514ad1dfc6cfee37e94033e97fdc83e0.ppt

- Количество слайдов: 24

1/9/2001 FINANCIAL ENGINEERING: DERIVATIVES AND RISK MANAGEMENT (J. Wiley, 2001) K. Cuthbertson and D. Nitzsche LECTURE REGULATION OF FINANCIAL INSTITUTIONS © K. Cuthbertson and D. Nitzsche

1/9/2001 FINANCIAL ENGINEERING: DERIVATIVES AND RISK MANAGEMENT (J. Wiley, 2001) K. Cuthbertson and D. Nitzsche LECTURE REGULATION OF FINANCIAL INSTITUTIONS © K. Cuthbertson and D. Nitzsche

TOPICS REASONS FOR REGULATION TYPES OF RISK REGULATORY FRAMEWORK WHAT IS “CAPITAL” ? TYPES OF RISK BASLE (1988) ACCORD - CREDIT RISK © K. Cuthbertson and D. Nitzsche

TOPICS REASONS FOR REGULATION TYPES OF RISK REGULATORY FRAMEWORK WHAT IS “CAPITAL” ? TYPES OF RISK BASLE (1988) ACCORD - CREDIT RISK © K. Cuthbertson and D. Nitzsche

REASONS FOR REGULATION 1. MARKET FAILURE a)externalities eg. bank run, credit crunch = systemic risk b)market power eg. fixed commissions monopoly/cartels (eg Japanese Banks) © K. Cuthbertson and D. Nitzsche

REASONS FOR REGULATION 1. MARKET FAILURE a)externalities eg. bank run, credit crunch = systemic risk b)market power eg. fixed commissions monopoly/cartels (eg Japanese Banks) © K. Cuthbertson and D. Nitzsche

REASONS FOR REGULATION 2. OTHER REASONS protection of payments system(Bo. E) protection from fraud (FSA) promotion of competition (FSA) protection of small depositors (FSA) education (FSA) © K. Cuthbertson and D. Nitzsche

REASONS FOR REGULATION 2. OTHER REASONS protection of payments system(Bo. E) protection from fraud (FSA) promotion of competition (FSA) protection of small depositors (FSA) education (FSA) © K. Cuthbertson and D. Nitzsche

REASONS FOR REGULATION 3. INFORMATION PROBLEMS asymmetric information leads to deposit insurance Fixed rate deposit insurance leads to problems of adverse selection (eg. motor insurance, too many risky drivers) moral hazard (eg. drives recklessly because he’s insured) Regulator has principal-agent problem (can’t fully monitor behaviour, eg. drinking and driving, after providing insurance). © K. Cuthbertson and D. Nitzsche

REASONS FOR REGULATION 3. INFORMATION PROBLEMS asymmetric information leads to deposit insurance Fixed rate deposit insurance leads to problems of adverse selection (eg. motor insurance, too many risky drivers) moral hazard (eg. drives recklessly because he’s insured) Regulator has principal-agent problem (can’t fully monitor behaviour, eg. drinking and driving, after providing insurance). © K. Cuthbertson and D. Nitzsche

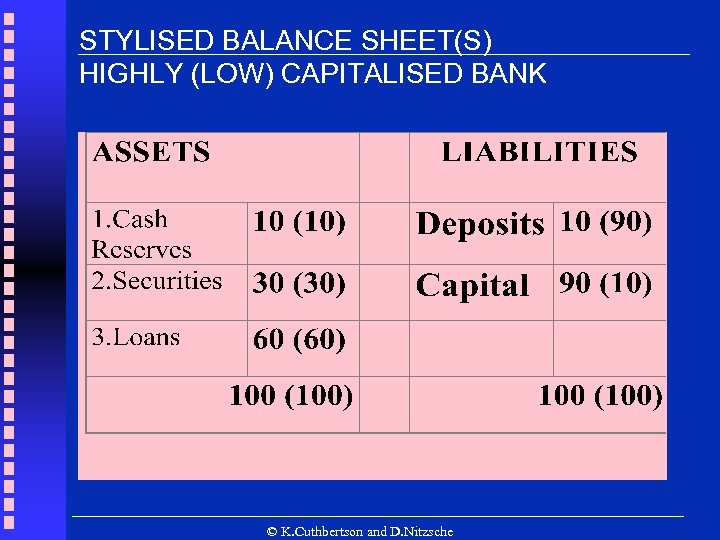

WHAT IS “CAPITAL” ? Capital(Equity) = Shareholder’s funds + past retained profits Capital acts as like a “deductible” or “excess” on an insurance policy It is a financial “cushion” for the “bank” Bank’s equity represents the amount the bank’s assets may fall, such that the depositors could in principle still sell off the remaining ‘good’ assets and obtain the full face value of their deposits © K. Cuthbertson and D. Nitzsche

WHAT IS “CAPITAL” ? Capital(Equity) = Shareholder’s funds + past retained profits Capital acts as like a “deductible” or “excess” on an insurance policy It is a financial “cushion” for the “bank” Bank’s equity represents the amount the bank’s assets may fall, such that the depositors could in principle still sell off the remaining ‘good’ assets and obtain the full face value of their deposits © K. Cuthbertson and D. Nitzsche

STYLISED BALANCE SHEET(S) HIGHLY (LOW) CAPITALISED BANK © K. Cuthbertson and D. Nitzsche

STYLISED BALANCE SHEET(S) HIGHLY (LOW) CAPITALISED BANK © K. Cuthbertson and D. Nitzsche

What Drives Financial Markets ? Rational Behaviour or : PIGS

What Drives Financial Markets ? Rational Behaviour or : PIGS

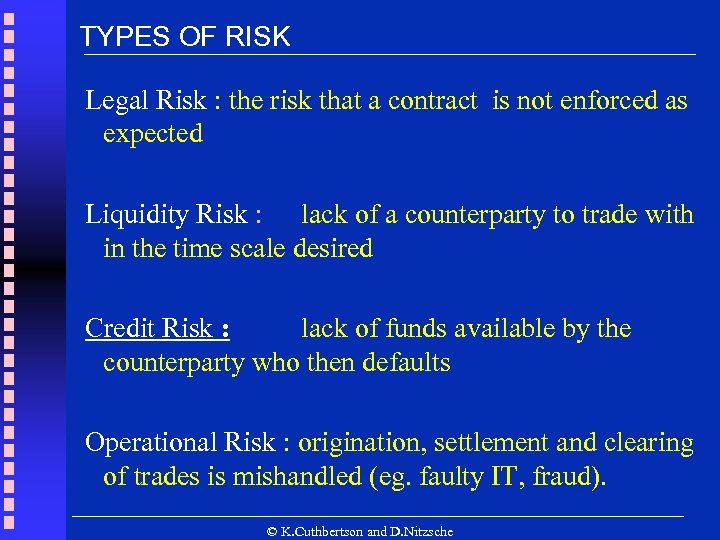

TYPES OF RISK Legal Risk : the risk that a contract is not enforced as expected Liquidity Risk : lack of a counterparty to trade with in the time scale desired Credit Risk : lack of funds available by the counterparty who then defaults Operational Risk : origination, settlement and clearing of trades is mishandled (eg. faulty IT, fraud). © K. Cuthbertson and D. Nitzsche

TYPES OF RISK Legal Risk : the risk that a contract is not enforced as expected Liquidity Risk : lack of a counterparty to trade with in the time scale desired Credit Risk : lack of funds available by the counterparty who then defaults Operational Risk : origination, settlement and clearing of trades is mishandled (eg. faulty IT, fraud). © K. Cuthbertson and D. Nitzsche

TYPES OF RISK Assimilation Risk : participants do not fully understand how assets are priced © K. Cuthbertson and D. Nitzsche

TYPES OF RISK Assimilation Risk : participants do not fully understand how assets are priced © K. Cuthbertson and D. Nitzsche

Leeson’s Futures Trades on Nikkei 225 Buy Close outSell “ Five eights make $1. 4 bn ? “ © K. Cuthbertson and D. Nitzsche

Leeson’s Futures Trades on Nikkei 225 Buy Close outSell “ Five eights make $1. 4 bn ? “ © K. Cuthbertson and D. Nitzsche

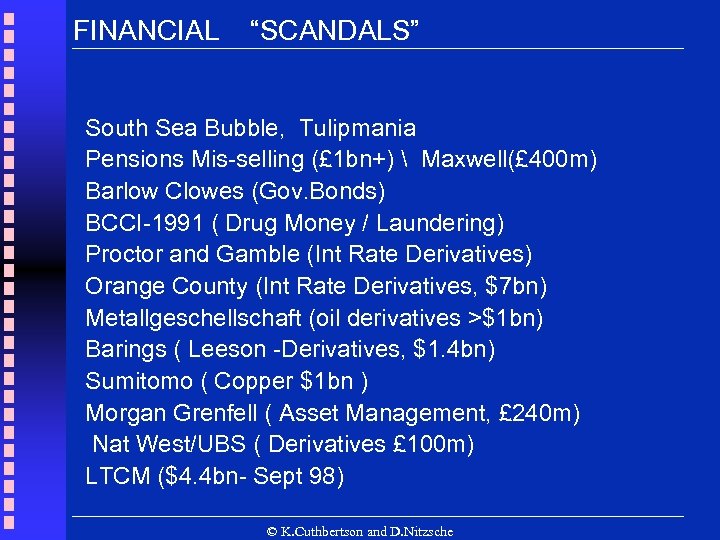

FINANCIAL “SCANDALS” South Sea Bubble, Tulipmania Pensions Mis-selling (£ 1 bn+) Maxwell(£ 400 m) Barlow Clowes (Gov. Bonds) BCCI-1991 ( Drug Money / Laundering) Proctor and Gamble (Int Rate Derivatives) Orange County (Int Rate Derivatives, $7 bn) Metallgeschellschaft (oil derivatives >$1 bn) Barings ( Leeson -Derivatives, $1. 4 bn) Sumitomo ( Copper $1 bn ) Morgan Grenfell ( Asset Management, £ 240 m) Nat West/UBS ( Derivatives £ 100 m) LTCM ($4. 4 bn- Sept 98) © K. Cuthbertson and D. Nitzsche

FINANCIAL “SCANDALS” South Sea Bubble, Tulipmania Pensions Mis-selling (£ 1 bn+) Maxwell(£ 400 m) Barlow Clowes (Gov. Bonds) BCCI-1991 ( Drug Money / Laundering) Proctor and Gamble (Int Rate Derivatives) Orange County (Int Rate Derivatives, $7 bn) Metallgeschellschaft (oil derivatives >$1 bn) Barings ( Leeson -Derivatives, $1. 4 bn) Sumitomo ( Copper $1 bn ) Morgan Grenfell ( Asset Management, £ 240 m) Nat West/UBS ( Derivatives £ 100 m) LTCM ($4. 4 bn- Sept 98) © K. Cuthbertson and D. Nitzsche

OPEN PRISON ? © K. Cuthbertson and D. Nitzsche

OPEN PRISON ? © K. Cuthbertson and D. Nitzsche

Basle (1988) “Accord” on Credit Risk © K. Cuthbertson and D. Nitzsche

Basle (1988) “Accord” on Credit Risk © K. Cuthbertson and D. Nitzsche

TOPICS BASLE (1988) ACCORD Risk Weights Equity-Assets Ratio/ Risk Adjusted Asset Ratio Bank Capital: Tier I and II © K. Cuthbertson and D. Nitzsche

TOPICS BASLE (1988) ACCORD Risk Weights Equity-Assets Ratio/ Risk Adjusted Asset Ratio Bank Capital: Tier I and II © K. Cuthbertson and D. Nitzsche

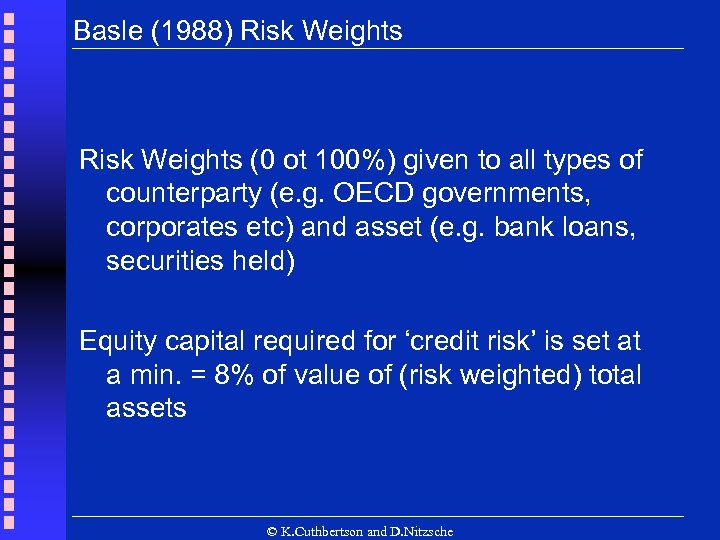

Basle (1988) Risk Weights (0 ot 100%) given to all types of counterparty (e. g. OECD governments, corporates etc) and asset (e. g. bank loans, securities held) Equity capital required for ‘credit risk’ is set at a min. = 8% of value of (risk weighted) total assets © K. Cuthbertson and D. Nitzsche

Basle (1988) Risk Weights (0 ot 100%) given to all types of counterparty (e. g. OECD governments, corporates etc) and asset (e. g. bank loans, securities held) Equity capital required for ‘credit risk’ is set at a min. = 8% of value of (risk weighted) total assets © K. Cuthbertson and D. Nitzsche

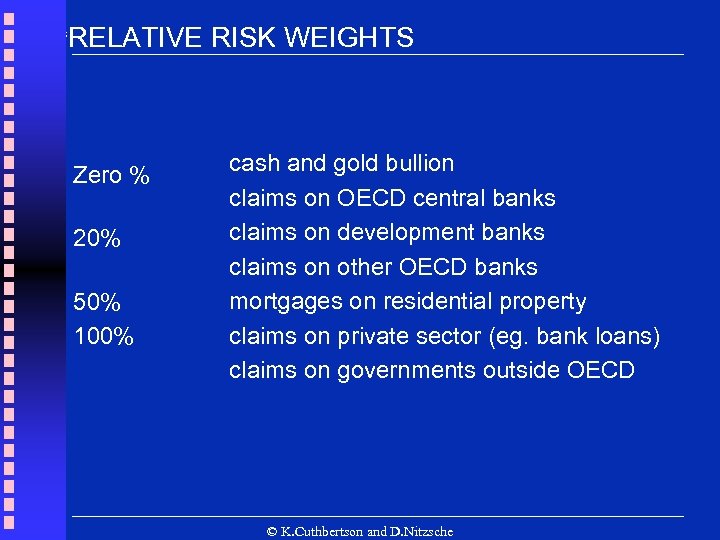

“RELATIVE Zero % 20% 50% 100% RISK WEIGHTS cash and gold bullion claims on OECD central banks claims on development banks claims on other OECD banks mortgages on residential property claims on private sector (eg. bank loans) claims on governments outside OECD © K. Cuthbertson and D. Nitzsche

“RELATIVE Zero % 20% 50% 100% RISK WEIGHTS cash and gold bullion claims on OECD central banks claims on development banks claims on other OECD banks mortgages on residential property claims on private sector (eg. bank loans) claims on governments outside OECD © K. Cuthbertson and D. Nitzsche

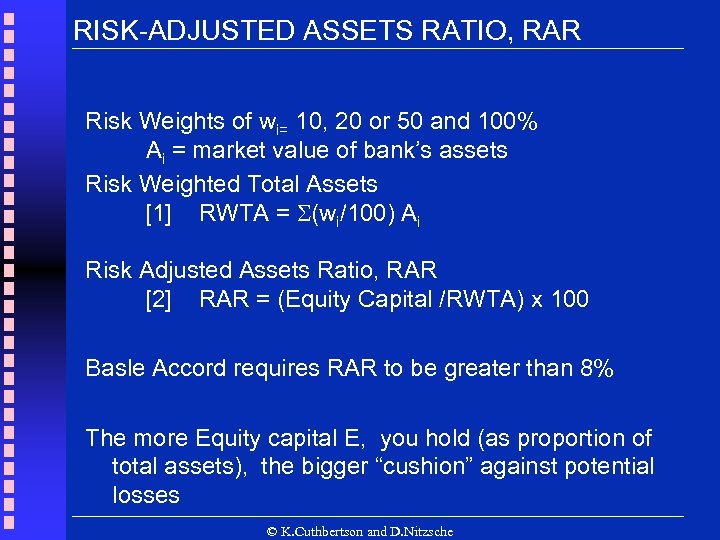

RISK-ADJUSTED ASSETS RATIO, RAR Risk Weights of wi= 10, 20 or 50 and 100% Ai = market value of bank’s assets Risk Weighted Total Assets [1] RWTA = S(wi/100) Ai Risk Adjusted Assets Ratio, RAR [2] RAR = (Equity Capital /RWTA) x 100 Basle Accord requires RAR to be greater than 8% The more Equity capital E, you hold (as proportion of total assets), the bigger “cushion” against potential losses © K. Cuthbertson and D. Nitzsche

RISK-ADJUSTED ASSETS RATIO, RAR Risk Weights of wi= 10, 20 or 50 and 100% Ai = market value of bank’s assets Risk Weighted Total Assets [1] RWTA = S(wi/100) Ai Risk Adjusted Assets Ratio, RAR [2] RAR = (Equity Capital /RWTA) x 100 Basle Accord requires RAR to be greater than 8% The more Equity capital E, you hold (as proportion of total assets), the bigger “cushion” against potential losses © K. Cuthbertson and D. Nitzsche

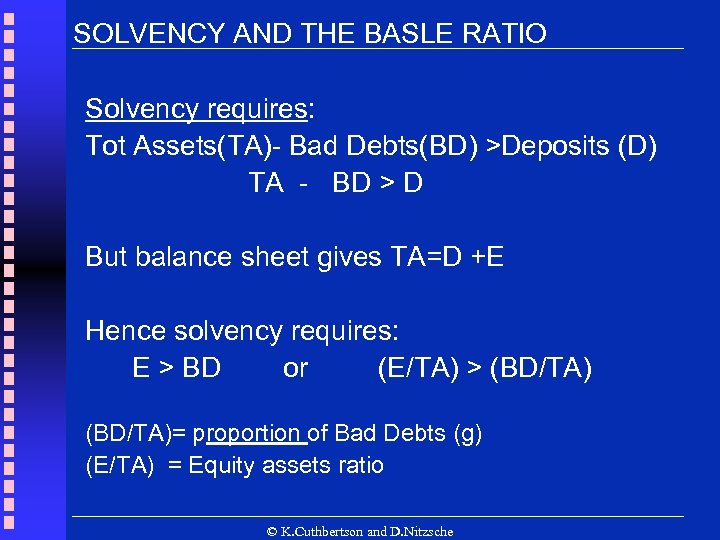

SOLVENCY AND THE BASLE RATIO Solvency requires: Tot Assets(TA)- Bad Debts(BD) >Deposits (D) TA - BD > D But balance sheet gives TA=D +E Hence solvency requires: E > BD or (E/TA) > (BD/TA)= proportion of Bad Debts (g) (E/TA) = Equity assets ratio © K. Cuthbertson and D. Nitzsche

SOLVENCY AND THE BASLE RATIO Solvency requires: Tot Assets(TA)- Bad Debts(BD) >Deposits (D) TA - BD > D But balance sheet gives TA=D +E Hence solvency requires: E > BD or (E/TA) > (BD/TA)= proportion of Bad Debts (g) (E/TA) = Equity assets ratio © K. Cuthbertson and D. Nitzsche

SOLVENCY AND THE BASLE RATIO Solvency requires: The equity-assets ratio, EAR (= E/TA), exceeds the proportion of bad debts, g. Risk Adjusted Assets Ratio RAR Replace ‘equity-assets ratio’ with RAR Solvency requires: RAR > g (latter set at 8% by Basle) g = proportion of bad debts © K. Cuthbertson and D. Nitzsche

SOLVENCY AND THE BASLE RATIO Solvency requires: The equity-assets ratio, EAR (= E/TA), exceeds the proportion of bad debts, g. Risk Adjusted Assets Ratio RAR Replace ‘equity-assets ratio’ with RAR Solvency requires: RAR > g (latter set at 8% by Basle) g = proportion of bad debts © K. Cuthbertson and D. Nitzsche

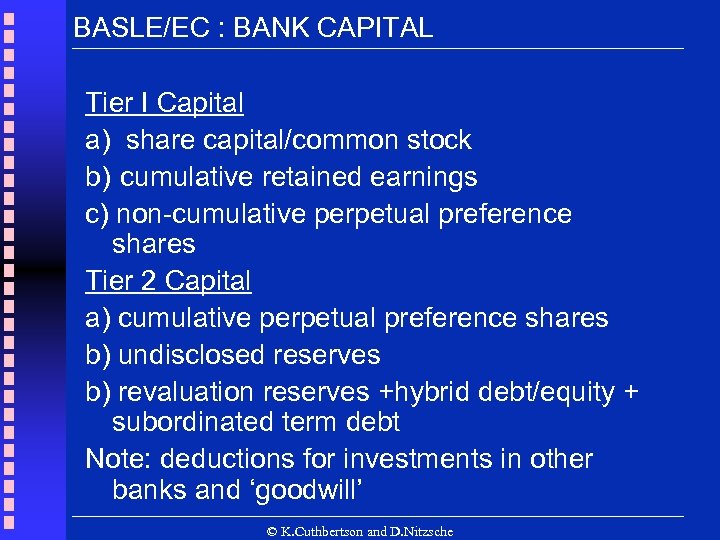

BASLE/EC : BANK CAPITAL Tier I Capital a) share capital/common stock b) cumulative retained earnings c) non-cumulative perpetual preference shares Tier 2 Capital a) cumulative perpetual preference shares b) undisclosed reserves b) revaluation reserves +hybrid debt/equity + subordinated term debt Note: deductions for investments in other banks and ‘goodwill’ © K. Cuthbertson and D. Nitzsche

BASLE/EC : BANK CAPITAL Tier I Capital a) share capital/common stock b) cumulative retained earnings c) non-cumulative perpetual preference shares Tier 2 Capital a) cumulative perpetual preference shares b) undisclosed reserves b) revaluation reserves +hybrid debt/equity + subordinated term debt Note: deductions for investments in other banks and ‘goodwill’ © K. Cuthbertson and D. Nitzsche

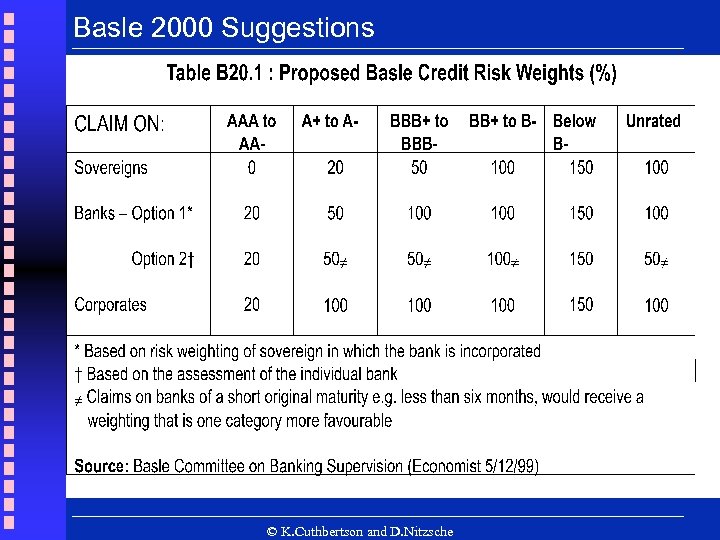

Basle 2000 Suggestions © K. Cuthbertson and D. Nitzsche

Basle 2000 Suggestions © K. Cuthbertson and D. Nitzsche

OFF-BALANCE-SHEET ACTIVITIES 1. INCOME FROM FEES a) commissions on FX transactions b) servicing mortgage-backed security c) guaranteeing debt securities d) backup lines of credit 2. NET POSITION IN FORWARD FOREIGN EXCHANGE © K. Cuthbertson and D. Nitzsche

OFF-BALANCE-SHEET ACTIVITIES 1. INCOME FROM FEES a) commissions on FX transactions b) servicing mortgage-backed security c) guaranteeing debt securities d) backup lines of credit 2. NET POSITION IN FORWARD FOREIGN EXCHANGE © K. Cuthbertson and D. Nitzsche

ENDS LECTURE © K. Cuthbertson and D. Nitzsche

ENDS LECTURE © K. Cuthbertson and D. Nitzsche