1 WIUU RM, Fall 2012, A. Zaporozhetz Class

- Размер: 135 Кб

- Количество слайдов: 8

Описание презентации 1 WIUU RM, Fall 2012, A. Zaporozhetz Class по слайдам

1 WIUU RM, Fall 2012, A. Zaporozhetz Class 5 Optimization models Demand function equation. Revenue maximization. Profit maximization. BEPs. Study materials: Slides

1 WIUU RM, Fall 2012, A. Zaporozhetz Class 5 Optimization models Demand function equation. Revenue maximization. Profit maximization. BEPs. Study materials: Slides

2 WIUU RM, Fall 2012, A. Zaporozhetz Demand function What shall we do with our selling Price, if: P 1 = $1, 000, then Q 1 = 400 units, and R 1 = $400, 000 P 2 = $1, 750, then Q 2 = 250 units, and R 2 = $437, 500 To do: (a) increase the price, or (b) decrease the price, or (c) keep the price at $1, 750? SOLUTION: The price that MAX the revenue shall be: $2, 250, $2, 000, $1, 750, $1, 500, $1, 250?

2 WIUU RM, Fall 2012, A. Zaporozhetz Demand function What shall we do with our selling Price, if: P 1 = $1, 000, then Q 1 = 400 units, and R 1 = $400, 000 P 2 = $1, 750, then Q 2 = 250 units, and R 2 = $437, 500 To do: (a) increase the price, or (b) decrease the price, or (c) keep the price at $1, 750? SOLUTION: The price that MAX the revenue shall be: $2, 250, $2, 000, $1, 750, $1, 500, $1, 250?

3 WIUU RM, Fall 2012, A. Zaporozhetz Demand function Correct answer: The “best” price to MAX the revenue would be: $1, 500 P opt = $1, 500, then Q opt = 300 units, and R MAX = $450, 000 To do: (a) increase the price (b) decrease the price (c) keep the price at $1, 750 This can be solved through (1) finding the demand function equation, and (2) solving a revenue maximization problem.

3 WIUU RM, Fall 2012, A. Zaporozhetz Demand function Correct answer: The “best” price to MAX the revenue would be: $1, 500 P opt = $1, 500, then Q opt = 300 units, and R MAX = $450, 000 To do: (a) increase the price (b) decrease the price (c) keep the price at $1, 750 This can be solved through (1) finding the demand function equation, and (2) solving a revenue maximization problem.

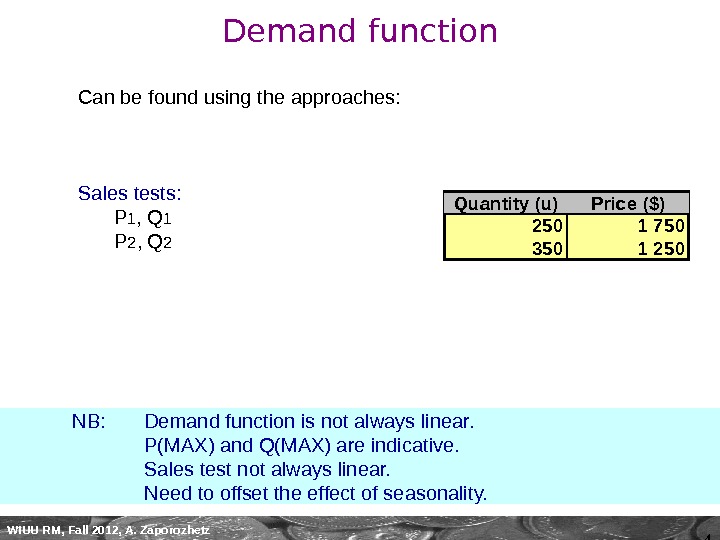

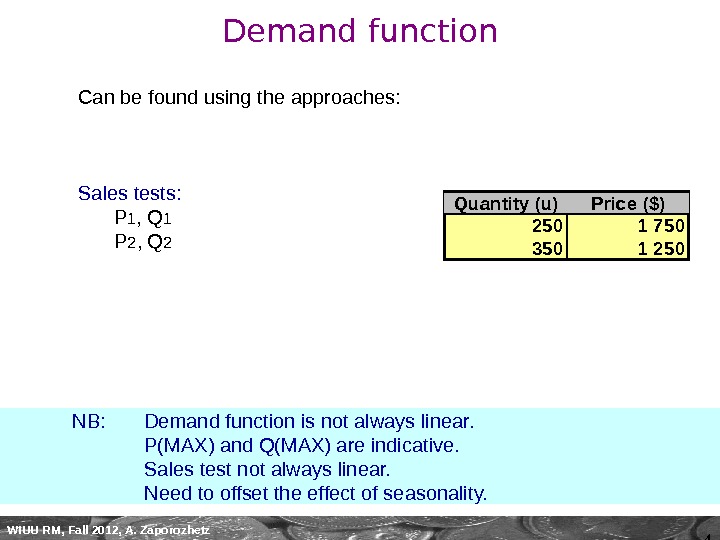

4 WIUU RM, Fall 2012, A. Zaporozhetz Demand function Can be found using the approaches: Sales tests: P 1 , Q 1 P 2 , Q 2 Quantity (u)Price ($) 2501 750 3501 250 NB: Demand function is not always linear. P(MAX) and Q(MAX) are indicative. Sales test not always linear. Need to offset the effect of seasonality.

4 WIUU RM, Fall 2012, A. Zaporozhetz Demand function Can be found using the approaches: Sales tests: P 1 , Q 1 P 2 , Q 2 Quantity (u)Price ($) 2501 750 3501 250 NB: Demand function is not always linear. P(MAX) and Q(MAX) are indicative. Sales test not always linear. Need to offset the effect of seasonality.

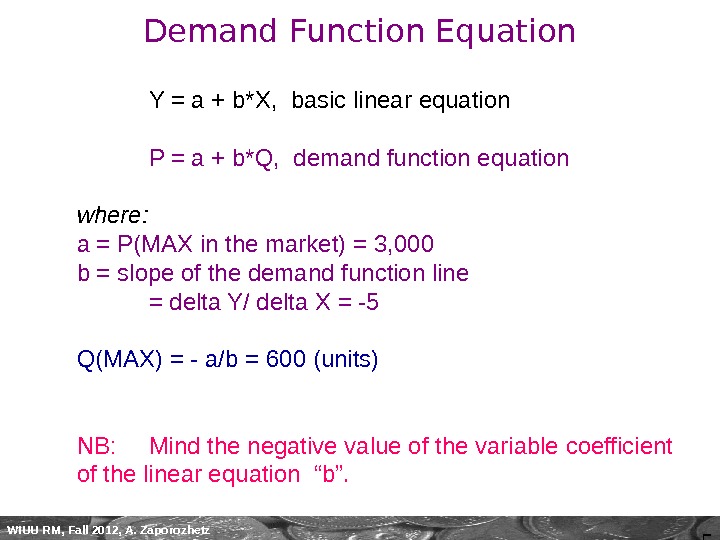

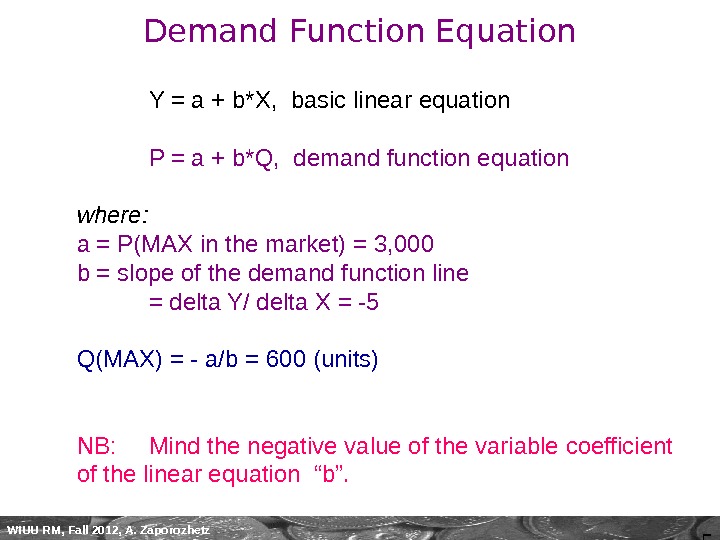

5 WIUU RM, Fall 2012, A. Zaporozhetz Demand Function Equation Y = a + b*X, basic linear equation P = a + b*Q, demand function equation where: a = P(MAX in the market) = 3, 000 b = slope of the demand function line = delta Y/ delta X = -5 Q(MAX) = — a/b = 600 (units) NB: Mind the negative value of the variable coefficient of the linear equation “b”.

5 WIUU RM, Fall 2012, A. Zaporozhetz Demand Function Equation Y = a + b*X, basic linear equation P = a + b*Q, demand function equation where: a = P(MAX in the market) = 3, 000 b = slope of the demand function line = delta Y/ delta X = -5 Q(MAX) = — a/b = 600 (units) NB: Mind the negative value of the variable coefficient of the linear equation “b”.

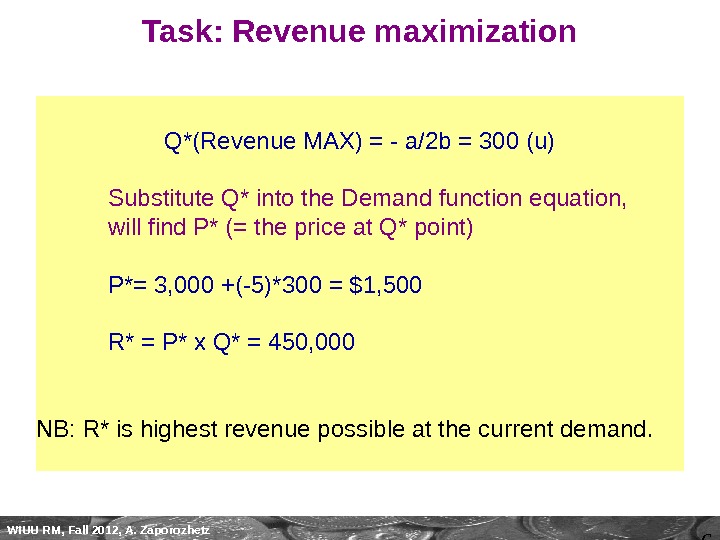

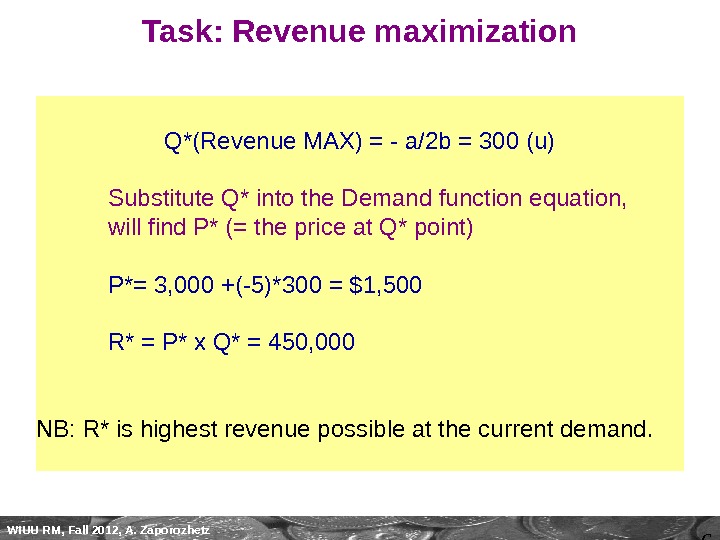

6 WIUU RM, Fall 2012, A. Zaporozhetz Task: Revenue maximization Q*(Revenue MAX) = — a/2 b = 300 (u) Substitute Q* into the Demand function equation, will find P* (= the price at Q* point) P*= 3, 000 +(-5)*300 = $1, 500 R* = P* x Q* = 450, 000 NB: R* is highest revenue possible at the current demand.

6 WIUU RM, Fall 2012, A. Zaporozhetz Task: Revenue maximization Q*(Revenue MAX) = — a/2 b = 300 (u) Substitute Q* into the Demand function equation, will find P* (= the price at Q* point) P*= 3, 000 +(-5)*300 = $1, 500 R* = P* x Q* = 450, 000 NB: R* is highest revenue possible at the current demand.

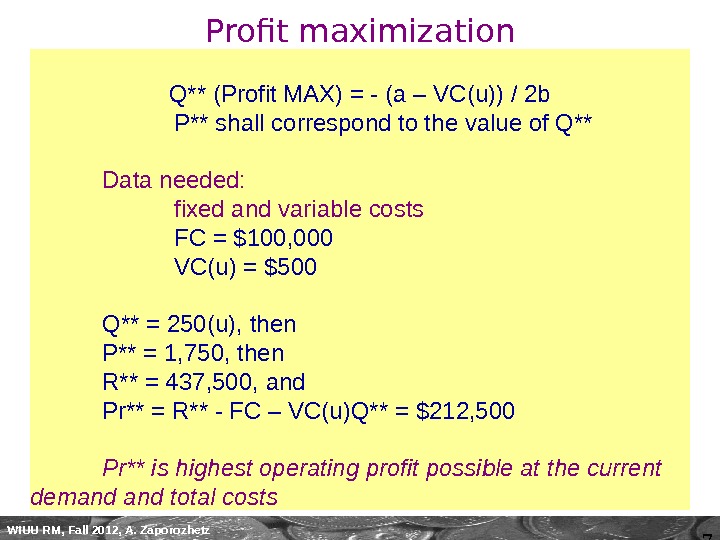

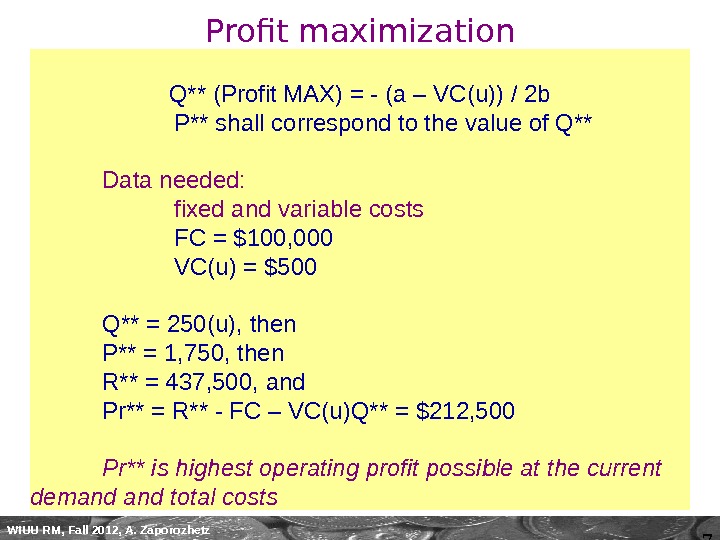

7 WIUU RM, Fall 2012, A. Zaporozhetz Profit maximization Q** (Profit MAX) = — (a – VC(u)) / 2 b P** shall correspond to the value of Q** Data needed: fixed and variable costs FC = $100, 000 VC(u) = $500 Q** = 250(u), then P** = 1, 750, then R** = 437, 500, and Pr** = R** — FC – VC(u)Q** = $212, 500 Pr** is highest operating profit possible at the current demand total costs

7 WIUU RM, Fall 2012, A. Zaporozhetz Profit maximization Q** (Profit MAX) = — (a – VC(u)) / 2 b P** shall correspond to the value of Q** Data needed: fixed and variable costs FC = $100, 000 VC(u) = $500 Q** = 250(u), then P** = 1, 750, then R** = 437, 500, and Pr** = R** — FC – VC(u)Q** = $212, 500 Pr** is highest operating profit possible at the current demand total costs

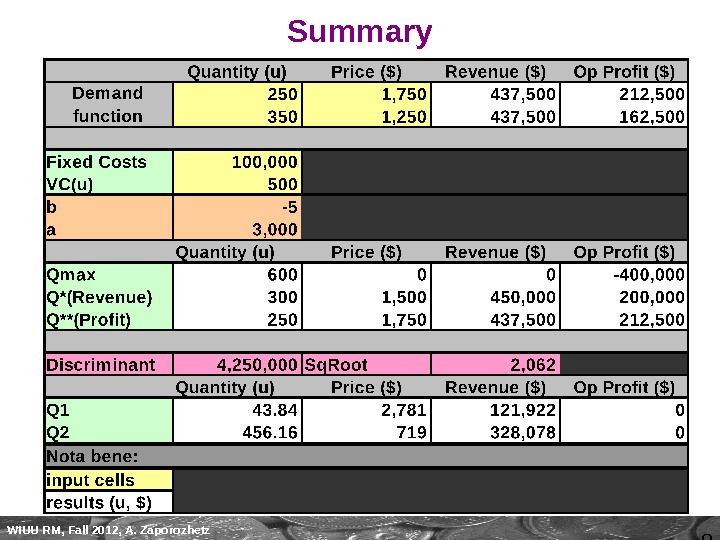

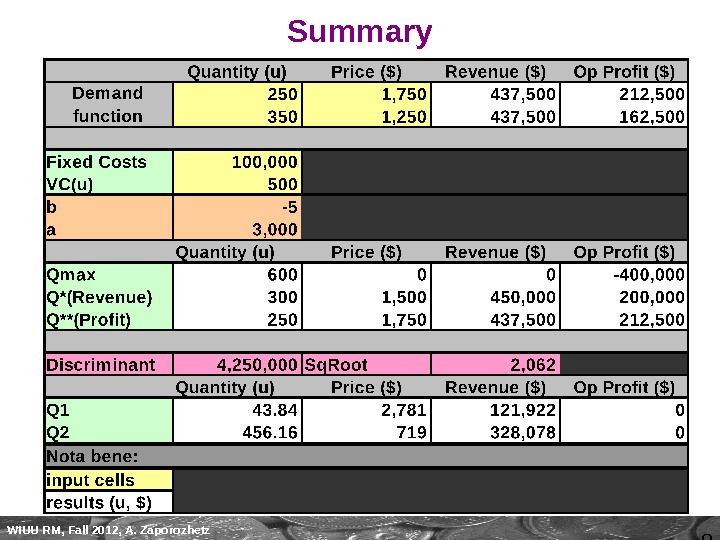

8 WIUU RM, Fall 2012, A. Zaporozhetz Summary

8 WIUU RM, Fall 2012, A. Zaporozhetz Summary