f4ee5ae9b92ad5685b8aa5f4a7329493.ppt

- Количество слайдов: 23

1 Short Selling • Objective: You’re bearish on a stock --- you think its price will be lower in the future. You want to Sell high now, and in the future Buy at a lower price. (The opposite of buy now and sell later. ) • Short selling is set up to let people do this. How it works: • You borrow shares from another investor (i. e. , someone who owns the shares) through broker, and your broker sells them for you. • Later you have your broker buy shares and these shares are used to repay the investor who lent you shares (i. e. , your stock loan is repaid). • If price drops, profit; if price increases, loss. • Short sellers have to reimburse the lender for any dividends. • Short seller has to deposit margin / collateral.

Short selling: Problem 1 a. If the price keeps going up your losses are unlimited. 2 3 -2

3 Types of Orders • Market orders: § Immediate execution of the order. § Filled at best available price. • Limit orders: § Only filled if “marketable”. i. e. , if limit price (or better) can be achieved. § Order may not get filled. § To buy: Buy only at that price or lower. § To sell: Sell only at that price or higher.

4 Types of Orders • Special orders: § Stop loss (sell if drops to specific price; you’re long and wrong) • E. G. : You own stock trading at $40. You could place a stop loss at $38. The stop loss would become a market order to sell if the price of the stock hits $38. § Stop buy (buy if price increases to specific price; you’re short and wrong) • E. G. : You shorted stock trading at $40. You could place a stop buy at $42. The stop buy would become a market order to buy if the price of the stock hits $42. CFALA/USC CFA Review Level 1, SS-13

Short selling: Problem 1 b. The stop-buy order at $128 limits your max loss to about $8 per share. 5 3 -5

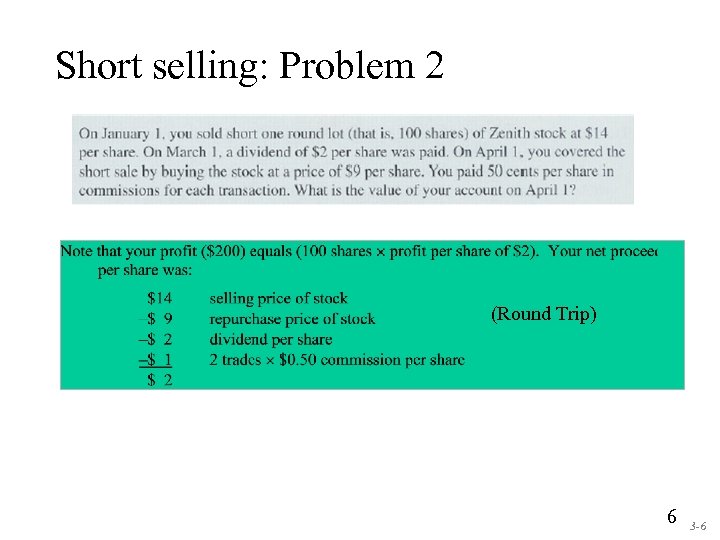

Short selling: Problem 2 (Round Trip) 6 3 -6

7 Buying on Margin • Margin transactions: Borrow part of the money to pay for the stock. • Brokers lend the money and hold the stock as collateral. They charge an interest rate called the call money rate (about 1% less than prime). • Equity is the stock value less the money borrowed from the broker. • Margin (initial) requirement is the minimum equity percentage required and determines how much can be borrowed from the broker. Set by the Federal Reserve Broker. Current margin requirement is 50%. • Maintenance Margin is a required % which is less than the initial margin. If the equity % falls below the maintenance margin, a margin call is made and additional funds must be deposited to meet the Maintenance Margin. If not, broker can close the position/sell stock. • Trading on margin increases risk. (see our example problems)

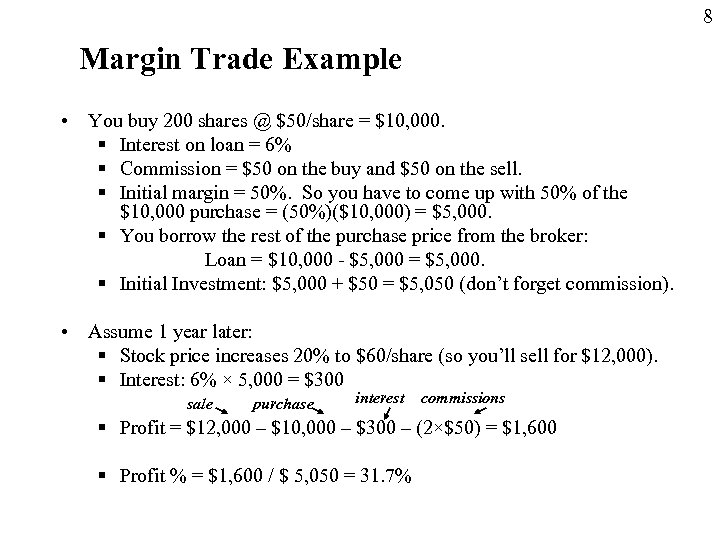

8 Margin Trade Example • You buy 200 shares @ $50/share = $10, 000. § Interest on loan = 6% § Commission = $50 on the buy and $50 on the sell. § Initial margin = 50%. So you have to come up with 50% of the $10, 000 purchase = (50%)($10, 000) = $5, 000. § You borrow the rest of the purchase price from the broker: Loan = $10, 000 - $5, 000 = $5, 000. § Initial Investment: $5, 000 + $50 = $5, 050 (don’t forget commission). • Assume 1 year later: § Stock price increases 20% to $60/share (so you’ll sell for $12, 000). § Interest: 6% × 5, 000 = $300 sale purchase interest commissions § Profit = $12, 000 – $10, 000 – $300 – (2×$50) = $1, 600 § Profit % = $1, 600 / $ 5, 050 = 31. 7%

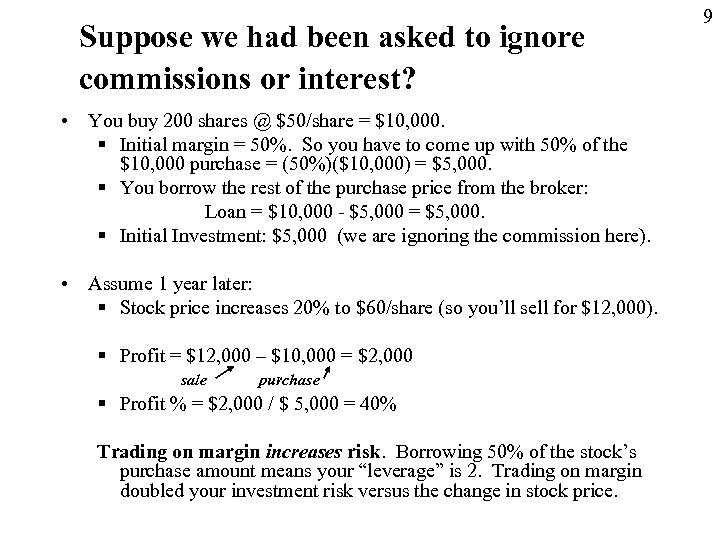

Suppose we had been asked to ignore commissions or interest? • You buy 200 shares @ $50/share = $10, 000. § Initial margin = 50%. So you have to come up with 50% of the $10, 000 purchase = (50%)($10, 000) = $5, 000. § You borrow the rest of the purchase price from the broker: Loan = $10, 000 - $5, 000 = $5, 000. § Initial Investment: $5, 000 (we are ignoring the commission here). • Assume 1 year later: § Stock price increases 20% to $60/share (so you’ll sell for $12, 000). § Profit = $12, 000 – $10, 000 = $2, 000 sale purchase § Profit % = $2, 000 / $ 5, 000 = 40% Trading on margin increases risk. Borrowing 50% of the stock’s purchase amount means your “leverage” is 2. Trading on margin doubled your investment risk versus the change in stock price. 9

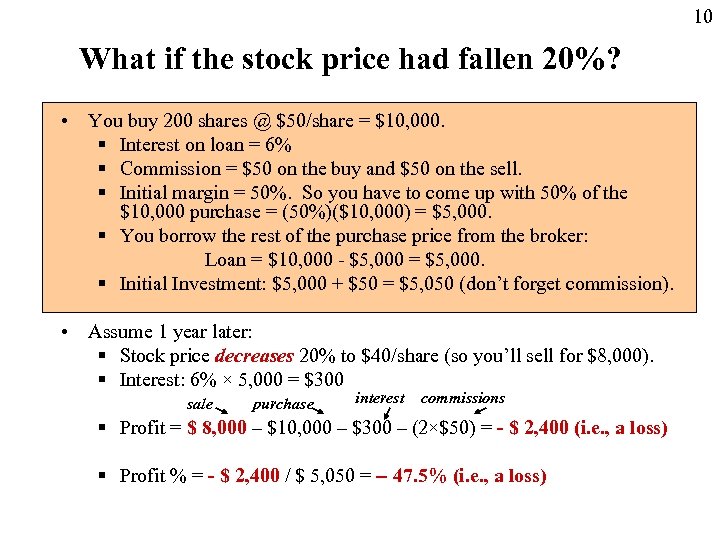

10 What if the stock price had fallen 20%? • You buy 200 shares @ $50/share = $10, 000. § Interest on loan = 6% § Commission = $50 on the buy and $50 on the sell. § Initial margin = 50%. So you have to come up with 50% of the $10, 000 purchase = (50%)($10, 000) = $5, 000. § You borrow the rest of the purchase price from the broker: Loan = $10, 000 - $5, 000 = $5, 000. § Initial Investment: $5, 000 + $50 = $5, 050 (don’t forget commission). • Assume 1 year later: § Stock price decreases 20% to $40/share (so you’ll sell for $8, 000). § Interest: 6% × 5, 000 = $300 sale purchase interest commissions § Profit = $ 8, 000 – $10, 000 – $300 – (2×$50) = - $ 2, 400 (i. e. , a loss) § Profit % = - $ 2, 400 / $ 5, 050 = 47. 5% (i. e. , a loss)

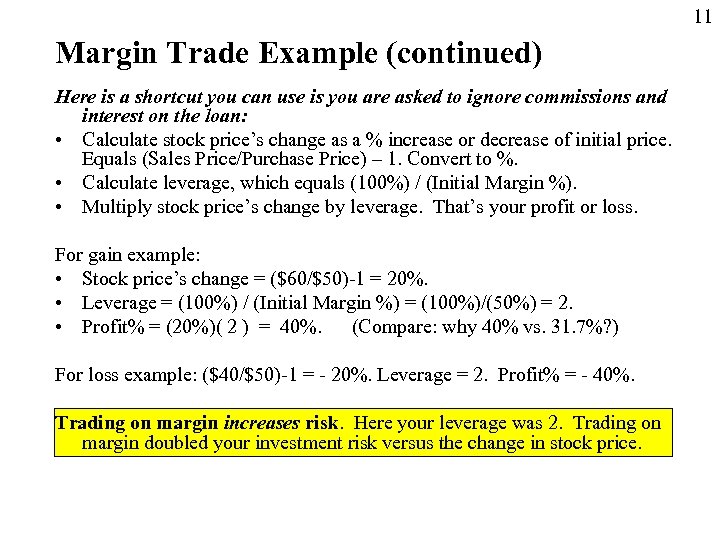

11 Margin Trade Example (continued) Here is a shortcut you can use is you are asked to ignore commissions and interest on the loan: • Calculate stock price’s change as a % increase or decrease of initial price. Equals (Sales Price/Purchase Price) – 1. Convert to %. • Calculate leverage, which equals (100%) / (Initial Margin %). • Multiply stock price’s change by leverage. That’s your profit or loss. For gain example: • Stock price’s change = ($60/$50)-1 = 20%. • Leverage = (100%) / (Initial Margin %) = (100%)/(50%) = 2. • Profit% = (20%)( 2 ) = 40%. (Compare: why 40% vs. 31. 7%? ) For loss example: ($40/$50)-1 = - 20%. Leverage = 2. Profit% = - 40%. Trading on margin increases risk. Here your leverage was 2. Trading on margin doubled your investment risk versus the change in stock price.

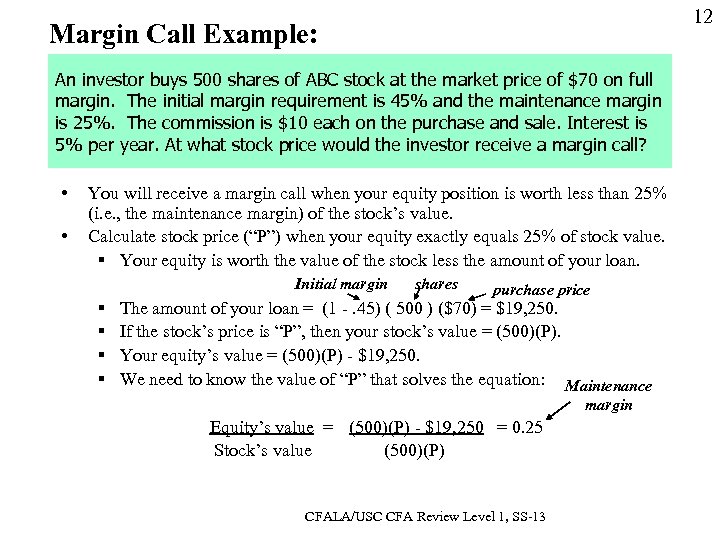

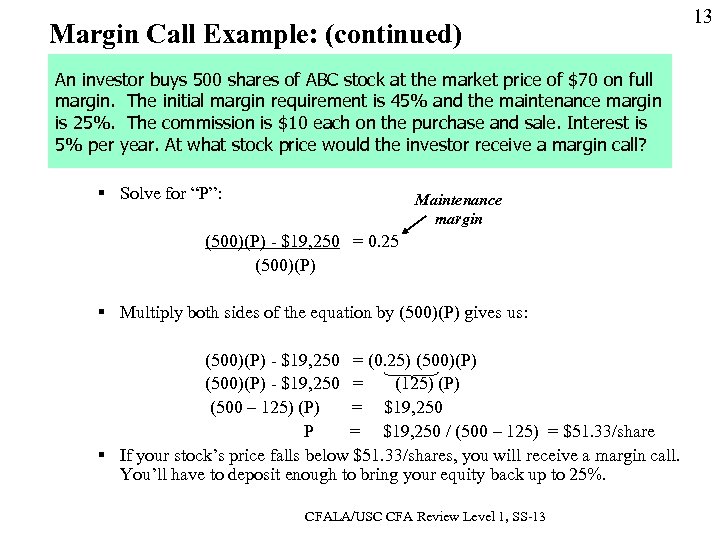

12 Margin Call Example: An investor buys 500 shares of ABC stock at the market price of $70 on full margin. The initial margin requirement is 45% and the maintenance margin is 25%. The commission is $10 each on the purchase and sale. Interest is 5% per year. At what stock price would the investor receive a margin call? • • You will receive a margin call when your equity position is worth less than 25% (i. e. , the maintenance margin) of the stock’s value. Calculate stock price (“P”) when your equity exactly equals 25% of stock value. § Your equity is worth the value of the stock less the amount of your loan. Initial margin § § shares purchase price The amount of your loan = (1 -. 45) ( 500 ) ($70) = $19, 250. If the stock’s price is “P”, then your stock’s value = (500)(P). Your equity’s value = (500)(P) - $19, 250. We need to know the value of “P” that solves the equation: Maintenance margin Equity’s value = (500)(P) - $19, 250 = 0. 25 Stock’s value (500)(P) CFALA/USC CFA Review Level 1, SS-13

Margin Call Example: (continued) 13 An investor buys 500 shares of ABC stock at the market price of $70 on full margin. The initial margin requirement is 45% and the maintenance margin is 25%. The commission is $10 each on the purchase and sale. Interest is 5% per year. At what stock price would the investor receive a margin call? § Solve for “P”: Maintenance margin (500)(P) - $19, 250 = 0. 25 (500)(P) § Multiply both sides of the equation by (500)(P) gives us: (500)(P) - $19, 250 = (0. 25) (500)(P) - $19, 250 = (125) (P) (500 – 125) (P) = $19, 250 P = $19, 250 / (500 – 125) = $51. 33/share § If your stock’s price falls below $51. 33/shares, you will receive a margin call. You’ll have to deposit enough to bring your equity back up to 25%. CFALA/USC CFA Review Level 1, SS-13

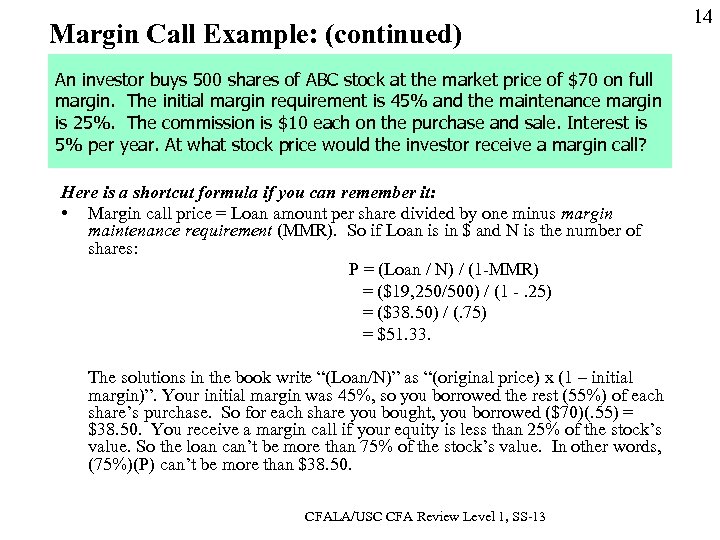

Margin Call Example: (continued) An investor buys 500 shares of ABC stock at the market price of $70 on full margin. The initial margin requirement is 45% and the maintenance margin is 25%. The commission is $10 each on the purchase and sale. Interest is 5% per year. At what stock price would the investor receive a margin call? Here is a shortcut formula if you can remember it: • Margin call price = Loan amount per share divided by one minus margin maintenance requirement (MMR). So if Loan is in $ and N is the number of shares: P = (Loan / N) / (1 -MMR) = ($19, 250/500) / (1 -. 25) = ($38. 50) / (. 75) = $51. 33. The solutions in the book write “(Loan/N)” as “(original price) x (1 – initial margin)”. Your initial margin was 45%, so you borrowed the rest (55%) of each share’s purchase. So for each share you bought, you borrowed ($70)(. 55) = $38. 50. You receive a margin call if your equity is less than 25% of the stock’s value. So the loan can’t be more than 75% of the stock’s value. In other words, (75%)(P) can’t be more than $38. 50. CFALA/USC CFA Review Level 1, SS-13 14

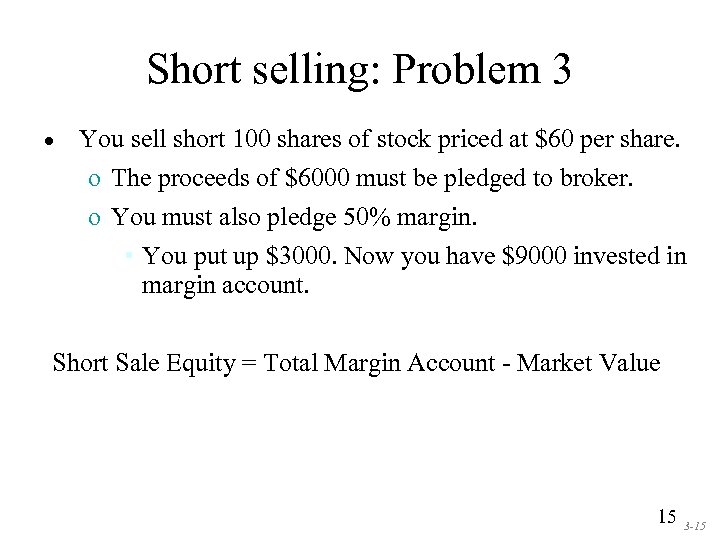

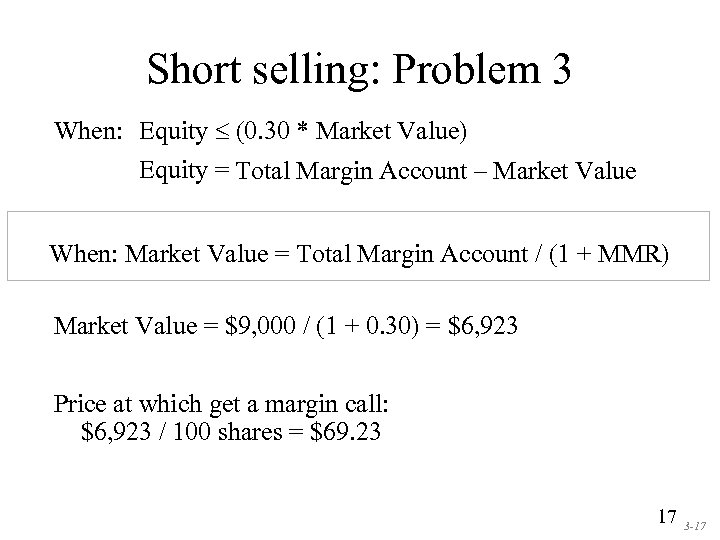

Short selling: Problem 3 • You sell short 100 shares of stock priced at $60 per share. o The proceeds of $6000 must be pledged to broker. o You must also pledge 50% margin. • You put up $3000. Now you have $9000 invested in margin account. Short Sale Equity = Total Margin Account - Market Value 15 3 -15

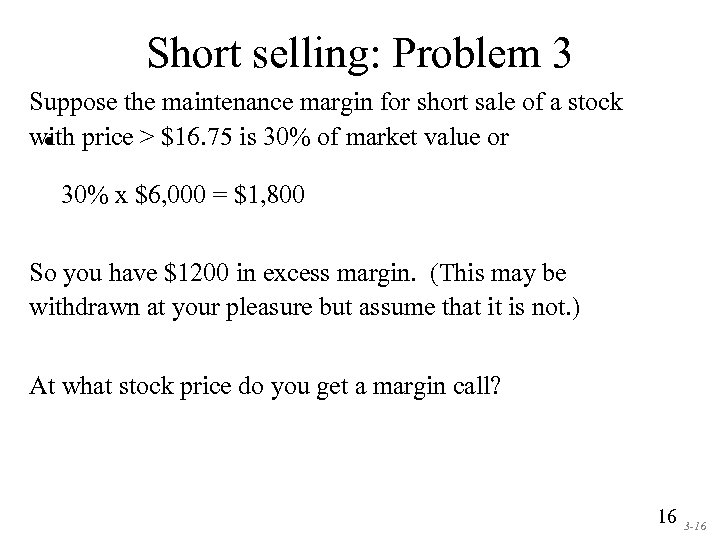

Short selling: Problem 3 Suppose the maintenance margin for short sale of a stock with price > $16. 75 is 30% of market value or • 30% x $6, 000 = $1, 800 So you have $1200 in excess margin. (This may be withdrawn at your pleasure but assume that it is not. ) At what stock price do you get a margin call? 16 3 -16

Short selling: Problem 3 When: Equity (0. 30 * Market Value) Equity = Total Margin Account – Market Value When: Market Value = Total Margin Account / (1 + MMR) Market Value = $9, 000 / (1 + 0. 30) = $6, 923 Price at which get a margin call: $6, 923 / 100 shares = $69. 23 17 3 -17

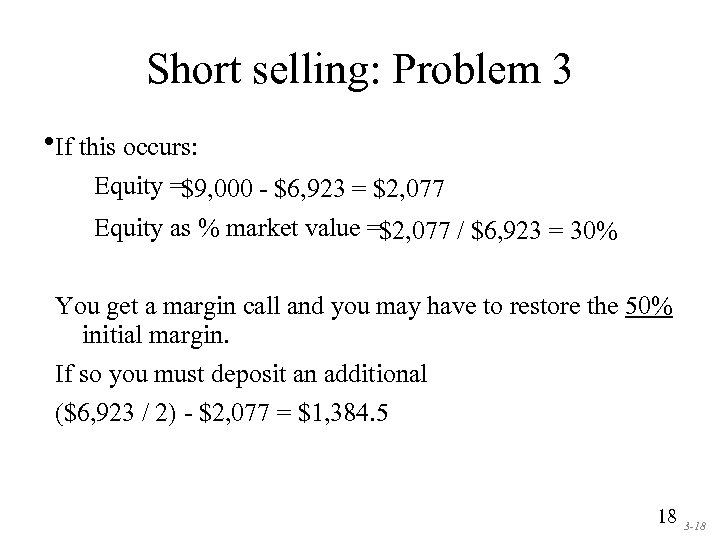

Short selling: Problem 3 • If this occurs: Equity = $9, 000 - $6, 923 = $2, 077 Equity as % market value = $2, 077 / $6, 923 = 30% You get a margin call and you may have to restore the 50% initial margin. If so you must deposit an additional ($6, 923 / 2) - $2, 077 = $1, 384. 5 18 3 -18

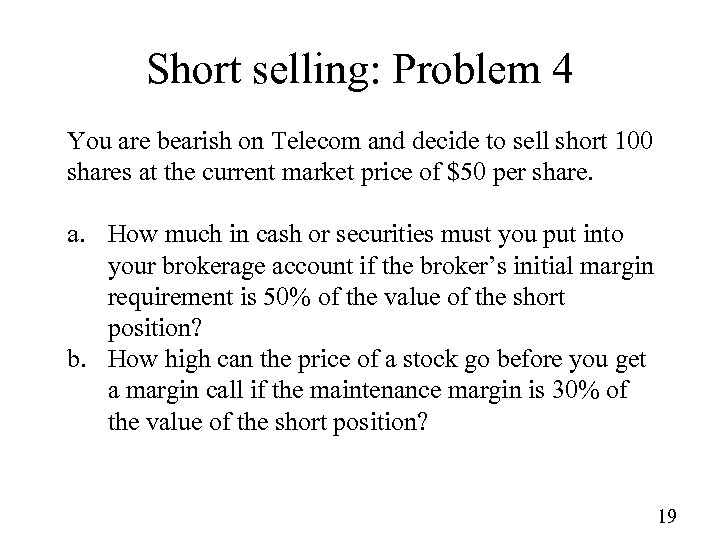

Short selling: Problem 4 You are bearish on Telecom and decide to sell short 100 shares at the current market price of $50 per share. a. How much in cash or securities must you put into your brokerage account if the broker’s initial margin requirement is 50% of the value of the short position? b. How high can the price of a stock go before you get a margin call if the maintenance margin is 30% of the value of the short position? 19

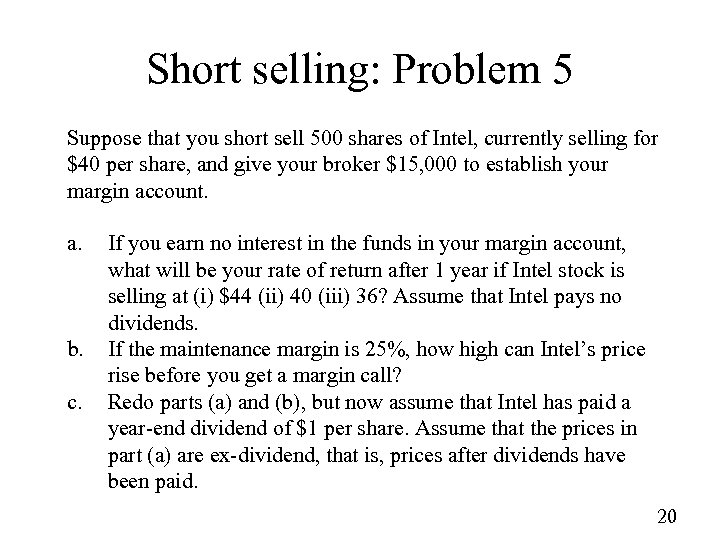

Short selling: Problem 5 Suppose that you short sell 500 shares of Intel, currently selling for $40 per share, and give your broker $15, 000 to establish your margin account. a. b. c. If you earn no interest in the funds in your margin account, what will be your rate of return after 1 year if Intel stock is selling at (i) $44 (ii) 40 (iii) 36? Assume that Intel pays no dividends. If the maintenance margin is 25%, how high can Intel’s price rise before you get a margin call? Redo parts (a) and (b), but now assume that Intel has paid a year-end dividend of $1 per share. Assume that the prices in part (a) are ex-dividend, that is, prices after dividends have been paid. 20

Short selling: Problem 5 Suppose that you short sell 500 shares of Intel, currently selling for $40 per share, and give your broker $15, 000 to establish your margin account. a. If you earn no interest in the funds in your margin account, what will be your rate of return after 1 year if Intel stock is selling at (i) $44 (ii) 40 (iii) 36? Assume that Intel pays no dividends. The gain or loss on the short position is: (– 500 X change in price) Invested funds = $15, 000 Therefore: rate of return = (– 500 x change in price)/15, 000 The rate of return in each of the three scenarios is: rate of return = (– 500 x $4)/$15, 000 = – 0. 1333 = – 13. 33% rate of return = (– 500 x $0)/$15, 000 = 0% rate of return = [– 500 x (–$4)]/$15, 000 = +0. 1333 = +13. 33% 21

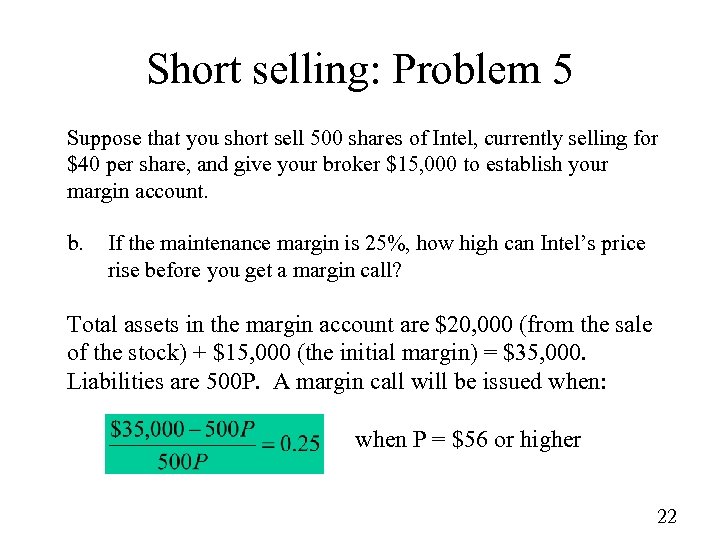

Short selling: Problem 5 Suppose that you short sell 500 shares of Intel, currently selling for $40 per share, and give your broker $15, 000 to establish your margin account. b. If the maintenance margin is 25%, how high can Intel’s price rise before you get a margin call? Total assets in the margin account are $20, 000 (from the sale of the stock) + $15, 000 (the initial margin) = $35, 000. Liabilities are 500 P. A margin call will be issued when: when P = $56 or higher 22

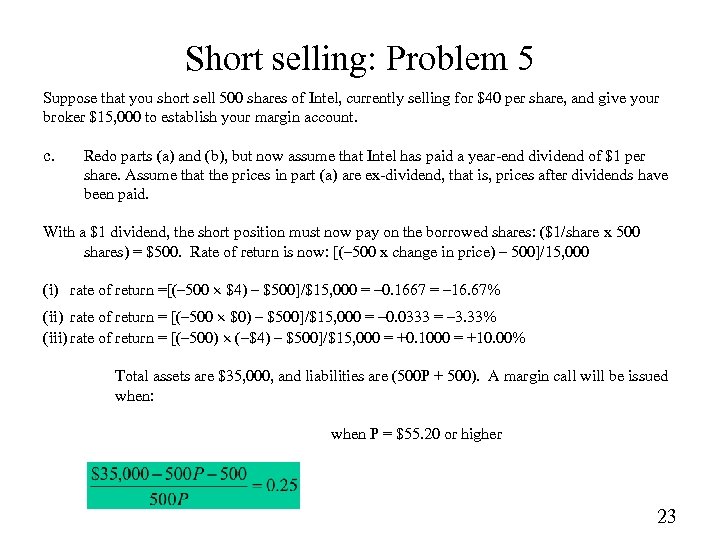

Short selling: Problem 5 Suppose that you short sell 500 shares of Intel, currently selling for $40 per share, and give your broker $15, 000 to establish your margin account. c. Redo parts (a) and (b), but now assume that Intel has paid a year-end dividend of $1 per share. Assume that the prices in part (a) are ex-dividend, that is, prices after dividends have been paid. With a $1 dividend, the short position must now pay on the borrowed shares: ($1/share x 500 shares) = $500. Rate of return is now: [(– 500 x change in price) – 500]/15, 000 (i) rate of return =[(– 500 $4) – $500]/$15, 000 = – 0. 1667 = – 16. 67% (ii) rate of return = [(– 500 $0) – $500]/$15, 000 = – 0. 0333 = – 3. 33% (iii) rate of return = [(– 500) (–$4) – $500]/$15, 000 = +0. 1000 = +10. 00% Total assets are $35, 000, and liabilities are (500 P + 500). A margin call will be issued when: when P = $55. 20 or higher 23

f4ee5ae9b92ad5685b8aa5f4a7329493.ppt