6e4928c557226b3f4afb6212445ebd6c.ppt

- Количество слайдов: 69

1 1. Trend & Momentum “The Trend is Your Friend” This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

1 1. Trend & Momentum “The Trend is Your Friend” This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

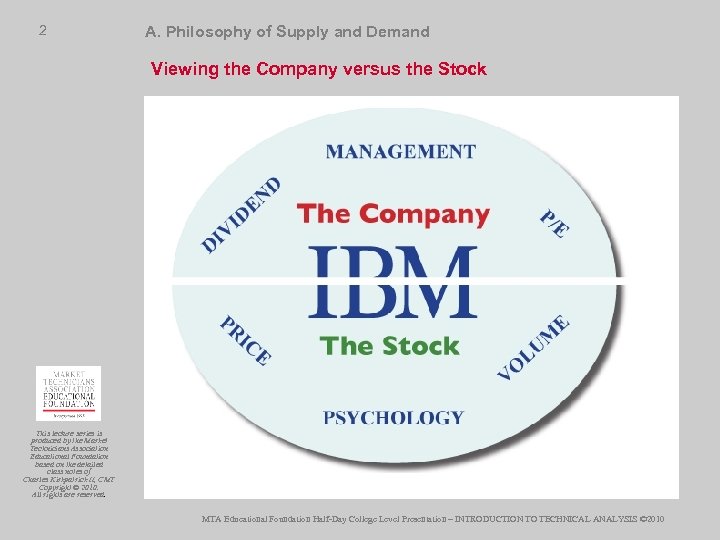

2 A. Philosophy of Supply and Demand Viewing the Company versus the Stock This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

2 A. Philosophy of Supply and Demand Viewing the Company versus the Stock This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

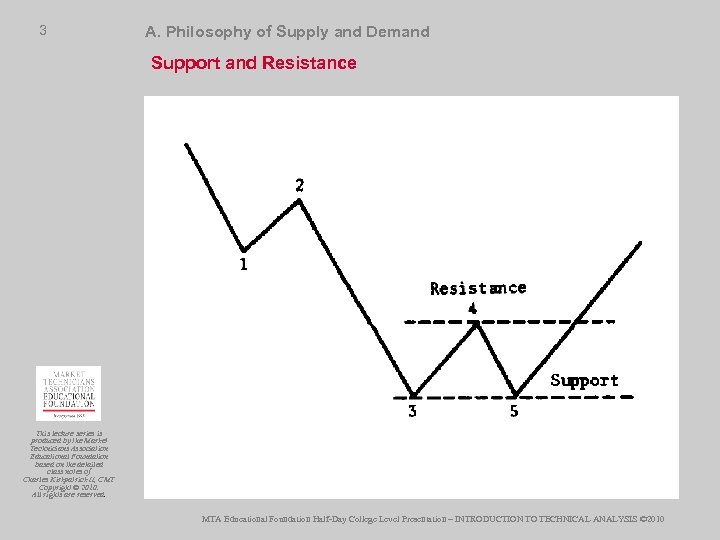

3 A. Philosophy of Supply and Demand Support and Resistance This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

3 A. Philosophy of Supply and Demand Support and Resistance This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

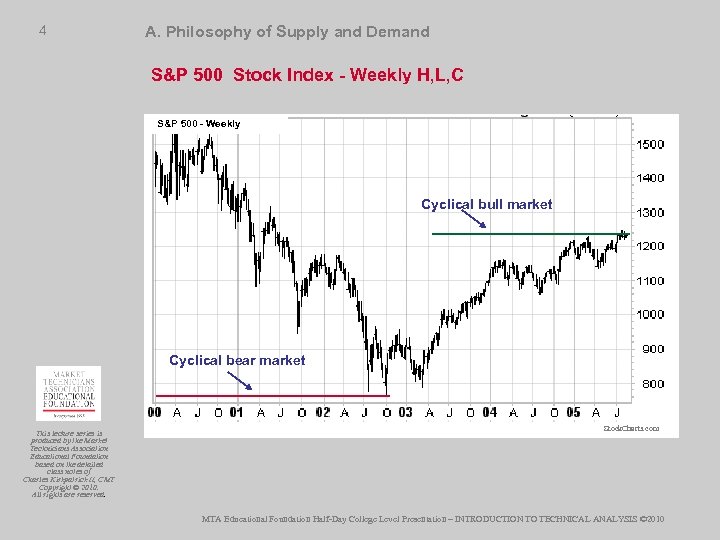

4 A. Philosophy of Supply and Demand S&P 500 Stock Index - Weekly H, L, C S&P 500 - Weekly Cyclical bull market Cyclical bear market This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

4 A. Philosophy of Supply and Demand S&P 500 Stock Index - Weekly H, L, C S&P 500 - Weekly Cyclical bull market Cyclical bear market This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

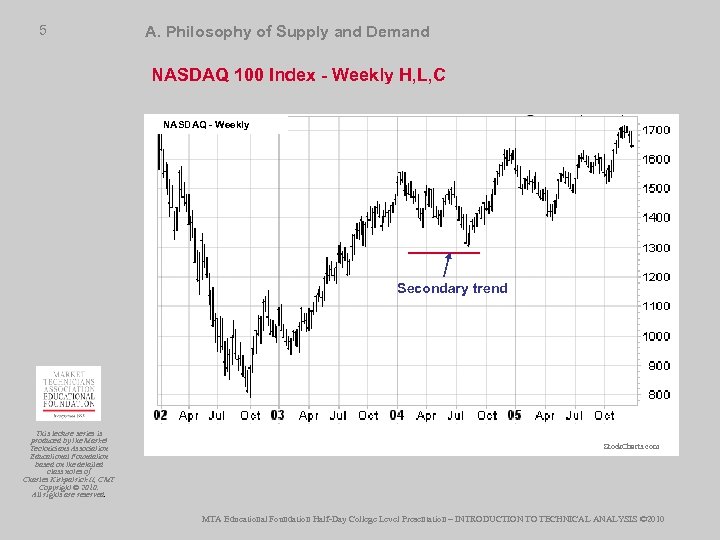

5 A. Philosophy of Supply and Demand NASDAQ 100 Index - Weekly H, L, C NASDAQ - Weekly Secondary trend This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

5 A. Philosophy of Supply and Demand NASDAQ 100 Index - Weekly H, L, C NASDAQ - Weekly Secondary trend This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

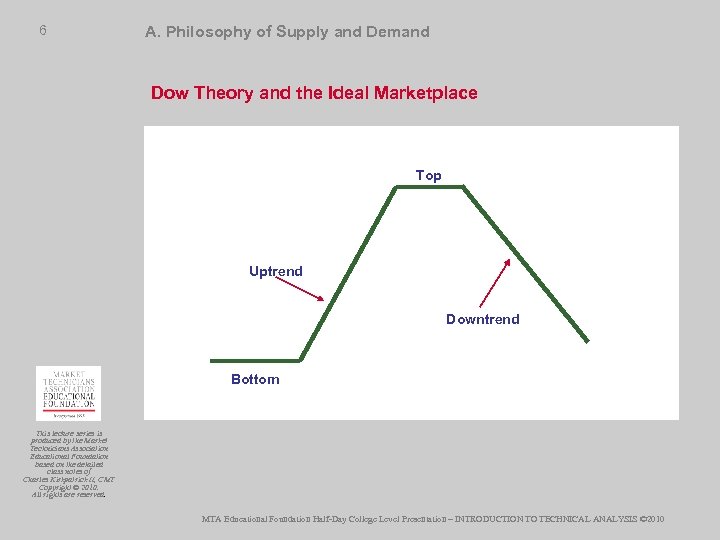

6 A. Philosophy of Supply and Demand Dow Theory and the Ideal Marketplace Top Uptrend Downtrend Bottom This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

6 A. Philosophy of Supply and Demand Dow Theory and the Ideal Marketplace Top Uptrend Downtrend Bottom This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

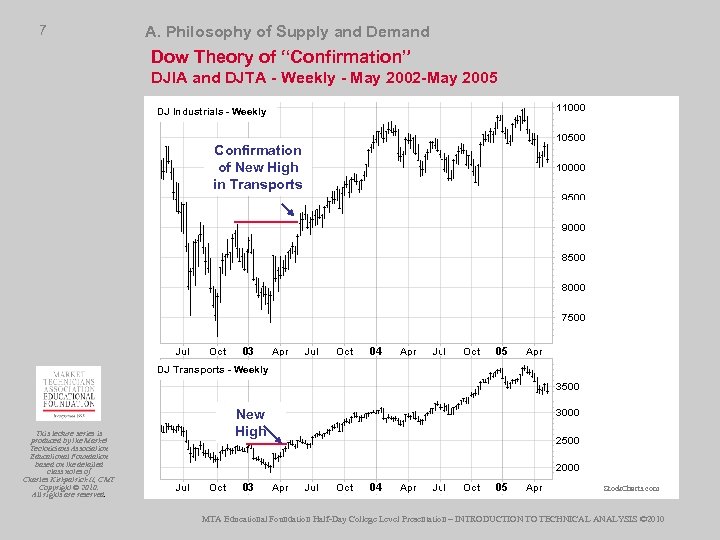

7 A. Philosophy of Supply and Demand Dow Theory of “Confirmation” DJIA and DJTA - Weekly - May 2002 -May 2005 DJ Industrials - Weekly Confirmation of New High in Transports DJ Transports - Weekly This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. New High Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

7 A. Philosophy of Supply and Demand Dow Theory of “Confirmation” DJIA and DJTA - Weekly - May 2002 -May 2005 DJ Industrials - Weekly Confirmation of New High in Transports DJ Transports - Weekly This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. New High Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

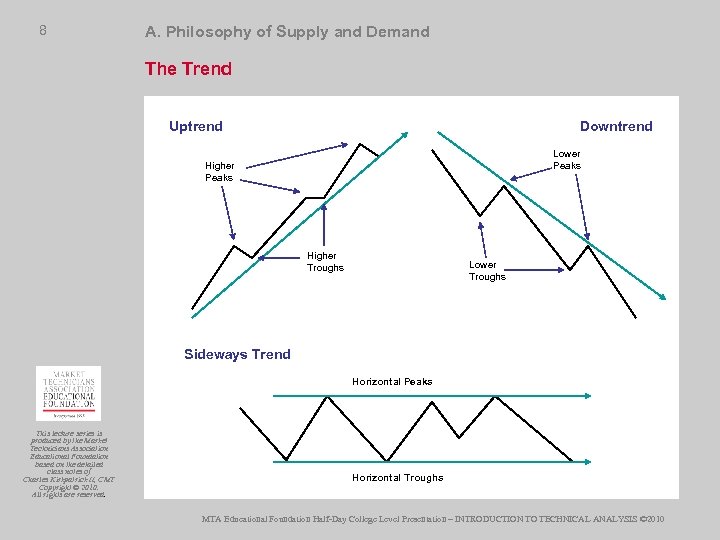

8 A. Philosophy of Supply and Demand The Trend Uptrend Downtrend Lower Peaks Higher Troughs Lower Troughs Sideways Trend Horizontal Peaks This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Horizontal Troughs MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

8 A. Philosophy of Supply and Demand The Trend Uptrend Downtrend Lower Peaks Higher Troughs Lower Troughs Sideways Trend Horizontal Peaks This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Horizontal Troughs MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

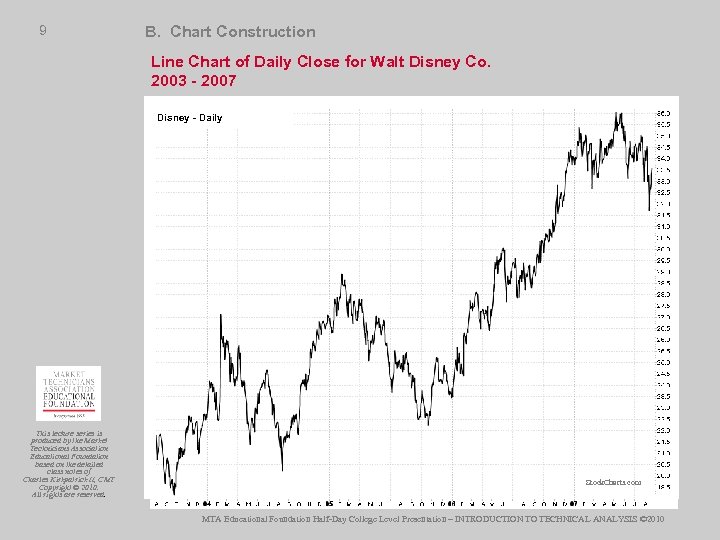

9 B. Chart Construction Line Chart of Daily Close for Walt Disney Co. 2003 - 2007 Disney - Daily This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

9 B. Chart Construction Line Chart of Daily Close for Walt Disney Co. 2003 - 2007 Disney - Daily This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

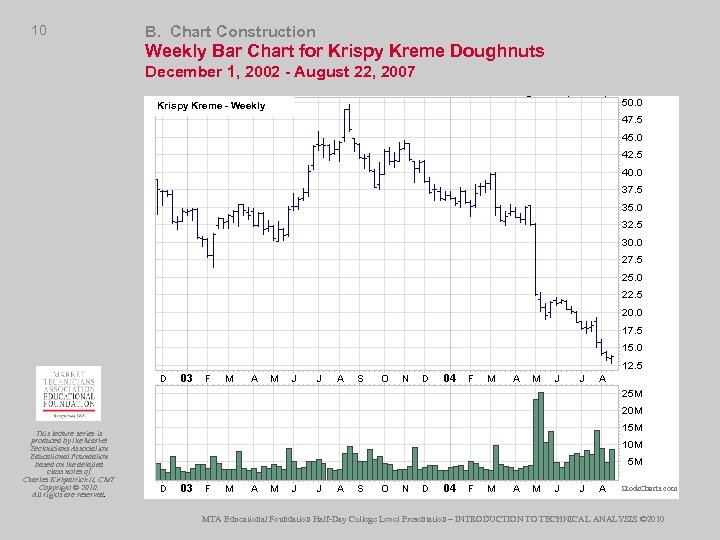

10 B. Chart Construction Weekly Bar Chart for Krispy Kreme Doughnuts December 1, 2002 - August 22, 2007 Krispy Kreme - Weekly This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

10 B. Chart Construction Weekly Bar Chart for Krispy Kreme Doughnuts December 1, 2002 - August 22, 2007 Krispy Kreme - Weekly This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

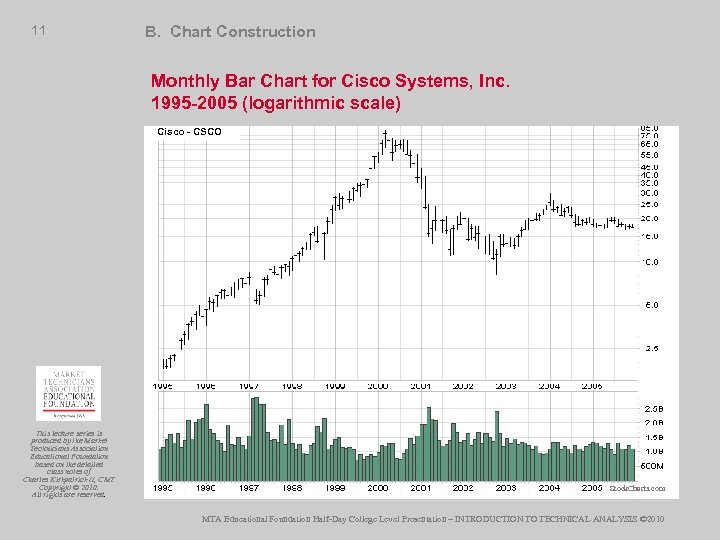

11 B. Chart Construction Monthly Bar Chart for Cisco Systems, Inc. 1995 -2005 (logarithmic scale) Cisco - CSCO This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

11 B. Chart Construction Monthly Bar Chart for Cisco Systems, Inc. 1995 -2005 (logarithmic scale) Cisco - CSCO This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

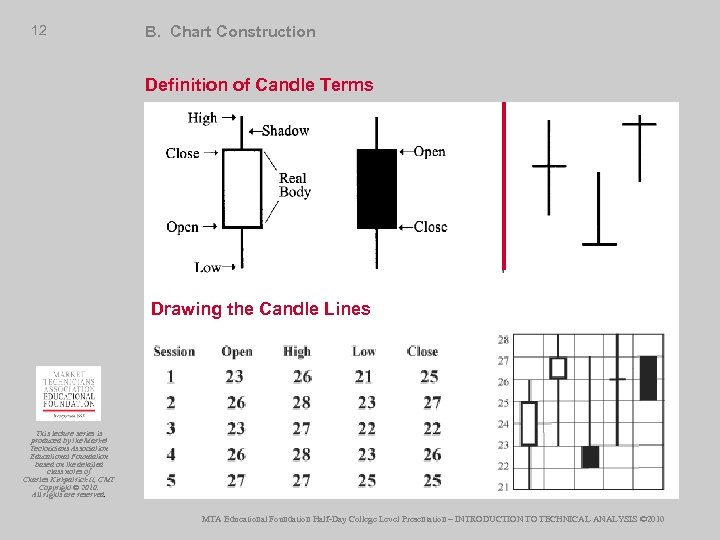

12 B. Chart Construction Definition of Candle Terms Drawing the Candle Lines This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

12 B. Chart Construction Definition of Candle Terms Drawing the Candle Lines This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

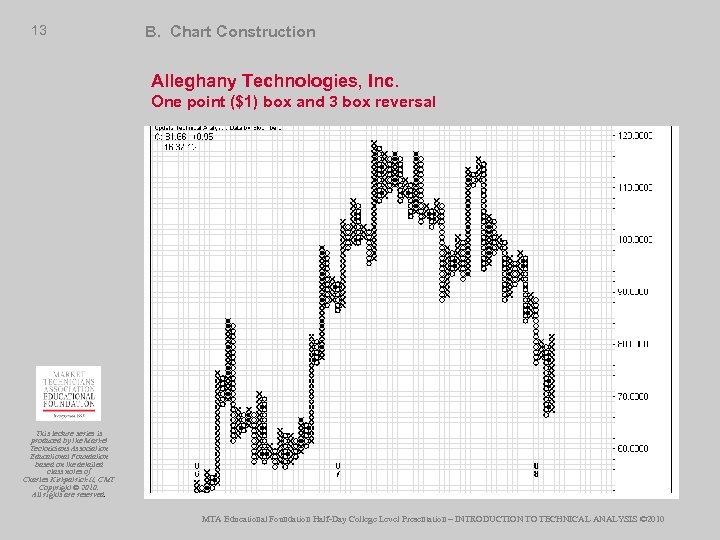

13 B. Chart Construction Alleghany Technologies, Inc. One point ($1) box and 3 box reversal This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

13 B. Chart Construction Alleghany Technologies, Inc. One point ($1) box and 3 box reversal This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

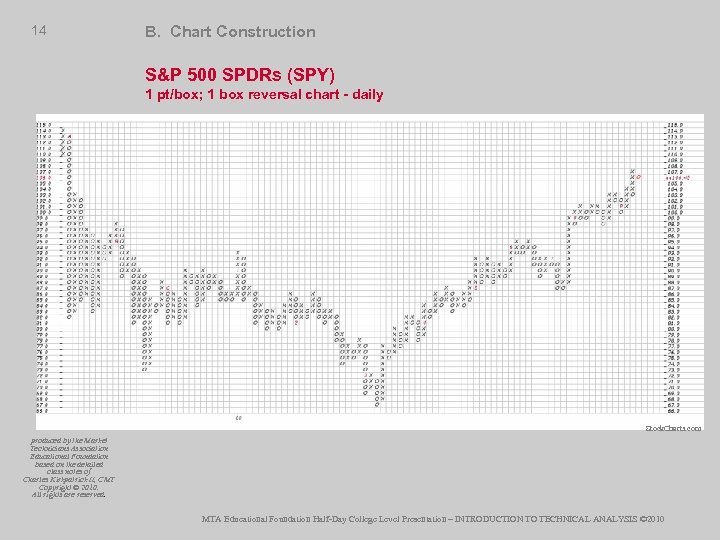

14 B. Chart Construction S&P 500 SPDRs (SPY) 1 pt/box; 1 box reversal chart - daily This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

14 B. Chart Construction S&P 500 SPDRs (SPY) 1 pt/box; 1 box reversal chart - daily This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

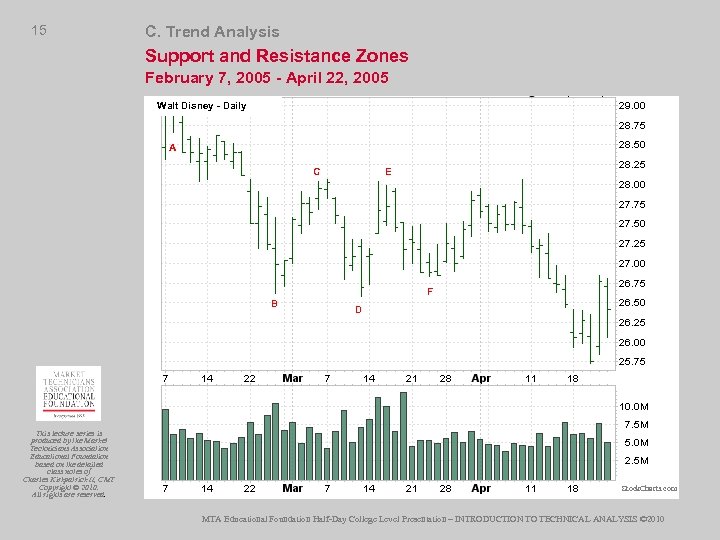

15 C. Trend Analysis Support and Resistance Zones February 7, 2005 - April 22, 2005 Walt Disney - Daily A C E F B This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. D Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

15 C. Trend Analysis Support and Resistance Zones February 7, 2005 - April 22, 2005 Walt Disney - Daily A C E F B This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. D Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

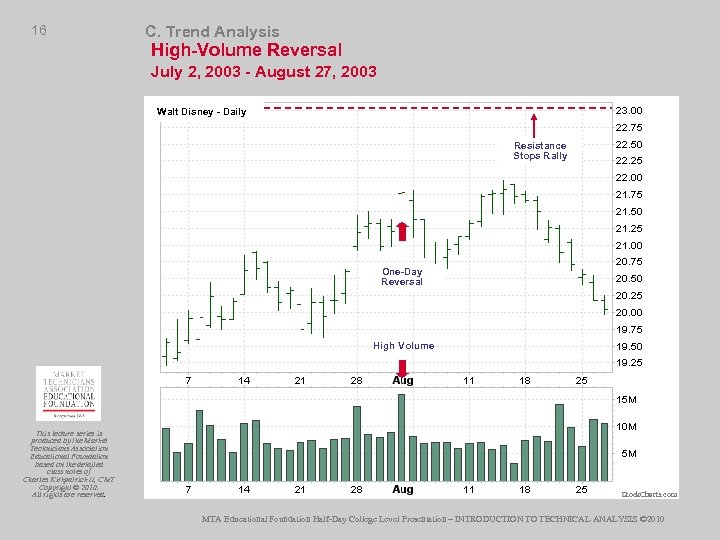

16 C. Trend Analysis High-Volume Reversal July 2, 2003 - August 27, 2003 Walt Disney - Daily Resistance Stops Rally One-Day Reversal High Volume This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

16 C. Trend Analysis High-Volume Reversal July 2, 2003 - August 27, 2003 Walt Disney - Daily Resistance Stops Rally One-Day Reversal High Volume This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

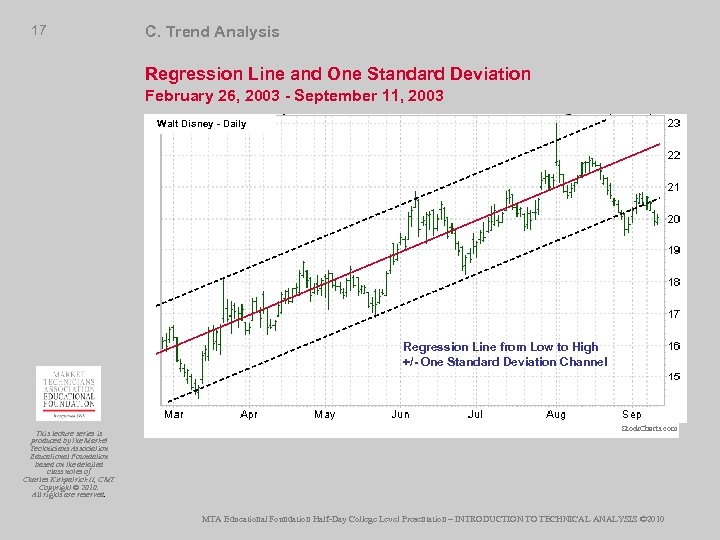

17 C. Trend Analysis Regression Line and One Standard Deviation February 26, 2003 - September 11, 2003 Walt Disney - Daily Regression Line from Low to High +/- One Standard Deviation Channel This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

17 C. Trend Analysis Regression Line and One Standard Deviation February 26, 2003 - September 11, 2003 Walt Disney - Daily Regression Line from Low to High +/- One Standard Deviation Channel This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

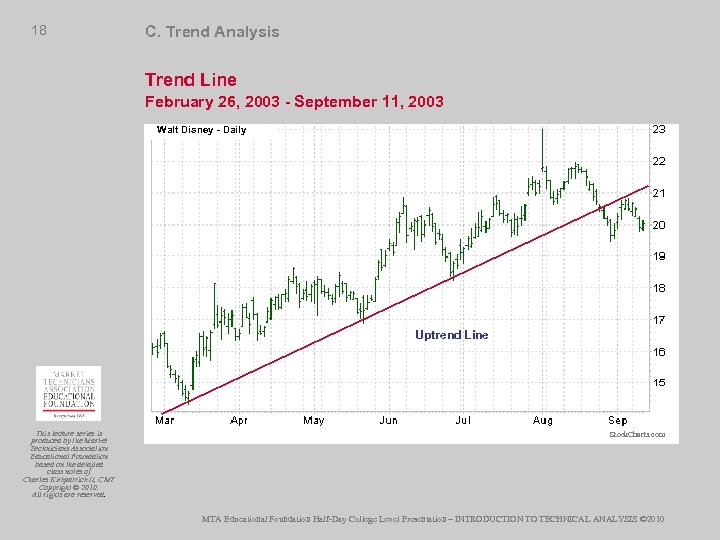

18 C. Trend Analysis Trend Line February 26, 2003 - September 11, 2003 Walt Disney - Daily Uptrend Line This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

18 C. Trend Analysis Trend Line February 26, 2003 - September 11, 2003 Walt Disney - Daily Uptrend Line This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

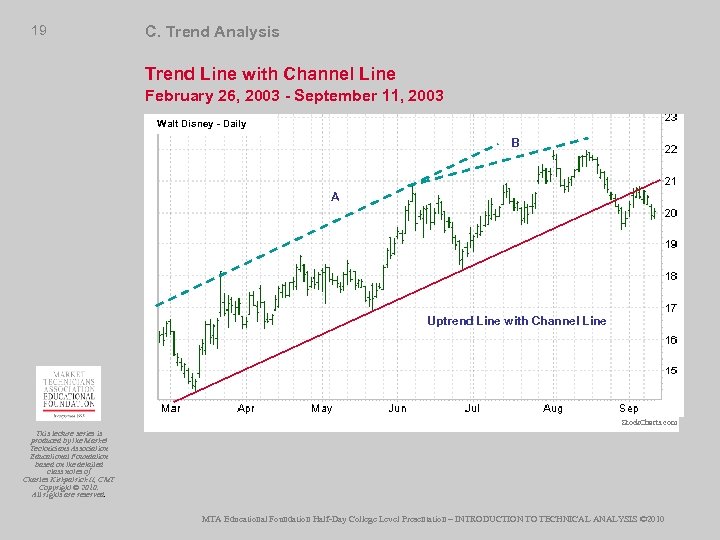

19 C. Trend Analysis Trend Line with Channel Line February 26, 2003 - September 11, 2003 Walt Disney - Daily B A Uptrend Line with Channel Line Stock. Charts. com This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

19 C. Trend Analysis Trend Line with Channel Line February 26, 2003 - September 11, 2003 Walt Disney - Daily B A Uptrend Line with Channel Line Stock. Charts. com This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

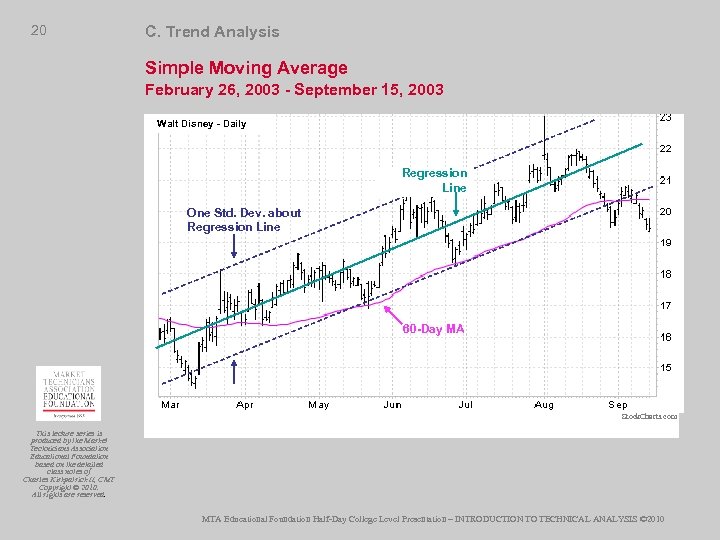

20 C. Trend Analysis Simple Moving Average February 26, 2003 - September 15, 2003 Walt Disney - Daily Regression Line One Std. Dev. about Regression Line 60 -Day MA Stock. Charts. com This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

20 C. Trend Analysis Simple Moving Average February 26, 2003 - September 15, 2003 Walt Disney - Daily Regression Line One Std. Dev. about Regression Line 60 -Day MA Stock. Charts. com This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

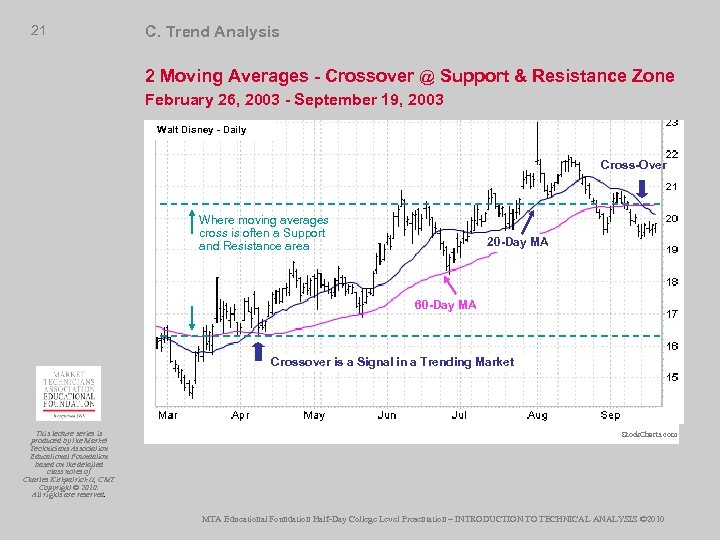

21 C. Trend Analysis 2 Moving Averages - Crossover @ Support & Resistance Zone February 26, 2003 - September 19, 2003 Walt Disney - Daily Cross-Over Where moving averages cross is often a Support and Resistance area 20 -Day MA 60 -Day MA Crossover is a Signal in a Trending Market This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

21 C. Trend Analysis 2 Moving Averages - Crossover @ Support & Resistance Zone February 26, 2003 - September 19, 2003 Walt Disney - Daily Cross-Over Where moving averages cross is often a Support and Resistance area 20 -Day MA 60 -Day MA Crossover is a Signal in a Trending Market This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

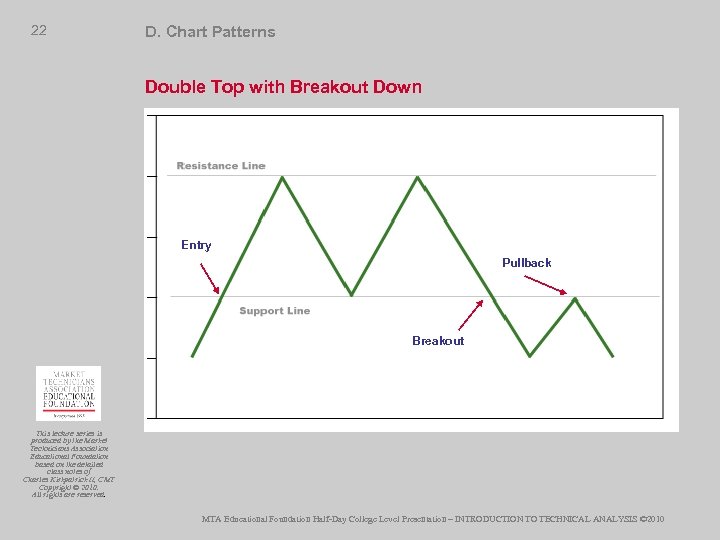

22 D. Chart Patterns Double Top with Breakout Down Entry Pullback Breakout This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

22 D. Chart Patterns Double Top with Breakout Down Entry Pullback Breakout This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

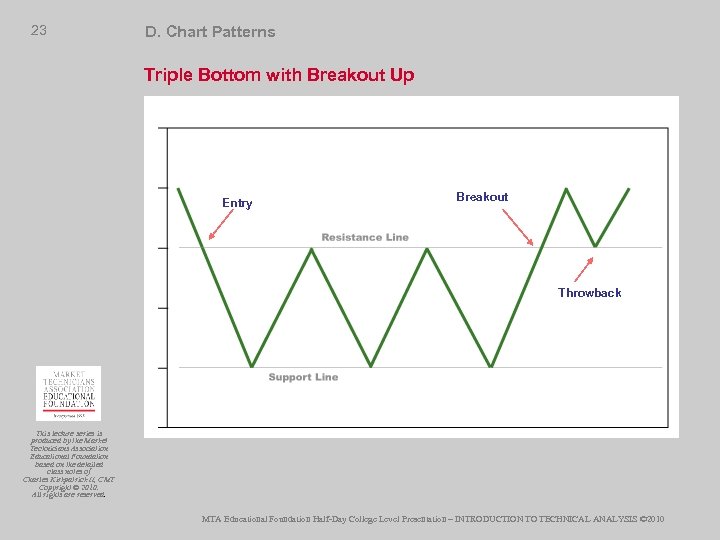

23 D. Chart Patterns Triple Bottom with Breakout Up Entry Breakout Throwback This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

23 D. Chart Patterns Triple Bottom with Breakout Up Entry Breakout Throwback This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

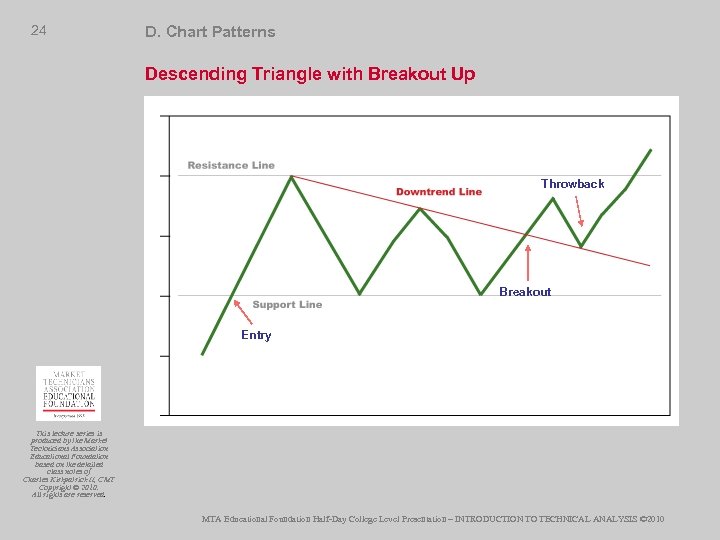

24 D. Chart Patterns Descending Triangle with Breakout Up Throwback Breakout Entry This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

24 D. Chart Patterns Descending Triangle with Breakout Up Throwback Breakout Entry This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

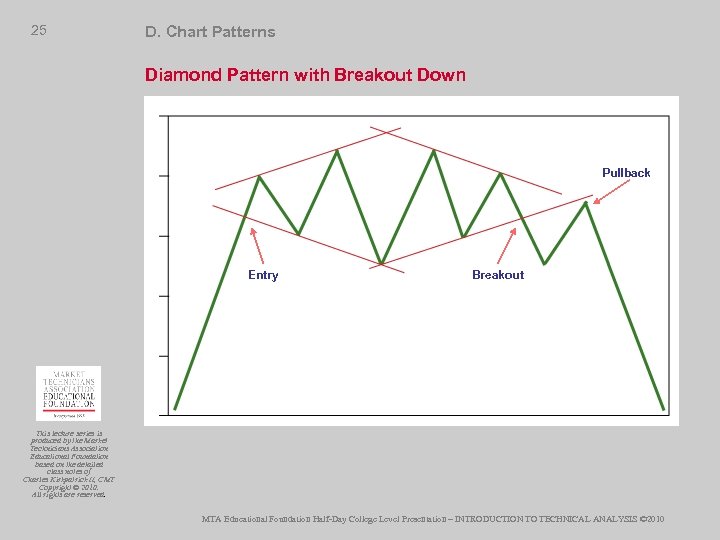

25 D. Chart Patterns Diamond Pattern with Breakout Down Pullback Entry Breakout This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

25 D. Chart Patterns Diamond Pattern with Breakout Down Pullback Entry Breakout This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

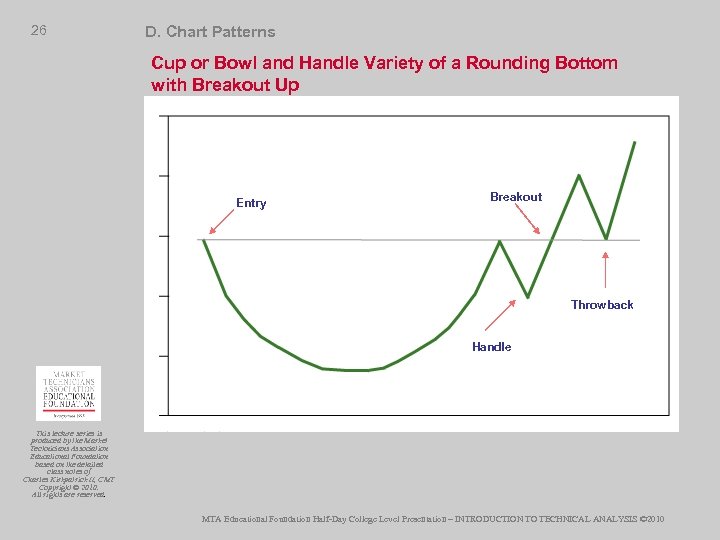

26 D. Chart Patterns Cup or Bowl and Handle Variety of a Rounding Bottom with Breakout Up Entry Breakout Throwback Handle This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

26 D. Chart Patterns Cup or Bowl and Handle Variety of a Rounding Bottom with Breakout Up Entry Breakout Throwback Handle This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

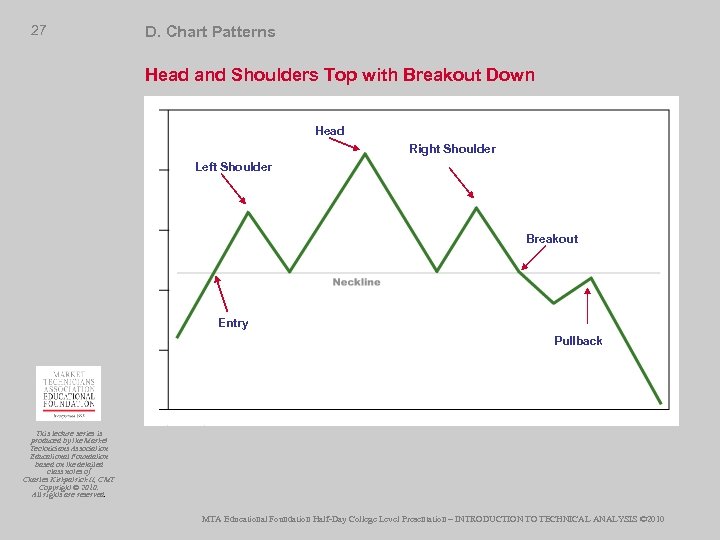

27 D. Chart Patterns Head and Shoulders Top with Breakout Down Head Right Shoulder Left Shoulder Breakout Entry Pullback This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

27 D. Chart Patterns Head and Shoulders Top with Breakout Down Head Right Shoulder Left Shoulder Breakout Entry Pullback This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

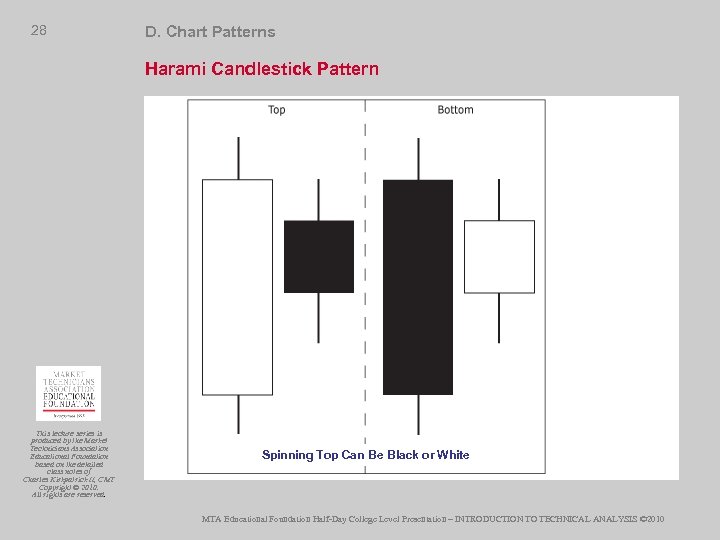

28 D. Chart Patterns Harami Candlestick Pattern This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Spinning Top Can Be Black or White MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

28 D. Chart Patterns Harami Candlestick Pattern This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Spinning Top Can Be Black or White MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

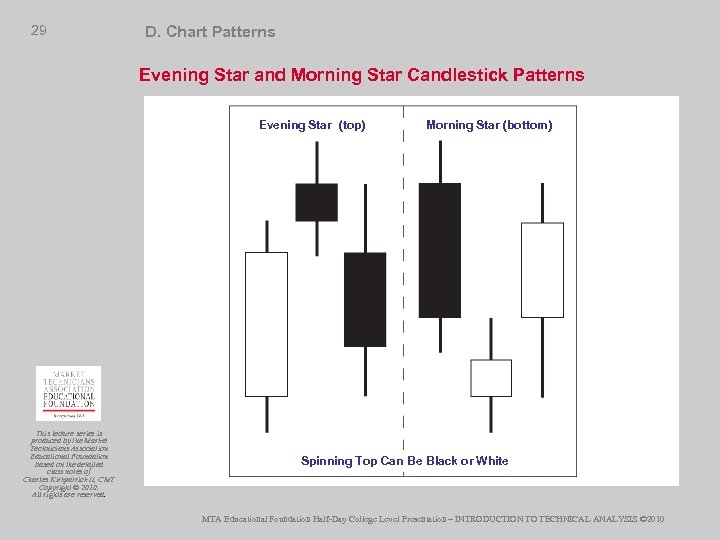

29 D. Chart Patterns Evening Star and Morning Star Candlestick Patterns Evening Star (top) This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Morning Star (bottom) Spinning Top Can Be Black or White MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

29 D. Chart Patterns Evening Star and Morning Star Candlestick Patterns Evening Star (top) This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Morning Star (bottom) Spinning Top Can Be Black or White MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

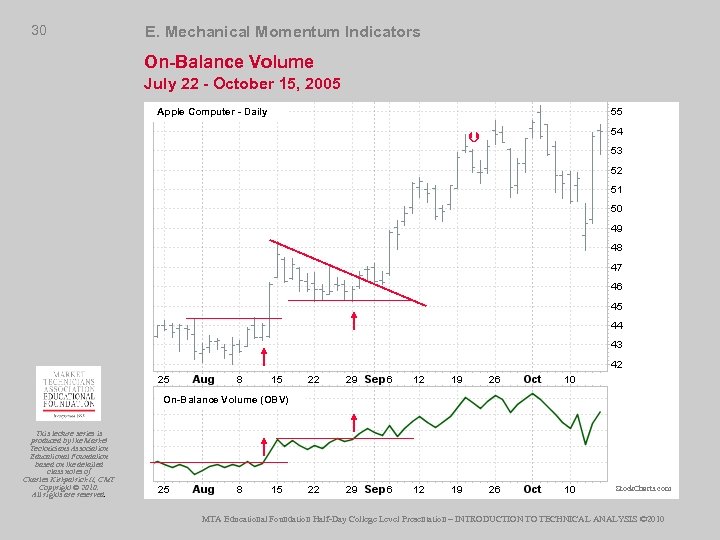

30 E. Mechanical Momentum Indicators On-Balance Volume July 22 - October 15, 2005 Apple Computer - Daily On-Balance Volume (OBV) This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

30 E. Mechanical Momentum Indicators On-Balance Volume July 22 - October 15, 2005 Apple Computer - Daily On-Balance Volume (OBV) This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

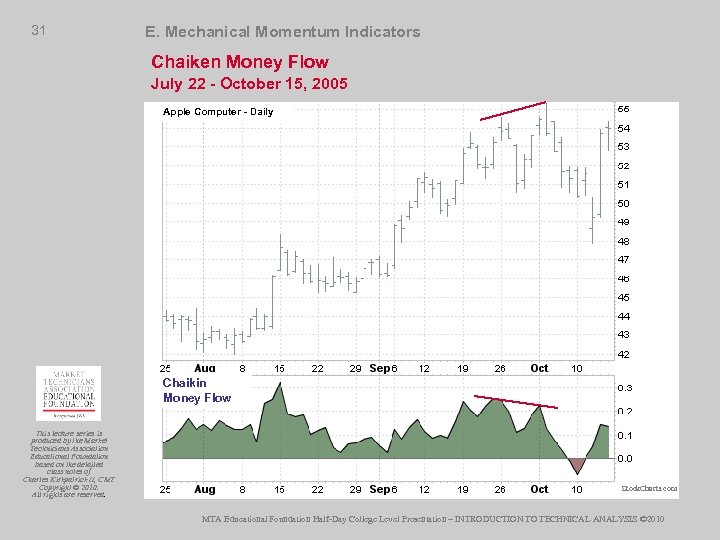

31 E. Mechanical Momentum Indicators Chaiken Money Flow July 22 - October 15, 2005 Apple Computer - Daily Chaikin Money Flow This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

31 E. Mechanical Momentum Indicators Chaiken Money Flow July 22 - October 15, 2005 Apple Computer - Daily Chaikin Money Flow This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

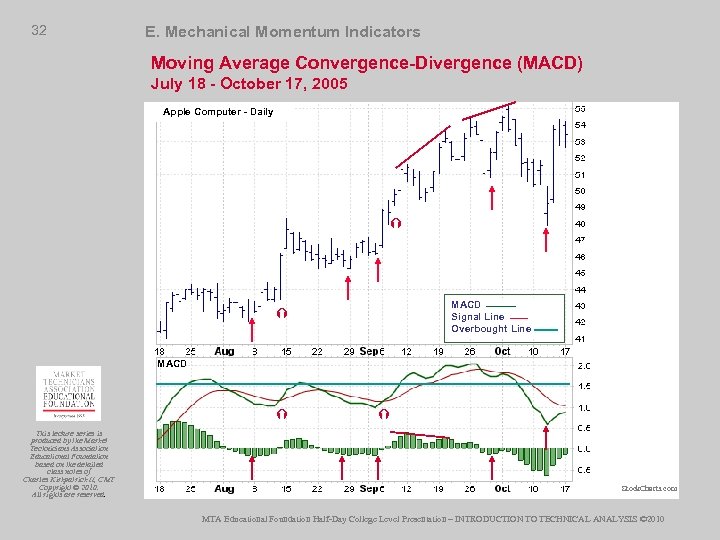

32 E. Mechanical Momentum Indicators Moving Average Convergence-Divergence (MACD) July 18 - October 17, 2005 Apple Computer - Daily MACD Signal Line Overbought Line MACD This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

32 E. Mechanical Momentum Indicators Moving Average Convergence-Divergence (MACD) July 18 - October 17, 2005 Apple Computer - Daily MACD Signal Line Overbought Line MACD This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

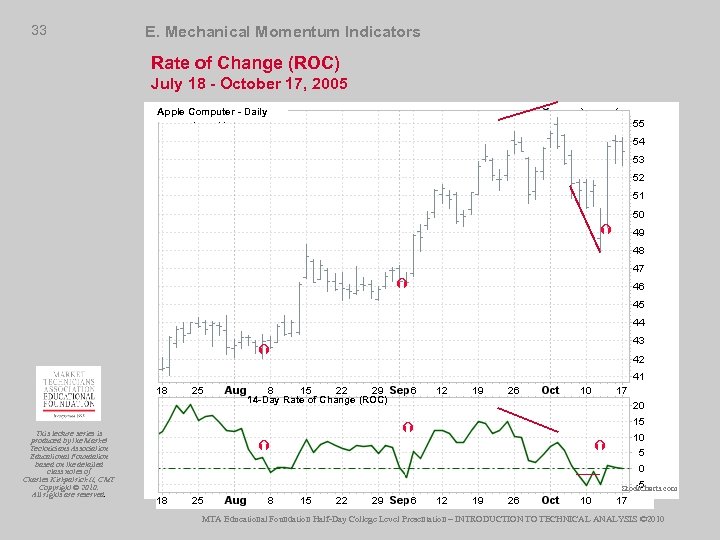

33 E. Mechanical Momentum Indicators Rate of Change (ROC) July 18 - October 17, 2005 Apple Computer - Daily 14 -Day Rate of Change (ROC) This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

33 E. Mechanical Momentum Indicators Rate of Change (ROC) July 18 - October 17, 2005 Apple Computer - Daily 14 -Day Rate of Change (ROC) This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

34 E. Mechanical Momentum Indicators Relative Strength Index (RSI) July 19 - October 15, 2005 Apple Computer - Daily 14 -Day Relative Strength Index (RSI) Swing Failure This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Breakout Triangle Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

34 E. Mechanical Momentum Indicators Relative Strength Index (RSI) July 19 - October 15, 2005 Apple Computer - Daily 14 -Day Relative Strength Index (RSI) Swing Failure This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Breakout Triangle Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

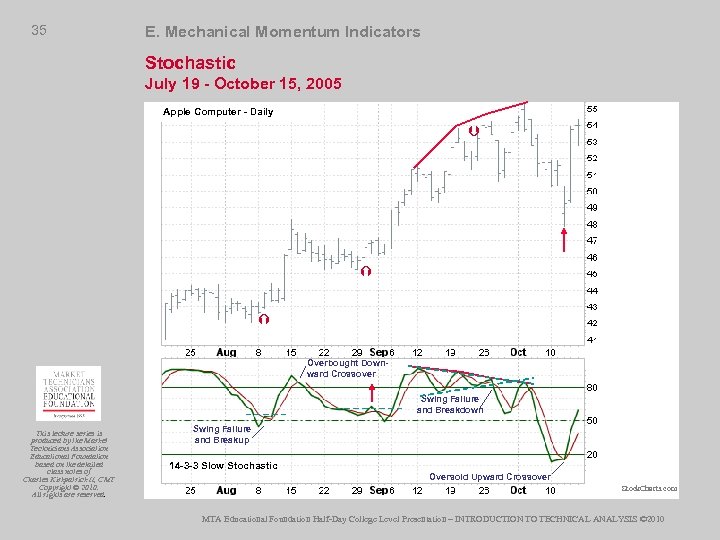

35 E. Mechanical Momentum Indicators Stochastic July 19 - October 15, 2005 Apple Computer - Daily Overbought Downward Crossover Swing Failure and Breakdown This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Swing Failure and Breakup 14 -3 -3 Slow Stochastic Oversold Upward Crossover Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

35 E. Mechanical Momentum Indicators Stochastic July 19 - October 15, 2005 Apple Computer - Daily Overbought Downward Crossover Swing Failure and Breakdown This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Swing Failure and Breakup 14 -3 -3 Slow Stochastic Oversold Upward Crossover Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

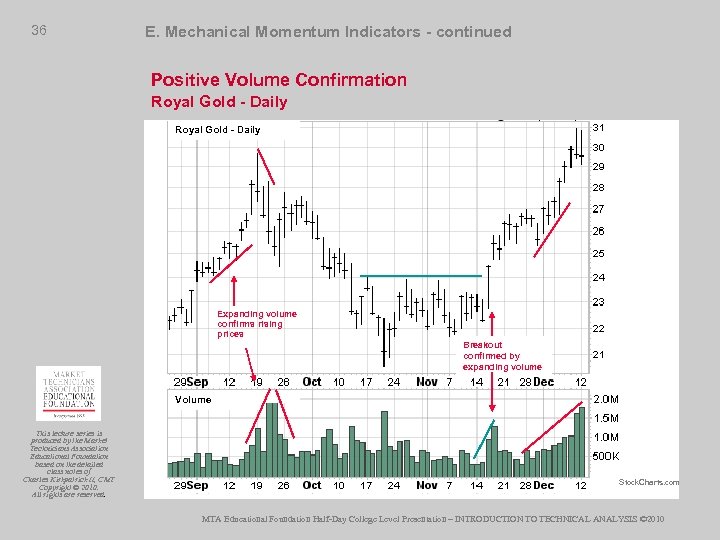

36 E. Mechanical Momentum Indicators - continued Positive Volume Confirmation Royal Gold - Daily Expanding volume confirms rising prices Breakout confirmed by expanding volume Volume This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

36 E. Mechanical Momentum Indicators - continued Positive Volume Confirmation Royal Gold - Daily Expanding volume confirms rising prices Breakout confirmed by expanding volume Volume This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

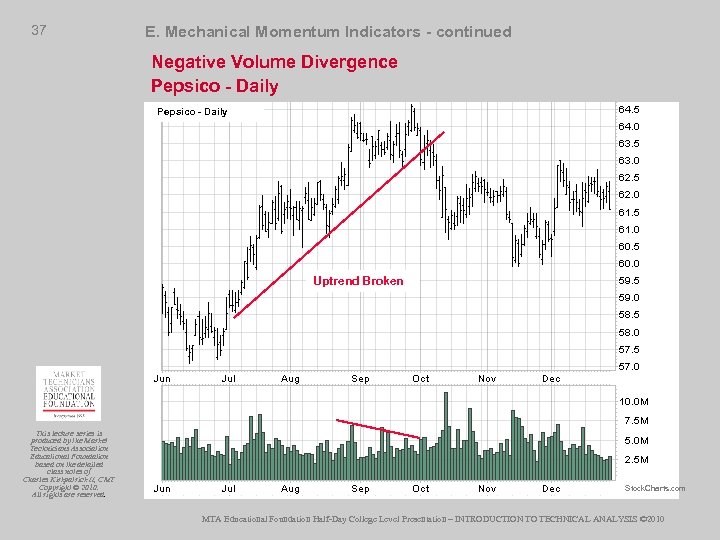

37 E. Mechanical Momentum Indicators - continued Negative Volume Divergence Pepsico - Daily Uptrend Broken This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

37 E. Mechanical Momentum Indicators - continued Negative Volume Divergence Pepsico - Daily Uptrend Broken This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

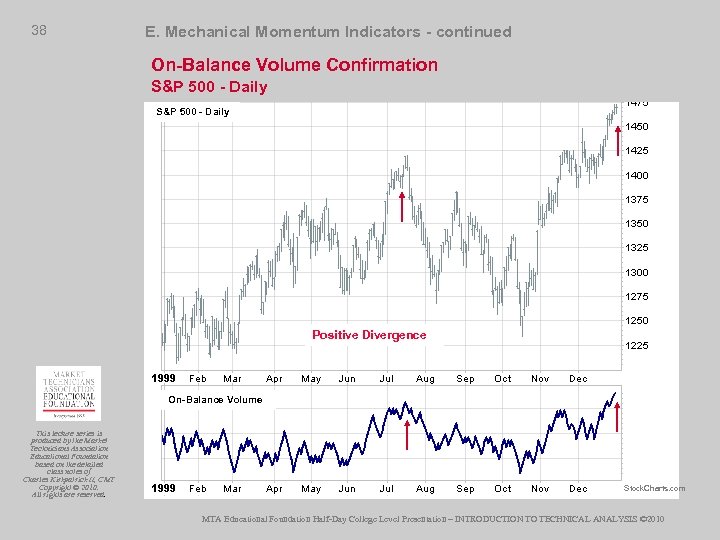

38 E. Mechanical Momentum Indicators - continued On-Balance Volume Confirmation S&P 500 - Daily Positive Divergence On-Balance Volume This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

38 E. Mechanical Momentum Indicators - continued On-Balance Volume Confirmation S&P 500 - Daily Positive Divergence On-Balance Volume This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

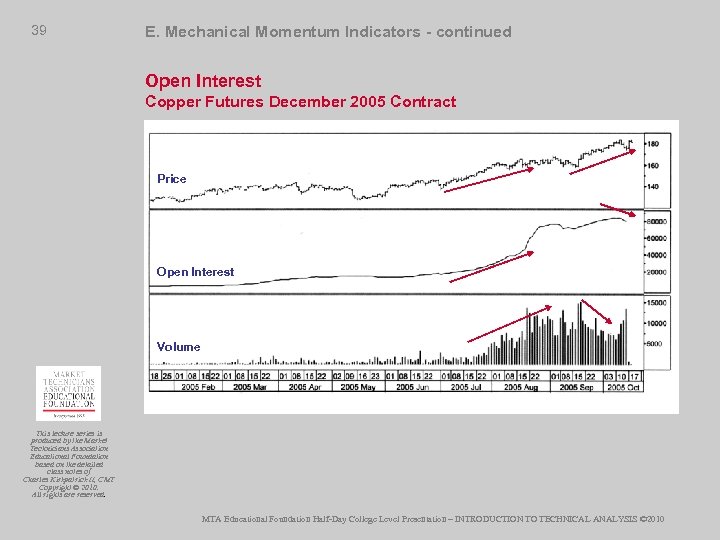

39 E. Mechanical Momentum Indicators - continued Open Interest Copper Futures December 2005 Contract Price Open Interest Volume This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

39 E. Mechanical Momentum Indicators - continued Open Interest Copper Futures December 2005 Contract Price Open Interest Volume This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

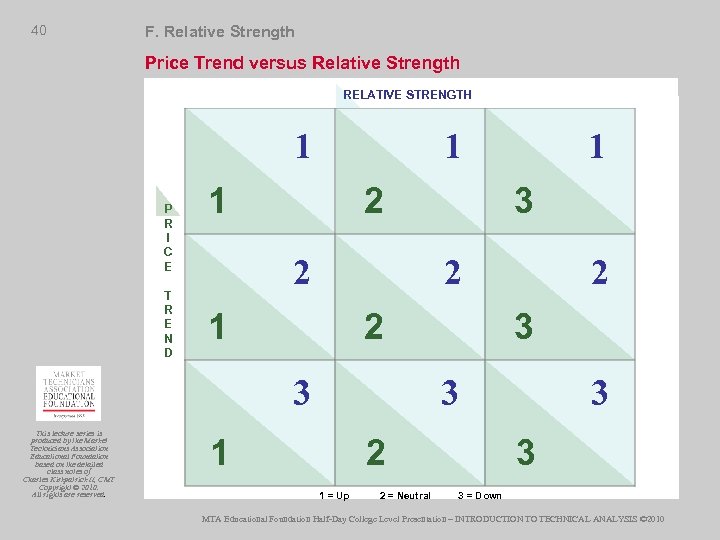

40 F. Relative Strength Price Trend versus Relative Strength RELATIVE STRENGTH 1 P R I C E T R E N D 1 1 2 2 3 2 1 2 3 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. 1 2 3 3 1 2 1 = Up 2 = Neutral 3 3 3 = Down MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

40 F. Relative Strength Price Trend versus Relative Strength RELATIVE STRENGTH 1 P R I C E T R E N D 1 1 2 2 3 2 1 2 3 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. 1 2 3 3 1 2 1 = Up 2 = Neutral 3 3 3 = Down MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

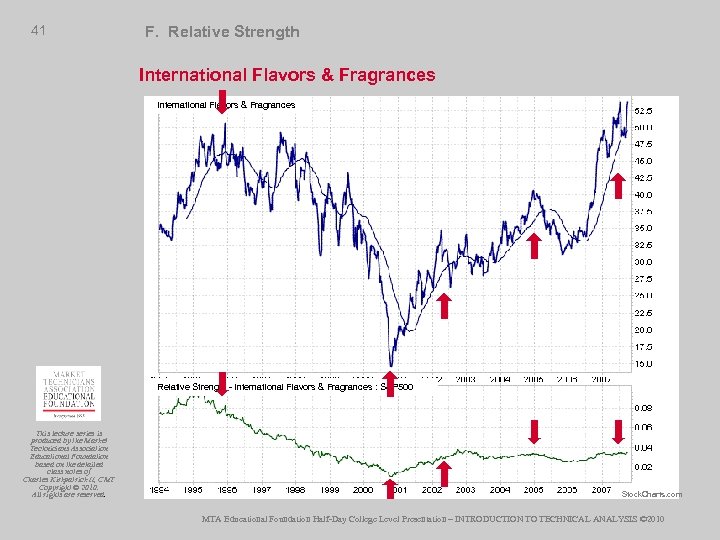

41 F. Relative Strength International Flavors & Fragrances Relative Strength - International Flavors & Fragrances : S&P 500 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

41 F. Relative Strength International Flavors & Fragrances Relative Strength - International Flavors & Fragrances : S&P 500 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

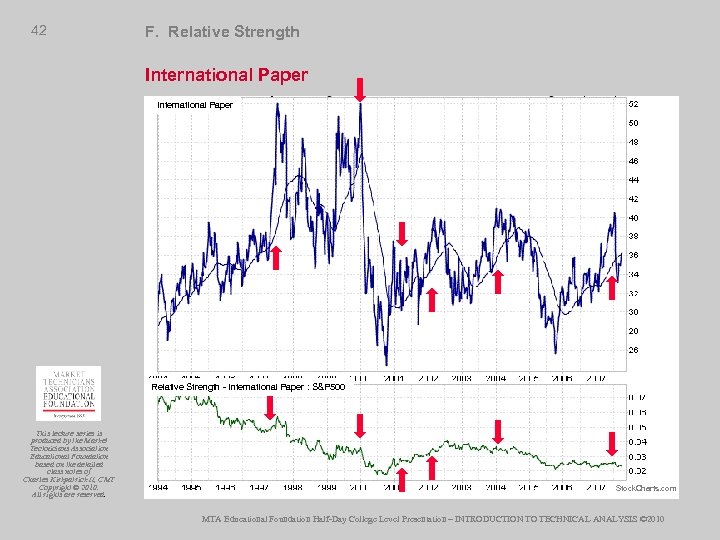

42 F. Relative Strength International Paper Relative Strength - International Paper : S&P 500 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

42 F. Relative Strength International Paper Relative Strength - International Paper : S&P 500 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

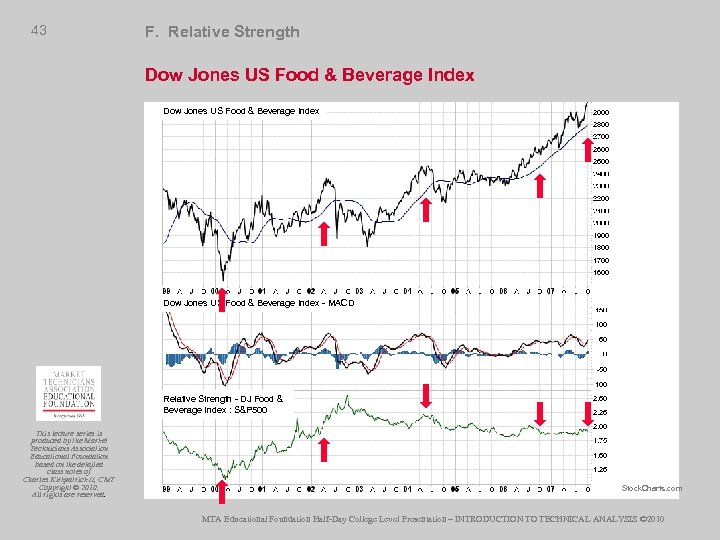

43 F. Relative Strength Dow Jones US Food & Beverage Index - MACD Relative Strength - DJ Food & Beverage Index : S&P 500 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

43 F. Relative Strength Dow Jones US Food & Beverage Index - MACD Relative Strength - DJ Food & Beverage Index : S&P 500 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

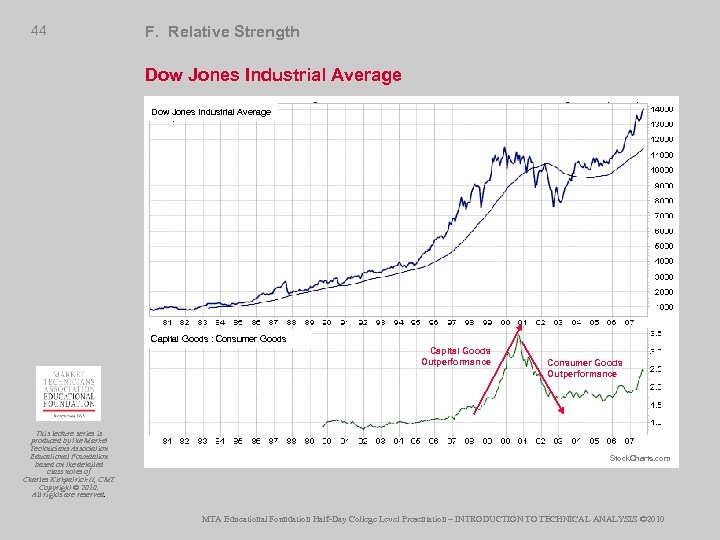

44 F. Relative Strength Dow Jones Industrial Average Capital Goods : Consumer Goods Capital Goods Outperformance This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Consumer Goods Outperformance Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

44 F. Relative Strength Dow Jones Industrial Average Capital Goods : Consumer Goods Capital Goods Outperformance This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Consumer Goods Outperformance Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

45 G. Money Management Portfolio Management • Asset Allocation – How much in stocks • Security Selection – What to buy – When to sell • Technical analysis is critical to answering “when? ” This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

45 G. Money Management Portfolio Management • Asset Allocation – How much in stocks • Security Selection – What to buy – When to sell • Technical analysis is critical to answering “when? ” This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

46 G. Money Management Investment Policy - Why It Matters “Almost all of the really big trouble that you’re going to experience in the next year is in your portfolio right now; if you could reduce some of these really big problems, you might come out the winner in the Loser’s Game. ” - Charles D. Ellis This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

46 G. Money Management Investment Policy - Why It Matters “Almost all of the really big trouble that you’re going to experience in the next year is in your portfolio right now; if you could reduce some of these really big problems, you might come out the winner in the Loser’s Game. ” - Charles D. Ellis This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

47 G. Money Management C-A-N-S-L-I-M C = Current EPS growth – should be a minimum of 20% A = Annual EPS growth – should be at least 15 -20% for 3 years N = New. The greatest winners had a major new product, new management, or new industry conditions A new high in price can alert you to new This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. fundamental developments MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

47 G. Money Management C-A-N-S-L-I-M C = Current EPS growth – should be a minimum of 20% A = Annual EPS growth – should be at least 15 -20% for 3 years N = New. The greatest winners had a major new product, new management, or new industry conditions A new high in price can alert you to new This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. fundamental developments MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

48 G. Money Management C-A-N-S-L-I-M S = Shares outstanding – past winners have had an average of less than 25 million L = Leadership – demonstrated by high relative strength for the stock and the stock’s industry group I = Institutional sponsorship – good stocks are owned by institutions This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. M = Market – even good stocks go down in a bear market MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

48 G. Money Management C-A-N-S-L-I-M S = Shares outstanding – past winners have had an average of less than 25 million L = Leadership – demonstrated by high relative strength for the stock and the stock’s industry group I = Institutional sponsorship – good stocks are owned by institutions This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. M = Market – even good stocks go down in a bear market MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

49 2. Sentiment (Behavioral Finance Analysis) “The Little Guy is Not Always Wrong” This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

49 2. Sentiment (Behavioral Finance Analysis) “The Little Guy is Not Always Wrong” This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

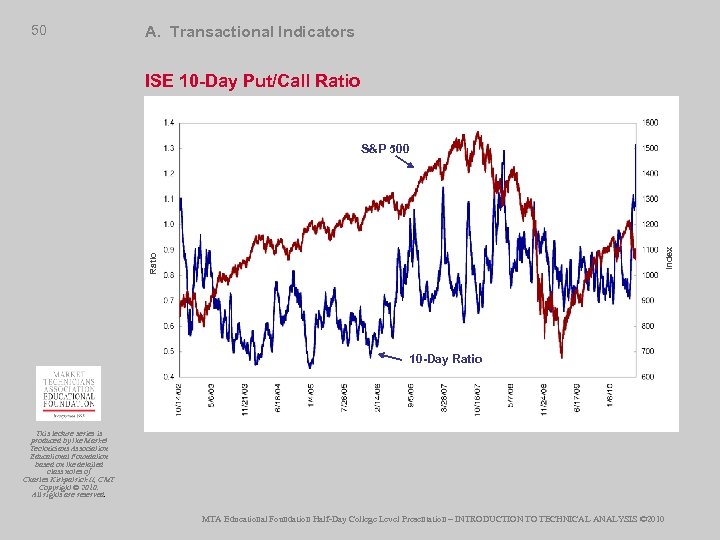

50 A. Transactional Indicators ISE 10 -Day Put/Call Ratio Index S&P 500 10 -Day Ratio This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

50 A. Transactional Indicators ISE 10 -Day Put/Call Ratio Index S&P 500 10 -Day Ratio This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

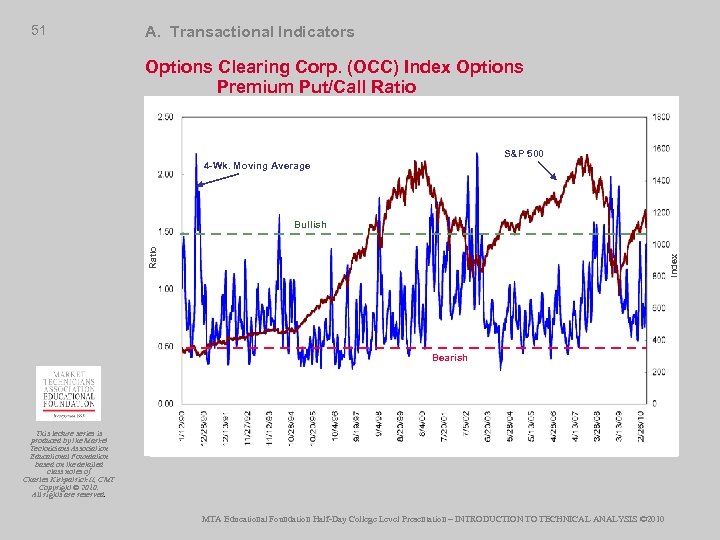

51 A. Transactional Indicators Options Clearing Corp. (OCC) Index Options Premium Put/Call Ratio S&P 500 4 -Wk. Moving Average Index Ratio Bullish Bearish This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

51 A. Transactional Indicators Options Clearing Corp. (OCC) Index Options Premium Put/Call Ratio S&P 500 4 -Wk. Moving Average Index Ratio Bullish Bearish This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

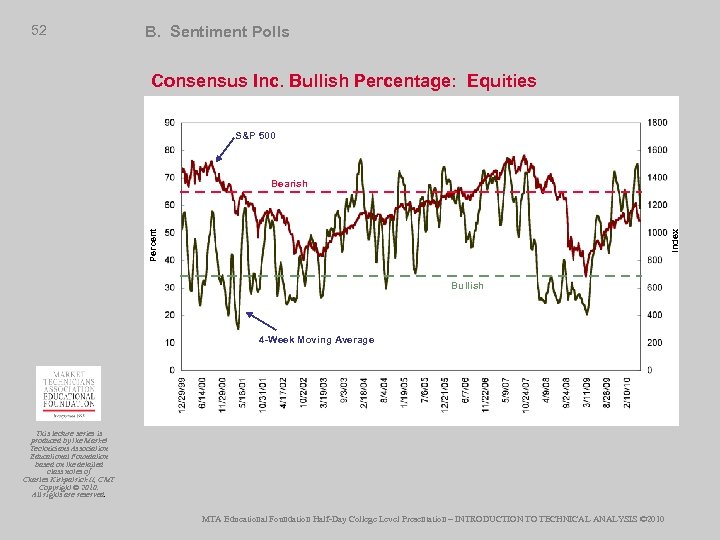

52 B. Sentiment Polls Consensus Inc. Bullish Percentage: Equities S&P 500 Index Percent Bearish Bullish 4 -Week Moving Average This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

52 B. Sentiment Polls Consensus Inc. Bullish Percentage: Equities S&P 500 Index Percent Bearish Bullish 4 -Week Moving Average This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

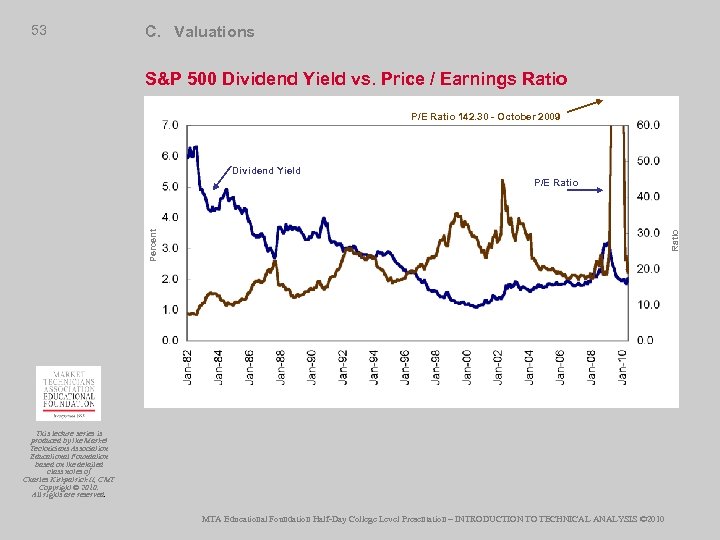

53 C. Valuations S&P 500 Dividend Yield vs. Price / Earnings Ratio P/E Ratio 142. 30 - October 2009 Dividend Yield Ratio Percent P/E Ratio This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

53 C. Valuations S&P 500 Dividend Yield vs. Price / Earnings Ratio P/E Ratio 142. 30 - October 2009 Dividend Yield Ratio Percent P/E Ratio This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

54 3. Supply/Demand (Quantitative Analysis, Flow of Funds) “Investors Make Bottoms and Traders Make Tops” This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

54 3. Supply/Demand (Quantitative Analysis, Flow of Funds) “Investors Make Bottoms and Traders Make Tops” This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

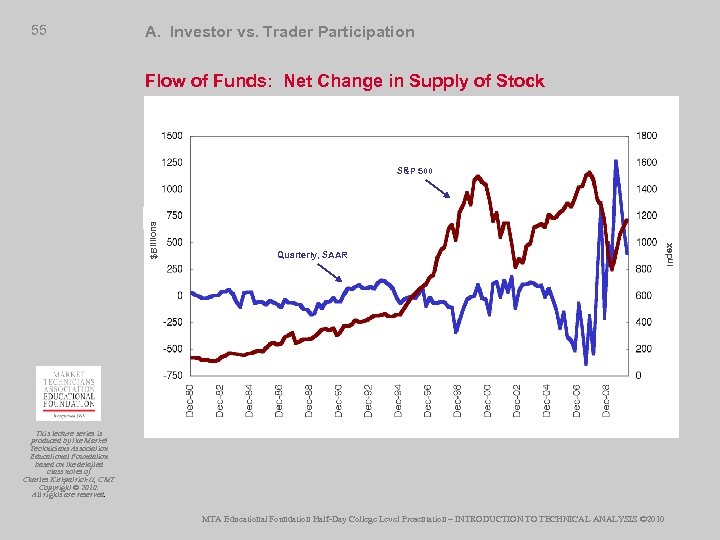

55 A. Investor vs. Trader Participation Flow of Funds: Net Change in Supply of Stock Quarterly, SAAR Index $Billions S&P 500 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

55 A. Investor vs. Trader Participation Flow of Funds: Net Change in Supply of Stock Quarterly, SAAR Index $Billions S&P 500 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

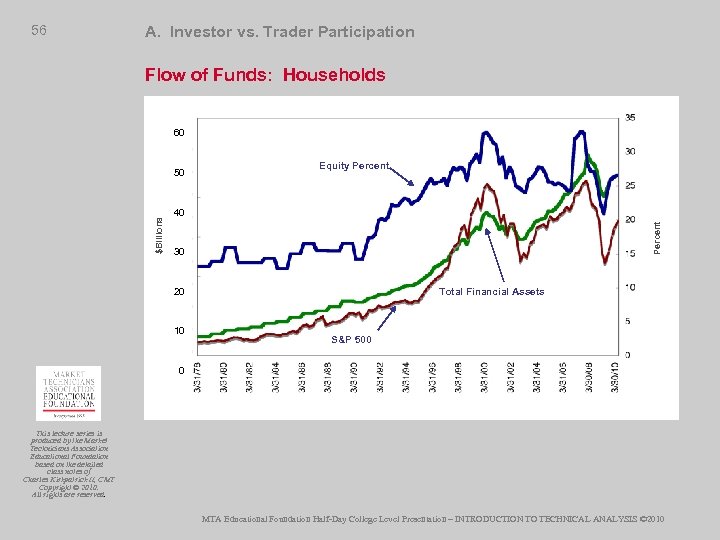

56 A. Investor vs. Trader Participation Flow of Funds: Households 60 60000 50 Equity Percent 50000 40 Percent $Billions 40000 30 30000 20 Total Financial Assets 20000 10 10000 S&P 500 0 0 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

56 A. Investor vs. Trader Participation Flow of Funds: Households 60 60000 50 Equity Percent 50000 40 Percent $Billions 40000 30 30000 20 Total Financial Assets 20000 10 10000 S&P 500 0 0 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

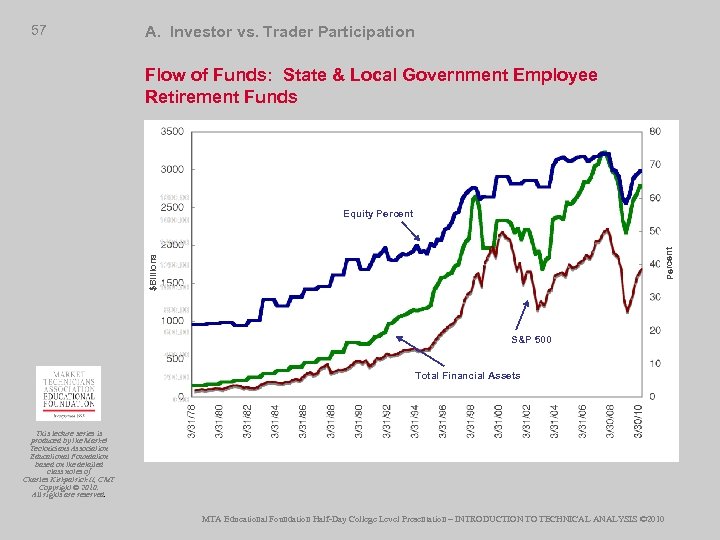

57 A. Investor vs. Trader Participation Flow of Funds: State & Local Government Employee Retirement Funds $Billions Percent Equity Percent S&P 500 Total Financial Assets This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

57 A. Investor vs. Trader Participation Flow of Funds: State & Local Government Employee Retirement Funds $Billions Percent Equity Percent S&P 500 Total Financial Assets This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

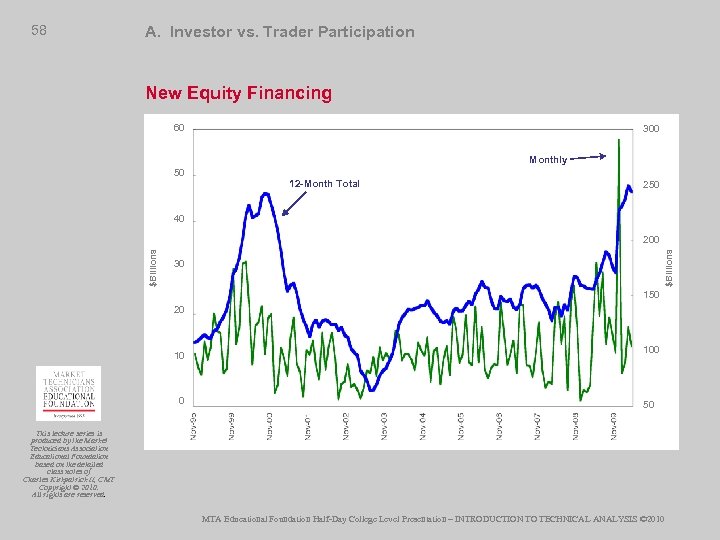

58 A. Investor vs. Trader Participation New Equity Financing 60 300 Monthly 50 12 -Month Total 250 40 $Billions 200 30 150 20 100 50 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

58 A. Investor vs. Trader Participation New Equity Financing 60 300 Monthly 50 12 -Month Total 250 40 $Billions 200 30 150 20 100 50 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

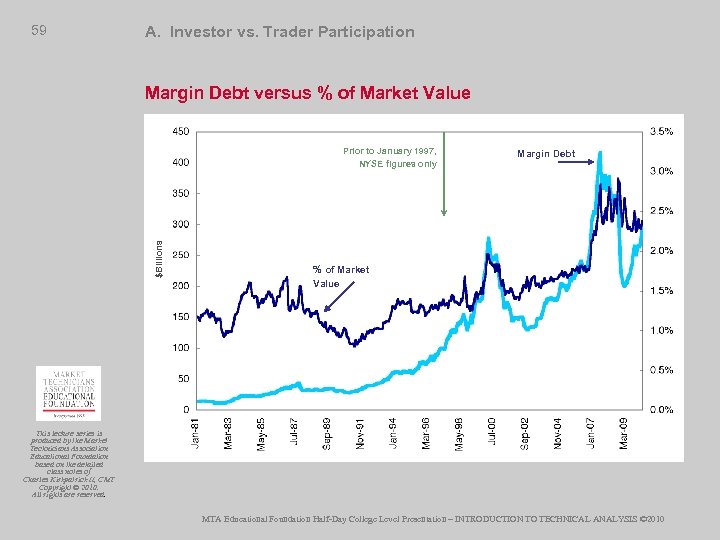

59 A. Investor vs. Trader Participation Margin Debt versus % of Market Value $Billions Prior to January 1997, NYSE figures only Margin Debt % of Market Value This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

59 A. Investor vs. Trader Participation Margin Debt versus % of Market Value $Billions Prior to January 1997, NYSE figures only Margin Debt % of Market Value This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

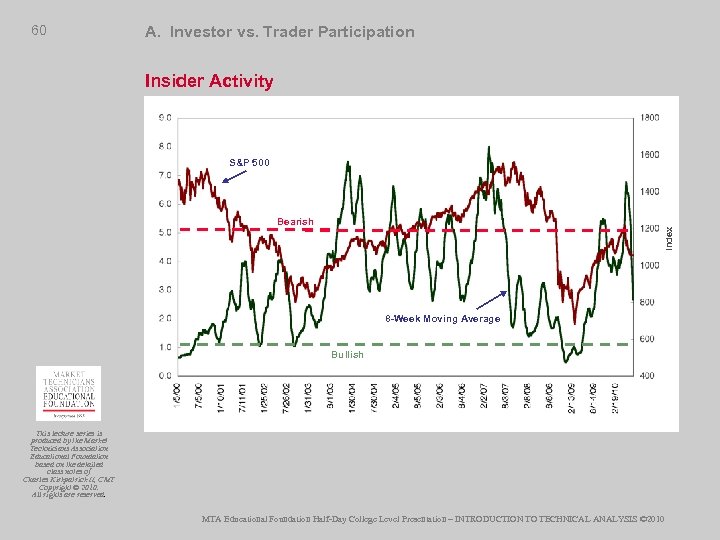

60 A. Investor vs. Trader Participation Insider Activity S&P 500 Index Bearish 8 -Week Moving Average Bullish This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

60 A. Investor vs. Trader Participation Insider Activity S&P 500 Index Bearish 8 -Week Moving Average Bullish This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

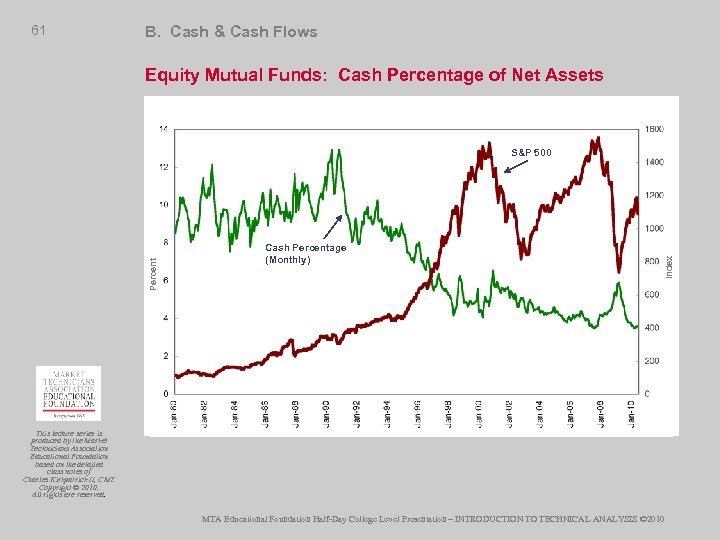

61 B. Cash & Cash Flows Equity Mutual Funds: Cash Percentage of Net Assets Cash Percentage (Monthly) Index Percent S&P 500 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

61 B. Cash & Cash Flows Equity Mutual Funds: Cash Percentage of Net Assets Cash Percentage (Monthly) Index Percent S&P 500 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

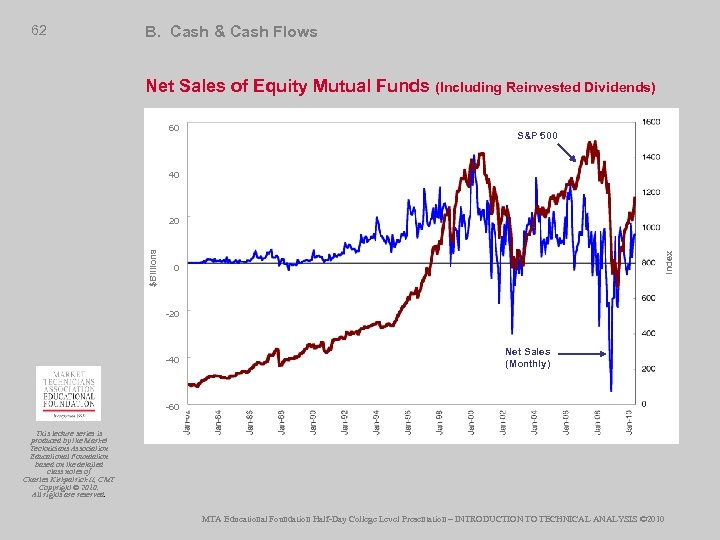

62 B. Cash & Cash Flows Net Sales of Equity Mutual Funds (Including Reinvested Dividends) 60 S&P 500 40 Index $Billions 20 0 -20 -40 Net Sales (Monthly) -60 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

62 B. Cash & Cash Flows Net Sales of Equity Mutual Funds (Including Reinvested Dividends) 60 S&P 500 40 Index $Billions 20 0 -20 -40 Net Sales (Monthly) -60 This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

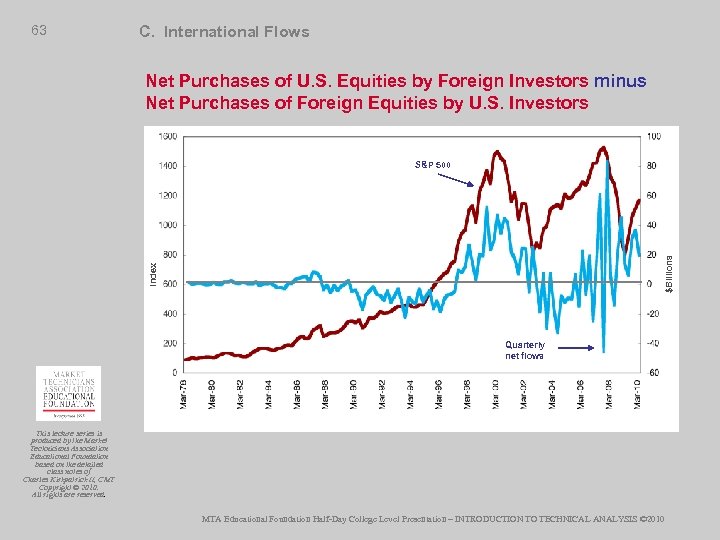

63 C. International Flows Net Purchases of U. S. Equities by Foreign Investors minus Net Purchases of Foreign Equities by U. S. Investors Index $Billions S&P 500 Quarterly net flows This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

63 C. International Flows Net Purchases of U. S. Equities by Foreign Investors minus Net Purchases of Foreign Equities by U. S. Investors Index $Billions S&P 500 Quarterly net flows This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

64 4. Intermarket (Economic Analysis) “Bonds Don’t Lead; Stocks Lead” This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

64 4. Intermarket (Economic Analysis) “Bonds Don’t Lead; Stocks Lead” This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

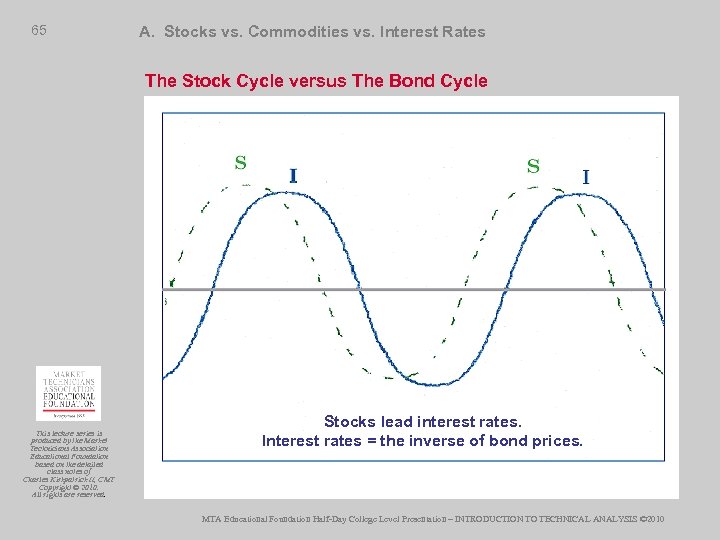

65 A. Stocks vs. Commodities vs. Interest Rates The Stock Cycle versus The Bond Cycle This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stocks lead interest rates. Interest rates = the inverse of bond prices. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

65 A. Stocks vs. Commodities vs. Interest Rates The Stock Cycle versus The Bond Cycle This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stocks lead interest rates. Interest rates = the inverse of bond prices. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

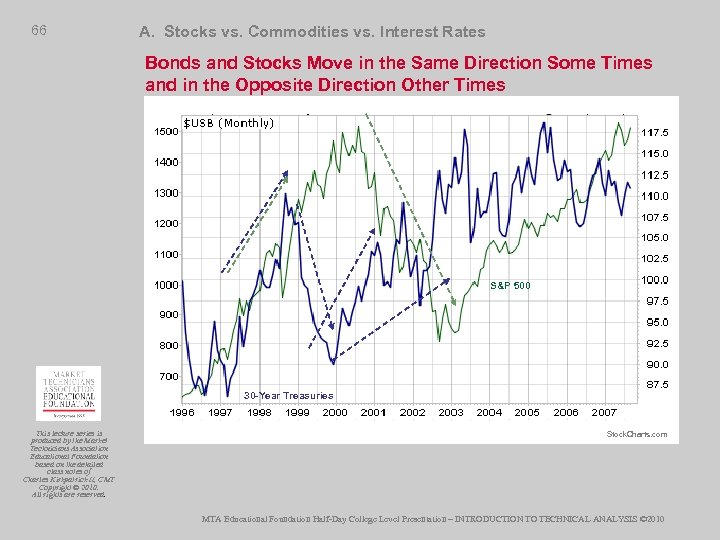

66 A. Stocks vs. Commodities vs. Interest Rates Bonds and Stocks Move in the Same Direction Some Times and in the Opposite Direction Other Times S&P 500 30 -Year Treasuries This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

66 A. Stocks vs. Commodities vs. Interest Rates Bonds and Stocks Move in the Same Direction Some Times and in the Opposite Direction Other Times S&P 500 30 -Year Treasuries This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. Stock. Charts. com MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

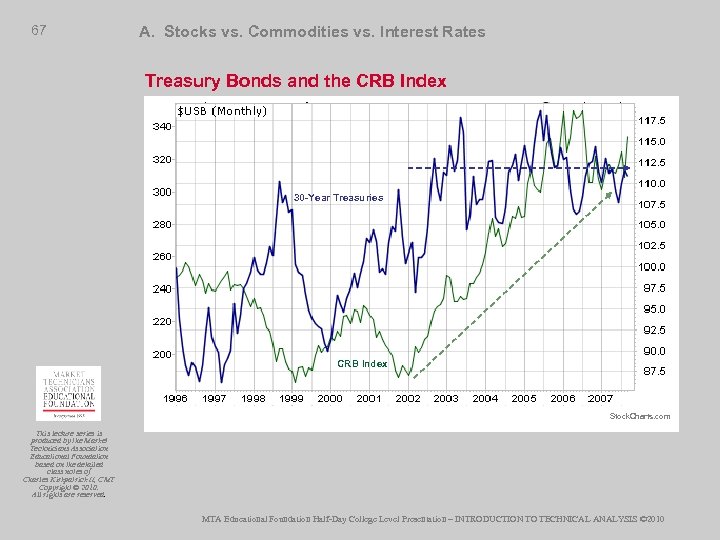

67 A. Stocks vs. Commodities vs. Interest Rates Treasury Bonds and the CRB Index 30 -Year Treasuries CRB Index Stock. Charts. com This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

67 A. Stocks vs. Commodities vs. Interest Rates Treasury Bonds and the CRB Index 30 -Year Treasuries CRB Index Stock. Charts. com This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

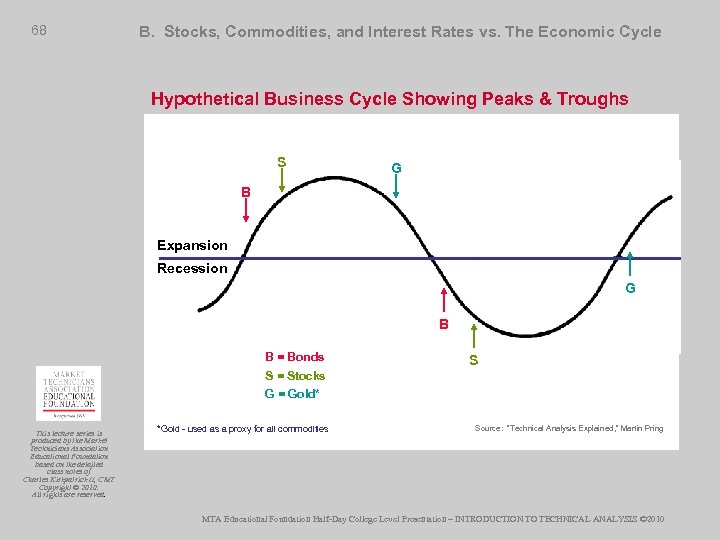

68 B. Stocks, Commodities, and Interest Rates vs. The Economic Cycle Hypothetical Business Cycle Showing Peaks & Troughs S G B Expansion Recession G B B = Bonds S S = Stocks G = Gold* This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. *Gold - used as a proxy for all commodities Source: “Technical Analysis Explained, ” Martin Pring MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

68 B. Stocks, Commodities, and Interest Rates vs. The Economic Cycle Hypothetical Business Cycle Showing Peaks & Troughs S G B Expansion Recession G B B = Bonds S S = Stocks G = Gold* This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. *Gold - used as a proxy for all commodities Source: “Technical Analysis Explained, ” Martin Pring MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

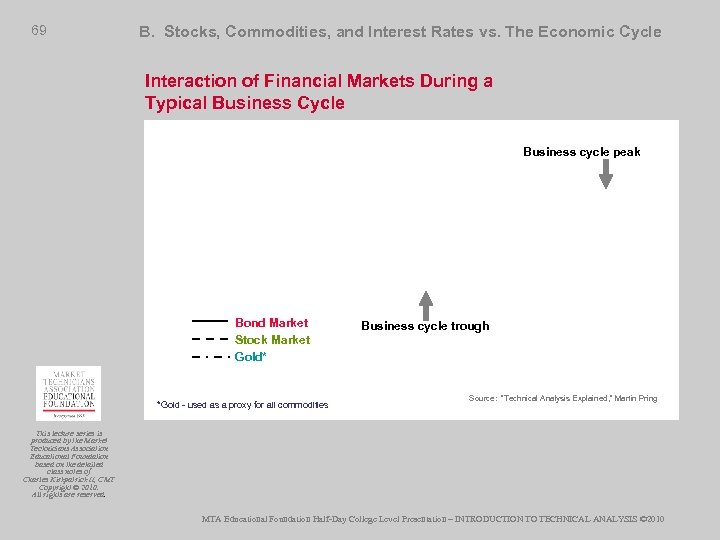

69 B. Stocks, Commodities, and Interest Rates vs. The Economic Cycle Interaction of Financial Markets During a Typical Business Cycle Business cycle peak Bond Market Stock Market Gold* *Gold - used as a proxy for all commodities Business cycle trough Source: “Technical Analysis Explained, ” Martin Pring This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010

69 B. Stocks, Commodities, and Interest Rates vs. The Economic Cycle Interaction of Financial Markets During a Typical Business Cycle Business cycle peak Bond Market Stock Market Gold* *Gold - used as a proxy for all commodities Business cycle trough Source: “Technical Analysis Explained, ” Martin Pring This lecture series is produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. MTA Educational Foundation Half-Day College Level Presentation – INTRODUCTION TO TECHNICAL ANALYSIS © 2010