e3a7e09dc6048f9e17237515866b660d.ppt

- Количество слайдов: 70

1 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

1 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Underwriting Profitability: Leveraging Policy and Claims Data Together Robert Hartwig, President & Economist, Insurance Information Institute Jason Mc. Donald, Director of Development and Strategy, Oracle 2 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Underwriting Profitability: Leveraging Policy and Claims Data Together Robert Hartwig, President & Economist, Insurance Information Institute Jason Mc. Donald, Director of Development and Strategy, Oracle 2 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Program Agenda • • P&C Industry financial overview Underwriting performance by segment Catastrophe loss developments and trends Other contributing factors to underwriting cycle and profitability • Taking the “what” and asking “why”? 3 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Program Agenda • • P&C Industry financial overview Underwriting performance by segment Catastrophe loss developments and trends Other contributing factors to underwriting cycle and profitability • Taking the “what” and asking “why”? 3 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Speaker Bio: Robert Hartwig • Robert P. Hartwig is president of the Insurance Information Institute. Since joining the I. I. I. in 1998 and becoming chief economist in 1999, Dr. Hartwig has focused his work on improving understanding of key insurance issues across all industry stakeholders • Dr. Hartwig received his Ph. D. and Master of Science degrees in economics from the University of Illinois at Urbana-Champaign. He also received a Bachelor of Arts degree in economics cum laude from the University of Massachusetts at Amherst. He has served as an instructor at the University of Illinois and at Florida Atlantic University. Dr. Hartwig also holds the Chartered Property Casualty Underwriter (CPCU) credential. 4 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Speaker Bio: Robert Hartwig • Robert P. Hartwig is president of the Insurance Information Institute. Since joining the I. I. I. in 1998 and becoming chief economist in 1999, Dr. Hartwig has focused his work on improving understanding of key insurance issues across all industry stakeholders • Dr. Hartwig received his Ph. D. and Master of Science degrees in economics from the University of Illinois at Urbana-Champaign. He also received a Bachelor of Arts degree in economics cum laude from the University of Massachusetts at Amherst. He has served as an instructor at the University of Illinois and at Florida Atlantic University. Dr. Hartwig also holds the Chartered Property Casualty Underwriter (CPCU) credential. 4 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Speaker: Jason Mc. Donald Director, Product Strategy and Development, Oracle • Jason Mc. Donald is the director of product strategy and development for Oracle insurance business intelligence and analytics platforms • As an industry thought leader, Jason originated and continues to champion the concept of “adaptive data modeling, ” • He has more than 13 years experience in the software development industry, and has worked in marketing, development and strategy capacities, giving him unique insight on both the business and technical aspects of software applications. Jason has been published in various insurance publications on a number of topics ranging from business intelligence to underwriting. 5 Copyright © 2011, Oracle and/or its affiliates. All rights reserved. Oracle Restricted Confidential

Speaker: Jason Mc. Donald Director, Product Strategy and Development, Oracle • Jason Mc. Donald is the director of product strategy and development for Oracle insurance business intelligence and analytics platforms • As an industry thought leader, Jason originated and continues to champion the concept of “adaptive data modeling, ” • He has more than 13 years experience in the software development industry, and has worked in marketing, development and strategy capacities, giving him unique insight on both the business and technical aspects of software applications. Jason has been published in various insurance publications on a number of topics ranging from business intelligence to underwriting. 5 Copyright © 2011, Oracle and/or its affiliates. All rights reserved. Oracle Restricted Confidential

P/C Insurance Industry Financial Overview Profit Recovery Was Set Back in 2011 by High Catastrophe Loss & Other Factors 6

P/C Insurance Industry Financial Overview Profit Recovery Was Set Back in 2011 by High Catastrophe Loss & Other Factors 6

P/C Net Income After Taxes 1991– 2011: Q 3 ($ Millions) n n n n 2005 ROE*= 9. 6% 2006 ROE = 12. 7% 2007 ROE = 10. 9% 2008 ROE = 0. 1% 2009 ROE = 5. 0% 2010 ROE = 5. 6% 2011: Q 3 ROAS 1 = 1. 9% P-C Industry 2011: Q 3 profits were down 71% to $8. 0 B vs. 2010: Q 3, due primarily to high catastrophe losses and as non-cat underwriting results deteriorated * ROE figures are GAAP; 1 Return on avg. surplus. Excluding Mortgage & Financial Guaranty insurers yields a 3. 0% ROAS for 2011: Q 3, 7. 5% for 2010 and 7. 4% for 2009. Sources: A. M. Best, ISO, Insurance Information Institute

P/C Net Income After Taxes 1991– 2011: Q 3 ($ Millions) n n n n 2005 ROE*= 9. 6% 2006 ROE = 12. 7% 2007 ROE = 10. 9% 2008 ROE = 0. 1% 2009 ROE = 5. 0% 2010 ROE = 5. 6% 2011: Q 3 ROAS 1 = 1. 9% P-C Industry 2011: Q 3 profits were down 71% to $8. 0 B vs. 2010: Q 3, due primarily to high catastrophe losses and as non-cat underwriting results deteriorated * ROE figures are GAAP; 1 Return on avg. surplus. Excluding Mortgage & Financial Guaranty insurers yields a 3. 0% ROAS for 2011: Q 3, 7. 5% for 2010 and 7. 4% for 2009. Sources: A. M. Best, ISO, Insurance Information Institute

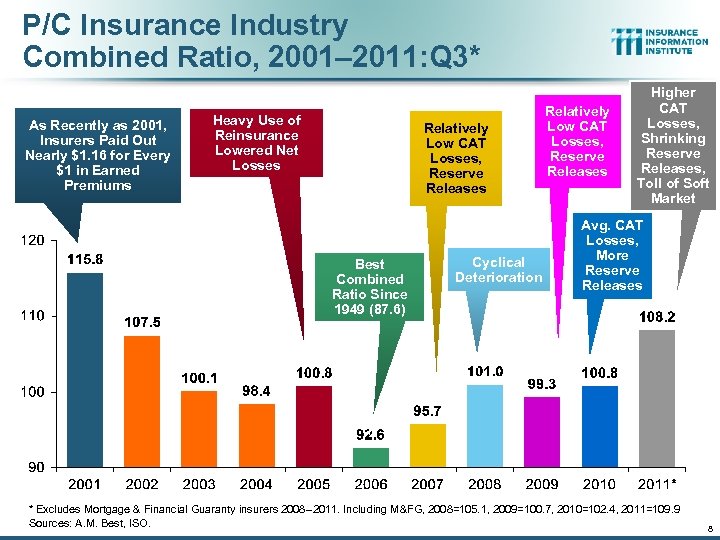

P/C Insurance Industry Combined Ratio, 2001– 2011: Q 3* As Recently as 2001, Insurers Paid Out Nearly $1. 16 for Every $1 in Earned Premiums Heavy Use of Reinsurance Lowered Net Losses Relatively Low CAT Losses, Reserve Releases Best Combined Ratio Since 1949 (87. 6) Cyclical Deterioration Relatively Low CAT Losses, Reserve Releases Higher CAT Losses, Shrinking Reserve Releases, Toll of Soft Market Avg. CAT Losses, More Reserve Releases * Excludes Mortgage & Financial Guaranty insurers 2008 --2011. Including M&FG, 2008=105. 1, 2009=100. 7, 2010=102. 4, 2011=109. 9 Sources: A. M. Best, ISO. 8

P/C Insurance Industry Combined Ratio, 2001– 2011: Q 3* As Recently as 2001, Insurers Paid Out Nearly $1. 16 for Every $1 in Earned Premiums Heavy Use of Reinsurance Lowered Net Losses Relatively Low CAT Losses, Reserve Releases Best Combined Ratio Since 1949 (87. 6) Cyclical Deterioration Relatively Low CAT Losses, Reserve Releases Higher CAT Losses, Shrinking Reserve Releases, Toll of Soft Market Avg. CAT Losses, More Reserve Releases * Excludes Mortgage & Financial Guaranty insurers 2008 --2011. Including M&FG, 2008=105. 1, 2009=100. 7, 2010=102. 4, 2011=109. 9 Sources: A. M. Best, ISO. 8

A 100 Combined Ratio Isn’t What It Once Was: Investment Impact on ROEs Combined Ratio / ROE A combined ratio of about 100 generated ~7. 5% ROE in 2009/10, 10% in 2005 and 16% in 1979 Combined Ratios Must Be Lower in Today’s Depressed Investment Environment to Generate Risk Appropriate ROEs * 2008 -2010 figures are return on average surplus and exclude mortgage and financial guaranty insurers. 2011 -12 combined ratios are A. M. Best estimate excl. M&FG insurers. Source: Insurance Information Institute from A. M. Best and ISO data.

A 100 Combined Ratio Isn’t What It Once Was: Investment Impact on ROEs Combined Ratio / ROE A combined ratio of about 100 generated ~7. 5% ROE in 2009/10, 10% in 2005 and 16% in 1979 Combined Ratios Must Be Lower in Today’s Depressed Investment Environment to Generate Risk Appropriate ROEs * 2008 -2010 figures are return on average surplus and exclude mortgage and financial guaranty insurers. 2011 -12 combined ratios are A. M. Best estimate excl. M&FG insurers. Source: Insurance Information Institute from A. M. Best and ISO data.

ROE: Property/Casualty Insurance vs. Fortune 500, 1987– 2011* (Percent) P/C Profitability Is Both by Cyclicality and Ordinary Volatility Katrina, Rita, Wilma Sept. 11 Hugo Lowest CAT Losses in 15 Years Andrew Northridge 4 Hurricanes Financial Crisis* * Excludes Mortgage & Financial Guarantee in 2008 - 2011. Sources: ISO, Fortune; A. M. Best (2011 P/C ROE); Insurance Information Institute (2011 Fortune 500 est. ) 10

ROE: Property/Casualty Insurance vs. Fortune 500, 1987– 2011* (Percent) P/C Profitability Is Both by Cyclicality and Ordinary Volatility Katrina, Rita, Wilma Sept. 11 Hugo Lowest CAT Losses in 15 Years Andrew Northridge 4 Hurricanes Financial Crisis* * Excludes Mortgage & Financial Guarantee in 2008 - 2011. Sources: ISO, Fortune; A. M. Best (2011 P/C ROE); Insurance Information Institute (2011 Fortune 500 est. ) 10

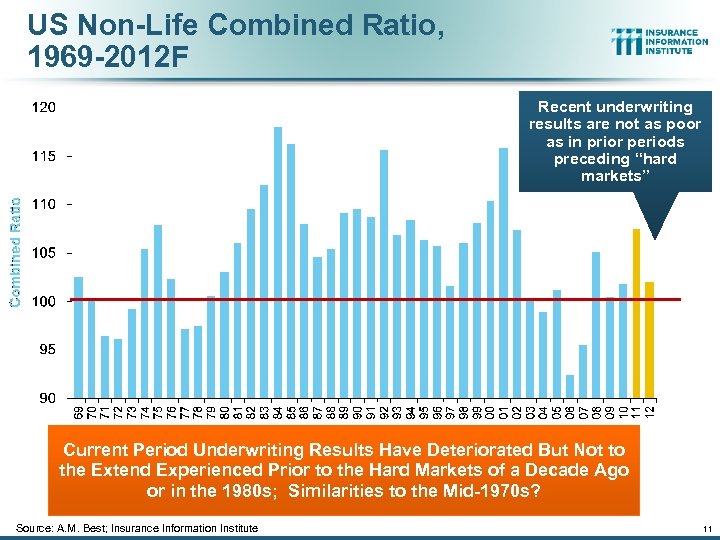

US Non-Life Combined Ratio, 1969 -2012 F Recent underwriting results are not as poor as in prior periods preceding “hard markets” Current Period Underwriting Results Have Deteriorated But Not to the Extend Experienced Prior to the Hard Markets of a Decade Ago or in the 1980 s; Similarities to the Mid-1970 s? Source: A. M. Best; Insurance Information Institute 11

US Non-Life Combined Ratio, 1969 -2012 F Recent underwriting results are not as poor as in prior periods preceding “hard markets” Current Period Underwriting Results Have Deteriorated But Not to the Extend Experienced Prior to the Hard Markets of a Decade Ago or in the 1980 s; Similarities to the Mid-1970 s? Source: A. M. Best; Insurance Information Institute 11

US Non-Life Net Written Premium Growth vs. Combined Ratio, 1971 -2012 F Premium growth tends to accelerate a few years after underwriting results deteriorate Premium Growth and Underwriting Results Are Highly Correlated, But the Relationship is Lagged Source: A. M. Best; Insurance Information Institute 12

US Non-Life Net Written Premium Growth vs. Combined Ratio, 1971 -2012 F Premium growth tends to accelerate a few years after underwriting results deteriorate Premium Growth and Underwriting Results Are Highly Correlated, But the Relationship is Lagged Source: A. M. Best; Insurance Information Institute 12

Underwriting Gain (Loss) 1975– 2011* ($ Billions) Cumulative underwriting deficit from 1975 through 2010 is $455 B Large Underwriting Losses Are NOT Sustainable in Current Investment Environment * Includes mortgage and financial guaranty insurers in all years Sources: A. M. Best, ISO; Insurance Information Institute. Underwriting losses in 2011 at $34. 9 through Q 3 will be largest since 2001

Underwriting Gain (Loss) 1975– 2011* ($ Billions) Cumulative underwriting deficit from 1975 through 2010 is $455 B Large Underwriting Losses Are NOT Sustainable in Current Investment Environment * Includes mortgage and financial guaranty insurers in all years Sources: A. M. Best, ISO; Insurance Information Institute. Underwriting losses in 2011 at $34. 9 through Q 3 will be largest since 2001

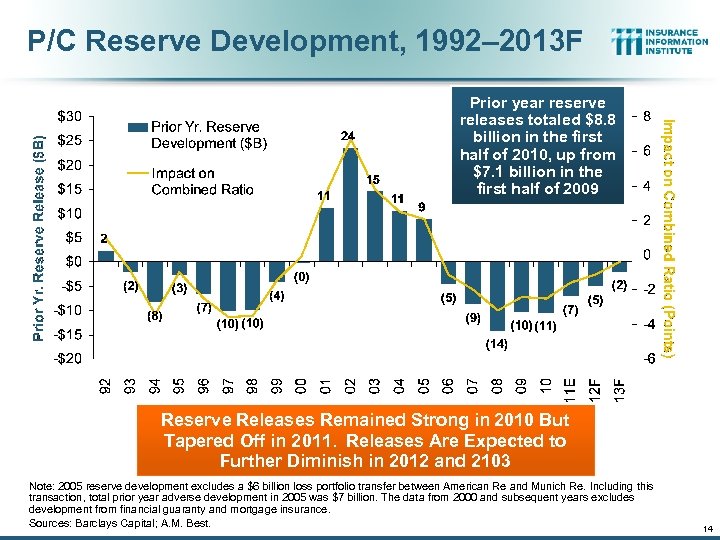

P/C Reserve Development, 1992– 2013 F Prior year reserve releases totaled $8. 8 billion in the first half of 2010, up from $7. 1 billion in the first half of 2009 Reserve Releases Remained Strong in 2010 But Tapered Off in 2011. Releases Are Expected to Further Diminish in 2012 and 2103 Note: 2005 reserve development excludes a $6 billion loss portfolio transfer between American Re and Munich Re. Including this transaction, total prior year adverse development in 2005 was $7 billion. The data from 2000 and subsequent years excludes development from financial guaranty and mortgage insurance. Sources: Barclays Capital; A. M. Best. 14

P/C Reserve Development, 1992– 2013 F Prior year reserve releases totaled $8. 8 billion in the first half of 2010, up from $7. 1 billion in the first half of 2009 Reserve Releases Remained Strong in 2010 But Tapered Off in 2011. Releases Are Expected to Further Diminish in 2012 and 2103 Note: 2005 reserve development excludes a $6 billion loss portfolio transfer between American Re and Munich Re. Including this transaction, total prior year adverse development in 2005 was $7 billion. The data from 2000 and subsequent years excludes development from financial guaranty and mortgage insurance. Sources: Barclays Capital; A. M. Best. 14

RENEWED PRICING DISCIPLINE? Is There Evidence of a Broad and Sustained Shift in Pricing Showing Up in Premium Growth? 15

RENEWED PRICING DISCIPLINE? Is There Evidence of a Broad and Sustained Shift in Pricing Showing Up in Premium Growth? 15

Soft Market Persisted into Early 2011 but Growth Returned: More in 2012? (Percent) 1975 -78 1984 -87 2000 -03 Net Written Premiums Fell 0. 7% in 2007 (First Decline Since 1943) by 2. 0% in 2008, and 4. 2% in 2009, the First 3 Year Decline Since 1930 -33. *2011 and 2012 figures are A. M. Best Estimates Shaded areas denote “hard market” periods Sources: A. M. Best (historical and forecast), ISO, Insurance Information Institute. NWP was up 3. 5% (est. ) in 2011 2012 expected growth is 3. 8% 16

Soft Market Persisted into Early 2011 but Growth Returned: More in 2012? (Percent) 1975 -78 1984 -87 2000 -03 Net Written Premiums Fell 0. 7% in 2007 (First Decline Since 1943) by 2. 0% in 2008, and 4. 2% in 2009, the First 3 Year Decline Since 1930 -33. *2011 and 2012 figures are A. M. Best Estimates Shaded areas denote “hard market” periods Sources: A. M. Best (historical and forecast), ISO, Insurance Information Institute. NWP was up 3. 5% (est. ) in 2011 2012 expected growth is 3. 8% 16

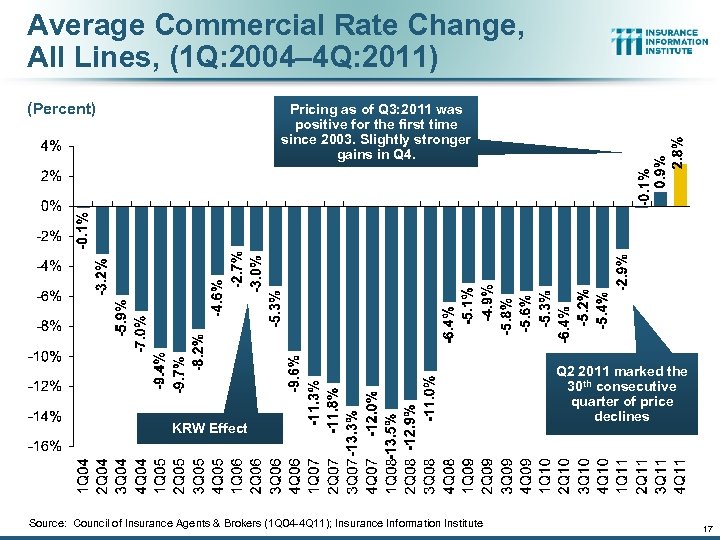

Average Commercial Rate Change, All Lines, (1 Q: 2004– 4 Q: 2011) (Percent) Pricing as of Q 3: 2011 was positive for the first time since 2003. Slightly stronger gains in Q 4. KRW Effect Source: Council of Insurance Agents & Brokers (1 Q 04 -4 Q 11); Insurance Information Institute Q 2 2011 marked the 30 th consecutive quarter of price declines 17

Average Commercial Rate Change, All Lines, (1 Q: 2004– 4 Q: 2011) (Percent) Pricing as of Q 3: 2011 was positive for the first time since 2003. Slightly stronger gains in Q 4. KRW Effect Source: Council of Insurance Agents & Brokers (1 Q 04 -4 Q 11); Insurance Information Institute Q 2 2011 marked the 30 th consecutive quarter of price declines 17

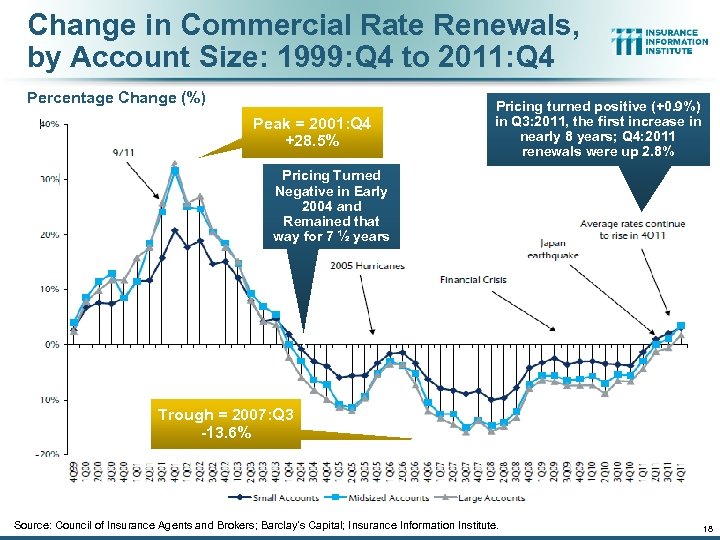

Change in Commercial Rate Renewals, by Account Size: 1999: Q 4 to 2011: Q 4 Percentage Change (%) Peak = 2001: Q 4 +28. 5% Pricing turned positive (+0. 9%) in Q 3: 2011, the first increase in KRW Effect: No nearly 8 years; Q 4: 2011 Lasting Impact renewals were up 2. 8% Pricing Turned Negative in Early 2004 and Remained that way for 7 ½ years Trough = 2007: Q 3 -13. 6% Source: Council of Insurance Agents and Brokers; Barclay’s Capital; Insurance Information Institute. 18

Change in Commercial Rate Renewals, by Account Size: 1999: Q 4 to 2011: Q 4 Percentage Change (%) Peak = 2001: Q 4 +28. 5% Pricing turned positive (+0. 9%) in Q 3: 2011, the first increase in KRW Effect: No nearly 8 years; Q 4: 2011 Lasting Impact renewals were up 2. 8% Pricing Turned Negative in Early 2004 and Remained that way for 7 ½ years Trough = 2007: Q 3 -13. 6% Source: Council of Insurance Agents and Brokers; Barclay’s Capital; Insurance Information Institute. 18

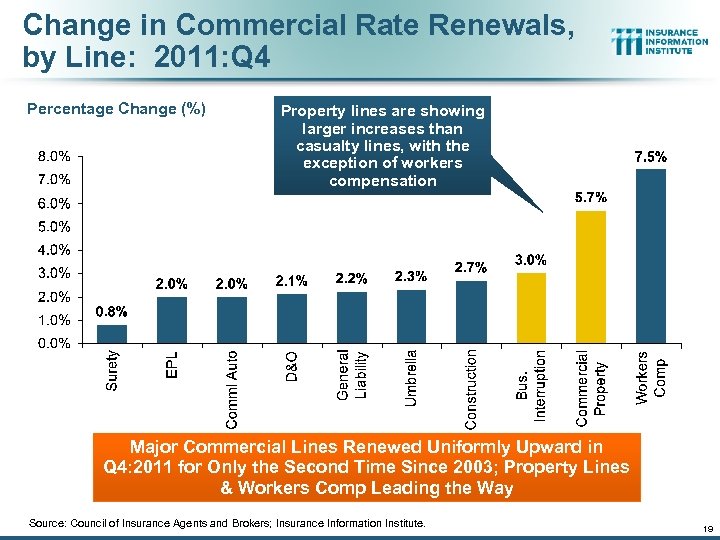

Change in Commercial Rate Renewals, by Line: 2011: Q 4 Percentage Change (%) Property lines are showing larger increases than casualty lines, with the exception of workers compensation Major Commercial Lines Renewed Uniformly Upward in Q 4: 2011 for Only the Second Time Since 2003; Property Lines & Workers Comp Leading the Way Source: Council of Insurance Agents and Brokers; Insurance Information Institute. 19

Change in Commercial Rate Renewals, by Line: 2011: Q 4 Percentage Change (%) Property lines are showing larger increases than casualty lines, with the exception of workers compensation Major Commercial Lines Renewed Uniformly Upward in Q 4: 2011 for Only the Second Time Since 2003; Property Lines & Workers Comp Leading the Way Source: Council of Insurance Agents and Brokers; Insurance Information Institute. 19

Global Property Catastrophe Rate on Line Index, 1990— 2012 (as of Jan. 1) Property-Cat reinsurance pricing is up about 8% as of 1/1/12—modest relative to the level CAT losses Sources: Guy Carpenter; Insurance Information Institute. 20

Global Property Catastrophe Rate on Line Index, 1990— 2012 (as of Jan. 1) Property-Cat reinsurance pricing is up about 8% as of 1/1/12—modest relative to the level CAT losses Sources: Guy Carpenter; Insurance Information Institute. 20

Underwriting Performance by Segment: Personal Lines 21

Underwriting Performance by Segment: Personal Lines 21

Homeowners Insurance Combined Ratio: 1990– 2012 F Homeowners Line Could Deteriorate in 2011 Due to Large Cat Losses. Extreme Regional Variation Can Be Expected Due to Local Catastrophe Loss Activity Sources: A. M. Best (1990 -2012 E); Insurance Information Institute.

Homeowners Insurance Combined Ratio: 1990– 2012 F Homeowners Line Could Deteriorate in 2011 Due to Large Cat Losses. Extreme Regional Variation Can Be Expected Due to Local Catastrophe Loss Activity Sources: A. M. Best (1990 -2012 E); Insurance Information Institute.

Private Passenger Auto Combined Ratio: 1993– 2012 P Private Passenger Auto Accounts for 34% of Industry Premiums and Remains the Profit Juggernaut of the P/C Insurance Industry Sources: A. M. Best (1990 -2012 F); Insurance Information Institute.

Private Passenger Auto Combined Ratio: 1993– 2012 P Private Passenger Auto Accounts for 34% of Industry Premiums and Remains the Profit Juggernaut of the P/C Insurance Industry Sources: A. M. Best (1990 -2012 F); Insurance Information Institute.

Claim Trends in Auto Insurance Frequency and Severity Trends Are Mixed But On Net Have Deteriorated 24

Claim Trends in Auto Insurance Frequency and Severity Trends Are Mixed But On Net Have Deteriorated 24

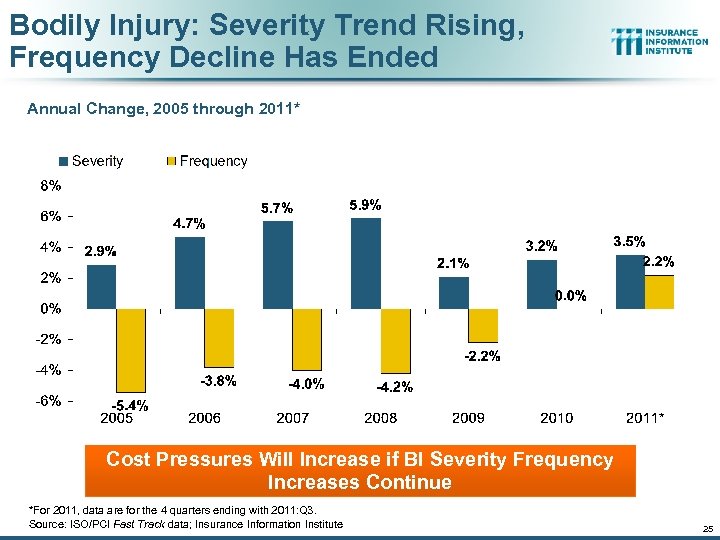

Bodily Injury: Severity Trend Rising, Frequency Decline Has Ended Annual Change, 2005 through 2011* Cost Pressures Will Increase if BI Severity Frequency Increases Continue *For 2011, data are for the 4 quarters ending with 2011: Q 3. Source: ISO/PCI Fast Track data; Insurance Information Institute 25

Bodily Injury: Severity Trend Rising, Frequency Decline Has Ended Annual Change, 2005 through 2011* Cost Pressures Will Increase if BI Severity Frequency Increases Continue *For 2011, data are for the 4 quarters ending with 2011: Q 3. Source: ISO/PCI Fast Track data; Insurance Information Institute 25

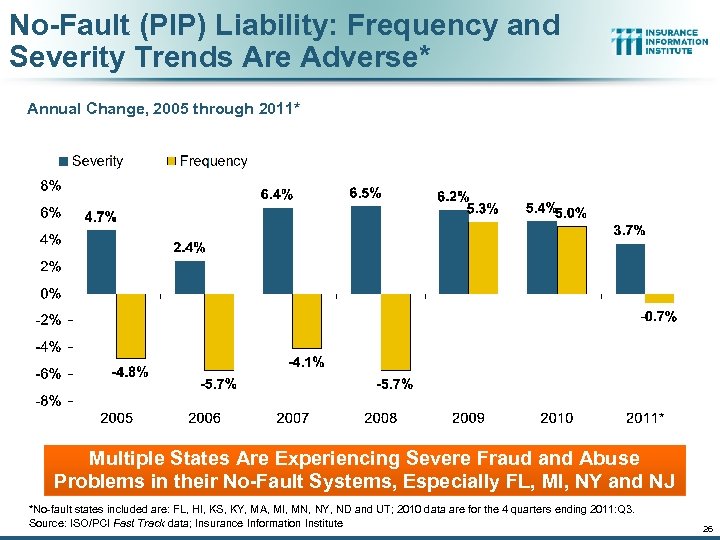

No-Fault (PIP) Liability: Frequency and Severity Trends Are Adverse* Annual Change, 2005 through 2011* Multiple States Are Experiencing Severe Fraud and Abuse Problems in their No-Fault Systems, Especially FL, MI, NY and NJ *No-fault states included are: FL, HI, KS, KY, MA, MI, MN, NY, ND and UT; 2010 data are for the 4 quarters ending 2011: Q 3. Source: ISO/PCI Fast Track data; Insurance Information Institute 26

No-Fault (PIP) Liability: Frequency and Severity Trends Are Adverse* Annual Change, 2005 through 2011* Multiple States Are Experiencing Severe Fraud and Abuse Problems in their No-Fault Systems, Especially FL, MI, NY and NJ *No-fault states included are: FL, HI, KS, KY, MA, MI, MN, NY, ND and UT; 2010 data are for the 4 quarters ending 2011: Q 3. Source: ISO/PCI Fast Track data; Insurance Information Institute 26

Performance by Segment: Commercial Lines 27

Performance by Segment: Commercial Lines 27

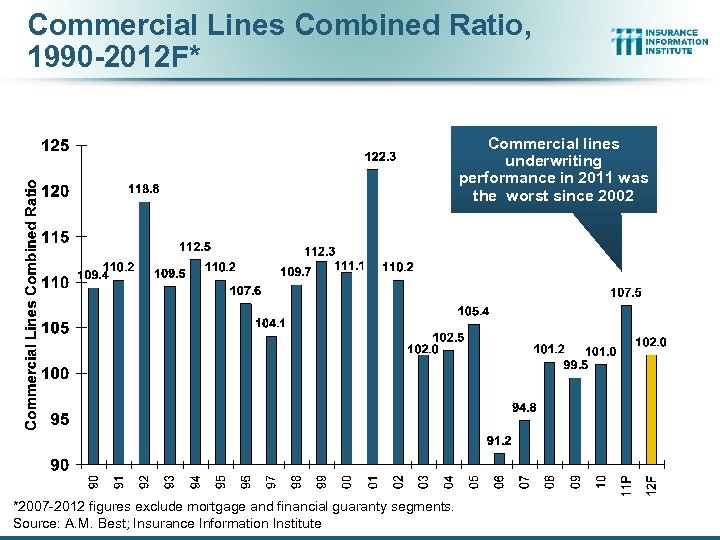

Commercial Lines Combined Ratio, 1990 -2012 F* Commercial lines underwriting performance in 2011 was the worst since 2002 *2007 -2012 figures exclude mortgage and financial guaranty segments. Source: A. M. Best; Insurance Information Institute

Commercial Lines Combined Ratio, 1990 -2012 F* Commercial lines underwriting performance in 2011 was the worst since 2002 *2007 -2012 figures exclude mortgage and financial guaranty segments. Source: A. M. Best; Insurance Information Institute

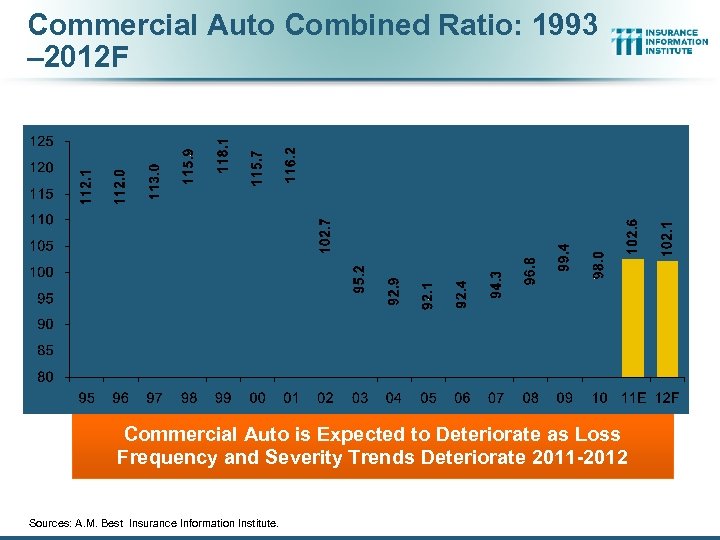

Commercial Auto Combined Ratio: 1993 – 2012 F Commercial Auto is Expected to Deteriorate as Loss Frequency and Severity Trends Deteriorate 2011 -2012 Sources: A. M. Best Insurance Information Institute.

Commercial Auto Combined Ratio: 1993 – 2012 F Commercial Auto is Expected to Deteriorate as Loss Frequency and Severity Trends Deteriorate 2011 -2012 Sources: A. M. Best Insurance Information Institute.

Commercial Multi-Peril Combined Ratio: 1995– 2012 F Commercial Multi-Peril Underwriting Performance is Expected to Improve in 2012 Assuming Normal Catastrophe Loss Activity *2011 -12 figures are A. M. Best estimate/forecast for the combined liability and non-liability components. Sources: A. M. Best; Insurance Information Institute.

Commercial Multi-Peril Combined Ratio: 1995– 2012 F Commercial Multi-Peril Underwriting Performance is Expected to Improve in 2012 Assuming Normal Catastrophe Loss Activity *2011 -12 figures are A. M. Best estimate/forecast for the combined liability and non-liability components. Sources: A. M. Best; Insurance Information Institute.

Other & Products Liability Combined Ratio: 1991– 2012 F Liability Lines Have Performed Better in the Post-Tort Reform Era (~2005), but There Has Been Some Deterioration in Recent Years Sources: A. M. Best ; Insurance Information Institute.

Other & Products Liability Combined Ratio: 1991– 2012 F Liability Lines Have Performed Better in the Post-Tort Reform Era (~2005), but There Has Been Some Deterioration in Recent Years Sources: A. M. Best ; Insurance Information Institute.

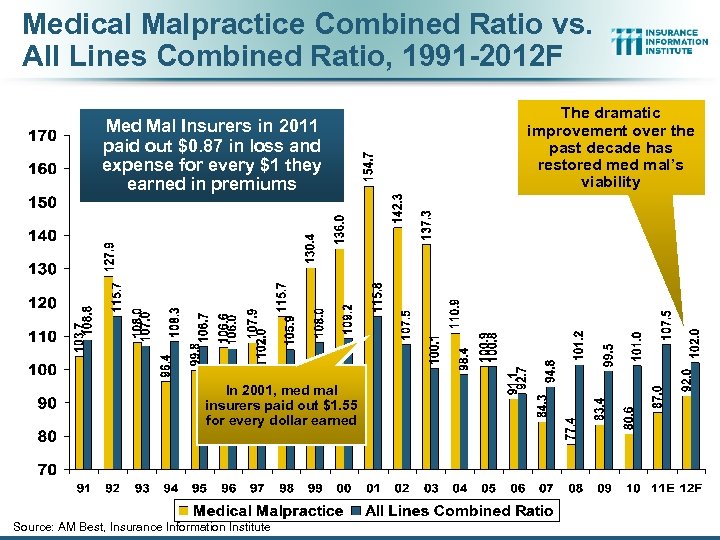

Medical Malpractice Combined Ratio vs. All Lines Combined Ratio, 1991 -2012 F Med Mal Insurers in 2011 paid out $0. 87 in loss and expense for every $1 they earned in premiums In 2001, med mal insurers paid out $1. 55 for every dollar earned Source: AM Best, Insurance Information Institute The dramatic improvement over the past decade has restored mal’s viability

Medical Malpractice Combined Ratio vs. All Lines Combined Ratio, 1991 -2012 F Med Mal Insurers in 2011 paid out $0. 87 in loss and expense for every $1 they earned in premiums In 2001, med mal insurers paid out $1. 55 for every dollar earned Source: AM Best, Insurance Information Institute The dramatic improvement over the past decade has restored mal’s viability

Workers Compensation Combined Ratio: 1994– 2012 F Workers Comp Underwriting Results Are Deteriorating Markedly and the Worst They Have Been in a Decade Sources: A. M. Best ; Insurance Information Institute.

Workers Compensation Combined Ratio: 1994– 2012 F Workers Comp Underwriting Results Are Deteriorating Markedly and the Worst They Have Been in a Decade Sources: A. M. Best ; Insurance Information Institute.

Workers Compensation Operating Environment The Weak Economy and Soft Market Have Made the Workers Comp Operating Increasingly Challenging 34

Workers Compensation Operating Environment The Weak Economy and Soft Market Have Made the Workers Comp Operating Increasingly Challenging 34

Workers Comp Medical Claim Costs Continue to Rise Medical Claim Cost ($000 s) Average Medical Cost per Lost-Time Claim Annual Change 1991– 1993: Annual Change 1994– 2001: Annual Change 2002 -2009: Does smaller pace of increase suggest that small med-only claims are becoming lost-time claims? +1. 9% +8. 9% +6. 6% Cumulative Change = 238% (1991 -2010 p) +2. 0% +5. 4% +5. 0% +6. 1% +9. 1% +5. 4% +7. 7% +8. 8% +13. 5% +7. 3% +10. 6% +8. 3% +10. 1% +7. 4% +9. 0%+5. 1% +1. 3%-2. 1% +6. 8% Accident Year 2010 p: Preliminary based on data valued as of 12/31/2010 1991 -2008: Based on data through 12/31/2008, developed to ultimate Based on the states where NCCI provides ratemaking services; Excludes the effects of deductible policies

Workers Comp Medical Claim Costs Continue to Rise Medical Claim Cost ($000 s) Average Medical Cost per Lost-Time Claim Annual Change 1991– 1993: Annual Change 1994– 2001: Annual Change 2002 -2009: Does smaller pace of increase suggest that small med-only claims are becoming lost-time claims? +1. 9% +8. 9% +6. 6% Cumulative Change = 238% (1991 -2010 p) +2. 0% +5. 4% +5. 0% +6. 1% +9. 1% +5. 4% +7. 7% +8. 8% +13. 5% +7. 3% +10. 6% +8. 3% +10. 1% +7. 4% +9. 0%+5. 1% +1. 3%-2. 1% +6. 8% Accident Year 2010 p: Preliminary based on data valued as of 12/31/2010 1991 -2008: Based on data through 12/31/2008, developed to ultimate Based on the states where NCCI provides ratemaking services; Excludes the effects of deductible policies

Workers Comp Indemnity Claim Costs Decline in 2010 Indemnity Claim Cost ($ 000 s) Average Indemnity Cost per Lost-Time Claiming behavior has changed significantly. Large numbers of lost time, low severity claims have entered the system—claims that previously were medical only, driving down average indemnity costs per claim. Annual Change 1991– 1993: Annual Change 1994– 2001: Annual Change 2002– 2009: -1. 7% +7. 3% +4. 1% Accident Year 2010 p: Preliminary based on data valued as of 12/31/2010 1991– 2008: Based on data through 12/31/2008, developed to ultimate Based on the states where NCCI provides ratemaking services Excludes the effects of deductible policies +0. 8% +8. 2% -3%

Workers Comp Indemnity Claim Costs Decline in 2010 Indemnity Claim Cost ($ 000 s) Average Indemnity Cost per Lost-Time Claiming behavior has changed significantly. Large numbers of lost time, low severity claims have entered the system—claims that previously were medical only, driving down average indemnity costs per claim. Annual Change 1991– 1993: Annual Change 1994– 2001: Annual Change 2002– 2009: -1. 7% +7. 3% +4. 1% Accident Year 2010 p: Preliminary based on data valued as of 12/31/2010 1991– 2008: Based on data through 12/31/2008, developed to ultimate Based on the states where NCCI provides ratemaking services Excludes the effects of deductible policies +0. 8% +8. 2% -3%

Payroll vs. Workers Comp Net Written Premiums, 1990 -2011 Payroll Base* $Billions WC NWP $Billions 12/07 -6/09 7/90 -3/91 3/01 -11/01 WC premium volume dropped two years before the recession began WC net premiums written were down $14 B or 29. 3% to $33. 8 B in 2010 after peaking at $47. 8 B in 2005 Resumption of payroll growth and rate increases suggests WC NWP will grow again in 2012 *Private employment; Shaded areas indicate recessions. Payroll and WC premiums for 2011 is I. I. I. estimate Sources: NBER (recessions); Federal Reserve Bank of St. Louis at http: //research. stlouisfed. org/fred 2/series/WASCUR ; NCCI; I. I. I. 37

Payroll vs. Workers Comp Net Written Premiums, 1990 -2011 Payroll Base* $Billions WC NWP $Billions 12/07 -6/09 7/90 -3/91 3/01 -11/01 WC premium volume dropped two years before the recession began WC net premiums written were down $14 B or 29. 3% to $33. 8 B in 2010 after peaking at $47. 8 B in 2005 Resumption of payroll growth and rate increases suggests WC NWP will grow again in 2012 *Private employment; Shaded areas indicate recessions. Payroll and WC premiums for 2011 is I. I. I. estimate Sources: NBER (recessions); Federal Reserve Bank of St. Louis at http: //research. stlouisfed. org/fred 2/series/WASCUR ; NCCI; I. I. I. 37

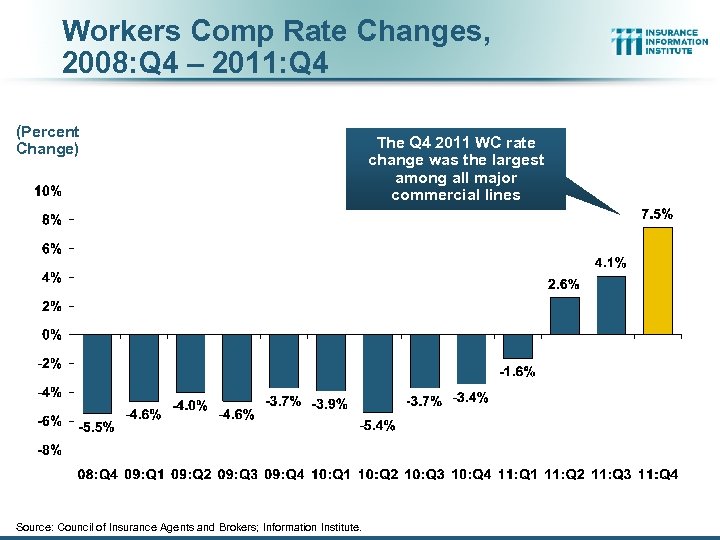

Workers Comp Rate Changes, 2008: Q 4 – 2011: Q 4 (Percent Change) Source: Council of Insurance Agents and Brokers; Information Institute. The Q 4 2011 WC rate change was the largest among all major commercial lines

Workers Comp Rate Changes, 2008: Q 4 – 2011: Q 4 (Percent Change) Source: Council of Insurance Agents and Brokers; Information Institute. The Q 4 2011 WC rate change was the largest among all major commercial lines

Catastrophe Loss Update 2011 Was One of the Most Expensive Years on Record 39

Catastrophe Loss Update 2011 Was One of the Most Expensive Years on Record 39

Natural Loss Events, 2011 World Map Winter Storm Joachim France, Switzerland, Germany, 15– 17 Dec. Wildfires Canada, 14– 22 May Severe storms, tornadoes USA, 20– 27 May Hurricane Irene USA, Caribbean 22 Aug. – 2 Sept. Floods USA, April–May Drought Severe storms, tornadoes USA, Oct. 2010– USA, 22– 28 April ongoing Flash floods, floods Italy, France, Spain 4– 9 Nov. Earthquake Turkey 23 Oct. Wildfires USA, April/Sept. Earthquake, tsunami Japan, 11 March Floods Pakistan Aug. –Sept. Floods, flash floods Australia, Dec. 2010–Jan. 2011 Landslides, flash floods Brazil, 12/16 Jan. Natural catastrophes Selection of significant loss events (see table) Source: MR Nat. Cat. SERVICE Cyclone Yasi Australia, 2– 7 Feb. Floods Thailand Aug. –Nov. Floods, landslides Guatemala, El Salvador 11– 19 Oct. Number of Events: 820 Tropical Storm Washi Philippines, 16– 18 Dec. Drought Somalia Oct. 2010–Sept. 2011 Geophysical events (earthquake, tsunami, volcanic activity) Meteorological events (storm) Earthquake New Zealand, 22 Feb. Earthquake New Zealand, 13 June Hydrological events (flood, mass movement) Climatological events (extreme temperature, drought, wildfire) 40

Natural Loss Events, 2011 World Map Winter Storm Joachim France, Switzerland, Germany, 15– 17 Dec. Wildfires Canada, 14– 22 May Severe storms, tornadoes USA, 20– 27 May Hurricane Irene USA, Caribbean 22 Aug. – 2 Sept. Floods USA, April–May Drought Severe storms, tornadoes USA, Oct. 2010– USA, 22– 28 April ongoing Flash floods, floods Italy, France, Spain 4– 9 Nov. Earthquake Turkey 23 Oct. Wildfires USA, April/Sept. Earthquake, tsunami Japan, 11 March Floods Pakistan Aug. –Sept. Floods, flash floods Australia, Dec. 2010–Jan. 2011 Landslides, flash floods Brazil, 12/16 Jan. Natural catastrophes Selection of significant loss events (see table) Source: MR Nat. Cat. SERVICE Cyclone Yasi Australia, 2– 7 Feb. Floods Thailand Aug. –Nov. Floods, landslides Guatemala, El Salvador 11– 19 Oct. Number of Events: 820 Tropical Storm Washi Philippines, 16– 18 Dec. Drought Somalia Oct. 2010–Sept. 2011 Geophysical events (earthquake, tsunami, volcanic activity) Meteorological events (storm) Earthquake New Zealand, 22 Feb. Earthquake New Zealand, 13 June Hydrological events (flood, mass movement) Climatological events (extreme temperature, drought, wildfire) 40

Top 14 Most Costly Disasters in U. S. History (Insured Losses, 2011 Dollars, $ Billions) Taken as a single event, the Spring 2011 tornado and storm season are is the 4 th costliest event in US insurance history Hurricane Irene became the 11 th most expense hurricane in US history *Losses will actually be broken down into several “events” as determined by PCS. Includes losses for the period April 1 – June 30. Sources: PCS; Insurance Information Institute inflation adjustments. 41

Top 14 Most Costly Disasters in U. S. History (Insured Losses, 2011 Dollars, $ Billions) Taken as a single event, the Spring 2011 tornado and storm season are is the 4 th costliest event in US insurance history Hurricane Irene became the 11 th most expense hurricane in US history *Losses will actually be broken down into several “events” as determined by PCS. Includes losses for the period April 1 – June 30. Sources: PCS; Insurance Information Institute inflation adjustments. 41

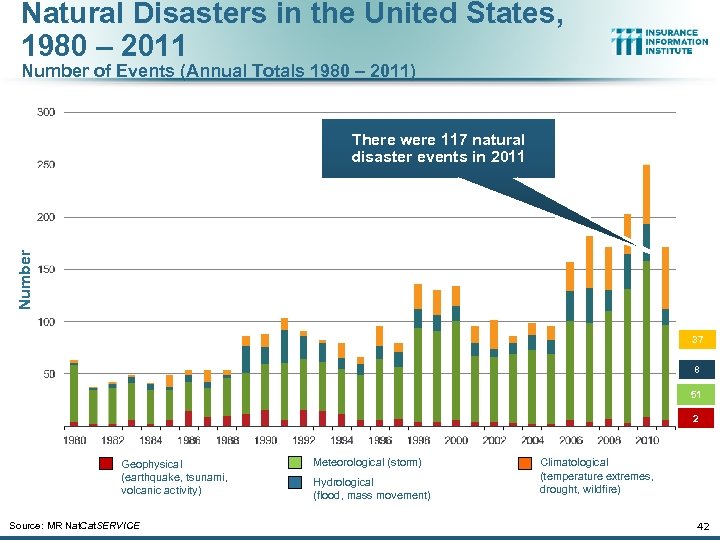

Natural Disasters in the United States, 1980 – 2011 Number of Events (Annual Totals 1980 – 2011) Number There were 117 natural disaster events in 2011 37 8 51 2 Geophysical (earthquake, tsunami, volcanic activity) Source: MR Nat. Cat. SERVICE Meteorological (storm) Hydrological (flood, mass movement) Climatological (temperature extremes, drought, wildfire) 42

Natural Disasters in the United States, 1980 – 2011 Number of Events (Annual Totals 1980 – 2011) Number There were 117 natural disaster events in 2011 37 8 51 2 Geophysical (earthquake, tsunami, volcanic activity) Source: MR Nat. Cat. SERVICE Meteorological (storm) Hydrological (flood, mass movement) Climatological (temperature extremes, drought, wildfire) 42

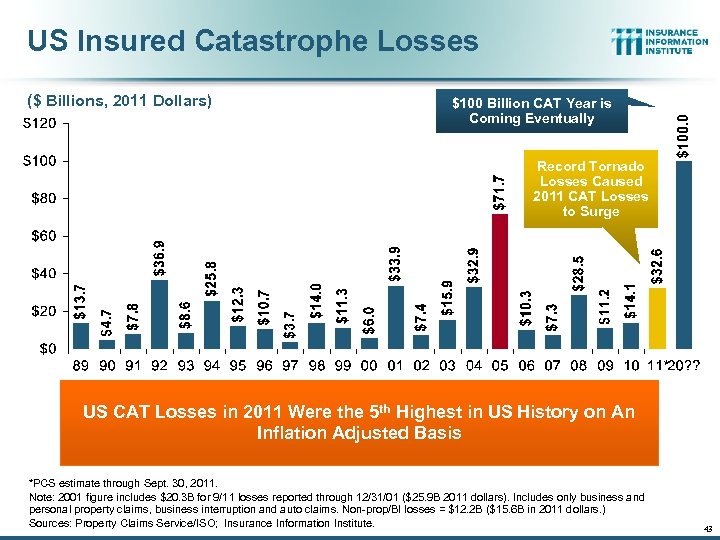

US Insured Catastrophe Losses ($ Billions, 2011 Dollars) $100 Billion CAT Year is Coming Eventually Record Tornado Losses Caused 2011 CAT Losses to Surge US CAT Losses in 2011 Were the 5 th Highest in US History on An Inflation Adjusted Basis *PCS estimate through Sept. 30, 2011. Note: 2001 figure includes $20. 3 B for 9/11 losses reported through 12/31/01 ($25. 9 B 2011 dollars). Includes only business and personal property claims, business interruption and auto claims. Non-prop/BI losses = $12. 2 B ($15. 6 B in 2011 dollars. ) Sources: Property Claims Service/ISO; Insurance Information Institute. 43

US Insured Catastrophe Losses ($ Billions, 2011 Dollars) $100 Billion CAT Year is Coming Eventually Record Tornado Losses Caused 2011 CAT Losses to Surge US CAT Losses in 2011 Were the 5 th Highest in US History on An Inflation Adjusted Basis *PCS estimate through Sept. 30, 2011. Note: 2001 figure includes $20. 3 B for 9/11 losses reported through 12/31/01 ($25. 9 B 2011 dollars). Includes only business and personal property claims, business interruption and auto claims. Non-prop/BI losses = $12. 2 B ($15. 6 B in 2011 dollars. ) Sources: Property Claims Service/ISO; Insurance Information Institute. 43

2011’s Most Expensive Catastrophes, Insured Losses Includes approximately $2 B in losses for May 22 Joplin tornado **Includes $700 million in flood losses insured through the National Flood Insurance Program. Source: PCS except as noted by “*” which are sourced to Munich Re; Insurance Information Institute. Includes $1. 65 B in AL, mostly in the Tuscaloosa and Birmingham areas

2011’s Most Expensive Catastrophes, Insured Losses Includes approximately $2 B in losses for May 22 Joplin tornado **Includes $700 million in flood losses insured through the National Flood Insurance Program. Source: PCS except as noted by “*” which are sourced to Munich Re; Insurance Information Institute. Includes $1. 65 B in AL, mostly in the Tuscaloosa and Birmingham areas

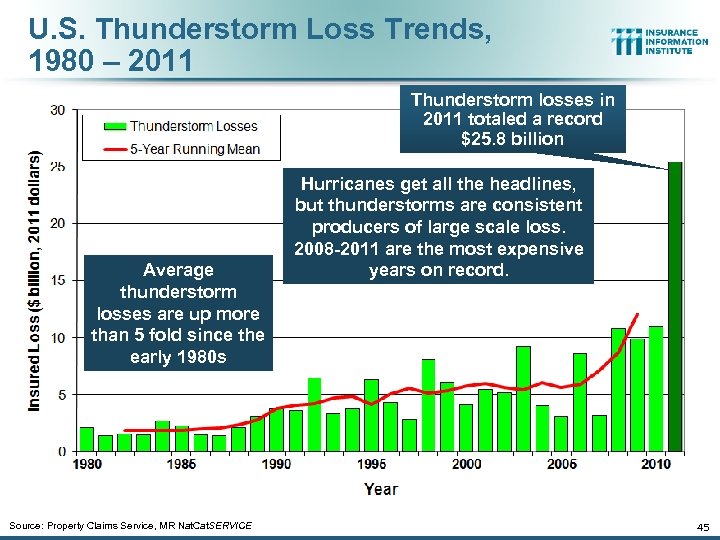

U. S. Thunderstorm Loss Trends, 1980 – 2011 Thunderstorm losses in 2011 totaled a record $25. 8 billion Average thunderstorm losses are up more than 5 fold since the early 1980 s Source: Property Claims Service, MR Nat. Cat. SERVICE Hurricanes get all the headlines, but thunderstorms are consistent producers of large scale loss. 2008 -2011 are the most expensive years on record. 45

U. S. Thunderstorm Loss Trends, 1980 – 2011 Thunderstorm losses in 2011 totaled a record $25. 8 billion Average thunderstorm losses are up more than 5 fold since the early 1980 s Source: Property Claims Service, MR Nat. Cat. SERVICE Hurricanes get all the headlines, but thunderstorms are consistent producers of large scale loss. 2008 -2011 are the most expensive years on record. 45

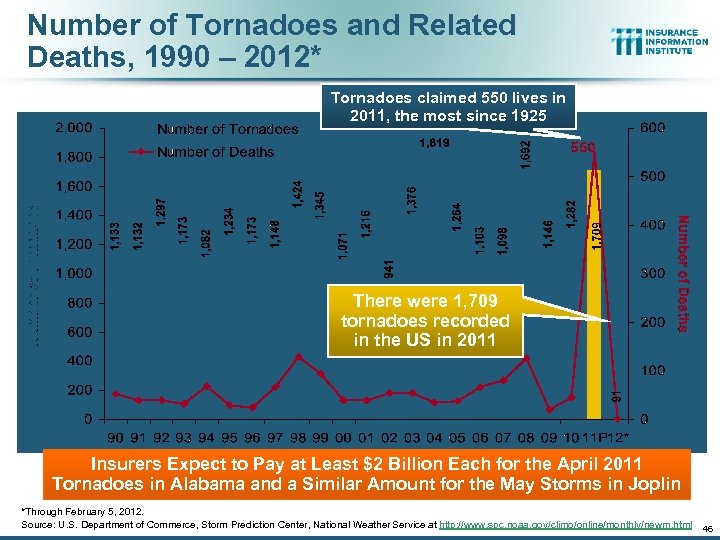

Number of Tornadoes and Related Deaths, 1990 – 2012* Tornadoes claimed 550 lives in 2011, the most since 1925 There were 1, 709 tornadoes recorded in the US in 2011 Insurers Expect to Pay at Least $2 Billion Each for the April 2011 Tornadoes in Alabama and a Similar Amount for the May Storms in Joplin *Through February 5, 2012. Source: U. S. Department of Commerce, Storm Prediction Center, National Weather Service at http: //www. spc. noaa. gov/climo/online/monthly/newm. html 46

Number of Tornadoes and Related Deaths, 1990 – 2012* Tornadoes claimed 550 lives in 2011, the most since 1925 There were 1, 709 tornadoes recorded in the US in 2011 Insurers Expect to Pay at Least $2 Billion Each for the April 2011 Tornadoes in Alabama and a Similar Amount for the May Storms in Joplin *Through February 5, 2012. Source: U. S. Department of Commerce, Storm Prediction Center, National Weather Service at http: //www. spc. noaa. gov/climo/online/monthly/newm. html 46

Financial Strength & Underwriting Cyclical Pattern is P-C Impairment History is Directly Tied to Underwriting, Reserving & Pricing 47

Financial Strength & Underwriting Cyclical Pattern is P-C Impairment History is Directly Tied to Underwriting, Reserving & Pricing 47

P/C Insurer Impairments, 1969– 2011 3 small insurers in Missouri did encounter problems in 2011 following the May tornado in Joplin. They were absorbed by a larger insurer and all claims were paid. The Number of Impairments Varies Significantly Over the P/C Insurance Cycle, With Peaks Occurring Well into Hard Markets Source: A. M. Best Special Report “ 1969 -2011 Impairment Review, ” January 23, 2012; Insurance Information Institute.

P/C Insurer Impairments, 1969– 2011 3 small insurers in Missouri did encounter problems in 2011 following the May tornado in Joplin. They were absorbed by a larger insurer and all claims were paid. The Number of Impairments Varies Significantly Over the P/C Insurance Cycle, With Peaks Occurring Well into Hard Markets Source: A. M. Best Special Report “ 1969 -2011 Impairment Review, ” January 23, 2012; Insurance Information Institute.

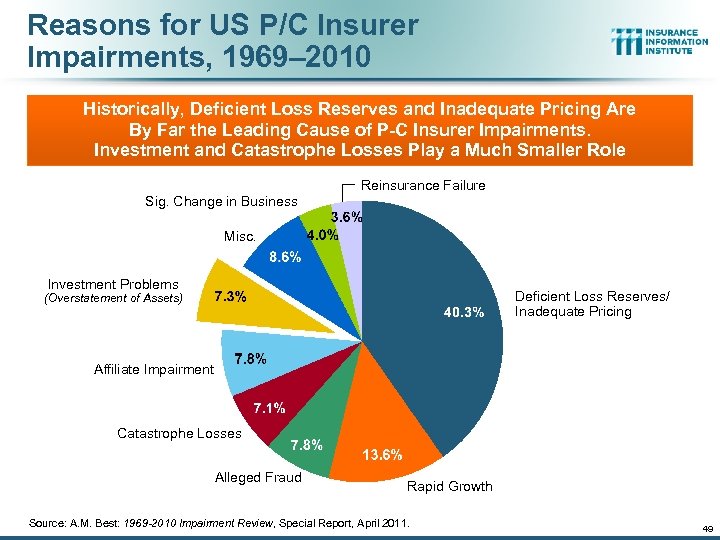

Reasons for US P/C Insurer Impairments, 1969– 2010 Historically, Deficient Loss Reserves and Inadequate Pricing Are By Far the Leading Cause of P-C Insurer Impairments. Investment and Catastrophe Losses Play a Much Smaller Role Reinsurance Failure Sig. Change in Business Misc. Investment Problems Deficient Loss Reserves/ Inadequate Pricing (Overstatement of Assets) Affiliate Impairment Catastrophe Losses Alleged Fraud Rapid Growth Source: A. M. Best: 1969 -2010 Impairment Review, Special Report, April 2011. 49

Reasons for US P/C Insurer Impairments, 1969– 2010 Historically, Deficient Loss Reserves and Inadequate Pricing Are By Far the Leading Cause of P-C Insurer Impairments. Investment and Catastrophe Losses Play a Much Smaller Role Reinsurance Failure Sig. Change in Business Misc. Investment Problems Deficient Loss Reserves/ Inadequate Pricing (Overstatement of Assets) Affiliate Impairment Catastrophe Losses Alleged Fraud Rapid Growth Source: A. M. Best: 1969 -2010 Impairment Review, Special Report, April 2011. 49

SURPLUS/CAPITAL/CAPACITY Have Large Global Losses Reduced Capacity in the Industry, Setting the Stage for a Market Turn? 50

SURPLUS/CAPITAL/CAPACITY Have Large Global Losses Reduced Capacity in the Industry, Setting the Stage for a Market Turn? 50

Policyholder Surplus, 2006: Q 4– 2011: Q 3 ($ Billions) 2007: Q 3 Previous Surplus Peak A. M. Best is predicting year-end 2011 surplus was down just 1. 7% and that surplus will increase sharply by 8. 4% in 2012 The Industry now has $1 of surplus for every $0. 83 of NPW, close to the strongest claimspaying status in its history. *Includes $22. 5 B of paid-in capital from a holding company parent for one insurer’s investment in a non-insurance business in early 2010. Sources: ISO, A. M. Best. Surplus as of 9/30/11 was down 4. 6% below its all time record high of $564. 7 B set as of 3/31/11. Further declines are possible. Quarterly Surplus Changes Since 2011: Q 1 Peak 11: Q 2: -$5. 6 B (-1. 0%) 11: Q 3: -$26. 1 B (-4. 6%) 51

Policyholder Surplus, 2006: Q 4– 2011: Q 3 ($ Billions) 2007: Q 3 Previous Surplus Peak A. M. Best is predicting year-end 2011 surplus was down just 1. 7% and that surplus will increase sharply by 8. 4% in 2012 The Industry now has $1 of surplus for every $0. 83 of NPW, close to the strongest claimspaying status in its history. *Includes $22. 5 B of paid-in capital from a holding company parent for one insurer’s investment in a non-insurance business in early 2010. Sources: ISO, A. M. Best. Surplus as of 9/30/11 was down 4. 6% below its all time record high of $564. 7 B set as of 3/31/11. Further declines are possible. Quarterly Surplus Changes Since 2011: Q 1 Peak 11: Q 2: -$5. 6 B (-1. 0%) 11: Q 3: -$26. 1 B (-4. 6%) 51

Shifting Legal Liability & Tort Environment Is the Tort Pendulum Swinging Against Insurers? 52

Shifting Legal Liability & Tort Environment Is the Tort Pendulum Swinging Against Insurers? 52

Over the Last Three Decades, Total Tort Costs as a % of GDP Appear Somewhat Cyclical, 1980 -2013 E ($ Billions) 2. 21% of GDP in 2003 = pre-tort reform peak Tort costs in dollar terms have remained high but relatively stable since the mid-2000 s. , but are down substantially as a share of GDP Sources: Towers Watson, 2011 Update on US Tort Cost Trends, Appendix 1 A Deepwater Horizon Spike in 2010 1. 68% of GDP in 2013 53

Over the Last Three Decades, Total Tort Costs as a % of GDP Appear Somewhat Cyclical, 1980 -2013 E ($ Billions) 2. 21% of GDP in 2003 = pre-tort reform peak Tort costs in dollar terms have remained high but relatively stable since the mid-2000 s. , but are down substantially as a share of GDP Sources: Towers Watson, 2011 Update on US Tort Cost Trends, Appendix 1 A Deepwater Horizon Spike in 2010 1. 68% of GDP in 2013 53

Inflation Is it a Threat to Claim Cost Severities 54

Inflation Is it a Threat to Claim Cost Severities 54

Annual Inflation Rates, (CPI-U, %), 1990– 2017 F Annual Inflation Rates (%) Inflation peaked at 5. 6% in August 2008 on high energy and commodity crisis. The recession and the collapse of the commodity bubble reduced inflationary pressures in 2009/10 Higher energy, commodity and food prices pushed up inflation in 2011, but not longer turn inflationary expectations. The slack in the U. S. economy suggests that inflationary pressures should remain subdued for an extended period of times. Energy, health care and commodity prices, plus U. S. debt burden, remain longer-run concerns Sources: US Bureau of Labor Statistics; Blue Chip Economic Indicators, 10/11 and 1/12 (forecasts). 55

Annual Inflation Rates, (CPI-U, %), 1990– 2017 F Annual Inflation Rates (%) Inflation peaked at 5. 6% in August 2008 on high energy and commodity crisis. The recession and the collapse of the commodity bubble reduced inflationary pressures in 2009/10 Higher energy, commodity and food prices pushed up inflation in 2011, but not longer turn inflationary expectations. The slack in the U. S. economy suggests that inflationary pressures should remain subdued for an extended period of times. Energy, health care and commodity prices, plus U. S. debt burden, remain longer-run concerns Sources: US Bureau of Labor Statistics; Blue Chip Economic Indicators, 10/11 and 1/12 (forecasts). 55

P/C Personal Insurance Claim Cost Drivers Grow Faster Than the Core CPI Suggests Price Level Change: 2011 vs. 2010 Excludes Food and Energy Healthcare costs are a major liability, med pay, and PIP claim cost driver. They are likely to grow faster than the CPI for the next few years, at least Sources: Bureau of Labor Statistics; Insurance Information Institute. 56

P/C Personal Insurance Claim Cost Drivers Grow Faster Than the Core CPI Suggests Price Level Change: 2011 vs. 2010 Excludes Food and Energy Healthcare costs are a major liability, med pay, and PIP claim cost driver. They are likely to grow faster than the CPI for the next few years, at least Sources: Bureau of Labor Statistics; Insurance Information Institute. 56

Insurance Information Institute Online: www. iii. org Thank you for your time and your attention! Twitter: twitter. com/bob_hartwig

Insurance Information Institute Online: www. iii. org Thank you for your time and your attention! Twitter: twitter. com/bob_hartwig

Knowing What and Asking Why? “Many underwriting decisions include subjective components, which leads to a great deal of variability in underwriting and pricing decisions. ” -Advanced Analytics and the Art of Underwriting, Deloitte, 2007 58 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Knowing What and Asking Why? “Many underwriting decisions include subjective components, which leads to a great deal of variability in underwriting and pricing decisions. ” -Advanced Analytics and the Art of Underwriting, Deloitte, 2007 58 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

BI Maturity Model High Complexity Prediction What might happen? Predictive analytics and mining Monitoring What’s happening now? Dashboards and scorecards Analysis: Why did it happen? OLAP and advanced visualization tools Reporting: What Happened? Low Query, reporting, data search High Business value 59 Copyright © 2011, Oracle and/or its affiliates. All rights reserved. Oracle Restricted Confidential

BI Maturity Model High Complexity Prediction What might happen? Predictive analytics and mining Monitoring What’s happening now? Dashboards and scorecards Analysis: Why did it happen? OLAP and advanced visualization tools Reporting: What Happened? Low Query, reporting, data search High Business value 59 Copyright © 2011, Oracle and/or its affiliates. All rights reserved. Oracle Restricted Confidential

Polling Question #1 60 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Polling Question #1 60 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

![Knowing What and Asking Why? “[The] wish for all insurers to achieve this happy Knowing What and Asking Why? “[The] wish for all insurers to achieve this happy](https://present5.com/presentation/e3a7e09dc6048f9e17237515866b660d/image-61.jpg) Knowing What and Asking Why? “[The] wish for all insurers to achieve this happy result (underwriting profitability) creates intense competition, so vigorous in most years that it causes the P/C industry as a whole to operate at a significant underwriting loss. ” -Warren Buffet Feb 2012 61 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Knowing What and Asking Why? “[The] wish for all insurers to achieve this happy result (underwriting profitability) creates intense competition, so vigorous in most years that it causes the P/C industry as a whole to operate at a significant underwriting loss. ” -Warren Buffet Feb 2012 61 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Underwriting Profit Drivers Three key items Oracle can help with • Underwriting Discipline – The controlled effort of writing or refusing to write premium Underwriting Discipline • Cost Control – The controlled effort of containing costs as they pertain to the claim, underwriting and adjusting process within an insurer • Claim Efficiency and Responsiveness – The controlled effort of quickly and effectively paying legal claims quickly. 62 Copyright © 2011, Oracle and/or its affiliates. All rights reserved. Claim Efficiency and Responsiveness Cost Control Underwritin g Profit

Underwriting Profit Drivers Three key items Oracle can help with • Underwriting Discipline – The controlled effort of writing or refusing to write premium Underwriting Discipline • Cost Control – The controlled effort of containing costs as they pertain to the claim, underwriting and adjusting process within an insurer • Claim Efficiency and Responsiveness – The controlled effort of quickly and effectively paying legal claims quickly. 62 Copyright © 2011, Oracle and/or its affiliates. All rights reserved. Claim Efficiency and Responsiveness Cost Control Underwritin g Profit

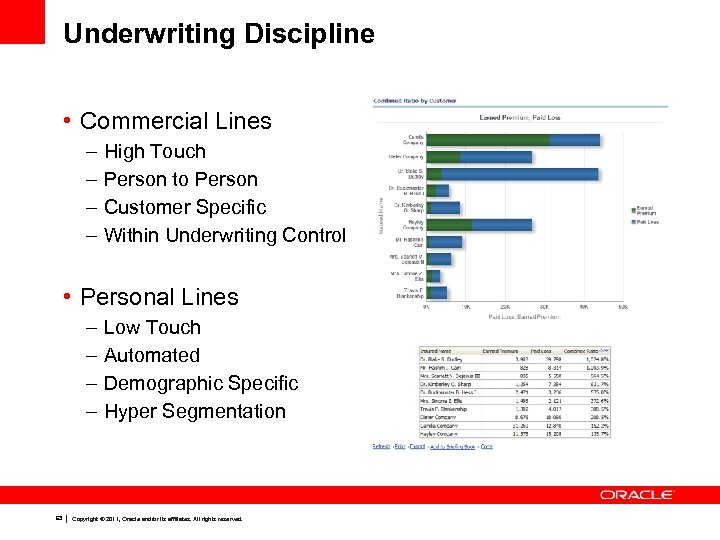

Underwriting Discipline • Commercial Lines – – High Touch Person to Person Customer Specific Within Underwriting Control • Personal Lines – – 63 Low Touch Automated Demographic Specific Hyper Segmentation Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Underwriting Discipline • Commercial Lines – – High Touch Person to Person Customer Specific Within Underwriting Control • Personal Lines – – 63 Low Touch Automated Demographic Specific Hyper Segmentation Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

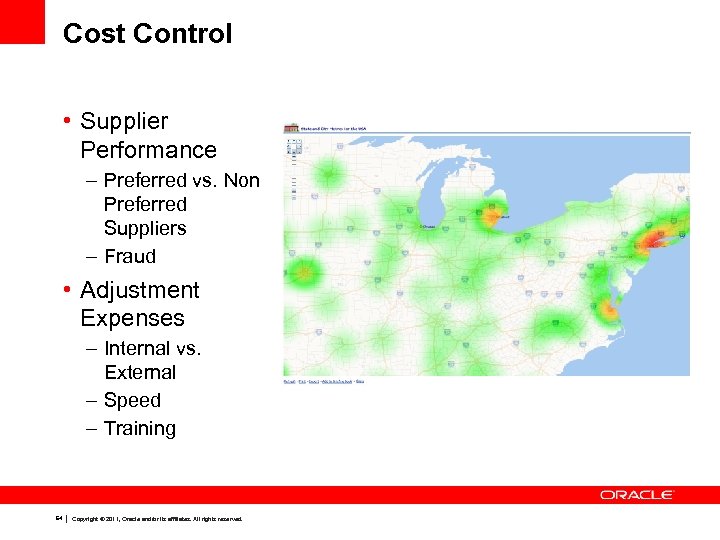

Cost Control • Supplier Performance – Preferred vs. Non Preferred Suppliers – Fraud • Adjustment Expenses – Internal vs. External – Speed – Training 64 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Cost Control • Supplier Performance – Preferred vs. Non Preferred Suppliers – Fraud • Adjustment Expenses – Internal vs. External – Speed – Training 64 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

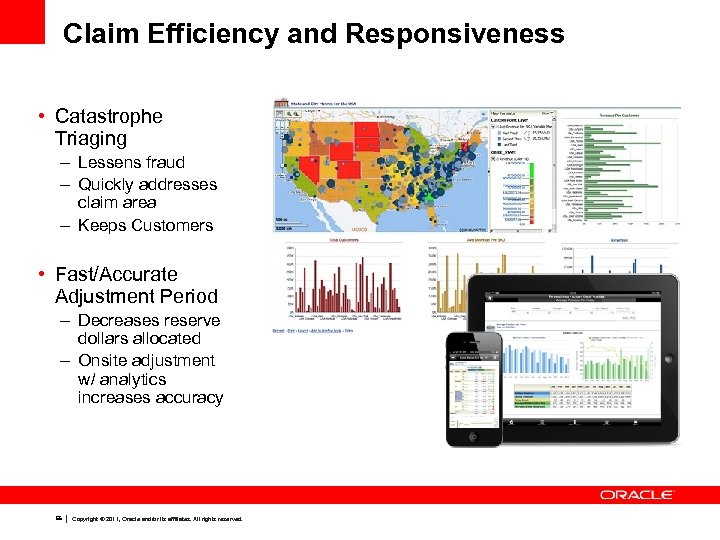

Claim Efficiency and Responsiveness • Catastrophe Triaging – Lessens fraud – Quickly addresses claim area – Keeps Customers • Fast/Accurate Adjustment Period – Decreases reserve dollars allocated – Onsite adjustment w/ analytics increases accuracy 65 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Claim Efficiency and Responsiveness • Catastrophe Triaging – Lessens fraud – Quickly addresses claim area – Keeps Customers • Fast/Accurate Adjustment Period – Decreases reserve dollars allocated – Onsite adjustment w/ analytics increases accuracy 65 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Closing the Analytics Loop • Typical/manual rating/pricing methodology Model • Model the rate in Insbridge • View the Impact of the rate Analyze Impact • Push Rate to production and put to use • Analyze the results of the rating over time Rate

Closing the Analytics Loop • Typical/manual rating/pricing methodology Model • Model the rate in Insbridge • View the Impact of the rate Analyze Impact • Push Rate to production and put to use • Analyze the results of the rating over time Rate

Q&A 67 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

Q&A 67 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

For more information • Please contact insurance_ww@oracle. com for a copy of these slides • For specific questions, contact jason. mcdonald@oracle. com or nicole. bruns@oracle. com 68 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

For more information • Please contact insurance_ww@oracle. com for a copy of these slides • For specific questions, contact jason. mcdonald@oracle. com or nicole. bruns@oracle. com 68 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

69 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

69 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

70 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.

70 Copyright © 2011, Oracle and/or its affiliates. All rights reserved.