daeb198c9dfc9d7374ae4024e4d1658c.ppt

- Количество слайдов: 24

1 Lecture 11 - Technical Analysis and Portfolio Management Successful Investors Need 3 Characteristics 1. Self knowledge 2. Market knowledge 3. Discipline to employ market knowledge This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

1 Lecture 11 - Technical Analysis and Portfolio Management Successful Investors Need 3 Characteristics 1. Self knowledge 2. Market knowledge 3. Discipline to employ market knowledge This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

2 Lecture 11 - Technical Analysis and Portfolio Management • Asset Allocation – How much in stocks • Security Selection – What to buy – When to sell This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. • Technical analysis is critical to answering “when? ” MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

2 Lecture 11 - Technical Analysis and Portfolio Management • Asset Allocation – How much in stocks • Security Selection – What to buy – When to sell This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. • Technical analysis is critical to answering “when? ” MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

3 Lecture 11 - Technical Analysis and Portfolio Management The Loser’s Game Example: Tennis is actually two games • At the amateur level, players lose points – The victor gets a higher score because the other player makes more mistakes • At the professional level, players win points This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. – Ultimate outcome is determined by the actions of the winner • Professional sports are a Winner’s Game, amateurs play a Loser’s Game MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

3 Lecture 11 - Technical Analysis and Portfolio Management The Loser’s Game Example: Tennis is actually two games • At the amateur level, players lose points – The victor gets a higher score because the other player makes more mistakes • At the professional level, players win points This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. – Ultimate outcome is determined by the actions of the winner • Professional sports are a Winner’s Game, amateurs play a Loser’s Game MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

4 Lecture 11 - Technical Analysis and Portfolio Management is a Loser’s Game • Passive indexes, the benchmark (or the other player in the game) have no costs – To win, investment managers must overcome the cost disadvantage • Winning requires making fewer mistakes This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. – Following defined sell disciplines prevents holding stocks falling to zero MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

4 Lecture 11 - Technical Analysis and Portfolio Management is a Loser’s Game • Passive indexes, the benchmark (or the other player in the game) have no costs – To win, investment managers must overcome the cost disadvantage • Winning requires making fewer mistakes This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. – Following defined sell disciplines prevents holding stocks falling to zero MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

5 Lecture 11 - Technical Analysis and Portfolio Management Investment Policy - Why It Matters “Almost all of the really big trouble that you’re going to experience in the next year is in your portfolio right now; if you could reduce some of these really big problems, you might come out the winner in the Loser’s Game. ” This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. - Charles D. Ellis MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

5 Lecture 11 - Technical Analysis and Portfolio Management Investment Policy - Why It Matters “Almost all of the really big trouble that you’re going to experience in the next year is in your portfolio right now; if you could reduce some of these really big problems, you might come out the winner in the Loser’s Game. ” This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. - Charles D. Ellis MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

6 Lecture 11 - Technical Analysis and Portfolio Management Beating the Market • Market Timing – Due to costs and risk of being out of the market, investment managers need to be right 75% of the time to break even • Stock Selection This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. – Efficient markets result from well-done analysis – Selecting tomorrow’s winners is a challenging task MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

6 Lecture 11 - Technical Analysis and Portfolio Management Beating the Market • Market Timing – Due to costs and risk of being out of the market, investment managers need to be right 75% of the time to break even • Stock Selection This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. – Efficient markets result from well-done analysis – Selecting tomorrow’s winners is a challenging task MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

7 Lecture 11 - Technical Analysis and Portfolio Management Beating the Market (continued) • Portfolio Strategy – Asset allocation or sector allocation can define success; challenges are similar to market timing • Investment Philosophy – Develop a well-defined set of principles and strictly adhere to them This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

7 Lecture 11 - Technical Analysis and Portfolio Management Beating the Market (continued) • Portfolio Strategy – Asset allocation or sector allocation can define success; challenges are similar to market timing • Investment Philosophy – Develop a well-defined set of principles and strictly adhere to them This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

8 Lecture 11 - Technical Analysis and Portfolio Management Invest Like the Best • James O’Shaughnessy studied great investors and tested their ideas • Successful portfolios had characteristics different than the overall market This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

8 Lecture 11 - Technical Analysis and Portfolio Management Invest Like the Best • James O’Shaughnessy studied great investors and tested their ideas • Successful portfolios had characteristics different than the overall market This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

9 Lecture 11 - Technical Analysis and Portfolio Management Investing Styles • Growth – Aggressive growth – Established growth – Momentum • Value This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. – – Low price-to-earnings Low price-to-sales Low price-to-book High yield 80% of a portfolio's return is attributable to style MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

9 Lecture 11 - Technical Analysis and Portfolio Management Investing Styles • Growth – Aggressive growth – Established growth – Momentum • Value This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. – – Low price-to-earnings Low price-to-sales Low price-to-book High yield 80% of a portfolio's return is attributable to style MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

10 Lecture 11 - Technical Analysis and Portfolio Management Timing • Styles come into and out of favor – 1999 growth outperformed value – 2003 value outperformed growth • The best long-term managers stick with their style through various market cycles This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

10 Lecture 11 - Technical Analysis and Portfolio Management Timing • Styles come into and out of favor – 1999 growth outperformed value – 2003 value outperformed growth • The best long-term managers stick with their style through various market cycles This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

11 Lecture 11 - Technical Analysis and Portfolio Management Value Investing • Combining value factors can be a winning strategy – For example, a low P/E by itself may lead to purchasing stocks heading into bankruptcy • Best combination: This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. – – – Low price-to-sales ratio Earnings persistency (EPS up 5 years in a row) Low price-to-book ratio ROE > 15% High share price relative strength MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

11 Lecture 11 - Technical Analysis and Portfolio Management Value Investing • Combining value factors can be a winning strategy – For example, a low P/E by itself may lead to purchasing stocks heading into bankruptcy • Best combination: This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. – – – Low price-to-sales ratio Earnings persistency (EPS up 5 years in a row) Low price-to-book ratio ROE > 15% High share price relative strength MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

12 Lecture 11 - Technical Analysis and Portfolio Management Stock Market Winners • Biggest stock market winners share common characteristics: – – Strong quarterly earnings acceleration Identifiable group leadership Important volume indicators New leadership This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

12 Lecture 11 - Technical Analysis and Portfolio Management Stock Market Winners • Biggest stock market winners share common characteristics: – – Strong quarterly earnings acceleration Identifiable group leadership Important volume indicators New leadership This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

13 Lecture 11 - Technical Analysis and Portfolio Management Stock Market Winners (continued) • Also, note the percentage increase in earnings per share was substantially more crucial than the P/E ratio as a cause of impressive stock performance – Look at the P/E at the pivot “buy point” and how as the advance continued, these stocks expanded their P/E’s This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

13 Lecture 11 - Technical Analysis and Portfolio Management Stock Market Winners (continued) • Also, note the percentage increase in earnings per share was substantially more crucial than the P/E ratio as a cause of impressive stock performance – Look at the P/E at the pivot “buy point” and how as the advance continued, these stocks expanded their P/E’s This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

14 Lecture 11 - Technical Analysis and Portfolio Management Growth Factors This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. • Twelve-month EPS change higher than average • Last quarter EPS change higher than average • Estimated EPS change higher than average • Strong relative strength MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

14 Lecture 11 - Technical Analysis and Portfolio Management Growth Factors This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. • Twelve-month EPS change higher than average • Last quarter EPS change higher than average • Estimated EPS change higher than average • Strong relative strength MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

15 Lecture 11 - Technical Analysis and Portfolio Management C-A-N-S-L-I-M • Popularized by William O’Neil • Data readily available in Investor’s Business Daily • Combines growth and value • Based upon a study of past market winners This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

15 Lecture 11 - Technical Analysis and Portfolio Management C-A-N-S-L-I-M • Popularized by William O’Neil • Data readily available in Investor’s Business Daily • Combines growth and value • Based upon a study of past market winners This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

16 Lecture 11 - Technical Analysis and Portfolio Management C-A-N-S-L-I-M This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. C = Current EPS growth – should be a minimum of 20% A = Annual EPS growth – should be at least 15 -20% for 3 years N = New. The greatest winners had a major new product, new management, or new industry conditions A new high in price can alert you to new fundamental developments MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

16 Lecture 11 - Technical Analysis and Portfolio Management C-A-N-S-L-I-M This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. C = Current EPS growth – should be a minimum of 20% A = Annual EPS growth – should be at least 15 -20% for 3 years N = New. The greatest winners had a major new product, new management, or new industry conditions A new high in price can alert you to new fundamental developments MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

17 Lecture 11 - Technical Analysis and Portfolio Management C-A-N-S-L-I-M This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. S = Shares outstanding – past winners have had an average of less than 25 million L = Leadership – demonstrated by high relative strength for the stock and the stock’s industry group I = Institutional sponsorship – good stocks are owned by institutions M = Market – even good stocks go down in a bear market MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

17 Lecture 11 - Technical Analysis and Portfolio Management C-A-N-S-L-I-M This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. S = Shares outstanding – past winners have had an average of less than 25 million L = Leadership – demonstrated by high relative strength for the stock and the stock’s industry group I = Institutional sponsorship – good stocks are owned by institutions M = Market – even good stocks go down in a bear market MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

18 Lecture 11 - Technical Analysis and Portfolio Management C-A-N-S-L-I-M: When to Buy • Buy on a breakout to a new high – Popularizes “cup and handle” formation – Confirmed by at least a 50% increase in volume • Buy after the stock has formed a base – Minimum 7 weeks consolidation works best This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. • Buy within 5 -10% of the breakout point • Use an 8% stop loss MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

18 Lecture 11 - Technical Analysis and Portfolio Management C-A-N-S-L-I-M: When to Buy • Buy on a breakout to a new high – Popularizes “cup and handle” formation – Confirmed by at least a 50% increase in volume • Buy after the stock has formed a base – Minimum 7 weeks consolidation works best This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. • Buy within 5 -10% of the breakout point • Use an 8% stop loss MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

19 Lecture 11 - Technical Analysis and Portfolio Management The Buy Decision • High relative strength – Screens for stocks in the highest 10% – Calculated as (closing price/26 -week moving average of price) • High earnings per share growth rate This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. – Screens for stock in the highest 10% – Calculated with quarters of the reported data to minimize seasonal influences (most recent 4 quarters/first 4 quarters) MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

19 Lecture 11 - Technical Analysis and Portfolio Management The Buy Decision • High relative strength – Screens for stocks in the highest 10% – Calculated as (closing price/26 -week moving average of price) • High earnings per share growth rate This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. – Screens for stock in the highest 10% – Calculated with quarters of the reported data to minimize seasonal influences (most recent 4 quarters/first 4 quarters) MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

20 Lecture 11 - Technical Analysis and Portfolio Management The Buy Decision (continued) • Low price-to-sales ratio – Screens for stocks in lowest 30% – Calculated as: (Price)/(Last 4 quarters of sales) This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

20 Lecture 11 - Technical Analysis and Portfolio Management The Buy Decision (continued) • Low price-to-sales ratio – Screens for stocks in lowest 30% – Calculated as: (Price)/(Last 4 quarters of sales) This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

21 Lecture 11 - Technical Analysis and Portfolio Management The Sell Decision • Hold until – Relative strength declines below the 30 th percentile or – Earnings per share growth rate declines below the 50 th percentile This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

21 Lecture 11 - Technical Analysis and Portfolio Management The Sell Decision • Hold until – Relative strength declines below the 30 th percentile or – Earnings per share growth rate declines below the 50 th percentile This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

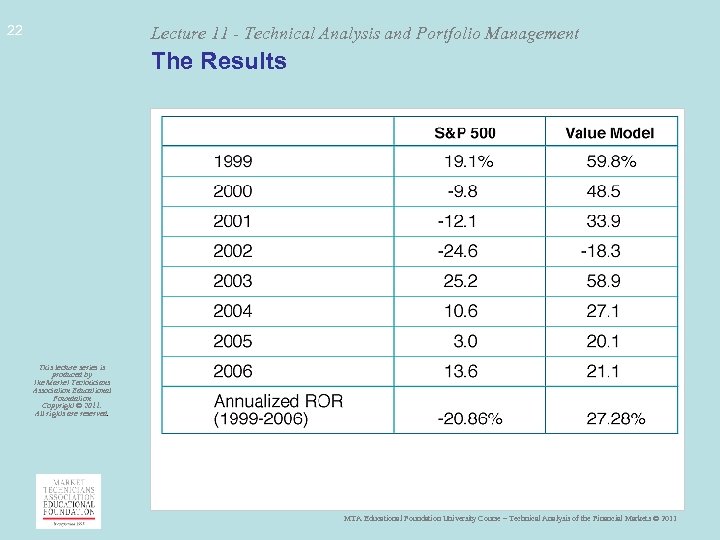

22 Lecture 11 - Technical Analysis and Portfolio Management The Results This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

22 Lecture 11 - Technical Analysis and Portfolio Management The Results This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

23 Lecture 11 - Technical Analysis and Portfolio Management Conclusion • Portfolio management requires buy and sell rules • Technical analysis adds value to this process This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

23 Lecture 11 - Technical Analysis and Portfolio Management Conclusion • Portfolio management requires buy and sell rules • Technical analysis adds value to this process This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

24 Lecture 11 - Technical Analysis and Portfolio Management Putting It All Together Stock Selection: A test of relative stock values reported over 17 -1/2 years* – by Charles D. Kirkpatrick II, CMT – 2001 Dow Award Winning Paper – Provides results of real-time tracking of two portfolio management models – Portfolio usually holds 10 -20 stocks This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. *Paper available for download on www. mtaeducationalfoundation. org/lecture MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011

24 Lecture 11 - Technical Analysis and Portfolio Management Putting It All Together Stock Selection: A test of relative stock values reported over 17 -1/2 years* – by Charles D. Kirkpatrick II, CMT – 2001 Dow Award Winning Paper – Provides results of real-time tracking of two portfolio management models – Portfolio usually holds 10 -20 stocks This lecture series is produced by the Market Technicians Association Educational Foundation Copyright © 2011. All rights are reserved. *Paper available for download on www. mtaeducationalfoundation. org/lecture MTA Educational Foundation University Course – Technical Analysis of the Financial Markets © 2011