979c1270c0a03c2526856889047442eb.ppt

- Количество слайдов: 15

1 Privatisations The French and the Swedish perspectives Sharing experiences … Stockholm Thursday, March 29 2007

1 Privatisations The French and the Swedish perspectives Sharing experiences … Stockholm Thursday, March 29 2007

Proposed Agenda l Privatisations in France in a historical perspective l Privatisation routes applied by the French government l Role of Investment Banks l Some examples of recent French privatisations 2

Proposed Agenda l Privatisations in France in a historical perspective l Privatisation routes applied by the French government l Role of Investment Banks l Some examples of recent French privatisations 2

Privatisations in France – Historical perspective l Build-up of portfolio of public companies n Nationalisations in the 1930’s, in 1944 -46 and in the early 1980’s n Creation of government controlled companies l l Airports, Motorways, Nuclear industry etc. Launch of privatisation initiative in the mid-1980’s n 1986 – 88: Launch of privatisation process l n 1988 – 93: Some minor privatisations, but programme essentially on hold l n Rhône-Poulenc, BNP, Renault, Elf Aquitaire, AGF etc. 1997 – 2002: Selective privatisations l n Péchiney, AGF, Total etc. 1993 – 97: Re-launch of privatisation initiative l n Saint-Gobain, Alcatel, TFI, Paribas, Suez, Société Générale etc. France Telecom, Air France, Aérospatiale, Thales etc. 2002 onwards l Ed. F, Gd. F, Aéroports de Paris, Autoroutes du Sud de la France (ASF) etc. l Around € 54 bn raised in the market since the beginning of the current programme 3

Privatisations in France – Historical perspective l Build-up of portfolio of public companies n Nationalisations in the 1930’s, in 1944 -46 and in the early 1980’s n Creation of government controlled companies l l Airports, Motorways, Nuclear industry etc. Launch of privatisation initiative in the mid-1980’s n 1986 – 88: Launch of privatisation process l n 1988 – 93: Some minor privatisations, but programme essentially on hold l n Rhône-Poulenc, BNP, Renault, Elf Aquitaire, AGF etc. 1997 – 2002: Selective privatisations l n Péchiney, AGF, Total etc. 1993 – 97: Re-launch of privatisation initiative l n Saint-Gobain, Alcatel, TFI, Paribas, Suez, Société Générale etc. France Telecom, Air France, Aérospatiale, Thales etc. 2002 onwards l Ed. F, Gd. F, Aéroports de Paris, Autoroutes du Sud de la France (ASF) etc. l Around € 54 bn raised in the market since the beginning of the current programme 3

The French government has applied different privatisation routes l The stock exchange routes n Stock exchange listing n Sale of shares in companies already listed on the stock exchange l l l Accelerated bookbuilding Marketed offerings The M&A routes n Disposal of stakes in listed companies n Mergers n Full or partial divestments of non-listed companies 4

The French government has applied different privatisation routes l The stock exchange routes n Stock exchange listing n Sale of shares in companies already listed on the stock exchange l l l Accelerated bookbuilding Marketed offerings The M&A routes n Disposal of stakes in listed companies n Mergers n Full or partial divestments of non-listed companies 4

Key decision parameters and considerations for the choice of route? l Value considerations n n n l Stock market vs. M&A route (which route would maximise the value for the State? ) Full vs. partial exit - E. g. IPO to obtain market valuation followed by sale of majority shareholding to strategic investor (Motorways’ cases for example ) Timing: Market conditions at the time the company is ready for privatisation Industrial considerations n n l Creation of larger entities better positioned to compete in a global environment Anti-trust issues Political considerations n Employment issues n Perception among the public n Process transparency 5

Key decision parameters and considerations for the choice of route? l Value considerations n n n l Stock market vs. M&A route (which route would maximise the value for the State? ) Full vs. partial exit - E. g. IPO to obtain market valuation followed by sale of majority shareholding to strategic investor (Motorways’ cases for example ) Timing: Market conditions at the time the company is ready for privatisation Industrial considerations n n l Creation of larger entities better positioned to compete in a global environment Anti-trust issues Political considerations n Employment issues n Perception among the public n Process transparency 5

Role of Investment Banks? l Advisor to the Government l Advisor to the Company l Advisor to Buyers in the context of trade sales l In case of an IPO, the advisory mandate includes: n n l Structure of the entity to be listed and transfer from a public status to a ”private like status” Preparation and execution of the market offering (Global coordinator / Bookrunner) In case of market disposal of stakes in listed companies, the advisory mandate includes: n Evaluation of best timing and market technique (accelerated bookbuilding versus marketed offering for example) n Underwriting n Distribution 6

Role of Investment Banks? l Advisor to the Government l Advisor to the Company l Advisor to Buyers in the context of trade sales l In case of an IPO, the advisory mandate includes: n n l Structure of the entity to be listed and transfer from a public status to a ”private like status” Preparation and execution of the market offering (Global coordinator / Bookrunner) In case of market disposal of stakes in listed companies, the advisory mandate includes: n Evaluation of best timing and market technique (accelerated bookbuilding versus marketed offering for example) n Underwriting n Distribution 6

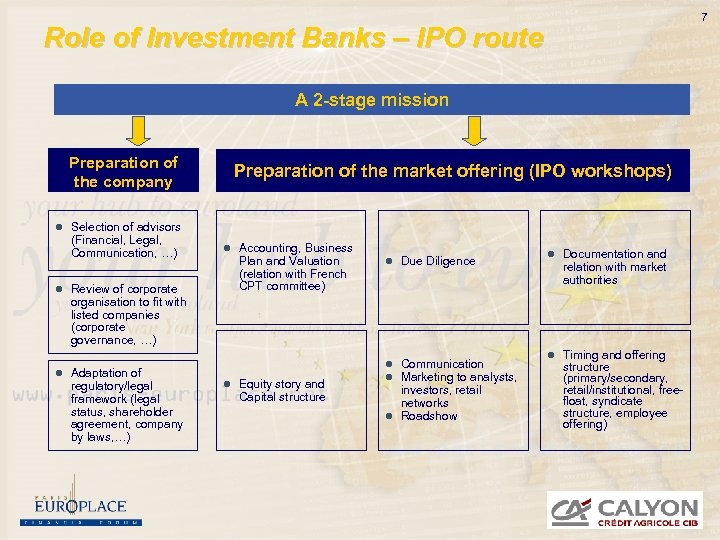

7 Role of Investment Banks – IPO route A 2 -stage mission Preparation of the company Preparation of the market offering (IPO workshops) l Selection of advisors (Financial, Legal, Communication, …) l Review of corporate l Accounting, Business Plan and Valuation (relation with French CPT committee) l Due Diligence l Documentation and relation with market authorities organisation to fit with listed companies (corporate governance, …) l Adaptation of regulatory/legal framework (legal status, shareholder agreement, company by laws, …) l Equity story and Capital structure l Communication l Marketing to analysts, investors, retail networks l Roadshow l Timing and offering structure (primary/secondary, retail/institutional, freefloat, syndicate structure, employee offering)

7 Role of Investment Banks – IPO route A 2 -stage mission Preparation of the company Preparation of the market offering (IPO workshops) l Selection of advisors (Financial, Legal, Communication, …) l Review of corporate l Accounting, Business Plan and Valuation (relation with French CPT committee) l Due Diligence l Documentation and relation with market authorities organisation to fit with listed companies (corporate governance, …) l Adaptation of regulatory/legal framework (legal status, shareholder agreement, company by laws, …) l Equity story and Capital structure l Communication l Marketing to analysts, investors, retail networks l Roadshow l Timing and offering structure (primary/secondary, retail/institutional, freefloat, syndicate structure, employee offering)

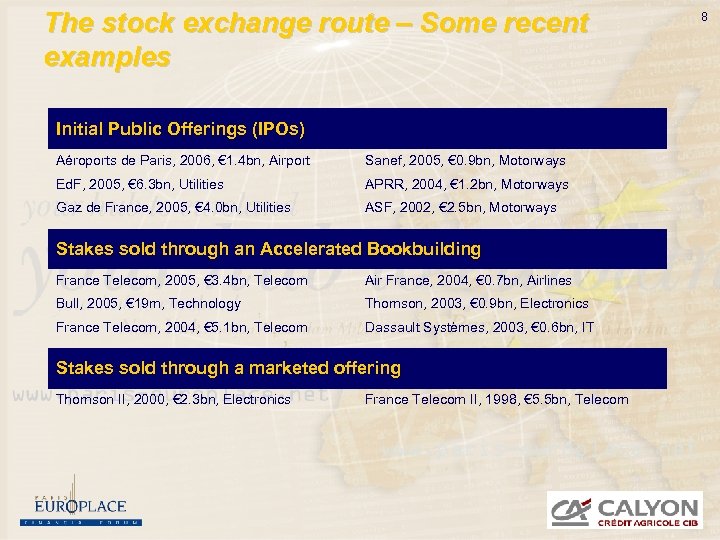

The stock exchange route – Some recent examples Initial Public Offerings (IPOs) Aéroports de Paris, 2006, € 1. 4 bn, Airport Sanef, 2005, € 0. 9 bn, Motorways Ed. F, 2005, € 6. 3 bn, Utilities APRR, 2004, € 1. 2 bn, Motorways Gaz de France, 2005, € 4. 0 bn, Utilities ASF, 2002, € 2. 5 bn, Motorways Stakes sold through an Accelerated Bookbuilding France Telecom, 2005, € 3. 4 bn, Telecom Air France, 2004, € 0. 7 bn, Airlines Bull, 2005, € 19 m, Technology Thomson, 2003, € 0. 9 bn, Electronics France Telecom, 2004, € 5. 1 bn, Telecom Dassault Systèmes, 2003, € 0. 6 bn, IT Stakes sold through a marketed offering Thomson II, 2000, € 2. 3 bn, Electronics France Telecom II, 1998, € 5. 5 bn, Telecom 8

The stock exchange route – Some recent examples Initial Public Offerings (IPOs) Aéroports de Paris, 2006, € 1. 4 bn, Airport Sanef, 2005, € 0. 9 bn, Motorways Ed. F, 2005, € 6. 3 bn, Utilities APRR, 2004, € 1. 2 bn, Motorways Gaz de France, 2005, € 4. 0 bn, Utilities ASF, 2002, € 2. 5 bn, Motorways Stakes sold through an Accelerated Bookbuilding France Telecom, 2005, € 3. 4 bn, Telecom Air France, 2004, € 0. 7 bn, Airlines Bull, 2005, € 19 m, Technology Thomson, 2003, € 0. 9 bn, Electronics France Telecom, 2004, € 5. 1 bn, Telecom Dassault Systèmes, 2003, € 0. 6 bn, IT Stakes sold through a marketed offering Thomson II, 2000, € 2. 3 bn, Electronics France Telecom II, 1998, € 5. 5 bn, Telecom 8

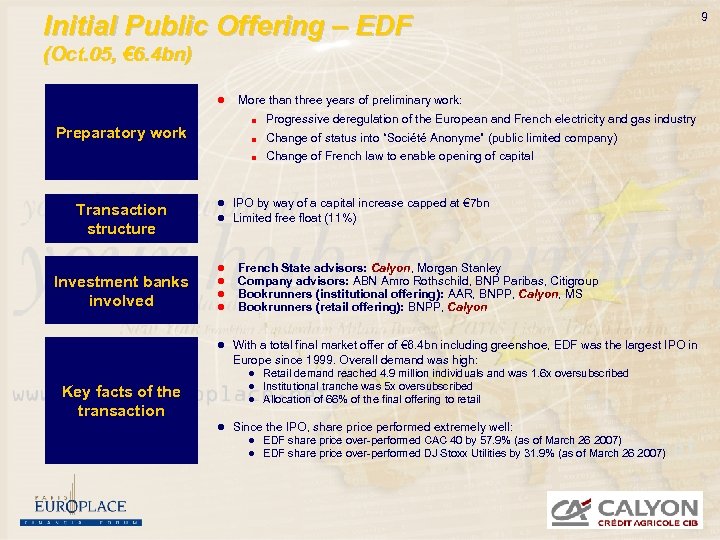

Initial Public Offering – EDF (Oct. 05, € 6. 4 bn) l More than three years of preliminary work: n n Transaction structure Investment banks involved Change of status into “Société Anonyme” (public limited company) n Preparatory work Progressive deregulation of the European and French electricity and gas industry Change of French law to enable opening of capital l IPO by way of a capital increase capped at € 7 bn l Limited free float (11%) l l French State advisors: Calyon, Morgan Stanley Company advisors: ABN Amro Rothschild, BNP Paribas, Citigroup Bookrunners (institutional offering): AAR, BNPP, Calyon, MS Bookrunners (retail offering): BNPP, Calyon l With a total final market offer of € 6. 4 bn including greenshoe, EDF was the largest IPO in Europe since 1999. Overall demand was high: Key facts of the transaction l Retail demand reached 4. 9 million individuals and was 1. 6 x oversubscribed l Institutional tranche was 5 x oversubscribed l Allocation of 66% of the final offering to retail l Since the IPO, share price performed extremely well: l EDF share price over-performed CAC 40 by 57. 9% (as of March 26 2007) l EDF share price over-performed DJ Stoxx Utilities by 31. 9% (as of March 26 2007) 9

Initial Public Offering – EDF (Oct. 05, € 6. 4 bn) l More than three years of preliminary work: n n Transaction structure Investment banks involved Change of status into “Société Anonyme” (public limited company) n Preparatory work Progressive deregulation of the European and French electricity and gas industry Change of French law to enable opening of capital l IPO by way of a capital increase capped at € 7 bn l Limited free float (11%) l l French State advisors: Calyon, Morgan Stanley Company advisors: ABN Amro Rothschild, BNP Paribas, Citigroup Bookrunners (institutional offering): AAR, BNPP, Calyon, MS Bookrunners (retail offering): BNPP, Calyon l With a total final market offer of € 6. 4 bn including greenshoe, EDF was the largest IPO in Europe since 1999. Overall demand was high: Key facts of the transaction l Retail demand reached 4. 9 million individuals and was 1. 6 x oversubscribed l Institutional tranche was 5 x oversubscribed l Allocation of 66% of the final offering to retail l Since the IPO, share price performed extremely well: l EDF share price over-performed CAC 40 by 57. 9% (as of March 26 2007) l EDF share price over-performed DJ Stoxx Utilities by 31. 9% (as of March 26 2007) 9

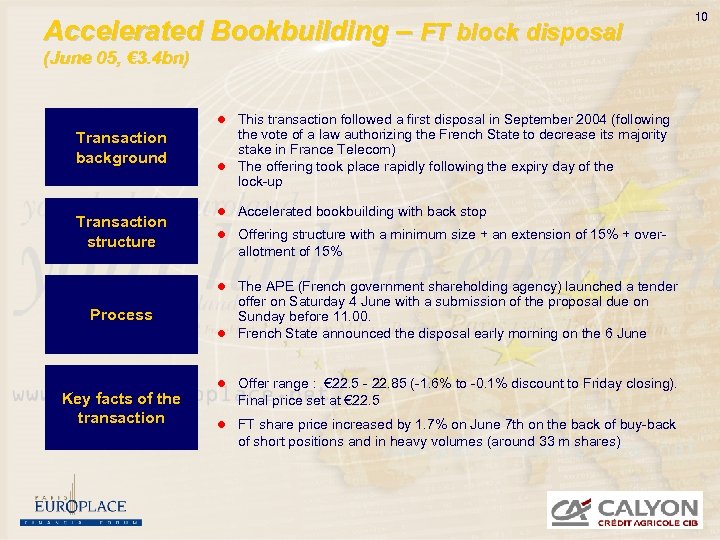

Accelerated Bookbuilding – FT block disposal (June 05, € 3. 4 bn) This transaction followed a first disposal in September 2004 (following the vote of a law authorizing the French State to decrease its majority stake in France Telecom) l The offering took place rapidly following the expiry day of the lock-up l Transaction background Transaction structure l Accelerated bookbuilding with back stop l Offering structure with a minimum size + an extension of 15% + overallotment of 15% The APE (French government shareholding agency) launched a tender offer on Saturday 4 June with a submission of the proposal due on Sunday before 11. 00. l French State announced the disposal early morning on the 6 June l Process Key facts of the transaction l Offer range : € 22. 5 - 22. 85 (-1. 6% to -0. 1% discount to Friday closing). Final price set at € 22. 5 l FT share price increased by 1. 7% on June 7 th on the back of buy-back of short positions and in heavy volumes (around 33 m shares) 10

Accelerated Bookbuilding – FT block disposal (June 05, € 3. 4 bn) This transaction followed a first disposal in September 2004 (following the vote of a law authorizing the French State to decrease its majority stake in France Telecom) l The offering took place rapidly following the expiry day of the lock-up l Transaction background Transaction structure l Accelerated bookbuilding with back stop l Offering structure with a minimum size + an extension of 15% + overallotment of 15% The APE (French government shareholding agency) launched a tender offer on Saturday 4 June with a submission of the proposal due on Sunday before 11. 00. l French State announced the disposal early morning on the 6 June l Process Key facts of the transaction l Offer range : € 22. 5 - 22. 85 (-1. 6% to -0. 1% discount to Friday closing). Final price set at € 22. 5 l FT share price increased by 1. 7% on June 7 th on the back of buy-back of short positions and in heavy volumes (around 33 m shares) 10

The stock exchange route – Key take-aways l Aim at sufficient liquidity at IPO to enable accelerated deals post lock -up, either through a capital increase or a disposal of a block of shares l Involve diversified set of banks at the time of the IPO with strong local commitment and recognised brokerage capabilities to ensure aftermarket performance of the shares l Retail demand is key to secure success, especially for landmark transactions 11

The stock exchange route – Key take-aways l Aim at sufficient liquidity at IPO to enable accelerated deals post lock -up, either through a capital increase or a disposal of a block of shares l Involve diversified set of banks at the time of the IPO with strong local commitment and recognised brokerage capabilities to ensure aftermarket performance of the shares l Retail demand is key to secure success, especially for landmark transactions 11

The M&A route – Some examples l Disposal of stakes in listed companies to industrial purchasers n n l Sale of a 50. 4% stake in ASF to Vinci in 2005 Sale of a 10. 9% stake in Crédit Lyonnais to BNP Paribas in 2002 Mergers n n l Merger of DCN with Thales Naval Services (pending) Merger of Suez with Gaz de France (pending) Full or partial divestments of non-listed companies n Sale of a 65% stake of SNET (coal thermal plants) in two tranches (2000 and 2004) to Endesa 12

The M&A route – Some examples l Disposal of stakes in listed companies to industrial purchasers n n l Sale of a 50. 4% stake in ASF to Vinci in 2005 Sale of a 10. 9% stake in Crédit Lyonnais to BNP Paribas in 2002 Mergers n n l Merger of DCN with Thales Naval Services (pending) Merger of Suez with Gaz de France (pending) Full or partial divestments of non-listed companies n Sale of a 65% stake of SNET (coal thermal plants) in two tranches (2000 and 2004) to Endesa 12

Privatisation of ASF: an example of value maximisation through a combination of the IPO and M&A routes l March 2002: IPO 49% of ASF, France’s #1 motorways operator n € 2. 6 bn offering @ € 25 per share n Institutions (56%), Retail Investors (40%) and Employees (4%) n Key aspects of the transaction : l l ASF leadership position in France and expertise in concessions l l Legal framework providing stable conditions Defensive characteristics of Toll Motorways 2004 -05: IPO of remaining French motorways operators n APRR and SANEF n Limitation of the free float (max 30%) to avoid unsolicited shareholders n Opportunity to float motorway companies with a high level of debt 13

Privatisation of ASF: an example of value maximisation through a combination of the IPO and M&A routes l March 2002: IPO 49% of ASF, France’s #1 motorways operator n € 2. 6 bn offering @ € 25 per share n Institutions (56%), Retail Investors (40%) and Employees (4%) n Key aspects of the transaction : l l ASF leadership position in France and expertise in concessions l l Legal framework providing stable conditions Defensive characteristics of Toll Motorways 2004 -05: IPO of remaining French motorways operators n APRR and SANEF n Limitation of the free float (max 30%) to avoid unsolicited shareholders n Opportunity to float motorway companies with a high level of debt 13

Privatisation of ASF: an example of value maximisation through a combination of the IPO and M&A routes (Cont’d) l July 2005: Divestment of remaining stakes in the 3 French motorways operators n n Vinci acquires the Government’s remaining 50. 4% stake in ASF n l Competitive process attracting numerous bidders Price: € 51 per share vs. € 25 at the time of the IPO Privatisation through an IPO followed by a sale of a block enabled the Government to maximise proceeds n Education of the financial community (financing / valuation) n Pricing reference obtained through stock market rating 14

Privatisation of ASF: an example of value maximisation through a combination of the IPO and M&A routes (Cont’d) l July 2005: Divestment of remaining stakes in the 3 French motorways operators n n Vinci acquires the Government’s remaining 50. 4% stake in ASF n l Competitive process attracting numerous bidders Price: € 51 per share vs. € 25 at the time of the IPO Privatisation through an IPO followed by a sale of a block enabled the Government to maximise proceeds n Education of the financial community (financing / valuation) n Pricing reference obtained through stock market rating 14

Involvement of Calyon in selected privatisations (2002 – to date) Advisor to French State ADP Advisor to French State Merger with Thales Naval Services Privatization of Sale of Alcatel’s satellite division to Thales Advisor to French State Initial Public Offering In its acquisition by Euro 1 658 m Euro 5 933 m Pending June 2006 April 2006 Advisor to Acquisition of a 16% stake in March 2006 November 2005 Advisor to CDC French State Initial Public Offering Charbonnages De France Disposal of For the disposal of 65% of EULIA SNET to to Euro 4 006 m June 2005 Euro 6 351 m Euro 1 110 m November 2004 Euro 3 100 m July 2004 Advisor to French State Kingdom of Morocco ASF Initial Public Offering Disposal of a 80% stake in Euro 1. 500 m Euro 1 673 m June 2004 June 2003 Initial Public Offering Euro 2. 633 m March 2002 (2000 – 2004) 15

Involvement of Calyon in selected privatisations (2002 – to date) Advisor to French State ADP Advisor to French State Merger with Thales Naval Services Privatization of Sale of Alcatel’s satellite division to Thales Advisor to French State Initial Public Offering In its acquisition by Euro 1 658 m Euro 5 933 m Pending June 2006 April 2006 Advisor to Acquisition of a 16% stake in March 2006 November 2005 Advisor to CDC French State Initial Public Offering Charbonnages De France Disposal of For the disposal of 65% of EULIA SNET to to Euro 4 006 m June 2005 Euro 6 351 m Euro 1 110 m November 2004 Euro 3 100 m July 2004 Advisor to French State Kingdom of Morocco ASF Initial Public Offering Disposal of a 80% stake in Euro 1. 500 m Euro 1 673 m June 2004 June 2003 Initial Public Offering Euro 2. 633 m March 2002 (2000 – 2004) 15