5a412993114b536c465be2a8f6dbedc5.ppt

- Количество слайдов: 49

1

1

Dairy Crest’s Strategy Mark Allen

Dairy Crest’s Strategy Mark Allen

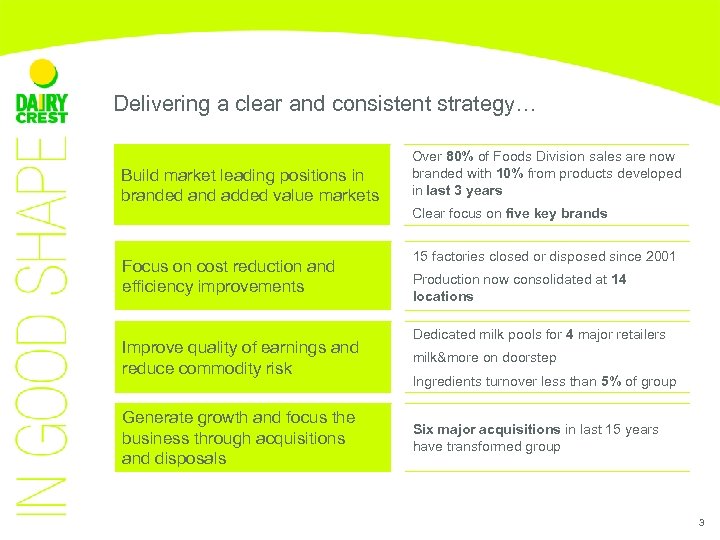

Delivering a clear and consistent strategy… Build market leading positions in branded and added value markets Over 80% of Foods Division sales are now branded with 10% from products developed in last 3 years Clear focus on five key brands Focus on cost reduction and efficiency improvements Improve quality of earnings and reduce commodity risk Generate growth and focus the business through acquisitions and disposals 15 factories closed or disposed since 2001 Production now consolidated at 14 locations Dedicated milk pools for 4 major retailers milk&more on doorstep Ingredients turnover less than 5% of group Six major acquisitions in last 15 years have transformed group 3

Delivering a clear and consistent strategy… Build market leading positions in branded and added value markets Over 80% of Foods Division sales are now branded with 10% from products developed in last 3 years Clear focus on five key brands Focus on cost reduction and efficiency improvements Improve quality of earnings and reduce commodity risk Generate growth and focus the business through acquisitions and disposals 15 factories closed or disposed since 2001 Production now consolidated at 14 locations Dedicated milk pools for 4 major retailers milk&more on doorstep Ingredients turnover less than 5% of group Six major acquisitions in last 15 years have transformed group 3

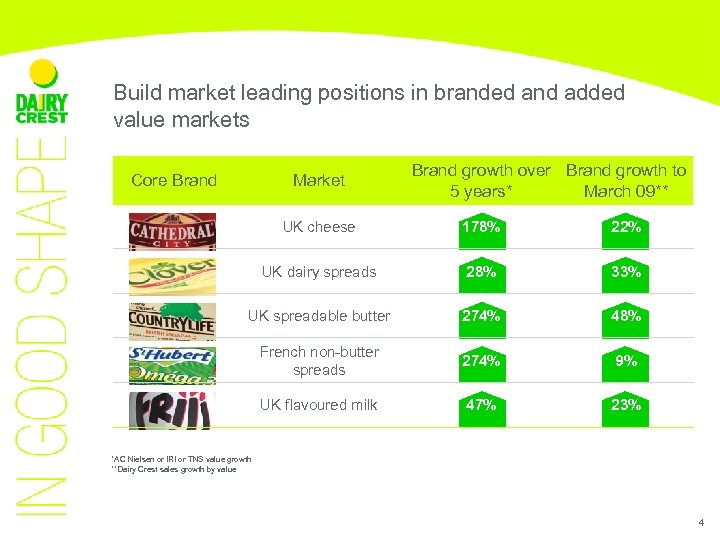

Build market leading positions in branded and added value markets Core Brand Market Brand growth over Brand growth to 5 years* March 09** UK cheese 178% 22% UK dairy spreads 28% 33% UK spreadable butter 274% 48% French non-butter spreads 274% 9% UK flavoured milk 47% 23% *AC Nielsen or IRI or TNS value growth **Dairy Crest sales growth by value 4

Build market leading positions in branded and added value markets Core Brand Market Brand growth over Brand growth to 5 years* March 09** UK cheese 178% 22% UK dairy spreads 28% 33% UK spreadable butter 274% 48% French non-butter spreads 274% 9% UK flavoured milk 47% 23% *AC Nielsen or IRI or TNS value growth **Dairy Crest sales growth by value 4

Build market leading positions in branded and added value markets Added Value Milk Pools A modern doorstep proposition Own-label flavoured milk 5

Build market leading positions in branded and added value markets Added Value Milk Pools A modern doorstep proposition Own-label flavoured milk 5

Focus on cost reduction and efficiency improvements • 2006 • Closed Birmingham dairy Closed final salary pension scheme to new employees • 2007 • • 2008 • Closed Totnes dairy • • Sold Stilton and speciality cheese • Closed Nottingham dairy • Head office restructure • Contracted out milk collection • 2009 • 2010 • On-going Household depot rationalisation • Regional Distribution Centres for Dairies Review of final salary pension scheme for existing employees 6

Focus on cost reduction and efficiency improvements • 2006 • Closed Birmingham dairy Closed final salary pension scheme to new employees • 2007 • • 2008 • Closed Totnes dairy • • Sold Stilton and speciality cheese • Closed Nottingham dairy • Head office restructure • Contracted out milk collection • 2009 • 2010 • On-going Household depot rationalisation • Regional Distribution Centres for Dairies Review of final salary pension scheme for existing employees 6

Reducing commodity risk and improving quality of earnings • 2003 Closure of ingredients operation at Chard and disposal of own label chilled juice business • 2006 Disposal of retailer branded cheese operations to First Milk • 2009 Disposal of Stilton and speciality cheese business • 2009 Disposal of YDC • 2010 Minimise milk through ingredients 7

Reducing commodity risk and improving quality of earnings • 2003 Closure of ingredients operation at Chard and disposal of own label chilled juice business • 2006 Disposal of retailer branded cheese operations to First Milk • 2009 Disposal of Stilton and speciality cheese business • 2009 Disposal of YDC • 2010 Minimise milk through ingredients 7

Generate growth and focus the business through acquisitions • 1995 Mendip Foods (Cathedral City) • 2000 Unigate’s Dairy and Cheese Business • 2002 St Ivel Spreads • 2004 Country Life • 2005 Starcross Foods and Midlands Coop Dairies • 2006 Express Dairies • 2007 St Hubert • 2009 Fayrefield Foodtec 8

Generate growth and focus the business through acquisitions • 1995 Mendip Foods (Cathedral City) • 2000 Unigate’s Dairy and Cheese Business • 2002 St Ivel Spreads • 2004 Country Life • 2005 Starcross Foods and Midlands Coop Dairies • 2006 Express Dairies • 2007 St Hubert • 2009 Fayrefield Foodtec 8

The strategy is delivering results Revenue (£m) Profit on operations (£m) Adjusted earnings per share (pence) Operating cash flow (£m) Consistent top line growth Increasing operating profits and eps organically and through acquisition Strong cash flow 9

The strategy is delivering results Revenue (£m) Profit on operations (£m) Adjusted earnings per share (pence) Operating cash flow (£m) Consistent top line growth Increasing operating profits and eps organically and through acquisition Strong cash flow 9

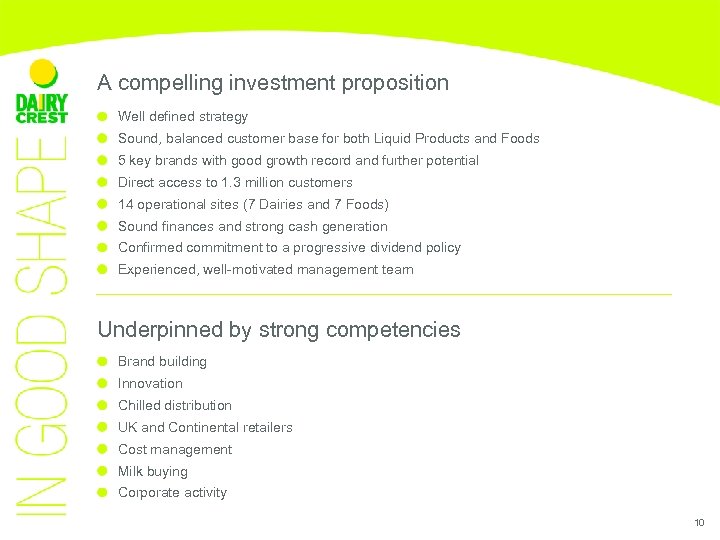

A compelling investment proposition Well defined strategy Sound, balanced customer base for both Liquid Products and Foods 5 key brands with good growth record and further potential Direct access to 1. 3 million customers 14 operational sites (7 Dairies and 7 Foods) Sound finances and strong cash generation Confirmed commitment to a progressive dividend policy Experienced, well-motivated management team Underpinned by strong competencies Brand building Innovation Chilled distribution UK and Continental retailers Cost management Milk buying Corporate activity 10

A compelling investment proposition Well defined strategy Sound, balanced customer base for both Liquid Products and Foods 5 key brands with good growth record and further potential Direct access to 1. 3 million customers 14 operational sites (7 Dairies and 7 Foods) Sound finances and strong cash generation Confirmed commitment to a progressive dividend policy Experienced, well-motivated management team Underpinned by strong competencies Brand building Innovation Chilled distribution UK and Continental retailers Cost management Milk buying Corporate activity 10

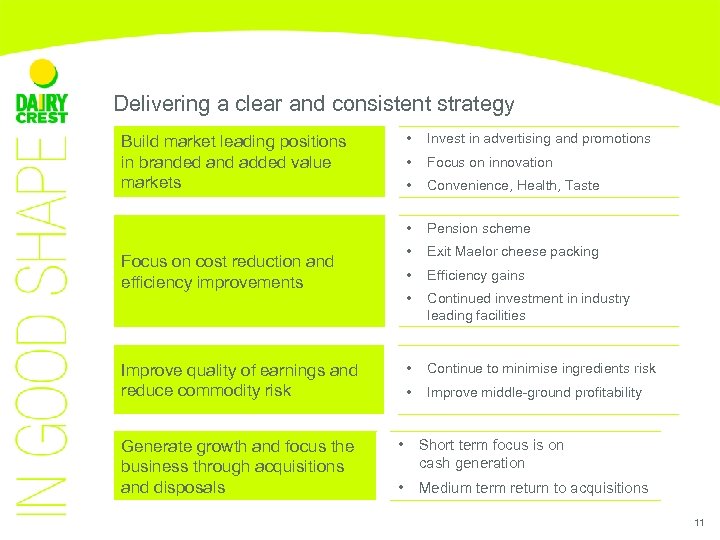

Delivering a clear and consistent strategy • Generate growth and focus the business through acquisitions and disposals Convenience, Health, Taste • Pension scheme • Exit Maelor cheese packing • Efficiency gains • Continued investment in industry leading facilities • Continue to minimise ingredients risk • Improve quality of earnings and reduce commodity risk Focus on innovation • Focus on cost reduction and efficiency improvements Invest in advertising and promotions • Build market leading positions in branded and added value markets Improve middle-ground profitability • Short term focus is on cash generation • Medium term return to acquisitions 11

Delivering a clear and consistent strategy • Generate growth and focus the business through acquisitions and disposals Convenience, Health, Taste • Pension scheme • Exit Maelor cheese packing • Efficiency gains • Continued investment in industry leading facilities • Continue to minimise ingredients risk • Improve quality of earnings and reduce commodity risk Focus on innovation • Focus on cost reduction and efficiency improvements Invest in advertising and promotions • Build market leading positions in branded and added value markets Improve middle-ground profitability • Short term focus is on cash generation • Medium term return to acquisitions 11

Dairy Crest Milk Flows Alastair Murray

Dairy Crest Milk Flows Alastair Murray

Introduction This presentation covers Background to milk supply Dairy Crest milk flows Dairy Crest’s Ingredients business 13

Introduction This presentation covers Background to milk supply Dairy Crest milk flows Dairy Crest’s Ingredients business 13

Background A sustainable supply of high quality milk is important to Dairy Crest We sell packed milk across a broad spectrum of different customers We also use a significant quantity of milk in our cheddar factory at Davidstow, Cornwall Raw milk contains around 4% fat, but the most popular drinking milk is semi-skimmed with 1. 6% fat Cream, skimmed from packed liquid milk, is a major ingredient in our Spreads business Milk is produced on a seasonal profile, with more in the Spring and less in the Autumn Current milk purchase prices make it uneconomic to process milk into commodity ingredients 14

Background A sustainable supply of high quality milk is important to Dairy Crest We sell packed milk across a broad spectrum of different customers We also use a significant quantity of milk in our cheddar factory at Davidstow, Cornwall Raw milk contains around 4% fat, but the most popular drinking milk is semi-skimmed with 1. 6% fat Cream, skimmed from packed liquid milk, is a major ingredient in our Spreads business Milk is produced on a seasonal profile, with more in the Spring and less in the Autumn Current milk purchase prices make it uneconomic to process milk into commodity ingredients 14

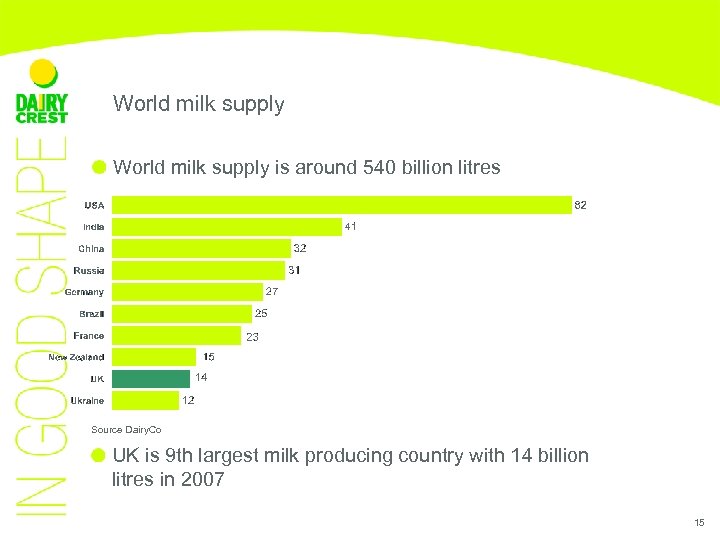

World milk supply is around 540 billion litres Source Dairy. Co UK is 9 th largest milk producing country with 14 billion litres in 2007 15

World milk supply is around 540 billion litres Source Dairy. Co UK is 9 th largest milk producing country with 14 billion litres in 2007 15

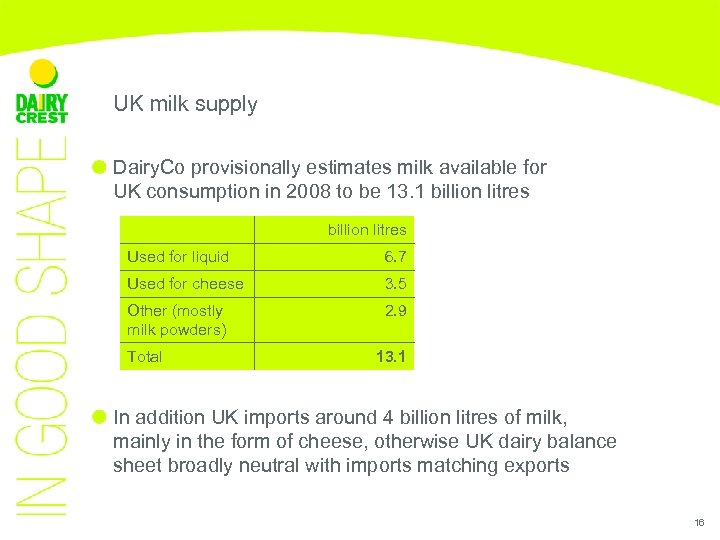

UK milk supply Dairy. Co provisionally estimates milk available for UK consumption in 2008 to be 13. 1 billion litres Used for liquid 6. 7 Used for cheese 3. 5 Other (mostly milk powders) 2. 9 Total 13. 1 In addition UK imports around 4 billion litres of milk, mainly in the form of cheese, otherwise UK dairy balance sheet broadly neutral with imports matching exports 16

UK milk supply Dairy. Co provisionally estimates milk available for UK consumption in 2008 to be 13. 1 billion litres Used for liquid 6. 7 Used for cheese 3. 5 Other (mostly milk powders) 2. 9 Total 13. 1 In addition UK imports around 4 billion litres of milk, mainly in the form of cheese, otherwise UK dairy balance sheet broadly neutral with imports matching exports 16

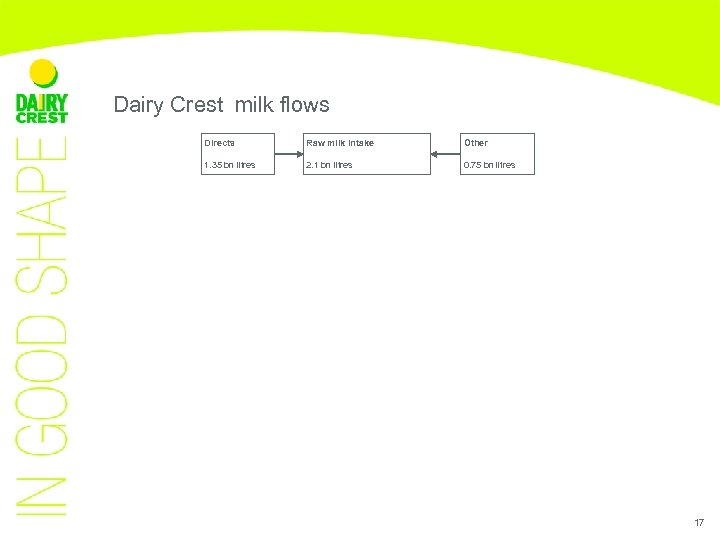

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres 17

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres 17

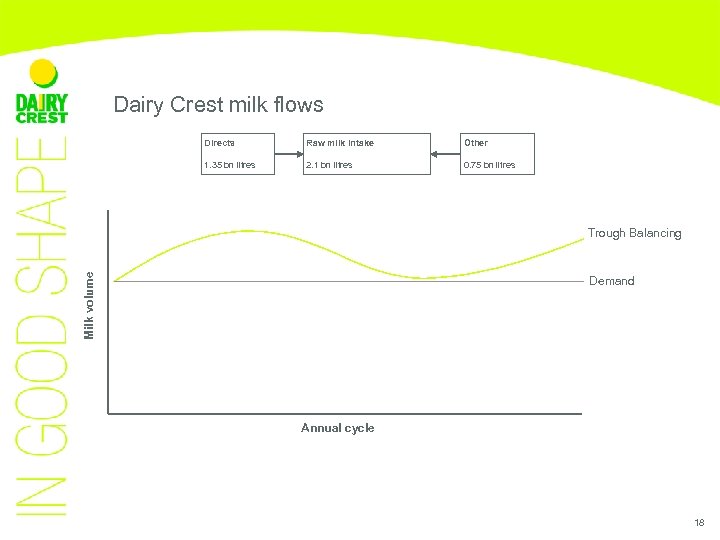

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres Milk volume Trough Balancing Demand Annual cycle 18

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres Milk volume Trough Balancing Demand Annual cycle 18

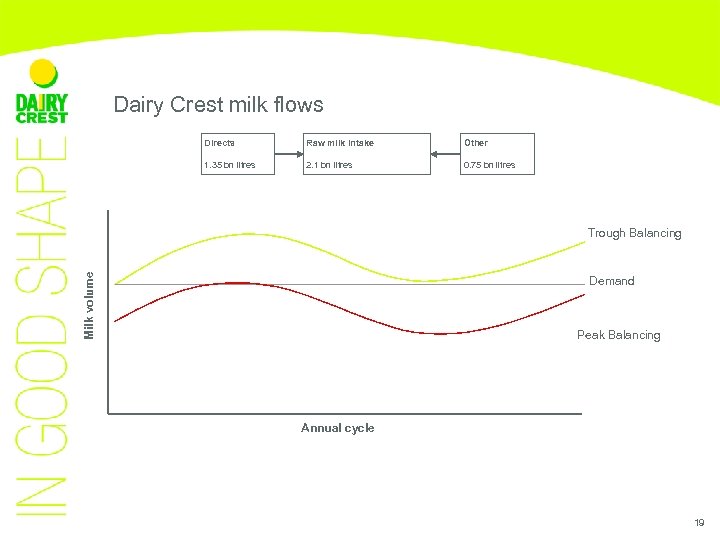

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres Milk volume Trough Balancing Demand Peak Balancing Annual cycle 19

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres Milk volume Trough Balancing Demand Peak Balancing Annual cycle 19

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres 20

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres 20

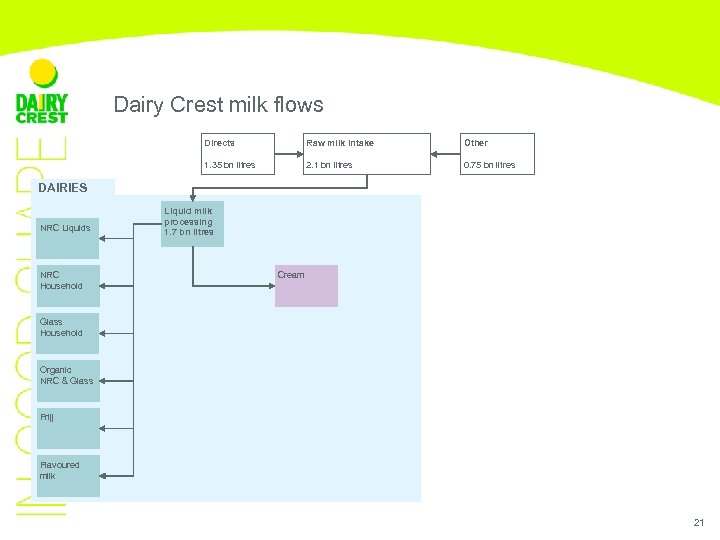

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres DAIRIES NRC Liquids NRC Household Liquid milk processing 1. 7 bn litres Cream Glass Household Organic NRC & Glass Frijj Flavoured milk 21

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres DAIRIES NRC Liquids NRC Household Liquid milk processing 1. 7 bn litres Cream Glass Household Organic NRC & Glass Frijj Flavoured milk 21

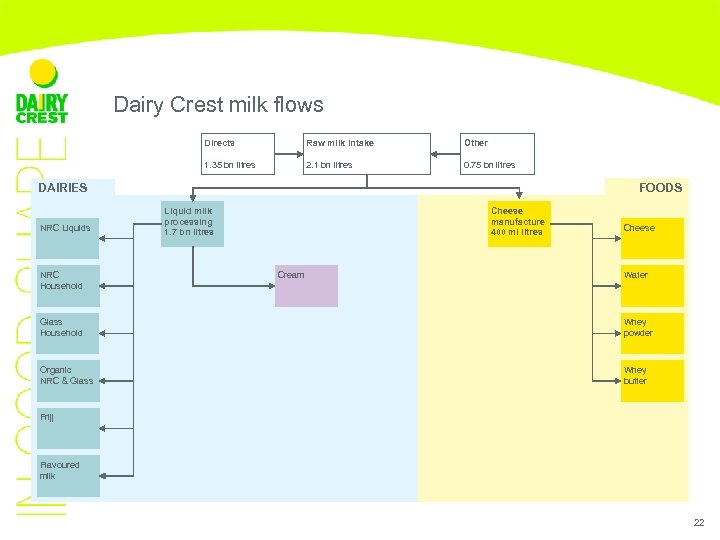

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres FOODS DAIRIES NRC Liquids NRC Household Liquid milk processing 1. 7 bn litres Cheese manufacture 400 ml litres Cream Cheese Water Glass Household Whey powder Organic NRC & Glass Whey butter Frijj Flavoured milk 22

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres FOODS DAIRIES NRC Liquids NRC Household Liquid milk processing 1. 7 bn litres Cheese manufacture 400 ml litres Cream Cheese Water Glass Household Whey powder Organic NRC & Glass Whey butter Frijj Flavoured milk 22

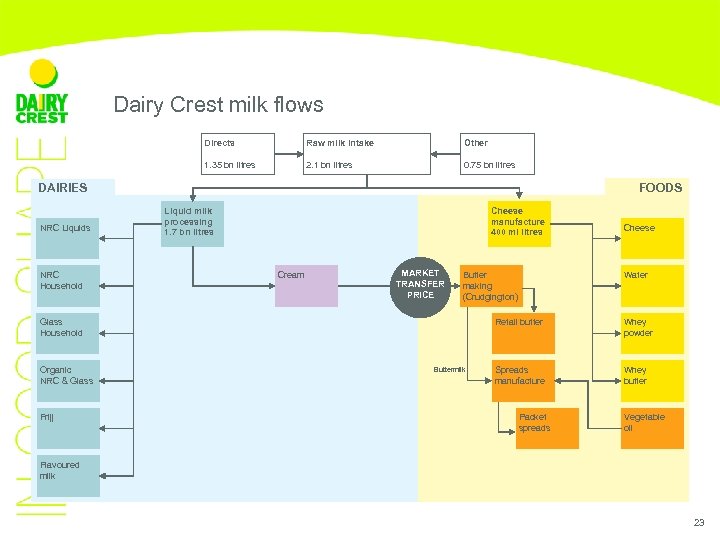

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres FOODS DAIRIES NRC Liquids NRC Household Liquid milk processing 1. 7 bn litres Cheese manufacture 400 ml litres Cream MARKET TRANSFER PRICE Butter making (Crudgington) Frijj Water Retail butter Glass Household Organic NRC & Glass Cheese Buttermilk Whey powder Spreads manufacture Whey butter Packet spreads Vegetable oil Flavoured milk 23

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres FOODS DAIRIES NRC Liquids NRC Household Liquid milk processing 1. 7 bn litres Cheese manufacture 400 ml litres Cream MARKET TRANSFER PRICE Butter making (Crudgington) Frijj Water Retail butter Glass Household Organic NRC & Glass Cheese Buttermilk Whey powder Spreads manufacture Whey butter Packet spreads Vegetable oil Flavoured milk 23

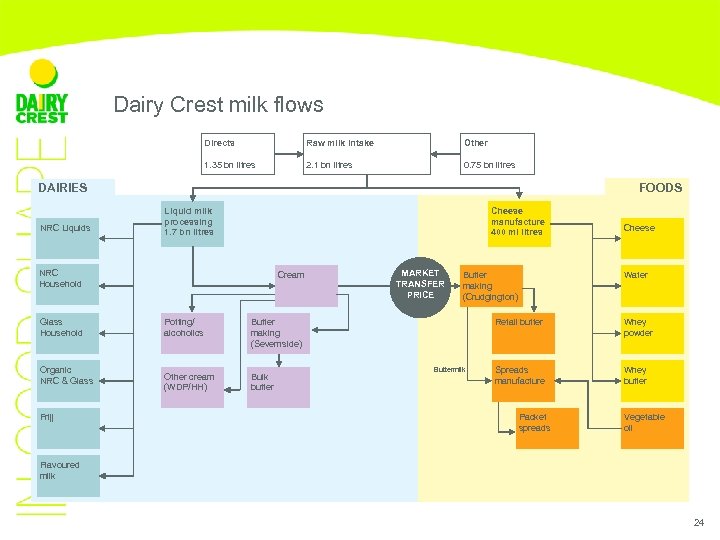

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres FOODS DAIRIES NRC Liquids Liquid milk processing 1. 7 bn litres Cheese manufacture 400 ml litres NRC Household Glass Household Organic NRC & Glass Frijj Cream Potting/ alcoholics Bulk butter Butter making (Crudgington) Water Retail butter Butter making (Severnside) Other cream (WDP/HH) MARKET TRANSFER PRICE Cheese Buttermilk Whey powder Spreads manufacture Whey butter Packet spreads Vegetable oil Flavoured milk 24

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres FOODS DAIRIES NRC Liquids Liquid milk processing 1. 7 bn litres Cheese manufacture 400 ml litres NRC Household Glass Household Organic NRC & Glass Frijj Cream Potting/ alcoholics Bulk butter Butter making (Crudgington) Water Retail butter Butter making (Severnside) Other cream (WDP/HH) MARKET TRANSFER PRICE Cheese Buttermilk Whey powder Spreads manufacture Whey butter Packet spreads Vegetable oil Flavoured milk 24

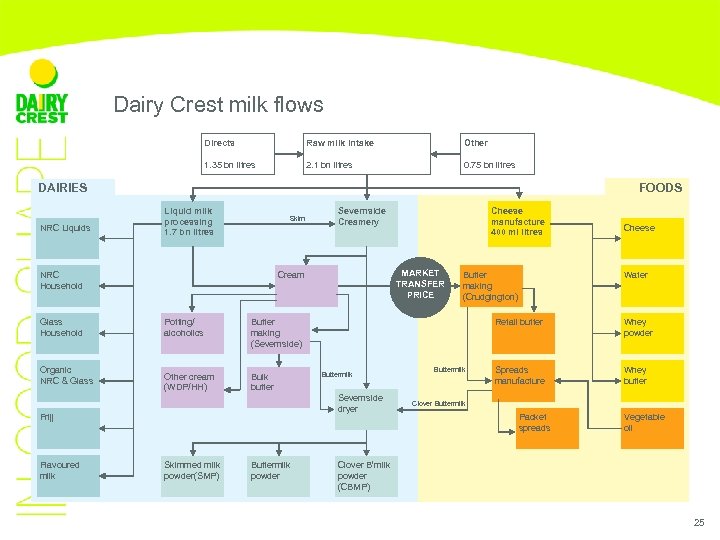

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres FOODS DAIRIES NRC Liquids Liquid milk processing 1. 7 bn litres Skim NRC Household Glass Household Organic NRC & Glass Potting/ alcoholics Bulk butter Butter making (Crudgington) Buttermilk Severnside dryer Skimmed milk powder(SMP) Buttermilk powder Cheese Water Retail butter Butter making (Severnside) Other cream (WDP/HH) Cheese manufacture 400 ml litres MARKET TRANSFER PRICE Cream Frijj Flavoured milk Severnside Creamery Buttermilk Whey powder Spreads manufacture Whey butter Clover Buttermilk Packet spreads Vegetable oil Clover B’milk powder (CBMP) 25

Dairy Crest milk flows Directs Raw milk intake Other 1. 35 bn litres 2. 1 bn litres 0. 75 bn litres FOODS DAIRIES NRC Liquids Liquid milk processing 1. 7 bn litres Skim NRC Household Glass Household Organic NRC & Glass Potting/ alcoholics Bulk butter Butter making (Crudgington) Buttermilk Severnside dryer Skimmed milk powder(SMP) Buttermilk powder Cheese Water Retail butter Butter making (Severnside) Other cream (WDP/HH) Cheese manufacture 400 ml litres MARKET TRANSFER PRICE Cream Frijj Flavoured milk Severnside Creamery Buttermilk Whey powder Spreads manufacture Whey butter Clover Buttermilk Packet spreads Vegetable oil Clover B’milk powder (CBMP) 25

Key points from milk flow chart We have a broadly based dairy business which uses all fractions of the milk Cream is an important internal commodity. Our principle competitors have a different model Balancing milk requires us to put some milk into ingredients…albeit we presently lose money on every litre We are working hard to reduce our exposure to ingredients in the current year 26

Key points from milk flow chart We have a broadly based dairy business which uses all fractions of the milk Cream is an important internal commodity. Our principle competitors have a different model Balancing milk requires us to put some milk into ingredients…albeit we presently lose money on every litre We are working hard to reduce our exposure to ingredients in the current year 26

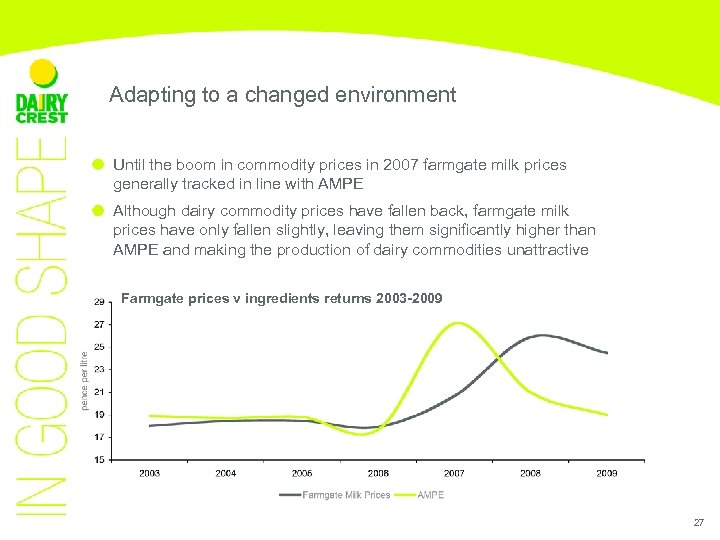

Adapting to a changed environment Until the boom in commodity prices in 2007 farmgate milk prices generally tracked in line with AMPE Although dairy commodity prices have fallen back, farmgate milk prices have only fallen slightly, leaving them significantly higher than AMPE and making the production of dairy commodities unattractive Farmgate prices v ingredients returns 2003 -2009 27

Adapting to a changed environment Until the boom in commodity prices in 2007 farmgate milk prices generally tracked in line with AMPE Although dairy commodity prices have fallen back, farmgate milk prices have only fallen slightly, leaving them significantly higher than AMPE and making the production of dairy commodities unattractive Farmgate prices v ingredients returns 2003 -2009 27

Minimising risk and exposure to commodity markets – Action taken AMPE remains below farmgate prices so focus has been based on minimising the volume of milk into Ingredients Milk Purchasing strategy moved from trough balancing to peak balancing Alternative uses for surplus milk include additional cheese production, marginal middle ground liquid business, spot milk sales Ensure ingredients product quality is optimised to guarantee access to blue-chip customers 28

Minimising risk and exposure to commodity markets – Action taken AMPE remains below farmgate prices so focus has been based on minimising the volume of milk into Ingredients Milk Purchasing strategy moved from trough balancing to peak balancing Alternative uses for surplus milk include additional cheese production, marginal middle ground liquid business, spot milk sales Ensure ingredients product quality is optimised to guarantee access to blue-chip customers 28

Summary Our ‘broadly based dairy’ strategy allows us to maximise the value we get from our milk supply while mitigating market risk The primary role of our Ingredients business is to sell by-products. Our real focus is on consumer products…. 29

Summary Our ‘broadly based dairy’ strategy allows us to maximise the value we get from our milk supply while mitigating market risk The primary role of our Ingredients business is to sell by-products. Our real focus is on consumer products…. 29

milk&more Mike Sheldon

milk&more Mike Sheldon

milk&more – a unique opportunity We have 1. 3 million doorstep customers, a large number of whom are young and affluent and have children at home We know that our customers like what we do Milkmen Glass bottles Electric vehicles Regular deliveries – to keep the fridge full But many also want to be able to operate their account with us in a more convenient and flexible way Many of our customers are used to shopping on-line and over 65% have broadband access We have taken the opportunity to retain the good, but to modernise and make our service more relevant to current and new customers 31

milk&more – a unique opportunity We have 1. 3 million doorstep customers, a large number of whom are young and affluent and have children at home We know that our customers like what we do Milkmen Glass bottles Electric vehicles Regular deliveries – to keep the fridge full But many also want to be able to operate their account with us in a more convenient and flexible way Many of our customers are used to shopping on-line and over 65% have broadband access We have taken the opportunity to retain the good, but to modernise and make our service more relevant to current and new customers 31

An affluent customer base with great potential Offline = 13% Offline = 28% Online = 26% Online = 39% Healthy futures Wealthy heartland Offline = 21% Offline = 16% Online = 5% Golden years Tight budget pensioners 32

An affluent customer base with great potential Offline = 13% Offline = 28% Online = 26% Online = 39% Healthy futures Wealthy heartland Offline = 21% Offline = 16% Online = 5% Golden years Tight budget pensioners 32

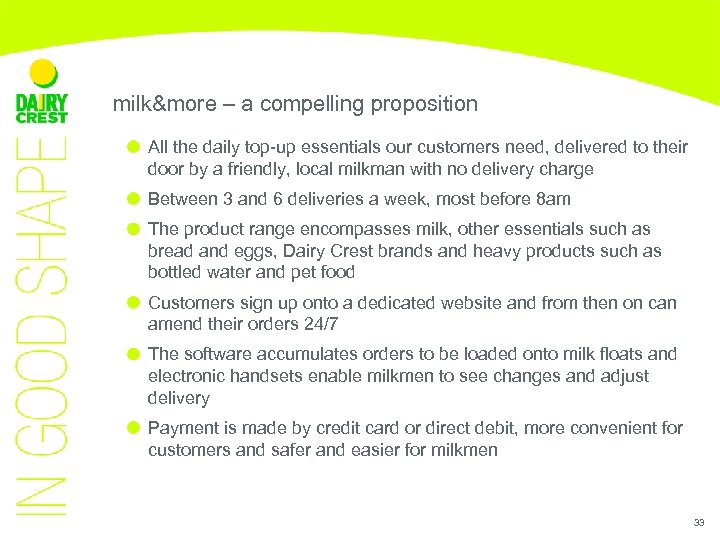

milk&more – a compelling proposition All the daily top-up essentials our customers need, delivered to their door by a friendly, local milkman with no delivery charge Between 3 and 6 deliveries a week, most before 8 am The product range encompasses milk, other essentials such as bread and eggs, Dairy Crest brands and heavy products such as bottled water and pet food Customers sign up onto a dedicated website and from then on can amend their orders 24/7 The software accumulates orders to be loaded onto milk floats and electronic handsets enable milkmen to see changes and adjust delivery Payment is made by credit card or direct debit, more convenient for customers and safer and easier for milkmen 33

milk&more – a compelling proposition All the daily top-up essentials our customers need, delivered to their door by a friendly, local milkman with no delivery charge Between 3 and 6 deliveries a week, most before 8 am The product range encompasses milk, other essentials such as bread and eggs, Dairy Crest brands and heavy products such as bottled water and pet food Customers sign up onto a dedicated website and from then on can amend their orders 24/7 The software accumulates orders to be loaded onto milk floats and electronic handsets enable milkmen to see changes and adjust delivery Payment is made by credit card or direct debit, more convenient for customers and safer and easier for milkmen 33

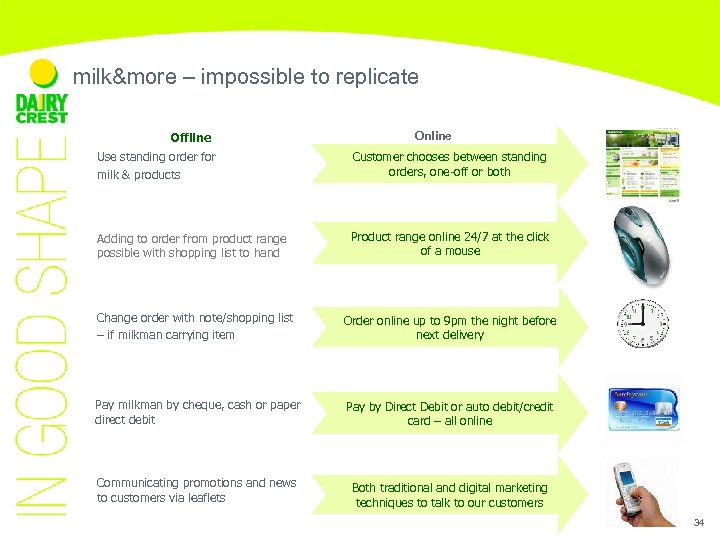

milk&more – impossible to replicate Offline Online Use standing order for milk & products Customer chooses between standing orders, one-off or both Adding to order from product range possible with shopping list to hand Product range online 24/7 at the click of a mouse Change order with note/shopping list – if milkman carrying item Order online up to 9 pm the night before next delivery Pay milkman by cheque, cash or paper direct debit Pay by Direct Debit or auto debit/credit card – all online Communicating promotions and news to customers via leaflets Both traditional and digital marketing techniques to talk to our customers 34

milk&more – impossible to replicate Offline Online Use standing order for milk & products Customer chooses between standing orders, one-off or both Adding to order from product range possible with shopping list to hand Product range online 24/7 at the click of a mouse Change order with note/shopping list – if milkman carrying item Order online up to 9 pm the night before next delivery Pay milkman by cheque, cash or paper direct debit Pay by Direct Debit or auto debit/credit card – all online Communicating promotions and news to customers via leaflets Both traditional and digital marketing techniques to talk to our customers 34

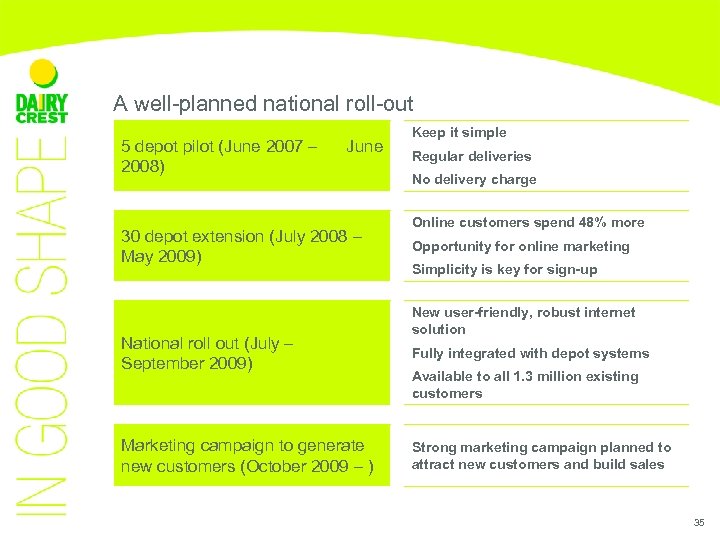

A well-planned national roll-out 5 depot pilot (June 2007 – 2008) June 30 depot extension (July 2008 – May 2009) National roll out (July – September 2009) Marketing campaign to generate new customers (October 2009 – ) Keep it simple Regular deliveries No delivery charge Online customers spend 48% more Opportunity for online marketing Simplicity is key for sign-up New user-friendly, robust internet solution Fully integrated with depot systems Available to all 1. 3 million existing customers Strong marketing campaign planned to attract new customers and build sales 35

A well-planned national roll-out 5 depot pilot (June 2007 – 2008) June 30 depot extension (July 2008 – May 2009) National roll out (July – September 2009) Marketing campaign to generate new customers (October 2009 – ) Keep it simple Regular deliveries No delivery charge Online customers spend 48% more Opportunity for online marketing Simplicity is key for sign-up New user-friendly, robust internet solution Fully integrated with depot systems Available to all 1. 3 million existing customers Strong marketing campaign planned to attract new customers and build sales 35

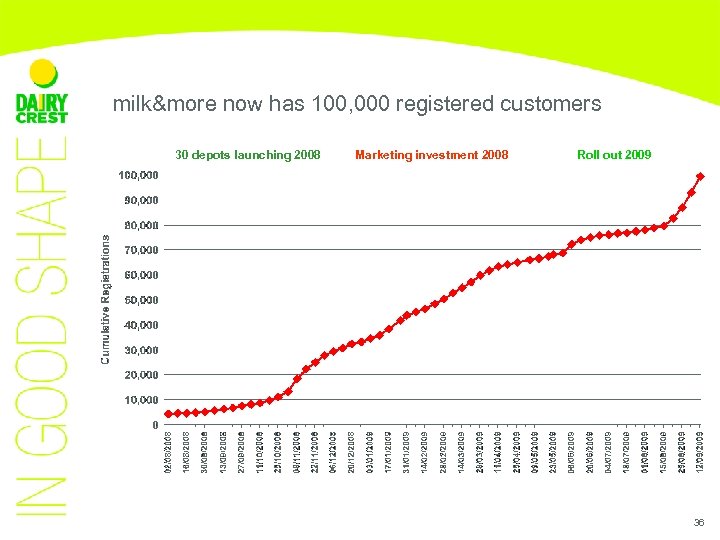

milk&more now has 100, 000 registered customers 30 depots launching 2008 Marketing investment 2008 Roll out 2009 36

milk&more now has 100, 000 registered customers 30 depots launching 2008 Marketing investment 2008 Roll out 2009 36

milk&more customers spend more with us £ 6. 20 Weekly expenditure £ 4. 54 Source: DC, 6 months to July ‘ 09 37

milk&more customers spend more with us £ 6. 20 Weekly expenditure £ 4. 54 Source: DC, 6 months to July ‘ 09 37

2009/10 objectives 1. Drive acquisition to online service Switch traditional customers onto milk&more Recruit new customers £ 2. 6 million marketing support 250 k customers by 31 March 2010 2. Increase customer spend using targeted, data-base marketing 3. Reduce debt and cost of cash-handling 38

2009/10 objectives 1. Drive acquisition to online service Switch traditional customers onto milk&more Recruit new customers £ 2. 6 million marketing support 250 k customers by 31 March 2010 2. Increase customer spend using targeted, data-base marketing 3. Reduce debt and cost of cash-handling 38

Summary milk&more can reverse the long-term decline in doorstep sales as it lets us retain existing customers, attract new customers and sell more to both groups The trials we carried out showed a real demand for the milkman from an affluent customer base but a need to modernise some aspects of our proposition We have developed a user-friendly, robust internet-based solution Roll out of milk&more is complete We have a marketing campaign planned which will make sure everyone has heard of milk&more 39

Summary milk&more can reverse the long-term decline in doorstep sales as it lets us retain existing customers, attract new customers and sell more to both groups The trials we carried out showed a real demand for the milkman from an affluent customer base but a need to modernise some aspects of our proposition We have developed a user-friendly, robust internet-based solution Roll out of milk&more is complete We have a marketing campaign planned which will make sure everyone has heard of milk&more 39

Dairy Crest Cheese – a world class supply chain Martyn Wilks

Dairy Crest Cheese – a world class supply chain Martyn Wilks

Dairy Crest cheese – a world class supply chain Dedicated West Country milk pool State of the art creamery creating high quality cheese for brands and premium retailer sub brands Single site for cheese maturation, high speed cut and wrap and National Distribution Centre A second, highly flexible facility where we cut, slice, grate and wrap £ 100 million invested over the last 8 years Together makes the UK’s favourite cheese brand 41

Dairy Crest cheese – a world class supply chain Dedicated West Country milk pool State of the art creamery creating high quality cheese for brands and premium retailer sub brands Single site for cheese maturation, high speed cut and wrap and National Distribution Centre A second, highly flexible facility where we cut, slice, grate and wrap £ 100 million invested over the last 8 years Together makes the UK’s favourite cheese brand 41

Dairy Crest - creating a world class cheese supply chain • 1995 • 1997 • 2000 • 2003 Purchased Mendip Foods and the Cathedral City brand – now has £ 195 million retail sales and is bigger than next three brands together Started recruiting direct milk suppliers – now have over 400 direct suppliers in Cornwall and Devon New National Distribution Centre at Nuneaton (Cost £ 37 million). Now despatching 67 million cases / year New Davidstow Creamery (Cost £ 55 million). The most modern and largest mature cheddar factory in the world • 2003 Launched first resealable packaging for Cathedral City • 2010 New Cheese Packing Facility at Nuneaton (Cost £ 25 million) 42

Dairy Crest - creating a world class cheese supply chain • 1995 • 1997 • 2000 • 2003 Purchased Mendip Foods and the Cathedral City brand – now has £ 195 million retail sales and is bigger than next three brands together Started recruiting direct milk suppliers – now have over 400 direct suppliers in Cornwall and Devon New National Distribution Centre at Nuneaton (Cost £ 37 million). Now despatching 67 million cases / year New Davidstow Creamery (Cost £ 55 million). The most modern and largest mature cheddar factory in the world • 2003 Launched first resealable packaging for Cathedral City • 2010 New Cheese Packing Facility at Nuneaton (Cost £ 25 million) 42

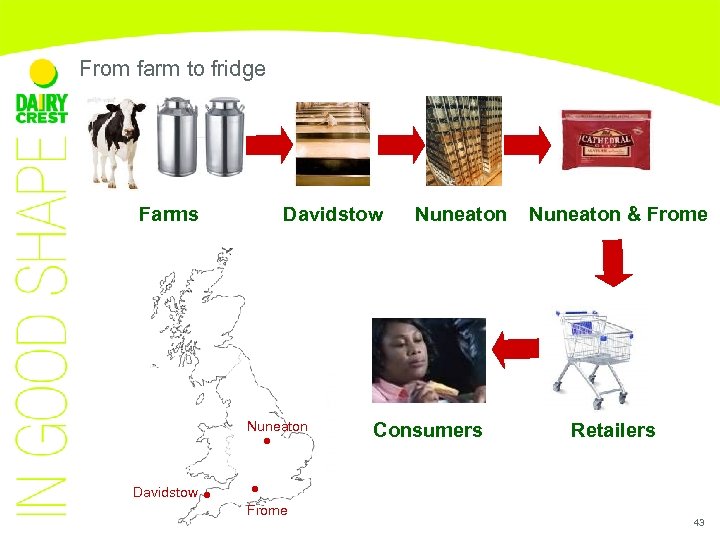

From farm to fridge Farms Davidstow Nuneaton Consumers Nuneaton & Frome Retailers Davidstow Frome 43

From farm to fridge Farms Davidstow Nuneaton Consumers Nuneaton & Frome Retailers Davidstow Frome 43

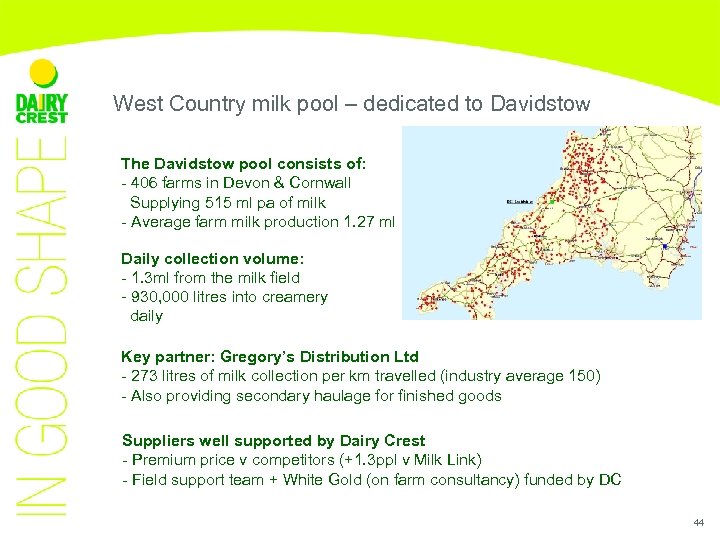

West Country milk pool – dedicated to Davidstow The Davidstow pool consists of: - 406 farms in Devon & Cornwall Supplying 515 ml pa of milk - Average farm milk production 1. 27 ml Daily collection volume: - 1. 3 ml from the milk field - 930, 000 litres into creamery daily Key partner: Gregory’s Distribution Ltd - 273 litres of milk collection per km travelled (industry average 150) - Also providing secondary haulage for finished goods Suppliers well supported by Dairy Crest - Premium price v competitors (+1. 3 ppl v Milk Link) - Field support team + White Gold (on farm consultancy) funded by DC 44

West Country milk pool – dedicated to Davidstow The Davidstow pool consists of: - 406 farms in Devon & Cornwall Supplying 515 ml pa of milk - Average farm milk production 1. 27 ml Daily collection volume: - 1. 3 ml from the milk field - 930, 000 litres into creamery daily Key partner: Gregory’s Distribution Ltd - 273 litres of milk collection per km travelled (industry average 150) - Also providing secondary haulage for finished goods Suppliers well supported by Dairy Crest - Premium price v competitors (+1. 3 ppl v Milk Link) - Field support team + White Gold (on farm consultancy) funded by DC 44

Davidstow - state of the art cheesemaking • Redeveloped in 2003 for £ 55 m • 100 employees Redeveloped in 2003 for • Capacity > 50, 000 tonnes cheese £ 55 million Capacity > 50, 000 tonnes • 09/10 42, 000 tonnes cheese • 65% Cathedral City and 35% Davidstow brand • 25, 000 tonnes whey 45

Davidstow - state of the art cheesemaking • Redeveloped in 2003 for £ 55 m • 100 employees Redeveloped in 2003 for • Capacity > 50, 000 tonnes cheese £ 55 million Capacity > 50, 000 tonnes • 09/10 42, 000 tonnes cheese • 65% Cathedral City and 35% Davidstow brand • 25, 000 tonnes whey 45

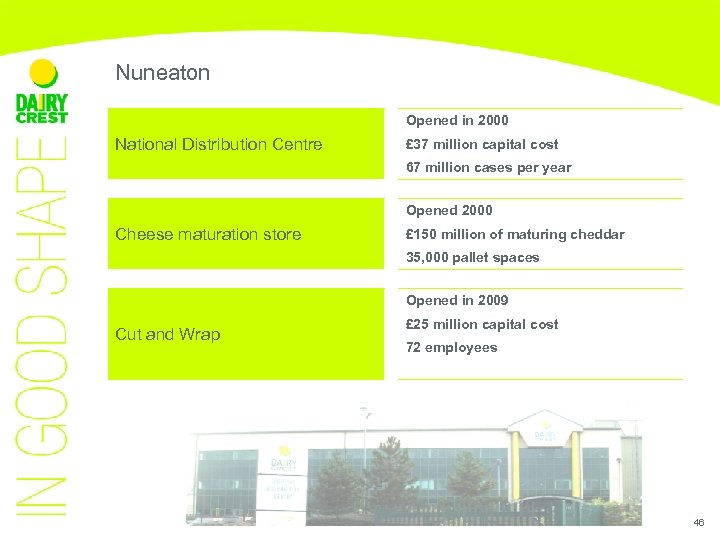

Nuneaton Opened in 2000 National Distribution Centre £ 37 million capital cost 67 million cases per year Opened 2000 Cheese maturation store £ 150 million of maturing cheddar 35, 000 pallet spaces Opened in 2009 Cut and Wrap £ 25 million capital cost 72 employees 46

Nuneaton Opened in 2000 National Distribution Centre £ 37 million capital cost 67 million cases per year Opened 2000 Cheese maturation store £ 150 million of maturing cheddar 35, 000 pallet spaces Opened in 2009 Cut and Wrap £ 25 million capital cost 72 employees 46

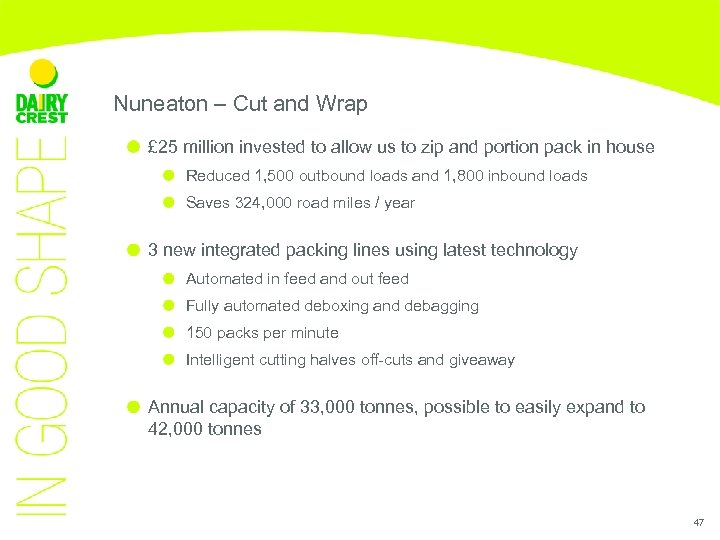

Nuneaton – Cut and Wrap £ 25 million invested to allow us to zip and portion pack in house Reduced 1, 500 outbound loads and 1, 800 inbound loads Saves 324, 000 road miles / year 3 new integrated packing lines using latest technology Automated in feed and out feed Fully automated deboxing and debagging 150 packs per minute Intelligent cutting halves off-cuts and giveaway Annual capacity of 33, 000 tonnes, possible to easily expand to 42, 000 tonnes 47

Nuneaton – Cut and Wrap £ 25 million invested to allow us to zip and portion pack in house Reduced 1, 500 outbound loads and 1, 800 inbound loads Saves 324, 000 road miles / year 3 new integrated packing lines using latest technology Automated in feed and out feed Fully automated deboxing and debagging 150 packs per minute Intelligent cutting halves off-cuts and giveaway Annual capacity of 33, 000 tonnes, possible to easily expand to 42, 000 tonnes 47

Cathedral City – the nation’s favourite cheddar Retail sales £ 195 million £ 27 million from ‘Lighter’ 83% weighted distribution The UK’s 21 st biggest grocery brand In every other fridge in UK But still only 13% of total UK cheddar 48

Cathedral City – the nation’s favourite cheddar Retail sales £ 195 million £ 27 million from ‘Lighter’ 83% weighted distribution The UK’s 21 st biggest grocery brand In every other fridge in UK But still only 13% of total UK cheddar 48

Looking forward…… Dairy Crest has a world class cheese supply chain Making the nation’s favourite cheddar Efficient production allows us to Pay a premium to our farmers Invest in advertising and promotion Innovate Invest in the future Continually innovating to drive growth New TV advert New packaging 49

Looking forward…… Dairy Crest has a world class cheese supply chain Making the nation’s favourite cheddar Efficient production allows us to Pay a premium to our farmers Invest in advertising and promotion Innovate Invest in the future Continually innovating to drive growth New TV advert New packaging 49