e951d1711fbda5acdc189e61bf384b2c.ppt

- Количество слайдов: 37

1 10 Division Performance Measurement Prepared by Douglas Cloud Pepperdine University

2 Objectives § Explain some of the advantages and After reading this disadvantages of decentralization. chapter, you should § Describe the commonly used measures of be able to: evaluating the performances of investment centers and their managers. § Describe how performance evaluation methods can encourage managers to act against the best interests of the company. Continued

3 Objectives 1. Describe variations in measuring income and investments. 2. Explain how evaluating a division is different from evaluating the manager of the division. 3. Explain the problems in developing transfer pricing policies. 4. Describe performance evaluation problems specific to multinational companies.

4 Decentralization refers to companies that give managers broad authority.

5 Some Benefits of Decentralization ü Promotes better decision making ü Able to react quicker ü Increases motivation ü Prepares managers as future leaders of the company

6 Problems with Decentralization § Managers operating in nearly autonomous fashion might make decisions that harm the company. § Retailers are unhappy to buy from several divisions, instead of one.

7 Managerial Accounting Issues Related to Decentralization q The need to develop methods of evaluating performance that work to the benefit of the company as a whole. q The need to develop transfer prices that produce decisions in the best interest of the company.

8 Measures of Performance Three principal measures to measure divisions: • Income • Return on Investment (ROI) • Residual Income (RI)

9 Measures of Performance Reasons income is unsatisfactory for measuring the performance of divisions: § In calculating net income, companies subtract interest and taxes, neither of which is normally under the control of divisional managers. § A division’s expenses usually include some charges for services provided by central headquarters. Continued

10 Measures of Performance Reasons income is unsatisfactory for measuring the performance of divisions: § Factors that influence GAAP-based income do not necessarily apply to internal reports. § Income is not a comprehensive measure of success.

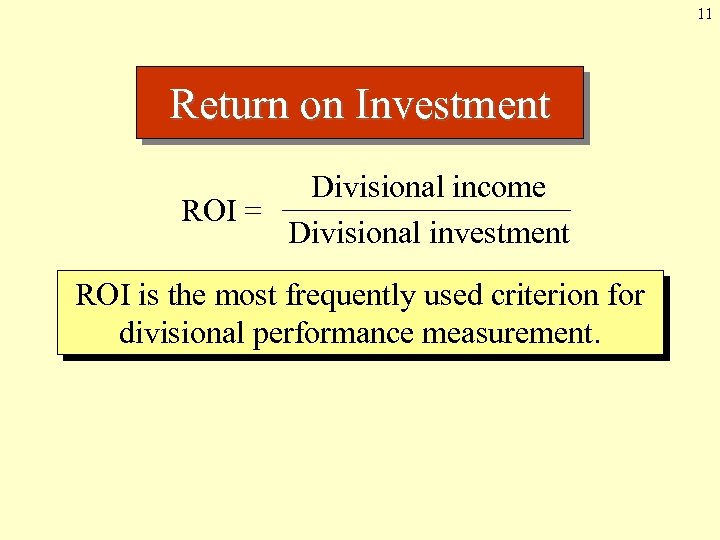

11 Return on Investment Divisional income ROI = Divisional investment ROI is the most frequently used criterion for divisional performance measurement.

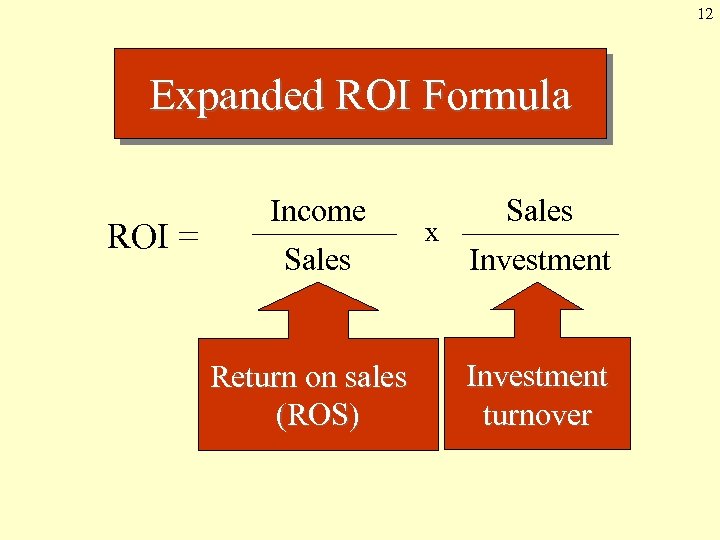

12 Expanded ROI Formula ROI = Income Sales Return on sales (ROS) x Sales Investment turnover

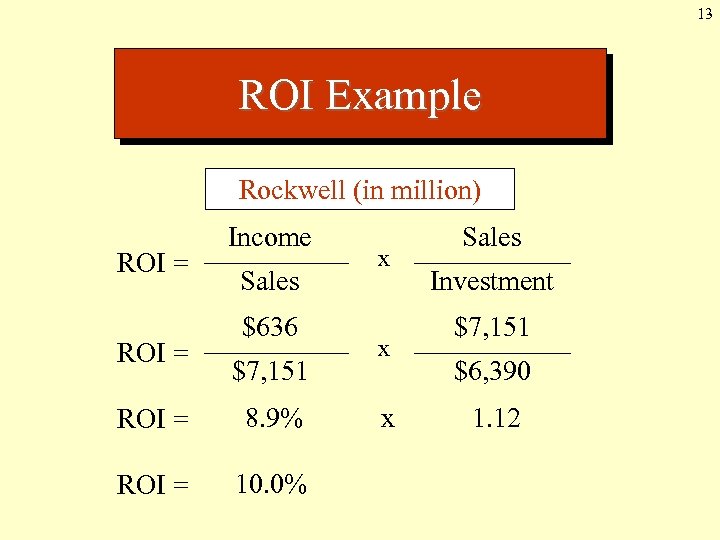

13 ROI Example Rockwell (in million) ROI = Income Sales $636 $7, 151 ROI = 8. 9% ROI = 10. 0% x x x Sales Investment $7, 151 $6, 390 1. 12

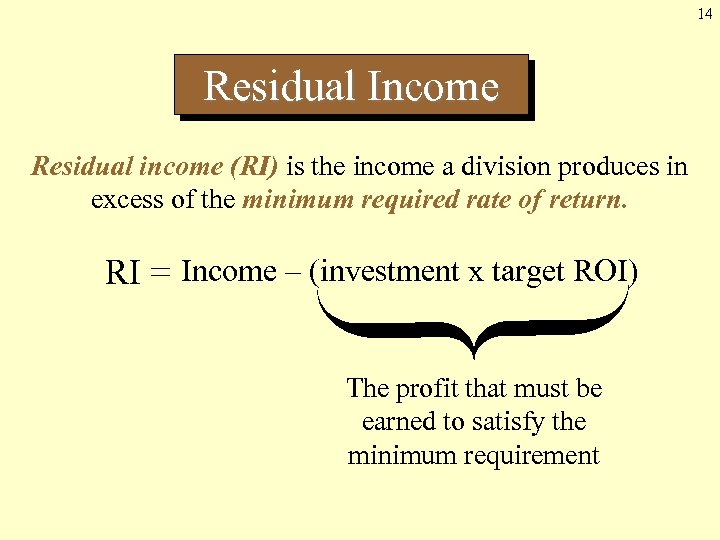

14 Residual Income Residual income (RI) is the income a division produces in excess of the minimum required rate of return. RI = Income – (investment x target ROI) The profit that must be earned to satisfy the minimum requirement

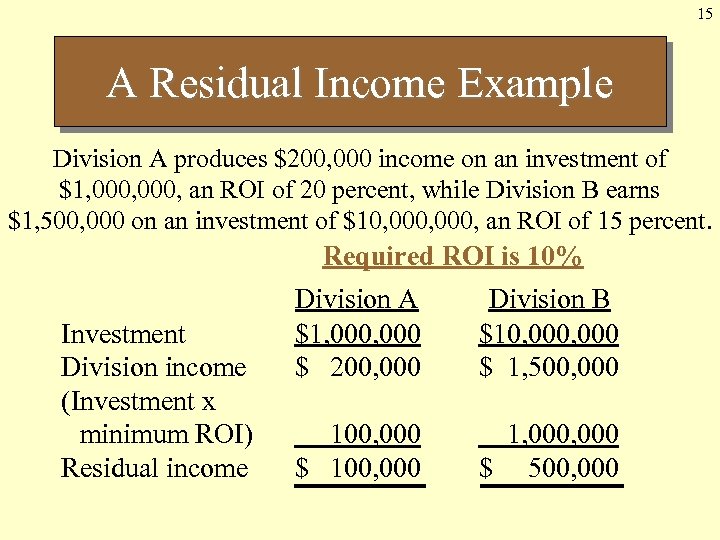

15 A Residual Income Example Division A produces $200, 000 income on an investment of $1, 000, an ROI of 20 percent, while Division B earns $1, 500, 000 on an investment of $10, 000, an ROI of 15 percent. Required ROI is 10% Investment Division income (Investment x minimum ROI) Residual income Division A $1, 000 $ 200, 000 Division B $10, 000 $ 1, 500, 000 100, 000 $ 100, 000 1, 000 $ 500, 000

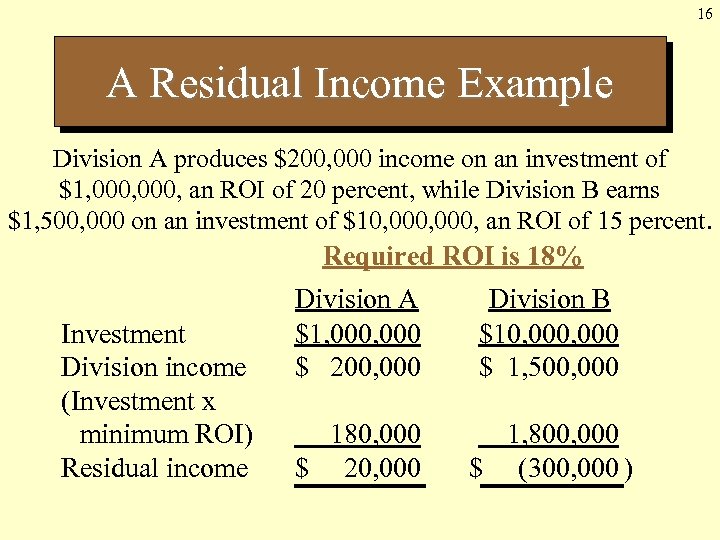

16 A Residual Income Example Division A produces $200, 000 income on an investment of $1, 000, an ROI of 20 percent, while Division B earns $1, 500, 000 on an investment of $10, 000, an ROI of 15 percent. Required ROI is 18% Investment Division income (Investment x minimum ROI) Residual income Division A $1, 000 $ 200, 000 Division B $10, 000 $ 1, 500, 000 180, 000 $ 20, 000 1, 800, 000 $ (300, 000 )

17 ROI Versus RI Using ROI to evaluate divisions can encourage them to reject good investments and accept poor investments.

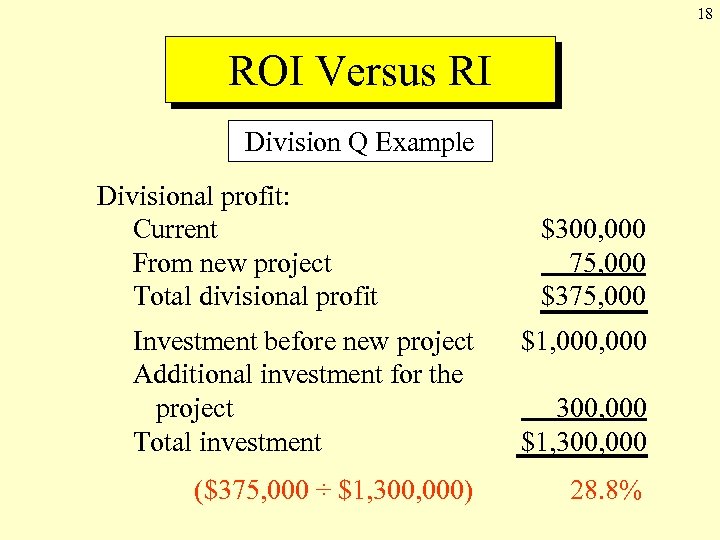

18 ROI Versus RI Division Q Example Divisional profit: Current From new project Total divisional profit $300, 000 75, 000 $375, 000 Investment before new project Additional investment for the project Total investment $1, 000 ($375, 000 ÷ $1, 300, 000) 28. 8% 300, 000 $1, 300, 000

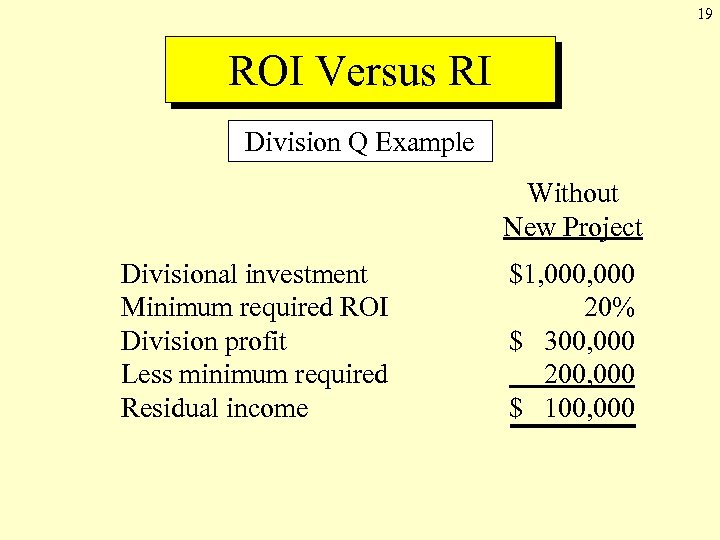

19 ROI Versus RI Division Q Example Without New Project Divisional investment Minimum required ROI Division profit Less minimum required Residual income $1, 000 20% $ 300, 000 200, 000 $ 100, 000

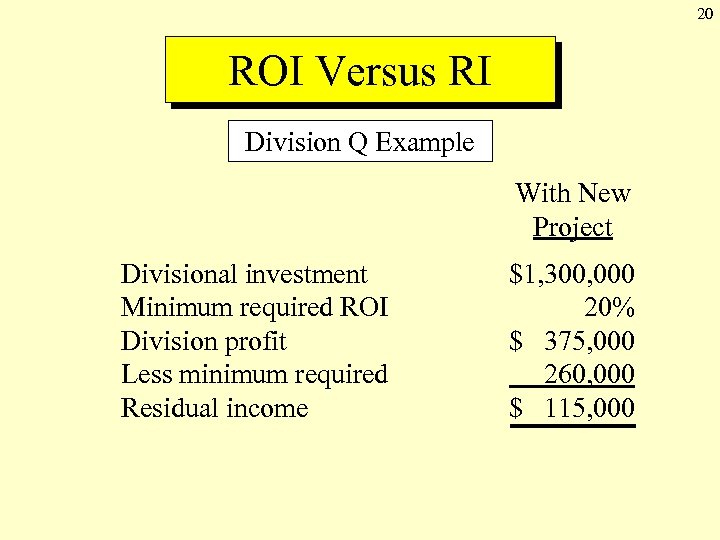

20 ROI Versus RI Division Q Example With New Project Divisional investment Minimum required ROI Division profit Less minimum required Residual income $1, 300, 000 20% $ 375, 000 260, 000 $ 115, 000

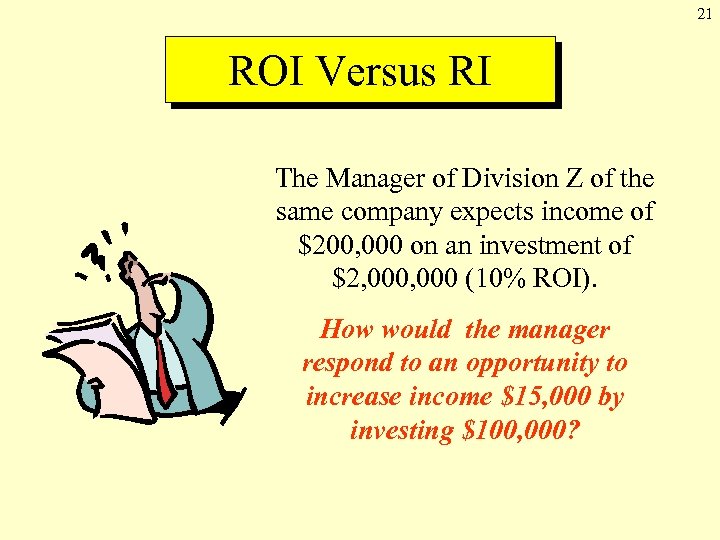

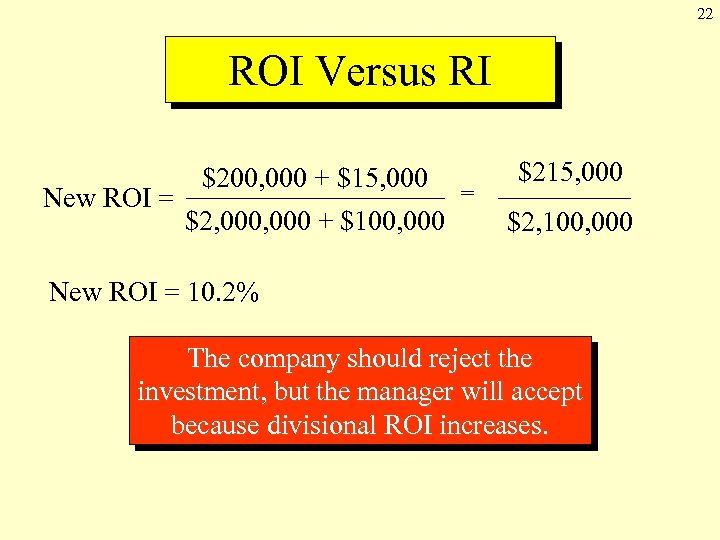

21 ROI Versus RI The Manager of Division Z of the same company expects income of $200, 000 on an investment of $2, 000 (10% ROI). How would the manager respond to an opportunity to increase income $15, 000 by investing $100, 000?

22 ROI Versus RI New ROI = $200, 000 + $15, 000 $2, 000 + $100, 000 = $215, 000 $2, 100, 000 New ROI = 10. 2% The company should reject the investment, but the manager will accept because divisional ROI increases.

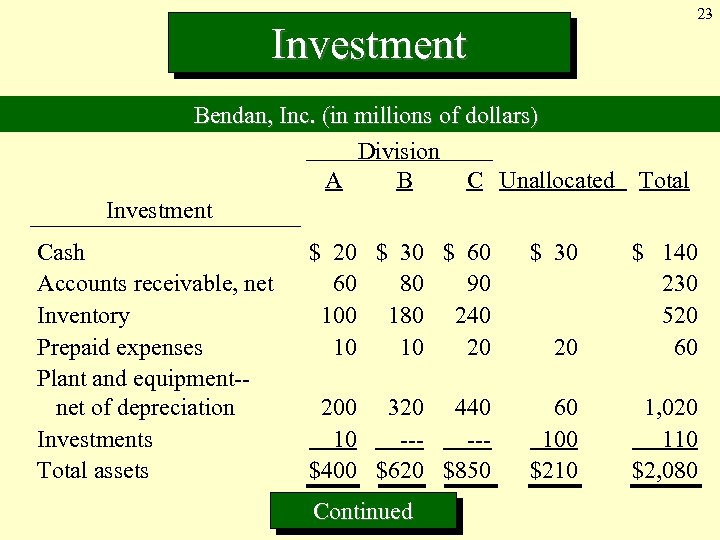

23 Investment Bendan, Inc. (in millions of dollars) Division A B C Unallocated Investment Cash Accounts receivable, net Inventory Prepaid expenses Plant and equipment-net of depreciation Investments Total assets Total $ 20 $ 30 $ 60 60 80 90 100 180 240 10 10 20 $ 30 20 $ 140 230 520 60 200 320 440 10 ----$400 $620 $850 60 100 $210 1, 020 110 $2, 080 Continued

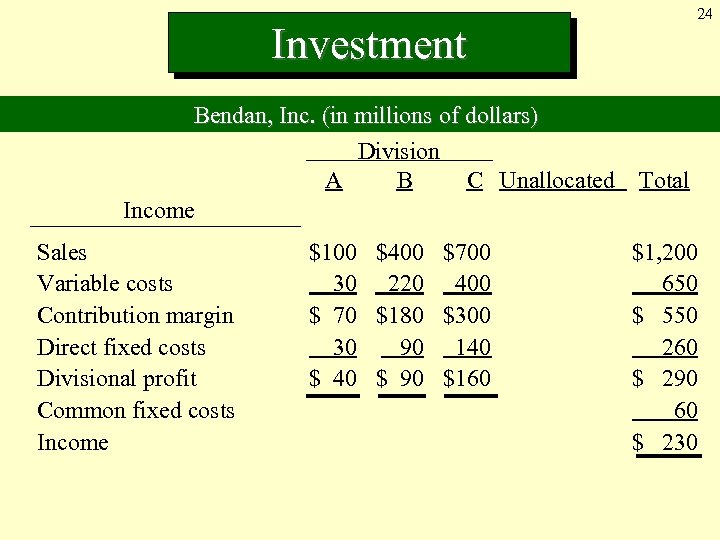

24 Investment Bendan, Inc. (in millions of dollars) Division A B C Unallocated Income Sales Variable costs Contribution margin Direct fixed costs Divisional profit Common fixed costs Income $100 $400 $700 30 220 400 $ 70 $180 $300 30 90 140 $ 90 $160 Total $1, 200 650 $ 550 260 $ 290 60 $ 230

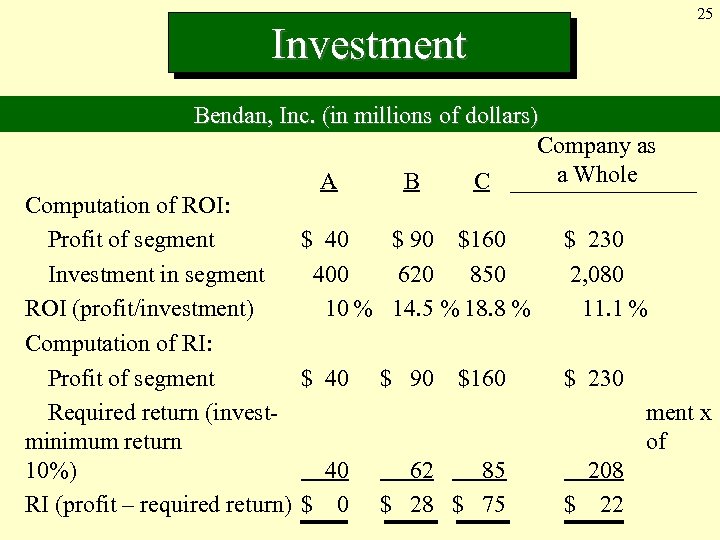

Investment 25 Bendan, Inc. (in millions of dollars) Company as a Whole A B C Computation of ROI: Profit of segment $ 40 $ 90 $160 $ 230 Investment in segment 400 620 850 2, 080 ROI (profit/investment) 10 % 14. 5 % 18. 8 % 11. 1 % Computation of RI: Profit of segment $ 40 $ 90 $160 $ 230 Required return (investment x minimum return of 10%) 40 62 85 208 RI (profit – required return) $ 0 $ 28 $ 75 $ 22

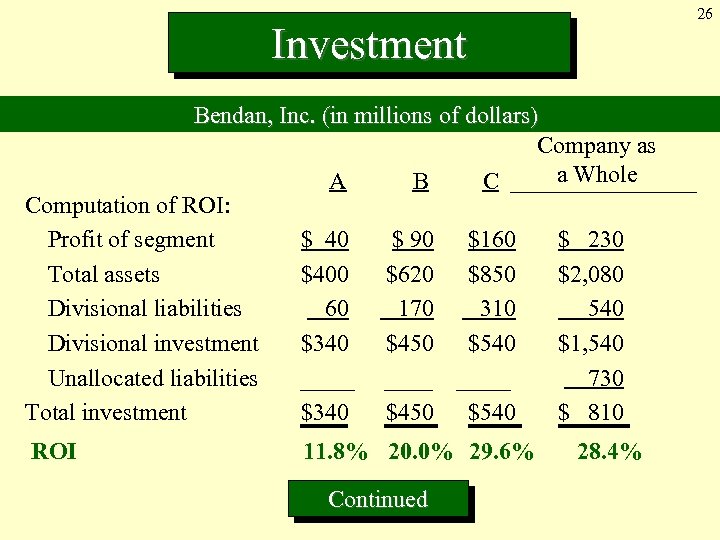

26 Investment Bendan, Inc. (in millions of dollars) Company as a Whole A B C Computation of ROI: Profit of segment $ 40 $ 90 $160 $ 230 Total assets $400 $620 $850 $2, 080 Divisional liabilities 60 170 310 540 Divisional investment $340 $450 $540 $1, 540 Unallocated liabilities 730 Total investment $340 $450 $540 $ 810 ROI 11. 8% 20. 0% 29. 6% Continued 28. 4%

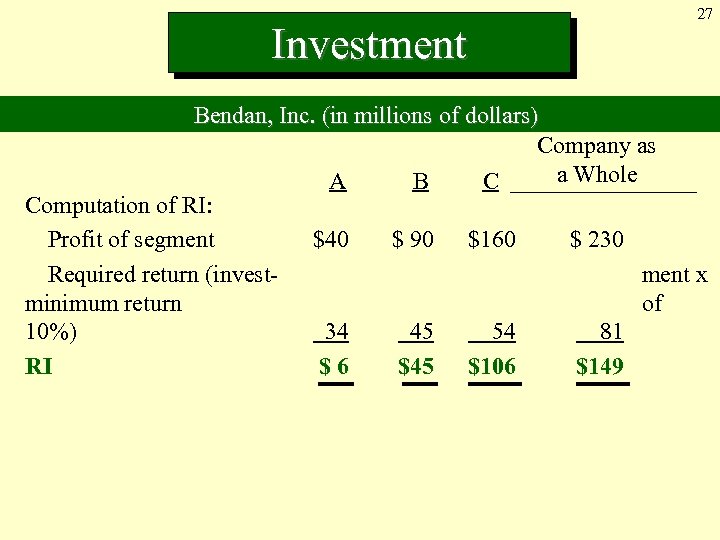

Investment 27 Bendan, Inc. (in millions of dollars) Company as a Whole A B C Computation of RI: Profit of segment $40 $ 90 $160 $ 230 Required return (investment x minimum return of 10%) 34 45 54 81 RI $6 $45 $106 $149

28 The Subject of Evaluation— Division or Manager Ø Internal ranking Ø Historical comparisons Ø Industry averages Ø Budgets

29 Transfer Pricing Actual costs with or without a markup Budgeted costs with or without a markup Market-based prices Incremental cost Negotiated prices

30 Transfer Pricing Actual Cost These transfer prices are not wise because the selling manager has no incentive to keep costs down. Worse, a price that is actual costs plus a percentage markup gives the selling manager more profit the higher costs go.

31 Transfer Pricing Budgeted Cost This method does not reward the selling manager if costs go up, and actually encourages the selling manager to keep costs down.

32 Transfer Pricing Market-Based Prices This method is generally consider, the best. The biggest problem is that an outside market price may not exist. The transfer price may be less than the market price due to cost savings from selling internally.

33 Transfer Pricing Incremental Cost Such prices are theoretically best from the company’s viewpoint when the selling division is operating below capacity. Incremental cost can be as low as the variable cost of the goods or services.

34 Transfer Pricing Negotiated Prices This method allows managers to bargain with each other and alleviates some problems that arise with other methods. The manager with the better negotiating skills will tend to prevail.

35 Multinational Companies Special Problems Evaluating performance More complicated reporting needs Currency translation problems Little or no on-site supervision by the home-office managers Significant cultural and language barriers Transfer pricing Foreign taxes Currency translation problems

36 Chapter 10 The End

37

e951d1711fbda5acdc189e61bf384b2c.ppt