d3d26c3b1594acb27551983b286e4d99.ppt

- Количество слайдов: 16

1 December 2008

VAB Bank. Overview n Short name VAB Bank (formerly known as VABank) n Established 2 nd July 1992, Kyiv n Member of VAB Group n Auditor Ernst&Young n Ratings □ Moody’s Local Currency Deposits: B 2 Foreign Currency Deposits: B 2 Outlook: Stable □ Fitch Foreign Currency: Long-Term IDR: B– Short-Term IDR: B Outlook: Negative 2

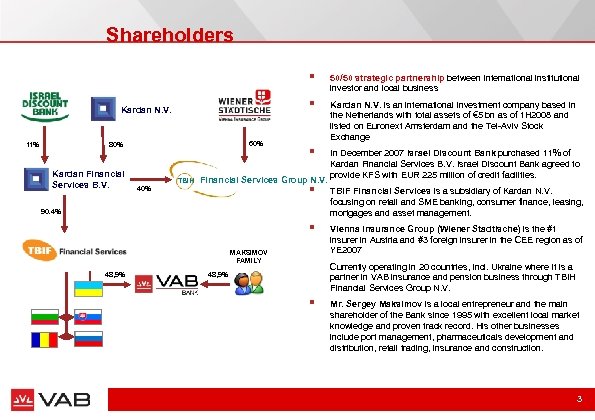

Shareholders § § Kardan N. V. 11% 60% 80% Kardan Financial Services B. V. TBIH 50/50 strategic partnership between international institutional investor and local business Kardan N. V. is an international investment company based in the Netherlands with total assets of € 5 bn as of 1 H 2008 and listed on Euronext Amsterdam and the Tel-Aviv Stock Exchange § In December 2007 Israel Discount Bank purchased 11% of Kardan Financial Services B. V. Israel Discount Bank agreed to provide KFS with EUR 225 million of credit facilities. Financial Services Group N. V. § TBIF Financial Services is a subsidiary of Kardan N. V. focusing on retail and SME banking, consumer finance, leasing, mortgages and asset management. § 40% Vienna Insurance Group (Wiener Stadtische) is the #1 insurer in Austria and #3 foreign insurer in the CEE region as of YE 2007 90. 4% MAKSIMOV FAMILY 48, 9% Currently operating in 20 countries, incl. Ukraine where it is a partner in VAB insurance and pension business through TBIH Financial Services Group N. V. 48, 9% § Mr. Sergey Maksimov is a local entrepreneur and the main shareholder of the Bank since 1995 with excellent local market knowledge and proven track record. His other businesses include port management, pharmaceuticals development and distribution, retail trading, insurance and construction. 3

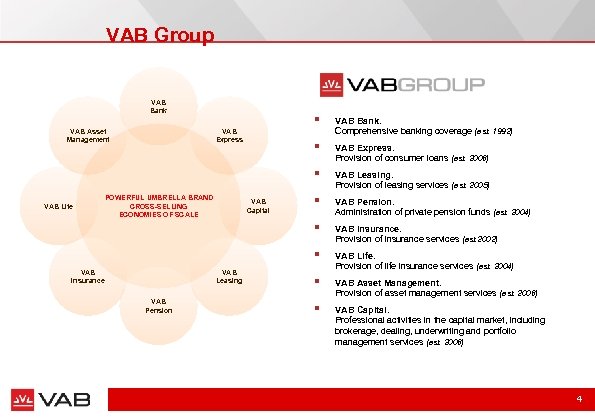

VAB Group VAB Bank § POWERFUL UMBRELLA BRAND CROSS-SELLING ECONOMIES OF SCALE VAB Insurance VAB Capital VAB Leasing VAB Pension VAB Express. Provision of consumer loans (est. 2006) VAB Leasing. Provision of leasing services (est. 2005) § VAB Pension. Administration of private pension funds (est. 2004) VAB Insurance. Provision of insurance services (est. 2002) § VAB Express VAB Bank. Comprehensive banking coverage (est. 1992) § VAB Life § § VAB Asset Management VAB Life. Provision of life insurance services (est. 2004) § VAB Asset Management. Provision of asset management services (est. 2006) § VAB Capital. Professional activities in the capital market, including brokerage, dealing, underwriting and portfolio management services (est. 2006) 4

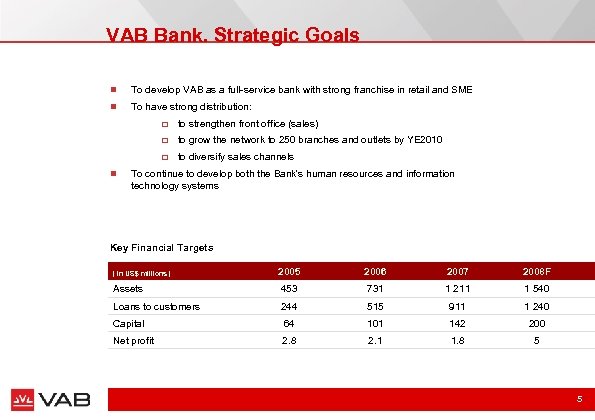

VAB Bank. Strategic Goals n To develop VAB as a full-service bank with strong franchise in retail and SME n To have strong distribution: □ to strengthen front office (sales) □ to grow the network to 250 branches and outlets by YE 2010 □ to diversify sales channels n To continue to develop both the Bank's human resources and information technology systems Key Financial Targets 2005 2006 2007 2008 F Assets 453 731 1 211 1 540 Loans to customers 244 515 911 1 240 Capital 64 101 142 200 Net profit 2. 8 2. 1 1. 8 5 | in US$ millions | 5

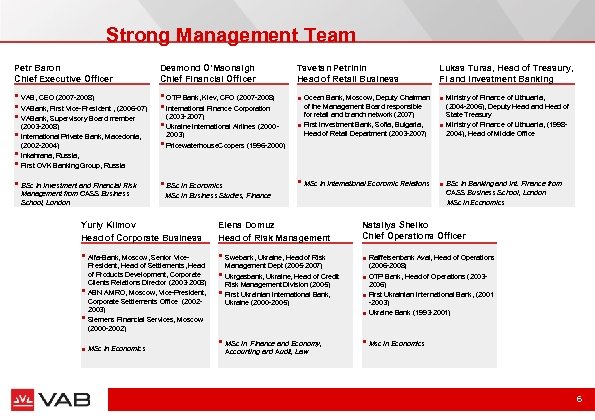

Strong Management Team Petr Baron Chief Executive Officer Desmond O’Maonaigh Chief Financial Officer § VAB, CEO (2007 -2008) § VABank, First Vice-President , (2006 -07) § VABank, Supervisory Board member § OTP Bank, Kiev, CFO (2007 -2008) § International Finance Corporation § § § (2003 -2008) International Private Bank, Macedonia, (2002 -2004) Inkahrana, Russia, First OVK Banking Group, Russia § BSc in Investment and Financial Risk Management from CASS Business School, London Tsvetan Petrinin Head of Retail Business n (2003 -2007) § Ukraine International Airlines (2000 § 2003) Pricewaterhouse. Coopers (1996 -2000) n Ocean Bank, Moscow, Deputy Chairman of the Management Board responsible for retail and branch network (2007) First Investment Bank, Sofia, Bulgaria, Head of Retail Department (2003 -2007) § MSc in International Economic Relations § BSc in Economics MSc in Business Studies, Finance Lukas Tursa, Head of Treasury, FI and Investment Banking n n n Ministry of Finance of Lithuania, (2004 -2006), Deputy Head and Head of State Treasury Ministry of Finance of Lithuania, (19982004), Head of Middle Office BSc in Banking and Int. Finance from CASS Business School, London MSc in Economics Yuriy Klimov Head of Corporate Business Elena Domuz Head of Risk Management Nataliya Shelko Chief Operations Officer § Alfa-Bank, Moscow, Senior Vice- § Swebank, Ukraine, Head of Risk n § § n President, Head of Settlements, Head of Products Development, Corporate Clients Relations Director (2003 -2008) ABN AMRO, Moscow, Vice-President, Corporate Settlements Office (20022003) Siemens Financial Services, Moscow (2000 -2002) MSc in Economics § Management Dept (2005 -2007) Ukrgasbank, Ukraine, Head of Credit Risk Management Division (2005) First Ukrainian International Bank, Ukraine (2000 -2005) n n § MSc in Finance and Economy, Accounting and Audit, Law Raiffeisenbank Aval, Head of Operations (2006 -2008) OTP Bank, Head of Operations (20032006) First Ukrainian International Bank, (2001 -2003) Ukraine Bank (1993 -2001) § Msc in Economics 6

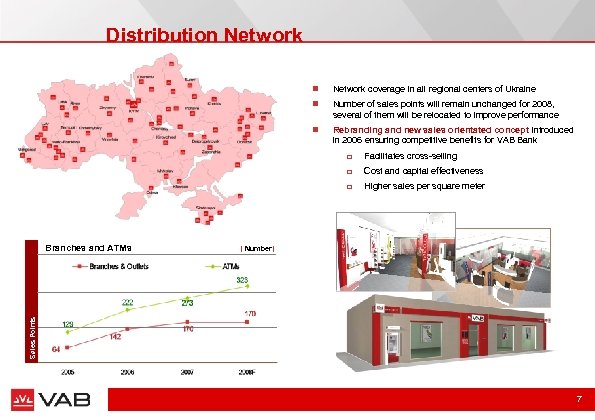

Distribution Network coverage in all regional centers of Ukraine n Number of sales points will remain unchanged for 2008, several of them will be relocated to improve performance n Rebranding and new sales orientated concept introduced in 2006 ensuring competitive benefits for VAB Bank □ □ Cost and capital effectiveness □ Higher sales per square meter | Number | Sales Points Branches and ATMs Facilitates cross-selling 7

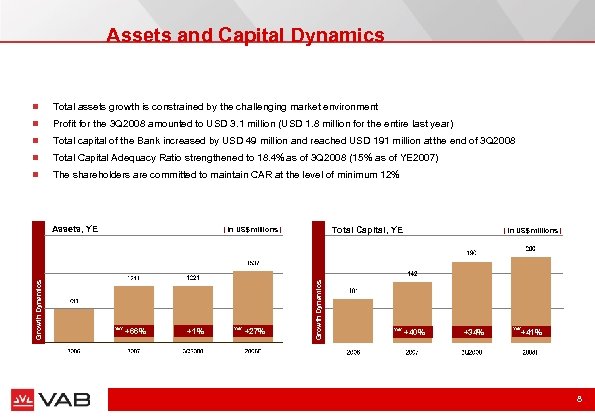

Assets and Capital Dynamics n Total assets growth is constrained by the challenging market environment n Profit for the 3 Q 2008 amounted to USD 3. 1 million (USD 1. 8 million for the entire last year) n Total capital of the Bank increased by USD 49 million and reached USD 191 million at the end of 3 Q 2008 n Total Capital Adequacy Ratio strengthened to 18. 4% as of 3 Q 2008 (15% as of YE 2007) n The shareholders are committed to maintain CAR at the level of minimum 12% Total Capital, YE | in US$ millions | Yo. Y +66% +1% Yo. Y +27% Growth Dynamics Assets, YE Yo. Y | in US$ millions | +40% +34% Yo. Y +41% 8

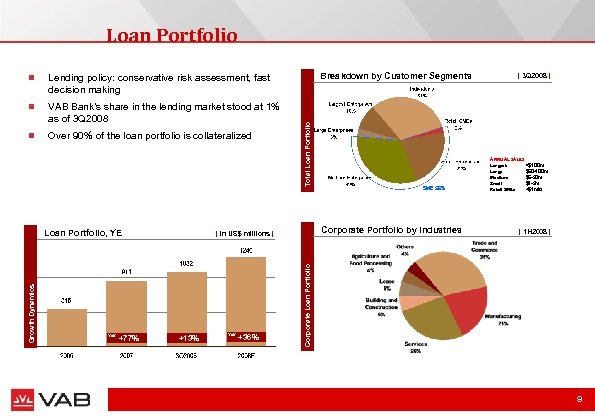

Loan Portfolio n VAB Bank’s share in the lending market stood at 1% as of 3 Q 2008 n Over 90% of the loan portfolio is collateralized Breakdown by Customer Segments Lending policy: conservative risk assessment, fast decision making Yo. Y +77% Corporate Portfolio by Industries | in US$ millions | +13% Yo. Y +36% SME 56% | 3 Q 2008 | ANNUAL SALES Largest >$100 m Large $50 -100 m Medium $5 -50 m Small $1 -5 m Retail SMEs <$1 mio | 1 H 2008 | Corporate Loan Portfolio Growth Dynamics Loan Portfolio, YE Total Loan Portfolio n 9

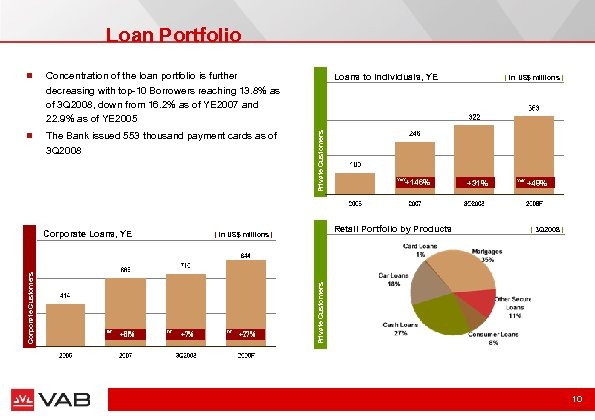

Loan Portfolio Concentration of the loan portfolio is further decreasing with top-10 Borrowers reaching 13. 8% as of 3 Q 2008, down from 16. 2% as of YE 2007 and 22. 9% as of YE 2005 n The Bank issued 553 thousand payment cards as of 3 Q 2008 Yo. Y +61% +7% Yo. Y +27% +146% Retail Portfolio by Products | in US$ millions | Yo. Y | in US$ millions | +31% Yo. Y +48% | 3 Q 2008 | Private Customers Corporate Loans, YE Loans to individuals, YE Private Customers n 10

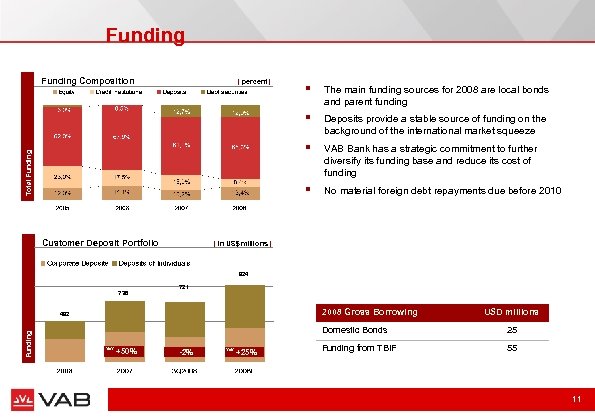

Funding Composition | percent | Deposits provide a stable source of funding on the background of the international market squeeze § VAB Bank has a strategic commitment to further diversify its funding base and reduce its cost of funding § Total Funding The main funding sources for 2008 are local bonds and parent funding § Customer Deposit Portfolio § No material foreign debt repayments due before 2010 | in US$ millions | 924 738 721 2008 Gross Borrowing Funding 492 USD millions Domestic Bonds Yo. Y +50% -2% Yo. Y +25% 25 Funding from TBIF 55 11

Funding. Capital Market Loans § Amount: US$15, 000 § § Tenor: 14 months § § Tenor: 11 months Facility Date: Feb 2006 Mandated Lead Arranger Tenor: 7 years Facility Date: Dec 2006 Lenders Bilateral Loan Syndicated Loan Mandated Lead Arranger Facility Date: Jun 2006 Amount: US$30, 000 § § § Amount: US$10, 000 § Amount: US$20, 000 § § § Tenor: 1 year § § Tenor: 10 years Facility Date: Apr 2007 Mandated Lead Arrangers Subordinated Loan Amount: US$51, 000 Syndicated Loan § Margin: LIBOR + 4. 5% Facility Date: Oct 2007 Lender 12

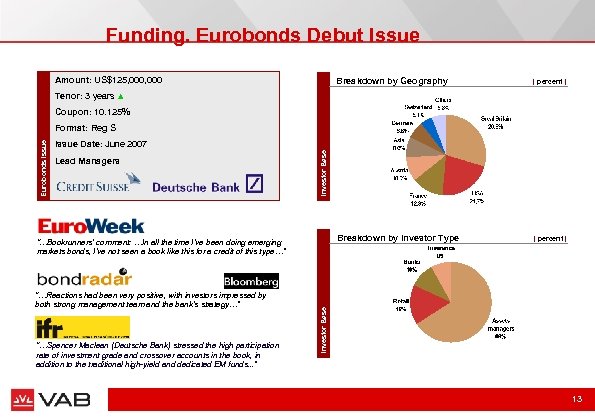

Funding. Eurobonds Debut Issue Amount: US$125, 000 Breakdown by Geography | percent | Breakdown by Investor Type | percent | Tenor: 3 years ▲ Coupon: 10. 125% Format: Reg S Issue Date: June 2007 Lead Managers Investor Base Eurobonds Issue § § § “…Reactions had been very positive, with investors impressed by both strong management team and the bank’s strategy…” “…Spencer Maclean (Deutsche Bank) stressed the high participation rate of investment grade and crossover accounts in the book, in addition to the traditional high-yield and dedicated EM funds. . . ” Investor Base “…Bookrunners’ comment: …In all the time I’ve been doing emerging markets bonds, I’ve not seen a book like this for a credit of this type…” 13

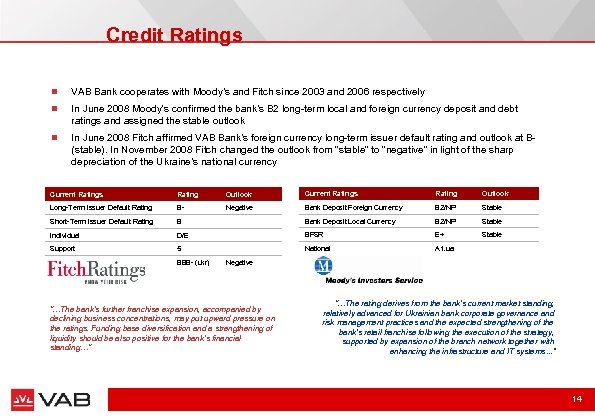

Credit Ratings n VAB Bank cooperates with Moody’s and Fitch since 2003 and 2006 respectively n In June 2008 Moody's confirmed the bank’s B 2 long-term local and foreign currency deposit and debt ratings and assigned the stable outlook n In June 2008 Fitch affirmed VAB Bank’s foreign currency long-term issuer default rating and outlook at B(stable). In November 2008 Fitch changed the outlook from “stable” to “negative” in light of the sharp depreciation of the Ukraine’s national currency Current Ratings Rating Outlook Long-Term Issuer Default Rating B- Negative Bank Deposit Foreign Currency B 2/NP Stable Short-Term Issuer Default Rating B Bank Deposit Local Currency B 2/NP Stable Individual D/E BFSR E+ Stable Support 5 National A 1. ua National Long-Term BBB- (ukr) Negative “…The bank’s further franchise expansion, accompanied by declining business concentrations, may put upward pressure on the ratings. Funding base diversification and a strengthening of liquidity should be also positive for the bank’s financial standing…“ “…The rating derives from the bank’s current market standing, relatively advanced for Ukrainian bank corporate governance and risk management practices and the expected strengthening of the bank’s retail franchise following the execution of the strategy, supported by expansion of the branch network together with enhancing the infrastructure and IT systems. . . ” 14

Summary n Strong, supportive, long-term strategic investors with sufficient financial resources and experience to ensure success n Top quality senior management team with extensive international experience n Strong branch network coverage n Unique customer service approach and well-developed brand. Brand awareness increased from 18% in 2006 to 47% in January 2008 n High capitalization level with 18. 4% Basel Capital Adequacy Ratio as of 3 Q 2008 n International standard risk management systems with proven capability to manage rapid growth n rd High standards of corporate governance and transparency: ranking the 3 among the most transparent banks in Ukraine according to Standard & Poor's survey in Nov 2008 staying among the leaders for the third consecutive year 15

Contact Details 5 Zoolohichna Street, Kyiv 04119, Ukraine Tel. : (38 044) 481 -33 -48 Fax: (38 044) 481 -33 -49 e-mail: fi@vab. ua ir@vab. ua § Telex: 631048 VABNK UX S. W. I. F. T. BIC: VABA UA UK REUTERS: VABK § Please see www. vabbank. com. ua for more details about VAB Mr. Lukas Tursa Deputy Chairman of the Management Board Head of Treasury and Financial Institutions Tel. : +38 044 492 39 80 e-mail: l. tursa@vab. ua Financial Institutions & International Borrowings Mr. Viktor Duma Head of Financial Institutions & International Financing Tel. : +38 044 481 33 48 e-mail: v. duma@vab. ua § Ms. Natalia Bastun Correspondent Banking Tel. : +38 044 481 33 47 e-mail: n. bastun@vab. ua § Mr. Oleksiy Tihiy Head of Dealing Tel. : +38 044 481 33 53 e-mail: a. tihiy@vab. ua § Ms. Iryna Drygalo Deputy Head of Documentary Business Tel. : +38 044 490 06 34 e-mail: i. drygalo@vab. ua FX & Money Market § Ms. Natalia Shishatska Head of Money & Forex Markets Tel. : +38 044 490 06 36 e-mail: n. shishatska@vab. ua Documentary Business § Ms. Tetyana Synitsyna Head of Documentary Business Tel. : +38 044 490 06 34 e-mail: t. synitsyna@vab. ua Investment Banking n Ms. Dorina Zilbermints Investment Business Tel: +38 044 481 33 55 E-mail: d. zilbermints@vab. ua 16 15/03/2018 20: 26

d3d26c3b1594acb27551983b286e4d99.ppt