ec86cef40d74072d52c90641958cd8dd.ppt

- Количество слайдов: 85

1 WITHHOLDING TAX AT SOURCE (Revenue Regulations No. 2 -98, as amended) Presented by: SUSAN D. TUSOY, CPA, MPS Asst. Chief, Assessment Division Revenue Region No. 19 -Davao City

1 WITHHOLDING TAX AT SOURCE (Revenue Regulations No. 2 -98, as amended) Presented by: SUSAN D. TUSOY, CPA, MPS Asst. Chief, Assessment Division Revenue Region No. 19 -Davao City

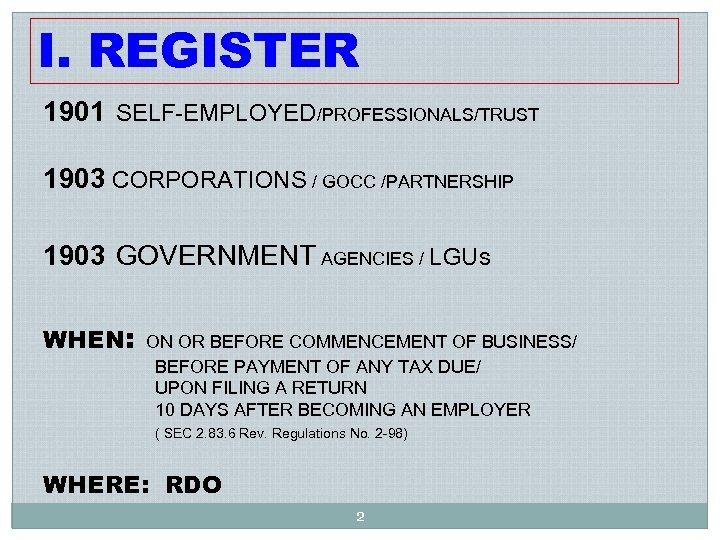

I. REGISTER 1901 SELF-EMPLOYED/PROFESSIONALS/TRUST 1903 CORPORATIONS / GOCC /PARTNERSHIP 1903 GOVERNMENT AGENCIES / LGUs WHEN: ON OR BEFORE COMMENCEMENT OF BUSINESS/ BEFORE PAYMENT OF ANY TAX DUE/ UPON FILING A RETURN 10 DAYS AFTER BECOMING AN EMPLOYER ( SEC 2. 83. 6 Rev. Regulations No. 2 -98) WHERE: RDO 2

I. REGISTER 1901 SELF-EMPLOYED/PROFESSIONALS/TRUST 1903 CORPORATIONS / GOCC /PARTNERSHIP 1903 GOVERNMENT AGENCIES / LGUs WHEN: ON OR BEFORE COMMENCEMENT OF BUSINESS/ BEFORE PAYMENT OF ANY TAX DUE/ UPON FILING A RETURN 10 DAYS AFTER BECOMING AN EMPLOYER ( SEC 2. 83. 6 Rev. Regulations No. 2 -98) WHERE: RDO 2

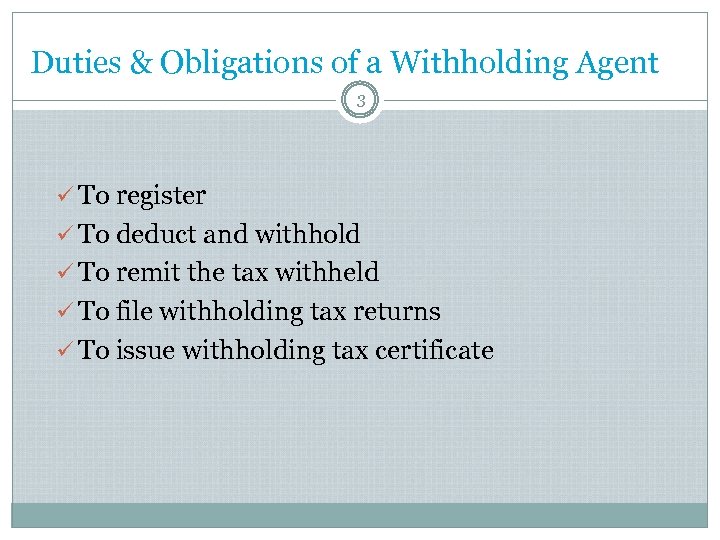

Duties & Obligations of a Withholding Agent 3 ü To register ü To deduct and withhold ü To remit the tax withheld ü To file withholding tax returns ü To issue withholding tax certificate

Duties & Obligations of a Withholding Agent 3 ü To register ü To deduct and withhold ü To remit the tax withheld ü To file withholding tax returns ü To issue withholding tax certificate

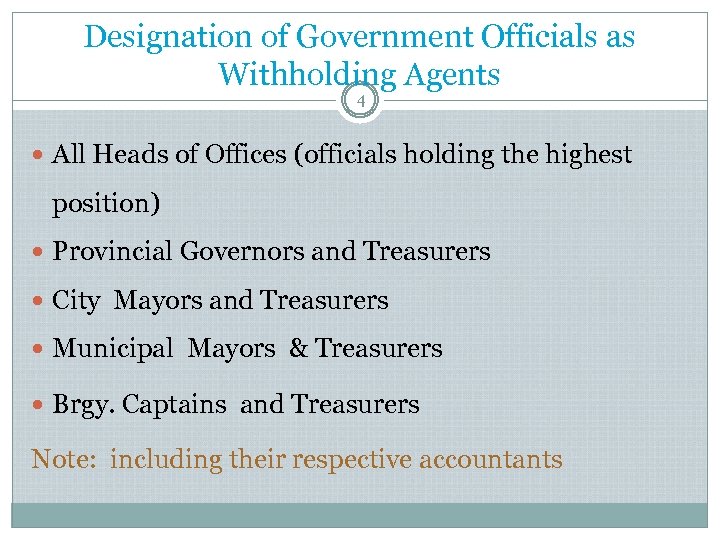

Designation of Government Officials as Withholding Agents 4 All Heads of Offices (officials holding the highest position) Provincial Governors and Treasurers City Mayors and Treasurers Municipal Mayors & Treasurers Brgy. Captains and Treasurers Note: including their respective accountants

Designation of Government Officials as Withholding Agents 4 All Heads of Offices (officials holding the highest position) Provincial Governors and Treasurers City Mayors and Treasurers Municipal Mayors & Treasurers Brgy. Captains and Treasurers Note: including their respective accountants

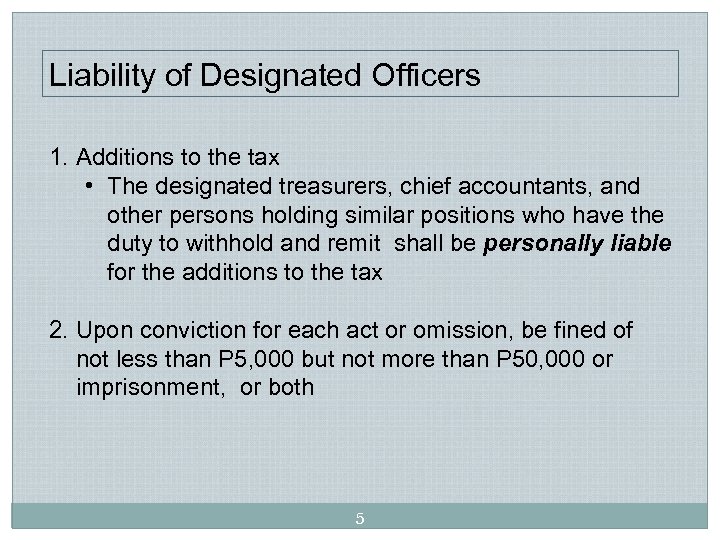

Liability of Designated Officers 1. Additions to the tax • The designated treasurers, chief accountants, and other persons holding similar positions who have the duty to withhold and remit shall be personally liable for the additions to the tax 2. Upon conviction for each act or omission, be fined of not less than P 5, 000 but not more than P 50, 000 or imprisonment, or both 5

Liability of Designated Officers 1. Additions to the tax • The designated treasurers, chief accountants, and other persons holding similar positions who have the duty to withhold and remit shall be personally liable for the additions to the tax 2. Upon conviction for each act or omission, be fined of not less than P 5, 000 but not more than P 50, 000 or imprisonment, or both 5

EXPANDED WITHHOLDING TAX 6

EXPANDED WITHHOLDING TAX 6

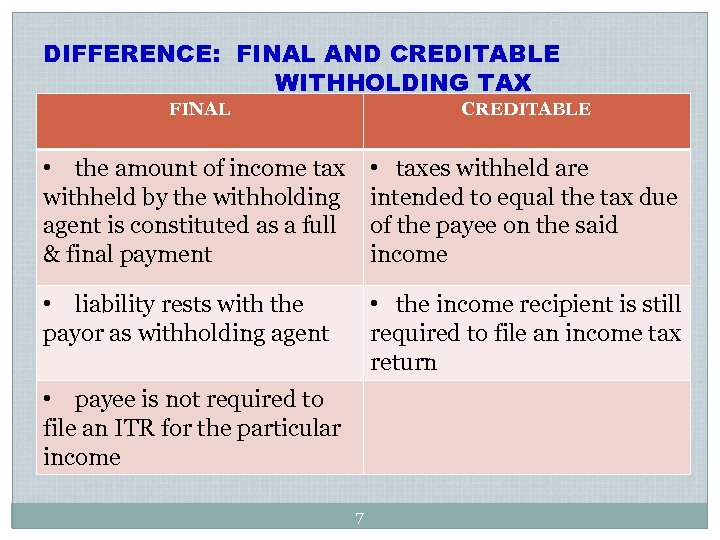

DIFFERENCE: FINAL AND CREDITABLE WITHHOLDING TAX FINAL CREDITABLE • the amount of income tax withheld by the withholding agent is constituted as a full & final payment • taxes withheld are intended to equal the tax due of the payee on the said income • liability rests with the payor as withholding agent • the income recipient is still required to file an income tax return • payee is not required to file an ITR for the particular income 7

DIFFERENCE: FINAL AND CREDITABLE WITHHOLDING TAX FINAL CREDITABLE • the amount of income tax withheld by the withholding agent is constituted as a full & final payment • taxes withheld are intended to equal the tax due of the payee on the said income • liability rests with the payor as withholding agent • the income recipient is still required to file an income tax return • payee is not required to file an ITR for the particular income 7

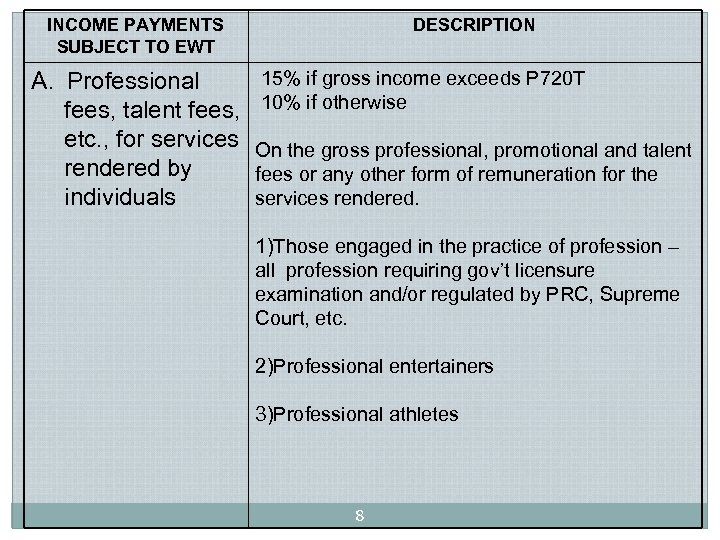

INCOME PAYMENTS SUBJECT TO EWT A. Professional fees, talent fees, etc. , for services rendered by individuals DESCRIPTION 15% if gross income exceeds P 720 T 10% if otherwise On the gross professional, promotional and talent fees or any other form of remuneration for the services rendered. 1)Those engaged in the practice of profession – all profession requiring gov’t licensure examination and/or regulated by PRC, Supreme Court, etc. 2)Professional entertainers 3)Professional athletes 8

INCOME PAYMENTS SUBJECT TO EWT A. Professional fees, talent fees, etc. , for services rendered by individuals DESCRIPTION 15% if gross income exceeds P 720 T 10% if otherwise On the gross professional, promotional and talent fees or any other form of remuneration for the services rendered. 1)Those engaged in the practice of profession – all profession requiring gov’t licensure examination and/or regulated by PRC, Supreme Court, etc. 2)Professional entertainers 3)Professional athletes 8

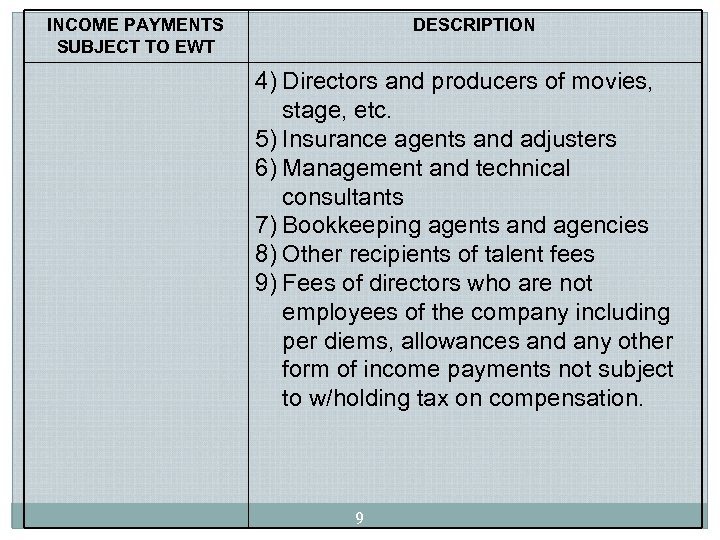

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION 4) Directors and producers of movies, stage, etc. 5) Insurance agents and adjusters 6) Management and technical consultants 7) Bookkeeping agents and agencies 8) Other recipients of talent fees 9) Fees of directors who are not employees of the company including per diems, allowances and any other form of income payments not subject to w/holding tax on compensation. 9

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION 4) Directors and producers of movies, stage, etc. 5) Insurance agents and adjusters 6) Management and technical consultants 7) Bookkeeping agents and agencies 8) Other recipients of talent fees 9) Fees of directors who are not employees of the company including per diems, allowances and any other form of income payments not subject to w/holding tax on compensation. 9

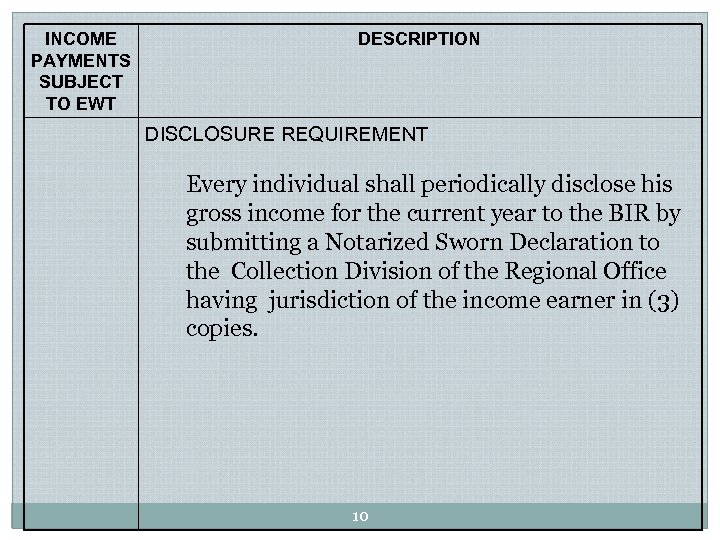

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION DISCLOSURE REQUIREMENT Every individual shall periodically disclose his gross income for the current year to the BIR by submitting a Notarized Sworn Declaration to the Collection Division of the Regional Office having jurisdiction of the income earner in (3) copies. 10

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION DISCLOSURE REQUIREMENT Every individual shall periodically disclose his gross income for the current year to the BIR by submitting a Notarized Sworn Declaration to the Collection Division of the Regional Office having jurisdiction of the income earner in (3) copies. 10

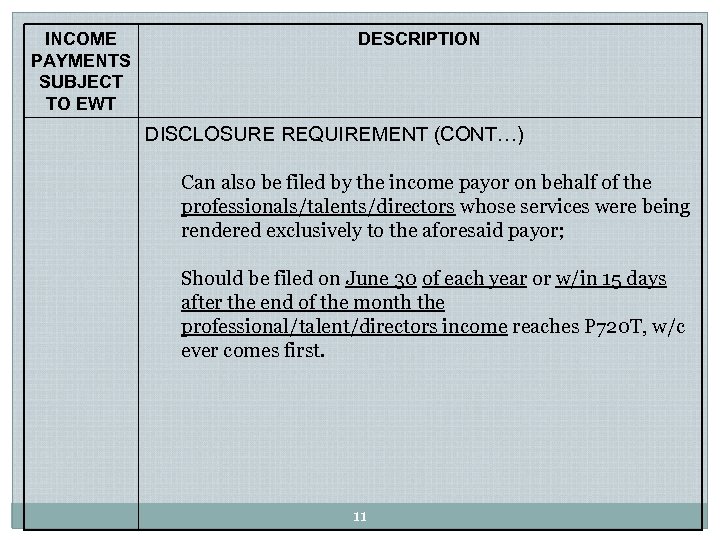

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION DISCLOSURE REQUIREMENT (CONT…) Can also be filed by the income payor on behalf of the professionals/talents/directors whose services were being rendered exclusively to the aforesaid payor; Should be filed on June 30 of each year or w/in 15 days after the end of the month the professional/talent/directors income reaches P 720 T, w/c ever comes first. 11

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION DISCLOSURE REQUIREMENT (CONT…) Can also be filed by the income payor on behalf of the professionals/talents/directors whose services were being rendered exclusively to the aforesaid payor; Should be filed on June 30 of each year or w/in 15 days after the end of the month the professional/talent/directors income reaches P 720 T, w/c ever comes first. 11

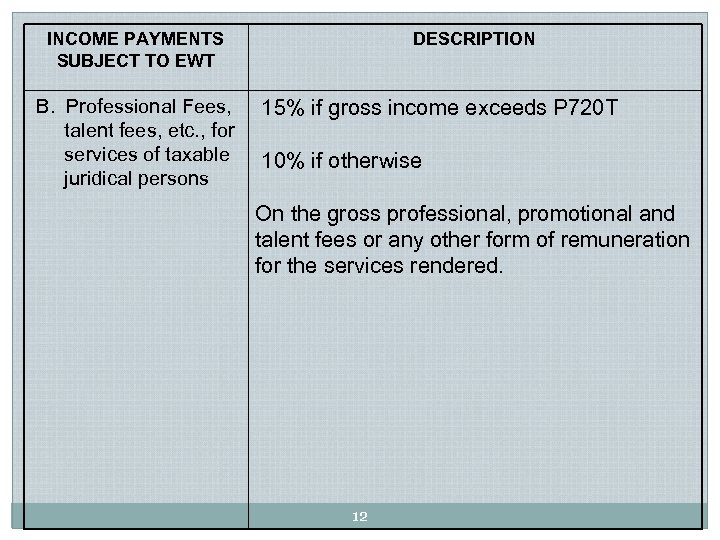

INCOME PAYMENTS SUBJECT TO EWT B. Professional Fees, talent fees, etc. , for services of taxable juridical persons DESCRIPTION 15% if gross income exceeds P 720 T 10% if otherwise On the gross professional, promotional and talent fees or any other form of remuneration for the services rendered. 12

INCOME PAYMENTS SUBJECT TO EWT B. Professional Fees, talent fees, etc. , for services of taxable juridical persons DESCRIPTION 15% if gross income exceeds P 720 T 10% if otherwise On the gross professional, promotional and talent fees or any other form of remuneration for the services rendered. 12

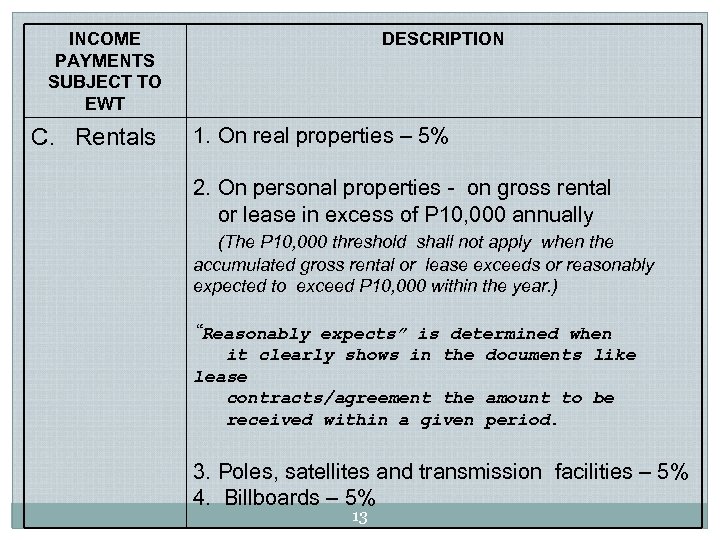

INCOME PAYMENTS SUBJECT TO EWT C. Rentals DESCRIPTION 1. On real properties – 5% 2. On personal properties - on gross rental or lease in excess of P 10, 000 annually (The P 10, 000 threshold shall not apply when the accumulated gross rental or lease exceeds or reasonably expected to exceed P 10, 000 within the year. ) “Reasonably expects” is determined when it clearly shows in the documents like lease contracts/agreement the amount to be received within a given period. 3. Poles, satellites and transmission facilities – 5% 4. Billboards – 5% 13

INCOME PAYMENTS SUBJECT TO EWT C. Rentals DESCRIPTION 1. On real properties – 5% 2. On personal properties - on gross rental or lease in excess of P 10, 000 annually (The P 10, 000 threshold shall not apply when the accumulated gross rental or lease exceeds or reasonably expected to exceed P 10, 000 within the year. ) “Reasonably expects” is determined when it clearly shows in the documents like lease contracts/agreement the amount to be received within a given period. 3. Poles, satellites and transmission facilities – 5% 4. Billboards – 5% 13

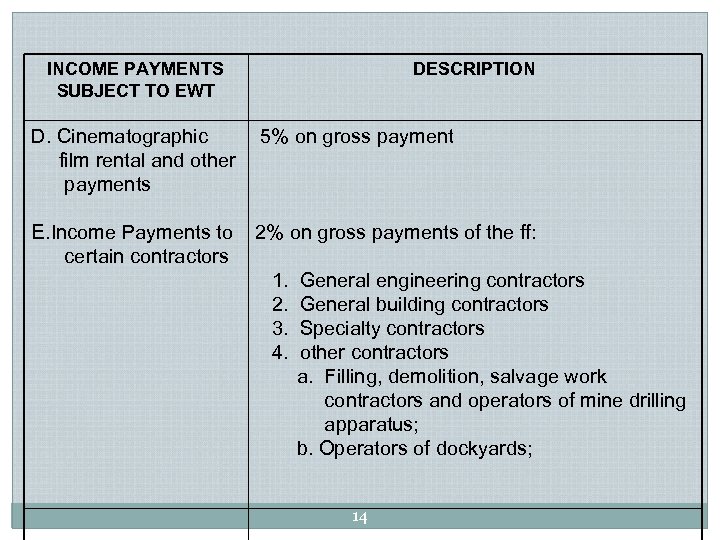

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION D. Cinematographic film rental and other payments 5% on gross payment E. Income Payments to certain contractors 2% on gross payments of the ff: 1. 2. 3. 4. General engineering contractors General building contractors Specialty contractors other contractors a. Filling, demolition, salvage work contractors and operators of mine drilling apparatus; b. Operators of dockyards; 14

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION D. Cinematographic film rental and other payments 5% on gross payment E. Income Payments to certain contractors 2% on gross payments of the ff: 1. 2. 3. 4. General engineering contractors General building contractors Specialty contractors other contractors a. Filling, demolition, salvage work contractors and operators of mine drilling apparatus; b. Operators of dockyards; 14

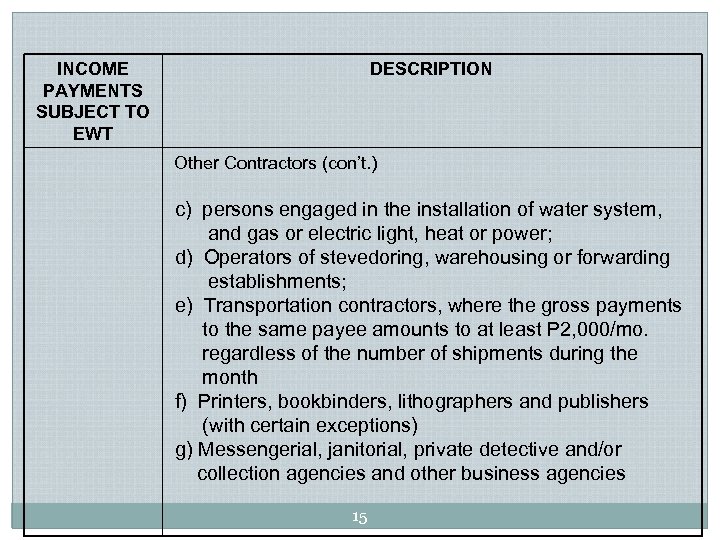

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION Other Contractors (con’t. ) c) persons engaged in the installation of water system, and gas or electric light, heat or power; d) Operators of stevedoring, warehousing or forwarding establishments; e) Transportation contractors, where the gross payments to the same payee amounts to at least P 2, 000/mo. regardless of the number of shipments during the month f) Printers, bookbinders, lithographers and publishers (with certain exceptions) g) Messengerial, janitorial, private detective and/or collection agencies and other business agencies 15

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION Other Contractors (con’t. ) c) persons engaged in the installation of water system, and gas or electric light, heat or power; d) Operators of stevedoring, warehousing or forwarding establishments; e) Transportation contractors, where the gross payments to the same payee amounts to at least P 2, 000/mo. regardless of the number of shipments during the month f) Printers, bookbinders, lithographers and publishers (with certain exceptions) g) Messengerial, janitorial, private detective and/or collection agencies and other business agencies 15

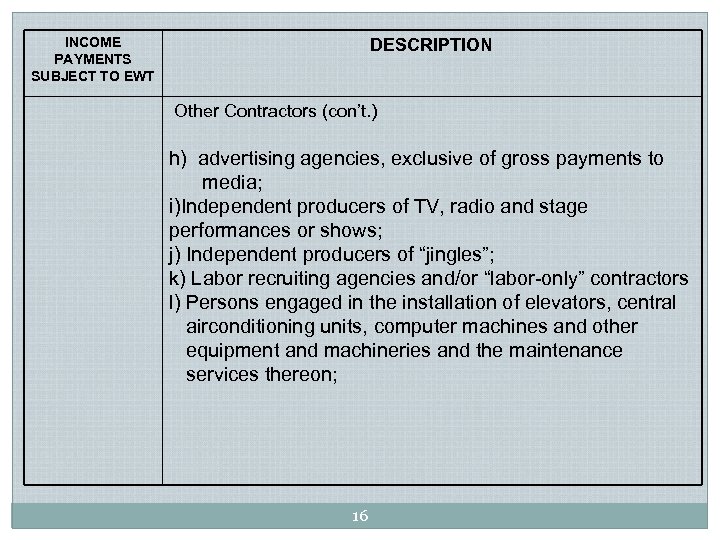

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION Other Contractors (con’t. ) h) advertising agencies, exclusive of gross payments to media; i)Independent producers of TV, radio and stage performances or shows; j) Independent producers of “jingles”; k) Labor recruiting agencies and/or “labor-only” contractors l) Persons engaged in the installation of elevators, central airconditioning units, computer machines and other equipment and machineries and the maintenance services thereon; 16

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION Other Contractors (con’t. ) h) advertising agencies, exclusive of gross payments to media; i)Independent producers of TV, radio and stage performances or shows; j) Independent producers of “jingles”; k) Labor recruiting agencies and/or “labor-only” contractors l) Persons engaged in the installation of elevators, central airconditioning units, computer machines and other equipment and machineries and the maintenance services thereon; 16

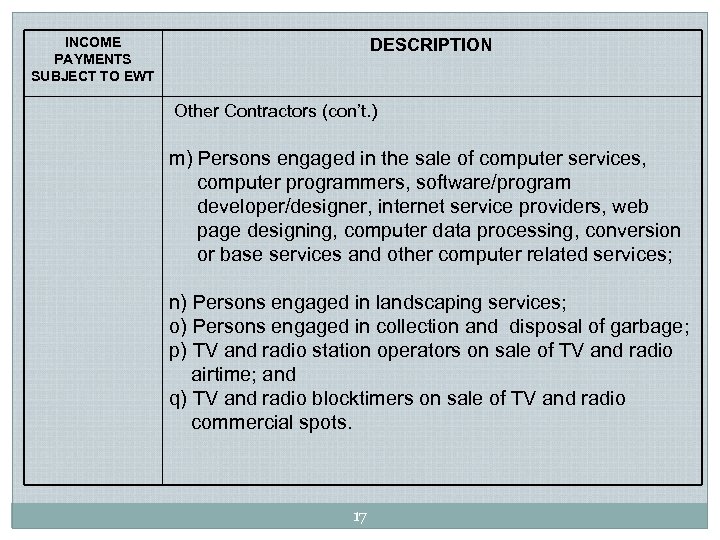

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION Other Contractors (con’t. ) m) Persons engaged in the sale of computer services, computer programmers, software/program developer/designer, internet service providers, web page designing, computer data processing, conversion or base services and other computer related services; n) Persons engaged in landscaping services; o) Persons engaged in collection and disposal of garbage; p) TV and radio station operators on sale of TV and radio airtime; and q) TV and radio blocktimers on sale of TV and radio commercial spots. 17

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION Other Contractors (con’t. ) m) Persons engaged in the sale of computer services, computer programmers, software/program developer/designer, internet service providers, web page designing, computer data processing, conversion or base services and other computer related services; n) Persons engaged in landscaping services; o) Persons engaged in collection and disposal of garbage; p) TV and radio station operators on sale of TV and radio airtime; and q) TV and radio blocktimers on sale of TV and radio commercial spots. 17

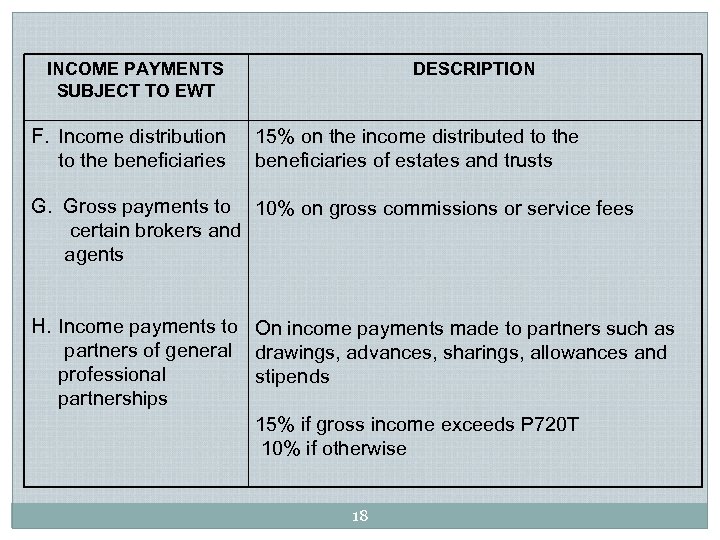

INCOME PAYMENTS SUBJECT TO EWT F. Income distribution to the beneficiaries DESCRIPTION 15% on the income distributed to the beneficiaries of estates and trusts G. Gross payments to 10% on gross commissions or service fees certain brokers and agents H. Income payments to On income payments made to partners such as partners of general drawings, advances, sharings, allowances and professional stipends partnerships 15% if gross income exceeds P 720 T 10% if otherwise 18

INCOME PAYMENTS SUBJECT TO EWT F. Income distribution to the beneficiaries DESCRIPTION 15% on the income distributed to the beneficiaries of estates and trusts G. Gross payments to 10% on gross commissions or service fees certain brokers and agents H. Income payments to On income payments made to partners such as partners of general drawings, advances, sharings, allowances and professional stipends partnerships 15% if gross income exceeds P 720 T 10% if otherwise 18

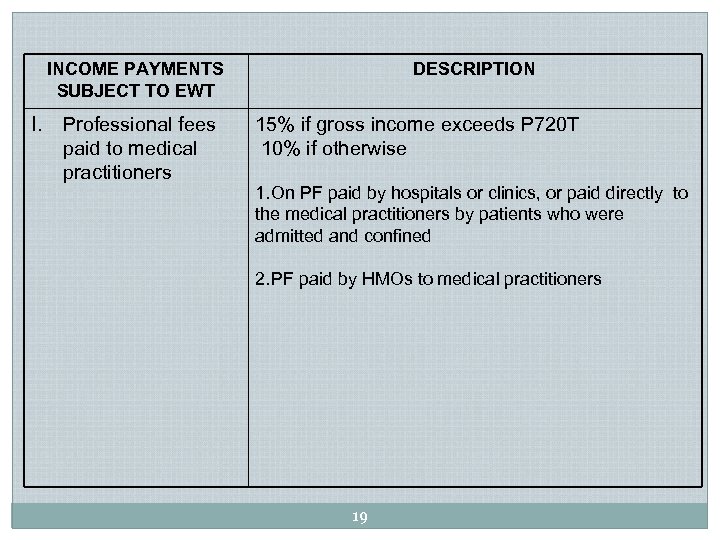

INCOME PAYMENTS SUBJECT TO EWT I. Professional fees paid to medical practitioners DESCRIPTION 15% if gross income exceeds P 720 T 10% if otherwise 1. On PF paid by hospitals or clinics, or paid directly to the medical practitioners by patients who were admitted and confined 2. PF paid by HMOs to medical practitioners 19

INCOME PAYMENTS SUBJECT TO EWT I. Professional fees paid to medical practitioners DESCRIPTION 15% if gross income exceeds P 720 T 10% if otherwise 1. On PF paid by hospitals or clinics, or paid directly to the medical practitioners by patients who were admitted and confined 2. PF paid by HMOs to medical practitioners 19

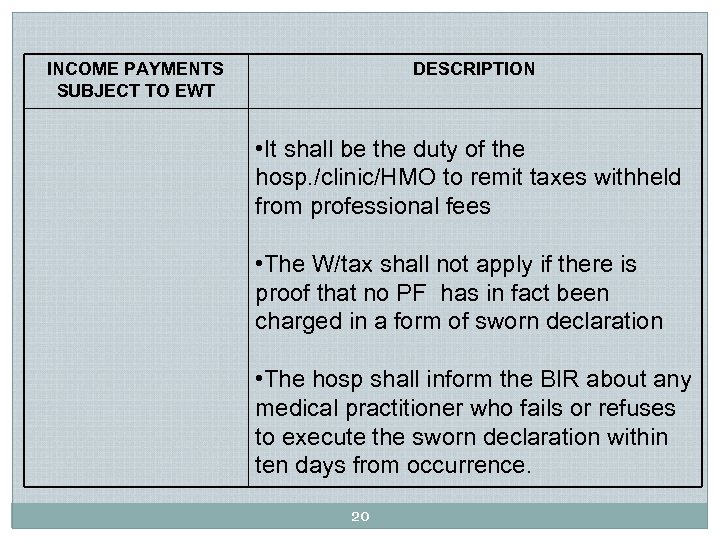

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION • It shall be the duty of the hosp. /clinic/HMO to remit taxes withheld from professional fees • The W/tax shall not apply if there is proof that no PF has in fact been charged in a form of sworn declaration • The hosp shall inform the BIR about any medical practitioner who fails or refuses to execute the sworn declaration within ten days from occurrence. 20

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION • It shall be the duty of the hosp. /clinic/HMO to remit taxes withheld from professional fees • The W/tax shall not apply if there is proof that no PF has in fact been charged in a form of sworn declaration • The hosp shall inform the BIR about any medical practitioner who fails or refuses to execute the sworn declaration within ten days from occurrence. 20

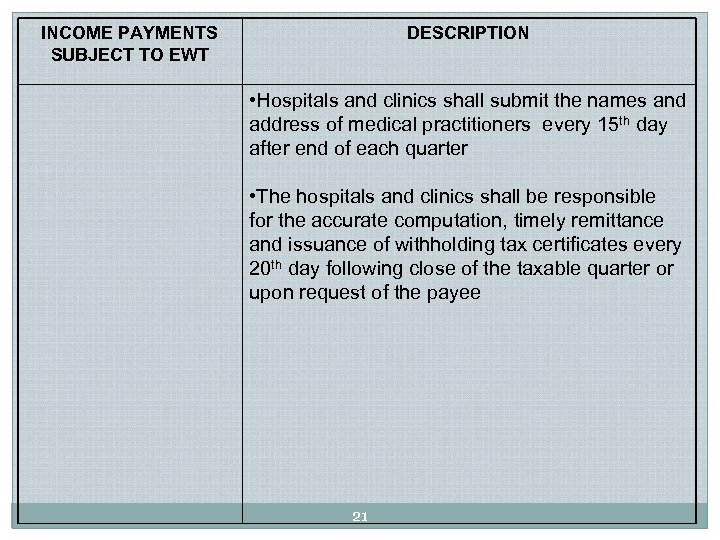

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION • Hospitals and clinics shall submit the names and address of medical practitioners every 15 th day after end of each quarter • The hospitals and clinics shall be responsible for the accurate computation, timely remittance and issuance of withholding tax certificates every 20 th day following close of the taxable quarter or upon request of the payee 21

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION • Hospitals and clinics shall submit the names and address of medical practitioners every 15 th day after end of each quarter • The hospitals and clinics shall be responsible for the accurate computation, timely remittance and issuance of withholding tax certificates every 20 th day following close of the taxable quarter or upon request of the payee 21

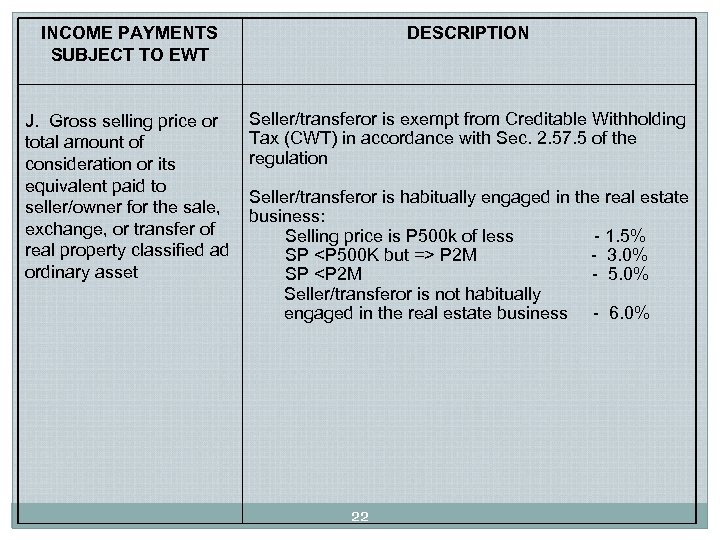

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION J. Gross selling price or total amount of consideration or its equivalent paid to seller/owner for the sale, exchange, or transfer of real property classified ad ordinary asset Seller/transferor is exempt from Creditable Withholding Tax (CWT) in accordance with Sec. 2. 57. 5 of the regulation Seller/transferor is habitually engaged in the real estate business: Selling price is P 500 k of less - 1. 5% SP

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION J. Gross selling price or total amount of consideration or its equivalent paid to seller/owner for the sale, exchange, or transfer of real property classified ad ordinary asset Seller/transferor is exempt from Creditable Withholding Tax (CWT) in accordance with Sec. 2. 57. 5 of the regulation Seller/transferor is habitually engaged in the real estate business: Selling price is P 500 k of less - 1. 5% SP

P 2 M - 3. 0% SP

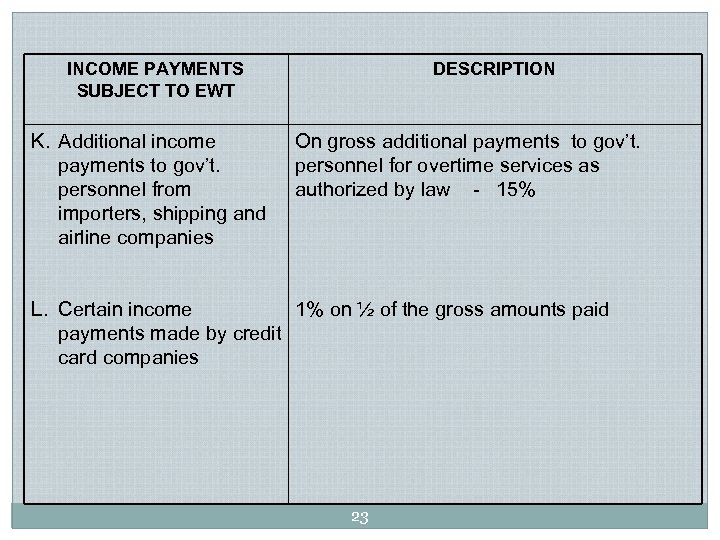

INCOME PAYMENTS SUBJECT TO EWT K. Additional income payments to gov’t. personnel from importers, shipping and airline companies DESCRIPTION On gross additional payments to gov’t. personnel for overtime services as authorized by law - 15% L. Certain income 1% on ½ of the gross amounts paid payments made by credit card companies 23

INCOME PAYMENTS SUBJECT TO EWT K. Additional income payments to gov’t. personnel from importers, shipping and airline companies DESCRIPTION On gross additional payments to gov’t. personnel for overtime services as authorized by law - 15% L. Certain income 1% on ½ of the gross amounts paid payments made by credit card companies 23

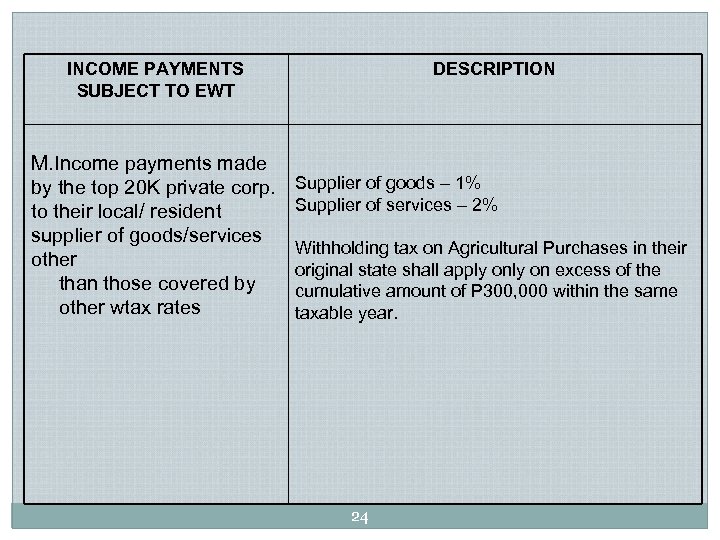

INCOME PAYMENTS SUBJECT TO EWT M. Income payments made by the top 20 K private corp. to their local/ resident supplier of goods/services other than those covered by other wtax rates DESCRIPTION Supplier of goods – 1% Supplier of services – 2% Withholding tax on Agricultural Purchases in their original state shall apply on excess of the cumulative amount of P 300, 000 within the same taxable year. 24

INCOME PAYMENTS SUBJECT TO EWT M. Income payments made by the top 20 K private corp. to their local/ resident supplier of goods/services other than those covered by other wtax rates DESCRIPTION Supplier of goods – 1% Supplier of services – 2% Withholding tax on Agricultural Purchases in their original state shall apply on excess of the cumulative amount of P 300, 000 within the same taxable year. 24

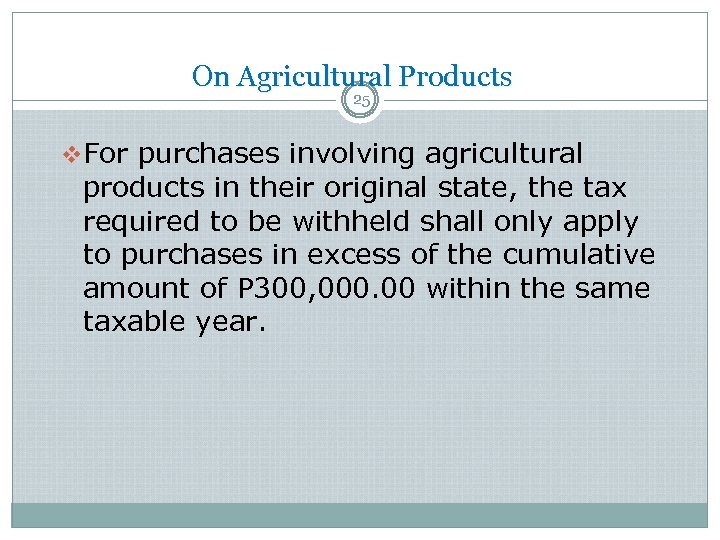

On Agricultural Products 25 v. For purchases involving agricultural products in their original state, the tax required to be withheld shall only apply to purchases in excess of the cumulative amount of P 300, 000. 00 within the same taxable year.

On Agricultural Products 25 v. For purchases involving agricultural products in their original state, the tax required to be withheld shall only apply to purchases in excess of the cumulative amount of P 300, 000. 00 within the same taxable year.

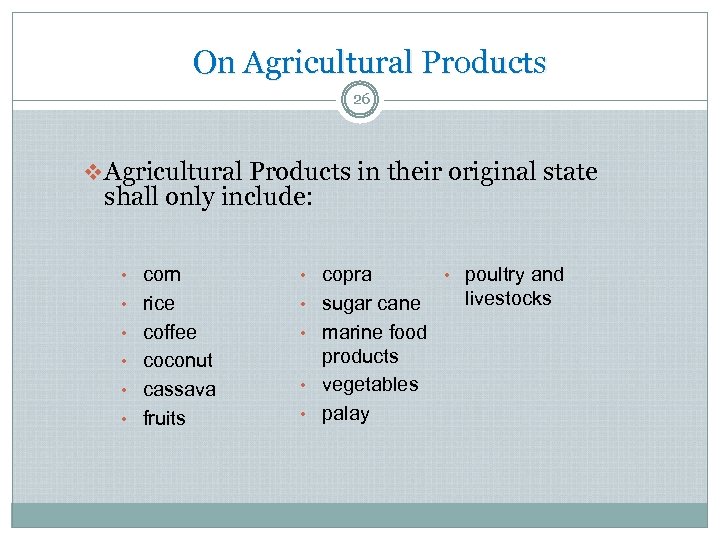

On Agricultural Products 26 v Agricultural Products in their original state shall only include: • corn • copra • rice • sugar cane • coffee • marine food • coconut products • vegetables • palay • cassava • fruits • poultry and livestocks

On Agricultural Products 26 v Agricultural Products in their original state shall only include: • corn • copra • rice • sugar cane • coffee • marine food • coconut products • vegetables • palay • cassava • fruits • poultry and livestocks

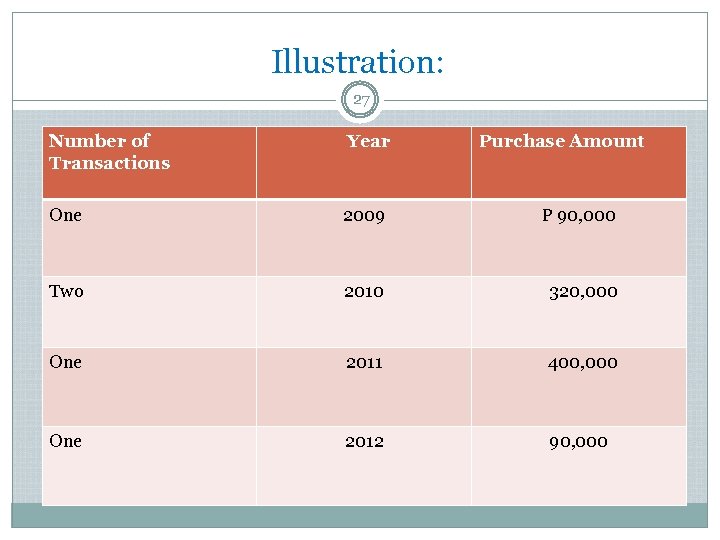

Illustration: 27 Number of Transactions Year Purchase Amount One 2009 P 90, 000 Two 2010 320, 000 One 2011 400, 000 One 2012 90, 000

Illustration: 27 Number of Transactions Year Purchase Amount One 2009 P 90, 000 Two 2010 320, 000 One 2011 400, 000 One 2012 90, 000

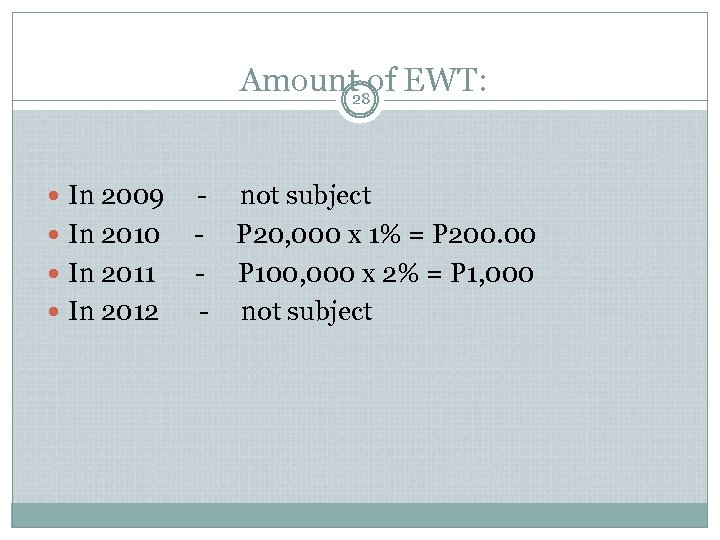

Amount of EWT: 28 In 2009 In 2010 In 2011 In 2012 - not subject P 20, 000 x 1% = P 200. 00 P 100, 000 x 2% = P 1, 000 not subject

Amount of EWT: 28 In 2009 In 2010 In 2011 In 2012 - not subject P 20, 000 x 1% = P 200. 00 P 100, 000 x 2% = P 1, 000 not subject

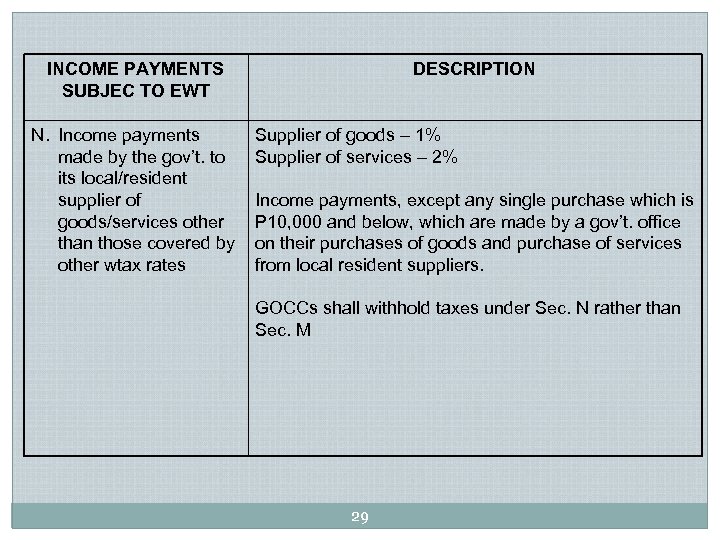

INCOME PAYMENTS SUBJEC TO EWT N. Income payments made by the gov’t. to its local/resident supplier of goods/services other than those covered by other wtax rates DESCRIPTION Supplier of goods – 1% Supplier of services – 2% Income payments, except any single purchase which is P 10, 000 and below, which are made by a gov’t. office on their purchases of goods and purchase of services from local resident suppliers. GOCCs shall withhold taxes under Sec. N rather than Sec. M 29

INCOME PAYMENTS SUBJEC TO EWT N. Income payments made by the gov’t. to its local/resident supplier of goods/services other than those covered by other wtax rates DESCRIPTION Supplier of goods – 1% Supplier of services – 2% Income payments, except any single purchase which is P 10, 000 and below, which are made by a gov’t. office on their purchases of goods and purchase of services from local resident suppliers. GOCCs shall withhold taxes under Sec. N rather than Sec. M 29

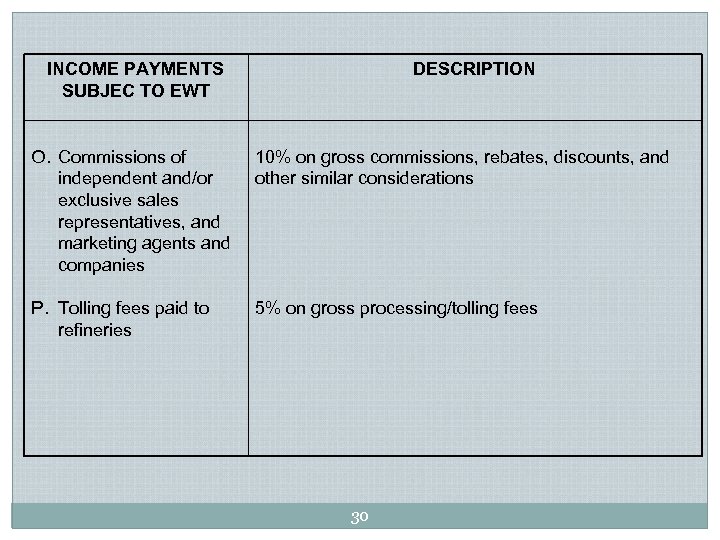

INCOME PAYMENTS SUBJEC TO EWT DESCRIPTION O. Commissions of independent and/or exclusive sales representatives, and marketing agents and companies 10% on gross commissions, rebates, discounts, and other similar considerations P. Tolling fees paid to refineries 5% on gross processing/tolling fees 30

INCOME PAYMENTS SUBJEC TO EWT DESCRIPTION O. Commissions of independent and/or exclusive sales representatives, and marketing agents and companies 10% on gross commissions, rebates, discounts, and other similar considerations P. Tolling fees paid to refineries 5% on gross processing/tolling fees 30

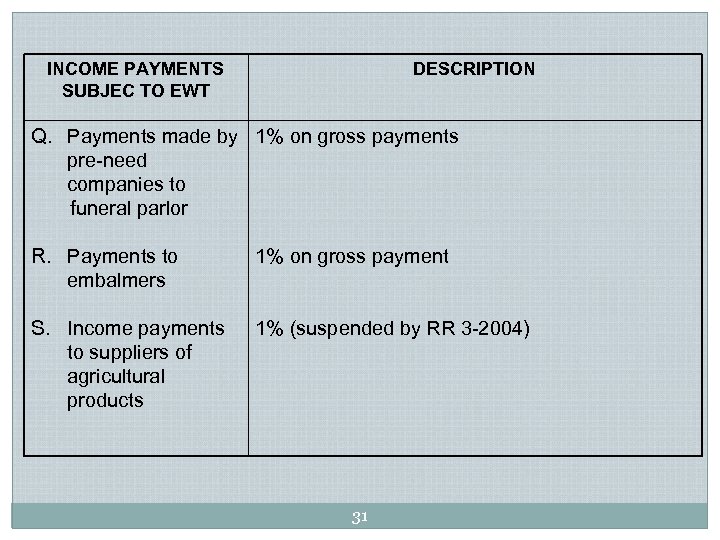

INCOME PAYMENTS SUBJEC TO EWT DESCRIPTION Q. Payments made by 1% on gross payments pre-need companies to funeral parlor R. Payments to embalmers 1% on gross payment S. Income payments to suppliers of agricultural products 1% (suspended by RR 3 -2004) 31

INCOME PAYMENTS SUBJEC TO EWT DESCRIPTION Q. Payments made by 1% on gross payments pre-need companies to funeral parlor R. Payments to embalmers 1% on gross payment S. Income payments to suppliers of agricultural products 1% (suspended by RR 3 -2004) 31

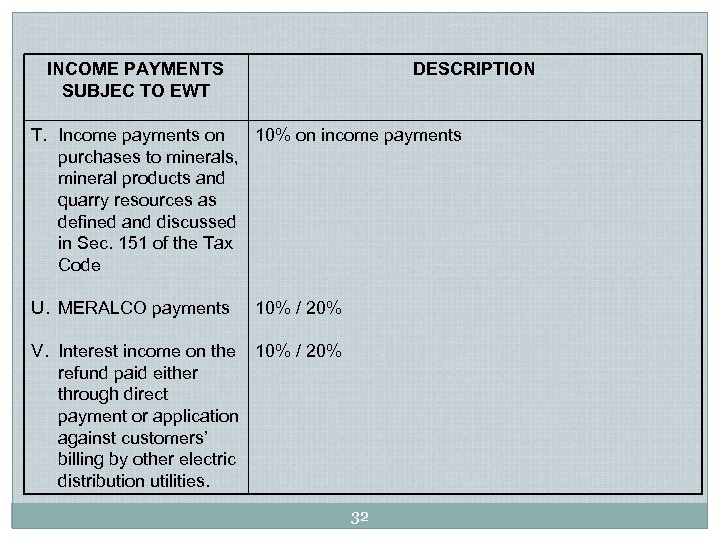

INCOME PAYMENTS SUBJEC TO EWT DESCRIPTION T. Income payments on 10% on income payments purchases to minerals, mineral products and quarry resources as defined and discussed in Sec. 151 of the Tax Code U. MERALCO payments 10% / 20% V. Interest income on the 10% / 20% refund paid either through direct payment or application against customers’ billing by other electric distribution utilities. 32

INCOME PAYMENTS SUBJEC TO EWT DESCRIPTION T. Income payments on 10% on income payments purchases to minerals, mineral products and quarry resources as defined and discussed in Sec. 151 of the Tax Code U. MERALCO payments 10% / 20% V. Interest income on the 10% / 20% refund paid either through direct payment or application against customers’ billing by other electric distribution utilities. 32

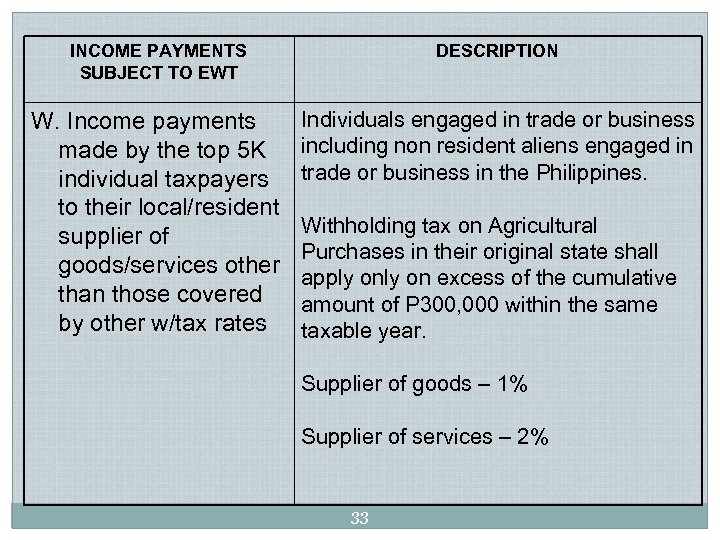

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION W. Income payments made by the top 5 K individual taxpayers to their local/resident supplier of goods/services other than those covered by other w/tax rates Individuals engaged in trade or business including non resident aliens engaged in trade or business in the Philippines. Withholding tax on Agricultural Purchases in their original state shall apply on excess of the cumulative amount of P 300, 000 within the same taxable year. Supplier of goods – 1% Supplier of services – 2% 33

INCOME PAYMENTS SUBJECT TO EWT DESCRIPTION W. Income payments made by the top 5 K individual taxpayers to their local/resident supplier of goods/services other than those covered by other w/tax rates Individuals engaged in trade or business including non resident aliens engaged in trade or business in the Philippines. Withholding tax on Agricultural Purchases in their original state shall apply on excess of the cumulative amount of P 300, 000 within the same taxable year. Supplier of goods – 1% Supplier of services – 2% 33

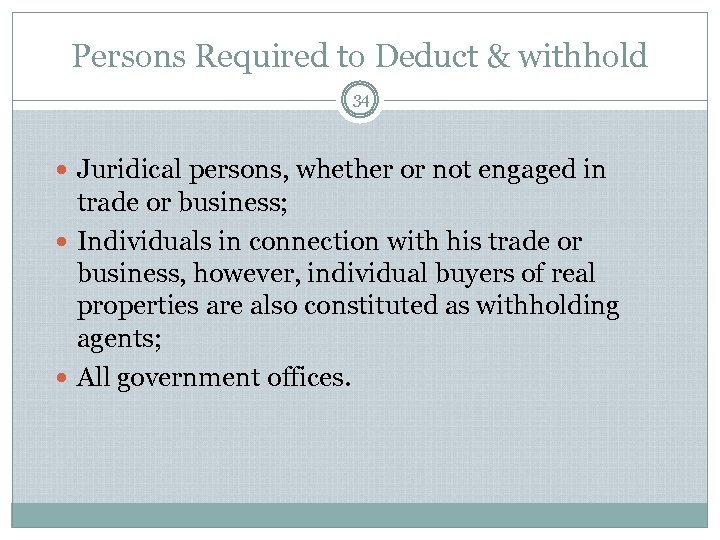

Persons Required to Deduct & withhold 34 Juridical persons, whether or not engaged in trade or business; Individuals in connection with his trade or business, however, individual buyers of real properties are also constituted as withholding agents; All government offices.

Persons Required to Deduct & withhold 34 Juridical persons, whether or not engaged in trade or business; Individuals in connection with his trade or business, however, individual buyers of real properties are also constituted as withholding agents; All government offices.

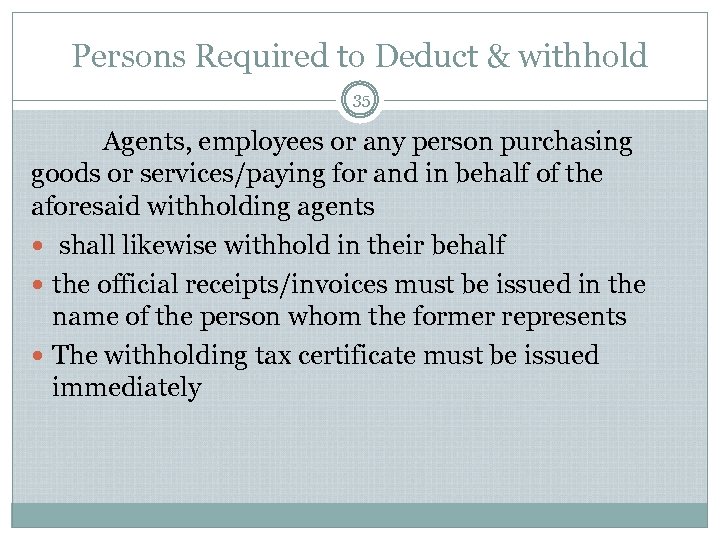

Persons Required to Deduct & withhold 35 Agents, employees or any person purchasing goods or services/paying for and in behalf of the aforesaid withholding agents shall likewise withhold in their behalf the official receipts/invoices must be issued in the name of the person whom the former represents The withholding tax certificate must be issued immediately

Persons Required to Deduct & withhold 35 Agents, employees or any person purchasing goods or services/paying for and in behalf of the aforesaid withholding agents shall likewise withhold in their behalf the official receipts/invoices must be issued in the name of the person whom the former represents The withholding tax certificate must be issued immediately

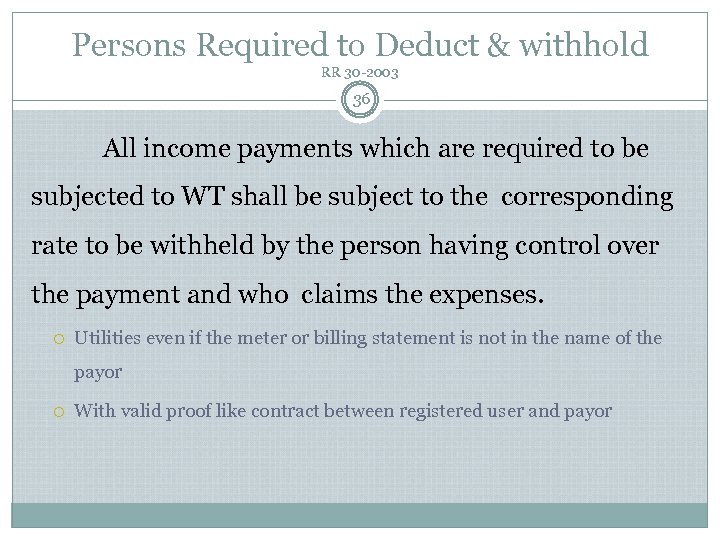

Persons Required to Deduct & withhold RR 30 -2003 36 All income payments which are required to be subjected to WT shall be subject to the corresponding rate to be withheld by the person having control over the payment and who claims the expenses. Utilities even if the meter or billing statement is not in the name of the payor With valid proof like contract between registered user and payor

Persons Required to Deduct & withhold RR 30 -2003 36 All income payments which are required to be subjected to WT shall be subject to the corresponding rate to be withheld by the person having control over the payment and who claims the expenses. Utilities even if the meter or billing statement is not in the name of the payor With valid proof like contract between registered user and payor

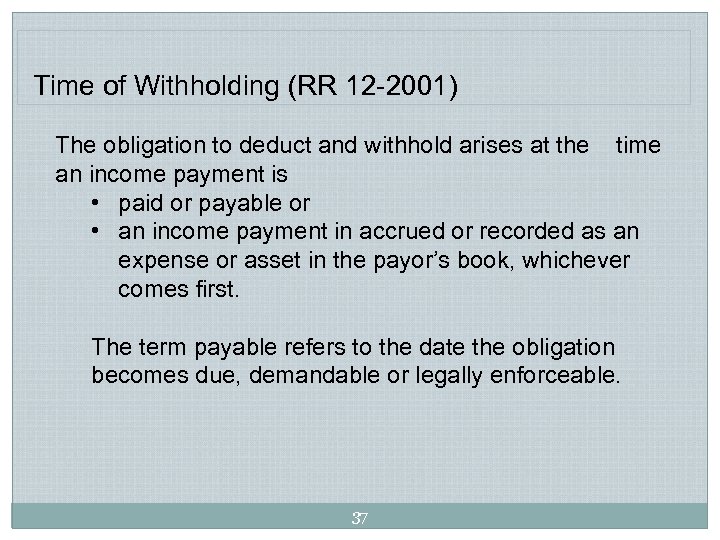

Time of Withholding (RR 12 -2001) The obligation to deduct and withhold arises at the time an income payment is • paid or payable or • an income payment in accrued or recorded as an expense or asset in the payor’s book, whichever comes first. The term payable refers to the date the obligation becomes due, demandable or legally enforceable. 37

Time of Withholding (RR 12 -2001) The obligation to deduct and withhold arises at the time an income payment is • paid or payable or • an income payment in accrued or recorded as an expense or asset in the payor’s book, whichever comes first. The term payable refers to the date the obligation becomes due, demandable or legally enforceable. 37

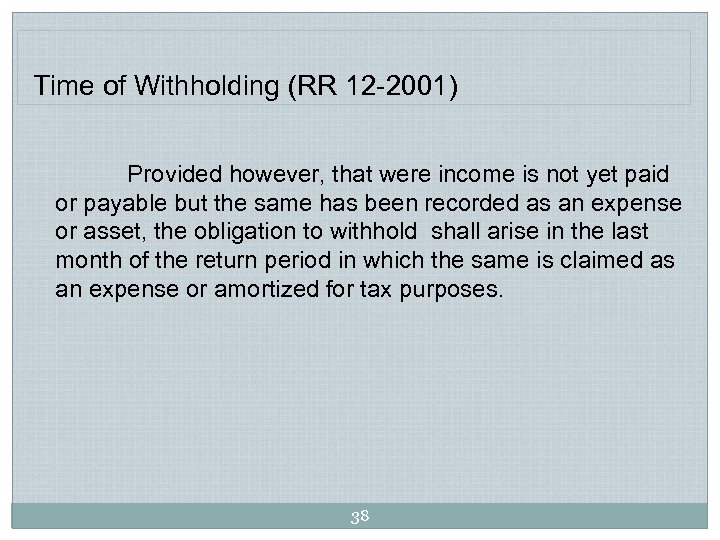

Time of Withholding (RR 12 -2001) Provided however, that were income is not yet paid or payable but the same has been recorded as an expense or asset, the obligation to withhold shall arise in the last month of the return period in which the same is claimed as an expense or amortized for tax purposes. 38

Time of Withholding (RR 12 -2001) Provided however, that were income is not yet paid or payable but the same has been recorded as an expense or asset, the obligation to withhold shall arise in the last month of the return period in which the same is claimed as an expense or amortized for tax purposes. 38

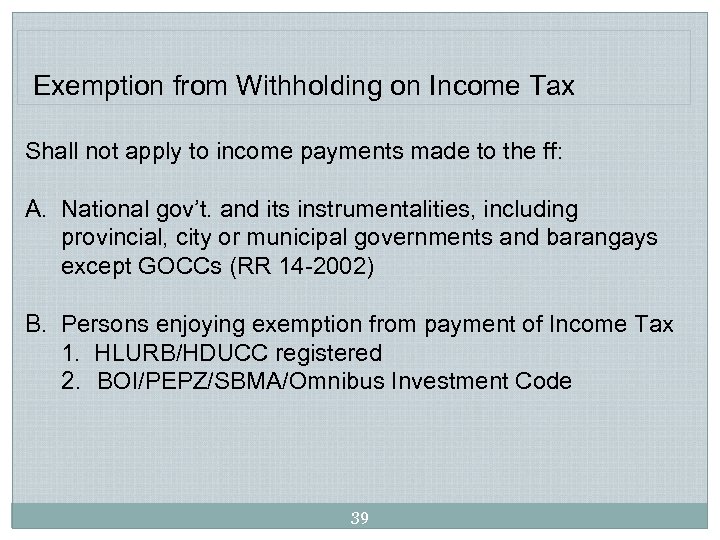

Exemption from Withholding on Income Tax Shall not apply to income payments made to the ff: A. National gov’t. and its instrumentalities, including provincial, city or municipal governments and barangays except GOCCs (RR 14 -2002) B. Persons enjoying exemption from payment of Income Tax 1. HLURB/HDUCC registered 2. BOI/PEPZ/SBMA/Omnibus Investment Code 39

Exemption from Withholding on Income Tax Shall not apply to income payments made to the ff: A. National gov’t. and its instrumentalities, including provincial, city or municipal governments and barangays except GOCCs (RR 14 -2002) B. Persons enjoying exemption from payment of Income Tax 1. HLURB/HDUCC registered 2. BOI/PEPZ/SBMA/Omnibus Investment Code 39

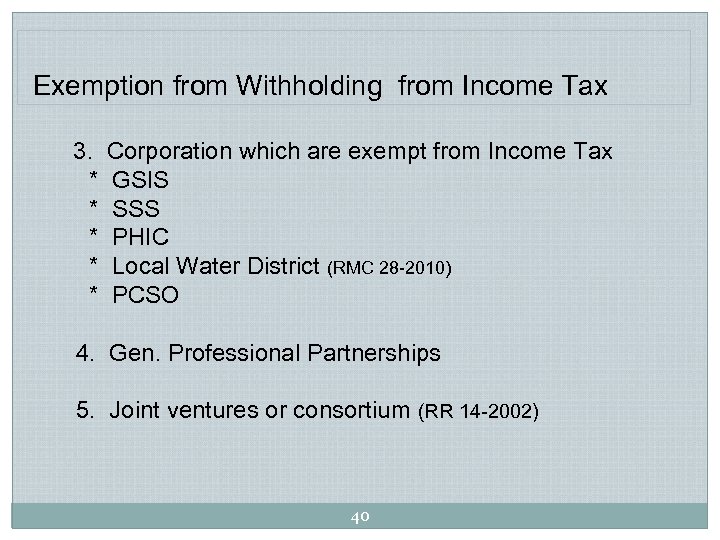

Exemption from Withholding from Income Tax 3. * * * Corporation which are exempt from Income Tax GSIS SSS PHIC Local Water District (RMC 28 -2010) PCSO 4. Gen. Professional Partnerships 5. Joint ventures or consortium (RR 14 -2002) 40

Exemption from Withholding from Income Tax 3. * * * Corporation which are exempt from Income Tax GSIS SSS PHIC Local Water District (RMC 28 -2010) PCSO 4. Gen. Professional Partnerships 5. Joint ventures or consortium (RR 14 -2002) 40

FINAL WITHHOLDING TAX 41

FINAL WITHHOLDING TAX 41

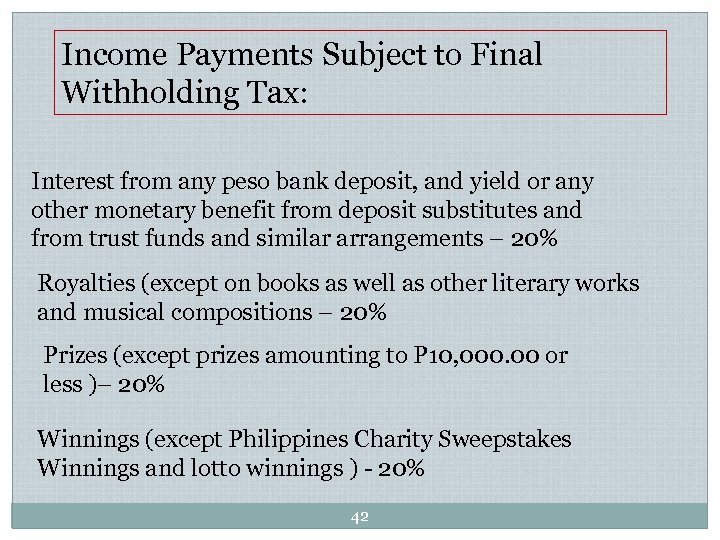

Income Payments Subject to Final Withholding Tax: Interest from any peso bank deposit, and yield or any other monetary benefit from deposit substitutes and from trust funds and similar arrangements – 20% Royalties (except on books as well as other literary works and musical compositions – 20% Prizes (except prizes amounting to P 10, 000. 00 or less )– 20% Winnings (except Philippines Charity Sweepstakes Winnings and lotto winnings ) - 20% 42

Income Payments Subject to Final Withholding Tax: Interest from any peso bank deposit, and yield or any other monetary benefit from deposit substitutes and from trust funds and similar arrangements – 20% Royalties (except on books as well as other literary works and musical compositions – 20% Prizes (except prizes amounting to P 10, 000. 00 or less )– 20% Winnings (except Philippines Charity Sweepstakes Winnings and lotto winnings ) - 20% 42

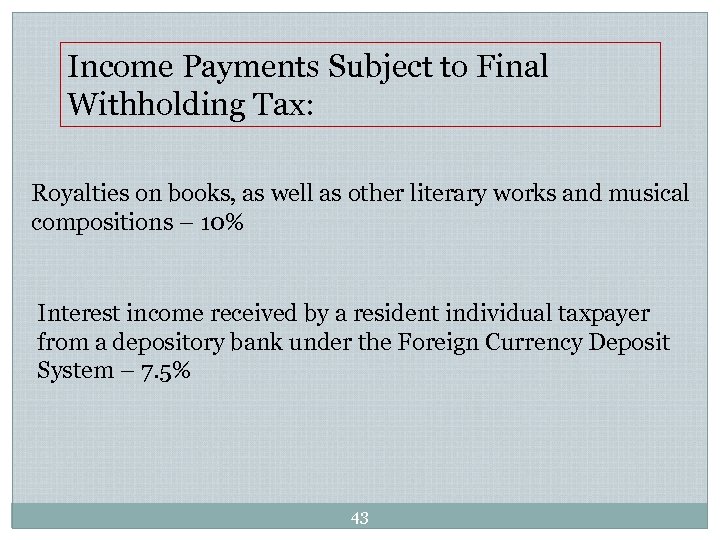

Income Payments Subject to Final Withholding Tax: Royalties on books, as well as other literary works and musical compositions – 10% Interest income received by a resident individual taxpayer from a depository bank under the Foreign Currency Deposit System – 7. 5% 43

Income Payments Subject to Final Withholding Tax: Royalties on books, as well as other literary works and musical compositions – 10% Interest income received by a resident individual taxpayer from a depository bank under the Foreign Currency Deposit System – 7. 5% 43

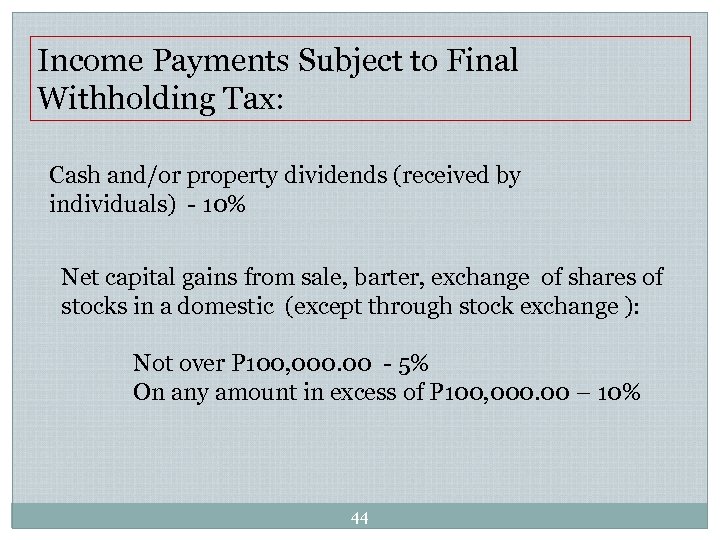

Income Payments Subject to Final Withholding Tax: Cash and/or property dividends (received by individuals) - 10% Net capital gains from sale, barter, exchange of shares of stocks in a domestic (except through stock exchange ): Not over P 100, 000. 00 - 5% On any amount in excess of P 100, 000. 00 – 10% 44

Income Payments Subject to Final Withholding Tax: Cash and/or property dividends (received by individuals) - 10% Net capital gains from sale, barter, exchange of shares of stocks in a domestic (except through stock exchange ): Not over P 100, 000. 00 - 5% On any amount in excess of P 100, 000. 00 – 10% 44

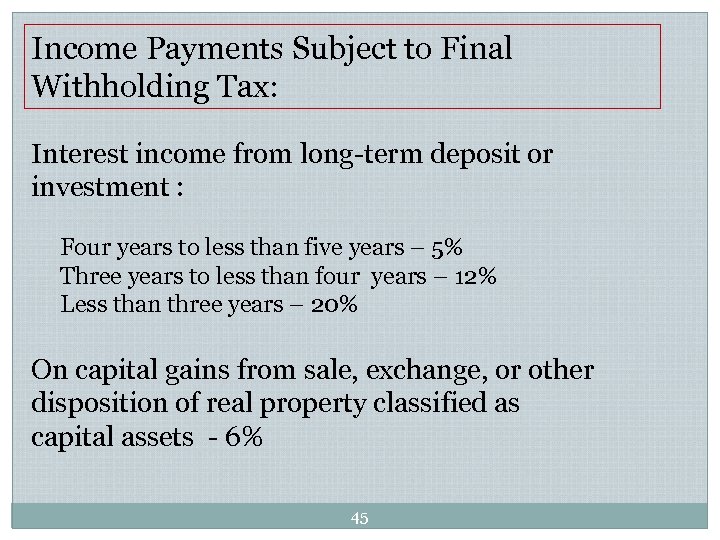

Income Payments Subject to Final Withholding Tax: Interest income from long-term deposit or investment : Four years to less than five years – 5% Three years to less than four years – 12% Less than three years – 20% On capital gains from sale, exchange, or other disposition of real property classified as capital assets - 6% 45

Income Payments Subject to Final Withholding Tax: Interest income from long-term deposit or investment : Four years to less than five years – 5% Three years to less than four years – 12% Less than three years – 20% On capital gains from sale, exchange, or other disposition of real property classified as capital assets - 6% 45

WITHHOLDING TAX ON VALUE ADDED TAX AND PERCENTAGE TAX 46

WITHHOLDING TAX ON VALUE ADDED TAX AND PERCENTAGE TAX 46

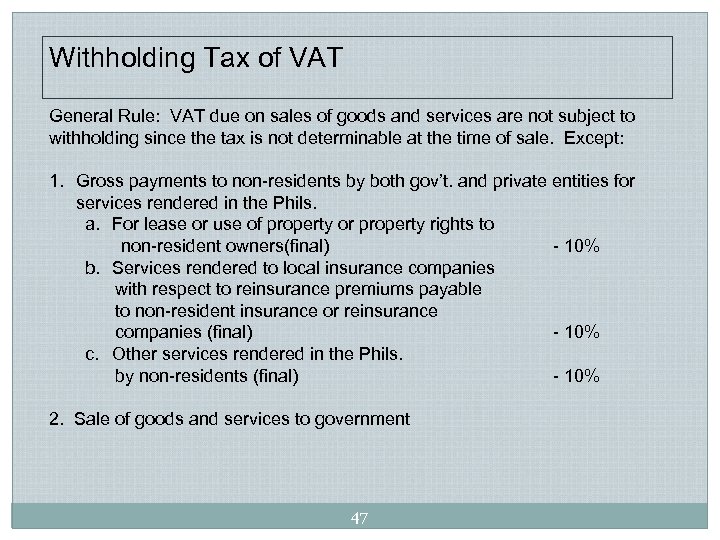

Withholding Tax of VAT General Rule: VAT due on sales of goods and services are not subject to withholding since the tax is not determinable at the time of sale. Except: 1. Gross payments to non-residents by both gov’t. and private entities for services rendered in the Phils. a. For lease or use of property or property rights to non-resident owners(final) - 10% b. Services rendered to local insurance companies with respect to reinsurance premiums payable to non-resident insurance or reinsurance companies (final) - 10% c. Other services rendered in the Phils. by non-residents (final) - 10% 2. Sale of goods and services to government 47

Withholding Tax of VAT General Rule: VAT due on sales of goods and services are not subject to withholding since the tax is not determinable at the time of sale. Except: 1. Gross payments to non-residents by both gov’t. and private entities for services rendered in the Phils. a. For lease or use of property or property rights to non-resident owners(final) - 10% b. Services rendered to local insurance companies with respect to reinsurance premiums payable to non-resident insurance or reinsurance companies (final) - 10% c. Other services rendered in the Phils. by non-residents (final) - 10% 2. Sale of goods and services to government 47

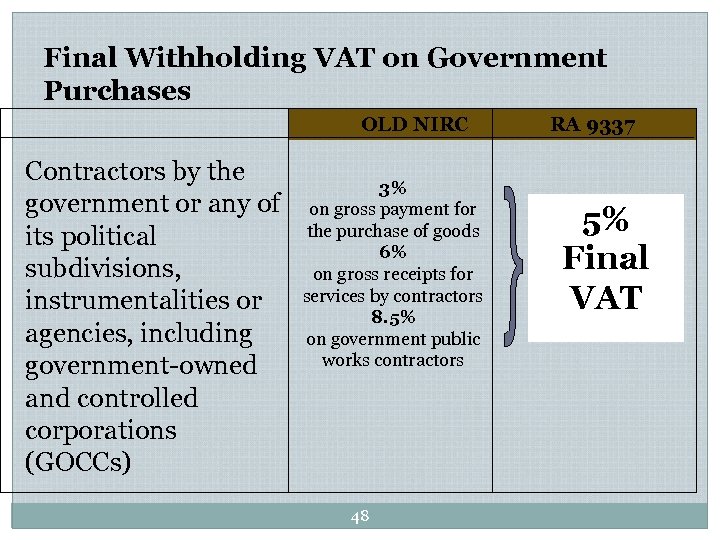

Final Withholding VAT on Government Purchases OLD NIRC Contractors by the government or any of its political subdivisions, instrumentalities or agencies, including government-owned and controlled corporations (GOCCs) 3% on gross payment for the purchase of goods 6% on gross receipts for services by contractors 8. 5% on government public works contractors 48 RA 9337 5% Final VAT

Final Withholding VAT on Government Purchases OLD NIRC Contractors by the government or any of its political subdivisions, instrumentalities or agencies, including government-owned and controlled corporations (GOCCs) 3% on gross payment for the purchase of goods 6% on gross receipts for services by contractors 8. 5% on government public works contractors 48 RA 9337 5% Final VAT

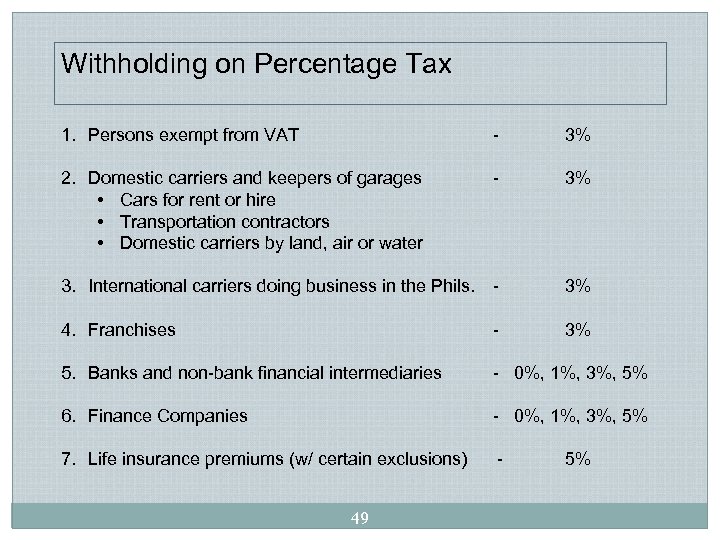

Withholding on Percentage Tax 1. Persons exempt from VAT - 3% 2. Domestic carriers and keepers of garages • Cars for rent or hire • Transportation contractors • Domestic carriers by land, air or water - 3% 3. International carriers doing business in the Phils. - 3% 4. Franchises - 3% 5. Banks and non-bank financial intermediaries - 0%, 1%, 3%, 5% 6. Finance Companies - 0%, 1%, 3%, 5% 7. Life insurance premiums (w/ certain exclusions) - 49 5%

Withholding on Percentage Tax 1. Persons exempt from VAT - 3% 2. Domestic carriers and keepers of garages • Cars for rent or hire • Transportation contractors • Domestic carriers by land, air or water - 3% 3. International carriers doing business in the Phils. - 3% 4. Franchises - 3% 5. Banks and non-bank financial intermediaries - 0%, 1%, 3%, 5% 6. Finance Companies - 0%, 1%, 3%, 5% 7. Life insurance premiums (w/ certain exclusions) - 49 5%

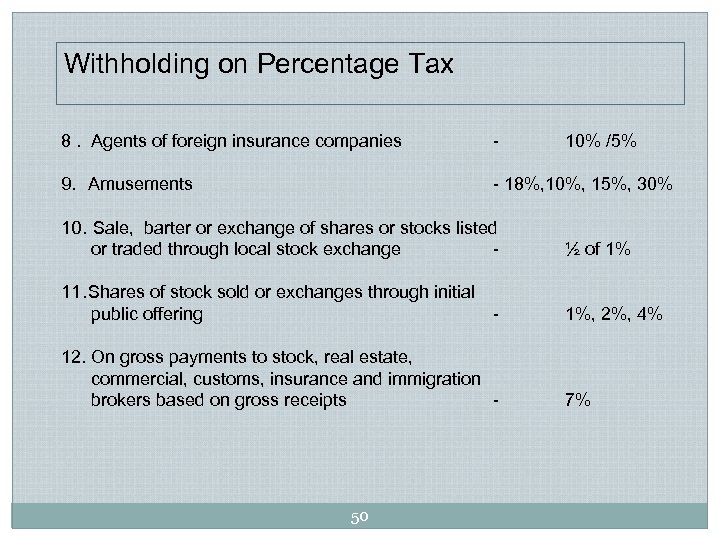

Withholding on Percentage Tax 8. Agents of foreign insurance companies - 10% /5% 9. Amusements - 18%, 10%, 15%, 30% 10. Sale, barter or exchange of shares or stocks listed or traded through local stock exchange - ½ of 1% 11. Shares of stock sold or exchanges through initial public offering - 1%, 2%, 4% 12. On gross payments to stock, real estate, commercial, customs, insurance and immigration brokers based on gross receipts - 7% 50

Withholding on Percentage Tax 8. Agents of foreign insurance companies - 10% /5% 9. Amusements - 18%, 10%, 15%, 30% 10. Sale, barter or exchange of shares or stocks listed or traded through local stock exchange - ½ of 1% 11. Shares of stock sold or exchanges through initial public offering - 1%, 2%, 4% 12. On gross payments to stock, real estate, commercial, customs, insurance and immigration brokers based on gross receipts - 7% 50

ON GOVERNMENT MONEY PAYMENTS RMC 56 -2009 51

ON GOVERNMENT MONEY PAYMENTS RMC 56 -2009 51

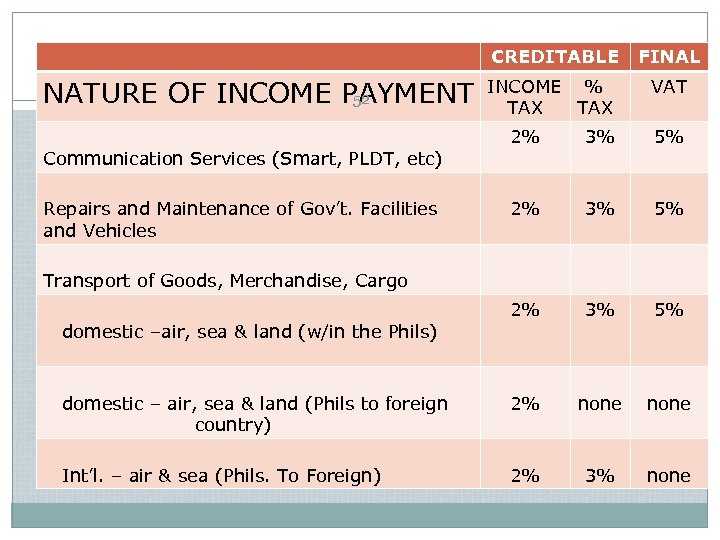

CREDITABLE NATURE OF INCOME PAYMENT 52 FINAL INCOME % TAX VAT 2% 3% 5% domestic – air, sea & land (Phils to foreign country) 2% none Int’l. – air & sea (Phils. To Foreign) 2% 3% none Communication Services (Smart, PLDT, etc) Repairs and Maintenance of Gov’t. Facilities and Vehicles Transport of Goods, Merchandise, Cargo domestic –air, sea & land (w/in the Phils)

CREDITABLE NATURE OF INCOME PAYMENT 52 FINAL INCOME % TAX VAT 2% 3% 5% domestic – air, sea & land (Phils to foreign country) 2% none Int’l. – air & sea (Phils. To Foreign) 2% 3% none Communication Services (Smart, PLDT, etc) Repairs and Maintenance of Gov’t. Facilities and Vehicles Transport of Goods, Merchandise, Cargo domestic –air, sea & land (w/in the Phils)

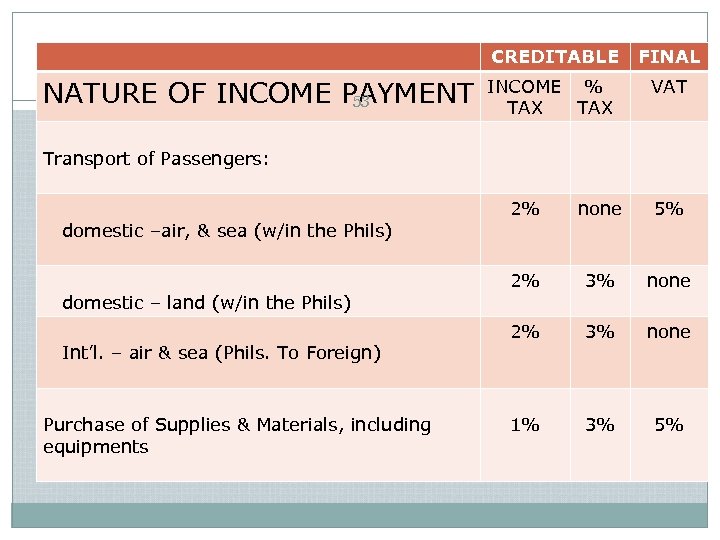

CREDITABLE NATURE OF INCOME PAYMENT 53 FINAL INCOME % TAX VAT Transport of Passengers: domestic –air, & sea (w/in the Phils) domestic – land (w/in the Phils) Int’l. – air & sea (Phils. To Foreign) Purchase of Supplies & Materials, including equipments 2% none 5% 2% 3% none 1% 3% 5%

CREDITABLE NATURE OF INCOME PAYMENT 53 FINAL INCOME % TAX VAT Transport of Passengers: domestic –air, & sea (w/in the Phils) domestic – land (w/in the Phils) Int’l. – air & sea (Phils. To Foreign) Purchase of Supplies & Materials, including equipments 2% none 5% 2% 3% none 1% 3% 5%

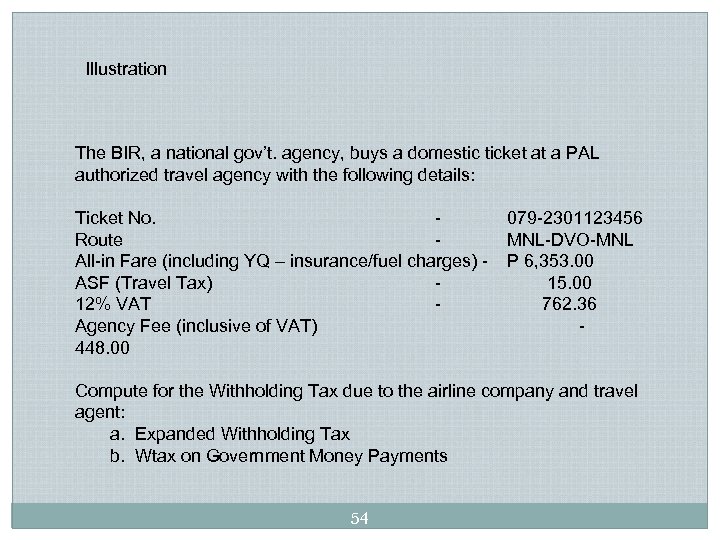

Illustration The BIR, a national gov’t. agency, buys a domestic ticket at a PAL authorized travel agency with the following details: Ticket No. Route All-in Fare (including YQ – insurance/fuel charges) ASF (Travel Tax) 12% VAT Agency Fee (inclusive of VAT) 448. 00 079 -2301123456 MNL-DVO-MNL P 6, 353. 00 15. 00 762. 36 - Compute for the Withholding Tax due to the airline company and travel agent: a. Expanded Withholding Tax b. Wtax on Government Money Payments 54

Illustration The BIR, a national gov’t. agency, buys a domestic ticket at a PAL authorized travel agency with the following details: Ticket No. Route All-in Fare (including YQ – insurance/fuel charges) ASF (Travel Tax) 12% VAT Agency Fee (inclusive of VAT) 448. 00 079 -2301123456 MNL-DVO-MNL P 6, 353. 00 15. 00 762. 36 - Compute for the Withholding Tax due to the airline company and travel agent: a. Expanded Withholding Tax b. Wtax on Government Money Payments 54

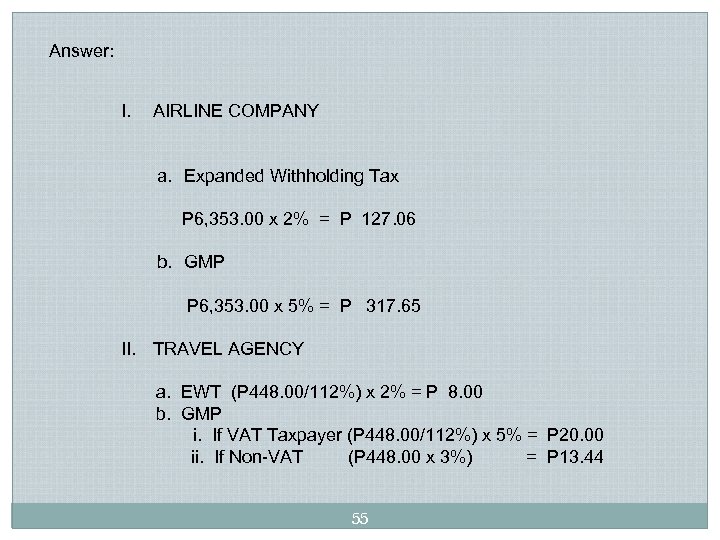

Answer: I. AIRLINE COMPANY a. Expanded Withholding Tax P 6, 353. 00 x 2% = P 127. 06 b. GMP P 6, 353. 00 x 5% = P 317. 65 II. TRAVEL AGENCY a. EWT (P 448. 00/112%) x 2% = P 8. 00 b. GMP i. If VAT Taxpayer (P 448. 00/112%) x 5% = P 20. 00 ii. If Non-VAT (P 448. 00 x 3%) = P 13. 44 55

Answer: I. AIRLINE COMPANY a. Expanded Withholding Tax P 6, 353. 00 x 2% = P 127. 06 b. GMP P 6, 353. 00 x 5% = P 317. 65 II. TRAVEL AGENCY a. EWT (P 448. 00/112%) x 2% = P 8. 00 b. GMP i. If VAT Taxpayer (P 448. 00/112%) x 5% = P 20. 00 ii. If Non-VAT (P 448. 00 x 3%) = P 13. 44 55

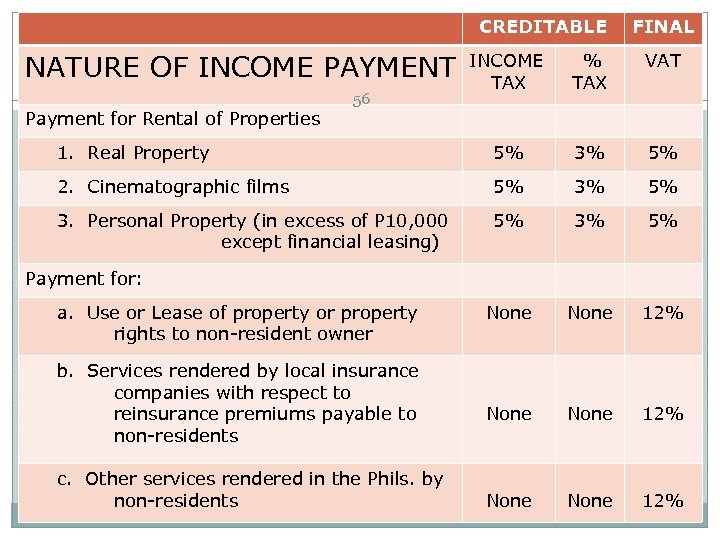

CREDITABLE NATURE OF INCOME PAYMENT FINAL INCOME TAX % TAX VAT 1. Real Property 5% 3% 5% 2. Cinematographic films 5% 3% 5% 3. Personal Property (in excess of P 10, 000 except financial leasing) 5% 3% 5% None 12% None 12% Payment for Rental of Properties 56 Payment for: a. Use or Lease of property or property rights to non-resident owner b. Services rendered by local insurance companies with respect to reinsurance premiums payable to non-residents c. Other services rendered in the Phils. by non-residents

CREDITABLE NATURE OF INCOME PAYMENT FINAL INCOME TAX % TAX VAT 1. Real Property 5% 3% 5% 2. Cinematographic films 5% 3% 5% 3. Personal Property (in excess of P 10, 000 except financial leasing) 5% 3% 5% None 12% None 12% Payment for Rental of Properties 56 Payment for: a. Use or Lease of property or property rights to non-resident owner b. Services rendered by local insurance companies with respect to reinsurance premiums payable to non-residents c. Other services rendered in the Phils. by non-residents

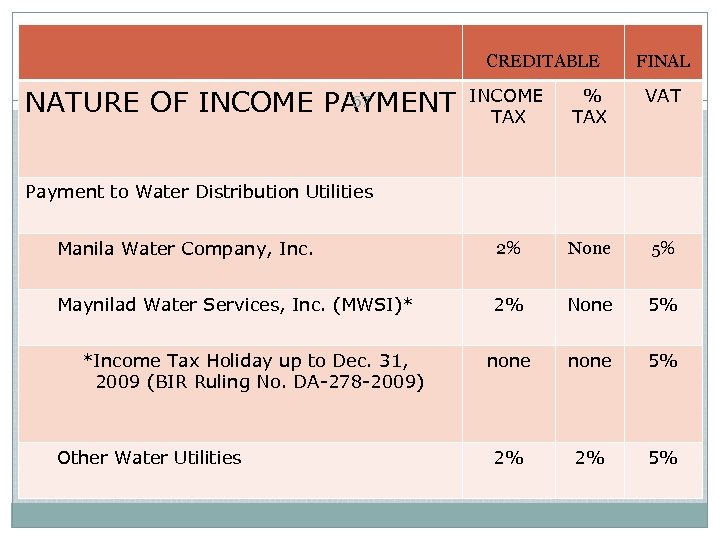

CREDITABLE 57 NATURE OF INCOME PAYMENT FINAL INCOME TAX % TAX VAT Manila Water Company, Inc. 2% None 5% Maynilad Water Services, Inc. (MWSI)* 2% None 5% none 5% 2% 2% 5% Payment to Water Distribution Utilities *Income Tax Holiday up to Dec. 31, 2009 (BIR Ruling No. DA-278 -2009) Other Water Utilities

CREDITABLE 57 NATURE OF INCOME PAYMENT FINAL INCOME TAX % TAX VAT Manila Water Company, Inc. 2% None 5% Maynilad Water Services, Inc. (MWSI)* 2% None 5% none 5% 2% 2% 5% Payment to Water Distribution Utilities *Income Tax Holiday up to Dec. 31, 2009 (BIR Ruling No. DA-278 -2009) Other Water Utilities

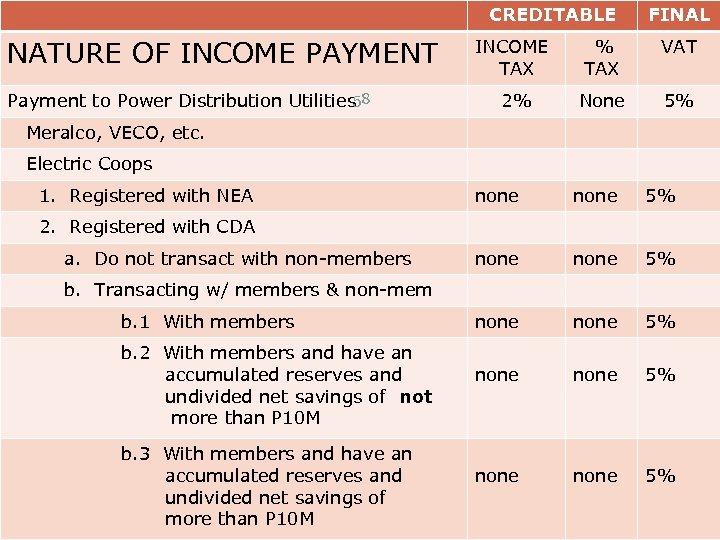

CREDITABLE NATURE OF INCOME PAYMENT 58 Payment to Power Distribution Utilities FINAL INCOME TAX % TAX VAT 2% None 5% Meralco, VECO, etc. Electric Coops 1. Registered with NEA none none 5% none 5% 2. Registered with CDA a. Do not transact with non-members b. Transacting w/ members & non-mem b. 1 With members b. 2 With members and have an accumulated reserves and undivided net savings of not more than P 10 M b. 3 With members and have an accumulated reserves and undivided net savings of more than P 10 M

CREDITABLE NATURE OF INCOME PAYMENT 58 Payment to Power Distribution Utilities FINAL INCOME TAX % TAX VAT 2% None 5% Meralco, VECO, etc. Electric Coops 1. Registered with NEA none none 5% none 5% 2. Registered with CDA a. Do not transact with non-members b. Transacting w/ members & non-mem b. 1 With members b. 2 With members and have an accumulated reserves and undivided net savings of not more than P 10 M b. 3 With members and have an accumulated reserves and undivided net savings of more than P 10 M

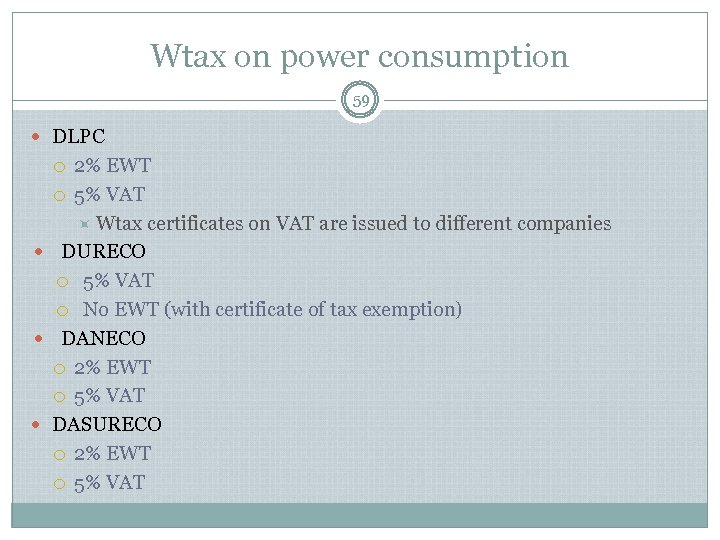

Wtax on power consumption 59 DLPC 2% EWT 5% VAT Wtax certificates on VAT are issued to different companies DURECO 5% VAT No EWT (with certificate of tax exemption) DANECO 2% EWT 5% VAT DASURECO 2% EWT 5% VAT

Wtax on power consumption 59 DLPC 2% EWT 5% VAT Wtax certificates on VAT are issued to different companies DURECO 5% VAT No EWT (with certificate of tax exemption) DANECO 2% EWT 5% VAT DASURECO 2% EWT 5% VAT

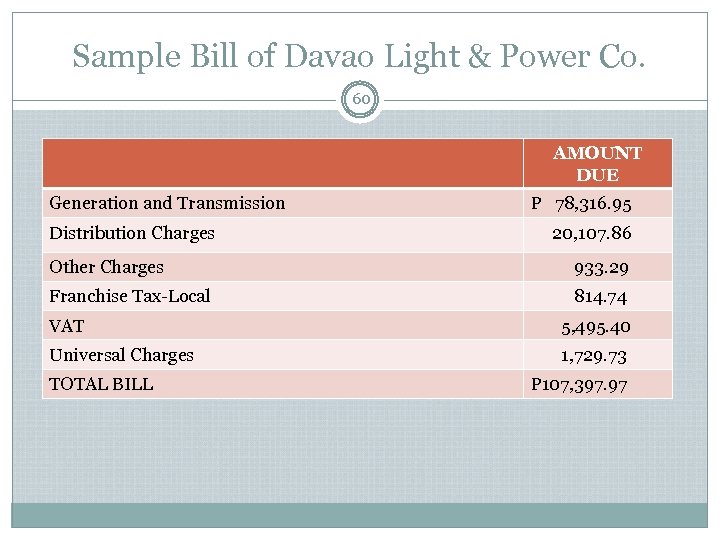

Sample Bill of Davao Light & Power Co. 60 AMOUNT DUE Generation and Transmission Distribution Charges P 78, 316. 95 20, 107. 86 Other Charges 933. 29 Franchise Tax-Local 814. 74 VAT 5, 495. 40 Universal Charges 1, 729. 73 TOTAL BILL P 107, 397. 97

Sample Bill of Davao Light & Power Co. 60 AMOUNT DUE Generation and Transmission Distribution Charges P 78, 316. 95 20, 107. 86 Other Charges 933. 29 Franchise Tax-Local 814. 74 VAT 5, 495. 40 Universal Charges 1, 729. 73 TOTAL BILL P 107, 397. 97

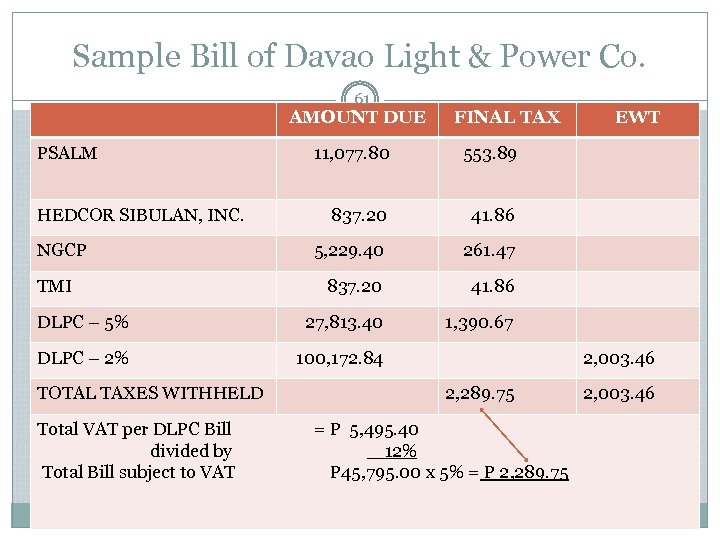

Sample Bill of Davao Light & Power Co. 61 AMOUNT DUE PSALM FINAL TAX 11, 077. 80 553. 89 837. 20 41. 86 5, 229. 40 261. 47 837. 20 41. 86 DLPC – 5% 27, 813. 40 1, 390. 67 DLPC – 2% 100, 172. 84 EWT HEDCOR SIBULAN, INC. NGCP TMI TOTAL TAXES WITHHELD Total VAT per DLPC Bill divided by Total Bill subject to VAT 2, 003. 46 2, 289. 75 = P 5, 495. 40 12% P 45, 795. 00 x 5% = P 2, 289. 75 2, 003. 46

Sample Bill of Davao Light & Power Co. 61 AMOUNT DUE PSALM FINAL TAX 11, 077. 80 553. 89 837. 20 41. 86 5, 229. 40 261. 47 837. 20 41. 86 DLPC – 5% 27, 813. 40 1, 390. 67 DLPC – 2% 100, 172. 84 EWT HEDCOR SIBULAN, INC. NGCP TMI TOTAL TAXES WITHHELD Total VAT per DLPC Bill divided by Total Bill subject to VAT 2, 003. 46 2, 289. 75 = P 5, 495. 40 12% P 45, 795. 00 x 5% = P 2, 289. 75 2, 003. 46

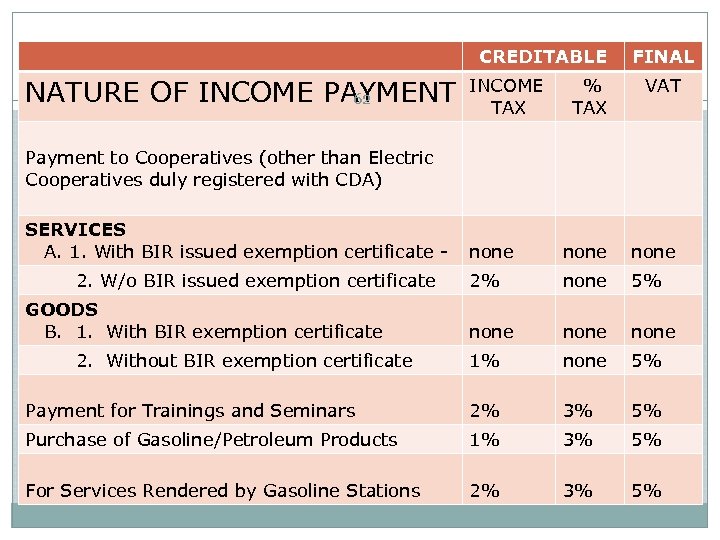

CREDITABLE NATURE OF INCOME PAYMENT 62 INCOME TAX FINAL % TAX VAT none 2% none 5% none 1% none 5% Payment for Trainings and Seminars 2% 3% 5% Purchase of Gasoline/Petroleum Products 1% 3% 5% For Services Rendered by Gasoline Stations 2% 3% 5% Payment to Cooperatives (other than Electric Cooperatives duly registered with CDA) SERVICES A. 1. With BIR issued exemption certificate 2. W/o BIR issued exemption certificate GOODS B. 1. With BIR exemption certificate 2. Without BIR exemption certificate

CREDITABLE NATURE OF INCOME PAYMENT 62 INCOME TAX FINAL % TAX VAT none 2% none 5% none 1% none 5% Payment for Trainings and Seminars 2% 3% 5% Purchase of Gasoline/Petroleum Products 1% 3% 5% For Services Rendered by Gasoline Stations 2% 3% 5% Payment to Cooperatives (other than Electric Cooperatives duly registered with CDA) SERVICES A. 1. With BIR issued exemption certificate 2. W/o BIR issued exemption certificate GOODS B. 1. With BIR exemption certificate 2. Without BIR exemption certificate

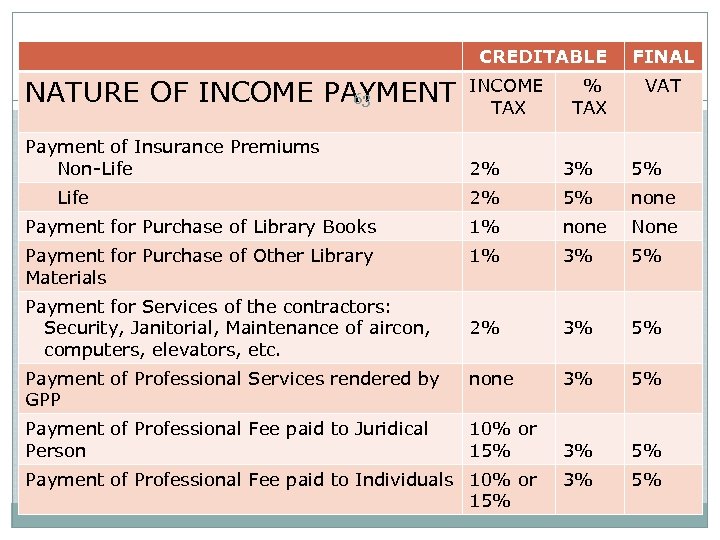

CREDITABLE NATURE OF INCOME PAYMENT 63 Payment of Insurance Premiums Non-Life INCOME TAX % TAX FINAL VAT 2% 3% 5% 2% 5% none Payment for Purchase of Library Books 1% none None Payment for Purchase of Other Library Materials 1% 3% 5% 2% 3% 5% Payment of Professional Services rendered by GPP none 3% 5% Payment of Professional Fee paid to Juridical Person 10% or 15% 3% 5% Life Payment for Services of the contractors: Security, Janitorial, Maintenance of aircon, computers, elevators, etc. Payment of Professional Fee paid to Individuals 10% or 15%

CREDITABLE NATURE OF INCOME PAYMENT 63 Payment of Insurance Premiums Non-Life INCOME TAX % TAX FINAL VAT 2% 3% 5% 2% 5% none Payment for Purchase of Library Books 1% none None Payment for Purchase of Other Library Materials 1% 3% 5% 2% 3% 5% Payment of Professional Services rendered by GPP none 3% 5% Payment of Professional Fee paid to Juridical Person 10% or 15% 3% 5% Life Payment for Services of the contractors: Security, Janitorial, Maintenance of aircon, computers, elevators, etc. Payment of Professional Fee paid to Individuals 10% or 15%

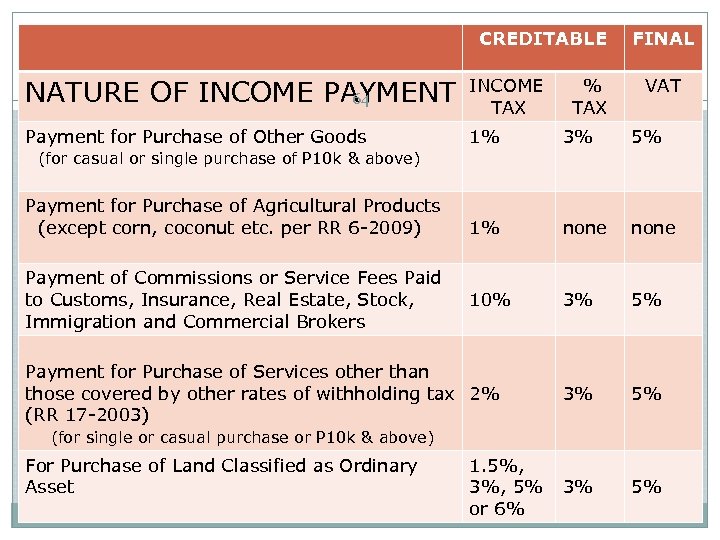

CREDITABLE FINAL NATURE OF INCOME PAYMENT 64 INCOME TAX Payment for Purchase of Other Goods 1% 3% 5% 1% none 10% 3% 5% % TAX VAT (for casual or single purchase of P 10 k & above) Payment for Purchase of Agricultural Products (except corn, coconut etc. per RR 6 -2009) Payment of Commissions or Service Fees Paid to Customs, Insurance, Real Estate, Stock, Immigration and Commercial Brokers Payment for Purchase of Services other than those covered by other rates of withholding tax 2% (RR 17 -2003) (for single or casual purchase or P 10 k & above) For Purchase of Land Classified as Ordinary Asset 1. 5%, 3%, 5% or 6%

CREDITABLE FINAL NATURE OF INCOME PAYMENT 64 INCOME TAX Payment for Purchase of Other Goods 1% 3% 5% 1% none 10% 3% 5% % TAX VAT (for casual or single purchase of P 10 k & above) Payment for Purchase of Agricultural Products (except corn, coconut etc. per RR 6 -2009) Payment of Commissions or Service Fees Paid to Customs, Insurance, Real Estate, Stock, Immigration and Commercial Brokers Payment for Purchase of Services other than those covered by other rates of withholding tax 2% (RR 17 -2003) (for single or casual purchase or P 10 k & above) For Purchase of Land Classified as Ordinary Asset 1. 5%, 3%, 5% or 6%

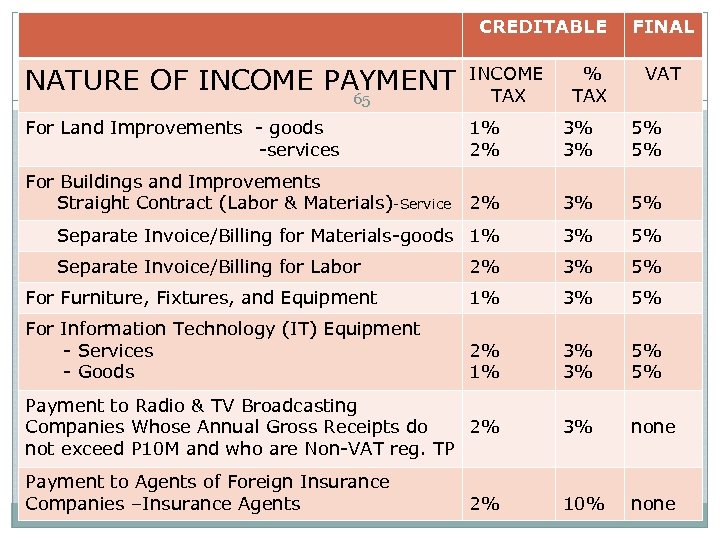

CREDITABLE FINAL NATURE OF INCOME PAYMENT 65 INCOME TAX For Land Improvements - goods -services 1% 2% 3% 3% 5% 5% For Buildings and Improvements Straight Contract (Labor & Materials)-Service 2% 3% 5% Separate Invoice/Billing for Materials-goods 1% 3% 5% Separate Invoice/Billing for Labor 2% 3% 5% For Furniture, Fixtures, and Equipment 1% 3% 5% For Information Technology (IT) Equipment - Services - Goods 2% 1% 3% 3% 5% 5% Payment to Radio & TV Broadcasting Companies Whose Annual Gross Receipts do 2% not exceed P 10 M and who are Non-VAT reg. TP 3% none 10% none Payment to Agents of Foreign Insurance Companies –Insurance Agents 2% % TAX VAT

CREDITABLE FINAL NATURE OF INCOME PAYMENT 65 INCOME TAX For Land Improvements - goods -services 1% 2% 3% 3% 5% 5% For Buildings and Improvements Straight Contract (Labor & Materials)-Service 2% 3% 5% Separate Invoice/Billing for Materials-goods 1% 3% 5% Separate Invoice/Billing for Labor 2% 3% 5% For Furniture, Fixtures, and Equipment 1% 3% 5% For Information Technology (IT) Equipment - Services - Goods 2% 1% 3% 3% 5% 5% Payment to Radio & TV Broadcasting Companies Whose Annual Gross Receipts do 2% not exceed P 10 M and who are Non-VAT reg. TP 3% none 10% none Payment to Agents of Foreign Insurance Companies –Insurance Agents 2% % TAX VAT

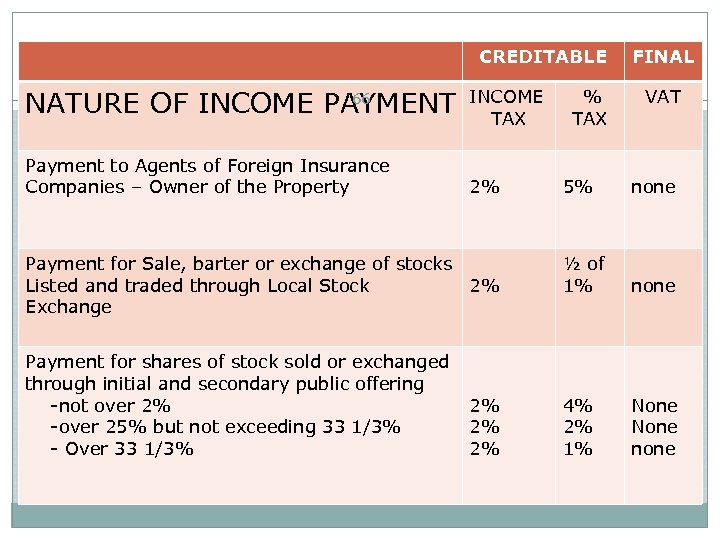

CREDITABLE 66 NATURE OF INCOME PAYMENT Payment to Agents of Foreign Insurance Companies – Owner of the Property INCOME TAX 2% Payment for Sale, barter or exchange of stocks Listed and traded through Local Stock 2% Exchange Payment for shares of stock sold or exchanged through initial and secondary public offering -not over 2% -over 25% but not exceeding 33 1/3% - Over 33 1/3% 2% 2% 2% % TAX FINAL VAT 5% none ½ of 1% none 4% 2% 1% None none

CREDITABLE 66 NATURE OF INCOME PAYMENT Payment to Agents of Foreign Insurance Companies – Owner of the Property INCOME TAX 2% Payment for Sale, barter or exchange of stocks Listed and traded through Local Stock 2% Exchange Payment for shares of stock sold or exchanged through initial and secondary public offering -not over 2% -over 25% but not exceeding 33 1/3% - Over 33 1/3% 2% 2% 2% % TAX FINAL VAT 5% none ½ of 1% none 4% 2% 1% None none

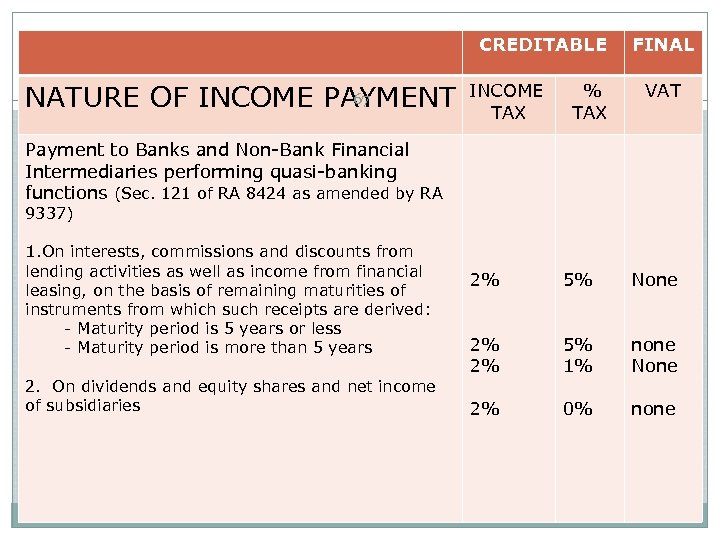

CREDITABLE 67 NATURE OF INCOME PAYMENT INCOME TAX % TAX FINAL VAT Payment to Banks and Non-Bank Financial Intermediaries performing quasi-banking functions (Sec. 121 of RA 8424 as amended by RA 9337) 1. On interests, commissions and discounts from lending activities as well as income from financial leasing, on the basis of remaining maturities of instruments from which such receipts are derived: - Maturity period is 5 years or less - Maturity period is more than 5 years 2. On dividends and equity shares and net income of subsidiaries 2% 5% None 2% 2% 5% 1% none None 2% 0% none

CREDITABLE 67 NATURE OF INCOME PAYMENT INCOME TAX % TAX FINAL VAT Payment to Banks and Non-Bank Financial Intermediaries performing quasi-banking functions (Sec. 121 of RA 8424 as amended by RA 9337) 1. On interests, commissions and discounts from lending activities as well as income from financial leasing, on the basis of remaining maturities of instruments from which such receipts are derived: - Maturity period is 5 years or less - Maturity period is more than 5 years 2. On dividends and equity shares and net income of subsidiaries 2% 5% None 2% 2% 5% 1% none None 2% 0% none

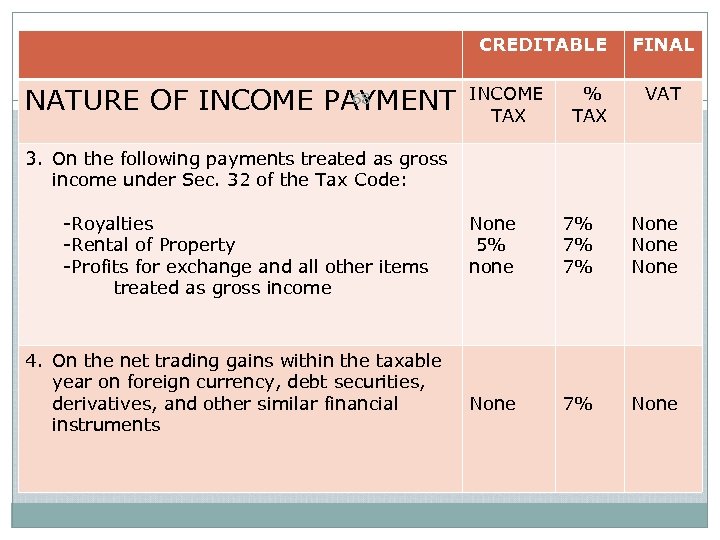

CREDITABLE 68 NATURE OF INCOME PAYMENT INCOME TAX % TAX FINAL VAT 3. On the following payments treated as gross income under Sec. 32 of the Tax Code: -Royalties -Rental of Property -Profits for exchange and all other items treated as gross income 4. On the net trading gains within the taxable year on foreign currency, debt securities, derivatives, and other similar financial instruments None 5% none 7% 7% 7% None 7% None

CREDITABLE 68 NATURE OF INCOME PAYMENT INCOME TAX % TAX FINAL VAT 3. On the following payments treated as gross income under Sec. 32 of the Tax Code: -Royalties -Rental of Property -Profits for exchange and all other items treated as gross income 4. On the net trading gains within the taxable year on foreign currency, debt securities, derivatives, and other similar financial instruments None 5% none 7% 7% 7% None 7% None

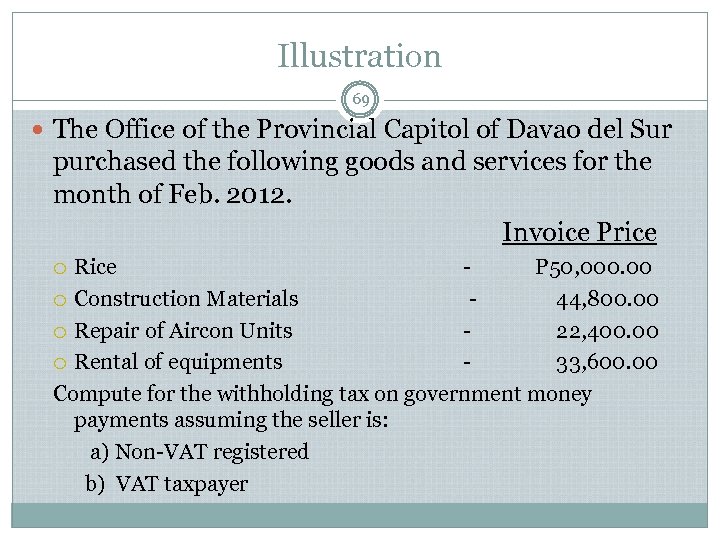

Illustration 69 The Office of the Provincial Capitol of Davao del Sur purchased the following goods and services for the month of Feb. 2012. Invoice Price Rice P 50, 000. 00 Construction Materials 44, 800. 00 Repair of Aircon Units 22, 400. 00 Rental of equipments 33, 600. 00 Compute for the withholding tax on government money payments assuming the seller is: a) Non-VAT registered b) VAT taxpayer

Illustration 69 The Office of the Provincial Capitol of Davao del Sur purchased the following goods and services for the month of Feb. 2012. Invoice Price Rice P 50, 000. 00 Construction Materials 44, 800. 00 Repair of Aircon Units 22, 400. 00 Rental of equipments 33, 600. 00 Compute for the withholding tax on government money payments assuming the seller is: a) Non-VAT registered b) VAT taxpayer

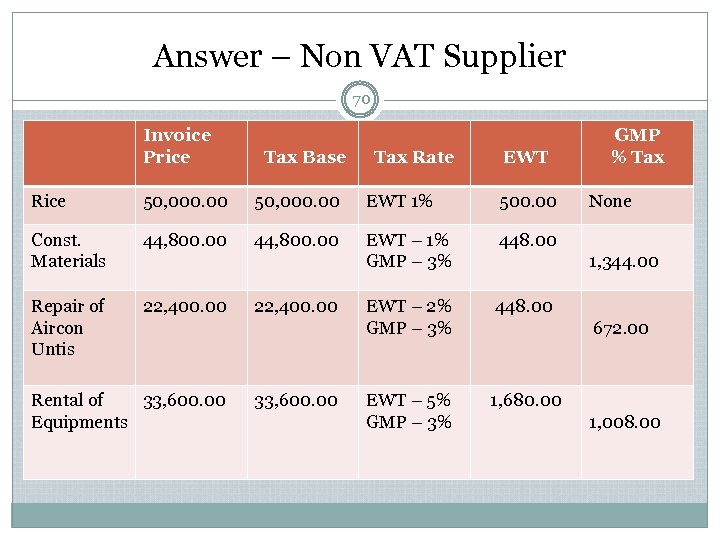

Answer – Non VAT Supplier 70 Invoice Price Tax Base Tax Rate EWT Rice 50, 000. 00 EWT 1% 500. 00 Const. Materials 44, 800. 00 EWT – 1% GMP – 3% 448. 00 Repair of Aircon Untis 22, 400. 00 EWT – 2% GMP – 3% 448. 00 EWT – 5% GMP – 3% GMP % Tax 1, 680. 00 Rental of 33, 600. 00 Equipments 22, 400. 00 33, 600. 00 None 1, 344. 00 672. 00 1, 008. 00

Answer – Non VAT Supplier 70 Invoice Price Tax Base Tax Rate EWT Rice 50, 000. 00 EWT 1% 500. 00 Const. Materials 44, 800. 00 EWT – 1% GMP – 3% 448. 00 Repair of Aircon Untis 22, 400. 00 EWT – 2% GMP – 3% 448. 00 EWT – 5% GMP – 3% GMP % Tax 1, 680. 00 Rental of 33, 600. 00 Equipments 22, 400. 00 33, 600. 00 None 1, 344. 00 672. 00 1, 008. 00

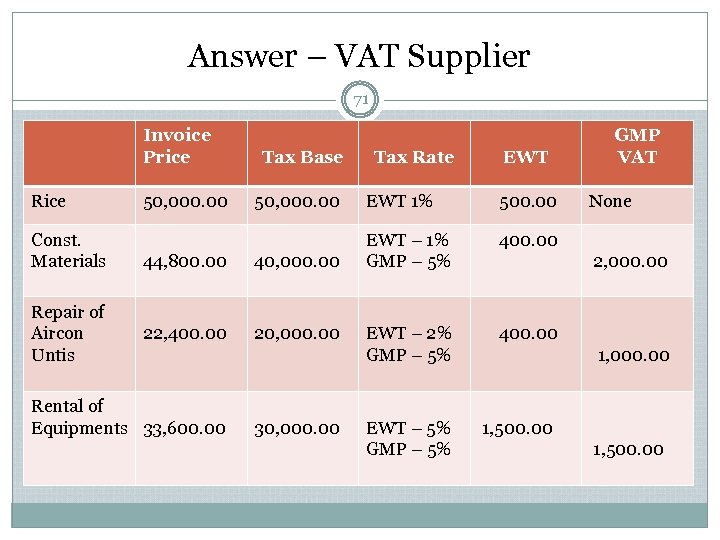

Answer – VAT Supplier 71 Invoice Price Rice Const. Materials Repair of Aircon Untis 50, 000. 00 Tax Base Tax Rate EWT 50, 000. 00 EWT 1% 500. 00 44, 800. 00 40, 000. 00 EWT – 1% GMP – 5% 22, 400. 00 20, 000. 00 EWT – 2% GMP – 5% GMP VAT 400. 00 Rental of Equipments 33, 600. 00 30, 000. 00 EWT – 5% GMP – 5% None 2, 000. 00 1, 500. 00

Answer – VAT Supplier 71 Invoice Price Rice Const. Materials Repair of Aircon Untis 50, 000. 00 Tax Base Tax Rate EWT 50, 000. 00 EWT 1% 500. 00 44, 800. 00 40, 000. 00 EWT – 1% GMP – 5% 22, 400. 00 20, 000. 00 EWT – 2% GMP – 5% GMP VAT 400. 00 Rental of Equipments 33, 600. 00 30, 000. 00 EWT – 5% GMP – 5% None 2, 000. 00 1, 500. 00

ON MANDATORY ATTACHMENTS RR No. 2 -2006 72

ON MANDATORY ATTACHMENTS RR No. 2 -2006 72

REVENUE REGULATIONS NO. 2 -2006 MANDATORY ATTACHMENTS : 1. M O N T H L Y A L P H A L I S T 73 O F P A Y E E S ( M A P ) WHOSE INCOME RECEIVED HAVE BEEN SUBJECTED TO WITHHOLDING TAX IN THE WITHHOLDING TAX REMITTANCE RETURN FILED BY THE WITHHOLDING AGENT/PAYOR OF INCOME PAYMENTS

REVENUE REGULATIONS NO. 2 -2006 MANDATORY ATTACHMENTS : 1. M O N T H L Y A L P H A L I S T 73 O F P A Y E E S ( M A P ) WHOSE INCOME RECEIVED HAVE BEEN SUBJECTED TO WITHHOLDING TAX IN THE WITHHOLDING TAX REMITTANCE RETURN FILED BY THE WITHHOLDING AGENT/PAYOR OF INCOME PAYMENTS

Monthly Alphalist of Payees(MAP) 74 is a consolidated alphalist of income earners from whom taxes have been withheld by the payor of income for a given return period and in whose behalf, the taxes were remitted. It contains a summary of information on taxes withheld and remitted through the monthly remittance returns (BIR Form Nos. 1601 E, 1601 -F, 1600) showing , among others, total amounts of income/gross sales/gross receipts and taxes withheld and remitted.

Monthly Alphalist of Payees(MAP) 74 is a consolidated alphalist of income earners from whom taxes have been withheld by the payor of income for a given return period and in whose behalf, the taxes were remitted. It contains a summary of information on taxes withheld and remitted through the monthly remittance returns (BIR Form Nos. 1601 E, 1601 -F, 1600) showing , among others, total amounts of income/gross sales/gross receipts and taxes withheld and remitted.

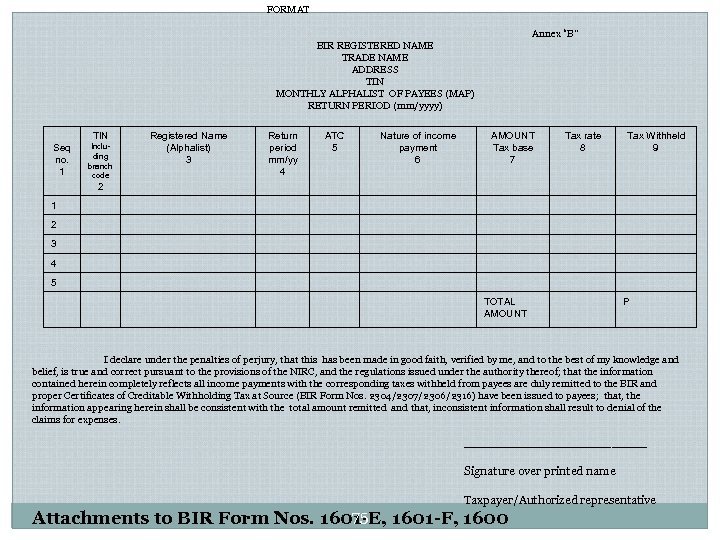

FORMAT Annex “B” BIR REGISTERED NAME TRADE NAME ADDRESS TIN MONTHLY ALPHALIST OF PAYEES (MAP) RETURN PERIOD (mm/yyyy) TIN Seq no. 1 Including branch code Registered Name (Alphalist) 3 Return period mm/yy 4 ATC 5 Nature of income payment 6 AMOUNT Tax base 7 Tax rate 8 Tax Withheld 9 2 1 2 3 4 5 TOTAL AMOUNT P I declare under the penalties of perjury, that this has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct pursuant to the provisions of the NIRC, and the regulations issued under the authority thereof; that the information contained herein completely reflects all income payments with the corresponding taxes withheld from payees are duly remitted to the BIR and proper Certificates of Creditable Withholding Tax at Source (BIR Form Nos. 2304/2307/2306/2316) have been issued to payees; that, the information appearing herein shall be consistent with the total amount remitted and that, inconsistent information shall result to denial of the claims for expenses. _____________ Signature over printed name Taxpayer/Authorized representative 75 Attachments to BIR Form Nos. 1601 -E, 1601 -F, 1600

FORMAT Annex “B” BIR REGISTERED NAME TRADE NAME ADDRESS TIN MONTHLY ALPHALIST OF PAYEES (MAP) RETURN PERIOD (mm/yyyy) TIN Seq no. 1 Including branch code Registered Name (Alphalist) 3 Return period mm/yy 4 ATC 5 Nature of income payment 6 AMOUNT Tax base 7 Tax rate 8 Tax Withheld 9 2 1 2 3 4 5 TOTAL AMOUNT P I declare under the penalties of perjury, that this has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct pursuant to the provisions of the NIRC, and the regulations issued under the authority thereof; that the information contained herein completely reflects all income payments with the corresponding taxes withheld from payees are duly remitted to the BIR and proper Certificates of Creditable Withholding Tax at Source (BIR Form Nos. 2304/2307/2306/2316) have been issued to payees; that, the information appearing herein shall be consistent with the total amount remitted and that, inconsistent information shall result to denial of the claims for expenses. _____________ Signature over printed name Taxpayer/Authorized representative 75 Attachments to BIR Form Nos. 1601 -E, 1601 -F, 1600

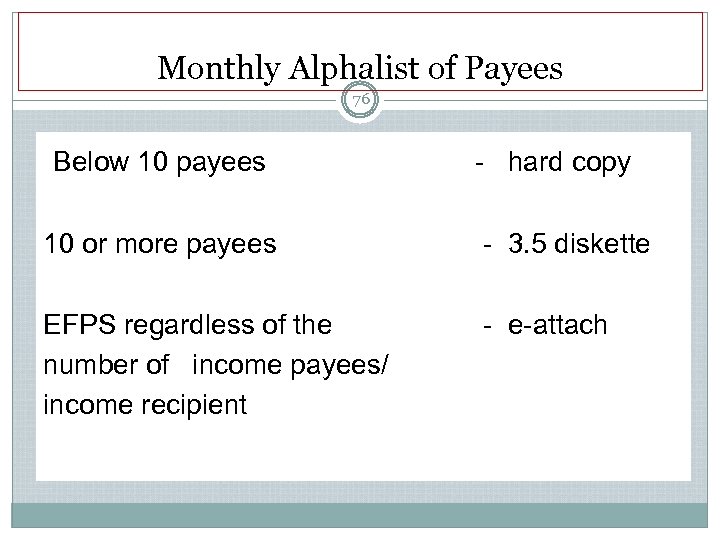

Monthly Alphalist of Payees 76 Below 10 payees - hard copy 10 or more payees - 3. 5 diskette EFPS regardless of the number of income payees/ income recipient - e-attach

Monthly Alphalist of Payees 76 Below 10 payees - hard copy 10 or more payees - 3. 5 diskette EFPS regardless of the number of income payees/ income recipient - e-attach

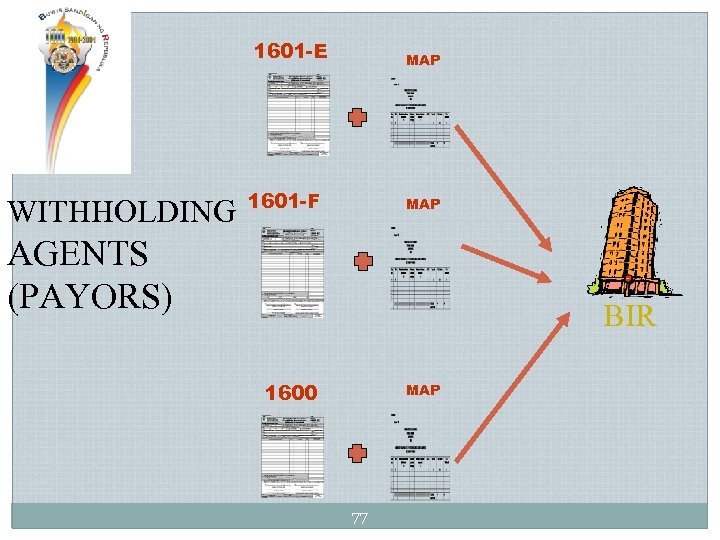

1601 -E WITHHOLDING MAP 1601 -F MAP AGENTS (PAYORS) BIR 1600 MAP 77

1601 -E WITHHOLDING MAP 1601 -F MAP AGENTS (PAYORS) BIR 1600 MAP 77

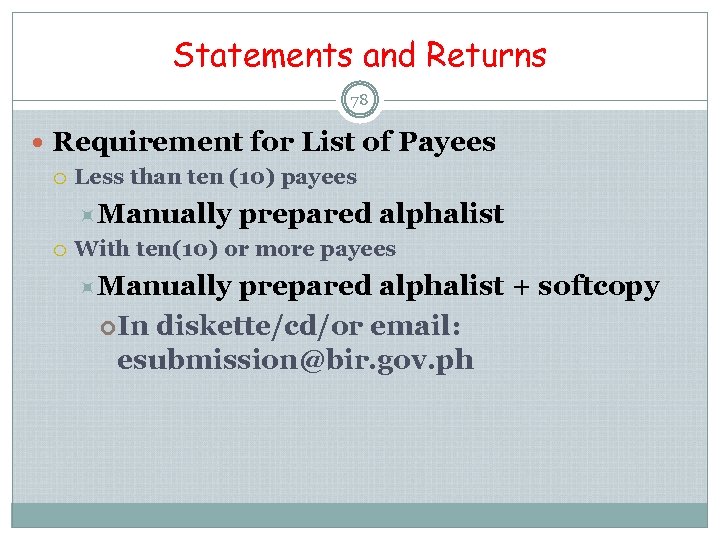

Statements and Returns 78 Requirement for List of Payees Less than ten (10) payees Manually prepared alphalist With ten(10) or more payees Manually prepared alphalist + softcopy In diskette/cd/or email: esubmission@bir. gov. ph

Statements and Returns 78 Requirement for List of Payees Less than ten (10) payees Manually prepared alphalist With ten(10) or more payees Manually prepared alphalist + softcopy In diskette/cd/or email: esubmission@bir. gov. ph

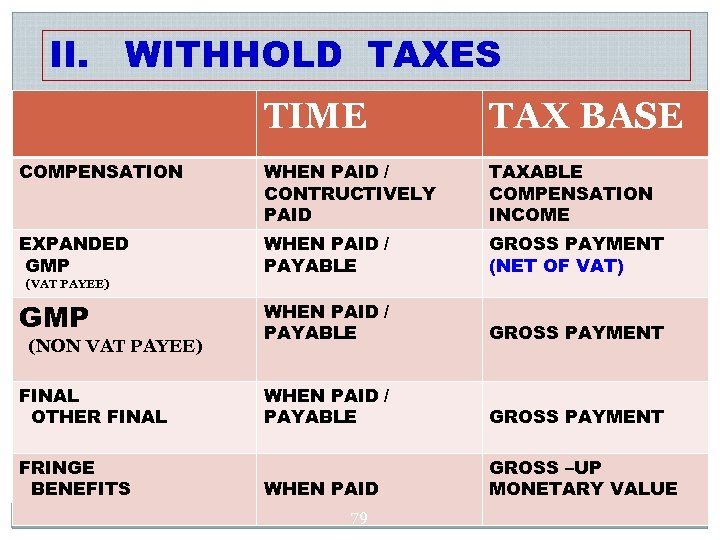

II. WITHHOLD TAXES TIME TAX BASE COMPENSATION WHEN PAID / CONTRUCTIVELY PAID TAXABLE COMPENSATION INCOME EXPANDED GMP WHEN PAID / PAYABLE GROSS PAYMENT (NET OF VAT) GMP WHEN PAID / PAYABLE GROSS PAYMENT FINAL OTHER FINAL WHEN PAID / PAYABLE GROSS PAYMENT WHEN PAID GROSS –UP MONETARY VALUE (VAT PAYEE) (NON VAT PAYEE) FRINGE BENEFITS 79

II. WITHHOLD TAXES TIME TAX BASE COMPENSATION WHEN PAID / CONTRUCTIVELY PAID TAXABLE COMPENSATION INCOME EXPANDED GMP WHEN PAID / PAYABLE GROSS PAYMENT (NET OF VAT) GMP WHEN PAID / PAYABLE GROSS PAYMENT FINAL OTHER FINAL WHEN PAID / PAYABLE GROSS PAYMENT WHEN PAID GROSS –UP MONETARY VALUE (VAT PAYEE) (NON VAT PAYEE) FRINGE BENEFITS 79

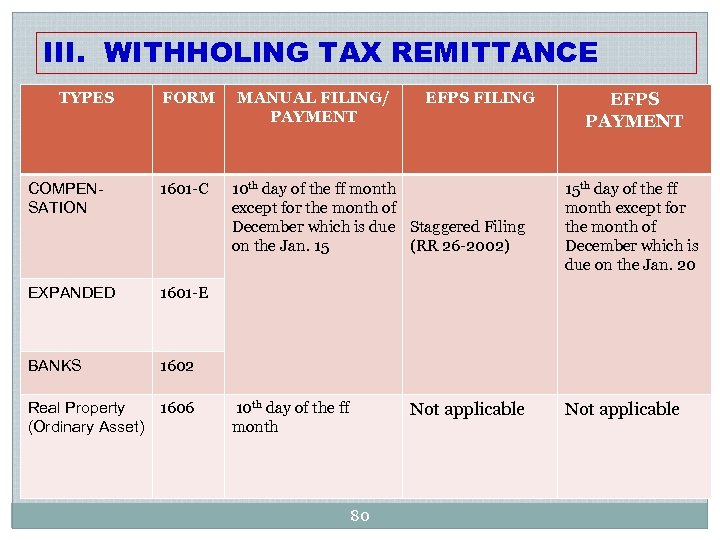

III. WITHHOLING TAX REMITTANCE TYPES FORM COMPENSATION 1601 -C EXPANDED EFPS FILING EFPS PAYMENT 1601 -E BANKS MANUAL FILING/ PAYMENT 1602 1606 Real Property (Ordinary Asset) 10 th day of the ff month except for the month of December which is due Staggered Filing on the Jan. 15 (RR 26 -2002) 15 th day of the ff month except for the month of December which is due on the Jan. 20 10 th day of the ff month Not applicable 80

III. WITHHOLING TAX REMITTANCE TYPES FORM COMPENSATION 1601 -C EXPANDED EFPS FILING EFPS PAYMENT 1601 -E BANKS MANUAL FILING/ PAYMENT 1602 1606 Real Property (Ordinary Asset) 10 th day of the ff month except for the month of December which is due Staggered Filing on the Jan. 15 (RR 26 -2002) 15 th day of the ff month except for the month of December which is due on the Jan. 20 10 th day of the ff month Not applicable 80

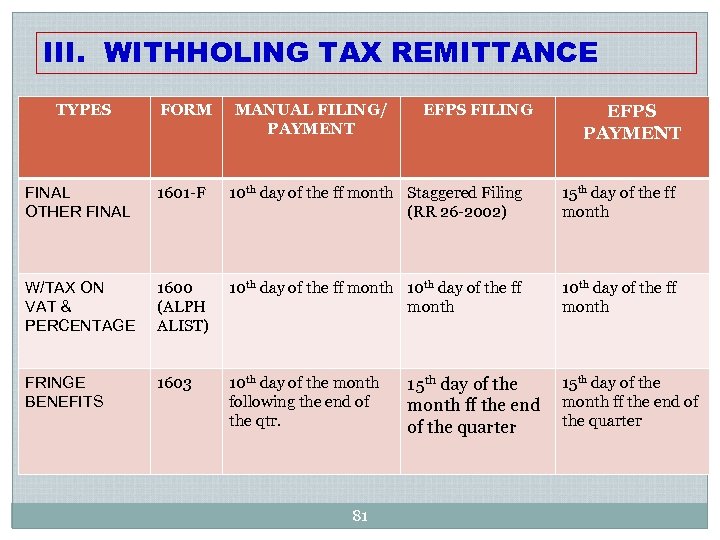

III. WITHHOLING TAX REMITTANCE TYPES FORM MANUAL FILING/ PAYMENT EFPS FILING EFPS PAYMENT FINAL OTHER FINAL 1601 -F 10 th day of the ff month Staggered Filing (RR 26 -2002) 15 th day of the ff month W/TAX ON VAT & PERCENTAGE 1600 (ALPH ALIST) 10 th day of the ff month FRINGE BENEFITS 1603 10 th day of the month following the end of the qtr. 15 th day of the month ff the end of the quarter 81 15 th day of the month ff the end of the quarter

III. WITHHOLING TAX REMITTANCE TYPES FORM MANUAL FILING/ PAYMENT EFPS FILING EFPS PAYMENT FINAL OTHER FINAL 1601 -F 10 th day of the ff month Staggered Filing (RR 26 -2002) 15 th day of the ff month W/TAX ON VAT & PERCENTAGE 1600 (ALPH ALIST) 10 th day of the ff month FRINGE BENEFITS 1603 10 th day of the month following the end of the qtr. 15 th day of the month ff the end of the quarter 81 15 th day of the month ff the end of the quarter

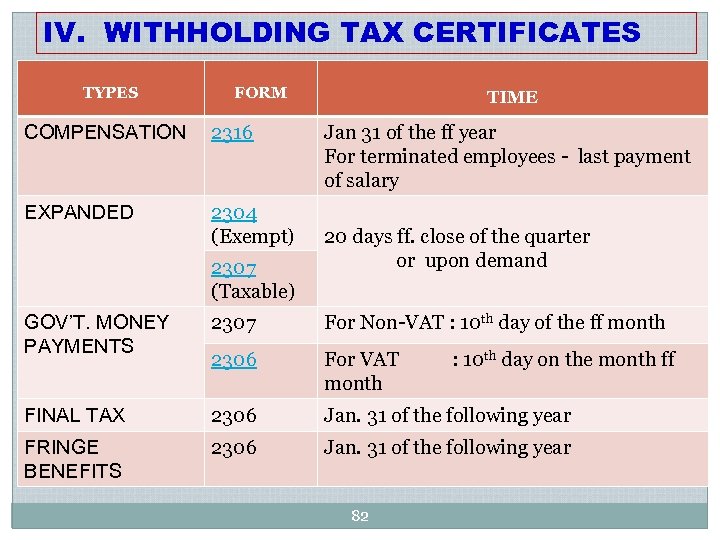

IV. WITHHOLDING TAX CERTIFICATES TYPES FORM COMPENSATION 2316 EXPANDED 2304 (Exempt) 2307 (Taxable) TIME Jan 31 of the ff year For terminated employees - last payment of salary 20 days ff. close of the quarter or upon demand GOV’T. MONEY PAYMENTS 2307 For Non-VAT : 10 th day of the ff month 2306 For VAT month FINAL TAX 2306 Jan. 31 of the following year FRINGE BENEFITS 2306 Jan. 31 of the following year 82 : 10 th day on the month ff

IV. WITHHOLDING TAX CERTIFICATES TYPES FORM COMPENSATION 2316 EXPANDED 2304 (Exempt) 2307 (Taxable) TIME Jan 31 of the ff year For terminated employees - last payment of salary 20 days ff. close of the quarter or upon demand GOV’T. MONEY PAYMENTS 2307 For Non-VAT : 10 th day of the ff month 2306 For VAT month FINAL TAX 2306 Jan. 31 of the following year FRINGE BENEFITS 2306 Jan. 31 of the following year 82 : 10 th day on the month ff

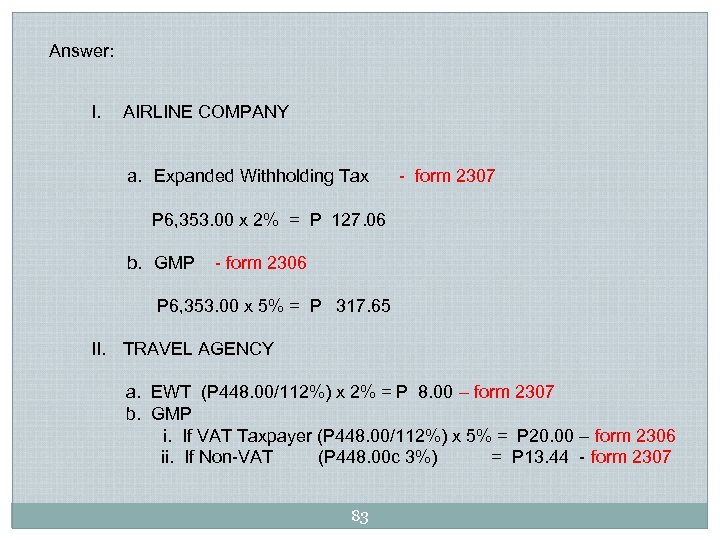

Answer: I. AIRLINE COMPANY a. Expanded Withholding Tax - form 2307 P 6, 353. 00 x 2% = P 127. 06 b. GMP - form 2306 P 6, 353. 00 x 5% = P 317. 65 II. TRAVEL AGENCY a. EWT (P 448. 00/112%) x 2% = P 8. 00 – form 2307 b. GMP i. If VAT Taxpayer (P 448. 00/112%) x 5% = P 20. 00 – form 2306 ii. If Non-VAT (P 448. 00 c 3%) = P 13. 44 - form 2307 83

Answer: I. AIRLINE COMPANY a. Expanded Withholding Tax - form 2307 P 6, 353. 00 x 2% = P 127. 06 b. GMP - form 2306 P 6, 353. 00 x 5% = P 317. 65 II. TRAVEL AGENCY a. EWT (P 448. 00/112%) x 2% = P 8. 00 – form 2307 b. GMP i. If VAT Taxpayer (P 448. 00/112%) x 5% = P 20. 00 – form 2306 ii. If Non-VAT (P 448. 00 c 3%) = P 13. 44 - form 2307 83

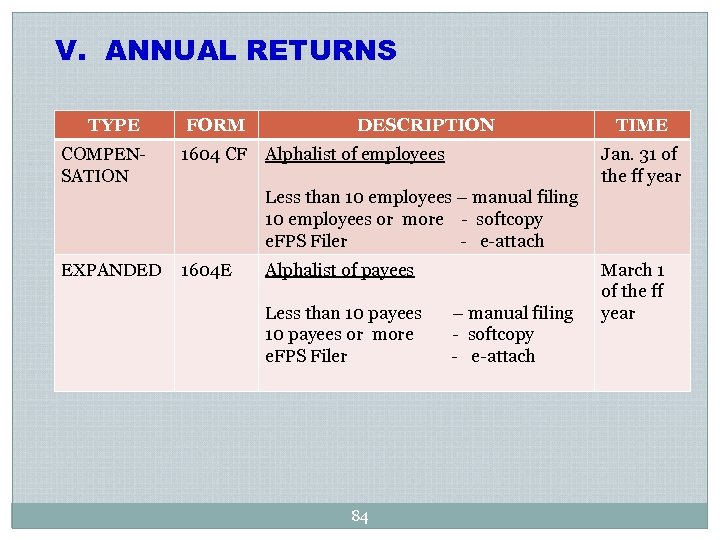

V. ANNUAL RETURNS TYPE COMPENSATION FORM 1604 CF DESCRIPTION Alphalist of employees TIME Jan. 31 of the ff year Less than 10 employees – manual filing 10 employees or more - softcopy e. FPS Filer - e-attach EXPANDED 1604 E Alphalist of payees Less than 10 payees or more e. FPS Filer 84 – manual filing - softcopy - e-attach March 1 of the ff year

V. ANNUAL RETURNS TYPE COMPENSATION FORM 1604 CF DESCRIPTION Alphalist of employees TIME Jan. 31 of the ff year Less than 10 employees – manual filing 10 employees or more - softcopy e. FPS Filer - e-attach EXPANDED 1604 E Alphalist of payees Less than 10 payees or more e. FPS Filer 84 – manual filing - softcopy - e-attach March 1 of the ff year

The End 85

The End 85