f6512ec2d65ff2d55dede622ad1e6890.ppt

- Количество слайдов: 23

1

1

Central Indiana Intermodal Service Growth and Network Expansion Opportunities for BNSF February 12, 2008

Central Indiana Intermodal Service Growth and Network Expansion Opportunities for BNSF February 12, 2008

3

3

Indiana’s Intermodal Team Here to make the case for run-through service to CSX Avon State: • IEDC • Ports of Indiana • INDOT Regional • Indy Partnership • Conexus Indiana Industry: • Browning Investments • Duke Realty Corporation • TJX Corporation 4

Indiana’s Intermodal Team Here to make the case for run-through service to CSX Avon State: • IEDC • Ports of Indiana • INDOT Regional • Indy Partnership • Conexus Indiana Industry: • Browning Investments • Duke Realty Corporation • TJX Corporation 4

Goal: Enhance Access to Global Markets Indiana recognizes: • Intermodal connections are key to global competitiveness • Intermodal logistics parks are the trade hubs of the future • West Coast connection critical to Indiana • BNSF is the premier intermodal carrier and the preferred service provider 5

Goal: Enhance Access to Global Markets Indiana recognizes: • Intermodal connections are key to global competitiveness • Intermodal logistics parks are the trade hubs of the future • West Coast connection critical to Indiana • BNSF is the premier intermodal carrier and the preferred service provider 5

Value Proposition for BNSF Opportunity for growth Run-through service from LA/LB ports to CSX Avon Yard benefits BNSF: – Significant growth of headhaul & backhaul volume – Minimal CAPEX and operating risk – “Plug and play” logistics park located in a premier distribution location – Complements existing network & Chicago ramps Avon provides strategic advantage for BNSF 6

Value Proposition for BNSF Opportunity for growth Run-through service from LA/LB ports to CSX Avon Yard benefits BNSF: – Significant growth of headhaul & backhaul volume – Minimal CAPEX and operating risk – “Plug and play” logistics park located in a premier distribution location – Complements existing network & Chicago ramps Avon provides strategic advantage for BNSF 6

Proposed Service Solution Run-through service to Avon from LA – – – Connect to CSX in St. Louis Possible mix with domestic (Clovis) 5 -day a week frequency in both directions Key Assumptions: – – – Economics work for carriers & shippers CSX agrees to trackage & terminal deals Operational issues are manageable 7

Proposed Service Solution Run-through service to Avon from LA – – – Connect to CSX in St. Louis Possible mix with domestic (Clovis) 5 -day a week frequency in both directions Key Assumptions: – – – Economics work for carriers & shippers CSX agrees to trackage & terminal deals Operational issues are manageable 7

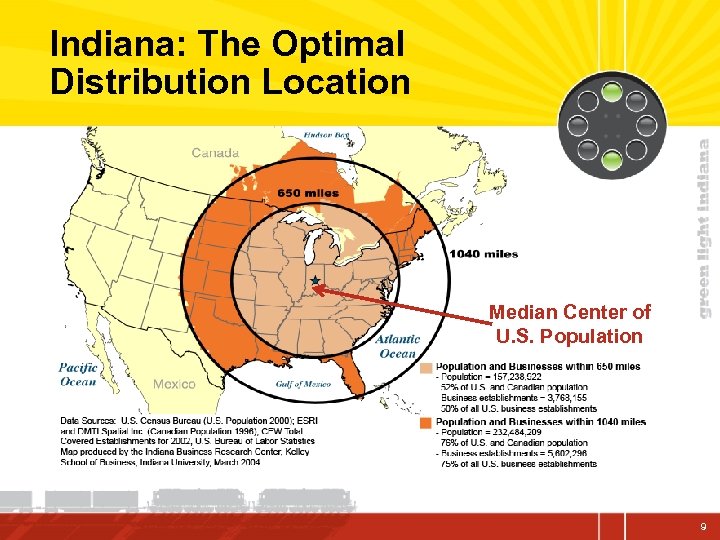

Growth Drivers for BNSF Central Indiana: Best location to serve greatest number of consumers, producers & exporters – – Median center of U. S. population Same-day delivery to over 50% of U. S. population Heart of manufacturing, agriculture, hardwood production 15% of U. S. freight by value touches Indiana • 12% by tonnage – Indiana ranks 2 nd in pass-thru tonnage, 5 th overall – Least congested infrastructure • 5. 3% peak congestion vs. 15. 3% national average • “Major Moves” fully funds 10 -year transportation plan 8

Growth Drivers for BNSF Central Indiana: Best location to serve greatest number of consumers, producers & exporters – – Median center of U. S. population Same-day delivery to over 50% of U. S. population Heart of manufacturing, agriculture, hardwood production 15% of U. S. freight by value touches Indiana • 12% by tonnage – Indiana ranks 2 nd in pass-thru tonnage, 5 th overall – Least congested infrastructure • 5. 3% peak congestion vs. 15. 3% national average • “Major Moves” fully funds 10 -year transportation plan 8

Indiana: The Optimal Distribution Location Median Center of U. S. Population 9

Indiana: The Optimal Distribution Location Median Center of U. S. Population 9

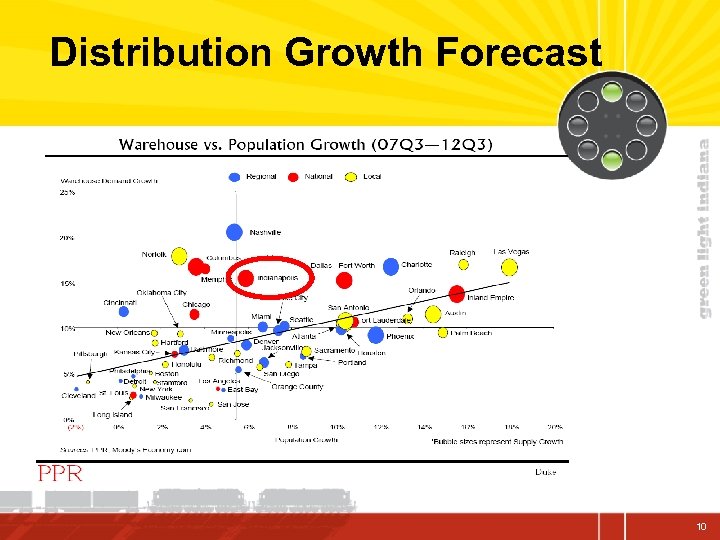

Distribution Growth Forecast 10

Distribution Growth Forecast 10

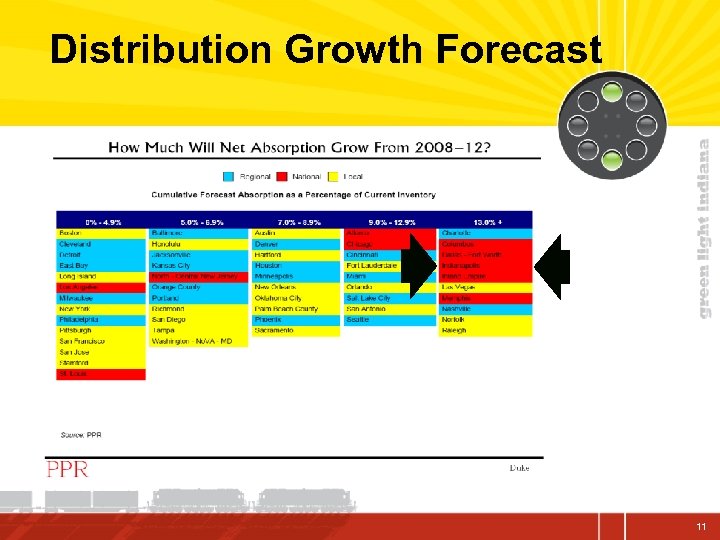

Distribution Growth Forecast 11

Distribution Growth Forecast 11

Indiana: Export & Manufacturing Powerhouse • Exports totaled $22. 6 billion in 2006 • 1 st in automotive manufacturing growth • 3 rd in car/truck production by 2011 • 1 st in manufacturing output per capita • 1 st in value-added manufacturing • Honda building newest assembly plant in Greensburg, IN. • Only state with 2 Toyota production sites 12

Indiana: Export & Manufacturing Powerhouse • Exports totaled $22. 6 billion in 2006 • 1 st in automotive manufacturing growth • 3 rd in car/truck production by 2011 • 1 st in manufacturing output per capita • 1 st in value-added manufacturing • Honda building newest assembly plant in Greensburg, IN. • Only state with 2 Toyota production sites 12

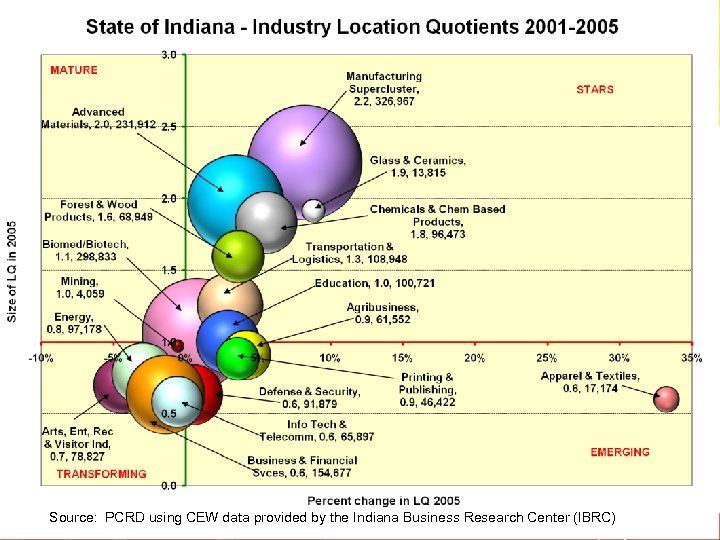

Indiana’s Manufacturing & Logistics Economy Source: PCRD using CEW data provided by the Indiana Business Research Center (IBRC)

Indiana’s Manufacturing & Logistics Economy Source: PCRD using CEW data provided by the Indiana Business Research Center (IBRC)

Indiana: Epicenter of U. S. Manufacturing Transportation Equipment Machinery Primary Metals Computers & Electronic Products Electrical Equipment, Appliances & Components Fabricated Metal Products 14

Indiana: Epicenter of U. S. Manufacturing Transportation Equipment Machinery Primary Metals Computers & Electronic Products Electrical Equipment, Appliances & Components Fabricated Metal Products 14

Indiana: Automotive Center of North America • Car/truck assembly plants within 650 miles of Indianapolis • 84% of North American auto production 15

Indiana: Automotive Center of North America • Car/truck assembly plants within 650 miles of Indianapolis • 84% of North American auto production 15

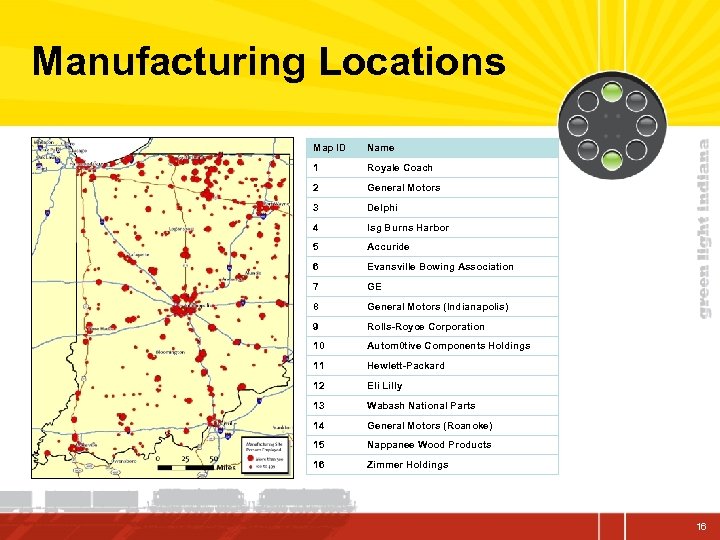

Manufacturing Locations Map ID Name 1 Royale Coach 2 General Motors 3 Delphi 4 Isg Burns Harbor 5 Accuride 6 Evansville Bowing Association 7 GE 8 General Motors (Indianapolis) 9 Rolls-Royce Corporation 10 Autom 0 tive Components Holdings 11 Hewlett-Packard 12 Eli Lilly 13 Wabash National Parts 14 General Motors (Roanoke) 15 Nappanee Wood Products 16 Zimmer Holdings 16

Manufacturing Locations Map ID Name 1 Royale Coach 2 General Motors 3 Delphi 4 Isg Burns Harbor 5 Accuride 6 Evansville Bowing Association 7 GE 8 General Motors (Indianapolis) 9 Rolls-Royce Corporation 10 Autom 0 tive Components Holdings 11 Hewlett-Packard 12 Eli Lilly 13 Wabash National Parts 14 General Motors (Roanoke) 15 Nappanee Wood Products 16 Zimmer Holdings 16

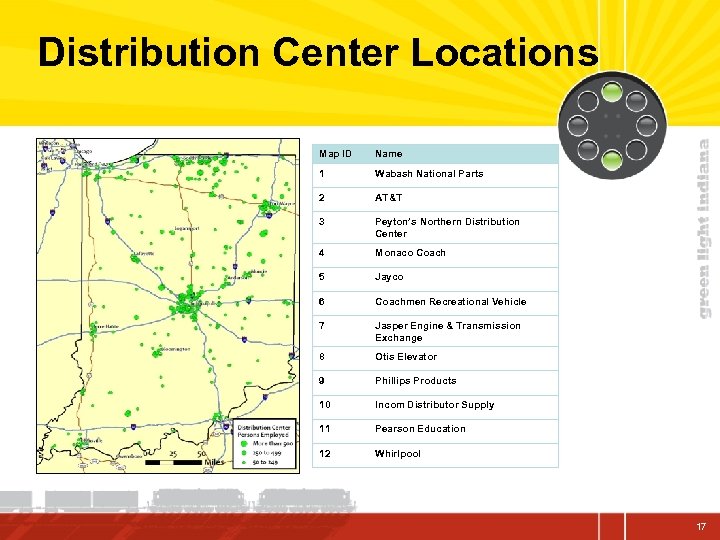

Distribution Center Locations Map ID Name 1 Wabash National Parts 2 AT&T 3 Peyton’s Northern Distribution Center 4 Monaco Coach 5 Jayco 6 Coachmen Recreational Vehicle 7 Jasper Engine & Transmission Exchange 8 Otis Elevator 9 Phillips Products 10 Incom Distributor Supply 11 Pearson Education 12 Whirlpool 17

Distribution Center Locations Map ID Name 1 Wabash National Parts 2 AT&T 3 Peyton’s Northern Distribution Center 4 Monaco Coach 5 Jayco 6 Coachmen Recreational Vehicle 7 Jasper Engine & Transmission Exchange 8 Otis Elevator 9 Phillips Products 10 Incom Distributor Supply 11 Pearson Education 12 Whirlpool 17

Recent Large Business Investments in Indiana Company Industry County New Jobs Investment Honda Mfg. - Auto Decatur 2, 067 $550, 000 Medco Life Sciences Boone 1, 306 $165, 000 Well. Point Insurance - Distribution Marion 1, 200 $12, 000 American Commercial Lines Mfg. - Barges Clark 1, 157 $17, 500, 000 Toyota Motor North America, Inc. Mfg. - Auto Tippecanoe 1, 000 $200, 000 Really Cool Foods Mfg. - Food Wayne 1, 000 $100, 000 Advance Stores Company (Distribution Center) Mfg. - Auto Jasper 636 $48, 400, 000 Wal-Mart Stores (Distribution Center) Dist. - Log. Grant 600 $60, 000 O'Reilly Auto Parts (Distribution Center) Dist. - Log. Hendricks 581 $46, 900, 000 Dollar General Corp. (Distribution Center) Dist. - Log. Grant 500 $68, 000 Cummins Mfg. - Auto Bartholomew 458 $250, 000 18

Recent Large Business Investments in Indiana Company Industry County New Jobs Investment Honda Mfg. - Auto Decatur 2, 067 $550, 000 Medco Life Sciences Boone 1, 306 $165, 000 Well. Point Insurance - Distribution Marion 1, 200 $12, 000 American Commercial Lines Mfg. - Barges Clark 1, 157 $17, 500, 000 Toyota Motor North America, Inc. Mfg. - Auto Tippecanoe 1, 000 $200, 000 Really Cool Foods Mfg. - Food Wayne 1, 000 $100, 000 Advance Stores Company (Distribution Center) Mfg. - Auto Jasper 636 $48, 400, 000 Wal-Mart Stores (Distribution Center) Dist. - Log. Grant 600 $60, 000 O'Reilly Auto Parts (Distribution Center) Dist. - Log. Hendricks 581 $46, 900, 000 Dollar General Corp. (Distribution Center) Dist. - Log. Grant 500 $68, 000 Cummins Mfg. - Auto Bartholomew 458 $250, 000 18

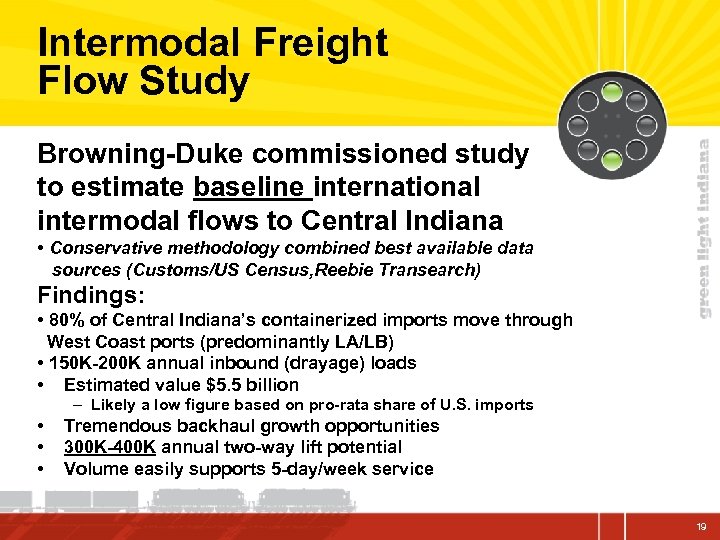

Intermodal Freight Flow Study Browning-Duke commissioned study to estimate baseline international intermodal flows to Central Indiana • Conservative methodology combined best available data sources (Customs/US Census, Reebie Transearch) Findings: • 80% of Central Indiana’s containerized imports move through West Coast ports (predominantly LA/LB) • 150 K-200 K annual inbound (drayage) loads • Estimated value $5. 5 billion – Likely a low figure based on pro-rata share of U. S. imports • • • Tremendous backhaul growth opportunities 300 K-400 K annual two-way lift potential Volume easily supports 5 -day/week service 19

Intermodal Freight Flow Study Browning-Duke commissioned study to estimate baseline international intermodal flows to Central Indiana • Conservative methodology combined best available data sources (Customs/US Census, Reebie Transearch) Findings: • 80% of Central Indiana’s containerized imports move through West Coast ports (predominantly LA/LB) • 150 K-200 K annual inbound (drayage) loads • Estimated value $5. 5 billion – Likely a low figure based on pro-rata share of U. S. imports • • • Tremendous backhaul growth opportunities 300 K-400 K annual two-way lift potential Volume easily supports 5 -day/week service 19

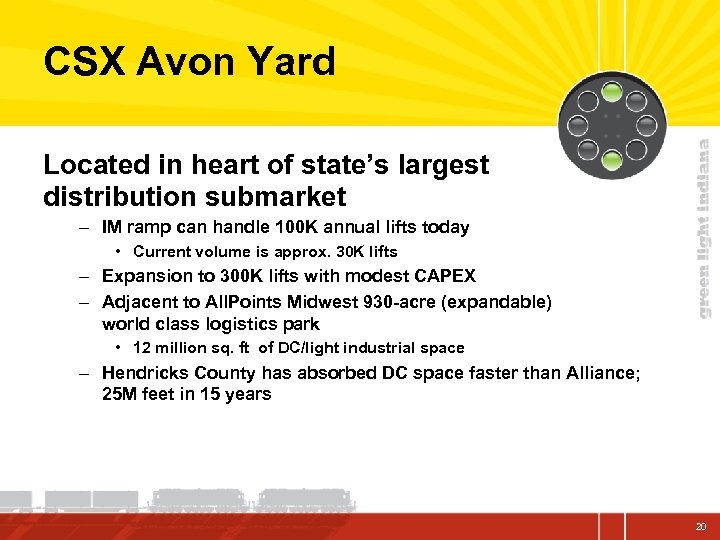

CSX Avon Yard Located in heart of state’s largest distribution submarket – IM ramp can handle 100 K annual lifts today • Current volume is approx. 30 K lifts – Expansion to 300 K lifts with modest CAPEX – Adjacent to All. Points Midwest 930 -acre (expandable) world class logistics park • 12 million sq. ft of DC/light industrial space – Hendricks County has absorbed DC space faster than Alliance; 25 M feet in 15 years 20

CSX Avon Yard Located in heart of state’s largest distribution submarket – IM ramp can handle 100 K annual lifts today • Current volume is approx. 30 K lifts – Expansion to 300 K lifts with modest CAPEX – Adjacent to All. Points Midwest 930 -acre (expandable) world class logistics park • 12 million sq. ft of DC/light industrial space – Hendricks County has absorbed DC space faster than Alliance; 25 M feet in 15 years 20

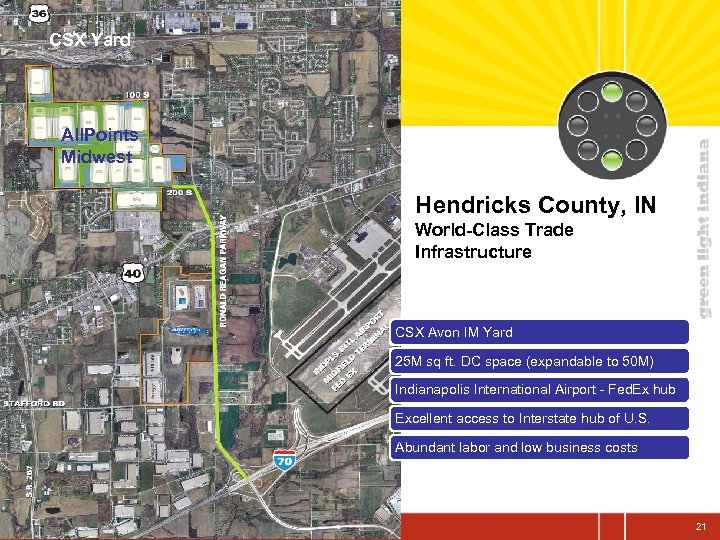

CSX Yard All. Points Midwest Hendricks County, IN World-Class Trade Infrastructure CSX Avon IM Yard 25 M sq ft. DC space (expandable to 50 M) Indianapolis International Airport - Fed. Ex hub Excellent access to Interstate hub of U. S. Abundant labor and low business costs 21

CSX Yard All. Points Midwest Hendricks County, IN World-Class Trade Infrastructure CSX Avon IM Yard 25 M sq ft. DC space (expandable to 50 M) Indianapolis International Airport - Fed. Ex hub Excellent access to Interstate hub of U. S. Abundant labor and low business costs 21

Indiana Proposal • “Take or Pay Train” arrangement - Minimize risk to BNSF • Conexus Indiana will organize Shippers Alliance & market service • Improvements to CSX Avon facility - Developers, local governments already jointly planning improvements with CSX • State/Ports of Indiana support - Potential Incentives, Financing, Foreign-Trade Zone 22

Indiana Proposal • “Take or Pay Train” arrangement - Minimize risk to BNSF • Conexus Indiana will organize Shippers Alliance & market service • Improvements to CSX Avon facility - Developers, local governments already jointly planning improvements with CSX • State/Ports of Indiana support - Potential Incentives, Financing, Foreign-Trade Zone 22

Going Forward • • BNSF reaction Commitment to evaluate concept Plans for future dialogue How do we move forward? Proposed Next Step: • BNSF invited to Indiana for meetings with key leaders and tour of region 23

Going Forward • • BNSF reaction Commitment to evaluate concept Plans for future dialogue How do we move forward? Proposed Next Step: • BNSF invited to Indiana for meetings with key leaders and tour of region 23