58fcb54378cf7f7d3931b47dab30f0a3.ppt

- Количество слайдов: 28

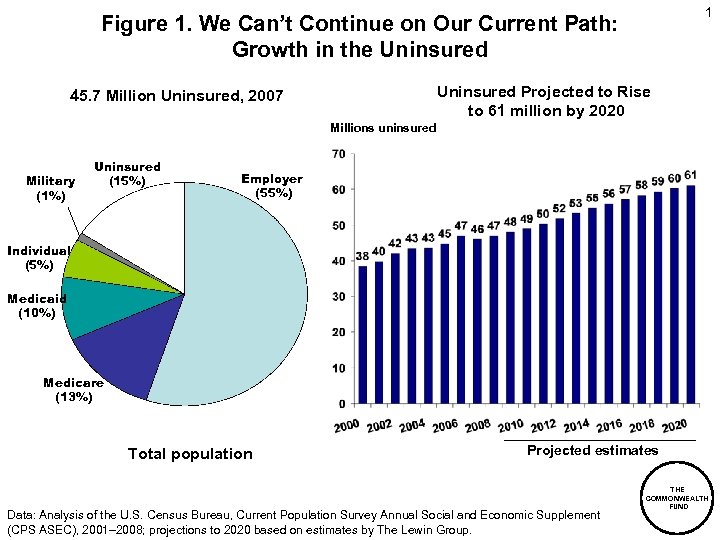

1 Figure 1. We Can’t Continue on Our Current Path: Growth in the Uninsured Projected to Rise to 61 million by 2020 45. 7 Million Uninsured, 2007 Millions uninsured Military (1%) Uninsured (15%) Employer (55%) Individual (5%) Medicaid (10%) Medicare (13%) Total population Projected estimates Data: Analysis of the U. S. Census Bureau, Current Population Survey Annual Social and Economic Supplement (CPS ASEC), 2001– 2008; projections to 2020 based on estimates by The Lewin Group. THE COMMONWEALTH FUND

1 Figure 1. We Can’t Continue on Our Current Path: Growth in the Uninsured Projected to Rise to 61 million by 2020 45. 7 Million Uninsured, 2007 Millions uninsured Military (1%) Uninsured (15%) Employer (55%) Individual (5%) Medicaid (10%) Medicare (13%) Total population Projected estimates Data: Analysis of the U. S. Census Bureau, Current Population Survey Annual Social and Economic Supplement (CPS ASEC), 2001– 2008; projections to 2020 based on estimates by The Lewin Group. THE COMMONWEALTH FUND

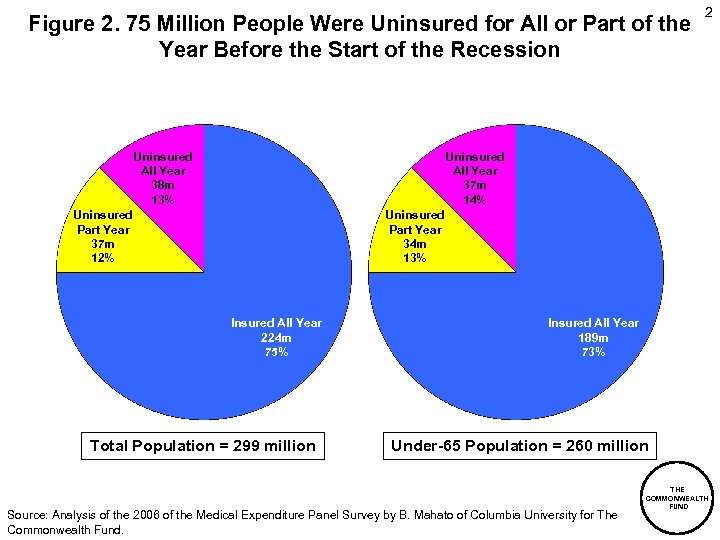

Figure 2. 75 Million People Were Uninsured for All or Part of the Year Before the Start of the Recession Uninsured All Year 38 m 13% 2 Uninsured All Year 37 m 14% Uninsured Part Year 37 m 12% Uninsured Part Year 34 m 13% Insured All Year 224 m 75% Total Population = 299 million Insured All Year 189 m 73% Under-65 Population = 260 million Source: Analysis of the 2006 of the Medical Expenditure Panel Survey by B. Mahato of Columbia University for The Commonwealth Fund. THE COMMONWEALTH FUND

Figure 2. 75 Million People Were Uninsured for All or Part of the Year Before the Start of the Recession Uninsured All Year 38 m 13% 2 Uninsured All Year 37 m 14% Uninsured Part Year 37 m 12% Uninsured Part Year 34 m 13% Insured All Year 224 m 75% Total Population = 299 million Insured All Year 189 m 73% Under-65 Population = 260 million Source: Analysis of the 2006 of the Medical Expenditure Panel Survey by B. Mahato of Columbia University for The Commonwealth Fund. THE COMMONWEALTH FUND

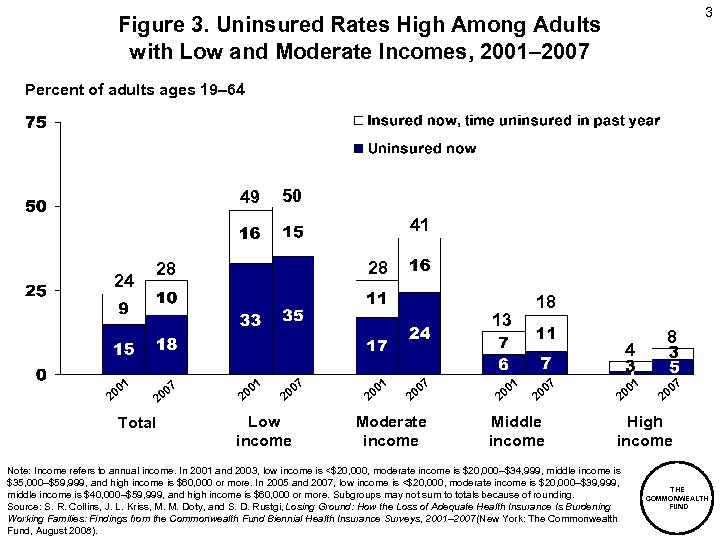

3 Figure 3. Uninsured Rates High Among Adults with Low and Moderate Incomes, 2001– 2007 Percent of adults ages 19– 64 49 50 41 24 28 28 18 13 8 4 1 0 20 Total 0 20 7 1 0 20 7 00 2 Low income 1 00 2 7 00 2 Moderate income 1 0 20 7 0 20 Middle income 1 0 20 7 0 20 High income Note: Income refers to annual income. In 2001 and 2003, low income is <$20, 000, moderate income is $20, 000–$34, 999, middle income is $35, 000–$59, 999, and high income is $60, 000 or more. In 2005 and 2007, low income is <$20, 000, moderate income is $20, 000–$39, 999, middle income is $40, 000–$59, 999, and high income is $60, 000 or more. Subgroups may not sum to totals because of rounding. Source: S. R. Collins, J. L. Kriss, M. M. Doty, and S. D. Rustgi, Losing Ground: How the Loss of Adequate Health Insurance Is Burdening Working Families: Findings from the Commonwealth Fund Biennial Health Insurance Surveys, 2001– 2007 (New York: The Commonwealth Fund, August 2008). THE COMMONWEALTH FUND

3 Figure 3. Uninsured Rates High Among Adults with Low and Moderate Incomes, 2001– 2007 Percent of adults ages 19– 64 49 50 41 24 28 28 18 13 8 4 1 0 20 Total 0 20 7 1 0 20 7 00 2 Low income 1 00 2 7 00 2 Moderate income 1 0 20 7 0 20 Middle income 1 0 20 7 0 20 High income Note: Income refers to annual income. In 2001 and 2003, low income is <$20, 000, moderate income is $20, 000–$34, 999, middle income is $35, 000–$59, 999, and high income is $60, 000 or more. In 2005 and 2007, low income is <$20, 000, moderate income is $20, 000–$39, 999, middle income is $40, 000–$59, 999, and high income is $60, 000 or more. Subgroups may not sum to totals because of rounding. Source: S. R. Collins, J. L. Kriss, M. M. Doty, and S. D. Rustgi, Losing Ground: How the Loss of Adequate Health Insurance Is Burdening Working Families: Findings from the Commonwealth Fund Biennial Health Insurance Surveys, 2001– 2007 (New York: The Commonwealth Fund, August 2008). THE COMMONWEALTH FUND

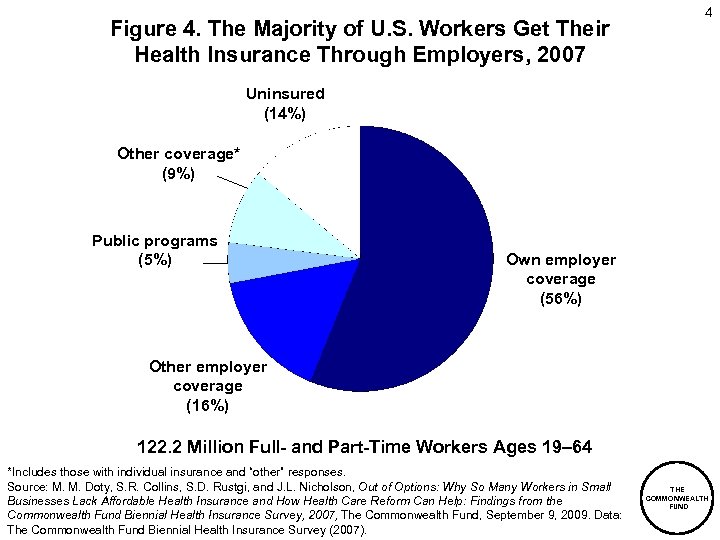

Figure 4. The Majority of U. S. Workers Get Their Health Insurance Through Employers, 2007 4 Uninsured (14%) Other coverage* (9%) Public programs (5%) Own employer coverage (56%) Other employer coverage (16%) 122. 2 Million Full- and Part-Time Workers Ages 19– 64 *Includes those with individual insurance and “other” responses. Source: M. M. Doty, S. R. Collins, S. D. Rustgi, and J. L. Nicholson, Out of Options: Why So Many Workers in Small Businesses Lack Affordable Health Insurance and How Health Care Reform Can Help: Findings from the Commonwealth Fund Biennial Health Insurance Survey, 2007, The Commonwealth Fund, September 9, 2009. Data: The Commonwealth Fund Biennial Health Insurance Survey (2007). THE COMMONWEALTH FUND

Figure 4. The Majority of U. S. Workers Get Their Health Insurance Through Employers, 2007 4 Uninsured (14%) Other coverage* (9%) Public programs (5%) Own employer coverage (56%) Other employer coverage (16%) 122. 2 Million Full- and Part-Time Workers Ages 19– 64 *Includes those with individual insurance and “other” responses. Source: M. M. Doty, S. R. Collins, S. D. Rustgi, and J. L. Nicholson, Out of Options: Why So Many Workers in Small Businesses Lack Affordable Health Insurance and How Health Care Reform Can Help: Findings from the Commonwealth Fund Biennial Health Insurance Survey, 2007, The Commonwealth Fund, September 9, 2009. Data: The Commonwealth Fund Biennial Health Insurance Survey (2007). THE COMMONWEALTH FUND

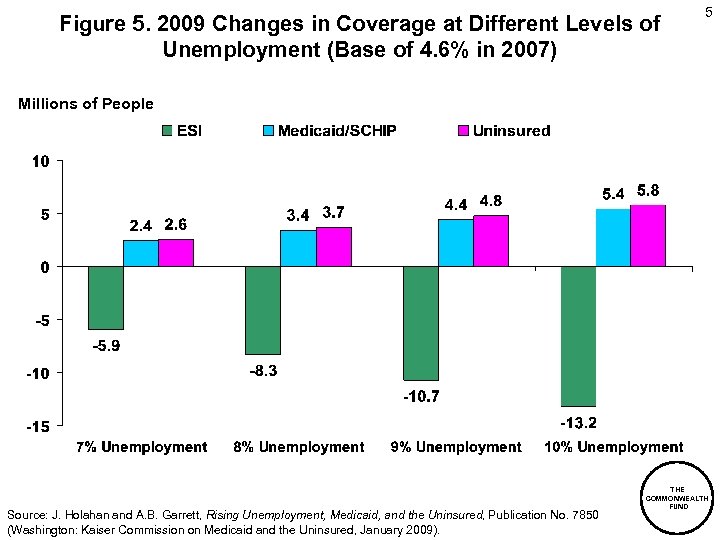

Figure 5. 2009 Changes in Coverage at Different Levels of Unemployment (Base of 4. 6% in 2007) 5 Millions of People Source: J. Holahan and A. B. Garrett, Rising Unemployment, Medicaid, and the Uninsured, Publication No. 7850 (Washington: Kaiser Commission on Medicaid and the Uninsured, January 2009). THE COMMONWEALTH FUND

Figure 5. 2009 Changes in Coverage at Different Levels of Unemployment (Base of 4. 6% in 2007) 5 Millions of People Source: J. Holahan and A. B. Garrett, Rising Unemployment, Medicaid, and the Uninsured, Publication No. 7850 (Washington: Kaiser Commission on Medicaid and the Uninsured, January 2009). THE COMMONWEALTH FUND

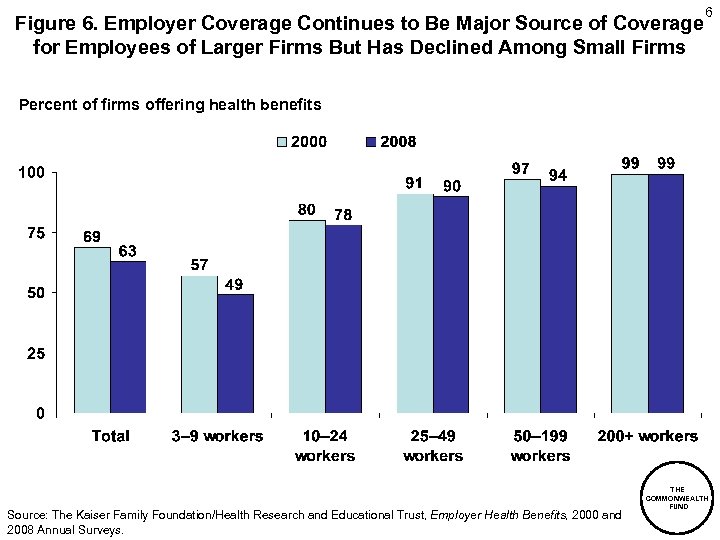

Figure 6. Employer Coverage Continues to Be Major Source of Coverage for Employees of Larger Firms But Has Declined Among Small Firms 6 Percent of firms offering health benefits Source: The Kaiser Family Foundation/Health Research and Educational Trust, Employer Health Benefits, 2000 and 2008 Annual Surveys. THE COMMONWEALTH FUND

Figure 6. Employer Coverage Continues to Be Major Source of Coverage for Employees of Larger Firms But Has Declined Among Small Firms 6 Percent of firms offering health benefits Source: The Kaiser Family Foundation/Health Research and Educational Trust, Employer Health Benefits, 2000 and 2008 Annual Surveys. THE COMMONWEALTH FUND

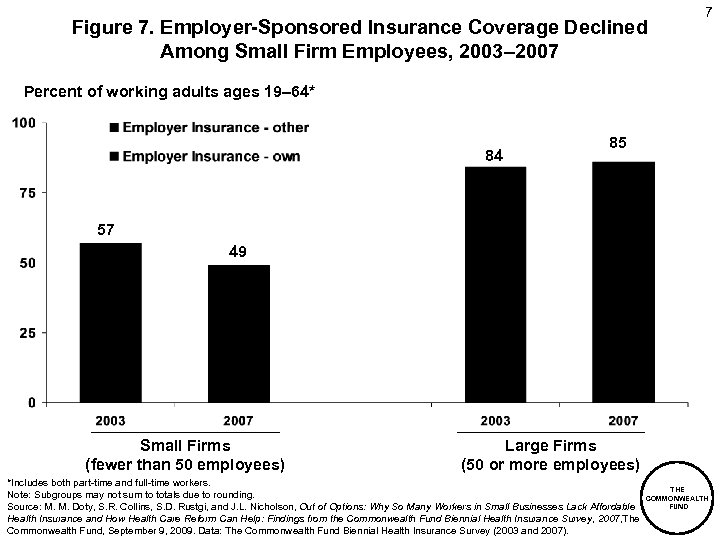

Figure 7. Employer-Sponsored Insurance Coverage Declined Among Small Firm Employees, 2003– 2007 7 Percent of working adults ages 19– 64* 84 85 57 49 Small Firms (fewer than 50 employees) Large Firms (50 or more employees) *Includes both part-time and full-time workers. Note: Subgroups may not sum to totals due to rounding. Source: M. M. Doty, S. R. Collins, S. D. Rustgi, and J. L. Nicholson, Out of Options: Why So Many Workers in Small Businesses Lack Affordable Health Insurance and How Health Care Reform Can Help: Findings from the Commonwealth Fund Biennial Health Insurance Survey, 2007, The Commonwealth Fund, September 9, 2009. Data: The Commonwealth Fund Biennial Health Insurance Survey (2003 and 2007). THE COMMONWEALTH FUND

Figure 7. Employer-Sponsored Insurance Coverage Declined Among Small Firm Employees, 2003– 2007 7 Percent of working adults ages 19– 64* 84 85 57 49 Small Firms (fewer than 50 employees) Large Firms (50 or more employees) *Includes both part-time and full-time workers. Note: Subgroups may not sum to totals due to rounding. Source: M. M. Doty, S. R. Collins, S. D. Rustgi, and J. L. Nicholson, Out of Options: Why So Many Workers in Small Businesses Lack Affordable Health Insurance and How Health Care Reform Can Help: Findings from the Commonwealth Fund Biennial Health Insurance Survey, 2007, The Commonwealth Fund, September 9, 2009. Data: The Commonwealth Fund Biennial Health Insurance Survey (2003 and 2007). THE COMMONWEALTH FUND

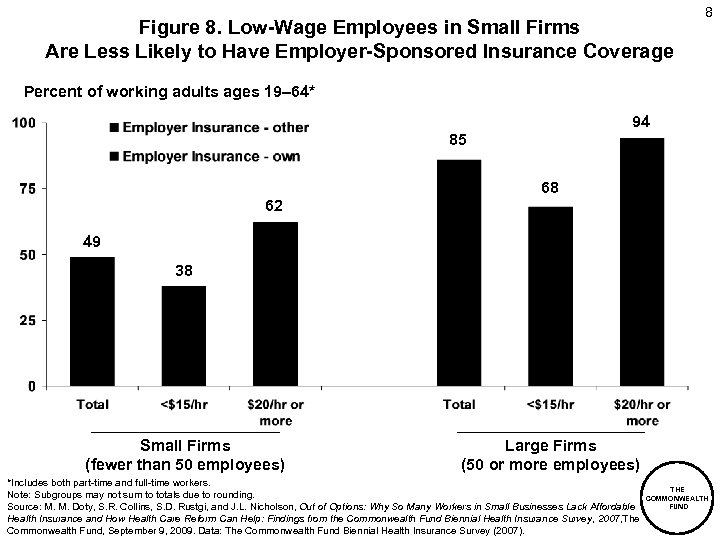

Figure 8. Low-Wage Employees in Small Firms Are Less Likely to Have Employer-Sponsored Insurance Coverage 8 Percent of working adults ages 19– 64* 94 85 68 62 49 38 Small Firms (fewer than 50 employees) Large Firms (50 or more employees) *Includes both part-time and full-time workers. Note: Subgroups may not sum to totals due to rounding. Source: M. M. Doty, S. R. Collins, S. D. Rustgi, and J. L. Nicholson, Out of Options: Why So Many Workers in Small Businesses Lack Affordable Health Insurance and How Health Care Reform Can Help: Findings from the Commonwealth Fund Biennial Health Insurance Survey, 2007, The Commonwealth Fund, September 9, 2009. Data: The Commonwealth Fund Biennial Health Insurance Survey (2007). THE COMMONWEALTH FUND

Figure 8. Low-Wage Employees in Small Firms Are Less Likely to Have Employer-Sponsored Insurance Coverage 8 Percent of working adults ages 19– 64* 94 85 68 62 49 38 Small Firms (fewer than 50 employees) Large Firms (50 or more employees) *Includes both part-time and full-time workers. Note: Subgroups may not sum to totals due to rounding. Source: M. M. Doty, S. R. Collins, S. D. Rustgi, and J. L. Nicholson, Out of Options: Why So Many Workers in Small Businesses Lack Affordable Health Insurance and How Health Care Reform Can Help: Findings from the Commonwealth Fund Biennial Health Insurance Survey, 2007, The Commonwealth Fund, September 9, 2009. Data: The Commonwealth Fund Biennial Health Insurance Survey (2007). THE COMMONWEALTH FUND

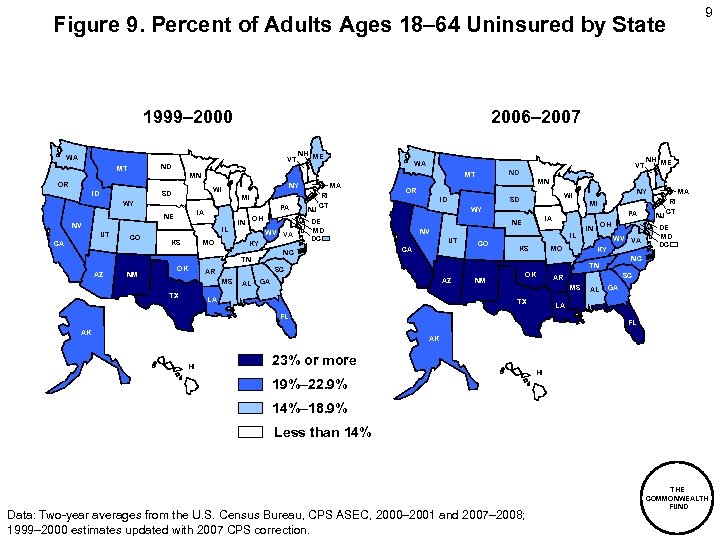

9 Figure 9. Percent of Adults Ages 18– 64 Uninsured by State 1999– 2000 2006– 2007 WA VT ND MT ID MI WY PA IA NE NV IL CO KS MO OH IN WV VA KY NM OK ID AL MI NV CA IL CO KS MO OH IN WV VA KY AZ LA NM OK DE MD DC SC AR MS TX NJ RI CT NC TN GA AL GA LA FL AK PA IA NE UT MA NY WI SD WY DE MD DC NH ME MN OR SC AR MS TX NJ RI CT NC TN AZ MA VT ND MT NY WI SD CA WA MN OR UT NH ME FL AK HI 23% or more 19%– 22. 9% HI 14%– 18. 9% Less than 14% Data: Two-year averages from the U. S. Census Bureau, CPS ASEC, 2000– 2001 and 2007– 2008; 1999– 2000 estimates updated with 2007 CPS correction. THE COMMONWEALTH FUND

9 Figure 9. Percent of Adults Ages 18– 64 Uninsured by State 1999– 2000 2006– 2007 WA VT ND MT ID MI WY PA IA NE NV IL CO KS MO OH IN WV VA KY NM OK ID AL MI NV CA IL CO KS MO OH IN WV VA KY AZ LA NM OK DE MD DC SC AR MS TX NJ RI CT NC TN GA AL GA LA FL AK PA IA NE UT MA NY WI SD WY DE MD DC NH ME MN OR SC AR MS TX NJ RI CT NC TN AZ MA VT ND MT NY WI SD CA WA MN OR UT NH ME FL AK HI 23% or more 19%– 22. 9% HI 14%– 18. 9% Less than 14% Data: Two-year averages from the U. S. Census Bureau, CPS ASEC, 2000– 2001 and 2007– 2008; 1999– 2000 estimates updated with 2007 CPS correction. THE COMMONWEALTH FUND

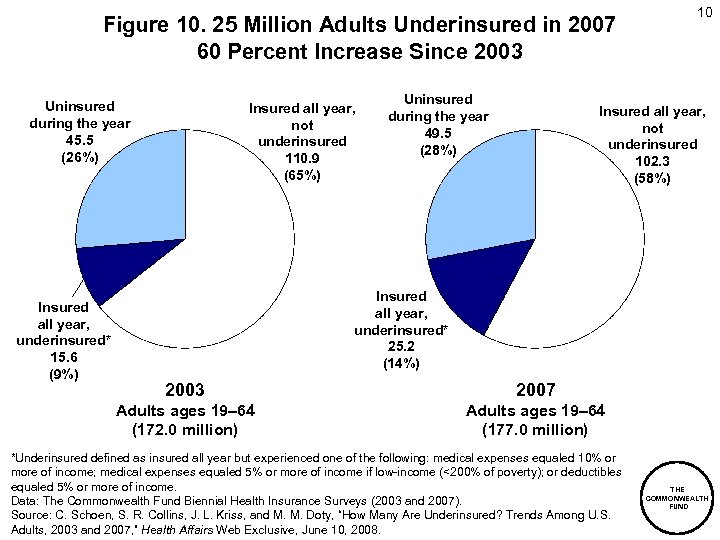

Figure 10. 25 Million Adults Underinsured in 2007 60 Percent Increase Since 2003 Uninsured during the year 45. 5 (26%) Insured all year, underinsured* 15. 6 (9%) Insured all year, not underinsured 110. 9 (65%) Uninsured during the year 49. 5 (28%) 10 Insured all year, not underinsured 102. 3 (58%) Insured all year, underinsured* 25. 2 (14%) 2003 2007 Adults ages 19– 64 (172. 0 million) Adults ages 19– 64 (177. 0 million) *Underinsured defined as insured all year but experienced one of the following: medical expenses equaled 10% or more of income; medical expenses equaled 5% or more of income if low-income (<200% of poverty); or deductibles equaled 5% or more of income. Data: The Commonwealth Fund Biennial Health Insurance Surveys (2003 and 2007). Source: C. Schoen, S. R. Collins, J. L. Kriss, and M. M. Doty, “How Many Are Underinsured? Trends Among U. S. Adults, 2003 and 2007, ” Health Affairs Web Exclusive, June 10, 2008. THE COMMONWEALTH FUND

Figure 10. 25 Million Adults Underinsured in 2007 60 Percent Increase Since 2003 Uninsured during the year 45. 5 (26%) Insured all year, underinsured* 15. 6 (9%) Insured all year, not underinsured 110. 9 (65%) Uninsured during the year 49. 5 (28%) 10 Insured all year, not underinsured 102. 3 (58%) Insured all year, underinsured* 25. 2 (14%) 2003 2007 Adults ages 19– 64 (172. 0 million) Adults ages 19– 64 (177. 0 million) *Underinsured defined as insured all year but experienced one of the following: medical expenses equaled 10% or more of income; medical expenses equaled 5% or more of income if low-income (<200% of poverty); or deductibles equaled 5% or more of income. Data: The Commonwealth Fund Biennial Health Insurance Surveys (2003 and 2007). Source: C. Schoen, S. R. Collins, J. L. Kriss, and M. M. Doty, “How Many Are Underinsured? Trends Among U. S. Adults, 2003 and 2007, ” Health Affairs Web Exclusive, June 10, 2008. THE COMMONWEALTH FUND

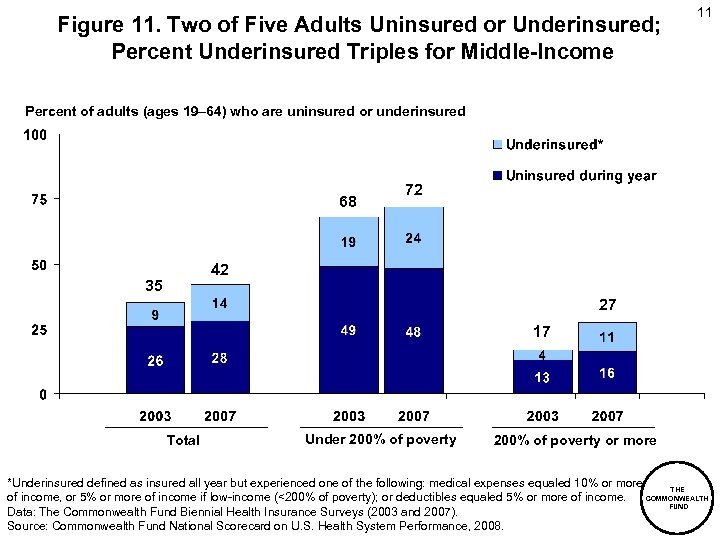

Figure 11. Two of Five Adults Uninsured or Underinsured; Percent Underinsured Triples for Middle-Income 11 Percent of adults (ages 19– 64) who are uninsured or underinsured 68 72 42 35 27 17 Total Under 200% of poverty or more *Underinsured defined as insured all year but experienced one of the following: medical expenses equaled 10% or more THE COMMONWEALTH of income, or 5% or more of income if low-income (<200% of poverty); or deductibles equaled 5% or more of income. FUND Data: The Commonwealth Fund Biennial Health Insurance Surveys (2003 and 2007). Source: Commonwealth Fund National Scorecard on U. S. Health System Performance, 2008.

Figure 11. Two of Five Adults Uninsured or Underinsured; Percent Underinsured Triples for Middle-Income 11 Percent of adults (ages 19– 64) who are uninsured or underinsured 68 72 42 35 27 17 Total Under 200% of poverty or more *Underinsured defined as insured all year but experienced one of the following: medical expenses equaled 10% or more THE COMMONWEALTH of income, or 5% or more of income if low-income (<200% of poverty); or deductibles equaled 5% or more of income. FUND Data: The Commonwealth Fund Biennial Health Insurance Surveys (2003 and 2007). Source: Commonwealth Fund National Scorecard on U. S. Health System Performance, 2008.

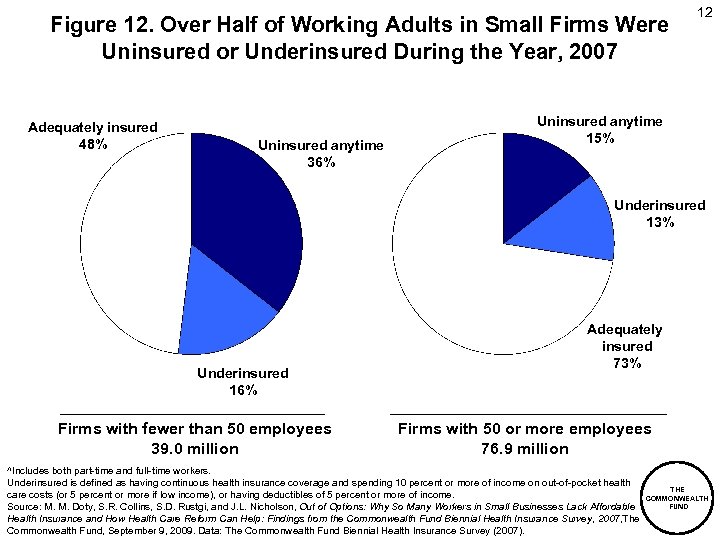

Figure 12. Over Half of Working Adults in Small Firms Were Uninsured or Underinsured During the Year, 2007 Adequately insured 48% Uninsured anytime 36% 12 Uninsured anytime 15% Underinsured 13% Underinsured 16% Firms with fewer than 50 employees 39. 0 million Adequately insured 73% Firms with 50 or more employees 76. 9 million ^Includes both part-time and full-time workers. Underinsured is defined as having continuous health insurance coverage and spending 10 percent or more of income on out-of-pocket health care costs (or 5 percent or more if low income), or having deductibles of 5 percent or more of income. Source: M. M. Doty, S. R. Collins, S. D. Rustgi, and J. L. Nicholson, Out of Options: Why So Many Workers in Small Businesses Lack Affordable Health Insurance and How Health Care Reform Can Help: Findings from the Commonwealth Fund Biennial Health Insurance Survey, 2007, The Commonwealth Fund, September 9, 2009. Data: The Commonwealth Fund Biennial Health Insurance Survey (2007). THE COMMONWEALTH FUND

Figure 12. Over Half of Working Adults in Small Firms Were Uninsured or Underinsured During the Year, 2007 Adequately insured 48% Uninsured anytime 36% 12 Uninsured anytime 15% Underinsured 13% Underinsured 16% Firms with fewer than 50 employees 39. 0 million Adequately insured 73% Firms with 50 or more employees 76. 9 million ^Includes both part-time and full-time workers. Underinsured is defined as having continuous health insurance coverage and spending 10 percent or more of income on out-of-pocket health care costs (or 5 percent or more if low income), or having deductibles of 5 percent or more of income. Source: M. M. Doty, S. R. Collins, S. D. Rustgi, and J. L. Nicholson, Out of Options: Why So Many Workers in Small Businesses Lack Affordable Health Insurance and How Health Care Reform Can Help: Findings from the Commonwealth Fund Biennial Health Insurance Survey, 2007, The Commonwealth Fund, September 9, 2009. Data: The Commonwealth Fund Biennial Health Insurance Survey (2007). THE COMMONWEALTH FUND

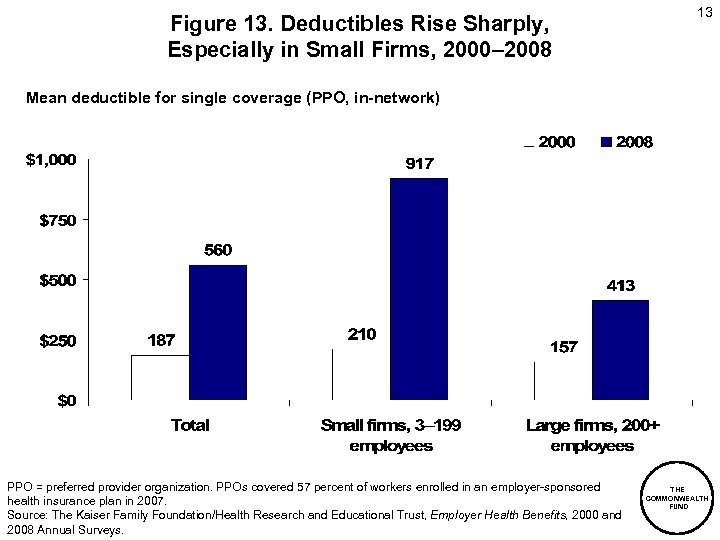

Figure 13. Deductibles Rise Sharply, Especially in Small Firms, 2000– 2008 13 Mean deductible for single coverage (PPO, in-network) PPO = preferred provider organization. PPOs covered 57 percent of workers enrolled in an employer-sponsored health insurance plan in 2007. Source: The Kaiser Family Foundation/Health Research and Educational Trust, Employer Health Benefits, 2000 and 2008 Annual Surveys. THE COMMONWEALTH FUND

Figure 13. Deductibles Rise Sharply, Especially in Small Firms, 2000– 2008 13 Mean deductible for single coverage (PPO, in-network) PPO = preferred provider organization. PPOs covered 57 percent of workers enrolled in an employer-sponsored health insurance plan in 2007. Source: The Kaiser Family Foundation/Health Research and Educational Trust, Employer Health Benefits, 2000 and 2008 Annual Surveys. THE COMMONWEALTH FUND

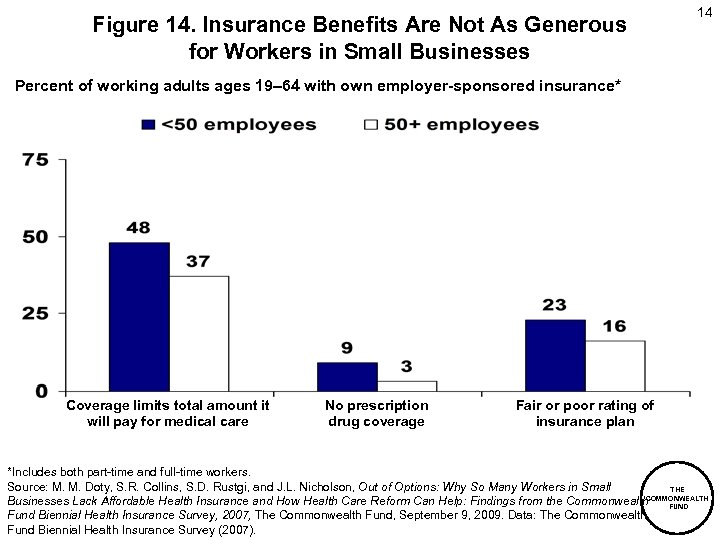

Figure 14. Insurance Benefits Are Not As Generous for Workers in Small Businesses 14 Percent of working adults ages 19– 64 with own employer-sponsored insurance* Coverage limits total amount it will pay for medical care No prescription drug coverage Fair or poor rating of insurance plan *Includes both part-time and full-time workers. Source: M. M. Doty, S. R. Collins, S. D. Rustgi, and J. L. Nicholson, Out of Options: Why So Many Workers in Small THE COMMONWEALTH Businesses Lack Affordable Health Insurance and How Health Care Reform Can Help: Findings from the Commonwealth FUND Fund Biennial Health Insurance Survey, 2007, The Commonwealth Fund, September 9, 2009. Data: The Commonwealth Fund Biennial Health Insurance Survey (2007).

Figure 14. Insurance Benefits Are Not As Generous for Workers in Small Businesses 14 Percent of working adults ages 19– 64 with own employer-sponsored insurance* Coverage limits total amount it will pay for medical care No prescription drug coverage Fair or poor rating of insurance plan *Includes both part-time and full-time workers. Source: M. M. Doty, S. R. Collins, S. D. Rustgi, and J. L. Nicholson, Out of Options: Why So Many Workers in Small THE COMMONWEALTH Businesses Lack Affordable Health Insurance and How Health Care Reform Can Help: Findings from the Commonwealth FUND Fund Biennial Health Insurance Survey, 2007, The Commonwealth Fund, September 9, 2009. Data: The Commonwealth Fund Biennial Health Insurance Survey (2007).

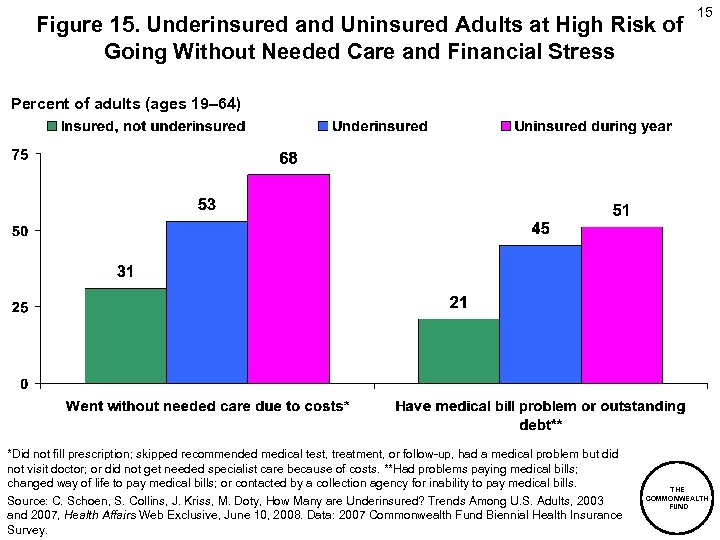

Figure 15. Underinsured and Uninsured Adults at High Risk of Going Without Needed Care and Financial Stress 15 Percent of adults (ages 19– 64) *Did not fill prescription; skipped recommended medical test, treatment, or follow-up, had a medical problem but did not visit doctor; or did not get needed specialist care because of costs. **Had problems paying medical bills; changed way of life to pay medical bills; or contacted by a collection agency for inability to pay medical bills. Source: C. Schoen, S. Collins, J. Kriss, M. Doty, How Many are Underinsured? Trends Among U. S. Adults, 2003 and 2007, Health Affairs Web Exclusive, June 10, 2008. Data: 2007 Commonwealth Fund Biennial Health Insurance Survey. THE COMMONWEALTH FUND

Figure 15. Underinsured and Uninsured Adults at High Risk of Going Without Needed Care and Financial Stress 15 Percent of adults (ages 19– 64) *Did not fill prescription; skipped recommended medical test, treatment, or follow-up, had a medical problem but did not visit doctor; or did not get needed specialist care because of costs. **Had problems paying medical bills; changed way of life to pay medical bills; or contacted by a collection agency for inability to pay medical bills. Source: C. Schoen, S. Collins, J. Kriss, M. Doty, How Many are Underinsured? Trends Among U. S. Adults, 2003 and 2007, Health Affairs Web Exclusive, June 10, 2008. Data: 2007 Commonwealth Fund Biennial Health Insurance Survey. THE COMMONWEALTH FUND

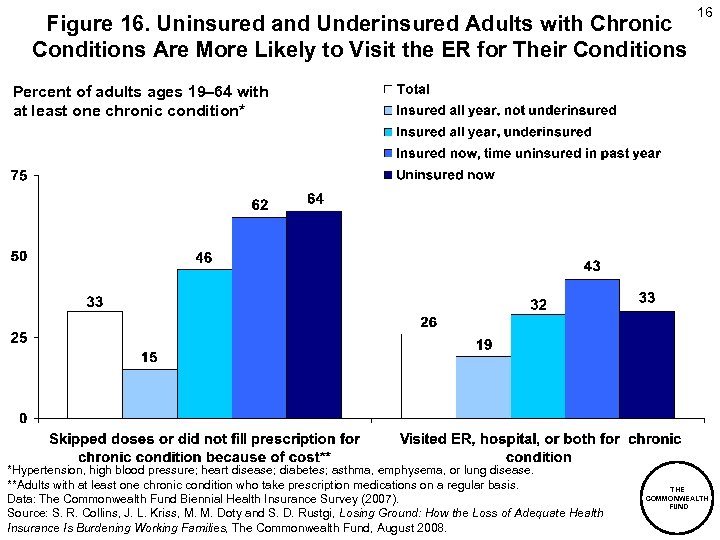

Figure 16. Uninsured and Underinsured Adults with Chronic Conditions Are More Likely to Visit the ER for Their Conditions 16 Percent of adults ages 19– 64 with at least one chronic condition* *Hypertension, high blood pressure; heart disease; diabetes; asthma, emphysema, or lung disease. **Adults with at least one chronic condition who take prescription medications on a regular basis. Data: The Commonwealth Fund Biennial Health Insurance Survey (2007). Source: S. R. Collins, J. L. Kriss, M. M. Doty and S. D. Rustgi, Losing Ground: How the Loss of Adequate Health Insurance Is Burdening Working Families, The Commonwealth Fund, August 2008. THE COMMONWEALTH FUND

Figure 16. Uninsured and Underinsured Adults with Chronic Conditions Are More Likely to Visit the ER for Their Conditions 16 Percent of adults ages 19– 64 with at least one chronic condition* *Hypertension, high blood pressure; heart disease; diabetes; asthma, emphysema, or lung disease. **Adults with at least one chronic condition who take prescription medications on a regular basis. Data: The Commonwealth Fund Biennial Health Insurance Survey (2007). Source: S. R. Collins, J. L. Kriss, M. M. Doty and S. D. Rustgi, Losing Ground: How the Loss of Adequate Health Insurance Is Burdening Working Families, The Commonwealth Fund, August 2008. THE COMMONWEALTH FUND

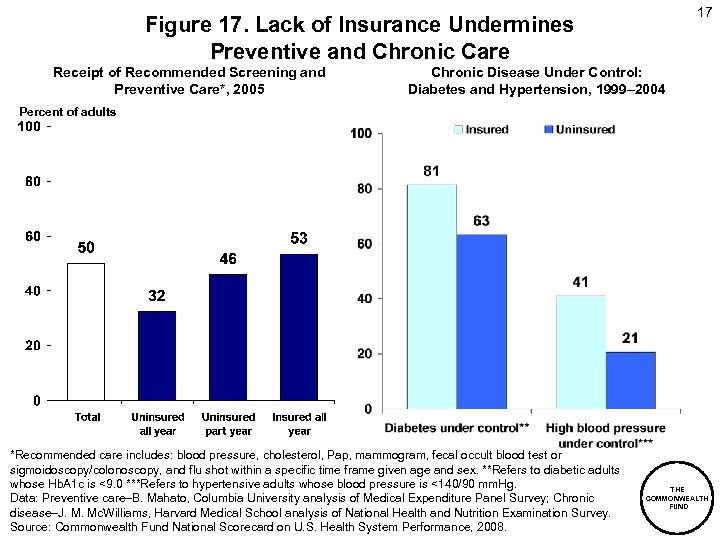

17 Figure 17. Lack of Insurance Undermines Preventive and Chronic Care Receipt of Recommended Screening and Preventive Care*, 2005 Chronic Disease Under Control: Diabetes and Hypertension, 1999– 2004 Percent of adults *Recommended care includes: blood pressure, cholesterol, Pap, mammogram, fecal occult blood test or sigmoidoscopy/colonoscopy, and flu shot within a specific time frame given age and sex. **Refers to diabetic adults whose Hb. A 1 c is <9. 0 ***Refers to hypertensive adults whose blood pressure is <140/90 mm. Hg. Data: Preventive care–B. Mahato, Columbia University analysis of Medical Expenditure Panel Survey; Chronic disease–J. M. Mc. Williams, Harvard Medical School analysis of National Health and Nutrition Examination Survey. Source: Commonwealth Fund National Scorecard on U. S. Health System Performance, 2008. THE COMMONWEALTH FUND

17 Figure 17. Lack of Insurance Undermines Preventive and Chronic Care Receipt of Recommended Screening and Preventive Care*, 2005 Chronic Disease Under Control: Diabetes and Hypertension, 1999– 2004 Percent of adults *Recommended care includes: blood pressure, cholesterol, Pap, mammogram, fecal occult blood test or sigmoidoscopy/colonoscopy, and flu shot within a specific time frame given age and sex. **Refers to diabetic adults whose Hb. A 1 c is <9. 0 ***Refers to hypertensive adults whose blood pressure is <140/90 mm. Hg. Data: Preventive care–B. Mahato, Columbia University analysis of Medical Expenditure Panel Survey; Chronic disease–J. M. Mc. Williams, Harvard Medical School analysis of National Health and Nutrition Examination Survey. Source: Commonwealth Fund National Scorecard on U. S. Health System Performance, 2008. THE COMMONWEALTH FUND

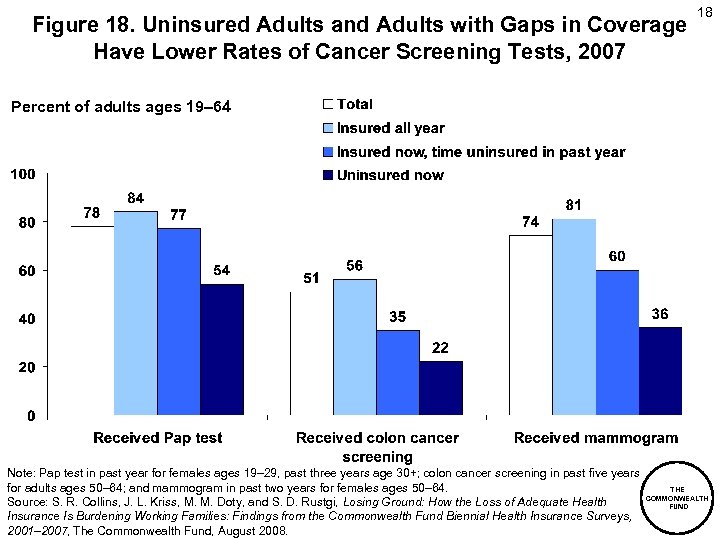

Figure 18. Uninsured Adults and Adults with Gaps in Coverage Have Lower Rates of Cancer Screening Tests, 2007 18 Percent of adults ages 19– 64 Note: Pap test in past year for females ages 19– 29, past three years age 30+; colon cancer screening in past five years for adults ages 50– 64; and mammogram in past two years for females ages 50– 64. Source: S. R. Collins, J. L. Kriss, M. M. Doty, and S. D. Rustgi, Losing Ground: How the Loss of Adequate Health Insurance Is Burdening Working Families: Findings from the Commonwealth Fund Biennial Health Insurance Surveys, 2001– 2007, The Commonwealth Fund, August 2008. THE COMMONWEALTH FUND

Figure 18. Uninsured Adults and Adults with Gaps in Coverage Have Lower Rates of Cancer Screening Tests, 2007 18 Percent of adults ages 19– 64 Note: Pap test in past year for females ages 19– 29, past three years age 30+; colon cancer screening in past five years for adults ages 50– 64; and mammogram in past two years for females ages 50– 64. Source: S. R. Collins, J. L. Kriss, M. M. Doty, and S. D. Rustgi, Losing Ground: How the Loss of Adequate Health Insurance Is Burdening Working Families: Findings from the Commonwealth Fund Biennial Health Insurance Surveys, 2001– 2007, The Commonwealth Fund, August 2008. THE COMMONWEALTH FUND

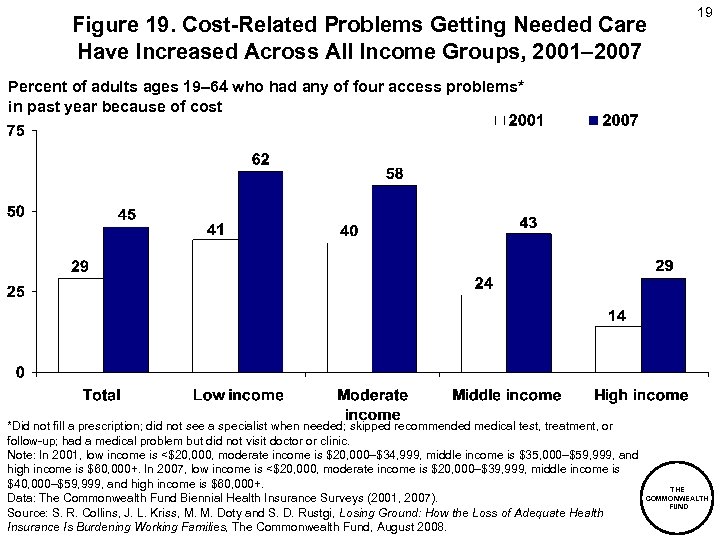

Figure 19. Cost-Related Problems Getting Needed Care Have Increased Across All Income Groups, 2001– 2007 19 Percent of adults ages 19– 64 who had any of four access problems* in past year because of cost *Did not fill a prescription; did not see a specialist when needed; skipped recommended medical test, treatment, or follow-up; had a medical problem but did not visit doctor or clinic. Note: In 2001, low income is <$20, 000, moderate income is $20, 000–$34, 999, middle income is $35, 000–$59, 999, and high income is $60, 000+. In 2007, low income is <$20, 000, moderate income is $20, 000–$39, 999, middle income is $40, 000–$59, 999, and high income is $60, 000+. Data: The Commonwealth Fund Biennial Health Insurance Surveys (2001, 2007). Source: S. R. Collins, J. L. Kriss, M. M. Doty and S. D. Rustgi, Losing Ground: How the Loss of Adequate Health Insurance Is Burdening Working Families, The Commonwealth Fund, August 2008. THE COMMONWEALTH FUND

Figure 19. Cost-Related Problems Getting Needed Care Have Increased Across All Income Groups, 2001– 2007 19 Percent of adults ages 19– 64 who had any of four access problems* in past year because of cost *Did not fill a prescription; did not see a specialist when needed; skipped recommended medical test, treatment, or follow-up; had a medical problem but did not visit doctor or clinic. Note: In 2001, low income is <$20, 000, moderate income is $20, 000–$34, 999, middle income is $35, 000–$59, 999, and high income is $60, 000+. In 2007, low income is <$20, 000, moderate income is $20, 000–$39, 999, middle income is $40, 000–$59, 999, and high income is $60, 000+. Data: The Commonwealth Fund Biennial Health Insurance Surveys (2001, 2007). Source: S. R. Collins, J. L. Kriss, M. M. Doty and S. D. Rustgi, Losing Ground: How the Loss of Adequate Health Insurance Is Burdening Working Families, The Commonwealth Fund, August 2008. THE COMMONWEALTH FUND

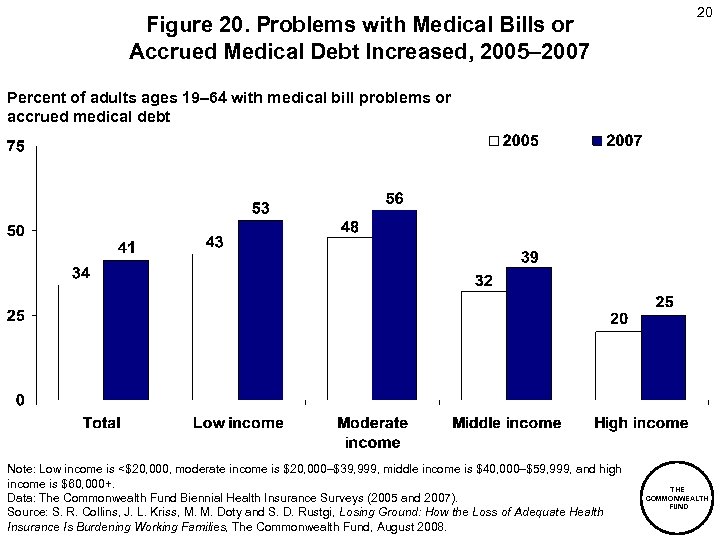

Figure 20. Problems with Medical Bills or Accrued Medical Debt Increased, 2005– 2007 20 Percent of adults ages 19– 64 with medical bill problems or accrued medical debt Note: Low income is <$20, 000, moderate income is $20, 000–$39, 999, middle income is $40, 000–$59, 999, and high income is $60, 000+. Data: The Commonwealth Fund Biennial Health Insurance Surveys (2005 and 2007). Source: S. R. Collins, J. L. Kriss, M. M. Doty and S. D. Rustgi, Losing Ground: How the Loss of Adequate Health Insurance Is Burdening Working Families, The Commonwealth Fund, August 2008. THE COMMONWEALTH FUND

Figure 20. Problems with Medical Bills or Accrued Medical Debt Increased, 2005– 2007 20 Percent of adults ages 19– 64 with medical bill problems or accrued medical debt Note: Low income is <$20, 000, moderate income is $20, 000–$39, 999, middle income is $40, 000–$59, 999, and high income is $60, 000+. Data: The Commonwealth Fund Biennial Health Insurance Surveys (2005 and 2007). Source: S. R. Collins, J. L. Kriss, M. M. Doty and S. D. Rustgi, Losing Ground: How the Loss of Adequate Health Insurance Is Burdening Working Families, The Commonwealth Fund, August 2008. THE COMMONWEALTH FUND

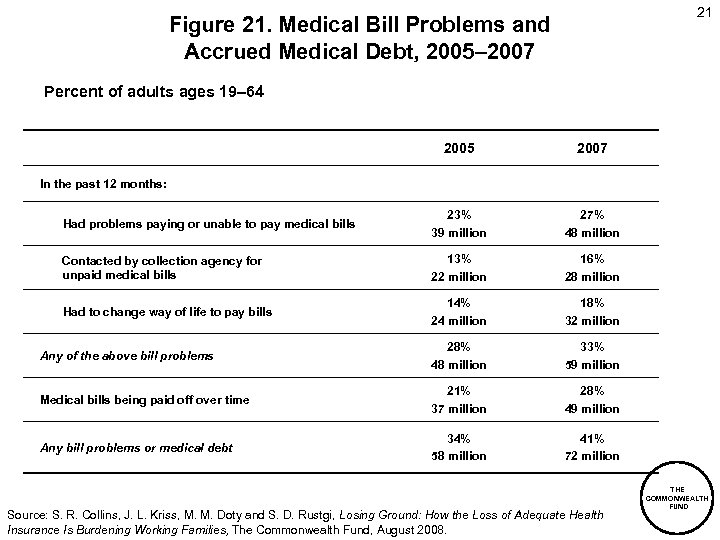

21 Figure 21. Medical Bill Problems and Accrued Medical Debt, 2005– 2007 Percent of adults ages 19– 64 2005 2007 Had problems paying or unable to pay medical bills 23% 39 million 27% 48 million Contacted by collection agency for unpaid medical bills 13% 22 million 16% 28 million Had to change way of life to pay bills 14% 24 million 18% 32 million Any of the above bill problems 28% 48 million 33% 59 million Medical bills being paid off over time 21% 37 million 28% 49 million Any bill problems or medical debt 34% 58 million 41% 72 million In the past 12 months: Source: S. R. Collins, J. L. Kriss, M. M. Doty and S. D. Rustgi, Losing Ground: How the Loss of Adequate Health Insurance Is Burdening Working Families, The Commonwealth Fund, August 2008. THE COMMONWEALTH FUND

21 Figure 21. Medical Bill Problems and Accrued Medical Debt, 2005– 2007 Percent of adults ages 19– 64 2005 2007 Had problems paying or unable to pay medical bills 23% 39 million 27% 48 million Contacted by collection agency for unpaid medical bills 13% 22 million 16% 28 million Had to change way of life to pay bills 14% 24 million 18% 32 million Any of the above bill problems 28% 48 million 33% 59 million Medical bills being paid off over time 21% 37 million 28% 49 million Any bill problems or medical debt 34% 58 million 41% 72 million In the past 12 months: Source: S. R. Collins, J. L. Kriss, M. M. Doty and S. D. Rustgi, Losing Ground: How the Loss of Adequate Health Insurance Is Burdening Working Families, The Commonwealth Fund, August 2008. THE COMMONWEALTH FUND

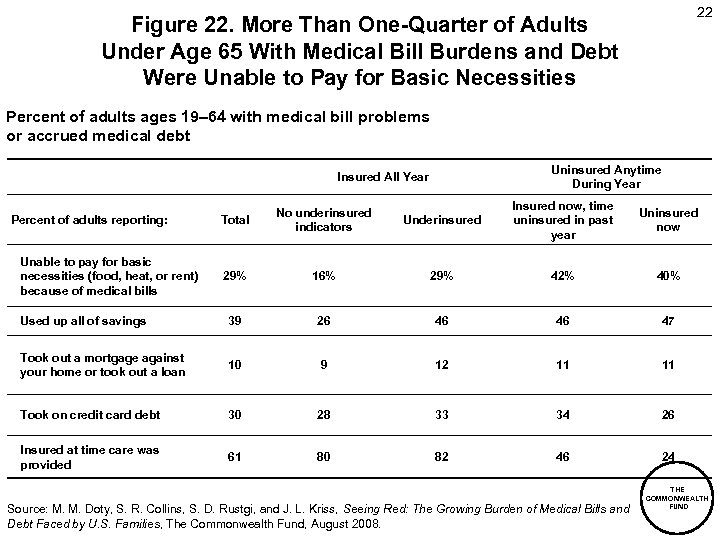

22 Figure 22. More Than One-Quarter of Adults Under Age 65 With Medical Bill Burdens and Debt Were Unable to Pay for Basic Necessities Percent of adults ages 19– 64 with medical bill problems or accrued medical debt Uninsured Anytime During Year Insured All Year Underinsured Insured now, time uninsured in past year Uninsured now 16% 29% 42% 40% 39 26 46 46 47 Took out a mortgage against your home or took out a loan 10 9 12 11 11 Took on credit card debt 30 28 33 34 26 Insured at time care was provided 61 80 82 46 24 Total No underinsured indicators 29% Used up all of savings Percent of adults reporting: Unable to pay for basic necessities (food, heat, or rent) because of medical bills Source: M. M. Doty, S. R. Collins, S. D. Rustgi, and J. L. Kriss, Seeing Red: The Growing Burden of Medical Bills and Debt Faced by U. S. Families, The Commonwealth Fund, August 2008. THE COMMONWEALTH FUND

22 Figure 22. More Than One-Quarter of Adults Under Age 65 With Medical Bill Burdens and Debt Were Unable to Pay for Basic Necessities Percent of adults ages 19– 64 with medical bill problems or accrued medical debt Uninsured Anytime During Year Insured All Year Underinsured Insured now, time uninsured in past year Uninsured now 16% 29% 42% 40% 39 26 46 46 47 Took out a mortgage against your home or took out a loan 10 9 12 11 11 Took on credit card debt 30 28 33 34 26 Insured at time care was provided 61 80 82 46 24 Total No underinsured indicators 29% Used up all of savings Percent of adults reporting: Unable to pay for basic necessities (food, heat, or rent) because of medical bills Source: M. M. Doty, S. R. Collins, S. D. Rustgi, and J. L. Kriss, Seeing Red: The Growing Burden of Medical Bills and Debt Faced by U. S. Families, The Commonwealth Fund, August 2008. THE COMMONWEALTH FUND

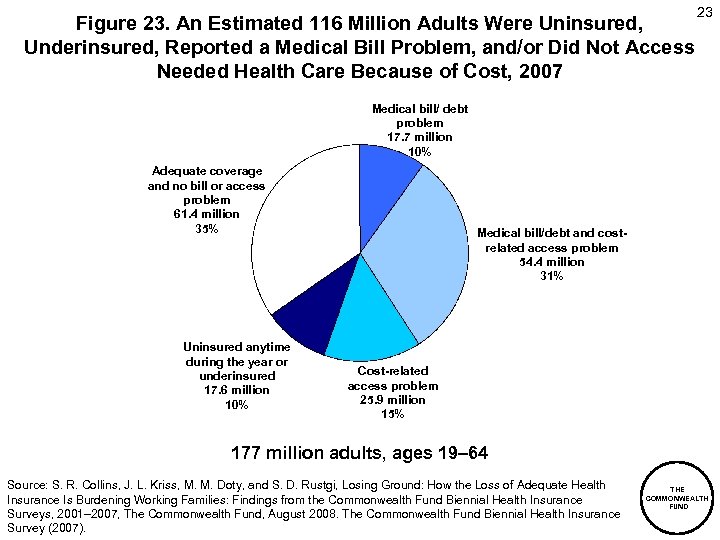

Figure 23. An Estimated 116 Million Adults Were Uninsured, Underinsured, Reported a Medical Bill Problem, and/or Did Not Access Needed Health Care Because of Cost, 2007 23 Medical bill/ debt problem 17. 7 million 10% Adequate coverage and no bill or access problem 61. 4 million 35% Uninsured anytime during the year or underinsured 17. 6 million 10% Medical bill/debt and costrelated access problem 54. 4 million 31% Cost-related access problem 25. 9 million 15% 177 million adults, ages 19– 64 Source: S. R. Collins, J. L. Kriss, M. M. Doty, and S. D. Rustgi, Losing Ground: How the Loss of Adequate Health Insurance Is Burdening Working Families: Findings from the Commonwealth Fund Biennial Health Insurance Surveys, 2001– 2007, The Commonwealth Fund, August 2008. The Commonwealth Fund Biennial Health Insurance Survey (2007). THE COMMONWEALTH FUND

Figure 23. An Estimated 116 Million Adults Were Uninsured, Underinsured, Reported a Medical Bill Problem, and/or Did Not Access Needed Health Care Because of Cost, 2007 23 Medical bill/ debt problem 17. 7 million 10% Adequate coverage and no bill or access problem 61. 4 million 35% Uninsured anytime during the year or underinsured 17. 6 million 10% Medical bill/debt and costrelated access problem 54. 4 million 31% Cost-related access problem 25. 9 million 15% 177 million adults, ages 19– 64 Source: S. R. Collins, J. L. Kriss, M. M. Doty, and S. D. Rustgi, Losing Ground: How the Loss of Adequate Health Insurance Is Burdening Working Families: Findings from the Commonwealth Fund Biennial Health Insurance Surveys, 2001– 2007, The Commonwealth Fund, August 2008. The Commonwealth Fund Biennial Health Insurance Survey (2007). THE COMMONWEALTH FUND

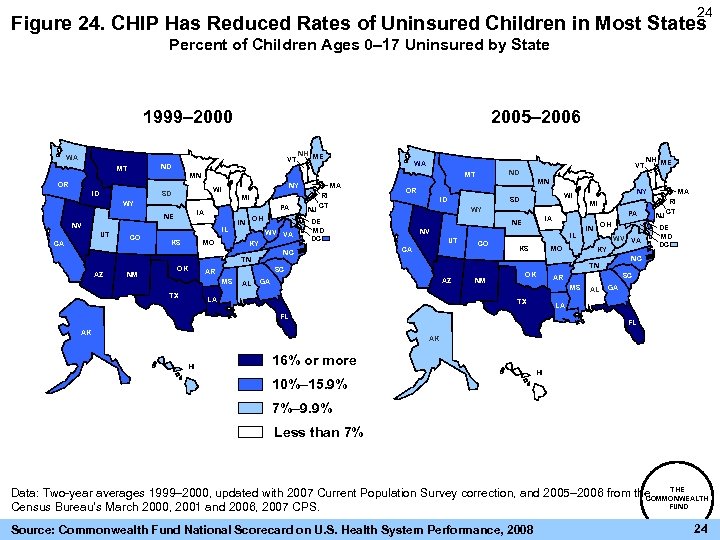

24 Figure 24. CHIP Has Reduced Rates of Uninsured Children in Most States Percent of Children Ages 0– 17 Uninsured by State 1999– 2000 2005– 2006 WA VT ND MT ID MI WY PA IA NE NV IL CO KS MO OH IN WV VA KY NM OK ID AL MI NV CA IL CO KS MO OH IN WV VA KY AZ LA NM OK DE MD DC SC AR MS TX NJ RI CT NC TN GA AL GA LA FL AK PA IA NE UT MA NY WI SD WY DE MD DC NH ME MN OR SC AR MS TX NJ RI CT NC TN AZ MA VT ND MT NY WI SD CA WA MN OR UT NH ME FL AK HI 16% or more 10%– 15. 9% HI 7%– 9. 9% Less than 7% THE Data: Two-year averages 1999– 2000, updated with 2007 Current Population Survey correction, and 2005– 2006 from the COMMONWEALTH FUND Census Bureau’s March 2000, 2001 and 2006, 2007 CPS. Source: Commonwealth Fund National Scorecard on U. S. Health System Performance, 2008 24

24 Figure 24. CHIP Has Reduced Rates of Uninsured Children in Most States Percent of Children Ages 0– 17 Uninsured by State 1999– 2000 2005– 2006 WA VT ND MT ID MI WY PA IA NE NV IL CO KS MO OH IN WV VA KY NM OK ID AL MI NV CA IL CO KS MO OH IN WV VA KY AZ LA NM OK DE MD DC SC AR MS TX NJ RI CT NC TN GA AL GA LA FL AK PA IA NE UT MA NY WI SD WY DE MD DC NH ME MN OR SC AR MS TX NJ RI CT NC TN AZ MA VT ND MT NY WI SD CA WA MN OR UT NH ME FL AK HI 16% or more 10%– 15. 9% HI 7%– 9. 9% Less than 7% THE Data: Two-year averages 1999– 2000, updated with 2007 Current Population Survey correction, and 2005– 2006 from the COMMONWEALTH FUND Census Bureau’s March 2000, 2001 and 2006, 2007 CPS. Source: Commonwealth Fund National Scorecard on U. S. Health System Performance, 2008 24

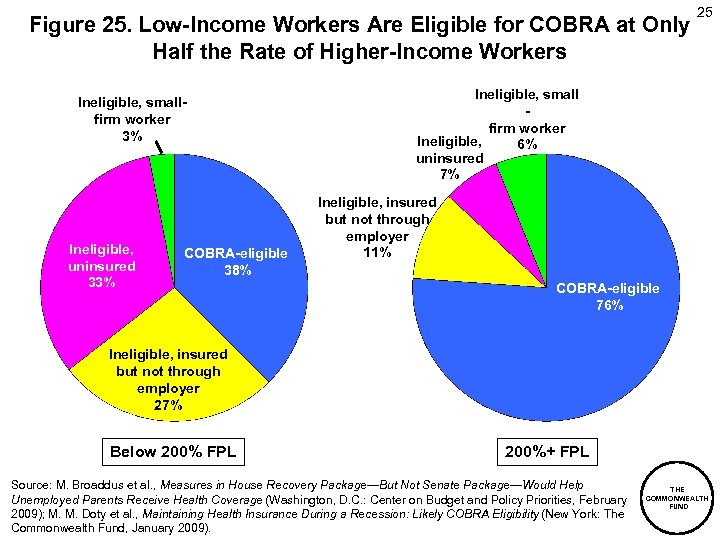

Figure 25. Low-Income Workers Are Eligible for COBRA at Only Half the Rate of Higher-Income Workers Ineligible, smallfirm worker 3% Ineligible, uninsured 33% COBRA-eligible 38% 25 Ineligible, small firm worker Ineligible, 6% uninsured 7% Ineligible, insured but not through employer 11% COBRA-eligible 76% Ineligible, insured but not through employer 27% Below 200% FPL 200%+ FPL Source: M. Broaddus et al. , Measures in House Recovery Package—But Not Senate Package—Would Help Unemployed Parents Receive Health Coverage (Washington, D. C. : Center on Budget and Policy Priorities, February 2009); M. M. Doty et al. , Maintaining Health Insurance During a Recession: Likely COBRA Eligibility (New York: The Commonwealth Fund, January 2009). THE COMMONWEALTH FUND

Figure 25. Low-Income Workers Are Eligible for COBRA at Only Half the Rate of Higher-Income Workers Ineligible, smallfirm worker 3% Ineligible, uninsured 33% COBRA-eligible 38% 25 Ineligible, small firm worker Ineligible, 6% uninsured 7% Ineligible, insured but not through employer 11% COBRA-eligible 76% Ineligible, insured but not through employer 27% Below 200% FPL 200%+ FPL Source: M. Broaddus et al. , Measures in House Recovery Package—But Not Senate Package—Would Help Unemployed Parents Receive Health Coverage (Washington, D. C. : Center on Budget and Policy Priorities, February 2009); M. M. Doty et al. , Maintaining Health Insurance During a Recession: Likely COBRA Eligibility (New York: The Commonwealth Fund, January 2009). THE COMMONWEALTH FUND

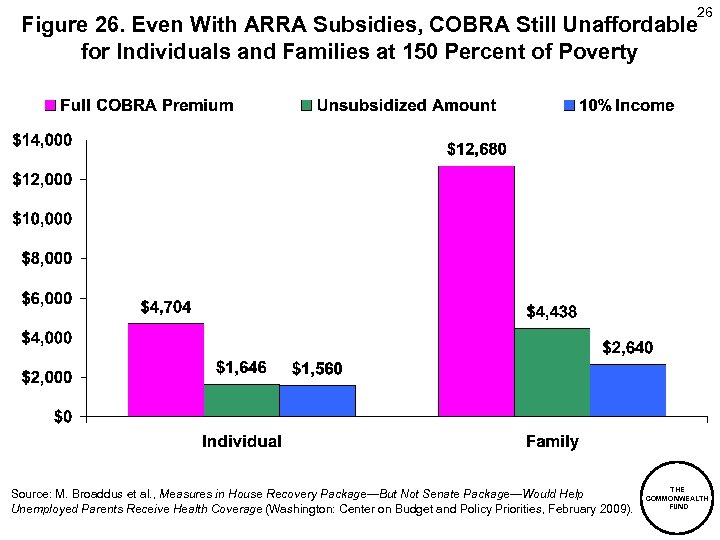

26 Figure 26. Even With ARRA Subsidies, COBRA Still Unaffordable for Individuals and Families at 150 Percent of Poverty Source: M. Broaddus et al. , Measures in House Recovery Package—But Not Senate Package—Would Help Unemployed Parents Receive Health Coverage (Washington: Center on Budget and Policy Priorities, February 2009). THE COMMONWEALTH FUND

26 Figure 26. Even With ARRA Subsidies, COBRA Still Unaffordable for Individuals and Families at 150 Percent of Poverty Source: M. Broaddus et al. , Measures in House Recovery Package—But Not Senate Package—Would Help Unemployed Parents Receive Health Coverage (Washington: Center on Budget and Policy Priorities, February 2009). THE COMMONWEALTH FUND

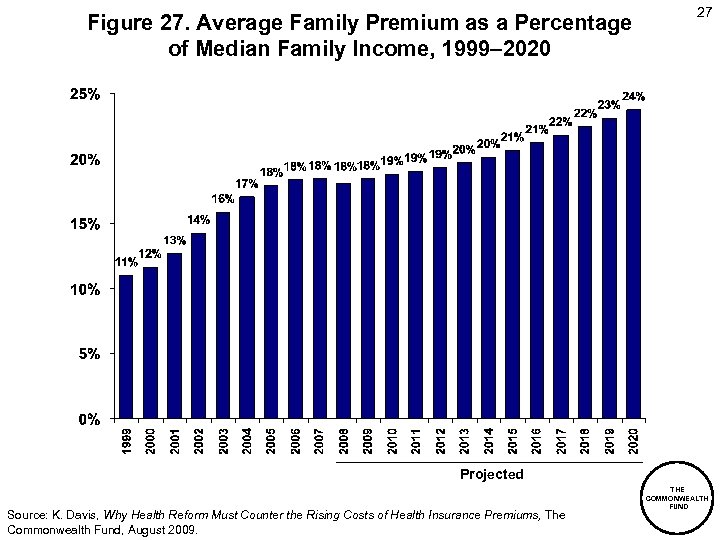

Figure 27. Average Family Premium as a Percentage of Median Family Income, 1999– 2020 27 Projected Source: K. Davis, Why Health Reform Must Counter the Rising Costs of Health Insurance Premiums, The Commonwealth Fund, August 2009. THE COMMONWEALTH FUND

Figure 27. Average Family Premium as a Percentage of Median Family Income, 1999– 2020 27 Projected Source: K. Davis, Why Health Reform Must Counter the Rising Costs of Health Insurance Premiums, The Commonwealth Fund, August 2009. THE COMMONWEALTH FUND

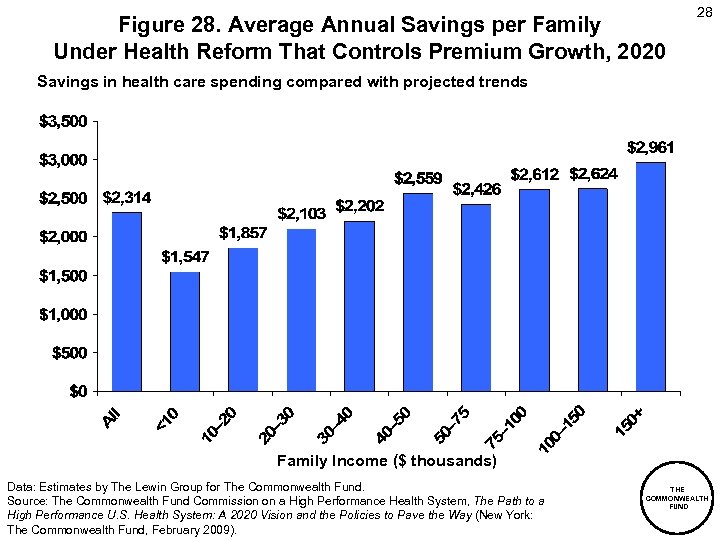

Figure 28. Average Annual Savings per Family Under Health Reform That Controls Premium Growth, 2020 28 Savings in health care spending compared with projected trends Family Income ($ thousands) Data: Estimates by The Lewin Group for The Commonwealth Fund. Source: The Commonwealth Fund Commission on a High Performance Health System, The Path to a High Performance U. S. Health System: A 2020 Vision and the Policies to Pave the Way (New York: The Commonwealth Fund, February 2009). THE COMMONWEALTH FUND

Figure 28. Average Annual Savings per Family Under Health Reform That Controls Premium Growth, 2020 28 Savings in health care spending compared with projected trends Family Income ($ thousands) Data: Estimates by The Lewin Group for The Commonwealth Fund. Source: The Commonwealth Fund Commission on a High Performance Health System, The Path to a High Performance U. S. Health System: A 2020 Vision and the Policies to Pave the Way (New York: The Commonwealth Fund, February 2009). THE COMMONWEALTH FUND