9514b48c5c6df24aab95189ac0c93eeb.ppt

- Количество слайдов: 44

10 - 1 CHAPTER 10 Financial Risk and Return n Financial returns n Stand-alone risk n Portfolio risk l Corporate risk l Market risk n Risk and return Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 1 CHAPTER 10 Financial Risk and Return n Financial returns n Stand-alone risk n Portfolio risk l Corporate risk l Market risk n Risk and return Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 2 Financial Management Implications of Risk and Return n Investors--both individuals and businesses--dislike risk. Thus, risk affects required returns. n Healthcare managers must understand concepts of risk and return in order to: l Understand financing costs. l Understand how service decisions affect a business’ financial condition. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 2 Financial Management Implications of Risk and Return n Investors--both individuals and businesses--dislike risk. Thus, risk affects required returns. n Healthcare managers must understand concepts of risk and return in order to: l Understand financing costs. l Understand how service decisions affect a business’ financial condition. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 3 Investment Returns n The financial performance of an investment, whether made by an individual or a business, is measured by its return. n Investment returns can be measured in two ways: l Dollar returns. l Percentage returns (rate of return). Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 3 Investment Returns n The financial performance of an investment, whether made by an individual or a business, is measured by its return. n Investment returns can be measured in two ways: l Dollar returns. l Percentage returns (rate of return). Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 4 Investment Return Illustration n Suppose you buy 10 shares of stock for $1, 000 in total. n The stock pays no dividends, but after one year you sell the stock for $1, 100. 0 1 -$1000 $1100 Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 4 Investment Return Illustration n Suppose you buy 10 shares of stock for $1, 000 in total. n The stock pays no dividends, but after one year you sell the stock for $1, 100. 0 1 -$1000 $1100 Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 5 Return Calculations n The dollar return is found as follows: $ Return = Amount received - Amount invested = $1, 100 - $1, 000 = $100 n The rate of return is found as follows: % Return = Dollar return / Amount invested = ($1, 100 - $1, 000) / $1, 000 = $100 / $1, 000 = 0. 10 = 10. 0% >>> Which one to use? ? Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 5 Return Calculations n The dollar return is found as follows: $ Return = Amount received - Amount invested = $1, 100 - $1, 000 = $100 n The rate of return is found as follows: % Return = Dollar return / Amount invested = ($1, 100 - $1, 000) / $1, 000 = $100 / $1, 000 = 0. 10 = 10. 0% >>> Which one to use? ? Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 6 Financial Risk n Financial risk is present when there is some chance of earning a return on an investment that is less than the amount expected. (not necessarily a financial loss) n The greater the probability of a return far below the expected return, the greater the financial risk. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 6 Financial Risk n Financial risk is present when there is some chance of earning a return on an investment that is less than the amount expected. (not necessarily a financial loss) n The greater the probability of a return far below the expected return, the greater the financial risk. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

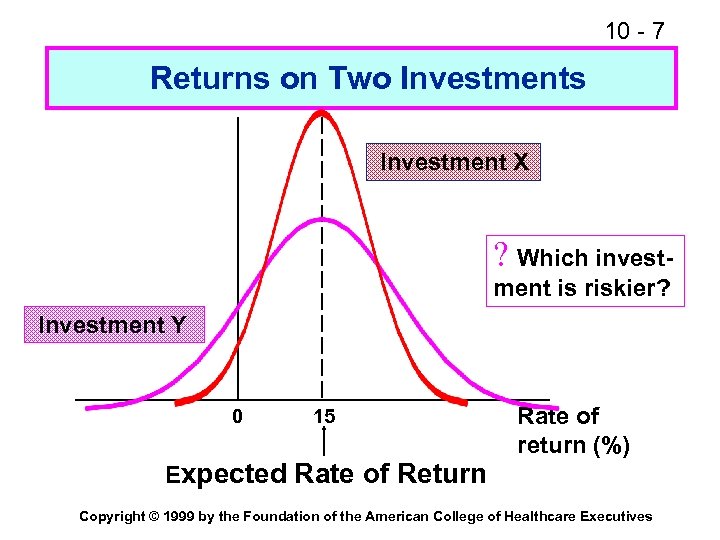

10 - 7 Returns on Two Investments Investment X ? Which investment is riskier? Investment Y 0 15 Rate of return (%) Expected Rate of Return Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 7 Returns on Two Investments Investment X ? Which investment is riskier? Investment Y 0 15 Rate of return (%) Expected Rate of Return Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 8 Risk Aversion n Investors can be: l Risk neutral. l Risk averse. l Risk seeking. n Most investors are risk averse: l If two investments have the same risk but different returns, choose the higher return. l If two investments have the same return but different risks, choose the lower risk. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 8 Risk Aversion n Investors can be: l Risk neutral. l Risk averse. l Risk seeking. n Most investors are risk averse: l If two investments have the same risk but different returns, choose the higher return. l If two investments have the same return but different risks, choose the lower risk. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

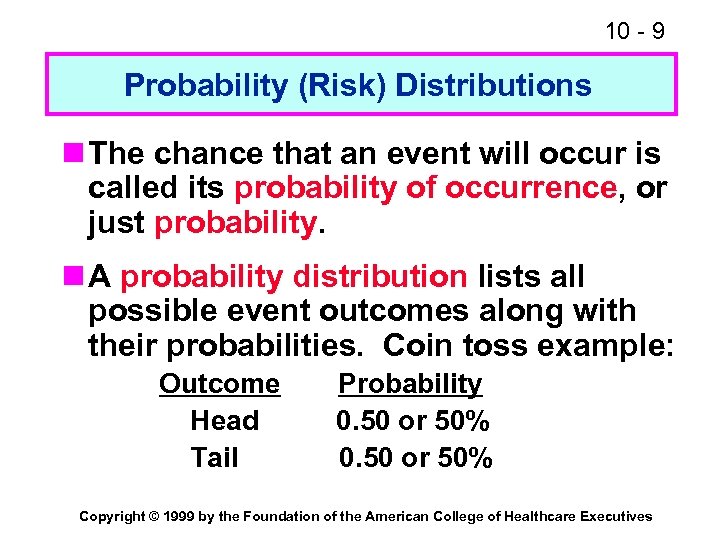

10 - 9 Probability (Risk) Distributions n The chance that an event will occur is called its probability of occurrence, or just probability. n A probability distribution lists all possible event outcomes along with their probabilities. Coin toss example: Outcome Head Tail Probability 0. 50 or 50% Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 9 Probability (Risk) Distributions n The chance that an event will occur is called its probability of occurrence, or just probability. n A probability distribution lists all possible event outcomes along with their probabilities. Coin toss example: Outcome Head Tail Probability 0. 50 or 50% Copyright © 1999 by the Foundation of the American College of Healthcare Executives

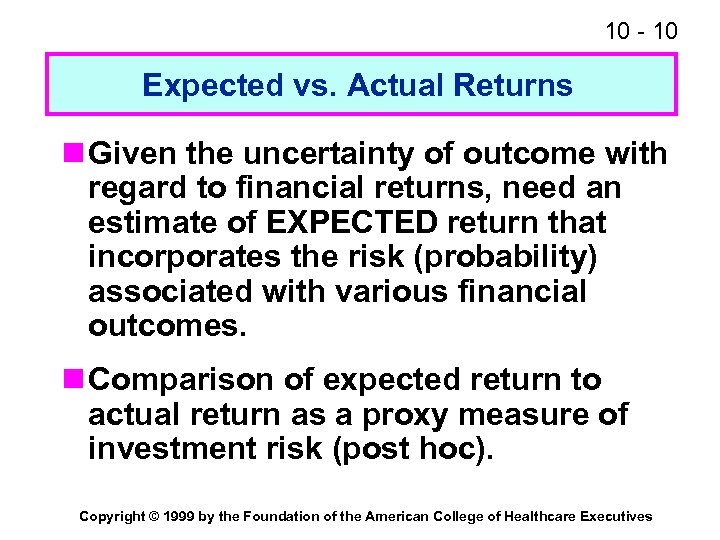

10 - 10 Expected vs. Actual Returns n Given the uncertainty of outcome with regard to financial returns, need an estimate of EXPECTED return that incorporates the risk (probability) associated with various financial outcomes. n Comparison of expected return to actual return as a proxy measure of investment risk (post hoc). Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 10 Expected vs. Actual Returns n Given the uncertainty of outcome with regard to financial returns, need an estimate of EXPECTED return that incorporates the risk (probability) associated with various financial outcomes. n Comparison of expected return to actual return as a proxy measure of investment risk (post hoc). Copyright © 1999 by the Foundation of the American College of Healthcare Executives

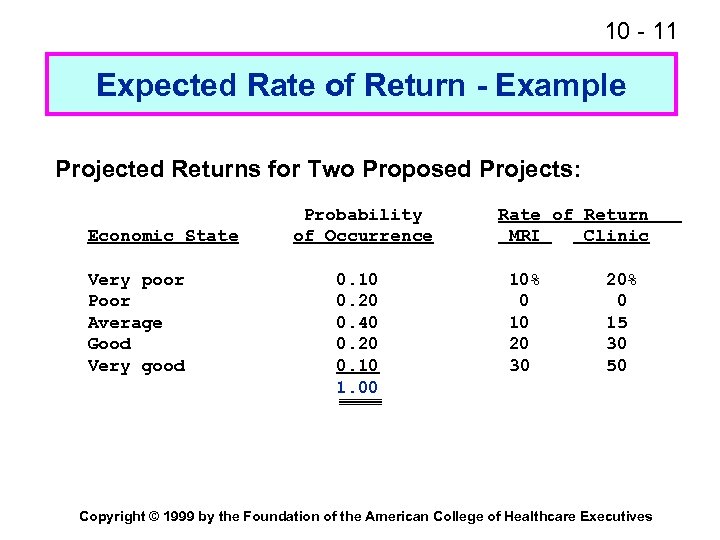

10 - 11 Expected Rate of Return - Example Projected Returns for Two Proposed Projects: Economic State Very poor Poor Average Good Very good Probability of Occurrence 0. 10 0. 20 0. 40 0. 20 0. 10 1. 00 Rate of Return MRI Clinic 10% 0 10 20 30 20% 0 15 30 50 Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 11 Expected Rate of Return - Example Projected Returns for Two Proposed Projects: Economic State Very poor Poor Average Good Very good Probability of Occurrence 0. 10 0. 20 0. 40 0. 20 0. 10 1. 00 Rate of Return MRI Clinic 10% 0 10 20 30 20% 0 15 30 50 Copyright © 1999 by the Foundation of the American College of Healthcare Executives

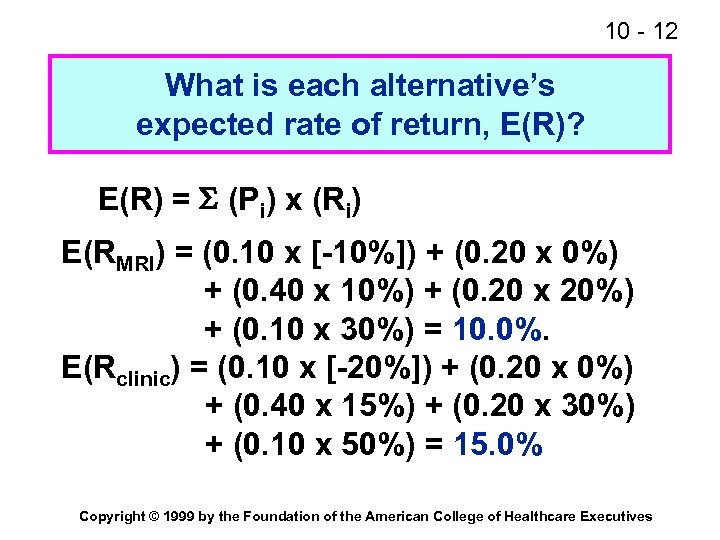

10 - 12 What is each alternative’s expected rate of return, E(R)? E(R) = (Pi) x (Ri) E(RMRI) = (0. 10 x [-10%]) + (0. 20 x 0%) + (0. 40 x 10%) + (0. 20 x 20%) + (0. 10 x 30%) = 10. 0%. E(Rclinic) = (0. 10 x [-20%]) + (0. 20 x 0%) + (0. 40 x 15%) + (0. 20 x 30%) + (0. 10 x 50%) = 15. 0% Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 12 What is each alternative’s expected rate of return, E(R)? E(R) = (Pi) x (Ri) E(RMRI) = (0. 10 x [-10%]) + (0. 20 x 0%) + (0. 40 x 10%) + (0. 20 x 20%) + (0. 10 x 30%) = 10. 0%. E(Rclinic) = (0. 10 x [-20%]) + (0. 20 x 0%) + (0. 40 x 15%) + (0. 20 x 30%) + (0. 10 x 50%) = 15. 0% Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 13 Realized Rates of Return n The expected rate of return is estimated before an investment is made. n After the fact, the return that is actually achieved is called the realized (actual) rate of return. n When risk is present, the realized rate of return rarely equals the expected rate of return. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 13 Realized Rates of Return n The expected rate of return is estimated before an investment is made. n After the fact, the return that is actually achieved is called the realized (actual) rate of return. n When risk is present, the realized rate of return rarely equals the expected rate of return. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 14 Stand-Alone Risk n Stand-alone risk is relevant when an investment will be held in isolation. n Stand-alone risk can be measured by the degree of “tightness” of the return distribution. n One common measure of stand-alone risk is the standard deviation of the return distribution, usually represented by a lower case sigma, . Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 14 Stand-Alone Risk n Stand-alone risk is relevant when an investment will be held in isolation. n Stand-alone risk can be measured by the degree of “tightness” of the return distribution. n One common measure of stand-alone risk is the standard deviation of the return distribution, usually represented by a lower case sigma, . Copyright © 1999 by the Foundation of the American College of Healthcare Executives

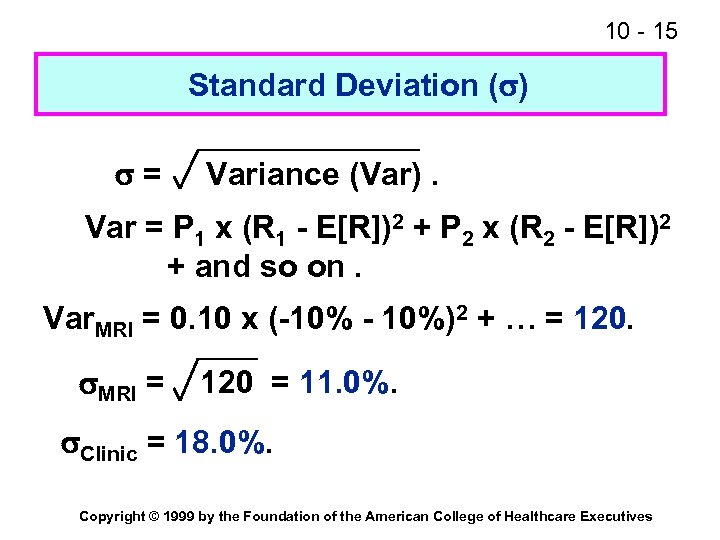

10 - 15 Standard Deviation ( ) = Variance (Var). Var = P 1 x (R 1 - E[R])2 + P 2 x (R 2 - E[R])2 + and so on. Var. MRI = 0. 10 x (-10% - 10%)2 + … = 120. MRI = 120 = 11. 0%. Clinic = 18. 0%. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 15 Standard Deviation ( ) = Variance (Var). Var = P 1 x (R 1 - E[R])2 + P 2 x (R 2 - E[R])2 + and so on. Var. MRI = 0. 10 x (-10% - 10%)2 + … = 120. MRI = 120 = 11. 0%. Clinic = 18. 0%. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

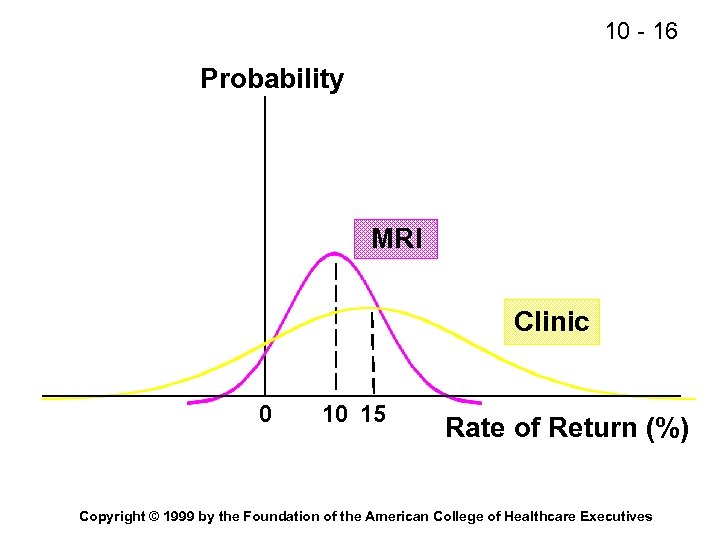

10 - 16 Probability MRI Clinic 0 10 15 Rate of Return (%) Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 16 Probability MRI Clinic 0 10 15 Rate of Return (%) Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 17 Portfolio Risk and Return n Standard deviation is an applicable risk measure only when an investment is held in isolation. n Most investments are held as part of a collection, or portfolio, of investments. n When investments are held in portfolios, the relevant risk and return is that of the entire portfolio. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 17 Portfolio Risk and Return n Standard deviation is an applicable risk measure only when an investment is held in isolation. n Most investments are held as part of a collection, or portfolio, of investments. n When investments are held in portfolios, the relevant risk and return is that of the entire portfolio. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

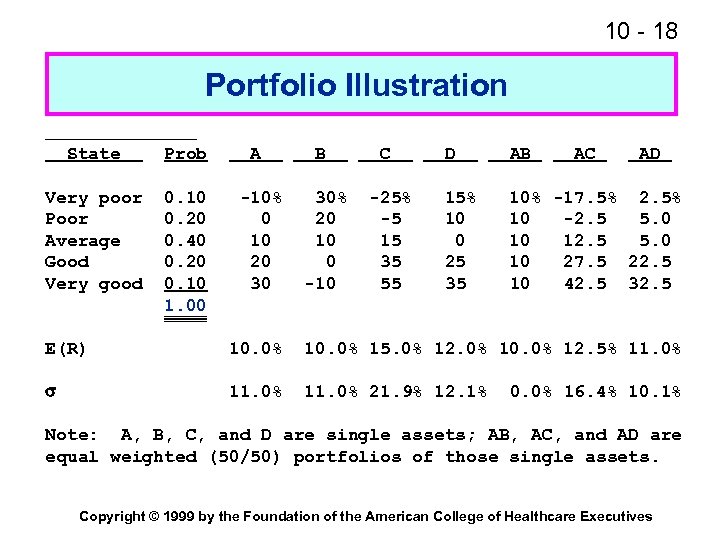

10 - 18 Portfolio Illustration State Prob A B C Very poor Poor Average Good Very good 0. 10 0. 20 0. 40 0. 20 0. 10 1. 00 -10% 0 10 20 30 30% 20 10 0 -10 -25% -5 15 35 55 D AB AC AD 15% 10 0 25 35 10% -17. 5% 2. 5% 10 -2. 5 5. 0 10 12. 5 5. 0 10 27. 5 22. 5 10 42. 5 32. 5 E(R) 10. 0% 15. 0% 12. 0% 10. 0% 12. 5% 11. 0% 21. 9% 12. 1% 0. 0% 16. 4% 10. 1% Note: A, B, C, and D are single assets; AB, AC, and AD are equal weighted (50/50) portfolios of those single assets. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 18 Portfolio Illustration State Prob A B C Very poor Poor Average Good Very good 0. 10 0. 20 0. 40 0. 20 0. 10 1. 00 -10% 0 10 20 30 30% 20 10 0 -10 -25% -5 15 35 55 D AB AC AD 15% 10 0 25 35 10% -17. 5% 2. 5% 10 -2. 5 5. 0 10 12. 5 5. 0 10 27. 5 22. 5 10 42. 5 32. 5 E(R) 10. 0% 15. 0% 12. 0% 10. 0% 12. 5% 11. 0% 21. 9% 12. 1% 0. 0% 16. 4% 10. 1% Note: A, B, C, and D are single assets; AB, AC, and AD are equal weighted (50/50) portfolios of those single assets. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

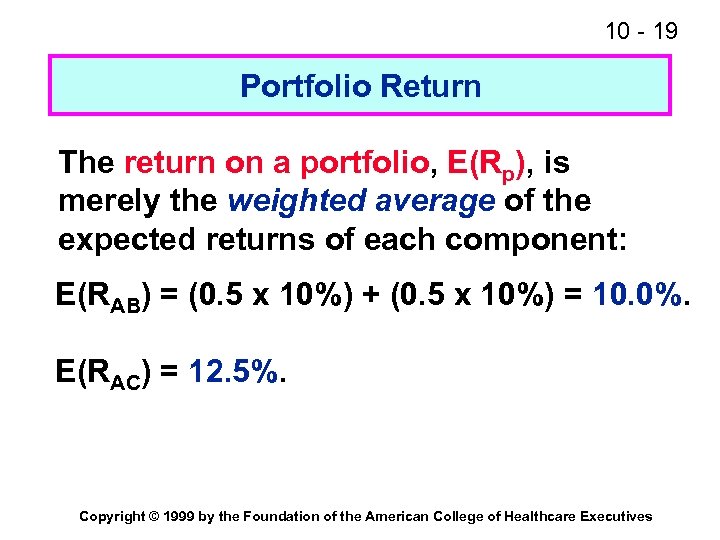

10 - 19 Portfolio Return The return on a portfolio, E(Rp), is merely the weighted average of the expected returns of each component: E(RAB) = (0. 5 x 10%) + (0. 5 x 10%) = 10. 0%. E(RAC) = 12. 5%. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 19 Portfolio Return The return on a portfolio, E(Rp), is merely the weighted average of the expected returns of each component: E(RAB) = (0. 5 x 10%) + (0. 5 x 10%) = 10. 0%. E(RAC) = 12. 5%. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

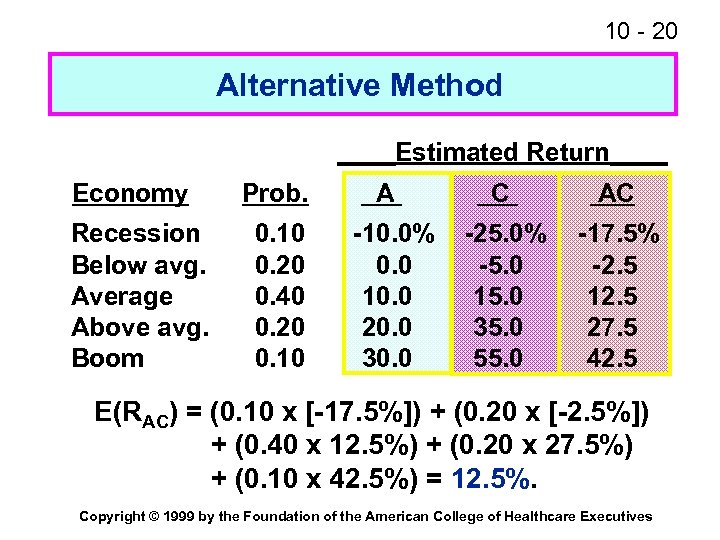

10 - 20 Alternative Method ____Estimated Return____ Economy Recession Below avg. Average Above avg. Boom Prob. 0. 10 0. 20 0. 40 0. 20 0. 10 A -10. 0% 0. 0 10. 0 20. 0 30. 0 C AC -25. 0% -5. 0 15. 0 35. 0 55. 0 -17. 5% -2. 5 12. 5 27. 5 42. 5 E(RAC) = (0. 10 x [-17. 5%]) + (0. 20 x [-2. 5%]) + (0. 40 x 12. 5%) + (0. 20 x 27. 5%) + (0. 10 x 42. 5%) = 12. 5%. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 20 Alternative Method ____Estimated Return____ Economy Recession Below avg. Average Above avg. Boom Prob. 0. 10 0. 20 0. 40 0. 20 0. 10 A -10. 0% 0. 0 10. 0 20. 0 30. 0 C AC -25. 0% -5. 0 15. 0 35. 0 55. 0 -17. 5% -2. 5 12. 5 27. 5 42. 5 E(RAC) = (0. 10 x [-17. 5%]) + (0. 20 x [-2. 5%]) + (0. 40 x 12. 5%) + (0. 20 x 27. 5%) + (0. 10 x 42. 5%) = 12. 5%. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 21 Portfolio Risk n Portfolio return is simply the weighted average of the returns of the components. n However, portfolio risk, which is measured by the portfolio’s standard deviation, is not merely the weighted average of each component’s standard deviation. It depends on the relationships among the returns. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 21 Portfolio Risk n Portfolio return is simply the weighted average of the returns of the components. n However, portfolio risk, which is measured by the portfolio’s standard deviation, is not merely the weighted average of each component’s standard deviation. It depends on the relationships among the returns. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 22 Portfolio Risk (Cont. ) n Consider Portfolio AB. n Each component is risky when held in isolation ( = 10%), yet the portfolio has zero risk ( = 0%). n The reason is that the expected returns for each asset are perfectly negatively correlated with one another so that risk is cancelled out. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 22 Portfolio Risk (Cont. ) n Consider Portfolio AB. n Each component is risky when held in isolation ( = 10%), yet the portfolio has zero risk ( = 0%). n The reason is that the expected returns for each asset are perfectly negatively correlated with one another so that risk is cancelled out. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 23 Correlation n The movement relationship between two variables is called correlation. n Correlation is measured by the correlation coefficient, r: l r = +1 = perfect positive correlation, such as in Portfolio AC. l r = -1 = perfect negative correlation, such as in Portfolio AB. l r = 0 = zero correlation. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 23 Correlation n The movement relationship between two variables is called correlation. n Correlation is measured by the correlation coefficient, r: l r = +1 = perfect positive correlation, such as in Portfolio AC. l r = -1 = perfect negative correlation, such as in Portfolio AB. l r = 0 = zero correlation. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

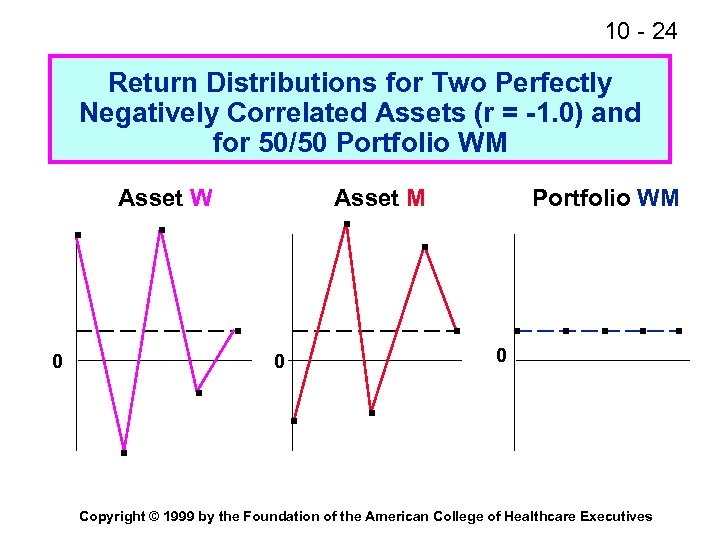

10 - 24 Return Distributions for Two Perfectly Negatively Correlated Assets (r = -1. 0) and for 50/50 Portfolio WM . Asset W Asset M . . 0 . . Portfolio WM . . . 0 0 . . Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 24 Return Distributions for Two Perfectly Negatively Correlated Assets (r = -1. 0) and for 50/50 Portfolio WM . Asset W Asset M . . 0 . . Portfolio WM . . . 0 0 . . Copyright © 1999 by the Foundation of the American College of Healthcare Executives

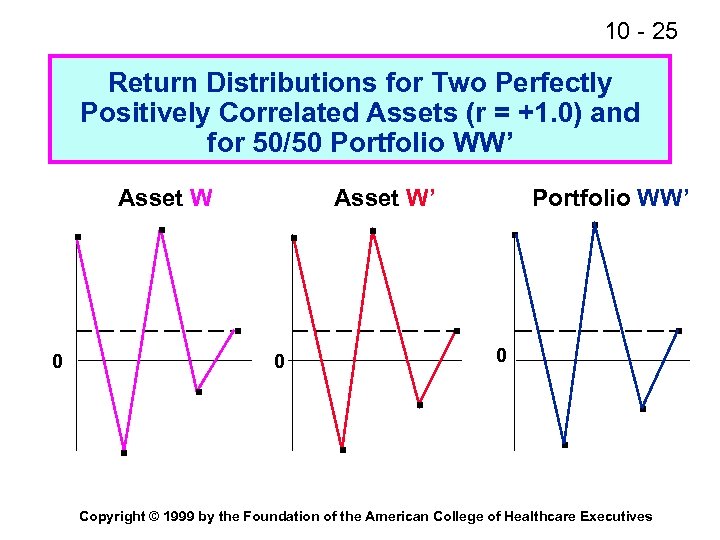

10 - 25 Return Distributions for Two Perfectly Positively Correlated Assets (r = +1. 0) and for 50/50 Portfolio WW’ . Asset W . . Asset W’ . . 0 . . . Portfolio WW’ . . . 0 0 . . Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 25 Return Distributions for Two Perfectly Positively Correlated Assets (r = +1. 0) and for 50/50 Portfolio WW’ . Asset W . . Asset W’ . . 0 . . . Portfolio WW’ . . . 0 0 . . Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 26 Statements About Portfolio Risk n It is difficult to generalize about “real world” correlations. n However, it is rare (if not impossible) to find r = +1, r = -1, or even r = 0. n The correlation between two randomly chosen investments is likely to range from +0. 4 to +0. 8. n Cumulative economic effects Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 26 Statements About Portfolio Risk n It is difficult to generalize about “real world” correlations. n However, it is rare (if not impossible) to find r = +1, r = -1, or even r = 0. n The correlation between two randomly chosen investments is likely to range from +0. 4 to +0. 8. n Cumulative economic effects Copyright © 1999 by the Foundation of the American College of Healthcare Executives

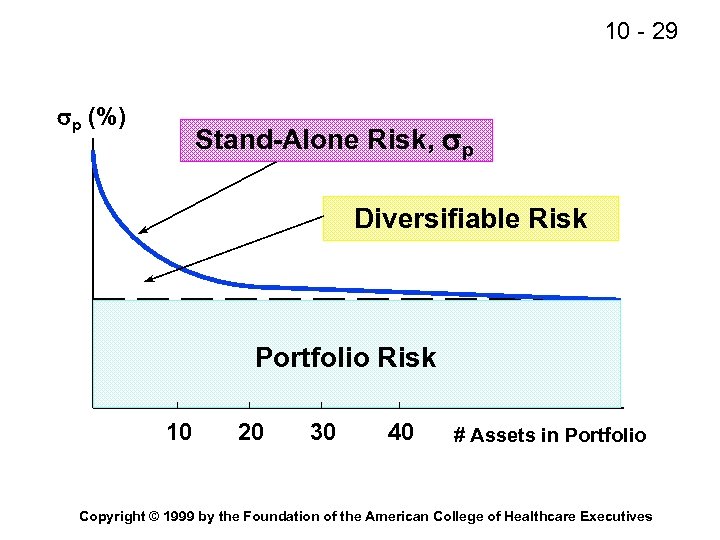

10 - 27 Portfolio Effects on Risk n p decreases as more assets are added. n However, the incremental risk reduction decreases as more assets are added. n Considerable risk remains regardless of the number of assets added. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 27 Portfolio Effects on Risk n p decreases as more assets are added. n However, the incremental risk reduction decreases as more assets are added. n Considerable risk remains regardless of the number of assets added. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

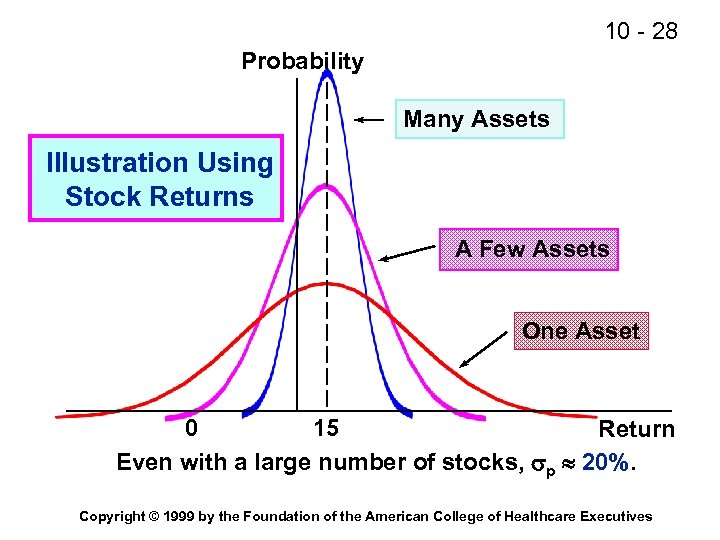

10 - 28 Probability Many Assets Illustration Using Stock Returns A Few Assets One Asset 0 15 Return Even with a large number of stocks, p » 20%. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 28 Probability Many Assets Illustration Using Stock Returns A Few Assets One Asset 0 15 Return Even with a large number of stocks, p » 20%. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 29 p (%) Stand-Alone Risk, p Diversifiable Risk Portfolio Risk 10 20 30 40 # Assets in Portfolio Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 29 p (%) Stand-Alone Risk, p Diversifiable Risk Portfolio Risk 10 20 30 40 # Assets in Portfolio Copyright © 1999 by the Foundation of the American College of Healthcare Executives

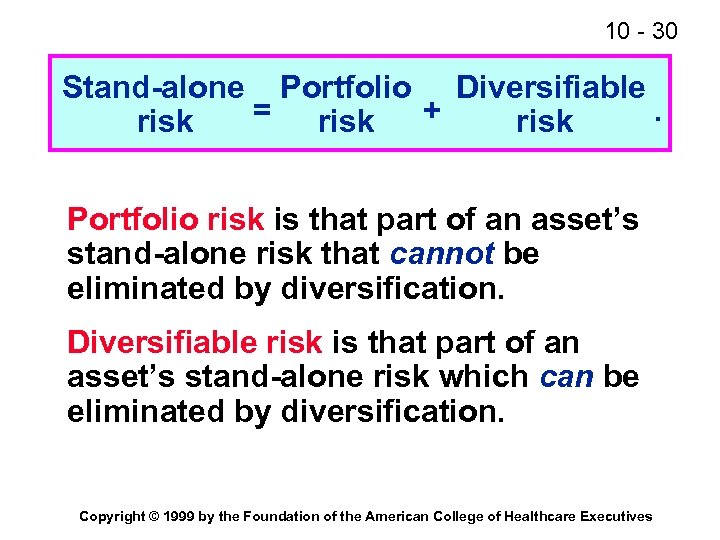

10 - 30 Stand-alone Portfolio Diversifiable = risk +. risk Portfolio risk is that part of an asset’s stand-alone risk that cannot be eliminated by diversification. Diversifiable risk is that part of an asset’s stand-alone risk which can be eliminated by diversification. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 30 Stand-alone Portfolio Diversifiable = risk +. risk Portfolio risk is that part of an asset’s stand-alone risk that cannot be eliminated by diversification. Diversifiable risk is that part of an asset’s stand-alone risk which can be eliminated by diversification. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 31 Implications for Investors n It is not rational to hold a single investment. (unless risk seeking) n Stand-alone risk measures are not generally relevant when assets are held in portfolios. n The need for measure(s) of relative risk of individual assets held in larger asset portfolios. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 31 Implications for Investors n It is not rational to hold a single investment. (unless risk seeking) n Stand-alone risk measures are not generally relevant when assets are held in portfolios. n The need for measure(s) of relative risk of individual assets held in larger asset portfolios. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 32 Beta Coefficients n The most widely used measure of risk for assets held in portfolios is the beta coefficient, or just beta. n Beta measures the volatility of the asset’s returns relative to the returns on the portfolio. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 32 Beta Coefficients n The most widely used measure of risk for assets held in portfolios is the beta coefficient, or just beta. n Beta measures the volatility of the asset’s returns relative to the returns on the portfolio. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

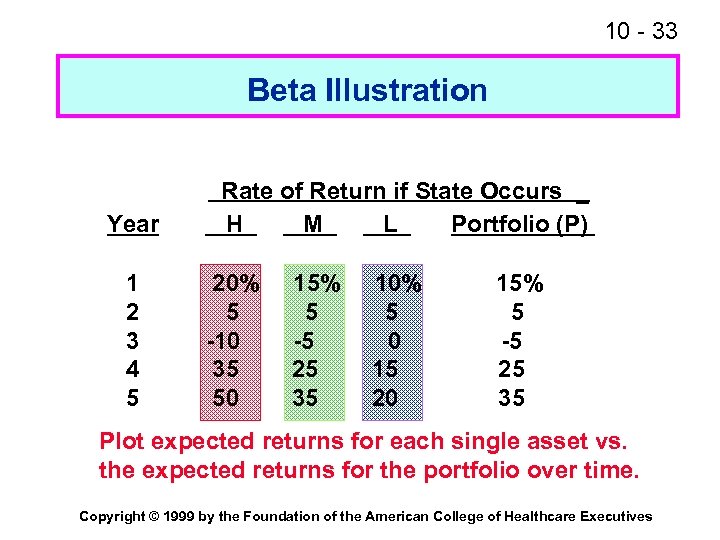

10 - 33 Beta Illustration Year 1 2 3 4 5 Rate of Return if State Occurs _ H M L Portfolio (P) 20% 5 -10 35 50 15% 5 -5 25 35 10% 5 0 15 20 15% 5 -5 25 35 Plot expected returns for each single asset vs. the expected returns for the portfolio over time. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 33 Beta Illustration Year 1 2 3 4 5 Rate of Return if State Occurs _ H M L Portfolio (P) 20% 5 -10 35 50 15% 5 -5 25 35 10% 5 0 15 20 15% 5 -5 25 35 Plot expected returns for each single asset vs. the expected returns for the portfolio over time. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

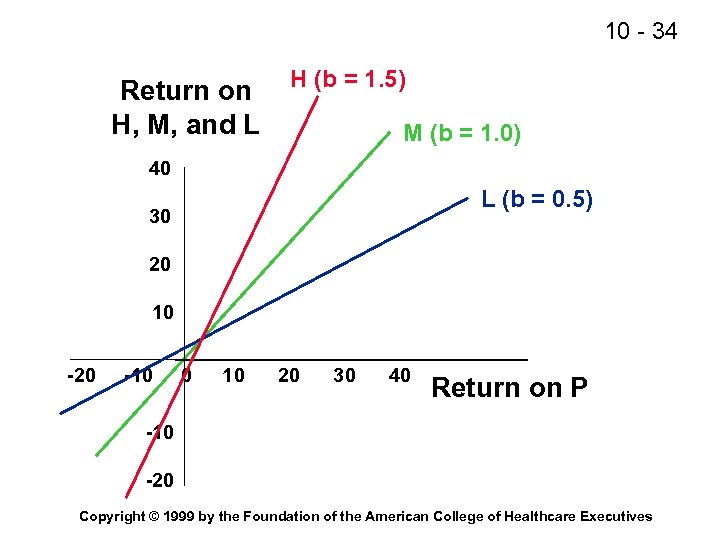

10 - 34 Return on H, M, and L H (b = 1. 5) M (b = 1. 0) 40 L (b = 0. 5) 30 20 10 -20 -10 0 10 20 30 40 Return on P -10 -20 Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 34 Return on H, M, and L H (b = 1. 5) M (b = 1. 0) 40 L (b = 0. 5) 30 20 10 -20 -10 0 10 20 30 40 Return on P -10 -20 Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 35 n If beta = 1. 0, asset has average risk, where average is defined as the riskiness of the portfolio. n If beta > 1. 0, asset is more risky than average. n If beta < 1. 0, asset is less risky than average. n Most assets have betas in the range of 0. 5 to 1. 5. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 35 n If beta = 1. 0, asset has average risk, where average is defined as the riskiness of the portfolio. n If beta > 1. 0, asset is more risky than average. n If beta < 1. 0, asset is less risky than average. n Most assets have betas in the range of 0. 5 to 1. 5. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 36 Relevant Measures of Portfolio Risk n If the investor is an individual, the assets are individual securities (stocks), the portfolio is the market portfolio, and the relevant risk of each asset is called market risk. n If the investor is a business, the assets are real assets (business lines), the portfolio is the entire business, and the relevant risk of each asset is called corporate risk. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 36 Relevant Measures of Portfolio Risk n If the investor is an individual, the assets are individual securities (stocks), the portfolio is the market portfolio, and the relevant risk of each asset is called market risk. n If the investor is a business, the assets are real assets (business lines), the portfolio is the entire business, and the relevant risk of each asset is called corporate risk. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

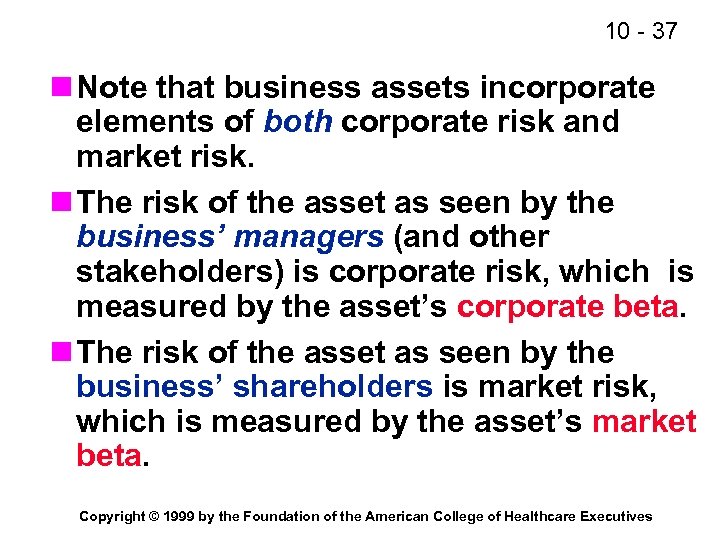

10 - 37 n Note that business assets incorporate elements of both corporate risk and market risk. n The risk of the asset as seen by the business’ managers (and other stakeholders) is corporate risk, which is measured by the asset’s corporate beta. n The risk of the asset as seen by the business’ shareholders is market risk, which is measured by the asset’s market beta. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 37 n Note that business assets incorporate elements of both corporate risk and market risk. n The risk of the asset as seen by the business’ managers (and other stakeholders) is corporate risk, which is measured by the asset’s corporate beta. n The risk of the asset as seen by the business’ shareholders is market risk, which is measured by the asset’s market beta. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

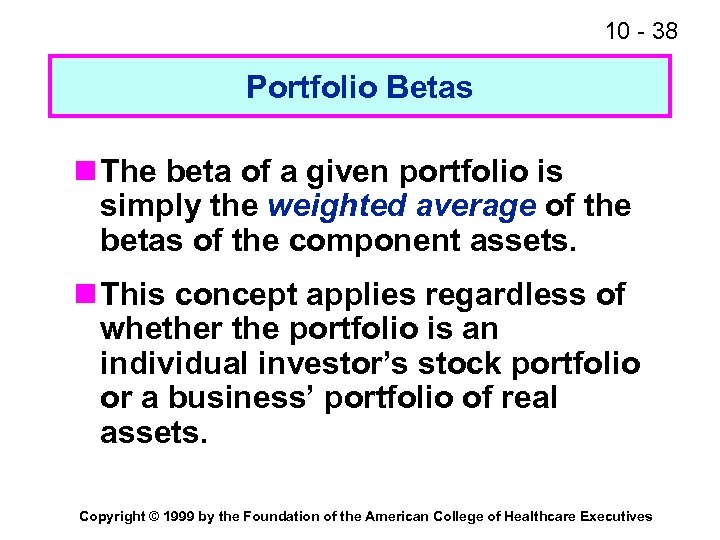

10 - 38 Portfolio Betas n The beta of a given portfolio is simply the weighted average of the betas of the component assets. n This concept applies regardless of whether the portfolio is an individual investor’s stock portfolio or a business’ portfolio of real assets. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 38 Portfolio Betas n The beta of a given portfolio is simply the weighted average of the betas of the component assets. n This concept applies regardless of whether the portfolio is an individual investor’s stock portfolio or a business’ portfolio of real assets. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

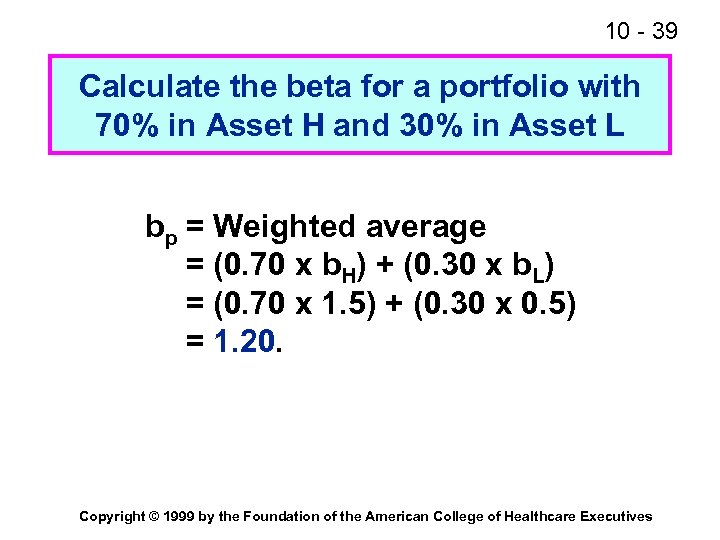

10 - 39 Calculate the beta for a portfolio with 70% in Asset H and 30% in Asset L bp = Weighted average = (0. 70 x b. H) + (0. 30 x b. L) = (0. 70 x 1. 5) + (0. 30 x 0. 5) = 1. 20. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 39 Calculate the beta for a portfolio with 70% in Asset H and 30% in Asset L bp = Weighted average = (0. 70 x b. H) + (0. 30 x b. L) = (0. 70 x 1. 5) + (0. 30 x 0. 5) = 1. 20. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

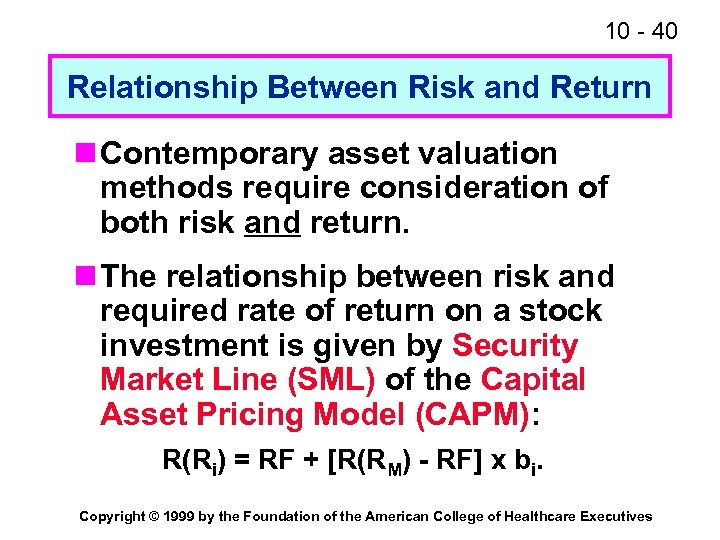

10 - 40 Relationship Between Risk and Return n Contemporary asset valuation methods require consideration of both risk and return. n The relationship between risk and required rate of return on a stock investment is given by Security Market Line (SML) of the Capital Asset Pricing Model (CAPM): R(Ri) = RF + [R(RM) - RF] x bi. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 40 Relationship Between Risk and Return n Contemporary asset valuation methods require consideration of both risk and return. n The relationship between risk and required rate of return on a stock investment is given by Security Market Line (SML) of the Capital Asset Pricing Model (CAPM): R(Ri) = RF + [R(RM) - RF] x bi. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 41 CAPM Definitions n Where: l R(Ri) = required return on asset i l RF = risk free rate of return l R(Rm) = required market return l bi = market beta value for asset I n Both RF and R(Rm) rates are determined by current marketplace conditions l RF -- U. S. treasury rates (10 yr) l R(Rm) -- avg. expected market returns Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 41 CAPM Definitions n Where: l R(Ri) = required return on asset i l RF = risk free rate of return l R(Rm) = required market return l bi = market beta value for asset I n Both RF and R(Rm) rates are determined by current marketplace conditions l RF -- U. S. treasury rates (10 yr) l R(Rm) -- avg. expected market returns Copyright © 1999 by the Foundation of the American College of Healthcare Executives

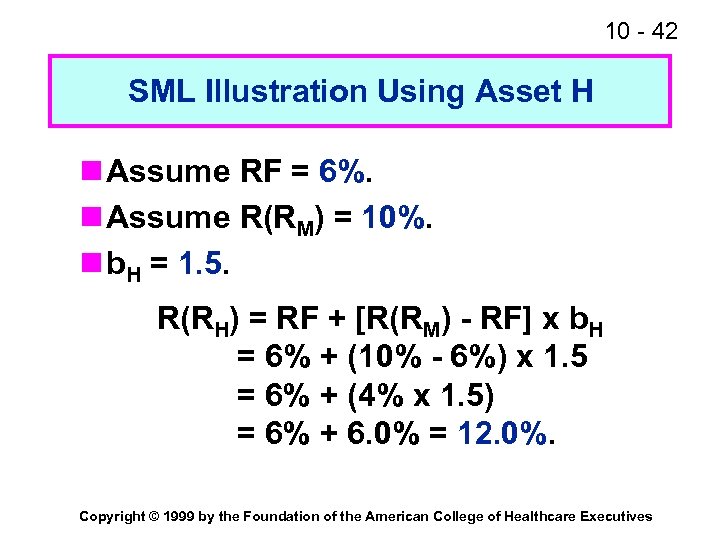

10 - 42 SML Illustration Using Asset H n Assume RF = 6%. n Assume R(RM) = 10%. n b. H = 1. 5. R(RH) = RF + [R(RM) - RF] x b. H = 6% + (10% - 6%) x 1. 5 = 6% + (4% x 1. 5) = 6% + 6. 0% = 12. 0%. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 42 SML Illustration Using Asset H n Assume RF = 6%. n Assume R(RM) = 10%. n b. H = 1. 5. R(RH) = RF + [R(RM) - RF] x b. H = 6% + (10% - 6%) x 1. 5 = 6% + (4% x 1. 5) = 6% + 6. 0% = 12. 0%. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

![10 - 43 n Note that the term [R(RM) - RF] is called the 10 - 43 n Note that the term [R(RM) - RF] is called the](https://present5.com/presentation/9514b48c5c6df24aab95189ac0c93eeb/image-43.jpg) 10 - 43 n Note that the term [R(RM) - RF] is called the market risk premium. It is the amount above the risk-free rate that investors require to assume average (b = 1) risk. n Represents the premium that investors are currently requiring to assume commensurate risk. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 43 n Note that the term [R(RM) - RF] is called the market risk premium. It is the amount above the risk-free rate that investors require to assume average (b = 1) risk. n Represents the premium that investors are currently requiring to assume commensurate risk. Copyright © 1999 by the Foundation of the American College of Healthcare Executives

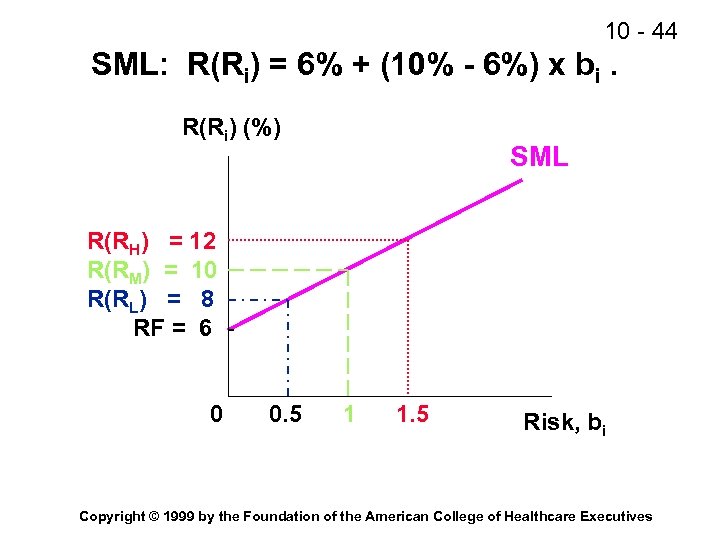

10 - 44 SML: R(Ri) = 6% + (10% - 6%) x bi. R(Ri) (%) SML R(RH) = 12 R(RM) = 10 R(RL) = 8 RF = 6 0 0. 5 1 1. 5 Risk, bi Copyright © 1999 by the Foundation of the American College of Healthcare Executives

10 - 44 SML: R(Ri) = 6% + (10% - 6%) x bi. R(Ri) (%) SML R(RH) = 12 R(RM) = 10 R(RL) = 8 RF = 6 0 0. 5 1 1. 5 Risk, bi Copyright © 1999 by the Foundation of the American College of Healthcare Executives