3dd15615461d9f40fc896caaf59f7a99.ppt

- Количество слайдов: 48

1 Amortization 3 of Loans Chapter 14 Mc. Graw-Hill Ryerson© of

1 Amortization 3 of Loans Chapter 14 Mc. Graw-Hill Ryerson© of

2 Amortization 3 of Loans Learning Objectives After completing this chapter, you will be able to: Calculate LO 1. …the principal balance after any payment using both the Prospective Method and the Retrospective Method LO 2. … the final loan payment when it differs from the others LO 3. … the principal and interest components of any payment And… Mc. Graw-Hill Ryerson©

2 Amortization 3 of Loans Learning Objectives After completing this chapter, you will be able to: Calculate LO 1. …the principal balance after any payment using both the Prospective Method and the Retrospective Method LO 2. … the final loan payment when it differs from the others LO 3. … the principal and interest components of any payment And… Mc. Graw-Hill Ryerson©

3 Amortization 3 of Loans Learning Objectives Calculate LO 4. LO 5. Mc. Graw-Hill Ryerson© … mortgage payments for the initial loan and its renewals … mortgage loan balances and amortization periods to reflect prepayments of principal

3 Amortization 3 of Loans Learning Objectives Calculate LO 4. LO 5. Mc. Graw-Hill Ryerson© … mortgage payments for the initial loan and its renewals … mortgage loan balances and amortization periods to reflect prepayments of principal

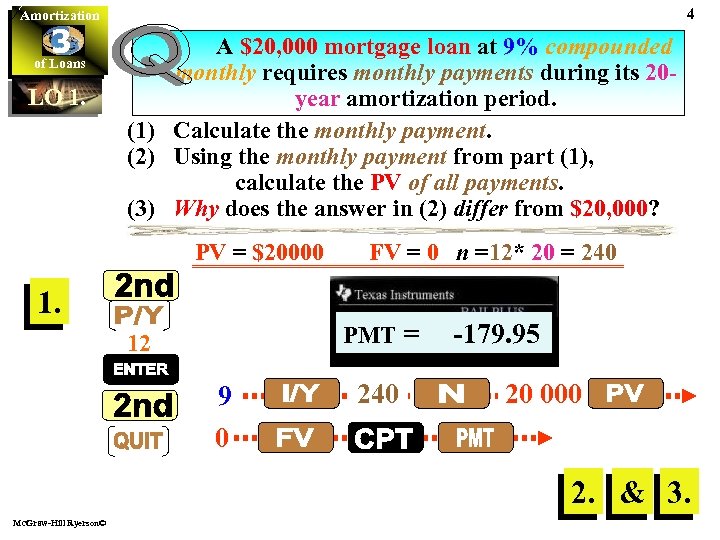

4 Amortization 3 of Loans LO 1. A $20, 000 mortgage loan at 9% compounded monthly requires monthly payments during its 20 year amortization period. (1) Calculate the monthly payment. (2) Using the monthly payment from part (1), calculate the PV of all payments. (3) Why does the answer in (2) differ from $20, 000? PV = $20000 1. FV = 0 n =12* 20 = 240 PMT = 12 9 0 240 -179. 95 20 000 2. & 3. Mc. Graw-Hill Ryerson©

4 Amortization 3 of Loans LO 1. A $20, 000 mortgage loan at 9% compounded monthly requires monthly payments during its 20 year amortization period. (1) Calculate the monthly payment. (2) Using the monthly payment from part (1), calculate the PV of all payments. (3) Why does the answer in (2) differ from $20, 000? PV = $20000 1. FV = 0 n =12* 20 = 240 PMT = 12 9 0 240 -179. 95 20 000 2. & 3. Mc. Graw-Hill Ryerson©

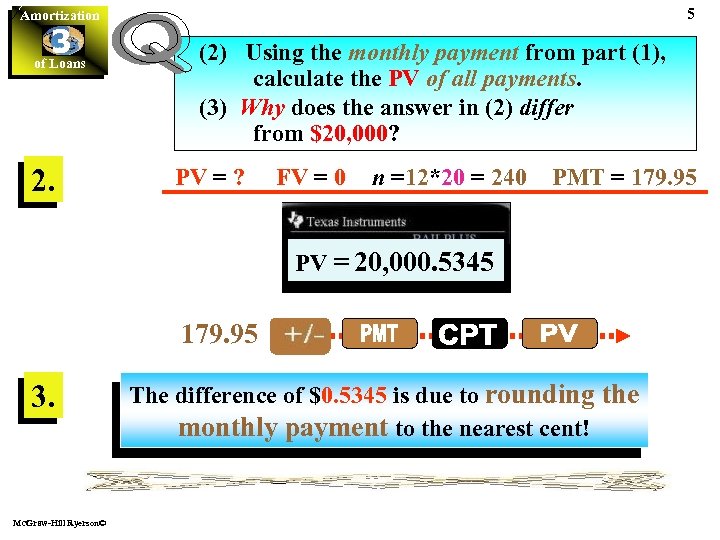

5 Amortization 3 of Loans 2. (2) Using the monthly payment from part (1), calculate the PV of all payments. (3) Why does the answer in (2) differ from $20, 000? PV = ? FV = 0 n =12*20 = 240 PMT = 179. 95 PV = 20, 000. 5345 179. 95 3. Mc. Graw-Hill Ryerson© The difference of $0. 5345 is due to rounding the monthly payment to the nearest cent!

5 Amortization 3 of Loans 2. (2) Using the monthly payment from part (1), calculate the PV of all payments. (3) Why does the answer in (2) differ from $20, 000? PV = ? FV = 0 n =12*20 = 240 PMT = 179. 95 PV = 20, 000. 5345 179. 95 3. Mc. Graw-Hill Ryerson© The difference of $0. 5345 is due to rounding the monthly payment to the nearest cent!

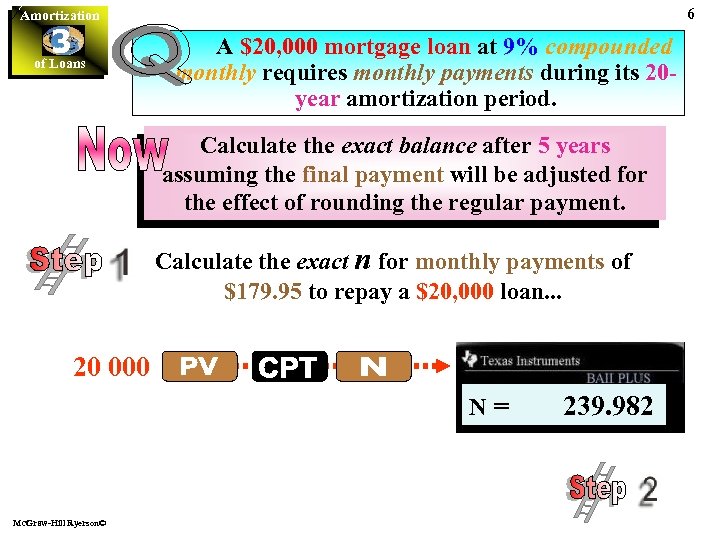

6 Amortization 3 of Loans A $20, 000 mortgage loan at 9% compounded monthly requires monthly payments during its 20 year amortization period. Calculate the exact balance after 5 years assuming the final payment will be adjusted for the effect of rounding the regular payment. Calculate the exact n for monthly payments of $179. 95 to repay a $20, 000 loan. . . 20 000 N= Mc. Graw-Hill Ryerson© 239. 982

6 Amortization 3 of Loans A $20, 000 mortgage loan at 9% compounded monthly requires monthly payments during its 20 year amortization period. Calculate the exact balance after 5 years assuming the final payment will be adjusted for the effect of rounding the regular payment. Calculate the exact n for monthly payments of $179. 95 to repay a $20, 000 loan. . . 20 000 N= Mc. Graw-Hill Ryerson© 239. 982

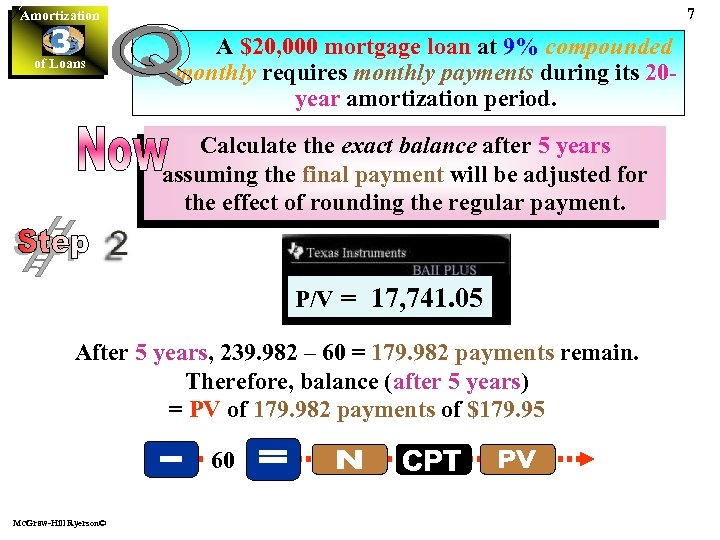

7 Amortization 3 of Loans A $20, 000 mortgage loan at 9% compounded monthly requires monthly payments during its 20 year amortization period. Calculate the exact balance after 5 years assuming the final payment will be adjusted for the effect of rounding the regular payment. P/V N = = 17, 741. 05 179. 9821 239. 982 After 5 years, 239. 982 – 60 = 179. 982 payments remain. Therefore, balance (after 5 years) = PV of 179. 982 payments of $179. 95 60 Mc. Graw-Hill Ryerson©

7 Amortization 3 of Loans A $20, 000 mortgage loan at 9% compounded monthly requires monthly payments during its 20 year amortization period. Calculate the exact balance after 5 years assuming the final payment will be adjusted for the effect of rounding the regular payment. P/V N = = 17, 741. 05 179. 9821 239. 982 After 5 years, 239. 982 – 60 = 179. 982 payments remain. Therefore, balance (after 5 years) = PV of 179. 982 payments of $179. 95 60 Mc. Graw-Hill Ryerson©

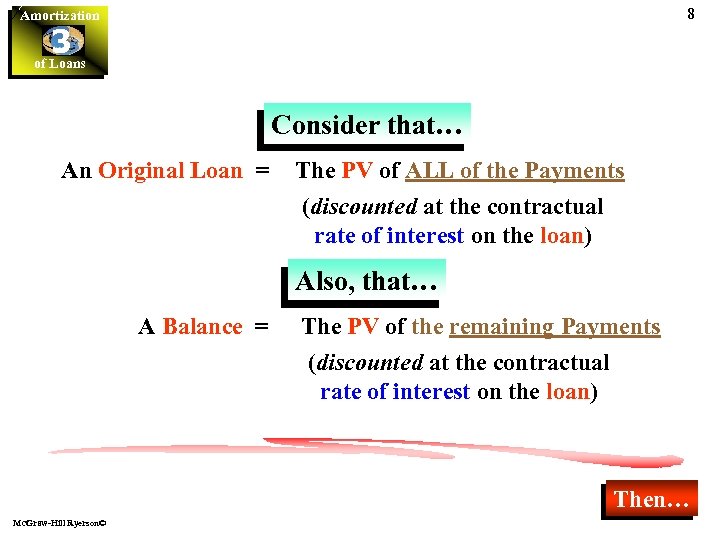

8 Amortization 3 of Loans Consider that… An Original Loan = The PV of ALL of the Payments (discounted at the contractual rate of interest on the loan) Also, that… A Balance = The PV of the remaining Payments (discounted at the contractual rate of interest on the loan) Then… Mc. Graw-Hill Ryerson©

8 Amortization 3 of Loans Consider that… An Original Loan = The PV of ALL of the Payments (discounted at the contractual rate of interest on the loan) Also, that… A Balance = The PV of the remaining Payments (discounted at the contractual rate of interest on the loan) Then… Mc. Graw-Hill Ryerson©

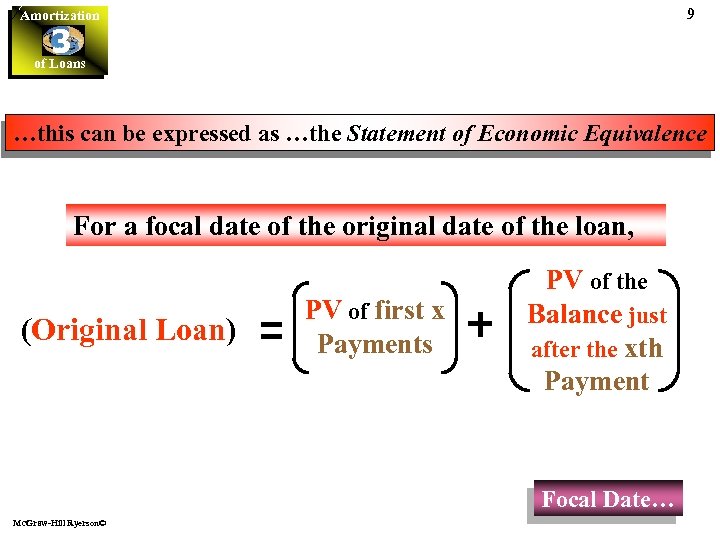

9 Amortization 3 of Loans …this can be expressed as …the Statement of Economic Equivalence For a focal date of the original date of the loan, (Original Loan) PV of first x Payments PV of the Balance just after the xth Payment Focal Date… Mc. Graw-Hill Ryerson©

9 Amortization 3 of Loans …this can be expressed as …the Statement of Economic Equivalence For a focal date of the original date of the loan, (Original Loan) PV of first x Payments PV of the Balance just after the xth Payment Focal Date… Mc. Graw-Hill Ryerson©

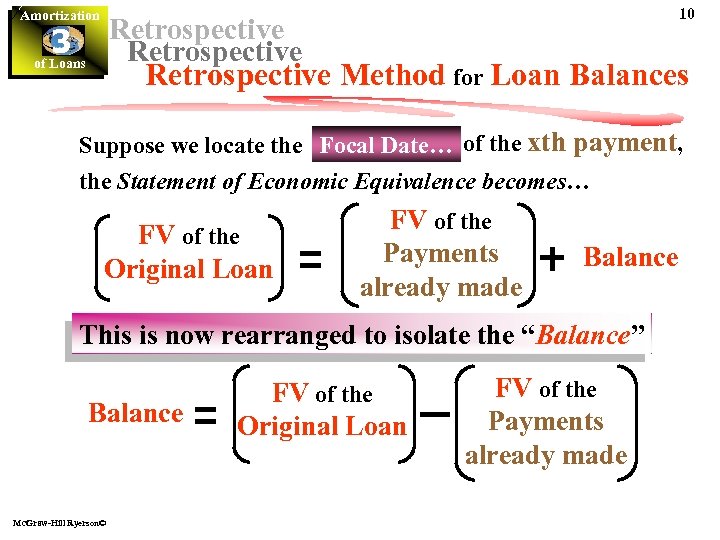

Amortization 10 Retrospective 3 of Loans Retrospective Method for Loan Balances Suppose we locate the Focal Date… of the xth payment, the Statement of Economic Equivalence becomes… FV of the Original Loan FV of the Payments already made Balance This is now rearranged to isolate the “Balance” Balance Mc. Graw-Hill Ryerson© FV of the Original Loan FV of the Payments already made

Amortization 10 Retrospective 3 of Loans Retrospective Method for Loan Balances Suppose we locate the Focal Date… of the xth payment, the Statement of Economic Equivalence becomes… FV of the Original Loan FV of the Payments already made Balance This is now rearranged to isolate the “Balance” Balance Mc. Graw-Hill Ryerson© FV of the Original Loan FV of the Payments already made

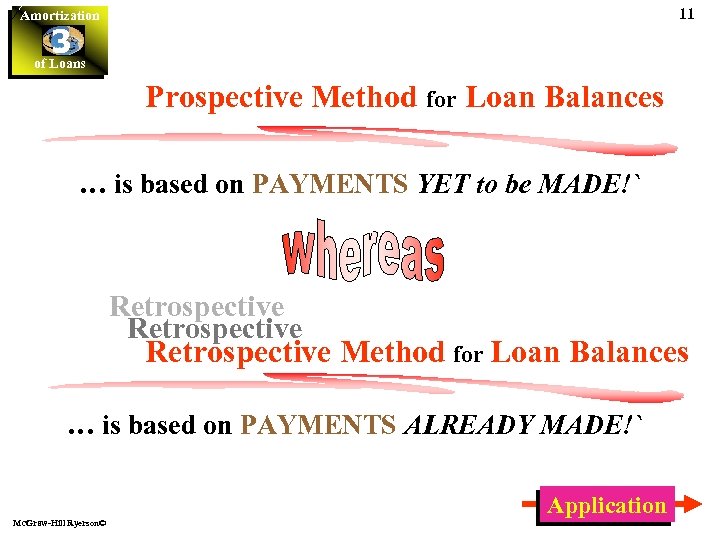

11 Amortization 3 of Loans Prospective Method for Loan Balances … is based on PAYMENTS YET to be MADE!` Retrospective Method for Loan Balances … is based on PAYMENTS ALREADY MADE!` Mc. Graw-Hill Ryerson© Application

11 Amortization 3 of Loans Prospective Method for Loan Balances … is based on PAYMENTS YET to be MADE!` Retrospective Method for Loan Balances … is based on PAYMENTS ALREADY MADE!` Mc. Graw-Hill Ryerson© Application

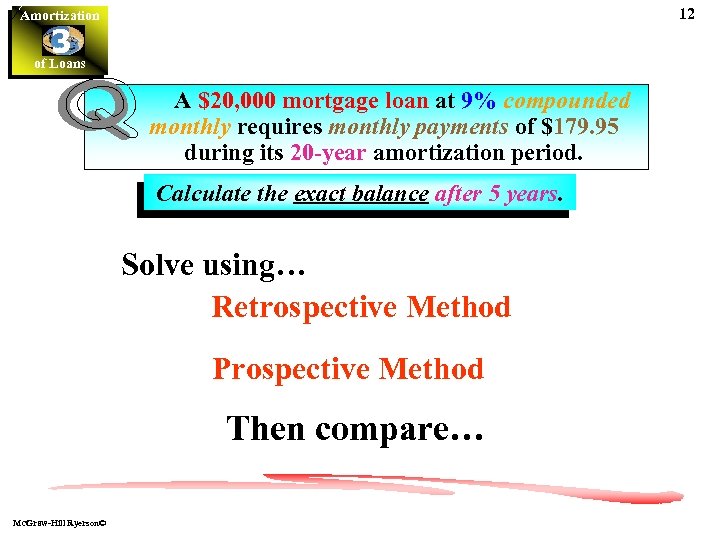

12 Amortization 3 of Loans A $20, 000 mortgage loan at 9% compounded monthly requires monthly payments of $179. 95 during its 20 -year amortization period. Calculate the exact balance after 5 years. Solve using… Retrospective Method Prospective Method Then compare… Mc. Graw-Hill Ryerson©

12 Amortization 3 of Loans A $20, 000 mortgage loan at 9% compounded monthly requires monthly payments of $179. 95 during its 20 -year amortization period. Calculate the exact balance after 5 years. Solve using… Retrospective Method Prospective Method Then compare… Mc. Graw-Hill Ryerson©

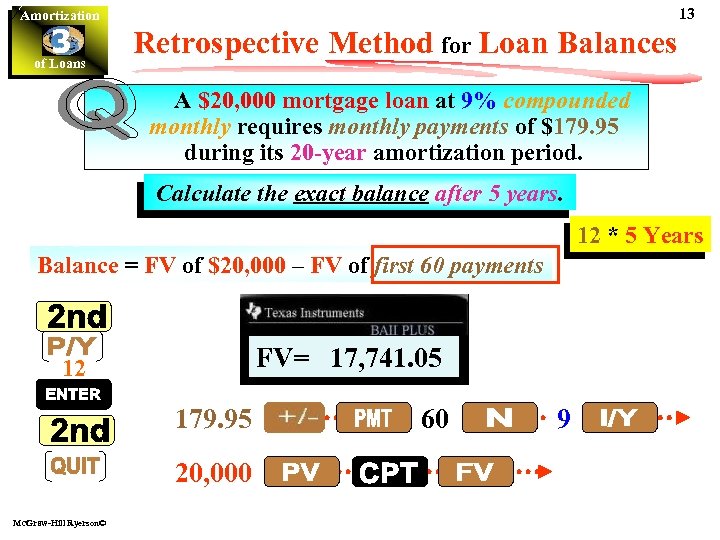

13 Amortization 3 of Loans Retrospective Method for Loan Balances A $20, 000 mortgage loan at 9% compounded monthly requires monthly payments of $179. 95 during its 20 -year amortization period. Calculate the exact balance after 5 years. 12 * 5 Years Balance = FV of $20, 000 – FV of first 60 payments FV= 17, 741. 05 12 179. 95 20, 000 Mc. Graw-Hill Ryerson© 60 9

13 Amortization 3 of Loans Retrospective Method for Loan Balances A $20, 000 mortgage loan at 9% compounded monthly requires monthly payments of $179. 95 during its 20 -year amortization period. Calculate the exact balance after 5 years. 12 * 5 Years Balance = FV of $20, 000 – FV of first 60 payments FV= 17, 741. 05 12 179. 95 20, 000 Mc. Graw-Hill Ryerson© 60 9

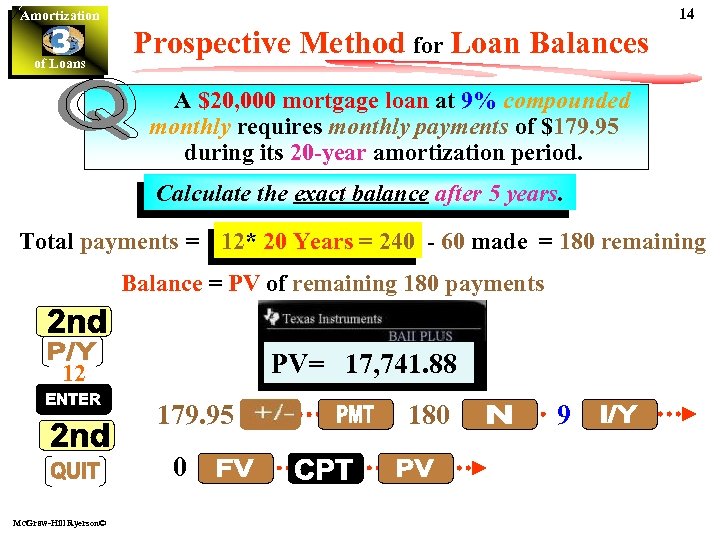

14 Amortization 3 of Loans Prospective Method for Loan Balances A $20, 000 mortgage loan at 9% compounded monthly requires monthly payments of $179. 95 during its 20 -year amortization period. Calculate the exact balance after 5 years. Total payments = 12* 20 Years = 240 - 60 made = 180 remaining Balance = PV of remaining 180 payments PV= 17, 741. 88 12 179. 95 0 Mc. Graw-Hill Ryerson© 180 9

14 Amortization 3 of Loans Prospective Method for Loan Balances A $20, 000 mortgage loan at 9% compounded monthly requires monthly payments of $179. 95 during its 20 -year amortization period. Calculate the exact balance after 5 years. Total payments = 12* 20 Years = 240 - 60 made = 180 remaining Balance = PV of remaining 180 payments PV= 17, 741. 88 12 179. 95 0 Mc. Graw-Hill Ryerson© 180 9

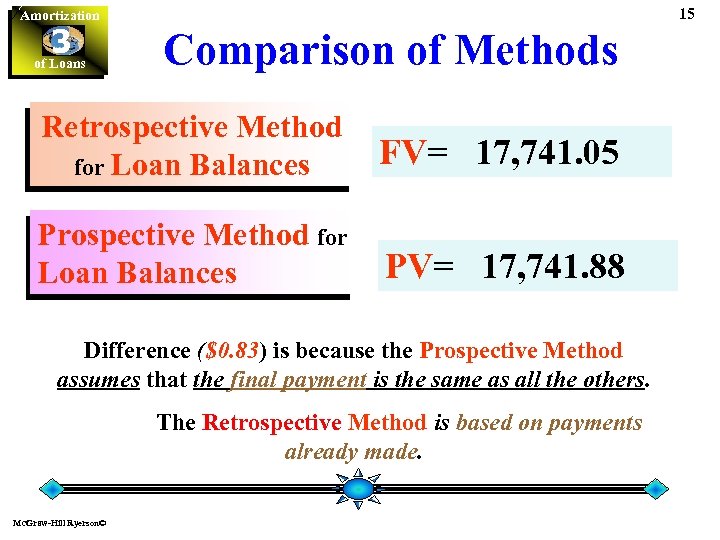

15 Amortization 3 of Loans Comparison of Methods Retrospective Method for Loan Balances FV= 17, 741. 05 Prospective Method for Loan Balances PV= 17, 741. 88 Difference ($0. 83) is because the Prospective Method assumes that the final payment is the same as all the others. The Retrospective Method is based on payments already made. Mc. Graw-Hill Ryerson©

15 Amortization 3 of Loans Comparison of Methods Retrospective Method for Loan Balances FV= 17, 741. 05 Prospective Method for Loan Balances PV= 17, 741. 88 Difference ($0. 83) is because the Prospective Method assumes that the final payment is the same as all the others. The Retrospective Method is based on payments already made. Mc. Graw-Hill Ryerson©

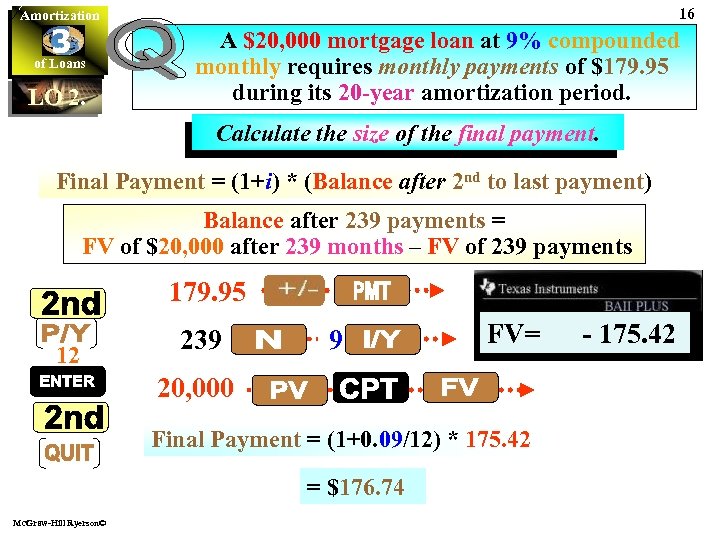

16 Amortization 3 of Loans LO 2. A $20, 000 mortgage loan at 9% compounded monthly requires monthly payments of $179. 95 during its 20 -year amortization period. Calculate the size of the final payment. Final Payment = (1+i) * (Balance after 2 nd to last payment) Balance after 239 payments = FV of $20, 000 after 239 months – FV of 239 payments 179. 95 12 239 9 FV= 20, 000 Final Payment = (1+0. 09/12) * 175. 42 = $176. 74 Mc. Graw-Hill Ryerson© - 175. 42

16 Amortization 3 of Loans LO 2. A $20, 000 mortgage loan at 9% compounded monthly requires monthly payments of $179. 95 during its 20 -year amortization period. Calculate the size of the final payment. Final Payment = (1+i) * (Balance after 2 nd to last payment) Balance after 239 payments = FV of $20, 000 after 239 months – FV of 239 payments 179. 95 12 239 9 FV= 20, 000 Final Payment = (1+0. 09/12) * 175. 42 = $176. 74 Mc. Graw-Hill Ryerson© - 175. 42

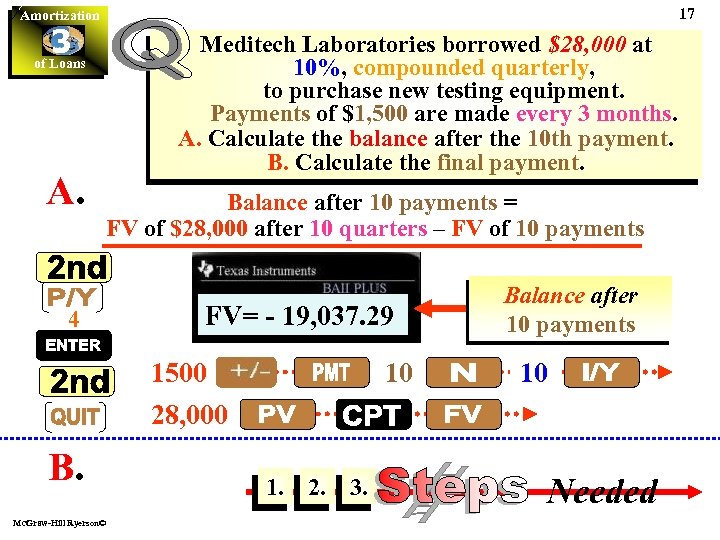

17 Amortization 3 of Loans A. Meditech Laboratories borrowed $28, 000 at 10%, compounded quarterly, to purchase new testing equipment. Payments of $1, 500 are made every 3 months. A. Calculate the balance after the 10 th payment. B. Calculate the final payment. Balance after 10 payments = FV of $28, 000 after 10 quarters – FV of 10 payments 4 FV= - 19, 037. 29 1500 28, 000 B. Mc. Graw-Hill Ryerson© 10 1. 2. 3. Balance after 10 payments 10 Needed

17 Amortization 3 of Loans A. Meditech Laboratories borrowed $28, 000 at 10%, compounded quarterly, to purchase new testing equipment. Payments of $1, 500 are made every 3 months. A. Calculate the balance after the 10 th payment. B. Calculate the final payment. Balance after 10 payments = FV of $28, 000 after 10 quarters – FV of 10 payments 4 FV= - 19, 037. 29 1500 28, 000 B. Mc. Graw-Hill Ryerson© 10 1. 2. 3. Balance after 10 payments 10 Needed

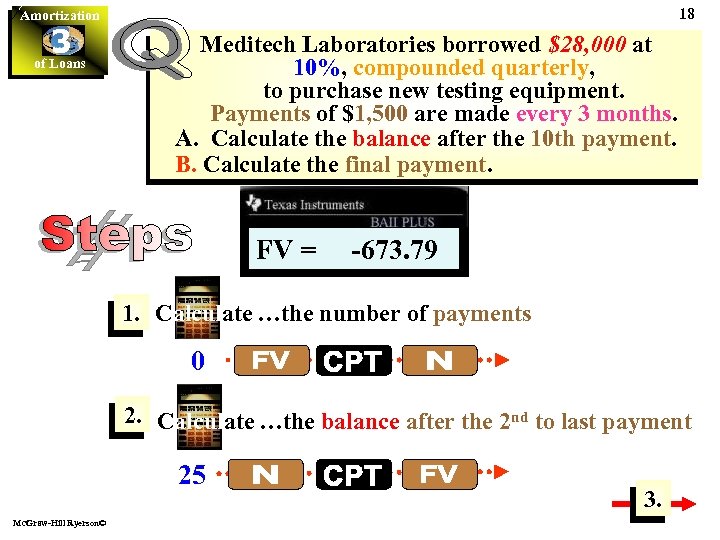

18 Amortization 3 of Loans Meditech Laboratories borrowed $28, 000 at 10%, compounded quarterly, to purchase new testing equipment. Payments of $1, 500 are made every 3 months. A. Calculate the balance after the 10 th payment. B. Calculate the final payment. FV N == -673. 79 25. 457 1. Calculate …the number of payments 0 2. Calculate …the balance after the 2 nd to last payment 25 Mc. Graw-Hill Ryerson© 3.

18 Amortization 3 of Loans Meditech Laboratories borrowed $28, 000 at 10%, compounded quarterly, to purchase new testing equipment. Payments of $1, 500 are made every 3 months. A. Calculate the balance after the 10 th payment. B. Calculate the final payment. FV N == -673. 79 25. 457 1. Calculate …the number of payments 0 2. Calculate …the balance after the 2 nd to last payment 25 Mc. Graw-Hill Ryerson© 3.

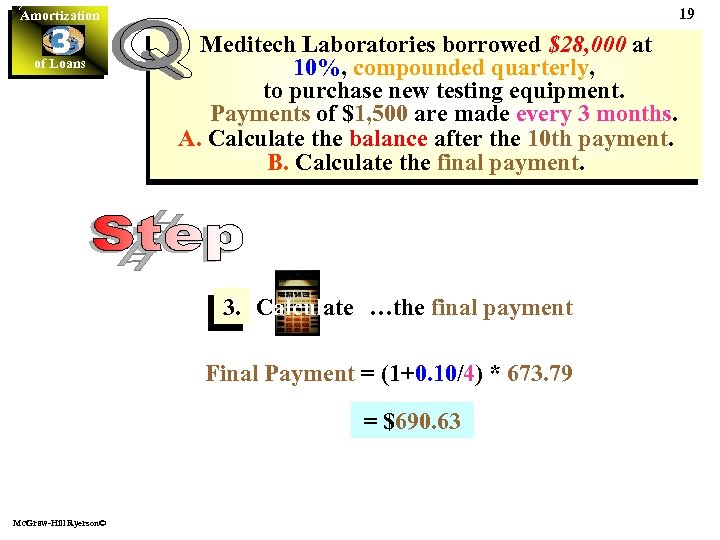

19 Amortization 3 of Loans Meditech Laboratories borrowed $28, 000 at 10%, compounded quarterly, to purchase new testing equipment. Payments of $1, 500 are made every 3 months. A. Calculate the balance after the 10 th payment. B. Calculate the final payment. 3. Calculate …the final payment Final Payment = (1+0. 10/4) * 673. 79 = $690. 63 Mc. Graw-Hill Ryerson©

19 Amortization 3 of Loans Meditech Laboratories borrowed $28, 000 at 10%, compounded quarterly, to purchase new testing equipment. Payments of $1, 500 are made every 3 months. A. Calculate the balance after the 10 th payment. B. Calculate the final payment. 3. Calculate …the final payment Final Payment = (1+0. 10/4) * 673. 79 = $690. 63 Mc. Graw-Hill Ryerson©

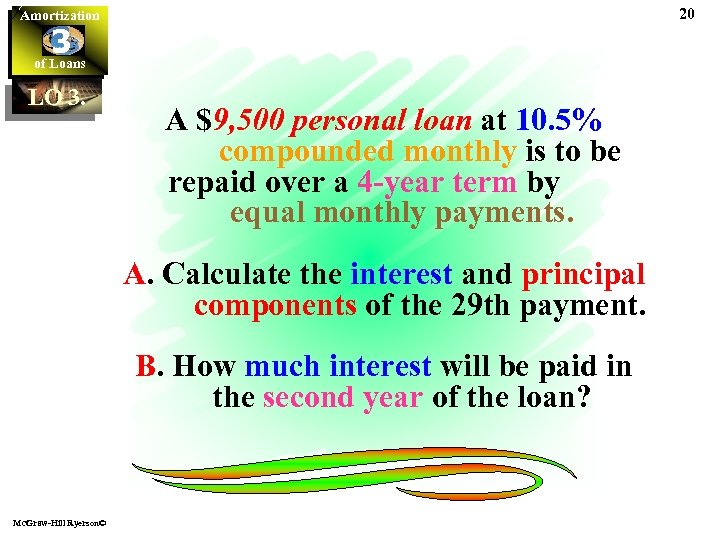

20 Amortization 3 of Loans LO 3. A $9, 500 personal loan at 10. 5% compounded monthly is to be repaid over a 4 -year term by equal monthly payments. A. Calculate the interest and principal components of the 29 th payment. B. How much interest will be paid in the second year of the loan? Mc. Graw-Hill Ryerson©

20 Amortization 3 of Loans LO 3. A $9, 500 personal loan at 10. 5% compounded monthly is to be repaid over a 4 -year term by equal monthly payments. A. Calculate the interest and principal components of the 29 th payment. B. How much interest will be paid in the second year of the loan? Mc. Graw-Hill Ryerson©

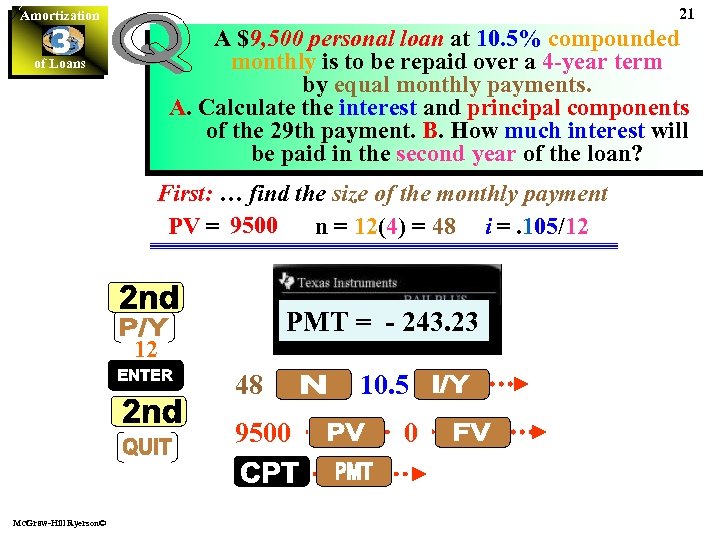

21 Amortization 3 of Loans A $9, 500 personal loan at 10. 5% compounded monthly is to be repaid over a 4 -year term by equal monthly payments. A. Calculate the interest and principal components of the 29 th payment. B. How much interest will be paid in the second year of the loan? First: … find the size of the monthly payment PV = 9500 n = 12(4) = 48 i =. 105/12 PMT = - 243. 23 12 48 9500 Mc. Graw-Hill Ryerson© 10. 5 0

21 Amortization 3 of Loans A $9, 500 personal loan at 10. 5% compounded monthly is to be repaid over a 4 -year term by equal monthly payments. A. Calculate the interest and principal components of the 29 th payment. B. How much interest will be paid in the second year of the loan? First: … find the size of the monthly payment PV = 9500 n = 12(4) = 48 i =. 105/12 PMT = - 243. 23 12 48 9500 Mc. Graw-Hill Ryerson© 10. 5 0

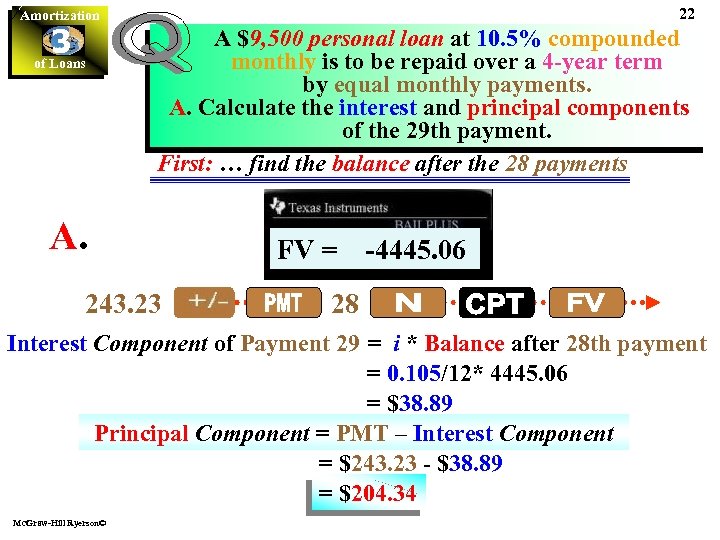

22 Amortization 3 of Loans A $9, 500 personal loan at 10. 5% compounded monthly is to be repaid over a 4 -year term by equal monthly payments. A. Calculate the interest and principal components of the 29 th payment. First: … find the balance after the 28 payments A. 243. 23 FV = - 243. 23 PMT = -4445. 06 28 Interest Component of Payment 29 = i * Balance after 28 th payment = 0. 105/12* 4445. 06 = $38. 89 Principal Component = PMT – Interest Component = $243. 23 - $38. 89 = $204. 34 Mc. Graw-Hill Ryerson©

22 Amortization 3 of Loans A $9, 500 personal loan at 10. 5% compounded monthly is to be repaid over a 4 -year term by equal monthly payments. A. Calculate the interest and principal components of the 29 th payment. First: … find the balance after the 28 payments A. 243. 23 FV = - 243. 23 PMT = -4445. 06 28 Interest Component of Payment 29 = i * Balance after 28 th payment = 0. 105/12* 4445. 06 = $38. 89 Principal Component = PMT – Interest Component = $243. 23 - $38. 89 = $204. 34 Mc. Graw-Hill Ryerson©

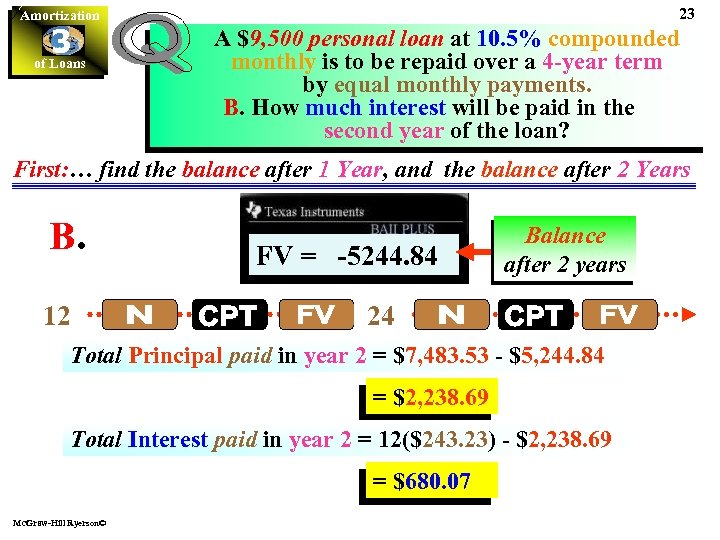

23 Amortization 3 of Loans A $9, 500 personal loan at 10. 5% compounded monthly is to be repaid over a 4 -year term by equal monthly payments. B. How much interest will be paid in the second year of the loan? First: … find the balance after 1 Year, and the balance after 2 Years B. 12 FV = -7483. 53 -5244. 84 Balance after 2 years after 1 year 24 Total Principal paid in year 2 = $7, 483. 53 - $5, 244. 84 = $2, 238. 69 Total Interest paid in year 2 = 12($243. 23) - $2, 238. 69 = $680. 07 Mc. Graw-Hill Ryerson©

23 Amortization 3 of Loans A $9, 500 personal loan at 10. 5% compounded monthly is to be repaid over a 4 -year term by equal monthly payments. B. How much interest will be paid in the second year of the loan? First: … find the balance after 1 Year, and the balance after 2 Years B. 12 FV = -7483. 53 -5244. 84 Balance after 2 years after 1 year 24 Total Principal paid in year 2 = $7, 483. 53 - $5, 244. 84 = $2, 238. 69 Total Interest paid in year 2 = 12($243. 23) - $2, 238. 69 = $680. 07 Mc. Graw-Hill Ryerson©

24 Amortization 3 of Loans … is a loan secured by some physical property Mc. Graw-Hill Ryerson©

24 Amortization 3 of Loans … is a loan secured by some physical property Mc. Graw-Hill Ryerson©

25 Amortization 3 of Loans Mortgage Loans …Basic Concepts and Definitions MORT GAGE Borrower …the borrower is called the mortgagor Mc. Graw-Hill Ryerson© APPLI CATIO N Lender …the lender is called the mortgagee

25 Amortization 3 of Loans Mortgage Loans …Basic Concepts and Definitions MORT GAGE Borrower …the borrower is called the mortgagor Mc. Graw-Hill Ryerson© APPLI CATIO N Lender …the lender is called the mortgagee

26 Amortization 3 of Loans Mortgage Loans …Basic Concepts and Definitions Face Value of MORT AGE A mortgage Goriginal PPLIC ATION = principal amount Term … From … date on which loan advanced To … date on which the remaining Principal Balance is due and payable …most common periods are 20 and 25 years. Interest Rate Mc. Graw-Hill Ryerson© …usually a lender will commit to a fixed interest rate for only a shorter period or term (6 months to 7 years)

26 Amortization 3 of Loans Mortgage Loans …Basic Concepts and Definitions Face Value of MORT AGE A mortgage Goriginal PPLIC ATION = principal amount Term … From … date on which loan advanced To … date on which the remaining Principal Balance is due and payable …most common periods are 20 and 25 years. Interest Rate Mc. Graw-Hill Ryerson© …usually a lender will commit to a fixed interest rate for only a shorter period or term (6 months to 7 years)

27 Amortization 3 of Loans MORT GAGE APPLI CATIO N A Mortgage Loan at 8. 5% compounded semiannually with a 25 -year amortization period Graphic Illustrations Mc. Graw-Hill Ryerson©

27 Amortization 3 of Loans MORT GAGE APPLI CATIO N A Mortgage Loan at 8. 5% compounded semiannually with a 25 -year amortization period Graphic Illustrations Mc. Graw-Hill Ryerson©

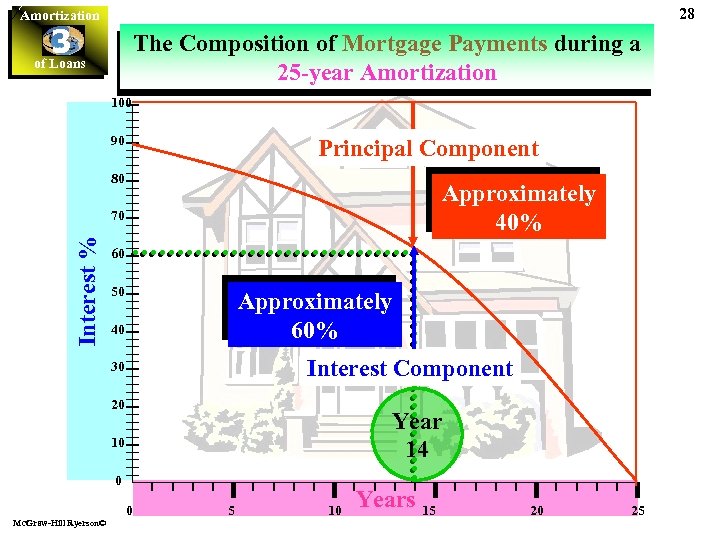

28 Amortization 3 of Loans The Composition of Mortgage Payments during a 25 -year Amortization 100 90 Principal Component 80 Approximately 40% Interest % 70 60 50 Approximately 60% 40 Interest Component 30 20 Year 14 10 0 Mc. Graw-Hill Ryerson© 0 5 10 Years 15 20 25

28 Amortization 3 of Loans The Composition of Mortgage Payments during a 25 -year Amortization 100 90 Principal Component 80 Approximately 40% Interest % 70 60 50 Approximately 60% 40 Interest Component 30 20 Year 14 10 0 Mc. Graw-Hill Ryerson© 0 5 10 Years 15 20 25

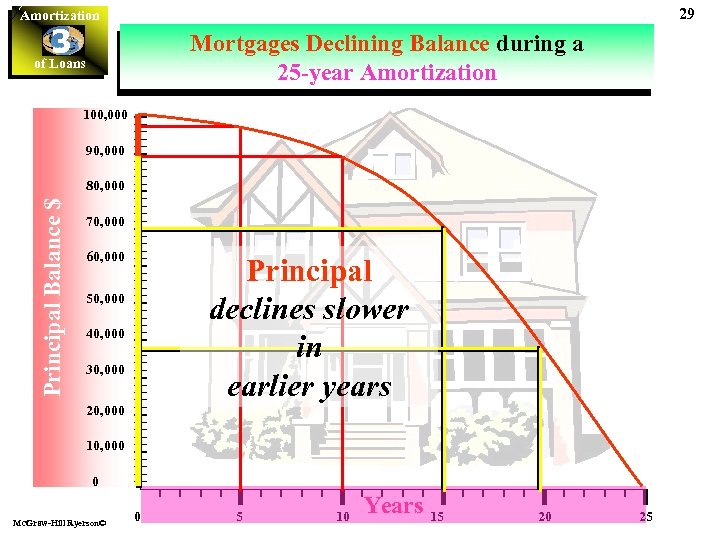

29 Amortization 3 of Loans Mortgages Declining Balance during a 25 -year Amortization 100, 000 90, 000 Principal Balance $ 80, 000 70, 000 60, 000 Principal declines slower in earlier years 50, 000 40, 000 30, 000 20, 000 10, 000 0 Mc. Graw-Hill Ryerson© 0 5 10 Years 15 20 25

29 Amortization 3 of Loans Mortgages Declining Balance during a 25 -year Amortization 100, 000 90, 000 Principal Balance $ 80, 000 70, 000 60, 000 Principal declines slower in earlier years 50, 000 40, 000 30, 000 20, 000 10, 000 0 Mc. Graw-Hill Ryerson© 0 5 10 Years 15 20 25

Amortization 3 of Loans Mc. Graw-Hill Ryerson© 30

Amortization 3 of Loans Mc. Graw-Hill Ryerson© 30

31 Amortization 3 of Loans MORT GAGE APPLI CATIO N …need to satisfy all 3 of the following Ratios… Loan-to-Value Ratio (LVR) Gross Debt Service Ratio (GDS) Total Debt Service Ratio (TDS) Mc. Graw-Hill Ryerson©

31 Amortization 3 of Loans MORT GAGE APPLI CATIO N …need to satisfy all 3 of the following Ratios… Loan-to-Value Ratio (LVR) Gross Debt Service Ratio (GDS) Total Debt Service Ratio (TDS) Mc. Graw-Hill Ryerson©

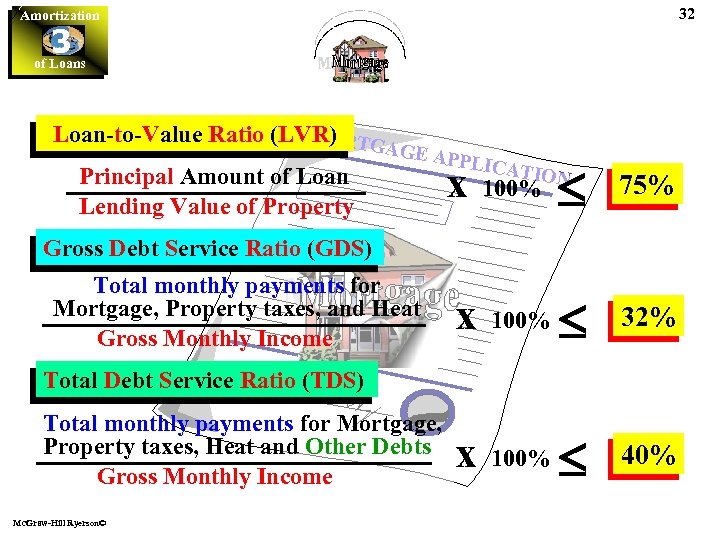

32 Amortization 3 of Loans MO Loan-to-Value Ratio (LVR) RTG Principal Amount of Loan Lending Value of Property AGE A PPLIC x £ 75% ATION 100% Gross Debt Service Ratio (GDS) Total monthly payments for Mortgage, Property taxes, and Heat Gross Monthly Income x 100% £ 32% x 100% £ 40% Total Debt Service Ratio (TDS) Total monthly payments for Mortgage, Property taxes, Heat and Other Debts Gross Monthly Income Mc. Graw-Hill Ryerson©

32 Amortization 3 of Loans MO Loan-to-Value Ratio (LVR) RTG Principal Amount of Loan Lending Value of Property AGE A PPLIC x £ 75% ATION 100% Gross Debt Service Ratio (GDS) Total monthly payments for Mortgage, Property taxes, and Heat Gross Monthly Income x 100% £ 32% x 100% £ 40% Total Debt Service Ratio (TDS) Total monthly payments for Mortgage, Property taxes, Heat and Other Debts Gross Monthly Income Mc. Graw-Hill Ryerson©

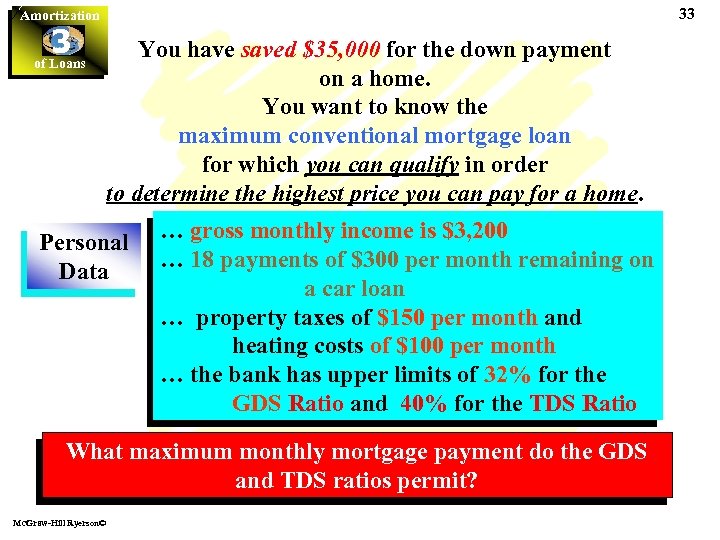

33 Amortization 3 of Loans You have saved $35, 000 for the down payment on a home. You want to know the maximum conventional mortgage loan for which you can qualify in order to determine the highest price you can pay for a home. Personal Data … gross monthly income is $3, 200 … 18 payments of $300 per month remaining on a car loan … property taxes of $150 per month and heating costs of $100 per month … the bank has upper limits of 32% for the GDS Ratio and 40% for the TDS Ratio What maximum monthly mortgage payment do the GDS and TDS ratios permit? Mc. Graw-Hill Ryerson©

33 Amortization 3 of Loans You have saved $35, 000 for the down payment on a home. You want to know the maximum conventional mortgage loan for which you can qualify in order to determine the highest price you can pay for a home. Personal Data … gross monthly income is $3, 200 … 18 payments of $300 per month remaining on a car loan … property taxes of $150 per month and heating costs of $100 per month … the bank has upper limits of 32% for the GDS Ratio and 40% for the TDS Ratio What maximum monthly mortgage payment do the GDS and TDS ratios permit? Mc. Graw-Hill Ryerson©

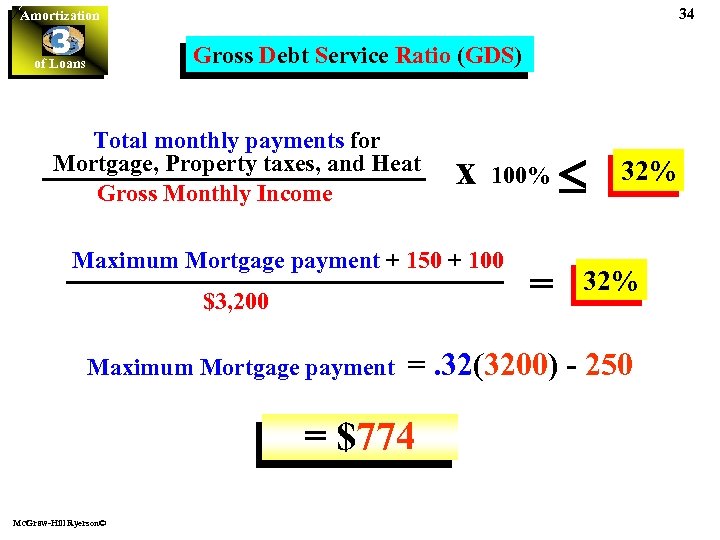

34 Amortization 3 of Loans Gross Debt Service Ratio (GDS) Total monthly payments for Mortgage, Property taxes, and Heat Gross Monthly Income x 100% Maximum Mortgage payment + 150 + 100 $3, 200 Maximum Mortgage payment 32% =. 32(3200) - 250 = $774 Mc. Graw-Hill Ryerson© = £

34 Amortization 3 of Loans Gross Debt Service Ratio (GDS) Total monthly payments for Mortgage, Property taxes, and Heat Gross Monthly Income x 100% Maximum Mortgage payment + 150 + 100 $3, 200 Maximum Mortgage payment 32% =. 32(3200) - 250 = $774 Mc. Graw-Hill Ryerson© = £

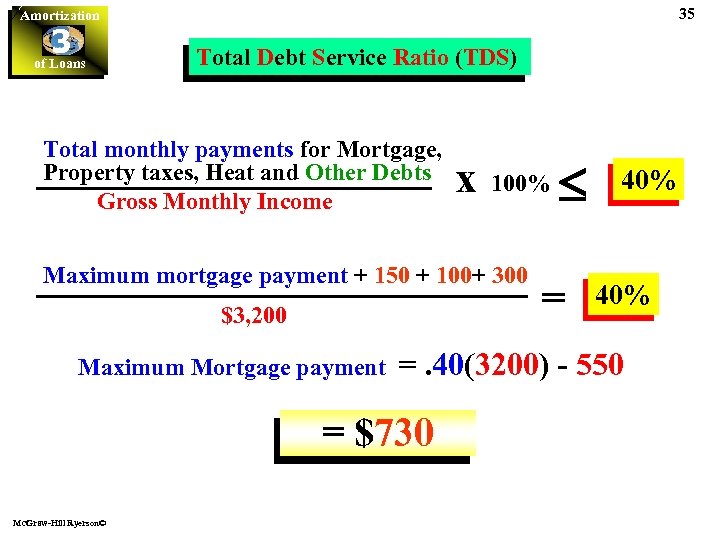

35 Amortization 3 of Loans Total Debt Service Ratio (TDS) Total monthly payments for Mortgage, Property taxes, Heat and Other Debts Gross Monthly Income x 100% Maximum mortgage payment + 150 + 100+ 300 $3, 200 Maximum Mortgage payment = 40% =. 40(3200) - 550 = $730 Mc. Graw-Hill Ryerson© £

35 Amortization 3 of Loans Total Debt Service Ratio (TDS) Total monthly payments for Mortgage, Property taxes, Heat and Other Debts Gross Monthly Income x 100% Maximum mortgage payment + 150 + 100+ 300 $3, 200 Maximum Mortgage payment = 40% =. 40(3200) - 550 = $730 Mc. Graw-Hill Ryerson© £

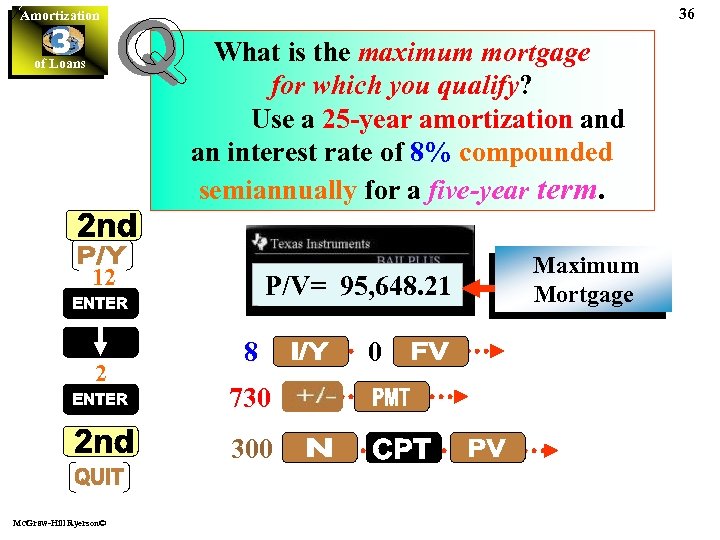

36 Amortization 3 of Loans What is the maximum mortgage for which you qualify? Use a 25 -year amortization and an interest rate of 8% compounded semiannually for a five-year term. 12 2 P/Y = 95, 648. 21 12 C/Y = 2 P/V= 0 8 730 300 Mc. Graw-Hill Ryerson© 0 Maximum Mortgage

36 Amortization 3 of Loans What is the maximum mortgage for which you qualify? Use a 25 -year amortization and an interest rate of 8% compounded semiannually for a five-year term. 12 2 P/Y = 95, 648. 21 12 C/Y = 2 P/V= 0 8 730 300 Mc. Graw-Hill Ryerson© 0 Maximum Mortgage

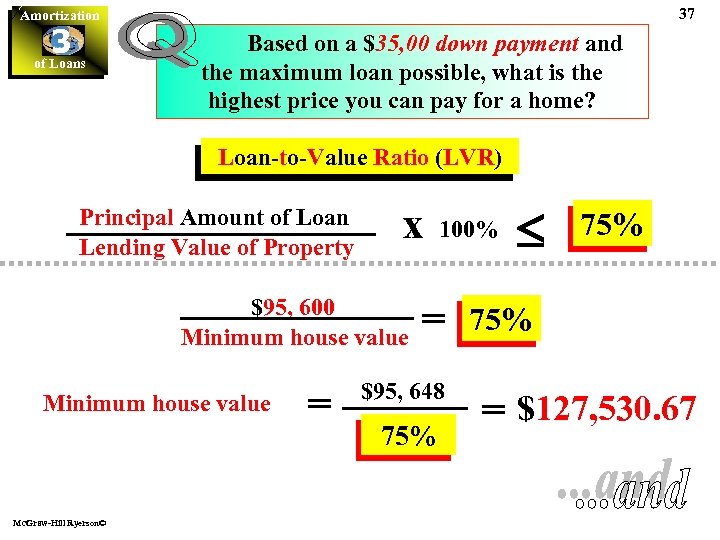

37 Amortization 3 of Loans Based on a $35, 00 down payment and the maximum loan possible, what is the highest price you can pay for a home? Loan-to-Value Ratio (LVR) Principal Amount of Loan Lending Value of Property x $95, 600 Minimum house value Mc. Graw-Hill Ryerson© = 100% = $95, 648 75% £ 75% = $127, 530. 67

37 Amortization 3 of Loans Based on a $35, 00 down payment and the maximum loan possible, what is the highest price you can pay for a home? Loan-to-Value Ratio (LVR) Principal Amount of Loan Lending Value of Property x $95, 600 Minimum house value Mc. Graw-Hill Ryerson© = 100% = $95, 648 75% £ 75% = $127, 530. 67

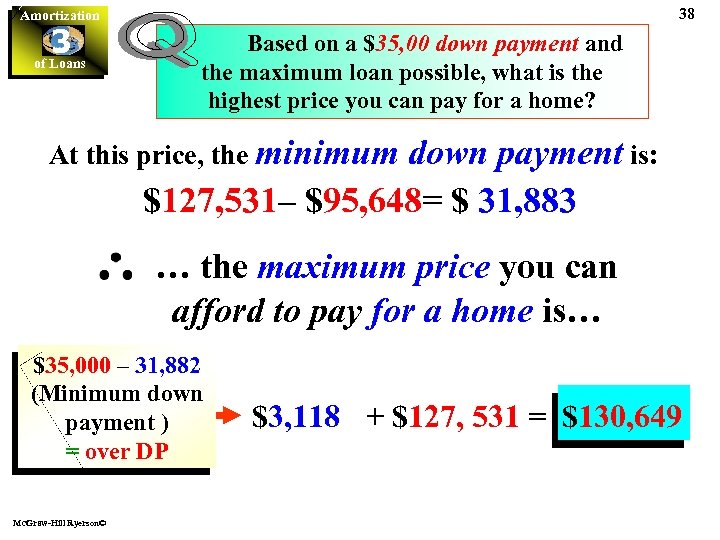

38 Amortization 3 of Loans Based on a $35, 00 down payment and the maximum loan possible, what is the highest price you can pay for a home? At this price, the minimum down payment is: $127, 531– $95, 648= $ 31, 883 … the maximum price you can afford to pay for a home is… $35, 000 – 31, 882 (Minimum down payment ) = over DP Mc. Graw-Hill Ryerson© $3, 118 + $127, 531 = $130, 649

38 Amortization 3 of Loans Based on a $35, 00 down payment and the maximum loan possible, what is the highest price you can pay for a home? At this price, the minimum down payment is: $127, 531– $95, 648= $ 31, 883 … the maximum price you can afford to pay for a home is… $35, 000 – 31, 882 (Minimum down payment ) = over DP Mc. Graw-Hill Ryerson© $3, 118 + $127, 531 = $130, 649

39 Amortization 3 of Loans MORT GAGE APPLI CATIO N Common Prepayment Privileges & Penalties Mc. Graw-Hill Ryerson©

39 Amortization 3 of Loans MORT GAGE APPLI CATIO N Common Prepayment Privileges & Penalties Mc. Graw-Hill Ryerson©

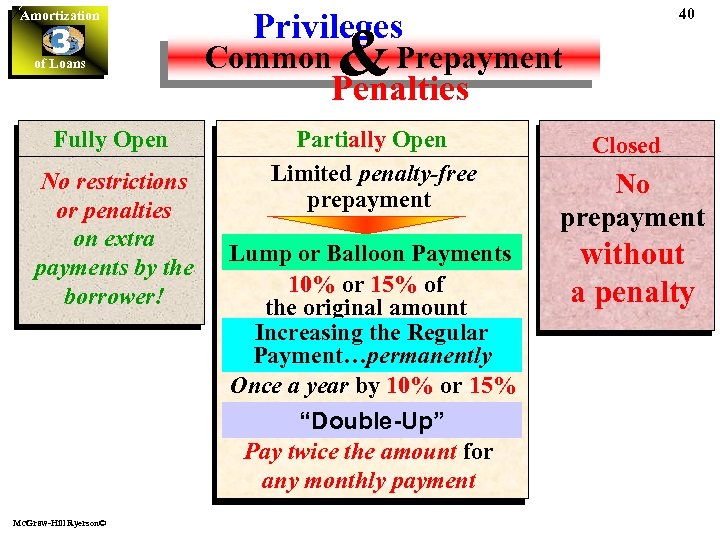

Amortization 3 of Loans Fully Open No restrictions or penalties on extra payments by the borrower! Privileges & Prepayment Penalties Common Partially Open Limited penalty-free prepayment Lump or Balloon Payments 10% or 15% of the original amount Increasing the Regular Payment…permanently Once a year by 10% or 15% “Double-Up” Pay twice the amount for any monthly payment Mc. Graw-Hill Ryerson© 40 Closed No prepayment without a penalty

Amortization 3 of Loans Fully Open No restrictions or penalties on extra payments by the borrower! Privileges & Prepayment Penalties Common Partially Open Limited penalty-free prepayment Lump or Balloon Payments 10% or 15% of the original amount Increasing the Regular Payment…permanently Once a year by 10% or 15% “Double-Up” Pay twice the amount for any monthly payment Mc. Graw-Hill Ryerson© 40 Closed No prepayment without a penalty

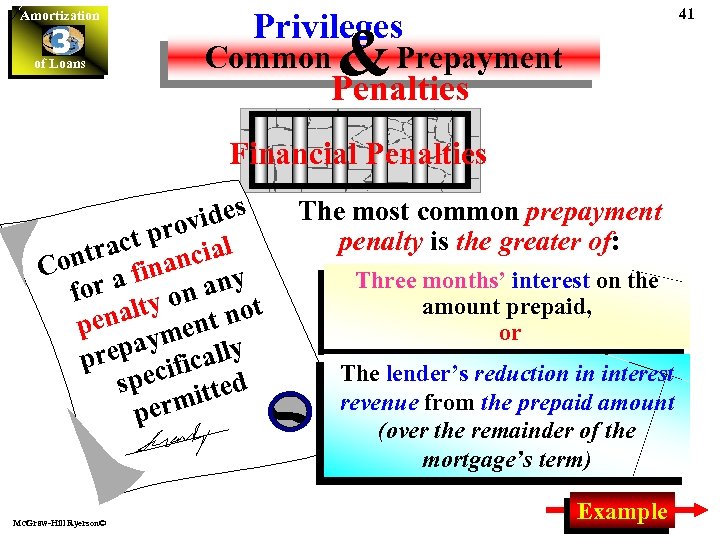

Amortization 3 of Loans 41 Privileges & Prepayment Penalties Common Financial Penalties s vide t pro ial trac anc Con a fin any or f ty on t not enal p men y epay icall pr ecif ed sp mitt per Mc. Graw-Hill Ryerson© The most common prepayment penalty is the greater of: Three months’ interest on the amount prepaid, or The lender’s reduction in interest revenue from the prepaid amount (over the remainder of the mortgage’s term) Example

Amortization 3 of Loans 41 Privileges & Prepayment Penalties Common Financial Penalties s vide t pro ial trac anc Con a fin any or f ty on t not enal p men y epay icall pr ecif ed sp mitt per Mc. Graw-Hill Ryerson© The most common prepayment penalty is the greater of: Three months’ interest on the amount prepaid, or The lender’s reduction in interest revenue from the prepaid amount (over the remainder of the mortgage’s term) Example

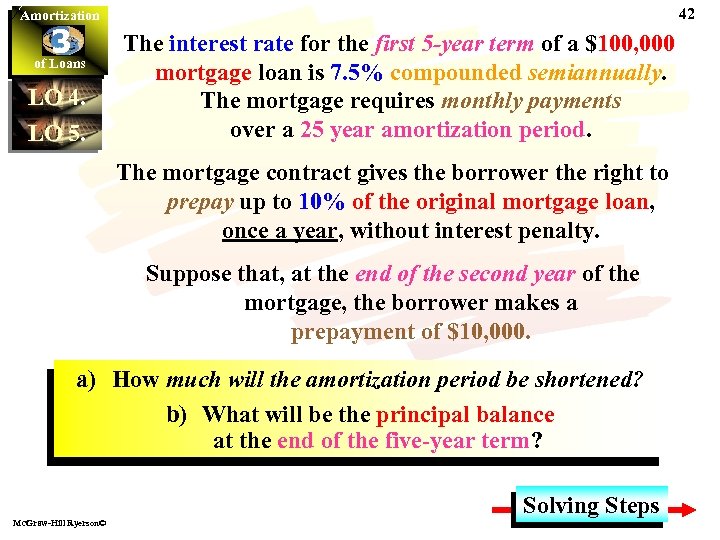

42 Amortization 3 of Loans LO 4. LO 5. The interest rate for the first 5 -year term of a $100, 000 mortgage loan is 7. 5% compounded semiannually. The mortgage requires monthly payments over a 25 year amortization period. The mortgage contract gives the borrower the right to prepay up to 10% of the original mortgage loan, once a year, without interest penalty. Suppose that, at the end of the second year of the mortgage, the borrower makes a prepayment of $10, 000. a) How much will the amortization period be shortened? b) What will be the principal balance at the end of the five-year term? Mc. Graw-Hill Ryerson© Solving Steps

42 Amortization 3 of Loans LO 4. LO 5. The interest rate for the first 5 -year term of a $100, 000 mortgage loan is 7. 5% compounded semiannually. The mortgage requires monthly payments over a 25 year amortization period. The mortgage contract gives the borrower the right to prepay up to 10% of the original mortgage loan, once a year, without interest penalty. Suppose that, at the end of the second year of the mortgage, the borrower makes a prepayment of $10, 000. a) How much will the amortization period be shortened? b) What will be the principal balance at the end of the five-year term? Mc. Graw-Hill Ryerson© Solving Steps

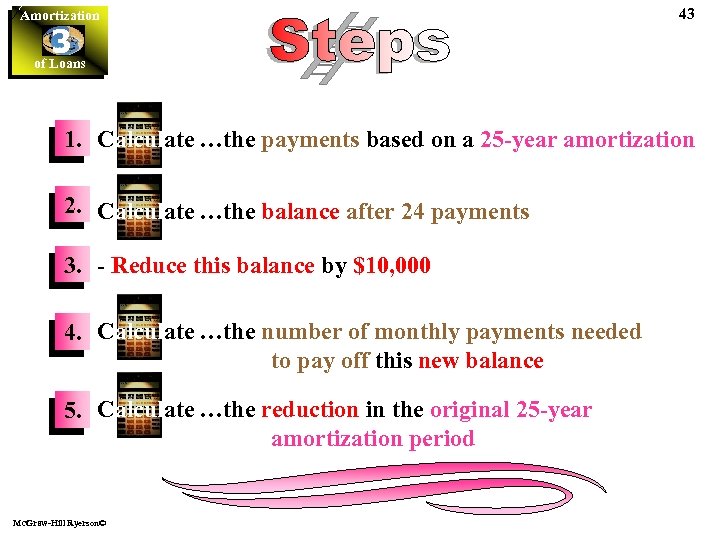

Amortization 3 of Loans 43 1. Calculate …the payments based on a 25 -year amortization 2. Calculate …the balance after 24 payments 3. - Reduce this balance by $10, 000 4. Calculate …the number of monthly payments needed to pay off this new balance 5. Calculate …the reduction in the original 25 -year amortization period Mc. Graw-Hill Ryerson©

Amortization 3 of Loans 43 1. Calculate …the payments based on a 25 -year amortization 2. Calculate …the balance after 24 payments 3. - Reduce this balance by $10, 000 4. Calculate …the number of monthly payments needed to pay off this new balance 5. Calculate …the reduction in the original 25 -year amortization period Mc. Graw-Hill Ryerson©

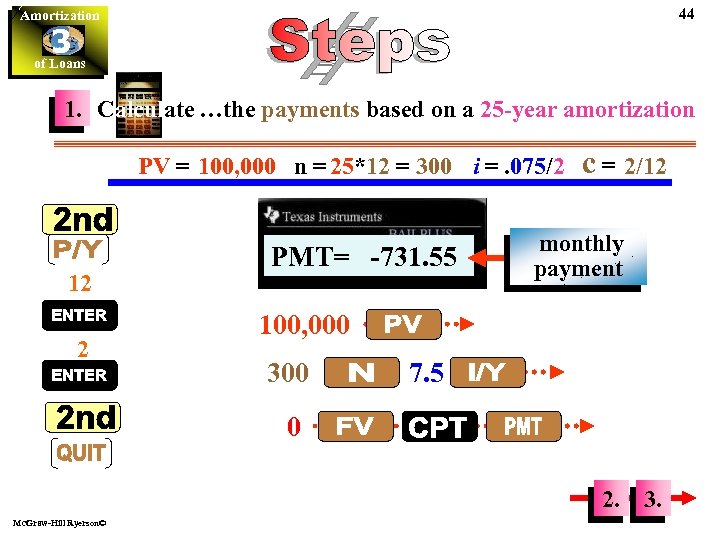

44 Amortization 3 of Loans 1. Calculate …the payments based on a 25 -year amortization PV = 100, 000 n = 25*12 = 300 i =. 075/2 12 2 PMT= -731. 55 c = 2/12 monthly payment 100, 000 300 7. 5 0 2. Mc. Graw-Hill Ryerson© 3.

44 Amortization 3 of Loans 1. Calculate …the payments based on a 25 -year amortization PV = 100, 000 n = 25*12 = 300 i =. 075/2 12 2 PMT= -731. 55 c = 2/12 monthly payment 100, 000 300 7. 5 0 2. Mc. Graw-Hill Ryerson© 3.

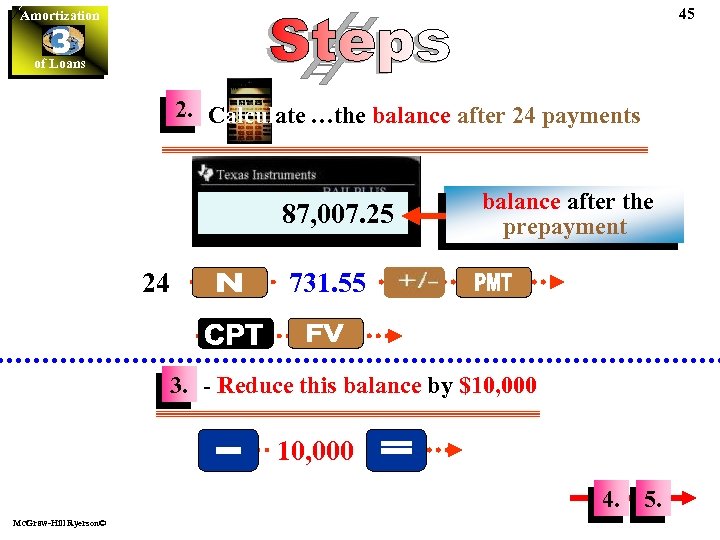

45 Amortization 3 of Loans 2. Calculate …the balance after 24 payments 87, 007. 25 FV= -97, 007. 25 24 balance after the balance after 24 payments prepayment 731. 55 3. - Reduce this balance by $10, 000 4. Mc. Graw-Hill Ryerson© 5.

45 Amortization 3 of Loans 2. Calculate …the balance after 24 payments 87, 007. 25 FV= -97, 007. 25 24 balance after the balance after 24 payments prepayment 731. 55 3. - Reduce this balance by $10, 000 4. Mc. Graw-Hill Ryerson© 5.

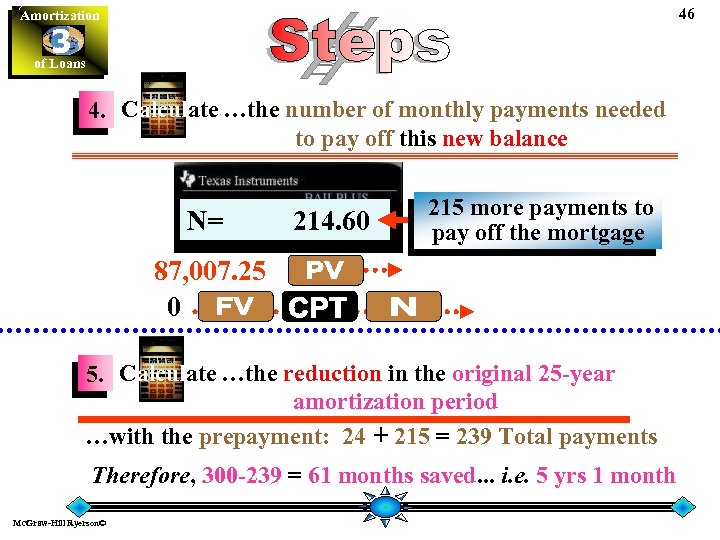

46 Amortization 3 of Loans 4. Calculate …the number of monthly payments needed to pay off this new balance N= 214. 60 215 more payments to pay off the mortgage 87, 007. 25 0 5. Calculate …the reduction in the original 25 -year amortization period …with the prepayment: 24 + 215 = 239 Total payments Therefore, 300 -239 = 61 months saved. . . i. e. 5 yrs 1 month Mc. Graw-Hill Ryerson©

46 Amortization 3 of Loans 4. Calculate …the number of monthly payments needed to pay off this new balance N= 214. 60 215 more payments to pay off the mortgage 87, 007. 25 0 5. Calculate …the reduction in the original 25 -year amortization period …with the prepayment: 24 + 215 = 239 Total payments Therefore, 300 -239 = 61 months saved. . . i. e. 5 yrs 1 month Mc. Graw-Hill Ryerson©

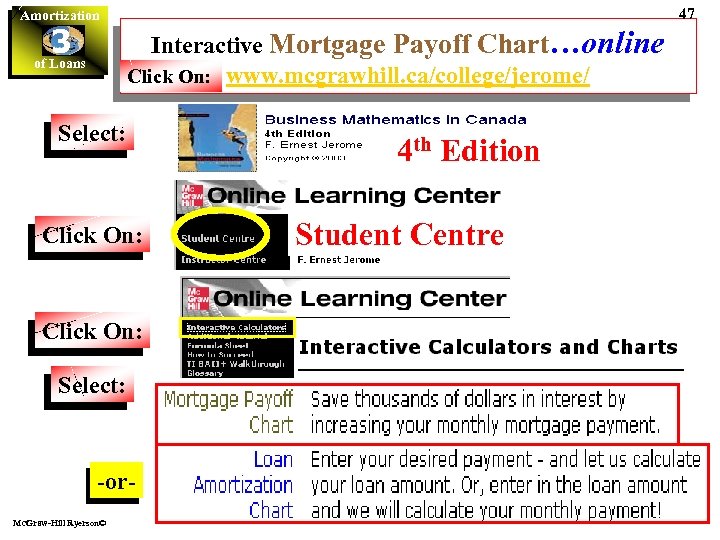

47 Amortization 3 of Loans Interactive Mortgage Payoff Chart…online Click On: www. mcgrawhill. ca/college/jerome/ Select: Click On: Select: -or. Mc. Graw-Hill Ryerson© 4 th Edition Student Centre

47 Amortization 3 of Loans Interactive Mortgage Payoff Chart…online Click On: www. mcgrawhill. ca/college/jerome/ Select: Click On: Select: -or. Mc. Graw-Hill Ryerson© 4 th Edition Student Centre

Amortization 3 of Loans This completes Chapter 14 Mc. Graw-Hill Ryerson© 48

Amortization 3 of Loans This completes Chapter 14 Mc. Graw-Hill Ryerson© 48