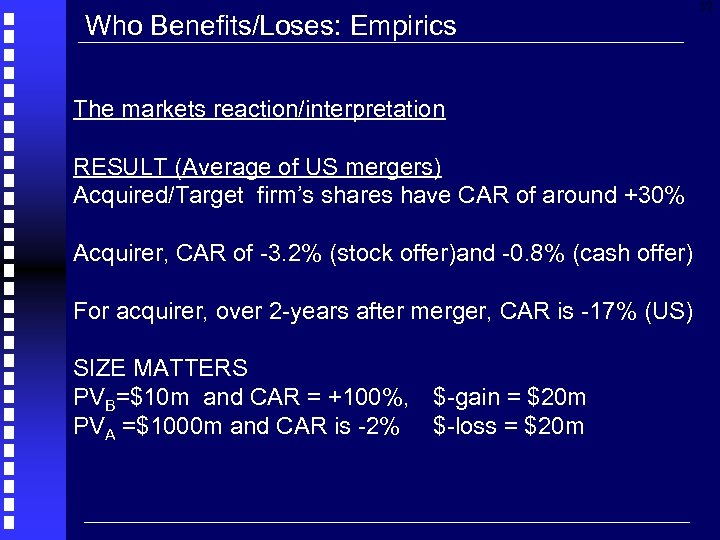

Who Benefits/Loses: Empirics The markets reaction/interpretation RESULT (Average of US mergers) Acquired/Target firm’s shares have CAR of around +30% Acquirer, CAR of -3. 2% (stock offer)and -0. 8% (cash offer) For acquirer, over 2 -years after merger, CAR is -17% (US) SIZE MATTERS PVB=$10 m and CAR = +100%, $-gain = $20 m PVA =$1000 m and CAR is -2% $-loss = $20 m 32

Who Benefits/Loses: Empirics The markets reaction/interpretation RESULT (Average of US mergers) Acquired/Target firm’s shares have CAR of around +30% Acquirer, CAR of -3. 2% (stock offer)and -0. 8% (cash offer) For acquirer, over 2 -years after merger, CAR is -17% (US) SIZE MATTERS PVB=$10 m and CAR = +100%, $-gain = $20 m PVA =$1000 m and CAR is -2% $-loss = $20 m 32

Who Benefits/Loses: Empirics Long term Post-Merger Performance Uses accounting measures of return (eg. ROC ) in the merged firm relative to those in the ‘control group’ (eg. non-merged firms in the same industry= ‘matched sample’). - Result mergers (on average) are ‘neutral’ or ‘negative’ (UK and US) 33

Who Benefits/Loses: Empirics Long term Post-Merger Performance Uses accounting measures of return (eg. ROC ) in the merged firm relative to those in the ‘control group’ (eg. non-merged firms in the same industry= ‘matched sample’). - Result mergers (on average) are ‘neutral’ or ‘negative’ (UK and US) 33

34 End of Lecture

34 End of Lecture

35 Self Study Regulation of Mergers

35 Self Study Regulation of Mergers

Regulation of Mergers: UK 36 Takeover Panel - to ensure fairness for all shareholders - In UK when ‘one firm’ holds 3% of the total shares outstanding of B, then you must make this public. - Purchase of more than 10% of shares in B within 7 days is not allowed if this takes total shareholding to over 15% - to prevent purchases from ‘professionals’ rather than general shareholders

Regulation of Mergers: UK 36 Takeover Panel - to ensure fairness for all shareholders - In UK when ‘one firm’ holds 3% of the total shares outstanding of B, then you must make this public. - Purchase of more than 10% of shares in B within 7 days is not allowed if this takes total shareholding to over 15% - to prevent purchases from ‘professionals’ rather than general shareholders

Regulation of Mergers: UK - over 30% holding then T. P usually insists on a bid for all of B’s remaining shares. B comes ‘into play’ as a takeover target (observable by all). Office of Fair Trading (OFT) - ensures competition Monopolies and Mergers Commission - investigates M&A referred to it by OFT. 37

Regulation of Mergers: UK - over 30% holding then T. P usually insists on a bid for all of B’s remaining shares. B comes ‘into play’ as a takeover target (observable by all). Office of Fair Trading (OFT) - ensures competition Monopolies and Mergers Commission - investigates M&A referred to it by OFT. 37

38 End of Slides

38 End of Slides