0b93fb6b09375410bd4246273ed10597.ppt

- Количество слайдов: 39

11 - 1

11 - 1

11 - 2 Financial Planning and Pro Forma Statements

11 - 2 Financial Planning and Pro Forma Statements

11 - 3 Steps in Financial Forecasting

11 - 3 Steps in Financial Forecasting

11 - 4 2002 Balance Sheet (Millions of $)

11 - 4 2002 Balance Sheet (Millions of $)

11 - 5 2002 Income Statement (Millions of $)

11 - 5 2002 Income Statement (Millions of $)

11 - 6 AFN (Additional Funds Needed): Key Assumptions

11 - 6 AFN (Additional Funds Needed): Key Assumptions

11 - 7 Definitions of Variables in AFN

11 - 7 Definitions of Variables in AFN

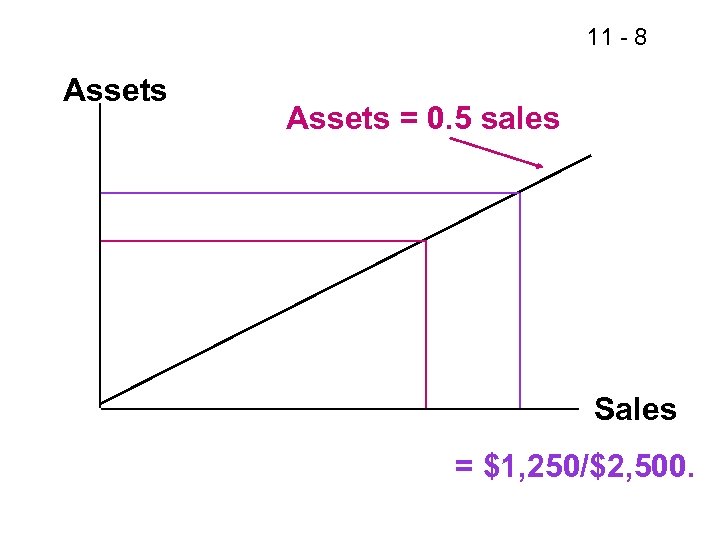

11 - 8 Assets = 0. 5 sales Sales = $1, 250/$2, 500.

11 - 8 Assets = 0. 5 sales Sales = $1, 250/$2, 500.

11 - 9 Assets must increase by $250 million. What is the AFN, based on the AFN equation?

11 - 9 Assets must increase by $250 million. What is the AFN, based on the AFN equation?

11 - 10 How would increases in these items affect the AFN?

11 - 10 How would increases in these items affect the AFN?

11 - 11

11 - 11

11 - 12 Projecting Pro Forma Statements with the Percent of Sales Method

11 - 12 Projecting Pro Forma Statements with the Percent of Sales Method

11 - 13

11 - 13

11 - 14 Sources of Financing Needed to Support Asset Requirements

11 - 14 Sources of Financing Needed to Support Asset Requirements

11 - 15 Implications of AFN

11 - 15 Implications of AFN

11 - 16 How to Forecast Interest Expense

11 - 16 How to Forecast Interest Expense

11 - 17 Basing Interest Expense on Debt at End of Year

11 - 17 Basing Interest Expense on Debt at End of Year

11 - 18 Basing Interest Expense on Debt at Beginning of Year

11 - 18 Basing Interest Expense on Debt at Beginning of Year

11 - 19 Basing Interest Expense on Average of Beginning and Ending Debt

11 - 19 Basing Interest Expense on Average of Beginning and Ending Debt

11 - 20 A Solution that Balances Accuracy and Complexity

11 - 20 A Solution that Balances Accuracy and Complexity

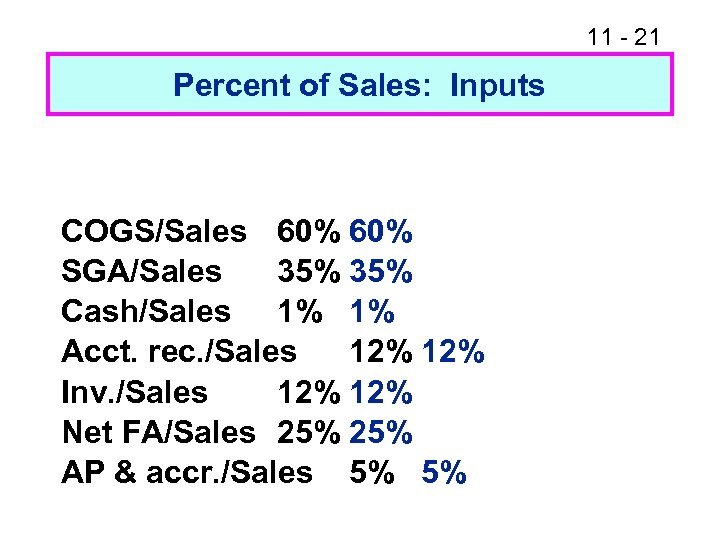

11 - 21 Percent of Sales: Inputs COGS/Sales 60% SGA/Sales 35% Cash/Sales 1% 1% Acct. rec. /Sales 12% Inv. /Sales 12% Net FA/Sales 25% AP & accr. /Sales 5% 5%

11 - 21 Percent of Sales: Inputs COGS/Sales 60% SGA/Sales 35% Cash/Sales 1% 1% Acct. rec. /Sales 12% Inv. /Sales 12% Net FA/Sales 25% AP & accr. /Sales 5% 5%

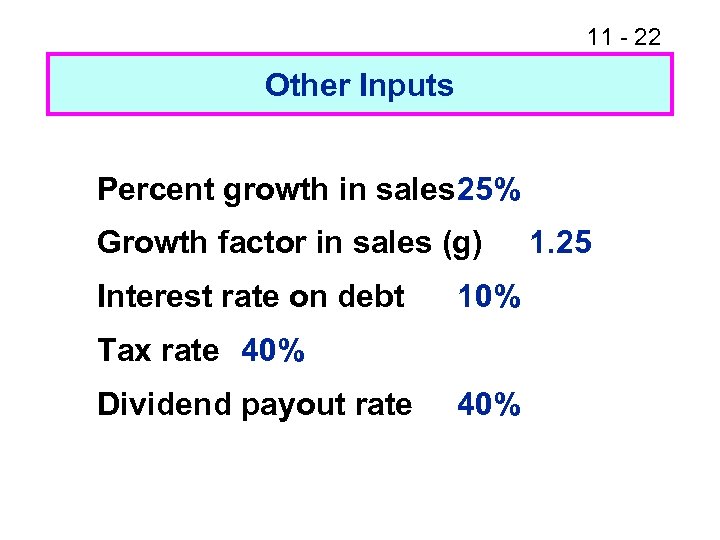

11 - 22 Other Inputs Percent growth in sales 25% Growth factor in sales (g) Interest rate on debt 10% Tax rate 40% Dividend payout rate 40% 1. 25

11 - 22 Other Inputs Percent growth in sales 25% Growth factor in sales (g) Interest rate on debt 10% Tax rate 40% Dividend payout rate 40% 1. 25

11 - 23 2003 Forecasted Income Statement

11 - 23 2003 Forecasted Income Statement

11 - 24 2003 Balance Sheet (Assets)

11 - 24 2003 Balance Sheet (Assets)

11 - 25

11 - 25

11 - 26 What are the additional funds needed (AFN)? NWC must have the assets to make forecasted sales, and so it needs an equal amount of financing. So, we must secure another $187. 2 of financing.

11 - 26 What are the additional funds needed (AFN)? NWC must have the assets to make forecasted sales, and so it needs an equal amount of financing. So, we must secure another $187. 2 of financing.

11 - 27 Assumptions about How AFN Will Be Raised

11 - 27 Assumptions about How AFN Will Be Raised

11 - 28 How will the AFN be financed? Additional notes payable = 0. 5 ($187. 2) = $93. 6. Additional L-T debt = 0. 5 ($187. 2) = $93. 6.

11 - 28 How will the AFN be financed? Additional notes payable = 0. 5 ($187. 2) = $93. 6. Additional L-T debt = 0. 5 ($187. 2) = $93. 6.

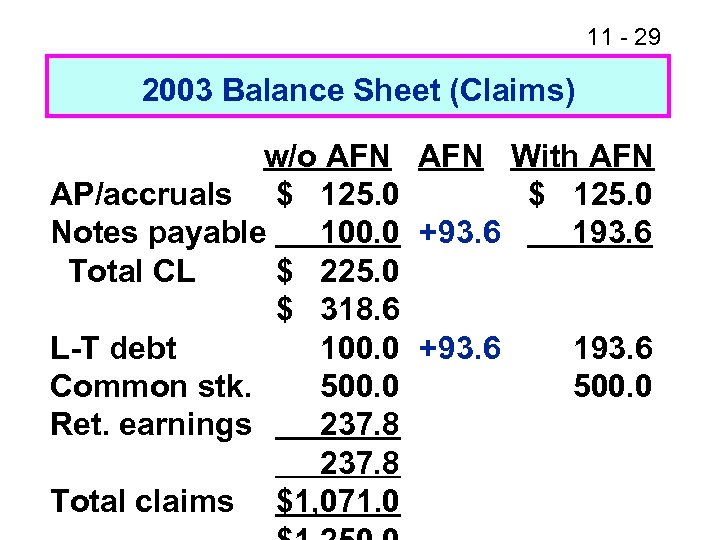

11 - 29 2003 Balance Sheet (Claims) w/o AFN With AFN AP/accruals $ 125. 0 Notes payable 100. 0 +93. 6 193. 6 Total CL $ 225. 0 $ 318. 6 L-T debt 100. 0 +93. 6 193. 6 Common stk. 500. 0 Ret. earnings 237. 8 Total claims $1, 071. 0

11 - 29 2003 Balance Sheet (Claims) w/o AFN With AFN AP/accruals $ 125. 0 Notes payable 100. 0 +93. 6 193. 6 Total CL $ 225. 0 $ 318. 6 L-T debt 100. 0 +93. 6 193. 6 Common stk. 500. 0 Ret. earnings 237. 8 Total claims $1, 071. 0

11 - 30 Equation AFN = $184. 5 vs. Pro Forma AFN = $187. 2. Why are they different?

11 - 30 Equation AFN = $184. 5 vs. Pro Forma AFN = $187. 2. Why are they different?

11 - 31 Forecasted Ratios

11 - 31 Forecasted Ratios

11 - 32 What are the forecasted free cash flow and ROIC?

11 - 32 What are the forecasted free cash flow and ROIC?

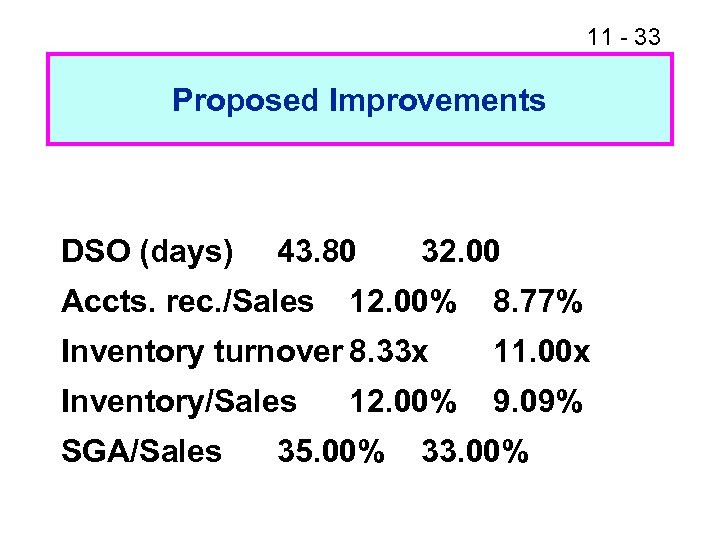

11 - 33 Proposed Improvements DSO (days) 43. 80 Accts. rec. /Sales 32. 00 12. 00% 8. 77% Inventory turnover 8. 33 x 11. 00 x Inventory/Sales 9. 09% SGA/Sales 12. 00% 35. 00% 33. 00%

11 - 33 Proposed Improvements DSO (days) 43. 80 Accts. rec. /Sales 32. 00 12. 00% 8. 77% Inventory turnover 8. 33 x 11. 00 x Inventory/Sales 9. 09% SGA/Sales 12. 00% 35. 00% 33. 00%

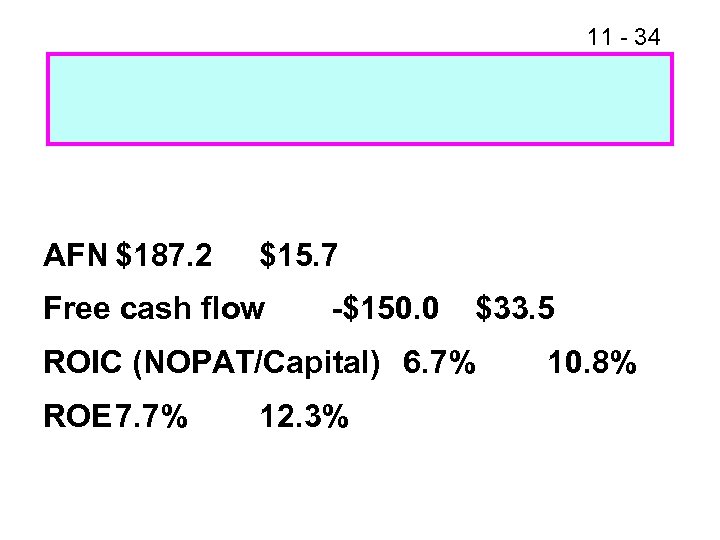

11 - 34 AFN $187. 2 $15. 7 Free cash flow -$150. 0 $33. 5 ROIC (NOPAT/Capital) 6. 7% ROE 7. 7% 12. 3% 10. 8%

11 - 34 AFN $187. 2 $15. 7 Free cash flow -$150. 0 $33. 5 ROIC (NOPAT/Capital) 6. 7% ROE 7. 7% 12. 3% 10. 8%

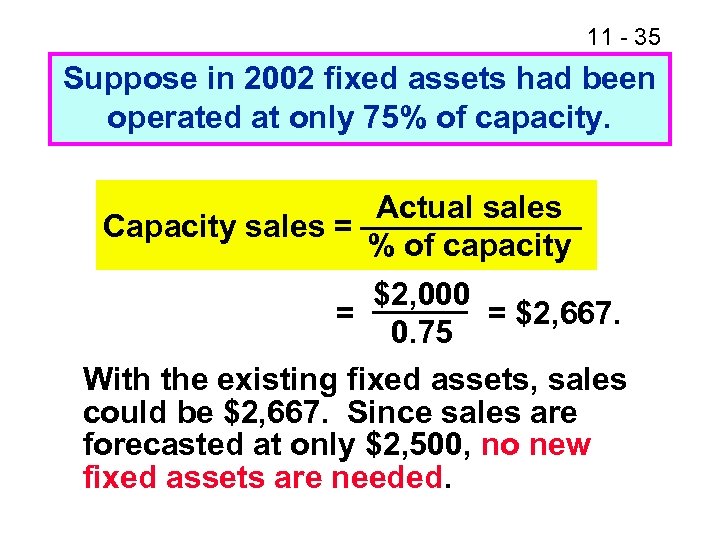

11 - 35 Suppose in 2002 fixed assets had been operated at only 75% of capacity. Actual sales Capacity sales = % of capacity $2, 000 = = $2, 667. 0. 75 With the existing fixed assets, sales could be $2, 667. Since sales are forecasted at only $2, 500, no new fixed assets are needed.

11 - 35 Suppose in 2002 fixed assets had been operated at only 75% of capacity. Actual sales Capacity sales = % of capacity $2, 000 = = $2, 667. 0. 75 With the existing fixed assets, sales could be $2, 667. Since sales are forecasted at only $2, 500, no new fixed assets are needed.

11 - 36 How would the excess capacity situation affect the 2003 AFN?

11 - 36 How would the excess capacity situation affect the 2003 AFN?

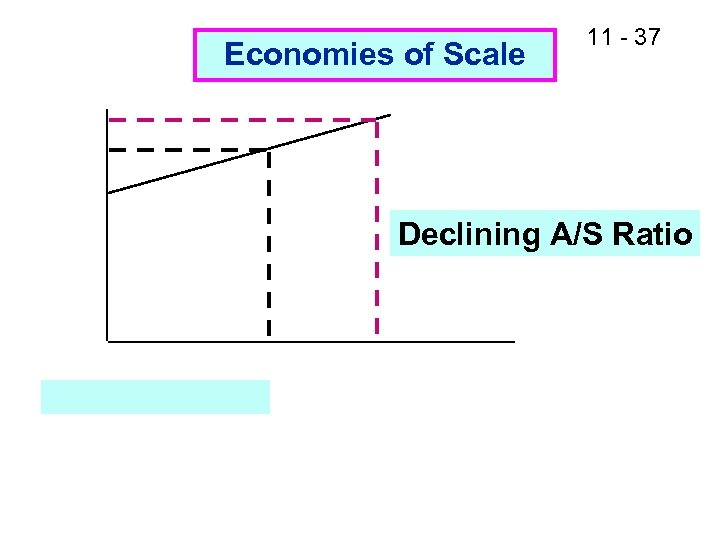

Economies of Scale 11 - 37 Declining A/S Ratio

Economies of Scale 11 - 37 Declining A/S Ratio

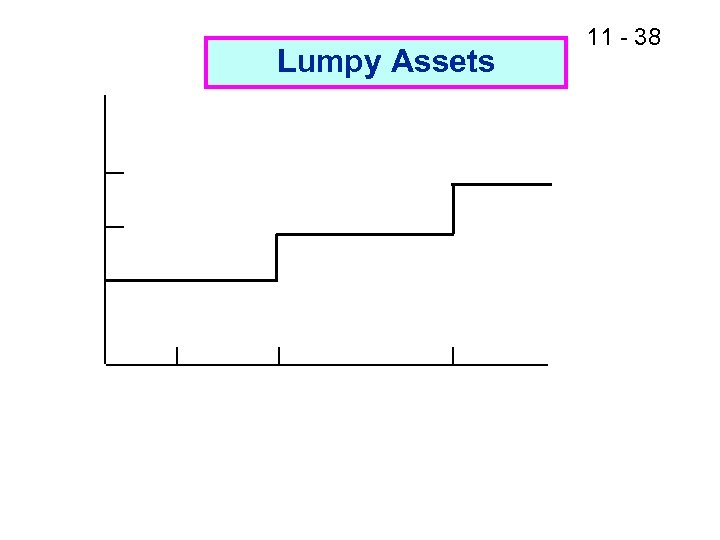

Lumpy Assets 11 - 38

Lumpy Assets 11 - 38

11 - 39 Summary: How different factors affect the AFN forecast.

11 - 39 Summary: How different factors affect the AFN forecast.