1 Investors and managers demonstrates risk aversion in different ways

1 Investors and managers demonstrates risk aversion in different ways

2 People try to avoid risk

2 People try to avoid risk

3 Why managers invest in risky projects?

3 Why managers invest in risky projects?

4 RISK PREMIUM

4 RISK PREMIUM

5 I want to have a compensation not only for the use of my money, but for the risk to remain without them! … a higher rate of profit, if there is a risk…

5 I want to have a compensation not only for the use of my money, but for the risk to remain without them! … a higher rate of profit, if there is a risk…

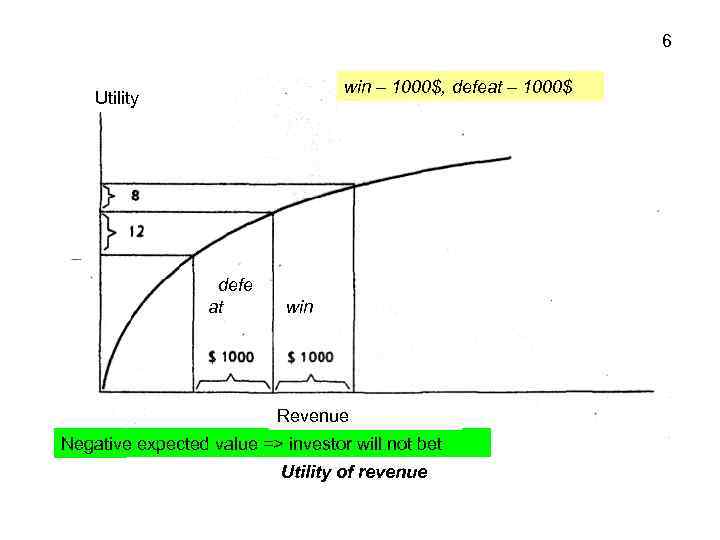

6 win – 1000$, defeat – 1000$ Utility defe at win Revenue Negative expected value => investor will not bet Utility of revenue

6 win – 1000$, defeat – 1000$ Utility defe at win Revenue Negative expected value => investor will not bet Utility of revenue

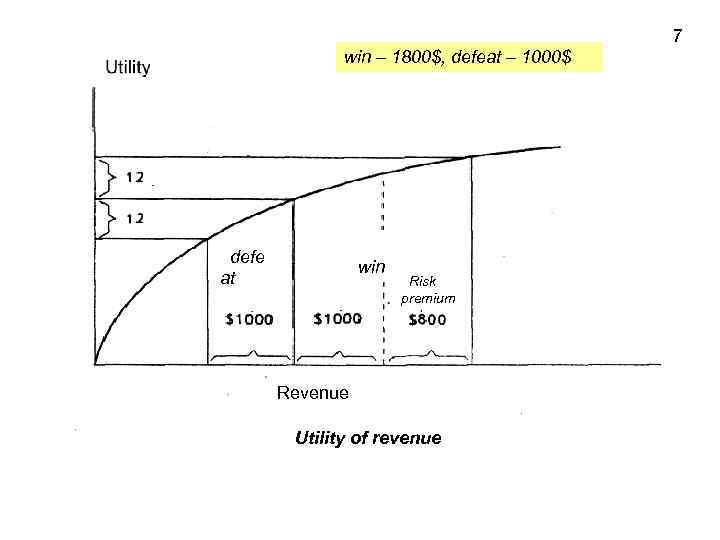

7 win – 1800$, defeat – 1000$ defe at win Risk premium Revenue Utility of revenue

7 win – 1800$, defeat – 1000$ defe at win Risk premium Revenue Utility of revenue

8 Business risk associated with a firm decision about investment

8 Business risk associated with a firm decision about investment

9 Business risk is always there - no business does not guarantee success

9 Business risk is always there - no business does not guarantee success

Within one business direction, the investor usually faced with higher business risk in the newly created company

Within one business direction, the investor usually faced with higher business risk in the newly created company

10 On the other hand, the "old" company, products or methods of entrepreneurship which are outdated, can have high enough degree of business risk

10 On the other hand, the "old" company, products or methods of entrepreneurship which are outdated, can have high enough degree of business risk

11 Financial risk is determined by the financial decisions of the firm (the risk of possible insolvency)

11 Financial risk is determined by the financial decisions of the firm (the risk of possible insolvency)

12 The income of the company must first of all go to debt service

12 The income of the company must first of all go to debt service

14 Adjustment of risk

14 Adjustment of risk

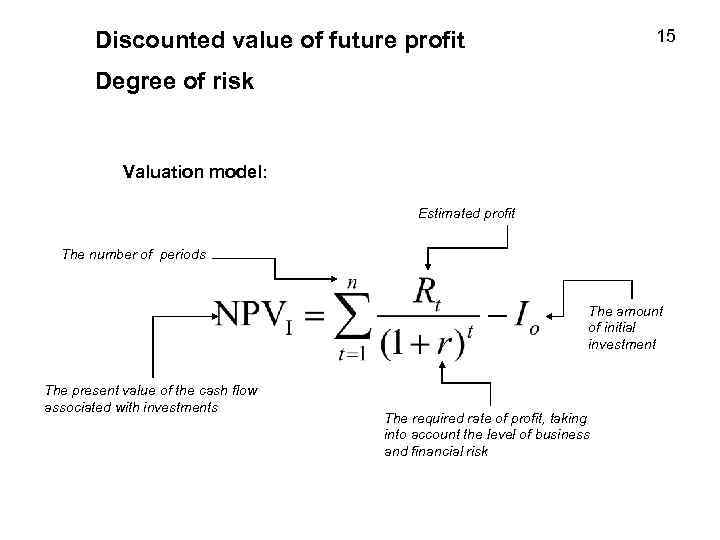

15 Discounted value of future profit Degree of risk Valuation model: Estimated profit The number of periods The amount of initial investment The present value of the cash flow associated with investments The required rate of profit, taking into account the level of business and financial risk

15 Discounted value of future profit Degree of risk Valuation model: Estimated profit The number of periods The amount of initial investment The present value of the cash flow associated with investments The required rate of profit, taking into account the level of business and financial risk

16 Methods of risk account : The rate method, corrected for risk Method of certainty equivalent

16 Methods of risk account : The rate method, corrected for risk Method of certainty equivalent

17 The rate method, corrected for risk The rate, corrected for risk -the required rate of profit from prospective investments after due consideration of the existing risk Ех:

17 The rate method, corrected for risk The rate, corrected for risk -the required rate of profit from prospective investments after due consideration of the existing risk Ех:

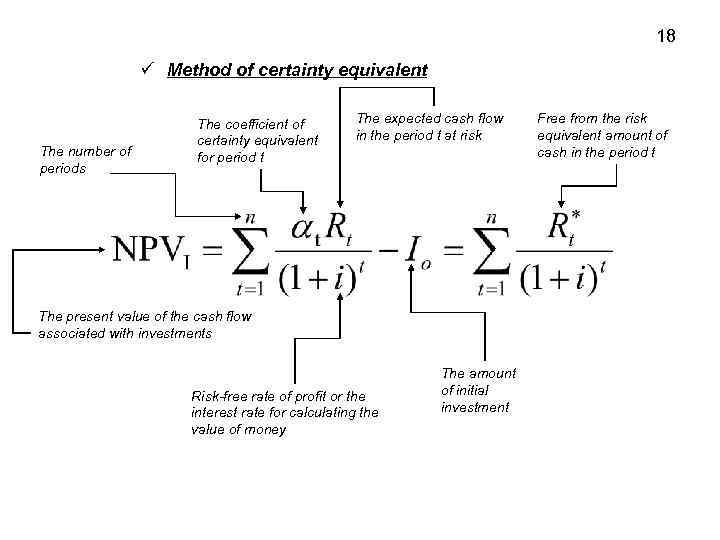

18 Method of certainty equivalent The number of periods The coefficient of certainty equivalent for period t The expected cash flow in the period t at risk The present value of the cash flow associated with investments Risk-free rate of profit or the interest rate for calculating the value of money The amount of initial investment Free from the risk equivalent amount of cash in the period t

18 Method of certainty equivalent The number of periods The coefficient of certainty equivalent for period t The expected cash flow in the period t at risk The present value of the cash flow associated with investments Risk-free rate of profit or the interest rate for calculating the value of money The amount of initial investment Free from the risk equivalent amount of cash in the period t

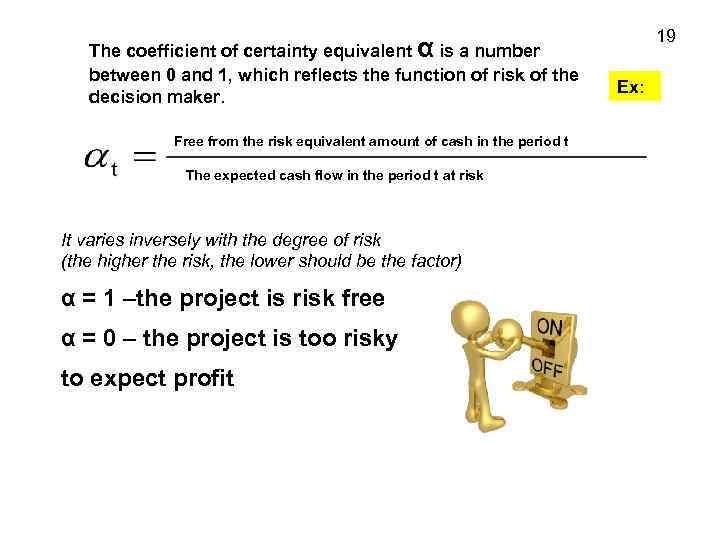

The coefficient of certainty equivalent α is a number between 0 and 1, which reflects the function of risk of the decision maker. Free from the risk equivalent amount of cash in the period t The expected cash flow in the period t at risk It varies inversely with the degree of risk (the higher the risk, the lower should be the factor) α = 1 –the project is risk free α = 0 – the project is too risky to expect profit 19 Ех:

The coefficient of certainty equivalent α is a number between 0 and 1, which reflects the function of risk of the decision maker. Free from the risk equivalent amount of cash in the period t The expected cash flow in the period t at risk It varies inversely with the degree of risk (the higher the risk, the lower should be the factor) α = 1 –the project is risk free α = 0 – the project is too risky to expect profit 19 Ех:

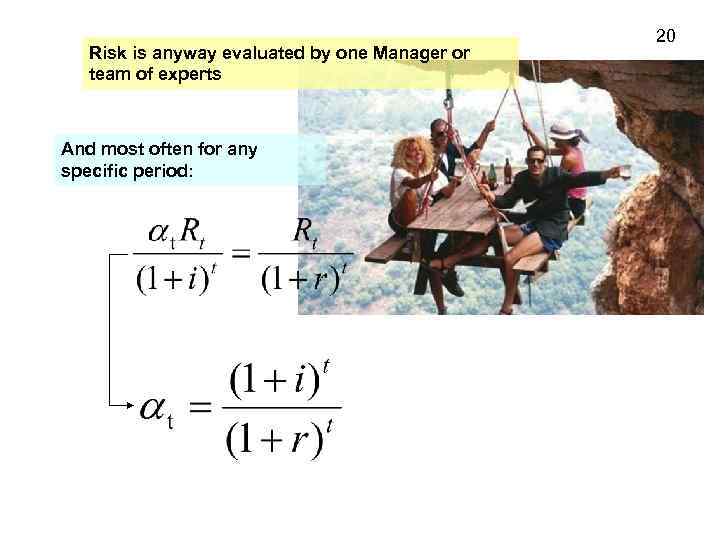

Risk is anyway evaluated by one Manager or team of experts And most often for any specific period: 20

Risk is anyway evaluated by one Manager or team of experts And most often for any specific period: 20

East-West Trading Company

East-West Trading Company