62bdaf795dcb59bf2bb42ce023520a44.ppt

- Количество слайдов: 32

10 - 1 CHAPTER 10 The Cost of Capital n Cost of Capital Components l. Debt l. Preferred l. Common Equity n WACC Copyright © 1999 by The Dryden Press All rights reserved.

10 - 1 CHAPTER 10 The Cost of Capital n Cost of Capital Components l. Debt l. Preferred l. Common Equity n WACC Copyright © 1999 by The Dryden Press All rights reserved.

10 - 2 What types of long-term capital do firms use? n. Long-term debt n. Preferred stock n. Common equity Copyright © 1999 by The Dryden Press All rights reserved.

10 - 2 What types of long-term capital do firms use? n. Long-term debt n. Preferred stock n. Common equity Copyright © 1999 by The Dryden Press All rights reserved.

10 - 3 Should we focus on before-tax or after-tax capital costs? n. Tax effects associated with financing can be incorporated either in capital budgeting cash flows or in cost of capital. n. Most firms incorporate tax effects in the cost of capital. Therefore, focus on after-tax costs. n. Only cost of debt is affected. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 3 Should we focus on before-tax or after-tax capital costs? n. Tax effects associated with financing can be incorporated either in capital budgeting cash flows or in cost of capital. n. Most firms incorporate tax effects in the cost of capital. Therefore, focus on after-tax costs. n. Only cost of debt is affected. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 4 Should we focus on historical (embedded) costs or new (marginal) costs? The cost of capital is used primarily to make decisions which involve raising and investing new capital. So, we should focus on marginal costs. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 4 Should we focus on historical (embedded) costs or new (marginal) costs? The cost of capital is used primarily to make decisions which involve raising and investing new capital. So, we should focus on marginal costs. Copyright © 1999 by The Dryden Press All rights reserved.

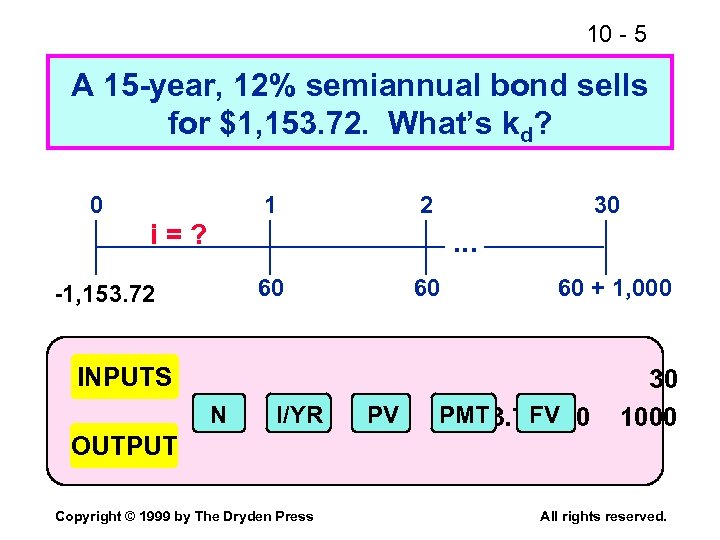

10 - 5 A 15 -year, 12% semiannual bond sells for $1, 153. 72. What’s kd? 0 1 i=? 2 30 . . . 60 -1, 153. 72 60 60 + 1, 000 INPUTS N I/YR PV PMT FV -1153. 72 60 30 1000 OUTPUT Copyright © 1999 by The Dryden Press All rights reserved.

10 - 5 A 15 -year, 12% semiannual bond sells for $1, 153. 72. What’s kd? 0 1 i=? 2 30 . . . 60 -1, 153. 72 60 60 + 1, 000 INPUTS N I/YR PV PMT FV -1153. 72 60 30 1000 OUTPUT Copyright © 1999 by The Dryden Press All rights reserved.

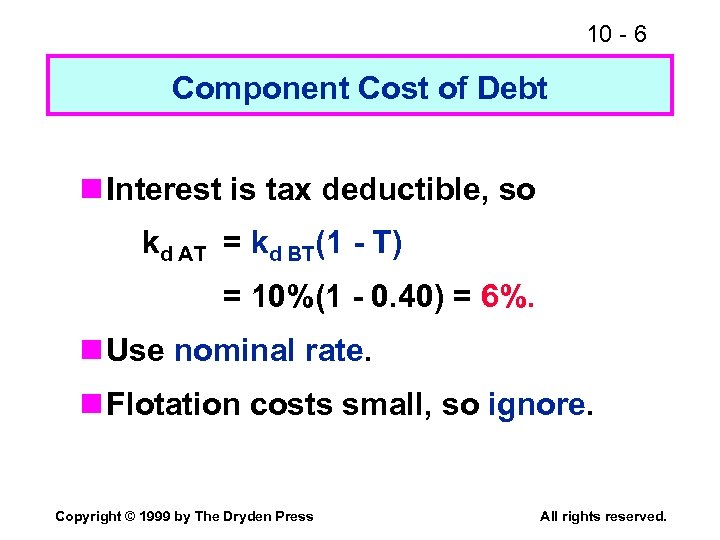

10 - 6 Component Cost of Debt n Interest is tax deductible, so kd AT = kd BT(1 - T) = 10%(1 - 0. 40) = 6%. n Use nominal rate. n Flotation costs small, so ignore. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 6 Component Cost of Debt n Interest is tax deductible, so kd AT = kd BT(1 - T) = 10%(1 - 0. 40) = 6%. n Use nominal rate. n Flotation costs small, so ignore. Copyright © 1999 by The Dryden Press All rights reserved.

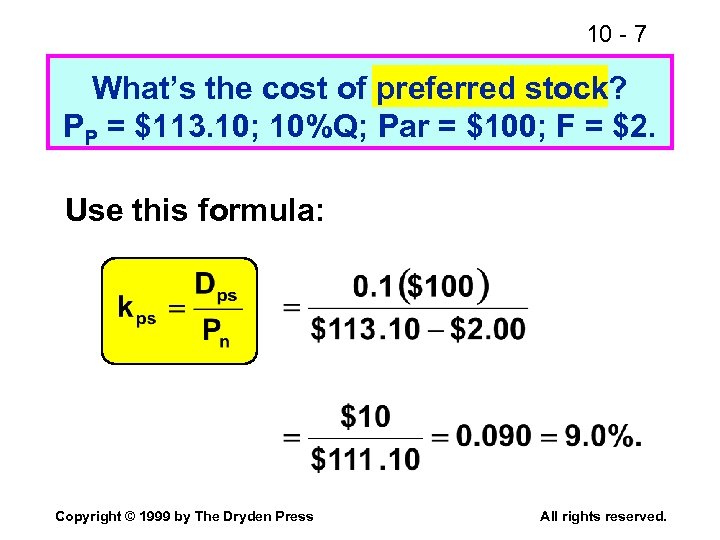

10 - 7 What’s the cost of preferred stock? PP = $113. 10; 10%Q; Par = $100; F = $2. Use this formula: Copyright © 1999 by The Dryden Press All rights reserved.

10 - 7 What’s the cost of preferred stock? PP = $113. 10; 10%Q; Par = $100; F = $2. Use this formula: Copyright © 1999 by The Dryden Press All rights reserved.

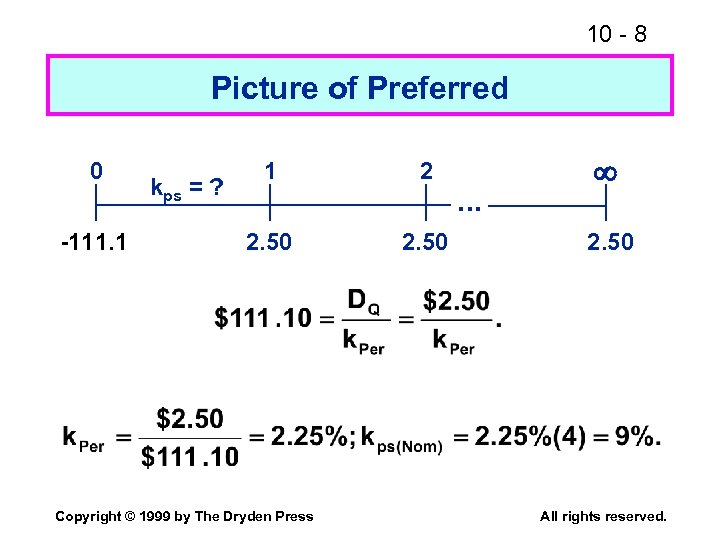

10 - 8 Picture of Preferred 0 -111. 1 kps = ? 1 2 2. 50 Copyright © 1999 by The Dryden Press . . . ¥ 2. 50 All rights reserved.

10 - 8 Picture of Preferred 0 -111. 1 kps = ? 1 2 2. 50 Copyright © 1999 by The Dryden Press . . . ¥ 2. 50 All rights reserved.

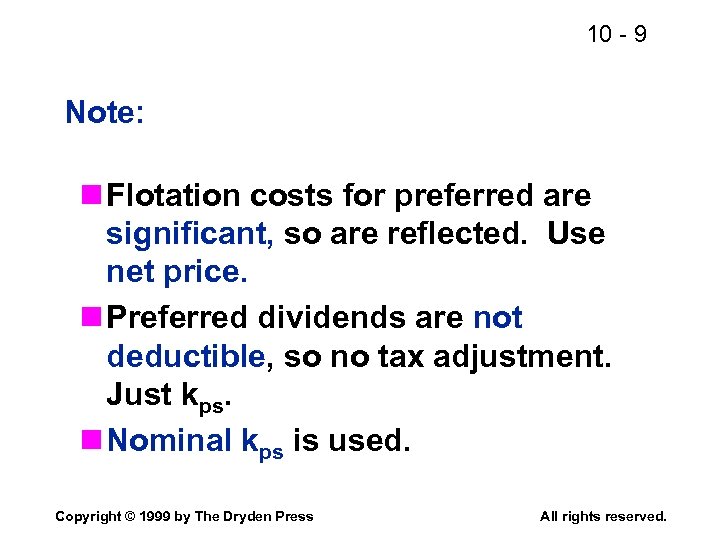

10 - 9 Note: n Flotation costs for preferred are significant, so are reflected. Use net price. n Preferred dividends are not deductible, so no tax adjustment. Just kps. n Nominal kps is used. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 9 Note: n Flotation costs for preferred are significant, so are reflected. Use net price. n Preferred dividends are not deductible, so no tax adjustment. Just kps. n Nominal kps is used. Copyright © 1999 by The Dryden Press All rights reserved.

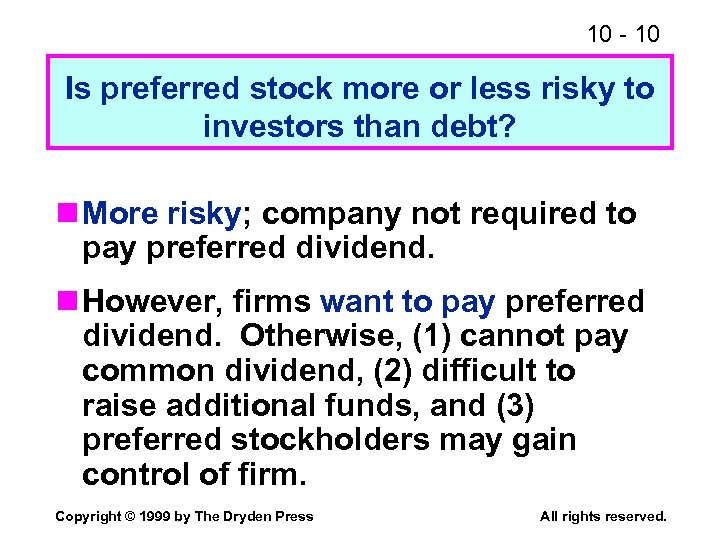

10 - 10 Is preferred stock more or less risky to investors than debt? n More risky; company not required to pay preferred dividend. n However, firms want to pay preferred dividend. Otherwise, (1) cannot pay common dividend, (2) difficult to raise additional funds, and (3) preferred stockholders may gain control of firm. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 10 Is preferred stock more or less risky to investors than debt? n More risky; company not required to pay preferred dividend. n However, firms want to pay preferred dividend. Otherwise, (1) cannot pay common dividend, (2) difficult to raise additional funds, and (3) preferred stockholders may gain control of firm. Copyright © 1999 by The Dryden Press All rights reserved.

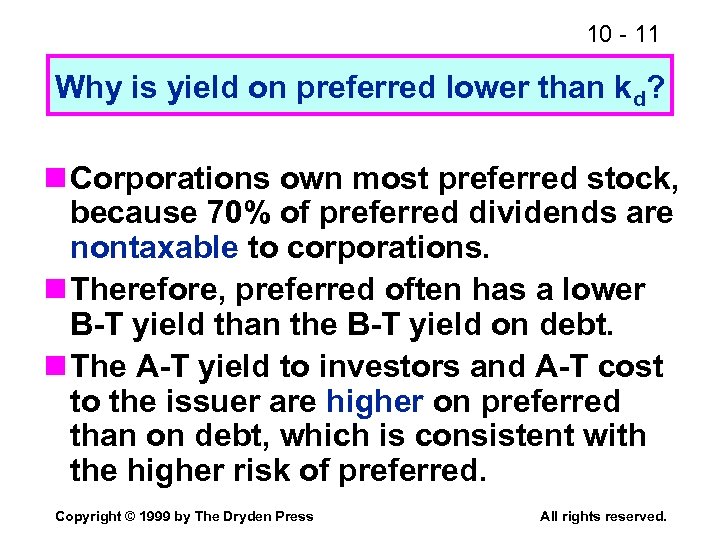

10 - 11 Why is yield on preferred lower than kd? n Corporations own most preferred stock, because 70% of preferred dividends are nontaxable to corporations. n Therefore, preferred often has a lower B-T yield than the B-T yield on debt. n The A-T yield to investors and A-T cost to the issuer are higher on preferred than on debt, which is consistent with the higher risk of preferred. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 11 Why is yield on preferred lower than kd? n Corporations own most preferred stock, because 70% of preferred dividends are nontaxable to corporations. n Therefore, preferred often has a lower B-T yield than the B-T yield on debt. n The A-T yield to investors and A-T cost to the issuer are higher on preferred than on debt, which is consistent with the higher risk of preferred. Copyright © 1999 by The Dryden Press All rights reserved.

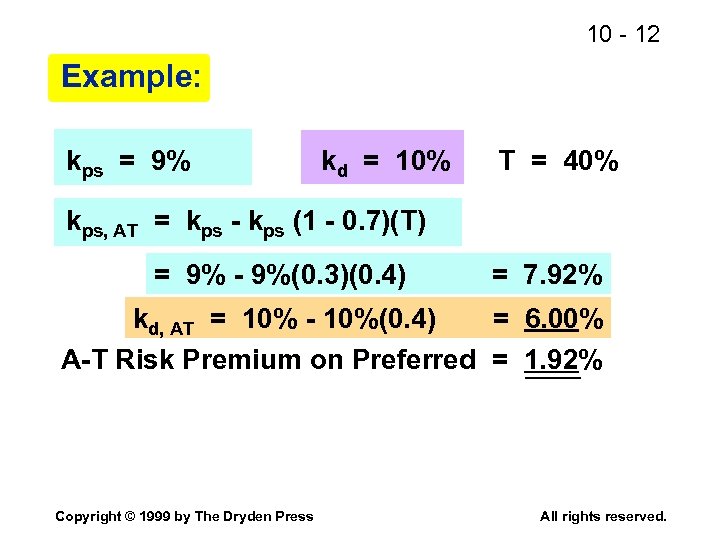

10 - 12 Example: kps = 9% kd = 10% T = 40% kps, AT = kps - kps (1 - 0. 7)(T) = 9% - 9%(0. 3)(0. 4) = 7. 92% kd, AT = 10% - 10%(0. 4) = 6. 00% A-T Risk Premium on Preferred = 1. 92% Copyright © 1999 by The Dryden Press All rights reserved.

10 - 12 Example: kps = 9% kd = 10% T = 40% kps, AT = kps - kps (1 - 0. 7)(T) = 9% - 9%(0. 3)(0. 4) = 7. 92% kd, AT = 10% - 10%(0. 4) = 6. 00% A-T Risk Premium on Preferred = 1. 92% Copyright © 1999 by The Dryden Press All rights reserved.

10 - 13 What are the two ways that companies can raise common equity? n Companies can issue new shares of common stock. n Companies can reinvest earnings. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 13 What are the two ways that companies can raise common equity? n Companies can issue new shares of common stock. n Companies can reinvest earnings. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 14 Why is there a cost for reinvested earnings? n Earnings can be reinvested or paid out as dividends. n Investors could buy other securities, earn a return. n Thus, there is an opportunity cost if earnings are reinvested. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 14 Why is there a cost for reinvested earnings? n Earnings can be reinvested or paid out as dividends. n Investors could buy other securities, earn a return. n Thus, there is an opportunity cost if earnings are reinvested. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 15 n Opportunity cost: The return stockholders could earn on alternative investments of equal risk. n They could buy similar stocks and earn ks, or company could repurchase its own stock and earn ks. So, ks, is the cost of reinvested earnings and it is the cost of equity. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 15 n Opportunity cost: The return stockholders could earn on alternative investments of equal risk. n They could buy similar stocks and earn ks, or company could repurchase its own stock and earn ks. So, ks, is the cost of reinvested earnings and it is the cost of equity. Copyright © 1999 by The Dryden Press All rights reserved.

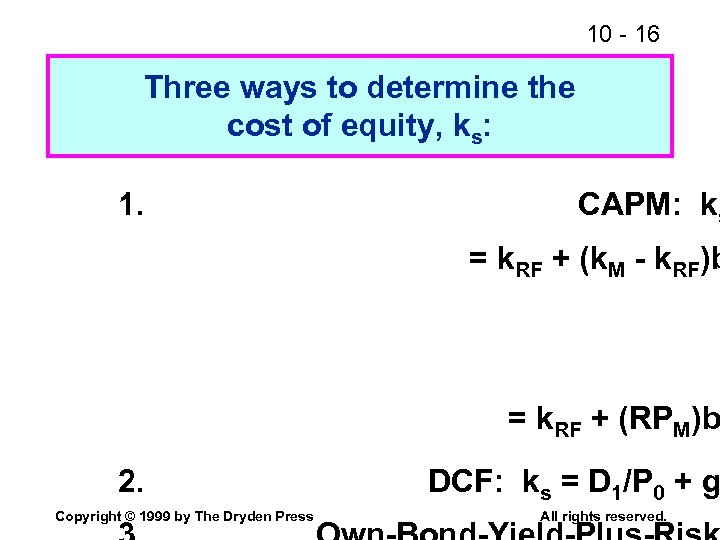

10 - 16 Three ways to determine the cost of equity, ks: 1. CAPM: ks = k. RF + (k. M - k. RF)b = k. RF + (RPM)b 2. Copyright © 1999 by The Dryden Press DCF: ks = D 1/P 0 + g All rights reserved.

10 - 16 Three ways to determine the cost of equity, ks: 1. CAPM: ks = k. RF + (k. M - k. RF)b = k. RF + (RPM)b 2. Copyright © 1999 by The Dryden Press DCF: ks = D 1/P 0 + g All rights reserved.

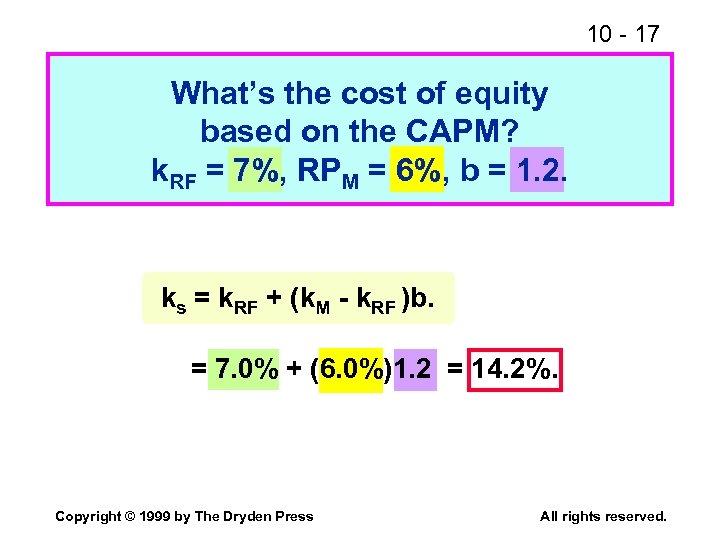

10 - 17 What’s the cost of equity based on the CAPM? k. RF = 7%, RPM = 6%, b = 1. 2. ks = k. RF + (k. M - k. RF )b. = 7. 0% + (6. 0%)1. 2 = 14. 2%. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 17 What’s the cost of equity based on the CAPM? k. RF = 7%, RPM = 6%, b = 1. 2. ks = k. RF + (k. M - k. RF )b. = 7. 0% + (6. 0%)1. 2 = 14. 2%. Copyright © 1999 by The Dryden Press All rights reserved.

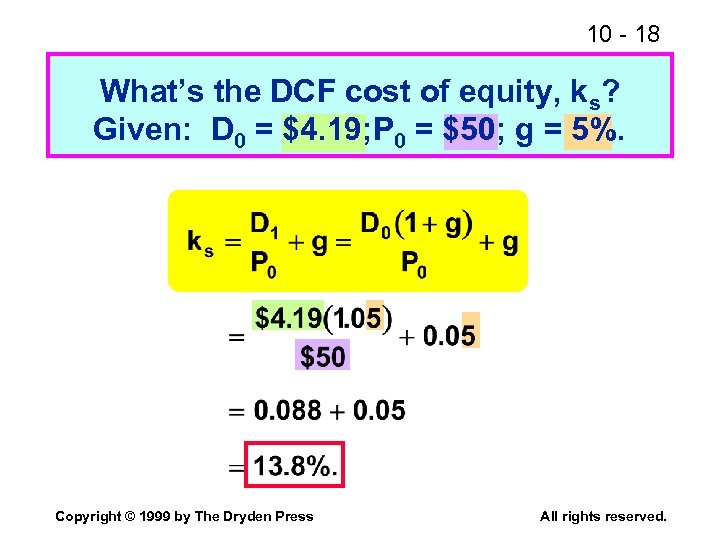

10 - 18 What’s the DCF cost of equity, ks? Given: D 0 = $4. 19; P 0 = $50; g = 5%. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 18 What’s the DCF cost of equity, ks? Given: D 0 = $4. 19; P 0 = $50; g = 5%. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 19 Suppose the company has been earning 15% on equity (ROE = 15%) and retaining 35% (dividend payout = 65%), and this situation is expected to continue. What’s the expected future g? Copyright © 1999 by The Dryden Press All rights reserved.

10 - 19 Suppose the company has been earning 15% on equity (ROE = 15%) and retaining 35% (dividend payout = 65%), and this situation is expected to continue. What’s the expected future g? Copyright © 1999 by The Dryden Press All rights reserved.

10 - 20 Retention growth rate: g = b(ROE) = 0. 35(15%) = 5. 25%. Here b = Fraction retained. Close to g = 5% given earlier. Think of bank account paying 10% with b = 0, b = 1. 0, and b = 0. 5. What’s g? Copyright © 1999 by The Dryden Press All rights reserved.

10 - 20 Retention growth rate: g = b(ROE) = 0. 35(15%) = 5. 25%. Here b = Fraction retained. Close to g = 5% given earlier. Think of bank account paying 10% with b = 0, b = 1. 0, and b = 0. 5. What’s g? Copyright © 1999 by The Dryden Press All rights reserved.

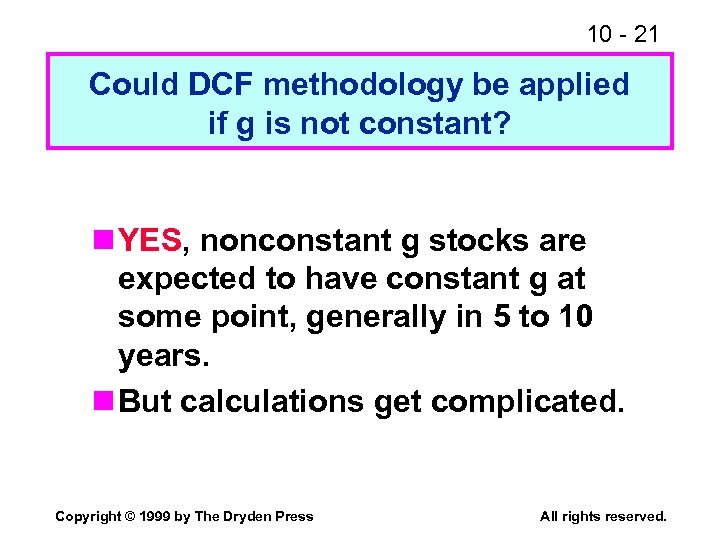

10 - 21 Could DCF methodology be applied if g is not constant? n YES, nonconstant g stocks are expected to have constant g at some point, generally in 5 to 10 years. n But calculations get complicated. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 21 Could DCF methodology be applied if g is not constant? n YES, nonconstant g stocks are expected to have constant g at some point, generally in 5 to 10 years. n But calculations get complicated. Copyright © 1999 by The Dryden Press All rights reserved.

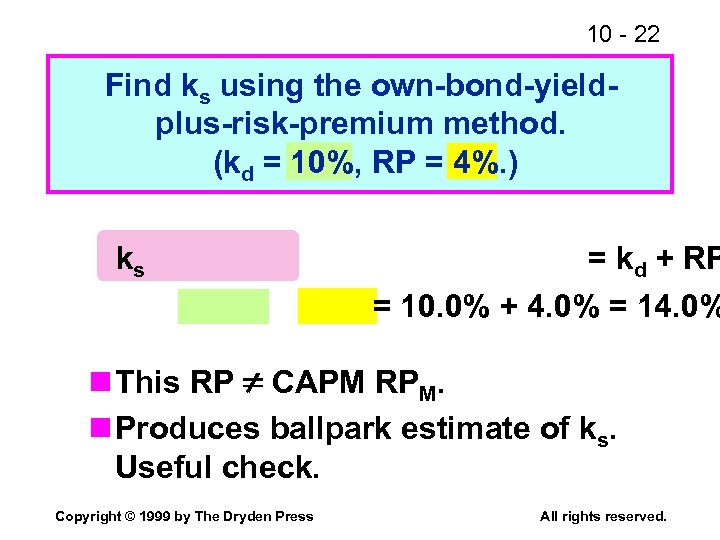

10 - 22 Find ks using the own-bond-yieldplus-risk-premium method. (kd = 10%, RP = 4%. ) ks = kd + RP = 10. 0% + 4. 0% = 14. 0% n This RP ¹ CAPM RPM. n Produces ballpark estimate of ks. Useful check. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 22 Find ks using the own-bond-yieldplus-risk-premium method. (kd = 10%, RP = 4%. ) ks = kd + RP = 10. 0% + 4. 0% = 14. 0% n This RP ¹ CAPM RPM. n Produces ballpark estimate of ks. Useful check. Copyright © 1999 by The Dryden Press All rights reserved.

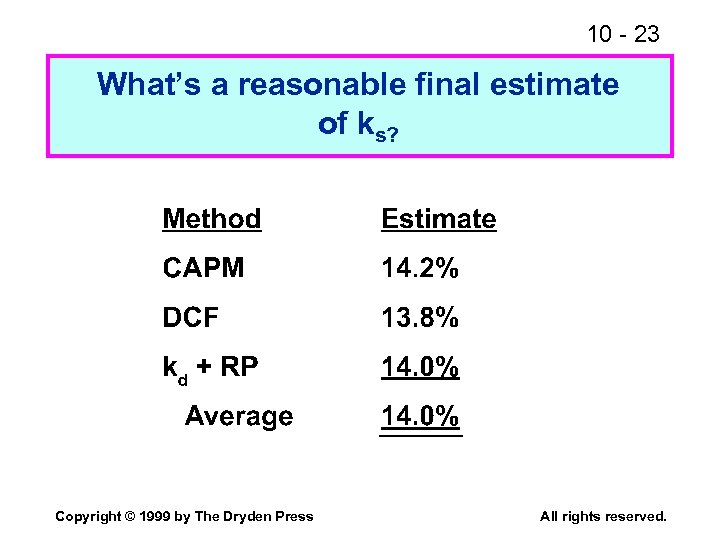

10 - 23 What’s a reasonable final estimate of ks? Copyright © 1999 by The Dryden Press All rights reserved.

10 - 23 What’s a reasonable final estimate of ks? Copyright © 1999 by The Dryden Press All rights reserved.

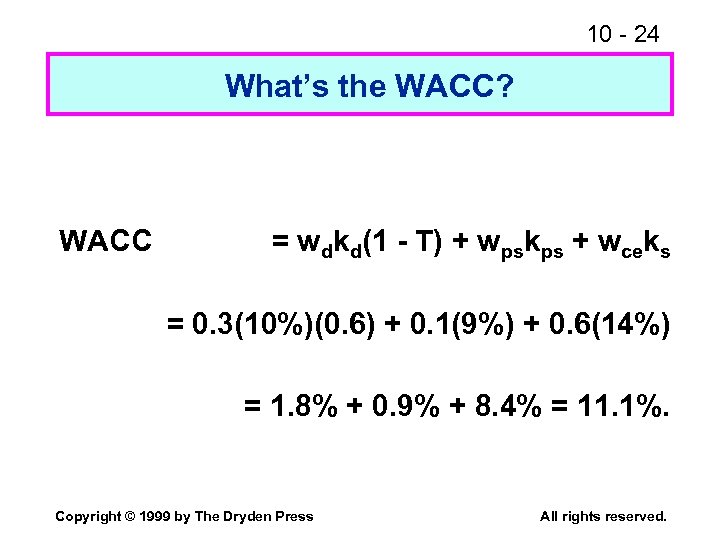

10 - 24 What’s the WACC? WACC = wdkd(1 - T) + wpskps + wceks = 0. 3(10%)(0. 6) + 0. 1(9%) + 0. 6(14%) = 1. 8% + 0. 9% + 8. 4% = 11. 1%. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 24 What’s the WACC? WACC = wdkd(1 - T) + wpskps + wceks = 0. 3(10%)(0. 6) + 0. 1(9%) + 0. 6(14%) = 1. 8% + 0. 9% + 8. 4% = 11. 1%. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 25 Four Mistakes to Avoid 1. When estimating the cost of debt, use the current interest rate on new debt, not the coupon rate on existing debt. 2. When estimating the risk premium for the CAPM approach, don’t subtract the current long-term T-bond rate from the historical average return on common stocks. (More. . . ) Copyright © 1999 by The Dryden Press All rights reserved.

10 - 25 Four Mistakes to Avoid 1. When estimating the cost of debt, use the current interest rate on new debt, not the coupon rate on existing debt. 2. When estimating the risk premium for the CAPM approach, don’t subtract the current long-term T-bond rate from the historical average return on common stocks. (More. . . ) Copyright © 1999 by The Dryden Press All rights reserved.

10 - 26 For example, if the historical k. M has been about 12. 7% and inflation drives the current k. RF up to 10%, the current market risk premium is not 12. 7% - 10% = 2. 7%! (More. . . ) Copyright © 1999 by The Dryden Press All rights reserved.

10 - 26 For example, if the historical k. M has been about 12. 7% and inflation drives the current k. RF up to 10%, the current market risk premium is not 12. 7% - 10% = 2. 7%! (More. . . ) Copyright © 1999 by The Dryden Press All rights reserved.

10 - 27 3. Use the target capital structure to determine the weights. If you don’t know the target weights, then use the current market value of equity, and never the book value of equity. If you don’t know the market value of debt, then the book value of debt often is a reasonable approximation, especially for short-term debt. (More. . . ) Copyright © 1999 by The Dryden Press All rights reserved.

10 - 27 3. Use the target capital structure to determine the weights. If you don’t know the target weights, then use the current market value of equity, and never the book value of equity. If you don’t know the market value of debt, then the book value of debt often is a reasonable approximation, especially for short-term debt. (More. . . ) Copyright © 1999 by The Dryden Press All rights reserved.

10 - 28 4. Capital components are sources of funding that come from investors. Accounts payable, accruals, and deferred taxes are not sources of funding that come from investors, so they are not included in the calculation of the WACC. We do adjust for these items when calculating the cash flows of the project, but not when calculating the WACC. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 28 4. Capital components are sources of funding that come from investors. Accounts payable, accruals, and deferred taxes are not sources of funding that come from investors, so they are not included in the calculation of the WACC. We do adjust for these items when calculating the cash flows of the project, but not when calculating the WACC. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 29 Three Types of Risk n Stand-alone risk n Corporate risk n Market risk Market, or beta, risk is most relevant for estimating the WACC. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 29 Three Types of Risk n Stand-alone risk n Corporate risk n Market risk Market, or beta, risk is most relevant for estimating the WACC. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 30 Methods for estimating a division’s or a project’s beta n Pure play. Find several publicly traded companies exclusively in project’s business. Use average of their betas as proxy for project’s beta. Hard to find such companies. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 30 Methods for estimating a division’s or a project’s beta n Pure play. Find several publicly traded companies exclusively in project’s business. Use average of their betas as proxy for project’s beta. Hard to find such companies. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 31 n Accounting beta. Run regression between project’s ROA and S&P index ROA. Accounting betas are correlated (0. 5 -0. 6) with market betas. But normally can’t get data on new projects’ ROAs before the capital budgeting decision has been made. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 31 n Accounting beta. Run regression between project’s ROA and S&P index ROA. Accounting betas are correlated (0. 5 -0. 6) with market betas. But normally can’t get data on new projects’ ROAs before the capital budgeting decision has been made. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 32 Should Cox use the same WACC for all projects? No! n Cox should estimate divisional WACCs based on divisional betas and divisional debt capacities. n Cox might consider further adjustments to divisional WACCs for particularly risky or safe projects. Copyright © 1999 by The Dryden Press All rights reserved.

10 - 32 Should Cox use the same WACC for all projects? No! n Cox should estimate divisional WACCs based on divisional betas and divisional debt capacities. n Cox might consider further adjustments to divisional WACCs for particularly risky or safe projects. Copyright © 1999 by The Dryden Press All rights reserved.