1 Public Financial Management Economic Functions and the

1 Public Financial Management Economic Functions and the State Defining Public Financial Management Public Financial Management Process Meaning and Nature of Financial Management How are Companies Organized? Financial Management Decision The Goal of Financial Management Accounting versus Economic Profit 1

2 Economic Functions and the State Public financial management seeks to create and preserve value in society by helping public decision-makers and managers (1) to make choices about how large government should be within the capacity of the overall national economy and according to the preferences of the citizenry. (2) to raise resources from private hands so that they may be put to public use, but doing so in a fashion that minimizes social and economic damage; (3)to allocate and control resources carefully when they have been moved to government supervision so that they suffer neither waste nor misappropriation; and (4) to report periodically on the financial and program results to the public, and to legislative and executive bodies, and external observers. 2

3 Economic Functions and the State The aggregate resources of society are mostly in the hands of private owners. They are used in the market economy but some resources are transferred to public use by the coercive power of taxation which democratic societies allow the sovereign only under limited circumstances. Public financial management helps to see that these resources are managed at the margin to achieve the maximum benefit to society. Financial administration choices include balancing the private and public use and the alternate use and timing of use of economic resources, the manner in which the revenue system allocates the cost of public operations among sectors of the private economy, the control of public resources to prevent waste and theft, and the creation and operation of systems to provide overall protection of assets in public control. 3

4 Economic Functions and the State In many respects, these tasks closely follow those practiced in the financial management of a private business. Managers try to protect and to add to the value of the private firm by judicious allocation and control of that firm's resources. Differences emerge because the nature of goods and services practiced in private markets-the domain of private financial management-is fundamentally different from that of the public sector, which causes the terms of the resource constraints faced, the ownership of goods and services, and the objectives of private and public managers to differ. Many tools and skills are, however; substantially transferrable between the sectors. 4

5 Sensing Public Financial Management Financial management is, arguably, the most important part of the internal management of government. Any activity of government needs money in order to operate; indeed the ability to raise taxation and to spend it is what sets the institution of government apart from other parts of society. Raising and spending money are not narrow, technical operations for any government. The use of money determines the very nature and extent of government activity, as well as the winners and losers in the political competition for financial favors. A party or group in government has access to the government’s taxation revenues to spend; a loser has nothing. With the increasing pressures on government both to provide services and to contain or reduce its costs, the budgetary process has become a crucial battleground, one which exists within the bureaucracy no less than in the community at large.

6 Sensing Public Financial Management Financial management is as old as government. It is a critical management function that fuels the engine of public administration, and it is the only function that touches every employee in an organization. In broad terms, public financial management consists of three main concerns: (1) determining fiscal policies, a process in which community or political leaders identify the general programs and authorize appropriations to get them implemented (problems such as employment, taxation, inflation, revenue raising, and borrowing or deficit financing); (2) ensuring accountability, so that public funds are spent honestly and wisely for the purpose duly authorized by the public at large; and (3) providing the required organizational structures and controls to effectively carry out the fiscal duties and responsibilities.

7 Public Financial Management Process The financial management process consists of the following components: 1. Planning identifies the goals and objectives that a government unit or agency determines that it will pursue at some specified time in the future. 2. Programming identifies and selects the activities that will achieve the plans outlined in terms of stated goals and objectives. 3. Financing involves securing and raising funds (creating a pool of financial resources) necessary to carry out identified programs and activities. 4. Budgeting requires that plans (long or short range), policies, and priorities be reduced to specific courses of action and that the level of funding be specifically identified within a defined period of time such as the work plan for a one-year period. 7

8 Public Financial Management Process 5. Controlling attempts to ensure that programs and activities are carried out as planned, programmed, and budgeted and that activities are executed according to established work plans. This phase subsumes the accounting function, measuring the activities in monetary terms, recording, ordering, reporting, and analyzing information about financial resources. 6. Evaluating measures, tests, and judges the appropriateness, utility, and congruence between the stated and achieved goals. It attempts to assess the extent to which programs and activities that have been properly planned, programmed, budgeted, implemented, and controlled have achieved the stated goals and objectives. 8

9 Nature of Financial Management Financial management plays a critical role in every business enterprise. Without money and its successful management, a firm would not survive much less grow and prosper. In today’s rapidly changing business environment, financial management is more complex than in any time in history. In attempting to define financial management one of the first problems we encounter is that of terminology. Confusingly, as so often the case in finance and accounting, multiple terms can be used to describe the same thing. For example, financial management is alternatively called, ‘business finance’, ‘managerial finance’, and ‘corporate finance’. 9

10 Nature of Financial Management All of these terms refer to the management of the essential investing and financing activities which business firms must undertake to produce the goods and services which people require. One possible definition of financial management is simply: ‘the ways and means of managing money’. A more formal definition would be: Financial Management is an integrated decision-making process concerned with determining, acquiring, allocating, and utilizing financial resources, usually with the aim of achieving some particular goals or objectives. 10

11 Goals of Successful Companies 1. All successful companies identify, create, and deliver products or services that are highly valued by customers, so highly valued that customers choose to purchase them from the company rather than from its competitors. This happens only if the company provides more value than its competitors, either in the form of lower prices or better products. 2. All successful companies sell their products/services at prices that are high enough to cover costs and to compensate owners and creditors for their exposure to risk. In other words, it’s not enough just to win market share and to show a profit. The profit must be high enough to adequately compensate investors.

12 Key Attributes of Successful Companies First, successful companies have skilled people at all levels inside the company, including (1) leaders who develop and articulate sound strategic visions; (2) managers who make value-adding decisions, design efficient business processes, and train and motivate work forces; and (3) a capable work force willing to implement the company’s strategies and tactics. Second, successful companies have strong relationships with groups that are outside the company. For example, successful companies develop win-win relationships with suppliers, who deliver high-quality materials on time and at a reasonable cost. Successful companies also develop strong relationships with their customers, leading to repeat sales, higher profit margins, and lower customer acquisition costs.

13 Key Attributes of Successful Companies Third, successful companies have sufficient capital to execute their plans and support their operations. For example, most growing companies must purchase land, buildings, equipment, and materials. To make these purchases, companies can reinvest a portion of their earnings, but must also raise additional funds externally, by some combination of selling stock or borrowing from banks and other creditors. In a nutshell, these companies reduce costs by having innovative production processes, they create value for customers by providing high-quality products and services, and they create value for employees through training and fostering an environment that allows employees to utilize all of their skills and talents

14 Corporate Forms of Business Orgs. Most principles and concepts underlying financial management apply across the three major forms of business organization: Sole proprietorship: a business owned and controlled by a single person. Partnership: a business owned by two or more individuals. Corporation: a legal entity separate and distinct from its owners. A sole proprietorship is an unincorporated business owned by one individual. Going into business as a sole proprietor is easy—one merely begins business operations. However, even the smallest businesses normally must be licensed by a governmental unit. 14

15 Corporate Forms of Business Orgs. The proprietorship has three important advantages: (1) It is easily and inexpensively formed, (2) it is subject to few government regulations, and (3) the business avoids corporate income taxes. The proprietorship also has three important limitations: (1) It is difficult for a proprietorship to obtain large sums of capital; (2) The proprietor has unlimited personal liability for the business’s debts, which can result in losses that exceed the money he or she has invested in the company; and (3) The life of a business organized as a proprietorship is limited to the life of the individual who created it. For these three reasons, sole proprietorships are used primarily for small-business operations. 15

16 Corporate Forms of Business Orgs. A partnership exists whenever two or more persons associate to conduct a non-corporate business. Partnerships may operate under different degrees of formality, ranging from informal, oral understandings to formal agreements The major advantage of a partnership is its low cost and ease of formation. The disadvantages are similar to those associated with proprietorships: (1) unlimited liability, (2) limited life of the organization, (3) difficulty of transferring ownership, and (4) difficulty of raising large amounts of capital. The tax treatment of a partnership is similar to that for proprietorships, which is often an advantage. 16

17 Corporate Forms of Business Orgs. Regarding liability, the partners can potentially lose all of their personal assets, even assets not invested in the business, because under partnership law, each partner is liable for the business’s debts. Therefore, if any partner is unable to meet his or her pro rata liability in the event the partnership goes bankrupt, the remaining partners must make good on the unsatisfied claims, drawing on their personal assets to the extent necessary. The first three disadvantages—unlimited liability, impermanence of the organization, and difficulty of transferring ownership—lead to the fourth, the difficulty partnerships have in attracting substantial amounts of capital. 17

18 Corporate Forms of Business Orgs. This is generally not a problem for a slow-growing business, but if a business’s products or services really catch on, and if it needs to raise large amounts of capital to capitalize on its opportunities, the difficulty in attracting capital becomes a real drawback. Thus, growth companies such as Hewlett-Packard and Microsoft generally begin life as a proprietorship or partnership, but at some point their founders find it necessary to convert to a corporation. A corporation is a legal entity created by a state, and it is separate and distinct from its owners and managers. This separateness gives the corporation three major advantages: (1) Unlimited life. A corporation can continue after its original owners and managers are deceased. 18

19 Corporate Forms of Business Orgs. (2) Easy transferability of ownership interest. Ownership interests can be divided into shares of stock, which, in turn, can be transferred far more easily than can proprietorship or partnership interests. (3) Limited liability: Losses are limited to the actual funds invested. For instance, if you invested $10,000 in the stock of a corporation that then went bankrupt, your potential loss on the investment would be limited to your $10,000 investment. These three factors—unlimited life, easy transferability of ownership interest, and limited liability—make it much easier for corporations than for proprietorships or partnerships to raise money in the capital markets. 19

20 Corporate Forms of Business Orgs. The value of any business other than a very small one will probably be maximized if it is organized as a corporation for these three reasons: 1. Limited liability reduces the risks borne by investors, and, other things held constant, the lower the firm’s risk, the higher its value. 2. A firm’s value depends on its growth opportunities, which, in turn, depend on the firm’s ability to attract capital. Because corporations can attract capital more easily than unincorporated businesses, they are better able to take advantage of growth opportunities. 3. The value of an asset also depends on its liquidity, which means the ease of selling the asset and converting it to cash at a “fair market value.” Because the stock of a corporation is much more liquid than a similar investment in a proprietorship or partnership, this too enhances the value of a corporation. 20

21 Corporate Forms of Business Orgs. Disadvantages of Corporations Cost and complexity to start. A corporation is more difficult and costly to set up than are other forms of business organization. In the United States, a corporation is incorporated in a specific state. Forming a corporation requires preparing a charter and a set of bylaws. Public corporations must incur the expense of preparing and disclosing information to their shareholders and various regulatory bodies. Double taxation. Unlike income from a sole proprietorship and general partnership, which is taxed once, income paid to owners is subject to double taxation. That is, the corporation pays taxes on taxable income and individual shareholders pay taxes on the income received. Separation of ownership and management. In many corporations, especially larger ones, managers and owners represent separate groups. Their interests may conflict. 21

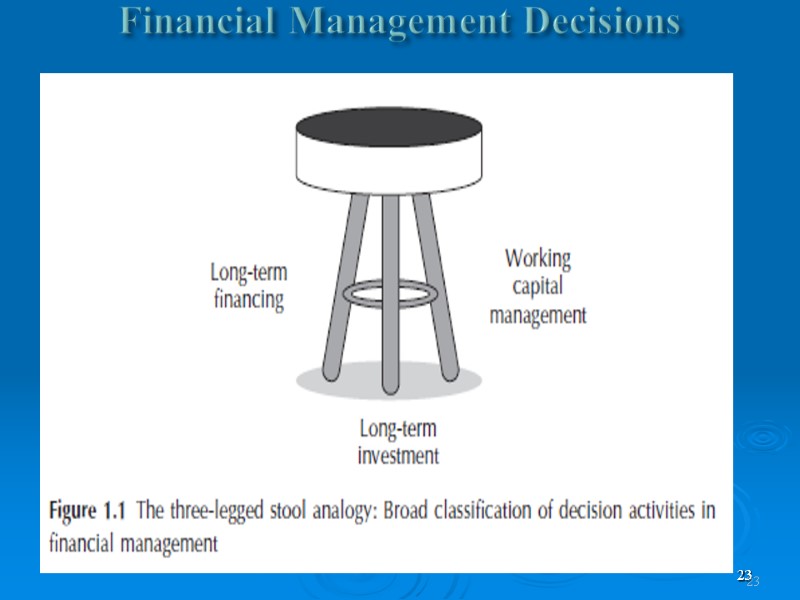

22 Financial Management Decisions Financial management involves three major types of decisions: (1) long-term investment decisions, (2) long-term financing decisions, and (3) working capital management decisions. These decisions concern the acquisition and allocation of resources among the firm’s various activities. The first two decisions are long term in nature and the third is short term. Managers should not consider these decisions on a piecemeal basis but as an integrated whole because they are seldom independent of one another. Investment decisions typically affect financing decisions and vice versa. For example, a decision to build a new plant or to buy new equipment requires other decisions on how to obtain the funds needed to finance the project and to manage the asset once acquired. 22

23 Financial Management Decisions 23

24 Investment Decisions Long-term investment decisions involve determining the type and amount of assets that the firm wants to hold. That is, investing concerns allocating or using funds. The financial manager makes investment decisions about all types of assets – items on the left-hand side of the balance sheet. These decisions often involve buying, holding, reducing, replacing, selling, and managing assets. The process of planning and managing a firm’s long-term investments is called capital budgeting. Common questions involving long-term investments include: • In what lines of business should the firm engage? • Should the firm acquire other companies? • What sorts of property, plant, and equipment should the firm hold? 24

25 Investment Decisions • Should the firm modernize or sell an old production facility? • Should the firm introduce a more efficient distribution system than the current one? As these examples show, investment decisions involve not only those that create revenues and profits, but also those that save money. The answers to these questions flow from the firm’s long-term investment strategy. Making investment decisions requires applying a key principle of financial management. The investment principle states that the firm should invest in assets and projects yielding a return greater than the minimum acceptable hurdle rate. A hurdle rate is the minimum acceptable rate of return for investing resources in a project. The financial manager should set the hurdle rate to reflect the riskiness of the project with higher hurdle rates for riskier projects. 25

26 Financing Decisions Long-term financing decisions involve the acquisition of funds needed to support long-term investments. Such decisions concern the firm’s capital structure, which is the mix of long-term debt and equity (value of assets after all liabilities or debts have been paid) the firm uses to finance its operations. These sources of financing are shown on the right-hand side of the balance sheet. Firms have much flexibility in choosing a capital structure.Typical financing questions facing the financial manager include: • Does the type of financing used make a difference? • Is the existing capital structure the right one? • How and where should the firm raise money? • Should the firm use funds raised through its revenues? • Should the firm raise money from outside the business? • If the firm seeks external financing, should it bring in other owners or borrow the money? 26

27 Finnacing Decisions The financial manager can obtain the needed funds for its investments and operations either internally or externally. Internally generated funds represent the amount of earnings that the firm decides to retain after paying a cash dividend, if any, to its stockholders. According to the dividend principle, a firm should return cash to the owners if there are not enough investments that earn the hurdle rate. For publicly traded firms, a firm has the option of returning cash to owners either through dividends or stock repurchases. The form of return depends largely on the characteristics of the firm’s stockholders. 27

28 Finnacing Decisions If the firm decides to raise funds externally, the financial manager can do so by incurring debts, such as through bank loans or the sale of bonds, or by selling ownership interests through a stock offering. The choice of financing method involves various tradeoffs. When making financing decisions, managers should keep the financing principle in mind. The financing principle states that the financial manager should choose a financing mix that maximizes the value of the investments made and matches the financing to the assets being financed. Matching the cash inflows from the assets being financed with the cash outflows used to finance these assets reduces the potential risk. 28

29 Working Capital Management Decisions involving a firm’s short-term assets and liabilities refer to working capital management. Net working capital is defined as current assets minus current liabilities. The financial manager has varying degrees of operating responsibility over current assets and liabilities. Some key questions that the financial manager faces involving working capital management include: • How much of a firm’s total assets should the firm hold in each type of current asset such as cash, marketable securities, and inventory? • How much credit should the firm grant to customers? • How should the firm obtain needed short-term financing? 29

30 Working Capital Management In summary, some of the more important concerns of financial management can be distilled into three questions: 1 What long-term investments should the firm undertake? (Investment decisions) 2 How should the firm raise money to fund these investments? (Financing decisions) 3 How should the firm manage its short-term assets and liabilities? (Working capital management decisions) These decisions affect a firm’s success and ultimately the overall economy. For example, misallocation of resources can affect a company’s prospects of survival and growth and can be detrimental to the economy as a whole. 30

31 Risk-Return Tradeoff At the heart of most financial decisions is the concern about two specific factors: risk and return. An underlying assumption of finance is that investors should demand compensation for bearing risk. According to the concept of risk aversion, investors should expect a higher return for taking on higher levels of risk. Although considerable debate exists over the precise model for estimating risk and return, few contest the notion of a risk–return tradeoff. When making financial decisions, managers should assess the potential risk and rewards associated with these decisions. In fact, the foundation for maximizing shareholder wealth lies in understanding tradeoffs between risk and return. 31

32 The Goal of Financial Management To make effective decisions, the financial manager needs a clear objective or goal to serve as a standard for evaluating performance and deciding between alternative courses of actions. Without such a criterion, the financial manager would be unable to keep score –that is, to measure better from worse. Although much division of opinion exists on the goal of financial management, two leading contenders are stakeholder theory and value (wealth) maximization. Stakeholder theory is the main contender to value maximization as the corporate goal. Stakeholder theory asserts that managers should make decisions that take into account the interests of all of a firm’s stakeholders. 32

33 The Goal of Financial Management Such stakeholders include not only financial claimholders but also employees, managers, customers, suppliers, local communities, and the government. The major problem with stakeholder theory is that it involves multiple objectives. Telling the financial manager to maximize multiple objectives, some of which may be conflicting, would leave that manager with no way to make a reasoned decision. That is, corporate managers cannot effectively serve many masters. Purposeful behavior requires the existence of a single-valued objective function. 33

34 The Goal of Financial Management Value or Wealth Maximization- Most corporate financial theorists agree that the primary corporate goal is to maximize long-term firm value or wealth. From the stockholders’ perspective, a good management decision would lead to an increase in the value of the stock. This is because investors generally prefer more wealth to less. Thus, the financial goal of the firm is to maximize shareholder wealth as reflected in the market price of the stock. The term shareholders refers to the firm’s current owners or stockholders. 34

35 The Goal of Financial Management In practice, this goal means that the financial manager can best serve business owners by identifying goods and services that add value to the firm because the marketplace desires and values the firm’s offerings. This single-valued objective serves as a prerequisite for rational behavior within an organization. In fact, maximizing shareholder wealth has become the premier business mantra. Shareholder wealth maximization rests on several assumptions. The corporate objective function assumes that managers operate in the best interests of stockholders, not themselves, and do not attempt to expropriate wealth from lenders to benefit stockholders. 35

36 The Goal of Financial Management Shareholder wealth maximization also assumes that managers do not take actions to deceive financial markets in order to boost the price of the firm’s stock. Another assumption is that managers act in a socially responsible manner and do not create unreasonable costs to society in pursuit of shareholder wealth maximization. This implies that the financial manager should not take illegal or unethical actions to increase the value of the equity owners. Given these assumptions, shareholder wealth maximization is consistent with the best interests of stakeholders and society in the long run. 36

37 Accounting versus Economic Profit Accounting profit is the difference between revenues and usually only explicit costs, recorded according to accounting principles. Explicit costs are measurable costs of doing business. Typical explicit costs include operating expenses such as cost of goods sold. Accounting costs generally do not include implicit costs, which are the returns the employed resource would have earned in its next best use. Implicit costs include opportunity costs associated with a firm’s equity, costs of assets used in production, and owner-provided services. For example, the opportunity cost of equity capital is the implied rate of return that investors could earn by investing these funds elsewhere. 37

38 Accounting versus Economic Profit Economic profit is the difference between revenues and total costs (explicit and implicit costs, including the normal rate of return on capital). Normal profit is the minimum rate of return that investors are willing to accept for taking the risks of investment. By earning revenues in excess of its total costs, the firm has an economic profit. When revenues equal total costs, economic profit is zero. This does not mean, however, that investors are receiving no returns. Instead, investors are getting a return that provides the appropriate compensation for bearing the risk of the investment. When accounting profit is zero, investors would be better off investing elsewhere because they are not recovering their full costs. 38

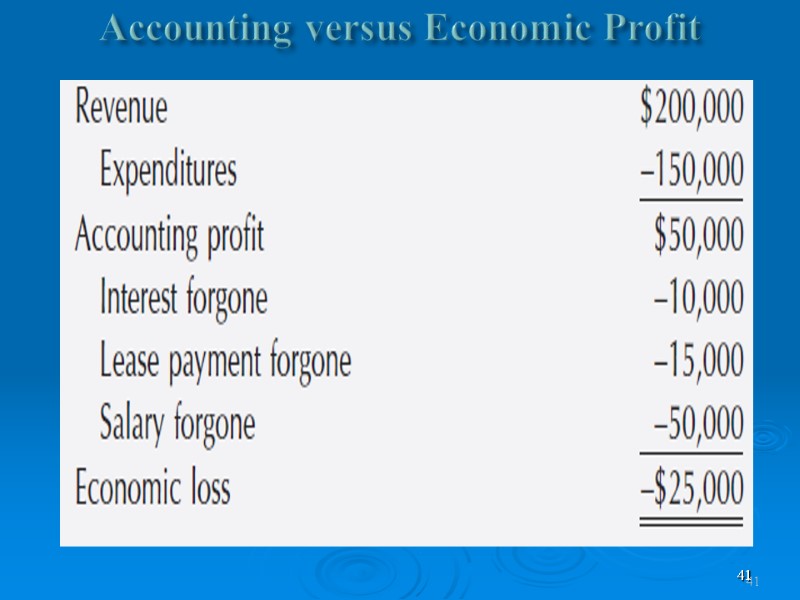

39 Accounting versus Economic Profit Because accounting profit ignores implicit costs, accounting profit is generally higher than economic profit. By maximizing economic profit, the financial manager can maximize shareholder wealth. Suppose an entrepreneur has $100,000 in cash and also owns a small building. This individual uses the cash to start a new venture and the building as a place of business. During the next year, the business generates $200,000 in sales revenues and incurs $150,000 in operating expenditures. 39

40 Accounting versus Economic Profit The entrepreneur does not take any salary. Instead of opening the business, the entrepreneur’s next best opportunities were to invest the cash elsewhere and earn $10,000, lease the building for $15,000, and take a job paying $50,000 for the year. Has this entrepreneur made a profit? Solution: The answer depends on the type of profit under consideration. From an accounting standpoint, the entrepreneur earned a profit because revenues exceed costs by $50,000. After factoring in less obvious costs such as opportunity costs, the entrepreneur actually experienced an economic loss. 40

41 Accounting versus Economic Profit 41

7366-lecture-1-economic_functions_of_the_state.ppt

- Количество слайдов: 41