1 BBA BF-I, Fall 2014, A. Zaporozhetz Class

- Размер: 636.5 Кб

- Количество слайдов: 20

Описание презентации 1 BBA BF-I, Fall 2014, A. Zaporozhetz Class по слайдам

1 BBA BF-I, Fall 2014, A. Zaporozhetz Class 2 Financial Instruments Money market. T-bills. Bond market. Bond characteristics and yields. Stock market. Stock indexes. Study materials: Zvi Bodie, Investments, 8 th ed: Ch. 2. 1. — 2. 4. , Ch. 3. 3. -3. 4.

1 BBA BF-I, Fall 2014, A. Zaporozhetz Class 2 Financial Instruments Money market. T-bills. Bond market. Bond characteristics and yields. Stock market. Stock indexes. Study materials: Zvi Bodie, Investments, 8 th ed: Ch. 2. 1. — 2. 4. , Ch. 3. 3. -3. 4.

2 BBA BF-I, Fall 2014, A. Zaporozhetz Asset allocation vs. Security selection Financial markets: Money markets vs. Capital markets MM instruments: Cash, Cash equivalents, T-bills, etc CM instruments: Bonds, Common stock, Preferred stock, Derivatives: options, futures, swaps. Major Classes of Financial Assets (Securities)

2 BBA BF-I, Fall 2014, A. Zaporozhetz Asset allocation vs. Security selection Financial markets: Money markets vs. Capital markets MM instruments: Cash, Cash equivalents, T-bills, etc CM instruments: Bonds, Common stock, Preferred stock, Derivatives: options, futures, swaps. Major Classes of Financial Assets (Securities)

3 BBA BF-I, Fall 2014, A. Zaporozhetz Treasury bills Certificates of deposit (CD) Commercial Paper Bankers’ Acceptances Eurodollars Repurchase Agreements (RPs) Federal Funds Brokers’ Calls 1. Money Market Instruments

3 BBA BF-I, Fall 2014, A. Zaporozhetz Treasury bills Certificates of deposit (CD) Commercial Paper Bankers’ Acceptances Eurodollars Repurchase Agreements (RPs) Federal Funds Brokers’ Calls 1. Money Market Instruments

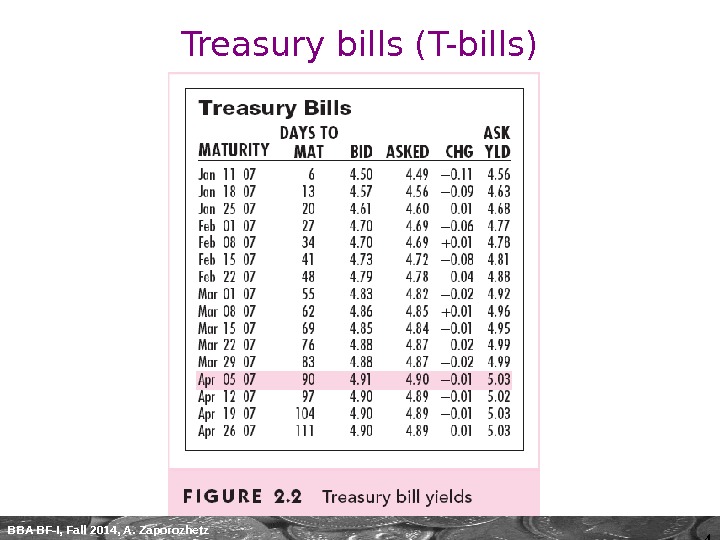

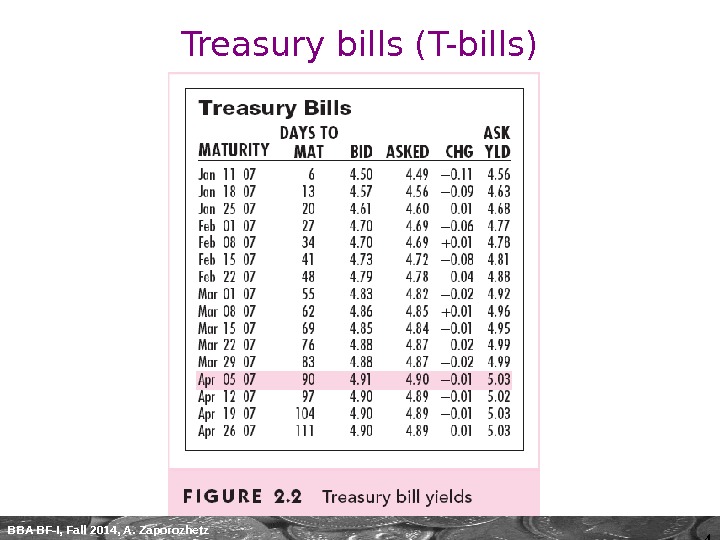

4 BBA BF-I, Fall 2014, A. Zaporozhetz Treasury bills (T-bills)

4 BBA BF-I, Fall 2014, A. Zaporozhetz Treasury bills (T-bills)

5 BBA BF-I, Fall 2014, A. Zaporozhetz R bd = bank discount rate P = market price of the bill n = number of days to maturity. Bank Discount Rate (T-Bills) %90. 4 90360 000, 10 5. 877, 9000, 10 50. 877, 9: 90: 360 000, 10 rr bdbd Pday. Example n. P

5 BBA BF-I, Fall 2014, A. Zaporozhetz R bd = bank discount rate P = market price of the bill n = number of days to maturity. Bank Discount Rate (T-Bills) %90. 4 90360 000, 10 5. 877, 9000, 10 50. 877, 9: 90: 360 000, 10 rr bdbd Pday. Example n. P

6 BBA BF-I, Fall 2014, A. Zaporozhetz Bond Equivalent Yield (T-Bills)%03. 5 05029. 90 365 5. 877, 9000, 10 : 365000, 10 r r r BEY BEY Example n. P P Can’t compare T-bill directly to a bond because: (1) 360 vs 365 days; (2) Return is figured on par vs. price paid Adjust the bank discounted rate (“ASKED”) to “bond equivalent yield (ASK YLD”) make it comparable.

6 BBA BF-I, Fall 2014, A. Zaporozhetz Bond Equivalent Yield (T-Bills)%03. 5 05029. 90 365 5. 877, 9000, 10 : 365000, 10 r r r BEY BEY Example n. P P Can’t compare T-bill directly to a bond because: (1) 360 vs 365 days; (2) Return is figured on par vs. price paid Adjust the bank discounted rate (“ASKED”) to “bond equivalent yield (ASK YLD”) make it comparable.

7 BBA BF-I, Fall 2014, A. Zaporozhetz Shortcut: BEY vs. BDY%03. 5 05029. 049, 0*90360 049, 0*365 : *360 *365 r r r BEY BEY Example BDYn BDY Mind the leap year of 366 days.

7 BBA BF-I, Fall 2014, A. Zaporozhetz Shortcut: BEY vs. BDY%03. 5 05029. 049, 0*90360 049, 0*365 : *360 *365 r r r BEY BEY Example BDYn BDY Mind the leap year of 366 days.

8 BBA BF-I, Fall 2014, A. Zaporozhetz 2. Capital Markets: Bond Markets • Publicly Issued Instruments US Treasury Notes US Treasury Bonds Federal Agency Debt Municipal Bonds • Privately Issued Instruments Corporate Bonds

8 BBA BF-I, Fall 2014, A. Zaporozhetz 2. Capital Markets: Bond Markets • Publicly Issued Instruments US Treasury Notes US Treasury Bonds Federal Agency Debt Municipal Bonds • Privately Issued Instruments Corporate Bonds

9 BBA BF-I, Fall 2014, A. Zaporozhetz Bonds A bond is a contract or a promissory note issued by a corporation or government promising to pay the owner of the bond a predetermined amount of interest each year. Par Value (Face Value, F) — The principal amount of a bond that is repaid to the lender at the end of the bond’s term. Coupon Payment -The periodic interest payment (in dollars) made on a bond. Coupon Rate — The annual coupon payment expressed as a percent of face value. Maturity Date — The specified date at which the principal amount of the bond is paid. Market Value (Price, P) — The value of a bond based on its market price. Current Yield, % = $C/$P. Yield to maturity (YTM) = the rate of return that equates the market price of a bond to its intrinsic value. Implicit rate of return the market has in mind when setting the market price of the bond, i. e. , the implicit rate being used by the market to price the bond.

9 BBA BF-I, Fall 2014, A. Zaporozhetz Bonds A bond is a contract or a promissory note issued by a corporation or government promising to pay the owner of the bond a predetermined amount of interest each year. Par Value (Face Value, F) — The principal amount of a bond that is repaid to the lender at the end of the bond’s term. Coupon Payment -The periodic interest payment (in dollars) made on a bond. Coupon Rate — The annual coupon payment expressed as a percent of face value. Maturity Date — The specified date at which the principal amount of the bond is paid. Market Value (Price, P) — The value of a bond based on its market price. Current Yield, % = $C/$P. Yield to maturity (YTM) = the rate of return that equates the market price of a bond to its intrinsic value. Implicit rate of return the market has in mind when setting the market price of the bond, i. e. , the implicit rate being used by the market to price the bond.

10 BBA BF-I, Fall 2014, A. Zaporozhetz US Treasury Notes and Bonds

10 BBA BF-I, Fall 2014, A. Zaporozhetz US Treasury Notes and Bonds

11 BBA BF-I, Fall 2014, A. Zaporozhetz Corporate Bonds http: //reports. finance. yahoo. com/z 1? is=caterpillar

11 BBA BF-I, Fall 2014, A. Zaporozhetz Corporate Bonds http: //reports. finance. yahoo. com/z 1? is=caterpillar

12 BBA BF-I, Fall 2014, A. Zaporozhetz 3. Capital Market: Equity • Common stock: features Residual claim Limited liability • Preferred stock: features Fixed dividends Priority over common Cumulative and non-cumulative stocks

12 BBA BF-I, Fall 2014, A. Zaporozhetz 3. Capital Market: Equity • Common stock: features Residual claim Limited liability • Preferred stock: features Fixed dividends Priority over common Cumulative and non-cumulative stocks

13 BBA BF-I, Fall 2014, A. Zaporozhetz How to Read a Stock Table / Quote

13 BBA BF-I, Fall 2014, A. Zaporozhetz How to Read a Stock Table / Quote

14 BBA BF-I, Fall 2014, A. Zaporozhetz Stock Indexes • Uses Track average returns Comparing performance of portfolios Base of derivatives • Factors in constructing or using an Index Representative? Broad or narrow? How is it constructed? • How are stocks weighted? Price-weighted (DJIA) Market-value weighted (S&P 500, NASDAQ) Equally weighted (Value Line Index)

14 BBA BF-I, Fall 2014, A. Zaporozhetz Stock Indexes • Uses Track average returns Comparing performance of portfolios Base of derivatives • Factors in constructing or using an Index Representative? Broad or narrow? How is it constructed? • How are stocks weighted? Price-weighted (DJIA) Market-value weighted (S&P 500, NASDAQ) Equally weighted (Value Line Index)

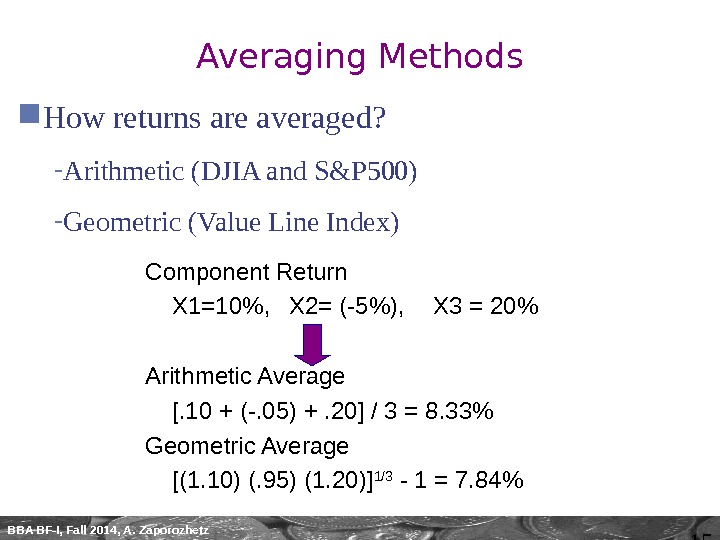

15 BBA BF-I, Fall 2014, A. Zaporozhetz Component Return X 1=10%, X 2= (-5%), X 3 = 20% Arithmetic Average [. 10 + (-. 05) +. 20] / 3 = 8. 33% Geometric Average [(1. 10) (. 95) (1. 20)] 1/3 — 1 = 7. 84%Averaging Methods How returns are averaged? — Arithmetic (DJIA and S&P 500) — Geometric (Value Line Index)

15 BBA BF-I, Fall 2014, A. Zaporozhetz Component Return X 1=10%, X 2= (-5%), X 3 = 20% Arithmetic Average [. 10 + (-. 05) +. 20] / 3 = 8. 33% Geometric Average [(1. 10) (. 95) (1. 20)] 1/3 — 1 = 7. 84%Averaging Methods How returns are averaged? — Arithmetic (DJIA and S&P 500) — Geometric (Value Line Index)

16 BBA BF-I, Fall 2014, A. Zaporozhetz World Stock Markets Americas: Stock Exchanges: Major Indices: USA: NYSE DJIA, S&P 500 NASDAQComposite Canada: Toronto stock exchange (TSX) TSX Comp (210) Brazil: Sao Paolo stock exchange Bovespa (67) Europe: UK: London stock exchange (LSE/AIM) FTSE-100 Germany: Frankfurt stock exchange (DB) DAX France: Paris Bourse CAC-40 Euronext (belongs to NYSE) Euro. Top

16 BBA BF-I, Fall 2014, A. Zaporozhetz World Stock Markets Americas: Stock Exchanges: Major Indices: USA: NYSE DJIA, S&P 500 NASDAQComposite Canada: Toronto stock exchange (TSX) TSX Comp (210) Brazil: Sao Paolo stock exchange Bovespa (67) Europe: UK: London stock exchange (LSE/AIM) FTSE-100 Germany: Frankfurt stock exchange (DB) DAX France: Paris Bourse CAC-40 Euronext (belongs to NYSE) Euro. Top

17 BBA BF-I, Fall 2014, A. Zaporozhetz World Stock Markets Countries: Stock Exchanges: Major Indices: Russia: Moscow Interbank Currency MICEX (50) Exchange (MICEX) Russian Trading System (RTS) RTSI (50) Merged to MOEX in 2012 RTS 2 (70) RTSSTD (15) Ukraine: PFTS (20) Ukrainian Exchange (UX) UX (10) (opened: March 26, 2009) Kazakhstan: Kazakhstan Stock Exchange KASE (20)

17 BBA BF-I, Fall 2014, A. Zaporozhetz World Stock Markets Countries: Stock Exchanges: Major Indices: Russia: Moscow Interbank Currency MICEX (50) Exchange (MICEX) Russian Trading System (RTS) RTSI (50) Merged to MOEX in 2012 RTS 2 (70) RTSSTD (15) Ukraine: PFTS (20) Ukrainian Exchange (UX) UX (10) (opened: March 26, 2009) Kazakhstan: Kazakhstan Stock Exchange KASE (20)

18 BBA BF-I, Fall 2014, A. Zaporozhetz World Stock Markets Asia: Stock Exchanges: Major Indices: Japan: Tokyo stock exchange (TSE) Nikkei-225 China: Hong Kong stock exchange (HKSE) Hang Seng (49) Shanghai stock exchange (SSE) SSE Comp (>850) Shenzhen Stock Exchange (SZSE) India: Bombay stock exchange (BSE) BSE-30 South Korea: Korea Exchange (KRX) KOSPI (775) Taiwan: Taiwan Stock Exchange (TAIEX) TWII (762)

18 BBA BF-I, Fall 2014, A. Zaporozhetz World Stock Markets Asia: Stock Exchanges: Major Indices: Japan: Tokyo stock exchange (TSE) Nikkei-225 China: Hong Kong stock exchange (HKSE) Hang Seng (49) Shanghai stock exchange (SSE) SSE Comp (>850) Shenzhen Stock Exchange (SZSE) India: Bombay stock exchange (BSE) BSE-30 South Korea: Korea Exchange (KRX) KOSPI (775) Taiwan: Taiwan Stock Exchange (TAIEX) TWII (762)

19 BBA BF-I, Fall 2014, A. Zaporozhetz World Stock Markets

19 BBA BF-I, Fall 2014, A. Zaporozhetz World Stock Markets

20 BBA BF-I, Fall 2014, A. Zaporozhetz Ukrainian Stock Markets: UX index (before June 2012)

20 BBA BF-I, Fall 2014, A. Zaporozhetz Ukrainian Stock Markets: UX index (before June 2012)