a49bd3077fc8c411982b1420f2659831.ppt

- Количество слайдов: 23

1 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Chapter 8 Capital Asset Pricing and Arbitrage Pricing Theory Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

2 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Capital Asset Pricing Model (CAPM) • Equilibrium model that underlies all modern financial theory • Derived using principles of diversification with simplified assumptions • Markowitz, Sharpe, Lintner and Mossin are researchers credited with its development Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

3 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Assumptions • Individual investors are price takers • Single-period investment horizon • Investments are limited to traded financial assets • No taxes, and transaction costs Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

4 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Assumptions (cont. ) • Information is costless and available to all investors • Investors are rational mean-variance optimizers • Homogeneous expectations Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

5 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Resulting Equilibrium Conditions • All investors will hold the same portfolio for risky assets – market portfolio • Market portfolio contains all securities and the proportion of each security is its market value as a percentage of total market value Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

6 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Resulting Equilibrium Conditions (cont. ) • Risk premium on the market depends on the average risk aversion of all market participants • Risk premium on an individual security is a function of its covariance with the market Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

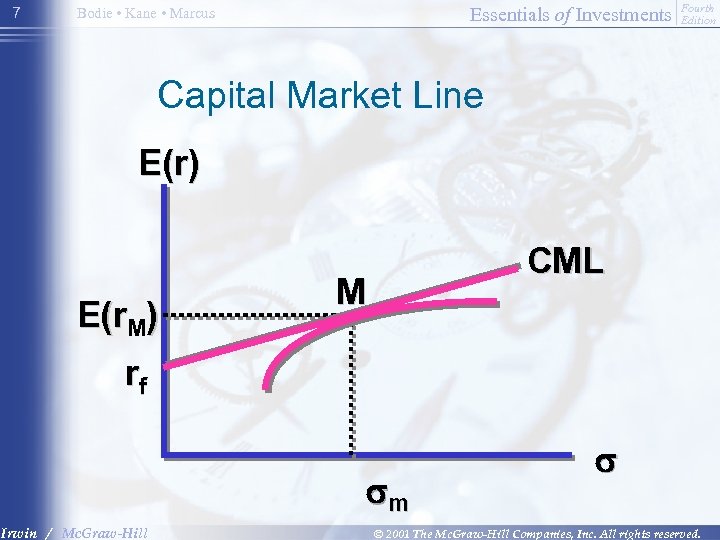

7 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Capital Market Line E(r) E(r. M) CML M rf sm Irwin / Mc. Graw-Hill s © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

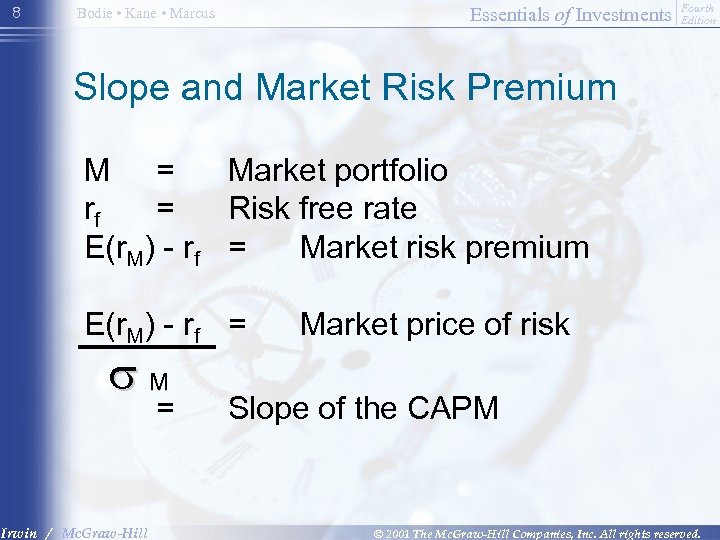

8 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Slope and Market Risk Premium M = Market portfolio rf = Risk free rate E(r. M) - rf = Market risk premium E(r. M) - rf = s. M = Irwin / Mc. Graw-Hill Market price of risk Slope of the CAPM © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

9 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Expected Return and Risk on Individual Securities • The risk premium on individual securities is a function of the individual security’s contribution to the risk of the market portfolio • Individual security’s risk premium is a function of the covariance of returns with the assets that make up the market portfolio Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

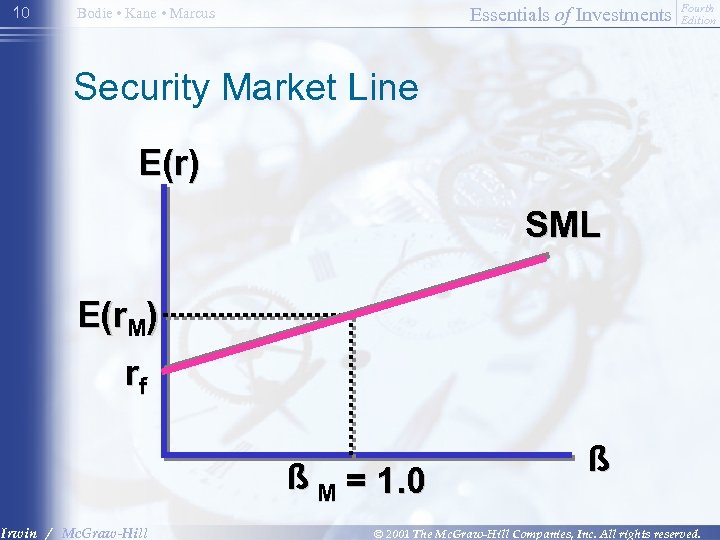

10 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Security Market Line E(r) SML E(r. M) rf ß M = 1. 0 Irwin / Mc. Graw-Hill ß © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

11 Essentials of Investments Bodie • Kane • Marcus Fourth Edition SML Relationships b = [COV(ri, rm)] / sm 2 Slope SML = E(rm) - rf = market risk premium SML = rf + b[E(rm) - rf] Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

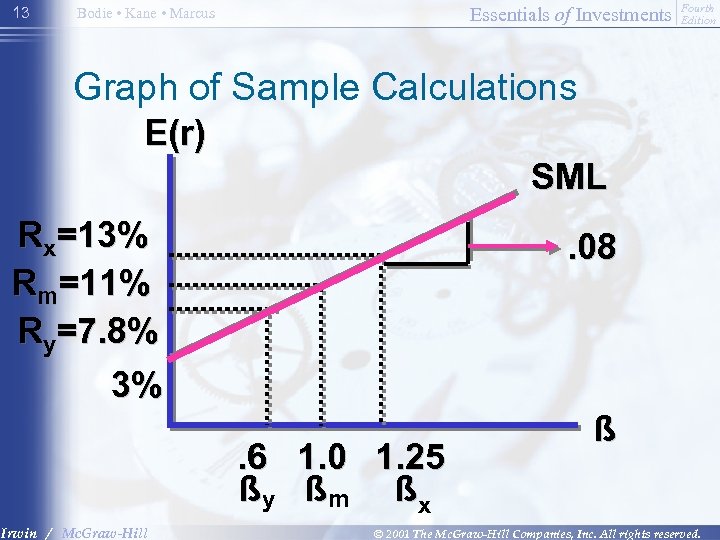

12 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Sample Calculations for SML E(rm) - rf =. 08 rf =. 03 bx = 1. 25 E(rx) =. 03 + 1. 25(. 08) =. 13 or 13% by =. 6 e(ry) =. 03 +. 6(. 08) =. 078 or 7. 8% Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

13 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Graph of Sample Calculations E(r) SML Rx=13% Rm=11% Ry=7. 8% 3% . 08 . 6 1. 0 1. 25 ßy ßm ßx Irwin / Mc. Graw-Hill ß © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

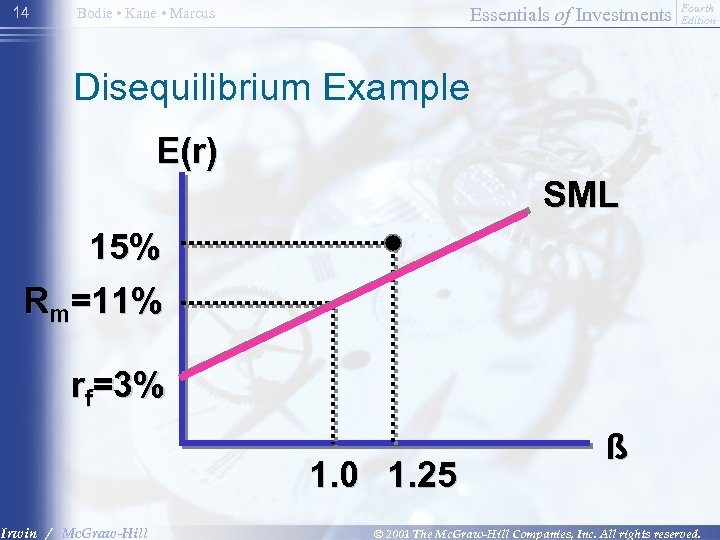

14 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Disequilibrium Example E(r) SML 15% Rm=11% rf=3% 1. 0 1. 25 Irwin / Mc. Graw-Hill ß © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

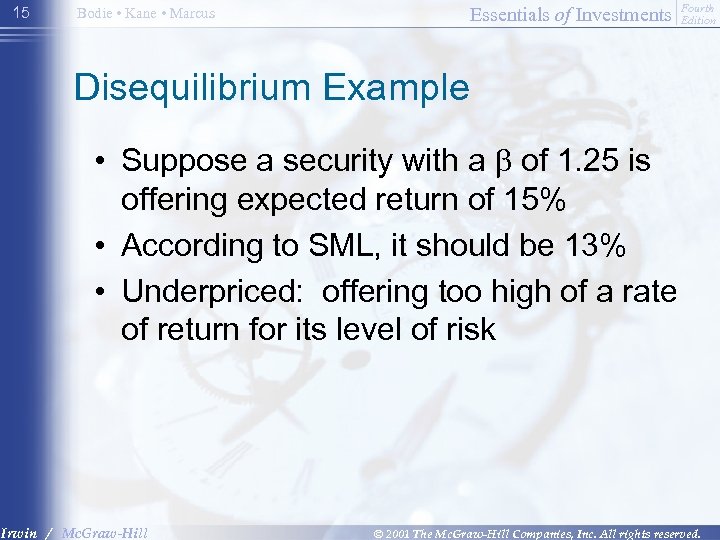

15 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Disequilibrium Example • Suppose a security with a b of 1. 25 is offering expected return of 15% • According to SML, it should be 13% • Underpriced: offering too high of a rate of return for its level of risk Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

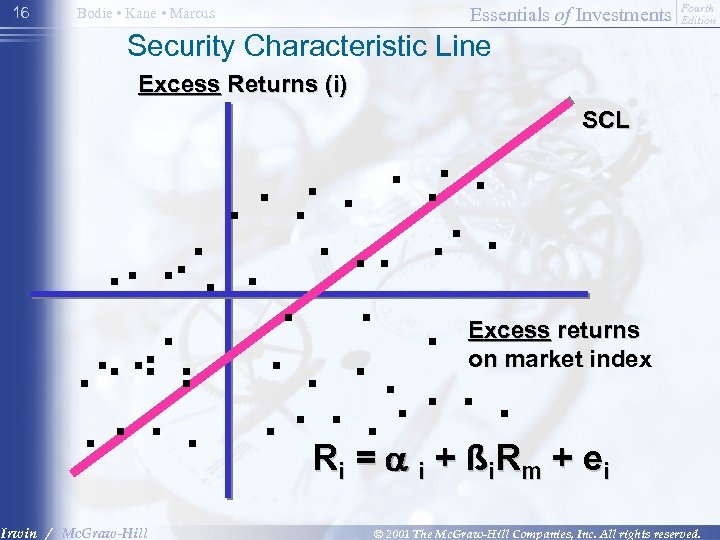

16 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Security Characteristic Line Excess Returns (i) SCL . . . Excess returns. . on market index. . . . R = a + ßR + e Ri = a i + ßi Rm + ei Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

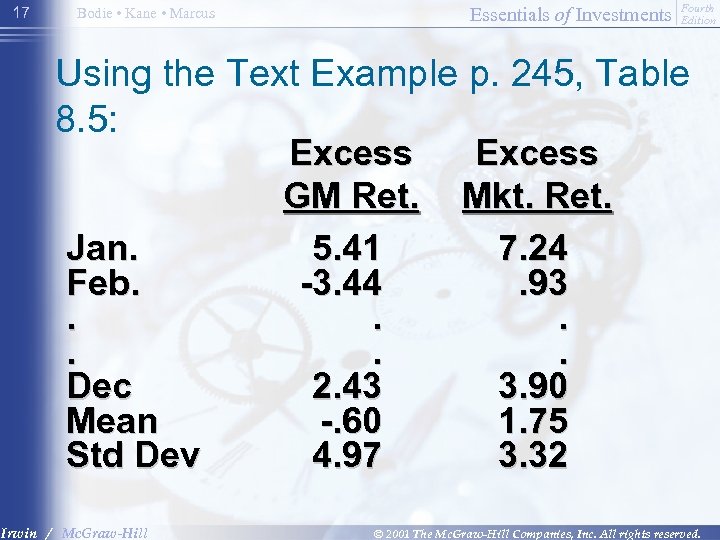

17 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Using the Text Example p. 245, Table 8. 5: Jan. Feb. . . Dec Mean Std Dev Irwin / Mc. Graw-Hill Excess GM Ret. 5. 41 -3. 44. . 2. 43 -. 60 4. 97 Excess Mkt. Ret. 7. 24. 93. . 3. 90 1. 75 3. 32 © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

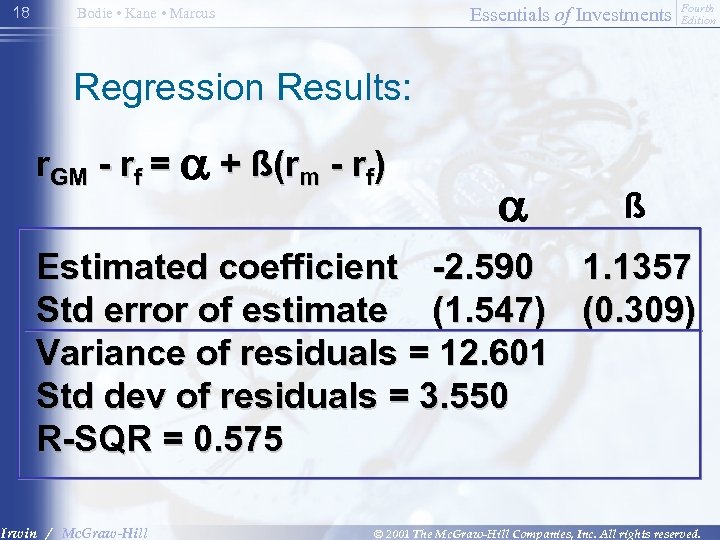

18 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Regression Results: r. GM - rf = a + ß(rm - rf) a ß Estimated coefficient -2. 590 1. 1357 Std error of estimate (1. 547) (0. 309) Variance of residuals = 12. 601 Std dev of residuals = 3. 550 R-SQR = 0. 575 Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

19 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Arbitrage Pricing Theory Arbitrage - arises if an investor can construct a zero investment portfolio with a sure profit • Since no investment is required, an investor can create large positions to secure large levels of profit • In efficient markets, profitable arbitrage opportunities will quickly disappear Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

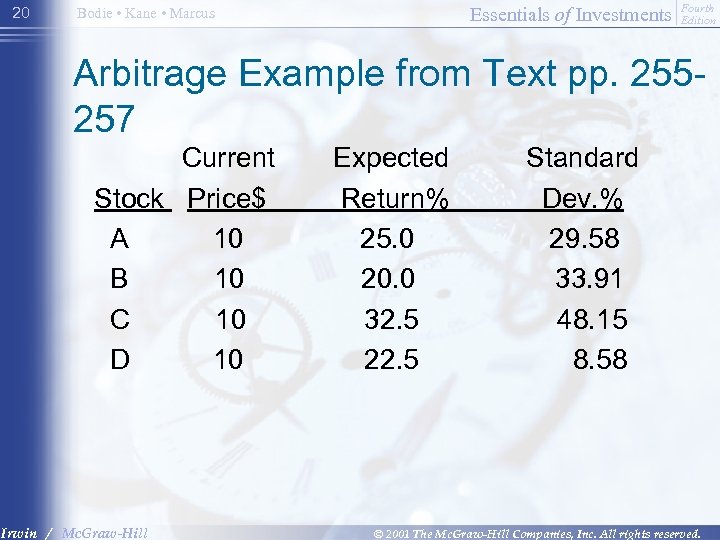

20 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Arbitrage Example from Text pp. 255257 Current Stock Price$ A 10 B 10 C 10 D 10 Irwin / Mc. Graw-Hill Expected Return% 25. 0 20. 0 32. 5 22. 5 Standard Dev. % 29. 58 33. 91 48. 15 8. 58 © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

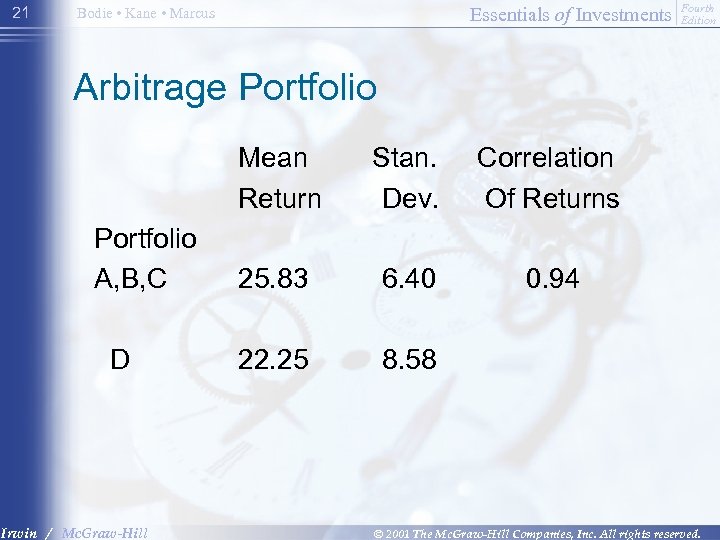

21 Essentials of Investments Bodie • Kane • Marcus Fourth Edition Arbitrage Portfolio Mean Return Portfolio A, B, C D Irwin / Mc. Graw-Hill Stan. Dev. Correlation Of Returns 25. 83 6. 40 0. 94 22. 25 8. 58 © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

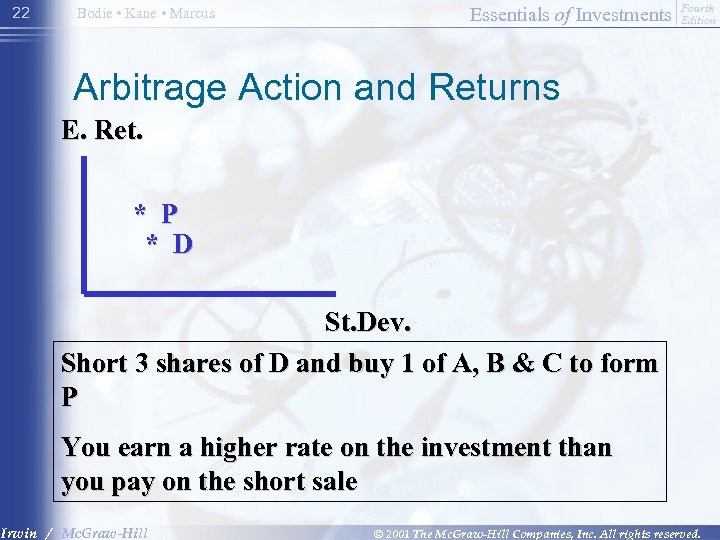

22 Bodie • Kane • Marcus Essentials of Investments Fourth Edition Arbitrage Action and Returns E. Ret. * P * D St. Dev. Short 3 shares of D and buy 1 of A, B & C to form P You earn a higher rate on the investment than you pay on the short sale Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

23 Bodie • Kane • Marcus Essentials of Investments Fourth Edition APT and CAPM Compared • APT applies to well diversified portfolios and not necessarily to individual stocks • With APT it is possible for some individual stocks to be mispriced - not lie on the SML • APT is more general in that it gets to an expected return and beta relationship without the assumption of the market portfolio • APT can be extended to multifactor models Irwin / Mc. Graw-Hill © 2001 The Mc. Graw-Hill Companies, Inc. All rights reserved.

a49bd3077fc8c411982b1420f2659831.ppt