a8f1ad2cfc62bf0e7041945035df7780.ppt

- Количество слайдов: 46

10. 2009 Webinar: PV Financial Analysis Matt Heling Program Manager Solar & Customer Generation Pacific Gas & Electric Co. Garen Grigoryan Business Analyst Solar & Customer Generation Pacific Gas & Electric Co.

PG&E Webinar: PV Financial Analysis Webinar Goal Review concepts and resources needed to understand and/or perform an analysis of PV system cost-effectiveness. 2

PG&E Webinar: PV Financial Analysis Agenda • PV system costs • PV systems benefits (financial) • Methods of financial analysis 3

PG&E Webinar: PV Financial Analysis Energy Efficiency 4

PG&E Webinar: PV Financial Analysis 5 Energy Efficiency • Energy efficiency is typically the most costeffective way to reduce your energy bill • Energy efficiency also reduces the size of the solar system you need – Can save $1, 000’s of dollars on the cost of the system • An energy efficiency audit is required to be eligible for some customer-side incentive programs

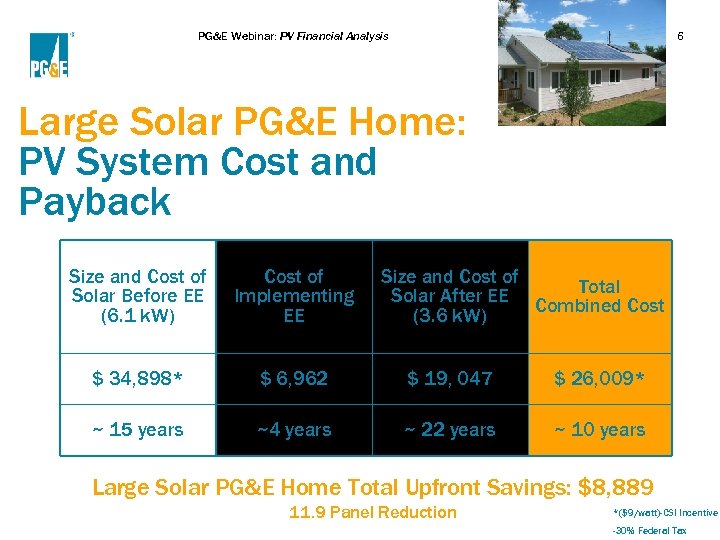

PG&E Webinar: PV Financial Analysis 6 Large Solar PG&E Home: PV System Cost and Payback Size and Cost of Solar Before EE (6. 1 k. W) Cost of Implementing EE Size and Cost of Total Solar After EE Combined Cost (3. 6 k. W) $ 34, 898* $ 6, 962 $ 19, 047 $ 26, 009* ~ 15 years ~4 years ~ 22 years ~ 10 years Large Solar PG&E Home Total Upfront Savings: $8, 889 11. 9 Panel Reduction *($9/watt)-CSI Incentive -30% Federal Tax

PG&E Webinar: PV Financial Analysis Site Screening Criteria 7

PG&E Webinar: PV Financial Analysis 8 Site Screening What physical site characteristics makes a site a good candidate for PV? – Orientation – S or SW is best – Solar “window” – Access to mid-day sunlight – Roof tilt – ~30º is ideal, but even flat is okay – Weather – Typically good in CA

PG&E Webinar: PV Financial Analysis System Performance 9

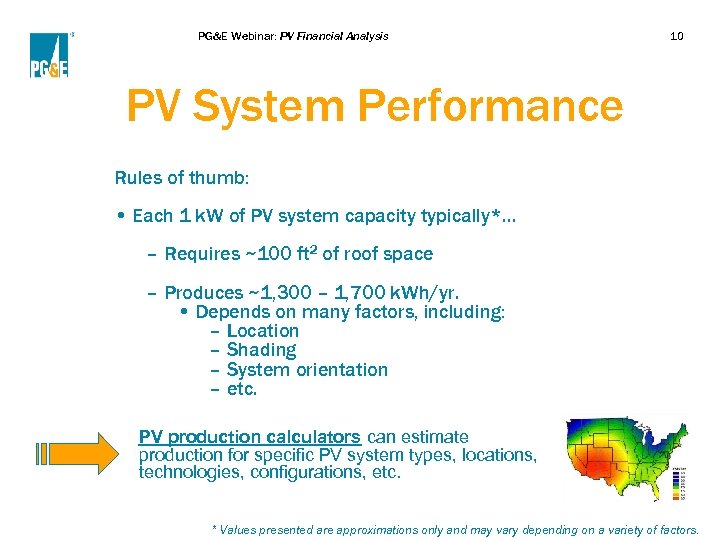

PG&E Webinar: PV Financial Analysis 10 PV System Performance Rules of thumb: • Each 1 k. W of PV system capacity typically*… – Requires ~100 ft 2 of roof space – Produces ~1, 300 – 1, 700 k. Wh/yr. • Depends on many factors, including: – Location – Shading – System orientation – etc. PV production calculators can estimate production for specific PV system types, locations, technologies, configurations, etc. * Values presented are approximations only and may vary depending on a variety of factors.

PG&E Webinar: PV Financial Analysis System Costs 11

PG&E Webinar: PV Financial Analysis Capital Investment • Modules (Panels) • Inverters • Balance of system cost Typical installed costs are $8 to $10 per Watt 12

PG&E Webinar: PV Financial Analysis 13 Operations and Maintenance Costs • Washing – Cost related to hiring a service to perform this maintenance twice a year • Inverter replacement – Typically every ten years • PMRS (Performance Monitoring and Reporting Service) – Additional monthly cost - offset by owner’s awareness of system performance

PG&E Webinar: PV Financial Analysis Incentives 14

PG&E Webinar: PV Financial Analysis 15 Types of Incentives • CSI – California Solar Initiative • NSHP – New Solar Homes Partnership • MASH – Multifamily Affordable Solar Homes • SASH – Single Family Affordable Solar Homes • Local Incentives and Financing Opportunities – San Francisco – Berkeley (Berkeley First) – Sonoma (SCEIP) • Federal ITC / Depreciation

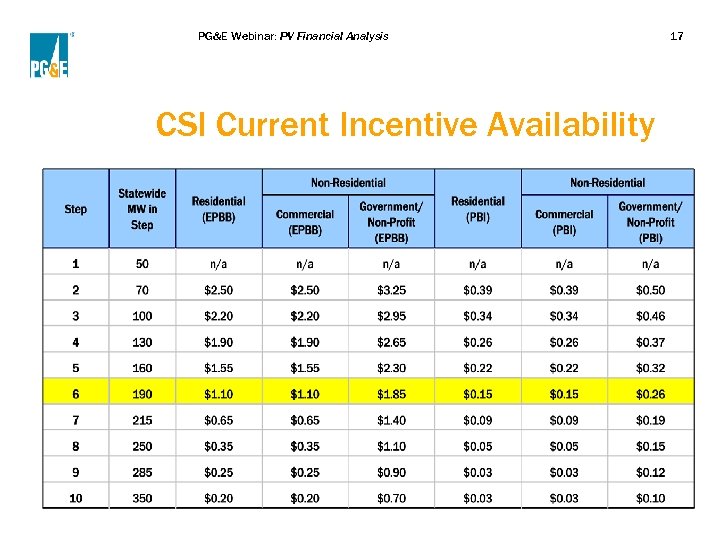

PG&E Webinar: PV Financial Analysis 16 CSI – California Solar Initiative • Applies to Retrofit Residential and Non. Residential, plus New Construction Non. Residential • Incentives designed to decline over time – Currently both Residential & Non-Residential are in step 6 • Two types of Incentive Payments – EPBB (Expected Performance Based Buy-Down) – one lump sum paid upfront – PBI (Performance Based Incentive) – once a month payments made over 5 years

PG&E Webinar: PV Financial Analysis CSI Current Incentive Availability 17

PG&E Webinar: PV Financial Analysis 18 NHSP – New Solar Homes Partnership • Only For New Residential Home Construction – Builders – Developers – Custom home owners • Aims to install 400 MW • Incentive budget is $400 MM • One time, upfront, expected performance based incentive (EPBI) • PV system size 1 k. W AC or larger (>5 k. W requires justification)

PG&E Webinar: PV Financial Analysis 19 MASH and SASH • Designed to encourage solar adoption for low income housing residents • MASH – Administered by PG&E – $108 MM available for incentives – Track 1 a: $3. 30/Watt for systems that offset common load – Track 1 b: $4. 00/Watt for systems that offset tenant load • SASH – Administered by Grid Alternatives – $108 MM available for incentives – Very low income customers may receive a 1 k. W fully subsidized (up to $10, 000) system

PG&E Webinar: PV Financial Analysis 20 City Government Incentive • San Francisco – 10 year program – In addition to other incentives – $1, 000 to $3, 500 for Residential – Up to $10, 000 for Commercial – Low income residents may qualify for additional grants

PG&E Webinar: PV Financial Analysis 21 Federal ITC • Solar Investment Tax Credit* – Went into effect January 1 st 2009 – Available for next 8 years (through 2016) – 30% of net solar system cost – No monetary cap – Applies to residential & commercial *All tax related statement are designed to inform and not to be construed as tax advise. Please consult a tax attorney before making any purchasing decisions.

PG&E Webinar: PV Financial Analysis 22 Bonus Depreciation • Applies to commercial system owners Only – Benefits extended for systems installed in 2009 • 50% of cost of capital investment • Up to $250, 000 with phase-out threshold of $800, 000 – Benefits will continue for systems installed 2010 with reduced depreciation allowances • Allowed write-off up to $125, 000 of capital expenditure • Subject to phase-out once capital expenditure exceeds $500, 000 *All tax related statement are designed to inform and not to be construed as tax advise. Please consult a tax attorney before making any purchasing decisions.

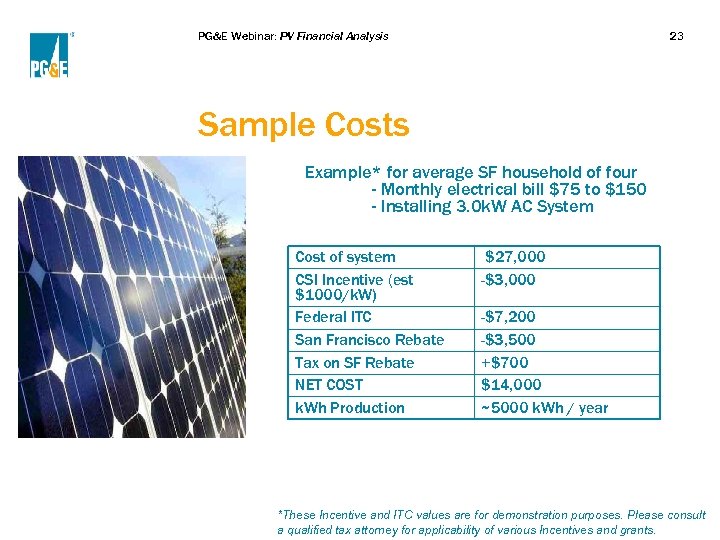

PG&E Webinar: PV Financial Analysis 23 Sample Costs Example* for average SF household of four - Monthly electrical bill $75 to $150 - Installing 3. 0 k. W AC System Cost of system CSI Incentive (est $1000/k. W) Federal ITC San Francisco Rebate Tax on SF Rebate NET COST k. Wh Production $27, 000 -$3, 000 -$7, 200 -$3, 500 +$700 $14, 000 ~5000 k. Wh / year *These Incentive and ITC values are for demonstration purposes. Please consult a qualified tax attorney for applicability of various Incentives and grants.

PG&E Webinar: PV Financial Analysis Electricity Costs and Net Energy Metering 24

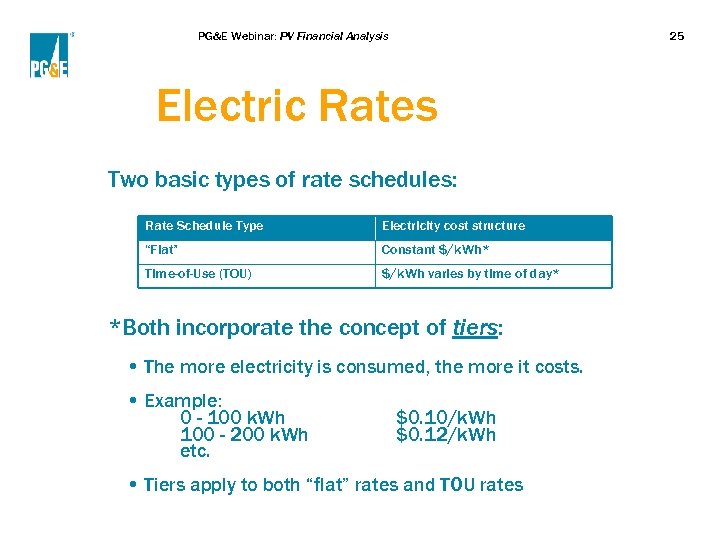

PG&E Webinar: PV Financial Analysis 25 Electric Rates Two basic types of rate schedules: Rate Schedule Type Electricity cost structure “Flat” Constant $/k. Wh* Time-of-Use (TOU) $/k. Wh varies by time of day* *Both incorporate the concept of tiers: • The more electricity is consumed, the more it costs. • Example: 0 - 100 k. Wh 100 - 200 k. Wh etc. $0. 10/k. Wh $0. 12/k. Wh • Tiers apply to both “flat” rates and TOU rates

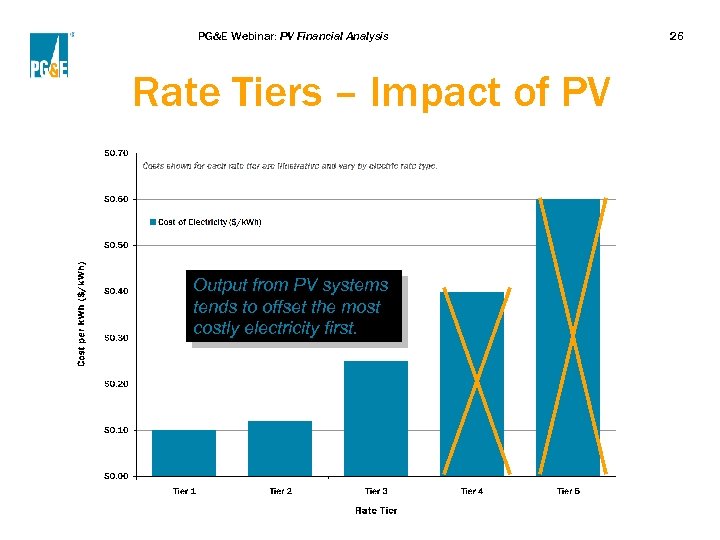

PG&E Webinar: PV Financial Analysis Rate Tiers – Impact of PV Output from PV systems tends to offset the most costly electricity first. 26

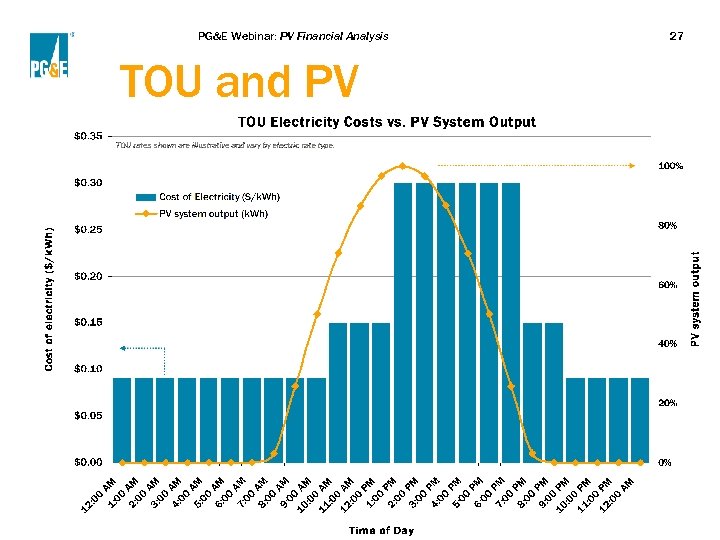

PG&E Webinar: PV Financial Analysis TOU and PV 27

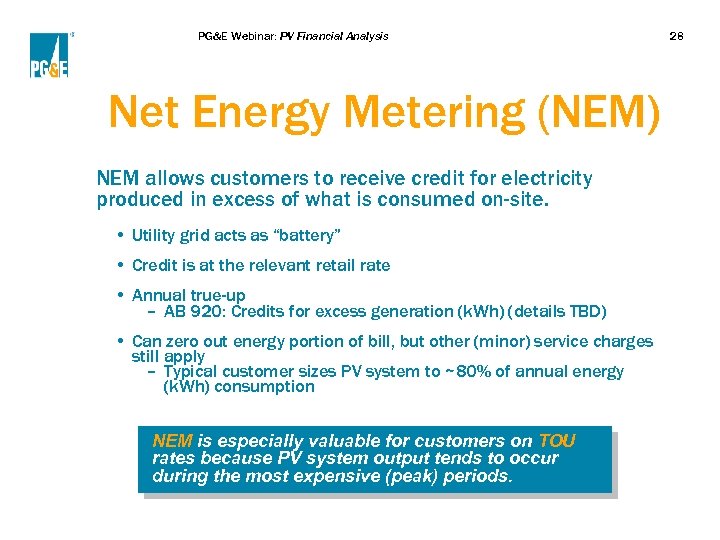

PG&E Webinar: PV Financial Analysis Net Energy Metering (NEM) NEM allows customers to receive credit for electricity produced in excess of what is consumed on-site. • Utility grid acts as “battery” • Credit is at the relevant retail rate • Annual true-up – AB 920: Credits for excess generation (k. Wh) (details TBD) • Can zero out energy portion of bill, but other (minor) service charges still apply – Typical customer sizes PV system to ~80% of annual energy (k. Wh) consumption NEM is especially valuable for customers on TOU rates because PV system output tends to occur during the most expensive (peak) periods. 28

PG&E Webinar: PV Financial Analysis Financing Options 29

PG&E Webinar: PV Financial Analysis Purchasing Options • Cash / Financing • Power Purchase Agreement • Lease To Own 30

PG&E Webinar: PV Financial Analysis 31 City and County Financing • Berkeley – Creative financing – Berkeley First • Sonoma County – SCEIP – Sonoma County Energy Independence Program – Financing is for existing buildings only – Repayments made through property tax bills over time

PG&E Webinar: PV Financial Analysis 32 PPA Structure • Third Party owns system and is responsible for financing, designing, installing, monitoring and maintaining for the customer • No upfront fee required • Customer purchases electricity (k. Wh) the system generates at contracted rates • Customer may purchase system after contract expires • Contracts are typically 20 to 25 years • RECs (Renewable Energy Credits) are claimed by third party

PG&E Webinar: PV Financial Analysis 33 Lease To Own • Third Party owns system and is responsible for financing, designing, installing, monitoring and maintaining for the customer • Customer typically pays a small upfront fee • Customer enters into a lease agreement • Significant reduction in electricity bill • Contracts are typically ~10 years • Leases may have annual built-in increases – typically not exceeding increases of electricity rates

PG&E Webinar: PV Financial Analysis Renewable Energy Credits 34

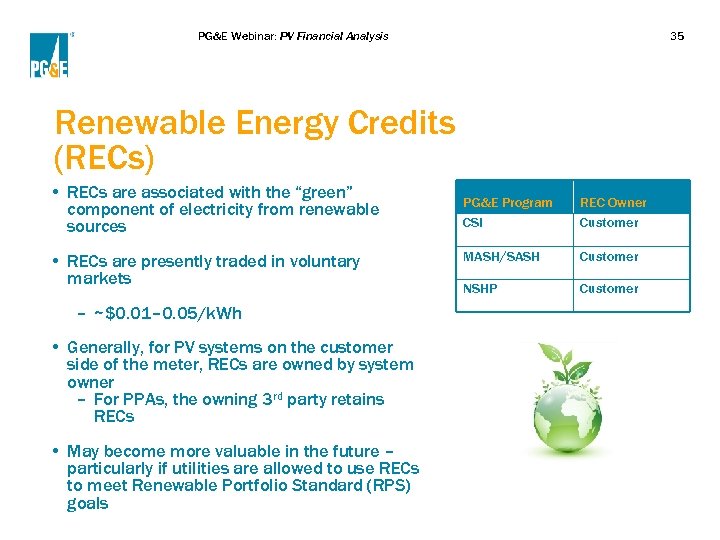

PG&E Webinar: PV Financial Analysis 35 Renewable Energy Credits (RECs) • RECs are associated with the “green” component of electricity from renewable sources • RECs are presently traded in voluntary markets – ~$0. 01– 0. 05/k. Wh • Generally, for PV systems on the customer side of the meter, RECs are owned by system owner – For PPAs, the owning 3 rd party retains RECs • May become more valuable in the future – particularly if utilities are allowed to use RECs to meet Renewable Portfolio Standard (RPS) goals PG&E Program CSI REC Owner Customer MASH/SASH Customer NSHP Customer

PG&E Webinar: PV Financial Analysis Methods of Financial Analysis 36

PG&E Webinar: PV Financial Analysis 37 The Key Questions 1. How much does/will my PV system cost? vs. 2. What is the value of the avoided electricity costs and other financial benefits?

PG&E Webinar: PV Financial Analysis 38 Key Inputs and Variables • Capital (installed) costs – PV modules, inverter, installation, monitoring equipment, etc. – Inverter replacement • Incentives – May be received up-front or over time • O&M costs – Panel-washing, monitoring service, etc. • Tax credits – ITC – Other local tax benefits • PV system performance – Annual energy production – Performance degradation – System life • Financing method – Cash vs. loan vs. PPA vs. … • Value of electricity displaced – Projected electricity production – Electric rate type (TOU vs. not) – Projected future electricity rate increases • Other assumptions/concepts – Discount rate (opportunity cost) – Compound interest

PG&E Webinar: PV Financial Analysis Methods of Analysis • Simple payback – Years until costs are recovered • Total life cycle payback – Considers benefits received after simple payback is attained • Cash flow model – Shows expenses and revenues each year – See Appendix for example/illustration • Internal rate of return – Average annual profit (loss) over life of system 39

PG&E Webinar: PV Financial Analysis Information Resources 40

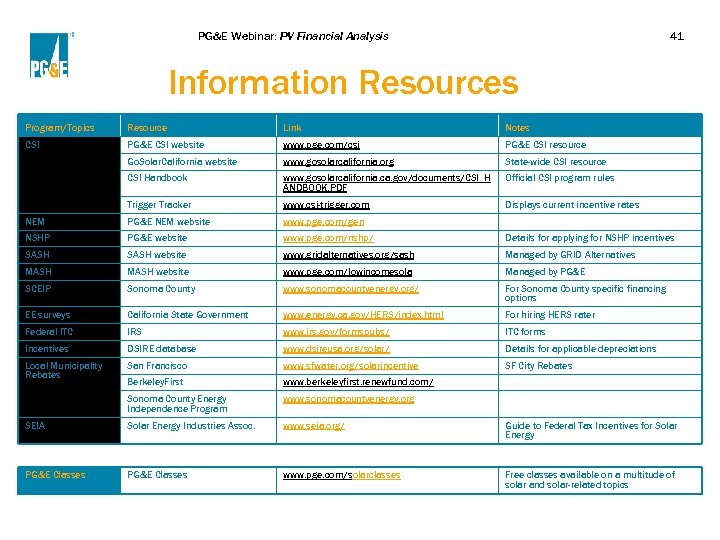

PG&E Webinar: PV Financial Analysis 41 Information Resources Program/Topics Resource Link Notes CSI PG&E CSI website www. pge. com/csi PG&E CSI resource Go. Solar. California website www. gosolarcalifornia. org State-wide CSI resource CSI Handbook www. gosolarcalifornia. ca. gov/documents/CSI_H ANDBOOK. PDF Official CSI program rules Trigger Tracker www. csi-trigger. com Displays current incentive rates NEM PG&E NEM website www. pge. com/gen NSHP PG&E website www. pge. com/nshp/ Details for applying for NSHP incentives SASH website www. gridalternatives. org/sash Managed by GRID Alternatives MASH website www. pge. com/lowincomesola Managed by PG&E SCEIP Sonoma County www. sonomacountyenergy. org/ For Sonoma County specific financing options EE surveys California State Government www. energy. ca. gov/HERS/index. html For hiring HERS rater Federal ITC IRS www. irs. gov/formspubs/ ITC forms Incentives DSIRE database www. dsireusa. org/solar/ Details for applicable depreciations Local Municipality Rebates San Francisco www. sfwater. org/solarincentive SF City Rebates Berkeley. First www. berkeleyfirst. renewfund. com/ Sonoma County Energy Independence Program www. sonomacountyenergy. org SEIA Solar Energy Industries Assoc. www. seia. org/ Guide to Federal Tax Incentives for Solar Energy PG&E Classes www. pge. com/solarclasses Free classes available on a multitude of solar and solar-related topics

PG&E Webinar: PV Financial Analysis 42 Thank you! Your thoughts? • Suggestions for future content? • Opinions on content and delivery? • Topics to emphasize or de-emphasize? • How can we provide a better service? Feedback is welcomed! mgh 9@pge. com

PG&E Webinar: PV Financial Analysis Appendix 43

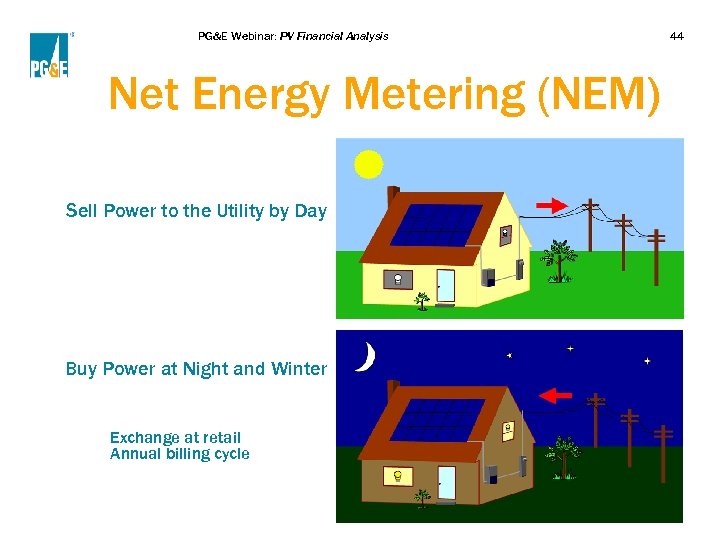

PG&E Webinar: PV Financial Analysis Net Energy Metering (NEM) Sell Power to the Utility by Day Buy Power at Night and Winter Exchange at retail Annual billing cycle 44

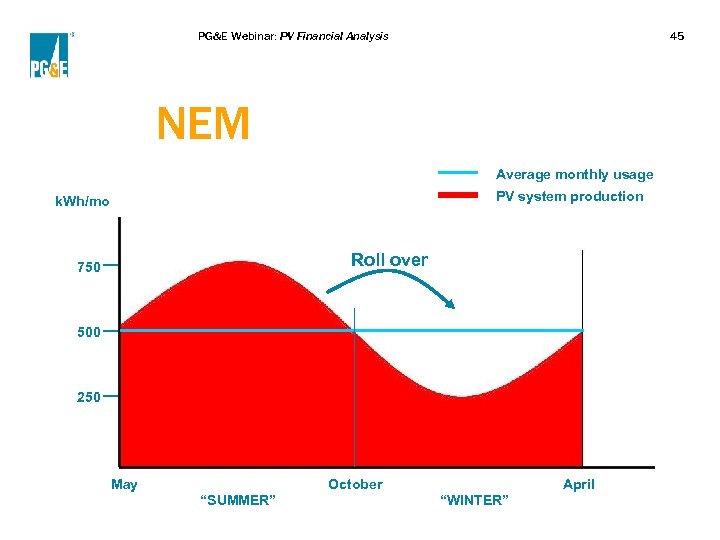

PG&E Webinar: PV Financial Analysis 45 NEM Average monthly usage PV system production k. Wh/mo Roll over 750 500 250 May October “SUMMER” April “WINTER”

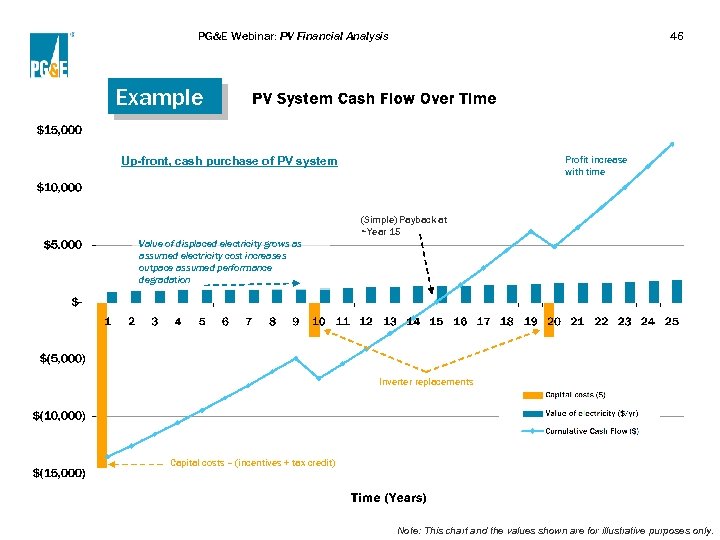

PG&E Webinar: PV Financial Analysis 46 Example Profit increase with time Up-front, cash purchase of PV system (Simple) Payback at ~Year 15 Value of displaced electricity grows as assumed electricity cost increases outpace assumed performance degradation Inverter replacements Capital costs – (incentives + tax credit) Note: This chart and the values shown are for illustrative purposes only.

a8f1ad2cfc62bf0e7041945035df7780.ppt