938b844e921a36078550bf062a6d1bda.ppt

- Количество слайдов: 29

1

1

CHALLENGES & OPPORTUNITIES IN A CHANGING HEALTH CARE ENVIRONMENT Pamela S. Hyde, J. D. SAMHSA Administrator NASMHPD Washington, DC • July 16, 2012

CHALLENGES & OPPORTUNITIES IN A CHANGING HEALTH CARE ENVIRONMENT Pamela S. Hyde, J. D. SAMHSA Administrator NASMHPD Washington, DC • July 16, 2012

TODAY’S DISCUSSION 3 SAMHSA’S BUDGET HEALTH REFORM DISASTER/EMERGENCY RESPONSE

TODAY’S DISCUSSION 3 SAMHSA’S BUDGET HEALTH REFORM DISASTER/EMERGENCY RESPONSE

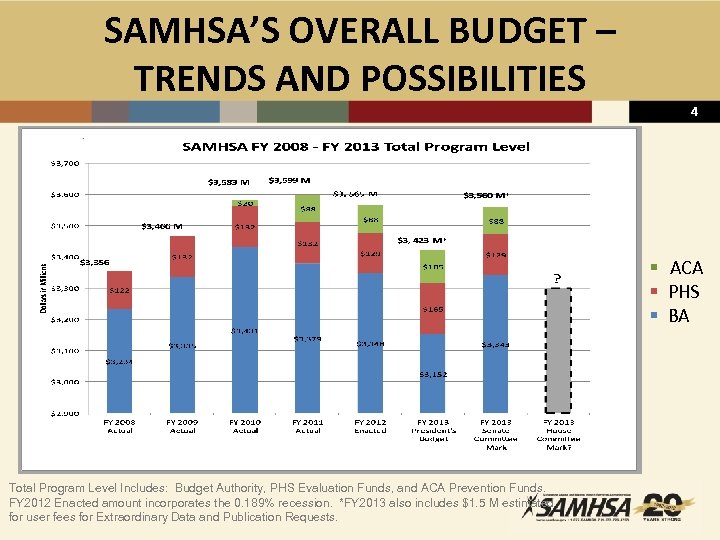

SAMHSA’S OVERALL BUDGET – TRENDS AND POSSIBILITIES 4 § ACA § PHS § BA Total Program Level Includes: Budget Authority, PHS Evaluation Funds, and ACA Prevention Funds. FY 2012 Enacted amount incorporates the 0. 189% recession. *FY 2013 also includes $1. 5 M estimated for user fees for Extraordinary Data and Publication Requests.

SAMHSA’S OVERALL BUDGET – TRENDS AND POSSIBILITIES 4 § ACA § PHS § BA Total Program Level Includes: Budget Authority, PHS Evaluation Funds, and ACA Prevention Funds. FY 2012 Enacted amount incorporates the 0. 189% recession. *FY 2013 also includes $1. 5 M estimated for user fees for Extraordinary Data and Publication Requests.

FY 2013 LIKELY SCENARIOS 5 èPresident’s Budget, Senate Committee Mark, and House Mark (7/18/12) • All signal positions, not decisions èCR(s) Likely • How long and how much depends. . . • Likely equal to or less than FY 2012 èSequester Jan 2013 = ~ 7. 8 percent ↓ from FY 12 • Applied to FY 2013 (enacted or CR) • Executive’s/OMB’s role

FY 2013 LIKELY SCENARIOS 5 èPresident’s Budget, Senate Committee Mark, and House Mark (7/18/12) • All signal positions, not decisions èCR(s) Likely • How long and how much depends. . . • Likely equal to or less than FY 2012 èSequester Jan 2013 = ~ 7. 8 percent ↓ from FY 12 • Applied to FY 2013 (enacted or CR) • Executive’s/OMB’s role

FY 2013 BUDGET ISSUES 6 èPrevention èBlock Grants èDisaster Distress Hotline èGrants for Adult Trauma Screening and Brief Intervention (GATSBI) èPHS Evaluation/HHS Taps èSAMHSA’s 4 Appropriations & Central Cost Budget (CCB)

FY 2013 BUDGET ISSUES 6 èPrevention èBlock Grants èDisaster Distress Hotline èGrants for Adult Trauma Screening and Brief Intervention (GATSBI) èPHS Evaluation/HHS Taps èSAMHSA’s 4 Appropriations & Central Cost Budget (CCB)

FY 2014 CHALLENGES 7 èFlat From or 5 Percent ↓ From President’s FY 2013 èEnacted FY 2013 or FY 2013 CR(s) = Different Base èImpact of Health Reform on Individual Line Items

FY 2014 CHALLENGES 7 èFlat From or 5 Percent ↓ From President’s FY 2013 èEnacted FY 2013 or FY 2013 CR(s) = Different Base èImpact of Health Reform on Individual Line Items

SAMHSA’S FY 2014 PRINCIPLES (IF POSSIBLE. . . ) èContinue holistic approach through joint funding èBuild off innovations from previous funding cycles èMaintain support for Strategic Initiatives; target available funding for top priorities èAvoid terminations and reducing continuation awards èMaintain ratio of SA and MH funding (~ 70/30) èMaintain approximate ratio of block grant to discretionary funding (~ 65/35) 8

SAMHSA’S FY 2014 PRINCIPLES (IF POSSIBLE. . . ) èContinue holistic approach through joint funding èBuild off innovations from previous funding cycles èMaintain support for Strategic Initiatives; target available funding for top priorities èAvoid terminations and reducing continuation awards èMaintain ratio of SA and MH funding (~ 70/30) èMaintain approximate ratio of block grant to discretionary funding (~ 65/35) 8

9 HEALTH REFORM http: //www. samhsa. gov/Health. Reform/

9 HEALTH REFORM http: //www. samhsa. gov/Health. Reform/

SAMHSA’S HEALTH REFORM PRIORITIES – FY 2012 AND FY 2013 èUniform Block Grant Application FYs 2014 -2015 • In Fed Reg for 60 -day public comment as of 7 -13 -12 èEnrollment – Preparation èEssential Benefits and Qualified Health Plans èProvider Capacity Development èWorkforce èContinuing Work with Medicaid • Health homes, rules/regs, service definitions and evidence, screening, prevention, duals, PBHCI • Parity – MHPAEA/ACA Implementation & Communication èQuality and Data (including HIT) 10

SAMHSA’S HEALTH REFORM PRIORITIES – FY 2012 AND FY 2013 èUniform Block Grant Application FYs 2014 -2015 • In Fed Reg for 60 -day public comment as of 7 -13 -12 èEnrollment – Preparation èEssential Benefits and Qualified Health Plans èProvider Capacity Development èWorkforce èContinuing Work with Medicaid • Health homes, rules/regs, service definitions and evidence, screening, prevention, duals, PBHCI • Parity – MHPAEA/ACA Implementation & Communication èQuality and Data (including HIT) 10

2014 – MORE AMERICANS WILL HAVE HEALTH COVERAGE OPPORTUNITIES 11 è Currently, 37. 9 million are uninsured <400% FPL* • 18. 0 M – Medicaid expansion eligible • 19. 9 M – ACA exchange eligible** • 11. 019 M (29%) – Have BH condition(s) * Source: 2010 NSDUH **Eligible for premium tax credits and not eligible for Medicaid

2014 – MORE AMERICANS WILL HAVE HEALTH COVERAGE OPPORTUNITIES 11 è Currently, 37. 9 million are uninsured <400% FPL* • 18. 0 M – Medicaid expansion eligible • 19. 9 M – ACA exchange eligible** • 11. 019 M (29%) – Have BH condition(s) * Source: 2010 NSDUH **Eligible for premium tax credits and not eligible for Medicaid

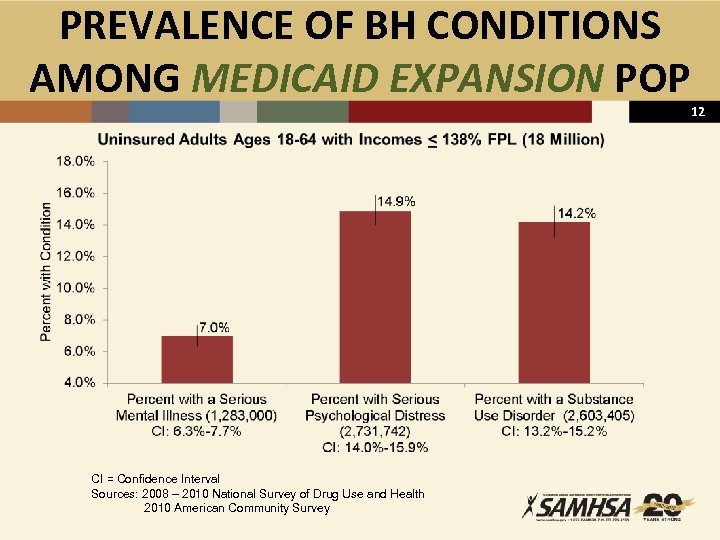

PREVALENCE OF BH CONDITIONS AMONG MEDICAID EXPANSION POP CI = Confidence Interval Sources: 2008 – 2010 National Survey of Drug Use and Health 2010 American Community Survey 12

PREVALENCE OF BH CONDITIONS AMONG MEDICAID EXPANSION POP CI = Confidence Interval Sources: 2008 – 2010 National Survey of Drug Use and Health 2010 American Community Survey 12

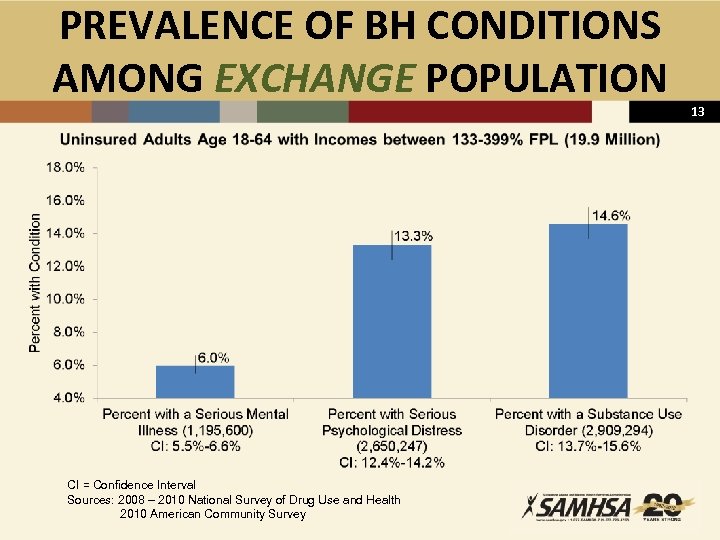

PREVALENCE OF BH CONDITIONS AMONG EXCHANGE POPULATION CI = Confidence Interval Sources: 2008 – 2010 National Survey of Drug Use and Health 2010 American Community Survey 13

PREVALENCE OF BH CONDITIONS AMONG EXCHANGE POPULATION CI = Confidence Interval Sources: 2008 – 2010 National Survey of Drug Use and Health 2010 American Community Survey 13

FOCUS: ENROLLMENT 14 èConsumer Enrollment Assistance (in 8 states) • • • Outreach/public education Enrollment/re-determination assistance Plan comparison and selection Grievance procedures Eligibility/enrollment communication materials èEnrollment Assistance Best Practices TA and Toolkits èCommunication Strategy – Message Testing, Outreach to Stakeholder Groups, Webinars/Training Opportunities èSOAR Changes to Address New Environment èData Work with ASPE and CMS

FOCUS: ENROLLMENT 14 èConsumer Enrollment Assistance (in 8 states) • • • Outreach/public education Enrollment/re-determination assistance Plan comparison and selection Grievance procedures Eligibility/enrollment communication materials èEnrollment Assistance Best Practices TA and Toolkits èCommunication Strategy – Message Testing, Outreach to Stakeholder Groups, Webinars/Training Opportunities èSOAR Changes to Address New Environment èData Work with ASPE and CMS

ESSENTIAL HEALTH BENEFITS (EHB) 10 BENEFIT CATEGORIES 15 1. Ambulatory patient services 2. Emergency services 3. Hospitalization 4. Maternity and newborn care 5. Mental health and substance use disorder services, including behavioral health treatment 6. Prescription drugs 7. Rehabilitative and habilitative services and devices 8. Laboratory services 9. Preventive and wellness services and chronic disease management 10. Pediatric services, including oral and vision care

ESSENTIAL HEALTH BENEFITS (EHB) 10 BENEFIT CATEGORIES 15 1. Ambulatory patient services 2. Emergency services 3. Hospitalization 4. Maternity and newborn care 5. Mental health and substance use disorder services, including behavioral health treatment 6. Prescription drugs 7. Rehabilitative and habilitative services and devices 8. Laboratory services 9. Preventive and wellness services and chronic disease management 10. Pediatric services, including oral and vision care

EHB BENCHMARK APPROACH èServes as Reference Plan 16 • Reflecting scope of services and limits offered by a “typical employer plan” in that state èStates Allowed to Select a Single Benchmark Plan: • 1 of 3 largest small group market plans (default), or • 1 of 3 largest state employee plans, or • 1 of 3 largest federal employee plans, or • Largest HMO plan in a state èEHB Mini Rule – Thru 9/30/12 Critical

EHB BENCHMARK APPROACH èServes as Reference Plan 16 • Reflecting scope of services and limits offered by a “typical employer plan” in that state èStates Allowed to Select a Single Benchmark Plan: • 1 of 3 largest small group market plans (default), or • 1 of 3 largest state employee plans, or • 1 of 3 largest federal employee plans, or • Largest HMO plan in a state èEHB Mini Rule – Thru 9/30/12 Critical

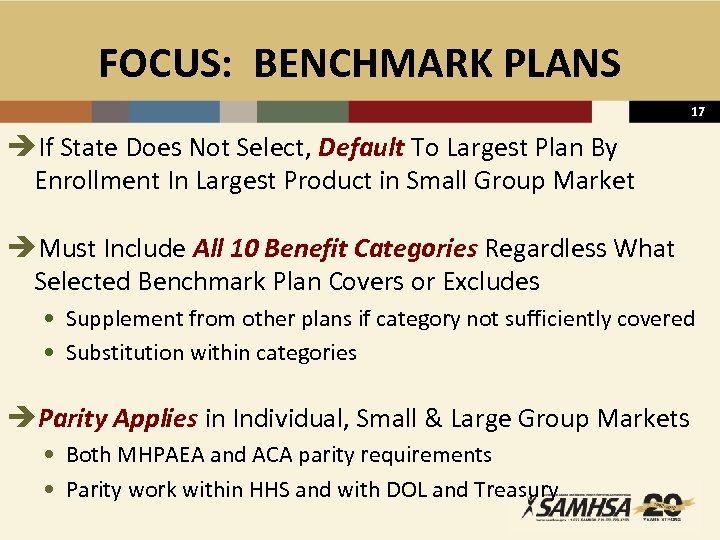

FOCUS: BENCHMARK PLANS 17 èIf State Does Not Select, Default To Largest Plan By Enrollment In Largest Product in Small Group Market èMust Include All 10 Benefit Categories Regardless What Selected Benchmark Plan Covers or Excludes • Supplement from other plans if category not sufficiently covered • Substitution within categories èParity Applies in Individual, Small & Large Group Markets • Both MHPAEA and ACA parity requirements • Parity work within HHS and with DOL and Treasury

FOCUS: BENCHMARK PLANS 17 èIf State Does Not Select, Default To Largest Plan By Enrollment In Largest Product in Small Group Market èMust Include All 10 Benefit Categories Regardless What Selected Benchmark Plan Covers or Excludes • Supplement from other plans if category not sufficiently covered • Substitution within categories èParity Applies in Individual, Small & Large Group Markets • Both MHPAEA and ACA parity requirements • Parity work within HHS and with DOL and Treasury

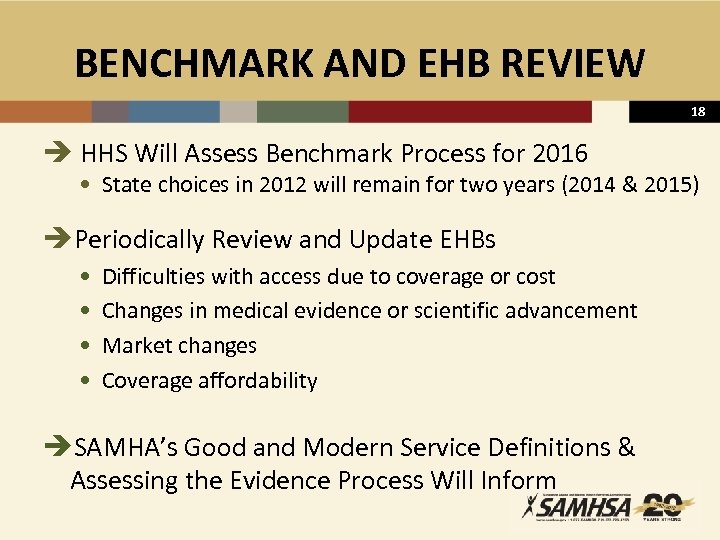

BENCHMARK AND EHB REVIEW 18 è HHS Will Assess Benchmark Process for 2016 • State choices in 2012 will remain for two years (2014 & 2015) èPeriodically Review and Update EHBs • • Difficulties with access due to coverage or cost Changes in medical evidence or scientific advancement Market changes Coverage affordability èSAMHA’s Good and Modern Service Definitions & Assessing the Evidence Process Will Inform

BENCHMARK AND EHB REVIEW 18 è HHS Will Assess Benchmark Process for 2016 • State choices in 2012 will remain for two years (2014 & 2015) èPeriodically Review and Update EHBs • • Difficulties with access due to coverage or cost Changes in medical evidence or scientific advancement Market changes Coverage affordability èSAMHA’s Good and Modern Service Definitions & Assessing the Evidence Process Will Inform

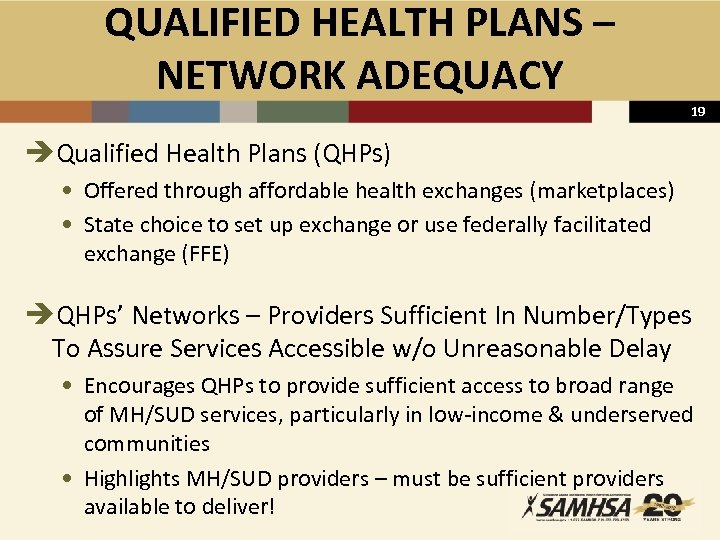

QUALIFIED HEALTH PLANS – NETWORK ADEQUACY 19 èQualified Health Plans (QHPs) • Offered through affordable health exchanges (marketplaces) • State choice to set up exchange or use federally facilitated exchange (FFE) èQHPs’ Networks – Providers Sufficient In Number/Types To Assure Services Accessible w/o Unreasonable Delay • Encourages QHPs to provide sufficient access to broad range of MH/SUD services, particularly in low-income & underserved communities • Highlights MH/SUD providers – must be sufficient providers available to deliver!

QUALIFIED HEALTH PLANS – NETWORK ADEQUACY 19 èQualified Health Plans (QHPs) • Offered through affordable health exchanges (marketplaces) • State choice to set up exchange or use federally facilitated exchange (FFE) èQHPs’ Networks – Providers Sufficient In Number/Types To Assure Services Accessible w/o Unreasonable Delay • Encourages QHPs to provide sufficient access to broad range of MH/SUD services, particularly in low-income & underserved communities • Highlights MH/SUD providers – must be sufficient providers available to deliver!

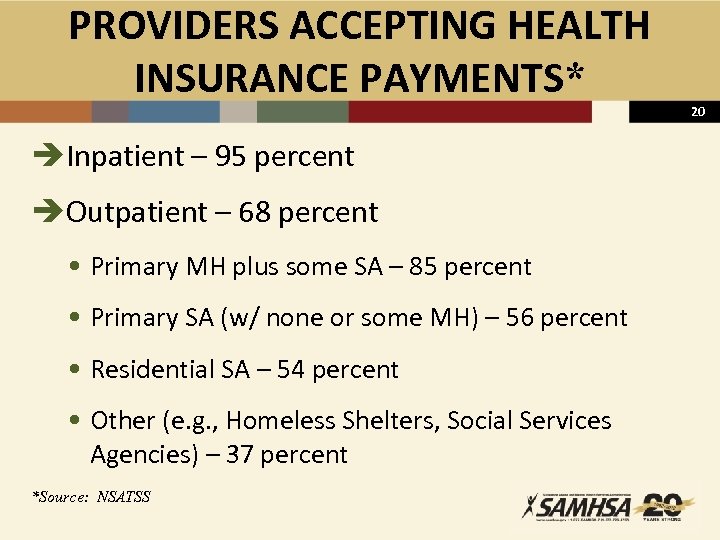

PROVIDERS ACCEPTING HEALTH INSURANCE PAYMENTS* èInpatient – 95 percent èOutpatient – 68 percent • Primary MH plus some SA – 85 percent • Primary SA (w/ none or some MH) – 56 percent • Residential SA – 54 percent • Other (e. g. , Homeless Shelters, Social Services Agencies) – 37 percent *Source: NSATSS 20

PROVIDERS ACCEPTING HEALTH INSURANCE PAYMENTS* èInpatient – 95 percent èOutpatient – 68 percent • Primary MH plus some SA – 85 percent • Primary SA (w/ none or some MH) – 56 percent • Residential SA – 54 percent • Other (e. g. , Homeless Shelters, Social Services Agencies) – 37 percent *Source: NSATSS 20

SOURCE OF FUNDS FOR CMHCS* 21 èState/County Indigent Funds – 43 percent èMedicaid – 37 percent èPrivate health insurance – 6 percent èSelf-pay – 6 percent *Source: 2011 National Council Survey

SOURCE OF FUNDS FOR CMHCS* 21 èState/County Indigent Funds – 43 percent èMedicaid – 37 percent èPrivate health insurance – 6 percent èSelf-pay – 6 percent *Source: 2011 National Council Survey

FOCUS: PROVIDER READINESS 22 èSAMHSA Provider Training/TA Topics for FY 2013 • • • Business strategy under health reform Third-party contract negotiation – provider network skills Third-party billing and compliance Eligibility determinations and enrollment assistance HIT adoption to meaningful use standards Targeting high-risk providers èProvider Infrastructure (“Biz Ops”) Contract • Proposals in review; selected before end of FY 2012 • Training and technical assistance • Learning collaboratives

FOCUS: PROVIDER READINESS 22 èSAMHSA Provider Training/TA Topics for FY 2013 • • • Business strategy under health reform Third-party contract negotiation – provider network skills Third-party billing and compliance Eligibility determinations and enrollment assistance HIT adoption to meaningful use standards Targeting high-risk providers èProvider Infrastructure (“Biz Ops”) Contract • Proposals in review; selected before end of FY 2012 • Training and technical assistance • Learning collaboratives

WORKFORCE CHALLENGES 23 è Worker shortages and distribution è More than one-half of BH workforce is over age 50 è Between 70 to 90 percent of BH workforce is white è Inadequately and inconsistently trained workers è Education/training programs not reflecting current research base è Billing involves increasing licensing & credentialing requirements è High levels of turnover è Difficulties recruiting people to field – esp. , from minority communities è Inadequate compensation è Poorly defined career pathways

WORKFORCE CHALLENGES 23 è Worker shortages and distribution è More than one-half of BH workforce is over age 50 è Between 70 to 90 percent of BH workforce is white è Inadequately and inconsistently trained workers è Education/training programs not reflecting current research base è Billing involves increasing licensing & credentialing requirements è High levels of turnover è Difficulties recruiting people to field – esp. , from minority communities è Inadequate compensation è Poorly defined career pathways

SAMHSA WORKFORCE ACTIVITIES 24 èPlans and Reports • To Congress – in Process èTraining/TA – Technology Transfer & Evidence-Based Practices • ATTCs, SBIRT Medical Residency Training, TA Centers, Webinars, Mtgs èResources – Written and Electronic • Publications, TIPS, TAPS, Websites, Facebook, Texting, Archived Webinars èLearning Collaboratives • National Network to Eliminate Disparities in BH (NNED) èMinority Fellowship Program

SAMHSA WORKFORCE ACTIVITIES 24 èPlans and Reports • To Congress – in Process èTraining/TA – Technology Transfer & Evidence-Based Practices • ATTCs, SBIRT Medical Residency Training, TA Centers, Webinars, Mtgs èResources – Written and Electronic • Publications, TIPS, TAPS, Websites, Facebook, Texting, Archived Webinars èLearning Collaboratives • National Network to Eliminate Disparities in BH (NNED) èMinority Fellowship Program

HRSA BH WORKFORCE ACTIVITIES 25 è Community Health Centers (CHCs) • 2/3 Provide MH and 1/3 Provide SA Services (SBIRT encouraged through training and data reporting) è National Health Service Corps • 2, 426 BH Providers (May 2012) • Up from 5 in 1995 èGraduate Psychology Educ Prog • 710 trainees in 2010 -2011; ½ in underserved areas è Mental and BH Education and Training Grants – FOA • 280 Psychologists and Social Workers

HRSA BH WORKFORCE ACTIVITIES 25 è Community Health Centers (CHCs) • 2/3 Provide MH and 1/3 Provide SA Services (SBIRT encouraged through training and data reporting) è National Health Service Corps • 2, 426 BH Providers (May 2012) • Up from 5 in 1995 èGraduate Psychology Educ Prog • 710 trainees in 2010 -2011; ½ in underserved areas è Mental and BH Education and Training Grants – FOA • 280 Psychologists and Social Workers

HRSA/SAMHSA EFFORTS 26 èJune 5 Listening Session re BH Workforce • Data – National Database thru HRSA National Center for Workforce Analysis • Capacity – National Health Service Corps; minority internships; same day billing analysis w/ Medicare; credentialing issues; DOL SBIRT training • Training – e. g. , military culture for health/BH providers w/ AHECs; integrated care thru joint TA Center (CIHS) • Non-Traditional Workforce – e. g. , peers, recovery coaches • Partnerships – e. g. , professional orgs, peer/recovery/family orgs, community colleges

HRSA/SAMHSA EFFORTS 26 èJune 5 Listening Session re BH Workforce • Data – National Database thru HRSA National Center for Workforce Analysis • Capacity – National Health Service Corps; minority internships; same day billing analysis w/ Medicare; credentialing issues; DOL SBIRT training • Training – e. g. , military culture for health/BH providers w/ AHECs; integrated care thru joint TA Center (CIHS) • Non-Traditional Workforce – e. g. , peers, recovery coaches • Partnerships – e. g. , professional orgs, peer/recovery/family orgs, community colleges

27 DISASTER/EMERGENCY PREPAREDNESS AND RESPONSE

27 DISASTER/EMERGENCY PREPAREDNESS AND RESPONSE

FEMA ISSUES IN PROCESS 28 èISP Grant Period Extension • Historical analysis of past ISP extensions in progress • Possible regulatory change needed èUse of Existing BH Professionals – Pay • SAMHSA & FEMA working together to determine feasibility èStreamlined and/or Preapproved Applications • SAMHSA & FEMA working together to determine what can be pre-populated • FEMA will continue to offer training for states at EMI èIndirect Costs for CCP • Regulation change needed – in process

FEMA ISSUES IN PROCESS 28 èISP Grant Period Extension • Historical analysis of past ISP extensions in progress • Possible regulatory change needed èUse of Existing BH Professionals – Pay • SAMHSA & FEMA working together to determine feasibility èStreamlined and/or Preapproved Applications • SAMHSA & FEMA working together to determine what can be pre-populated • FEMA will continue to offer training for states at EMI èIndirect Costs for CCP • Regulation change needed – in process

FEMA TRAINING 29 èJuly 16 – 19, 2012 èEmmitsburg, MD è 22 State Representatives èFEMA Offer to Meet with NASMHPD Reps

FEMA TRAINING 29 èJuly 16 – 19, 2012 èEmmitsburg, MD è 22 State Representatives èFEMA Offer to Meet with NASMHPD Reps