93a69701749f1b34d2275b7693376243.ppt

- Количество слайдов: 31

1

1

Mark R. Parthemer, Managing Director and Fiduciary Counsel, Southeast US Mr. Parthemer is Fiduciary Counsel, Southeast Region, of Bessemer Trust, an exclusive wealth management company providing services to families with investment assets in excess of $10 million. Mr. Parthemer heads the region’s estate and legacy planning team, who assists Bessemer’s client families to develop generational wealth transfer strategies. Prior to joining Bessemer Trust, Mark was in private law practice in Pennsylvania and Florida and also spent several years at Pricewaterhouse. Coopers and was involved in private businesses. Mr. Parthemer is a national lecturer and published author. He has been faculty at University of Miami’s prestigious Heckerling Institute, as well as NYU and Tulane Tax Institutes, was an Adjunct Professor at the Widener School of Law, and is a guest lecturer at the University of Miami’s Law School LLM Program. He regularly contributes articles to tax and estate planning magazines and writes a regular column for the Journal of Financial Service Professionals. Mr. Parthemer is vice chair of the American Bar Association’s Insurance and Financial Planning Committee, a member of the executive council of the Florida Bankers Association, as well as chair of their Trust Law Legislation Committee. He is a member of the board and ABA Liaison to Synergy Summit. He received his J. D. from The Dickinson School of Law, Penn State University, and his B. A. and B. S. degrees from Franklin and Marshall College, has been awarded the Accredited Estate Planner designation and regularly recognized as one of The Best Lawyers in America (Trust and Estates) and a Florida Super Lawyer. 2

Mark R. Parthemer, Managing Director and Fiduciary Counsel, Southeast US Mr. Parthemer is Fiduciary Counsel, Southeast Region, of Bessemer Trust, an exclusive wealth management company providing services to families with investment assets in excess of $10 million. Mr. Parthemer heads the region’s estate and legacy planning team, who assists Bessemer’s client families to develop generational wealth transfer strategies. Prior to joining Bessemer Trust, Mark was in private law practice in Pennsylvania and Florida and also spent several years at Pricewaterhouse. Coopers and was involved in private businesses. Mr. Parthemer is a national lecturer and published author. He has been faculty at University of Miami’s prestigious Heckerling Institute, as well as NYU and Tulane Tax Institutes, was an Adjunct Professor at the Widener School of Law, and is a guest lecturer at the University of Miami’s Law School LLM Program. He regularly contributes articles to tax and estate planning magazines and writes a regular column for the Journal of Financial Service Professionals. Mr. Parthemer is vice chair of the American Bar Association’s Insurance and Financial Planning Committee, a member of the executive council of the Florida Bankers Association, as well as chair of their Trust Law Legislation Committee. He is a member of the board and ABA Liaison to Synergy Summit. He received his J. D. from The Dickinson School of Law, Penn State University, and his B. A. and B. S. degrees from Franklin and Marshall College, has been awarded the Accredited Estate Planner designation and regularly recognized as one of The Best Lawyers in America (Trust and Estates) and a Florida Super Lawyer. 2

The ABC’s of ETFs: What You Need to Know about Exchange Traded Funds Palm Beach Financial Planning Association Boca Raton, Fl March 24, 2011 Mark R. Parthemer, Esq. , AEP Managing Director Fiduciary Counsel, Southeast US Bessemer Trust 222 Royal Palm Way Palm Beach, FL 33480 parthemer@bessemer. com Copyright © 2011 by Bessemer Trust Company, N. A. All rights reserved.

The ABC’s of ETFs: What You Need to Know about Exchange Traded Funds Palm Beach Financial Planning Association Boca Raton, Fl March 24, 2011 Mark R. Parthemer, Esq. , AEP Managing Director Fiduciary Counsel, Southeast US Bessemer Trust 222 Royal Palm Way Palm Beach, FL 33480 parthemer@bessemer. com Copyright © 2011 by Bessemer Trust Company, N. A. All rights reserved.

The ABC’s of ETFs: Easy as One-Two-Three I. ETF Basics II. Modern Portfolio Theory and the Prudent Investor Act III. Case Studies – Four Thoughtful Planning Uses of ETFs 4

The ABC’s of ETFs: Easy as One-Two-Three I. ETF Basics II. Modern Portfolio Theory and the Prudent Investor Act III. Case Studies – Four Thoughtful Planning Uses of ETFs 4

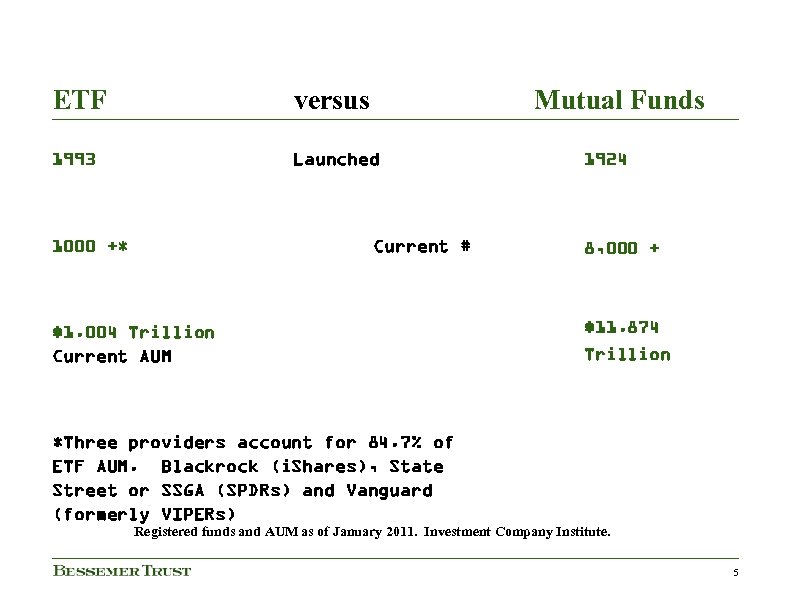

ETF versus 1993 Launched 1000 +* Mutual Funds Current # $1. 004 Trillion Current AUM 1924 8, 000 + $11. 874 Trillion *Three providers account for 84. 7% of ETF AUM. Blackrock (i. Shares), State Street or SSGA (SPDRs) and Vanguard (formerly VIPERs) Registered funds and AUM as of January 2011. Investment Company Institute. 5

ETF versus 1993 Launched 1000 +* Mutual Funds Current # $1. 004 Trillion Current AUM 1924 8, 000 + $11. 874 Trillion *Three providers account for 84. 7% of ETF AUM. Blackrock (i. Shares), State Street or SSGA (SPDRs) and Vanguard (formerly VIPERs) Registered funds and AUM as of January 2011. Investment Company Institute. 5

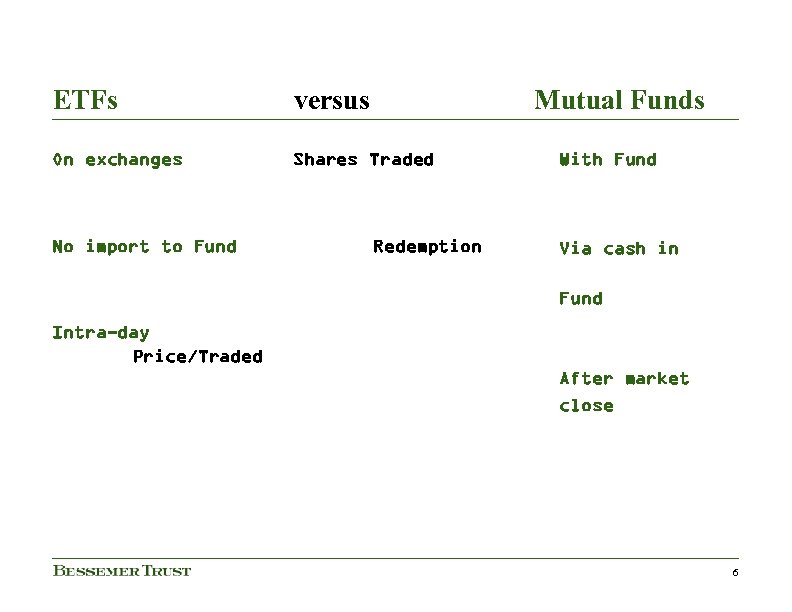

ETFs versus On exchanges Shares Traded No import to Fund Mutual Funds Redemption With Fund Via cash in Fund Intra-day Price/Traded After market close 6

ETFs versus On exchanges Shares Traded No import to Fund Mutual Funds Redemption With Fund Via cash in Fund Intra-day Price/Traded After market close 6

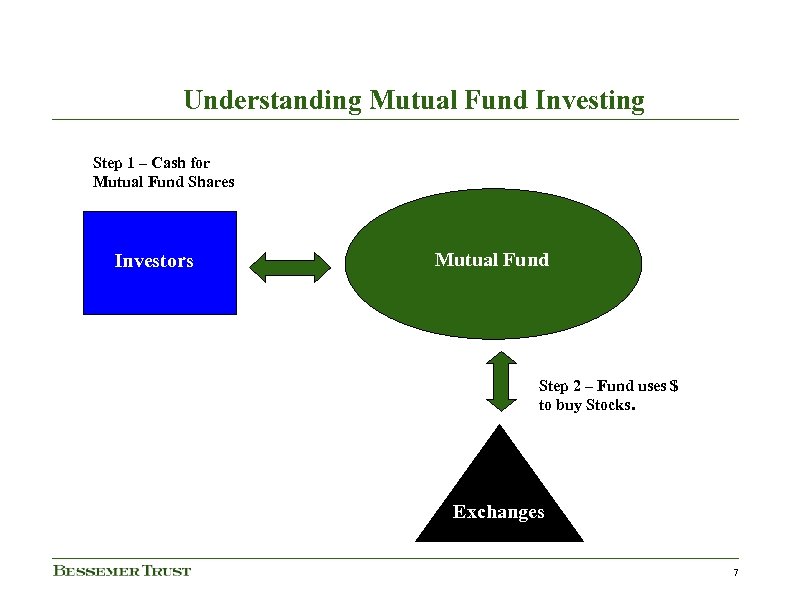

Understanding Mutual Fund Investing Step 1 – Cash for Mutual Fund Shares Investors Mutual Fund Step 2 – Fund uses $ to buy Stocks. Exchanges 7

Understanding Mutual Fund Investing Step 1 – Cash for Mutual Fund Shares Investors Mutual Fund Step 2 – Fund uses $ to buy Stocks. Exchanges 7

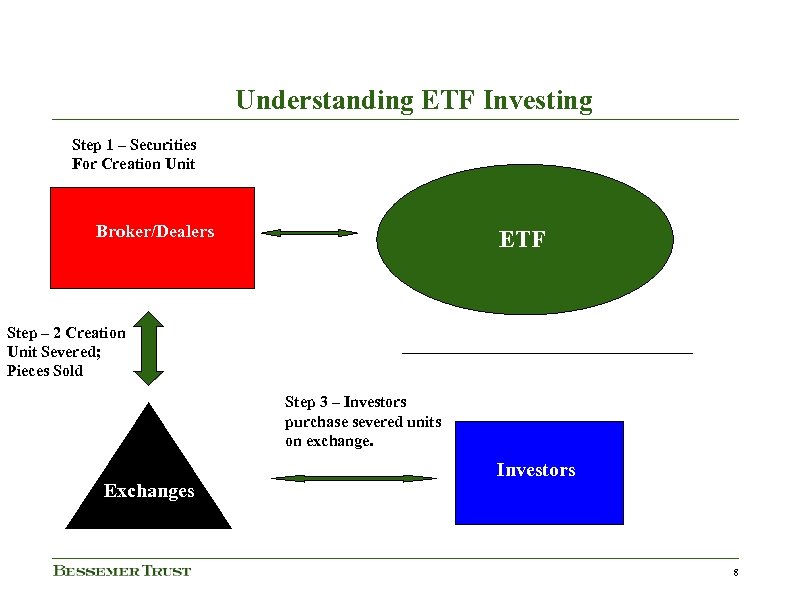

Understanding ETF Investing Step 1 – Securities For Creation Unit Broker/Dealers ETF Step – 2 Creation Unit Severed; Pieces Sold Step 3 – Investors purchase severed units on exchange. Exchanges Investors 8

Understanding ETF Investing Step 1 – Securities For Creation Unit Broker/Dealers ETF Step – 2 Creation Unit Severed; Pieces Sold Step 3 – Investors purchase severed units on exchange. Exchanges Investors 8

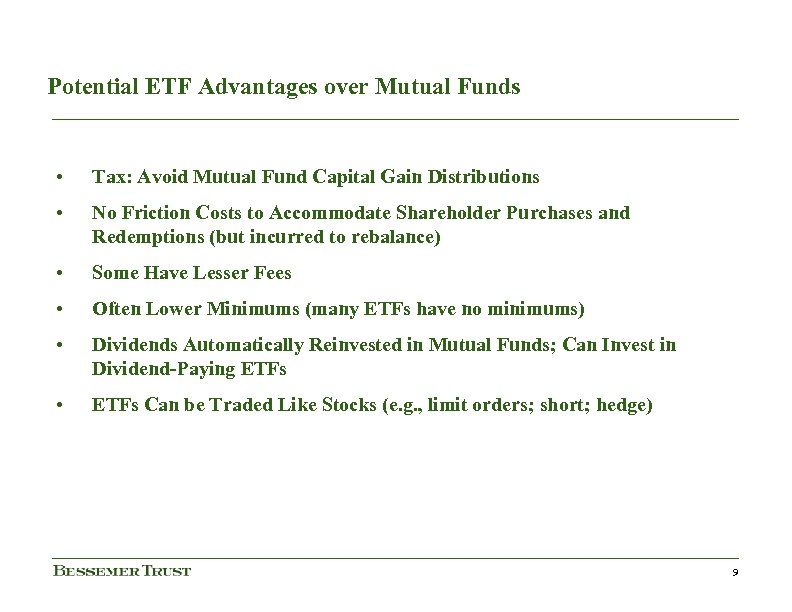

Potential ETF Advantages over Mutual Funds • Tax: Avoid Mutual Fund Capital Gain Distributions • No Friction Costs to Accommodate Shareholder Purchases and Redemptions (but incurred to rebalance) • Some Have Lesser Fees • Often Lower Minimums (many ETFs have no minimums) • Dividends Automatically Reinvested in Mutual Funds; Can Invest in Dividend-Paying ETFs • ETFs Can be Traded Like Stocks (e. g. , limit orders; short; hedge) 9

Potential ETF Advantages over Mutual Funds • Tax: Avoid Mutual Fund Capital Gain Distributions • No Friction Costs to Accommodate Shareholder Purchases and Redemptions (but incurred to rebalance) • Some Have Lesser Fees • Often Lower Minimums (many ETFs have no minimums) • Dividends Automatically Reinvested in Mutual Funds; Can Invest in Dividend-Paying ETFs • ETFs Can be Traded Like Stocks (e. g. , limit orders; short; hedge) 9

II. Modern Portfolio Theory and the Prudent Investor The Wisdom (and Law) Behind the Adage: Concentration to make wealth; diversification to preserve it. 10

II. Modern Portfolio Theory and the Prudent Investor The Wisdom (and Law) Behind the Adage: Concentration to make wealth; diversification to preserve it. 10

Understanding the Prudent Investor Act As adopted in 44 states and DC, there are four fundamental tenets: 1. Entire investment portfolio considered when determining prudence of an individual investment. 2. Diversification required for prudent fiduciary investing. 3. No category or type of investment is deemed inherently imprudent. • • 4. Suitability to the trust account's purposes and beneficiaries' needs is the determinant. Fiduciaries permitted/encouraged to develop greater flexibility in overall portfolio management. Delegation of investment management/other functions to third parties permitted. 11

Understanding the Prudent Investor Act As adopted in 44 states and DC, there are four fundamental tenets: 1. Entire investment portfolio considered when determining prudence of an individual investment. 2. Diversification required for prudent fiduciary investing. 3. No category or type of investment is deemed inherently imprudent. • • 4. Suitability to the trust account's purposes and beneficiaries' needs is the determinant. Fiduciaries permitted/encouraged to develop greater flexibility in overall portfolio management. Delegation of investment management/other functions to third parties permitted. 11

Understanding Modern Portfolio Theory • Rational investors will use diversification to optimize their portfolios, as markets do not reward for financial risks that can be managed. • The model assumes that investors are risk averse, thus seek best riskreturn profile: – If two assets offer the same expected return, investors will prefer the less risky one. – Investors will take on increased risk only if compensated by higher expected returns. Conversely, investors who wants higher returns must accept more risk. 12

Understanding Modern Portfolio Theory • Rational investors will use diversification to optimize their portfolios, as markets do not reward for financial risks that can be managed. • The model assumes that investors are risk averse, thus seek best riskreturn profile: – If two assets offer the same expected return, investors will prefer the less risky one. – Investors will take on increased risk only if compensated by higher expected returns. Conversely, investors who wants higher returns must accept more risk. 12

Understanding Modern Portfolio Theory Market will not reward for risks that can be managed: Company specific risk 1. • Managed by exposure to among securities in the same asset class • Think Enron, AIG, Lehman Market risk 2. • Managed by exposure among several uncorrelated asset classes or sectors • Think “tech bubble” Employing “hedge” strategies that protect against market volatility also may reduce both types of risk. 13

Understanding Modern Portfolio Theory Market will not reward for risks that can be managed: Company specific risk 1. • Managed by exposure to among securities in the same asset class • Think Enron, AIG, Lehman Market risk 2. • Managed by exposure among several uncorrelated asset classes or sectors • Think “tech bubble” Employing “hedge” strategies that protect against market volatility also may reduce both types of risk. 13

Satisfying the Obligation to Manage Risk with ETFs? Possible, but issues include: Many ETFs, including the biggest (SPDR), are cap weighted. 1. As stock price surges or wanes beyond standard deviation: • • One buys when would rather sell (or hold), and • One sells when it may be better to buy – Reconciliation when value reverts to its mean – Options include fundamental ETFs and equal weighting ETFs • NASDAQ article March 7, 2011 concludes both add volatility to a portfolio 14

Satisfying the Obligation to Manage Risk with ETFs? Possible, but issues include: Many ETFs, including the biggest (SPDR), are cap weighted. 1. As stock price surges or wanes beyond standard deviation: • • One buys when would rather sell (or hold), and • One sells when it may be better to buy – Reconciliation when value reverts to its mean – Options include fundamental ETFs and equal weighting ETFs • NASDAQ article March 7, 2011 concludes both add volatility to a portfolio 14

Satisfying the Obligation to Manage Risk with ETFs? 1. Cap Weighting 2. Most ETFs currently are passive. • • Yale study regarding how active managers can add value • 3. SEC slowly permitting actively managed ETFs Yet passive investing carries own risks Examples of indexing issues: • Owners – holding can cause unintended over- and underweighting • Buyers – trading at the wrong time 15

Satisfying the Obligation to Manage Risk with ETFs? 1. Cap Weighting 2. Most ETFs currently are passive. • • Yale study regarding how active managers can add value • 3. SEC slowly permitting actively managed ETFs Yet passive investing carries own risks Examples of indexing issues: • Owners – holding can cause unintended over- and underweighting • Buyers – trading at the wrong time 15

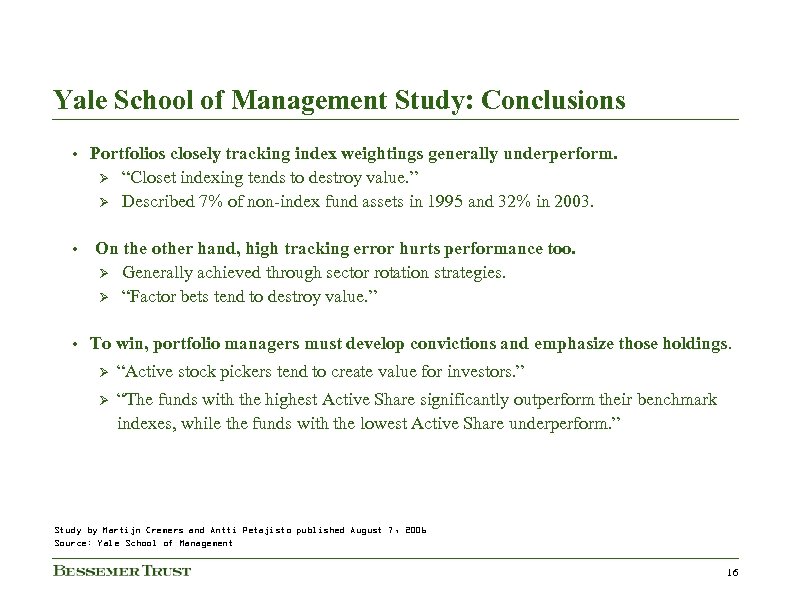

Yale School of Management Study: Conclusions • • • Portfolios closely tracking index weightings generally underperform. Ø “Closet indexing tends to destroy value. ” Ø Described 7% of non-index fund assets in 1995 and 32% in 2003. On the other hand, high tracking error hurts performance too. Ø Generally achieved through sector rotation strategies. Ø “Factor bets tend to destroy value. ” To win, portfolio managers must develop convictions and emphasize those holdings. Ø “Active stock pickers tend to create value for investors. ” Ø “The funds with the highest Active Share significantly outperform their benchmark indexes, while the funds with the lowest Active Share underperform. ” Study by Martijn Cremers and Antti Petajisto published August 7, 2006 Source: Yale School of Management 16

Yale School of Management Study: Conclusions • • • Portfolios closely tracking index weightings generally underperform. Ø “Closet indexing tends to destroy value. ” Ø Described 7% of non-index fund assets in 1995 and 32% in 2003. On the other hand, high tracking error hurts performance too. Ø Generally achieved through sector rotation strategies. Ø “Factor bets tend to destroy value. ” To win, portfolio managers must develop convictions and emphasize those holdings. Ø “Active stock pickers tend to create value for investors. ” Ø “The funds with the highest Active Share significantly outperform their benchmark indexes, while the funds with the lowest Active Share underperform. ” Study by Martijn Cremers and Antti Petajisto published August 7, 2006 Source: Yale School of Management 16

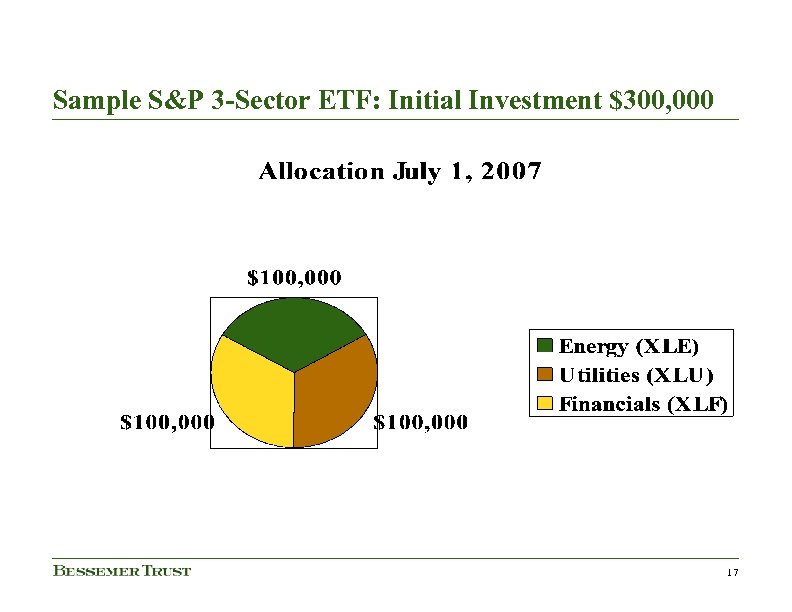

Sample S&P 3 -Sector ETF: Initial Investment $300, 000 17

Sample S&P 3 -Sector ETF: Initial Investment $300, 000 17

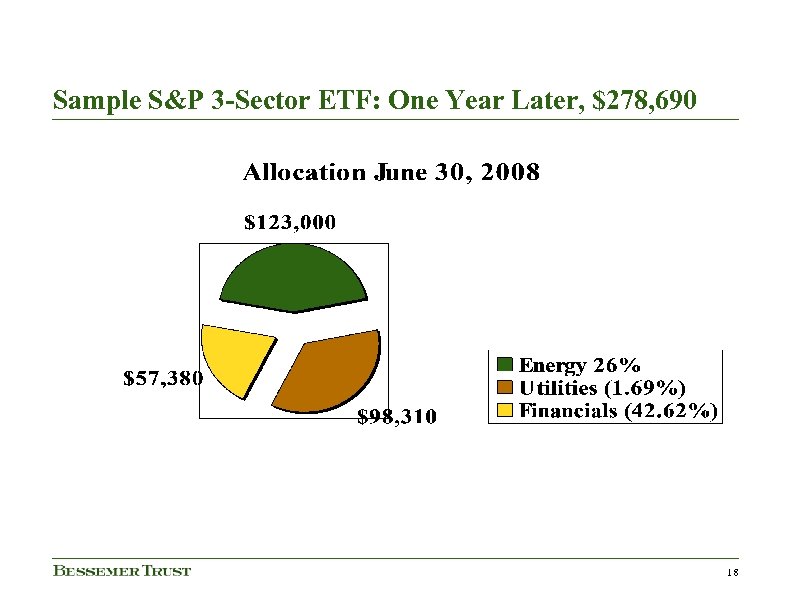

Sample S&P 3 -Sector ETF: One Year Later, $278, 690 18

Sample S&P 3 -Sector ETF: One Year Later, $278, 690 18

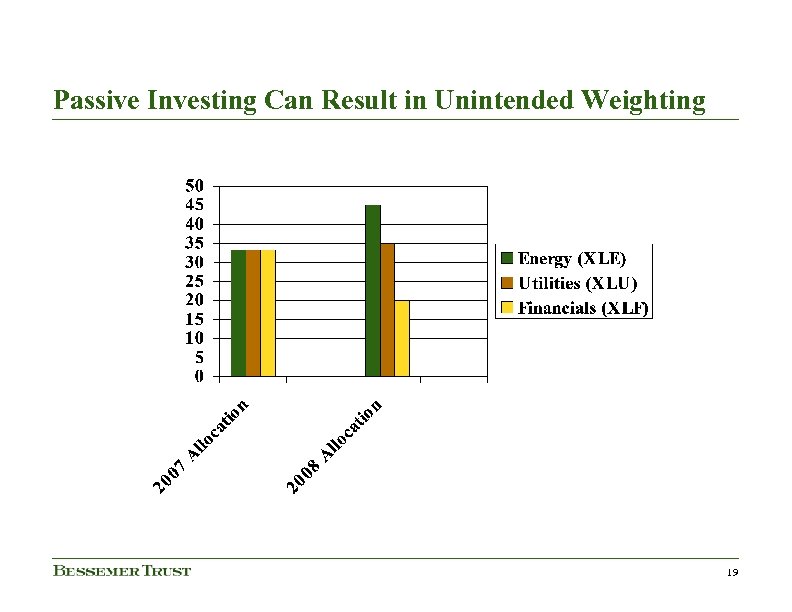

Passive Investing Can Result in Unintended Weighting 19

Passive Investing Can Result in Unintended Weighting 19

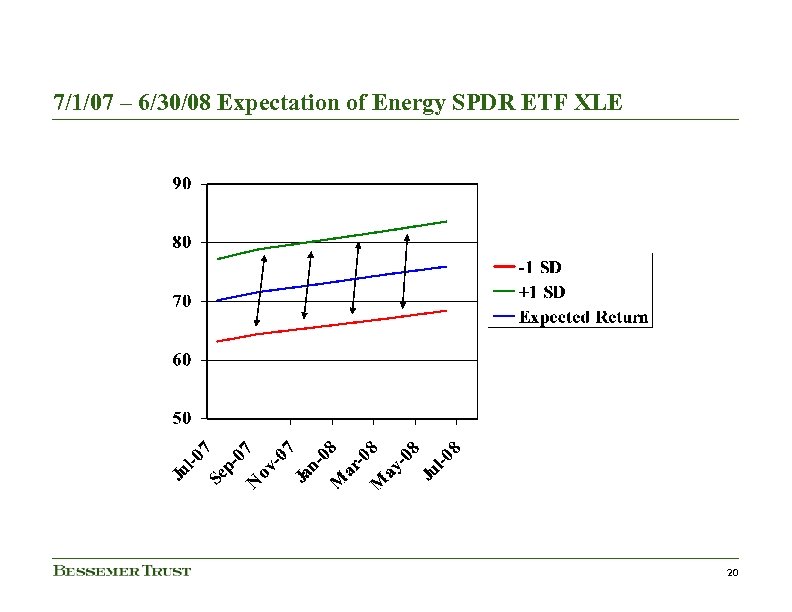

7/1/07 – 6/30/08 Expectation of Energy SPDR ETF XLE 20

7/1/07 – 6/30/08 Expectation of Energy SPDR ETF XLE 20

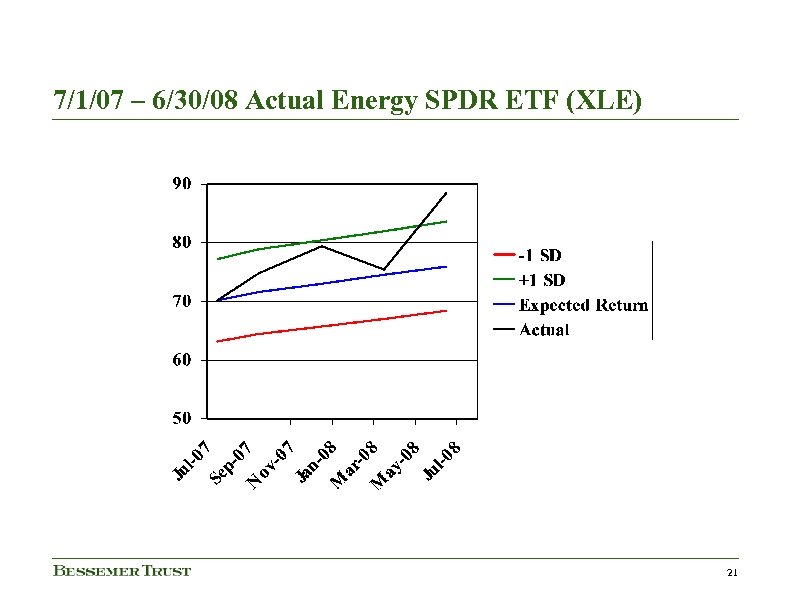

7/1/07 – 6/30/08 Actual Energy SPDR ETF (XLE) 21

7/1/07 – 6/30/08 Actual Energy SPDR ETF (XLE) 21

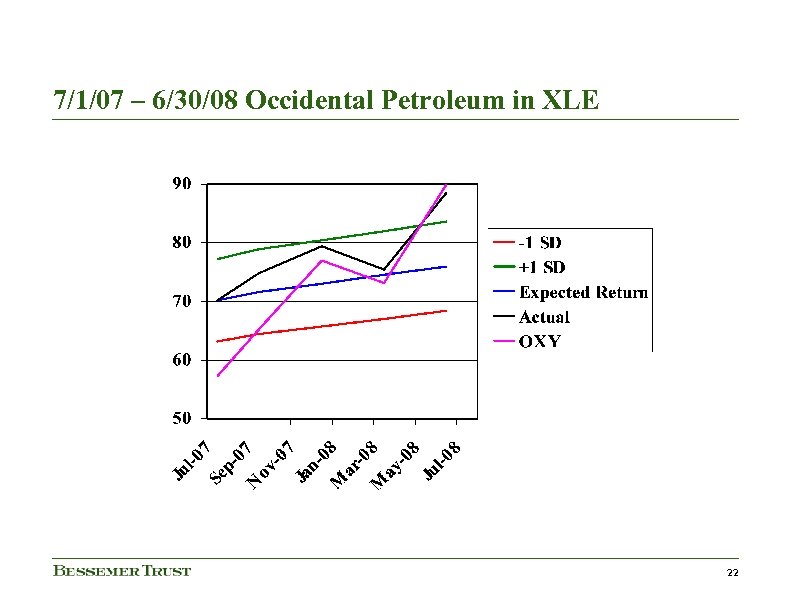

7/1/07 – 6/30/08 Occidental Petroleum in XLE 22

7/1/07 – 6/30/08 Occidental Petroleum in XLE 22

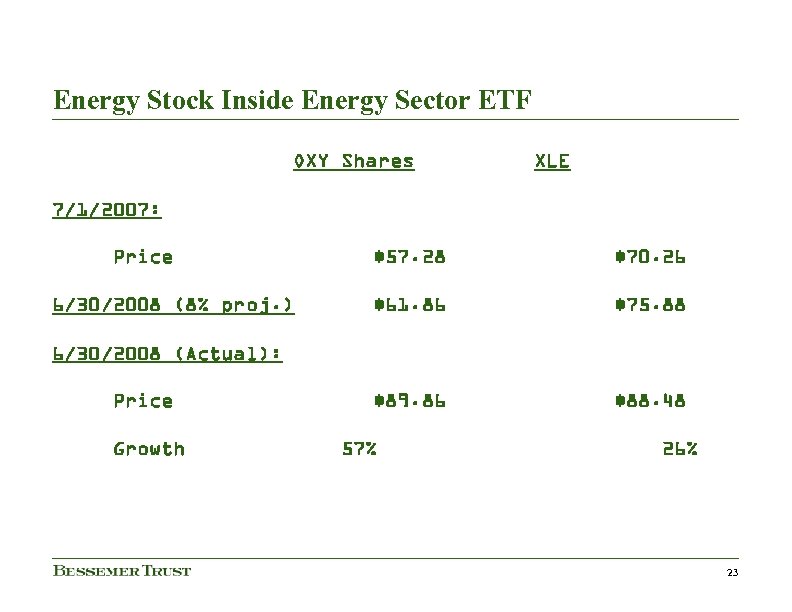

Energy Stock Inside Energy Sector ETF OXY Shares XLE 7/1/2007: Price 6/30/2008 (8% proj. ) $57. 28 $70. 26 $61. 86 $75. 88 $89. 86 $88. 48 6/30/2008 (Actual): Price Growth 57% 26% 23

Energy Stock Inside Energy Sector ETF OXY Shares XLE 7/1/2007: Price 6/30/2008 (8% proj. ) $57. 28 $70. 26 $61. 86 $75. 88 $89. 86 $88. 48 6/30/2008 (Actual): Price Growth 57% 26% 23

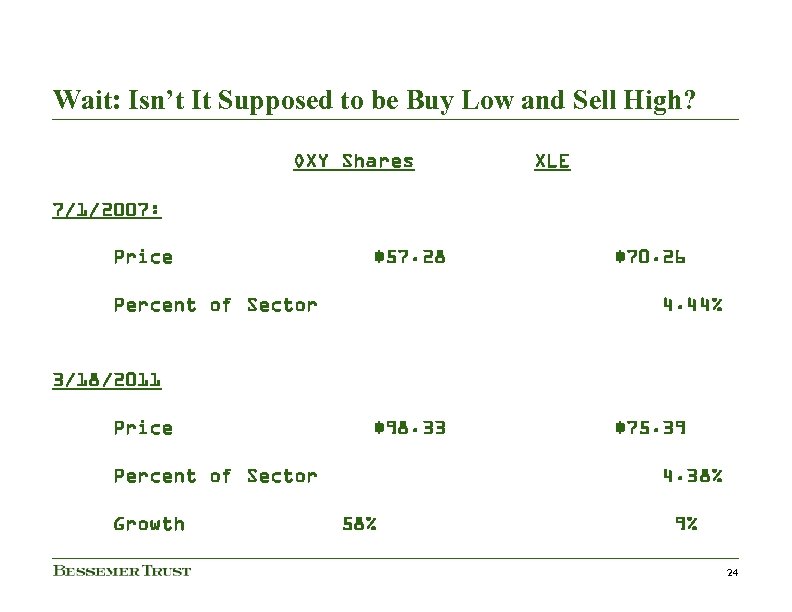

Wait: Isn’t It Supposed to be Buy Low and Sell High? OXY Shares XLE 7/1/2007: Price $57. 28 Percent of Sector $70. 26 4. 44% 3/18/2011 Price $98. 33 Percent of Sector Growth $75. 39 4. 38% 58% 9% 24

Wait: Isn’t It Supposed to be Buy Low and Sell High? OXY Shares XLE 7/1/2007: Price $57. 28 Percent of Sector $70. 26 4. 44% 3/18/2011 Price $98. 33 Percent of Sector Growth $75. 39 4. 38% 58% 9% 24

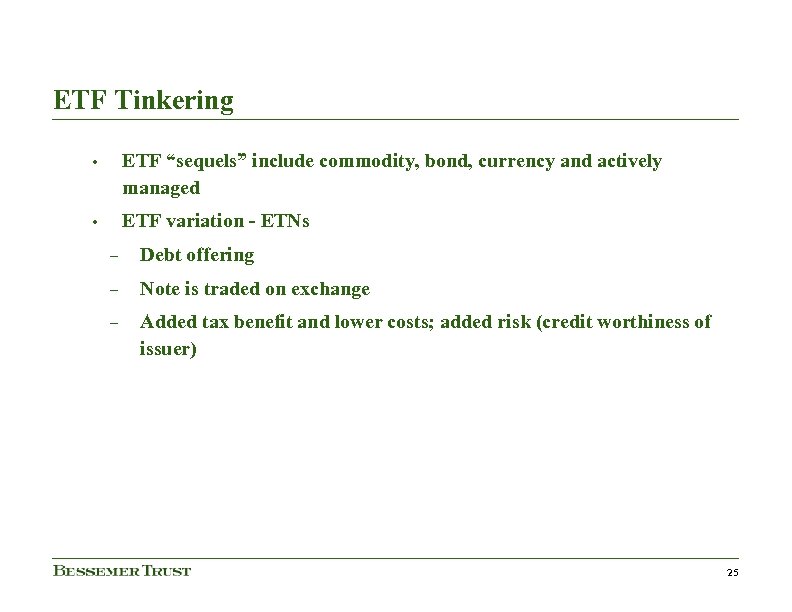

ETF Tinkering • ETF “sequels” include commodity, bond, currency and actively managed • ETF variation - ETNs – Debt offering – Note is traded on exchange – Added tax benefit and lower costs; added risk (credit worthiness of issuer) 25

ETF Tinkering • ETF “sequels” include commodity, bond, currency and actively managed • ETF variation - ETNs – Debt offering – Note is traded on exchange – Added tax benefit and lower costs; added risk (credit worthiness of issuer) 25

Key Take-A-Ways 1. ETFs are viable vehicles to assist the passive investor achieve diversification. 2. ETFs may be less expensive and more tax efficient than mutual funds. 3. ETFs are not necessarily a “safe harbor” so be diligent in selection. Consider if the ETF itself properly diversified: (a) A Russia ETF is 44% in 3 stocks – concentration issue? (b) A China ETF is 42% financials – is this China’s strength? 20

Key Take-A-Ways 1. ETFs are viable vehicles to assist the passive investor achieve diversification. 2. ETFs may be less expensive and more tax efficient than mutual funds. 3. ETFs are not necessarily a “safe harbor” so be diligent in selection. Consider if the ETF itself properly diversified: (a) A Russia ETF is 44% in 3 stocks – concentration issue? (b) A China ETF is 42% financials – is this China’s strength? 20

III. Case Studies – Four Thoughtful Uses of ETFs 1. Income Tax Loss Harvesting – Planning around wash sale rules without losing asset class exposure. 27

III. Case Studies – Four Thoughtful Uses of ETFs 1. Income Tax Loss Harvesting – Planning around wash sale rules without losing asset class exposure. 27

III. Case Studies – Four Thoughtful Uses of ETFs 2. Single or Correlated Asset GRATs – Coordinated investment and estate tax planning for mid-net worth individuals and clients whose portfolios are already diversified. 28

III. Case Studies – Four Thoughtful Uses of ETFs 2. Single or Correlated Asset GRATs – Coordinated investment and estate tax planning for mid-net worth individuals and clients whose portfolios are already diversified. 28

III. Case Studies – Four Thoughtful Uses of ETFs 3. The “Parking Space” – Use to invest cash from sale of stocks until replacement stock identified and buying conditions ripe. 29

III. Case Studies – Four Thoughtful Uses of ETFs 3. The “Parking Space” – Use to invest cash from sale of stocks until replacement stock identified and buying conditions ripe. 29

III. Case Studies – Four Thoughtful Uses of ETFs 4. “Gap” filler – As core or satellite strategy and individual security risk reduction, use ETF(s) to fill “gaps” in asset allocation. 30

III. Case Studies – Four Thoughtful Uses of ETFs 4. “Gap” filler – As core or satellite strategy and individual security risk reduction, use ETF(s) to fill “gaps” in asset allocation. 30

31

31