e0a8fff9efbe2cde1fb4b8bd7809a004.ppt

- Количество слайдов: 32

1 Cash Flows and Other Chapter 10 Topics in Capital Budgeting

1 Cash Flows and Other Chapter 10 Topics in Capital Budgeting

Cash Flows in General Measure Incremental Cash Flows v Measure cash flows that change if a project is undertaken v Sunk cost is irrelevant v Opportunity cost is relevant v Do not include allocation of existing overhead v Do subtract lost sales of other products v Include cost savings as a positive cash flow. 3

Cash Flows in General Measure Incremental Cash Flows v Measure cash flows that change if a project is undertaken v Sunk cost is irrelevant v Opportunity cost is relevant v Do not include allocation of existing overhead v Do subtract lost sales of other products v Include cost savings as a positive cash flow. 3

Cash Flows in General 4 v New Project vs. Replacement Project v. New project – simply addition to company v. Replacement – replace and existing old machine or plant. v Financing costs - Interest and Dividend payments. are not considered operating cash flows. Financing cost are used to discount the cash flows to find NPV, etc. v Only include CASH inflows and outflows.

Cash Flows in General 4 v New Project vs. Replacement Project v. New project – simply addition to company v. Replacement – replace and existing old machine or plant. v Financing costs - Interest and Dividend payments. are not considered operating cash flows. Financing cost are used to discount the cash flows to find NPV, etc. v Only include CASH inflows and outflows.

5 Estimating Cash Flows Three Types of Cash Flows v Initial Outlay 0 Initial Outlay 1 2 3 N

5 Estimating Cash Flows Three Types of Cash Flows v Initial Outlay 0 Initial Outlay 1 2 3 N

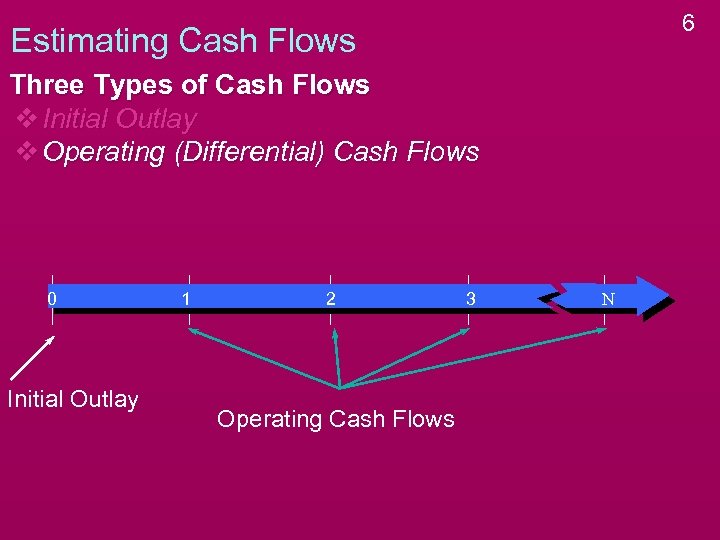

6 Estimating Cash Flows Three Types of Cash Flows v Initial Outlay v Operating (Differential) Cash Flows 0 Initial Outlay 1 2 Operating Cash Flows 3 N

6 Estimating Cash Flows Three Types of Cash Flows v Initial Outlay v Operating (Differential) Cash Flows 0 Initial Outlay 1 2 Operating Cash Flows 3 N

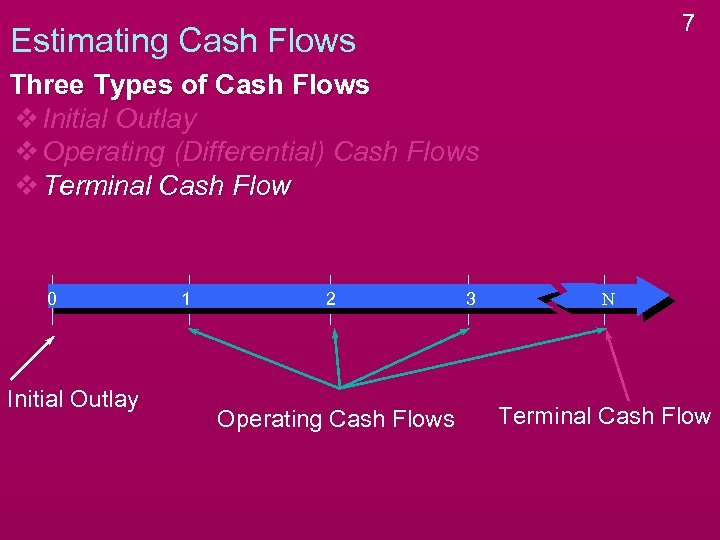

7 Estimating Cash Flows Three Types of Cash Flows v Initial Outlay v Operating (Differential) Cash Flows v Terminal Cash Flow 0 Initial Outlay 1 2 Operating Cash Flows 3 N Terminal Cash Flow

7 Estimating Cash Flows Three Types of Cash Flows v Initial Outlay v Operating (Differential) Cash Flows v Terminal Cash Flow 0 Initial Outlay 1 2 Operating Cash Flows 3 N Terminal Cash Flow

Estimating Cash Flows Initial Outlay v Cost of Assets v Installation and Shipping v Non-Expense Outlays (i. e. Working Capital) v Expense Outlays after tax (i. e. Training Expenses) 8

Estimating Cash Flows Initial Outlay v Cost of Assets v Installation and Shipping v Non-Expense Outlays (i. e. Working Capital) v Expense Outlays after tax (i. e. Training Expenses) 8

Estimating Cash Flows Initial Outlay v Cost of Assets v Installation and Shipping v Non-Expense Outlays (i. e. Working Capital) v Expense Outlays after tax (i. e. Training Expenses) Only for Replacement Projects v Sale of Old Machine 9

Estimating Cash Flows Initial Outlay v Cost of Assets v Installation and Shipping v Non-Expense Outlays (i. e. Working Capital) v Expense Outlays after tax (i. e. Training Expenses) Only for Replacement Projects v Sale of Old Machine 9

Estimating Cash Flows Initial Outlay v Cost of Assets v Installation and Shipping v Non-Expense Outlays (i. e. Working Capital) v Expense Outlays after tax (i. e. Training Expenses) Only for Replacement Projects v Sale of Old Machine v Taxes on Machine 10

Estimating Cash Flows Initial Outlay v Cost of Assets v Installation and Shipping v Non-Expense Outlays (i. e. Working Capital) v Expense Outlays after tax (i. e. Training Expenses) Only for Replacement Projects v Sale of Old Machine v Taxes on Machine 10

Estimating Cash Flows 11 Initial Outlay Example: Gasperini Corp. is considering replacing their old production machine with a new one. The cost of the new machine is $48, 000; installation and delivery cost $2, 000. Working Capital requirements on the new machine are $3, 000 immediately, and training costs amount to $4, 000. The old machine can be sold for $10, 000; its book value is zero. Gasperini has a marginal tax rate of 40%.

Estimating Cash Flows 11 Initial Outlay Example: Gasperini Corp. is considering replacing their old production machine with a new one. The cost of the new machine is $48, 000; installation and delivery cost $2, 000. Working Capital requirements on the new machine are $3, 000 immediately, and training costs amount to $4, 000. The old machine can be sold for $10, 000; its book value is zero. Gasperini has a marginal tax rate of 40%.

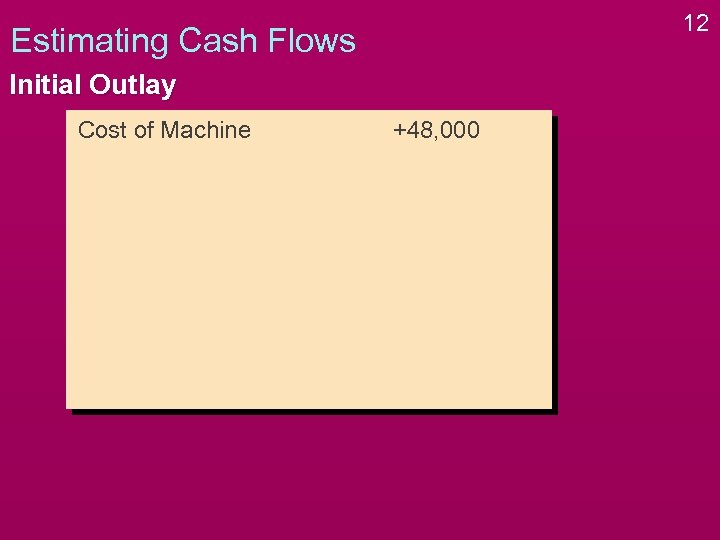

12 Estimating Cash Flows Initial Outlay Cost of Machine +48, 000

12 Estimating Cash Flows Initial Outlay Cost of Machine +48, 000

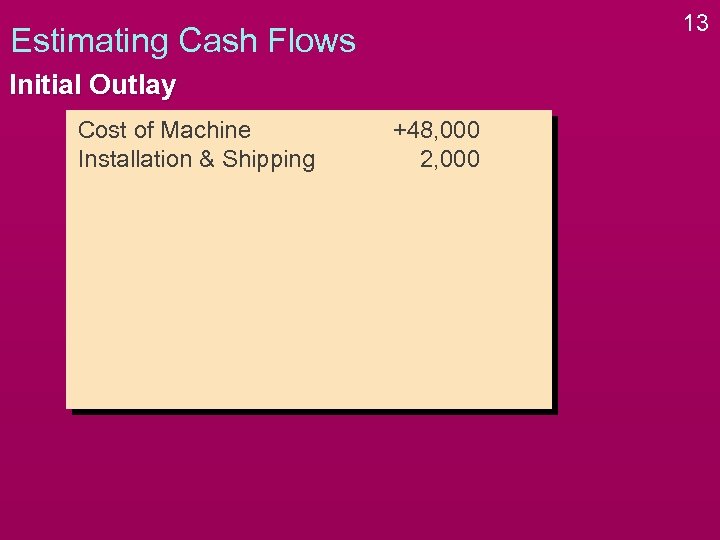

13 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping +48, 000 2, 000

13 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping +48, 000 2, 000

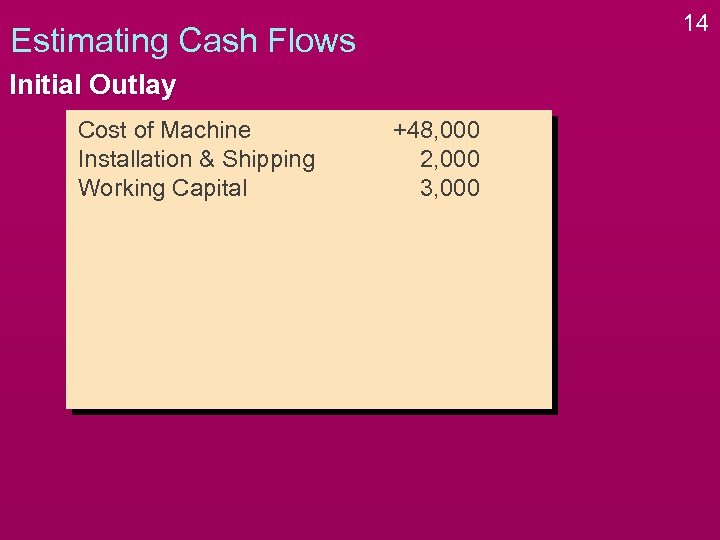

14 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital +48, 000 2, 000 3, 000

14 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital +48, 000 2, 000 3, 000

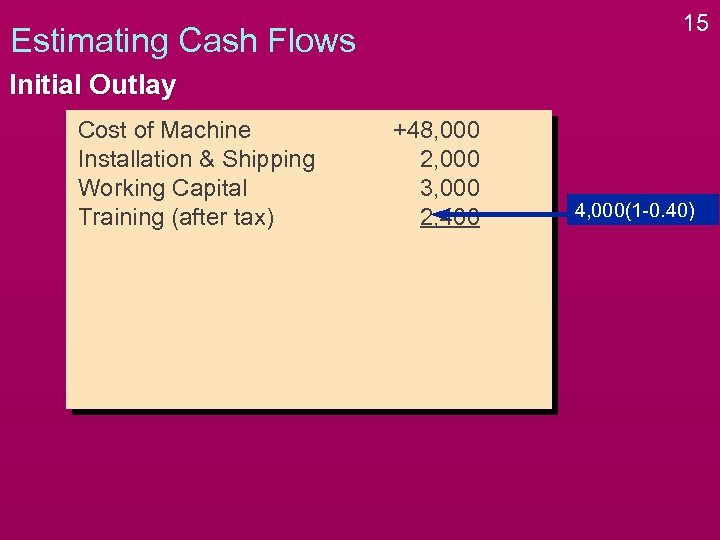

15 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital Training (after tax) +48, 000 2, 000 3, 000 2, 400 4, 000(1 -0. 40)

15 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital Training (after tax) +48, 000 2, 000 3, 000 2, 400 4, 000(1 -0. 40)

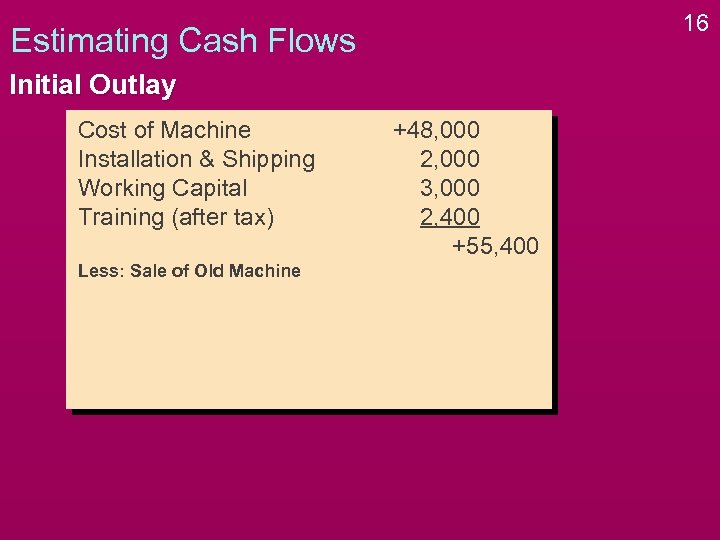

16 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital Training (after tax) Less: Sale of Old Machine +48, 000 2, 000 3, 000 2, 400 +55, 400

16 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital Training (after tax) Less: Sale of Old Machine +48, 000 2, 000 3, 000 2, 400 +55, 400

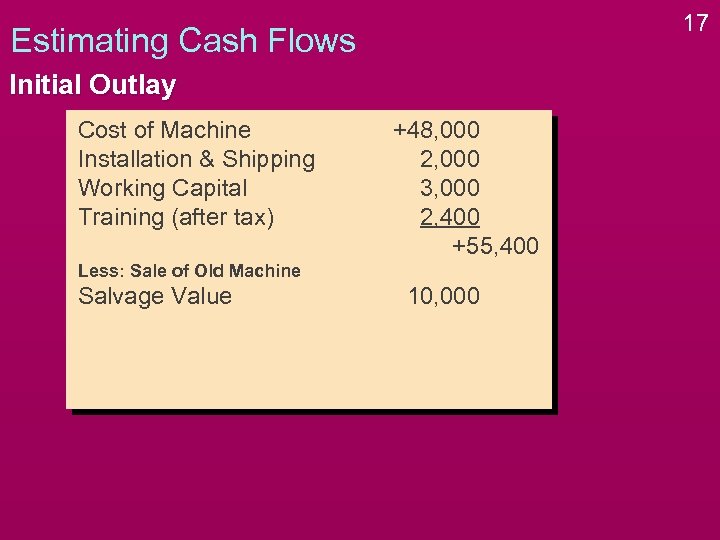

17 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital Training (after tax) +48, 000 2, 000 3, 000 2, 400 +55, 400 Less: Sale of Old Machine Salvage Value 10, 000

17 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital Training (after tax) +48, 000 2, 000 3, 000 2, 400 +55, 400 Less: Sale of Old Machine Salvage Value 10, 000

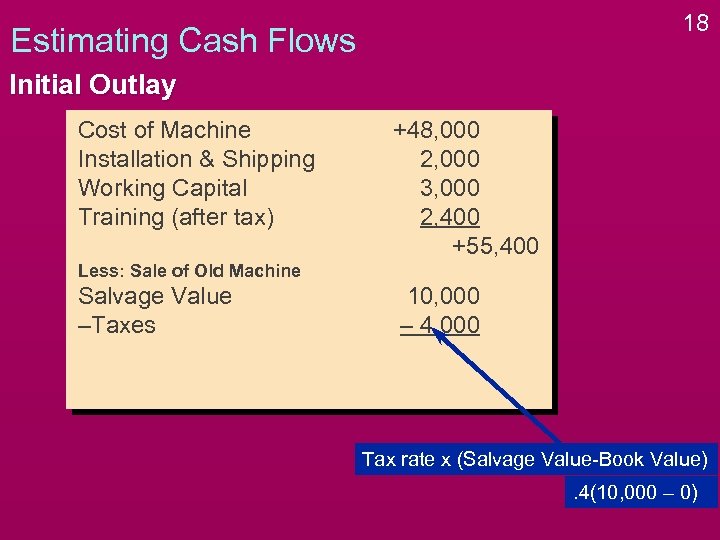

18 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital Training (after tax) +48, 000 2, 000 3, 000 2, 400 +55, 400 Less: Sale of Old Machine Salvage Value –Taxes 10, 000 – 4, 000 Tax rate x (Salvage Value-Book Value). 4(10, 000 – 0)

18 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital Training (after tax) +48, 000 2, 000 3, 000 2, 400 +55, 400 Less: Sale of Old Machine Salvage Value –Taxes 10, 000 – 4, 000 Tax rate x (Salvage Value-Book Value). 4(10, 000 – 0)

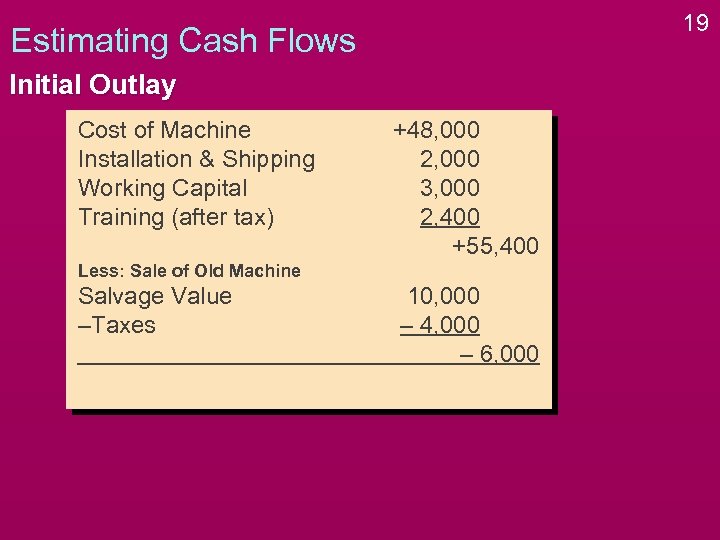

19 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital Training (after tax) +48, 000 2, 000 3, 000 2, 400 +55, 400 Less: Sale of Old Machine Salvage Value –Taxes 10, 000 – 4, 000 – 6, 000

19 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital Training (after tax) +48, 000 2, 000 3, 000 2, 400 +55, 400 Less: Sale of Old Machine Salvage Value –Taxes 10, 000 – 4, 000 – 6, 000

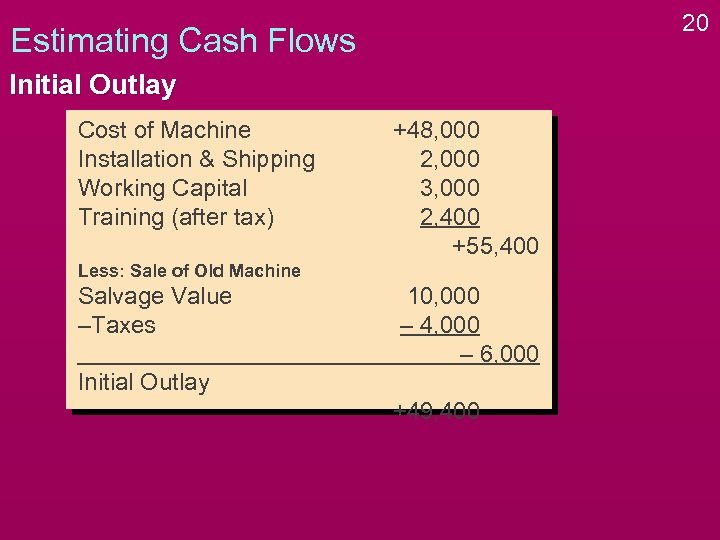

20 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital Training (after tax) +48, 000 2, 000 3, 000 2, 400 +55, 400 Less: Sale of Old Machine Salvage Value –Taxes 10, 000 – 4, 000 – 6, 000 Initial Outlay +49, 400

20 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital Training (after tax) +48, 000 2, 000 3, 000 2, 400 +55, 400 Less: Sale of Old Machine Salvage Value –Taxes 10, 000 – 4, 000 – 6, 000 Initial Outlay +49, 400

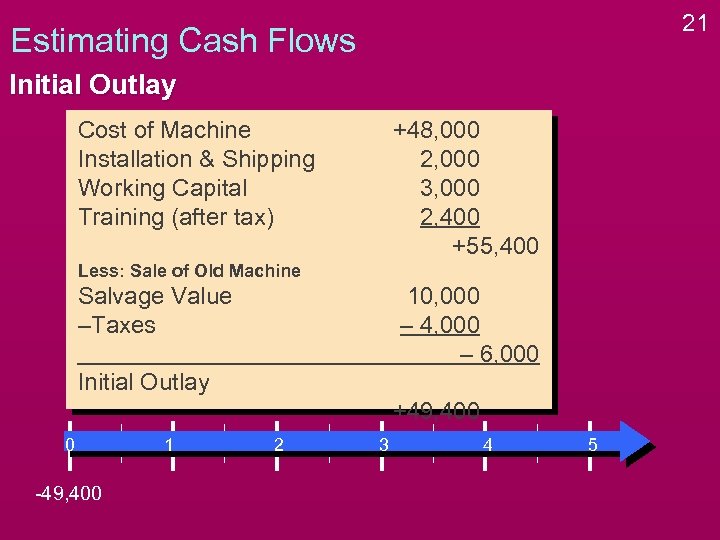

21 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital Training (after tax) +48, 000 2, 000 3, 000 2, 400 +55, 400 Less: Sale of Old Machine Salvage Value –Taxes 10, 000 – 4, 000 – 6, 000 Initial Outlay +49, 400 0 -49, 400 1 2 3 4 5

21 Estimating Cash Flows Initial Outlay Cost of Machine Installation & Shipping Working Capital Training (after tax) +48, 000 2, 000 3, 000 2, 400 +55, 400 Less: Sale of Old Machine Salvage Value –Taxes 10, 000 – 4, 000 – 6, 000 Initial Outlay +49, 400 0 -49, 400 1 2 3 4 5

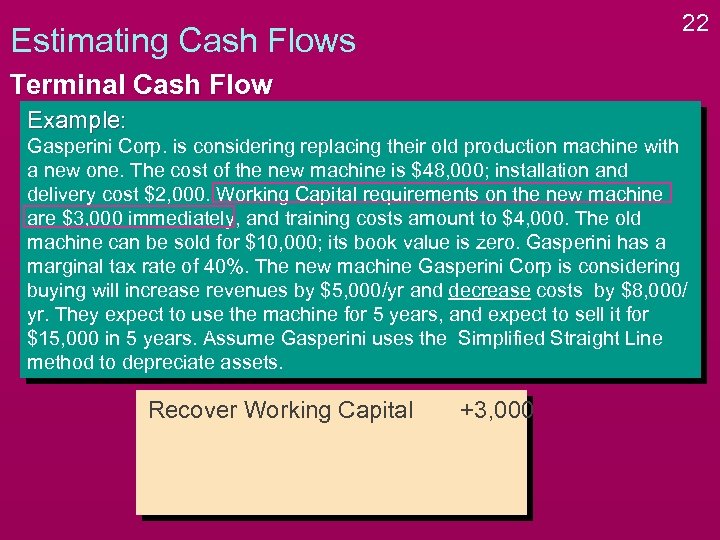

22 Estimating Cash Flows Terminal Cash Flow Example: Gasperini Corp. is considering replacing their old production machine with a new one. The cost of the new machine is $48, 000; installation and delivery cost $2, 000. Working Capital requirements on the new machine are $3, 000 immediately, and training costs amount to $4, 000. The old machine can be sold for $10, 000; its book value is zero. Gasperini has a marginal tax rate of 40%. The new machine Gasperini Corp is considering buying will increase revenues by $5, 000/yr and decrease costs by $8, 000/ yr. They expect to use the machine for 5 years, and expect to sell it for $15, 000 in 5 years. Assume Gasperini uses the Simplified Straight Line method to depreciate assets. Recover Working Capital +3, 000

22 Estimating Cash Flows Terminal Cash Flow Example: Gasperini Corp. is considering replacing their old production machine with a new one. The cost of the new machine is $48, 000; installation and delivery cost $2, 000. Working Capital requirements on the new machine are $3, 000 immediately, and training costs amount to $4, 000. The old machine can be sold for $10, 000; its book value is zero. Gasperini has a marginal tax rate of 40%. The new machine Gasperini Corp is considering buying will increase revenues by $5, 000/yr and decrease costs by $8, 000/ yr. They expect to use the machine for 5 years, and expect to sell it for $15, 000 in 5 years. Assume Gasperini uses the Simplified Straight Line method to depreciate assets. Recover Working Capital +3, 000

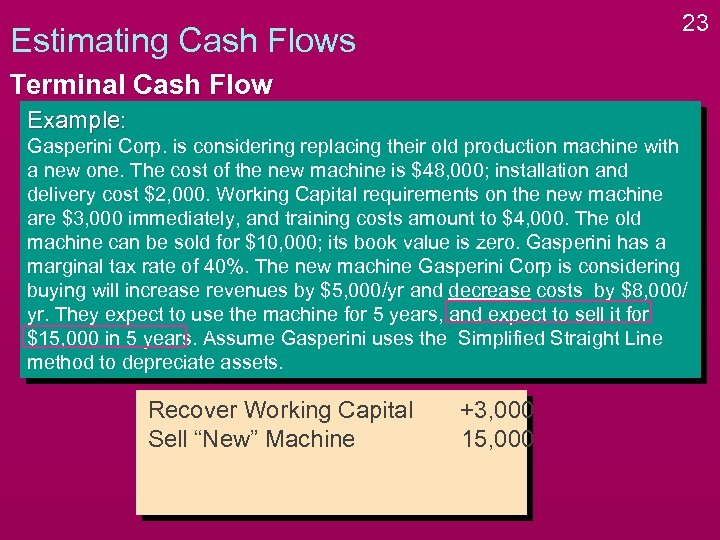

23 Estimating Cash Flows Terminal Cash Flow Example: Gasperini Corp. is considering replacing their old production machine with a new one. The cost of the new machine is $48, 000; installation and delivery cost $2, 000. Working Capital requirements on the new machine are $3, 000 immediately, and training costs amount to $4, 000. The old machine can be sold for $10, 000; its book value is zero. Gasperini has a marginal tax rate of 40%. The new machine Gasperini Corp is considering buying will increase revenues by $5, 000/yr and decrease costs by $8, 000/ yr. They expect to use the machine for 5 years, and expect to sell it for $15, 000 in 5 years. Assume Gasperini uses the Simplified Straight Line method to depreciate assets. Recover Working Capital Sell “New” Machine +3, 000 15, 000

23 Estimating Cash Flows Terminal Cash Flow Example: Gasperini Corp. is considering replacing their old production machine with a new one. The cost of the new machine is $48, 000; installation and delivery cost $2, 000. Working Capital requirements on the new machine are $3, 000 immediately, and training costs amount to $4, 000. The old machine can be sold for $10, 000; its book value is zero. Gasperini has a marginal tax rate of 40%. The new machine Gasperini Corp is considering buying will increase revenues by $5, 000/yr and decrease costs by $8, 000/ yr. They expect to use the machine for 5 years, and expect to sell it for $15, 000 in 5 years. Assume Gasperini uses the Simplified Straight Line method to depreciate assets. Recover Working Capital Sell “New” Machine +3, 000 15, 000

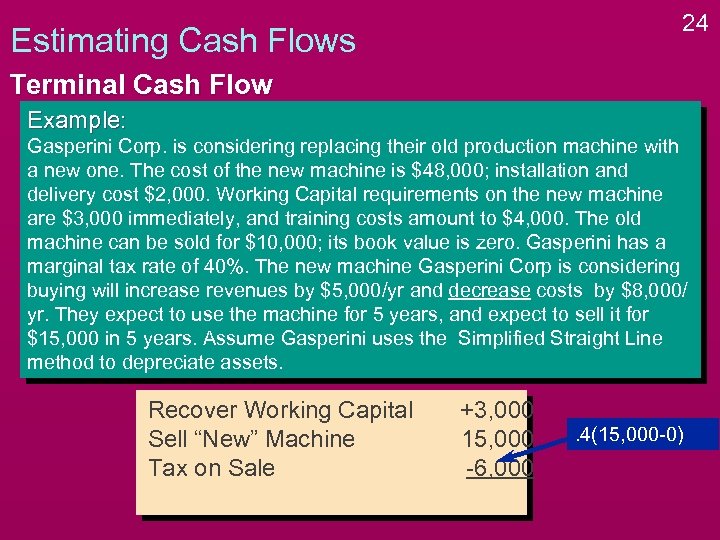

24 Estimating Cash Flows Terminal Cash Flow Example: Gasperini Corp. is considering replacing their old production machine with a new one. The cost of the new machine is $48, 000; installation and delivery cost $2, 000. Working Capital requirements on the new machine are $3, 000 immediately, and training costs amount to $4, 000. The old machine can be sold for $10, 000; its book value is zero. Gasperini has a marginal tax rate of 40%. The new machine Gasperini Corp is considering buying will increase revenues by $5, 000/yr and decrease costs by $8, 000/ yr. They expect to use the machine for 5 years, and expect to sell it for $15, 000 in 5 years. Assume Gasperini uses the Simplified Straight Line method to depreciate assets. Recover Working Capital Sell “New” Machine Tax on Sale +3, 000 15, 000 -6, 000 . 4(15, 000 -0)

24 Estimating Cash Flows Terminal Cash Flow Example: Gasperini Corp. is considering replacing their old production machine with a new one. The cost of the new machine is $48, 000; installation and delivery cost $2, 000. Working Capital requirements on the new machine are $3, 000 immediately, and training costs amount to $4, 000. The old machine can be sold for $10, 000; its book value is zero. Gasperini has a marginal tax rate of 40%. The new machine Gasperini Corp is considering buying will increase revenues by $5, 000/yr and decrease costs by $8, 000/ yr. They expect to use the machine for 5 years, and expect to sell it for $15, 000 in 5 years. Assume Gasperini uses the Simplified Straight Line method to depreciate assets. Recover Working Capital Sell “New” Machine Tax on Sale +3, 000 15, 000 -6, 000 . 4(15, 000 -0)

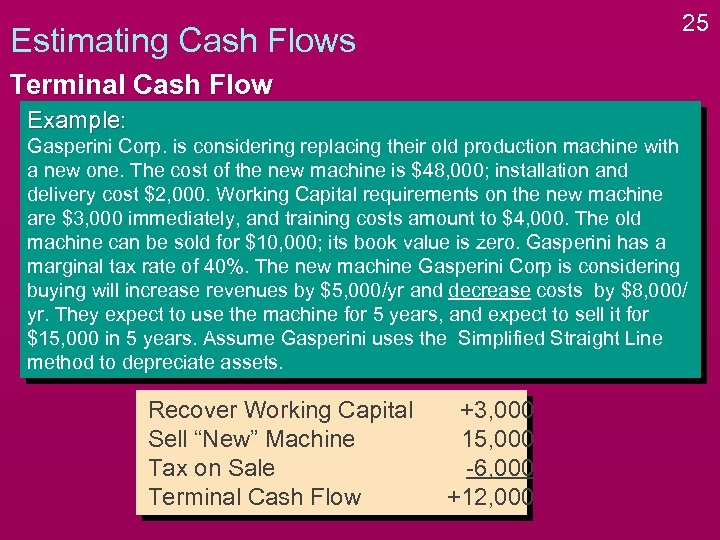

25 Estimating Cash Flows Terminal Cash Flow Example: Gasperini Corp. is considering replacing their old production machine with a new one. The cost of the new machine is $48, 000; installation and delivery cost $2, 000. Working Capital requirements on the new machine are $3, 000 immediately, and training costs amount to $4, 000. The old machine can be sold for $10, 000; its book value is zero. Gasperini has a marginal tax rate of 40%. The new machine Gasperini Corp is considering buying will increase revenues by $5, 000/yr and decrease costs by $8, 000/ yr. They expect to use the machine for 5 years, and expect to sell it for $15, 000 in 5 years. Assume Gasperini uses the Simplified Straight Line method to depreciate assets. Recover Working Capital Sell “New” Machine Tax on Sale Terminal Cash Flow +3, 000 15, 000 -6, 000 +12, 000

25 Estimating Cash Flows Terminal Cash Flow Example: Gasperini Corp. is considering replacing their old production machine with a new one. The cost of the new machine is $48, 000; installation and delivery cost $2, 000. Working Capital requirements on the new machine are $3, 000 immediately, and training costs amount to $4, 000. The old machine can be sold for $10, 000; its book value is zero. Gasperini has a marginal tax rate of 40%. The new machine Gasperini Corp is considering buying will increase revenues by $5, 000/yr and decrease costs by $8, 000/ yr. They expect to use the machine for 5 years, and expect to sell it for $15, 000 in 5 years. Assume Gasperini uses the Simplified Straight Line method to depreciate assets. Recover Working Capital Sell “New” Machine Tax on Sale Terminal Cash Flow +3, 000 15, 000 -6, 000 +12, 000

Capital Rationing v In large companies, many projects are evaluated each year v Management often imposes a limit that can be spent on new projects adopted during the year– Capital Rationing v In order to allocate scarce resources, choose the group of projects whose initial outlays are within the capital spending limit while at the same time maximizing NPV of the group of projects. 26

Capital Rationing v In large companies, many projects are evaluated each year v Management often imposes a limit that can be spent on new projects adopted during the year– Capital Rationing v In order to allocate scarce resources, choose the group of projects whose initial outlays are within the capital spending limit while at the same time maximizing NPV of the group of projects. 26

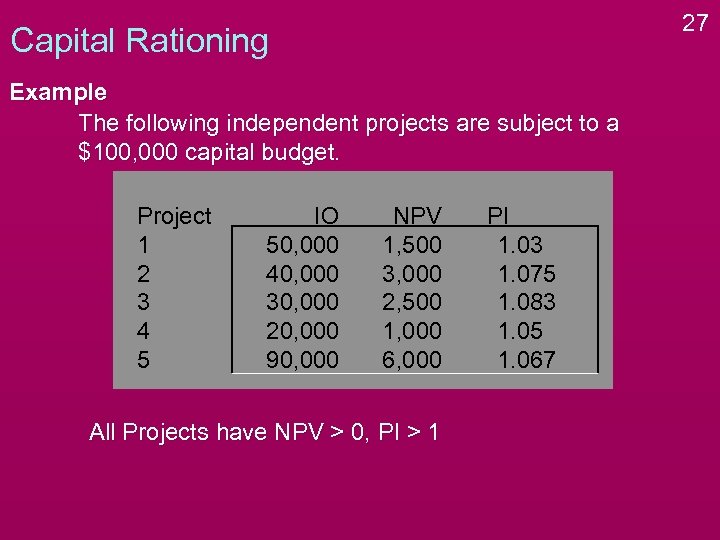

27 Capital Rationing Example The following independent projects are subject to a $100, 000 capital budget. Project 1 2 3 4 5 IO 50, 000 40, 000 30, 000 20, 000 90, 000 NPV 1, 500 3, 000 2, 500 1, 000 6, 000 All Projects have NPV > 0, PI > 1 PI 1. 03 1. 075 1. 083 1. 05 1. 067

27 Capital Rationing Example The following independent projects are subject to a $100, 000 capital budget. Project 1 2 3 4 5 IO 50, 000 40, 000 30, 000 20, 000 90, 000 NPV 1, 500 3, 000 2, 500 1, 000 6, 000 All Projects have NPV > 0, PI > 1 PI 1. 03 1. 075 1. 083 1. 05 1. 067

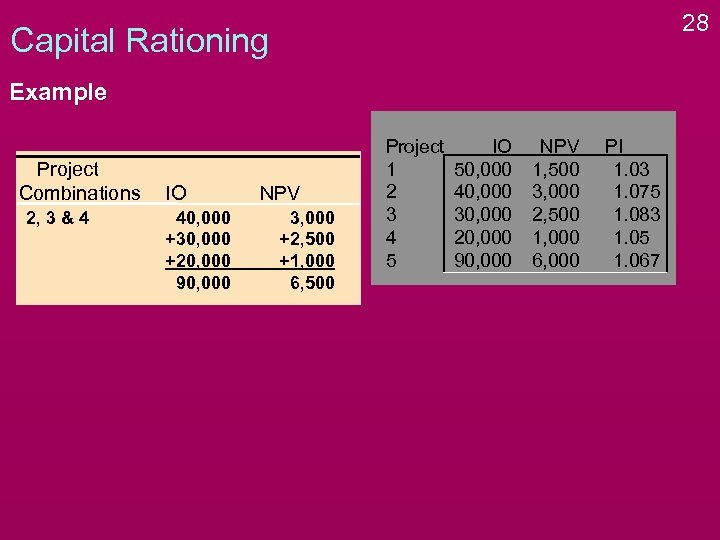

28 Capital Rationing Example Project Combinations 2, 3 & 4 IO 40, 000 +30, 000 +20, 000 90, 000 NPV 3, 000 +2, 500 +1, 000 6, 500 Project 1 2 3 4 5 IO 50, 000 40, 000 30, 000 20, 000 90, 000 NPV 1, 500 3, 000 2, 500 1, 000 6, 000 PI 1. 03 1. 075 1. 083 1. 05 1. 067

28 Capital Rationing Example Project Combinations 2, 3 & 4 IO 40, 000 +30, 000 +20, 000 90, 000 NPV 3, 000 +2, 500 +1, 000 6, 500 Project 1 2 3 4 5 IO 50, 000 40, 000 30, 000 20, 000 90, 000 NPV 1, 500 3, 000 2, 500 1, 000 6, 000 PI 1. 03 1. 075 1. 083 1. 05 1. 067

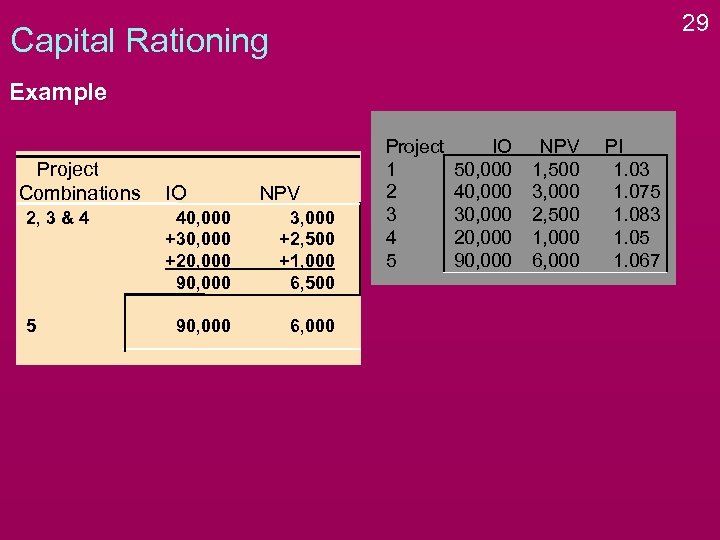

29 Capital Rationing Example Project Combinations 2, 3 & 4 5 IO NPV 40, 000 +30, 000 +20, 000 90, 000 3, 000 +2, 500 +1, 000 6, 500 90, 000 6, 000 Project 1 2 3 4 5 IO 50, 000 40, 000 30, 000 20, 000 90, 000 NPV 1, 500 3, 000 2, 500 1, 000 6, 000 PI 1. 03 1. 075 1. 083 1. 05 1. 067

29 Capital Rationing Example Project Combinations 2, 3 & 4 5 IO NPV 40, 000 +30, 000 +20, 000 90, 000 3, 000 +2, 500 +1, 000 6, 500 90, 000 6, 000 Project 1 2 3 4 5 IO 50, 000 40, 000 30, 000 20, 000 90, 000 NPV 1, 500 3, 000 2, 500 1, 000 6, 000 PI 1. 03 1. 075 1. 083 1. 05 1. 067

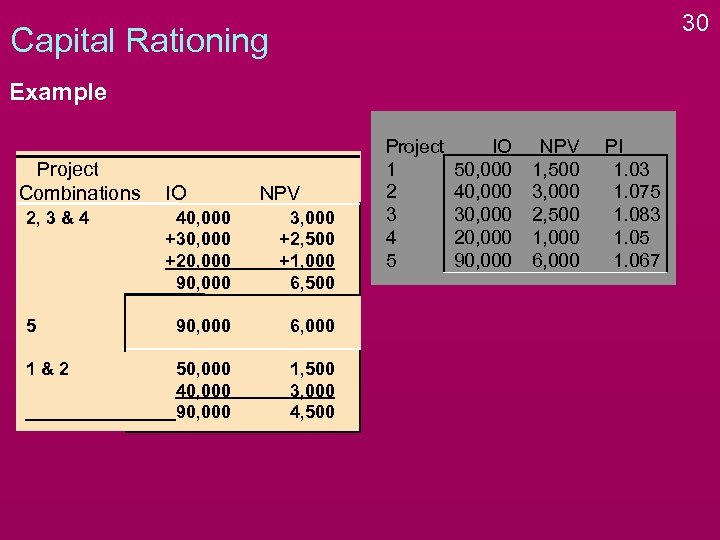

30 Capital Rationing Example Project Combinations 2, 3 & 4 IO NPV 40, 000 +30, 000 +20, 000 90, 000 3, 000 +2, 500 +1, 000 6, 500 5 90, 000 6, 000 1&2 50, 000 40, 000 90, 000 1, 500 3, 000 4, 500 Project 1 2 3 4 5 IO 50, 000 40, 000 30, 000 20, 000 90, 000 NPV 1, 500 3, 000 2, 500 1, 000 6, 000 PI 1. 03 1. 075 1. 083 1. 05 1. 067

30 Capital Rationing Example Project Combinations 2, 3 & 4 IO NPV 40, 000 +30, 000 +20, 000 90, 000 3, 000 +2, 500 +1, 000 6, 500 5 90, 000 6, 000 1&2 50, 000 40, 000 90, 000 1, 500 3, 000 4, 500 Project 1 2 3 4 5 IO 50, 000 40, 000 30, 000 20, 000 90, 000 NPV 1, 500 3, 000 2, 500 1, 000 6, 000 PI 1. 03 1. 075 1. 083 1. 05 1. 067

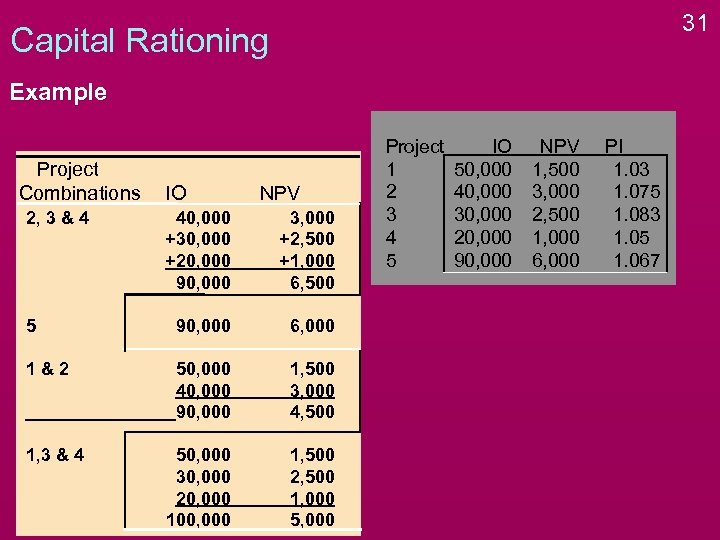

31 Capital Rationing Example Project Combinations 2, 3 & 4 IO NPV 40, 000 +30, 000 +20, 000 90, 000 3, 000 +2, 500 +1, 000 6, 500 5 90, 000 6, 000 1&2 50, 000 40, 000 90, 000 1, 500 3, 000 4, 500 50, 000 30, 000 20, 000 100, 000 1, 500 2, 500 1, 000 5, 000 1, 3 & 4 Project 1 2 3 4 5 IO 50, 000 40, 000 30, 000 20, 000 90, 000 NPV 1, 500 3, 000 2, 500 1, 000 6, 000 PI 1. 03 1. 075 1. 083 1. 05 1. 067

31 Capital Rationing Example Project Combinations 2, 3 & 4 IO NPV 40, 000 +30, 000 +20, 000 90, 000 3, 000 +2, 500 +1, 000 6, 500 5 90, 000 6, 000 1&2 50, 000 40, 000 90, 000 1, 500 3, 000 4, 500 50, 000 30, 000 20, 000 100, 000 1, 500 2, 500 1, 000 5, 000 1, 3 & 4 Project 1 2 3 4 5 IO 50, 000 40, 000 30, 000 20, 000 90, 000 NPV 1, 500 3, 000 2, 500 1, 000 6, 000 PI 1. 03 1. 075 1. 083 1. 05 1. 067

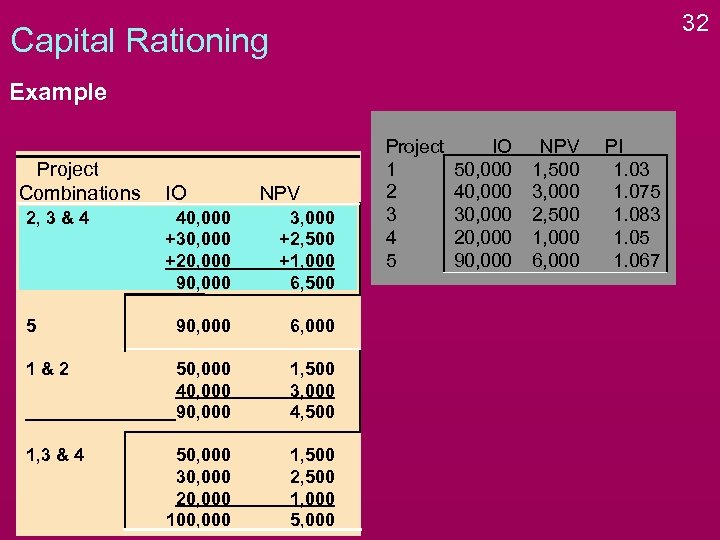

32 Capital Rationing Example Project Combinations 2, 3 & 4 IO NPV 40, 000 +30, 000 +20, 000 90, 000 3, 000 +2, 500 +1, 000 6, 500 5 90, 000 6, 000 1&2 50, 000 40, 000 90, 000 1, 500 3, 000 4, 500 50, 000 30, 000 20, 000 100, 000 1, 500 2, 500 1, 000 5, 000 1, 3 & 4 Project 1 2 3 4 5 IO 50, 000 40, 000 30, 000 20, 000 90, 000 NPV 1, 500 3, 000 2, 500 1, 000 6, 000 PI 1. 03 1. 075 1. 083 1. 05 1. 067

32 Capital Rationing Example Project Combinations 2, 3 & 4 IO NPV 40, 000 +30, 000 +20, 000 90, 000 3, 000 +2, 500 +1, 000 6, 500 5 90, 000 6, 000 1&2 50, 000 40, 000 90, 000 1, 500 3, 000 4, 500 50, 000 30, 000 20, 000 100, 000 1, 500 2, 500 1, 000 5, 000 1, 3 & 4 Project 1 2 3 4 5 IO 50, 000 40, 000 30, 000 20, 000 90, 000 NPV 1, 500 3, 000 2, 500 1, 000 6, 000 PI 1. 03 1. 075 1. 083 1. 05 1. 067

33

33