ed72541bdf7f1b8ac037c8f97f37411c.ppt

- Количество слайдов: 13

| 1

| 1

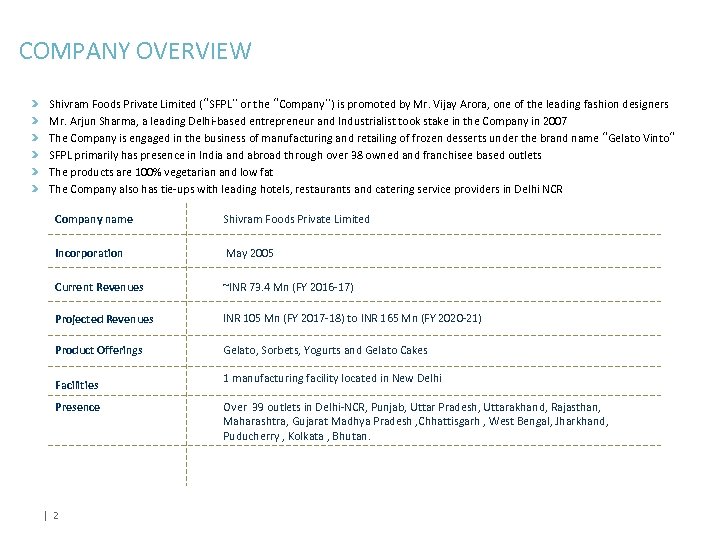

COMPANY OVERVIEW Shivram Foods Private Limited (“SFPL” or the “Company”) is promoted by Mr. Vijay Arora, one of the leading fashion designers Mr. Arjun Sharma, a leading Delhi-based entrepreneur and Industrialist took stake in the Company in 2007 The Company is engaged in the business of manufacturing and retailing of frozen desserts under the brand name “Gelato Vinto“ SFPL primarily has presence in India and abroad through over 38 owned and franchisee based outlets The products are 100% vegetarian and low fat The Company also has tie-ups with leading hotels, restaurants and catering service providers in Delhi NCR Company name Shivram Foods Private Limited Incorporation May 2005 Current Revenues ~INR 73. 4 Mn (FY 2016 -17) Projected Revenues INR 105 Mn (FY 2017 -18) to INR 165 Mn (FY 2020 -21) Product Offerings Gelato, Sorbets, Yogurts and Gelato Cakes Facilities Presence | 2 1 manufacturing facility located in New Delhi Over 39 outlets in Delhi-NCR, Punjab, Uttar Pradesh, Uttarakhand, Rajasthan, Maharashtra, Gujarat Madhya Pradesh , Chhattisgarh , West Bengal, Jharkhand, Puducherry , Kolkata , Bhutan.

COMPANY OVERVIEW Shivram Foods Private Limited (“SFPL” or the “Company”) is promoted by Mr. Vijay Arora, one of the leading fashion designers Mr. Arjun Sharma, a leading Delhi-based entrepreneur and Industrialist took stake in the Company in 2007 The Company is engaged in the business of manufacturing and retailing of frozen desserts under the brand name “Gelato Vinto“ SFPL primarily has presence in India and abroad through over 38 owned and franchisee based outlets The products are 100% vegetarian and low fat The Company also has tie-ups with leading hotels, restaurants and catering service providers in Delhi NCR Company name Shivram Foods Private Limited Incorporation May 2005 Current Revenues ~INR 73. 4 Mn (FY 2016 -17) Projected Revenues INR 105 Mn (FY 2017 -18) to INR 165 Mn (FY 2020 -21) Product Offerings Gelato, Sorbets, Yogurts and Gelato Cakes Facilities Presence | 2 1 manufacturing facility located in New Delhi Over 39 outlets in Delhi-NCR, Punjab, Uttar Pradesh, Uttarakhand, Rajasthan, Maharashtra, Gujarat Madhya Pradesh , Chhattisgarh , West Bengal, Jharkhand, Puducherry , Kolkata , Bhutan.

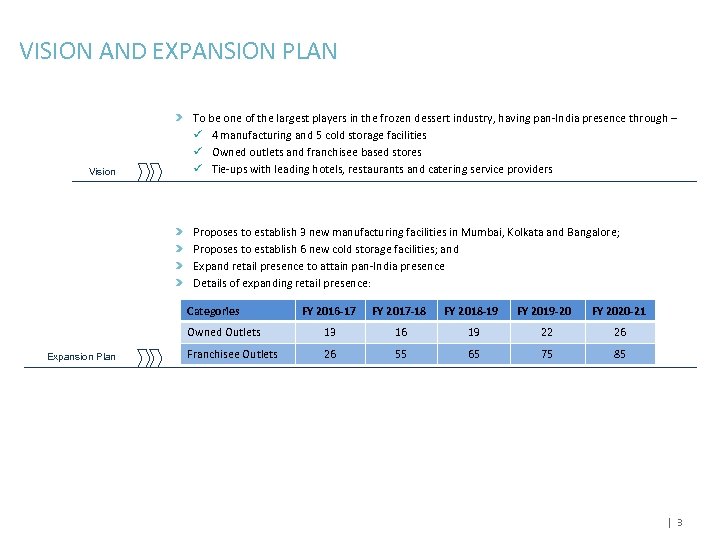

VISION AND EXPANSION PLAN Vision To be one of the largest players in the frozen dessert industry, having pan-India presence through – ü 4 manufacturing and 5 cold storage facilities ü Owned outlets and franchisee based stores ü Tie-ups with leading hotels, restaurants and catering service providers Proposes to establish 3 new manufacturing facilities in Mumbai, Kolkata and Bangalore; Proposes to establish 6 new cold storage facilities; and Expand retail presence to attain pan-India presence Details of expanding retail presence: Categories FY 2017 -18 FY 2018 -19 FY 2019 -20 FY 2020 -21 Owned Outlets Expansion Plan FY 2016 -17 13 16 19 22 26 Franchisee Outlets 26 55 65 75 85 | 3

VISION AND EXPANSION PLAN Vision To be one of the largest players in the frozen dessert industry, having pan-India presence through – ü 4 manufacturing and 5 cold storage facilities ü Owned outlets and franchisee based stores ü Tie-ups with leading hotels, restaurants and catering service providers Proposes to establish 3 new manufacturing facilities in Mumbai, Kolkata and Bangalore; Proposes to establish 6 new cold storage facilities; and Expand retail presence to attain pan-India presence Details of expanding retail presence: Categories FY 2017 -18 FY 2018 -19 FY 2019 -20 FY 2020 -21 Owned Outlets Expansion Plan FY 2016 -17 13 16 19 22 26 Franchisee Outlets 26 55 65 75 85 | 3

GELATO VINTO POTENTIAL High growth market Ice Cream and Frozen Dessert industry has grown at 20%-25% (CAGR) over the last few years and the growth expectation for organized players are: ü Ice Cream market – 20% - 25% CAGR over next 5 years ü Frozen Dessert market – 25% - 30% CAGR over next 5 years Established Brand Value ‘Gelato Vinto’ is a recognized brand among high-end consumers Product / Competitio n Niche superior product range coupled with personal involvement of Mr. Vijay Arora in product development, who has attended a Gelato course at the Gelato University in Italy Very few direct competitors having similar product range and pricing Growth and Margin Expected to grow at over 20% CAGR (FY 2015 -16 to FY 2019 -20) – high growth expectation due to aggressive expansion plan Currently, EBITDA margins are ~15% - the same is expected to be in the range of ~16% to ~28% primarily due to increase in franchisee based business Presence Has over 40 outlets in Delhi - NCR, Punjab, Uttar Pradesh, Rajasthan, Maharashtra, Gujarat, Madhya Pradesh and Chhattisgarh Also, has tie-ups with leading hotels and catering service providers including: Enjoys early mover advantage, as one of the first players to enter high end frozen desserts market | 4

GELATO VINTO POTENTIAL High growth market Ice Cream and Frozen Dessert industry has grown at 20%-25% (CAGR) over the last few years and the growth expectation for organized players are: ü Ice Cream market – 20% - 25% CAGR over next 5 years ü Frozen Dessert market – 25% - 30% CAGR over next 5 years Established Brand Value ‘Gelato Vinto’ is a recognized brand among high-end consumers Product / Competitio n Niche superior product range coupled with personal involvement of Mr. Vijay Arora in product development, who has attended a Gelato course at the Gelato University in Italy Very few direct competitors having similar product range and pricing Growth and Margin Expected to grow at over 20% CAGR (FY 2015 -16 to FY 2019 -20) – high growth expectation due to aggressive expansion plan Currently, EBITDA margins are ~15% - the same is expected to be in the range of ~16% to ~28% primarily due to increase in franchisee based business Presence Has over 40 outlets in Delhi - NCR, Punjab, Uttar Pradesh, Rajasthan, Maharashtra, Gujarat, Madhya Pradesh and Chhattisgarh Also, has tie-ups with leading hotels and catering service providers including: Enjoys early mover advantage, as one of the first players to enter high end frozen desserts market | 4

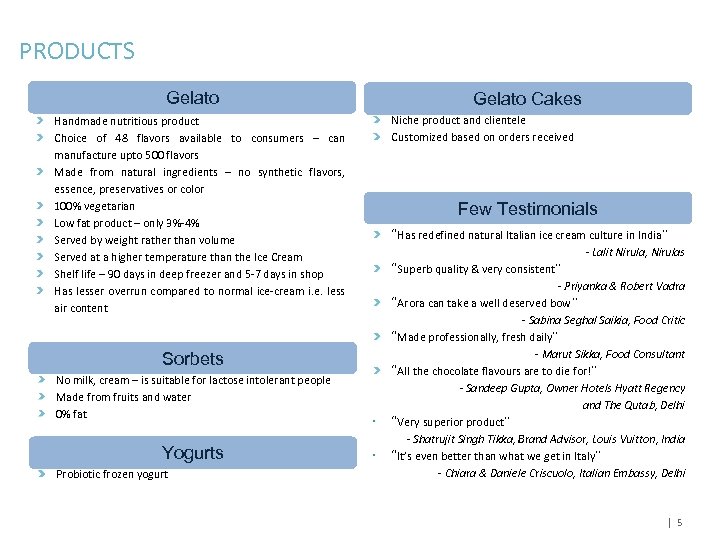

PRODUCTS Gelato Cakes Niche product and clientele Customized based on orders received Handmade nutritious product Choice of 48 flavors available to consumers – can manufacture upto 500 flavors Made from natural ingredients – no synthetic flavors, essence, preservatives or color 100% vegetarian Low fat product – only 3%-4% Served by weight rather than volume Served at a higher temperature than the Ice Cream Shelf life – 90 days in deep freezer and 5 -7 days in shop Has lesser overrun compared to normal ice-cream i. e. less air content Few Testimonials Sorbets No milk, cream – is suitable for lactose intolerant people Made from fruits and water 0% fat Yogurts Probiotic frozen yogurt • • “Has redefined natural Italian ice cream culture in India” - Lalit Nirula, Nirulas “Superb quality & very consistent” - Priyanka & Robert Vadra “Arora can take a well deserved bow” - Sabina Seghal Saikia, Food Critic “Made professionally, fresh daily” - Marut Sikka, Food Consultant “All the chocolate flavours are to die for!” - Sandeep Gupta, Owner Hotels Hyatt Regency and The Qutab, Delhi “Very superior product” - Shatrujit Singh Tikka, Brand Advisor, Louis Vuitton, India “It’s even better than what we get in Italy” - Chiara & Daniele Criscuolo, Italian Embassy, Delhi | 5

PRODUCTS Gelato Cakes Niche product and clientele Customized based on orders received Handmade nutritious product Choice of 48 flavors available to consumers – can manufacture upto 500 flavors Made from natural ingredients – no synthetic flavors, essence, preservatives or color 100% vegetarian Low fat product – only 3%-4% Served by weight rather than volume Served at a higher temperature than the Ice Cream Shelf life – 90 days in deep freezer and 5 -7 days in shop Has lesser overrun compared to normal ice-cream i. e. less air content Few Testimonials Sorbets No milk, cream – is suitable for lactose intolerant people Made from fruits and water 0% fat Yogurts Probiotic frozen yogurt • • “Has redefined natural Italian ice cream culture in India” - Lalit Nirula, Nirulas “Superb quality & very consistent” - Priyanka & Robert Vadra “Arora can take a well deserved bow” - Sabina Seghal Saikia, Food Critic “Made professionally, fresh daily” - Marut Sikka, Food Consultant “All the chocolate flavours are to die for!” - Sandeep Gupta, Owner Hotels Hyatt Regency and The Qutab, Delhi “Very superior product” - Shatrujit Singh Tikka, Brand Advisor, Louis Vuitton, India “It’s even better than what we get in Italy” - Chiara & Daniele Criscuolo, Italian Embassy, Delhi | 5

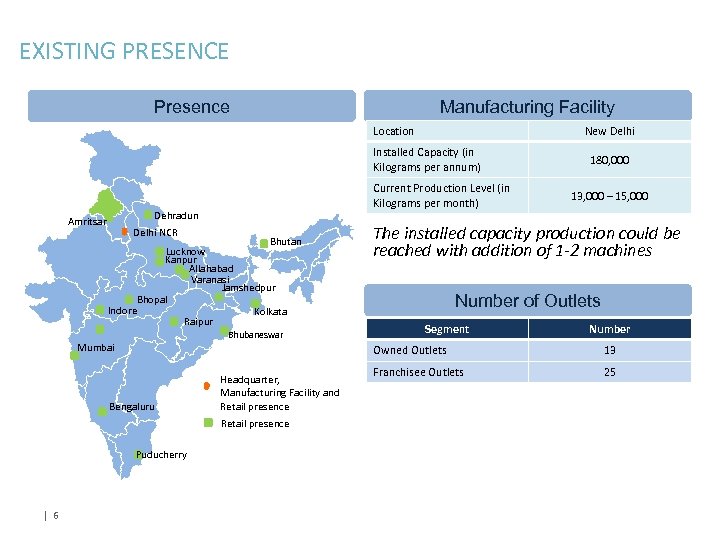

EXISTING PRESENCE Presence Manufacturing Facility Location New Delhi Installed Capacity (in Kilograms per annum) Current Production Level (in Kilograms per month) Dehradun Amritsar Delhi NCR Bhutan Lucknow Kanpur Allahabad Varanasi Jamshedpur Bhopal Indore Kolkata Raipur Bhubaneswar Mumbai 13, 000 – 15, 000 The installed capacity production could be reached with addition of 1 -2 machines Number of Outlets Segment Number Owned Outlets Bengaluru Headquarter, Manufacturing Facility and Retail presence Puducherry | 6 180, 000 13 Franchisee Outlets 25

EXISTING PRESENCE Presence Manufacturing Facility Location New Delhi Installed Capacity (in Kilograms per annum) Current Production Level (in Kilograms per month) Dehradun Amritsar Delhi NCR Bhutan Lucknow Kanpur Allahabad Varanasi Jamshedpur Bhopal Indore Kolkata Raipur Bhubaneswar Mumbai 13, 000 – 15, 000 The installed capacity production could be reached with addition of 1 -2 machines Number of Outlets Segment Number Owned Outlets Bengaluru Headquarter, Manufacturing Facility and Retail presence Puducherry | 6 180, 000 13 Franchisee Outlets 25

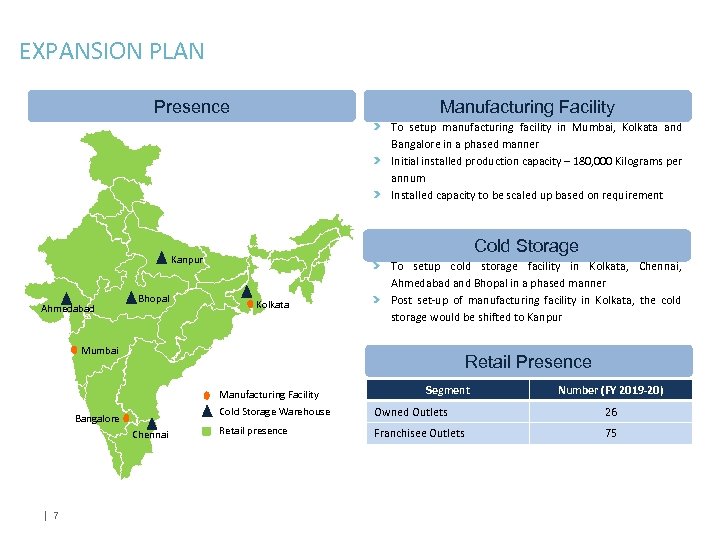

EXPANSION PLAN Presence Manufacturing Facility To setup manufacturing facility in Mumbai, Kolkata and Bangalore in a phased manner Initial installed production capacity – 180, 000 Kilograms per annum Installed capacity to be scaled up based on requirement Cold Storage Kanpur Ahmedabad Bhopal Kolkata To setup cold storage facility in Kolkata, Chennai, Ahmedabad and Bhopal in a phased manner Post set-up of manufacturing facility in Kolkata, the cold storage would be shifted to Kanpur Mumbai Retail Presence Manufacturing Facility Number (FY 2019 -20) Cold Storage Warehouse Bangalore Chennai | 7 Segment Owned Outlets 26 Retail presence Franchisee Outlets 75

EXPANSION PLAN Presence Manufacturing Facility To setup manufacturing facility in Mumbai, Kolkata and Bangalore in a phased manner Initial installed production capacity – 180, 000 Kilograms per annum Installed capacity to be scaled up based on requirement Cold Storage Kanpur Ahmedabad Bhopal Kolkata To setup cold storage facility in Kolkata, Chennai, Ahmedabad and Bhopal in a phased manner Post set-up of manufacturing facility in Kolkata, the cold storage would be shifted to Kanpur Mumbai Retail Presence Manufacturing Facility Number (FY 2019 -20) Cold Storage Warehouse Bangalore Chennai | 7 Segment Owned Outlets 26 Retail presence Franchisee Outlets 75

GO TO MARKET STRATEGY Brand visibility and customer acquisition for achieving the targets for pan-India presence would become a key – hence, the management proposes to engage one of the leading public relations agency for the same. Few marketing strategies are: Media Outreach Television advertisements focusing on key product quality of being low fat frozen dessert Articles and interviews in leading food based shows / channels, newspapers and food magazines Tasting sessions for journalists, food bloggers and health and nutrition experts to endorse brand in their respective areas Increase awareness and attract health conscious consumers Offers / Events Organizing festive carnivals / events in high footfall shopping malls along with media coverage of such carnivals / events Providing discount offers during such events and festive season Making presence felt among prospective consumers Product/ Store Launch Organizing brand launching events while entering new markets through launch parties / press conference Organizing new product launches in existing markets through media coverage Brand product awareness Brand Ambassado r | 8 Celebrity endorsements to promote ‘Gelato Vinto’ brand Attract celebrity driven mass market

GO TO MARKET STRATEGY Brand visibility and customer acquisition for achieving the targets for pan-India presence would become a key – hence, the management proposes to engage one of the leading public relations agency for the same. Few marketing strategies are: Media Outreach Television advertisements focusing on key product quality of being low fat frozen dessert Articles and interviews in leading food based shows / channels, newspapers and food magazines Tasting sessions for journalists, food bloggers and health and nutrition experts to endorse brand in their respective areas Increase awareness and attract health conscious consumers Offers / Events Organizing festive carnivals / events in high footfall shopping malls along with media coverage of such carnivals / events Providing discount offers during such events and festive season Making presence felt among prospective consumers Product/ Store Launch Organizing brand launching events while entering new markets through launch parties / press conference Organizing new product launches in existing markets through media coverage Brand product awareness Brand Ambassado r | 8 Celebrity endorsements to promote ‘Gelato Vinto’ brand Attract celebrity driven mass market

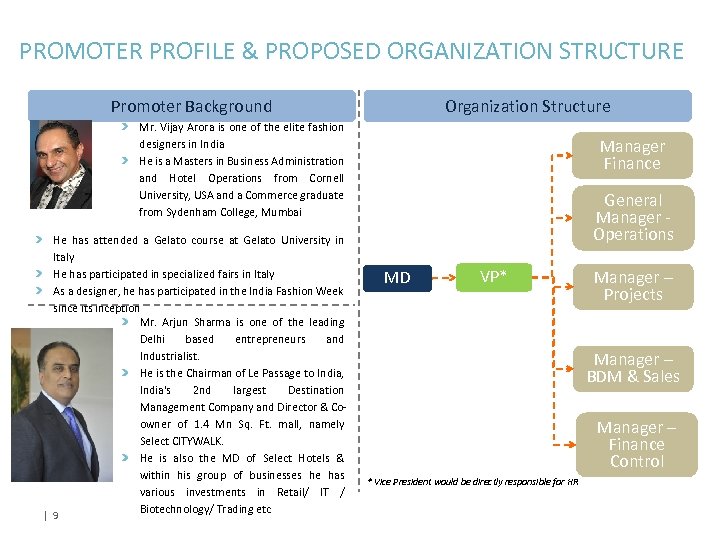

PROMOTER PROFILE & PROPOSED ORGANIZATION STRUCTURE Promoter Background Organization Structure Mr. Vijay Arora is one of the elite fashion designers in India He is a Masters in Business Administration and Hotel Operations from Cornell University, USA and a Commerce graduate from Sydenham College, Mumbai He has attended a Gelato course at Gelato University in Italy He has participated in specialized fairs in Italy As a designer, he has participated in the India Fashion Week since its inception Mr. Arjun Sharma is one of the leading Delhi based entrepreneurs and Industrialist. He is the Chairman of Le Passage to India, India's 2 nd largest Destination Management Company and Director & Coowner of 1. 4 Mn Sq. Ft. mall, namely Select CITYWALK. He is also the MD of Select Hotels & within his group of businesses he has various investments in Retail/ IT / Biotechnology/ Trading etc | 9 Manager Finance General Manager Operations MD VP* Manager – Projects Manager – BDM & Sales Manager – Finance Control * Vice President would be directly responsible for HR

PROMOTER PROFILE & PROPOSED ORGANIZATION STRUCTURE Promoter Background Organization Structure Mr. Vijay Arora is one of the elite fashion designers in India He is a Masters in Business Administration and Hotel Operations from Cornell University, USA and a Commerce graduate from Sydenham College, Mumbai He has attended a Gelato course at Gelato University in Italy He has participated in specialized fairs in Italy As a designer, he has participated in the India Fashion Week since its inception Mr. Arjun Sharma is one of the leading Delhi based entrepreneurs and Industrialist. He is the Chairman of Le Passage to India, India's 2 nd largest Destination Management Company and Director & Coowner of 1. 4 Mn Sq. Ft. mall, namely Select CITYWALK. He is also the MD of Select Hotels & within his group of businesses he has various investments in Retail/ IT / Biotechnology/ Trading etc | 9 Manager Finance General Manager Operations MD VP* Manager – Projects Manager – BDM & Sales Manager – Finance Control * Vice President would be directly responsible for HR

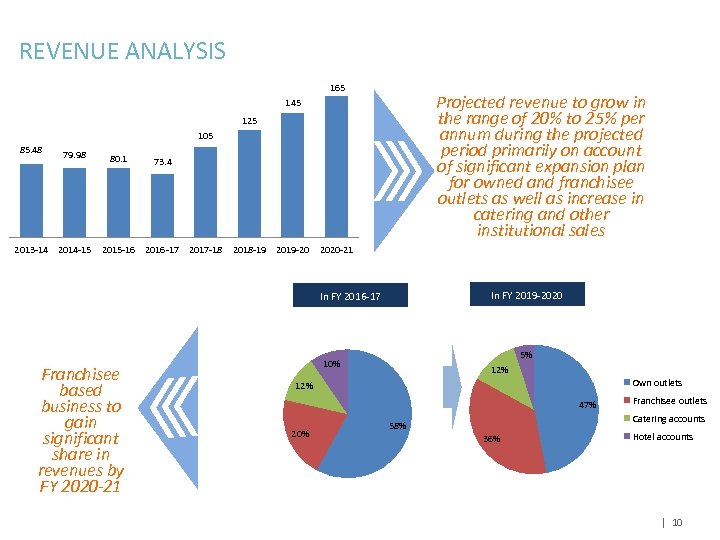

REVENUE ANALYSIS 165 Projected revenue to grow in the range of 20% to 25% per annum during the projected period primarily on account of significant expansion plan for owned and franchisee outlets as well as increase in catering and other institutional sales 145 125 105 85. 48 2013 -14 79. 98 80. 1 73. 4 2014 -15 2015 -16 2016 -17 2017 -18 2018 -19 2019 -20 2020 -21 In FY 2019 -2020 In FY 2016 -17 Franchisee based business to gain significant share in revenues by FY 2020 -21 5% 10% 12% Own outlets 12% 47% 20% Franchisee outlets Catering accounts 58% 36% Hotel accounts | 10

REVENUE ANALYSIS 165 Projected revenue to grow in the range of 20% to 25% per annum during the projected period primarily on account of significant expansion plan for owned and franchisee outlets as well as increase in catering and other institutional sales 145 125 105 85. 48 2013 -14 79. 98 80. 1 73. 4 2014 -15 2015 -16 2016 -17 2017 -18 2018 -19 2019 -20 2020 -21 In FY 2019 -2020 In FY 2016 -17 Franchisee based business to gain significant share in revenues by FY 2020 -21 5% 10% 12% Own outlets 12% 47% 20% Franchisee outlets Catering accounts 58% 36% Hotel accounts | 10

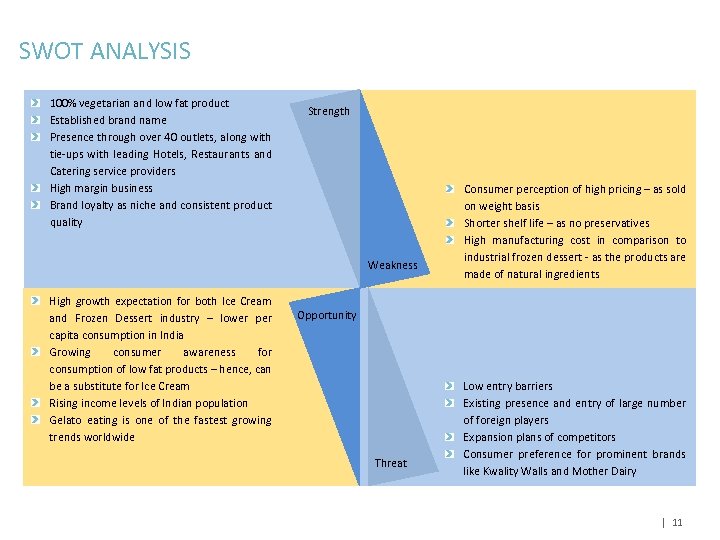

SWOT ANALYSIS 100% vegetarian and low fat product Established brand name Presence through over 40 outlets, along with tie-ups with leading Hotels, Restaurants and Catering service providers High margin business Brand loyalty as niche and consistent product quality Strength Weakness High growth expectation for both Ice Cream and Frozen Dessert industry – lower per capita consumption in India Growing consumer awareness for consumption of low fat products – hence, can be a substitute for Ice Cream Rising income levels of Indian population Gelato eating is one of the fastest growing trends worldwide Consumer perception of high pricing – as sold on weight basis Shorter shelf life – as no preservatives High manufacturing cost in comparison to industrial frozen dessert - as the products are made of natural ingredients Opportunity Threat Low entry barriers Existing presence and entry of large number of foreign players Expansion plans of competitors Consumer preference for prominent brands like Kwality Walls and Mother Dairy | 11

SWOT ANALYSIS 100% vegetarian and low fat product Established brand name Presence through over 40 outlets, along with tie-ups with leading Hotels, Restaurants and Catering service providers High margin business Brand loyalty as niche and consistent product quality Strength Weakness High growth expectation for both Ice Cream and Frozen Dessert industry – lower per capita consumption in India Growing consumer awareness for consumption of low fat products – hence, can be a substitute for Ice Cream Rising income levels of Indian population Gelato eating is one of the fastest growing trends worldwide Consumer perception of high pricing – as sold on weight basis Shorter shelf life – as no preservatives High manufacturing cost in comparison to industrial frozen dessert - as the products are made of natural ingredients Opportunity Threat Low entry barriers Existing presence and entry of large number of foreign players Expansion plans of competitors Consumer preference for prominent brands like Kwality Walls and Mother Dairy | 11

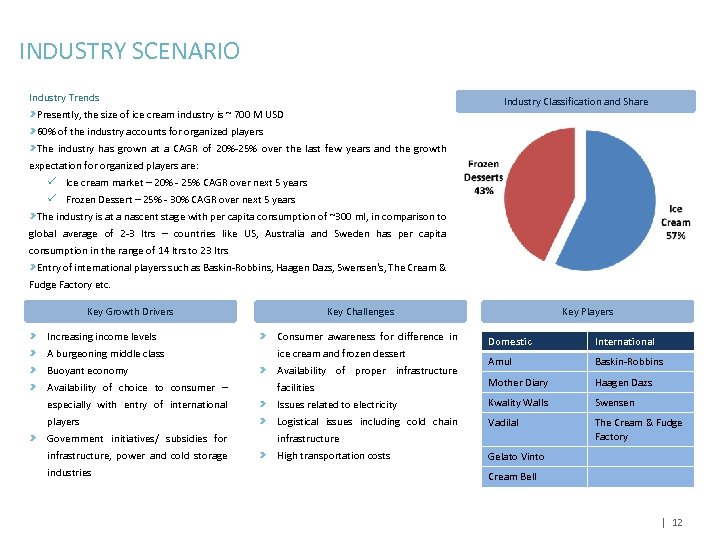

INDUSTRY SCENARIO Industry Trends Industry Classification and Share Presently, the size of ice cream industry is ~ 700 M USD 60% of the industry accounts for organized players The industry has grown at a CAGR of 20%-25% over the last few years and the growth expectation for organized players are: ü Ice cream market – 20% - 25% CAGR over next 5 years ü Frozen Dessert – 25% - 30% CAGR over next 5 years The industry is at a nascent stage with per capita consumption of ~300 ml, in comparison to global average of 2 -3 ltrs – countries like US, Australia and Sweden has per capita consumption in the range of 14 ltrs to 23 ltrs Entry of international players such as Baskin-Robbins, Haagen Dazs, Swensen's, The Cream & Fudge Factory etc. Key Growth Drivers Key Players Key Challenges Increasing income levels Consumer awareness for difference in A burgeoning middle class ice cream and frozen dessert Buoyant economy Availability of proper infrastructure Availability of choice to consumer – Domestic International Amul Baskin-Robbins facilities Mother Diary Haagen Dazs especially with entry of international Issues related to electricity Kwality Walls Swensen players Logistical issues including cold chain Vadilal Government initiatives/ subsidies for infrastructure The Cream & Fudge Factory infrastructure, power and cold storage High transportation costs industries Gelato Vinto Cream Bell | 12

INDUSTRY SCENARIO Industry Trends Industry Classification and Share Presently, the size of ice cream industry is ~ 700 M USD 60% of the industry accounts for organized players The industry has grown at a CAGR of 20%-25% over the last few years and the growth expectation for organized players are: ü Ice cream market – 20% - 25% CAGR over next 5 years ü Frozen Dessert – 25% - 30% CAGR over next 5 years The industry is at a nascent stage with per capita consumption of ~300 ml, in comparison to global average of 2 -3 ltrs – countries like US, Australia and Sweden has per capita consumption in the range of 14 ltrs to 23 ltrs Entry of international players such as Baskin-Robbins, Haagen Dazs, Swensen's, The Cream & Fudge Factory etc. Key Growth Drivers Key Players Key Challenges Increasing income levels Consumer awareness for difference in A burgeoning middle class ice cream and frozen dessert Buoyant economy Availability of proper infrastructure Availability of choice to consumer – Domestic International Amul Baskin-Robbins facilities Mother Diary Haagen Dazs especially with entry of international Issues related to electricity Kwality Walls Swensen players Logistical issues including cold chain Vadilal Government initiatives/ subsidies for infrastructure The Cream & Fudge Factory infrastructure, power and cold storage High transportation costs industries Gelato Vinto Cream Bell | 12

OUTLET PICTURES

OUTLET PICTURES