1 Case Study: Home Depot Lecture 5: Cash

- Размер: 507 Кб

- Количество слайдов: 33

Описание презентации 1 Case Study: Home Depot Lecture 5: Cash по слайдам

1 Case Study: Home Depot Lecture 5: Cash Flow Analysis

1 Case Study: Home Depot Lecture 5: Cash Flow Analysis

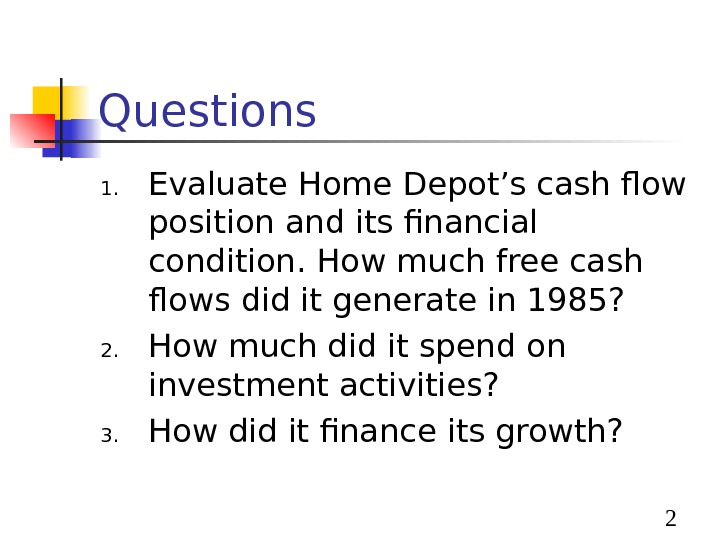

2 Questions 1. Evaluate Home Depot’s cash flow position and its financial condition. How much free cash flows did it generate in 1985? 2. How much did it spend on investment activities? 3. How did it finance its growth?

2 Questions 1. Evaluate Home Depot’s cash flow position and its financial condition. How much free cash flows did it generate in 1985? 2. How much did it spend on investment activities? 3. How did it finance its growth?

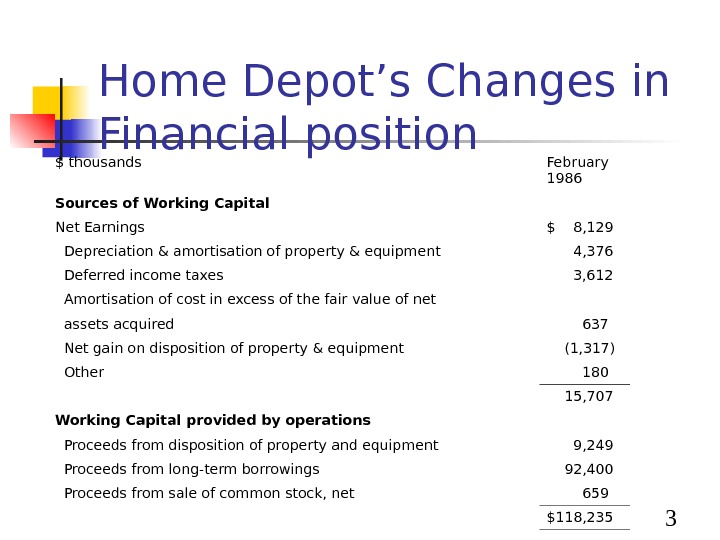

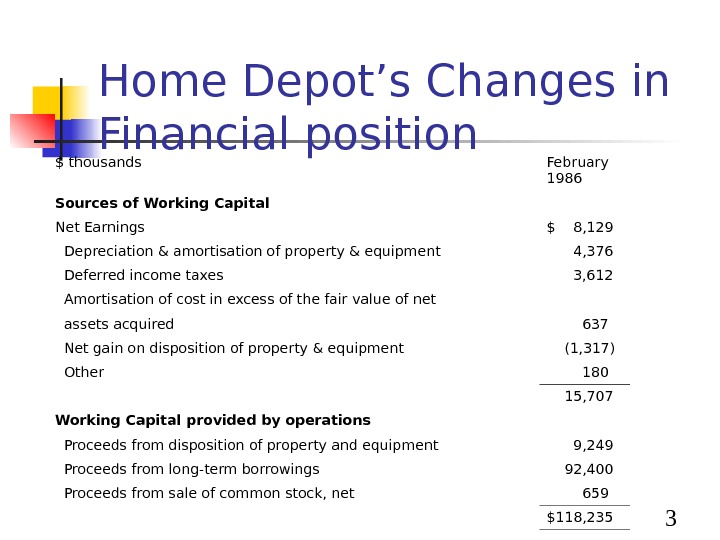

3 Home Depot’s Changes in Financial position $ thousands February 1986 Sources of Working Capital Net Earnings $ 8, 129 Depreciation & amortisation of property & equipment 4, 376 Deferred income taxes 3, 612 Amortisation of cost in excess of the fair value of net assets acquired 637 Net gain on disposition of property & equipment (1, 317) Other 180 15, 707 Working Capital provided by operations Proceeds from disposition of property and equipment 9, 249 Proceeds from long-term borrowings 92, 400 Proceeds from sale of common stock, net 659 $118,

3 Home Depot’s Changes in Financial position $ thousands February 1986 Sources of Working Capital Net Earnings $ 8, 129 Depreciation & amortisation of property & equipment 4, 376 Deferred income taxes 3, 612 Amortisation of cost in excess of the fair value of net assets acquired 637 Net gain on disposition of property & equipment (1, 317) Other 180 15, 707 Working Capital provided by operations Proceeds from disposition of property and equipment 9, 249 Proceeds from long-term borrowings 92, 400 Proceeds from sale of common stock, net 659 $118,

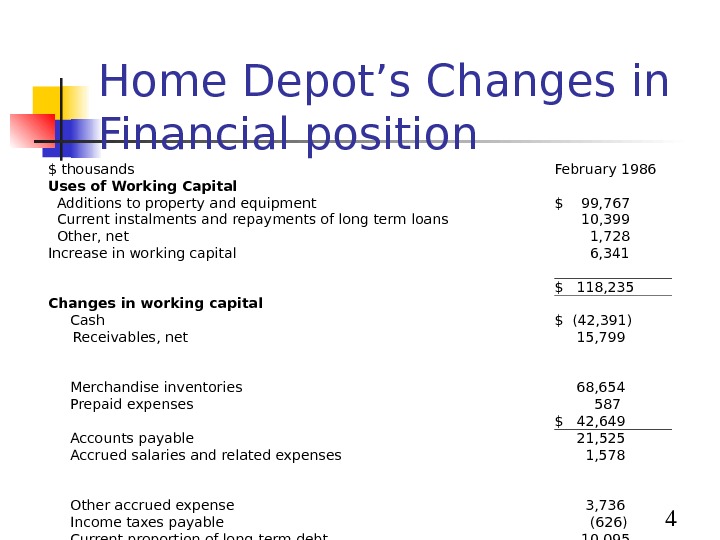

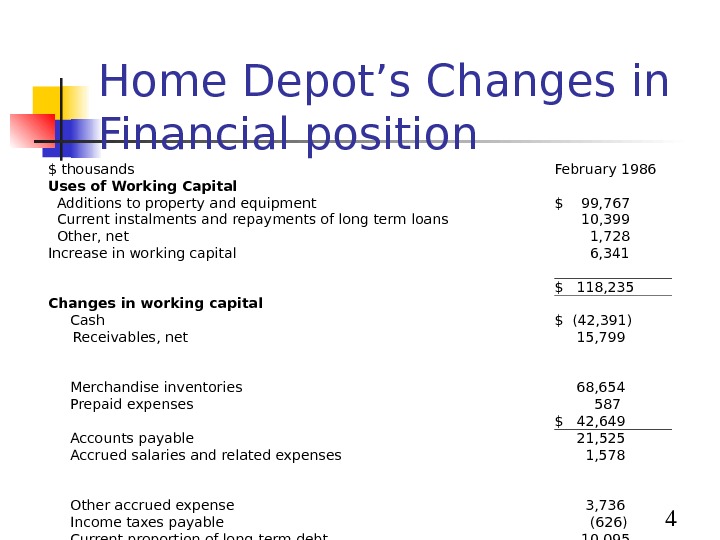

4 Home Depot’s Changes in Financial position $ thousands February 1986 Uses of Working Capital Additions to property and equipment $ 99, 767 Current instalments and repayments of long term loans 10, 399 Other, net 1, 728 Increase in working capital 6, 341 $ 118, 235 Changes in working capital Cash $ (42, 391) Receivables, net 15, 799 Merchandise inventories 68, 654 Prepaid expenses 587 $ 42, 649 Accounts payable 21, 525 Accrued salaries and related expenses 1, 578 Other accrued expense 3, 736 Income taxes payable (626) Current proportion of long-term debt 10, 095 $ 36, 308 Increase in working capital $ 6,

4 Home Depot’s Changes in Financial position $ thousands February 1986 Uses of Working Capital Additions to property and equipment $ 99, 767 Current instalments and repayments of long term loans 10, 399 Other, net 1, 728 Increase in working capital 6, 341 $ 118, 235 Changes in working capital Cash $ (42, 391) Receivables, net 15, 799 Merchandise inventories 68, 654 Prepaid expenses 587 $ 42, 649 Accounts payable 21, 525 Accrued salaries and related expenses 1, 578 Other accrued expense 3, 736 Income taxes payable (626) Current proportion of long-term debt 10, 095 $ 36, 308 Increase in working capital $ 6,

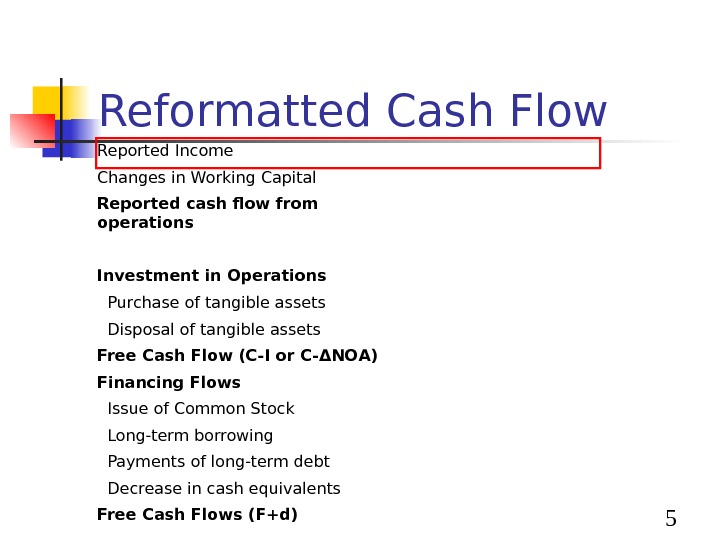

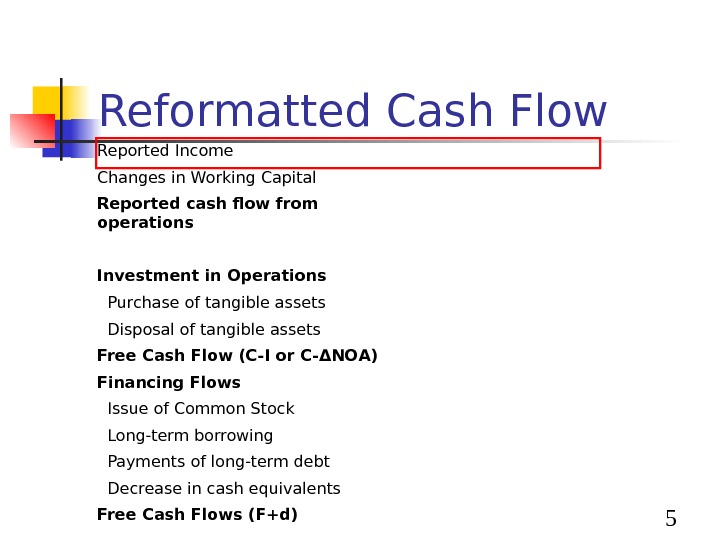

5 Reformatted Cash Flow Reported Income Changes in Working Capital Reported cash flow from operations Investment in Operations Purchase of tangible assets Disposal of tangible assets Free Cash Flow (C-I or C- ΔNOA) Financing Flows Issue of Common Stock Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

5 Reformatted Cash Flow Reported Income Changes in Working Capital Reported cash flow from operations Investment in Operations Purchase of tangible assets Disposal of tangible assets Free Cash Flow (C-I or C- ΔNOA) Financing Flows Issue of Common Stock Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

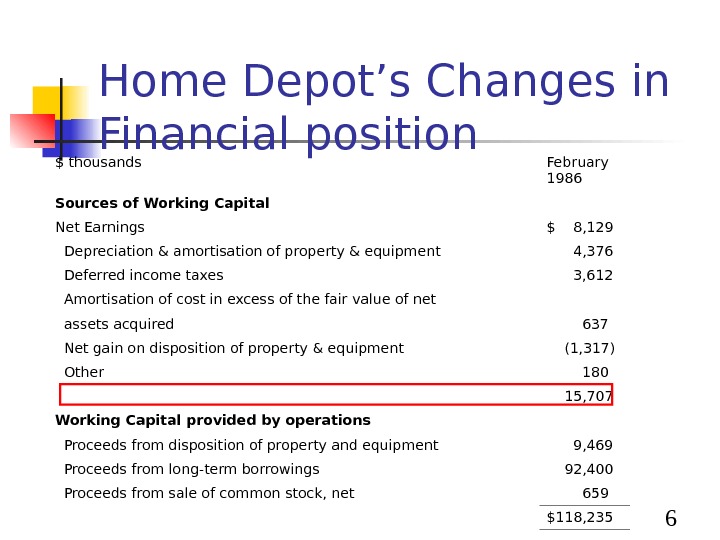

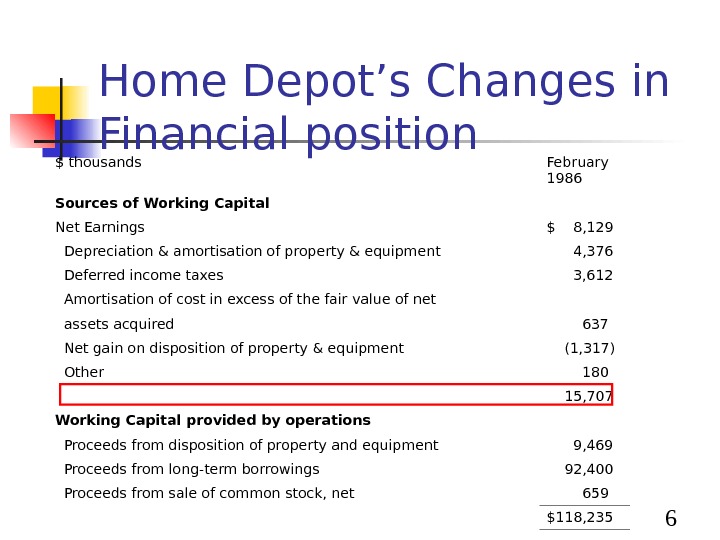

6 Home Depot’s Changes in Financial position $ thousands February 1986 Sources of Working Capital Net Earnings $ 8, 129 Depreciation & amortisation of property & equipment 4, 376 Deferred income taxes 3, 612 Amortisation of cost in excess of the fair value of net assets acquired 637 Net gain on disposition of property & equipment (1, 317) Other 180 15, 707 Working Capital provided by operations Proceeds from disposition of property and equipment 9, 469 Proceeds from long-term borrowings 92, 400 Proceeds from sale of common stock, net 659 $118,

6 Home Depot’s Changes in Financial position $ thousands February 1986 Sources of Working Capital Net Earnings $ 8, 129 Depreciation & amortisation of property & equipment 4, 376 Deferred income taxes 3, 612 Amortisation of cost in excess of the fair value of net assets acquired 637 Net gain on disposition of property & equipment (1, 317) Other 180 15, 707 Working Capital provided by operations Proceeds from disposition of property and equipment 9, 469 Proceeds from long-term borrowings 92, 400 Proceeds from sale of common stock, net 659 $118,

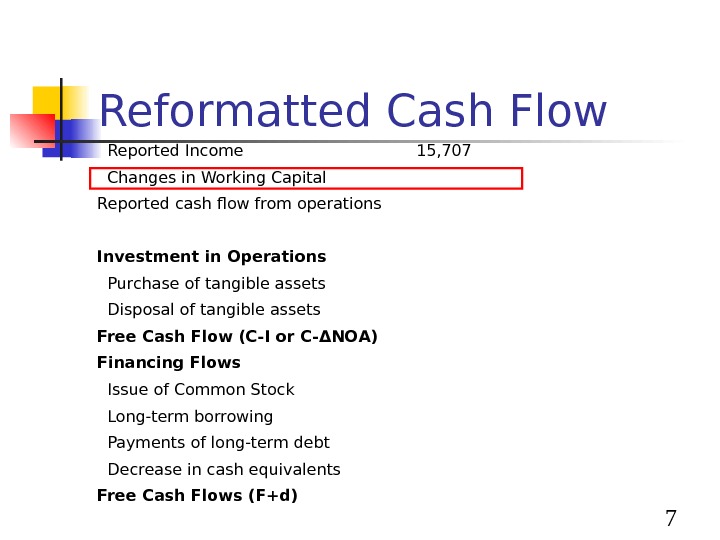

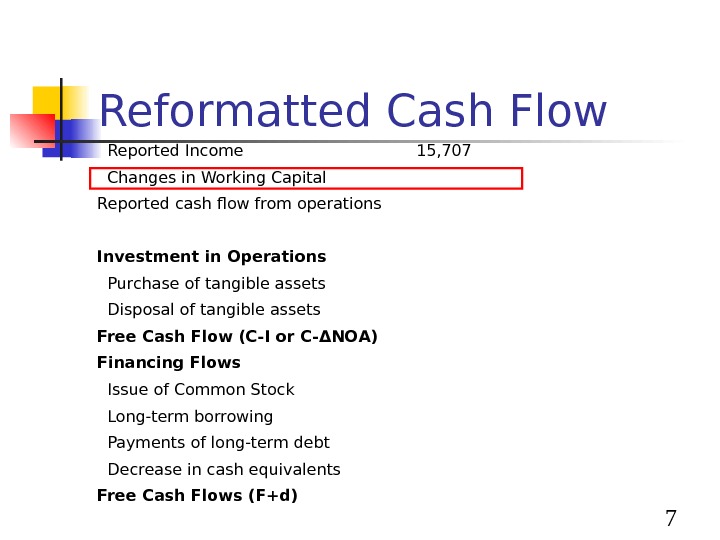

7 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital Reported cash flow from operations Investment in Operations Purchase of tangible assets Disposal of tangible assets Free Cash Flow (C-I or C- ΔNOA) Financing Flows Issue of Common Stock Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

7 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital Reported cash flow from operations Investment in Operations Purchase of tangible assets Disposal of tangible assets Free Cash Flow (C-I or C- ΔNOA) Financing Flows Issue of Common Stock Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

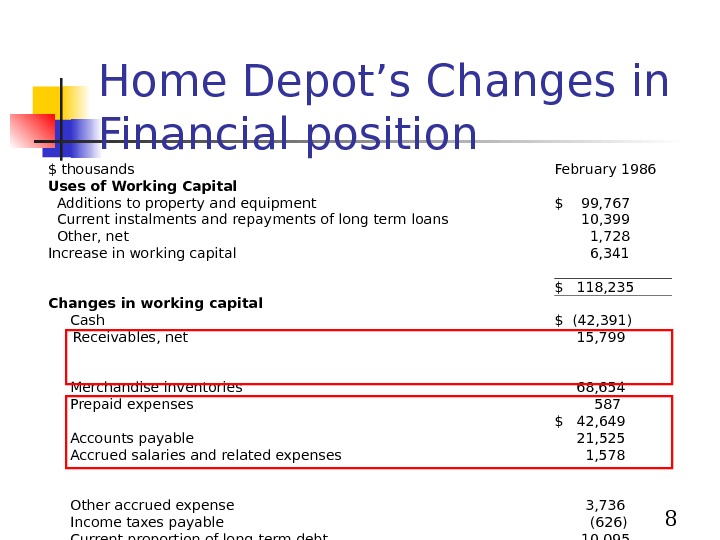

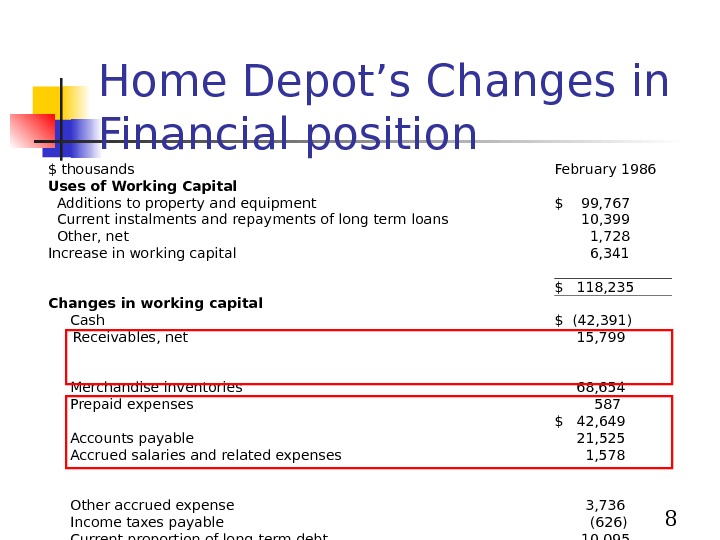

8 Home Depot’s Changes in Financial position $ thousands February 1986 Uses of Working Capital Additions to property and equipment $ 99, 767 Current instalments and repayments of long term loans 10, 399 Other, net 1, 728 Increase in working capital 6, 341 $ 118, 235 Changes in working capital Cash $ (42, 391) Receivables, net 15, 799 Merchandise inventories 68, 654 Prepaid expenses 587 $ 42, 649 Accounts payable 21, 525 Accrued salaries and related expenses 1, 578 Other accrued expense 3, 736 Income taxes payable (626) Current proportion of long-term debt 10, 095 $ 36, 308 Increase in working capital $ 6,

8 Home Depot’s Changes in Financial position $ thousands February 1986 Uses of Working Capital Additions to property and equipment $ 99, 767 Current instalments and repayments of long term loans 10, 399 Other, net 1, 728 Increase in working capital 6, 341 $ 118, 235 Changes in working capital Cash $ (42, 391) Receivables, net 15, 799 Merchandise inventories 68, 654 Prepaid expenses 587 $ 42, 649 Accounts payable 21, 525 Accrued salaries and related expenses 1, 578 Other accrued expense 3, 736 Income taxes payable (626) Current proportion of long-term debt 10, 095 $ 36, 308 Increase in working capital $ 6,

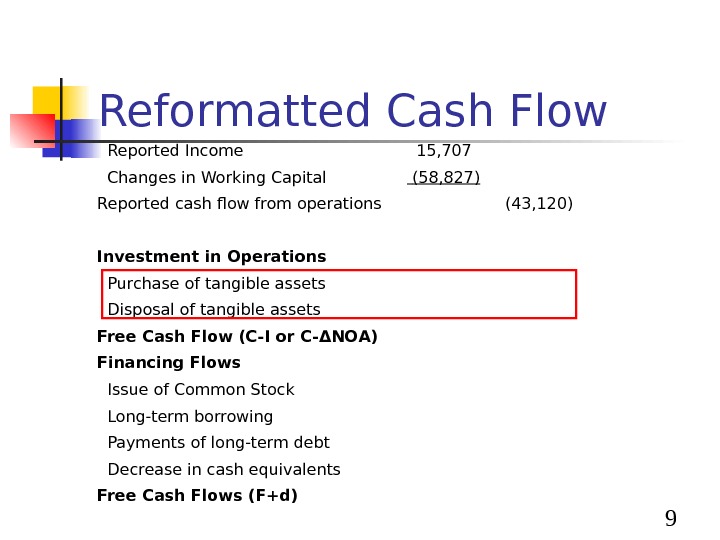

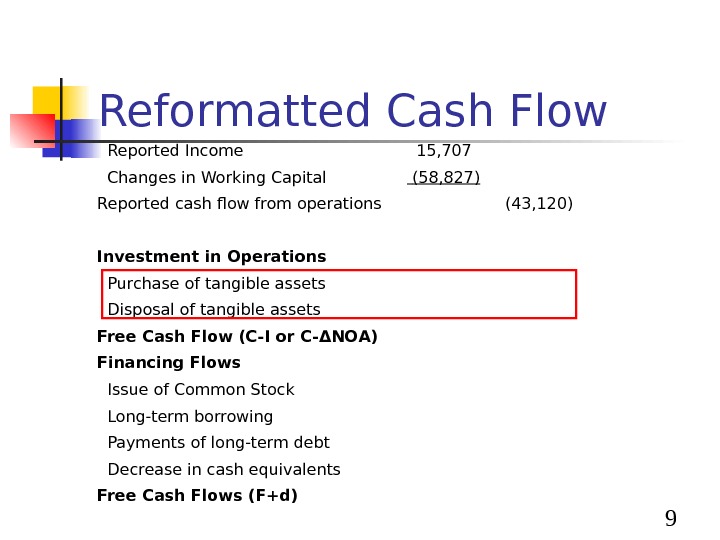

9 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets Disposal of tangible assets Free Cash Flow (C-I or C- ΔNOA) Financing Flows Issue of Common Stock Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

9 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets Disposal of tangible assets Free Cash Flow (C-I or C- ΔNOA) Financing Flows Issue of Common Stock Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

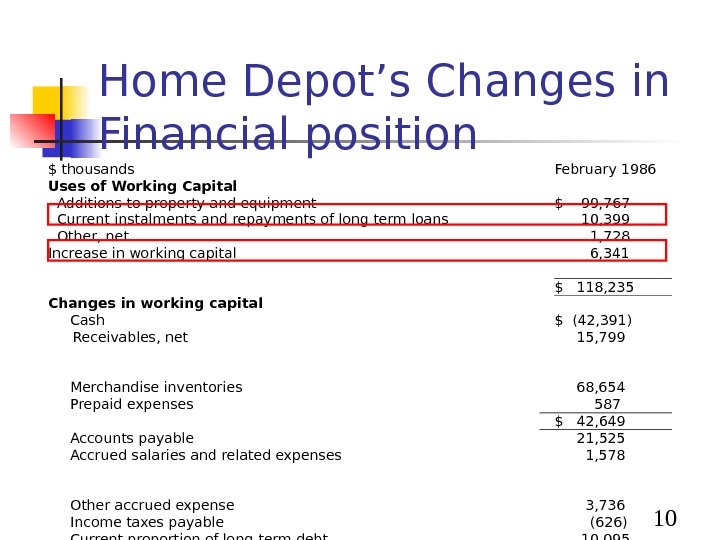

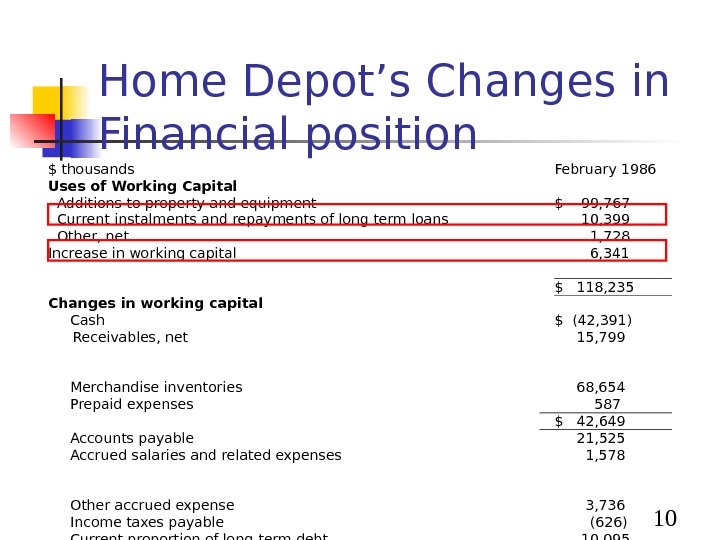

10 Home Depot’s Changes in Financial position $ thousands February 1986 Uses of Working Capital Additions to property and equipment $ 99, 767 Current instalments and repayments of long term loans 10, 399 Other, net 1, 728 Increase in working capital 6, 341 $ 118, 235 Changes in working capital Cash $ (42, 391) Receivables, net 15, 799 Merchandise inventories 68, 654 Prepaid expenses 587 $ 42, 649 Accounts payable 21, 525 Accrued salaries and related expenses 1, 578 Other accrued expense 3, 736 Income taxes payable (626) Current proportion of long-term debt 10, 095 $ 36, 308 Increase in working capital $ 6,

10 Home Depot’s Changes in Financial position $ thousands February 1986 Uses of Working Capital Additions to property and equipment $ 99, 767 Current instalments and repayments of long term loans 10, 399 Other, net 1, 728 Increase in working capital 6, 341 $ 118, 235 Changes in working capital Cash $ (42, 391) Receivables, net 15, 799 Merchandise inventories 68, 654 Prepaid expenses 587 $ 42, 649 Accounts payable 21, 525 Accrued salaries and related expenses 1, 578 Other accrued expense 3, 736 Income taxes payable (626) Current proportion of long-term debt 10, 095 $ 36, 308 Increase in working capital $ 6,

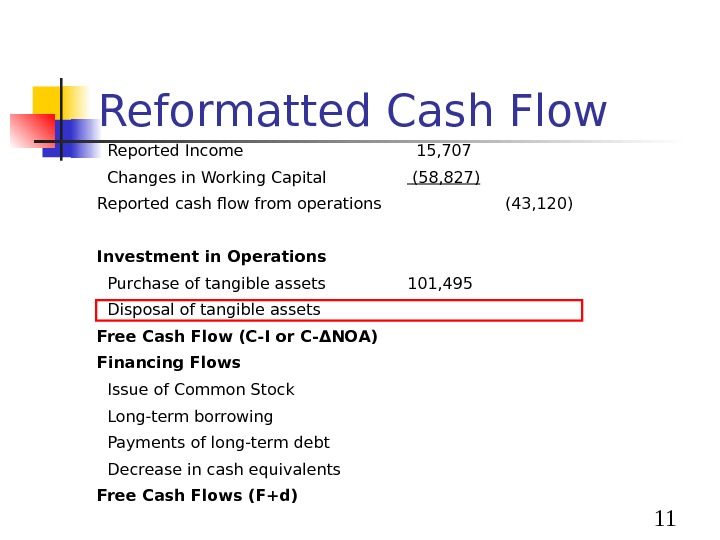

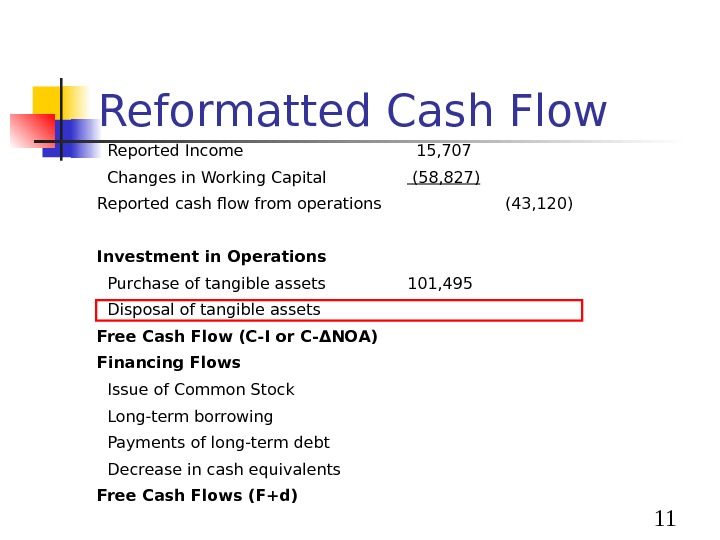

11 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets Free Cash Flow (C-I or C- ΔNOA) Financing Flows Issue of Common Stock Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

11 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets Free Cash Flow (C-I or C- ΔNOA) Financing Flows Issue of Common Stock Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

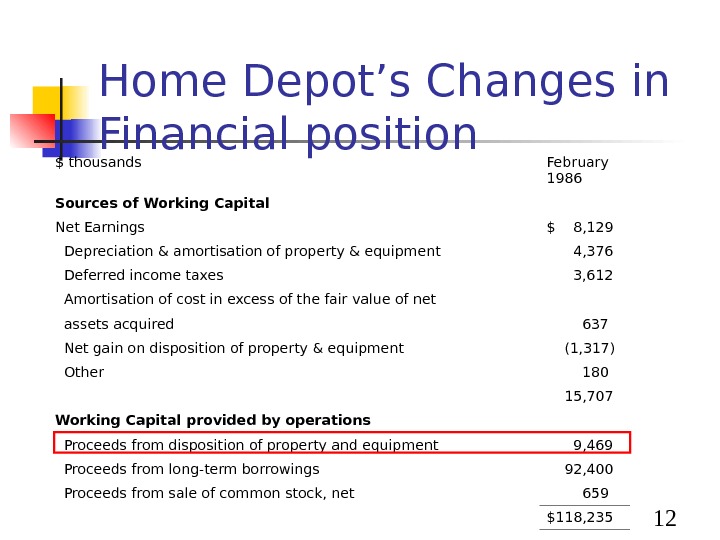

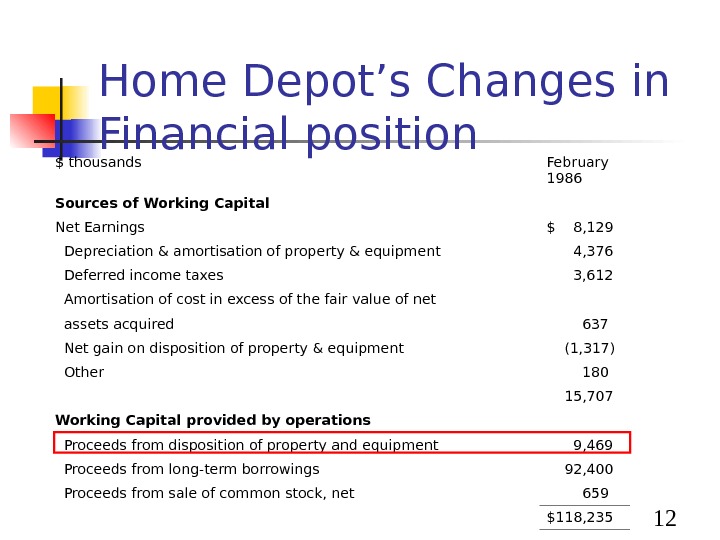

12 Home Depot’s Changes in Financial position $ thousands February 1986 Sources of Working Capital Net Earnings $ 8, 129 Depreciation & amortisation of property & equipment 4, 376 Deferred income taxes 3, 612 Amortisation of cost in excess of the fair value of net assets acquired 637 Net gain on disposition of property & equipment (1, 317) Other 180 15, 707 Working Capital provided by operations Proceeds from disposition of property and equipment 9, 469 Proceeds from long-term borrowings 92, 400 Proceeds from sale of common stock, net 659 $118,

12 Home Depot’s Changes in Financial position $ thousands February 1986 Sources of Working Capital Net Earnings $ 8, 129 Depreciation & amortisation of property & equipment 4, 376 Deferred income taxes 3, 612 Amortisation of cost in excess of the fair value of net assets acquired 637 Net gain on disposition of property & equipment (1, 317) Other 180 15, 707 Working Capital provided by operations Proceeds from disposition of property and equipment 9, 469 Proceeds from long-term borrowings 92, 400 Proceeds from sale of common stock, net 659 $118,

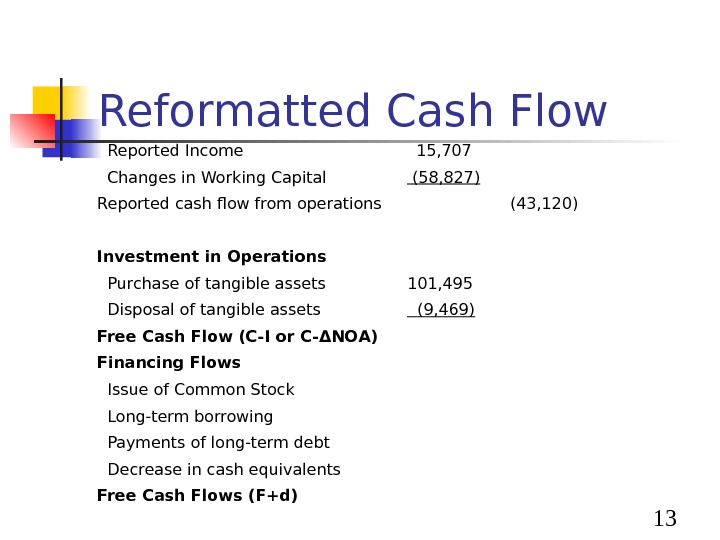

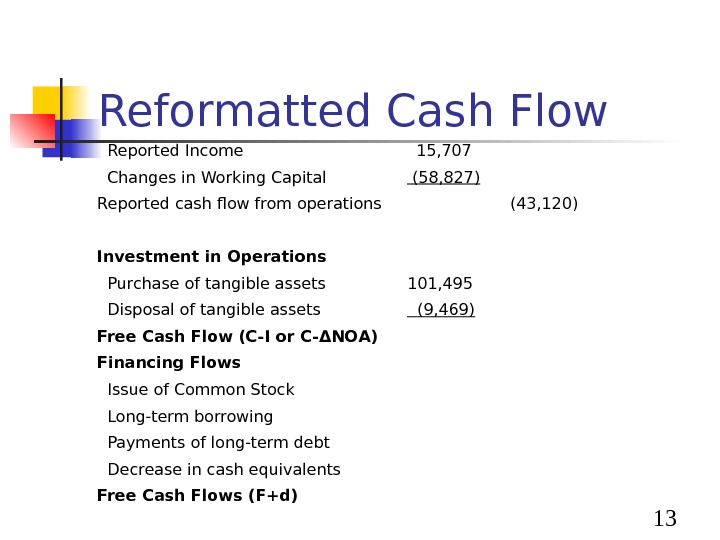

13 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) Free Cash Flow (C-I or C- ΔNOA) Financing Flows Issue of Common Stock Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

13 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) Free Cash Flow (C-I or C- ΔNOA) Financing Flows Issue of Common Stock Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

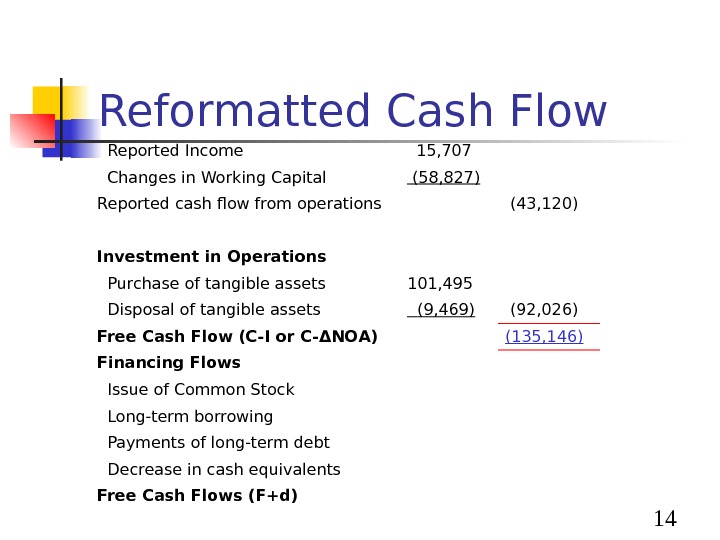

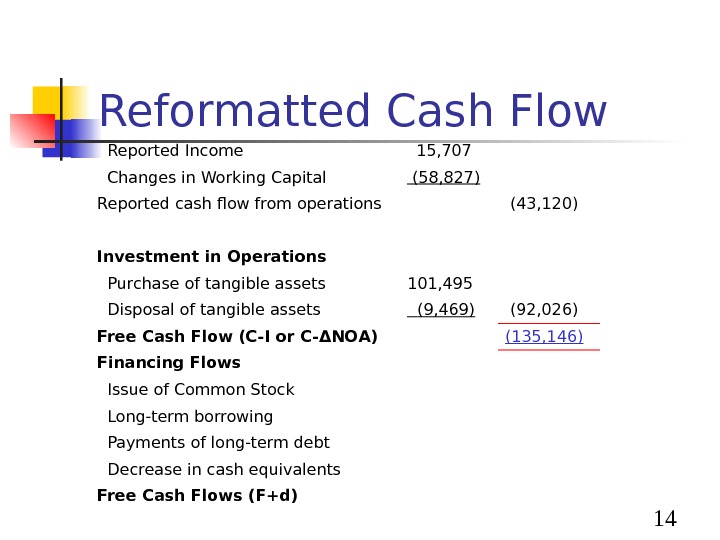

14 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) (92, 026) Free Cash Flow (C-I or C- ΔNOA) (135, 146) Financing Flows Issue of Common Stock Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

14 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) (92, 026) Free Cash Flow (C-I or C- ΔNOA) (135, 146) Financing Flows Issue of Common Stock Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

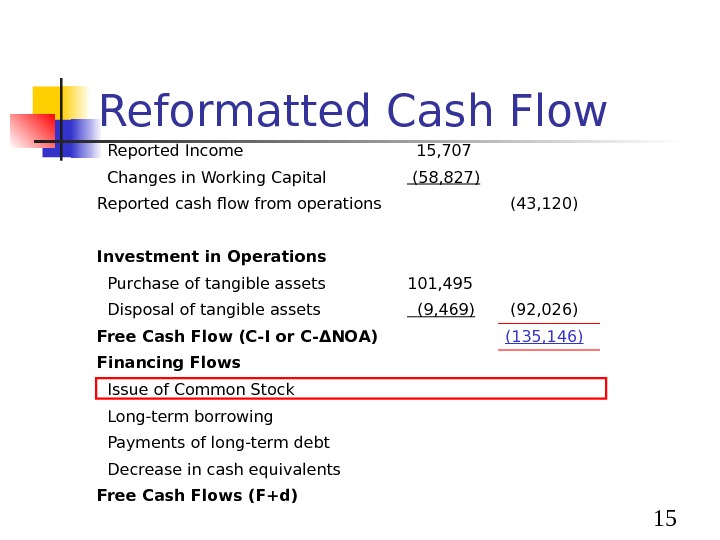

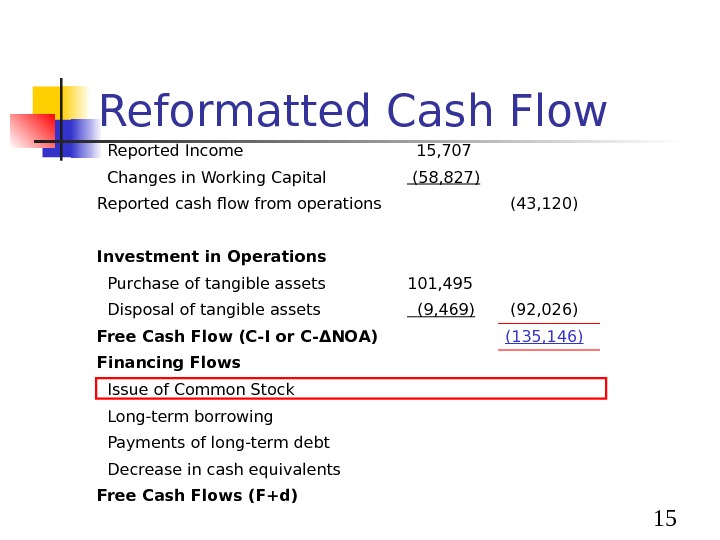

15 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) (92, 026) Free Cash Flow (C-I or C- ΔNOA) (135, 146) Financing Flows Issue of Common Stock Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

15 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) (92, 026) Free Cash Flow (C-I or C- ΔNOA) (135, 146) Financing Flows Issue of Common Stock Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

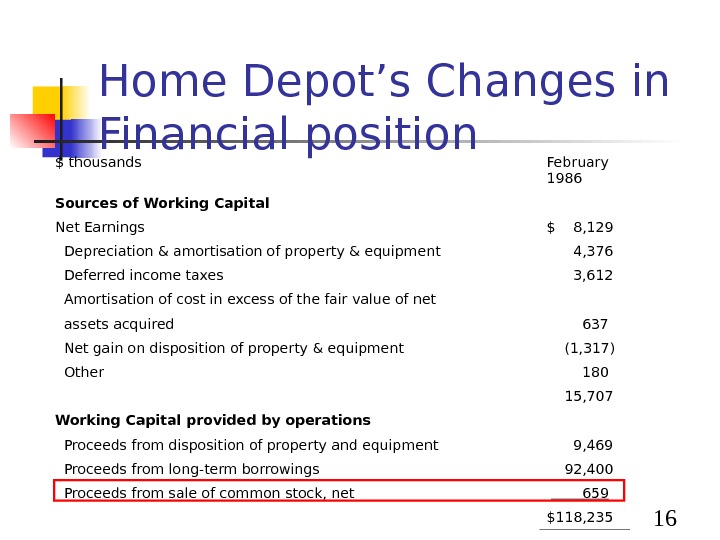

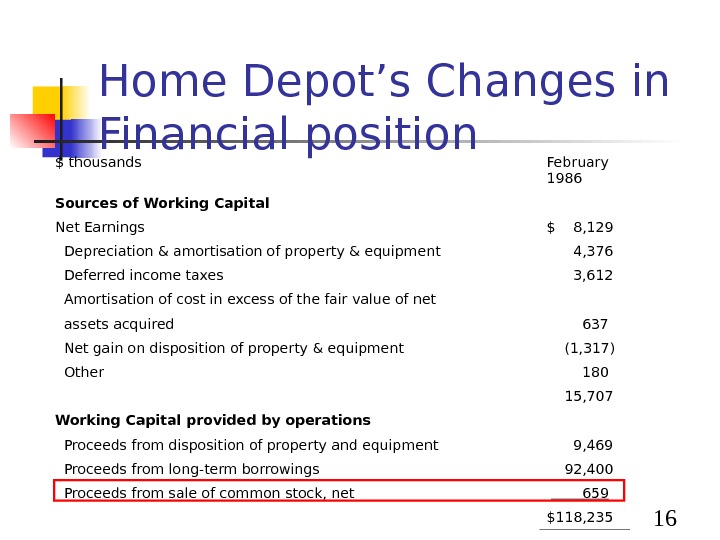

16 Home Depot’s Changes in Financial position $ thousands February 1986 Sources of Working Capital Net Earnings $ 8, 129 Depreciation & amortisation of property & equipment 4, 376 Deferred income taxes 3, 612 Amortisation of cost in excess of the fair value of net assets acquired 637 Net gain on disposition of property & equipment (1, 317) Other 180 15, 707 Working Capital provided by operations Proceeds from disposition of property and equipment 9, 469 Proceeds from long-term borrowings 92, 400 Proceeds from sale of common stock, net 659 $118,

16 Home Depot’s Changes in Financial position $ thousands February 1986 Sources of Working Capital Net Earnings $ 8, 129 Depreciation & amortisation of property & equipment 4, 376 Deferred income taxes 3, 612 Amortisation of cost in excess of the fair value of net assets acquired 637 Net gain on disposition of property & equipment (1, 317) Other 180 15, 707 Working Capital provided by operations Proceeds from disposition of property and equipment 9, 469 Proceeds from long-term borrowings 92, 400 Proceeds from sale of common stock, net 659 $118,

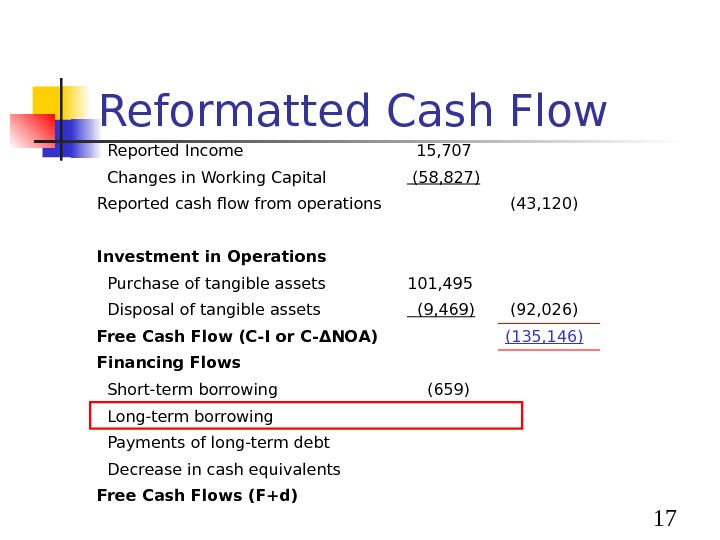

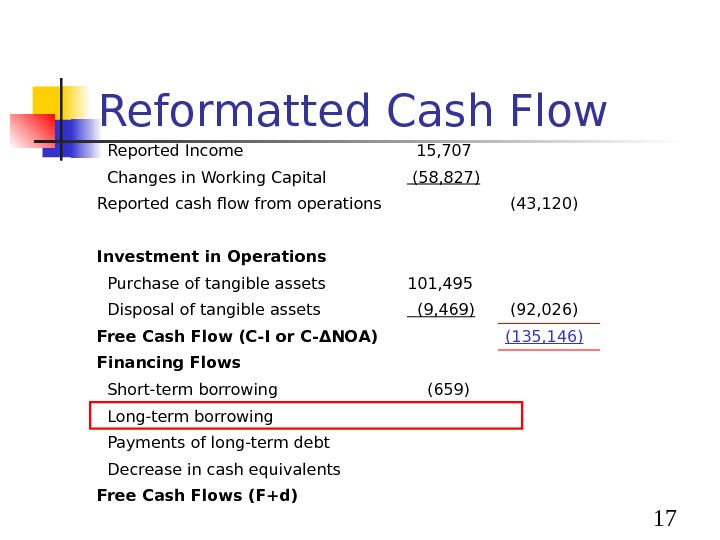

17 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) (92, 026) Free Cash Flow (C-I or C- ΔNOA) (135, 146) Financing Flows Short-term borrowing (659) Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

17 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) (92, 026) Free Cash Flow (C-I or C- ΔNOA) (135, 146) Financing Flows Short-term borrowing (659) Long-term borrowing Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

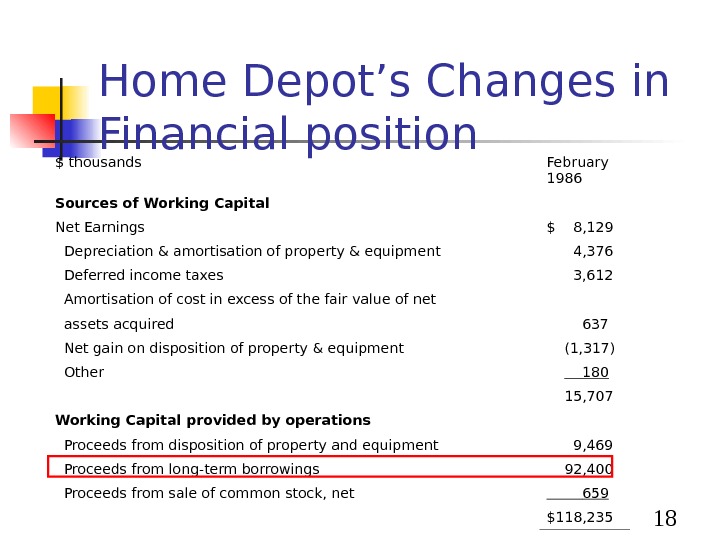

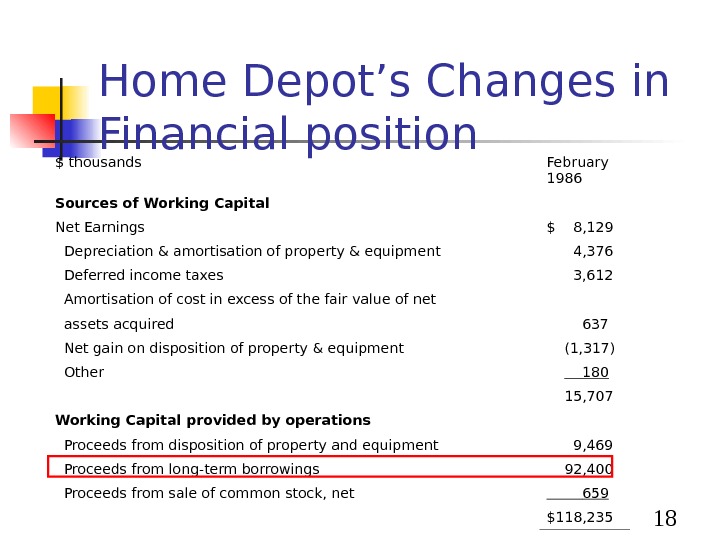

18 Home Depot’s Changes in Financial position $ thousands February 1986 Sources of Working Capital Net Earnings $ 8, 129 Depreciation & amortisation of property & equipment 4, 376 Deferred income taxes 3, 612 Amortisation of cost in excess of the fair value of net assets acquired 637 Net gain on disposition of property & equipment (1, 317) Other 180 15, 707 Working Capital provided by operations Proceeds from disposition of property and equipment 9, 469 Proceeds from long-term borrowings 92, 400 Proceeds from sale of common stock, net 659 $118,

18 Home Depot’s Changes in Financial position $ thousands February 1986 Sources of Working Capital Net Earnings $ 8, 129 Depreciation & amortisation of property & equipment 4, 376 Deferred income taxes 3, 612 Amortisation of cost in excess of the fair value of net assets acquired 637 Net gain on disposition of property & equipment (1, 317) Other 180 15, 707 Working Capital provided by operations Proceeds from disposition of property and equipment 9, 469 Proceeds from long-term borrowings 92, 400 Proceeds from sale of common stock, net 659 $118,

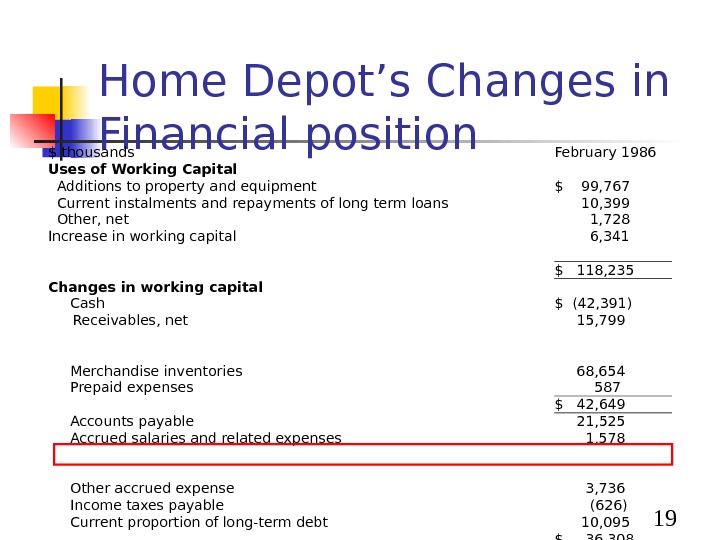

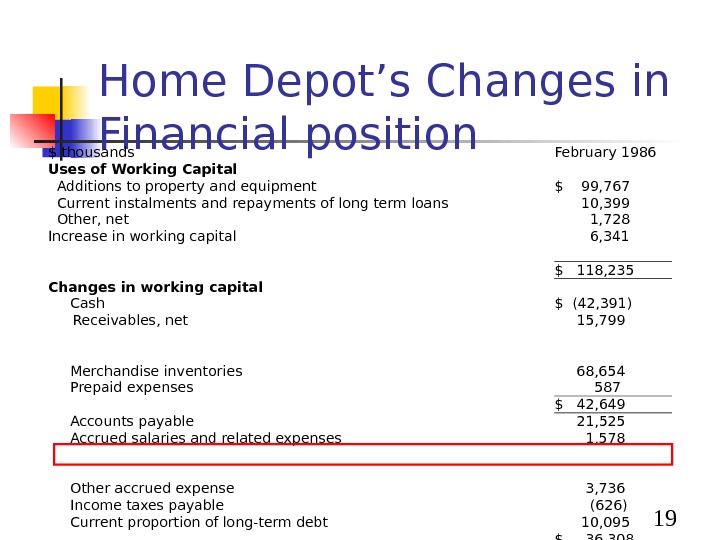

19 Home Depot’s Changes in Financial position $ thousands February 1986 Uses of Working Capital Additions to property and equipment $ 99, 767 Current instalments and repayments of long term loans 10, 399 Other, net 1, 728 Increase in working capital 6, 341 $ 118, 235 Changes in working capital Cash $ (42, 391) Receivables, net 15, 799 Merchandise inventories 68, 654 Prepaid expenses 587 $ 42, 649 Accounts payable 21, 525 Accrued salaries and related expenses 1, 578 Other accrued expense 3, 736 Income taxes payable (626) Current proportion of long-term debt 10, 095 $ 36, 308 Increase in working capital $ 6,

19 Home Depot’s Changes in Financial position $ thousands February 1986 Uses of Working Capital Additions to property and equipment $ 99, 767 Current instalments and repayments of long term loans 10, 399 Other, net 1, 728 Increase in working capital 6, 341 $ 118, 235 Changes in working capital Cash $ (42, 391) Receivables, net 15, 799 Merchandise inventories 68, 654 Prepaid expenses 587 $ 42, 649 Accounts payable 21, 525 Accrued salaries and related expenses 1, 578 Other accrued expense 3, 736 Income taxes payable (626) Current proportion of long-term debt 10, 095 $ 36, 308 Increase in working capital $ 6,

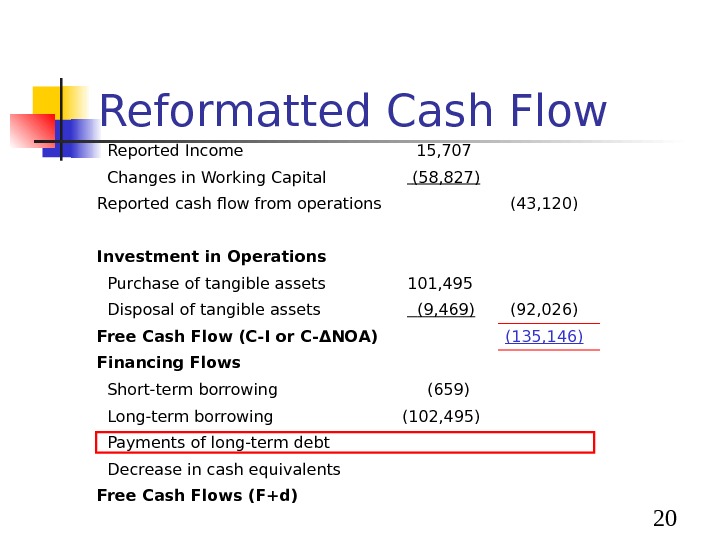

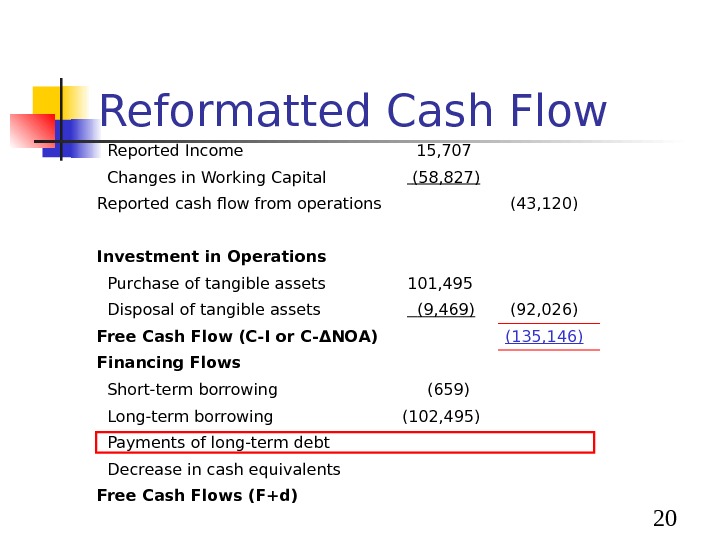

20 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) (92, 026) Free Cash Flow (C-I or C- ΔNOA) (135, 146) Financing Flows Short-term borrowing (659) Long-term borrowing (102, 495) Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

20 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) (92, 026) Free Cash Flow (C-I or C- ΔNOA) (135, 146) Financing Flows Short-term borrowing (659) Long-term borrowing (102, 495) Payments of long-term debt Decrease in cash equivalents Free Cash Flows (F+d)

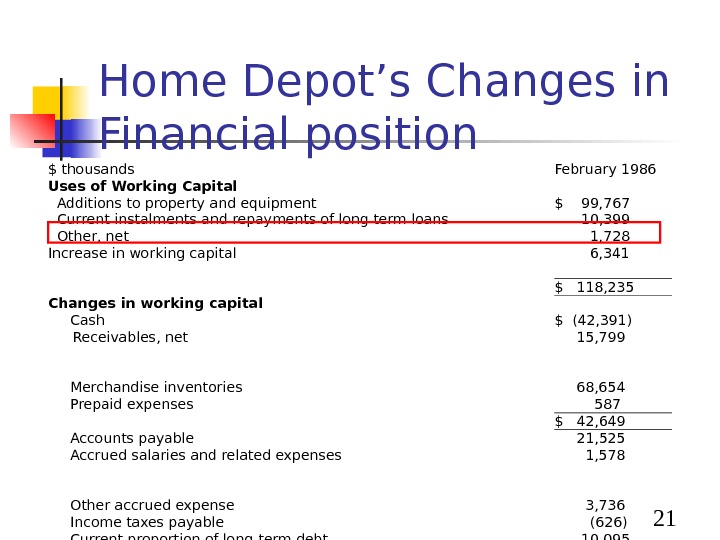

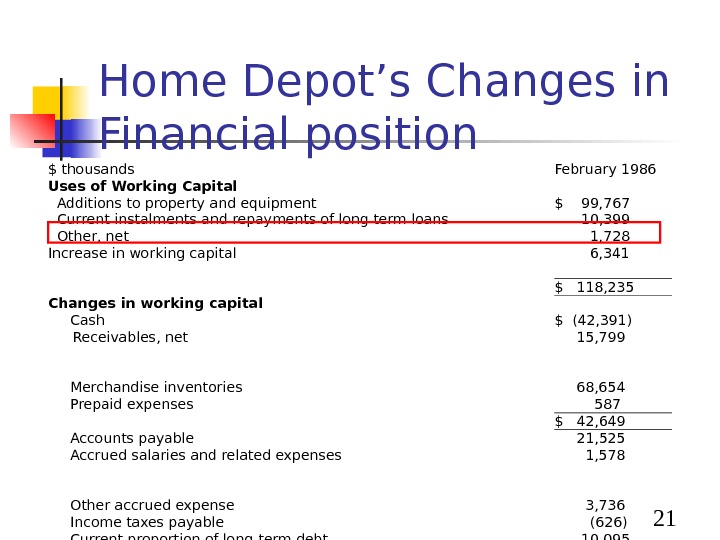

21 Home Depot’s Changes in Financial position $ thousands February 1986 Uses of Working Capital Additions to property and equipment $ 99, 767 Current instalments and repayments of long term loans 10, 399 Other, net 1, 728 Increase in working capital 6, 341 $ 118, 235 Changes in working capital Cash $ (42, 391) Receivables, net 15, 799 Merchandise inventories 68, 654 Prepaid expenses 587 $ 42, 649 Accounts payable 21, 525 Accrued salaries and related expenses 1, 578 Other accrued expense 3, 736 Income taxes payable (626) Current proportion of long-term debt 10, 095 $ 36, 308 Increase in working capital $ 6,

21 Home Depot’s Changes in Financial position $ thousands February 1986 Uses of Working Capital Additions to property and equipment $ 99, 767 Current instalments and repayments of long term loans 10, 399 Other, net 1, 728 Increase in working capital 6, 341 $ 118, 235 Changes in working capital Cash $ (42, 391) Receivables, net 15, 799 Merchandise inventories 68, 654 Prepaid expenses 587 $ 42, 649 Accounts payable 21, 525 Accrued salaries and related expenses 1, 578 Other accrued expense 3, 736 Income taxes payable (626) Current proportion of long-term debt 10, 095 $ 36, 308 Increase in working capital $ 6,

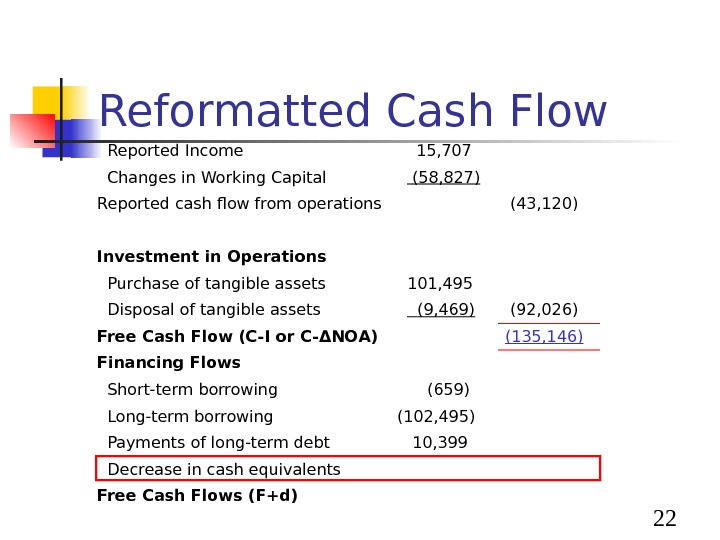

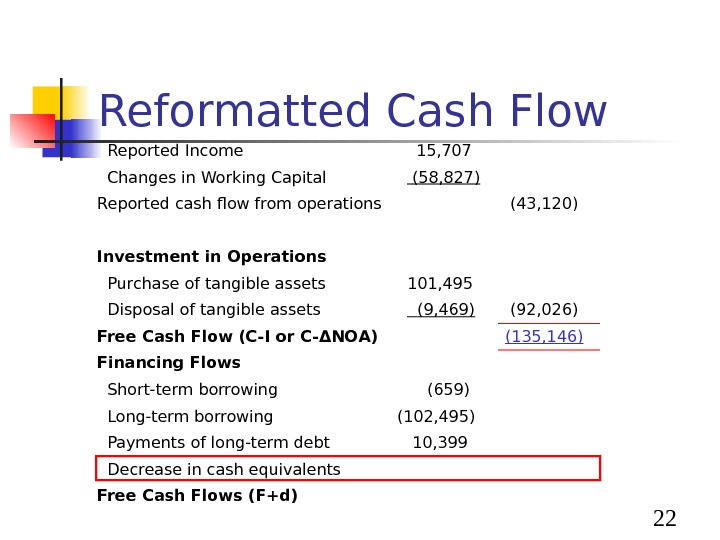

22 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) (92, 026) Free Cash Flow (C-I or C- ΔNOA) (135, 146) Financing Flows Short-term borrowing (659) Long-term borrowing (102, 495) Payments of long-term debt 10, 399 Decrease in cash equivalents Free Cash Flows (F+d)

22 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) (92, 026) Free Cash Flow (C-I or C- ΔNOA) (135, 146) Financing Flows Short-term borrowing (659) Long-term borrowing (102, 495) Payments of long-term debt 10, 399 Decrease in cash equivalents Free Cash Flows (F+d)

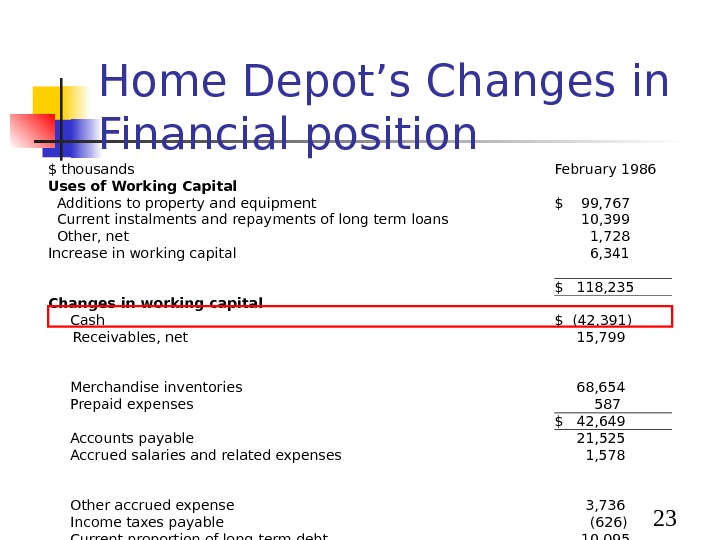

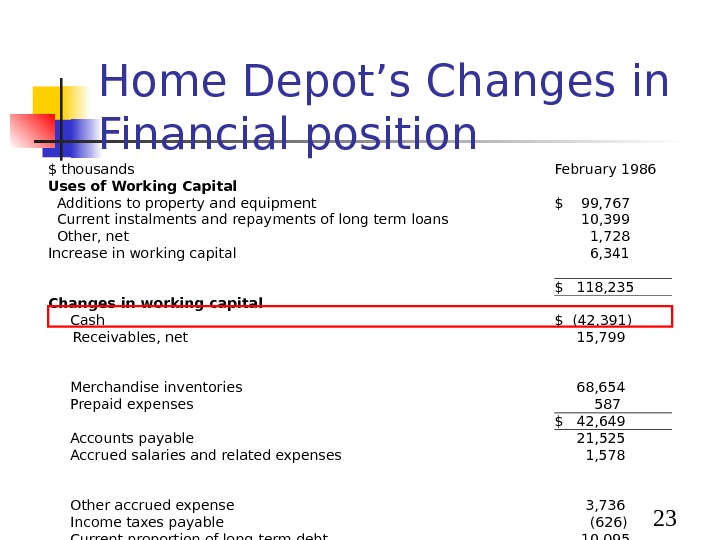

23 Home Depot’s Changes in Financial position $ thousands February 1986 Uses of Working Capital Additions to property and equipment $ 99, 767 Current instalments and repayments of long term loans 10, 399 Other, net 1, 728 Increase in working capital 6, 341 $ 118, 235 Changes in working capital Cash $ (42, 391) Receivables, net 15, 799 Merchandise inventories 68, 654 Prepaid expenses 587 $ 42, 649 Accounts payable 21, 525 Accrued salaries and related expenses 1, 578 Other accrued expense 3, 736 Income taxes payable (626) Current proportion of long-term debt 10, 095 $ 36, 308 Increase in working capital $ 6,

23 Home Depot’s Changes in Financial position $ thousands February 1986 Uses of Working Capital Additions to property and equipment $ 99, 767 Current instalments and repayments of long term loans 10, 399 Other, net 1, 728 Increase in working capital 6, 341 $ 118, 235 Changes in working capital Cash $ (42, 391) Receivables, net 15, 799 Merchandise inventories 68, 654 Prepaid expenses 587 $ 42, 649 Accounts payable 21, 525 Accrued salaries and related expenses 1, 578 Other accrued expense 3, 736 Income taxes payable (626) Current proportion of long-term debt 10, 095 $ 36, 308 Increase in working capital $ 6,

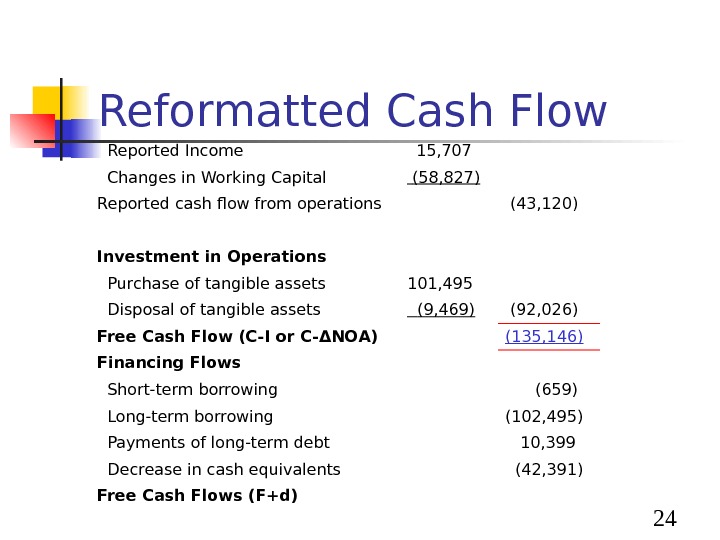

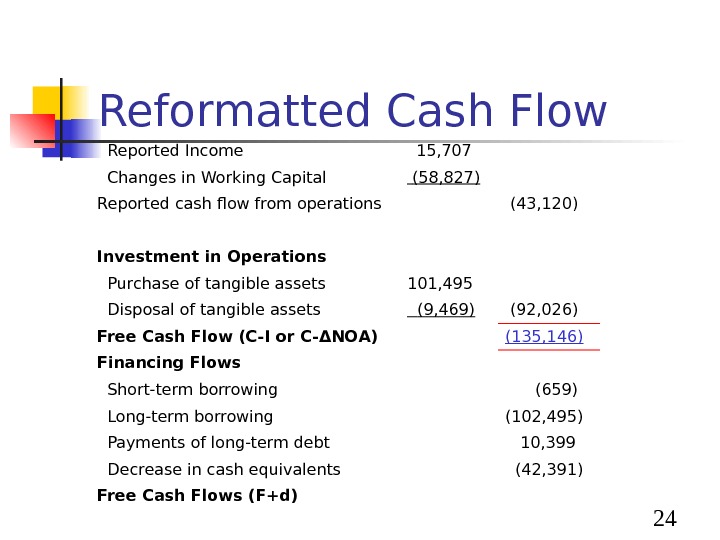

24 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) (92, 026) Free Cash Flow (C-I or C- ΔNOA) (135, 146) Financing Flows Short-term borrowing (659) Long-term borrowing (102, 495) Payments of long-term debt 10, 399 Decrease in cash equivalents (42, 391) Free Cash Flows (F+d)

24 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) (92, 026) Free Cash Flow (C-I or C- ΔNOA) (135, 146) Financing Flows Short-term borrowing (659) Long-term borrowing (102, 495) Payments of long-term debt 10, 399 Decrease in cash equivalents (42, 391) Free Cash Flows (F+d)

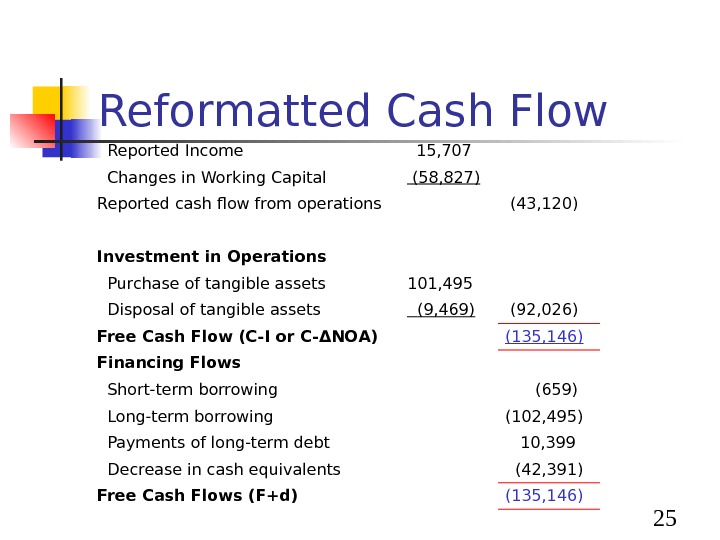

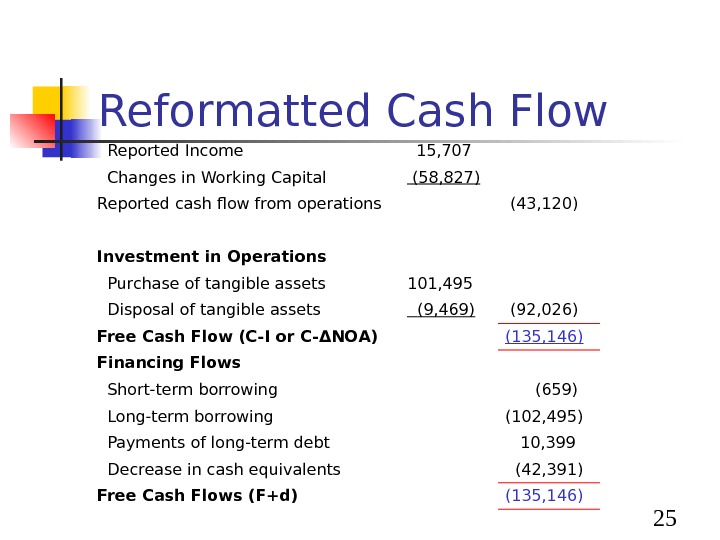

25 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) (92, 026) Free Cash Flow (C-I or C- ΔNOA) (135, 146) Financing Flows Short-term borrowing (659) Long-term borrowing (102, 495) Payments of long-term debt 10, 399 Decrease in cash equivalents (42, 391) Free Cash Flows (F+d) (135, 146)

25 Reformatted Cash Flow Reported Income 15, 707 Changes in Working Capital (58, 827) Reported cash flow from operations (43, 120) Investment in Operations Purchase of tangible assets 101, 495 Disposal of tangible assets (9, 469) (92, 026) Free Cash Flow (C-I or C- ΔNOA) (135, 146) Financing Flows Short-term borrowing (659) Long-term borrowing (102, 495) Payments of long-term debt 10, 399 Decrease in cash equivalents (42, 391) Free Cash Flows (F+d) (135, 146)

26 Cash Flow Analysis The company has negative cash flow from operations (in each of the three years) Alarming? Growing Company

26 Cash Flow Analysis The company has negative cash flow from operations (in each of the three years) Alarming? Growing Company

27 Alarming potentially alarming : huge increase in –ve free cash flows between 1984 and 1985 Why this increase: Primarily due large stock and debtor increases Not offset by increase in creditors Negative CF from operation exacerbated by the decline in Margins

27 Alarming potentially alarming : huge increase in –ve free cash flows between 1984 and 1985 Why this increase: Primarily due large stock and debtor increases Not offset by increase in creditors Negative CF from operation exacerbated by the decline in Margins

28 Cash Flow Analysis Significant investment in P&E was a second reason for deficit 1985 expansion required investment of $90 m Since company’s operations generated –ve CF, investment had to be funded externally

28 Cash Flow Analysis Significant investment in P&E was a second reason for deficit 1985 expansion required investment of $90 m Since company’s operations generated –ve CF, investment had to be funded externally

29 Cash Flow Analysis Most of company’s cash needs financed through long-term debt 1984 borrowed $120 m, then additional $92 m in 1985 Used convertible debt in both years Decline in stock price: dropped by 23% between Jan 1985 -Feb 1986 Unlikely debt converted anytime soon

29 Cash Flow Analysis Most of company’s cash needs financed through long-term debt 1984 borrowed $120 m, then additional $92 m in 1985 Used convertible debt in both years Decline in stock price: dropped by 23% between Jan 1985 -Feb 1986 Unlikely debt converted anytime soon

30 Contrast: Hechinger had a +ve CF from operations in each three years Did not rely on debt financing Used equity financing to fund its capital expansion Hence debt-equity ratio in 1985 = 1. 21 while Home Depot = 2.

30 Contrast: Hechinger had a +ve CF from operations in each three years Did not rely on debt financing Used equity financing to fund its capital expansion Hence debt-equity ratio in 1985 = 1. 21 while Home Depot = 2.

31 Subsequent Developments Company’s financial position improved dramatically during this period. Operations provided a +ve CF of $66. 8 m in 1986 and $56. 2 m in 1987 Company’s stock price increased (see FSA Case)

31 Subsequent Developments Company’s financial position improved dramatically during this period. Operations provided a +ve CF of $66. 8 m in 1986 and $56. 2 m in 1987 Company’s stock price increased (see FSA Case)

32 Subsequent Developments Company’s leverage dropped to a debt-equity ratio of 0. 91 in 1987 from 2. 7 in 1985 Several developments contributed: Company raised £ 50 m through equity issue $32 m from sale and lease-back transactions Money borrowed under revolving credit = fully paid Holders of 2 convertible debenture series converted their debentures to common stock

32 Subsequent Developments Company’s leverage dropped to a debt-equity ratio of 0. 91 in 1987 from 2. 7 in 1985 Several developments contributed: Company raised £ 50 m through equity issue $32 m from sale and lease-back transactions Money borrowed under revolving credit = fully paid Holders of 2 convertible debenture series converted their debentures to common stock

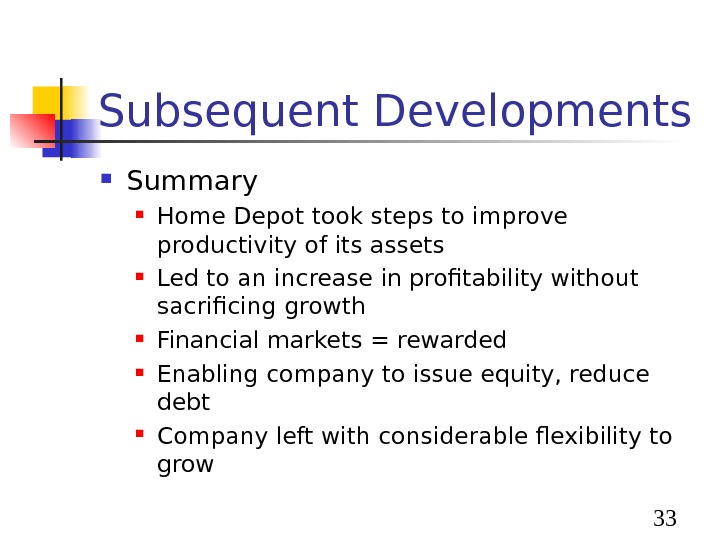

33 Subsequent Developments Summary Home Depot took steps to improve productivity of its assets Led to an increase in profitability without sacrificing growth Financial markets = rewarded Enabling company to issue equity, reduce debt Company left with considerable flexibility to grow

33 Subsequent Developments Summary Home Depot took steps to improve productivity of its assets Led to an increase in profitability without sacrificing growth Financial markets = rewarded Enabling company to issue equity, reduce debt Company left with considerable flexibility to grow