94b14d83e2a1cddd5c74bf58223a6755.ppt

- Количество слайдов: 59

11 -1 Inventory Management Production planning and control Chapter 2: Inventory management William J. Stevenson 9 th edition

11 -1 Inventory Management Production planning and control Chapter 2: Inventory management William J. Stevenson 9 th edition

11 -2 Inventory Management Types of Inventories Raw materials & purchased parts · Partially completed goods called work-in-process (WIP) · · Finished-goods inventories · (manufacturing firms) or merchandise (retail stores) · Replacement parts, tools, & supplies · Goods-in-transit to warehouses or customers

11 -2 Inventory Management Types of Inventories Raw materials & purchased parts · Partially completed goods called work-in-process (WIP) · · Finished-goods inventories · (manufacturing firms) or merchandise (retail stores) · Replacement parts, tools, & supplies · Goods-in-transit to warehouses or customers

11 -3 Inventory Management Functions of Inventory · To meet anticipated demand · To smooth production requirements · To decouple operations · To protect against stock-outs · To take advantage of order cycles · To help hedge against price increases · To permit operations · To take advantage of quantity discounts

11 -3 Inventory Management Functions of Inventory · To meet anticipated demand · To smooth production requirements · To decouple operations · To protect against stock-outs · To take advantage of order cycles · To help hedge against price increases · To permit operations · To take advantage of quantity discounts

11 -4 Inventory Management Objective of Inventory Control · To achieve satisfactory levels of customer service while keeping inventory costs within reasonable bounds · Level of customer service · Costs of ordering and carrying inventory

11 -4 Inventory Management Objective of Inventory Control · To achieve satisfactory levels of customer service while keeping inventory costs within reasonable bounds · Level of customer service · Costs of ordering and carrying inventory

11 -5 Inventory Management Effective Inventory Management To be effective, management must have the following: · A system to keep track of inventory on hand on order · A reliable forecast of demand · Knowledge of lead times and its variability · Reasonable estimates of: · · Ordering costs · · Inventory Holding (carrying) costs Shortage costs A classification system for inventory items

11 -5 Inventory Management Effective Inventory Management To be effective, management must have the following: · A system to keep track of inventory on hand on order · A reliable forecast of demand · Knowledge of lead times and its variability · Reasonable estimates of: · · Ordering costs · · Inventory Holding (carrying) costs Shortage costs A classification system for inventory items

11 -6 Inventory Management Inventory Counting Systems · Periodic System Physical count of items made at periodic intervals · Perpetual (continual) Inventory System that keeps track of removals from inventory continuously, thus monitoring current levels of each item

11 -6 Inventory Management Inventory Counting Systems · Periodic System Physical count of items made at periodic intervals · Perpetual (continual) Inventory System that keeps track of removals from inventory continuously, thus monitoring current levels of each item

11 -7 Inventory Management Inventory Counting Systems (Cont’d) Perpetual inventory system ranges between very simple to very sophisticated such as: · Two-Bin System - Two containers of inventory; reorder when the first is empty · Universal Bar Code (UBC)- Bar code printed on a label that has information about the item 0 to which it is attached 214800 232087768

11 -7 Inventory Management Inventory Counting Systems (Cont’d) Perpetual inventory system ranges between very simple to very sophisticated such as: · Two-Bin System - Two containers of inventory; reorder when the first is empty · Universal Bar Code (UBC)- Bar code printed on a label that has information about the item 0 to which it is attached 214800 232087768

11 -8 · · Inventory Management Key Inventory Terms Lead time: time interval between ordering and receiving the order Holding (carrying) costs: cost to carry an item in inventory for a length of time, usually a year (heat, light, rent, security, deterioration, spoilage, breakage, depreciation, opportunity cost, …, etc. , ) Ordering costs: costs of ordering and receiving inventory (shipping cost, cost of preparing how much is needed, preparing invoices, cost of inspecting goods upon arrival for quality and quantity, moving the goods to temporary storage) Shortage costs: costs when demand exceeds supply (the opportunity cost of not making a sale, loss of customer goodwill, late charges, the cost of lost of production or downtime)

11 -8 · · Inventory Management Key Inventory Terms Lead time: time interval between ordering and receiving the order Holding (carrying) costs: cost to carry an item in inventory for a length of time, usually a year (heat, light, rent, security, deterioration, spoilage, breakage, depreciation, opportunity cost, …, etc. , ) Ordering costs: costs of ordering and receiving inventory (shipping cost, cost of preparing how much is needed, preparing invoices, cost of inspecting goods upon arrival for quality and quantity, moving the goods to temporary storage) Shortage costs: costs when demand exceeds supply (the opportunity cost of not making a sale, loss of customer goodwill, late charges, the cost of lost of production or downtime)

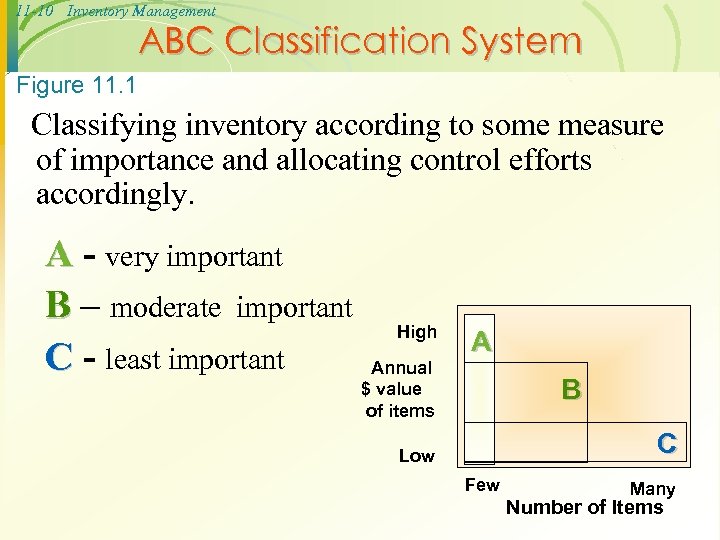

11 -9 · Inventory Management Classification system An important aspect of inventory management is that items held in inventory are not of equal importance in terms of dollar invested, profit potential, sales or usage volume, or stockout penalties. For instance, a producer of electrical equipment might have electric generators, coils of wire, and miscellaneous nuts and bolts among items carried in inventory. It would be unrealistic to devote equal attention to each of these items. Instead, a more reasonable approach would allocate control efforts according to the relative importance of various items in inventory. This approach is called A-B-C classification approach

11 -9 · Inventory Management Classification system An important aspect of inventory management is that items held in inventory are not of equal importance in terms of dollar invested, profit potential, sales or usage volume, or stockout penalties. For instance, a producer of electrical equipment might have electric generators, coils of wire, and miscellaneous nuts and bolts among items carried in inventory. It would be unrealistic to devote equal attention to each of these items. Instead, a more reasonable approach would allocate control efforts according to the relative importance of various items in inventory. This approach is called A-B-C classification approach

11 -10 Inventory Management ABC Classification System Figure 11. 1 Classifying inventory according to some measure of importance and allocating control efforts accordingly. A - very important B – moderate important C - least important High Annual $ value of items A B C Low Few Many Number of Items

11 -10 Inventory Management ABC Classification System Figure 11. 1 Classifying inventory according to some measure of importance and allocating control efforts accordingly. A - very important B – moderate important C - least important High Annual $ value of items A B C Low Few Many Number of Items

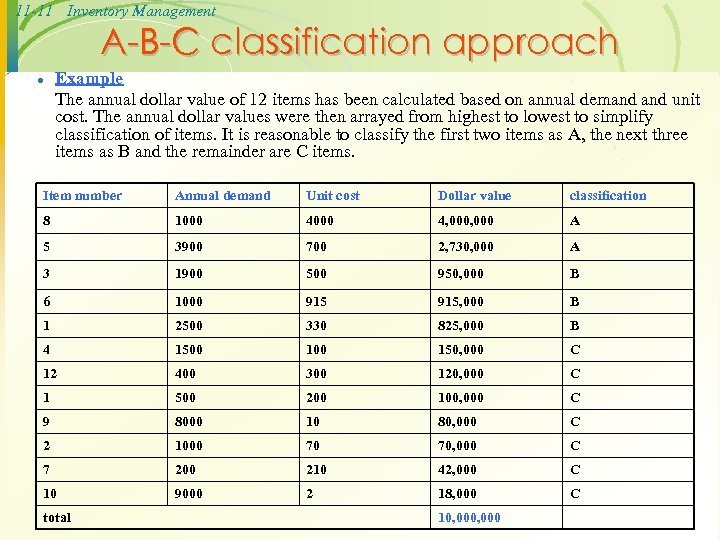

11 -11 Inventory Management A-B-C classification approach · Example The annual dollar value of 12 items has been calculated based on annual demand unit cost. The annual dollar values were then arrayed from highest to lowest to simplify classification of items. It is reasonable to classify the first two items as A, the next three items as B and the remainder are C items. Item number Annual demand Unit cost Dollar value classification 8 1000 4, 000 A 5 3900 700 2, 730, 000 A 3 1900 500 950, 000 B 6 1000 915, 000 B 1 2500 330 825, 000 B 4 1500 150, 000 C 12 400 300 120, 000 C 1 500 200 100, 000 C 9 8000 10 80, 000 C 2 1000 70 70, 000 C 7 200 210 42, 000 C 10 9000 2 18, 000 C total 10, 000

11 -11 Inventory Management A-B-C classification approach · Example The annual dollar value of 12 items has been calculated based on annual demand unit cost. The annual dollar values were then arrayed from highest to lowest to simplify classification of items. It is reasonable to classify the first two items as A, the next three items as B and the remainder are C items. Item number Annual demand Unit cost Dollar value classification 8 1000 4, 000 A 5 3900 700 2, 730, 000 A 3 1900 500 950, 000 B 6 1000 915, 000 B 1 2500 330 825, 000 B 4 1500 150, 000 C 12 400 300 120, 000 C 1 500 200 100, 000 C 9 8000 10 80, 000 C 2 1000 70 70, 000 C 7 200 210 42, 000 C 10 9000 2 18, 000 C total 10, 000

11 -12 Inventory Management Cycle Counting · Another application of the A-B-C classification approach is as a guide to cycle counting, which is a physical count of items in inventory. The purpose of cycle counting is to reduce discrepancies between the amounts indicated by inventory records and the actual quantities of inventory on hand. · The key questions concerning cycle counting for management are: · How much accuracy is needed? · When should cycle counting be performed? · Who should do it? N. B. The American Production and Inventory Control Society (APICS) recommends the following guidelines for inventory record accuracy: ± 0. 2 percent for A items, ± 1 percent for B items, and ± 5 percent for C items.

11 -12 Inventory Management Cycle Counting · Another application of the A-B-C classification approach is as a guide to cycle counting, which is a physical count of items in inventory. The purpose of cycle counting is to reduce discrepancies between the amounts indicated by inventory records and the actual quantities of inventory on hand. · The key questions concerning cycle counting for management are: · How much accuracy is needed? · When should cycle counting be performed? · Who should do it? N. B. The American Production and Inventory Control Society (APICS) recommends the following guidelines for inventory record accuracy: ± 0. 2 percent for A items, ± 1 percent for B items, and ± 5 percent for C items.

11 -13 Inventory Management Economic Order Quantity Models The question of how much to order is frequently determined by using an Economic Order Quantity (EOQ) model. EOQ models identify the optimal order quantity by minimizing the sum of certain annual costs that vary with order size. Three order size models are described: · The basic economic order quantity model · The economic production quantity model · The quantity discount model

11 -13 Inventory Management Economic Order Quantity Models The question of how much to order is frequently determined by using an Economic Order Quantity (EOQ) model. EOQ models identify the optimal order quantity by minimizing the sum of certain annual costs that vary with order size. Three order size models are described: · The basic economic order quantity model · The economic production quantity model · The quantity discount model

11 -14 Inventory Management Economic Order Quantity (EOQ) model Assumptions of EOQ Model 1. Only one product is involved 2. Annual demand requirements are known 3. Demand is even throughout the year 4. Lead time does not vary 5. Each order is received in a single delivery 6. There are no quantity discounts

11 -14 Inventory Management Economic Order Quantity (EOQ) model Assumptions of EOQ Model 1. Only one product is involved 2. Annual demand requirements are known 3. Demand is even throughout the year 4. Lead time does not vary 5. Each order is received in a single delivery 6. There are no quantity discounts

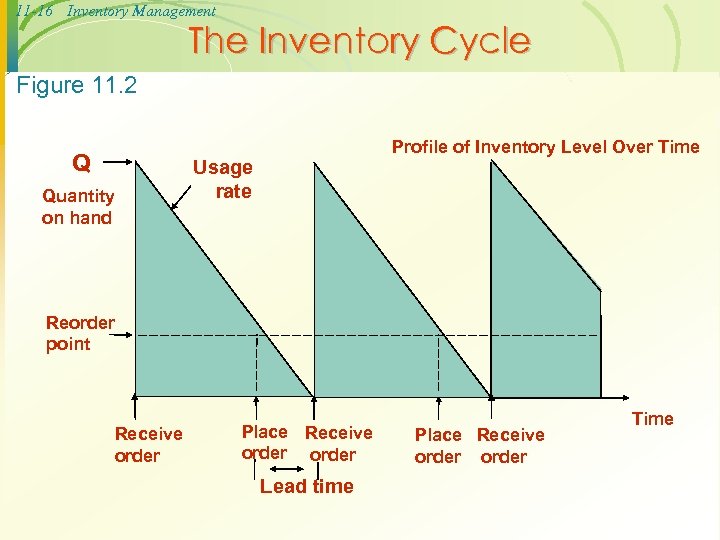

11 -15 Inventory Management EOQ Model inventory cycle · The inventory cycle begins with receipt of an order of Q units, which are withdrawn at a constant rate over time. When the quantity on hand is just sufficient to satisfy demand during lead time, an order for Q units is submitted to the supplier. Because it is assumed that both the usage rate and lead time don’t vary, the order will be received at the precise instant that the inventory on hand falls to zero. Thus, orders are timed to avoid both excess and stockouts (i. e. , running out of stock). The following figure illustrate this idea.

11 -15 Inventory Management EOQ Model inventory cycle · The inventory cycle begins with receipt of an order of Q units, which are withdrawn at a constant rate over time. When the quantity on hand is just sufficient to satisfy demand during lead time, an order for Q units is submitted to the supplier. Because it is assumed that both the usage rate and lead time don’t vary, the order will be received at the precise instant that the inventory on hand falls to zero. Thus, orders are timed to avoid both excess and stockouts (i. e. , running out of stock). The following figure illustrate this idea.

11 -16 Inventory Management The Inventory Cycle Figure 11. 2 Q Quantity on hand Profile of Inventory Level Over Time Usage rate Reorder point Receive order Place Receive order Lead time Place Receive order Time

11 -16 Inventory Management The Inventory Cycle Figure 11. 2 Q Quantity on hand Profile of Inventory Level Over Time Usage rate Reorder point Receive order Place Receive order Lead time Place Receive order Time

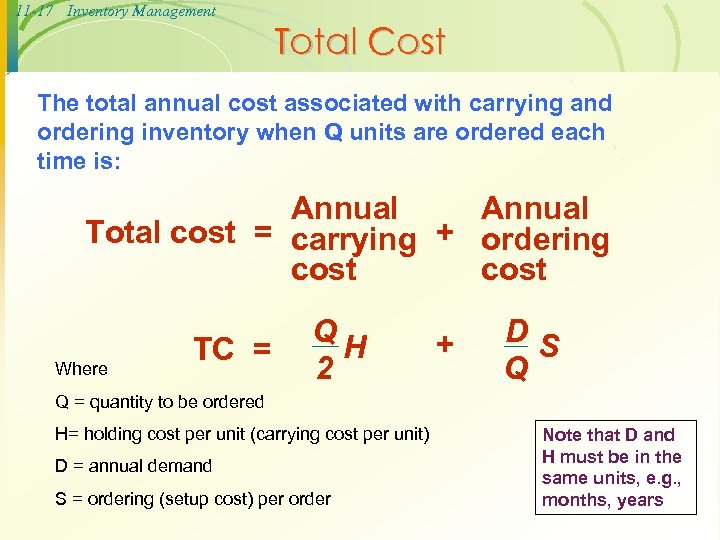

11 -17 Inventory Management Total Cost The total annual cost associated with carrying and ordering inventory when Q units are ordered each time is: Annual Total cost = carrying + ordering cost Where TC = Q H 2 + DS Q Q = quantity to be ordered H= holding cost per unit (carrying cost per unit) D = annual demand S = ordering (setup cost) per order Note that D and H must be in the same units, e. g. , months, years

11 -17 Inventory Management Total Cost The total annual cost associated with carrying and ordering inventory when Q units are ordered each time is: Annual Total cost = carrying + ordering cost Where TC = Q H 2 + DS Q Q = quantity to be ordered H= holding cost per unit (carrying cost per unit) D = annual demand S = ordering (setup cost) per order Note that D and H must be in the same units, e. g. , months, years

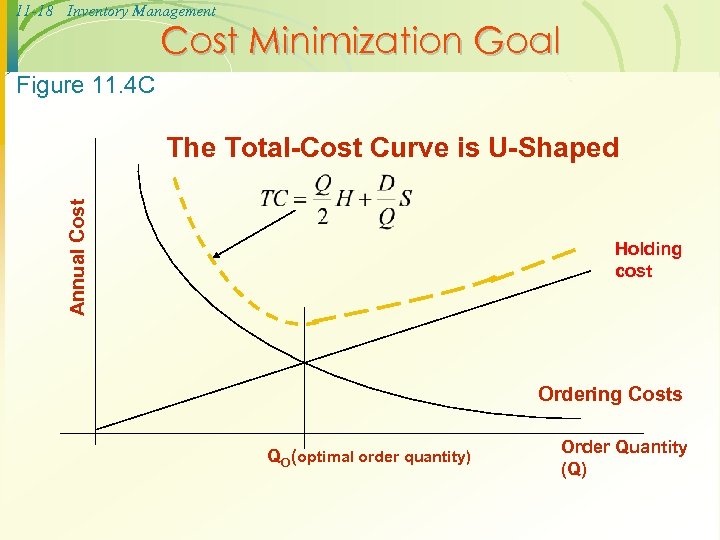

11 -18 Inventory Management Cost Minimization Goal Figure 11. 4 C Annual Cost The Total-Cost Curve is U-Shaped Holding cost Ordering Costs QO (optimal order quantity) Order Quantity (Q)

11 -18 Inventory Management Cost Minimization Goal Figure 11. 4 C Annual Cost The Total-Cost Curve is U-Shaped Holding cost Ordering Costs QO (optimal order quantity) Order Quantity (Q)

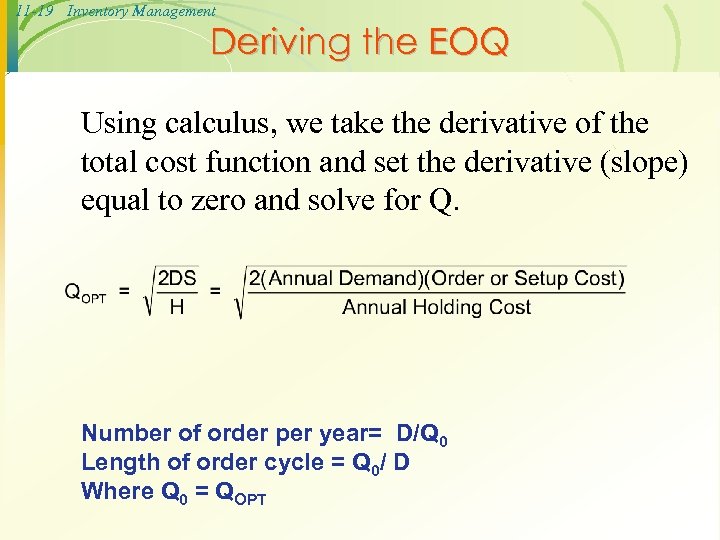

11 -19 Inventory Management Deriving the EOQ Using calculus, we take the derivative of the total cost function and set the derivative (slope) equal to zero and solve for Q. Number of order per year= D/Q 0 Length of order cycle = Q 0/ D Where Q 0 = QOPT

11 -19 Inventory Management Deriving the EOQ Using calculus, we take the derivative of the total cost function and set the derivative (slope) equal to zero and solve for Q. Number of order per year= D/Q 0 Length of order cycle = Q 0/ D Where Q 0 = QOPT

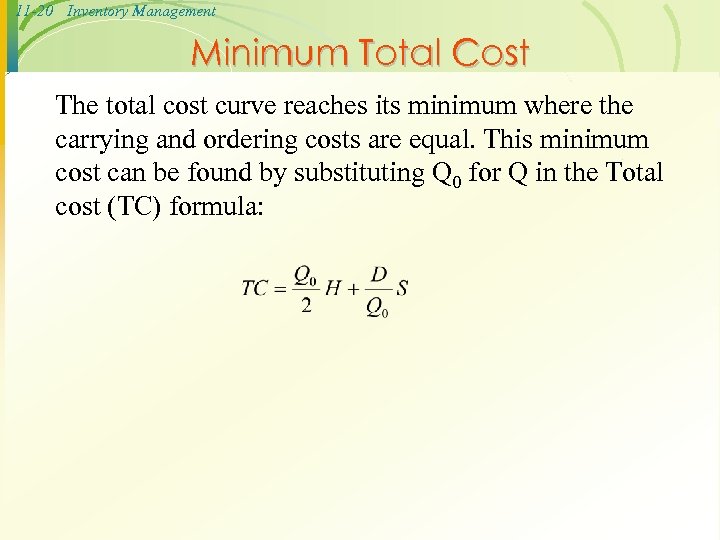

11 -20 Inventory Management Minimum Total Cost The total cost curve reaches its minimum where the carrying and ordering costs are equal. This minimum cost can be found by substituting Q 0 for Q in the Total cost (TC) formula:

11 -20 Inventory Management Minimum Total Cost The total cost curve reaches its minimum where the carrying and ordering costs are equal. This minimum cost can be found by substituting Q 0 for Q in the Total cost (TC) formula:

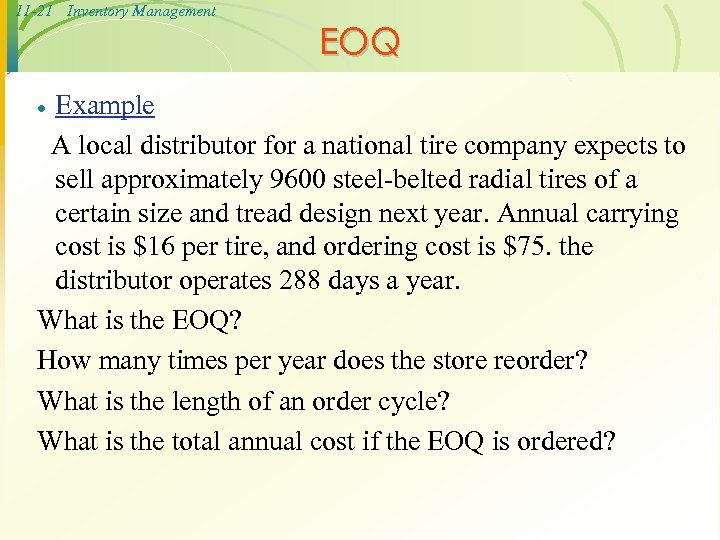

11 -21 Inventory Management EOQ Example A local distributor for a national tire company expects to sell approximately 9600 steel-belted radial tires of a certain size and tread design next year. Annual carrying cost is $16 per tire, and ordering cost is $75. the distributor operates 288 days a year. What is the EOQ? How many times per year does the store reorder? What is the length of an order cycle? What is the total annual cost if the EOQ is ordered? ·

11 -21 Inventory Management EOQ Example A local distributor for a national tire company expects to sell approximately 9600 steel-belted radial tires of a certain size and tread design next year. Annual carrying cost is $16 per tire, and ordering cost is $75. the distributor operates 288 days a year. What is the EOQ? How many times per year does the store reorder? What is the length of an order cycle? What is the total annual cost if the EOQ is ordered? ·

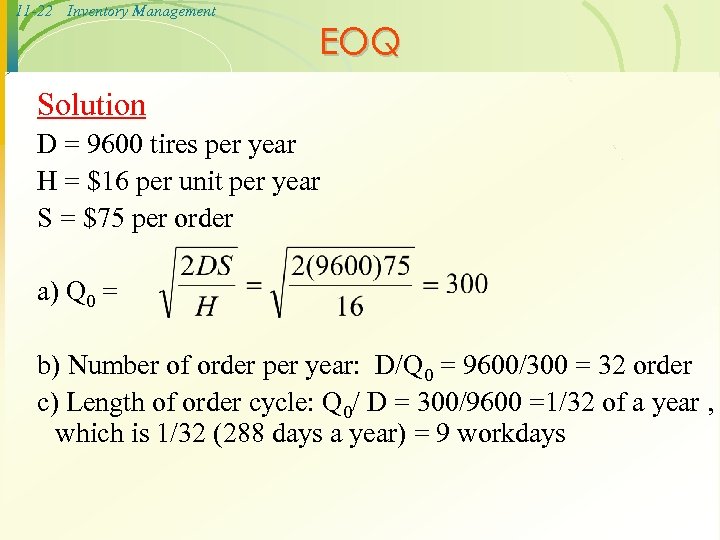

11 -22 Inventory Management EOQ Solution D = 9600 tires per year H = $16 per unit per year S = $75 per order a) Q 0 = b) Number of order per year: D/Q 0 = 9600/300 = 32 order c) Length of order cycle: Q 0/ D = 300/9600 =1/32 of a year , which is 1/32 (288 days a year) = 9 workdays

11 -22 Inventory Management EOQ Solution D = 9600 tires per year H = $16 per unit per year S = $75 per order a) Q 0 = b) Number of order per year: D/Q 0 = 9600/300 = 32 order c) Length of order cycle: Q 0/ D = 300/9600 =1/32 of a year , which is 1/32 (288 days a year) = 9 workdays

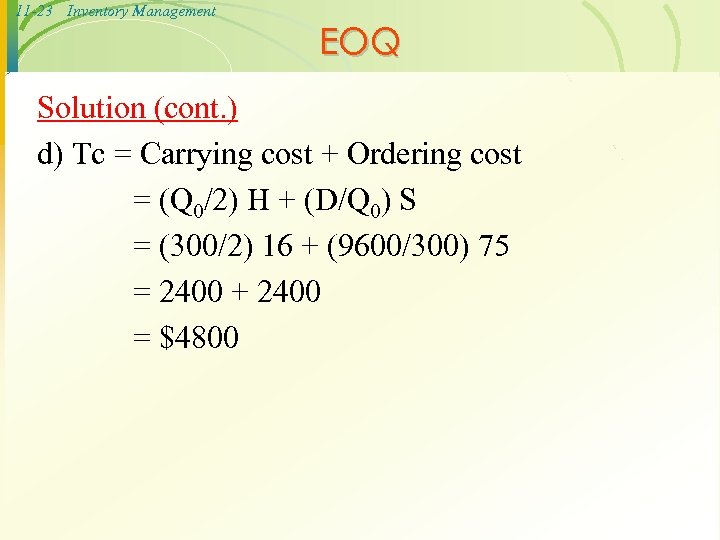

11 -23 Inventory Management EOQ Solution (cont. ) d) Tc = Carrying cost + Ordering cost = (Q 0/2) H + (D/Q 0) S = (300/2) 16 + (9600/300) 75 = 2400 + 2400 = $4800

11 -23 Inventory Management EOQ Solution (cont. ) d) Tc = Carrying cost + Ordering cost = (Q 0/2) H + (D/Q 0) S = (300/2) 16 + (9600/300) 75 = 2400 + 2400 = $4800

11 -24 Inventory Management Economic Production Quantity (EPQ) Production done in batches or lots · Capacity to produce a part exceeds the part’s usage or demand rate · Assumptions of EPQ are similar to EOQ except orders are received incrementally during production ·

11 -24 Inventory Management Economic Production Quantity (EPQ) Production done in batches or lots · Capacity to produce a part exceeds the part’s usage or demand rate · Assumptions of EPQ are similar to EOQ except orders are received incrementally during production ·

11 -25 Inventory Management Economic Production Quantity Assumptions Only one item is involved · Annual demand is known · Usage rate is constant · Usage occurs continually, but production occurs periodically · Production rate is constant · Lead time does not vary · No quantity discounts ·

11 -25 Inventory Management Economic Production Quantity Assumptions Only one item is involved · Annual demand is known · Usage rate is constant · Usage occurs continually, but production occurs periodically · Production rate is constant · Lead time does not vary · No quantity discounts ·

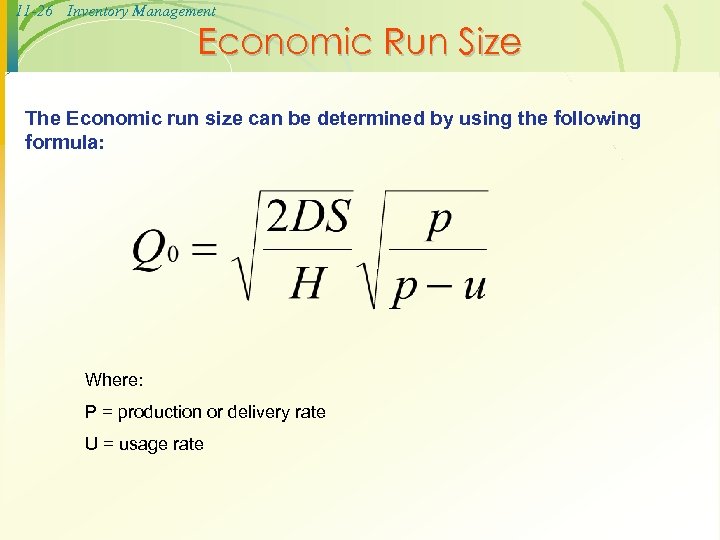

11 -26 Inventory Management Economic Run Size The Economic run size can be determined by using the following formula: Where: P = production or delivery rate U = usage rate

11 -26 Inventory Management Economic Run Size The Economic run size can be determined by using the following formula: Where: P = production or delivery rate U = usage rate

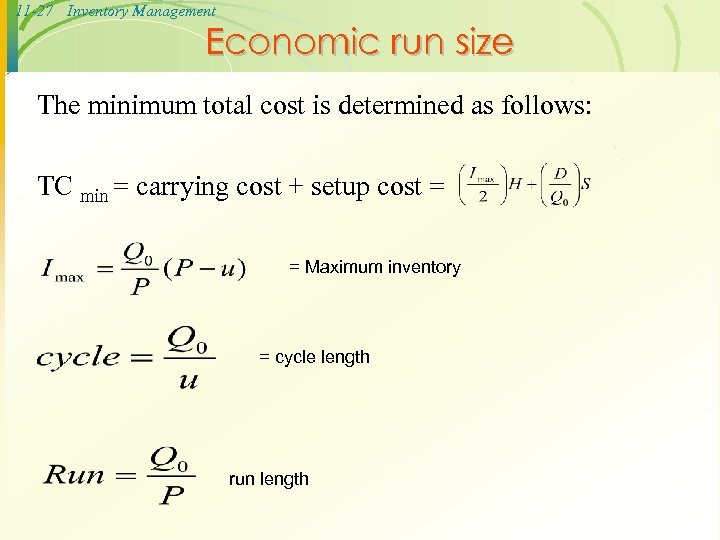

11 -27 Inventory Management Economic run size The minimum total cost is determined as follows: TC min = carrying cost + setup cost = = Maximum inventory = cycle length run length

11 -27 Inventory Management Economic run size The minimum total cost is determined as follows: TC min = carrying cost + setup cost = = Maximum inventory = cycle length run length

11 -28 Inventory Management · a. b. c. Example A toy manufacturer uses 48000 rubber wheels per year for its popular dump truck series. The firm makes its own wheels, which it can produce at rate of 800 per day. The toy trucks are assembled uniformly over the entire year. Carrying cost is $1 per wheel a year. Setup cost for a production run of wheels is $45. the firm operates 240 days per year. Determine the Optimal run size Minimum total annual cost for carrying and setup Run time

11 -28 Inventory Management · a. b. c. Example A toy manufacturer uses 48000 rubber wheels per year for its popular dump truck series. The firm makes its own wheels, which it can produce at rate of 800 per day. The toy trucks are assembled uniformly over the entire year. Carrying cost is $1 per wheel a year. Setup cost for a production run of wheels is $45. the firm operates 240 days per year. Determine the Optimal run size Minimum total annual cost for carrying and setup Run time

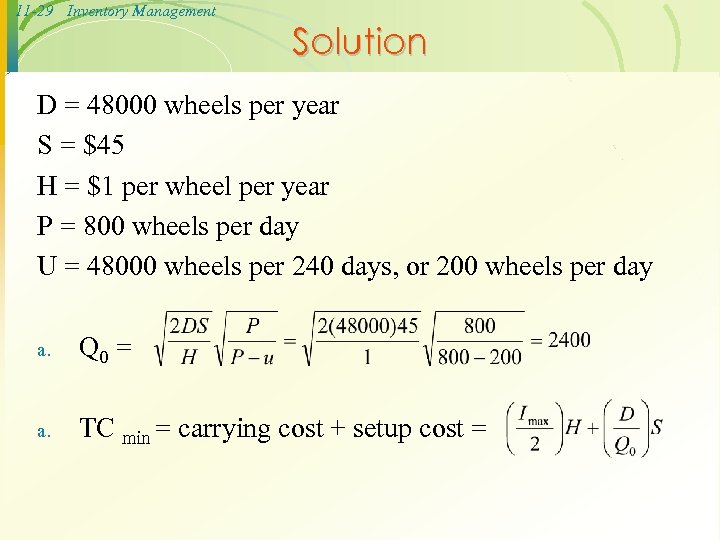

11 -29 Inventory Management Solution D = 48000 wheels per year S = $45 H = $1 per wheel per year P = 800 wheels per day U = 48000 wheels per 240 days, or 200 wheels per day a. Q 0 = a. TC min = carrying cost + setup cost =

11 -29 Inventory Management Solution D = 48000 wheels per year S = $45 H = $1 per wheel per year P = 800 wheels per day U = 48000 wheels per 240 days, or 200 wheels per day a. Q 0 = a. TC min = carrying cost + setup cost =

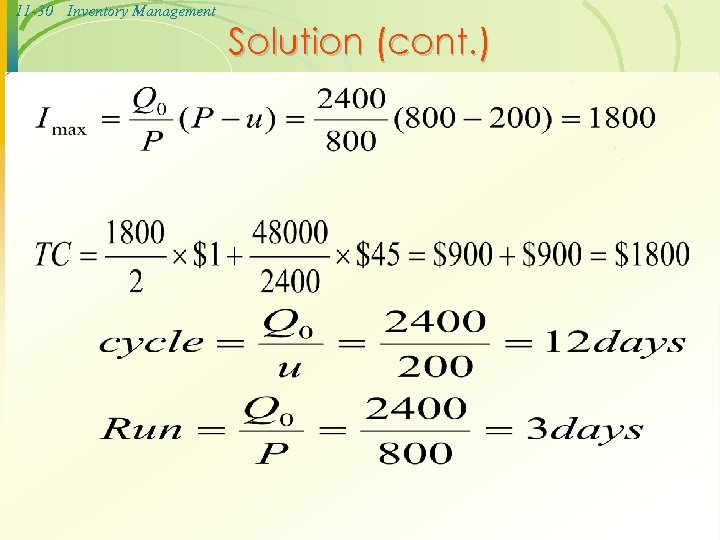

11 -30 Inventory Management Solution (cont. )

11 -30 Inventory Management Solution (cont. )

11 -31 Inventory Management Quantity discount model · · · Quantity discounts are price reductions for large orders offered to customers to induce them to buy in large quantities. In this case the price per unit decreases as order quantity increases. If the quantity discounts are offered, the buyer must weigh the potential benefits of reduced purchase price and fewer orders that will result from buying in large quantities against the increase in carrying cost caused by higher average inventories. The buyer’s goal with quantity discounts is to select the order quantity that will minimize the total cost, where the total cost is the sum of carrying cost, ordering cost, and purchasing (i. e. , product) cost.

11 -31 Inventory Management Quantity discount model · · · Quantity discounts are price reductions for large orders offered to customers to induce them to buy in large quantities. In this case the price per unit decreases as order quantity increases. If the quantity discounts are offered, the buyer must weigh the potential benefits of reduced purchase price and fewer orders that will result from buying in large quantities against the increase in carrying cost caused by higher average inventories. The buyer’s goal with quantity discounts is to select the order quantity that will minimize the total cost, where the total cost is the sum of carrying cost, ordering cost, and purchasing (i. e. , product) cost.

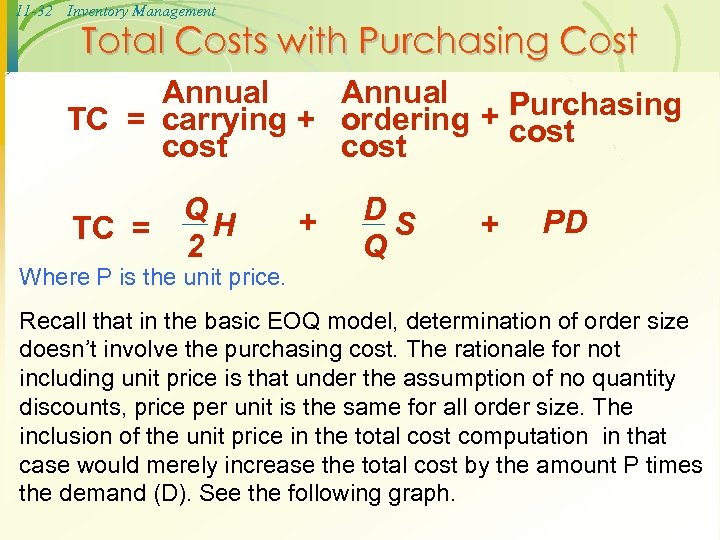

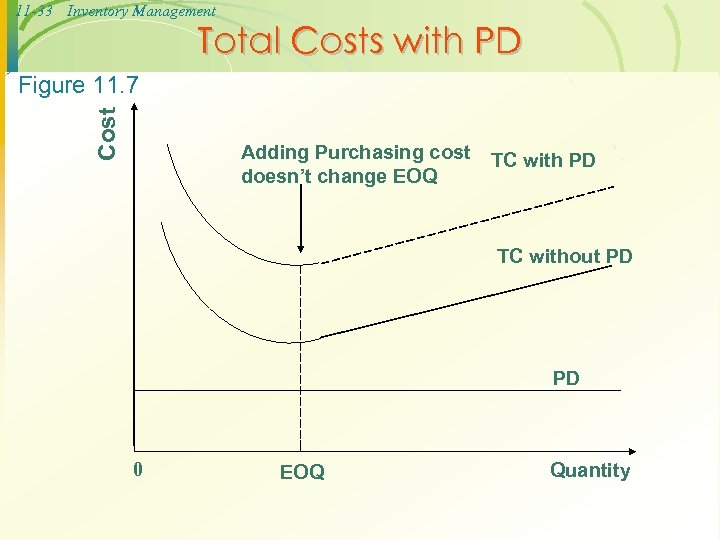

11 -32 Inventory Management Total Costs with Purchasing Cost Annual + Purchasing TC = carrying + ordering cost Q H TC = 2 Where P is the unit price. + DS Q + PD Recall that in the basic EOQ model, determination of order size doesn’t involve the purchasing cost. The rationale for not including unit price is that under the assumption of no quantity discounts, price per unit is the same for all order size. The inclusion of the unit price in the total cost computation in that case would merely increase the total cost by the amount P times the demand (D). See the following graph.

11 -32 Inventory Management Total Costs with Purchasing Cost Annual + Purchasing TC = carrying + ordering cost Q H TC = 2 Where P is the unit price. + DS Q + PD Recall that in the basic EOQ model, determination of order size doesn’t involve the purchasing cost. The rationale for not including unit price is that under the assumption of no quantity discounts, price per unit is the same for all order size. The inclusion of the unit price in the total cost computation in that case would merely increase the total cost by the amount P times the demand (D). See the following graph.

11 -33 Inventory Management Total Costs with PD Cost Figure 11. 7 Adding Purchasing cost doesn’t change EOQ TC with PD TC without PD PD 0 EOQ Quantity

11 -33 Inventory Management Total Costs with PD Cost Figure 11. 7 Adding Purchasing cost doesn’t change EOQ TC with PD TC without PD PD 0 EOQ Quantity

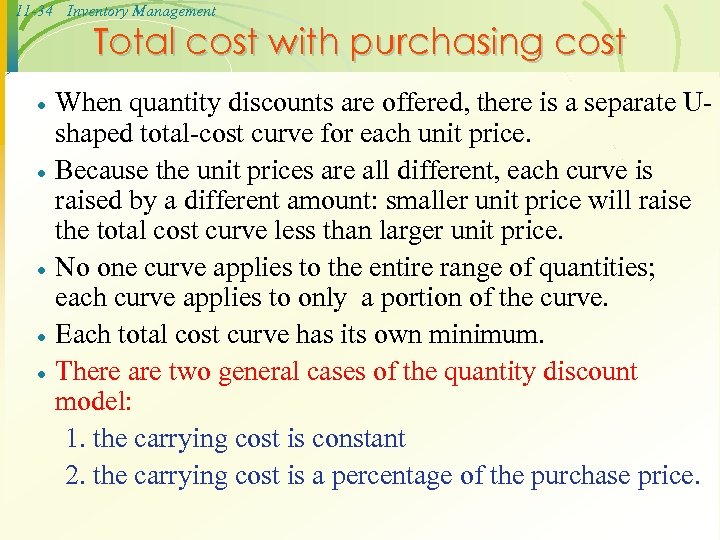

11 -34 Inventory Management Total cost with purchasing cost · · · When quantity discounts are offered, there is a separate Ushaped total-cost curve for each unit price. Because the unit prices are all different, each curve is raised by a different amount: smaller unit price will raise the total cost curve less than larger unit price. No one curve applies to the entire range of quantities; each curve applies to only a portion of the curve. Each total cost curve has its own minimum. There are two general cases of the quantity discount model: 1. the carrying cost is constant 2. the carrying cost is a percentage of the purchase price.

11 -34 Inventory Management Total cost with purchasing cost · · · When quantity discounts are offered, there is a separate Ushaped total-cost curve for each unit price. Because the unit prices are all different, each curve is raised by a different amount: smaller unit price will raise the total cost curve less than larger unit price. No one curve applies to the entire range of quantities; each curve applies to only a portion of the curve. Each total cost curve has its own minimum. There are two general cases of the quantity discount model: 1. the carrying cost is constant 2. the carrying cost is a percentage of the purchase price.

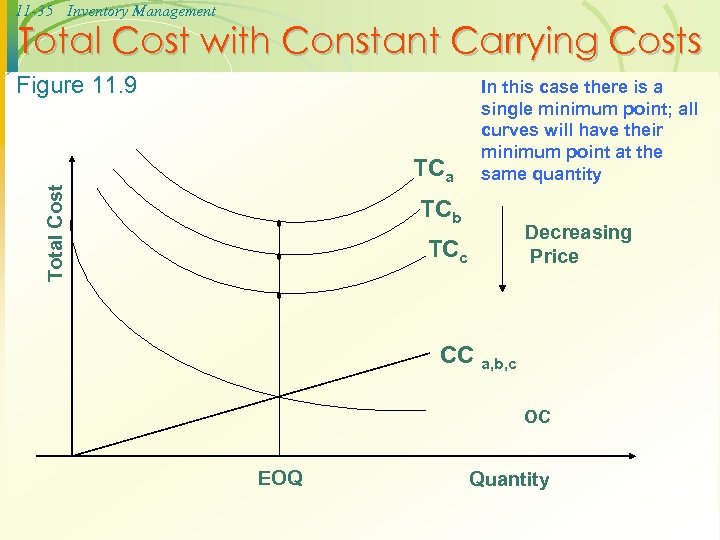

11 -35 Inventory Management Total Cost with Constant Carrying Costs Figure 11. 9 Total Cost TCa In this case there is a single minimum point; all curves will have their minimum point at the same quantity TCb Decreasing Price TCc CC a, b, c OC EOQ Quantity

11 -35 Inventory Management Total Cost with Constant Carrying Costs Figure 11. 9 Total Cost TCa In this case there is a single minimum point; all curves will have their minimum point at the same quantity TCb Decreasing Price TCc CC a, b, c OC EOQ Quantity

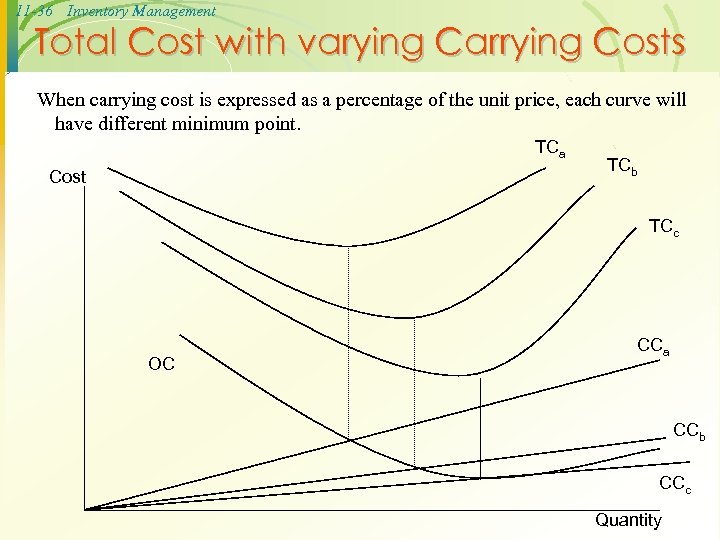

11 -36 Inventory Management Total Cost with varying Carrying Costs When carrying cost is expressed as a percentage of the unit price, each curve will have different minimum point. TCa Cost TCb TCc OC CCa CCb CCc Quantity

11 -36 Inventory Management Total Cost with varying Carrying Costs When carrying cost is expressed as a percentage of the unit price, each curve will have different minimum point. TCa Cost TCb TCc OC CCa CCb CCc Quantity

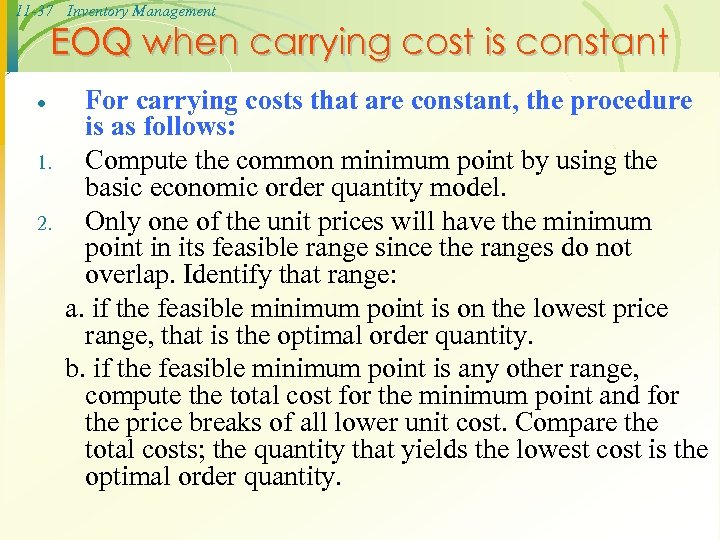

11 -37 Inventory Management EOQ when carrying cost is constant · 1. 2. For carrying costs that are constant, the procedure is as follows: Compute the common minimum point by using the basic economic order quantity model. Only one of the unit prices will have the minimum point in its feasible range since the ranges do not overlap. Identify that range: a. if the feasible minimum point is on the lowest price range, that is the optimal order quantity. b. if the feasible minimum point is any other range, compute the total cost for the minimum point and for the price breaks of all lower unit cost. Compare the total costs; the quantity that yields the lowest cost is the optimal order quantity.

11 -37 Inventory Management EOQ when carrying cost is constant · 1. 2. For carrying costs that are constant, the procedure is as follows: Compute the common minimum point by using the basic economic order quantity model. Only one of the unit prices will have the minimum point in its feasible range since the ranges do not overlap. Identify that range: a. if the feasible minimum point is on the lowest price range, that is the optimal order quantity. b. if the feasible minimum point is any other range, compute the total cost for the minimum point and for the price breaks of all lower unit cost. Compare the total costs; the quantity that yields the lowest cost is the optimal order quantity.

11 -38 Inventory Management Example the maintenance department of a large hospital uses about 816 cases of liquid cleanser annually. Ordering costs are $12, carrying costs are $4 per case a year, and the new price schedule indicates that orders of less than 50 cases will cost $20 per case, 50 to 79 cases will cost $18 per case, 80 to 99 cases will cost $17 per case. And larger orders will cost $16 per case. Determine the optimal order quantity and the total cost.

11 -38 Inventory Management Example the maintenance department of a large hospital uses about 816 cases of liquid cleanser annually. Ordering costs are $12, carrying costs are $4 per case a year, and the new price schedule indicates that orders of less than 50 cases will cost $20 per case, 50 to 79 cases will cost $18 per case, 80 to 99 cases will cost $17 per case. And larger orders will cost $16 per case. Determine the optimal order quantity and the total cost.

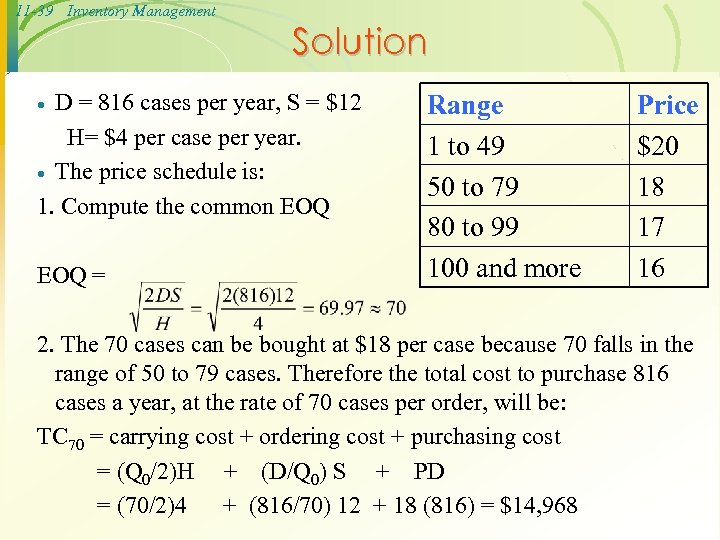

11 -39 Inventory Management Solution D = 816 cases per year, S = $12 H= $4 per case per year. · The price schedule is: 1. Compute the common EOQ · EOQ = Range 1 to 49 50 to 79 80 to 99 100 and more Price $20 18 17 16 2. The 70 cases can be bought at $18 per case because 70 falls in the range of 50 to 79 cases. Therefore the total cost to purchase 816 cases a year, at the rate of 70 cases per order, will be: TC 70 = carrying cost + ordering cost + purchasing cost = (Q 0/2)H + (D/Q 0) S + PD = (70/2)4 + (816/70) 12 + 18 (816) = $14, 968

11 -39 Inventory Management Solution D = 816 cases per year, S = $12 H= $4 per case per year. · The price schedule is: 1. Compute the common EOQ · EOQ = Range 1 to 49 50 to 79 80 to 99 100 and more Price $20 18 17 16 2. The 70 cases can be bought at $18 per case because 70 falls in the range of 50 to 79 cases. Therefore the total cost to purchase 816 cases a year, at the rate of 70 cases per order, will be: TC 70 = carrying cost + ordering cost + purchasing cost = (Q 0/2)H + (D/Q 0) S + PD = (70/2)4 + (816/70) 12 + 18 (816) = $14, 968

11 -40 Inventory Management Solution (cont. ) Because lower cost ranges exist, each must be checked against the minimum total cost generated by 70 cases at $18 each. In order to buy at $17 per case, at least 80 cases must be purchased. The total cost at 80 cases will be: TC 80 = (80/2) 4 + (816/80)12 + 17(816) = $14, 154 · To obtain a cost of $16 per case, at least 100 cases per order are required and the total cost at that price break point will be: TC 100 = (100/2)4 + (816/100) 12 + 16(816) = $13, 354 · Therefore, because 100 cases per order yield the lowest cost, 100 cases is the overall optimal order quantity.

11 -40 Inventory Management Solution (cont. ) Because lower cost ranges exist, each must be checked against the minimum total cost generated by 70 cases at $18 each. In order to buy at $17 per case, at least 80 cases must be purchased. The total cost at 80 cases will be: TC 80 = (80/2) 4 + (816/80)12 + 17(816) = $14, 154 · To obtain a cost of $16 per case, at least 100 cases per order are required and the total cost at that price break point will be: TC 100 = (100/2)4 + (816/100) 12 + 16(816) = $13, 354 · Therefore, because 100 cases per order yield the lowest cost, 100 cases is the overall optimal order quantity.

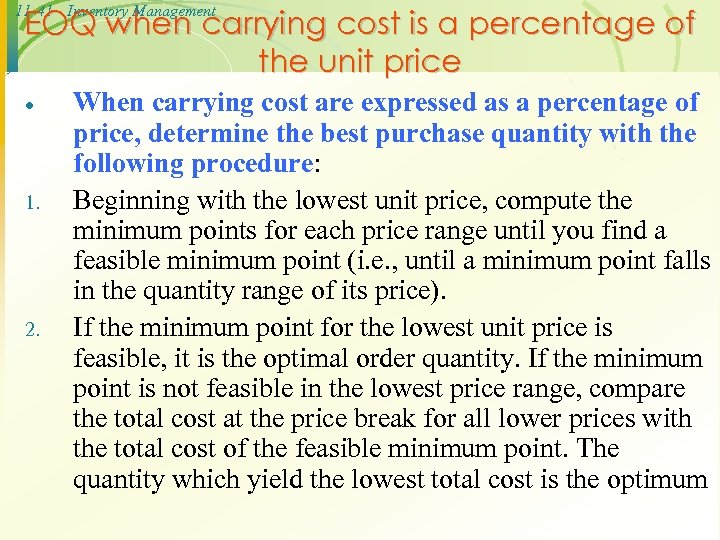

11 -41 Inventory Management EOQ when carrying cost is a percentage of the unit price · 1. 2. When carrying cost are expressed as a percentage of price, determine the best purchase quantity with the following procedure: Beginning with the lowest unit price, compute the minimum points for each price range until you find a feasible minimum point (i. e. , until a minimum point falls in the quantity range of its price). If the minimum point for the lowest unit price is feasible, it is the optimal order quantity. If the minimum point is not feasible in the lowest price range, compare the total cost at the price break for all lower prices with the total cost of the feasible minimum point. The quantity which yield the lowest total cost is the optimum

11 -41 Inventory Management EOQ when carrying cost is a percentage of the unit price · 1. 2. When carrying cost are expressed as a percentage of price, determine the best purchase quantity with the following procedure: Beginning with the lowest unit price, compute the minimum points for each price range until you find a feasible minimum point (i. e. , until a minimum point falls in the quantity range of its price). If the minimum point for the lowest unit price is feasible, it is the optimal order quantity. If the minimum point is not feasible in the lowest price range, compare the total cost at the price break for all lower prices with the total cost of the feasible minimum point. The quantity which yield the lowest total cost is the optimum

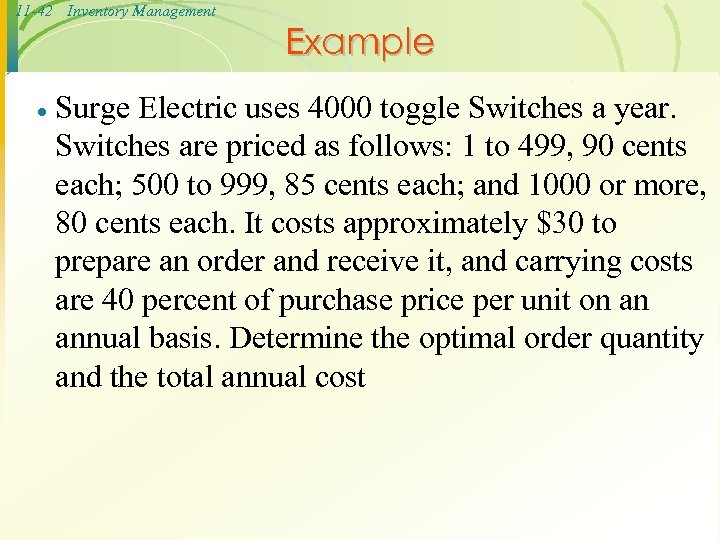

11 -42 Inventory Management · Example Surge Electric uses 4000 toggle Switches a year. Switches are priced as follows: 1 to 499, 90 cents each; 500 to 999, 85 cents each; and 1000 or more, 80 cents each. It costs approximately $30 to prepare an order and receive it, and carrying costs are 40 percent of purchase price per unit on an annual basis. Determine the optimal order quantity and the total annual cost

11 -42 Inventory Management · Example Surge Electric uses 4000 toggle Switches a year. Switches are priced as follows: 1 to 499, 90 cents each; 500 to 999, 85 cents each; and 1000 or more, 80 cents each. It costs approximately $30 to prepare an order and receive it, and carrying costs are 40 percent of purchase price per unit on an annual basis. Determine the optimal order quantity and the total annual cost

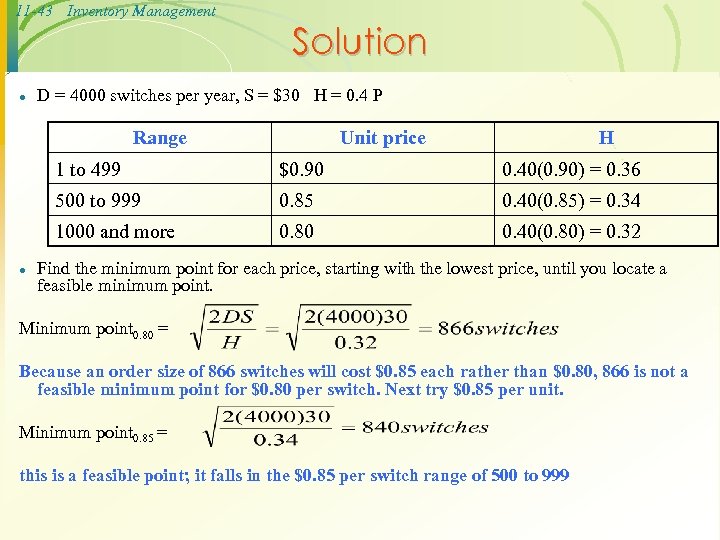

11 -43 Inventory Management · Solution D = 4000 switches per year, S = $30 H = 0. 4 P Range Unit price H 1 to 499 0. 40(0. 90) = 0. 36 500 to 999 0. 85 0. 40(0. 85) = 0. 34 1000 and more · $0. 90 0. 80 0. 40(0. 80) = 0. 32 Find the minimum point for each price, starting with the lowest price, until you locate a feasible minimum point. Minimum point 0. 80 = Because an order size of 866 switches will cost $0. 85 each rather than $0. 80, 866 is not a feasible minimum point for $0. 80 per switch. Next try $0. 85 per unit. Minimum point 0. 85 = this is a feasible point; it falls in the $0. 85 per switch range of 500 to 999

11 -43 Inventory Management · Solution D = 4000 switches per year, S = $30 H = 0. 4 P Range Unit price H 1 to 499 0. 40(0. 90) = 0. 36 500 to 999 0. 85 0. 40(0. 85) = 0. 34 1000 and more · $0. 90 0. 80 0. 40(0. 80) = 0. 32 Find the minimum point for each price, starting with the lowest price, until you locate a feasible minimum point. Minimum point 0. 80 = Because an order size of 866 switches will cost $0. 85 each rather than $0. 80, 866 is not a feasible minimum point for $0. 80 per switch. Next try $0. 85 per unit. Minimum point 0. 85 = this is a feasible point; it falls in the $0. 85 per switch range of 500 to 999

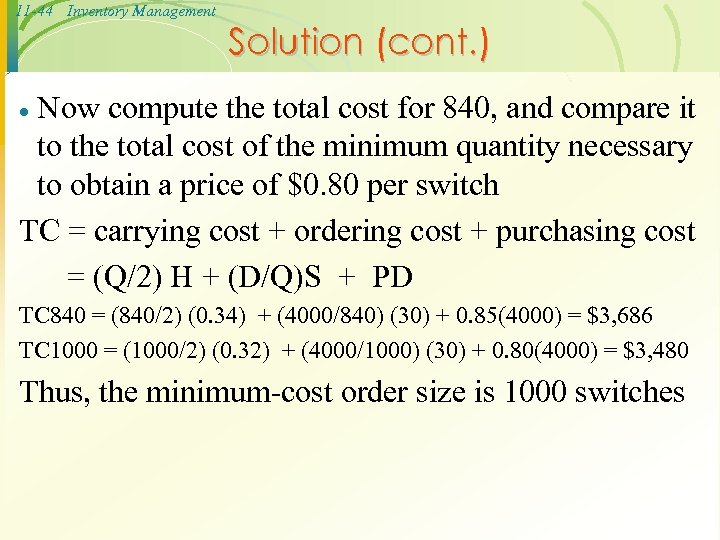

11 -44 Inventory Management Solution (cont. ) Now compute the total cost for 840, and compare it to the total cost of the minimum quantity necessary to obtain a price of $0. 80 per switch TC = carrying cost + ordering cost + purchasing cost = (Q/2) H + (D/Q)S + PD · TC 840 = (840/2) (0. 34) + (4000/840) (30) + 0. 85(4000) = $3, 686 TC 1000 = (1000/2) (0. 32) + (4000/1000) (30) + 0. 80(4000) = $3, 480 Thus, the minimum-cost order size is 1000 switches

11 -44 Inventory Management Solution (cont. ) Now compute the total cost for 840, and compare it to the total cost of the minimum quantity necessary to obtain a price of $0. 80 per switch TC = carrying cost + ordering cost + purchasing cost = (Q/2) H + (D/Q)S + PD · TC 840 = (840/2) (0. 34) + (4000/840) (30) + 0. 85(4000) = $3, 686 TC 1000 = (1000/2) (0. 32) + (4000/1000) (30) + 0. 80(4000) = $3, 480 Thus, the minimum-cost order size is 1000 switches

11 -45 Inventory Management When to Reorder with EOQ Ordering · · The EOQ models answer the equation of how much to order, but not the question of when to order. The latter is the function of models that identify the reorder point (ROP) in terms of a quantity: the reorder point occurs when the quantity on hand drops to predetermined amount. That amount generally includes expected demand during lead time and perhaps an extra cushion of stock, which serves to reduce the probability of experiencing a stockout during lead time. In order to know when the reorder point has been reached, a perpetual inventory is required. The goal of ordering is to place an order when the amount of inventory on hand is sufficient to satisfy demand during the time it takes to receive that order (i. e. , lead time)

11 -45 Inventory Management When to Reorder with EOQ Ordering · · The EOQ models answer the equation of how much to order, but not the question of when to order. The latter is the function of models that identify the reorder point (ROP) in terms of a quantity: the reorder point occurs when the quantity on hand drops to predetermined amount. That amount generally includes expected demand during lead time and perhaps an extra cushion of stock, which serves to reduce the probability of experiencing a stockout during lead time. In order to know when the reorder point has been reached, a perpetual inventory is required. The goal of ordering is to place an order when the amount of inventory on hand is sufficient to satisfy demand during the time it takes to receive that order (i. e. , lead time)

11 -46 Inventory Management When to Reorder with EOQ Ordering · Reorder Point - When the quantity on hand of an item drops to this amount, the item is reordered · Safety Stock - Stock that is held in excess of expected demand due to variable demand rate and/or lead time. · Service Level - Probability that demand will not exceed supply during lead time.

11 -46 Inventory Management When to Reorder with EOQ Ordering · Reorder Point - When the quantity on hand of an item drops to this amount, the item is reordered · Safety Stock - Stock that is held in excess of expected demand due to variable demand rate and/or lead time. · Service Level - Probability that demand will not exceed supply during lead time.

11 -47 Inventory Management Determinants of the Reorder Point The rate of demand (usually based on a forecast) · The lead time · Demand and/or lead time variability · Stockout risk (safety stock) If the demand lead time are both constant, the reorder point is simply: ROP = d × LT Where: d = demand rate (units per day or week) LT = lead time in days or weeks Note that demand lead time must be expressed in the same time units. ·

11 -47 Inventory Management Determinants of the Reorder Point The rate of demand (usually based on a forecast) · The lead time · Demand and/or lead time variability · Stockout risk (safety stock) If the demand lead time are both constant, the reorder point is simply: ROP = d × LT Where: d = demand rate (units per day or week) LT = lead time in days or weeks Note that demand lead time must be expressed in the same time units. ·

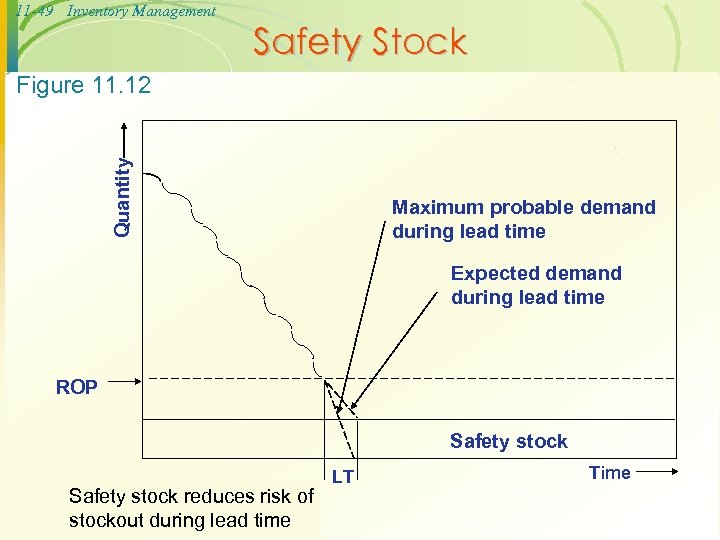

11 -48 Inventory Management · When to reorder When variability is present in demand or lead time, it creates the possibility that actual demand will exceed expected demand. Consequently, it becomes necessary to carry additional inventory, called “safety stock”, to reduce the risk of running out of stock during lead time. The reorder point then increases by the amount of the safety stock: ROP = expected demand during lead time + safety stock The following graph shows how safety stock can reduce the risk of stock out during lead time

11 -48 Inventory Management · When to reorder When variability is present in demand or lead time, it creates the possibility that actual demand will exceed expected demand. Consequently, it becomes necessary to carry additional inventory, called “safety stock”, to reduce the risk of running out of stock during lead time. The reorder point then increases by the amount of the safety stock: ROP = expected demand during lead time + safety stock The following graph shows how safety stock can reduce the risk of stock out during lead time

11 -49 Inventory Management Safety Stock Quantity Figure 11. 12 Maximum probable demand during lead time Expected demand during lead time ROP Safety stock reduces risk of stockout during lead time LT Time

11 -49 Inventory Management Safety Stock Quantity Figure 11. 12 Maximum probable demand during lead time Expected demand during lead time ROP Safety stock reduces risk of stockout during lead time LT Time

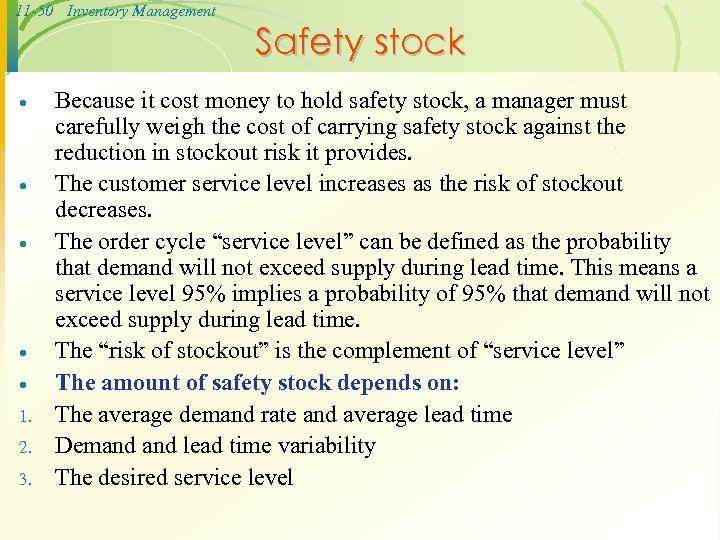

11 -50 Inventory Management · · · 1. 2. 3. Safety stock Because it cost money to hold safety stock, a manager must carefully weigh the cost of carrying safety stock against the reduction in stockout risk it provides. The customer service level increases as the risk of stockout decreases. The order cycle “service level” can be defined as the probability that demand will not exceed supply during lead time. This means a service level 95% implies a probability of 95% that demand will not exceed supply during lead time. The “risk of stockout” is the complement of “service level” The amount of safety stock depends on: The average demand rate and average lead time Demand lead time variability The desired service level

11 -50 Inventory Management · · · 1. 2. 3. Safety stock Because it cost money to hold safety stock, a manager must carefully weigh the cost of carrying safety stock against the reduction in stockout risk it provides. The customer service level increases as the risk of stockout decreases. The order cycle “service level” can be defined as the probability that demand will not exceed supply during lead time. This means a service level 95% implies a probability of 95% that demand will not exceed supply during lead time. The “risk of stockout” is the complement of “service level” The amount of safety stock depends on: The average demand rate and average lead time Demand lead time variability The desired service level

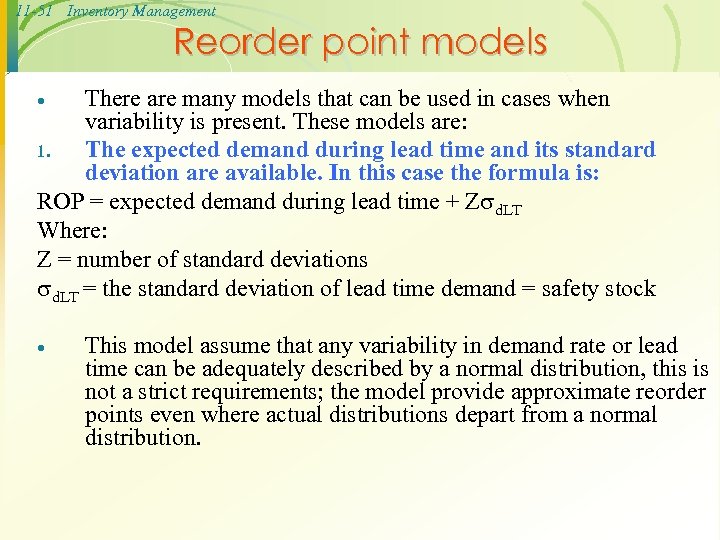

11 -51 Inventory Management Reorder point models There are many models that can be used in cases when variability is present. These models are: 1. The expected demand during lead time and its standard deviation are available. In this case the formula is: ROP = expected demand during lead time + Z d. LT Where: Z = number of standard deviations d. LT = the standard deviation of lead time demand = safety stock · · This model assume that any variability in demand rate or lead time can be adequately described by a normal distribution, this is not a strict requirements; the model provide approximate reorder points even where actual distributions depart from a normal distribution.

11 -51 Inventory Management Reorder point models There are many models that can be used in cases when variability is present. These models are: 1. The expected demand during lead time and its standard deviation are available. In this case the formula is: ROP = expected demand during lead time + Z d. LT Where: Z = number of standard deviations d. LT = the standard deviation of lead time demand = safety stock · · This model assume that any variability in demand rate or lead time can be adequately described by a normal distribution, this is not a strict requirements; the model provide approximate reorder points even where actual distributions depart from a normal distribution.

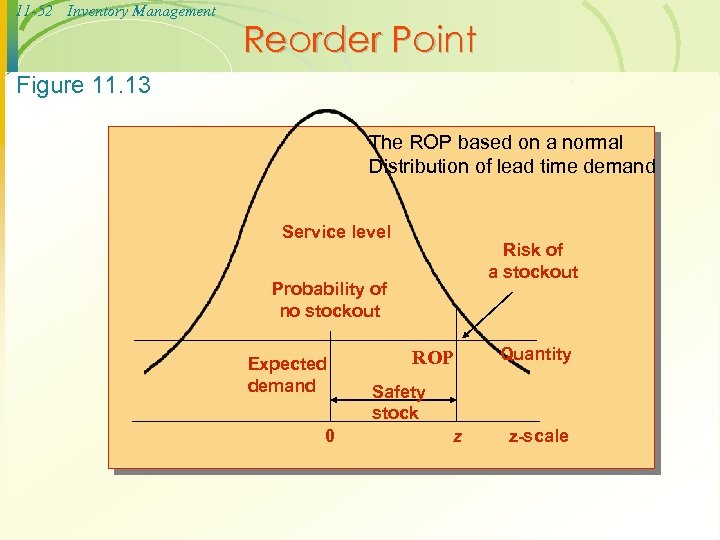

11 -52 Inventory Management Reorder Point Figure 11. 13 The ROP based on a normal Distribution of lead time demand Service level Risk of a stockout Probability of no stockout Expected demand 0 ROP Quantity Safety stock z z-scale

11 -52 Inventory Management Reorder Point Figure 11. 13 The ROP based on a normal Distribution of lead time demand Service level Risk of a stockout Probability of no stockout Expected demand 0 ROP Quantity Safety stock z z-scale

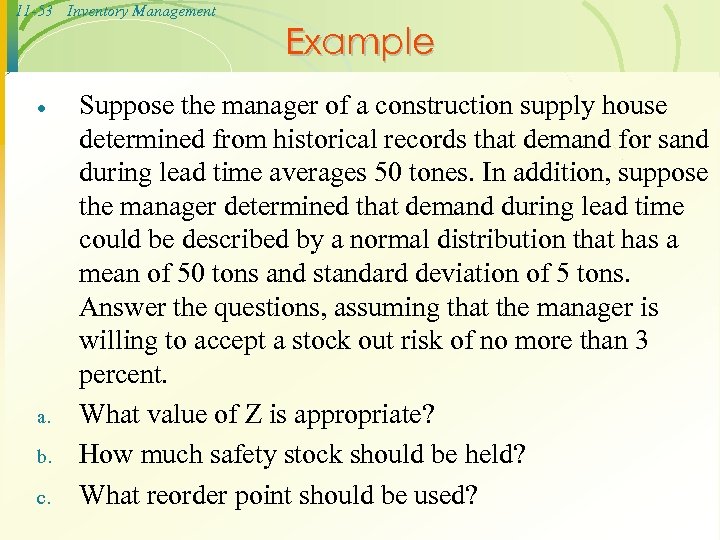

11 -53 Inventory Management · a. b. c. Example Suppose the manager of a construction supply house determined from historical records that demand for sand during lead time averages 50 tones. In addition, suppose the manager determined that demand during lead time could be described by a normal distribution that has a mean of 50 tons and standard deviation of 5 tons. Answer the questions, assuming that the manager is willing to accept a stock out risk of no more than 3 percent. What value of Z is appropriate? How much safety stock should be held? What reorder point should be used?

11 -53 Inventory Management · a. b. c. Example Suppose the manager of a construction supply house determined from historical records that demand for sand during lead time averages 50 tones. In addition, suppose the manager determined that demand during lead time could be described by a normal distribution that has a mean of 50 tons and standard deviation of 5 tons. Answer the questions, assuming that the manager is willing to accept a stock out risk of no more than 3 percent. What value of Z is appropriate? How much safety stock should be held? What reorder point should be used?

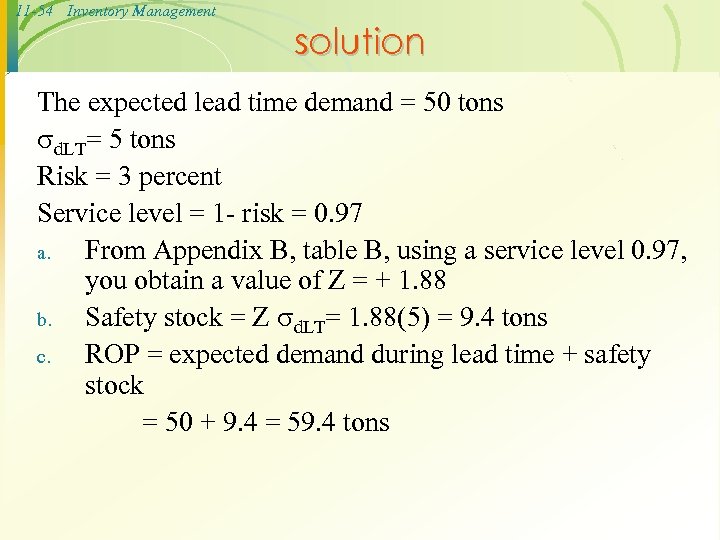

11 -54 Inventory Management solution The expected lead time demand = 50 tons d. LT= 5 tons Risk = 3 percent Service level = 1 - risk = 0. 97 a. From Appendix B, table B, using a service level 0. 97, you obtain a value of Z = + 1. 88 b. Safety stock = Z d. LT= 1. 88(5) = 9. 4 tons c. ROP = expected demand during lead time + safety stock = 50 + 9. 4 = 59. 4 tons

11 -54 Inventory Management solution The expected lead time demand = 50 tons d. LT= 5 tons Risk = 3 percent Service level = 1 - risk = 0. 97 a. From Appendix B, table B, using a service level 0. 97, you obtain a value of Z = + 1. 88 b. Safety stock = Z d. LT= 1. 88(5) = 9. 4 tons c. ROP = expected demand during lead time + safety stock = 50 + 9. 4 = 59. 4 tons

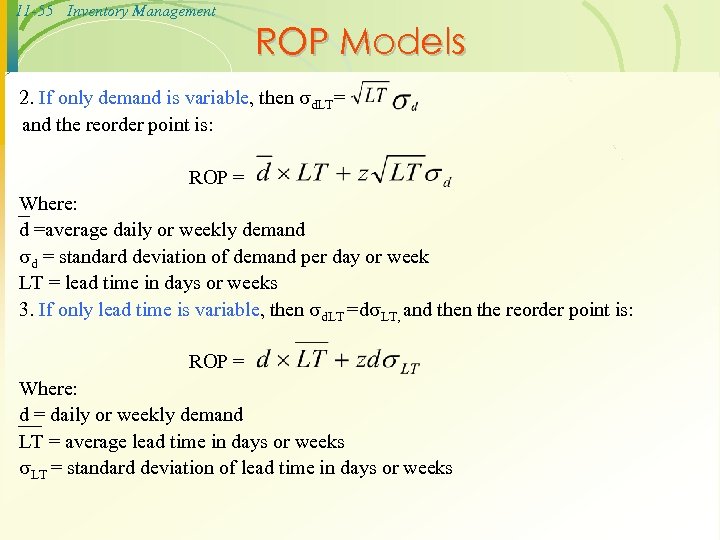

11 -55 Inventory Management ROP Models 2. If only demand is variable, then d. LT= and the reorder point is: ROP = Where: d =average daily or weekly demand d = standard deviation of demand per day or week LT = lead time in days or weeks 3. If only lead time is variable, then d. LT =d LT, and then the reorder point is: ROP = Where: d = daily or weekly demand LT = average lead time in days or weeks LT = standard deviation of lead time in days or weeks

11 -55 Inventory Management ROP Models 2. If only demand is variable, then d. LT= and the reorder point is: ROP = Where: d =average daily or weekly demand d = standard deviation of demand per day or week LT = lead time in days or weeks 3. If only lead time is variable, then d. LT =d LT, and then the reorder point is: ROP = Where: d = daily or weekly demand LT = average lead time in days or weeks LT = standard deviation of lead time in days or weeks

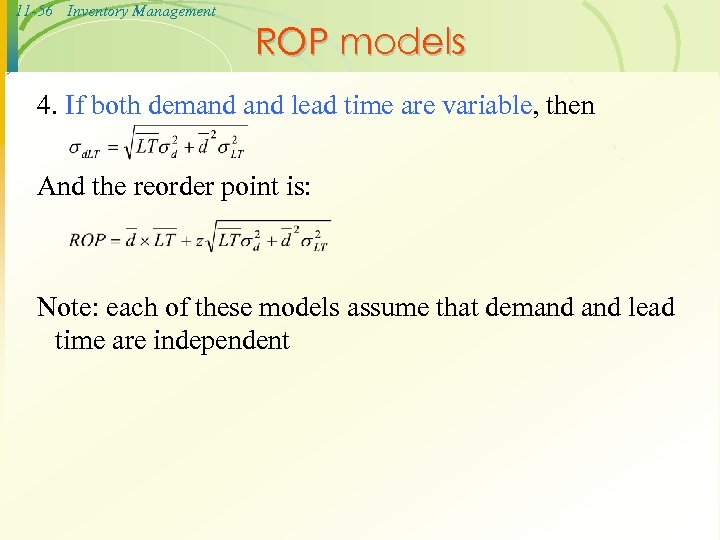

11 -56 Inventory Management ROP models 4. If both demand lead time are variable, then And the reorder point is: Note: each of these models assume that demand lead time are independent

11 -56 Inventory Management ROP models 4. If both demand lead time are variable, then And the reorder point is: Note: each of these models assume that demand lead time are independent

11 -57 Inventory Management · a. b. c. Example A restaurant uses an average of 50 jars of a special sauce each week. Weekly usage of sauce has a standard deviation of 3 jars. The manager is willing to accept no more than a 10 percent risk of stockout during lead time, which is two weeks. Assume the distribution of usage is normal. Which of the above formulas is appropriate for this situation? Why? Determine the value of z? Determine the ROP?

11 -57 Inventory Management · a. b. c. Example A restaurant uses an average of 50 jars of a special sauce each week. Weekly usage of sauce has a standard deviation of 3 jars. The manager is willing to accept no more than a 10 percent risk of stockout during lead time, which is two weeks. Assume the distribution of usage is normal. Which of the above formulas is appropriate for this situation? Why? Determine the value of z? Determine the ROP?

11 -58 Inventory Management Solution d = 50 jars/week, LT = 2 weeks, d = 3 jars/week Acceptable risk = 10 percent, so service level is 0. 90 a. Because only demand is variable ( i. e. , has a standard deviation) the second model is appropriate. b. From appendix B, table B, using a service level of 0. 90, you obtain z = 1. 28. c. ROP = = 50(2) + 1. 28 (3) = 100 + 5. 43 = 105. 43 Because the inventory is discrete units (jars) we round this amount to 106 (generally, round up. ) Note that a 2 -bin ordering system involves ROP re-ordering: the quantity in the second bin is equal to ROP

11 -58 Inventory Management Solution d = 50 jars/week, LT = 2 weeks, d = 3 jars/week Acceptable risk = 10 percent, so service level is 0. 90 a. Because only demand is variable ( i. e. , has a standard deviation) the second model is appropriate. b. From appendix B, table B, using a service level of 0. 90, you obtain z = 1. 28. c. ROP = = 50(2) + 1. 28 (3) = 100 + 5. 43 = 105. 43 Because the inventory is discrete units (jars) we round this amount to 106 (generally, round up. ) Note that a 2 -bin ordering system involves ROP re-ordering: the quantity in the second bin is equal to ROP

11 -59 Inventory Management Comment The logic of the last three formulas for the reorder point is as follows: 1. The first part of each formula is the expected demand, which is the product of daily (or weekly) demand the number of days (or weeks) of lead time. 2. The second part of the formula is z times the standard deviation of lead time demand, i. e. , the safety stock. ·

11 -59 Inventory Management Comment The logic of the last three formulas for the reorder point is as follows: 1. The first part of each formula is the expected demand, which is the product of daily (or weekly) demand the number of days (or weeks) of lead time. 2. The second part of the formula is z times the standard deviation of lead time demand, i. e. , the safety stock. ·