d091195fca46c5e9c5aedcf98bc52958.ppt

- Количество слайдов: 35

1 Compagnie de Financement Foncier Obligations Foncières Sandrine GUERIN Deputy CEO, Crédit Foncier

Historical issues 2

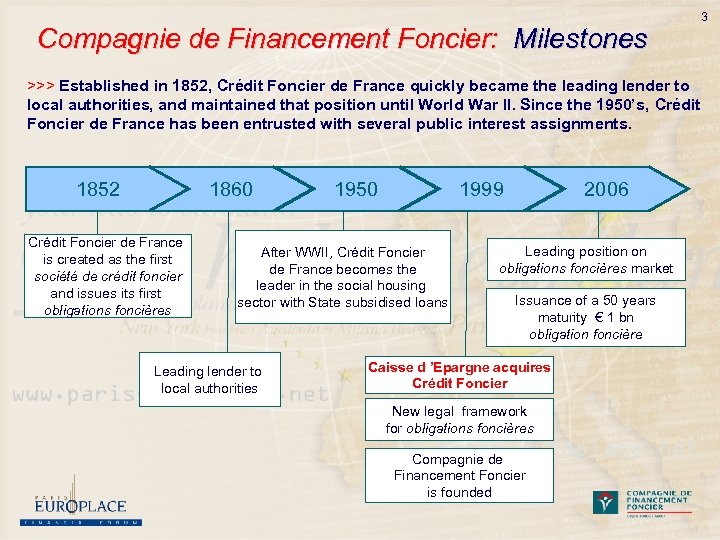

Compagnie de Financement Foncier: Milestones 3 >>> Established in 1852, Crédit Foncier de France quickly became the leading lender to local authorities, and maintained that position until World War II. Since the 1950’s, Crédit Foncier de France has been entrusted with several public interest assignments. 1852 1860 Crédit Foncier de France is created as the first société de crédit foncier and issues its first obligations foncières 1950 1999 After WWII, Crédit Foncier de France becomes the leader in the social housing sector with State subsidised loans Leading lender to local authorities 2006 Leading position on obligations foncières market Issuance of a 50 years maturity € 1 bn obligation foncière Caisse d ’Epargne acquires Crédit Foncier New legal framework for obligations foncières Compagnie de Financement Foncier is founded

Profile: Compagnie de Financement Foncier § Missions § (Articles L 515 – 13 et seq. of the Code monétaire et financier, the French Monetary and Financial Code) § Grant or acquire eligible assets: § Loans with a first rank mortgage, § Local authorities and public sector loans, § Securities issued or guaranteed by local authorities and public entities, § Senior securisation units of mortgage loans or loans to public entities. § Issue obligations foncières (French covered bonds). 4

Profile: Covered Bonds >>> Recent legal developments in Europe have provided a clear definition for covered bonds (UCITS) and ensure : § Legal security § § § Obligation to have a domestic legal framework which defines the covered bonds, Privileged claim on eligible assets. Economic security § § § High quality assets: i. e public sector, first rank mortgages, Permanent overcollateralisation. Institutional Security § Issuer is a European credit institution, § Specific control ensured by independent auditors. 5

Transparency & Security: the French legal framework >>> Stringent legal and regulatory framework designed to ensure maximum protection. § Transparency of the activity § A dedicated balance sheet and a sole purpose, § Mortgage loans, loans to local authorities and public entities. § Protection of bond holders § The bankruptcy or liquidation of its parent corporation cannot be extended to the société de crédit foncier itself, § Investors benefit from the privilege of obligations foncières, § Permanent overcollateralisation, § No ALM mismatch. All assets and liabilities are swapped to euros. 6

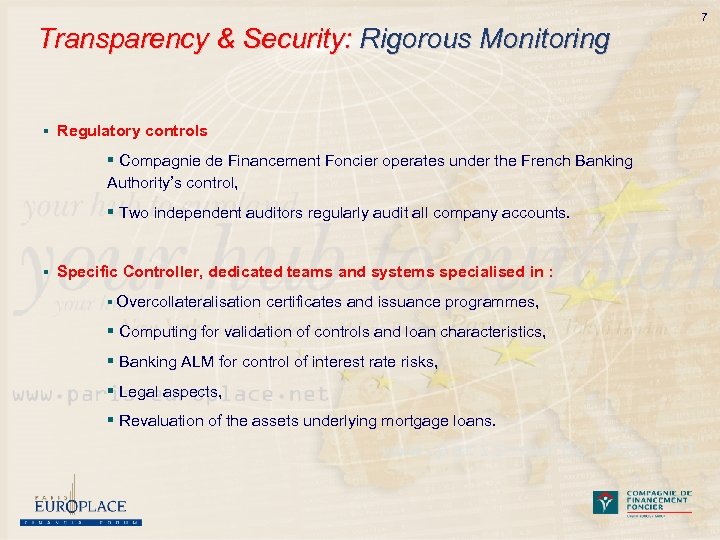

Transparency & Security: Rigorous Monitoring § Regulatory controls § Compagnie de Financement Foncier operates under the French Banking Authority’s control, § Two independent auditors regularly audit all company accounts. § Specific Controller, dedicated teams and systems specialised in : § Overcollateralisation certificates and issuance programmes, § Computing for validation of controls and loan characteristics, § Banking ALM for control of interest rate risks, § Legal aspects, § Revaluation of the assets underlying mortgage loans. 7

8 Key Figures (1/2) >>> Compagnie de Financement Foncier is a subsidiary of Crédit Foncier, Groupe Caisse d’Epargne, France’s third largest banking group. A robust and transparent balance sheet ( at June 30, 2006) ASSETS (EUR Billion) LIABILITIES (EUR Billion) Mortgage loans 17. 3 Obligations foncières 56. 8 Loans to public entities 19. 4 Other resources with privilege 1. 9 Securitisation Units (RMBS) 13. 9 Other eligible outstanding loans 2. 2 11. 5 Subordinated debts and capital 5. 6 64. 4 TOTAL LIABILITIES 64. 4 Replacement securities TOTAL ASSETS

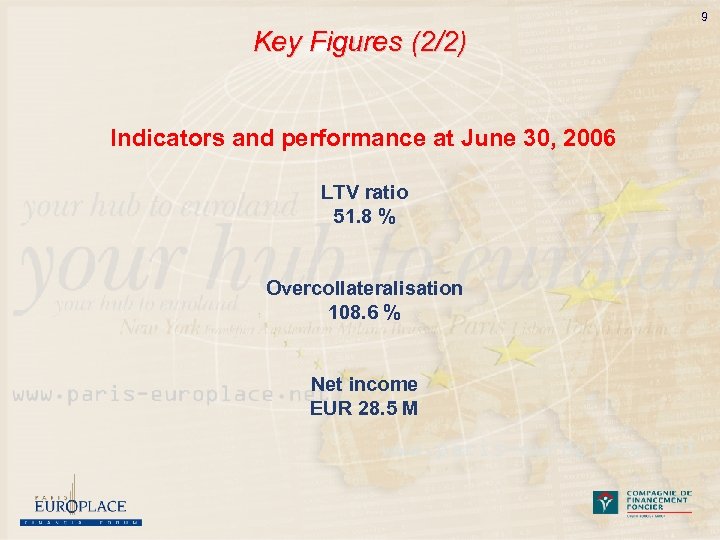

9 Key Figures (2/2) Indicators and performance at June 30, 2006 LTV ratio 51. 8 % Overcollateralisation 108. 6 % Net income EUR 28. 5 M

10 Our Strength: Differentiation in the Covered Bond Market

11 A transparent structure with a unique business model Compagnie de Financement Foncier Mortgage loans Obligations Foncières Replacement securities Public loans Eligible assets Subordinated Debt & Capital Investors Bonds issued by Local Authorities Securitisation Derivatives (swaps) >>> The obligations foncières of the Compagnie de Financement Foncier enjoy the best AAA/Aaa/AAA (stable outlook) ratings from the three Rating Agencies.

A stable AAA , Aaa, AAA rating >>> Compagnie de Financement Foncier has taken additional commitments to the three Rating Agencies, Standard and Poor’s, Moody’s and Fitch Ratings: § Strengthen its management rules in order to minimise its risks with regard to the regulation in force § Constitute an overcollateralisation greater than the legally required minimum level for a high residual risk coverage >>> Observance of these commitments allows the obligations foncières of the Compagnie de Financement Foncier, even in a stressed environment, with a cash flow analysis, to be awarded a AAA/Aaa/AAA rating from the three leading Rating Agencies 12

Transparency & Security: risk management (1/2) 13 >>> Compagnie de Financement Foncier is committed to maintaining overcollateralisation in order to eliminate risk exposure (credit risk, interest rate risk, liquidity risk and currency risk). § Credit risk § Loans : minimum rates of overcollateralisation, § Off-balance sheet operations, according to counterparty ratings. § Interest rate risk § All assets and liabilities on fixed-rate assets are swapped to floating rates, § Limitation of rate gaps (examined quarterly) and duration variances (< two years), § Stress test scenarios : to determine the level of non-privileged debt needed to meet obligations, even in worst case scenarios.

Transparency & Security : risk management (2/2) § Liquidity risk § Maintenance of 1 Year’s equivalent of liabilities in high quality liquid assets, § Maintenance of sufficient cash to cover the total daily debt maturities. § Currency risk §No open positions, § All transactions swapped to euros. >>> Strict management rules which ensure risk control and total transparency of financial information. >>> Structured AAA/Aaa/AAA rating by the three major Rating Agencies (Stable outlook 14

15 High Quality Assets

A portfolio of high quality assets >>> The quality of the assets results from the law on the société de crédit foncier as well as Compagnie de Financement Foncier’s extensive expertise. Breakdown of assets at June 30, 2006 EUR 64. 4 bn >>> Loans guaranteed or granted to public entities represent more than 47% of total assets, >>> Pure mortgage loans < 10%. 16

17 An Investor Focused Funding Approach

Four pillars of development Benchmarks • In EUR or USD • Market making by at least 5 major banks per benchmark • Taps of existing benchmark issues give liquidity on the secondary market Taps Private Placements Other Currencies • Ability to adapt to dynamic investor demand: currencies and structures • Development of liquid yield curves in non-euro currencies : AUD, CHF, GBP, JPY, CAD EUR 6. 9 bn in obligations foncières issued year to date 18

Recognised Issuing policy (1/2) Swap spread performance 5 Y 19

Recognised Issuing policy (2/2) Swap spread performance 10 Y 20

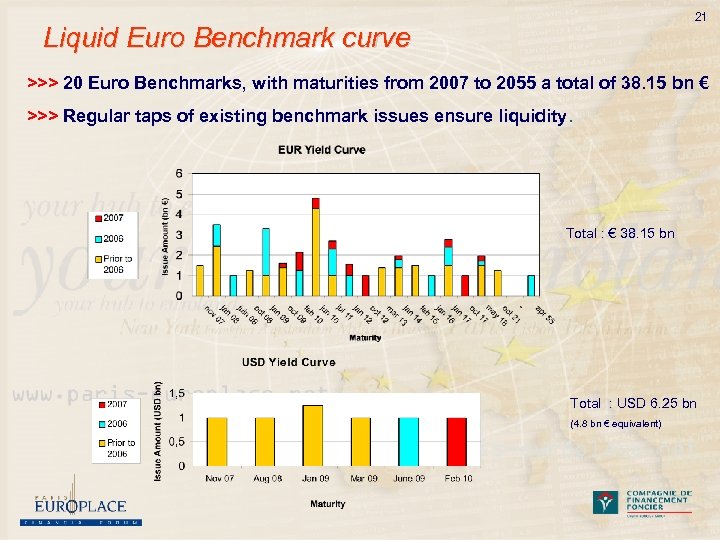

21 Liquid Euro Benchmark curve >>> 20 Euro Benchmarks, with maturities from 2007 to 2055 a total of 38. 15 bn € >>> Regular taps of existing benchmark issues ensure liquidity. Total : € 38. 15 bn Total : USD 6. 25 bn (4. 8 bn € equivalent)

22 Currency diversification: Liquid Public Issues GBP yield curve CHF yield curve 900 425 350 325 600 300 500 450 350 375 300 200 dec 07 may 11 dec 12 jan 14 jan 27 Total : GBP 1. 7 bn Dec 06 Jun 09 May 11 Apr 12 CAD yield curve Euro CAD (M) Feb 31 JPY yield curve Euro Yen (Md) 250 200 Aug 18 (2. 33 bn € equivalent) 750 200 Nov 16 Total : CHF 3. 68 bn AUD yield curve Kangaroo program (A$ 5 bn) (2. 55 bn € equivalent) Oct 14 50 Feb 10 100 Sep 15 50 50 Mar 10 Jan 11 Dec 11 Jan 17 Total : 1. 2 bn AUD (0. 6 bn € equivalent) Mar 08 Jun 12 Total : CAD 300 bn Total : JPY 150 bn (0. 20 bn € equivalent) (1 bn € equivalent)

An internationally recognised issuance policy (1/2) 23 >>> Selected transactions in 2006 Geographical distribution Others 4% Europe 11% Investor placement Banks 3% Asia 50% Others 1% Asset managers 8% USD 1 000 000 5. 5% Maturity 2009 3 y-r Issue Scandinavia 35% Pension funds 31% Central banks 57%

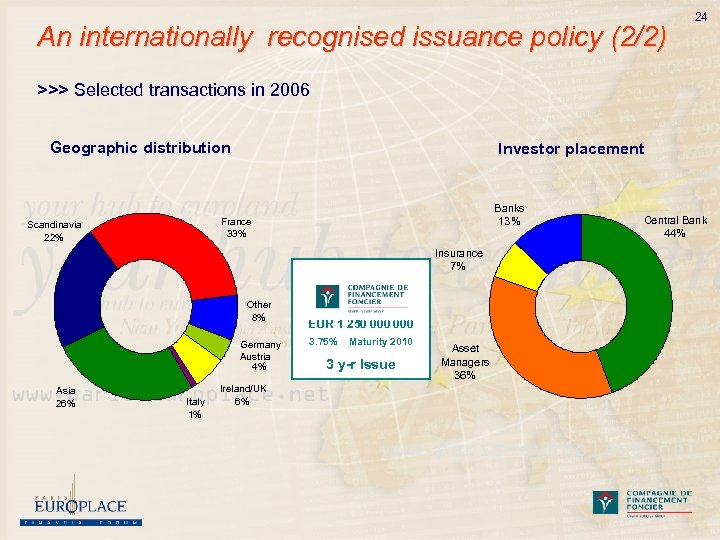

An internationally recognised issuance policy (2/2) 24 >>> Selected transactions in 2006 Geographic distribution Investor placement Banks 13% France 33% Scandinavia 22% Insurance 7% Other 8% Germany Austria 4% Asia 26% Italy 1% Ireland/UK 6% EUR 1 250 000 3. 75% Maturity 2010 3 y-r Issue Asset Managers 36% Central Bank 44%

Compagnie de Financement Foncier: an Innovative Issuer Investor placement Geographic distribution Austria Switz. (2 (1%) %) 25 Spain (3%) Hedge Funds (5%) Asia (1%) Lux. (2%) Banks (32%) Ireland (5%) Pension Funds UK (36%) (15%) Netherlands (7%) Central Banks (6%) EUR 1 000 000 3. 875% Maturity 2055 Germany (8%) 50 y-r Issue Insurances (17%) Italy (2%) France (10%) Asset Managers (25%) Scandinavia (23%) >>> The transaction is the second AAA reference in euro after the French OAT 2055 launched in January 2005. It confirms Compagnie de Financement Foncier’s place as a leading issuer of obligations foncières and strengthens its position as one of Europe’s AAA issuers able to access the longest maturities.

26 Funding Policy Year 2006 2007 Year to date >>> Objective : Eur 15 bn >>> Objective : Eur 22 -25 bn >>> Eur 17. 26 bn in issuance >>> Eur 6. 90 bn in issuance § Public issues : 12. 93 bn § Public issues : 6. 18 bn § Private placement : 4. 33 bn, 54 issues, average size per issue : EUR 80. 23 M § Private placement : 0. 72 bn, 7 issues , average size per issue : EUR 44. 43 M 2006 Private placement by structures Zéro coupon 0, 7% Switchable 8, 5% Rev. Floater 4, 3% CMS Link 4, 5% Index Linked Callable Partly Paid 2, 1% 0, 2% 1, 2% FRN 5, 6% CMS Spread 2, 1% Range Accrual 3, 9% Fixed Rate 67, 2% 2007 Private placement by structures

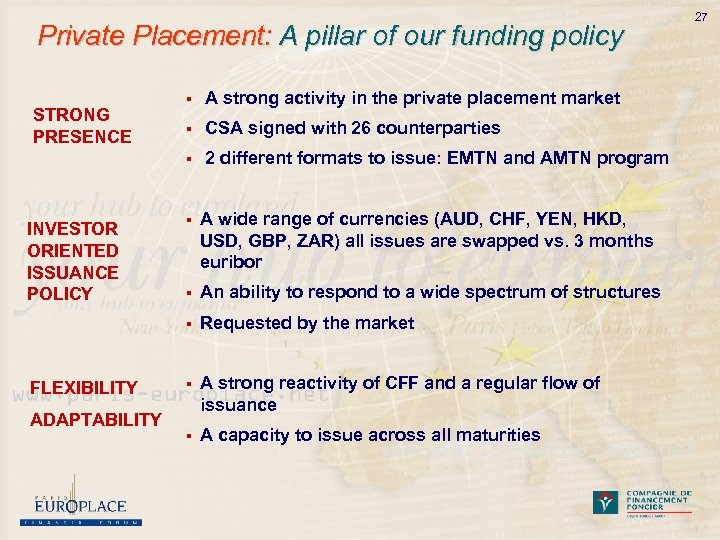

Private Placement: A pillar of our funding policy FLEXIBILITY ADAPTABILITY § CSA signed with 26 counterparties 2 different formats to issue: EMTN and AMTN program § A wide range of currencies (AUD, CHF, YEN, HKD, USD, GBP, ZAR) all issues are swapped vs. 3 months euribor § An ability to respond to a wide spectrum of structures § INVESTOR ORIENTED ISSUANCE POLICY A strong activity in the private placement market § STRONG PRESENCE § Requested by the market § A strong reactivity of CFF and a regular flow of issuance § A capacity to issue across all maturities 27

28 Private Placement Structured Issues CHF 150 M ZAR 565 M (EUR 58 M) EUR 221. 8 M CMS Linked 8. 97% Multi Index Linked Maturity : 21/03/2014 Maturity : 12/10/2007 Maturity : 25/02/2013 EUR 715 M BRL 300 M (EUR 107 M) EUR 115 M CMS Linked 11. 16% FRN Range Accrual Maturity : 06/08/2024 Maturity : 08/02/2008 Maturity : 16/03/2026 EUR 2 056 M EUR 44 M AUD 20 M (EUR 11. 7 M) Tec 10 Linked RA European Inflation FRN Range Accrual Maturity : 25/07/2020 Maturity : 27/03/2012 Maturity : 29/10/2010 EUR 20. 4 M EUR 342 M EUR 50 M 3. 25% Amortising French CPI Linked Partly Paid Maturity : 30/12/2044 Maturity : 17/02/2015 Maturity : 29/05/2021

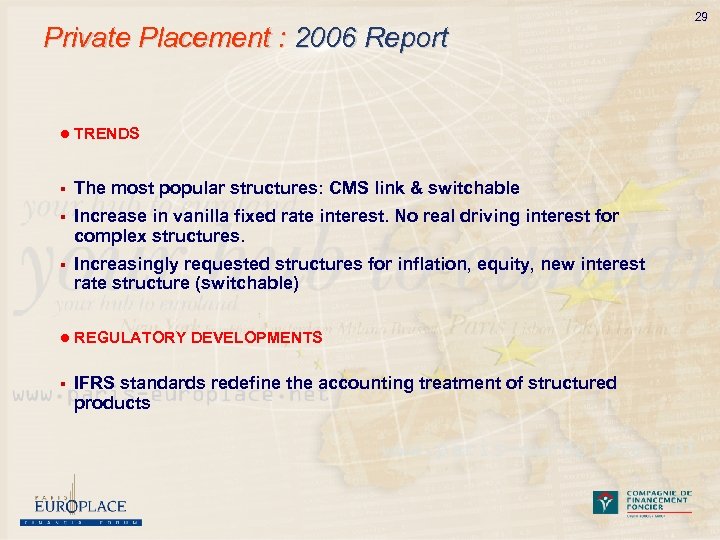

Private Placement : 2006 Report l TRENDS § The most popular structures: CMS link & switchable § Increase in vanilla fixed rate interest. No real driving interest for complex structures. § Increasingly requested structures for inflation, equity, new interest rate structure (switchable) l REGULATORY DEVELOPMENTS § IFRS standards redefine the accounting treatment of structured products 29

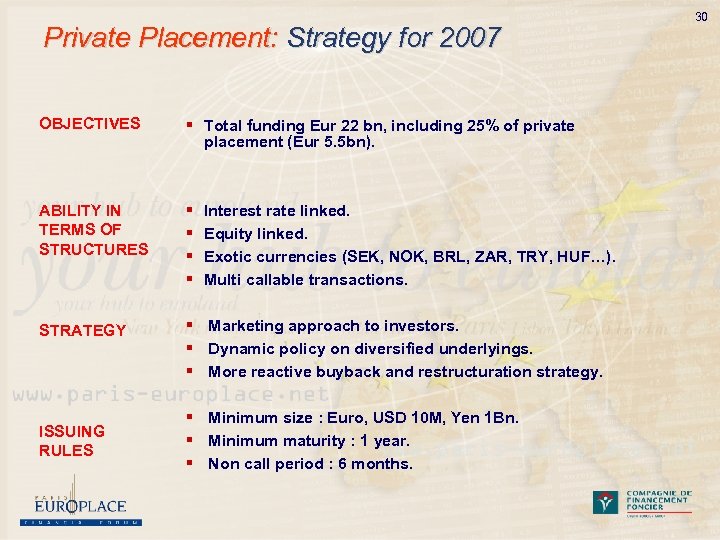

Private Placement: Strategy for 2007 OBJECTIVES § Total funding Eur 22 bn, including 25% of private placement (Eur 5. 5 bn). ABILITY IN TERMS OF STRUCTURES § § STRATEGY § Marketing approach to investors. § Dynamic policy on diversified underlyings. § More reactive buyback and restructuration strategy. ISSUING RULES Interest rate linked. Equity linked. Exotic currencies (SEK, NOK, BRL, ZAR, TRY, HUF…). Multi callable transactions. § Minimum size : Euro, USD 10 M, Yen 1 Bn. § Minimum maturity : 1 year. § Non call period : 6 months. 30

31 Appendix

Market-Making Agreement for Jumbo Obligations Foncières § Jumbo obligations foncières issues of at least EUR 500 million, quoted on at least two European markets and which have obtained the rating of at least 2 rating agencies § At least three market-makers per issue, who undertake to quote firm buy and sell prices throughout the life of the issue § Market-making commitment for amounts of EUR 15 million § Bid/Ask spreads of between 5 and 20 bp, depending on the remaining life of the issue § A specific quotation page (details of the issue, price, spreads, etc) § Repo facilities for issues exceeding EUR 1 billion >>> This general agreement has been signed by more than 20 banks 32

33 Issuer Information l. EUR 75, 000, 000 l. Euro Medium Term Note Programme lfor the issue of Obligations Foncières l. Offering circular: August 2006 l. Currencies: EUR, USD, HKD, CHF, GBP, JPY, CAD. l. Permitted maturity: from one month l. Minimum denomination: EUR 1, 000 l. Governing law: French law l. Arranger Deutsche Bank l. Dealers Crédit Foncier de France BNP Paribas ABN AMRO Dresdner Kleinwort IXIS CIB Morgan Stanley Merrill Lynch International Nomura International Barclay’s Capital Calyon CIB Crédit Suisse HSBC Société Générale CIB

34 Contacts Sandrine GUERIN Deputy CEO sandrine. guerin@creditfoncier. fr Christophe FRANKEL Managing Director Head of Financial Markets Christophe. frankel@creditfoncier. fr Paul DUDOUIT Managing Director Head of Long Term Funding +33 1 57 44 80 12 paul. dudouit@creditfoncier. fr Sean SMATT Director Public Issuance +33 1 57 44 92 08 sean. smatt@creditfoncier. fr Thibaut BIENAIME Public Issuance +33 1 57 44 92 17 thibaut. bienaime@creditfoncier. fr Nathalie MICHEL Executive Director Head of Private Placements +33 1 57 44 92 28 nathalie. michel@creditfoncier. fr Anne SADOURNY Investor Relations +33 1 57 44 72 27 anne. sadourny@creditfoncier. fr Arnaud MAURIN Private Placements +33 1 57 44 98 89 Arnaud. maurin@creditfoncier. fr

35 Disclaimer This document shall not be considered as an invitation to invest. It should in no event be considered as a solicitation of business or a public issue and does not constitute an offer to buy, sell, subscribe, or provide financial services. It should also not be considered as a recommendation or a solicitation to buy or sell of obligations foncières or any other investment product. This information is provided "as is", and is for information purposes only. It has nonetheless been supplied by sources that are deemed to be reliable. Compagnie de Financement Foncier endeavors to ensure that the information is accurate and up-to-date, and reserves the right to make corrections to the content at any time, without prior notice. It is not however in a position to guarantee that such information is complete. It moreover refuses all responsibility in the event of any mistake or omission relating to such information. You hereby acknowledge that the use and interpretation of this information requires specific and in-depth knowledge of financial markets. Compagnie de Financement Foncier and its contributors refuse any responsibility in relation to the use that could be made of the financial information contained in this document and the possible consequences of such use, in particular as regards decisions made or actions taken on the basis thereof. In this respect, you shall remain solely responsible for the information and results obtained on the basis of this information. Additional information regarding this presentation will be furnished upon request. Compagnie de Financement Foncier 4, Quai de Bercy 94224 Charenton cedex France www. foncier. fr 15 mars 2007

d091195fca46c5e9c5aedcf98bc52958.ppt