e2f2d621e13f68574ddda964d55d6d0e.ppt

- Количество слайдов: 20

1 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Chapter 13 Equity Valuation Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

2 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Fundamental Stock Analysis: Models of Equity Valuation • Basic Types of Models – Balance Sheet Models – Dividend Discount Models – Price/Earning Ratios • Estimating Growth Rates and Opportunities Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

3 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Intrinsic Value and Market Price • Intrinsic Value – Self assigned Value – Variety of models are used for estimation • Market Price – Consensus value of all potential traders • Trading Signal – IV > MP Buy – IV < MP Sell or Short Sell – IV = MP Hold or Fairly Priced Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

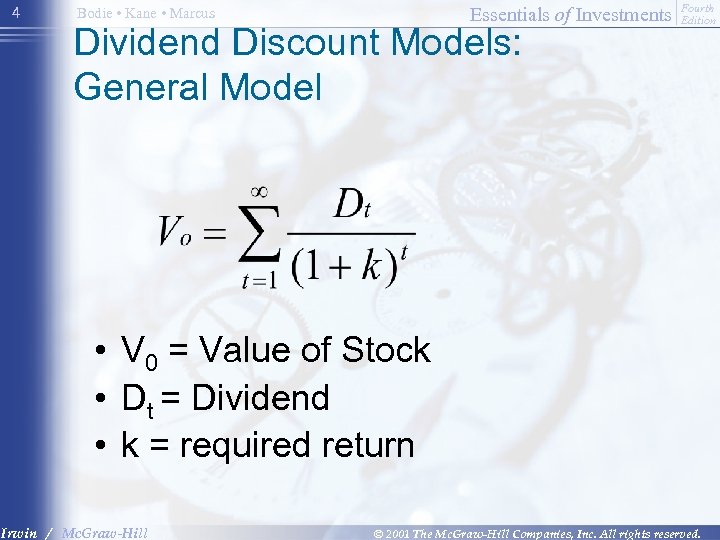

4 Essentials of Investments Bodie • Kane • Marcus Dividend Discount Models: General Model Fourth Edition • V 0 = Value of Stock • Dt = Dividend • k = required return Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

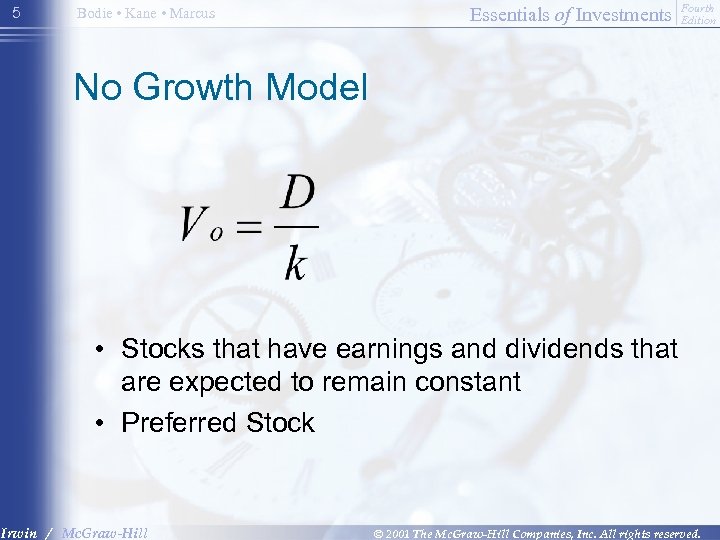

5 Bodie • Kane • Marcus Essentials of Investments Fourth Edition No Growth Model • Stocks that have earnings and dividends that are expected to remain constant • Preferred Stock Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

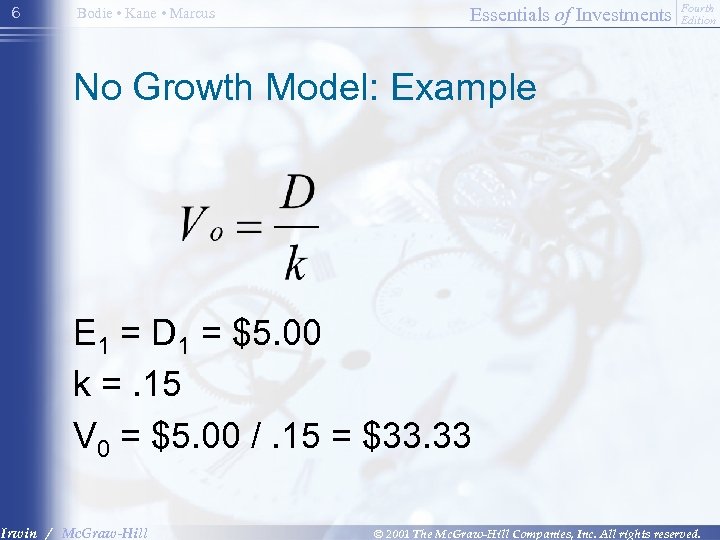

6 Bodie • Kane • Marcus Essentials of Investments Fourth Edition No Growth Model: Example E 1 = D 1 = $5. 00 k =. 15 V 0 = $5. 00 /. 15 = $33. 33 Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

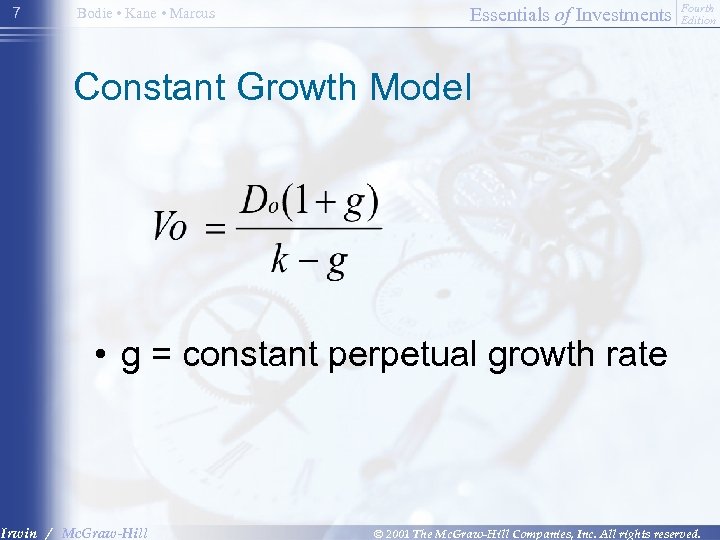

7 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Constant Growth Model • g = constant perpetual growth rate Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

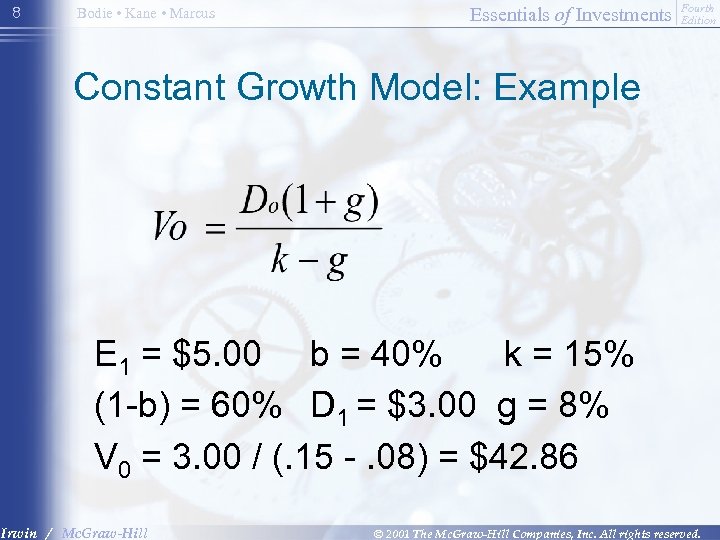

8 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Constant Growth Model: Example E 1 = $5. 00 b = 40% k = 15% (1 -b) = 60% D 1 = $3. 00 g = 8% V 0 = 3. 00 / (. 15 -. 08) = $42. 86 Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

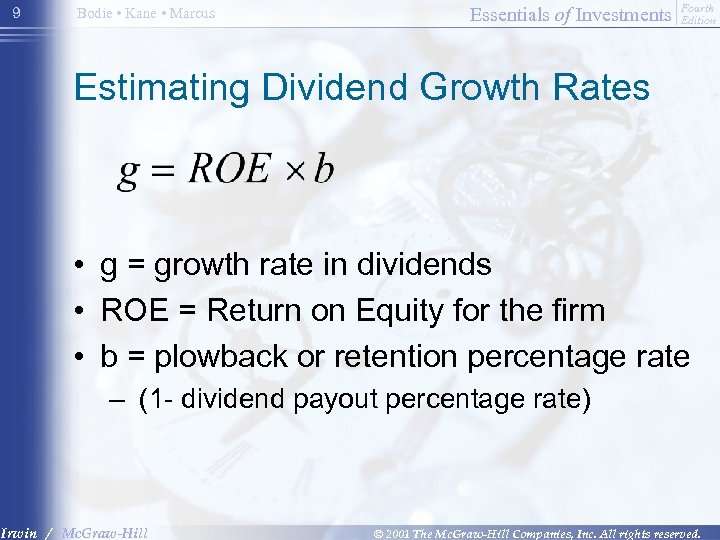

9 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Estimating Dividend Growth Rates • g = growth rate in dividends • ROE = Return on Equity for the firm • b = plowback or retention percentage rate – (1 - dividend payout percentage rate) Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

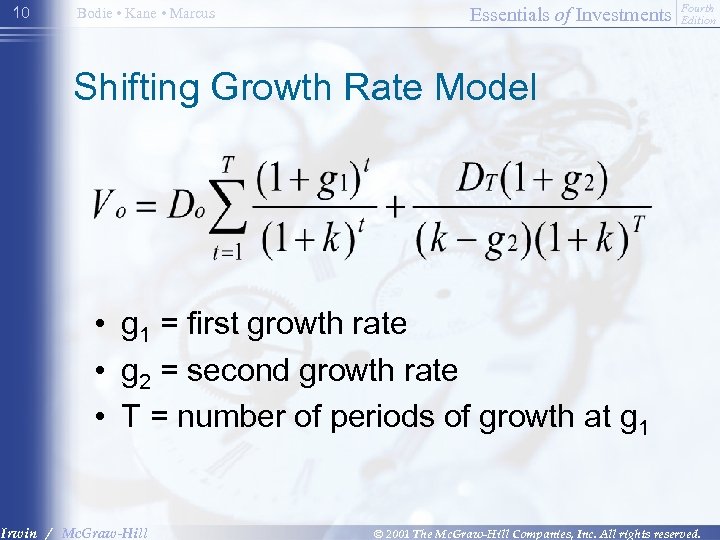

10 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Shifting Growth Rate Model • g 1 = first growth rate • g 2 = second growth rate • T = number of periods of growth at g 1 Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

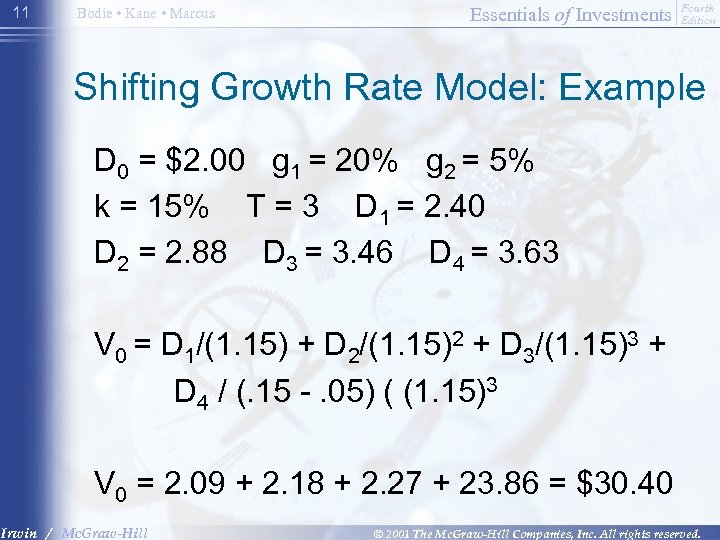

11 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Shifting Growth Rate Model: Example D 0 = $2. 00 g 1 = 20% g 2 = 5% k = 15% T = 3 D 1 = 2. 40 D 2 = 2. 88 D 3 = 3. 46 D 4 = 3. 63 V 0 = D 1/(1. 15) + D 2/(1. 15)2 + D 3/(1. 15)3 + D 4 / (. 15 -. 05) ( (1. 15)3 V 0 = 2. 09 + 2. 18 + 2. 27 + 23. 86 = $30. 40 Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

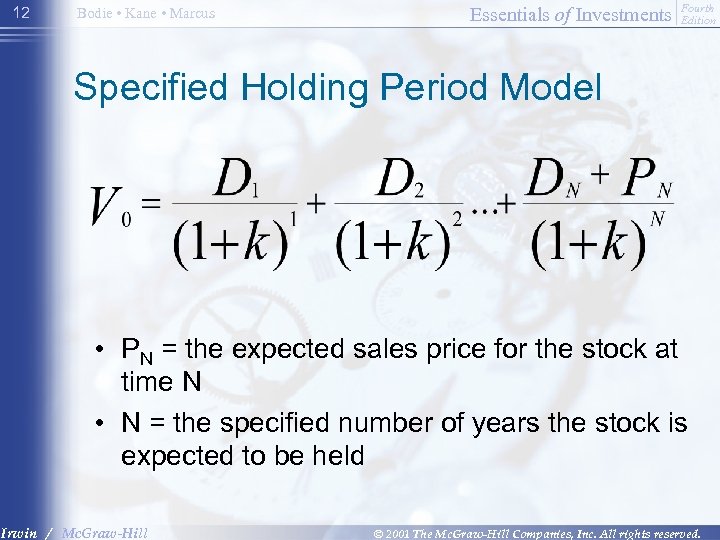

12 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Specified Holding Period Model • PN = the expected sales price for the stock at time N • N = the specified number of years the stock is expected to be held Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

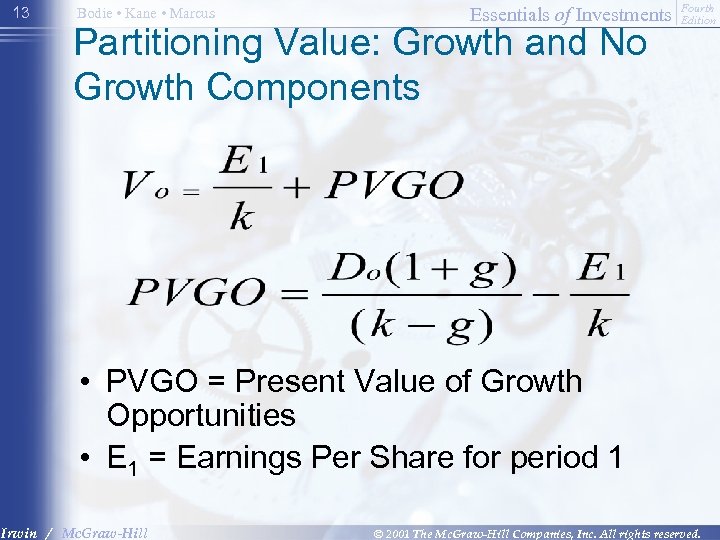

13 Bodie • Kane • Marcus Essentials of Investments Partitioning Value: Growth and No Growth Components Fourth Edition • PVGO = Present Value of Growth Opportunities • E 1 = Earnings Per Share for period 1 Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

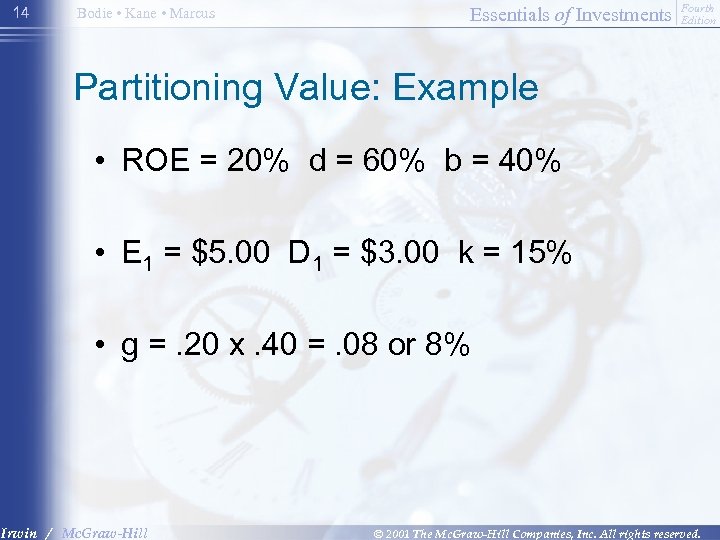

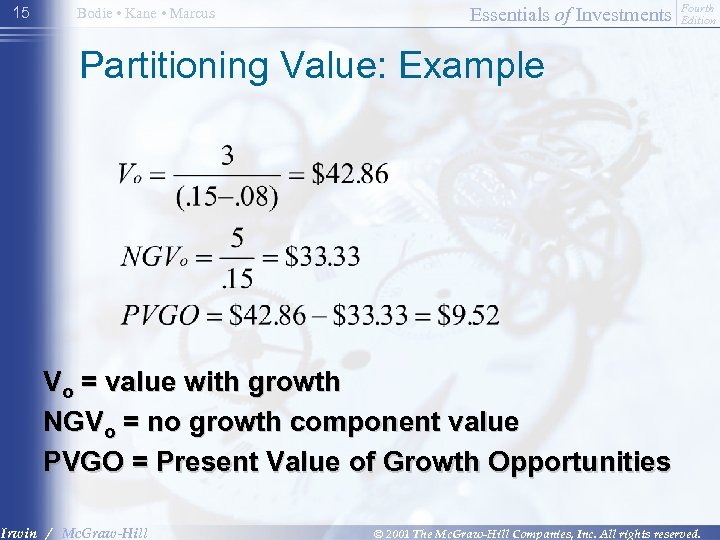

14 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Partitioning Value: Example • ROE = 20% d = 60% b = 40% • E 1 = $5. 00 D 1 = $3. 00 k = 15% • g =. 20 x. 40 =. 08 or 8% Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

15 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Partitioning Value: Example Vo = value with growth NGVo = no growth component value PVGO = Present Value of Growth Opportunities Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

16 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Price Earnings Ratios • P/E Ratios are a function of two factors – Required Rates of Return (k) – Expected growth in Dividends • Uses – Relative valuation – Extensive Use in industry Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

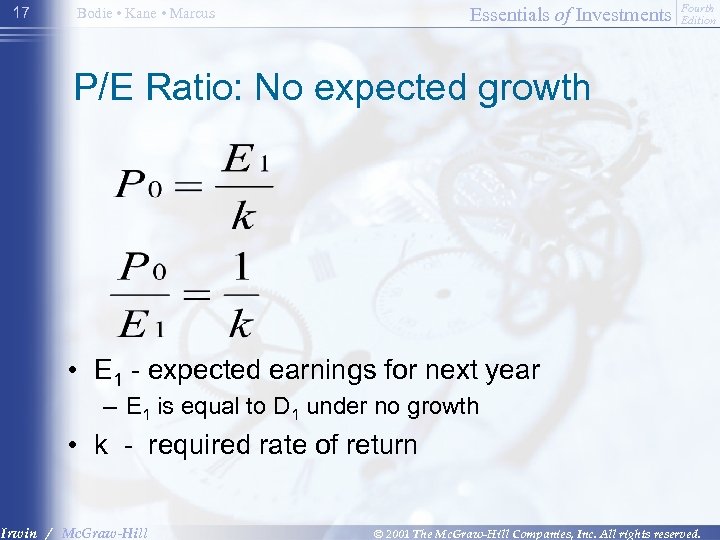

17 Essentials of Investments Bodie • Kane • Marcus Fourth Edition P/E Ratio: No expected growth • E 1 - expected earnings for next year – E 1 is equal to D 1 under no growth • k - required rate of return Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

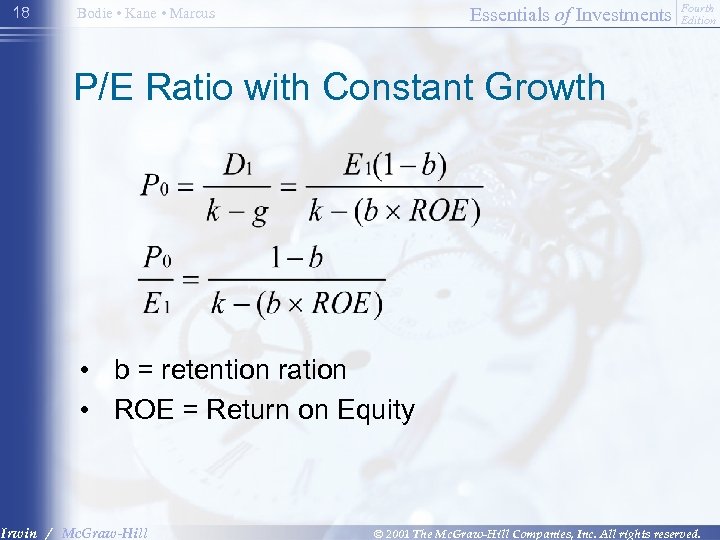

18 Essentials of Investments Bodie • Kane • Marcus Fourth Edition P/E Ratio with Constant Growth • b = retention ration • ROE = Return on Equity Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

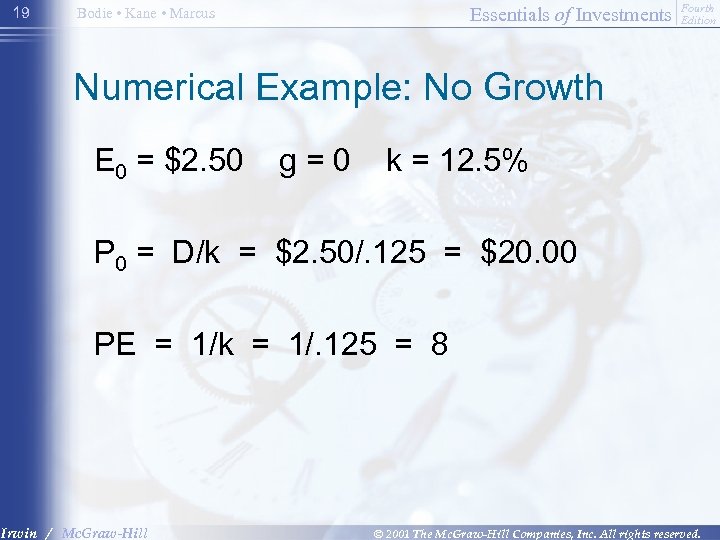

19 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Numerical Example: No Growth E 0 = $2. 50 g=0 k = 12. 5% P 0 = D/k = $2. 50/. 125 = $20. 00 PE = 1/k = 1/. 125 = 8 Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

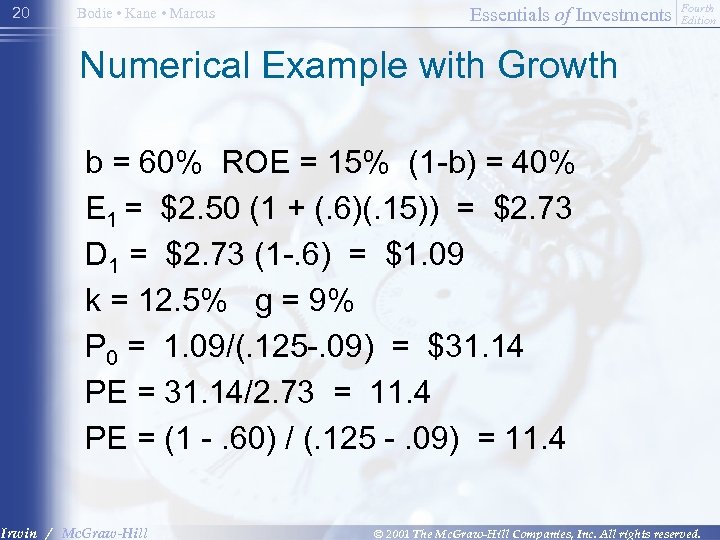

20 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Numerical Example with Growth b = 60% ROE = 15% (1 -b) = 40% E 1 = $2. 50 (1 + (. 6)(. 15)) = $2. 73 D 1 = $2. 73 (1 -. 6) = $1. 09 k = 12. 5% g = 9% P 0 = 1. 09/(. 125 -. 09) = $31. 14 PE = 31. 14/2. 73 = 11. 4 PE = (1 -. 60) / (. 125 -. 09) = 11. 4 Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

e2f2d621e13f68574ddda964d55d6d0e.ppt