1288cce9f8099c5ebaa607760dc9e7ba.ppt

- Количество слайдов: 60

1. 0 Introduction MRTeam (UTM) was appointed by the Yayasan Tun Ismail Mohamed Ali Berdaftar Permodalan Nasional Berhad (PNB) on September 7, 2007 to conduct a study on The Psychographic and Demographic Segmentation of Malaysian Population in Expenditure and Investment Pattern. The study was carried out nationwide and took 18 months from the inception until the delivery of the final report (December 2008). The result of the study will be able to contribute to the understanding of the Malaysian attitude, interest, and opinion regarding investment products and more importantly reveal the newly developed segments for expenditure and investment pattern.

2. 0 Main Objectives 1. To generate the psychographics dimensions and demographic impact of Malaysian population 2. To develop a typology of Malaysian population based on their expenditure and investment pattern

3. 0 Research Approach Developed Survey research tool Identified Population and Sampling Size Conducted survey and interviews Analyzed Data

3. 1 Survey Research Tool 1. The survey Questionnaire (refer to Appendix A) consists of 77 items includes the following: • Psychographics (35 items): based on AIO (attitude, interest and opinion) measurement that were tailored to financial environment. • Demographic (12 items): Profile of the respondents. • Behaviouristic (30 items): Investment pattern of the respondents. 2. The team conducted a pilot study to test the validity of the items. 3. PNB endorsed the questionnaire on 21 September 2007.

3. 2 Population and Sampling Technique • The population of the study comprises of Malaysian citizen. • Samples were drawn from all states of Malaysia. • The sampling method employed were mall-intercept and omnibus survey. • Convenience sampling technique was utilized in selecting respondents for the study. However, quota sampling were observed to ensure that the sample were evenly distributed. • The sample size of the study was 1700, however only 89 % (1520) of the questionnaires were usable.

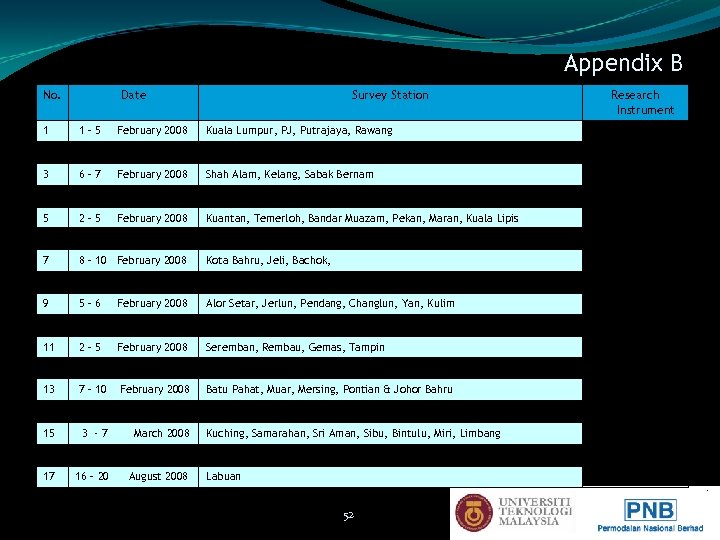

3. 3 Conducting Survey & Interviews • The research instrument was applied between early February to April 2008. • The locations of the survey were chosen (refer to Appendix B) based on the availability of volunteer respondent and ability to being able to accommodate surveyors without impinging on the respondents’ private time. 6

3. 3 Conducting Survey & Interviews (cont. ) Interviewers The self completed surveys were distributed by the interviewers. A group of trained marketing under graduate students from UTM were employed to carry out the interviews. An induction program was provided which included: training in the administration of the surveys; data gathering; etiquette for approaching potential respondents; and etiquette when working within crowded commercial environments such as mall, hospital, banks, recreational park and other public areas. 7

3. 4 Limitations As with most research, this study was subject to some limitations. Due to budgetary constraints, random and representative face to face sampling of the entire population of Malaysia was not possible to be utilized for the survey. Rather, convenience sampling was conducted along with a self completed survey. Further research would be required to determine whether this sample was representative of visitation to the region over the entire year. 8

3. 5 Data Analyses • The tool used for analyses was SPSS (version 12) –licensed to UTM. • For Descriptive Analyses; mean, t-test & Anova were exploited to compare mean, standard deviation and variances between groups of respondents (Investors and noninvestors). • For Multivariate Analyses; Factor Analysis was exploited to generate segments of consumer according to their psychographic dimensions. • Data were tested on its reliability by utilizing the Cronbach Alpha test, whilst validity was tested using Factor Analysis & KMO Bartlett tests. Data of the study is attached: Refer to Appendix C

3. 6 Reliability & Validity 1. Reliability of psychographic variables: • 2. Overall Cronbach Alpha score (0. 8365) Validity of Psychographic Variables • KMO Bartlett score (0. 876) • Explain Variance (0. 577)

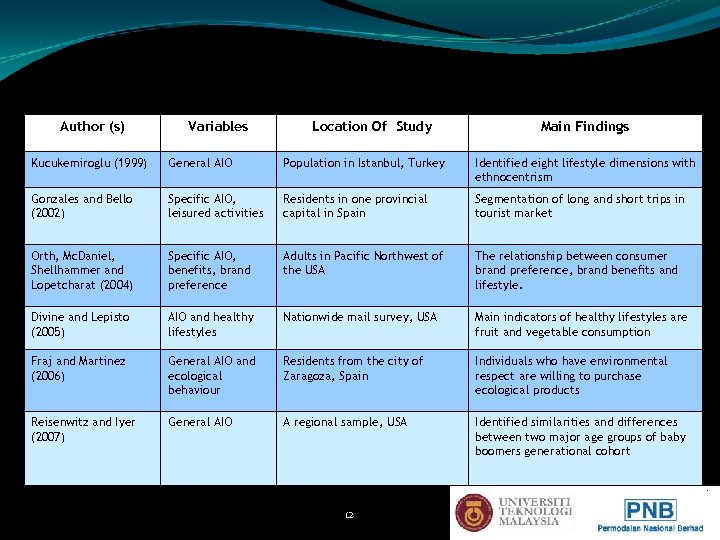

4. 0 AIO Worldwide Psychographics research focuses on individual activities known as Attitude, interest and opinions (AIO). This model is the most widely used approach to lifestyle measurement in many researches. The model has been tested worldwide and been endorsed as reliable model to be utilized in establishing the market segments. Attempts to measure the quantitative dimensions of lifestyle were initially referred to as psychographics. (research on the application of AIO in segmentation studies is presented in Table 1). Evidences of the adoption of AIO in industries world-wide are presented in the Table 2.

Table 1: Research on the Application of AIO in segmentation studies Author (s) Variables Location Of Study Main Findings Kucukemiroglu (1999) General AIO Population in Istanbul, Turkey Identified eight lifestyle dimensions with ethnocentrism Gonzales and Bello (2002) Specific AIO, leisured activities Residents in one provincial capital in Spain Segmentation of long and short trips in tourist market Orth, Mc. Daniel, Shellhammer and Lopetcharat (2004) Specific AIO, benefits, brand preference Adults in Pacific Northwest of the USA The relationship between consumer brand preference, brand benefits and lifestyle. Divine and Lepisto (2005) AIO and healthy lifestyles Nationwide mail survey, USA Main indicators of healthy lifestyles are fruit and vegetable consumption Fraj and Martinez (2006) General AIO and ecological behaviour Residents from the city of Zaragoza, Spain Individuals who have environmental respect are willing to purchase ecological products Reisenwitz and Iyer (2007) General AIO A regional sample, USA Identified similarities and differences between two major age groups of baby boomers generational cohort 12

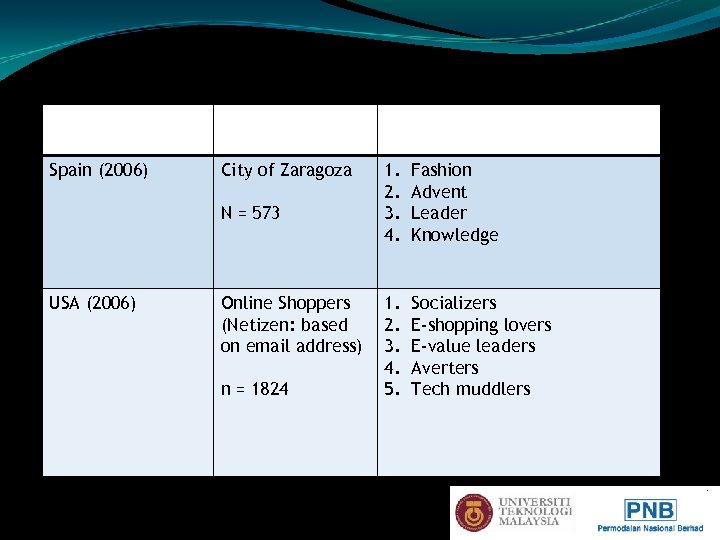

Table 2: Application Of AIO in Industries Across the World Country (Years) Spain (2006) Sample (Pop & Size) City of Zaragoza N = 573 USA (2006) Online Shoppers (Netizen: based on email address) n = 1824 Segmentation Group 1. 2. 3. 4. Fashion Advent Leader Knowledge 1. 2. 3. 4. 5. Socializers E-shopping lovers E-value leaders Averters Tech muddlers

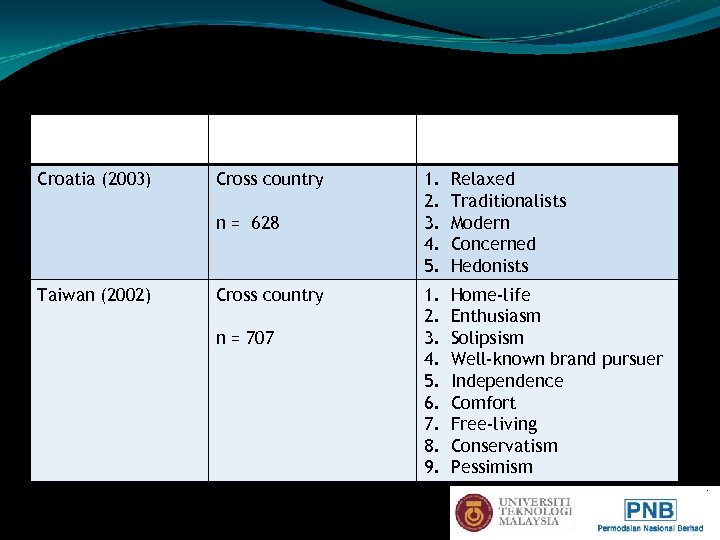

Table 2: Application Of AIO in Industries Across the World Country (Year) Croatia (2003) Sample (Pop & Size) Cross country n = 628 Taiwan (2002) Cross country n = 707 Segmentation Group 1. 2. 3. 4. 5. Relaxed Traditionalists Modern Concerned Hedonists 1. 2. 3. 4. 5. 6. 7. 8. 9. Home-life Enthusiasm Solipsism Well-known brand pursuer Independence Comfort Free-living Conservatism Pessimism

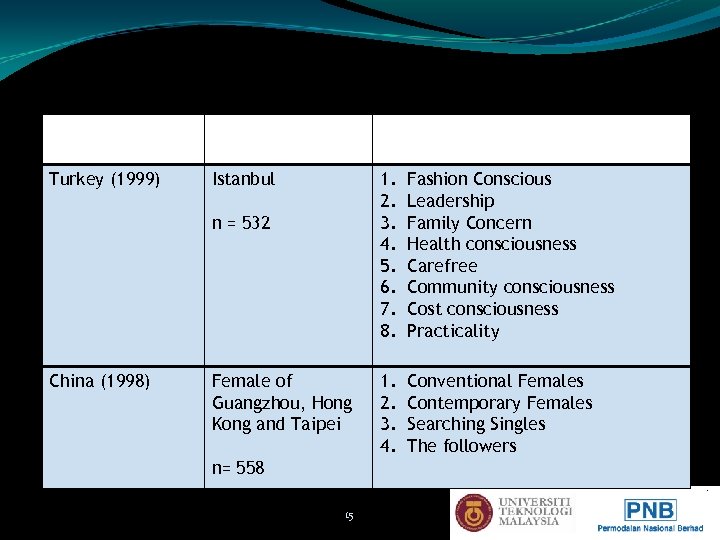

Table 2: Application Of AIO in Industries Across the World Country (Year) Turkey (1999) Sample (Pop & Size) Segmentation Group 1. 2. 3. 4. 5. 6. 7. 8. Istanbul n = 532 China (1998) Female of Guangzhou, Hong Kong and Taipei n= 558 15 Fashion Conscious Leadership Family Concern Health consciousness Carefree Community consciousness Cost consciousness Practicality 1. 2. 3. 4. Conventional Females Contemporary Females Searching Singles The followers

Table 2: Application Of AIO in Industries Across the World Country (Year) New Zealand (1996) Sample (Pop & Size) Cross country n = 3773 Segmentation Group 1. 2. 3. 4. 5. 6. 7. Family values people Conservative quiet lifers Educated liberals Accepting mid-lifers Success-driven extroverts Pragmatic strugglers Social strivers

4. 1 Application of AIO Worldwide: The Conclusion Lifestyle patterns provide a broader, more three dimensional view of consumers that marketers and businessmen should not ignore. The success of a marketing model inherently lies in the researchers’ ability to identify variables that can really distinguish people’s performance in the marketplace. Bojanic (2007)1 listed a few criteria that are normally used to evaluate the effectiveness of the market segmentation strategies such as substitutability, measurability, accessibility and actionability. Once the segmentation strategy satisfies these four criteria, the next step is to choose the segmentation variables that would work best at segmenting the market. Bojanic, D. C. , 2007, “Customer profile of the “carryout” segment for restaurants”, International Journal of Contemporary Hospitality Management, Vol. 19 No. 1, pp. 21 -31 1 17

Cont. Prominent findings from the psychographic and lifestyle research worldwide indicate that psychographic segmentation is able to provide the essential information that financial institutions are seeking, i. e. : Who are the likely to be the profitable customers Where they could be found? The rationale of employing both, the demographic and psychographic dimensions is that the segmentation strategy would be more holistic and provide greater understanding of consumers’ profile and behavior. 18

5. 0 Scope of the Study Cross Sectional Study in nature. Consumer sentiment may vary over time due to the dynamic change in the world and local economic environment. Consumer Price Index is assumed to remain constant and not affect the outcome of the study. Reluctance of the respondents to produce honest response on certain particular variable related to monetary figures. The findings should not be deemed as the conclusive outcome of the overall Malaysian population attributes. This research only focus on the development of Psychographic Segmentation in Malaysia and will not address any specific strategic implications on the part of the client. 19

6. 0 Main Findings The findings show that there is a strong dependency relationship between customers’ behaviours and lifestyle (on an AIO approach) is also evident in the Malaysian context. Demographic segmentation seems to be less significant as the trend of the characteristics appear similar between investor and non-investor groups, and between investment zone (high, moderate and lower prospect of investment). Behavioristic segmentation indicates some differences in the and conduct, nevertheless some actions are parallel. The labels Pioneering Innovator, Cognizant Contemporary, Assertive Leader, Self-reliant Advocate, Conformist Excitement Hunter, Gizmo Eager, Civilized Persona and Solo Sustainer provide a general idea of lifestyle dimensions of each segment.

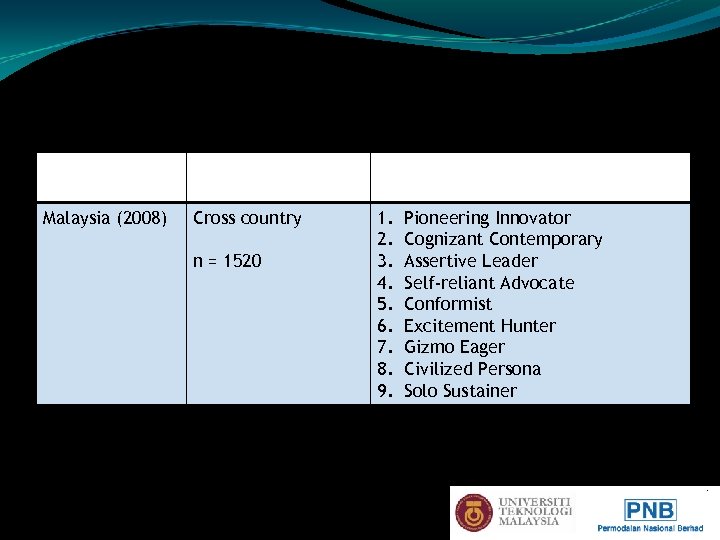

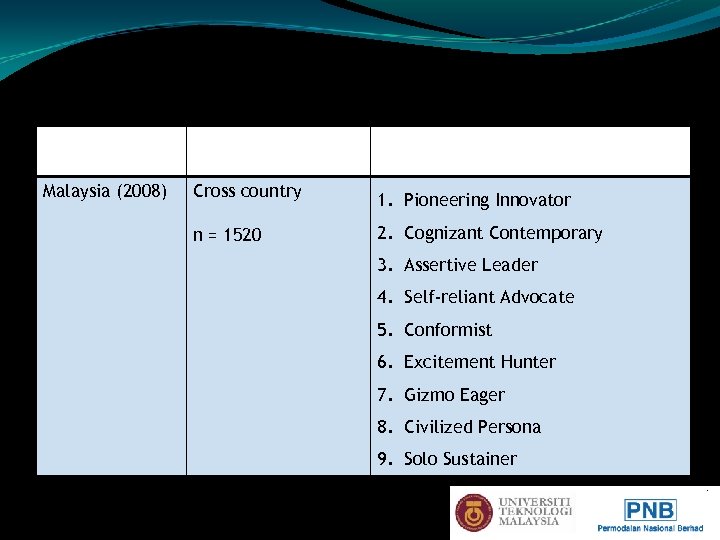

6. 1 Application of AIO in Malaysia Country (Year) Malaysia (2008) Sample (Pop & Size) Cross country n = 1520 Segmentation Group 1. 2. 3. 4. 5. 6. 7. 8. 9. Pioneering Innovator Cognizant Contemporary Assertive Leader Self-reliant Advocate Conformist Excitement Hunter Gizmo Eager Civilized Persona Solo Sustainer

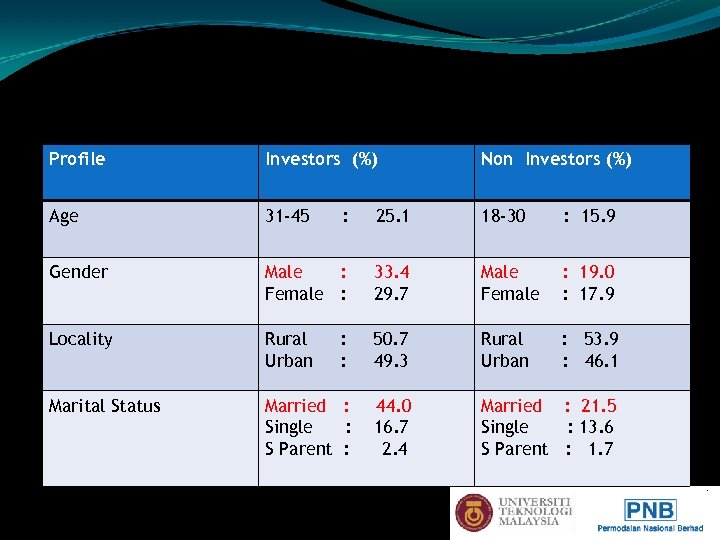

6. 2 Demographic Segmentation Investors Vs Non Investors Profile Investors (%) Non Investors (%) Age 31 -45 : 25. 1 18 -30 : 15. 9 Gender Male : Female : 33. 4 29. 7 Male Female : 19. 0 : 17. 9 Locality Rural Urban : : 50. 7 49. 3 Rural Urban : 53. 9 : 46. 1 Marital Status Married : Single : S Parent : 44. 0 16. 7 2. 4 Married : 21. 5 Single : 13. 6 S Parent : 1. 7

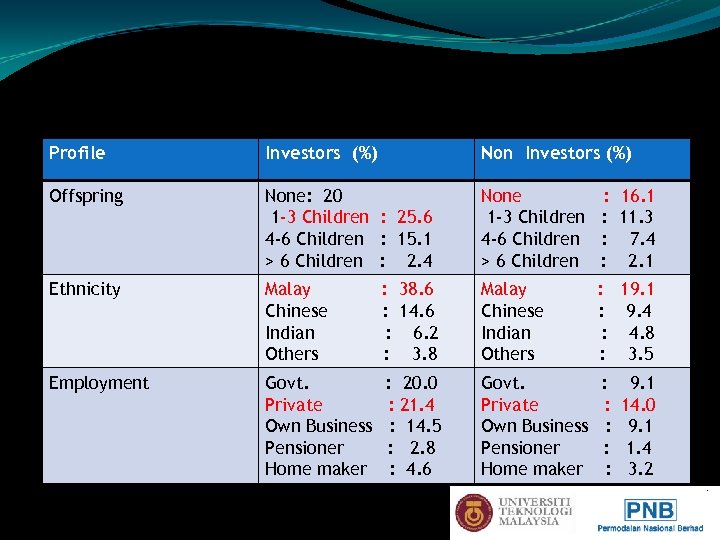

Demographic Segmentation (cont. ) Investors Vs Non Investors Profile Investors (%) Non Investors (%) Offspring None: 20 1 -3 Children : 25. 6 4 -6 Children : 15. 1 > 6 Children : 2. 4 None : 16. 1 1 -3 Children : 11. 3 4 -6 Children : 7. 4 > 6 Children : 2. 1 Ethnicity Malay Chinese Indian Others : 38. 6 : 14. 6 : 6. 2 : 3. 8 Malay Chinese Indian Others : 19. 1 : 9. 4 : 4. 8 : 3. 5 Employment Govt. Private Own Business Pensioner Home maker : 20. 0 : 21. 4 : 14. 5 : 2. 8 : 4. 6 Govt. Private Own Business Pensioner Home maker : : : 9. 1 14. 0 9. 1 1. 4 3. 2

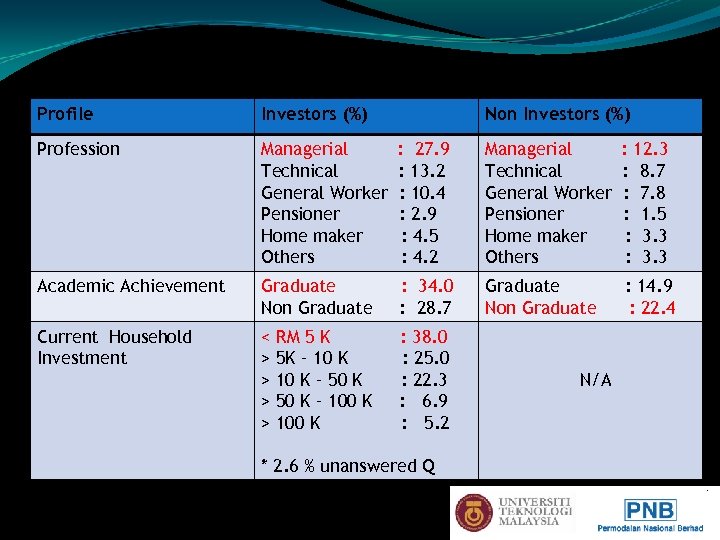

Demographic Segmentation (cont. ) Profile Investors (%) Profession Managerial Technical General Worker Pensioner Home maker Others : 27. 9 : 13. 2 : 10. 4 : 2. 9 : 4. 5 : 4. 2 Managerial Technical General Worker Pensioner Home maker Others : 12. 3 : 8. 7 : 7. 8 : 1. 5 : 3. 3 Academic Achievement Graduate Non Graduate : 34. 0 : 28. 7 Graduate Non Graduate : 14. 9 : 22. 4 Current Household Investment < > > : 38. 0 : 25. 0 : 22. 3 : 6. 9 : 5. 2 RM 5 K 5 K – 10 K – 50 K – 100 K Non Investors (%) * 2. 6 % unanswered Q N/A

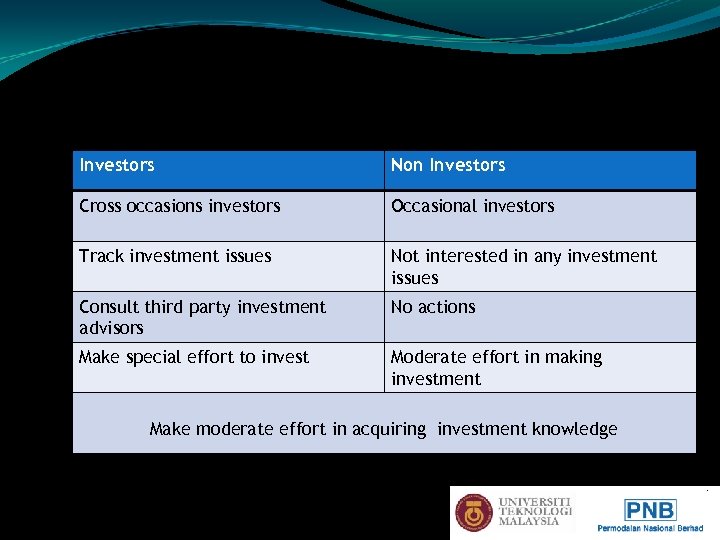

6. 3 Behavioral Profile Investors Non Investors Cross occasions investors Occasional investors Track investment issues Not interested in any investment issues Consult third party investment advisors No actions Make special effort to invest Moderate effort in making investment Make moderate effort in acquiring investment knowledge

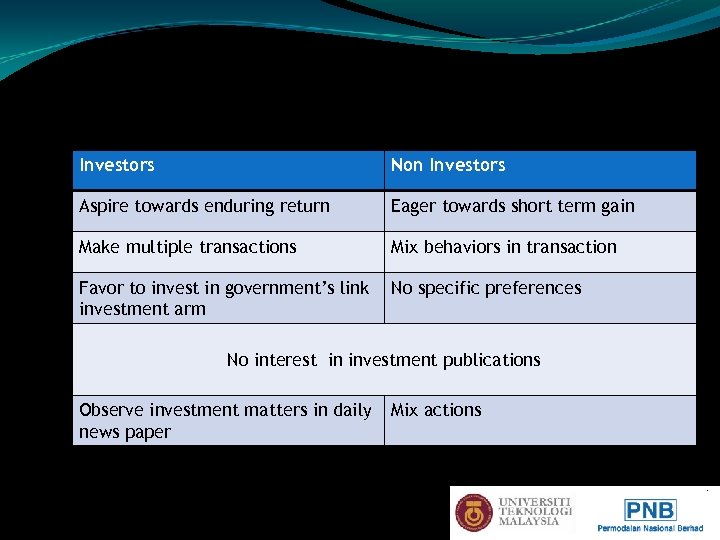

Behavioral Profile (cont. ) Investors Non Investors Aspire towards enduring return Eager towards short term gain Make multiple transactions Mix behaviors in transaction Favor to invest in government’s link investment arm No specific preferences No interest in investment publications Observe investment matters in daily news paper Mix actions

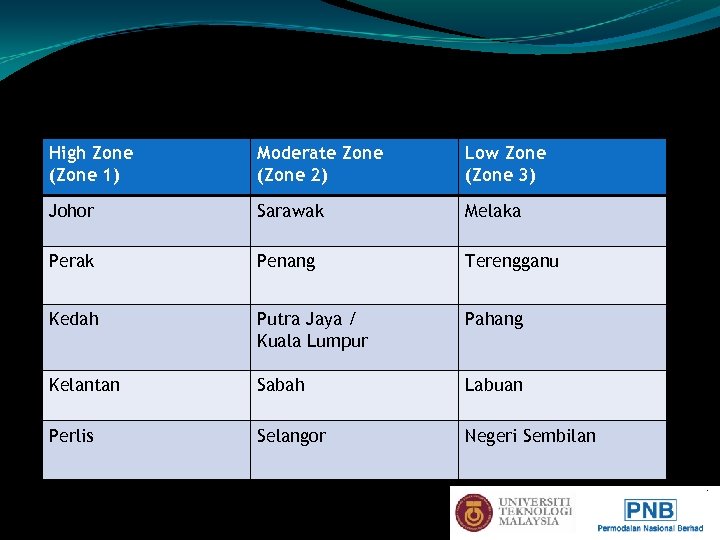

6. 4 Current Investment by Zone & State High Zone (Zone 1) Moderate Zone (Zone 2) Low Zone (Zone 3) Johor Sarawak Melaka Perak Penang Terengganu Kedah Putra Jaya / Kuala Lumpur Pahang Kelantan Sabah Labuan Perlis Selangor Negeri Sembilan

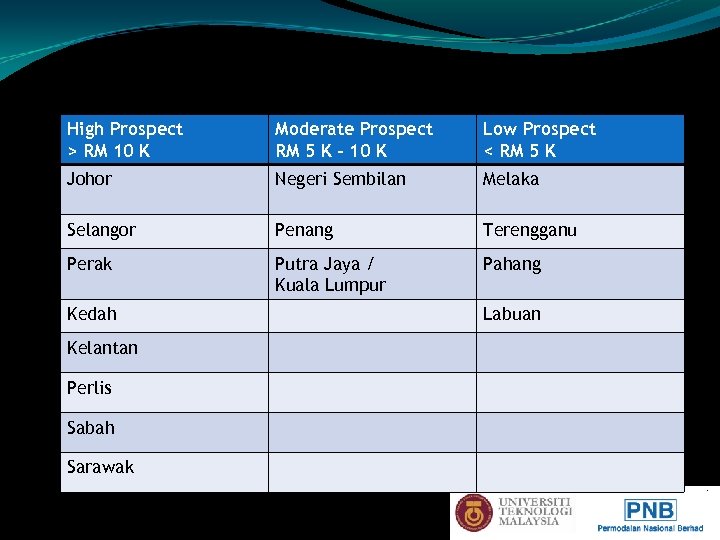

6. 5 Zoning by Prospect & State High Prospect > RM 10 K Moderate Prospect RM 5 K – 10 K Low Prospect < RM 5 K Johor Negeri Sembilan Melaka Selangor Penang Terengganu Perak Putra Jaya / Kuala Lumpur Pahang Kedah Kelantan Perlis Sabah Sarawak Labuan

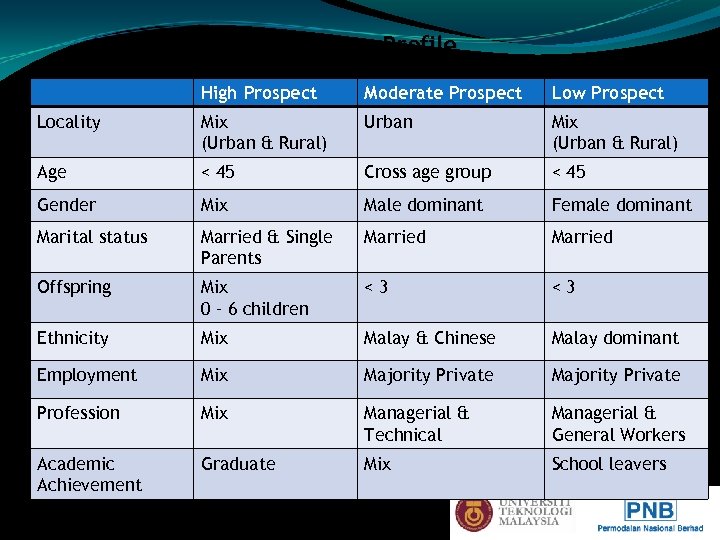

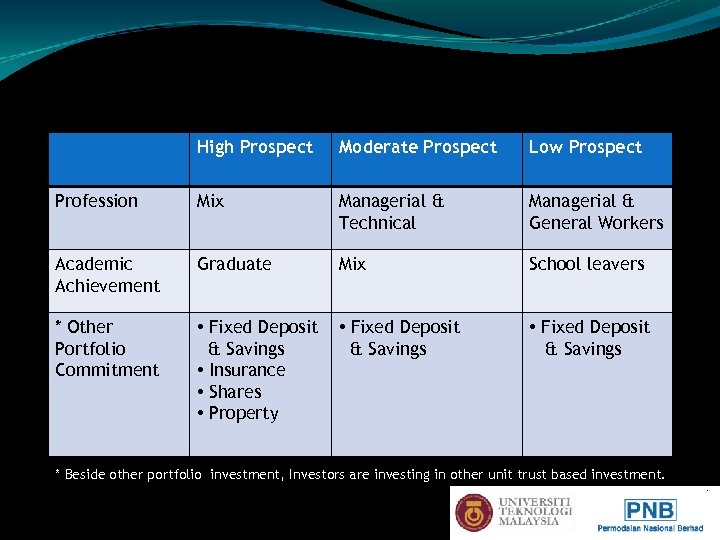

6. 6 Zone Profile High Prospect Moderate Prospect Low Prospect Locality Mix (Urban & Rural) Urban Mix (Urban & Rural) Age < 45 Cross age group < 45 Gender Mix Male dominant Female dominant Marital status Married & Single Parents Married Offspring Mix 0 – 6 children <3 <3 Ethnicity Mix Malay & Chinese Malay dominant Employment Mix Majority Private Profession Mix Managerial & Technical Managerial & General Workers Academic Achievement Graduate Mix School leavers

Zone Profile (cont. ) High Prospect Moderate Prospect Low Prospect Profession Mix Managerial & Technical Managerial & General Workers Academic Achievement Graduate Mix School leavers * Other Portfolio Commitment • Fixed Deposit & Savings • Insurance • Shares • Property • Fixed Deposit & Savings * Beside other portfolio investment, Investors are investing in other unit trust based investment.

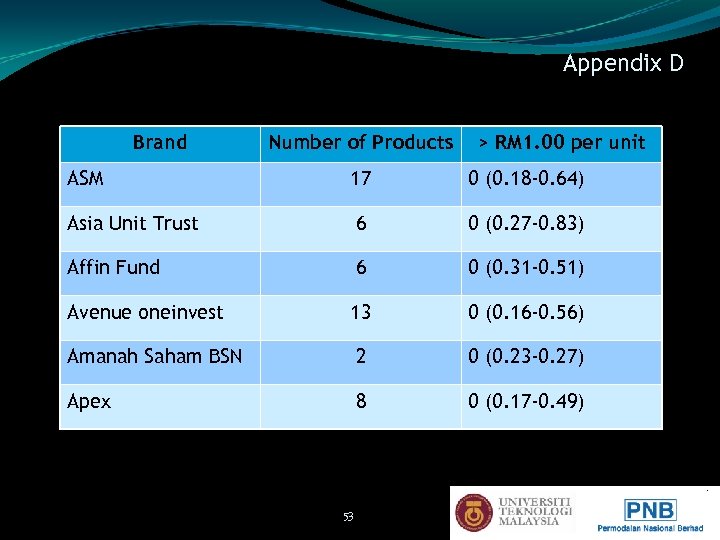

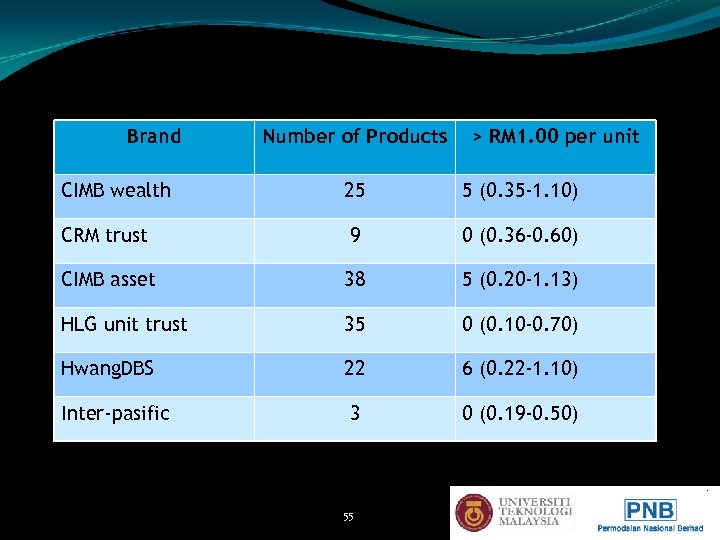

6. 7 Unit Trust Market: Competitive Scenario Malaysian Unit Trust investors are also investing in other unit trust investment that are provided by private and government service providers. The market of unit trust is currently shared by other 33 providers (refer to Appendix D) with ranges of offering prices. This group of service providers is regarded as direct competitors. In term of price offers, 17 providers offer several portfolio at the price of above RM 1. 00. Nevertheless, most service providers are offering lower than RM 1. 00, therefore the price is considered as competitive. Besides direct competitors, market is also served by several other types of investment service providers, such as investment-linked fund (refer to Appendix E) 31

6. 8 The Findings: Malaysian Psychographics Segmentation Country (Year) Malaysia (2008) Sample (Pop & Size) Segmentation Group Cross country 1. Pioneering Innovator n = 1520 2. Cognizant Contemporary 3. Assertive Leader 4. Self-reliant Advocate 5. Conformist 6. Excitement Hunter 7. Gizmo Eager 8. Civilized Persona 9. Solo Sustainer

6. 8. 1 Pioneering Innovator Typology Traits & Features • Love challenges Adventurous Thrill seekers Willing to learn new things Fond of outrageous things and people • • • • Mostly live in Zone 1 Age: < 45 Single & Married with 1 – 3 Kids Majority Malay Work mostly with private companies Mostly hold managerial post Graduates Earn < RM 40 K annually Current investment < RM 10 K Intend to invest RM 10 K - 50 K in future Other investment commitment: FD & Savings Health conscious Balanced Life (work & family) Seek advice over investment matters Prefer GLC investment products

6. 8. 2 Cognizant Contemporary Traits and Features Fashionable Trendy Up to date • • • • Typology Mostly live in Zone 1 Age < 45 Mostly Male Mostly Married with < 3 Kids Majority Malay Work mostly with government & private Mostly hold managerial & technical post School leaver & Graduates Earn < RM 40 K annually Current investment < RM 10 K Intend to invest < RM 10 K - 50 K in future Other investment commitment: FD & Savings & Insurance Health conscious Prefer GLC investment products Follow investment column

6. 8. 3 Assertive Leader Typology Traits & Features Like being in-charge Like to lead others Believe have more ability than most people Self proclaim intellectual • • • • Mostly live in Zone 1 & Zone 2 Age 31 – 45 Mostly Male Mostly Married with < 3 Kids Majority Malay Work mostly with government & private Mostly hold managerial & technical post School leaver & Graduates Earn < RM 40 K annually Current investment < RM 10 K Intend to invest < RM 10 K - 50 K in future Other investment commitment: FD & Savings & Insurance Health conscious Prefer GLC investment products Follow investment column

6. 8. 4 Self-reliant Advocate Typology Traits & Features Prefer making than buying Creative D I Y attitude • • • • Mostly live in Zone 1, Age < 45, Mostly Male Mostly Married with < 3 Kids, Majority Malay Work mostly with government & private Mostly hold managerial & technical post School leaver & Graduates Earn < RM 40 K annually Current investment < RM 10 K Intend to invest < 50 K in future Other investment commitment: FD & Savings & Insurance Health conscious Balanced Life (work & family) Seek advice over investment matters Prefer GLC investment products Follow investment column

6. 8. 5 Conformist Typology Traits & Features Conservative Hold certain traditional and religious values Concern on social environment • • • • Mostly live in Zone 1 & Zone 2 Age < 45 Mostly Male Mostly Married with < 3 Kids Majority Malay Work: Government, private & own business, as well as home makers. School leaver & Graduates Earn < RM 40 K annually Current investment < RM 10 K Intend to invest < RM 10 K - 50 K in future Other investment commitment: FD & Savings & Insurance, share and property Prefer GLC investment products Follow investment column Switch product for better long term gain

6. 8. 6 Excitement Hunter Typology Traits & Features Crave exhilarating experience Joyful Pleasure-seeking Vacationer Enjoy hedonistic lifestyle • • • • Mostly live in Zone 1 & Zone 2, Age < 55 Mostly Male, female group is increasing Mostly Married with < 3 Kids, segment Kids 4 – 6 is increasing Majority Malay Work mostly with government & private Mostly hold managerial & technical post School leaver & Graduates Earn < RM 40 K annually K Prospect: Income level > 60 K annually Current investment < RM 10 K Intend to invest < RM 10 K - 50 K in future Other investment commitment: FD & Savings & Insurance, Property Health conscious Prefer GLC investment products Follow investment column

6. 8. 7 Gizmo Eager Typology Traits & Features Enjoy tools and equipment Like hardware and automotive gadgets Like to work on metal and woods • • • • Mostly live in Zone 1 & Zone 2, Age < 45 Both genders, Single & Married with < 6 Kids Majority Malay & Chinese Work mostly with government , private & own business Mostly hold managerial, technical & general worker post School leaver & Graduates Earn < RM 40 K annually K Current investment : Nil to < RM 50 K Intend to invest < RM 50 K in future Other investment commitment: FD & Savings, Insurance & Property Health conscious Balanced life (work & family) Prefer GLC investment products Follow investment column

6. 8. 8 Civilized Persona Typology Traits & Features Appreciate art and culture • Mostly live in Zone 1 & Zone 2, Age < 45 Love knowledge Deep person Enjoy colorful life The thinker • • • • Both genders, Single & Married with < 3 Kids Majority Malay & Chinese Work mostly with private & own business Mostly hold managerial & technical post School leaver & Graduates Earn < RM 40 K annually K Prospect: Income level > 60 K annually Current investment : Nil to < RM 10 K Intend to invest < RM 10 K in future Other investment commitment: FD & Savings & Insurance Health conscious Prefer GLC investment products Follow investment column

6. 8. 9 Solo Sustainer Typology Traits & Features Limited life pursuit Restricted interest Risk averse Resist changes • • • • Mostly live in Zone 1 & Zone 2 Age < 45, age group > 56 is catching up Both genders Single & Married with < 3 Kids, family with 6 kids is catching up. Majority Malay & Chinese Work mostly with private & own business Mostly hold managerial & technical post School leaver Cross income groups Current investment : cross investment group Intend to invest < RM 10 K in future Other investment commitment: FD & Savings & Insurance Prefer GLC investment products

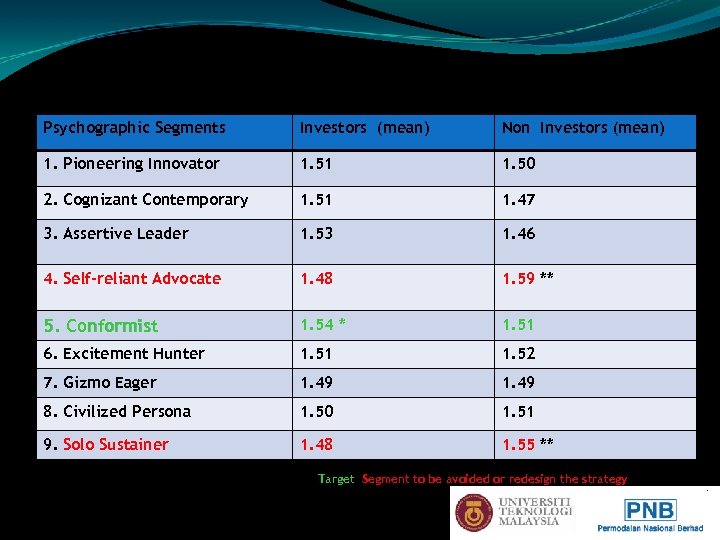

6. 9 Psychographics Segmentation: Key Values Psychographic Segments Investors (mean) Non Investors (mean) 1. Pioneering Innovator 1. 51 1. 50 2. Cognizant Contemporary 1. 51 1. 47 3. Assertive Leader 1. 53 1. 46 4. Self-reliant Advocate 1. 48 1. 59 ** 5. Conformist 1. 54 * 1. 51 6. Excitement Hunter 1. 51 1. 52 7. Gizmo Eager 1. 49 8. Civilized Persona 1. 50 1. 51 9. Solo Sustainer 1. 48 1. 55 ** * ** T-test – significant at 0. 5 and 1. 0 df : Target Segment to be avoided or redesign the strategy

6. 10 Target Segment Prime Target CONFORMIST Secondary Target The rest 6 segments Avoid or Innovate the product SOLO SUSTAINER & SELF RELIANT ADVOCATE

6. 11 Where to Market Psychographic Segments Zone to Target 2. Cognizant Contemporary Whole country 3. Assertive Leader Whole country 5. Conformist Zone 1 & Zone 2 7. Gizmo Eager Zone 1 & Zone 3 8. Civilized Persona Zone 1 & Zone 2

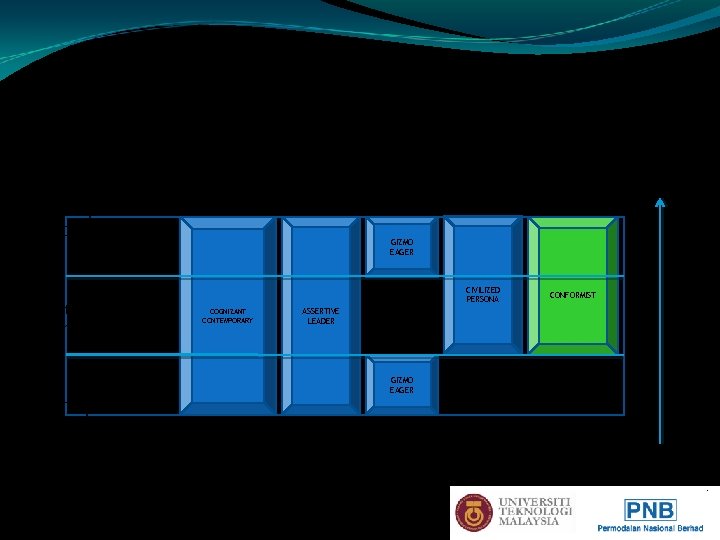

6. 11 The Position of Malaysian Psychographics Segments On Unit Trust Product Based on Market Prospect I High N High Prospect Investors Moderate Prospect Investors V E S T M E N T GIZMO EAGER CIVILIZED PERSONA COGNIZANT CONTEMPORARY CONFORMIST ASSERTIVE LEADER GIZMO EAGER Low Prospect Investors Low C O M M I T M E N T

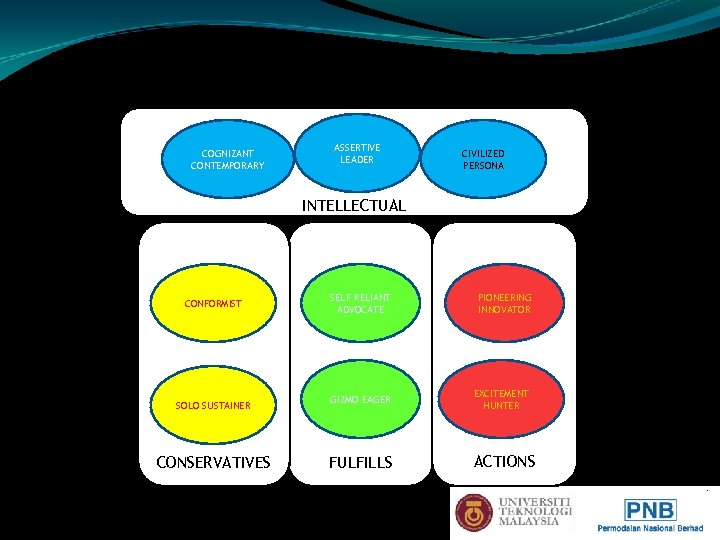

6. 12 The Shared Value Among Existing Consumer Psychographics Segment COGNIZANT CONTEMPORARY ASSERTIVE LEADER CIVILIZED PERSONA INTELLECTUAL CONFORMIST SOLO SUSTAINER CONSERVATIVES SELF RELIANT ADVOCATE PIONEERING INNOVATOR GIZMO EAGER EXCITEMENT HUNTER FULFILLS ACTIONS

7. 0 Managerial Implications • Market segmentation as a means of establishing the right positioning for the product and enhance the brand’s real value and equity. • On the tactical level, psychographic variables can be applied to the design of the marketing communications tools. It will be able to provide an input to improved media selection or better advertising copy treatment. • Malaysian Unit Trust market is still not reaching maturity stage. It showed by the homogeneity characteristics of all the segments identified.

Managerial Implications (cont. ) • Psychographic provides depth in understanding of consumer market. - to develop a more effective segmentation strategy, a psychographic based segmentation should be applied. - while demographic is necessary for effectively targeting the consumer, psychographic is indispensable for understanding the consumer. Hence the psychographic variable should be used as the main basis for segmenting the market and supported by the demographic variables.

References Bone, P. F, 1991. “Identifying mature segments”, The Journal of Service Marketing, Vol. 5(Winter), pp. 47 -60. Bojanic, D. C. , 2007, “Customer profile of the “carryout” segment for restaurants”, International Journal of Contemporary Hospitality Management, Vol. 19 No. 1, pp. 21 -31 Chin, F. L, 2002. “Segmenting customer brand preference: demographic or psychographic”, Journal of Product & Brand Management, Vol. 11 No. 4, pp. 249 -268. Engel, J. F. ; Blackwell, R. D. and Miniard, P. W. 1996, “Customer Behaviour”, 7 th ed. , The Dryden Press, Hinsdale, IL. Divine, R. L. and Lepisto, L. , 2005. “Analysis of the healthy lifestyle consumer”, Journal of Consumer Marketing, Vol. 22 No. 5, pp. 275 -283. Fraj, E. and Martinez, E. , 2006. “Environmental values and lifestyles as determining factors of ecological consumer behaviour: an empirical analysis, Journal of Consumer Marketing, Vol. 23 No. 3, pp. 133 -144. Gonzalez, A. N. and Bello, L. , 2002. “The construct “lifestyle” in market segmentation: The behaviour of tourist consumers”, European Journal of Marketing, Vol. 36 No. 1/2, pp. 5185. 49

References Kesic, T. and Piri-Rajh, S. , 2003. “Market segmentation on the basis of food-related lifestyles of Croatian families”, British Food Journal, Vol. 105 No. 3, pp. 162 -174. Kotler, P. and Armstrong, G. , 2007. Principles of Marketing, 11 th ed. , Prentice Hall International, Englewood Cliffs, NJ. Kucukemiroglu, O. , 1999. “Market segmentation by using consumer lifestyle dimensions and ethnocentrism: An empirical study”, European Journal of Marketing, Vol. 33 No. 5/6, pp. 470487. Minhas, R. S. and Jacobs, E. M. , 1996. “Benefit segmentation by factor analysis: an improved method of targeting customers for financial services”, International Journal of Bank Marketing, Vol. 14 No. 3, pp. 3 -13. Oates, B; Shufeldt, L. and Vaught, B. , 1996. “A psychographic study of the elderly and retail store attributes”, Journal of Consumer Marketing, Vol. 13 No. 6, pp. 14 -27. Orth, U. R. ; Mc. Daniel, M. ; Shellhammer, T. and Lopetcharat, K, 2004. “Promoting brand benefits: the role of consumer psychographics and lifestyle”, Journal of Consumer Marketing, Vol. 21, No. 3, pp. 97 -108. Quinn, L; Hines, T. and Bennison, D. , 2007. “Making sense of market segmentation: a fashion retailing case”, European Journal of Marketing, Vol. 41 No. 5/6, pp. 439 -465. 50

References Reisenwitz, T. and Iyer, R. , 2007. “A comparison of younger and older baby boomers: investigating the viability of cohort segmentation”, Journal of Consumer Marketing, Vol. 24 No. 4, pp. 202 -213. Segal, M. N. and Giacobbe, R. W. , 1994. “Market Segmentation and competitive analysis for supermarket retailing”, International Journal of Retail & Distribution Management, Vol. 22 No. 1, pp. 38 -48. Solomon, M. R. ; Marshall, G. W. and Stuart, E. W. , 2008. Marketing: real people, real choices, 5 th ed. , Prentice Hall International, Englewood Cliffs, NJ. SRI Consulting 1997. Investor Styles: A Psychographic Segmentation, Consumer Financial Decisions, pp. 1 -3. Tam, J. L. M. and Tai, S. H. C. , 1998. ‘The psychographic segmentation of the female market in Greater China”, International Marketing Review, Vol. 15 No. 1, pp. 61 -77. Todd, S. ; Lawson, R. and Faris, F. , 1997. “A Lifestyle Analysis of New Zealand Consumers”, Asia Pacific Journal of Marketing and Logistics, pp. 30 -47. Wall, G. and Mitchell, V. , 2005. “Demographic characteristics of consumers who find it difficult to decide”, Marketing Intelligence & Planning, Vol. 23 No. 3, pp. 281 -295. 51

Appendix B No. Date Survey Station 1 1– 5 February 2008 Kuala Lumpur, PJ, Putrajaya, Rawang 2 4 February 2008 Ipoh 3 6– 7 February 2008 Shah Alam, Kelang, Sabak Bernam 4 8 – 10 February 2008 Tanjung Malim 5 2– 5 February 2008 Kuantan, Temerloh, Bandar Muazam, Pekan, Maran, Kuala Lipis 6 6– 7 February 2008 Kuala Terengganu, Jertih, Setiu, Dungun, Paka & Kerteh 7 8 – 10 February 2008 Kota Bahru, Jeli, Bachok, 8 7– 8 February 2008 Pulau Pinang, Butterworth, Seberang Prai, Kepala Batas 9 5– 6 February 2008 Alor Setar, Jerlun, Pendang, Changlun, Yan, Kulim February 2008 Kangar, Langkawi February 2008 Seremban, Rembau, Gemas, Tampin Research Instrument 10 11 6 2– 5 12 6 February 2008 Melaka Tengah, Merlimau, Jasin 13 7 – 10 February 2008 Batu Pahat, Muar, Mersing, Pontian & Johor Bahru 25 – 28 February 2008 Kota Kinabalu, Tuaran, Ranau, Beufort, Tamparuli 14 15 3 -7 March 2008 Kuching, Samarahan, Sri Aman, Sibu, Bintulu, Miri, Limbang 16 16 – 20 August 2008 Tawau, Lahad Datu & Sandakan 17 16 – 20 August 2008 Labuan 52 Self-completed questionnaire

List of Unit Trusts Brand Number of Products Appendix D > RM 1. 00 per unit ASM 17 0 (0. 18 -0. 64) Asia Unit Trust 6 0 (0. 27 -0. 83) Affin Fund 6 0 (0. 31 -0. 51) Avenue oneinvest 13 0 (0. 16 -0. 56) Amanah Saham BSN 2 0 (0. 23 -0. 27) Apex 8 0 (0. 17 -0. 49) 53

List of Unit Trusts Brands (cont. ) Brand Number of Products > RM 1. 00 per unit Areca 6 2 (0. 41 -1. 02) Alliance 14 1 (0. 23 -1. 00) AMmutual 42 12 (0. 20 -1. 17) AMassurancelink 10 0 (0. 30 -0. 62) Amanahraya 4 2 (0. 46 -1. 00) BIMB unit trust 4 0 (0. 21 -0. 51) 54

List of Unit Trusts Brands (cont. ) Brand Number of Products > RM 1. 00 per unit CIMB wealth 25 5 (0. 35 -1. 10) CRM trust 9 0 (0. 36 -0. 60) CIMB asset 38 5 (0. 20 -1. 13) HLG unit trust 35 0 (0. 10 -0. 70) Hwang. DBS 22 6 (0. 22 -1. 10) Inter-pasific 3 0 (0. 19 -0. 50) 55

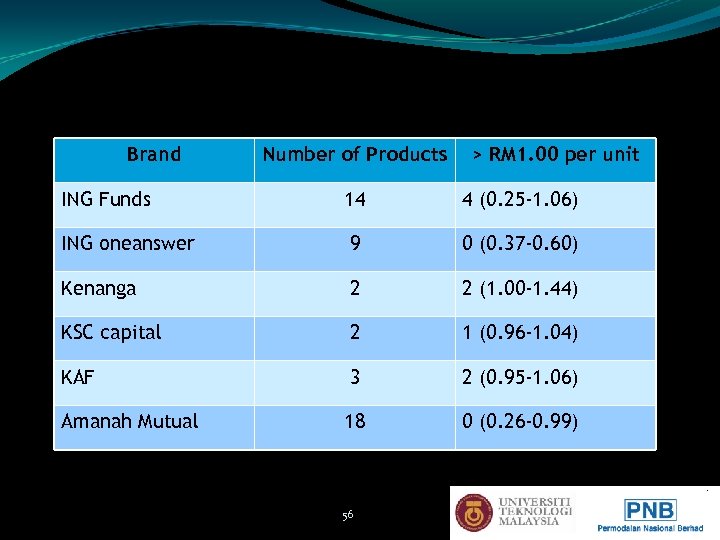

List of Unit Trusts Brands (cont. ) Brand Number of Products > RM 1. 00 per unit ING Funds 14 4 (0. 25 -1. 06) ING oneanswer 9 0 (0. 37 -0. 60) Kenanga 2 2 (1. 00 -1. 44) KSC capital 2 1 (0. 96 -1. 04) KAF 3 2 (0. 95 -1. 06) Amanah Mutual 18 0 (0. 26 -0. 99) 56

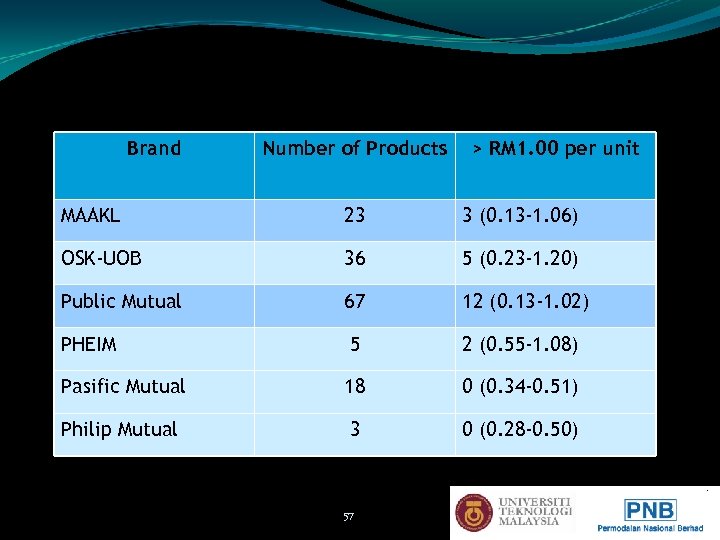

List of Unit Trusts Brands (cont. ) Brand Number of Products > RM 1. 00 per unit MAAKL 23 3 (0. 13 -1. 06) OSK-UOB 36 5 (0. 23 -1. 20) Public Mutual 67 12 (0. 13 -1. 02) PHEIM 5 2 (0. 55 -1. 08) Pasific Mutual 18 0 (0. 34 -0. 51) Philip Mutual 3 0 (0. 28 -0. 50) 57

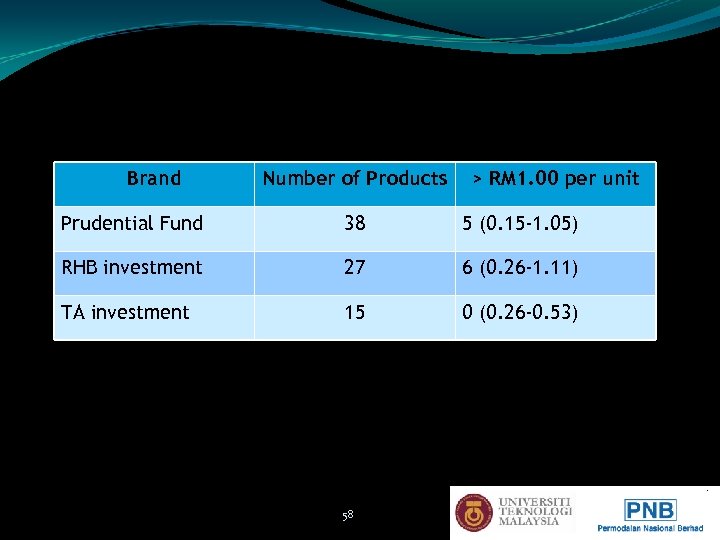

List of Unit Trusts Brands (cont. ) Brand Number of Products > RM 1. 00 per unit Prudential Fund 38 5 (0. 15 -1. 05) RHB investment 27 6 (0. 26 -1. 11) TA investment 15 0 (0. 26 -0. 53) 58

Appendix E Investment-Linked Funds 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Allianz life AIA/AIA Takaful TM Asia AXA Affin CIMB Aviva/Takaful Great Eastern Ass. Hong Leong Ass. HSBC Amanah HLTMT ING Insurance 11. Takaful Ikhlas 12. Manulife 13. MAA/MAA International/ MAAIA/Takaful 14. Mayban Life 15. ETIQA/Takaful 16. MCIS Zurich 17. Prudential Assurance/ P-BSN Takaful 18. Takaful Malaysia 19. UNI ASIA life Insurance 59

The Team 1. Assoc. Prof. Dr. Hj. Rohaizat Baharun (Leader) 2. Assoc. Prof. Dr. Abu Bakar Abdul Hamid 3. Ahmad Sharifuddin Shamsuddin 4. Norzaidahwati Zaidin 5. Norzafir Md. Salleh 6. Zuraidah Sulaiman (Currently attached to the Sydney University of Technology) 45 60

1288cce9f8099c5ebaa607760dc9e7ba.ppt