7d6e097d2ca2e0a5d9d50c0e450b66d2.ppt

- Количество слайдов: 37

1031 Exchanges: Yesterday, Today and Tomorrow PRESENTED BY Margo Mc. Donnell, CES® Certified Exchange Specialist® 1031 CORP. , President

ABOUT ME Margo Mc. Donnell Certified Exchange Specialist® § Over 19 years in 1031 industry § Involved in thousands of exchanges of various size and complexity § Serve on Board of Directors of FEA § Spearheaded industry’s effort to launch a 1031 certification and CE program

TODAY’S OBJECTIVES § Current 1031 trends § Anticipated 1031 activity over next decade § Misconceptions about capital gains and their unexpected tax bills § Quick overview of 1031 exchanges § Using your 1031 knowledge to your advantage § Selecting a Qualified Intermediary (QI) § Q&A

1031 EXCHANGE WHAT IS A 1031 EXCHANGE? Section 1031 of Internal Revenue Code provides no gain or loss will be recognized on the exchange of property held for productive use in a trade or business or for investment. Not for primary residences, flips or most vacation homes.

1031 BENEFITS § Immediate Tax Avoidance § Time Value of Deferral § Avoid higher income tax bracket and new 3. 8% Medicare Tax § Preserve personal exemptions and stay out of Pease Tax § Greater Buying Power § Increased ROI § Fresh depreciation schedule § Create new cash flow § Diversification of assets § Relocation or expansion of business § Future conversion to primary residence or vacation home § Possible elimination of

Tax Facts and Rates The Power of a 1031 Exchange

TAX FACTS AND RATES FACTS § Taxes are due on capital gain § Due on appreciation § Short-term capital gains are taxed as ordinary income § Maximum long-term capital gain tax rate for individuals who held property more than 12 months

TAX FACTS AND RATES CAPITAL GAINS* § 20% for taxpayers with ordinary incomes exceeding $400, 000 ($450, 000 for married taxpayers) § 15% for incomes more than approx. $36, 000 ($71, 000 for married taxpayers) and less than $400, 000 ($450, 000 for married taxpayers) § 0% for incomes less than approx. $36, 000 ($71, 000 for married taxpayers) *Consult tax advisor to determine actual tax rates.

TAX FACTS AND RATES NEW 3. 8% UNEARNED INCOME MEDICARE CONTRIBUTION § New tax goes went into effect 1/1/2013; part of Affordable Care Act (Obama Care) § Applies to unearned income (rental income, capital gains, dividends, annuities) § Affects individuals with a gross annual income exceeding $200, 000 and married couples exceeding $250, 000

TAX FACTS AND RATES DEPRECIATION MUST BE RECAPTURED § Generally taxed at 25% regardless of tax bracket.

STATE INCOME TAX § Each state has different rules regarding exchanges. § The Commonwealth of Pennsylvania generally does NOT recognize a 1031 exchange. § PA Gov. Corbett called for a PA version of section 1031 in 2013 budget address. § Many states simply follow the Federal Code or have adopted similar regulations § Some states have special requirements such as the replacement property must be

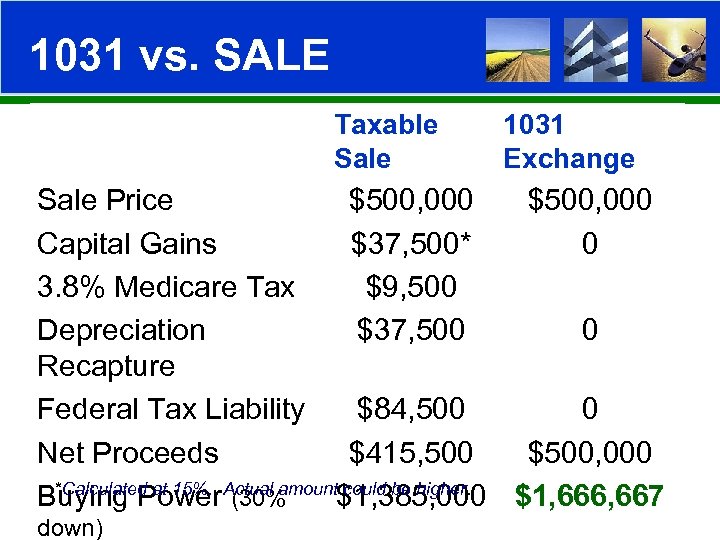

1031 vs. SALE ASSUMPTIONS § Individual owned property for many years § Annual Salary of $125, 000 and $50, 000 of add’l income (interest, dividends, rental income) § Paid $250, 000 § Made no capital improvements § Depreciated down to $100, 000 § Selling for $500, 000

1031 vs. SALE ASSUMPTIONS § Capital gains of $250, 000 § With $175, 000 of income, falls into 20% capital gains tax rate § Subject to 3. 8% Medicare Tax § Subject to highest income tax bracket of 39. 6% § Deprecation recapture of $150, 000 @ 25% § Would likely face a phase out of Personal Exemptions and be subject to the Pease Tax

1031 vs. SALE Taxable Sale 1031 Exchange Sale Price $500, 000 Capital Gains $37, 500* 0 3. 8% Medicare Tax $9, 500 Depreciation $37, 500 0 Recapture Federal Tax Liability $84, 500 0 Net Proceeds $415, 500 $500, 000 *Calculated at 15%. could be higher. Buying Power Actual amount$1, 385, 000 $1, 666, 667 (30% down)

1031 vs. SALE § Immediately avoids $84, 500 federal tax liability § Able to invest all proceeds § Leverage extra $84, 500 § Acquire new property worth $281, 667 MORE than you could if you paid the tax § Collect higher rents from Day 1 § More depreciation available § Enjoy greater appreciation long-term

1031 Trends and Projections

CURRENT TRENDS MULTIPLE REPLACEMENT PROPERTIES § Investors are taking advantage of current CRE market opportunities and historically low interest rates to leverage into several replacement properties

CURRENT TRENDS COMMERCIAL PROPERTIES § Commercial properties selling for over $2. 5 M are being exchanged as a much faster rate than in many years

CURRENT TRENDS SHORT EXCHANGE PERIODS § Exchangers are lining up their replacement property and are ready to acquire it immediately after conveying the old property to a buyer § Average exchange is now completed within 43 days (down from average of 93 days just two years ago)

CURRENT TRENDS REVERSE EXCHANGES § More and more investors are finding the ideal replacement property before lining up a buyer § Must be structured several weeks in advance § Preserves clients ability to defer gain when property eventually sells § QI thru an EAT acquires either the old or the new property and “parks” title for up to 180 days

CURRENT TRENDS OIL & GAS ROYALTIES § Investors are acquiring oil and gas royalties as replacement property § Current oil prices make this investment more attractive § Provides good returns with no hands on

CURRENT TRENDS NO MORTGAGES ON REPLACEMENT PROPERTY § Higher than usual number of Exchangers choosing to put in additional equity or trade down in property value rather than put a mortgage on the new property § Trade downs are taxed on the amount of the trade down

CURRENT TRENDS INCREASE IN PERSONAL PROPERTY 1031 s § Without the 100% bonus depreciation we had for 18 months, we are seeing a big increase in exchanges of other assets held for investment § Companies are purchasing capital assets using 1031 § New purchases to increase efficiency § Examples: airplanes, equipment (cranes,

CURRENT TRENDS EXCHANGING PROPERTY WITH NO GAIN § Investors are exchanging properties with little or no gain, maybe even selling at a loss, to avoid costly depreciation recapture

1031 ACTIVITY: YESTERDAY , TODAY & TOMORROW § FEA member surveys estimated exchange activity dropped approximately 80% from 2005 to 2010 § Activity is definitely picking up nationwide § Using data from FEA member surveys, the Joint Committee on Taxation (JCT) estimates 1031 deferrals of $2. 5 B in next 5 years and $18. 2 B in next 10 years § Significant increase is expected as the real estate market continues its rebound

1031 ACTIVITY: YESTERDAY , TODAY & TOMORROW § Beginning in September 2012, there has been quite a bit of noise regarding section 1031 § 1031 has been identified as one of the top tax expenditures and a potential target in the tax reform battle § JTC has rescores section 1031. Now $42 – 47 B! § Entire real estate industry, including FEA, working together to preserve top real estate expenditures

Unlocking the Power of Exchanges Overview of 1031 Exchanges

LIKE-KIND DEFINED REAL PROPERTY (REAL ESTATE) EXCHANGES § Refers to the nature or character of property § Specific type of property not essential § Very broad and liberal definition § Must be used for business use or investment § Located within 50 states, D. C. or selected territories

LIKE-KIND EXAMPLES § Examples of like-kind real estate § § § Duplex, apartment building, rental house Office building, warehouse, shopping center Land Tenant-in-Common (TIC) interest Conservation easements, utility easements Leasehold interest of 30 years (including options) § Cell tower easements § Oil and Gas Royalties; Mineral Interests

LIKE-KIND EXAMPLES § Examples of non like-kind real estate § § § § Personal residence and most vacation homes Partnership interests Mortgages and notes Cash Non real estate assets Dealer property and inventory Stocks

LIKE-KIND DEFINED PERSONAL PROPERTY EXCHANGES § Any asset held for business use or investment can be exchanged. § Definition of like-kind is much more restrictive for personal property § Assets must be within the same asset classification code or the same kind of asset § Examples of personal property assets: Equipment, aircraft, franchise agreements, livestock, collectibles, antiques, distribution routes, furniture and fixtures, etc.

QUALIFIED USE § Holding period not defined in regulations § One year is good rule of thumb § Taxpayer Relief Act of 1997 defined “long-term” investments as held longer than one year § Two year safe harbor in Rev. Proc. 2008 -16 § Intent of taxpayer is key § Look at the picture you have painted § Personal use must be minimal (§ 280 A) Consult tax and/or legal advisor to determine best strategy.

ADDITIONAL REQUIREMENTS § QI acts as “middleman” to facilitate an exchange § Exchanger cannot have access to exchange proceeds § Time Periods: § Replacement Property* must be identified within 45 -Day Identification Period § Replacement Property must be acquired within 180 -Day Exchange Period *Title must be held in the same name as relinquished property

ADDITIONAL REQUIREMENTS § Exchange must be set up (and 1031 docs signed) before title passed to buyer § To maximize deferral, replacement property must have equal or greater VALUE and EQUITY. § Value takes closing costs into account. § A trade down in property value or equity is taxed just on the trade down.

CHOOSING YOUR QI § Your QI is your partner throughout the exchange § Choose company who is responsive, experienced and has good knowledge of local real estate and title practices § Make sure funds are held in segregated FDIC insured exchange account § Look for fidelity bond coverage § Seek Certified Exchange Specialist® (CES®) § Look for member of Federation of Exchange

SUMMARY § 1031 exchanges are a great wealth accumulation vehicle. § § Build real estate portfolio with pre-tax dollars Great way to accomplish long-term objectives Excellent estate planning tool Creates many opportunities to grow your business § The more you know, the more you will benefit. § 1031 CORP. can help!

QUESTIONS & ANSWERS Margo Mc. Donnell, CES® Certified Exchange Specialist® 1. 800. 828. 1031 margo@1031 CORP. com Mobile: 610. 6896 www. 1031 CORP. com www. facebook. com/1031 CORP www. twitter. com/1031 CORP www. linkedin. com/in/Margo. Mc. Donnell www. facebook. com/Margo. Mc. Donnell

7d6e097d2ca2e0a5d9d50c0e450b66d2.ppt