Profit repatriation.pptx

- Количество слайдов: 21

1 PROFIT REPATRIATION IN CHINA Бизнес и предпринимательство в странах Азии 2017 Сучкова Александра, Намсараева Норжима, Птичкина Анастасия

2 For foreign companies with subsidiaries in China, repatriating profit from their subsidiaries has always been an important and challenging issue China maintains a strict system of foreign exchange controls, meaning funds flowing into and out of China are tightly regulated. It is important foreign investors to incorporate a profit repatriation strategy into the set-up planning of a subsidiary in China to ensure its ability to access the profits earned and to achieve significant cost savings.

3 1. Company’s China-based entity pays dividends WAYS TO REPATRIATE PROFIT FROM CHINA directly to its foreign parent company. BUT: only profits that have undergone annual audit can be repatriated, and the gross profit will be subject to 25 percent CIT (Corporate Income Tax). Dividends are subject to a further 10 percent withholding CIT when distributed to foreign investors.

4 WAYS TO REPATRIATE PROFIT FROM CHINA ü FIE (Foreign Invested Enterprise) can only distribute dividends out of its accumulated profits (and its prior accumulated losses must be more than offset by its profits in other years, including the current year). ü An FIE its prior accumulated losses must be more than offset by its profits in other years, including the current year

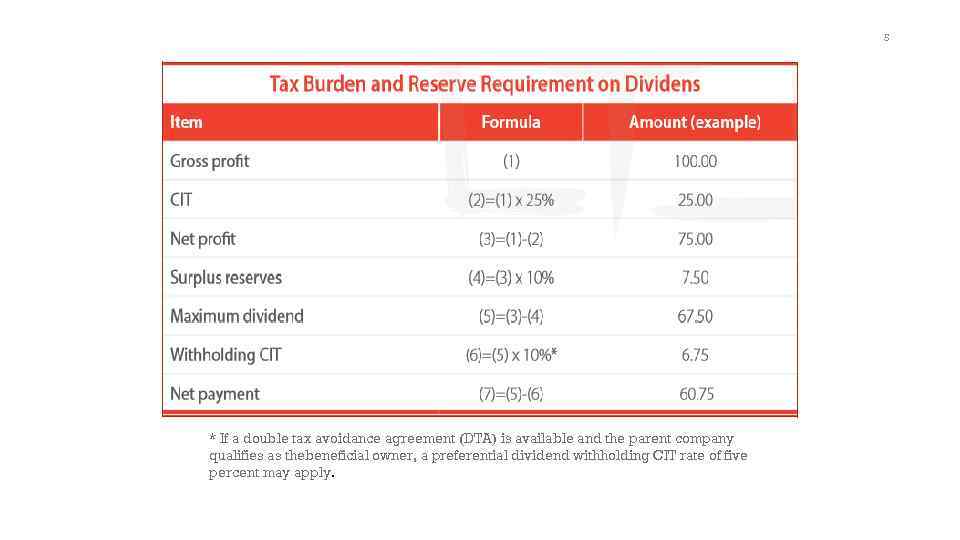

5 * If a double tax avoidance agreement (DTA) is available and the parent company qualifies as thebeneficial owner, a preferential dividend withholding CIT rate of five percent may apply.

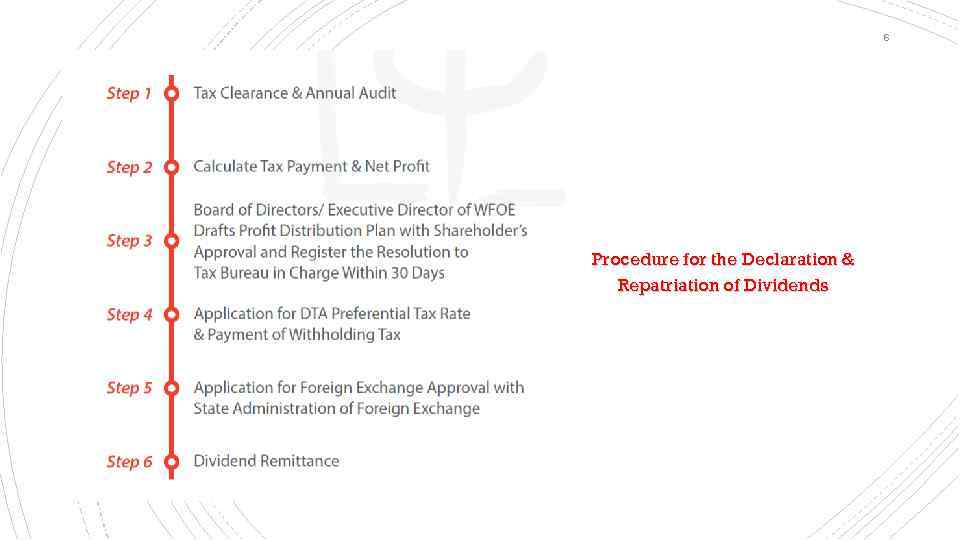

6 Procedure for the Declaration & Repatriation of Dividends

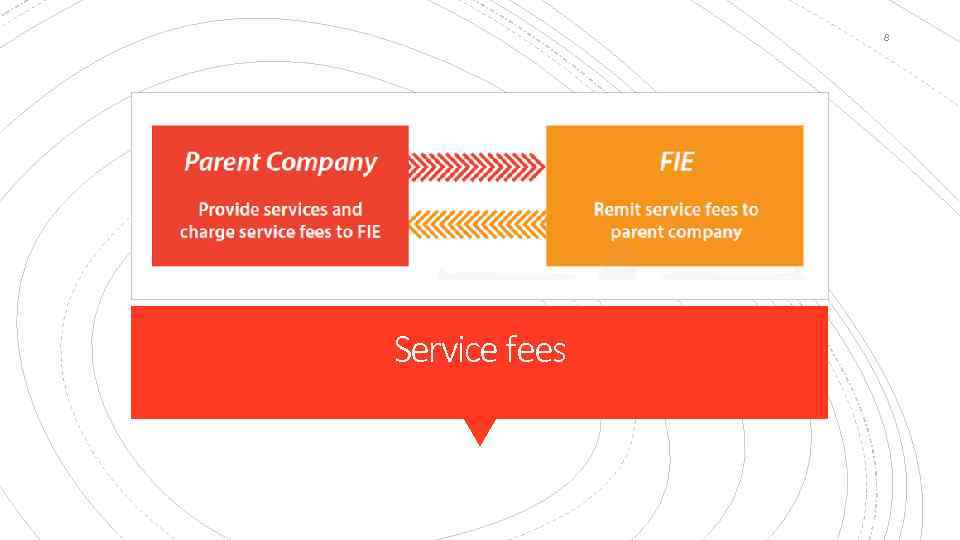

7 Many multinational corporations have adopted certain implicit policies, such as minimizing their profits in China in a legitimate manner via intercompany payments (i. e. charging their Chinese entity royalty or service fees); These transactions will be subject to turnover tax, and possible withholding CIT (Corporate Income Tax), the fees are deductible from the CIT taxable income and thus are exempt from the 25 percent CIT, resulting in significant cost savings.

8 Service fees

9 § Service fees paid to overseas related parties are deductible for CIT purposes provided they are directly related to the FIE’s business operations and charged at normal market rates - the service charges between a parent company and its China subsidiary must be based on an arm’s length principle. Further, all applicable taxes must have been withheld.

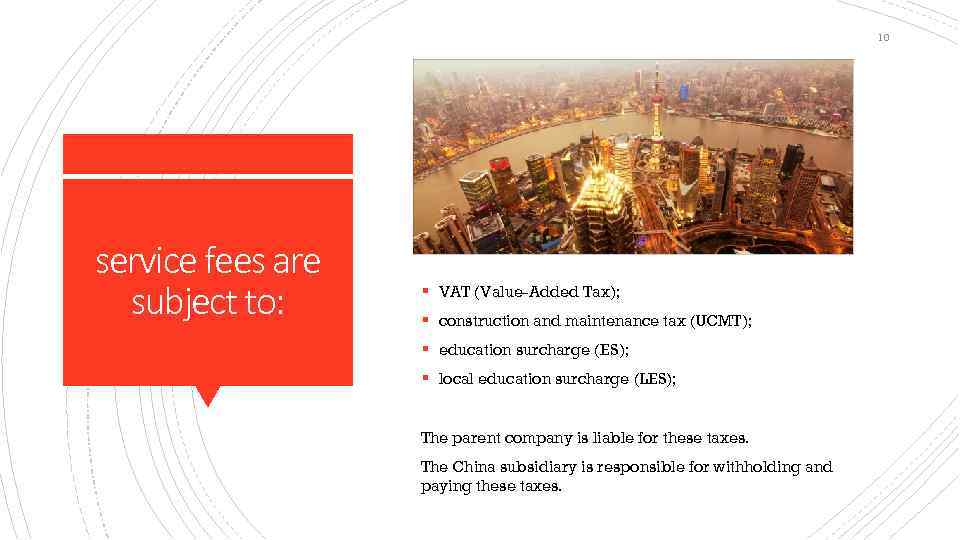

10 service fees are subject to: § VAT (Value-Added Tax); § construction and maintenance tax (UCMT); § education surcharge (ES); § local education surcharge (LES); The parent company is liable for these taxes. The China subsidiary is responsible for withholding and paying these taxes.

11 After the VAT reform, VAT rates are: § 6% - the most common rate § 11% § 17% *depending on the service If the FIE is a VAT general taxpayer, it will be able to deduct VAT paid against output VAT incurred in its business operations.

12 Services rendered outside China are exempt from CIT (but are still subject to VAT). The Chinese company should specify the offshore services that it received in the relevant service agreements and be prepared to clarify the nature of the services. If the services are (or deemed to be) provided in China, the service fees will be subject to CIT at 25% on the deemed profit rate of 15 -50%, unless a CIT exemption applies under a DTA.

13 § Under most DTAs signed between China and other countries/regions, the provision of services in China by a foreign enterprise overseas will, constitute a permanen; establishment (PE) if such activities continue for a period of more than 183 days within any 12 -month period; § If the headquarter (HQ) is deemed to have a PE in China, a 25 percent CIT is payable on the service income; § Tax compliance burden for a PE is heavier than for a non-PE; the Chinese subsidiary and HQ should carefully manage contracts and related projects in China.

14 It is important to note that the tax officer always has the right to call into question the legitimacy of a service agreement. The taxpayer should be prepared to provide further evidence, including a detailed service agreement to clarify the nature of the services provided. 你有钱吗 ?

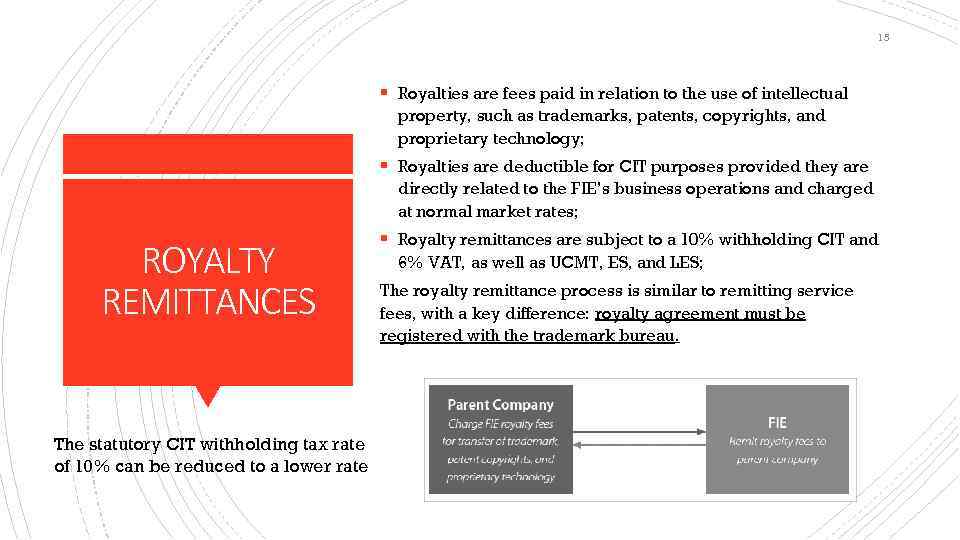

15 § Royalties are fees paid in relation to the use of intellectual property, such as trademarks, patents, copyrights, and proprietary technology; § Royalties are deductible for CIT purposes provided they are directly related to the FIE’s business operations and charged at normal market rates; ROYALTY REMITTANCES The statutory CIT withholding tax rate of 10% can be reduced to a lower rate § Royalty remittances are subject to a 10% withholding CIT and 6% VAT, as well as UCMT, ES, and LES; The royalty remittance process is similar to remitting service fees, with a key difference: royalty agreement must be registered with the trademark bureau.

16 When services fees are deemed to be royalties The Notice of the State Administration of Taxation on Issues Relevant to the Execution of the Royalty Clauses of Tax Treaties (Guo Shui Han [2009] No. 507), where the service provider uses certain expertise and technologies in the provision of services under a service contract, but does not transfer or license such technologies, then such services shall not fall under the scope of royalties. The results of the provision of services fall under the scope of definition of royalties under a DTA (Direct Transfer Agreement) then the service recipient shall merely have use rights for such results and the service fees derived shall be deemed as royalties.

17 If, in the course of the transfer or licensing of technical know-how, a licensor assigns personnel to support and guide the licensee, then these service fees will be deemed as royalty fees. Accordingly, even if these services are provided offshore, they will be subject to VAT in addition to 10% CIT withholding tax.

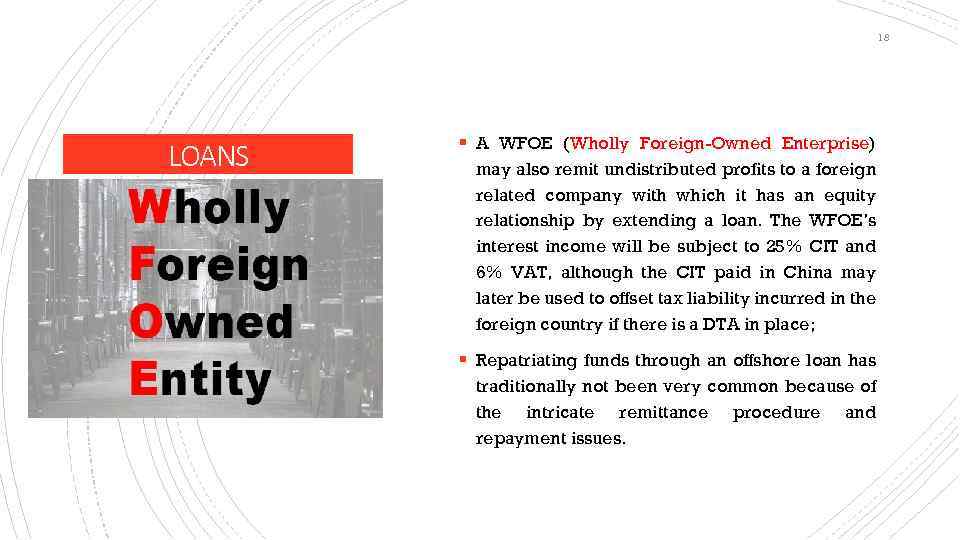

18 LOANS § A WFOE (Wholly Foreign-Owned Enterprise) may also remit undistributed profits to a foreign related company with which it has an equity relationship by extending a loan. The WFOE’s interest income will be subject to 25% CIT and 6% VAT, although the CIT paid in China may later be used to offset tax liability incurred in the foreign country if there is a DTA in place; § Repatriating funds through an offshore loan has traditionally not been very common because of the intricate remittance procedure and repayment issues.

19 § The situation has changed since WFOEs may now apply for longer-term offshore loans according to their business needs. the promulgation of the Hui Fa [2014] No. 2 (Circular 2) by SAFE in January 2014. Under Circular 2, offshore lending is limited to 30% of the owner’s equity in a Chinese WFOE unless special approval has been obtained from SAFE.

20 References Tax, Accounting and Audit in China, 2017 (9 th Edition). Ltd, Asia Briefing 2017. pp. 100 -107.

21 Thank you for your attention!

Profit repatriation.pptx