0c58a1acb0b78f5277c69a98c3e8649f.ppt

- Количество слайдов: 29

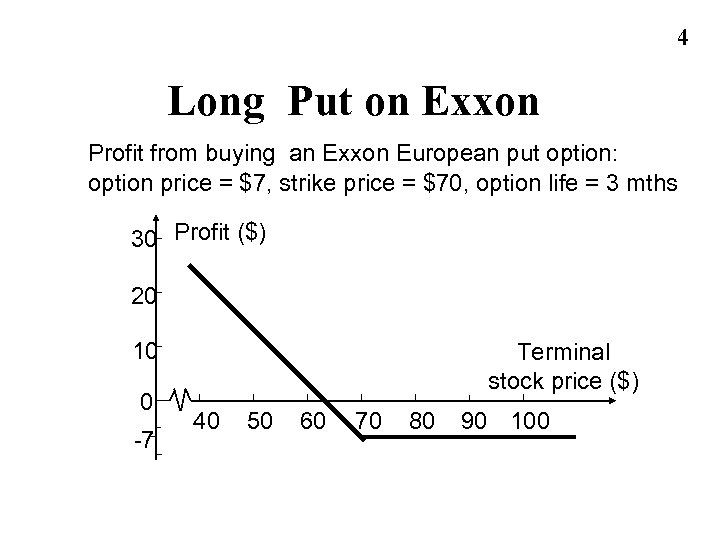

1 Options Lecture 3

1 Options Lecture 3

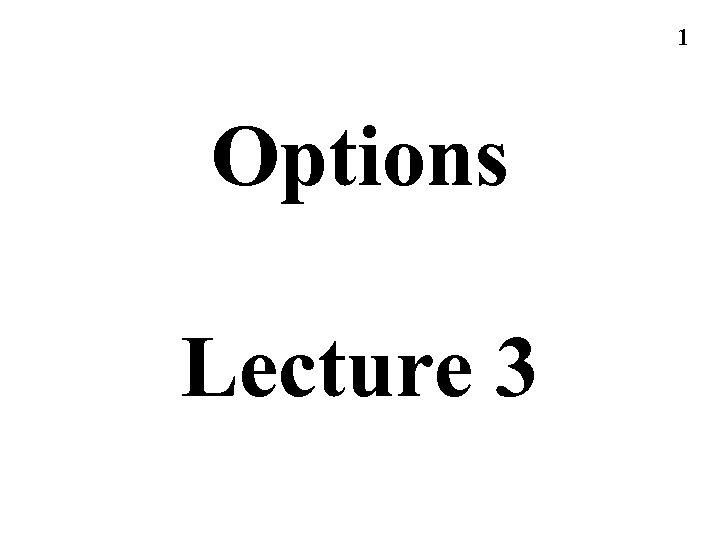

2 Long Call on IBM Profit from buying an IBM European call option: option price = $5, strike price = $100, option life = 2 months 30 Profit ($) 20 10 0 -5 70 80 90 100 Terminal stock price ($) 110 120 130

2 Long Call on IBM Profit from buying an IBM European call option: option price = $5, strike price = $100, option life = 2 months 30 Profit ($) 20 10 0 -5 70 80 90 100 Terminal stock price ($) 110 120 130

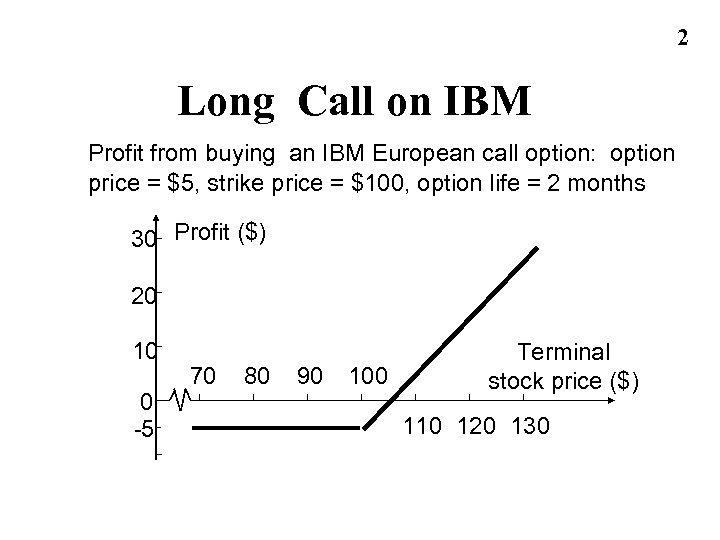

3 Short Call on IBM Profit from writing an IBM European call option: option price = $5, strike price = $100, option life = 2 months Profit ($) 5 0 -10 -20 -30 110 120 130 70 80 90 100 Terminal stock price ($)

3 Short Call on IBM Profit from writing an IBM European call option: option price = $5, strike price = $100, option life = 2 months Profit ($) 5 0 -10 -20 -30 110 120 130 70 80 90 100 Terminal stock price ($)

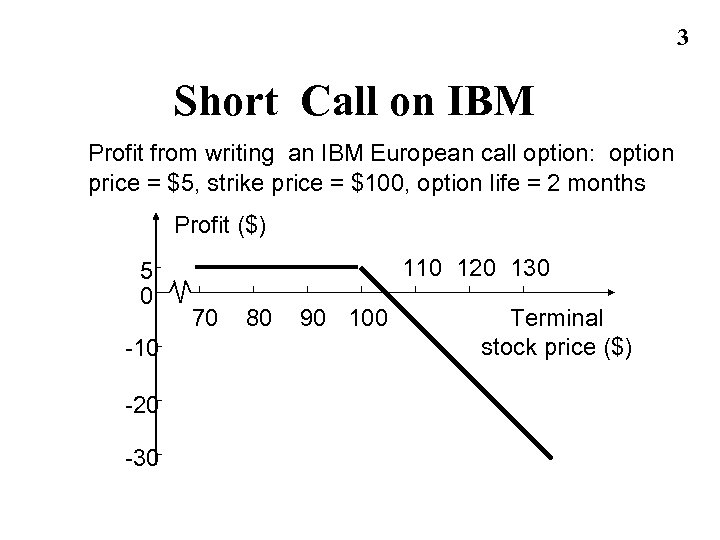

4 Long Put on Exxon Profit from buying an Exxon European put option: option price = $7, strike price = $70, option life = 3 mths 30 Profit ($) 20 10 0 -7 Terminal stock price ($) 40 50 60 70 80 90 100

4 Long Put on Exxon Profit from buying an Exxon European put option: option price = $7, strike price = $70, option life = 3 mths 30 Profit ($) 20 10 0 -7 Terminal stock price ($) 40 50 60 70 80 90 100

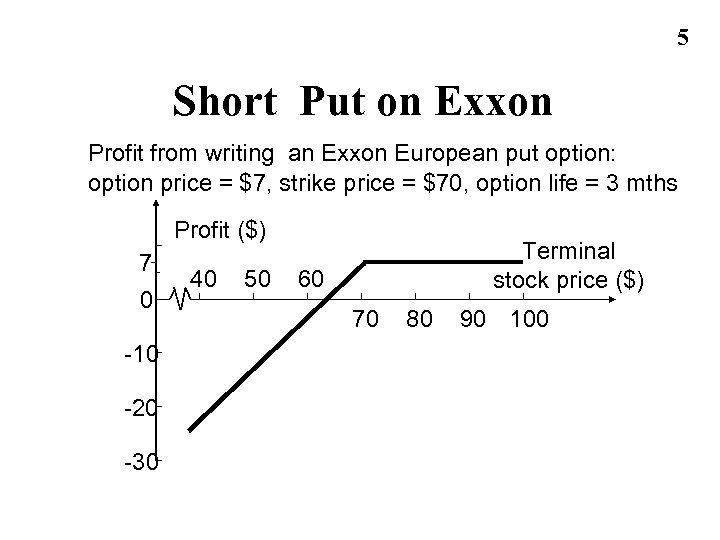

5 Short Put on Exxon Profit from writing an Exxon European put option: option price = $7, strike price = $70, option life = 3 mths Profit ($) 7 0 -10 -20 -30 40 50 Terminal stock price ($) 60 70 80 90 100

5 Short Put on Exxon Profit from writing an Exxon European put option: option price = $7, strike price = $70, option life = 3 mths Profit ($) 7 0 -10 -20 -30 40 50 Terminal stock price ($) 60 70 80 90 100

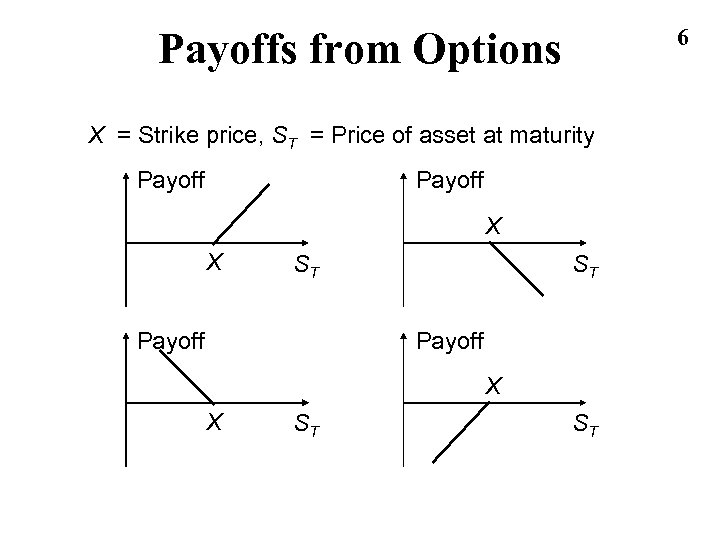

6 Payoffs from Options X = Strike price, ST = Price of asset at maturity Payoff X X ST ST

6 Payoffs from Options X = Strike price, ST = Price of asset at maturity Payoff X X ST ST

7 Terminology Moneyness : – At-the-money option – In-the-money option – Out-of-the-money option • • Expiration date Strike price European or American Call or Put (option class)

7 Terminology Moneyness : – At-the-money option – In-the-money option – Out-of-the-money option • • Expiration date Strike price European or American Call or Put (option class)

8 Types of Options • Exchange-traded options – Stocks – Foreign Currency – Stock Indices – Futures • • Warrants Convertible bonds swapoptions. .

8 Types of Options • Exchange-traded options – Stocks – Foreign Currency – Stock Indices – Futures • • Warrants Convertible bonds swapoptions. .

9 Warrants • Warrants are options that are issued (or written) by a corporation or a financial institution • The number of warrants outstanding is determined by the size of the original issue & changes only when they are exercised or when they expire

9 Warrants • Warrants are options that are issued (or written) by a corporation or a financial institution • The number of warrants outstanding is determined by the size of the original issue & changes only when they are exercised or when they expire

10 Warrants (continued) • Warrants are traded in the same way as stocks • When call warrants are issued by a corporation on its own stock, exercise will lead to new treasury stock being issued

10 Warrants (continued) • Warrants are traded in the same way as stocks • When call warrants are issued by a corporation on its own stock, exercise will lead to new treasury stock being issued

11 Executive Stock Options • Option issued by a company to executives • When the option is exercised the company issues more stock • Usually at-the-money when issued

11 Executive Stock Options • Option issued by a company to executives • When the option is exercised the company issues more stock • Usually at-the-money when issued

12 Executive Stock Options continued • They become vested after a period ot time • They cannot be sold • They often last for as long as 10 or 15 years

12 Executive Stock Options continued • They become vested after a period ot time • They cannot be sold • They often last for as long as 10 or 15 years

13 Convertible Bonds • Convertible bonds are regular bonds that can be exchanged for equity at certain times in the future according to a predetermined exchange ratio

13 Convertible Bonds • Convertible bonds are regular bonds that can be exchanged for equity at certain times in the future according to a predetermined exchange ratio

14 Convertible Bonds (continued) • Very often a convertible is callable • The call provision is a way in which the issuer can force conversion at a time earlier than the holder might otherwise choose

14 Convertible Bonds (continued) • Very often a convertible is callable • The call provision is a way in which the issuer can force conversion at a time earlier than the holder might otherwise choose

15 Exchangeable Bonds • An exchangeable bond is a sort of convertible bond that provides the conversion into the shares of a company different from the issuer • Usually, the underlying stock is the equity of a strategic partnership • There can be adverse signalling problem which are reduced with “best of” structures

15 Exchangeable Bonds • An exchangeable bond is a sort of convertible bond that provides the conversion into the shares of a company different from the issuer • Usually, the underlying stock is the equity of a strategic partnership • There can be adverse signalling problem which are reduced with “best of” structures

16 Trading Strategies Involving Options

16 Trading Strategies Involving Options

17 Three Alternative Strategies • Take a position in the option & the underlying • Take a position in 2 or more options of the same type (A spread) • Combination: Take a position in a mixture of calls & puts (A combination)

17 Three Alternative Strategies • Take a position in the option & the underlying • Take a position in 2 or more options of the same type (A spread) • Combination: Take a position in a mixture of calls & puts (A combination)

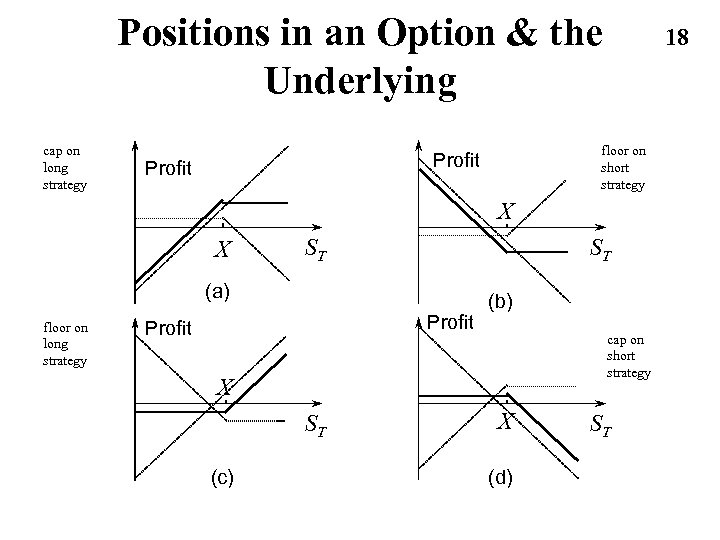

Positions in an Option & the Underlying cap on long strategy floor on short strategy Profit 18 X X ST ST (a) floor on long strategy Profit (b) cap on short strategy X ST (c) X (d) ST

Positions in an Option & the Underlying cap on long strategy floor on short strategy Profit 18 X X ST ST (a) floor on long strategy Profit (b) cap on short strategy X ST (c) X (d) ST

19 basket of options • spread type: basket of options of the same type (call or put) – bull spread – bearish spread – butterfly spread • combination type: basket of options of different types – straddles

19 basket of options • spread type: basket of options of the same type (call or put) – bull spread – bearish spread – butterfly spread • combination type: basket of options of different types – straddles

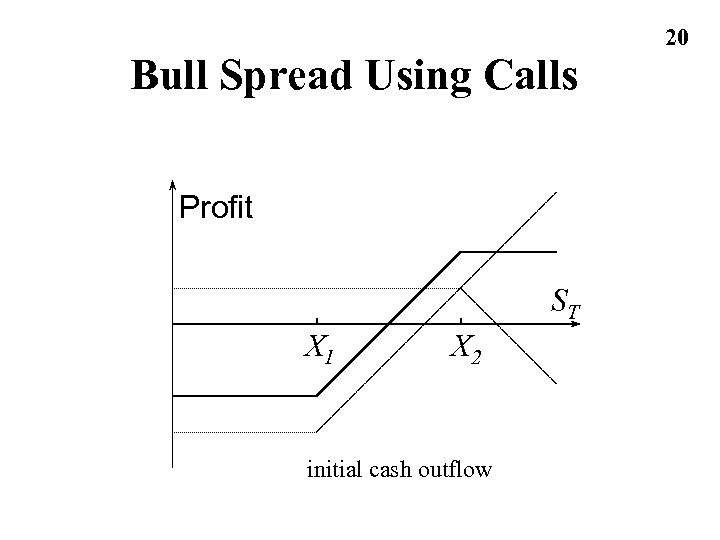

Bull Spread Using Calls Profit ST X 1 X 2 initial cash outflow 20

Bull Spread Using Calls Profit ST X 1 X 2 initial cash outflow 20

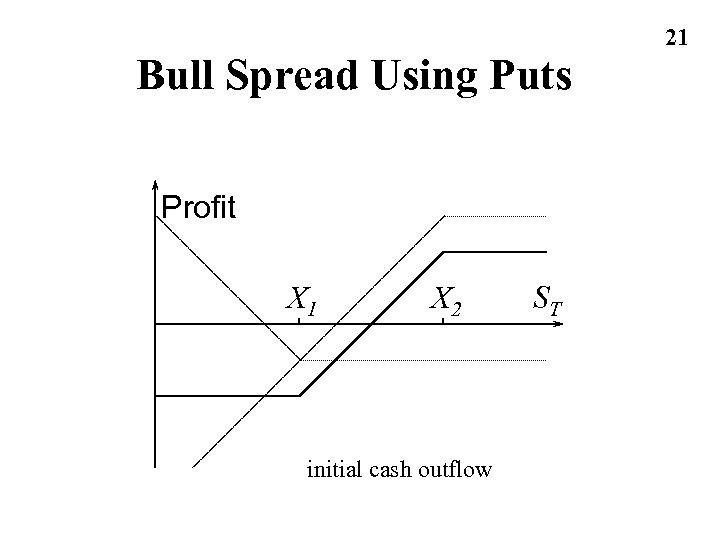

Bull Spread Using Puts Profit X 1 X 2 initial cash outflow ST 21

Bull Spread Using Puts Profit X 1 X 2 initial cash outflow ST 21

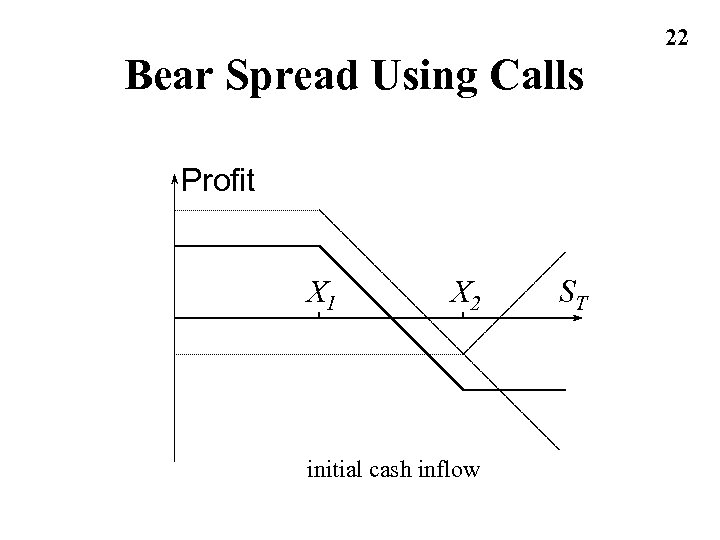

Bear Spread Using Calls Profit X 1 X 2 initial cash inflow ST 22

Bear Spread Using Calls Profit X 1 X 2 initial cash inflow ST 22

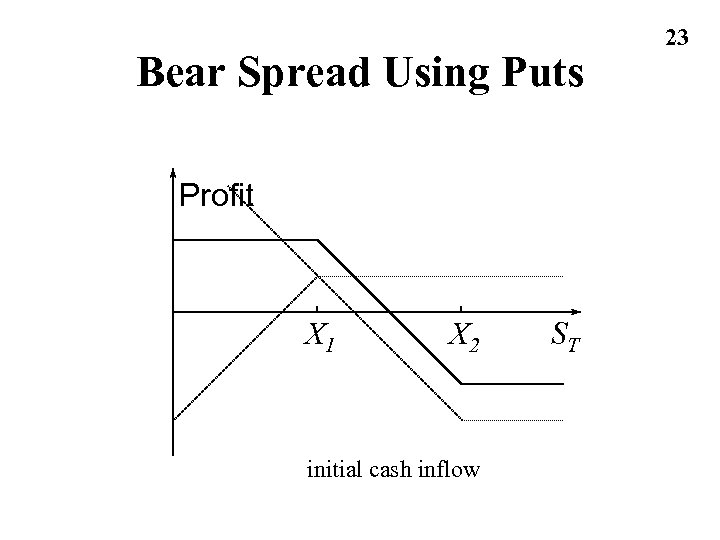

Bear Spread Using Puts Profit X 1 X 2 initial cash inflow ST 23

Bear Spread Using Puts Profit X 1 X 2 initial cash inflow ST 23

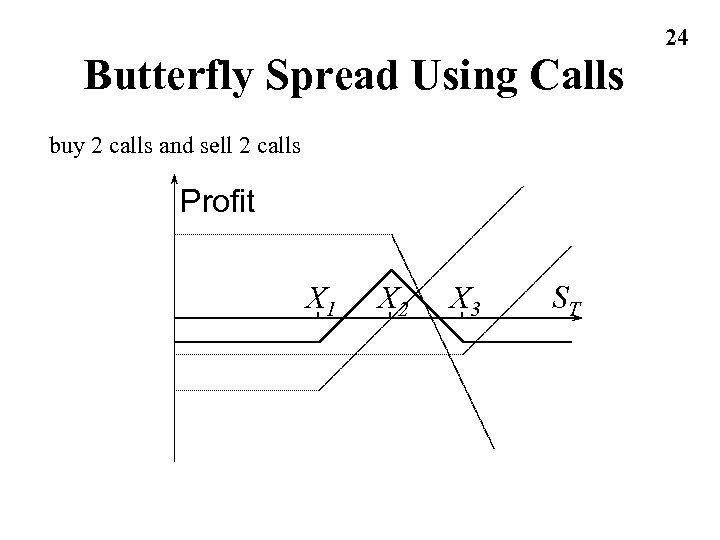

Butterfly Spread Using Calls buy 2 calls and sell 2 calls Profit X 1 X 2 X 3 ST 24

Butterfly Spread Using Calls buy 2 calls and sell 2 calls Profit X 1 X 2 X 3 ST 24

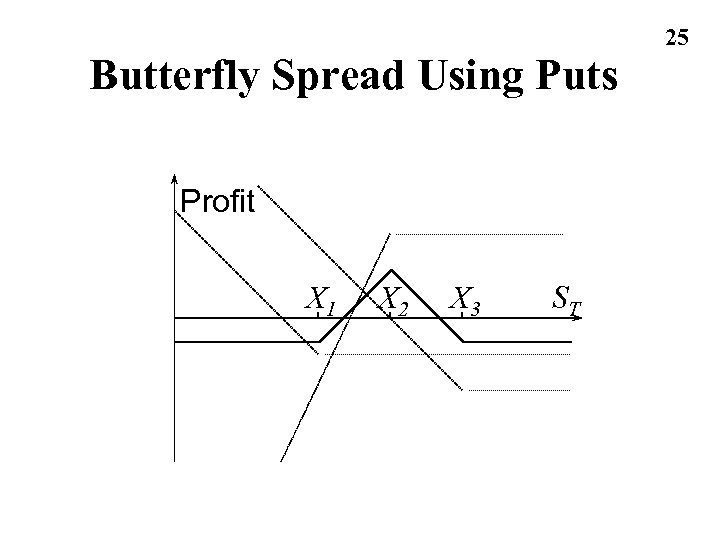

Butterfly Spread Using Puts Profit X 1 X 2 X 3 ST 25

Butterfly Spread Using Puts Profit X 1 X 2 X 3 ST 25

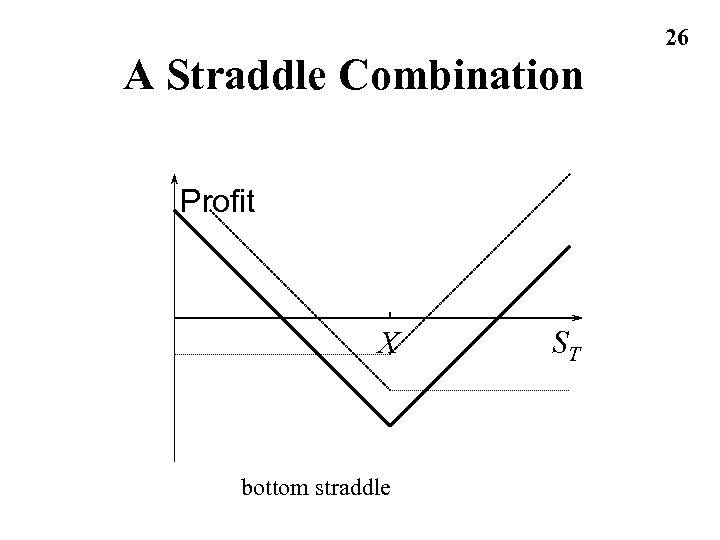

A Straddle Combination Profit X bottom straddle ST 26

A Straddle Combination Profit X bottom straddle ST 26

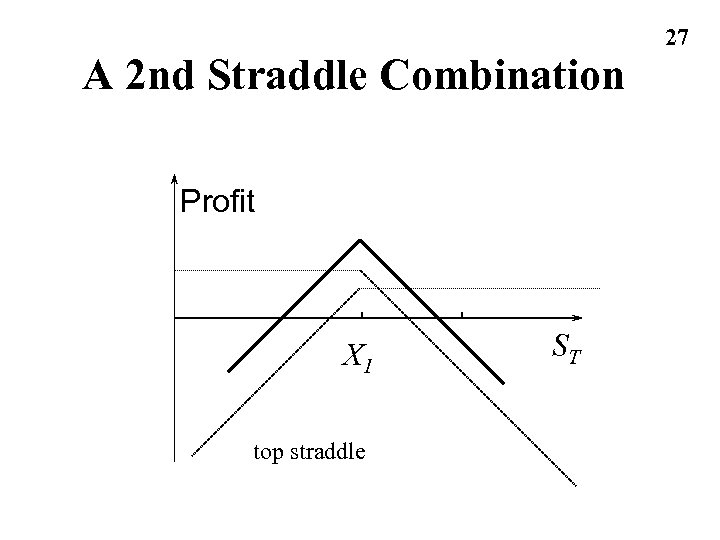

A 2 nd Straddle Combination Profit X 1 top straddle ST 27

A 2 nd Straddle Combination Profit X 1 top straddle ST 27

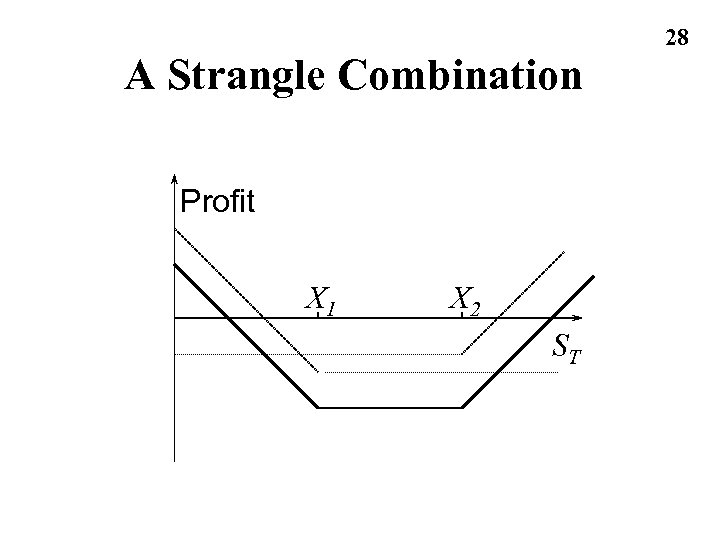

A Strangle Combination Profit X 1 X 2 ST 28

A Strangle Combination Profit X 1 X 2 ST 28

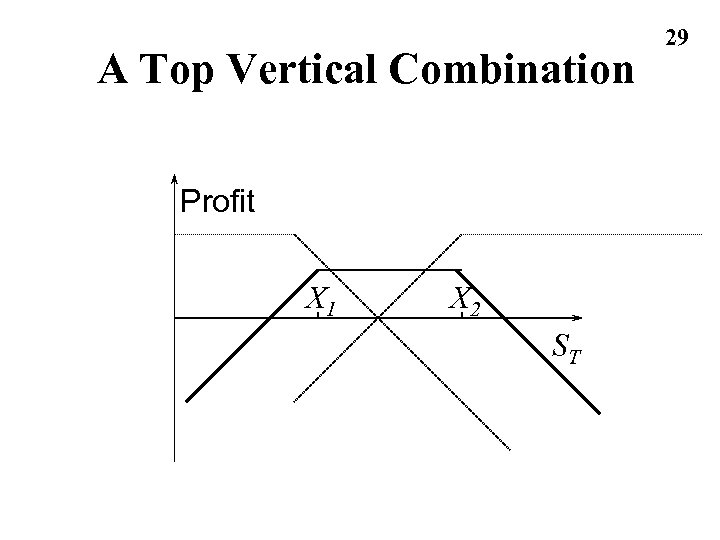

A Top Vertical Combination Profit X 1 X 2 ST 29

A Top Vertical Combination Profit X 1 X 2 ST 29