5d3a104064dbd5c4c80623e5ad0842aa.ppt

- Количество слайдов: 35

1 ROLE OF BANKS IN INTERNATIONAL TRADE

Why Trade? 2 Non availability of specific factors of production in some countries. (Land, Labour, Capital and Entrepreneurship) Product differentiation in different countries. Differences in comparative cost between countries e. g. Law of comparative Advantage Scarcity and specialization. (Opportunity Cost)

What is International Trade? 3 International trade is exchange of capital, goods, and services across international borders or territories. In most countries, it represents a significant share of gross domestic product (GDP). While international trade has been present throughout much of history, its economic, social, and political importance has been on the rise in recenturies. Industrialization, advanced transportation, globalization, multinational corporations, and outsourcing are all having a major impact on the international trade system. Increasing international trade is crucial to the continuance of globalization. Without international trade, nations would be limited to the goods and services produced within their own borders.

Domestic V/S International Trade 4 International trade is in principle not different from domestic trade as the motivation and the behavior of parties involved in a trade do not change fundamentally regardless of whether trade is across a border or not. The main difference is that international trade is typically more costly than domestic trade. The reason is that a border typically imposes additional costs such as tariffs, time costs due to border delays and costs associated with country differences such as language, the legal system or culture. Another difference between domestic and international trade is that factors of production such as capital and labour are typically more mobile within a country than across countries. Thus international trade is mostly restricted to trade in goods and services, and only to a lesser extent to trade in capital, labor or other factors of production. Then trade in goods and services can serve as a substitute for trade in factors of production. Continued…

Domestic V/S International Trade 5 Instead of importing a factor of production, a country can import goods that make intensive use of the factor of production and are thus embodying the respective factor. An example is the import of labor-intensive goods by the United States from China. Instead of importing Chinese labor the United States is importing goods from China that were produced with Chinese labor. Nutshell, differentiating factor are; A. Foreign Exchange Risk B. Political Risk C. Market Imperfection (MNCs are gift of this) D. Expanded opportunity set

Gains From International Trade 6 International trade leads to mutual gain because it allows each country to specialize in the production of those things that it does best. Trade permits each country to use more of its resources to produce those goods that it can produce at a relatively low cost. With trade, it is made possible for the trading partners to consume a bundle of goods that it would be impossible for them to produce domestically. Trade encourages competition & efficiency.

Top 20 Trading Nations (2009 Data) 7

Top Traded Commodities-Export (2009 Data) 8

Regulations Of International Trade 9 Traditionally trade was regulated through bilateral treaties between two nations. For centuries under the belief in mercantilism most nations had high tariffs and many restrictions on international trade. Liberalization (Free Trade) at global level; (2 World War) nd A. General Agreement on Tariffs and Trade (GATT) and B. World Trade Organization (1994) Liberalization (Free Trade) at regional level; A. MERCOSUR in South America. B. North American Free Trade Agreement (NAFTA) between the United States, Canada and Mexico. C. European Union between 27 independent states

Risks in International Trade 10 Buyer insolvency (purchaser cannot pay); Non-acceptance (buyer rejects goods as different from the agreed upon specifications); Credit risk (allowing the buyer to take possession of goods prior to payment); Regulatory risk (e. g. , a change in rules that prevents the transaction); Intervention (governmental action to prevent a transaction being completed); Political risk (change in leadership interfering with transactions or prices); War and other uncontrollable events; and Unfavorable exchange rate movements (and, the potential benefit of favorable movements) – Hedging (Direct/indirect hedging through Banking Channels)

Role of Banks (Commercial / Central) 11 It is impossible to be in international trade without involving your bank for all the services they provide such as advice on financial issues and the potential risks involved. It is true that one critical hurdle is the lack of information on international trade processes, documentation and banking procedures necessary to carry on with business abroad. For result oriented and cost effective international trade, you will very definitely need access to accurate and timely information and a sound knowledge of banking. Continue. . .

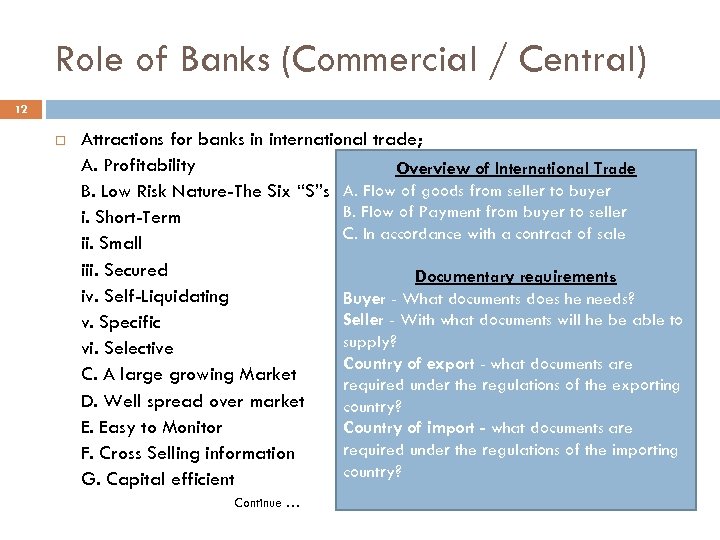

Role of Banks (Commercial / Central) 12 Attractions for banks in international trade; A. Profitability Overview of International Trade B. Low Risk Nature-The Six “S”s A. Flow of goods from seller to buyer B. Flow of Payment from buyer to seller i. Short-Term C. In accordance with a contract of sale ii. Small iii. Secured Documentary requirements iv. Self-Liquidating Buyer - What documents does he needs? Seller - With what documents will he be able to v. Specific supply? vi. Selective Country of export - what documents are C. A large growing Market required under the regulations of the exporting D. Well spread over market country? E. Easy to Monitor Country of import - what documents are required under the regulations of the importing F. Cross Selling information country? G. Capital efficient Continue …

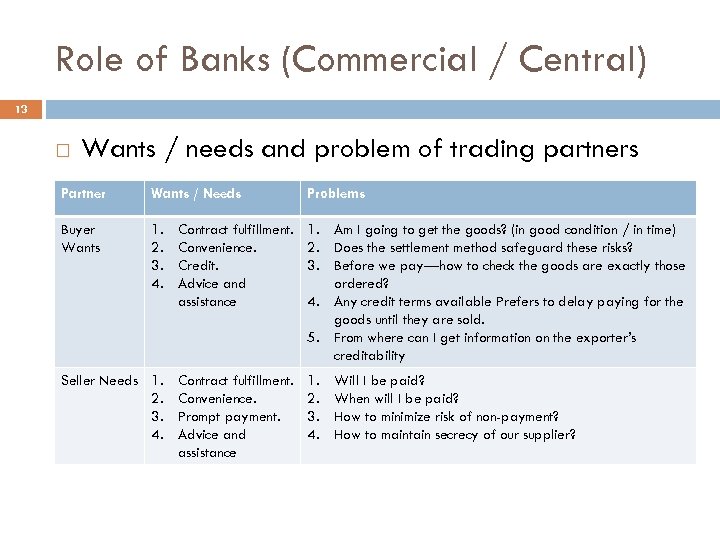

Role of Banks (Commercial / Central) 13 Wants / needs and problem of trading partners Partner Wants / Needs Problems Buyer Wants 1. 2. 3. 4. Contract fulfillment. Convenience. Credit. Advice and assistance 1. Am I going to get the goods? (in good condition / in time) 2. Does the settlement method safeguard these risks? 3. Before we pay—how to check the goods are exactly those ordered? 4. Any credit terms available Prefers to delay paying for the goods until they are sold. 5. From where can I get information on the exporter’s creditability Seller Needs 1. 2. 3. 4. Contract fulfillment. Convenience. Prompt payment. Advice and assistance 1. 2. 3. 4. Will I be paid? When will I be paid? How to minimize risk of non-payment? How to maintain secrecy of our supplier?

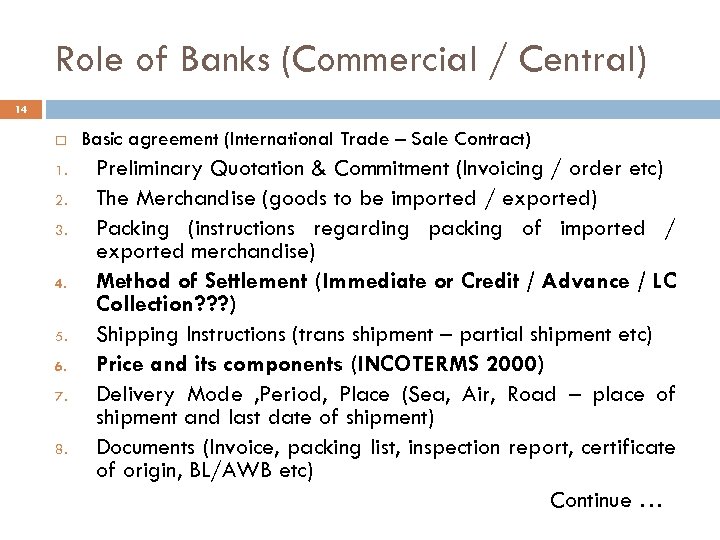

Role of Banks (Commercial / Central) 14 1. 2. 3. 4. 5. 6. 7. 8. Basic agreement (International Trade – Sale Contract) Preliminary Quotation & Commitment (Invoicing / order etc) The Merchandise (goods to be imported / exported) Packing (instructions regarding packing of imported / exported merchandise) Method of Settlement (Immediate or Credit / Advance / LC Collection? ? ? ) Shipping Instructions (trans shipment – partial shipment etc) Price and its components (INCOTERMS 2000) Delivery Mode , Period, Place (Sea, Air, Road – place of shipment and last date of shipment) Documents (Invoice, packing list, inspection report, certificate of origin, BL/AWB etc) Continue …

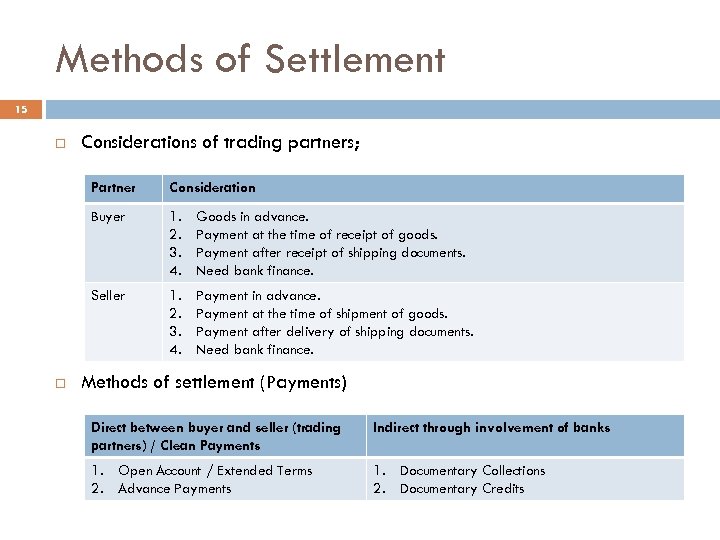

Methods of Settlement 15 Considerations of trading partners; Partner Buyer 1. 2. 3. 4. Goods in advance. Payment at the time of receipt of goods. Payment after receipt of shipping documents. Need bank finance. Seller Consideration 1. 2. 3. 4. Payment in advance. Payment at the time of shipment of goods. Payment after delivery of shipping documents. Need bank finance. Methods of settlement (Payments) Direct between buyer and seller (trading partners) / Clean Payments Indirect through involvement of banks 1. Open Account / Extended Terms 2. Advance Payments 1. Documentary Collections 2. Documentary Credits

Clean Payments 16 Clean Payments are characterized by trust. Either the Exporter sends the goods and TRUSTS the Importer to pay once the goods have been received (Open Account / Extended Terms), or the Importer TRUSTS the Exporter to send the goods after payment is affected (Advance Payments).

Documentary Collection 17 A method of payment used in international trade whereby the Exporter entrusts the handling of commercial and financial documents to banks and gives the banks instructions concerning the release of these documents to the Importer. Banks involved do not provide any guarantee of payment. Collections are subject to the Uniform Rules for Collections published by the International Chamber of Commerce. The last revision of these rules came into effect on January 1, 1996 and is referred to as the URC 522. Documentary collection may be carried out in two following ways; A. Documents against Payment (DAP) / Sight Collection (SC) / Cash Against Documents (CAD) Documents are released to the Importer only against payment. B. Documents against Acceptance (DAA) / Term Collection (TC) Documents are released to the Importer only against acceptance of a draft/promissory note. Also known as a Term Collection. Due date can be from any document date (BL/AWB etc) or from acceptance of promissory note date.

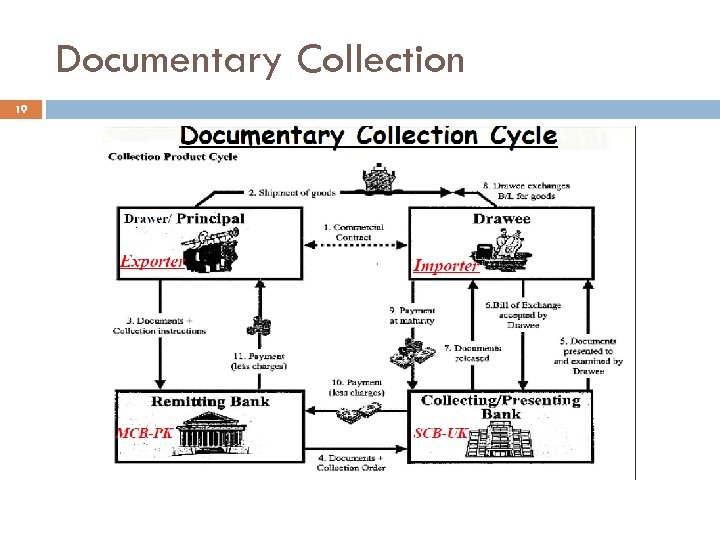

Documentary Collection 18 Parties to a Collection – General International Terminologies (URC 522) 1. 2. 3. 4. Importer’s bank Bank in exporter’s country Exporter Drawee (Importer) Collecting bank – of proceeds (Importer’s bank) Remitting bank – of documents (Bank in exporter’s country) Drawee (Exporter) Mechanism of Documentary Flow The mechanics of a Documentary Collection are easily understood when separated into the following three steps: A. Flow of Goods After the Importer and the Exporter have established a sales contract and agree on a Documentary Collection as the method of payment, the Exporter ships the goods. B. Flow of Documents After the goods are shipped, documents originating with the Exporter (e. g. commercial invoice) and the transport company (e. g. bill of lading) are delivered to a bank (Remitting Bank). The role of the Remitting Bank is to send these documents accompanied by a Collection Instruction giving complete and precise instructions to a bank in the Importer’s country (Collecting/ Presenting Bank). The Collecting/ Presenting Bank acts in accordance with the instructions given in the Collection Order and releases the documents to the Importer against payment (DAP/SC/CAD) or acceptance (DAA/TC), according to the Remitting Bank’s Collection instructions. C. Flow of Payment is forwarded by Collecting / Presenting Bank to the Remitting Bank for the Exporter’s account and the Importer can now present the transport/title document to the carrier in exchange for the goods.

Documentary Collection 19

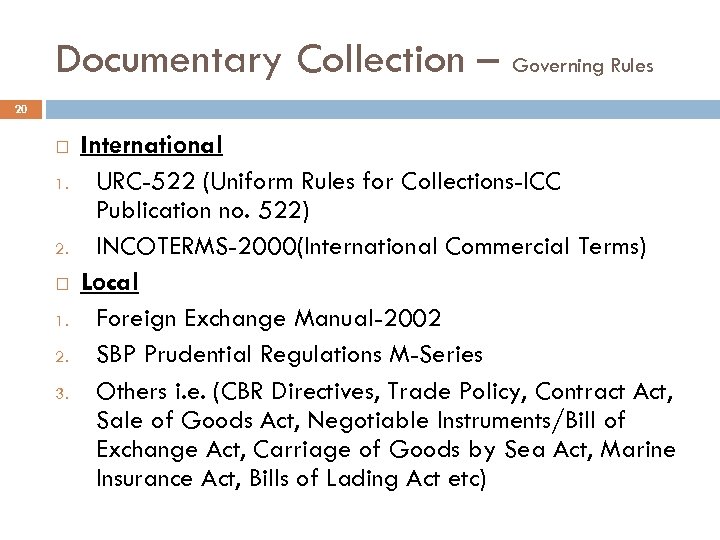

Documentary Collection – Governing Rules 20 1. 2. 1. 2. 3. International URC-522 (Uniform Rules for Collections-ICC Publication no. 522) INCOTERMS-2000(International Commercial Terms) Local Foreign Exchange Manual-2002 SBP Prudential Regulations M-Series Others i. e. (CBR Directives, Trade Policy, Contract Act, Sale of Goods Act, Negotiable Instruments/Bill of Exchange Act, Carriage of Goods by Sea Act, Marine Insurance Act, Bills of Lading Act etc)

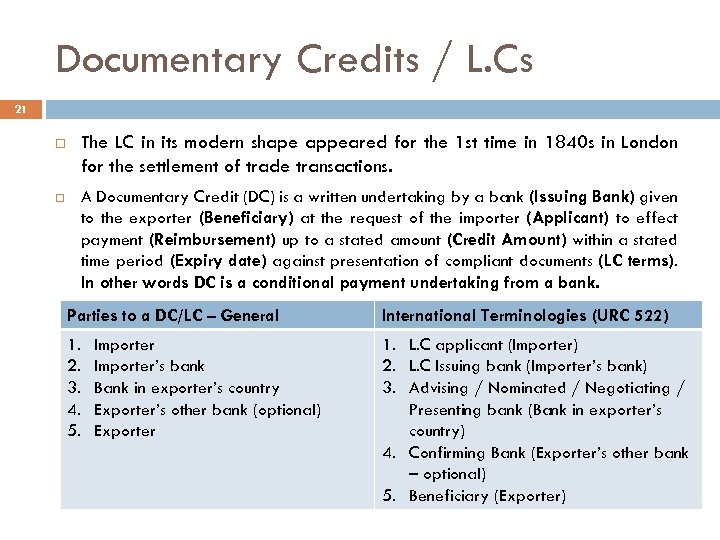

Documentary Credits / L. Cs 21 The LC in its modern shape appeared for the 1 st time in 1840 s in London for the settlement of trade transactions. A Documentary Credit (DC) is a written undertaking by a bank (Issuing Bank) given to the exporter (Beneficiary) at the request of the importer (Applicant) to effect payment (Reimbursement) up to a stated amount (Credit Amount) within a stated time period (Expiry date) against presentation of compliant documents (LC terms). In other words DC is a conditional payment undertaking from a bank. Parties to a DC/LC – General International Terminologies (URC 522) 1. 2. 3. 4. 5. 1. L. C applicant (Importer) 2. L. C Issuing bank (Importer’s bank) 3. Advising / Nominated / Negotiating / Presenting bank (Bank in exporter’s country) 4. Confirming Bank (Exporter’s other bank – optional) 5. Beneficiary (Exporter) Importer’s bank Bank in exporter’s country Exporter’s other bank (optional) Exporter

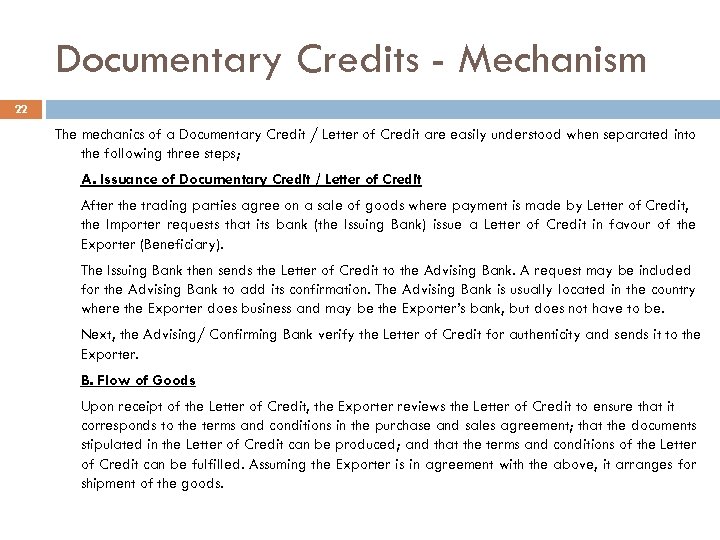

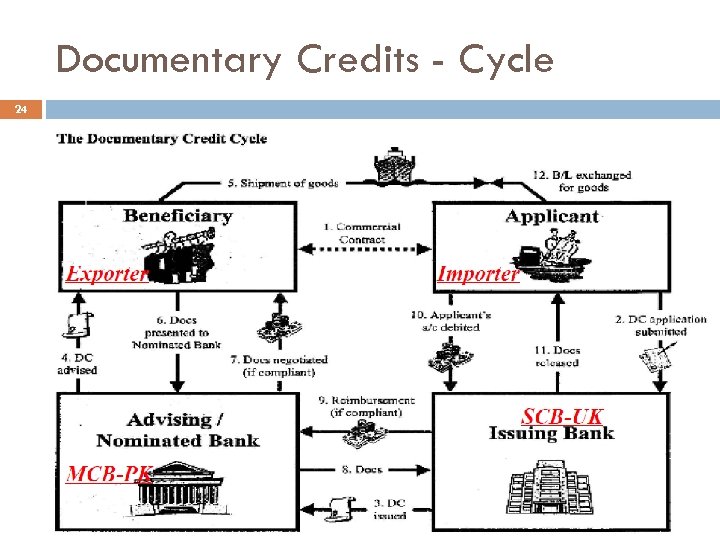

Documentary Credits - Mechanism 22 The mechanics of a Documentary Credit / Letter of Credit are easily understood when separated into the following three steps; A. Issuance of Documentary Credit / Letter of Credit After the trading parties agree on a sale of goods where payment is made by Letter of Credit, the Importer requests that its bank (the Issuing Bank) issue a Letter of Credit in favour of the Exporter (Beneficiary). The Issuing Bank then sends the Letter of Credit to the Advising Bank. A request may be included for the Advising Bank to add its confirmation. The Advising Bank is usually located in the country where the Exporter does business and may be the Exporter’s bank, but does not have to be. Next, the Advising/ Confirming Bank verify the Letter of Credit for authenticity and sends it to the Exporter. B. Flow of Goods Upon receipt of the Letter of Credit, the Exporter reviews the Letter of Credit to ensure that it corresponds to the terms and conditions in the purchase and sales agreement; that the documents stipulated in the Letter of Credit can be produced; and that the terms and conditions of the Letter of Credit can be fulfilled. Assuming the Exporter is in agreement with the above, it arranges for shipment of the goods.

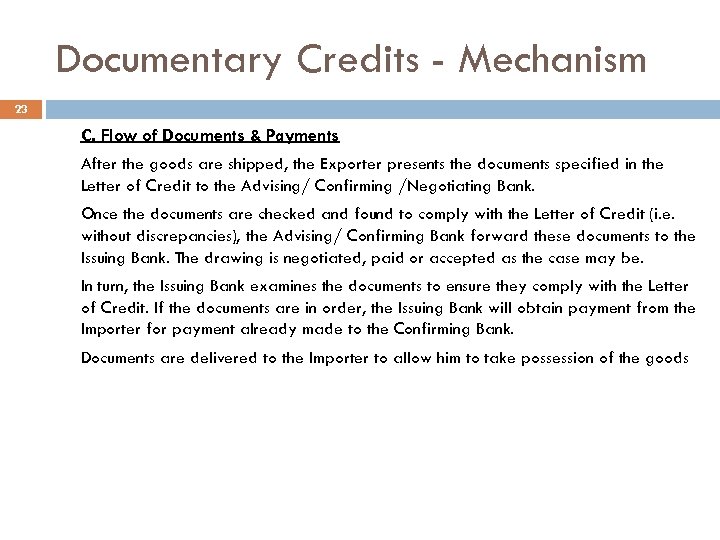

Documentary Credits - Mechanism 23 C. Flow of Documents & Payments After the goods are shipped, the Exporter presents the documents specified in the Letter of Credit to the Advising/ Confirming /Negotiating Bank. Once the documents are checked and found to comply with the Letter of Credit (i. e. without discrepancies), the Advising/ Confirming Bank forward these documents to the Issuing Bank. The drawing is negotiated, paid or accepted as the case may be. In turn, the Issuing Bank examines the documents to ensure they comply with the Letter of Credit. If the documents are in order, the Issuing Bank will obtain payment from the Importer for payment already made to the Confirming Bank. Documents are delivered to the Importer to allow him to take possession of the goods

Documentary Credits - Cycle 24

Documentary Credits – Governing Rules 25 1. 2. 3. 4. 5. 1. 2. 3. International UCP-600 (Uniform Customs and Practice for Documentary Credits ICC Publication no. 600) URR-525(Uniform Rules for Reimbursements, ICC-525) International Standby Practices ICC-ISP 98 International Standard Banking Practices INCOTERMS-2000(International Commercial Terms) Local Foreign Exchange Manual-2002 SBP Prudential Regulations M-Series Others i. e. (CBR Directives, Trade Policy, Contract Act, Sale of Goods Act, Negotiable Instruments/Bill of Exchange Act, Carriage of Goods by Sea Act, Marine Insurance Act, Bills of Lading Act etc)

SWIFT Operations 26 It (Society for Worldwide Interbank Financial Telecommunications) is Cooperative Society under Belgium Law and owned and controlled by its members-share holders. It has a board of 25 Independent directors appointed by the shareholders who are responsible for overseeing and governing the company. The National Bank of Belgium, the central bank of the country in which SWIFT head quarters are located and which is under arrangement with central Banks of G-10 countries i. e. Belgium, Canada, France, Germany, Italy, Japan, The Netherlands, United Kingdom, Unites States, Switzerland, Sweden, and the European Central Bank’’. A new SWIFT member will pay a onetime entry fee and recurring service fees to SWIFT.

SWIFT Operations - Benefits 27 1. 2. 3. 4. 5. 6. Benefits of joining SWIFT; Cost is much lower than telex message Use of standard formats for messages results in consistency. Improved accuracy. Timely delivery. Confidentiality and security. Reduced risk.

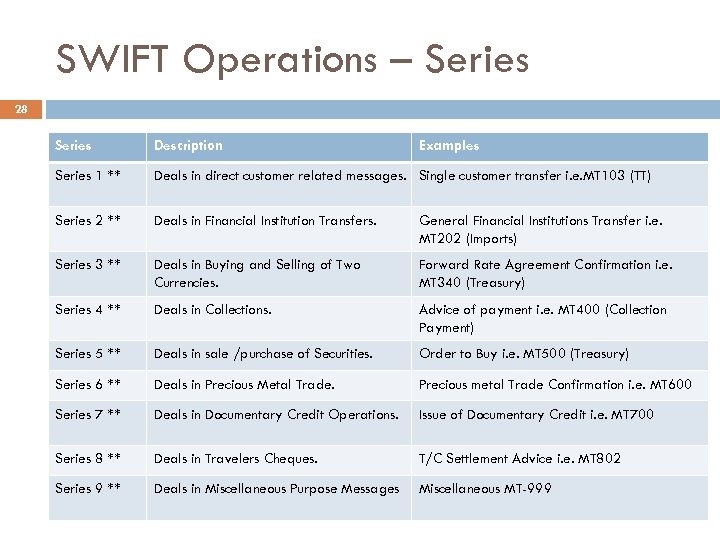

SWIFT Operations – Series 28 Series Description Examples Series 1 ** Deals in direct customer related messages. Single customer transfer i. e. MT 103 (TT) Series 2 ** Deals in Financial Institution Transfers. General Financial Institutions Transfer i. e. MT 202 (Imports) Series 3 ** Deals in Buying and Selling of Two Currencies. Forward Rate Agreement Confirmation i. e. MT 340 (Treasury) Series 4 ** Deals in Collections. Advice of payment i. e. MT 400 (Collection Payment) Series 5 ** Deals in sale /purchase of Securities. Order to Buy i. e. MT 500 (Treasury) Series 6 ** Deals in Precious Metal Trade. Precious metal Trade Confirmation i. e. MT 600 Series 7 ** Deals in Documentary Credit Operations. Issue of Documentary Credit i. e. MT 700 Series 8 ** Deals in Travelers Cheques. T/C Settlement Advice i. e. MT 802 Series 9 ** Deals in Miscellaneous Purpose Messages Miscellaneous MT-999

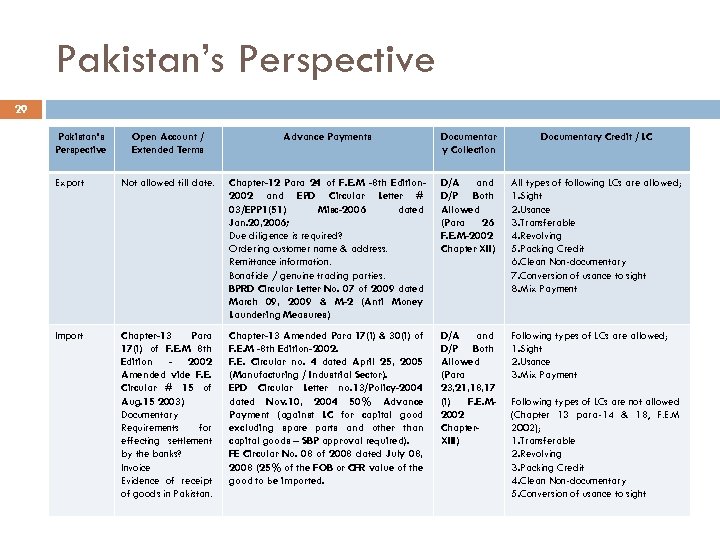

Pakistan’s Perspective 29 Pakistan’s Perspective Open Account / Extended Terms Advance Payments Documentar y Collection Documentary Credit / LC Export Not allowed till date. Chapter-12 Para 24 of F. E. M -8 th Edition 2002 and EPD Circular Letter # 03/EPP 1(51) Misc-2006 dated Jan. 20, 2006; Due diligence is required? Ordering customer name & address. Remittance information. Bonafide / genuine trading parties. BPRD Circular Letter No. 07 of 2009 dated March 09, 2009 & M-2 (Anti Money Laundering Measures) D/A and D/P Both Allowed (Para 26 F. E. M-2002 Chapter XII) All types of following LCs are allowed; 1. Sight 2. Usance 3. Transferable 4. Revolving 5. Packing Credit 6. Clean Non-documentary 7. Conversion of usance to sight 8. Mix Payment Import Chapter-13 Para 17(i) of F. E. M 8 th Edition - 2002 Amended vide F. E. Circular # 15 of Aug. 15 2003) Documentary Requirements for effecting settlement by the banks? Invoice Evidence of receipt of goods in Pakistan. Chapter-13 Amended Para 17(i) & 30(i) of F. E. M -8 th Edition-2002. F. E. Circular no. 4 dated April 25, 2005 (Manufacturing / Industrial Sector). EPD Circular Letter no. 13/Policy-2004 dated Nov. 10, 2004 50% Advance Payment (against LC for capital good excluding spare parts and other than capital goods – SBP approval required). FE Circular No. 08 of 2008 dated July 08, 2008 (25% of the FOB or CFR value of the good to be imported. D/A and D/P Both Allowed (Para 23, 21, 18, 17 (i) F. E. M 2002 Chapter. XIII) Following types of LCs are allowed; 1. Sight 2. Usance 3. Mix Payment Following types of LCs are not allowed (Chapter 13 para-14 & 18, F. E. M 2002); 1. Transferable 2. Revolving 3. Packing Credit 4. Clean Non-documentary 5. Conversion of usance to sight

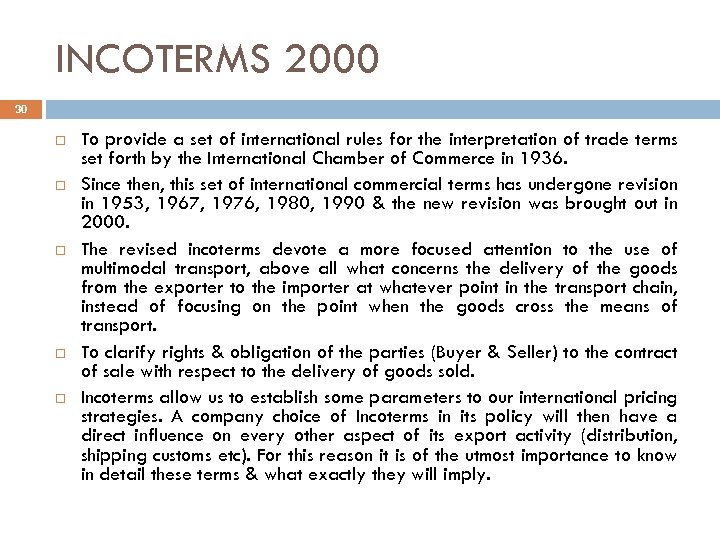

INCOTERMS 2000 30 To provide a set of international rules for the interpretation of trade terms set forth by the International Chamber of Commerce in 1936. Since then, this set of international commercial terms has undergone revision in 1953, 1967, 1976, 1980, 1990 & the new revision was brought out in 2000. The revised incoterms devote a more focused attention to the use of multimodal transport, above all what concerns the delivery of the goods from the exporter to the importer at whatever point in the transport chain, instead of focusing on the point when the goods cross the means of transport. To clarify rights & obligation of the parties (Buyer & Seller) to the contract of sale with respect to the delivery of goods sold. Incoterms allow us to establish some parameters to our international pricing strategies. A company choice of Incoterms in its policy will then have a direct influence on every other aspect of its export activity (distribution, shipping customs etc). For this reason it is of the utmost importance to know in detail these terms & what exactly they will imply.

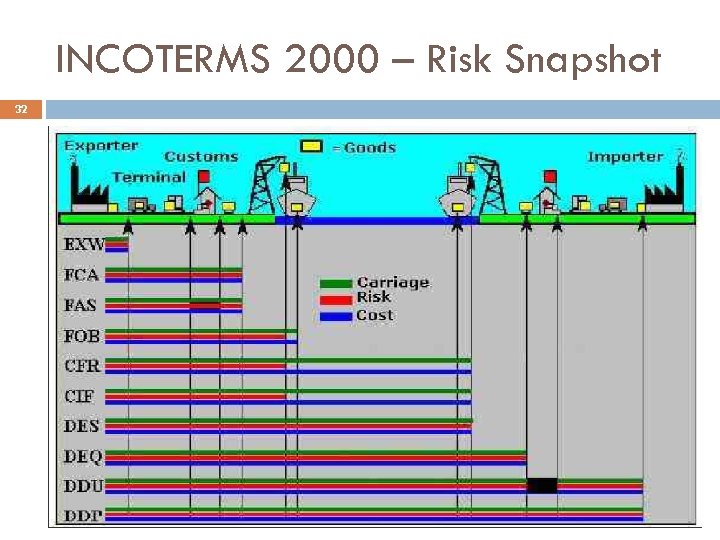

INCOTERMS 2000 - Groups 31 Group Description Abb. Terms Detail Terms E The seller’s obligation is at its minimum: the seller has to do no more than place the goods at the disposal of the buyer at the agreed place - usually at the seller’s own premises. EXW EX Work (Named Place) F The seller to deliver the goods to a nominated carrier as instructed by the buyer. F stands for Free. FAS Free Alongside Ship (Name port of loading/shipment) FOB Free On Board (Named port of shipment) FCA Free Carrier (Named Place) The seller to contract for carriage on usual terms at his own expense. Therefore, a point up to which he would have to pay transport costs must necessarily be indicated after the respective “C” term CFR Karachi. C stands for “Cost/Carriage”. CFR Cost of Freight (Named port of destination) CPT Carriage Paid To (Named place of destination) CIF Cost, Insurance & Freight (Named place of destination) CIP Carriage & Insurance Paid to (Named place of destination) The seller bears all costs & risks related to the delivery of the goods at the agreed place or point of destination. D stands for “Delivered”. DAF Delivered at Frontier (Named place) DES Delivered Ex Ship (Named port of destination) DEQ Delivered Ex Quay (Named port of destination) DDU Delivered Duty Unpaid (Named place of destination) DDP Delivered Duty Paid (Named place of destination) C D

INCOTERMS 2000 – Risk Snapshot 32

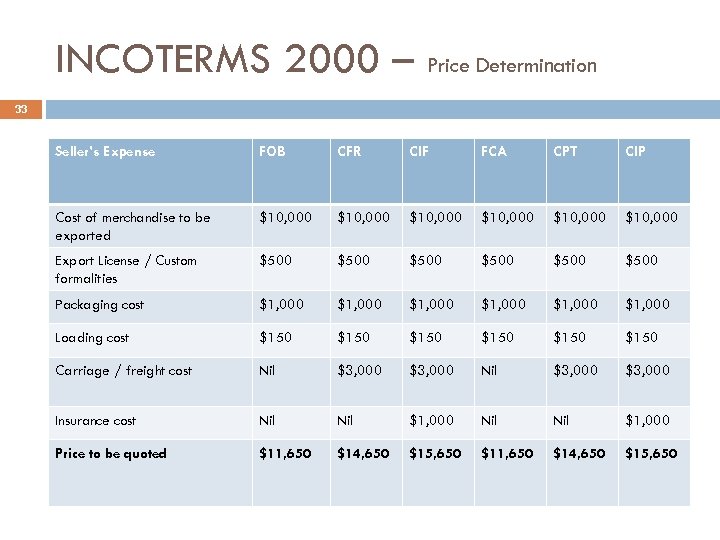

INCOTERMS 2000 – Price Determination 33 Seller’s Expense FOB CFR CIF FCA CPT CIP Cost of merchandise to be exported $10, 000 $10, 000 Export License / Custom formalities $500 $500 Packaging cost $1, 000 $1, 000 Loading cost $150 $150 Carriage / freight cost Nil $3, 000 Insurance cost Nil Nil $1, 000 Price to be quoted $11, 650 $14, 650 $15, 650

Financing Facilities 34 Fund Based (Actual bank’s funds are involved / utilised by the borrower) Non Fund Based (Actual funds of the bank are not utilised by the borrower / commitment) Financing in PKR (Commercial Banks) Financing in FCY (Commercial Banks) Re-finance Scheme (SBP) Facilities. xlsx

35

5d3a104064dbd5c4c80623e5ad0842aa.ppt