02ff1437cdf7405e2156f3af64e69625.ppt

- Количество слайдов: 36

10 th CLSA India Forum 2007 Asahi India Glass Ltd. Corporate Presentation 16 th November, 2007 1

10 th CLSA India Forum 2007 Asahi India Glass Ltd. Corporate Presentation 16 th November, 2007 1

Index § Corporate Profile § India Story § AIS Core Markets § Business Operations - Auto Glass - Float Glass - Glass Solutions § Opportunities & Plans § Strategy & Key Focus Areas § Financial Results 2

Index § Corporate Profile § India Story § AIS Core Markets § Business Operations - Auto Glass - Float Glass - Glass Solutions § Opportunities & Plans § Strategy & Key Focus Areas § Financial Results 2

Corporate Profile § Largest integrated glass company in India, manufacturing wide range of international quality automotive safety glass, float glass, value added glass like reflective glass, mirror, architectural processed glass and glass products. § Jointly promoted by Labroo family (Sanjay Labroo and his parents, Brij & Kanta Labroo), Asahi Glass Co. , Ltd. , Japan and Maruti-Suzuki. § Commenced operations and made initial public offer of USD 468, 000 in 1987, which largely remains undiluted. Shares are listed at BSE and NSE. § Promoters hold 55. 6 % of paid up equity capital of AIS, and the remaining 44. 4 % equity is held by public. § AIS has three operating business units : - AIS Auto Glass - AIS Float Glass - AIS Glass Solutions § AIS recorded gross sales & operating profits of USD 224. 87 million & USD 41. 21 million in FY 07. 3

Corporate Profile § Largest integrated glass company in India, manufacturing wide range of international quality automotive safety glass, float glass, value added glass like reflective glass, mirror, architectural processed glass and glass products. § Jointly promoted by Labroo family (Sanjay Labroo and his parents, Brij & Kanta Labroo), Asahi Glass Co. , Ltd. , Japan and Maruti-Suzuki. § Commenced operations and made initial public offer of USD 468, 000 in 1987, which largely remains undiluted. Shares are listed at BSE and NSE. § Promoters hold 55. 6 % of paid up equity capital of AIS, and the remaining 44. 4 % equity is held by public. § AIS has three operating business units : - AIS Auto Glass - AIS Float Glass - AIS Glass Solutions § AIS recorded gross sales & operating profits of USD 224. 87 million & USD 41. 21 million in FY 07. 3

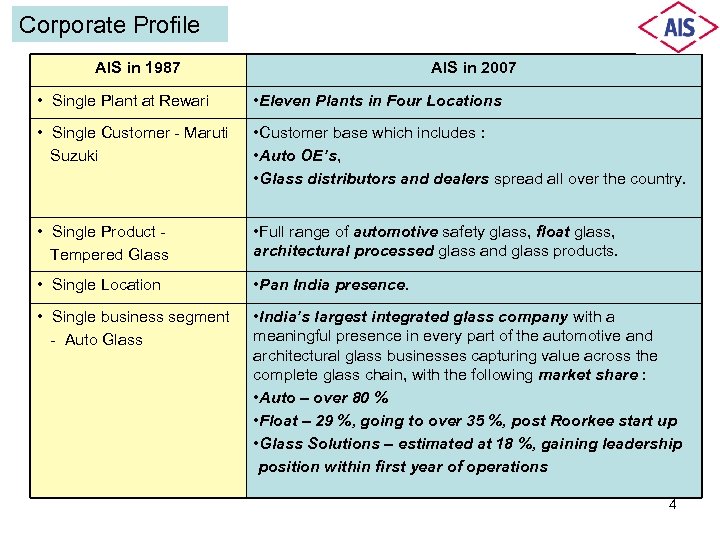

Corporate Profile AIS in 1987 AIS in 2007 • Single Plant at Rewari • Eleven Plants in Four Locations • Single Customer - Maruti Suzuki • Customer base which includes : • Auto OE’s, • Glass distributors and dealers spread all over the country. • Single Product Tempered Glass • Full range of automotive safety glass, float glass, architectural processed glass and glass products. • Single Location • Pan India presence. • Single business segment - Auto Glass • India’s largest integrated glass company with a meaningful presence in every part of the automotive and architectural glass businesses capturing value across the complete glass chain, with the following market share : • Auto – over 80 % • Float – 29 %, going to over 35 %, post Roorkee start up • Glass Solutions – estimated at 18 %, gaining leadership position within first year of operations 4

Corporate Profile AIS in 1987 AIS in 2007 • Single Plant at Rewari • Eleven Plants in Four Locations • Single Customer - Maruti Suzuki • Customer base which includes : • Auto OE’s, • Glass distributors and dealers spread all over the country. • Single Product Tempered Glass • Full range of automotive safety glass, float glass, architectural processed glass and glass products. • Single Location • Pan India presence. • Single business segment - Auto Glass • India’s largest integrated glass company with a meaningful presence in every part of the automotive and architectural glass businesses capturing value across the complete glass chain, with the following market share : • Auto – over 80 % • Float – 29 %, going to over 35 %, post Roorkee start up • Glass Solutions – estimated at 18 %, gaining leadership position within first year of operations 4

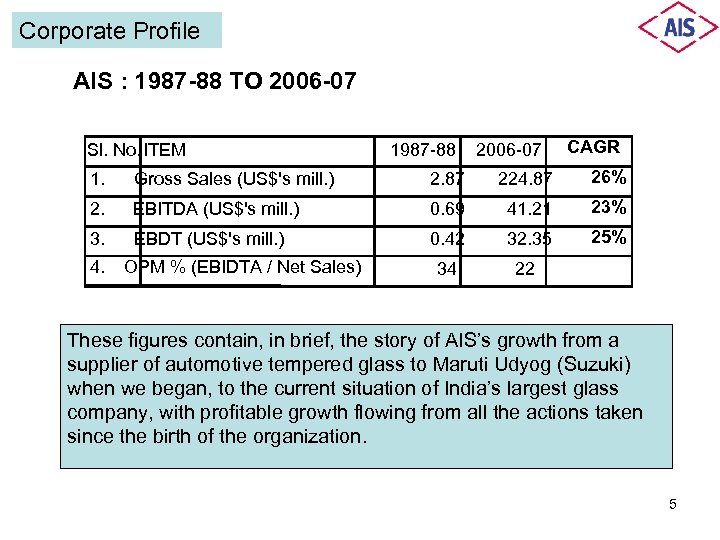

Corporate Profile AIS : 1987 -88 TO 2006 -07 Sl. No. ITEM 1987 -88 2006 -07 CAGR 1. Gross Sales (US$'s mill. ) 2. 87 224. 87 26% 2. EBITDA (US$'s mill. ) 0. 69 41. 21 23% 3. EBDT (US$'s mill. ) 0. 42 32. 35 25% 34 22 4. OPM % (EBIDTA / Net Sales) These figures contain, in brief, the story of AIS’s growth from a supplier of automotive tempered glass to Maruti Udyog (Suzuki) when we began, to the current situation of India’s largest glass company, with profitable growth flowing from all the actions taken since the birth of the organization. 5

Corporate Profile AIS : 1987 -88 TO 2006 -07 Sl. No. ITEM 1987 -88 2006 -07 CAGR 1. Gross Sales (US$'s mill. ) 2. 87 224. 87 26% 2. EBITDA (US$'s mill. ) 0. 69 41. 21 23% 3. EBDT (US$'s mill. ) 0. 42 32. 35 25% 34 22 4. OPM % (EBIDTA / Net Sales) These figures contain, in brief, the story of AIS’s growth from a supplier of automotive tempered glass to Maruti Udyog (Suzuki) when we began, to the current situation of India’s largest glass company, with profitable growth flowing from all the actions taken since the birth of the organization. 5

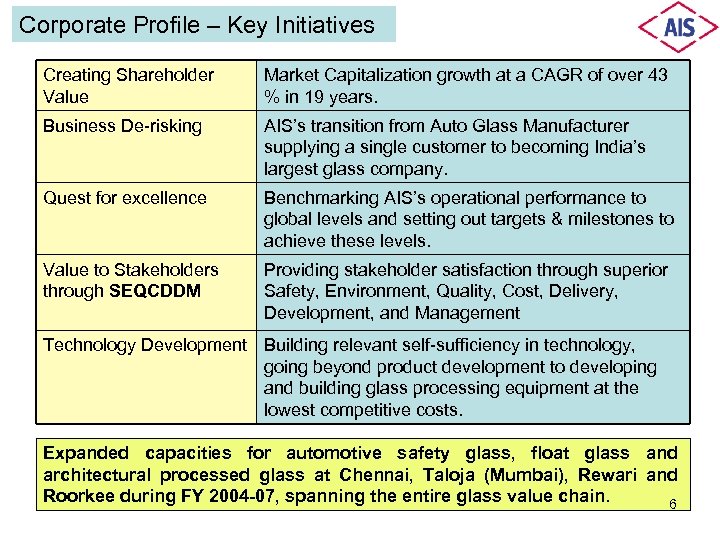

Corporate Profile – Key Initiatives Creating Shareholder Value Market Capitalization growth at a CAGR of over 43 % in 19 years. Business De-risking AIS’s transition from Auto Glass Manufacturer supplying a single customer to becoming India’s largest glass company. Quest for excellence Benchmarking AIS’s operational performance to global levels and setting out targets & milestones to achieve these levels. Value to Stakeholders through SEQCDDM Providing stakeholder satisfaction through superior Safety, Environment, Quality, Cost, Delivery, Development, and Management Technology Development Building relevant self-sufficiency in technology, going beyond product development to developing and building glass processing equipment at the lowest competitive costs. Expanded capacities for automotive safety glass, float glass and architectural processed glass at Chennai, Taloja (Mumbai), Rewari and Roorkee during FY 2004 -07, spanning the entire glass value chain. 6

Corporate Profile – Key Initiatives Creating Shareholder Value Market Capitalization growth at a CAGR of over 43 % in 19 years. Business De-risking AIS’s transition from Auto Glass Manufacturer supplying a single customer to becoming India’s largest glass company. Quest for excellence Benchmarking AIS’s operational performance to global levels and setting out targets & milestones to achieve these levels. Value to Stakeholders through SEQCDDM Providing stakeholder satisfaction through superior Safety, Environment, Quality, Cost, Delivery, Development, and Management Technology Development Building relevant self-sufficiency in technology, going beyond product development to developing and building glass processing equipment at the lowest competitive costs. Expanded capacities for automotive safety glass, float glass and architectural processed glass at Chennai, Taloja (Mumbai), Rewari and Roorkee during FY 2004 -07, spanning the entire glass value chain. 6

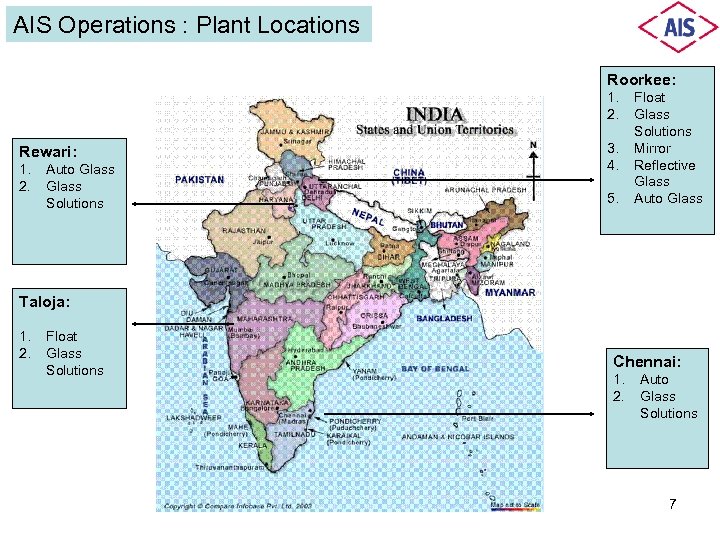

AIS Operations : Plant Locations Roorkee: 1. 2. Rewari: 1. 2. Auto Glass Solutions 3. 4. 5. Float Glass Solutions Mirror Reflective Glass Auto Glass Taloja: 1. 2. Float Glass Solutions Chennai: 1. 2. Auto Glass Solutions 7

AIS Operations : Plant Locations Roorkee: 1. 2. Rewari: 1. 2. Auto Glass Solutions 3. 4. 5. Float Glass Solutions Mirror Reflective Glass Auto Glass Taloja: 1. 2. Float Glass Solutions Chennai: 1. 2. Auto Glass Solutions 7

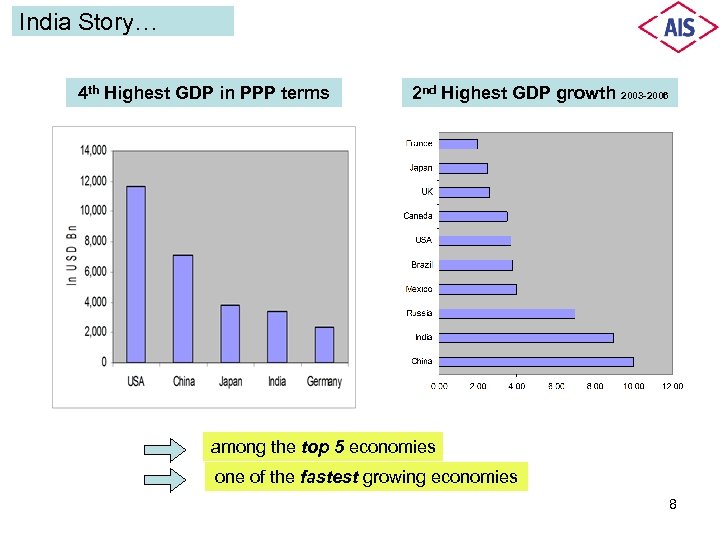

India Story… 4 th Highest GDP in PPP terms 2 nd Highest GDP growth 2003 -2006 among the top 5 economies one of the fastest growing economies 8

India Story… 4 th Highest GDP in PPP terms 2 nd Highest GDP growth 2003 -2006 among the top 5 economies one of the fastest growing economies 8

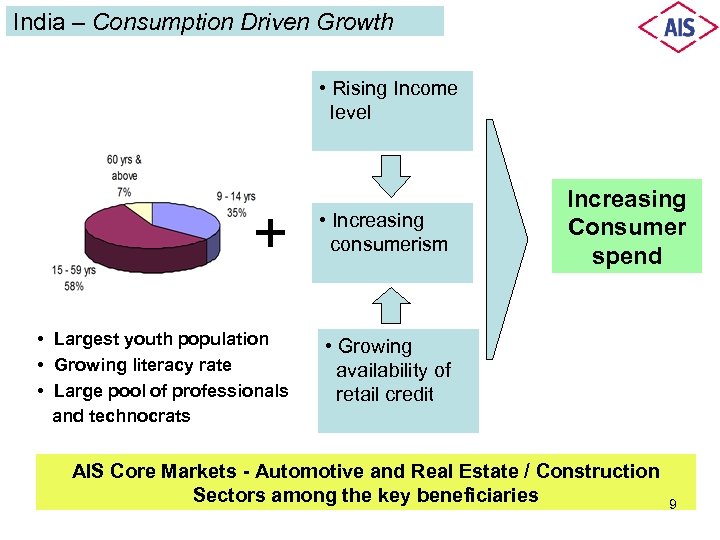

India – Consumption Driven Growth • Rising Income level + • Increasing consumerism • Largest youth population • Growing literacy rate • Large pool of professionals and technocrats Increasing Consumer spend • Growing availability of retail credit AIS Core Markets - Automotive and Real Estate / Construction Sectors among the key beneficiaries 9

India – Consumption Driven Growth • Rising Income level + • Increasing consumerism • Largest youth population • Growing literacy rate • Large pool of professionals and technocrats Increasing Consumer spend • Growing availability of retail credit AIS Core Markets - Automotive and Real Estate / Construction Sectors among the key beneficiaries 9

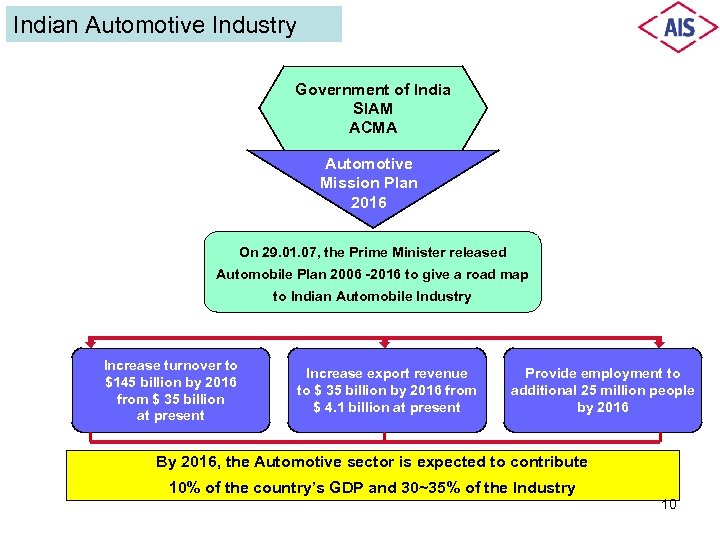

Indian Automotive Industry Government of India SIAM ACMA Automotive Mission Plan 2016 On 29. 01. 07, the Prime Minister released Automobile Plan 2006 -2016 to give a road map to Indian Automobile Industry Increase turnover to $145 billion by 2016 from $ 35 billion at present Increase export revenue to $ 35 billion by 2016 from $ 4. 1 billion at present Provide employment to additional 25 million people by 2016 By 2016, the Automotive sector is expected to contribute 10% of the country’s GDP and 30~35% of the Industry 10

Indian Automotive Industry Government of India SIAM ACMA Automotive Mission Plan 2016 On 29. 01. 07, the Prime Minister released Automobile Plan 2006 -2016 to give a road map to Indian Automobile Industry Increase turnover to $145 billion by 2016 from $ 35 billion at present Increase export revenue to $ 35 billion by 2016 from $ 4. 1 billion at present Provide employment to additional 25 million people by 2016 By 2016, the Automotive sector is expected to contribute 10% of the country’s GDP and 30~35% of the Industry 10

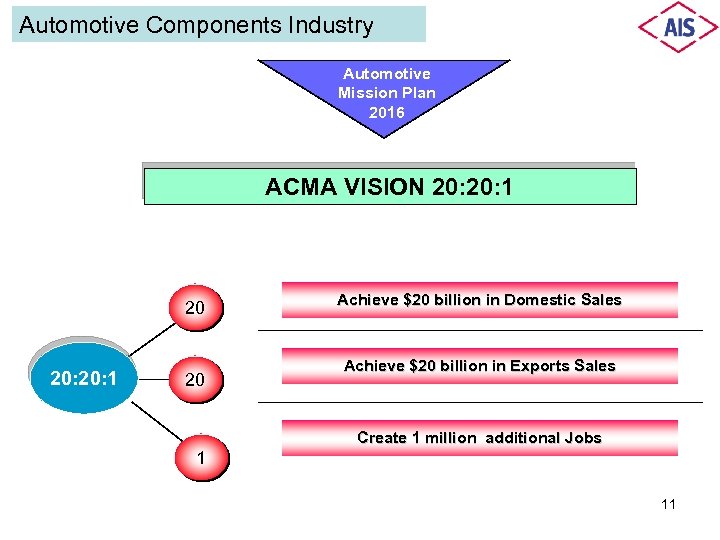

Automotive Components Industry Automotive Mission Plan 2016 ACMA VISION 20: 20: 1 20 1 Achieve $20 billion in Domestic Sales Achieve $20 billion in Exports Sales VISION 20: 1 Create 1 million additional Jobs 11

Automotive Components Industry Automotive Mission Plan 2016 ACMA VISION 20: 20: 1 20 1 Achieve $20 billion in Domestic Sales Achieve $20 billion in Exports Sales VISION 20: 1 Create 1 million additional Jobs 11

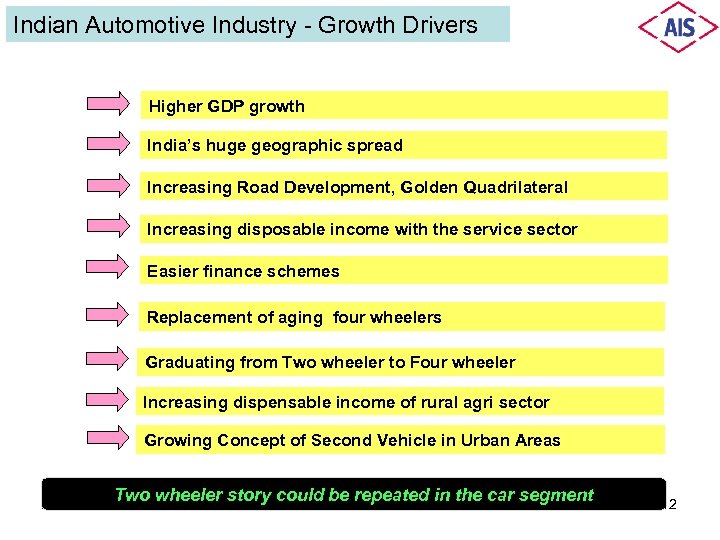

Indian Automotive Industry - Growth Drivers Higher GDP growth India’s huge geographic spread Increasing Road Development, Golden Quadrilateral Increasing disposable income with the service sector Easier finance schemes Replacement of aging four wheelers Graduating from Two wheeler to Four wheeler Increasing dispensable income of rural agri sector Growing Concept of Second Vehicle in Urban Areas Two wheeler story could be repeated in the car segment 12

Indian Automotive Industry - Growth Drivers Higher GDP growth India’s huge geographic spread Increasing Road Development, Golden Quadrilateral Increasing disposable income with the service sector Easier finance schemes Replacement of aging four wheelers Graduating from Two wheeler to Four wheeler Increasing dispensable income of rural agri sector Growing Concept of Second Vehicle in Urban Areas Two wheeler story could be repeated in the car segment 12

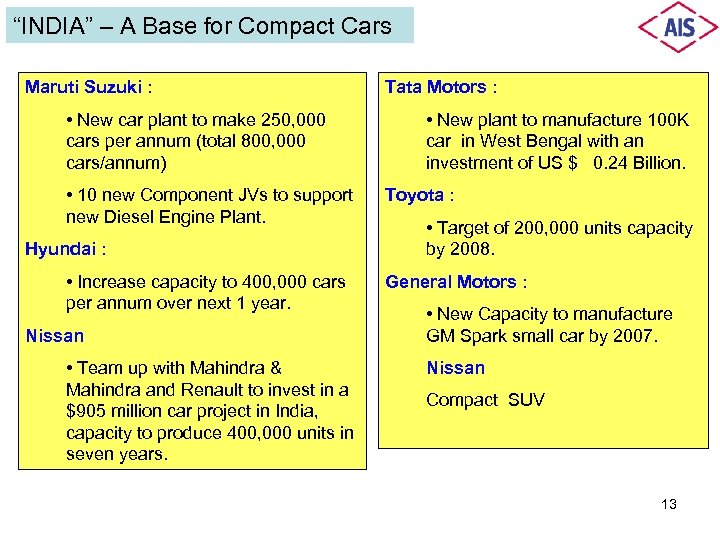

“INDIA” – A Base for Compact Cars Maruti Suzuki : • New car plant to make 250, 000 cars per annum (total 800, 000 cars/annum) • 10 new Component JVs to support new Diesel Engine Plant. Hyundai : • Increase capacity to 400, 000 cars per annum over next 1 year. Nissan • Team up with Mahindra & Mahindra and Renault to invest in a $905 million car project in India, capacity to produce 400, 000 units in seven years. Tata Motors : • New plant to manufacture 100 K car in West Bengal with an investment of US $ 0. 24 Billion. Toyota : • Target of 200, 000 units capacity by 2008. General Motors : • New Capacity to manufacture GM Spark small car by 2007. Nissan Compact SUV 13

“INDIA” – A Base for Compact Cars Maruti Suzuki : • New car plant to make 250, 000 cars per annum (total 800, 000 cars/annum) • 10 new Component JVs to support new Diesel Engine Plant. Hyundai : • Increase capacity to 400, 000 cars per annum over next 1 year. Nissan • Team up with Mahindra & Mahindra and Renault to invest in a $905 million car project in India, capacity to produce 400, 000 units in seven years. Tata Motors : • New plant to manufacture 100 K car in West Bengal with an investment of US $ 0. 24 Billion. Toyota : • Target of 200, 000 units capacity by 2008. General Motors : • New Capacity to manufacture GM Spark small car by 2007. Nissan Compact SUV 13

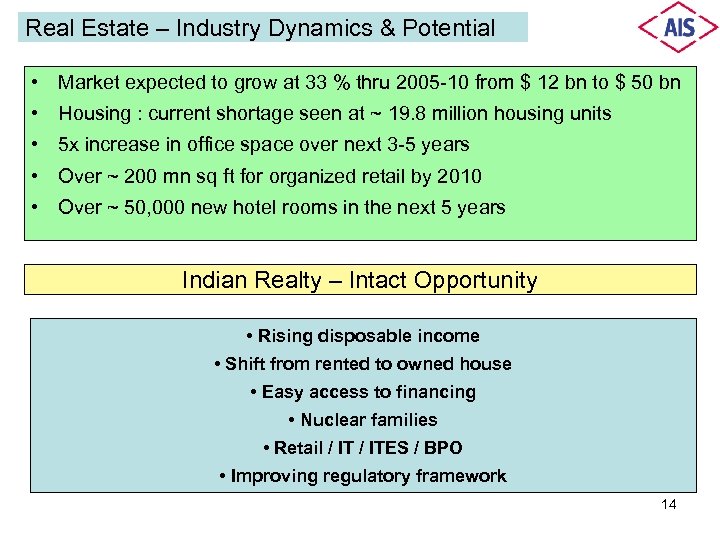

Real Estate – Industry Dynamics & Potential • Market expected to grow at 33 % thru 2005 -10 from $ 12 bn to $ 50 bn • Housing : current shortage seen at ~ 19. 8 million housing units • 5 x increase in office space over next 3 -5 years • Over ~ 200 mn sq ft for organized retail by 2010 • Over ~ 50, 000 new hotel rooms in the next 5 years Indian Realty – Intact Opportunity • Rising disposable income • Shift from rented to owned house • Easy access to financing • Nuclear families • Retail / ITES / BPO • Improving regulatory framework 14

Real Estate – Industry Dynamics & Potential • Market expected to grow at 33 % thru 2005 -10 from $ 12 bn to $ 50 bn • Housing : current shortage seen at ~ 19. 8 million housing units • 5 x increase in office space over next 3 -5 years • Over ~ 200 mn sq ft for organized retail by 2010 • Over ~ 50, 000 new hotel rooms in the next 5 years Indian Realty – Intact Opportunity • Rising disposable income • Shift from rented to owned house • Easy access to financing • Nuclear families • Retail / ITES / BPO • Improving regulatory framework 14

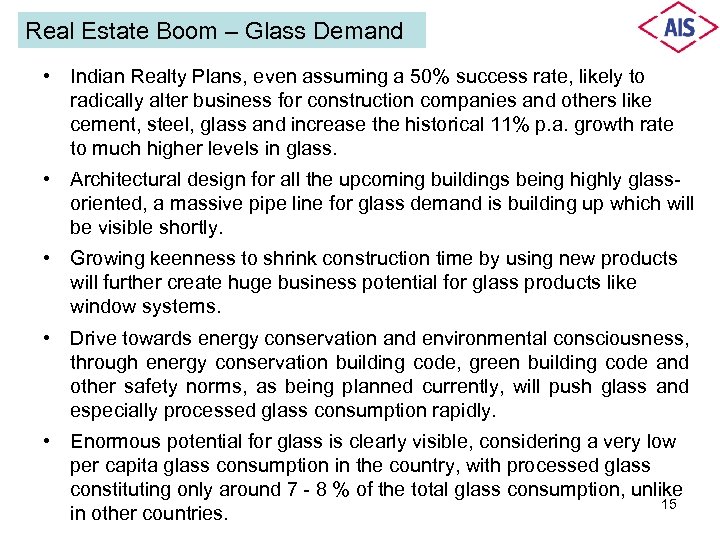

Real Estate Boom – Glass Demand • Indian Realty Plans, even assuming a 50% success rate, likely to radically alter business for construction companies and others like cement, steel, glass and increase the historical 11% p. a. growth rate to much higher levels in glass. • Architectural design for all the upcoming buildings being highly glassoriented, a massive pipe line for glass demand is building up which will be visible shortly. • Growing keenness to shrink construction time by using new products will further create huge business potential for glass products like window systems. • Drive towards energy conservation and environmental consciousness, through energy conservation building code, green building code and other safety norms, as being planned currently, will push glass and especially processed glass consumption rapidly. • Enormous potential for glass is clearly visible, considering a very low per capita glass consumption in the country, with processed glass constituting only around 7 - 8 % of the total glass consumption, unlike 15 in other countries.

Real Estate Boom – Glass Demand • Indian Realty Plans, even assuming a 50% success rate, likely to radically alter business for construction companies and others like cement, steel, glass and increase the historical 11% p. a. growth rate to much higher levels in glass. • Architectural design for all the upcoming buildings being highly glassoriented, a massive pipe line for glass demand is building up which will be visible shortly. • Growing keenness to shrink construction time by using new products will further create huge business potential for glass products like window systems. • Drive towards energy conservation and environmental consciousness, through energy conservation building code, green building code and other safety norms, as being planned currently, will push glass and especially processed glass consumption rapidly. • Enormous potential for glass is clearly visible, considering a very low per capita glass consumption in the country, with processed glass constituting only around 7 - 8 % of the total glass consumption, unlike 15 in other countries.

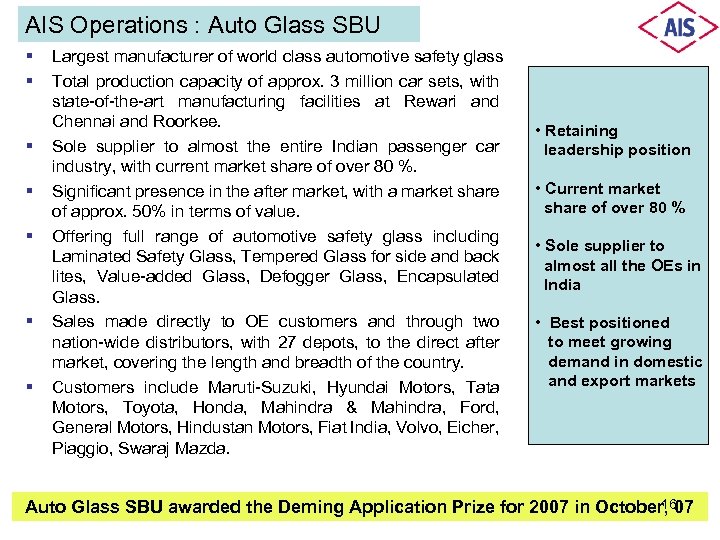

AIS Operations : Auto Glass SBU § § § § Largest manufacturer of world class automotive safety glass Total production capacity of approx. 3 million car sets, with state-of-the-art manufacturing facilities at Rewari and Chennai and Roorkee. Sole supplier to almost the entire Indian passenger car industry, with current market share of over 80 %. Significant presence in the after market, with a market share of approx. 50% in terms of value. Offering full range of automotive safety glass including Laminated Safety Glass, Tempered Glass for side and back lites, Value-added Glass, Defogger Glass, Encapsulated Glass. Sales made directly to OE customers and through two nation-wide distributors, with 27 depots, to the direct after market, covering the length and breadth of the country. Customers include Maruti-Suzuki, Hyundai Motors, Tata Motors, Toyota, Honda, Mahindra & Mahindra, Ford, General Motors, Hindustan Motors, Fiat India, Volvo, Eicher, Piaggio, Swaraj Mazda. • Retaining leadership position • Current market share of over 80 % • Sole supplier to almost all the OEs in India • Best positioned to meet growing demand in domestic and export markets 16 Auto Glass SBU awarded the Deming Application Prize for 2007 in October, 07

AIS Operations : Auto Glass SBU § § § § Largest manufacturer of world class automotive safety glass Total production capacity of approx. 3 million car sets, with state-of-the-art manufacturing facilities at Rewari and Chennai and Roorkee. Sole supplier to almost the entire Indian passenger car industry, with current market share of over 80 %. Significant presence in the after market, with a market share of approx. 50% in terms of value. Offering full range of automotive safety glass including Laminated Safety Glass, Tempered Glass for side and back lites, Value-added Glass, Defogger Glass, Encapsulated Glass. Sales made directly to OE customers and through two nation-wide distributors, with 27 depots, to the direct after market, covering the length and breadth of the country. Customers include Maruti-Suzuki, Hyundai Motors, Tata Motors, Toyota, Honda, Mahindra & Mahindra, Ford, General Motors, Hindustan Motors, Fiat India, Volvo, Eicher, Piaggio, Swaraj Mazda. • Retaining leadership position • Current market share of over 80 % • Sole supplier to almost all the OEs in India • Best positioned to meet growing demand in domestic and export markets 16 Auto Glass SBU awarded the Deming Application Prize for 2007 in October, 07

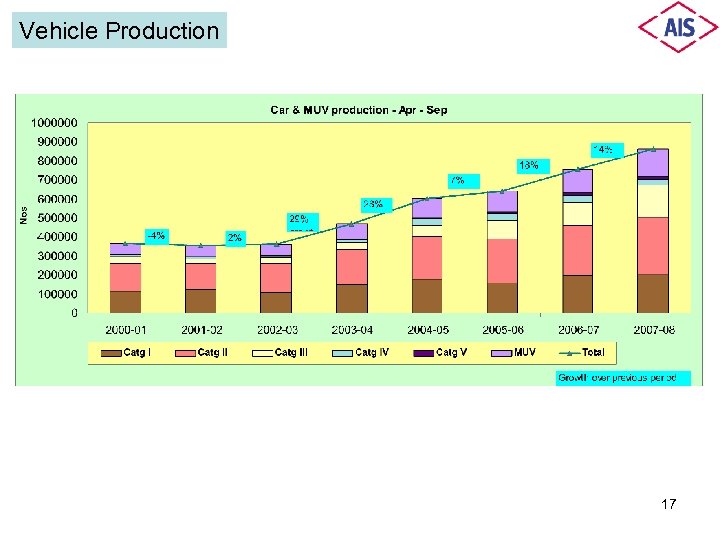

Vehicle Production 17

Vehicle Production 17

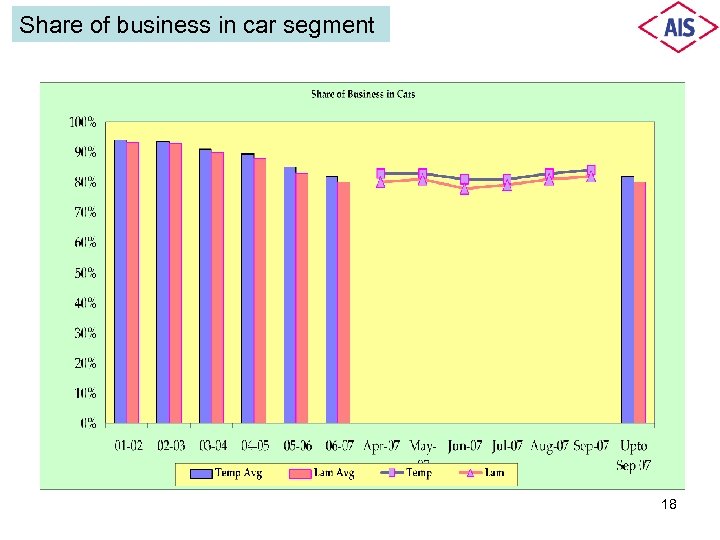

Share of business in car segment 18

Share of business in car segment 18

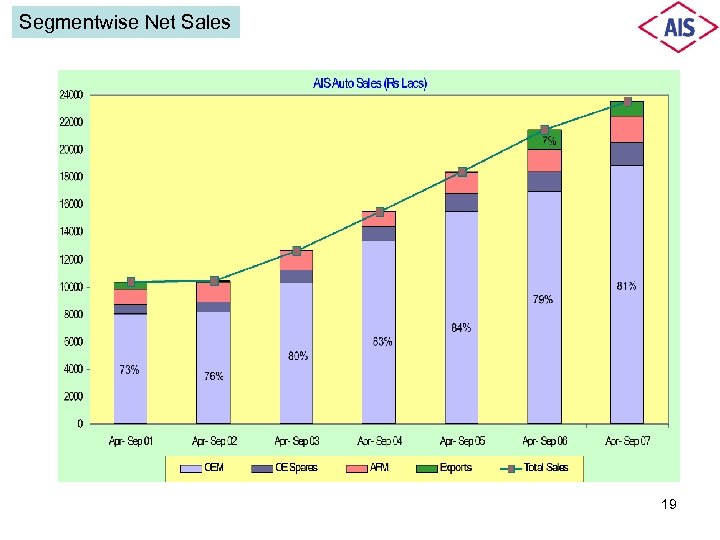

Segmentwise Net Sales 19

Segmentwise Net Sales 19

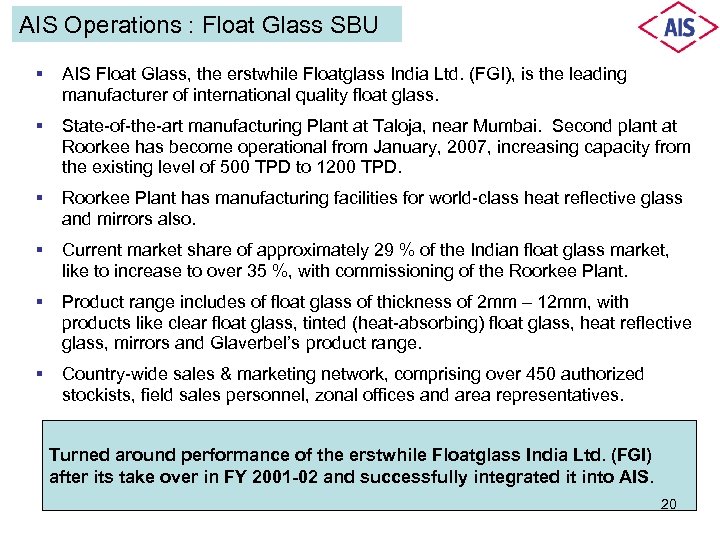

AIS Operations : Float Glass SBU § AIS Float Glass, the erstwhile Floatglass India Ltd. (FGI), is the leading manufacturer of international quality float glass. § State-of-the-art manufacturing Plant at Taloja, near Mumbai. Second plant at Roorkee has become operational from January, 2007, increasing capacity from the existing level of 500 TPD to 1200 TPD. § Roorkee Plant has manufacturing facilities for world-class heat reflective glass and mirrors also. § Current market share of approximately 29 % of the Indian float glass market, like to increase to over 35 %, with commissioning of the Roorkee Plant. § Product range includes of float glass of thickness of 2 mm – 12 mm, with products like clear float glass, tinted (heat-absorbing) float glass, heat reflective glass, mirrors and Glaverbel’s product range. § Country-wide sales & marketing network, comprising over 450 authorized stockists, field sales personnel, zonal offices and area representatives. Turned around performance of the erstwhile Floatglass India Ltd. (FGI) after its take over in FY 2001 -02 and successfully integrated it into AIS. 20

AIS Operations : Float Glass SBU § AIS Float Glass, the erstwhile Floatglass India Ltd. (FGI), is the leading manufacturer of international quality float glass. § State-of-the-art manufacturing Plant at Taloja, near Mumbai. Second plant at Roorkee has become operational from January, 2007, increasing capacity from the existing level of 500 TPD to 1200 TPD. § Roorkee Plant has manufacturing facilities for world-class heat reflective glass and mirrors also. § Current market share of approximately 29 % of the Indian float glass market, like to increase to over 35 %, with commissioning of the Roorkee Plant. § Product range includes of float glass of thickness of 2 mm – 12 mm, with products like clear float glass, tinted (heat-absorbing) float glass, heat reflective glass, mirrors and Glaverbel’s product range. § Country-wide sales & marketing network, comprising over 450 authorized stockists, field sales personnel, zonal offices and area representatives. Turned around performance of the erstwhile Floatglass India Ltd. (FGI) after its take over in FY 2001 -02 and successfully integrated it into AIS. 20

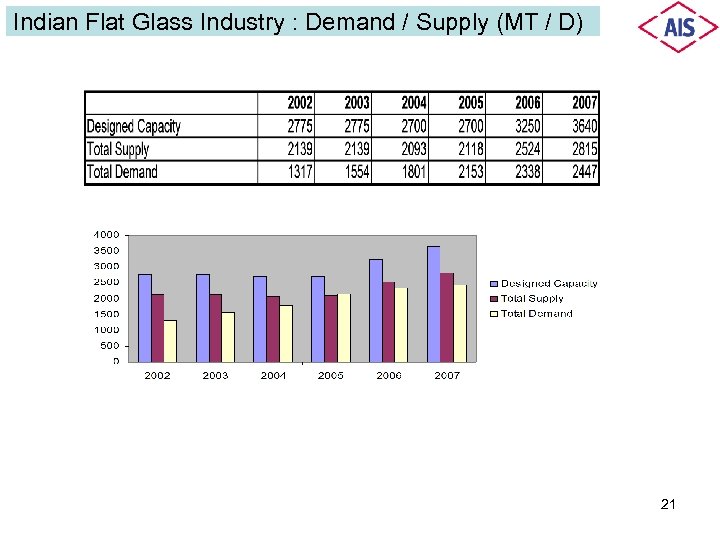

Indian Flat Glass Industry : Demand / Supply (MT / D) 21

Indian Flat Glass Industry : Demand / Supply (MT / D) 21

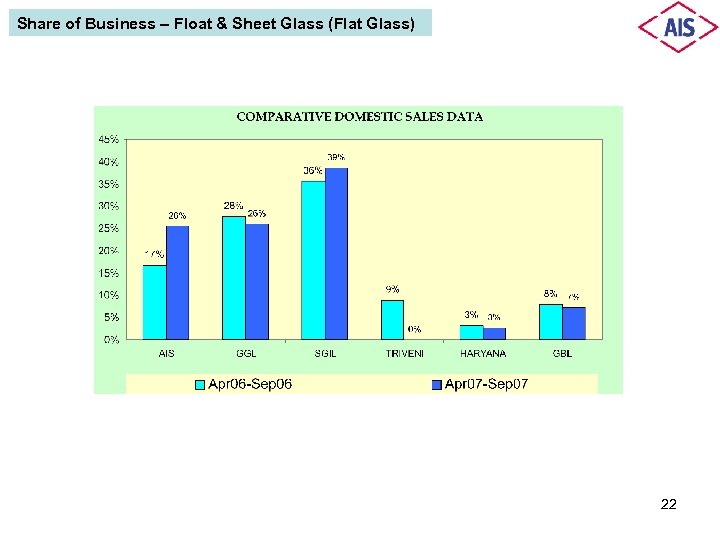

Share of Business – Float & Sheet Glass (Flat Glass) 22

Share of Business – Float & Sheet Glass (Flat Glass) 22

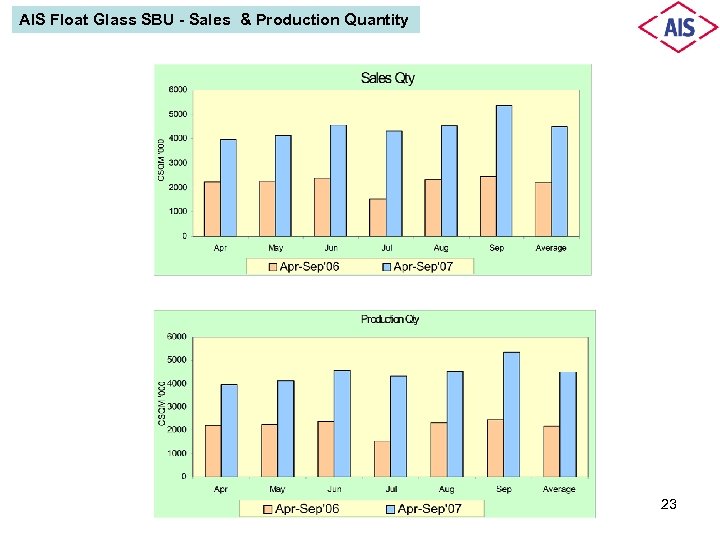

AIS Float Glass SBU - Sales & Production Quantity 23

AIS Float Glass SBU - Sales & Production Quantity 23

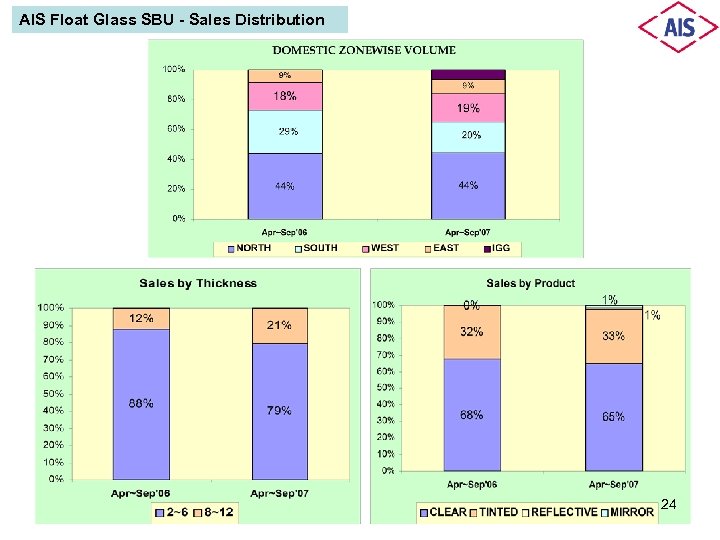

AIS Float Glass SBU - Sales Distribution 24

AIS Float Glass SBU - Sales Distribution 24

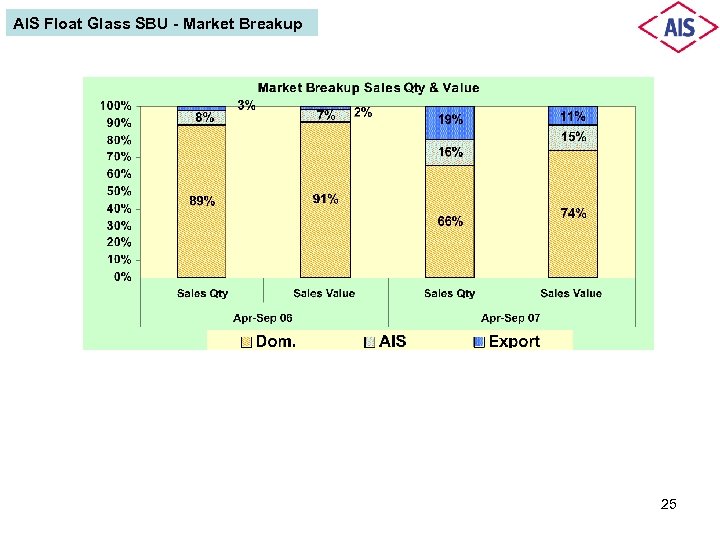

AIS Float Glass SBU - Market Breakup 25

AIS Float Glass SBU - Market Breakup 25

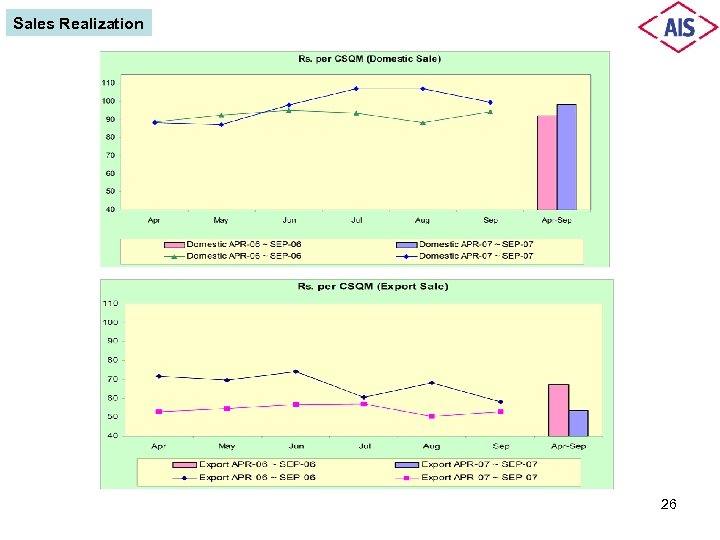

Sales Realization 26

Sales Realization 26

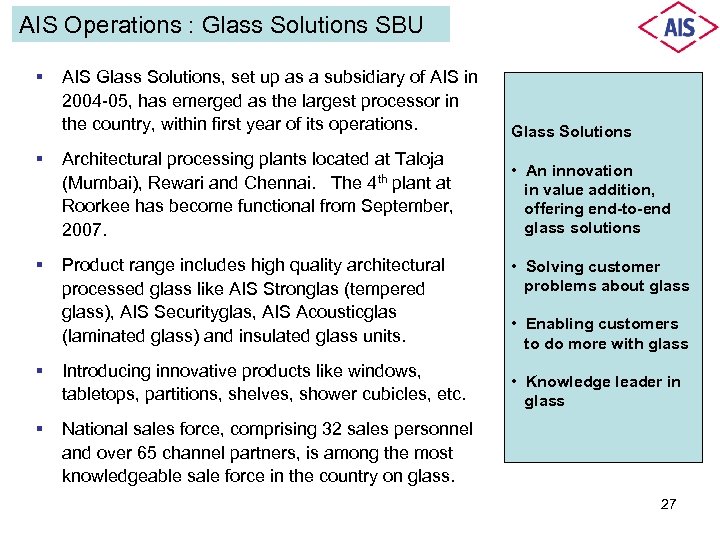

AIS Operations : Glass Solutions SBU § AIS Glass Solutions, set up as a subsidiary of AIS in 2004 -05, has emerged as the largest processor in the country, within first year of its operations. Glass Solutions § Architectural processing plants located at Taloja (Mumbai), Rewari and Chennai. The 4 th plant at Roorkee has become functional from September, 2007. • An innovation in value addition, offering end-to-end glass solutions § Product range includes high quality architectural processed glass like AIS Stronglas (tempered glass), AIS Securityglas, AIS Acousticglas (laminated glass) and insulated glass units. § Introducing innovative products like windows, tabletops, partitions, shelves, shower cubicles, etc. § • Solving customer problems about glass • Enabling customers to do more with glass National sales force, comprising 32 sales personnel and over 65 channel partners, is among the most knowledgeable sale force in the country on glass. • Knowledge leader in glass 27

AIS Operations : Glass Solutions SBU § AIS Glass Solutions, set up as a subsidiary of AIS in 2004 -05, has emerged as the largest processor in the country, within first year of its operations. Glass Solutions § Architectural processing plants located at Taloja (Mumbai), Rewari and Chennai. The 4 th plant at Roorkee has become functional from September, 2007. • An innovation in value addition, offering end-to-end glass solutions § Product range includes high quality architectural processed glass like AIS Stronglas (tempered glass), AIS Securityglas, AIS Acousticglas (laminated glass) and insulated glass units. § Introducing innovative products like windows, tabletops, partitions, shelves, shower cubicles, etc. § • Solving customer problems about glass • Enabling customers to do more with glass National sales force, comprising 32 sales personnel and over 65 channel partners, is among the most knowledgeable sale force in the country on glass. • Knowledge leader in glass 27

AIS Glass Solutions - Sales Trend by Zone 28

AIS Glass Solutions - Sales Trend by Zone 28

AIS Glass Solutions - Sales Trend by Product 29

AIS Glass Solutions - Sales Trend by Product 29

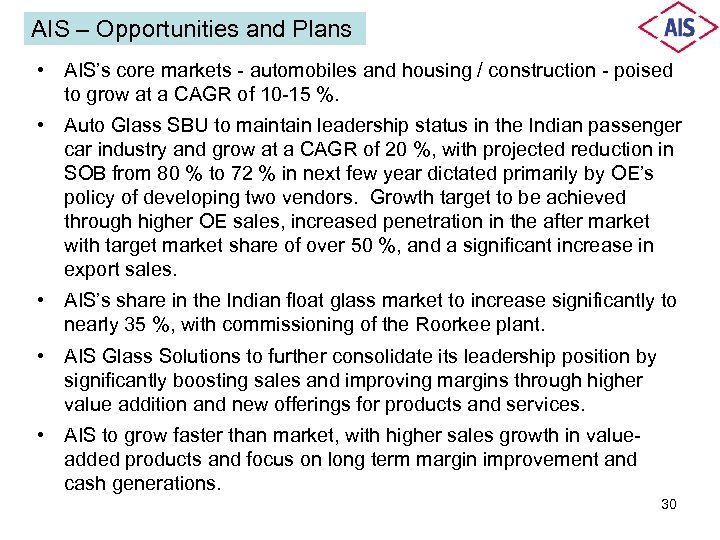

AIS – Opportunities and Plans • AIS’s core markets - automobiles and housing / construction - poised to grow at a CAGR of 10 -15 %. • Auto Glass SBU to maintain leadership status in the Indian passenger car industry and grow at a CAGR of 20 %, with projected reduction in SOB from 80 % to 72 % in next few year dictated primarily by OE’s policy of developing two vendors. Growth target to be achieved through higher OE sales, increased penetration in the after market with target market share of over 50 %, and a significant increase in export sales. • AIS’s share in the Indian float glass market to increase significantly to nearly 35 %, with commissioning of the Roorkee plant. • AIS Glass Solutions to further consolidate its leadership position by significantly boosting sales and improving margins through higher value addition and new offerings for products and services. • AIS to grow faster than market, with higher sales growth in valueadded products and focus on long term margin improvement and cash generations. 30

AIS – Opportunities and Plans • AIS’s core markets - automobiles and housing / construction - poised to grow at a CAGR of 10 -15 %. • Auto Glass SBU to maintain leadership status in the Indian passenger car industry and grow at a CAGR of 20 %, with projected reduction in SOB from 80 % to 72 % in next few year dictated primarily by OE’s policy of developing two vendors. Growth target to be achieved through higher OE sales, increased penetration in the after market with target market share of over 50 %, and a significant increase in export sales. • AIS’s share in the Indian float glass market to increase significantly to nearly 35 %, with commissioning of the Roorkee plant. • AIS Glass Solutions to further consolidate its leadership position by significantly boosting sales and improving margins through higher value addition and new offerings for products and services. • AIS to grow faster than market, with higher sales growth in valueadded products and focus on long term margin improvement and cash generations. 30

AIS – Strategy & Key Focus Areas • Follow Integrated Glass Strategy and - Captively consume nearly 50 - 60 % of AIS’s total float glass production for value-added auto glass and architectural glass products De-commoditize the glass business Improve profitability by capturing end markets and delivering value-added products and services • Improve product mix in domestic markets with a high proportion of innovative, high value-added products and solutions. • Export value added glass to insulate AIS from demand-supply imbalance • Improve operational efficiencies through TQM, TPM and Lean Manufacturing practices across all plants • Build self-sufficiency in process and product development through inhouse development to reduce costs and improving development cycle. • Explore and exploit alternative energy sources to reduce energy cost 31

AIS – Strategy & Key Focus Areas • Follow Integrated Glass Strategy and - Captively consume nearly 50 - 60 % of AIS’s total float glass production for value-added auto glass and architectural glass products De-commoditize the glass business Improve profitability by capturing end markets and delivering value-added products and services • Improve product mix in domestic markets with a high proportion of innovative, high value-added products and solutions. • Export value added glass to insulate AIS from demand-supply imbalance • Improve operational efficiencies through TQM, TPM and Lean Manufacturing practices across all plants • Build self-sufficiency in process and product development through inhouse development to reduce costs and improving development cycle. • Explore and exploit alternative energy sources to reduce energy cost 31

AIS – Goals • AIS Mid Term Plan, spanning through the five year period from FY 2007 to FY 2011, has set out the following goals : - Top line growth at a CAGR of 20 % - Operating profit of over 25 % - Quality of Japan at Cost of China • This Plan will give us Scale, Decommoditization, Customer Intimacy and Operational Excellence. • It will result in an orbital change for us wherein AIS will transform itself into a multi-location, totally integrated value added glass company with leadership in technology and product range at the lowest cost. 32

AIS – Goals • AIS Mid Term Plan, spanning through the five year period from FY 2007 to FY 2011, has set out the following goals : - Top line growth at a CAGR of 20 % - Operating profit of over 25 % - Quality of Japan at Cost of China • This Plan will give us Scale, Decommoditization, Customer Intimacy and Operational Excellence. • It will result in an orbital change for us wherein AIS will transform itself into a multi-location, totally integrated value added glass company with leadership in technology and product range at the lowest cost. 32

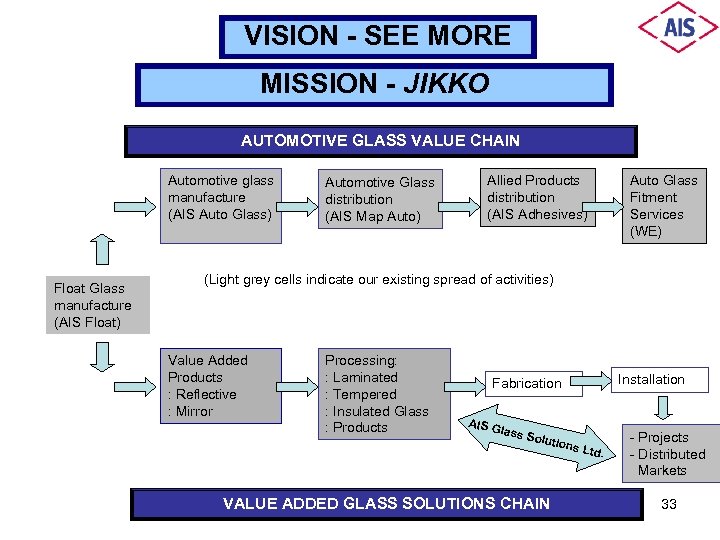

VISION - SEE MORE MISSION - JIKKO AUTOMOTIVE GLASS VALUE CHAIN Automotive glass manufacture (AIS Auto Glass) Float Glass manufacture (AIS Float) Automotive Glass distribution (AIS Map Auto) Allied Products distribution (AIS Adhesives) Auto Glass Fitment Services (WE) (Light grey cells indicate our existing spread of activities) Value Added Products : Reflective : Mirror Processing: : Laminated : Tempered : Insulated Glass : Products Installation Fabrication AIS G lass S olutio VALUE ADDED GLASS SOLUTIONS CHAIN ns Lt d. - Projects - Distributed Markets 33

VISION - SEE MORE MISSION - JIKKO AUTOMOTIVE GLASS VALUE CHAIN Automotive glass manufacture (AIS Auto Glass) Float Glass manufacture (AIS Float) Automotive Glass distribution (AIS Map Auto) Allied Products distribution (AIS Adhesives) Auto Glass Fitment Services (WE) (Light grey cells indicate our existing spread of activities) Value Added Products : Reflective : Mirror Processing: : Laminated : Tempered : Insulated Glass : Products Installation Fabrication AIS G lass S olutio VALUE ADDED GLASS SOLUTIONS CHAIN ns Lt d. - Projects - Distributed Markets 33

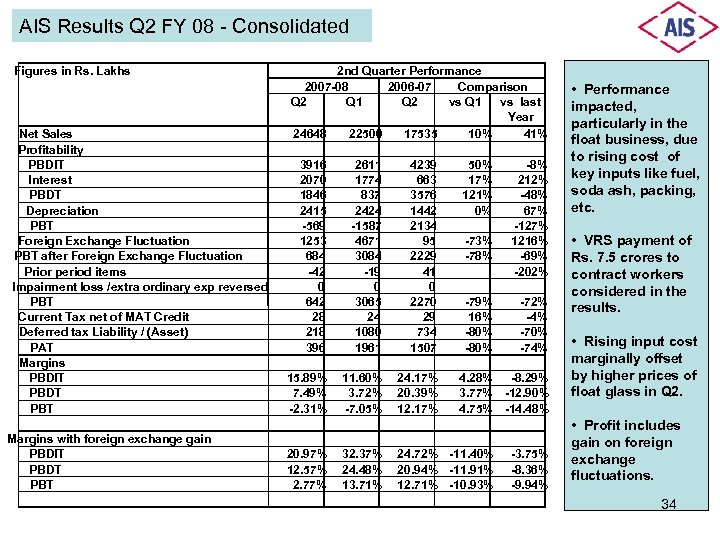

AIS Results Q 2 FY 08 - Consolidated Figures in Rs. Lakhs Net Sales Profitability PBDIT Interest PBDT Depreciation PBT Foreign Exchange Fluctuation PBT after Foreign Exchange Fluctuation Prior period items Impairment loss /extra ordinary exp reversed PBT Current Tax net of MAT Credit Deferred tax Liability / (Asset) PAT Margins PBDIT PBDT PBT Margins with foreign exchange gain PBDIT PBDT PBT 2 nd Quarter Performance 2007 -08 2006 -07 Comparison Q 2 Q 1 Q 2 vs Q 1 vs last Year 24648 22500 17535 10% 41% 3916 2070 1846 2415 -569 1253 684 -42 0 642 28 218 396 2611 1774 837 2424 -1587 4671 3084 -19 0 3065 24 1080 1961 4239 663 3576 1442 2134 95 2229 41 0 2270 29 734 1507 15. 89% 7. 49% -2. 31% 11. 60% 3. 72% -7. 05% 24. 17% 20. 39% 12. 17% 20. 97% 12. 57% 2. 77% 32. 37% 24. 48% 13. 71% 50% 17% 121% 0% -73% -78% -79% 16% -80% -8% 212% -48% 67% -127% 1216% -69% -202% -72% -4% -70% -74% 4. 28% -8. 29% 3. 77% -12. 90% 4. 75% -14. 48% 24. 72% -11. 40% 20. 94% -11. 91% 12. 71% -10. 93% -3. 75% -8. 36% -9. 94% • Performance impacted, particularly in the float business, due to rising cost of key inputs like fuel, soda ash, packing, etc. • VRS payment of Rs. 7. 5 crores to contract workers considered in the results. • Rising input cost marginally offset by higher prices of float glass in Q 2. • Profit includes gain on foreign exchange fluctuations. 34

AIS Results Q 2 FY 08 - Consolidated Figures in Rs. Lakhs Net Sales Profitability PBDIT Interest PBDT Depreciation PBT Foreign Exchange Fluctuation PBT after Foreign Exchange Fluctuation Prior period items Impairment loss /extra ordinary exp reversed PBT Current Tax net of MAT Credit Deferred tax Liability / (Asset) PAT Margins PBDIT PBDT PBT Margins with foreign exchange gain PBDIT PBDT PBT 2 nd Quarter Performance 2007 -08 2006 -07 Comparison Q 2 Q 1 Q 2 vs Q 1 vs last Year 24648 22500 17535 10% 41% 3916 2070 1846 2415 -569 1253 684 -42 0 642 28 218 396 2611 1774 837 2424 -1587 4671 3084 -19 0 3065 24 1080 1961 4239 663 3576 1442 2134 95 2229 41 0 2270 29 734 1507 15. 89% 7. 49% -2. 31% 11. 60% 3. 72% -7. 05% 24. 17% 20. 39% 12. 17% 20. 97% 12. 57% 2. 77% 32. 37% 24. 48% 13. 71% 50% 17% 121% 0% -73% -78% -79% 16% -80% -8% 212% -48% 67% -127% 1216% -69% -202% -72% -4% -70% -74% 4. 28% -8. 29% 3. 77% -12. 90% 4. 75% -14. 48% 24. 72% -11. 40% 20. 94% -11. 91% 12. 71% -10. 93% -3. 75% -8. 36% -9. 94% • Performance impacted, particularly in the float business, due to rising cost of key inputs like fuel, soda ash, packing, etc. • VRS payment of Rs. 7. 5 crores to contract workers considered in the results. • Rising input cost marginally offset by higher prices of float glass in Q 2. • Profit includes gain on foreign exchange fluctuations. 34

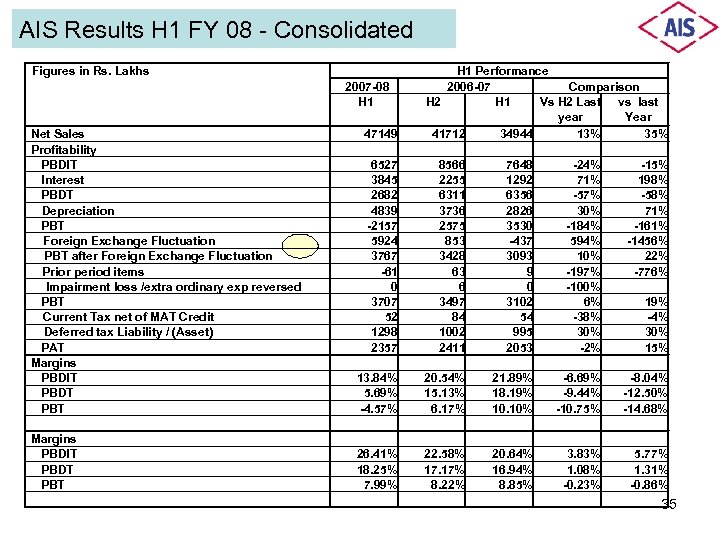

AIS Results H 1 FY 08 - Consolidated Figures in Rs. Lakhs 2007 -08 H 1 47149 H 1 Performance 2006 -07 Comparison H 2 H 1 Vs H 2 Last vs last year Year 41712 34944 13% 35% Net Sales Profitability PBDIT Interest PBDT Depreciation PBT Foreign Exchange Fluctuation PBT after Foreign Exchange Fluctuation Prior period items Impairment loss /extra ordinary exp reversed PBT Current Tax net of MAT Credit Deferred tax Liability / (Asset) PAT Margins PBDIT PBDT PBT 6527 3845 2682 4839 -2157 5924 3767 -61 0 3707 52 1298 2357 8566 2255 6311 3736 2575 853 3428 63 6 3497 84 1002 2411 7648 1292 6356 2826 3530 -437 3093 9 0 3102 54 995 2053 -24% 71% -57% 30% -184% 594% 10% -197% -100% 6% -38% 30% -2% -15% 198% -58% 71% -161% -1456% 22% -776% 13. 84% 5. 69% -4. 57% 20. 54% 15. 13% 6. 17% 21. 89% 18. 19% 10. 10% -6. 69% -9. 44% -10. 75% -8. 04% -12. 50% -14. 68% Margins PBDIT PBDT PBT 26. 41% 18. 25% 7. 99% 22. 58% 17. 17% 8. 22% 20. 64% 16. 94% 8. 85% 3. 83% 1. 08% -0. 23% 5. 77% 1. 31% -0. 86% 19% -4% 30% 15% 35

AIS Results H 1 FY 08 - Consolidated Figures in Rs. Lakhs 2007 -08 H 1 47149 H 1 Performance 2006 -07 Comparison H 2 H 1 Vs H 2 Last vs last year Year 41712 34944 13% 35% Net Sales Profitability PBDIT Interest PBDT Depreciation PBT Foreign Exchange Fluctuation PBT after Foreign Exchange Fluctuation Prior period items Impairment loss /extra ordinary exp reversed PBT Current Tax net of MAT Credit Deferred tax Liability / (Asset) PAT Margins PBDIT PBDT PBT 6527 3845 2682 4839 -2157 5924 3767 -61 0 3707 52 1298 2357 8566 2255 6311 3736 2575 853 3428 63 6 3497 84 1002 2411 7648 1292 6356 2826 3530 -437 3093 9 0 3102 54 995 2053 -24% 71% -57% 30% -184% 594% 10% -197% -100% 6% -38% 30% -2% -15% 198% -58% 71% -161% -1456% 22% -776% 13. 84% 5. 69% -4. 57% 20. 54% 15. 13% 6. 17% 21. 89% 18. 19% 10. 10% -6. 69% -9. 44% -10. 75% -8. 04% -12. 50% -14. 68% Margins PBDIT PBDT PBT 26. 41% 18. 25% 7. 99% 22. 58% 17. 17% 8. 22% 20. 64% 16. 94% 8. 85% 3. 83% 1. 08% -0. 23% 5. 77% 1. 31% -0. 86% 19% -4% 30% 15% 35

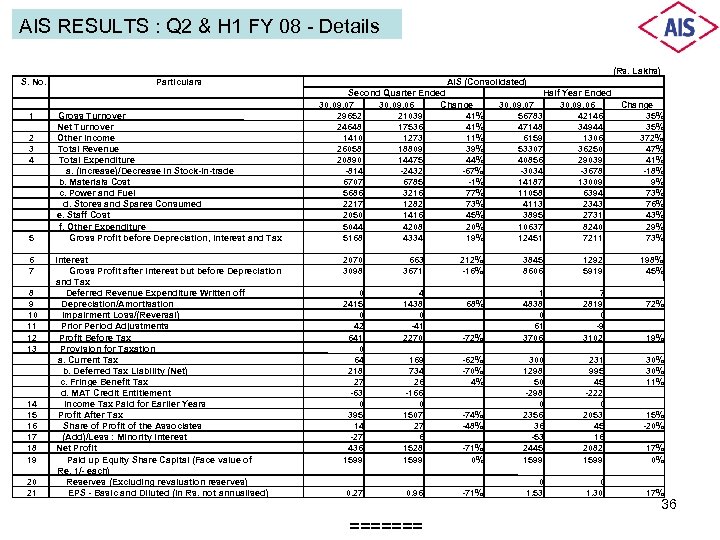

AIS RESULTS : Q 2 & H 1 FY 08 - Details (Rs. Lakhs) S. No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 Particulars Gross Turnover Net Turnover Other Income Total Revenue Total Expenditure a. (Increase)/Decrease in Stock-in-trade b. Materials Cost c. Power and Fuel d. Stores and Spares Consumed e. Staff Cost f. Other Expenditure Gross Profit before Depreciation, Interest and Tax Interest Gross Profit after Interest but before Depreciation and Tax Deferred Revenue Expenditure Written off Depreciation/Amortisation Impairment Loss/(Reversal) Prior Period Adjustments Profit Before Tax Provision for Taxation a. Current Tax b. Deferred Tax Liability (Net) c. Fringe Benefit Tax d. MAT Credit Entitlement Income Tax Paid for Earlier Years Profit After Tax Share of Profit of the Associates (Add)/Less : Minority Interest Net Profit Paid up Equity Share Capital (Face value of Re. 1/- each) Reserves (Excluding revaluation reserves) EPS - Basic and Diluted (in Rs. not annualised) AIS (Consolidated) Second Quarter Ended 30. 09. 07 30. 09. 06 Change 29652 21039 41% 24648 17536 41% 1410 1273 11% 26058 18809 39% 20890 14475 44% -814 -2432 -67% 6707 6785 -1% 5686 3216 77% 2217 1282 73% 2050 1416 45% 5044 4208 20% 5168 4334 19% 2070 3098 663 3671 0 2415 0 42 641 0 64 218 27 -63 0 395 14 -27 436 1599 4 1438 0 -41 2270 169 734 26 -166 0 1507 27 6 1528 1599 -62% -70% 4% 0. 27 0. 96 ======= 212% -16% Half Year Ended 30. 09. 07 30. 09. 06 Change 56783 42146 35% 47148 34944 35% 6159 1306 372% 53307 36250 47% 40856 29039 41% -3034 -3678 -18% 14187 13009 9% 11058 6394 73% 4113 2343 76% 3895 2731 43% 10637 8240 29% 12451 7211 73% 3845 8606 1292 5919 1 4838 0 61 3706 7 2819 0 -9 3102 -71% 0% 300 1298 50 -298 0 2356 36 -53 2445 1599 231 995 45 -222 0 2053 45 16 2082 1599 -71% 0 1. 53 0 1. 30 68% -72% -74% -48% 198% 45% 72% 19% 30% 11% 15% -20% 17% 36

AIS RESULTS : Q 2 & H 1 FY 08 - Details (Rs. Lakhs) S. No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 Particulars Gross Turnover Net Turnover Other Income Total Revenue Total Expenditure a. (Increase)/Decrease in Stock-in-trade b. Materials Cost c. Power and Fuel d. Stores and Spares Consumed e. Staff Cost f. Other Expenditure Gross Profit before Depreciation, Interest and Tax Interest Gross Profit after Interest but before Depreciation and Tax Deferred Revenue Expenditure Written off Depreciation/Amortisation Impairment Loss/(Reversal) Prior Period Adjustments Profit Before Tax Provision for Taxation a. Current Tax b. Deferred Tax Liability (Net) c. Fringe Benefit Tax d. MAT Credit Entitlement Income Tax Paid for Earlier Years Profit After Tax Share of Profit of the Associates (Add)/Less : Minority Interest Net Profit Paid up Equity Share Capital (Face value of Re. 1/- each) Reserves (Excluding revaluation reserves) EPS - Basic and Diluted (in Rs. not annualised) AIS (Consolidated) Second Quarter Ended 30. 09. 07 30. 09. 06 Change 29652 21039 41% 24648 17536 41% 1410 1273 11% 26058 18809 39% 20890 14475 44% -814 -2432 -67% 6707 6785 -1% 5686 3216 77% 2217 1282 73% 2050 1416 45% 5044 4208 20% 5168 4334 19% 2070 3098 663 3671 0 2415 0 42 641 0 64 218 27 -63 0 395 14 -27 436 1599 4 1438 0 -41 2270 169 734 26 -166 0 1507 27 6 1528 1599 -62% -70% 4% 0. 27 0. 96 ======= 212% -16% Half Year Ended 30. 09. 07 30. 09. 06 Change 56783 42146 35% 47148 34944 35% 6159 1306 372% 53307 36250 47% 40856 29039 41% -3034 -3678 -18% 14187 13009 9% 11058 6394 73% 4113 2343 76% 3895 2731 43% 10637 8240 29% 12451 7211 73% 3845 8606 1292 5919 1 4838 0 61 3706 7 2819 0 -9 3102 -71% 0% 300 1298 50 -298 0 2356 36 -53 2445 1599 231 995 45 -222 0 2053 45 16 2082 1599 -71% 0 1. 53 0 1. 30 68% -72% -74% -48% 198% 45% 72% 19% 30% 11% 15% -20% 17% 36