d40fdf073c2ca510b593eda0a067992e.ppt

- Количество слайдов: 41

1 The Investor Workshop • Introduction • Purpose of The Investor Workshop • Promoting The Investor Workshop • Preparing for delivering The Investor Workshop • Presenting The Investor Workshop

1 The Investor Workshop • Introduction • Purpose of The Investor Workshop • Promoting The Investor Workshop • Preparing for delivering The Investor Workshop • Presenting The Investor Workshop

2 Introduction of The Investor Workshop • This presentation is designed for entry-level investors from curious to qualified. ▫ Invite your Sphere of Influence, market to your farm, or market to the general public. • The workshop is taken from the Millionaire Real Estate Investor book by Gary Keller, with Dave Jenks and Jay Papasan. ▫ You should be fully aware of your market, the numbers regarding pricing trends, rental rates, flipping opportunities, and relevant investor strategies particular to your local market

2 Introduction of The Investor Workshop • This presentation is designed for entry-level investors from curious to qualified. ▫ Invite your Sphere of Influence, market to your farm, or market to the general public. • The workshop is taken from the Millionaire Real Estate Investor book by Gary Keller, with Dave Jenks and Jay Papasan. ▫ You should be fully aware of your market, the numbers regarding pricing trends, rental rates, flipping opportunities, and relevant investor strategies particular to your local market

3 Purpose of The Investor Workshop • This workshop is a presentation for associates to use to educate clients and partners regarding real estate investing, for lead generation and additional sales ▫ Leverage the MREI, FLIP, and other KW resources • Delivering the workshop is a lead generation tool ▫ Collect information from those who attend and, upon receiving comprehensive contact data, offer them an MREI book, and leverage for more conversations • Present workshop 11 times each year ▫ Direct attendees to read the entire book and to begin a journal to identify and track projects specific to their needs • FOLLOW UP POST-WORKSHOP AND GET THE APPOINTMENT

3 Purpose of The Investor Workshop • This workshop is a presentation for associates to use to educate clients and partners regarding real estate investing, for lead generation and additional sales ▫ Leverage the MREI, FLIP, and other KW resources • Delivering the workshop is a lead generation tool ▫ Collect information from those who attend and, upon receiving comprehensive contact data, offer them an MREI book, and leverage for more conversations • Present workshop 11 times each year ▫ Direct attendees to read the entire book and to begin a journal to identify and track projects specific to their needs • FOLLOW UP POST-WORKSHOP AND GET THE APPOINTMENT

4 Promoting The Investor Workshop • Attract attendees ▫ Partner with mortgage, insurance, title, home warranty, inspectors … look for like-mindedness, aligned partners ▫ Market to your past buyers, SOI, farm, Facebook, Twitter ▫ Use a free MREI book as a preregister draw (partners can pay for the book, or split the cost). Only those who preregister are guaranteed a book (be sure to have a walk-in policy) • Logistics ▫ Start at least three weeks in advance ▫ Reserve your presentation room in advance ▫ Be sure to have enough chairs, pens, and presentation packets ▫ Have water available - no snacks - that’s just a distraction • Confirm attendees one day prior to your workshop

4 Promoting The Investor Workshop • Attract attendees ▫ Partner with mortgage, insurance, title, home warranty, inspectors … look for like-mindedness, aligned partners ▫ Market to your past buyers, SOI, farm, Facebook, Twitter ▫ Use a free MREI book as a preregister draw (partners can pay for the book, or split the cost). Only those who preregister are guaranteed a book (be sure to have a walk-in policy) • Logistics ▫ Start at least three weeks in advance ▫ Reserve your presentation room in advance ▫ Be sure to have enough chairs, pens, and presentation packets ▫ Have water available - no snacks - that’s just a distraction • Confirm attendees one day prior to your workshop

5 Preparing The Investor Workshop • Read The Millionaire Real Estate Agent several times – present as an expert • Use the Workshop as a template ▫ ▫ ▫ Insert your professional info where indicated Change or add your graphics where you prefer Feel free to add or take away slides to personalize Add specific local and state resources as indicated Print, then delete slides 1 -4 and save the template as “My GYH Workshop. ” • Review new file to be sure it is perfect

5 Preparing The Investor Workshop • Read The Millionaire Real Estate Agent several times – present as an expert • Use the Workshop as a template ▫ ▫ ▫ Insert your professional info where indicated Change or add your graphics where you prefer Feel free to add or take away slides to personalize Add specific local and state resources as indicated Print, then delete slides 1 -4 and save the template as “My GYH Workshop. ” • Review new file to be sure it is perfect

6 Presenting The Investor Workshop • Before ▫ Practice the presentation for others (assistant, peers) ▫ Be early - start on time, end on time (one hour max) ▫ Dress professionally, and your partners as well • During ▫ Have workbooks and pens for each attendee (custom if you can, with your contact info … or partner’s) ▫ Ask often, “Any questions? ” Check for understanding, “Does this make sense? ” ▫ Make a list of local “Best Buy” properties available to those who have signed a Buyer Rep Agreement with you • After ▫ End on time and stay late to answer any questions ▫ Expect success: schedule appointments and sign contracts!

6 Presenting The Investor Workshop • Before ▫ Practice the presentation for others (assistant, peers) ▫ Be early - start on time, end on time (one hour max) ▫ Dress professionally, and your partners as well • During ▫ Have workbooks and pens for each attendee (custom if you can, with your contact info … or partner’s) ▫ Ask often, “Any questions? ” Check for understanding, “Does this make sense? ” ▫ Make a list of local “Best Buy” properties available to those who have signed a Buyer Rep Agreement with you • After ▫ End on time and stay late to answer any questions ▫ Expect success: schedule appointments and sign contracts!

Real Estate Investor Workshop © 2011 Keller Williams Realty, Inc

Real Estate Investor Workshop © 2011 Keller Williams Realty, Inc

8 Notices While Keller Williams Realty, Inc. (KWRI) has taken due care in the preparation of all course materials, we do not guarantee its accuracy now or in the future. KWRI makes no warranties either expressed or implied with regard to the information and programs presented in the presentation or associated workbook, and reserves the right to make changes from time to time. This presentation and workbook may contain hypothetical exercises that are designed to characterize typical investor strategies and return on investment, but in no way guarantees specific results or return on investment. Material excerpted from The Millionaire Real Estate Investor appears courtesy of The Mc. Graw-Hill Companies. The Millionaire Real Estate Investor is copyright © 2005 Rellek Publishing Partners LTD. All rights reserved. Copyright Notice All other materials are copyright © 2011 Keller Williams Realty, Inc. All rights reserved. No part of this publication and its associated materials may be reproduced or transmitted in any form or by any means without the prior permission of Keller Williams Realty, Inc. Any modification to this material is at the sole discretion of the presenter, and as such KWRI is held harmless for any acts or resulting acts from such alterations or modifications. All Keller Williams Realty agents are encouraged to personalize this material, and to clearly indicate the sources of any additional materials, including any necessary copyright notices.

8 Notices While Keller Williams Realty, Inc. (KWRI) has taken due care in the preparation of all course materials, we do not guarantee its accuracy now or in the future. KWRI makes no warranties either expressed or implied with regard to the information and programs presented in the presentation or associated workbook, and reserves the right to make changes from time to time. This presentation and workbook may contain hypothetical exercises that are designed to characterize typical investor strategies and return on investment, but in no way guarantees specific results or return on investment. Material excerpted from The Millionaire Real Estate Investor appears courtesy of The Mc. Graw-Hill Companies. The Millionaire Real Estate Investor is copyright © 2005 Rellek Publishing Partners LTD. All rights reserved. Copyright Notice All other materials are copyright © 2011 Keller Williams Realty, Inc. All rights reserved. No part of this publication and its associated materials may be reproduced or transmitted in any form or by any means without the prior permission of Keller Williams Realty, Inc. Any modification to this material is at the sole discretion of the presenter, and as such KWRI is held harmless for any acts or resulting acts from such alterations or modifications. All Keller Williams Realty agents are encouraged to personalize this material, and to clearly indicate the sources of any additional materials, including any necessary copyright notices.

9 Presented by: Your Name Here v Your Brand Name Mortgage Presenter’s Name (if presenting) v Company Name Property Management Presenter’s Name (if presenting) v Company Name

9 Presented by: Your Name Here v Your Brand Name Mortgage Presenter’s Name (if presenting) v Company Name Property Management Presenter’s Name (if presenting) v Company Name

10 Real Estate Investor Workshop • Why are you here today? • What has caused you to start thinking about investing in real estate? • Why am I here? … to share some of my thoughts on money, life, and investing in real estate Our presentation is drawn largely from The Millionaire Real Estate Investor by Gary Keller

10 Real Estate Investor Workshop • Why are you here today? • What has caused you to start thinking about investing in real estate? • Why am I here? … to share some of my thoughts on money, life, and investing in real estate Our presentation is drawn largely from The Millionaire Real Estate Investor by Gary Keller

11 What We Cover in the Investor Workshop • The Possibilities ▫ Myth. Understandings ▫ Real Estate Investing Current Statistics ▫ Your Big Why • The Power of Leverage ▫ Why Real Estate? ▫ Growing Your Net Worth • The Proven Systems ▫ What to Buy ▫ How to Buy

11 What We Cover in the Investor Workshop • The Possibilities ▫ Myth. Understandings ▫ Real Estate Investing Current Statistics ▫ Your Big Why • The Power of Leverage ▫ Why Real Estate? ▫ Growing Your Net Worth • The Proven Systems ▫ What to Buy ▫ How to Buy

12 About Me Your Name • Licensed REALTOR® • Your credentials (ABR, CRS, etc. ) • Other credentials • I am awesome!

12 About Me Your Name • Licensed REALTOR® • Your credentials (ABR, CRS, etc. ) • Other credentials • I am awesome!

13 The Possibilities (fĭ-năn sh. Эl, wĕlth) n. The unearned income to finance your life mission without having to work.

13 The Possibilities (fĭ-năn sh. Эl, wĕlth) n. The unearned income to finance your life mission without having to work.

14 The Possibilities There are eight Myth. Understandings between you and financial wealth. Myth. Understandings

14 The Possibilities There are eight Myth. Understandings between you and financial wealth. Myth. Understandings

15 The Possibilities Three Personal Myths 1 Myth: I Don’t Need to Be an Investor—My Job Will Take Care of My Financial Wealth Truth: Yes, You Do Need to Be an Investor—Your Job is Not Your Financial Wealth 2 Myth: I Don’t Need or Want to Be Financially Wealthy—I’m Happy with What I Have Truth: You Need to Open Your Eyes—You Do Need and Want to Be Financially Wealthy 3 Myth: It Doesn’t Matter If I Want or Need It - I Just Can’t Do It Truth: You Can’t Predict What You Can or Can’t Do Until You Try Myth. Understandings

15 The Possibilities Three Personal Myths 1 Myth: I Don’t Need to Be an Investor—My Job Will Take Care of My Financial Wealth Truth: Yes, You Do Need to Be an Investor—Your Job is Not Your Financial Wealth 2 Myth: I Don’t Need or Want to Be Financially Wealthy—I’m Happy with What I Have Truth: You Need to Open Your Eyes—You Do Need and Want to Be Financially Wealthy 3 Myth: It Doesn’t Matter If I Want or Need It - I Just Can’t Do It Truth: You Can’t Predict What You Can or Can’t Do Until You Try Myth. Understandings

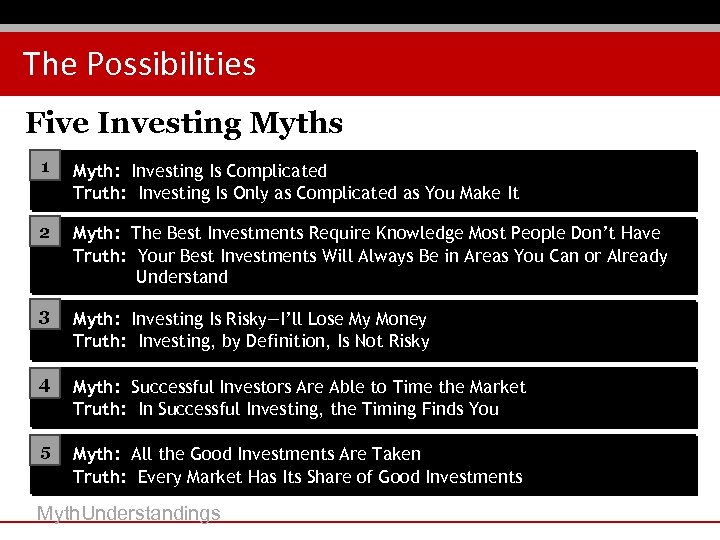

16 The Possibilities Five Investing Myths 1 Myth: Investing Is Complicated Truth: Investing Is Only as Complicated as You Make It 2 Myth: The Best Investments Require Knowledge Most People Don’t Have Truth: Your Best Investments Will Always Be in Areas You Can or Already Understand 3 Myth: Investing Is Risky—I’ll Lose My Money Truth: Investing, by Definition, Is Not Risky 4 Myth: Successful Investors Are Able to Time the Market Truth: In Successful Investing, the Timing Finds You 5 Myth: All the Good Investments Are Taken Truth: Every Market Has Its Share of Good Investments Myth. Understandings

16 The Possibilities Five Investing Myths 1 Myth: Investing Is Complicated Truth: Investing Is Only as Complicated as You Make It 2 Myth: The Best Investments Require Knowledge Most People Don’t Have Truth: Your Best Investments Will Always Be in Areas You Can or Already Understand 3 Myth: Investing Is Risky—I’ll Lose My Money Truth: Investing, by Definition, Is Not Risky 4 Myth: Successful Investors Are Able to Time the Market Truth: In Successful Investing, the Timing Finds You 5 Myth: All the Good Investments Are Taken Truth: Every Market Has Its Share of Good Investments Myth. Understandings

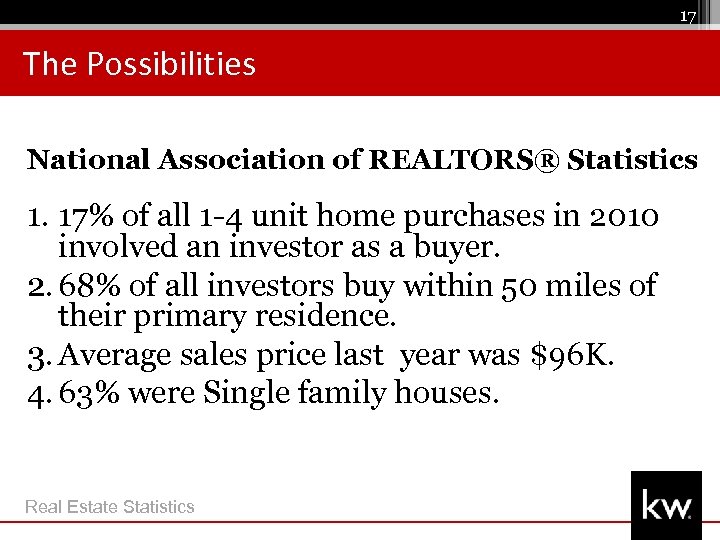

17 The Possibilities National Association of REALTORS® Statistics 1. 17% of all 1 -4 unit home purchases in 2010 involved an investor as a buyer. 2. 68% of all investors buy within 50 miles of their primary residence. 3. Average sales price last year was $96 K. 4. 63% were Single family houses. Real Estate Statistics

17 The Possibilities National Association of REALTORS® Statistics 1. 17% of all 1 -4 unit home purchases in 2010 involved an investor as a buyer. 2. 68% of all investors buy within 50 miles of their primary residence. 3. Average sales price last year was $96 K. 4. 63% were Single family houses. Real Estate Statistics

![18 The Possibilities [Your Local] Statistics 1. Statistic 1 2. Statistic 2 3. Statistic 18 The Possibilities [Your Local] Statistics 1. Statistic 1 2. Statistic 2 3. Statistic](https://present5.com/presentation/d40fdf073c2ca510b593eda0a067992e/image-18.jpg) 18 The Possibilities [Your Local] Statistics 1. Statistic 1 2. Statistic 2 3. Statistic 3 Real Estate Statistics

18 The Possibilities [Your Local] Statistics 1. Statistic 1 2. Statistic 2 3. Statistic 3 Real Estate Statistics

The Possibilities Discover Your Big Why! Your Big Why 19 Appears on Page 81

The Possibilities Discover Your Big Why! Your Big Why 19 Appears on Page 81

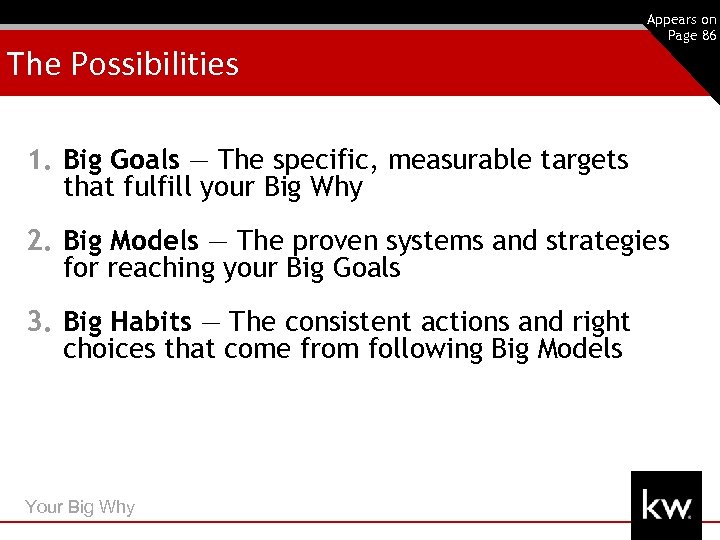

The Possibilities 20 Appears on Page 86 1. Big Goals — The specific, measurable targets that fulfill your Big Why 2. Big Models — The proven systems and strategies for reaching your Big Goals 3. Big Habits — The consistent actions and right choices that come from following Big Models Your Big Why

The Possibilities 20 Appears on Page 86 1. Big Goals — The specific, measurable targets that fulfill your Big Why 2. Big Models — The proven systems and strategies for reaching your Big Goals 3. Big Habits — The consistent actions and right choices that come from following Big Models Your Big Why

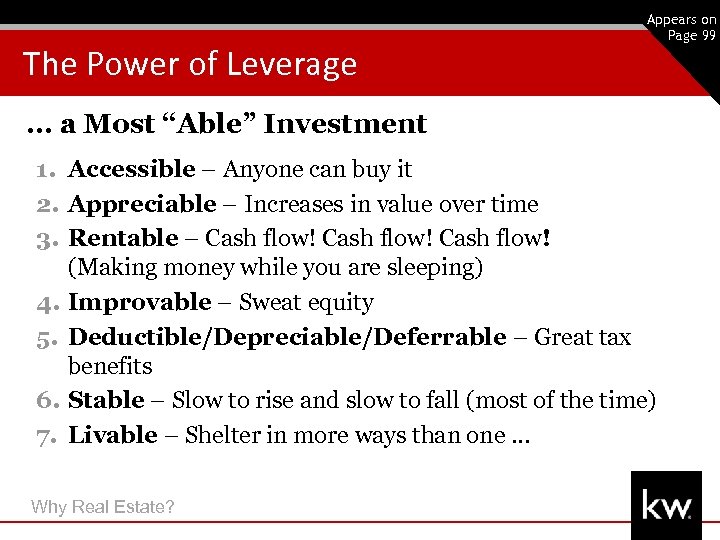

The Power of Leverage 21 Appears on Page 99 There are unique propositions of investing in real estate in contrast to stocks, mutual funds, and money markets: 1. Real property is an ABLE investment; its value never goes to “zero. ” 2. Purchasing real property can be leveraged. Why Real Estate?

The Power of Leverage 21 Appears on Page 99 There are unique propositions of investing in real estate in contrast to stocks, mutual funds, and money markets: 1. Real property is an ABLE investment; its value never goes to “zero. ” 2. Purchasing real property can be leveraged. Why Real Estate?

The Power of Leverage 22 Appears on Page 99 … a Most “Able” Investment 1. Accessible – Anyone can buy it 2. Appreciable – Increases in value over time 3. Rentable – Cash flow! (Making money while you are sleeping) 4. Improvable – Sweat equity 5. Deductible/Depreciable/Deferrable – Great tax benefits 6. Stable – Slow to rise and slow to fall (most of the time) 7. Livable – Shelter in more ways than one. . . Why Real Estate?

The Power of Leverage 22 Appears on Page 99 … a Most “Able” Investment 1. Accessible – Anyone can buy it 2. Appreciable – Increases in value over time 3. Rentable – Cash flow! (Making money while you are sleeping) 4. Improvable – Sweat equity 5. Deductible/Depreciable/Deferrable – Great tax benefits 6. Stable – Slow to rise and slow to fall (most of the time) 7. Livable – Shelter in more ways than one. . . Why Real Estate?

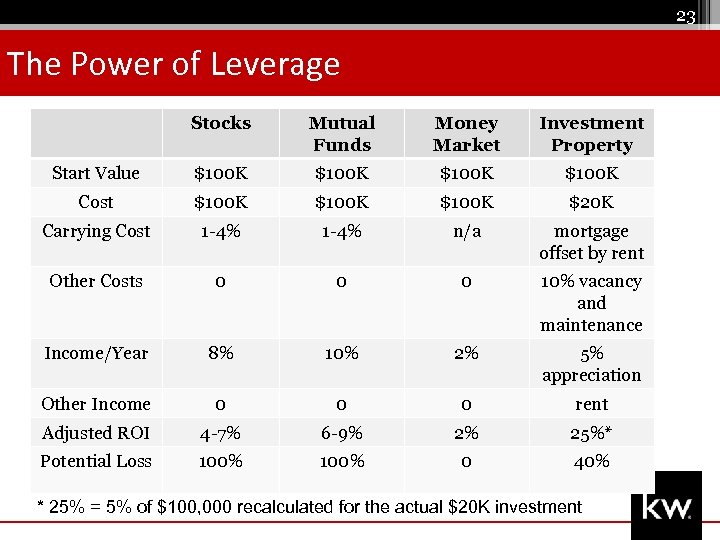

23 The Power of Leverage Stocks Mutual Funds Money Market Investment Property Start Value $100 K Cost $100 K $20 K Carrying Cost 1 -4% n/a mortgage offset by rent Other Costs 0 0 0 10% vacancy and maintenance Income/Year 8% 10% 2% 5% appreciation Other Income 0 0 0 rent Adjusted ROI 4 -7% 6 -9% 2% 25%* Potential Loss 100% 0 40% * 25% = 5% of $100, 000 recalculated for the actual $20 K investment

23 The Power of Leverage Stocks Mutual Funds Money Market Investment Property Start Value $100 K Cost $100 K $20 K Carrying Cost 1 -4% n/a mortgage offset by rent Other Costs 0 0 0 10% vacancy and maintenance Income/Year 8% 10% 2% 5% appreciation Other Income 0 0 0 rent Adjusted ROI 4 -7% 6 -9% 2% 25%* Potential Loss 100% 0 40% * 25% = 5% of $100, 000 recalculated for the actual $20 K investment

24 The Power of Leverage: Using other people’s money (banks, mortgage companies, and owner financiers) to make money. Leverage multiplies your profit. Appreciation and rent are based on total value of property. Return on Investment is calculated by money invested (20% or $20, 000) Here is the calculation, not taking rent into consideration - assuming property went up 5% (if you stick to your model when buying, this is conservative. ) 5% of $100, 000 = $5, 000 is x% of $20, 000 = 25% To make the same money in a mutual fund yielding 10% with no costs, you would need to have $250, 000 cash - I don’t have that, but I do have $20, 000! Why Real Estate?

24 The Power of Leverage: Using other people’s money (banks, mortgage companies, and owner financiers) to make money. Leverage multiplies your profit. Appreciation and rent are based on total value of property. Return on Investment is calculated by money invested (20% or $20, 000) Here is the calculation, not taking rent into consideration - assuming property went up 5% (if you stick to your model when buying, this is conservative. ) 5% of $100, 000 = $5, 000 is x% of $20, 000 = 25% To make the same money in a mutual fund yielding 10% with no costs, you would need to have $250, 000 cash - I don’t have that, but I do have $20, 000! Why Real Estate?

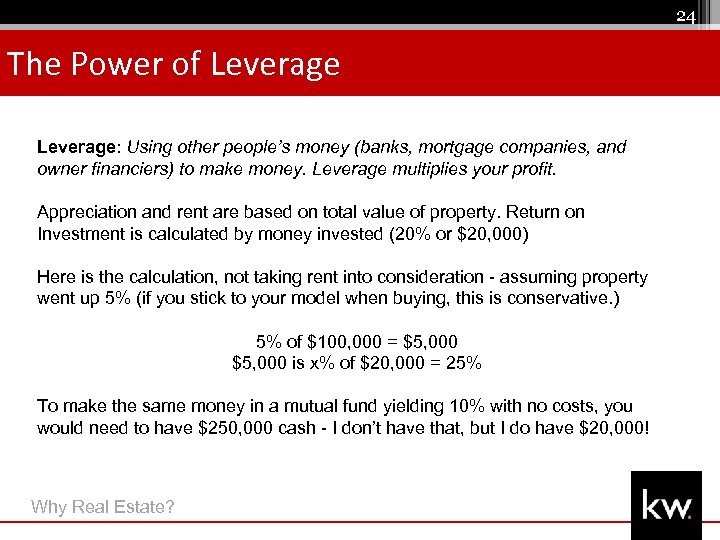

The Power of Leverage - The Money Matrix MONEY WORKS for you! Appears on Page 89 Financial wealth is built on CAPITAL and CASH FLOW Consumption Cash Flow Capital Consumption Shadow wealth is built on CONSUMPTION and CASH Cash Big Hat, No Cattle Growing Your Net Worth Cash Flow YOU WORK for money! Capital 25

The Power of Leverage - The Money Matrix MONEY WORKS for you! Appears on Page 89 Financial wealth is built on CAPITAL and CASH FLOW Consumption Cash Flow Capital Consumption Shadow wealth is built on CONSUMPTION and CASH Cash Big Hat, No Cattle Growing Your Net Worth Cash Flow YOU WORK for money! Capital 25

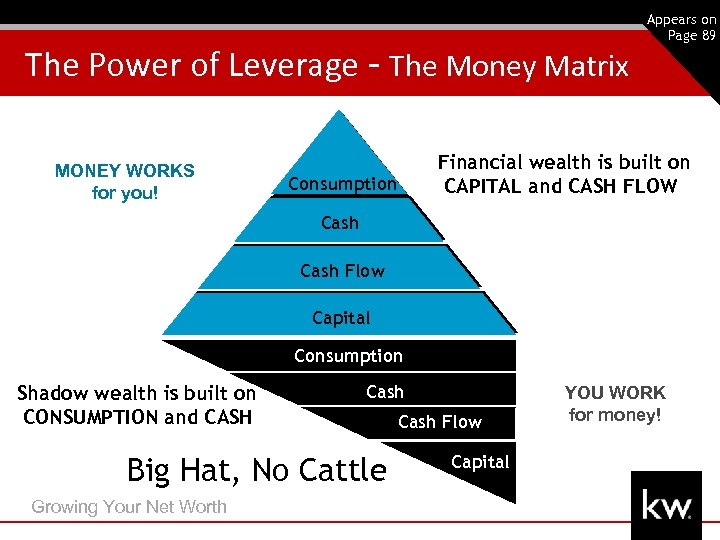

26 Appears on Page 146 The Power of Leverage Financial Model Part 1 - Equity Buildup Price Appreciation + Debt Paydown = Equity Buildup MARKET VALUE Equity MARKET VALUE Equity Investment Debt Investment Equity Investment Debt Buy It Right Growing Your Net Worth Investment Debt Pay It Down Pay It Off

26 Appears on Page 146 The Power of Leverage Financial Model Part 1 - Equity Buildup Price Appreciation + Debt Paydown = Equity Buildup MARKET VALUE Equity MARKET VALUE Equity Investment Debt Investment Equity Investment Debt Buy It Right Growing Your Net Worth Investment Debt Pay It Down Pay It Off

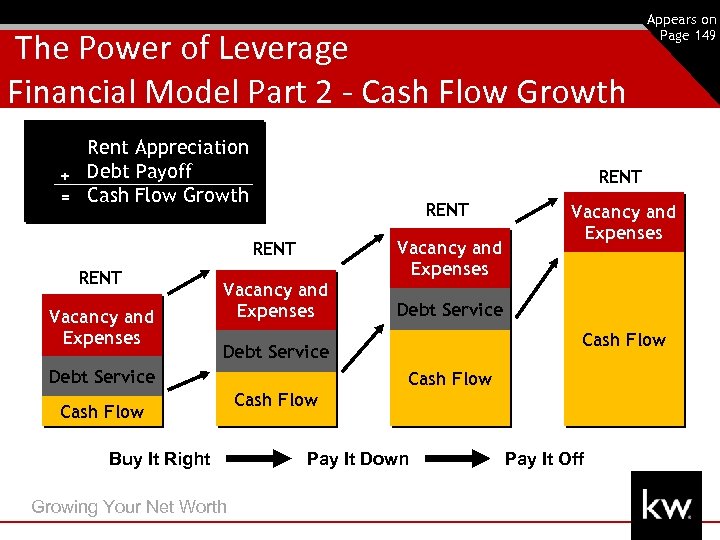

The Power of Leverage Financial Model Part 2 - Cash Flow Growth Rent Appreciation + Debt Payoff = Cash Flow Growth RENT Vacancy and Expenses Debt Service Buy It Right Growing Your Net Worth Vacancy and Expenses Debt Service Cash Flow 27 Appears on Page 149 Cash Flow Pay It Down Pay It Off

The Power of Leverage Financial Model Part 2 - Cash Flow Growth Rent Appreciation + Debt Payoff = Cash Flow Growth RENT Vacancy and Expenses Debt Service Buy It Right Growing Your Net Worth Vacancy and Expenses Debt Service Cash Flow 27 Appears on Page 149 Cash Flow Pay It Down Pay It Off

28 The Power of Leverage Why do people invest in real estate? 1. Return on Investment – Less “out of pocket” for more “into pocket!” 2. Tax write-offs 3. Grow net worth through equity 4. College education savings and many more reasons. . . There is no better method of investing your money! Growing Your Net Worth

28 The Power of Leverage Why do people invest in real estate? 1. Return on Investment – Less “out of pocket” for more “into pocket!” 2. Tax write-offs 3. Grow net worth through equity 4. College education savings and many more reasons. . . There is no better method of investing your money! Growing Your Net Worth

29 The Power of Leverage Tax Write-Offs* 1. 2. 3. 4. 5. 6. 7. 8. Operating Expenses - Management, leasing, etc. Mortgage Interest Financing Costs - Points paid on the loan Misc. Closing Costs - Fees connected with obtaining the loan Depreciation - Structural value of property Capital Improvements - New roof, siding, etc. Personal Property - Furniture, lawn mower, etc. Maintenance Expenses - toilets, paint, yard care *Consult with a CPA, or tax specialist prior to investing. Growing Your Net Worth

29 The Power of Leverage Tax Write-Offs* 1. 2. 3. 4. 5. 6. 7. 8. Operating Expenses - Management, leasing, etc. Mortgage Interest Financing Costs - Points paid on the loan Misc. Closing Costs - Fees connected with obtaining the loan Depreciation - Structural value of property Capital Improvements - New roof, siding, etc. Personal Property - Furniture, lawn mower, etc. Maintenance Expenses - toilets, paint, yard care *Consult with a CPA, or tax specialist prior to investing. Growing Your Net Worth

30 A Real Estate Investment Success Story • Your Story Here

30 A Real Estate Investment Success Story • Your Story Here

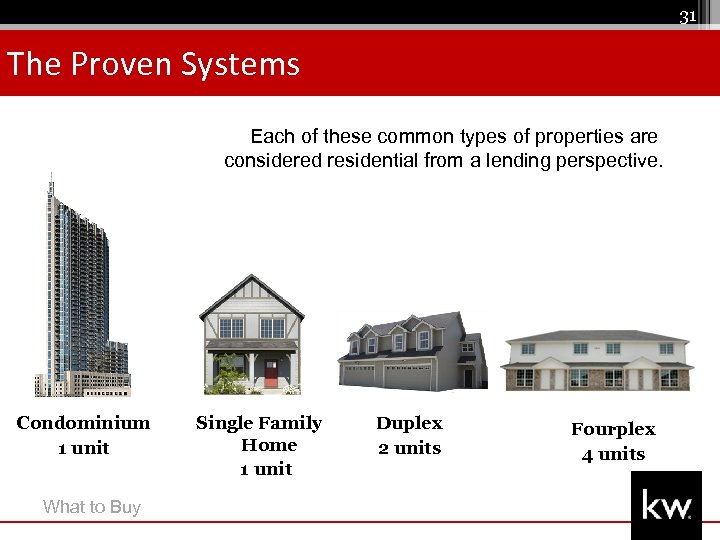

31 The Proven Systems Each of these common types of properties are considered residential from a lending perspective. Condominium 1 unit What to Buy Single Family Home 1 unit Duplex 2 units Fourplex 4 units

31 The Proven Systems Each of these common types of properties are considered residential from a lending perspective. Condominium 1 unit What to Buy Single Family Home 1 unit Duplex 2 units Fourplex 4 units

32 The Proven Systems Condominium – 1 Unit PROS • Lower purchase price than a home in area • Maintenance included • More amenities CONS • High HOA fees, less cash flow • Only own a percentage of the land. (Shared liabilities. ) • Less appreciation (typically) What to Buy

32 The Proven Systems Condominium – 1 Unit PROS • Lower purchase price than a home in area • Maintenance included • More amenities CONS • High HOA fees, less cash flow • Only own a percentage of the land. (Shared liabilities. ) • Less appreciation (typically) What to Buy

33 The Proven Systems Single Family Home – 1 Unit PROS • Easiest to resell • Typically surrounded by owner occupants • More appreciation CONS • Only 1 unit to generate income • 100% loss when vacant

33 The Proven Systems Single Family Home – 1 Unit PROS • Easiest to resell • Typically surrounded by owner occupants • More appreciation CONS • Only 1 unit to generate income • 100% loss when vacant

34 The Proven Systems Duplex – 2 Units PROS • Typically close to, or in, singlefamily home neighborhoods • Less risk than fourplex • More cash flow than singlefamily homes CONS • Lower appreciation • Usually surrounded by many other rental units What to Buy

34 The Proven Systems Duplex – 2 Units PROS • Typically close to, or in, singlefamily home neighborhoods • Less risk than fourplex • More cash flow than singlefamily homes CONS • Lower appreciation • Usually surrounded by many other rental units What to Buy

35 The Proven Systems Fourplex – 4 Units PROS • Generates high cash flow • Minimizes financial impact from vacancy • Economies of scale CONS • More upkeep/tenant damage • Less appreciation • Tenant conflicts What to Buy

35 The Proven Systems Fourplex – 4 Units PROS • Generates high cash flow • Minimizes financial impact from vacancy • Economies of scale CONS • More upkeep/tenant damage • Less appreciation • Tenant conflicts What to Buy

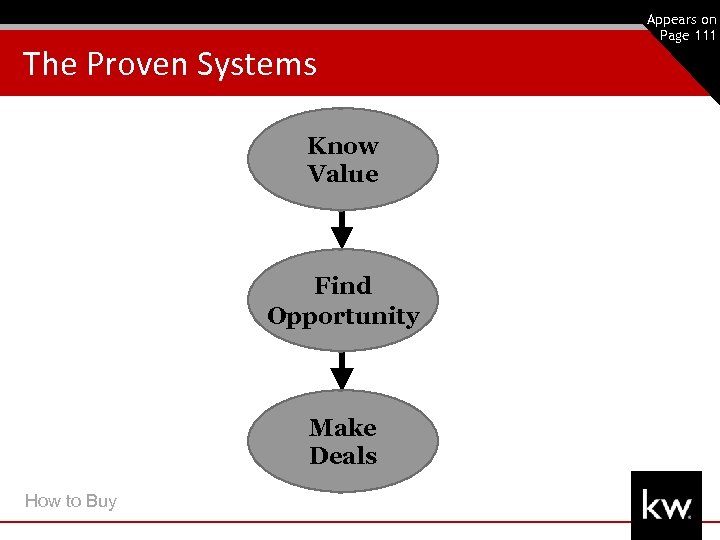

The Proven Systems Know Value Find Opportunity Make Deals How to Buy 36 Appears on Page 111

The Proven Systems Know Value Find Opportunity Make Deals How to Buy 36 Appears on Page 111

37 The Proven Systems Mortgages • 30 year vs. 15 year • 20% down or more? • Qualifying issues • Your first property - what to expect • Your next property - what to expect How to Buy

37 The Proven Systems Mortgages • 30 year vs. 15 year • 20% down or more? • Qualifying issues • Your first property - what to expect • Your next property - what to expect How to Buy

38 The Proven Systems Property Management Company vs. Self-Management

38 The Proven Systems Property Management Company vs. Self-Management

39 The Proven Systems Next Steps … 1. 2. 3. 4. Read The Millionaire Real Estate Investor. Talk to a mortgage professional. Talk to a financial professional. Let’s get together!

39 The Proven Systems Next Steps … 1. 2. 3. 4. Read The Millionaire Real Estate Investor. Talk to a mortgage professional. Talk to a financial professional. Let’s get together!

40 The Proven Systems Questions? How to Buy

40 The Proven Systems Questions? How to Buy

41 The Proven Person Your Name • Licensed REALTOR® • Your credentials (ABR, CRS, etc. ) • Other credentials

41 The Proven Person Your Name • Licensed REALTOR® • Your credentials (ABR, CRS, etc. ) • Other credentials