69119a0e4c7244f91fd5841aea7a8cde.ppt

- Количество слайдов: 25

1 OIL REFINERIES LTD. NASDAQ – TASE Annual Investor Conference 27 November, 2007 - NYC November 2007

1 OIL REFINERIES LTD. NASDAQ – TASE Annual Investor Conference 27 November, 2007 - NYC November 2007

Disclaimer This presentation has been prepared by Oil Refinery Ltd. (the "Company") solely for its presentation at the NASDAQ – TASE Second Annual Investor conference. The information included in the presentation and otherwise communicated by the Company in the course of the said convention (the "Information") is presented for convenience purposes only, it does not constitute a basis for investment decision, nor does it replaces independent collection and analyzing of Information and does not purport to express any recommendation and/or opinion and/or to substitute for the independent judgment of any potential investor. The Company does not warrant the completeness or accuracy of the Information and it disclaims any responsibility for any damages and/or losses whatsoever that are liable to be caused due to use of the Information. In any instance of a contradiction or inconsistency between the Information on this presentation and the information recorded in the Company's ledgers and/or appearing in official publications, the information recorded in the Company's ledgers and/or its official publications shall prevail, as the case may be. The Information may contain various forward-looking statements, based on current data and expectations. Actual operations, results and other data may differ materially due to various risks and uncertainties, including the risk factors discussed in the Company's periodic reports. The Company assumes no obligation to update the said data and expectations or any other Information. 2

Disclaimer This presentation has been prepared by Oil Refinery Ltd. (the "Company") solely for its presentation at the NASDAQ – TASE Second Annual Investor conference. The information included in the presentation and otherwise communicated by the Company in the course of the said convention (the "Information") is presented for convenience purposes only, it does not constitute a basis for investment decision, nor does it replaces independent collection and analyzing of Information and does not purport to express any recommendation and/or opinion and/or to substitute for the independent judgment of any potential investor. The Company does not warrant the completeness or accuracy of the Information and it disclaims any responsibility for any damages and/or losses whatsoever that are liable to be caused due to use of the Information. In any instance of a contradiction or inconsistency between the Information on this presentation and the information recorded in the Company's ledgers and/or appearing in official publications, the information recorded in the Company's ledgers and/or its official publications shall prevail, as the case may be. The Information may contain various forward-looking statements, based on current data and expectations. Actual operations, results and other data may differ materially due to various risks and uncertainties, including the risk factors discussed in the Company's periodic reports. The Company assumes no obligation to update the said data and expectations or any other Information. 2

Dynamic, New, Controlling Shareholders $7. 4 bn Mkt. Cap; >80% revenues overseas; Strong environmental agenda; Controlled 55% by global investment group - Ofer Group; 18% by Bank Leumi Chemicals ICL Shipping Energy Oil Refineries Transportation Semiconductors Global Producer of Fertilizers & Specialty Chemicals IDE [50% by ICL] Sea Water Desalination 3 Zim Integrated Shipping (98%) (45%) Inkia Global Container Shipping Chery Automobile Tower Semiconductors (45%), private China (52%) (26%* Fully Diluted) (100%) $1. 7 bn Mkt. Cap IC Green Energy (100%) Lat. AM Power Plants Better PLC Inc. (33 -40%)

Dynamic, New, Controlling Shareholders $7. 4 bn Mkt. Cap; >80% revenues overseas; Strong environmental agenda; Controlled 55% by global investment group - Ofer Group; 18% by Bank Leumi Chemicals ICL Shipping Energy Oil Refineries Transportation Semiconductors Global Producer of Fertilizers & Specialty Chemicals IDE [50% by ICL] Sea Water Desalination 3 Zim Integrated Shipping (98%) (45%) Inkia Global Container Shipping Chery Automobile Tower Semiconductors (45%), private China (52%) (26%* Fully Diluted) (100%) $1. 7 bn Mkt. Cap IC Green Energy (100%) Lat. AM Power Plants Better PLC Inc. (33 -40%)

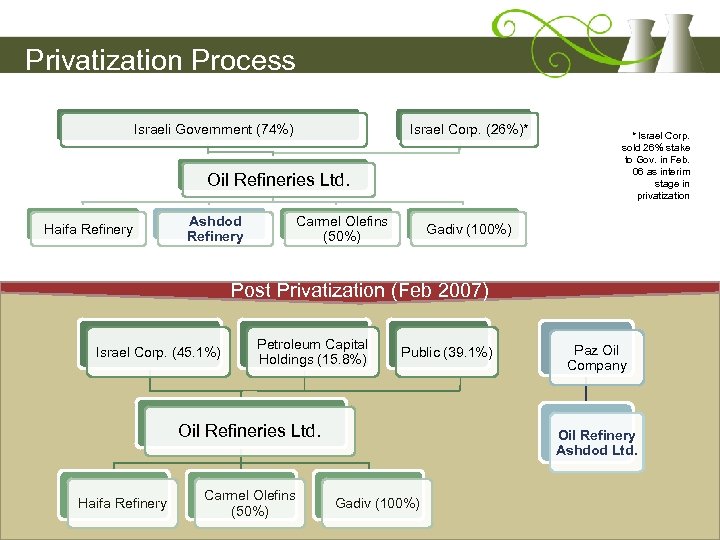

Privatization Process Israeli Government (74%) Israel Corp. (26%)* Oil Refineries Ltd. Haifa Refinery Ashdod Refinery Carmel Olefins (50%) * Israel Corp. sold 26% stake to Gov. in Feb. 06 as interim stage in privatization Gadiv (100%) Post Privatization (Feb 2007) Israel Corp. (45. 1%) Petroleum Capital Holdings (15. 8%) Public (39. 1%) Oil Refineries Ltd. Haifa Refinery 4 Carmel Olefins (50%) Paz Oil Company Oil Refinery Ashdod Ltd. Gadiv (100%)

Privatization Process Israeli Government (74%) Israel Corp. (26%)* Oil Refineries Ltd. Haifa Refinery Ashdod Refinery Carmel Olefins (50%) * Israel Corp. sold 26% stake to Gov. in Feb. 06 as interim stage in privatization Gadiv (100%) Post Privatization (Feb 2007) Israel Corp. (45. 1%) Petroleum Capital Holdings (15. 8%) Public (39. 1%) Oil Refineries Ltd. Haifa Refinery 4 Carmel Olefins (50%) Paz Oil Company Oil Refinery Ashdod Ltd. Gadiv (100%)

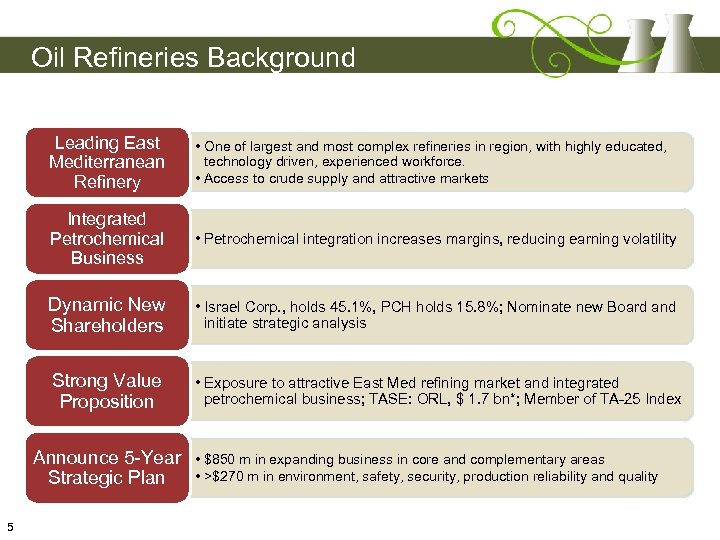

Oil Refineries Background Leading East Mediterranean Refinery • One of largest and most complex refineries in region, with highly educated, technology driven, experienced workforce. • Access to crude supply and attractive markets Integrated Petrochemical Business • Petrochemical integration increases margins, reducing earning volatility Dynamic New Shareholders • Israel Corp. , holds 45. 1%, PCH holds 15. 8%; Nominate new Board and initiate strategic analysis Strong Value Proposition • Exposure to attractive East Med refining market and integrated petrochemical business; TASE: ORL, $ 1. 7 bn*; Member of TA-25 Index Announce 5 -Year Strategic Plan 5 • $850 m in expanding business in core and complementary areas • >$270 m in environment, safety, security, production reliability and quality

Oil Refineries Background Leading East Mediterranean Refinery • One of largest and most complex refineries in region, with highly educated, technology driven, experienced workforce. • Access to crude supply and attractive markets Integrated Petrochemical Business • Petrochemical integration increases margins, reducing earning volatility Dynamic New Shareholders • Israel Corp. , holds 45. 1%, PCH holds 15. 8%; Nominate new Board and initiate strategic analysis Strong Value Proposition • Exposure to attractive East Med refining market and integrated petrochemical business; TASE: ORL, $ 1. 7 bn*; Member of TA-25 Index Announce 5 -Year Strategic Plan 5 • $850 m in expanding business in core and complementary areas • >$270 m in environment, safety, security, production reliability and quality

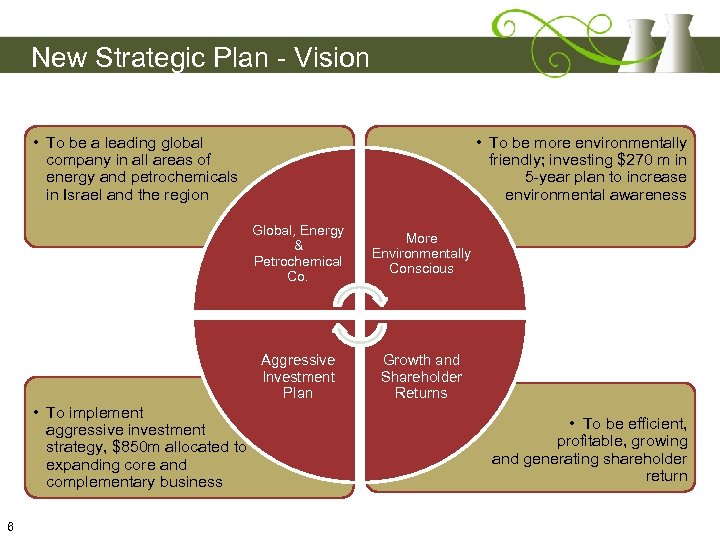

New Strategic Plan - Vision • To be a leading global company in all areas of energy and petrochemicals in Israel and the region • To be more environmentally friendly; investing $270 m in 5 -year plan to increase environmental awareness Global, Energy & Petrochemical Co. Aggressive Investment Plan • To implement aggressive investment strategy, $850 m allocated to expanding core and complementary business 6 More Environmentally Conscious Growth and Shareholder Returns • To be efficient, profitable, growing and generating shareholder return

New Strategic Plan - Vision • To be a leading global company in all areas of energy and petrochemicals in Israel and the region • To be more environmentally friendly; investing $270 m in 5 -year plan to increase environmental awareness Global, Energy & Petrochemical Co. Aggressive Investment Plan • To implement aggressive investment strategy, $850 m allocated to expanding core and complementary business 6 More Environmentally Conscious Growth and Shareholder Returns • To be efficient, profitable, growing and generating shareholder return

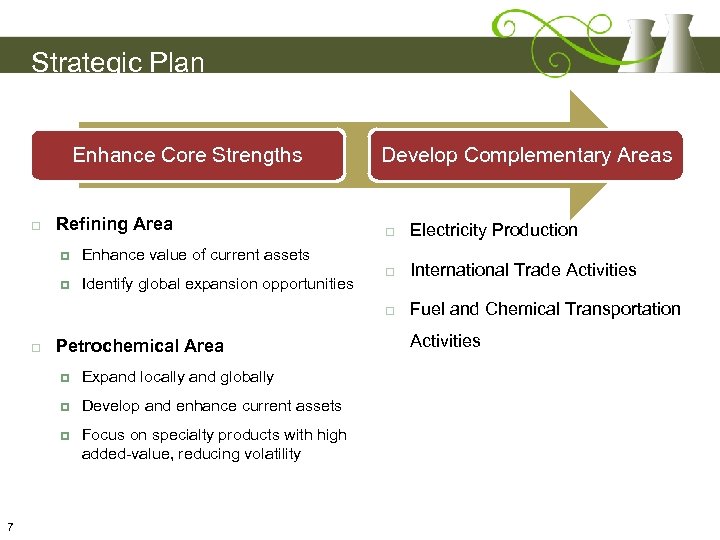

Strategic Plan Enhance Core Strengths Refining Area Develop Complementary Areas Electricity Production International Trade Activities Fuel and Chemical Transportation Enhance value of current assets Identify global expansion opportunities Petrochemical Area Expand locally and globally Develop and enhance current assets 7 Focus on specialty products with high added-value, reducing volatility Activities

Strategic Plan Enhance Core Strengths Refining Area Develop Complementary Areas Electricity Production International Trade Activities Fuel and Chemical Transportation Enhance value of current assets Identify global expansion opportunities Petrochemical Area Expand locally and globally Develop and enhance current assets 7 Focus on specialty products with high added-value, reducing volatility Activities

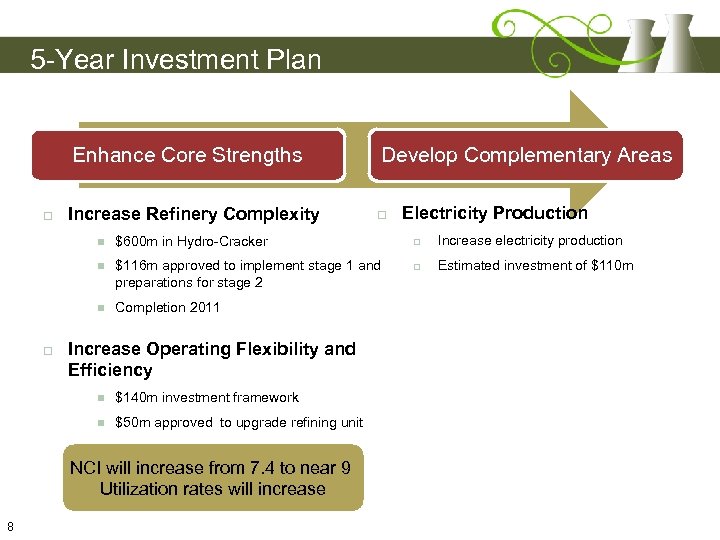

5 -Year Investment Plan Enhance Core Strengths Increase Refinery Complexity Develop Complementary Areas Electricity Production Increase electricity production $116 m approved to implement stage 1 and preparations for stage 2 Estimated investment of $110 m $600 m in Hydro-Cracker Completion 2011 Increase Operating Flexibility and Efficiency $140 m investment framework $50 m approved to upgrade refining unit NCI will increase from 7. 4 to near 9 Utilization rates will increase 8

5 -Year Investment Plan Enhance Core Strengths Increase Refinery Complexity Develop Complementary Areas Electricity Production Increase electricity production $116 m approved to implement stage 1 and preparations for stage 2 Estimated investment of $110 m $600 m in Hydro-Cracker Completion 2011 Increase Operating Flexibility and Efficiency $140 m investment framework $50 m approved to upgrade refining unit NCI will increase from 7. 4 to near 9 Utilization rates will increase 8

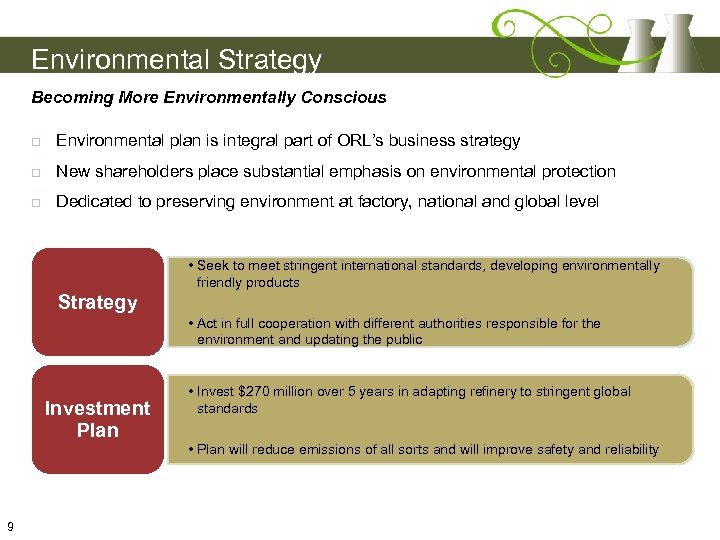

Environmental Strategy Becoming More Environmentally Conscious Environmental plan is integral part of ORL’s business strategy New shareholders place substantial emphasis on environmental protection Dedicated to preserving environment at factory, national and global level • Seek to meet stringent international standards, developing environmentally friendly products Strategy • Act in full cooperation with different authorities responsible for the environment and updating the public Investment Plan 9 • Invest $270 million over 5 years in adapting refinery to stringent global standards • Plan will reduce emissions of all sorts and will improve safety and reliability

Environmental Strategy Becoming More Environmentally Conscious Environmental plan is integral part of ORL’s business strategy New shareholders place substantial emphasis on environmental protection Dedicated to preserving environment at factory, national and global level • Seek to meet stringent international standards, developing environmentally friendly products Strategy • Act in full cooperation with different authorities responsible for the environment and updating the public Investment Plan 9 • Invest $270 million over 5 years in adapting refinery to stringent global standards • Plan will reduce emissions of all sorts and will improve safety and reliability

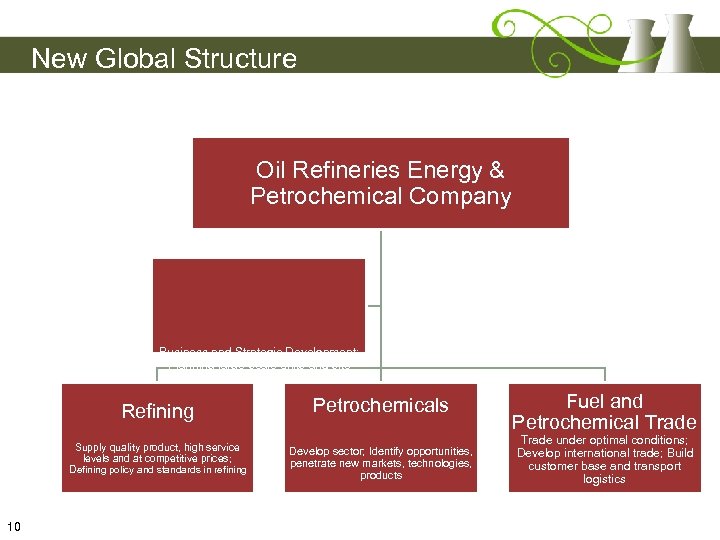

New Global Structure Oil Refineries Energy & Petrochemical Company Global Strategic HQ Business and Strategic Development; Planning large-scale units and site enhancement Refining Supply quality product, high service levels and at competitive prices; Defining policy and standards in refining 10 Petrochemicals Develop sector; Identify opportunities, penetrate new markets, technologies, products Fuel and Petrochemical Trade under optimal conditions; Develop international trade; Build customer base and transport logistics

New Global Structure Oil Refineries Energy & Petrochemical Company Global Strategic HQ Business and Strategic Development; Planning large-scale units and site enhancement Refining Supply quality product, high service levels and at competitive prices; Defining policy and standards in refining 10 Petrochemicals Develop sector; Identify opportunities, penetrate new markets, technologies, products Fuel and Petrochemical Trade under optimal conditions; Develop international trade; Build customer base and transport logistics

COMPANY OVERVIEW Leading Mediterranean Refinery with Strong Petrochemical Integration

COMPANY OVERVIEW Leading Mediterranean Refinery with Strong Petrochemical Integration

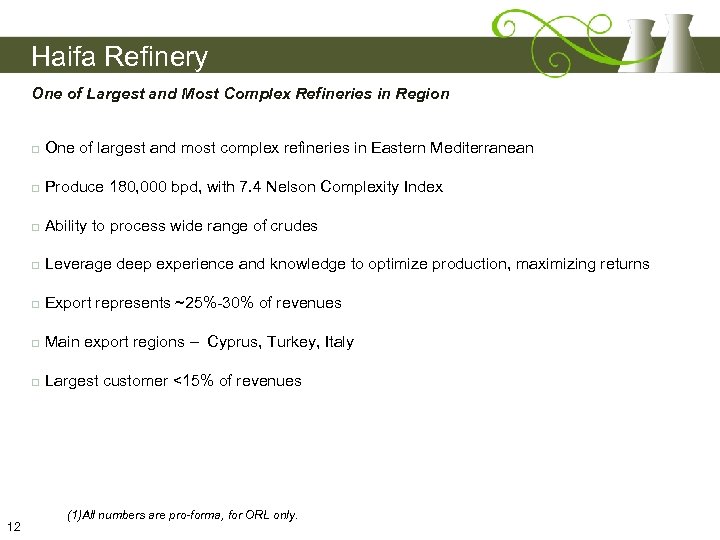

Haifa Refinery One of Largest and Most Complex Refineries in Region Produce 180, 000 bpd, with 7. 4 Nelson Complexity Index Ability to process wide range of crudes Leverage deep experience and knowledge to optimize production, maximizing returns Export represents ~25%-30% of revenues Main export regions – Cyprus, Turkey, Italy 12 One of largest and most complex refineries in Eastern Mediterranean Largest customer <15% of revenues (1)All numbers are pro-forma, for ORL only.

Haifa Refinery One of Largest and Most Complex Refineries in Region Produce 180, 000 bpd, with 7. 4 Nelson Complexity Index Ability to process wide range of crudes Leverage deep experience and knowledge to optimize production, maximizing returns Export represents ~25%-30% of revenues Main export regions – Cyprus, Turkey, Italy 12 One of largest and most complex refineries in Eastern Mediterranean Largest customer <15% of revenues (1)All numbers are pro-forma, for ORL only.

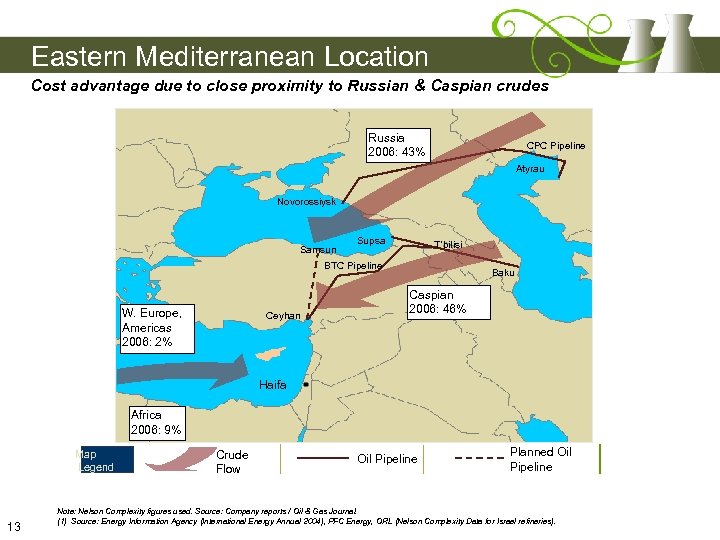

Eastern Mediterranean Location Cost advantage due to close proximity to Russian & Caspian crudes Russia 2006: 43% CPC Pipeline Atyrau Novorossiysk Samsun Supsa T’bilisi BTC Pipeline W. Europe, Americas 2006: 2% Ceyhan Baku Caspian 2006: 46% Haifa Africa 2006: 9% Map Legend 13 Crude Flow Oil Pipeline Planned Oil Pipeline Note: Nelson Complexity figures used. Source: Company reports / Oil & Gas Journal. (1) Source: Energy Information Agency (International Energy Annual 2004), PFC Energy, ORL (Nelson Complexity Data for Israel refineries).

Eastern Mediterranean Location Cost advantage due to close proximity to Russian & Caspian crudes Russia 2006: 43% CPC Pipeline Atyrau Novorossiysk Samsun Supsa T’bilisi BTC Pipeline W. Europe, Americas 2006: 2% Ceyhan Baku Caspian 2006: 46% Haifa Africa 2006: 9% Map Legend 13 Crude Flow Oil Pipeline Planned Oil Pipeline Note: Nelson Complexity figures used. Source: Company reports / Oil & Gas Journal. (1) Source: Energy Information Agency (International Energy Annual 2004), PFC Energy, ORL (Nelson Complexity Data for Israel refineries).

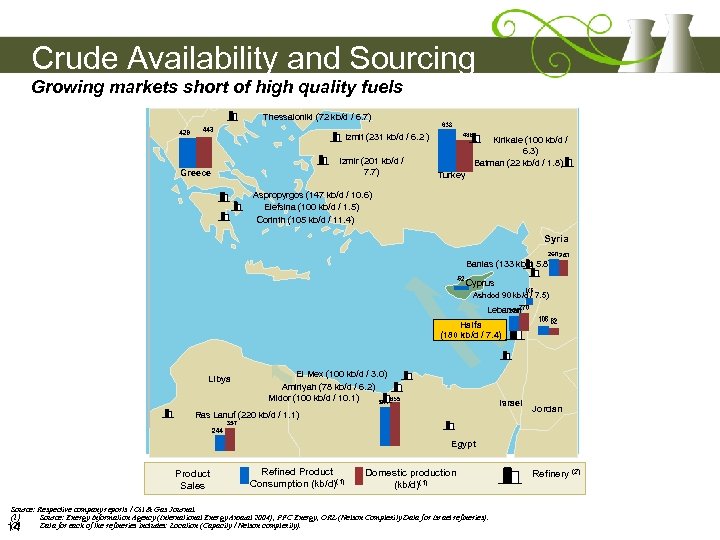

Crude Availability and Sourcing Growing markets short of high quality fuels Thessaloniki (72 kb/d / 6. 7) Izmit (231 kb/d / 6. 2 ) Izmir (201 kb/d / 7. 7) Greece Kirikale (100 kb/d / 6. 3) Batman (22 kb/d / 1. 8) Turkey Aspropyrgos (147 kb/d / 10. 6) Elefsina (100 kb/d / 1. 5) Corinth (105 kb/d / 11. 4) Syria Banias (133 kb/d 5. 8) Cyprus Ashdod 90 kb/d / 7. 5) Lebanon Haifa (180 kb/d / 7. 4) Libya El Mex (100 kb/d / 3. 0) Amiriyah (78 kb/d / 6. 2) Midor (100 kb/d / 10. 1) Israel Ras Lanuf (220 kb/d / 1. 1) Jordan Egypt Product Sales Refined Product Consumption (kb/d)(1) Domestic production (kb/d)(1) Source: Respective company reports / Oil & Gas Journal. (1) Source: Energy Information Agency (International Energy Annual 2004), PFC Energy, ORL (Nelson Complexity Data for Israel refineries). (2) Data for each of the refineries includes: Location (Capacity / Nelson complexity). 14 Refinery (2)

Crude Availability and Sourcing Growing markets short of high quality fuels Thessaloniki (72 kb/d / 6. 7) Izmit (231 kb/d / 6. 2 ) Izmir (201 kb/d / 7. 7) Greece Kirikale (100 kb/d / 6. 3) Batman (22 kb/d / 1. 8) Turkey Aspropyrgos (147 kb/d / 10. 6) Elefsina (100 kb/d / 1. 5) Corinth (105 kb/d / 11. 4) Syria Banias (133 kb/d 5. 8) Cyprus Ashdod 90 kb/d / 7. 5) Lebanon Haifa (180 kb/d / 7. 4) Libya El Mex (100 kb/d / 3. 0) Amiriyah (78 kb/d / 6. 2) Midor (100 kb/d / 10. 1) Israel Ras Lanuf (220 kb/d / 1. 1) Jordan Egypt Product Sales Refined Product Consumption (kb/d)(1) Domestic production (kb/d)(1) Source: Respective company reports / Oil & Gas Journal. (1) Source: Energy Information Agency (International Energy Annual 2004), PFC Energy, ORL (Nelson Complexity Data for Israel refineries). (2) Data for each of the refineries includes: Location (Capacity / Nelson complexity). 14 Refinery (2)

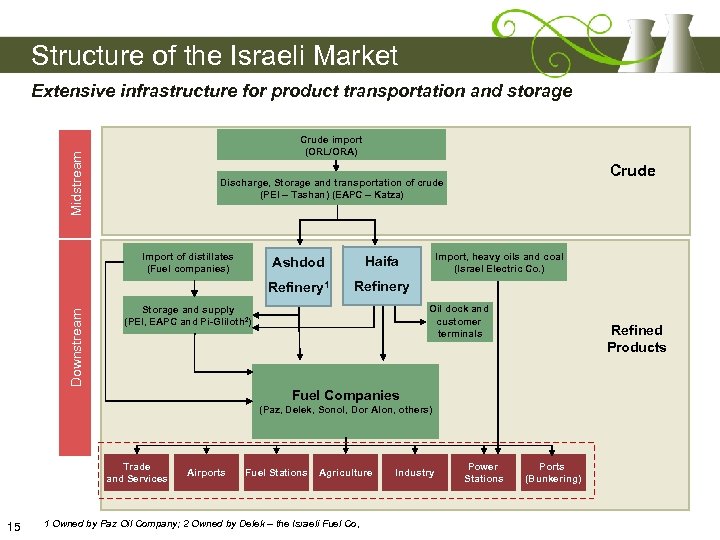

Structure of the Israeli Market Extensive infrastructure for product transportation and storage Midstream Crude import (ORL/ORA) Import of distillates (Fuel companies) Ashdod Import, heavy oils and coal (Israel Electric Co. ) Haifa Refinery 1 Downstream Crude Discharge, Storage and transportation of crude (PEI – Tashan) (EAPC – Katza) Refinery Oil dock and customer terminals Storage and supply (PEI, EAPC and Pi-Gliloth 2) Refined Products Fuel Companies (Paz, Delek, Sonol, Dor Alon, others) Trade and Services 15 Airports Fuel Stations Agriculture 1 Owned by Paz Oil Company; 2 Owned by Delek – the Israeli Fuel Co, Industry Power Stations Ports (Bunkering)

Structure of the Israeli Market Extensive infrastructure for product transportation and storage Midstream Crude import (ORL/ORA) Import of distillates (Fuel companies) Ashdod Import, heavy oils and coal (Israel Electric Co. ) Haifa Refinery 1 Downstream Crude Discharge, Storage and transportation of crude (PEI – Tashan) (EAPC – Katza) Refinery Oil dock and customer terminals Storage and supply (PEI, EAPC and Pi-Gliloth 2) Refined Products Fuel Companies (Paz, Delek, Sonol, Dor Alon, others) Trade and Services 15 Airports Fuel Stations Agriculture 1 Owned by Paz Oil Company; 2 Owned by Delek – the Israeli Fuel Co, Industry Power Stations Ports (Bunkering)

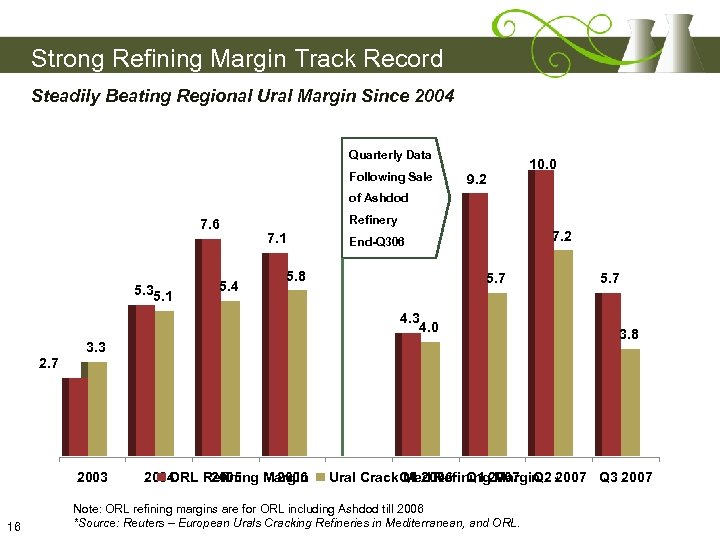

Strong Refining Margin Track Record Steadily Beating Regional Ural Margin Since 2004 Quarterly Data Following Sale 9. 2 10. 0 of Ashdod 7. 6 5. 35. 1 5. 4 Refinery 7. 1 7. 2 End-Q 306 5. 8 5. 7 4. 3 4. 0 3. 3 5. 7 3. 8 2. 7 2003 16 2004 2005 2006 ORL Refining Margin Ural Crack. Q 4 2006 Q 1 2007 Q 2 * Med Refining Margin 2007 Q 3 2007 Note: ORL refining margins are for ORL including Ashdod till 2006 *Source: Reuters – European Urals Cracking Refineries in Mediterranean, and ORL.

Strong Refining Margin Track Record Steadily Beating Regional Ural Margin Since 2004 Quarterly Data Following Sale 9. 2 10. 0 of Ashdod 7. 6 5. 35. 1 5. 4 Refinery 7. 1 7. 2 End-Q 306 5. 8 5. 7 4. 3 4. 0 3. 3 5. 7 3. 8 2. 7 2003 16 2004 2005 2006 ORL Refining Margin Ural Crack. Q 4 2006 Q 1 2007 Q 2 * Med Refining Margin 2007 Q 3 2007 Note: ORL refining margins are for ORL including Ashdod till 2006 *Source: Reuters – European Urals Cracking Refineries in Mediterranean, and ORL.

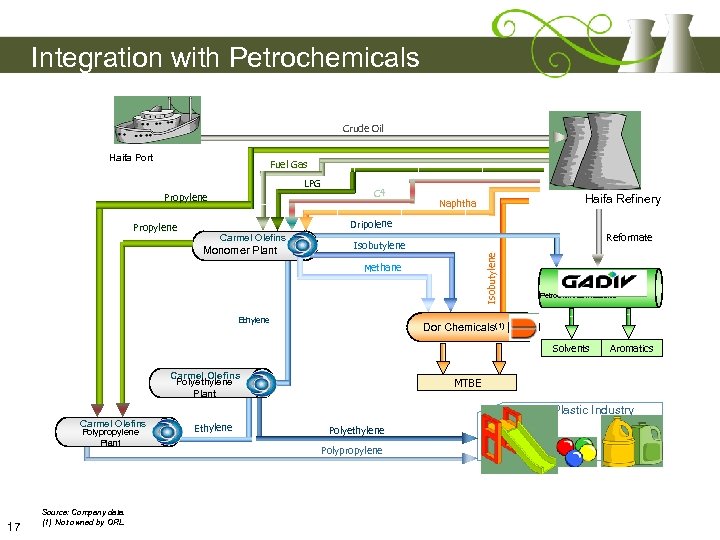

Integration with Petrochemicals Crude Oil Haifa Port Fuel Gas LPG Propylene Haifa Refinery Naphtha Dripolene Carmel Olefins Monomer Plant Reformate Isobutylene Propylene C 4 Methane Ethylene Petrochemical Industries Dor Chemicals(1) Solvents Carmel Olefins Polyethylene Plant Aromatics MTBE Plastic Industry Carmel Olefins Polypropylene Plant 17 Source: Company data. (1) Not owned by ORL. Ethylene Polyethylene Polypropylene

Integration with Petrochemicals Crude Oil Haifa Port Fuel Gas LPG Propylene Haifa Refinery Naphtha Dripolene Carmel Olefins Monomer Plant Reformate Isobutylene Propylene C 4 Methane Ethylene Petrochemical Industries Dor Chemicals(1) Solvents Carmel Olefins Polyethylene Plant Aromatics MTBE Plastic Industry Carmel Olefins Polypropylene Plant 17 Source: Company data. (1) Not owned by ORL. Ethylene Polyethylene Polypropylene

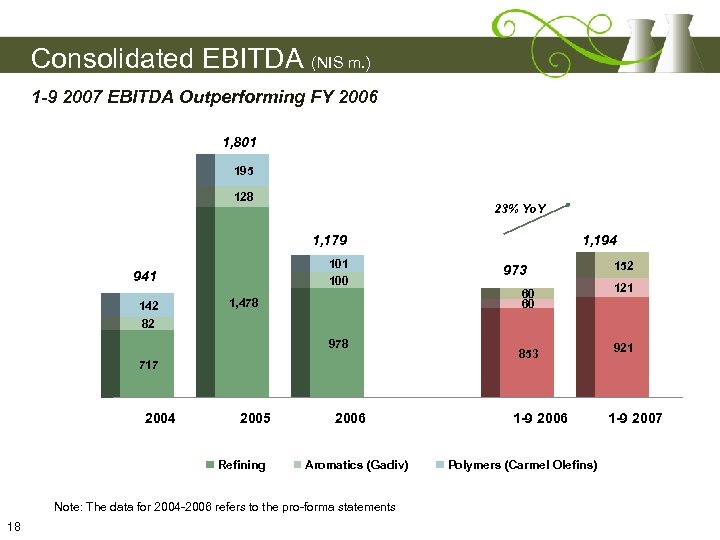

Consolidated EBITDA (NIS m. ) 1 -9 2007 EBITDA Outperforming FY 2006 1, 801 195 128 23% Yo. Y 1, 179 101 100 941 142 82 1, 478 978 717 2004 2005 Refining 2006 Aromatics (Gadiv) Note: The data for 2004 -2006 refers to the pro-forma statements 18 1, 194 973 152 60 60 121 853 921 1 -9 2006 Polymers (Carmel Olefins) 1 -9 2007

Consolidated EBITDA (NIS m. ) 1 -9 2007 EBITDA Outperforming FY 2006 1, 801 195 128 23% Yo. Y 1, 179 101 100 941 142 82 1, 478 978 717 2004 2005 Refining 2006 Aromatics (Gadiv) Note: The data for 2004 -2006 refers to the pro-forma statements 18 1, 194 973 152 60 60 121 853 921 1 -9 2006 Polymers (Carmel Olefins) 1 -9 2007

Summary Highlights High Quality Refinery • Track record of continuous investment and upgrades, with highly educated, technology driven, experienced workforce. • Strong refining margins, full compliance with 2009 Euro V. Strategic Location • Strategically located with access to regional crude supply and fast growing markets. Petrochemical Integration • Synergies with petrochemical industry allows optimization across refined product, enhances margins, and reduces margin volatility Strong Financial Position Comprehensive Strategic Plan 19 • Strong balance sheet with room for leverage • Strong cash flow allowing for growth CAPEX and dividend distribution. • Enhance core businesses and complementary growth drivers • Increase environmental awareness, incl. natural gas.

Summary Highlights High Quality Refinery • Track record of continuous investment and upgrades, with highly educated, technology driven, experienced workforce. • Strong refining margins, full compliance with 2009 Euro V. Strategic Location • Strategically located with access to regional crude supply and fast growing markets. Petrochemical Integration • Synergies with petrochemical industry allows optimization across refined product, enhances margins, and reduces margin volatility Strong Financial Position Comprehensive Strategic Plan 19 • Strong balance sheet with room for leverage • Strong cash flow allowing for growth CAPEX and dividend distribution. • Enhance core businesses and complementary growth drivers • Increase environmental awareness, incl. natural gas.

THANK YOU NASDAQ – TASE Annual Investor Conference 27 November, 2007 - NYC November 2007

THANK YOU NASDAQ – TASE Annual Investor Conference 27 November, 2007 - NYC November 2007

APPENDICES

APPENDICES

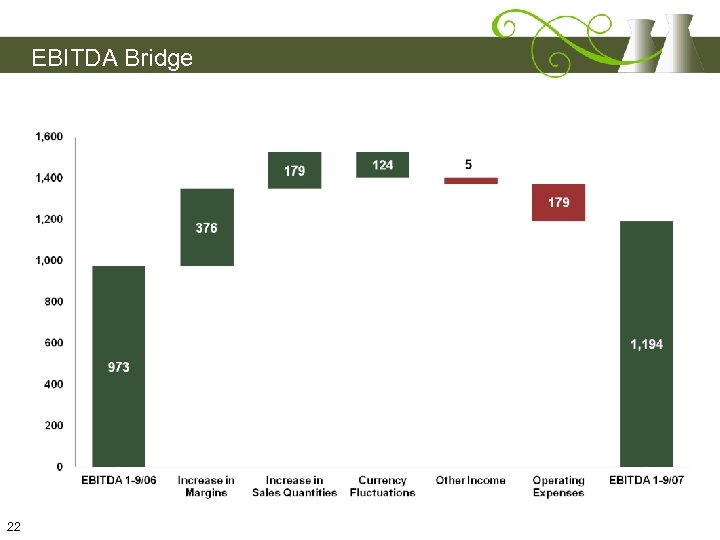

EBITDA Bridge 22

EBITDA Bridge 22

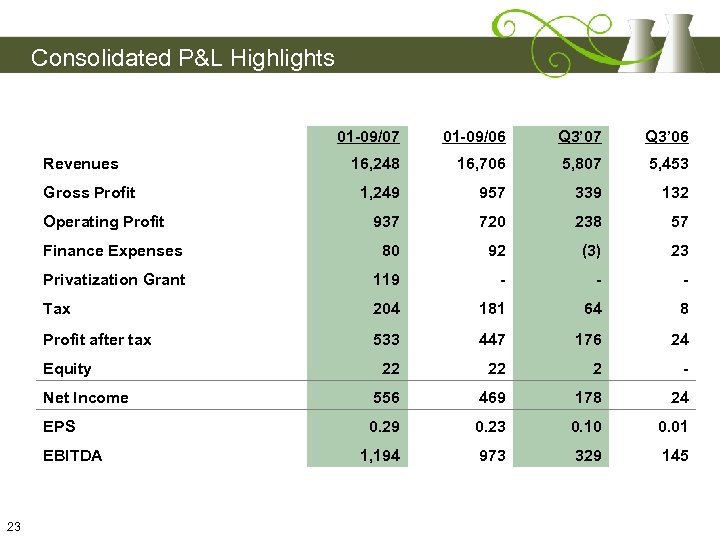

Consolidated P&L Highlights 01 -09/07 01 -09/06 Q 3’ 07 Q 3’ 06 16, 248 16, 706 5, 807 5, 453 1, 249 957 339 132 937 720 238 57 Finance Expenses 80 92 (3) 23 Privatization Grant 119 - - - Tax 204 181 64 8 Profit after tax 533 447 176 24 22 22 2 - Net Income 556 469 178 24 EPS 0. 29 0. 23 0. 10 0. 01 1, 194 973 329 145 Revenues Gross Profit Operating Profit Equity EBITDA 23

Consolidated P&L Highlights 01 -09/07 01 -09/06 Q 3’ 07 Q 3’ 06 16, 248 16, 706 5, 807 5, 453 1, 249 957 339 132 937 720 238 57 Finance Expenses 80 92 (3) 23 Privatization Grant 119 - - - Tax 204 181 64 8 Profit after tax 533 447 176 24 22 22 2 - Net Income 556 469 178 24 EPS 0. 29 0. 23 0. 10 0. 01 1, 194 973 329 145 Revenues Gross Profit Operating Profit Equity EBITDA 23

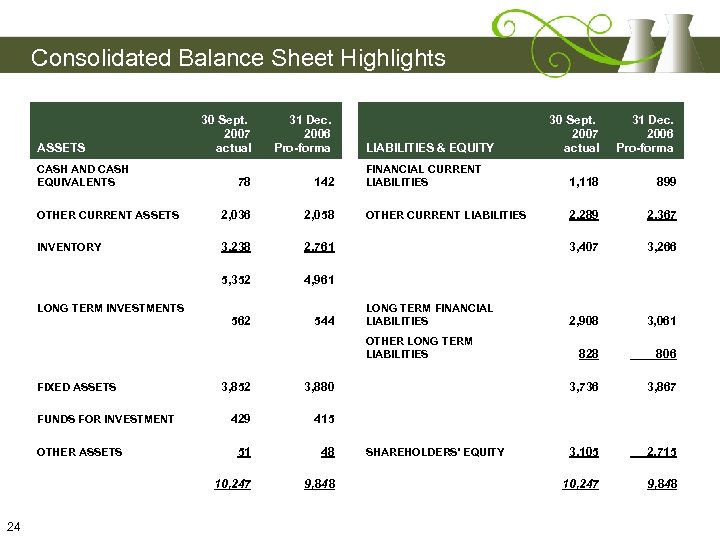

Consolidated Balance Sheet Highlights 30 Sept. 2007 actual 31 Dec. 2006 Pro-forma 78 142 OTHER CURRENT ASSETS 2, 036 2, 058 INVENTORY 3, 238 2, 761 5, 352 4, 961 ASSETS CASH AND CASH EQUIVALENTS LONG TERM INVESTMENTS 562 544 30 Sept. 2007 actual 31 Dec. 2006 Pro-forma FINANCIAL CURRENT LIABILITIES 1, 118 899 OTHER CURRENT LIABILITIES 2, 289 2, 367 3, 407 3, 266 2, 908 3, 061 828 806 3, 736 3, 867 3, 105 2, 715 10, 247 9, 848 LIABILITIES & EQUITY LONG TERM FINANCIAL LIABILITIES OTHER LONG TERM LIABILITIES FUNDS FOR INVESTMENT OTHER ASSETS 24 3, 852 3, 880 429 415 51 48 10, 247 FIXED ASSETS 9, 848 SHAREHOLDERS' EQUITY

Consolidated Balance Sheet Highlights 30 Sept. 2007 actual 31 Dec. 2006 Pro-forma 78 142 OTHER CURRENT ASSETS 2, 036 2, 058 INVENTORY 3, 238 2, 761 5, 352 4, 961 ASSETS CASH AND CASH EQUIVALENTS LONG TERM INVESTMENTS 562 544 30 Sept. 2007 actual 31 Dec. 2006 Pro-forma FINANCIAL CURRENT LIABILITIES 1, 118 899 OTHER CURRENT LIABILITIES 2, 289 2, 367 3, 407 3, 266 2, 908 3, 061 828 806 3, 736 3, 867 3, 105 2, 715 10, 247 9, 848 LIABILITIES & EQUITY LONG TERM FINANCIAL LIABILITIES OTHER LONG TERM LIABILITIES FUNDS FOR INVESTMENT OTHER ASSETS 24 3, 852 3, 880 429 415 51 48 10, 247 FIXED ASSETS 9, 848 SHAREHOLDERS' EQUITY

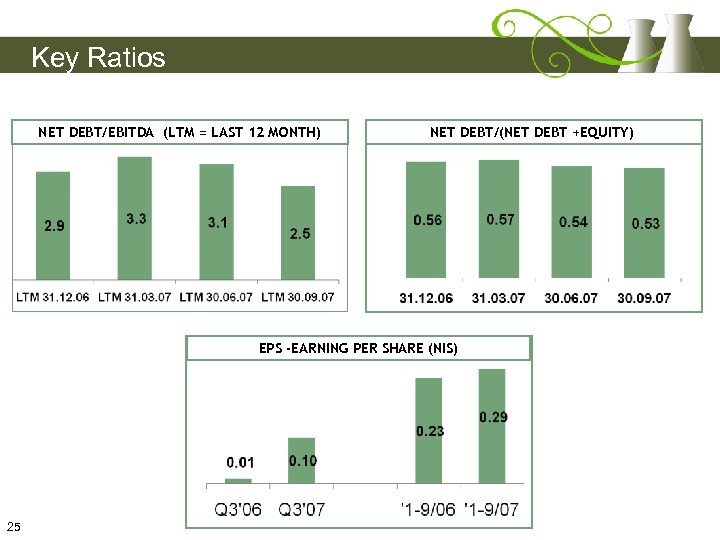

Key Ratios NET DEBT/EBITDA (LTM = LAST 12 MONTH) NET DEBT/(NET DEBT +EQUITY) EPS -EARNING PER SHARE (NIS) 25

Key Ratios NET DEBT/EBITDA (LTM = LAST 12 MONTH) NET DEBT/(NET DEBT +EQUITY) EPS -EARNING PER SHARE (NIS) 25