b329e7443c81f40f44143080fd5b34cb.ppt

- Количество слайдов: 20

1

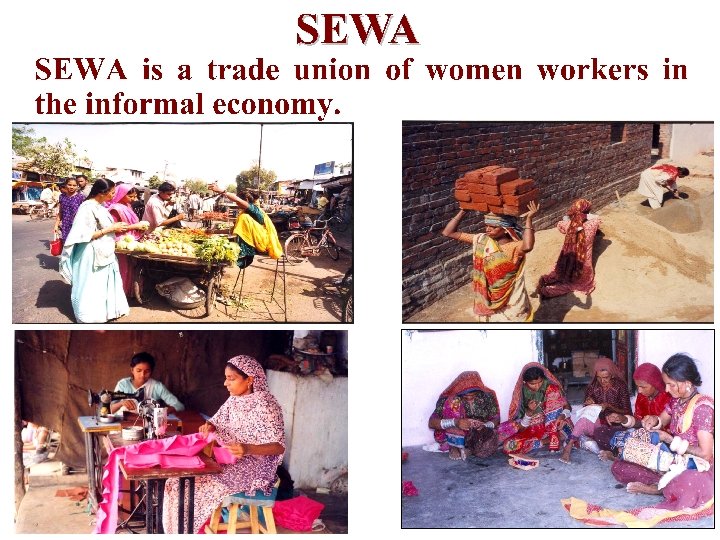

SEWA

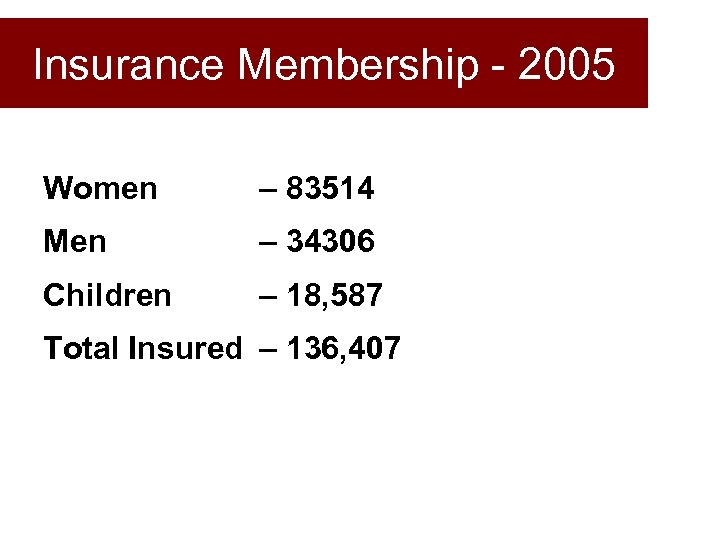

Insurance Membership - 2005 Women – 83514 Men – 34306 Children – 18, 587 Total Insured – 136, 407

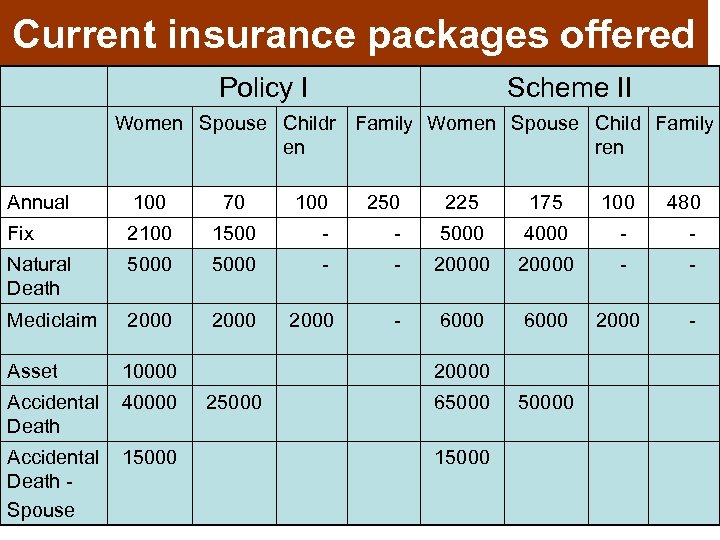

Current insurance packages offered Policy I Scheme II Women Spouse Childr Family Women Spouse Child Family en ren Annual 100 70 100 250 225 175 100 Fix 2100 Natural Death 1500 - - 5000 4000 - - 5000 - - 20000 - - Mediclaim 2000 - 6000 2000 - Asset 10000 Accidental Death 40000 Accidental Death Spouse 15000 20000 25000 65000 150000 480

Two recent initiatives - Hospital tie-ups - Renewal Campaign

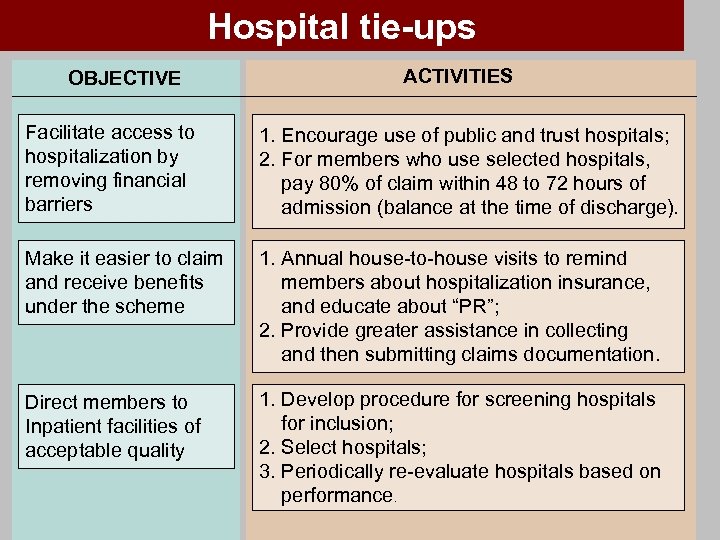

Hospital tie-ups OBJECTIVE ACTIVITIES Facilitate access to hospitalization by removing financial barriers 1. Encourage use of public and trust hospitals; 2. For members who use selected hospitals, pay 80% of claim within 48 to 72 hours of admission (balance at the time of discharge). Make it easier to claim and receive benefits under the scheme 1. Annual house-to-house visits to remind members about hospitalization insurance, and educate about “PR”; 2. Provide greater assistance in collecting and then submitting claims documentation. Direct members to Inpatient facilities of acceptable quality 1. Develop procedure for screening hospitals for inclusion; 2. Select hospitals; 3. Periodically re-evaluate hospitals based on performance.

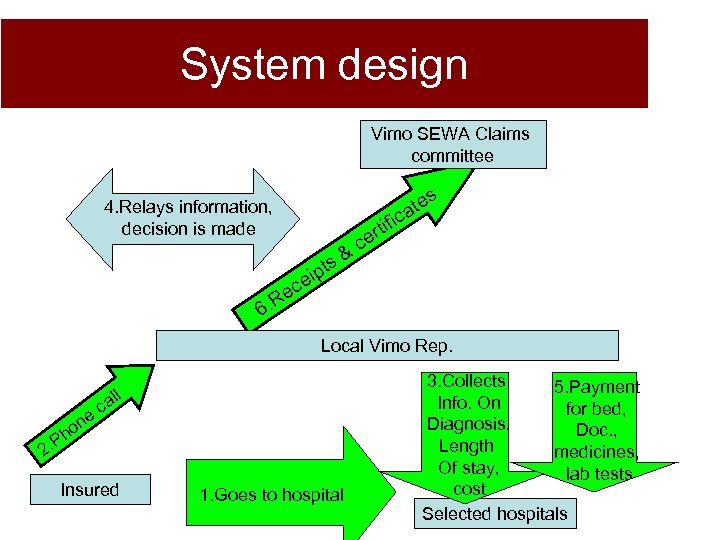

System design Vimo SEWA Claims committee 4. Relays information, decision is made tes a ic & ts ip rtif ce e ec R 6. Local Vimo Rep. e on Ph all c 2. Insured 1. Goes to hospital 3. Collects 5. Payment Info. On for bed, Diagnosis, Doc. , Length medicines, Of stay, lab tests cost Selected hospitals

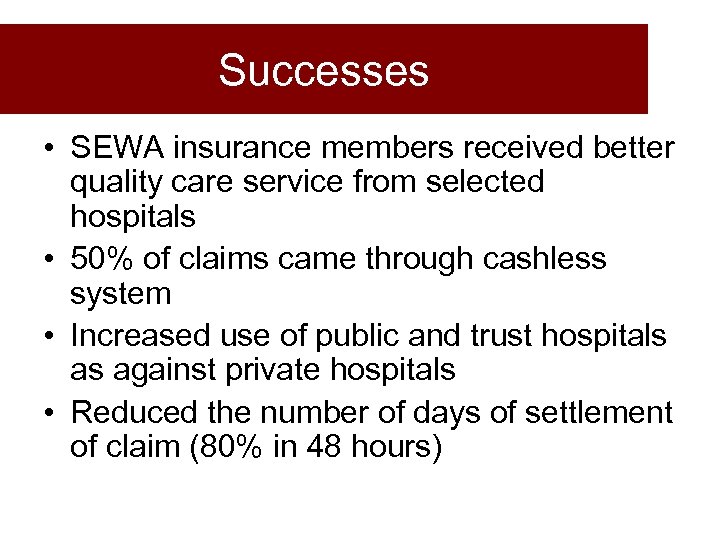

Successes • SEWA insurance members received better quality care service from selected hospitals • 50% of claims came through cashless system • Increased use of public and trust hospitals as against private hospitals • Reduced the number of days of settlement of claim (80% in 48 hours)

Challenges • Availability of suitable public or trust hospitals • Educating the members about cashless system • Skilled human resource – Local representative

SEWA’s Renewal Campaign Objective • Continued protection to Vimo SEWA members • Achieve renewal rate – 70% - policy year 2006 – Policy year 2004: renewal rate – 30% (YP) – Policy year 2005: renewal rate – 42% (YP)

Reasons for non renewal From Research • Limited understanding of Insurance • Lack of money at time of enrollment • Limited contact between members and aagewans after enrollment

Reasons for non renewal • Not enough focus and monitoring on renewals during enrollment campaign

Renewal Strategy – P. Y. 2006 • Limited to Ahmedabad city (30, 000 insureds) • Make individual contact with each member prior to enrollment campaign • Distribution of insurance and health education material • Visit each member during enrollment period for renewal

Implementation Process 1. Each aagewan was given user friendly member lists 2. Each aagewan was assigned manageable number of membership 3. Supportive supervision given to aagewans 4. Barcodes used for recording visits

Outcomes 1. Able to complete 82% of visits prior to enrollment period 2. Members felt good about the house-tohouse visits 3. For the first time aagewans went systematically house-to-house to meet each insured member 4. There was increase in members’ understanding and information

Challenges • Obtaining accurate addresses • Labour and time intensive • Monitoring of visits

Lessons Learnt 1. Supportive supervision is critical 2. Adequate human resources required for satisfactory completion of visits – Aagewans – Supervisors 3. Individual house-to-house visits build trust

THANK YOU Contact details: rupal_jayswal@yahoo. com Upasana_joshi 2000@yahoo. com

b329e7443c81f40f44143080fd5b34cb.ppt