80f93e005f118871e7cc4ca77cb243aa.ppt

- Количество слайдов: 20

1 NEW PRODUCT PACESETTERS – Benefit Trends of New Non-Food Brands Launched in 2002 -03 New Functional Designs Give Consumers More Control page 10 Prescription Strength Raises Category Expectations page 13 Innovative Benefits Drive Superior Sales page 17 Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 2 Table of Contents 3 Welcome Times&Trends overview and introduction to the June edition: New Product Pacesetters Non-Food Benefit Trends of Brands Launched in 2002 -03. 4 Data Sources & Methodology Assessment of the benefits driving the 137 non-food Pacesetters. Benefits are categorized and compared with benchmarks from seven prior reports. 5 Introduction & Highlights – New Technologies Raise Performance Expectations The most successful new non-food Pacesetters launched in 2002 -03 responded to consumers’ desires to more effectively and efficiently command the tasks of dealing with personal hygiene, appearance and health issues as well as minimizing house work. 8, 9 & 10 Expanded Effectiveness Benefits Dominate New technologies and designs raise category expectations on performance benefits – stronger, prescription strength, longer lasting, improved versus category standards, easier to use, closer shaving, whiter teeth, clearer photos, removes dirt and stains, stays closed – substantiating claims that grab consumers’ attention and interest. 11 Personal Hygiene Pacesetters Narrow Their Sights – Some Appeal to Men Touting stronger protection, whiter teeth, healthier gums, skin & hair and smoother shaves & moister skin, Pacesetters launched new technologies and designs – several targeting men. 12 Beauty products promise improved product efficacy 25% of all non-food Pacesetters presented “better-outside” appearance benefits – longer lasting, moister, smoother & more natural. 13 - 14 Health Care Benefits Linked to “Prescription Strength” & Weight Problems Rx products launched over the counter provide more affordable self-medicating relief. New lowcarb diet aids, supplements and weight-loss shakes are starting to appear. 15 Shelf Impact Variety & Assortment Becoming A Larger Factor 60% of non-food Pacesetters presented an assortment of remedies, strengths, scents, fragrances, functions or designs, key to the impact of these new products. Consumers can choose what fits their own unique needs. 16 House Care Upgrades Enhance Convenience, Make a Boring Task Easier. New technologies change designs, simplify the job, tackle messy surfaces and dispose of the cleaning agent in one easy step. 17 Innovative Non-Food Benefits Drive Superior Sales Pacesetters introducing innovative, new category benefits deliver a 66% year one sales bonus – innovative brand extensions have reaped huge returns. 19 Summary & Implications Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

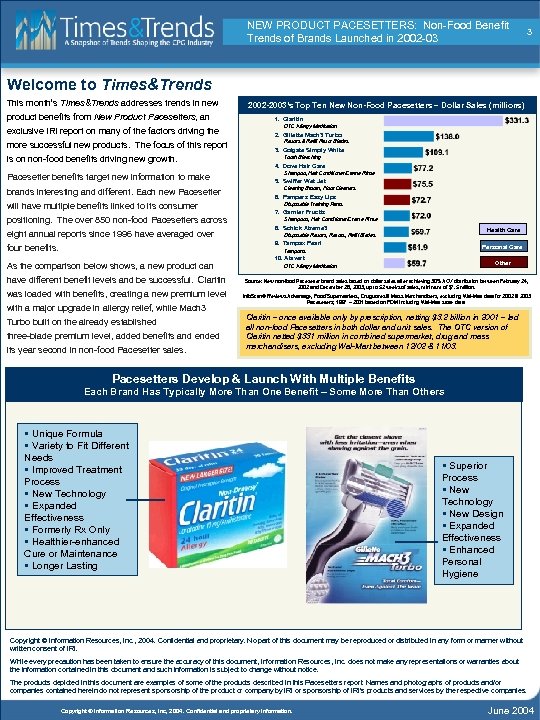

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 3 Welcome to Times&Trends This month’s Times&Trends addresses trends in new 2002 -2003’s Top Ten New Non-Food Pacesetters – Dollar Sales (millions) product benefits from New Product Pacesetters, an 1. Claritin exclusive IRI report on many of the factors driving the 2. Gillette Mach 3 Turbo more successful new products. The focus of this report is on non-food benefits driving new growth. Pacesetter benefits target new information to make brands interesting and different. Each new Pacesetter will have multiple benefits linked to its consumer positioning. The over 850 non-food Pacesetters across eight annual reports since 1996 have averaged over OTC Allergy Medication Razors & Refill Razor Blades 3. Colgate Simply White Tooth Bleaching 4. Dove Hair Care Shampoo, Hair Conditioner/Creme Rinse 5. Swiffer Wet Jet Cleaning Broom, Floor Cleaners 6. Pampers Easy Ups Disposable Training Pants 7. Garnier Fructis Shampoos, Hair Conditioner/Creme Rinse 8. Schick Xtreme 3 Health Care Disposable Razors, Refill Blades 9. Tampax Pearl four benefits. Personal Care Tampons As the comparison below shows, a new product can have different benefit levels and be successful. Claritin was loaded with benefits, creating a new premium level with a major upgrade in allergy relief, while Mach 3 Turbo built on the already established three-blade premium level, added benefits and ended its year second in non-food Pacesetter sales. 10. Alavert Other OTC Allergy Medication Source: New non-food Pacesetter brand sales based on dollar sales after achieving 30% ACV distribution between February 24, 2002 and December 28, 2003, up to 52 weeks of sales, minimum of $7. 5 million. Info. Scan® Reviews Advantage, Food/Supermarkets, Drugstores & Mass Merchandisers, excluding Wal-Mart data for 2002 & 2003 Pacesetters; 1997 – 2001 based on FDM including Wal-Mart store data. Claritin – once available only by prescription, netting $3. 2 billion in 2001 – led all non-food Pacesetters in both dollar and unit sales. The OTC version of Claritin netted $331 million in combined supermarket, drug and mass merchandisers, excluding Wal-Mart between 12/02 & 11/03. Pacesetters Develop & Launch With Multiple Benefits Each Brand Has Typically More Than One Benefit – Some More Than Others § Unique Formula § Variety to Fit Different Needs § Improved Treatment Process § New Technology § Expanded Effectiveness § Formerly Rx Only § Healthier-enhanced Cure or Maintenance § Longer Lasting § Superior Process § New Technology § New Design § Expanded Effectiveness § Enhanced Personal Hygiene Copyright © Information Resources, Inc. , 2004. Confidential and proprietary. No part of this document may be reproduced or distributed in any form or manner without written consent of IRI. While every precaution has been taken to ensure the accuracy of this document, Information Resources, Inc. does not make any representations or warranties about the information contained in this document and such information is subject to change without notice. The products depicted in this document are examples of some of the products described in this Pacesetters report. Names and photographs of products and/or companies contained herein do not represent sponsorship of the product or company by IRI or sponsorship of IRI's products and services by the respective companies. Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 Data Sources & Methodology 4 All of 2002 -03’s Top 10 Non-Food Pacesetters Present 5 or More Consumer Benefits The annual list of New Product Pacesetters leads most clients to ask what is it about these products that made them so successful, what product features and benefits are manufacturers using to differentiate one brand from another, and what benefits are consumers showing the most interest in? 6 Benefits Each Pacesetter’s benefits are determined from a personal 8 Benefits review of packaging aided by free-standing insert advertising, 5 Benefits other ads, and manufacturer information off their internet sites or the product itself. The list of 37 benefits below best describes the benefits manufacturers are using to separate their new brands from competition. Benefits are then compiled and averaged as well as trended over 7 Benefits eight years of Pacesetter reports. 6 Benefits 5 Benefits Other data and new product insights come from IRI’s Info. Scan® Reviews databases, IRI’s Consumer Network Shopper Panel database, Mosaic Info. Force Cross Category Display database & IRI Dictionary Department’s unique UPC database. 6 Benefits 5 Benefits 7 Benefits Non-Food Pacesetter Benefits in this Analysis: n Age-specific, age-targeted n Gender-specific, gender-targeted n Anti-bacterial n Healthier – enhanced cure, care, maintenance n Aroma therapy, stress management, therapeutic n Improved process, superior process n BFY: Added vitamins, calcium, nutrition, soy, herbs n Known brand in new category n BFY: Antioxidants n Longer lasting, durable n BFY: Diet aid n Lower priced, better value n BFY: Improved flavor, taste n Me-too benefit(s), no clear benefit n BFY: Increased energy, mobility n More natural, organic, herbs, 100% n BFY: Less, reduced calories, low-cal, low-carb n More attractive, better outside n Co-branding, double brand endorsement n New designs, patterns, look n Disposable convenience n New or unique formula n Doctor recommended n New technology n Enhanced baby care – health, snacking, feeding n New use, approach, application in old category n Enhanced house-care results, upkeep n Ultra, concentrated effectiveness n Expanded effectiveness, improved effectiveness n UV protection n Enhanced moisturizing; treats sensitive skin n Younger, anti-aging outside or inside n Enhanced personal upkeep, hygiene n n Enhanced pet care – health, snacking, nutrition Variety—multiple/unique scents, aids, or treatments to choose from n Extra convenience, disposability, portability, or ready-to-use or serve n Formerly prescription only BFY: Better For You/Your Pet Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

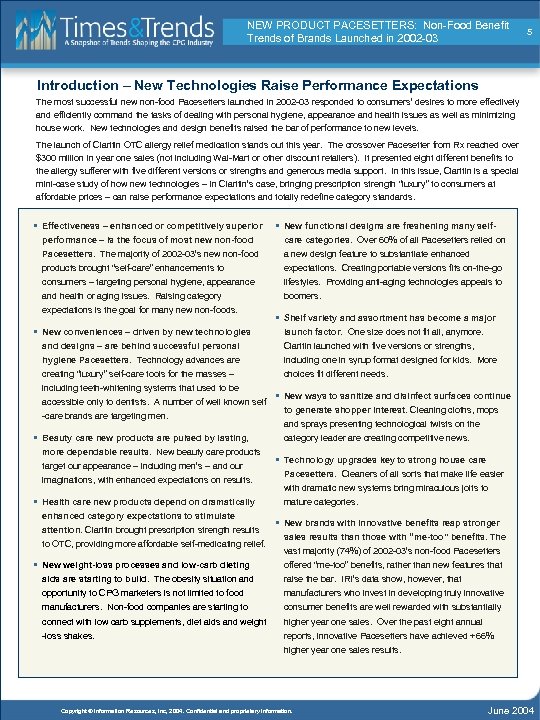

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 5 Introduction – New Technologies Raise Performance Expectations The most successful new non-food Pacesetters launched in 2002 -03 responded to consumers’ desires to more effectively and efficiently command the tasks of dealing with personal hygiene, appearance and health issues as well as minimizing house work. New technologies and design benefits raised the bar of performance to new levels. The launch of Claritin OTC allergy relief medication stands out this year. The crossover Pacesetter from Rx reached over $300 million in year one sales (not including Wal-Mart or other discount retailers). It presented eight different benefits to the allergy sufferer with five different versions or strengths and generous media support. In this issue, Claritin is a special mini-case study of how new technologies – in Claritin’s case, bringing prescription strength “luxury” to consumers at affordable prices – can raise performance expectations and totally redefine category standards. § Effectiveness – enhanced or competitively superior § New functional designs are freshening many self- performance – is the focus of most new non-food care categories. Over 60% of all Pacesetters relied on Pacesetters. The majority of 2002 -03’s new non-food a new design feature to substantiate enhanced products brought “self-care” enhancements to expectations. Creating portable versions fits on-the-go consumers – targeting personal hygiene, appearance lifestyles. Providing anti-aging technologies appeals to and health or aging issues. Raising category boomers. expectations is the goal for many new non-foods. § New conveniences – driven by new technologies § Shelf variety and assortment has become a major launch factor. One size does not fit all, anymore. and designs – are behind successful personal Claritin launched with five versions or strengths, hygiene Pacesetters. Technology advances are including one in syrup format designed for kids. More creating “luxury” self-care tools for the masses – choices fit different needs. including teeth-whitening systems that used to be accessible only to dentists. A number of well known self -care brands are targeting men. § Beauty care new products are pulsed by lasting, more dependable results. New beauty care products target our appearance – including men’s – and our imaginations, with enhanced expectations on results. § Health care new products depend on dramatically enhanced category expectations to stimulate attention. Claritin brought prescription strength results to OTC, providing more affordable self-medicating relief. § New weight-loss processes and low-carb dieting § New ways to sanitize and disinfect surfaces continue to generate shopper interest. Cleaning cloths, mops and sprays presenting technological twists on the category leader are creating competitive news. § Technology upgrades key to strong house care Pacesetters. Cleaners of all sorts that make life easier with dramatic new systems bring miraculous jolts to mature categories. § New brands with innovative benefits reap stronger sales results than those with “me-too” benefits. The vast majority (74%) of 2002 -03’s non-food Pacesetters offered “me-too” benefits, rather than new features that aids are starting to build. The obesity situation and raise the bar. IRI’s data show, however, that opportunity to CPG marketers is not limited to food manufacturers who invest in developing truly innovative manufacturers. Non-food companies are starting to consumer benefits are well rewarded with substantially connect with low carb supplements, diet aids and weight higher year one sales. Over the past eight annual -loss shakes. reports, innovative Pacesetters have achieved +66% higher year one sales results. Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

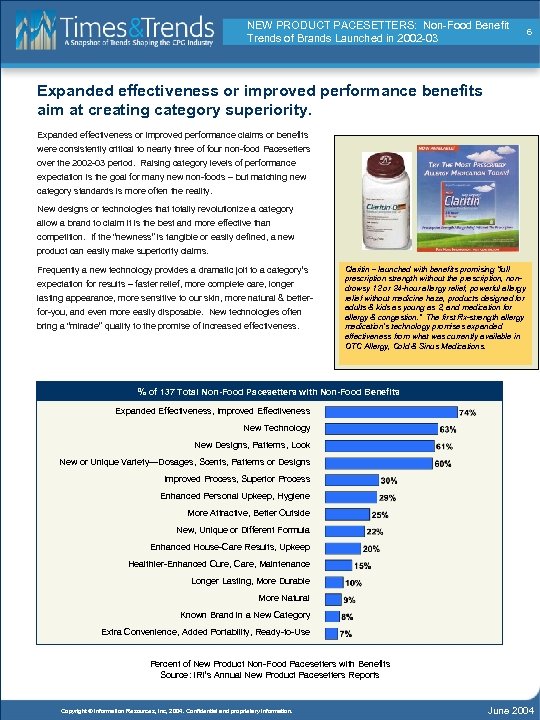

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 6 Expanded effectiveness or improved performance benefits aim at creating category superiority. Expanded effectiveness or improved performance claims or benefits were consistently critical to nearly three of four non-food Pacesetters over the 2002 -03 period. Raising category levels of performance expectation is the goal for many new non-foods – but matching new category standards is more often the reality. New designs or technologies that totally revolutionize a category allow a brand to claim it is the best and more effective than competition. If the “newness” is tangible or easily defined, a new product can easily make superiority claims. Frequently a new technology provides a dramatic jolt to a category’s expectation for results – faster relief, more complete care, longer lasting appearance, more sensitive to our skin, more natural & betterfor-you, and even more easily disposable. New technologies often bring a “miracle” quality to the promise of increased effectiveness. Claritin – launched with benefits promising “full prescription strength without the prescription, nondrowsy 12 or 24 -hour allergy relief, powerful allergy relief without medicine haze, products designed for adults & kids as young as 2, and medication for allergy & congestion. ” The first Rx-strength allergy medication’s technology promises expanded effectiveness from what was currently available in OTC Allergy, Cold & Sinus Medications. % of 137 Total Non-Food Pacesetters with Non-Food Benefits Expanded Effectiveness, Improved Effectiveness New Technology New Designs, Patterns, Look New or Unique Variety—Dosages, Scents, Patterns or Designs Improved Process, Superior Process Enhanced Personal Upkeep, Hygiene More Attractive, Better Outside New, Unique or Different Formula Enhanced House-Care Results, Upkeep Healthier-Enhanced Cure, Care, Maintenance Longer Lasting, More Durable More Natural Known Brand in a New Category Extra Convenience, Added Portability, Ready-to-Use Percent of New Product Non-Food Pacesetters with Benefits Source: IRI’s Annual New Product Pacesetters Reports Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

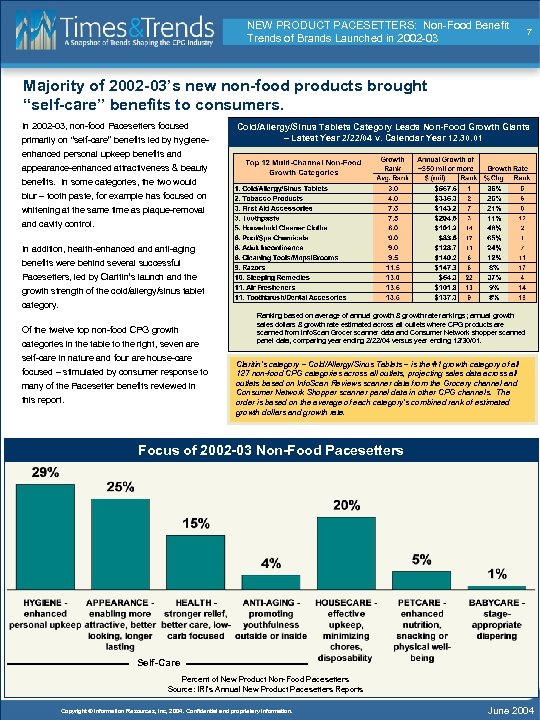

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 7 Majority of 2002 -03’s new non-food products brought “self-care” benefits to consumers. In 2002 -03, non-food Pacesetters focused primarily on “self-care” benefits led by hygiene- Cold/Allergy/Sinus Tablets Category Leads Non-Food Growth Giants – Latest Year 2/22/04 v. Calendar Year 12. 30. 01 enhanced personal upkeep benefits and appearance-enhanced attractiveness & beauty benefits. In some categories, the two would blur – tooth paste, for example has focused on whitening at the same time as plaque-removal and cavity control. In addition, health-enhanced anti-aging benefits were behind several successful Pacesetters, led by Claritin’s launch and the growth strength of the cold/allergy/sinus tablet category. Of the twelve top non-food CPG growth categories in the table to the right, seven are self-care in nature and four are house-care focused – stimulated by consumer response to many of the Pacesetter benefits reviewed in this report. Ranking based on average of annual growth & growth rate rankings; annual growth sales dollars & growth rate estimated across all outlets where CPG products are scanned from Info. Scan Grocer scanner data and Consumer Network shopper scanned panel data, comparing year ending 2/22/04 versus year ending 12/30/01. Claritin’s category – Cold/Allergy/Sinus Tablets – is the #1 growth category of all 127 non-food CPG categories across all outlets, projecting sales data across all outlets based on Info. Scan Reviews scanner data from the Grocery channel and Consumer Network Shopper scanner panel data in other CPG channels. The order is based on the average of each category’s combined rank of estimated growth dollars and growth rate. Focus of 2002 -03 Non-Food Pacesetters Self-Care Percent of New Product Non-Food Pacesetters Source: IRI’s Annual New Product Pacesetters Reports Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

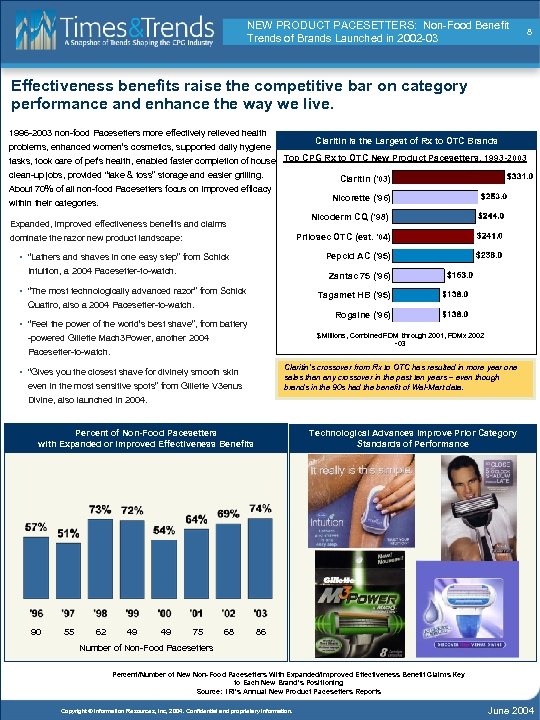

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 8 Effectiveness benefits raise the competitive bar on category performance and enhance the way we live. 1996 -2003 non-food Pacesetters more effectively relieved health Claritin Is the Largest of Rx to OTC Brands problems, enhanced women’s cosmetics, supported daily hygiene tasks, took care of pet’s health, enabled faster completion of house Top CPG Rx to OTC New Product Pacesetters, 1993 -2003 clean-up jobs, provided “take & toss” storage and easier grilling. Claritin (’ 03) About 70% of all non-food Pacesetters focus on improved efficacy Nicorette (‘ 96) within their categories. Nicoderm CQ (‘ 98) Expanded, improved effectiveness benefits and claims Prilosec OTC (est. ’ 04) dominate the razor new product landscape: Pepcid AC (‘ 95) • “Lathers and shaves in one easy step” from Schick Intuition, a 2004 Pacesetter-to-watch. Zantac 75 (‘ 96) • “The most technologically advanced razor” from Schick Tagamet HB (‘ 95) Quattro, also a 2004 Pacesetter-to-watch. Rogaine (‘ 96) • “Feel the power of the world’s best shave”, from battery $ Millions, Combined FDM through 2001, FDMx 2002 -03 -powered Gillette Mach 3 Power, another 2004 Pacesetter-to-watch. Claritin’s crossover from Rx to OTC has resulted in more year one sales than any crossover in the past ten years – even though brands in the 90 s had the benefit of Wal-Mart data. • “Gives you the closest shave for divinely smooth skin even in the most sensitive spots” from Gillette V 3 enus Divine, also launched in 2004. Percent of Non-Food Pacesetters with Expanded or Improved Effectiveness Benefits 90 55 62 49 49 75 68 Technological Advances Improve Prior Category Standards of Performance 86 Number of Non-Food Pacesetters Percent/Number of New Non-Food Pacesetters With Expanded/Improved Effectiveness Benefit Claims Key to Each New Brand’s Positioning Source: IRI’s Annual New Product Pacesetters Reports Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

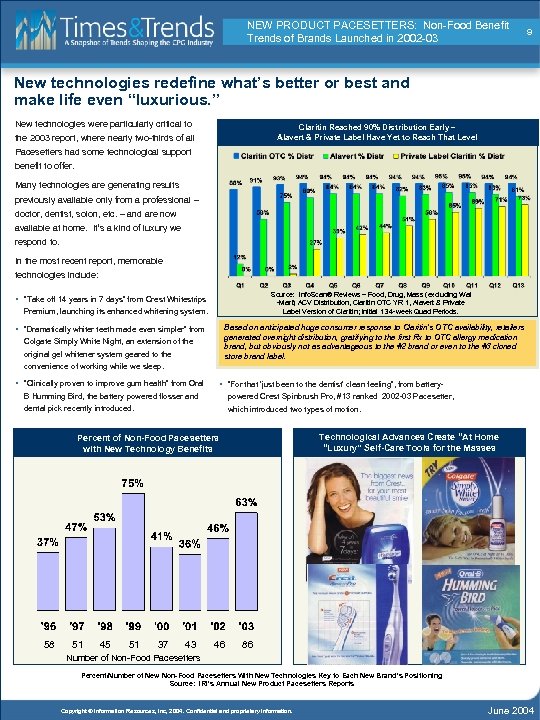

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 9 New technologies redefine what’s better or best and make life even “luxurious. ” New technologies were particularly critical to Claritin Reached 90% Distribution Early – Alavert & Private Label Have Yet to Reach That Level the 2003 report, where nearly two-thirds of all Pacesetters had some technological support benefit to offer. Many technologies are generating results previously available only from a professional – doctor, dentist, solon, etc. – and are now available at home. It’s a kind of luxury we respond to. In the most recent report, memorable technologies include: Source: Info. Scan® Reviews – Food, Drug, Mass (excluding Wal -Mart) ACV Distribution, Claritin OTC YR 1, Alavert & Private Label Version of Claritin; Initial 13 4 -week Quad Periods. • “Take off 14 years in 7 days” from Crest Whitestrips Premium, launching its enhanced whitening system. Based on anticipated huge consumer response to Claritin’s OTC availability, retailers generated overnight distribution, gratifying to the first Rx to OTC allergy medication brand, but obviously not as advantageous to the #2 brand or even to the #3 cloned store brand label. • “Dramatically whiter teeth made even simpler” from Colgate Simply White Night, an extension of the original gel whitener system geared to the convenience of working while we sleep. • “Clinically proven to improve gum health” from Oral • “For that ‘just been to the dentist’ clean feeling”, from battery- B Humming Bird, the battery powered flosser and powered Crest Spinbrush Pro, #13 ranked 2002 -03 Pacesetter, dental pick recently introduced. which introduced two types of motion. Technological Advances Create “At Home “Luxury” Self-Care Tools for the Masses Percent of Non-Food Pacesetters with New Technology Benefits 58 51 45 51 37 43 46 86 Number of Non-Food Pacesetters Percent/Number of New Non-Food Pacesetters With New Technologies Key to Each New Brand’s Positioning Source: IRI’s Annual New Product Pacesetters Reports Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

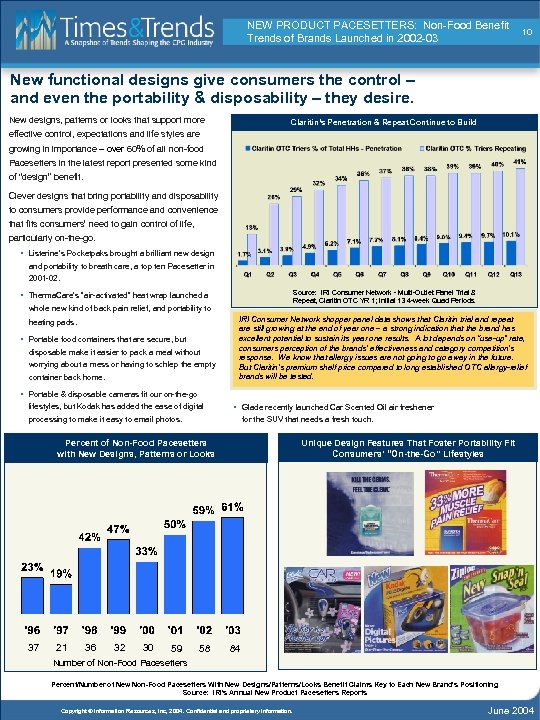

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 10 New functional designs give consumers the control – and even the portability & disposability – they desire. New designs, patterns or looks that support more Claritin’s Penetration & Repeat Continue to Build effective control, expectations and life styles are growing in importance – over 60% of all non-food Pacesetters in the latest report presented some kind of “design” benefit. Clever designs that bring portability and disposability to consumers provide performance and convenience that fits consumers’ need to gain control of life, particularly on-the-go. • Listerine’s Pocketpaks brought a brilliant new design and portability to breath care, a top ten Pacesetter in 2001 -02. Source: IRI Consumer Network - Multi-Outlet Panel Trial & Repeat, Claritin OTC YR 1; Initial 13 4 -week Quad Periods. • Therma. Care’s “air-activated” heat wrap launched a whole new kind of back pain relief, and portability to heating pads. • Portable food containers that are secure, but disposable make it easier to pack a meal without worrying about a mess or having to schlep the empty container back home. IRI Consumer Network shopper panel data shows that Claritin trial and repeat are still growing at the end of year one – a strong indication that the brand has excellent potential to sustain its year one results. A lot depends on “use-up” rate, consumers perception of the brands’ effectiveness and category competition’s response. We know that allergy issues are not going to go away in the future. But Claritin’s premium shelf price compared to long established OTC allergy-relief brands will be tested. • Portable & disposable cameras fit our on-the-go lifestyles, but Kodak has added the ease of digital • Glade recently launched Car Scented Oil air freshener processing to make it easy to email photos. for the SUV that needs a fresh touch. Unique Design Features That Foster Portability Fit Consumers’ “On-the-Go” Lifestyles Percent of Non-Food Pacesetters with New Designs, Patterns or Looks 37 21 36 32 30 59 58 84 Number of Non-Food Pacesetters Percent/Number of New Non-Food Pacesetters With New Designs/Patterns/Looks Benefit Claims Key to Each New Brand’s Positioning Source: IRI’s Annual New Product Pacesetters Reports Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

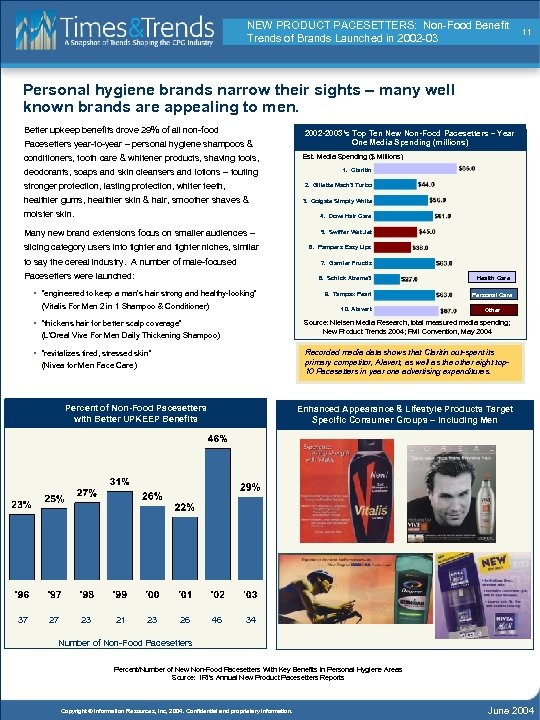

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 11 Personal hygiene brands narrow their sights – many well known brands are appealing to men. Better upkeep benefits drove 29% of all non-food Pacesetters year-to-year – personal hygiene shampoos & 2002 -2003’s Top Ten New Non-Food Pacesetters – Year One Media Spending (millions) conditioners, tooth care & whitener products, shaving tools, Est. Media Spending ($ Millions) deodorants, soaps and skin cleansers and lotions – touting stronger protection, lasting protection, whiter teeth, 1. Claritin 2. Gillette Mach 3 Turbo healthier gums, healthier skin & hair, smoother shaves & 3. Colgate Simply White moister skin. 4. Dove Hair Care Many new brand extensions focus on smaller audiences – 5. Swiffer Wet Jet slicing category users into tighter and tighter niches, similar to say the cereal industry. A number of male-focused 7. Garnier Fructis Pacesetters were launched: 8. Schick Xtreme 3 • “engineered to keep a man’s hair strong and healthy-looking” (Vitalis For Men 2 in 1 Shampoo & Conditioner) (Nivea for Men Face Care) Percent of Non-Food Pacesetters with Better UPKEEP Benefits 21 23 Personal Care Other Recorded media data shows that Claritin out-spent its primary competitor, Alavert, as well as the other eight top 10 Pacesetters in year one advertising expenditures. • “revitalizes tired, stressed skin” 23 Health Care Source: Nielsen Media Research, total measured media spending; New Product Trends 2004; FMI Convention, May 2004 (L’Oreal Vive For Men Daily Thickening Shampoo) 27 9. Tampax Pearl 10. Alavert • “thickens hair for better scalp coverage” 37 6. Pampers Easy Ups 26 Enhanced Appearance & Lifestyle Products Target Specific Consumer Groups – Including Men 46 34 Number of Non-Food Pacesetters Percent/Number of New Non-Food Pacesetters With Key Benefits in Personal Hygiene Areas Source: IRI’s Annual New Product Pacesetters Reports Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

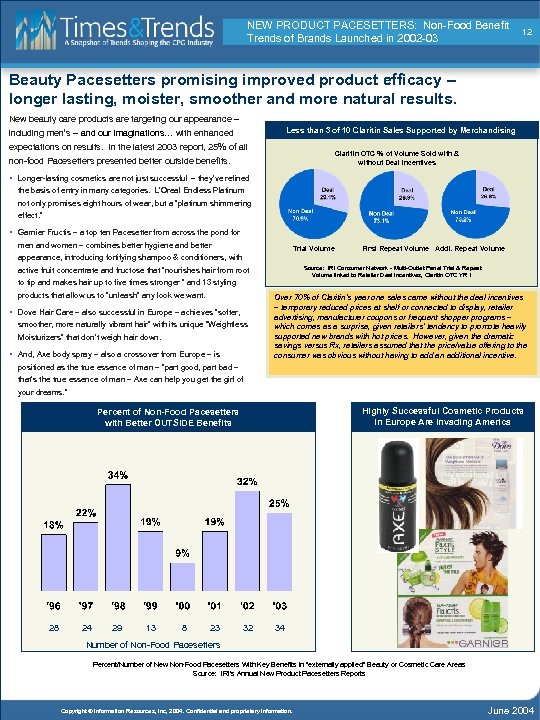

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 12 Beauty Pacesetters promising improved product efficacy – longer lasting, moister, smoother and more natural results. New beauty care products are targeting our appearance – Less than 3 of 10 Claritin Sales Supported by Merchandising including men’s – and our imaginations… with enhanced expectations on results. In the latest 2003 report, 25% of all Claritin OTC % of Volume Sold with & without Deal Incentives non-food Pacesetters presented better outside benefits. • Longer-lasting cosmetics are not just successful – they’ve refined the basis of entry in many categories. L’Oreal Endless Platinum not only promises eight hours of wear, but a “platinum shimmering effect. ” • Garnier Fructis – a top ten Pacesetter from across the pond for men and women – combines better hygiene and better Trial Volume First Repeat Volume Addl. Repeat Volume appearance, introducing fortifying shampoo & conditioners, with Source: IRI Consumer Network - Multi-Outlet Panel Trial & Repeat Volume linked to Retailer Deal Incentives, Claritin OTC YR 1 active fruit concentrate and fructose that “nourishes hair from root to tip and makes hair up to five times stronger ” and 13 styling products that allow us to “unleash” any look we want. • Dove Hair Care – also successful in Europe – achieves “softer, smoother, more naturally vibrant hair” with its unique “Weightless Moisturizers” that don’t weigh hair down. • And, Axe body spray – also a crossover from Europe – is Over 70% of Claritin’s year one sales came without the deal incentives – temporary reduced prices at shelf or connected to display, retailer advertising, manufacturer coupons or frequent shopper programs – which comes as a surprise, given retailers’ tendency to promote heavily supported new brands with hot prices. However, given the dramatic savings versus Rx, retailers assumed that the price/value offering to the consumer was obvious without having to add an additional incentive. positioned as the true essence of man – “part good, part bad – that’s the true essence of man – Axe can help you get the girl of your dreams. ” Highly Successful Cosmetic Products in Europe Are Invading America Percent of Non-Food Pacesetters with Better OUTSIDE Benefits 28 24 29 13 8 23 32 34 Number of Non-Food Pacesetters Percent/Number of New Non-Food Pacesetters With Key Benefits in “externally applied” Beauty or Cosmetic Care Areas Source: IRI’s Annual New Product Pacesetters Reports Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

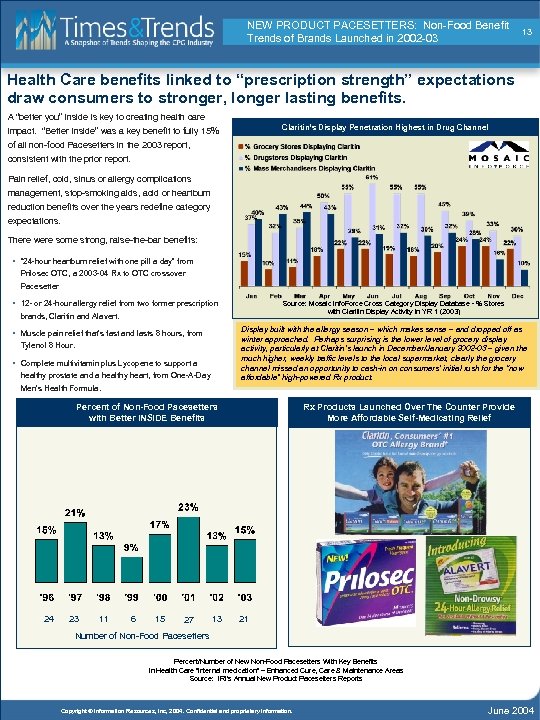

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 13 Health Care benefits linked to “prescription strength” expectations draw consumers to stronger, longer lasting benefits. A “better you” inside is key to creating health care Claritin’s Display Penetration Highest in Drug Channel impact. “Better Inside” was a key benefit to fully 15% of all non-food Pacesetters in the 2003 report, consistent with the prior report. Pain relief, cold, sinus or allergy complications management, stop-smoking aids, acid or heartburn reduction benefits over the years redefine category expectations. There were some strong, raise-the-bar benefits: • “ 24 -hour heartburn relief with one pill a day” from Prilosec OTC, a 2003 -04 Rx to OTC crossover Pacesetter • 12 - or 24 -hour allergy relief from two former prescription Source: Mosaic Info. Force Cross Category Display Database - % Stores with Claritin Display Activity in YR 1 (2003) brands, Claritin and Alavert. Display built with the allergy season – which makes sense – and dropped off as winter approached. Perhaps surprising is the lower level of grocery display activity, particularly at Claritin’s launch in December/January 2002 -03 – given the much higher, weekly traffic levels to the local supermarket, clearly the grocery channel missed an opportunity to cash-in on consumers’ initial rush for the “now affordable” high-powered Rx product. • Muscle pain relief that’s fast and lasts 8 hours, from Tylenol 8 Hour. • Complete multivitamin plus Lycopene to support a healthy prostate and a healthy heart, from One-A-Day Men’s Health Formula. Rx Products Launched Over The Counter Provide More Affordable Self-Medicating Relief Percent of Non-Food Pacesetters with Better INSIDE Benefits 24 23 11 6 15 27 13 21 Number of Non-Food Pacesetters Percent/Number of New Non-Food Pacesetters With Key Benefits in Health Care “internal medication” – Enhanced Cure, Care & Maintenance Areas Source: IRI’s Annual New Product Pacesetters Reports Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

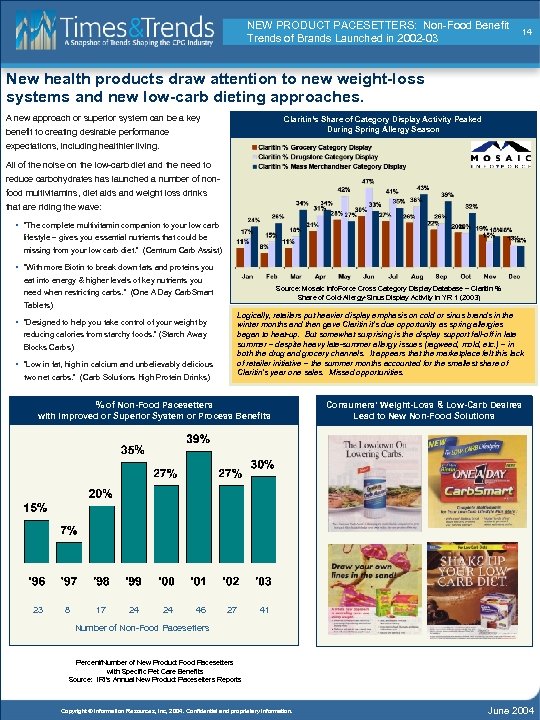

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 14 New health products draw attention to new weight-loss systems and new low-carb dieting approaches. A new approach or superior system can be a key Claritin’s Share of Category Display Activity Peaked During Spring Allergy Season benefit to creating desirable performance expectations, including healthier living. All of the noise on the low-carb diet and the need to reduce carbohydrates has launched a number of nonfood multivitamins, diet aids and weight loss drinks that are riding the wave: § “The complete multivitamin companion to your low carb lifestyle – gives you essential nutrients that could be missing from your low carb diet. ” (Centrum Carb Assist) § “With more Biotin to break down fats and proteins you eat into energy & higher levels of key nutrients you Source: Mosaic Info. Force Cross Category Display Database – Claritin % Share of Cold-Allergy-Sinus Display Activity in YR 1 (2003) need when restricting carbs. ” (One A Day Carb. Smart Tablets) Logically, retailers put heavier display emphasis on cold or sinus brands in the winter months and then gave Claritin it’s due opportunity as spring allergies began to heat-up. But somewhat surprising is the display support fall-off in late summer – despite heavy late-summer allergy issues (ragweed, mold, etc. ) – in both the drug and grocery channels. It appears that the marketplace felt this lack of retailer initiative – the summer months accounted for the smallest share of Claritin’s year one sales. Missed opportunities. § “Designed to help you take control of your weight by reducing calories from starchy foods. ” (Starch Away Blocks Carbs) § “Low in fat, high in calcium and unbelievably delicious two net carbs. ” (Carb Solutions High Protein Drinks) % of Non-Food Pacesetters with Improved or Superior System or Process Benefits 23 8 17 24 24 46 27 Consumers’ Weight-Loss & Low-Carb Desires Lead to New Non-Food Solutions 41 Number of Non-Food Pacesetters Percent/Number of New Product Food Pacesetters with Specific Pet Care Benefits Source: IRI’s Annual New Product Pacesetters Reports Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

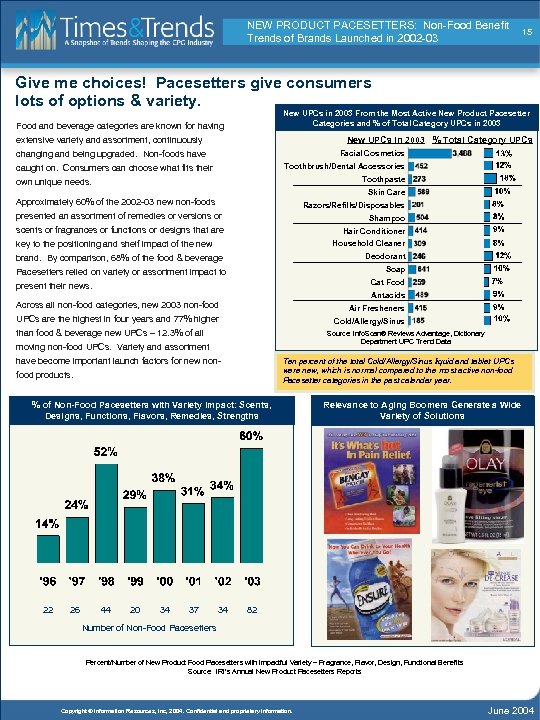

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 15 Give me choices! Pacesetters give consumers lots of options & variety. New UPCs in 2003 From the Most Active New Product Pacesetter Categories and % of Total Category UPCs in 2003 Food and beverage categories are known for having New UPCs in 2003 % Total Category UPCs extensive variety and assortment, continuously Facial Cosmetics changing and being upgraded. Non-foods have Toothbrush/Dental Accessories caught on. Consumers can choose what fits their Toothpaste own unique needs. Skin Care Approximately 60% of the 2002 -03 new non-foods Razors/Refills/Disposables presented an assortment of remedies or versions or Shampoo scents or fragrances or functions or designs that are Hair Conditioner key to the positioning and shelf impact of the new Household Cleaner Deodorant brand. By comparison, 68% of the food & beverage Soap Pacesetters relied on variety or assortment impact to Cat Food present their news. Antacids Across all non-food categories, new 2003 non-food Air Fresheners UPCs are the highest in four years and 77% higher Cold/Allergy/Sinus than food & beverage new UPCs – 12. 3% of all Source: Info. Scan® Reviews Advantage, Dictionary Department UPC Trend Data moving non-food UPCs. Variety and assortment Ten percent of the total Cold/Allergy/Sinus liquid and tablet UPCs were new, which is normal compared to the most active non-food Pacesetter categories in the past calendar year. have become important launch factors for new nonfood products. % of Non-Food Pacesetters with Variety Impact: Scents, Designs, Functions, Flavors, Remedies, Strengths 22 26 44 20 34 37 34 Relevance to Aging Boomers Generate a Wide Variety of Solutions 82 Number of Non-Food Pacesetters Percent/Number of New Product Food Pacesetters with Impactful Variety – Fragrance, Flavor, Design, Functional Benefits Source: IRI’s Annual New Product Pacesetters Reports Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

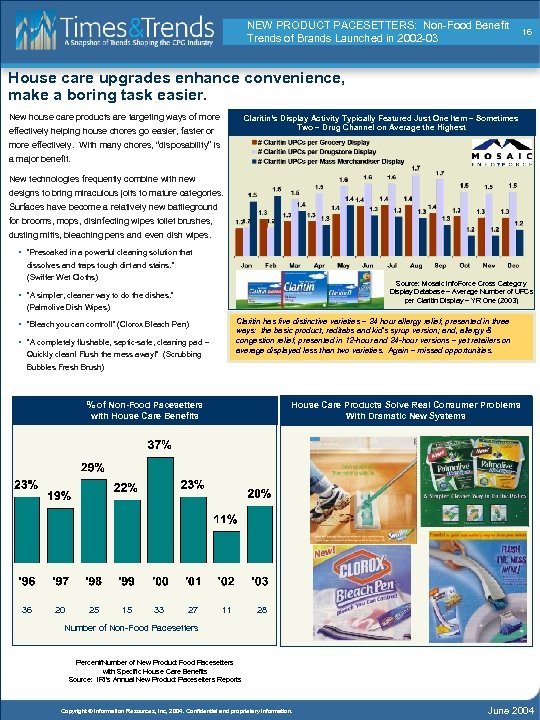

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 16 House care upgrades enhance convenience, make a boring task easier. New house care products are targeting ways of more Claritin’s Display Activity Typically Featured Just One Item – Sometimes Two – Drug Channel on Average the Highest effectively helping house chores go easier, faster or more effectively. With many chores, “disposability” is a major benefit. New technologies frequently combine with new designs to bring miraculous jolts to mature categories. Surfaces have become a relatively new battleground for brooms, mops, disinfecting wipes toilet brushes, dusting mitts, bleaching pens and even dish wipes. § “Presoaked in a powerful cleaning solution that dissolves and traps tough dirt and stains. ” (Swiffer Wet Cloths) Source: Mosaic Info. Force Cross Category Display Database – Average Number of UPCs per Claritin Display – YR One (2003) § “A simpler, cleaner way to do the dishes. ” (Palmolive Dish Wipes) Claritin has five distinctive varieties – 24 hour allergy relief, presented in three ways: the basic product, reditabs and kid’s syrup version; and, allergy & congestion relief, presented in 12 -hour and 24 -hour versions – yet retailers on average displayed less than two varieties. Again – missed opportunities. § “Bleach you can control!” (Clorox Bleach Pen) § “A completely flushable, septic-safe, cleaning pad – Quickly clean! Flush the mess away!” (Scrubbing Bubbles Fresh Brush) House Care Products Solve Real Consumer Problems With Dramatic New Systems % of Non-Food Pacesetters with House Care Benefits 36 20 25 15 33 27 11 28 Number of Non-Food Pacesetters Percent/Number of New Product Food Pacesetters with Specific House Care Benefits Source: IRI’s Annual New Product Pacesetters Reports Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

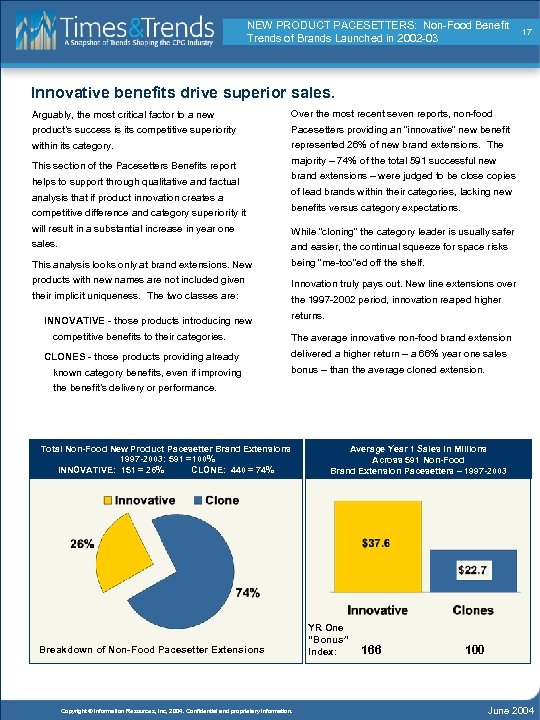

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 17 Innovative benefits drive superior sales. Arguably, the most critical factor to a new Over the most recent seven reports, non-food product’s success is its competitive superiority Pacesetters providing an “innovative” new benefit within its category. represented 26% of new brand extensions. The This section of the Pacesetters Benefits report helps to support through qualitative and factual analysis that if product innovation creates a competitive difference and category superiority it majority – 74% of the total 591 successful new brand extensions – were judged to be close copies of lead brands within their categories, lacking new benefits versus category expectations. will result in a substantial increase in year one While “cloning” the category leader is usually safer sales. and easier, the continual squeeze for space risks This analysis looks only at brand extensions. New being “me-too”ed off the shelf. products with new names are not included given Innovation truly pays out. New line extensions over their implicit uniqueness. The two classes are: the 1997 -2002 period, innovation reaped higher INNOVATIVE - those products introducing new returns. competitive benefits to their categories. The average innovative non-food brand extension CLONES - those products providing already delivered a higher return – a 66% year one sales known category benefits, even if improving bonus – than the average cloned extension. the benefit’s delivery or performance. Total Non-Food New Product Pacesetter Brand Extensions 1997 -2003: 591 =100% INNOVATIVE: 151 = 26% CLONE: 440 = 74% Breakdown of Non-Food Pacesetter Extensions Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. Average Year 1 Sales in Millions Across 591 Non-Food Brand Extension Pacesetters – 1997 -2003 YR One “Bonus” Index: 166 100 June 2004

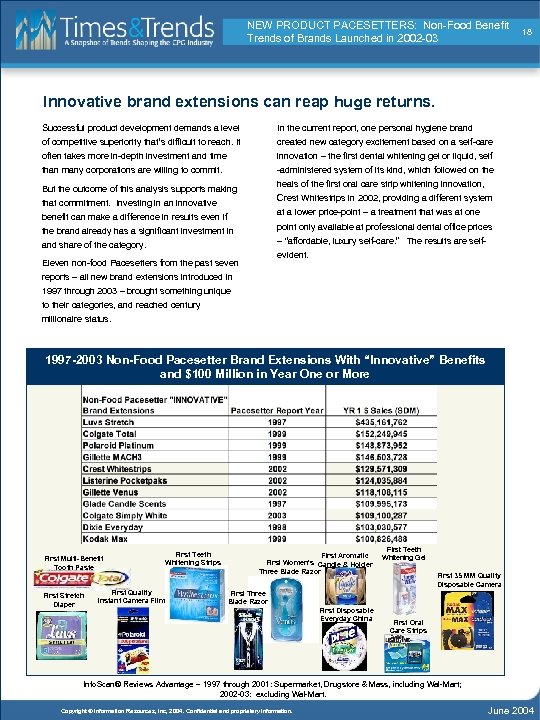

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 18 Innovative brand extensions can reap huge returns. Successful product development demands a level In the current report, one personal hygiene brand of competitive superiority that’s difficult to reach. It created new category excitement based on a self-care often takes more in-depth investment and time innovation – the first dental whitening gel or liquid, self than many corporations are willing to commit. -administered system of its kind, which followed on the But the outcome of this analysis supports making heals of the first oral care strip whitening innovation, Crest Whitestrips in 2002, providing a different system that commitment. Investing in an innovative at a lower price-point – a treatment that was at one benefit can make a difference in results even if point only available at professional dental office prices the brand already has a significant investment in – “affordable, luxury self-care. ” The results are self- and share of the category. evident. Eleven non-food Pacesetters from the past seven reports – all new brand extensions introduced in 1997 through 2003 – brought something unique to their categories, and reached century millionaire status. 1997 -2003 Non-Food Pacesetter Brand Extensions With “Innovative” Benefits and $100 Million in Year One or More First Multi-Benefit Tooth Paste First Stretch Diaper First Quality Instant Camera Film First Teeth Whitening Strips First Aromatic First Women’s Candle & Holder Three Blade Razor First Teeth Whitening Gel First 35 MM Quality Disposable Camera First Three Blade Razor First Disposable Everyday China First Oral Care Strips Info. Scan® Reviews Advantage – 1997 through 2001: Supermarket, Drugstore & Mass, including Wal-Mart; 2002 -03: excluding Wal-Mart. Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 19 Summary & Implications CPG Manufacturers are concentrating on building more successful core brand extensions. The challenge is to develop consumer benefits that take well-known equities to stimulating and appealing new expectations – to raise the bar of shopper expectations for each category based on benefits that have never been experienced before in that category. The trends in this recap lead us to ten factors that are generating success. Make Life Easier. House care gadgets that seem Great Designs That Solve Real Problems. Inexpensive miraculous, but that are extremely simple and convenient kitchen care or house care alternatives that can be and reasonably priced. Portable self-care products that disposed of without guilt are winning. Razors that get function effortlessly and effectively. Disposables that closer shaves without nicks. Hair care products that treat negate storage issues. Self-medicating products that cut and beautify at the same time. Tooth brushes that spin down on health costs. Feeding our need to minimize life’s and remove plaque. Diapers that correspond to all ages. pressures and gain control of life’s issues. Enhanced Health Care Performance. The obesity crisis Luxury For the Masses. Teeth whitening without having in particular is ripe for all sorts of do-it-yourself products to pay dentist chair prices but that gets good results. and systems, ala the Atkins or South Beach approaches. Prescription strength without having to pay Rx prices. It’s an issue that bridges all ages and demographics. It’s Even top-of-the-line pet food brands without having to pay an opportunity as big for non-foods as foods. pet specialty store prices. It’s all part of the desire for luxury in all facets of living at discount prices. It’s the buying a Mercedes at discount prices syndrome. More Convenient Health-Care Delivery or Maintenance. Simple, affordable products that aid dieting or weight management – a patch, a candy, a Significantly Improved Performance. Products that supplement, a liquid, a suppressant strip – will reap have serious technological or design advances that can rewards if proven effective. New devices that give promise a new peak in performance in category consumers control of health monitoring – including expectations and raise the bar on what constitutes “top-of- diabetes or blood-sugar and cholesterol levels – will feed the-line. ” consumers’ need to control their own destinies. Technical News That Creates New Categories. The Preservation of Our Youth – “De-Aging” Physical list of successes keeps growing: disposable cleaner Performance or Appearance. Products designed to cloths that redefine every imaginable house care chore, manipulate aging health or appearance issues without a portable mouthwash, gum that whitens teeth, strips that prescription have big potential. Technically superior, but whiten teeth, bandages that heat up, portable diet or affordable upgrades with hard facts will score with the energy bars, plug-in air fresheners, dog bones that clean highly critical boomer age group. teeth – redefining advances that fit the old adage “what will they think of next!” Crossing Over to OTC. With rising health care and prescription costs, consumers are looking for affordable Longer Lasting Benefits That Raise Category options with strong effectiveness reputations that they can Expectations. Dependability and longer-lasting benefits administer themselves with confidence. But the crossover particularly geared to women’s cosmetics have worked in phenomena is not just limited to Rx brands. Respected the past. Adding therapeutic benefits that reward and names in pet care, nutritional supplements, and sooth will also appeal to our self-gratification interests. restaurant or café specialty channels prove this is a way OTC medications that lengthen relief periods are proving to make it big in conventional CPG channels – even take successful – eight hours has become a minimum, given over category share leadership. all of the 12 and 24 hour products. Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

NEW PRODUCT PACESETTERS: Non-Food Benefit Trends of Brands Launched in 2002 -03 20 The Challenge: Building Strategies Around Compelling Consumer Propositions The challenge to building more successful extensions is developing more compelling consumer propositions, benefits that beg “I’ll try this!” and innovation that leads to “I’ll try this again!” Making benefit decisions must be made on better consumer information and understanding. A number of “next steps” recommendations come to mind. The first is called Attribute Drivers. IRI has developed a consumer-based information and modeling tool that can help provide better information and understanding of product benefits and variables. In a nutshell, Attribute Drivers is a consumer-choice modeling approach that provides insight into any one of numerous brand benefit scenarios. The second recommendation is a custom market structure analysis. A new and truly innovative Pacesetter will make a major impact on category dynamics and standards. And, the existing brands’ places in the market structure are going to change. These typically beg several questions: • Where is my existing brand’s place in the market structure? Am I now perceived as “about the same? Out-of-date? ” New • What will happen when my competitor replicates the key benefit of the innovative Pacesetter? • How have core consumers shifted their category preferences and standards? • What attitudes and idiosyncrasies separate a successful new Pacesetter’s consumers from core competitive brands? Understanding consumers and their biases is the key to understanding what variables and what combination of benefits are critical to the next successful Pacesetter. IRI’s ability to integrate census sales data and consumer panel purchase, demographic, health conditions & behavior and attitudinal data provides the accuracy and leverage that’s needed to generate actionable decisions. Our modeling expertise is well known in the industry. Contact your local IRI representative, or local IRI panel consultant to discuss this opportunity. Learn More About New Product Success from IRI “Creating New Products That Change How We Live” was a breakout topic at IRI’s Reinventing CPG conference in February and “Identifying Transformational New Products” a topic at the annual FMI convention this May. Both were presented by Valerie Skala, VP, Analytics Product Management at IRI. To learn more about these presentations or additional research on new product successes and failures, including a review of “ 10 ways to beat the odds in new products, ” contact your IRI account rep. Questions & Comments on This Brief IRI welcomes questions, comments and suggestions regarding the Times&Trends report and this brief. Please email the editor Tom Goettsche at times&trends@infores. com. About IRI Information Resources, Inc. is a leading global provider of market content, analytic services and businessperformance management (BPM) solutions to the CPG and retail industries. IRI's clients include the leading CPG and retail companies in the world. IRI's market content and analytic services provide these companies with market and consumer insights. IRI's BPM solutions uniquely combine its breakthrough enterprise analytics software, market content and analytic models to provide a total view of the market and to enable maximum business performance across marketing, sales and operations. IRI's solutions enable the consumer--driven real-time CPG and retail enterprise. More information is available at www. infores. com. Copyright © Information Resources, Inc, 2004. Confidential and proprietary information. June 2004

80f93e005f118871e7cc4ca77cb243aa.ppt