09.12.2017 1 Topic 3. Integration after M&A deals

14240-topic_3.ppt

- Количество слайдов: 41

09.12.2017 1 Topic 3. Integration after M&A deals Why M&As very often lead to market failures? Stages of a successful M&A Value creation as a result of M&A Key issues of companies’ integration

09.12.2017 1 Topic 3. Integration after M&A deals Why M&As very often lead to market failures? Stages of a successful M&A Value creation as a result of M&A Key issues of companies’ integration

09.12.2017 2 1. Why M&As very often lead to market failures?

09.12.2017 2 1. Why M&As very often lead to market failures?

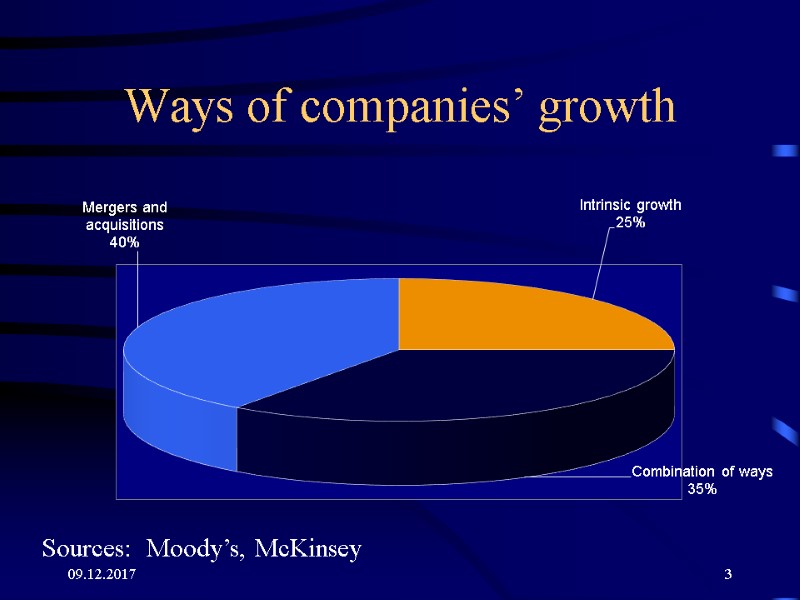

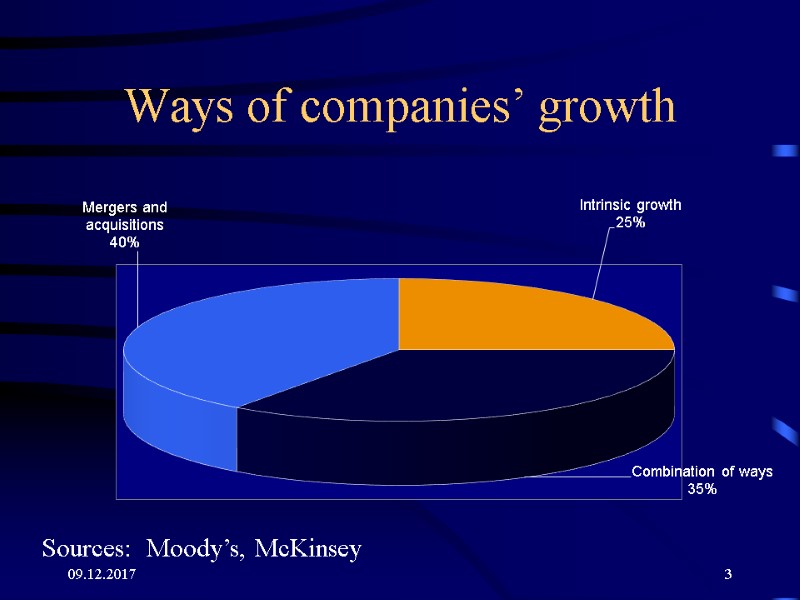

09.12.2017 3 Ways of companies’ growth Sources: Moody’s, McKinsey

09.12.2017 3 Ways of companies’ growth Sources: Moody’s, McKinsey

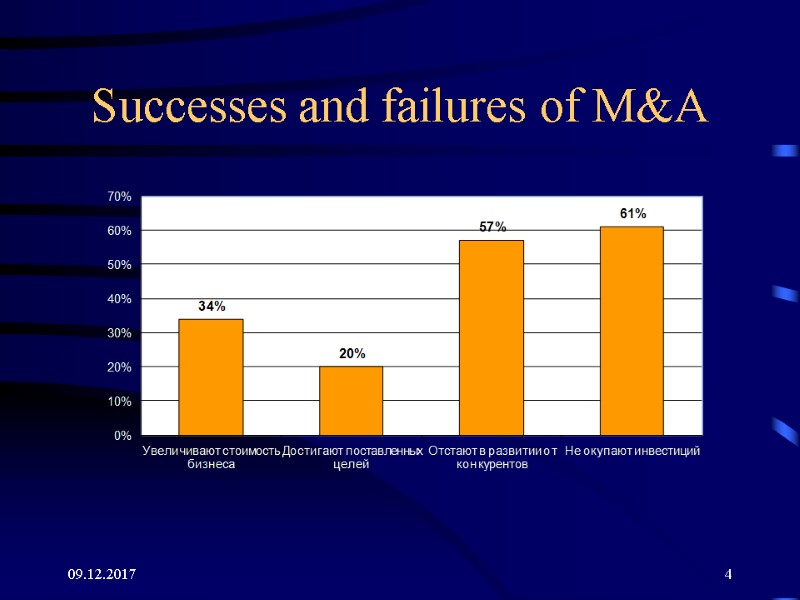

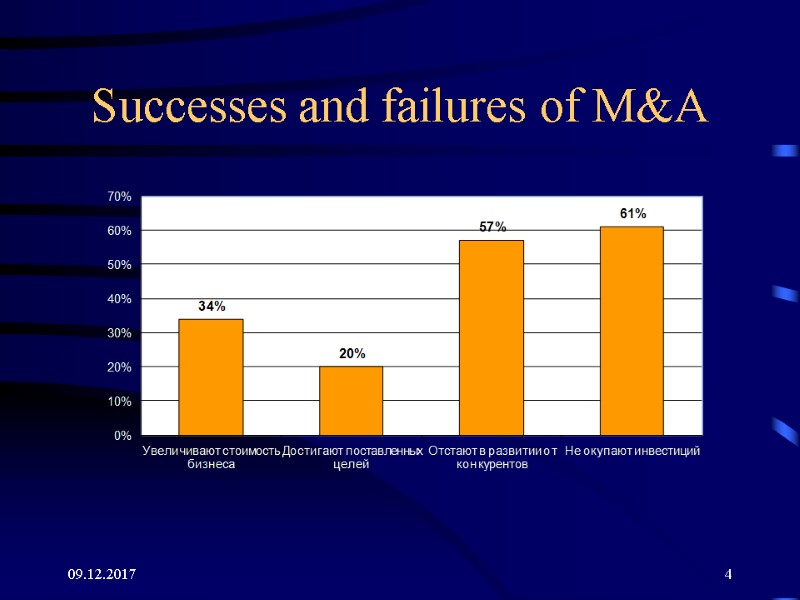

09.12.2017 4 Successes and failures of M&A

09.12.2017 4 Successes and failures of M&A

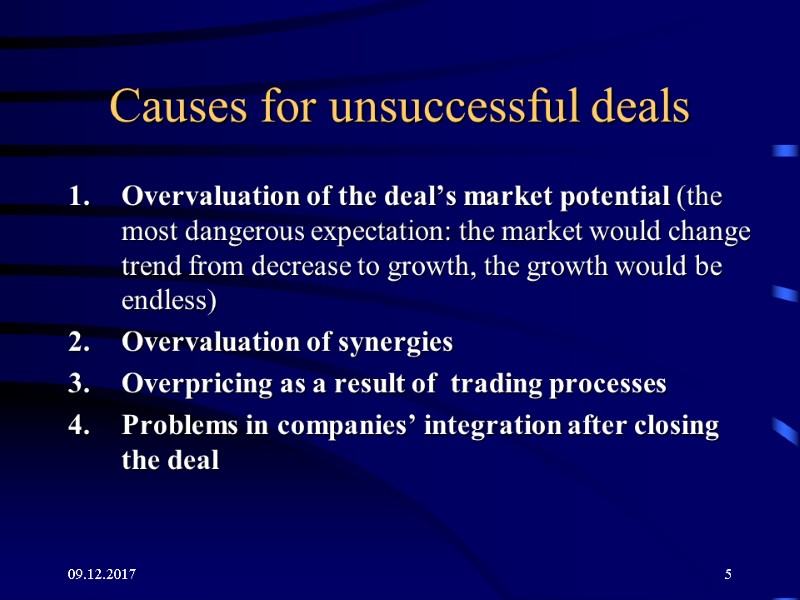

09.12.2017 5 Causes for unsuccessful deals Overvaluation of the deal’s market potential (the most dangerous expectation: the market would change trend from decrease to growth, the growth would be endless) Overvaluation of synergies Overpricing as a result of trading processes Problems in companies’ integration after closing the deal

09.12.2017 5 Causes for unsuccessful deals Overvaluation of the deal’s market potential (the most dangerous expectation: the market would change trend from decrease to growth, the growth would be endless) Overvaluation of synergies Overpricing as a result of trading processes Problems in companies’ integration after closing the deal

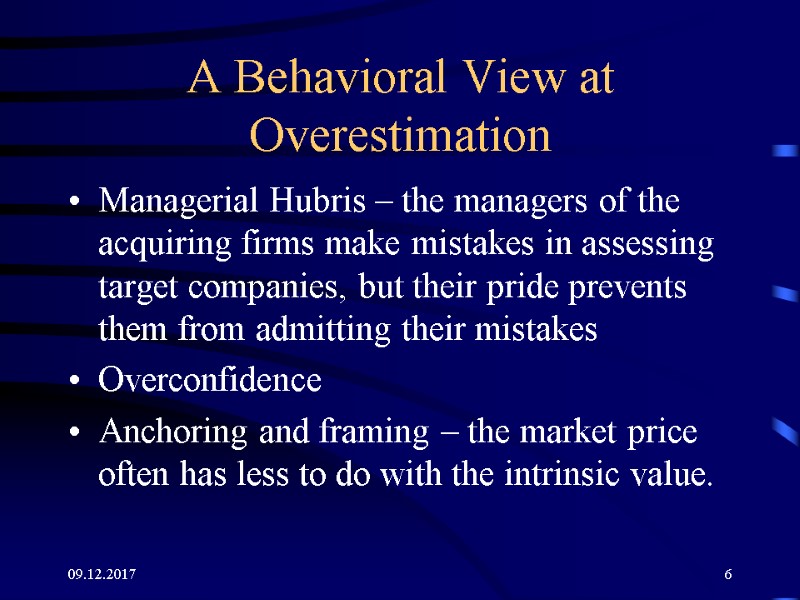

A Behavioral View at Overestimation Managerial Hubris – the managers of the acquiring firms make mistakes in assessing target companies, but their pride prevents them from admitting their mistakes Overconfidence Anchoring and framing – the market price often has less to do with the intrinsic value. 09.12.2017 6

A Behavioral View at Overestimation Managerial Hubris – the managers of the acquiring firms make mistakes in assessing target companies, but their pride prevents them from admitting their mistakes Overconfidence Anchoring and framing – the market price often has less to do with the intrinsic value. 09.12.2017 6

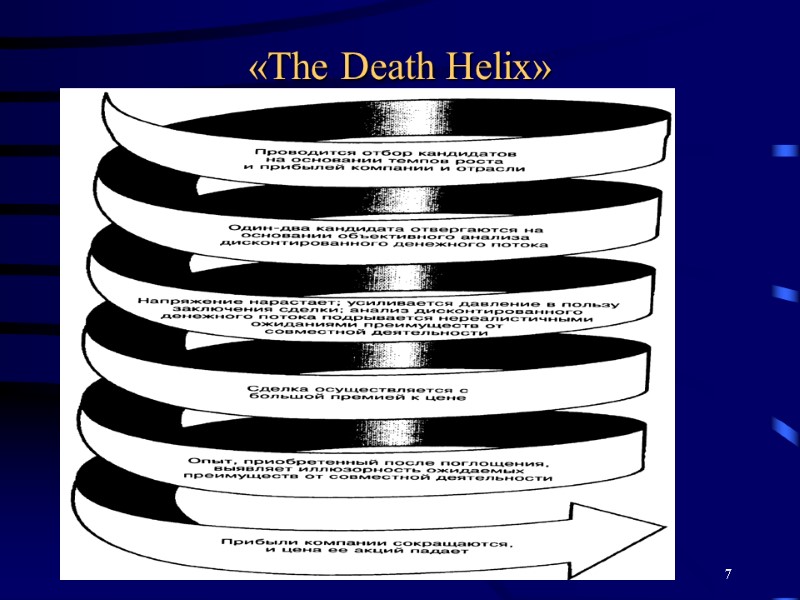

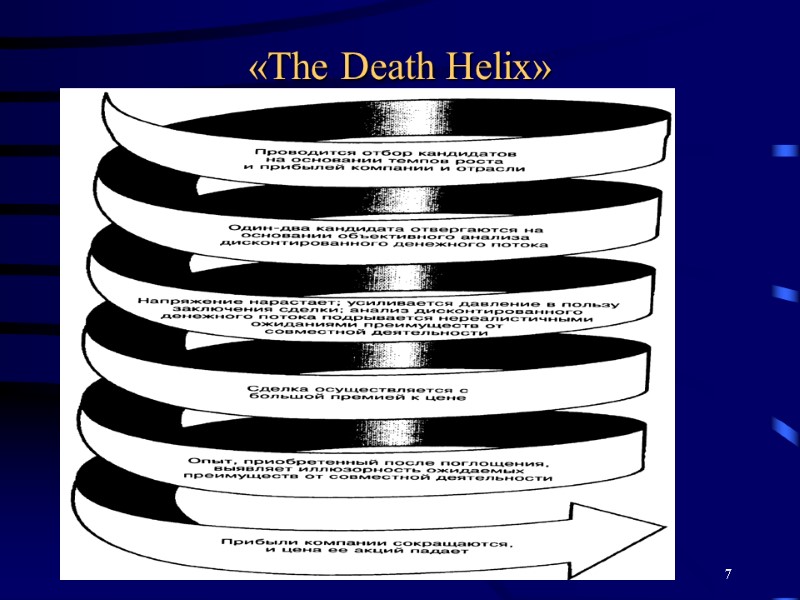

09.12.2017 7 «The Death Helix»

09.12.2017 7 «The Death Helix»

09.12.2017 8 The value may be added through the deal if: The target is adequate and terms of the deal are correct; The integration process meets the requirements and objectives of a specific situation; Each stage of the integration is planned and implemented thoroughly.

09.12.2017 8 The value may be added through the deal if: The target is adequate and terms of the deal are correct; The integration process meets the requirements and objectives of a specific situation; Each stage of the integration is planned and implemented thoroughly.

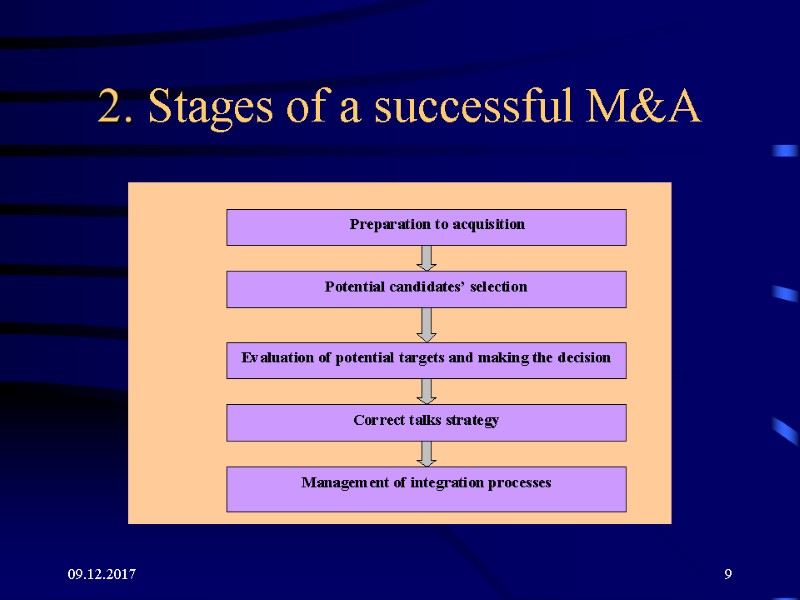

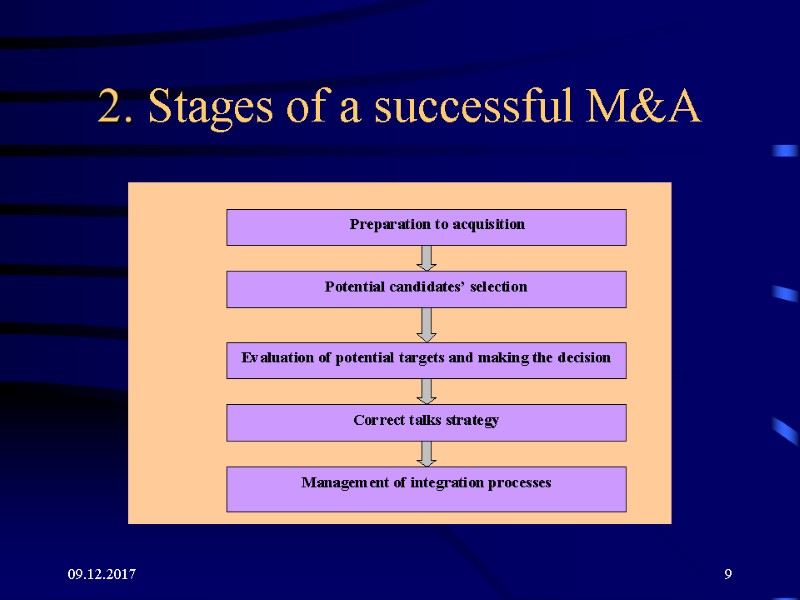

09.12.2017 9 2. Stages of a successful M&A

09.12.2017 9 2. Stages of a successful M&A

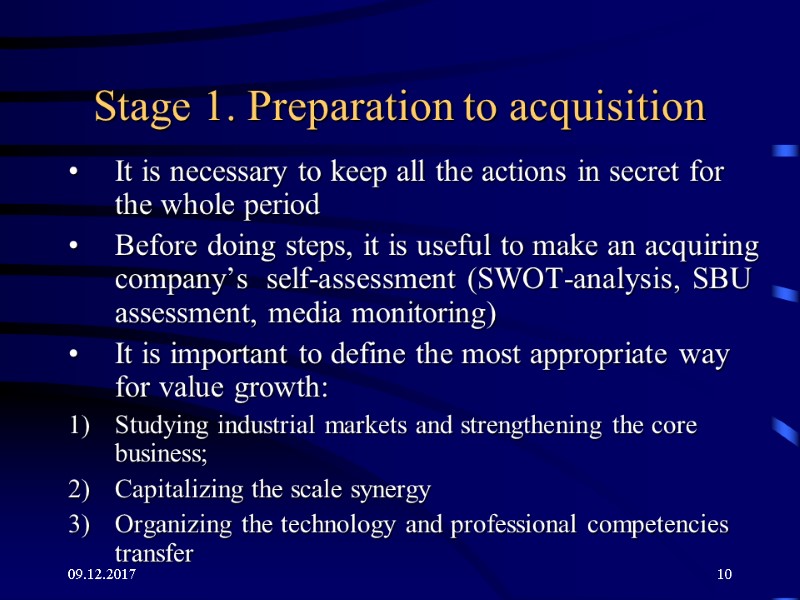

09.12.2017 10 Stage 1. Preparation to acquisition It is necessary to keep all the actions in secret for the whole period Before doing steps, it is useful to make an acquiring company’s self-assessment (SWOT-analysis, SBU assessment, media monitoring) It is important to define the most appropriate way for value growth: Studying industrial markets and strengthening the core business; Capitalizing the scale synergy Organizing the technology and professional competencies transfer

09.12.2017 10 Stage 1. Preparation to acquisition It is necessary to keep all the actions in secret for the whole period Before doing steps, it is useful to make an acquiring company’s self-assessment (SWOT-analysis, SBU assessment, media monitoring) It is important to define the most appropriate way for value growth: Studying industrial markets and strengthening the core business; Capitalizing the scale synergy Organizing the technology and professional competencies transfer

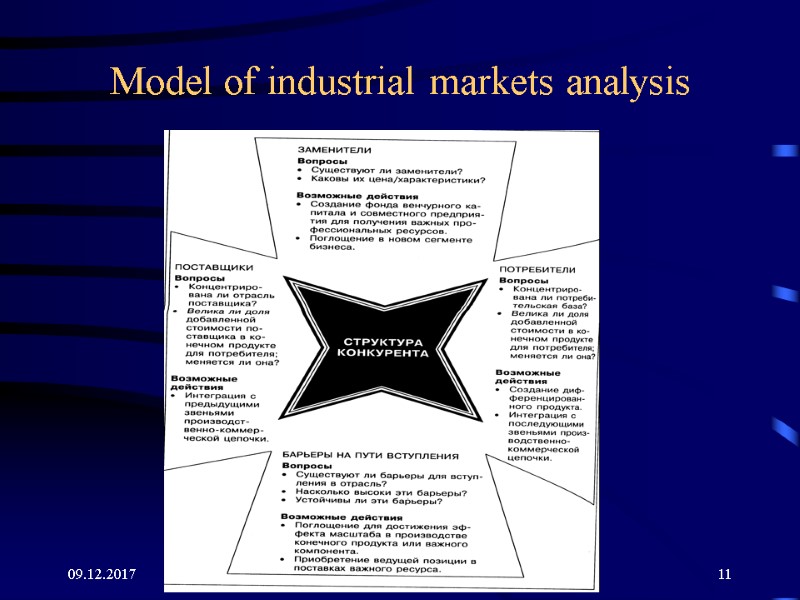

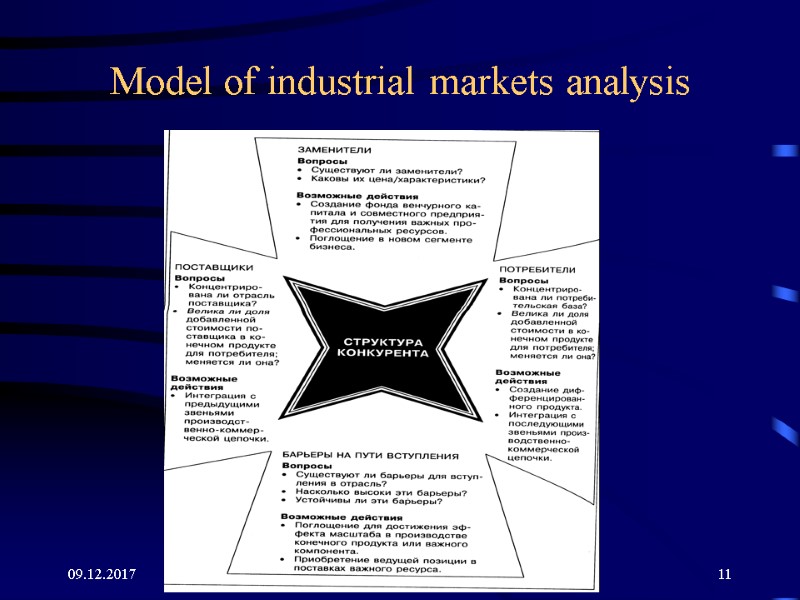

09.12.2017 11 Model of industrial markets analysis

09.12.2017 11 Model of industrial markets analysis

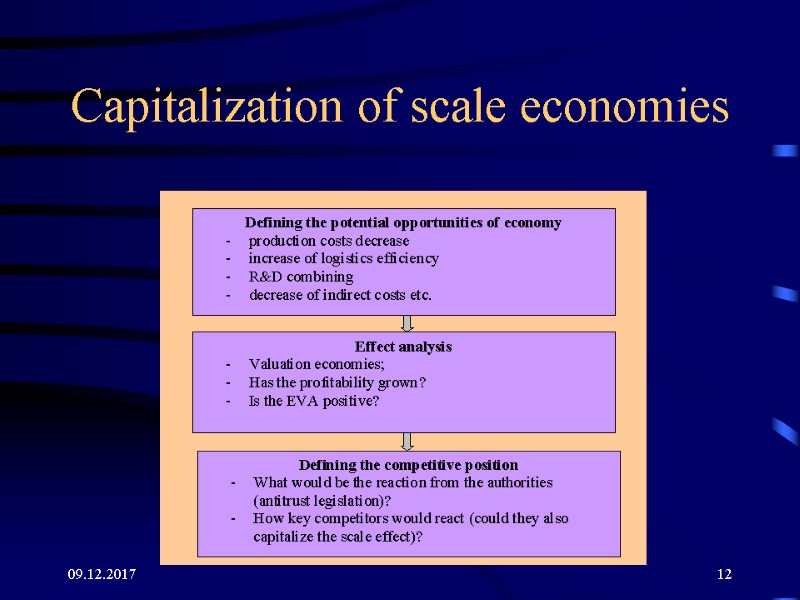

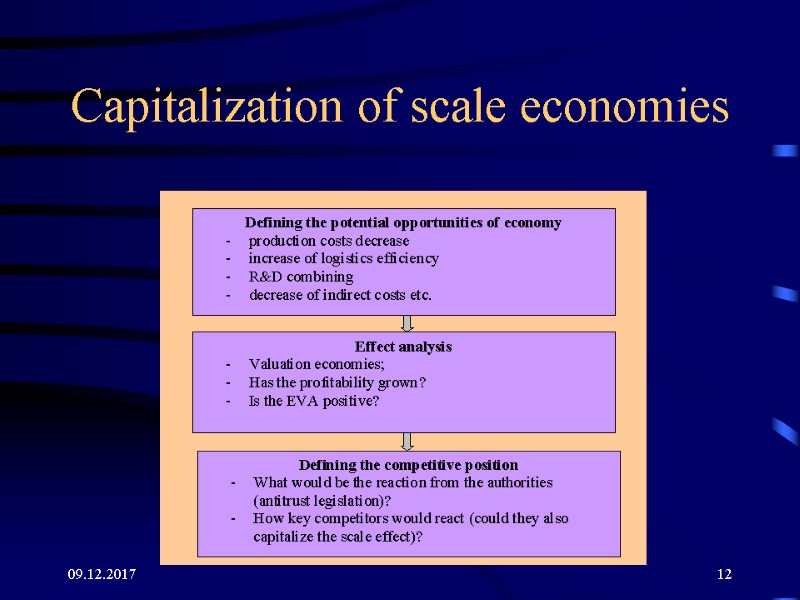

09.12.2017 12 Capitalization of scale economies

09.12.2017 12 Capitalization of scale economies

09.12.2017 13 Stage 2. Selection of targets Defining the selection criteria. Planning the role of investment banks and consultants. Priorities setting Companies studying

09.12.2017 13 Stage 2. Selection of targets Defining the selection criteria. Planning the role of investment banks and consultants. Priorities setting Companies studying

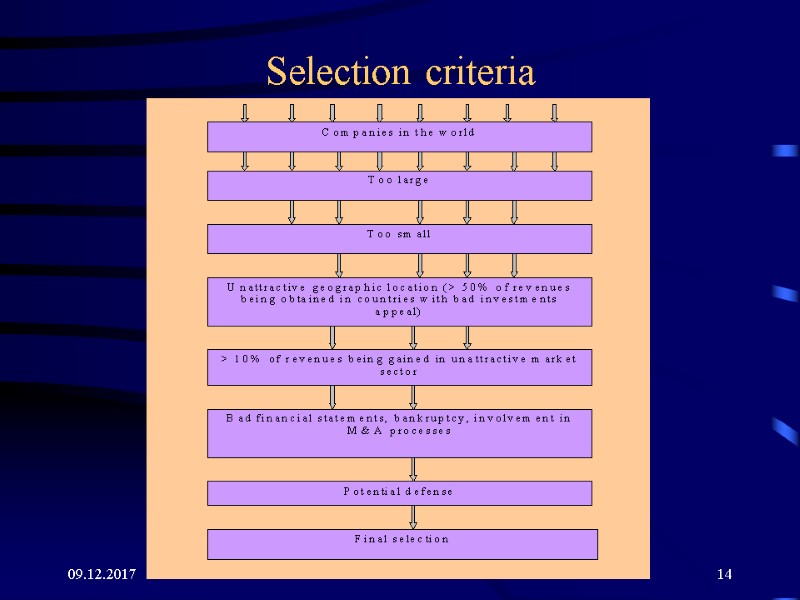

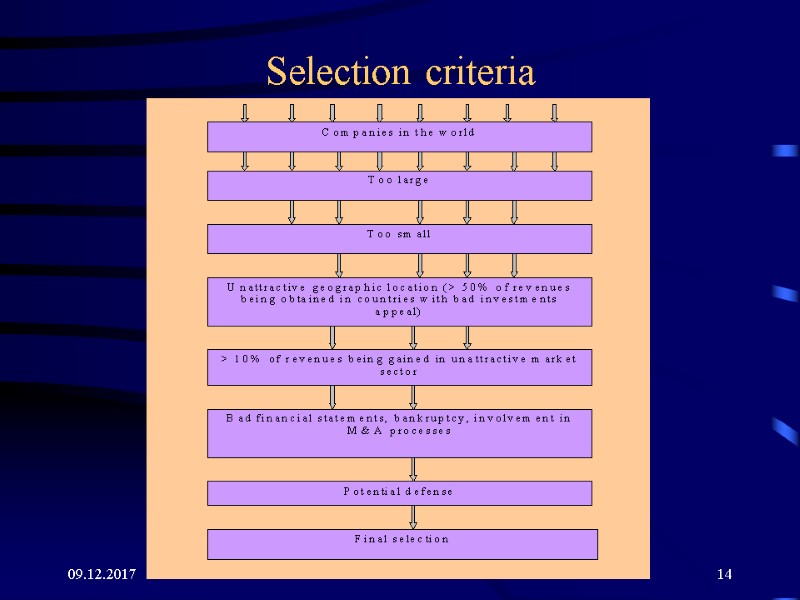

09.12.2017 14 Selection criteria

09.12.2017 14 Selection criteria

09.12.2017 15 Stage 3. Selected candidates’ valuation How to compensate the premium for acquisition; To find real advantages from acquisition and assess them; To develop the company restructuring plan; To use financial engineering (lease-back agreements, trust agreements with royalty, risk hedging etc.).

09.12.2017 15 Stage 3. Selected candidates’ valuation How to compensate the premium for acquisition; To find real advantages from acquisition and assess them; To develop the company restructuring plan; To use financial engineering (lease-back agreements, trust agreements with royalty, risk hedging etc.).

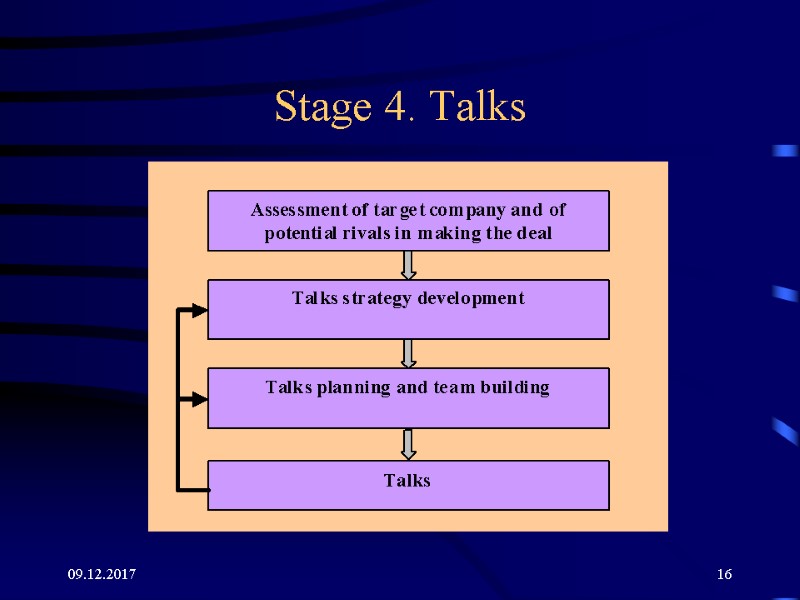

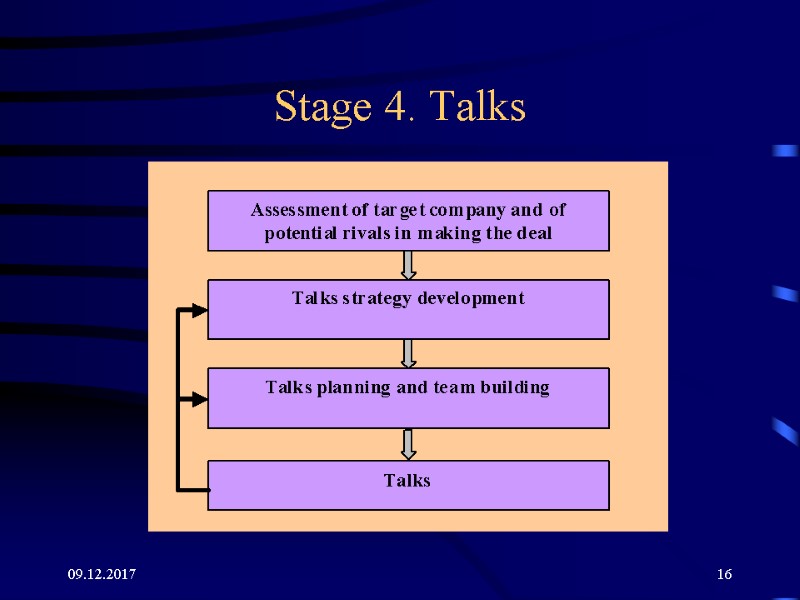

09.12.2017 16 Stage 4. Talks

09.12.2017 16 Stage 4. Talks

09.12.2017 17 What to clarify in talks Cost of acquisition for a bidder Value of target company for its owners and other potential acquirers Financial potential of owners and probable other acquirers Strategy and motivation for owners and probable buyers Mediators, their methods and experience in previous deals Potential defense actions

09.12.2017 17 What to clarify in talks Cost of acquisition for a bidder Value of target company for its owners and other potential acquirers Financial potential of owners and probable other acquirers Strategy and motivation for owners and probable buyers Mediators, their methods and experience in previous deals Potential defense actions

09.12.2017 18 Principal talks strategies Price: low or high? Information what we want to obtain from managers of the target company How much information they are ready to transfer in our possession? Tax releases Personal work with the board members

09.12.2017 18 Principal talks strategies Price: low or high? Information what we want to obtain from managers of the target company How much information they are ready to transfer in our possession? Tax releases Personal work with the board members

09.12.2017 19 Deal conducting First contacts Initial due diligence Signing the memorandum on intentions Final due diligence. Deal announcement. Deal closing.

09.12.2017 19 Deal conducting First contacts Initial due diligence Signing the memorandum on intentions Final due diligence. Deal announcement. Deal closing.

09.12.2017 20 Problems to solve in integration process What are the long-term objectives of the joined company and how they correspond with short-term tasks? Where are sources of value creation in long-term and short-term horizons and how to capture them? How to raise the organisational effectiveness for a New company? And, finally, how to implement integration strategy to create value and reach the objectives of the deal?

09.12.2017 20 Problems to solve in integration process What are the long-term objectives of the joined company and how they correspond with short-term tasks? Where are sources of value creation in long-term and short-term horizons and how to capture them? How to raise the organisational effectiveness for a New company? And, finally, how to implement integration strategy to create value and reach the objectives of the deal?

09.12.2017 21

09.12.2017 21

09.12.2017 22 3. Creating value in the process of the deal

09.12.2017 22 3. Creating value in the process of the deal

09.12.2017 23 What to take into account: Sources of value creation in the industry? What would be limitations for the joint company (agreements on staff, regulation etc.)? What common features merging companies have? What are their strengths and weaknesses? How large are differences in corporate culture? What managerial tools and style prefers the top manager of the new company and what are his personal interests?

09.12.2017 23 What to take into account: Sources of value creation in the industry? What would be limitations for the joint company (agreements on staff, regulation etc.)? What common features merging companies have? What are their strengths and weaknesses? How large are differences in corporate culture? What managerial tools and style prefers the top manager of the new company and what are his personal interests?

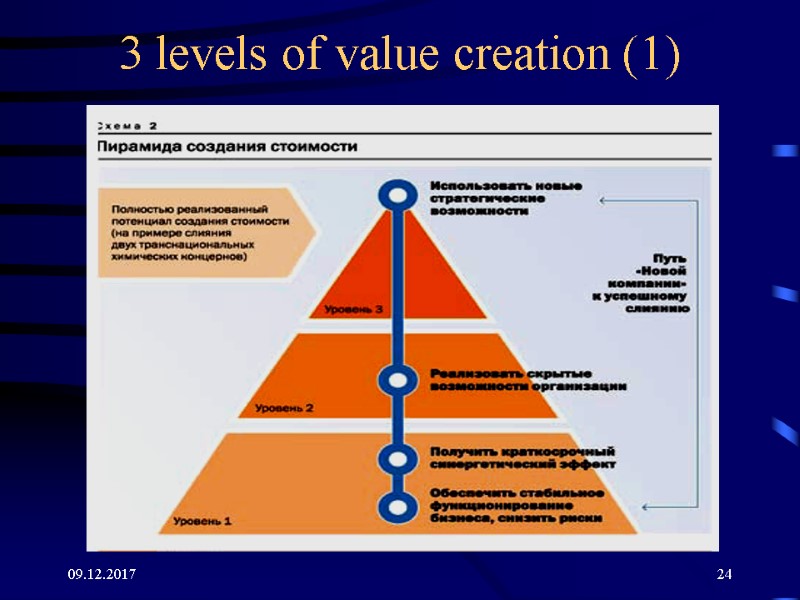

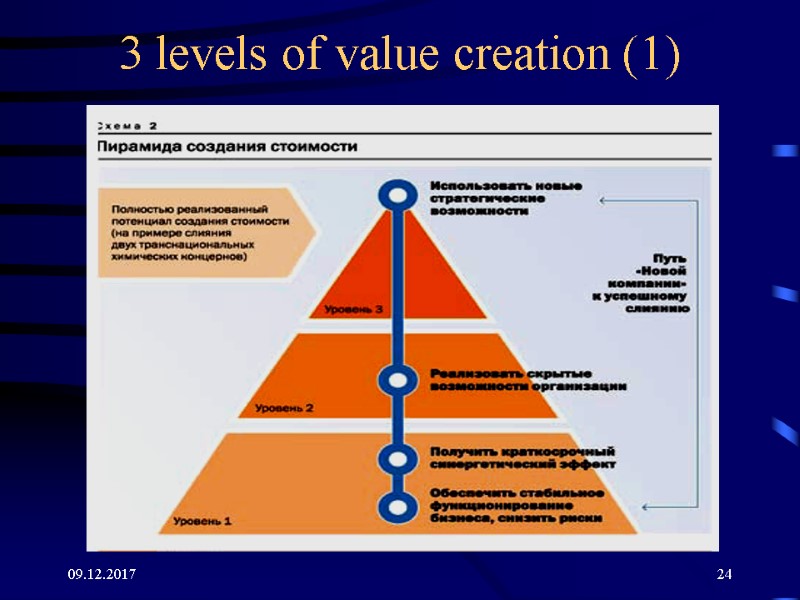

09.12.2017 24 3 levels of value creation (1)

09.12.2017 24 3 levels of value creation (1)

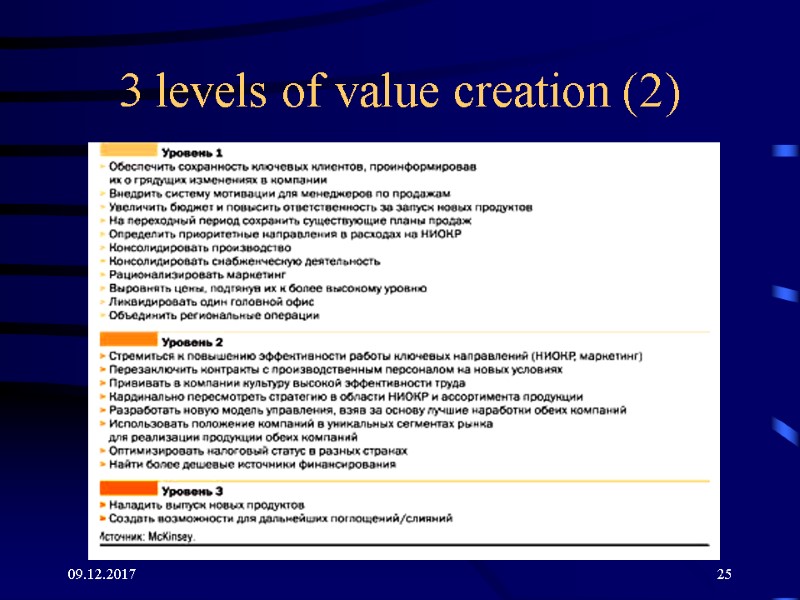

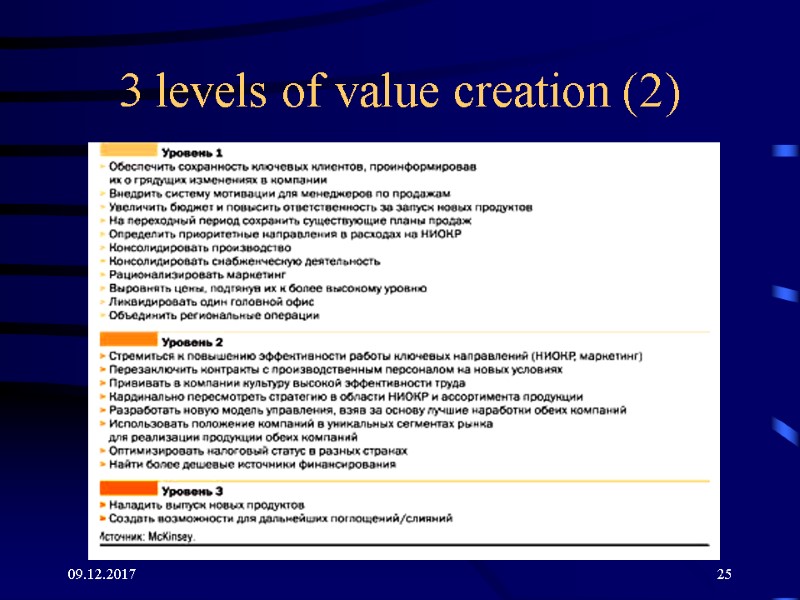

09.12.2017 25 3 levels of value creation (2)

09.12.2017 25 3 levels of value creation (2)

09.12.2017 26 Sources of short-term effects (Ist level) Elimination of doubling and excessive functions and operations through cost decreasing; Equal pricing policy – source for additional income Assets audit and selling excessive, non-working assets Cross-sales organization

09.12.2017 26 Sources of short-term effects (Ist level) Elimination of doubling and excessive functions and operations through cost decreasing; Equal pricing policy – source for additional income Assets audit and selling excessive, non-working assets Cross-sales organization

09.12.2017 27 Why Ist level effects are so important The market expects results and synergies, and these high expectations affect at managers; Quick results approve merger from the personal’s point of view and give impulse to a company’s development 15% of synergies are usually being obtained at first 100 days after the deal closing; Quick short-term results help the sustainability and let managers to pay their attention at strategic prospects

09.12.2017 27 Why Ist level effects are so important The market expects results and synergies, and these high expectations affect at managers; Quick results approve merger from the personal’s point of view and give impulse to a company’s development 15% of synergies are usually being obtained at first 100 days after the deal closing; Quick short-term results help the sustainability and let managers to pay their attention at strategic prospects

09.12.2017 28 How to gain synergies at the first level Clear aims at all the levels of hierarchy Aims should be transferred to tasks for all the employees The plans of value adding are to be the most important ones Aims should be well-balanced Monitoring, control and analysis of changes Transparency of change policy

09.12.2017 28 How to gain synergies at the first level Clear aims at all the levels of hierarchy Aims should be transferred to tasks for all the employees The plans of value adding are to be the most important ones Aims should be well-balanced Monitoring, control and analysis of changes Transparency of change policy

09.12.2017 29 Hidden opportunities (level 2) Re-engineering of business processes Implementation of new business models New factors of efficiency Assets combining Impulse of growth capturing

09.12.2017 29 Hidden opportunities (level 2) Re-engineering of business processes Implementation of new business models New factors of efficiency Assets combining Impulse of growth capturing

09.12.2017 30 New strategic opportunities (level 3) Creation and introducing of new technologies Development and diffusion of new products Entrance at new markets Strengthening of competitive advantages

09.12.2017 30 New strategic opportunities (level 3) Creation and introducing of new technologies Development and diffusion of new products Entrance at new markets Strengthening of competitive advantages

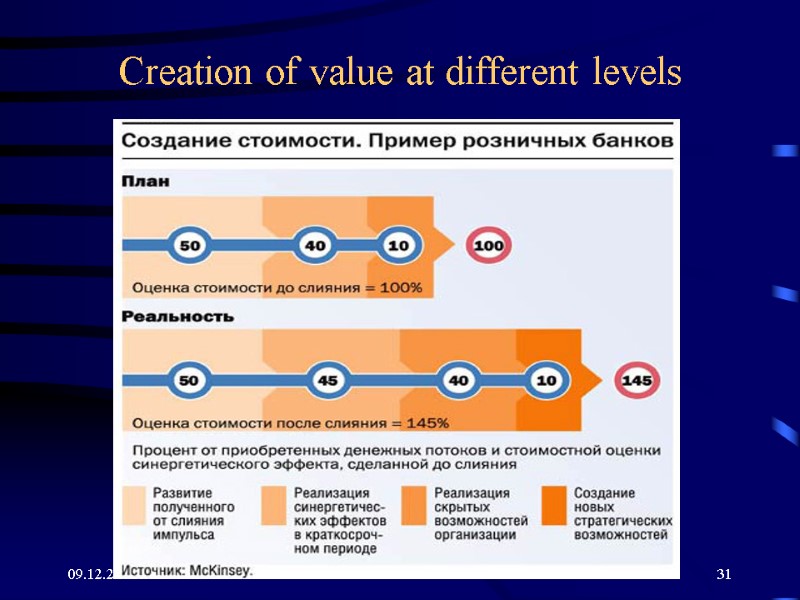

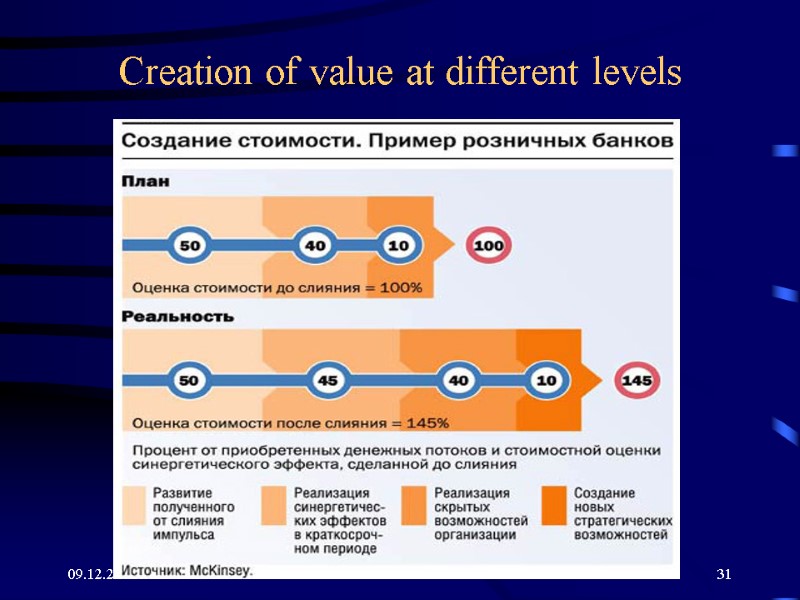

09.12.2017 31 Creation of value at different levels

09.12.2017 31 Creation of value at different levels

09.12.2017 32 4. Key issues of companies’ integration

09.12.2017 32 4. Key issues of companies’ integration

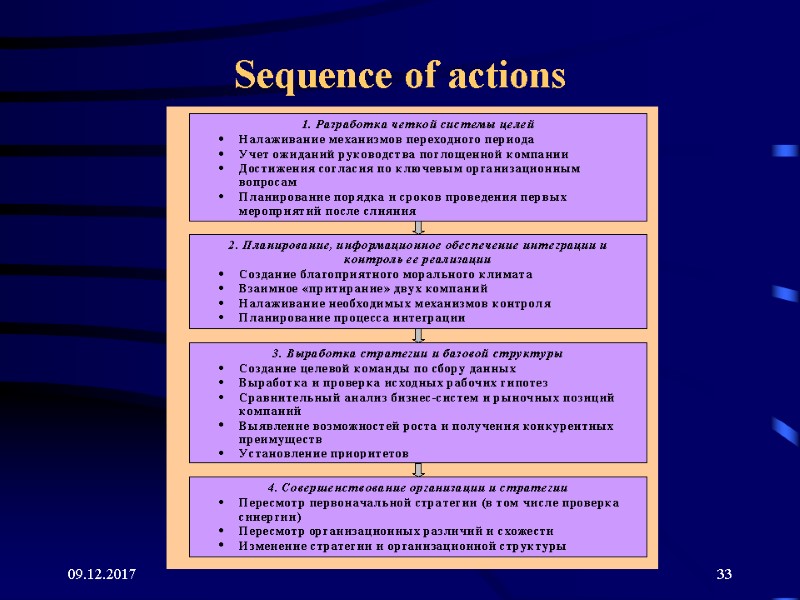

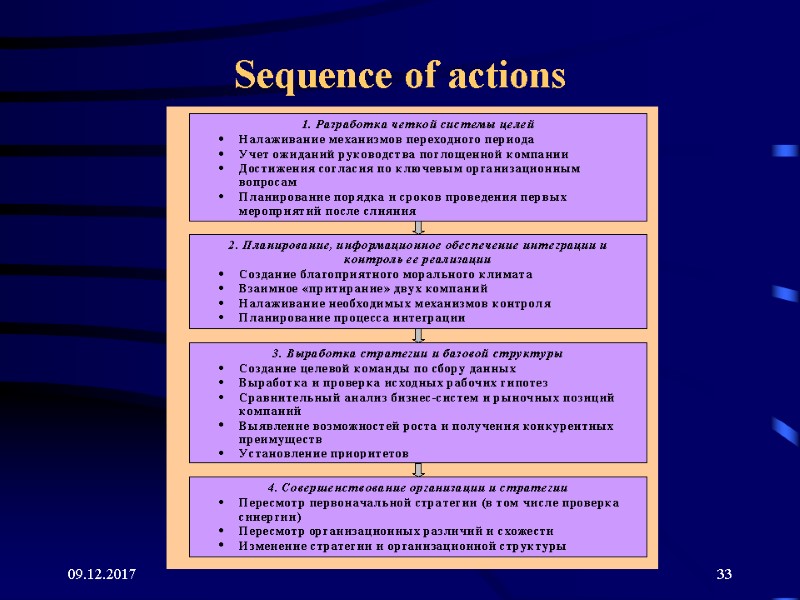

09.12.2017 33 Sequence of actions

09.12.2017 33 Sequence of actions

09.12.2017 34 Acquirers’ preferences 43% of potential acquirers claim they want to keep the staff of the target company 37% want to change top management and chief accountant 18% intend to renew all the staff Source: www.deloshop.ru

09.12.2017 34 Acquirers’ preferences 43% of potential acquirers claim they want to keep the staff of the target company 37% want to change top management and chief accountant 18% intend to renew all the staff Source: www.deloshop.ru

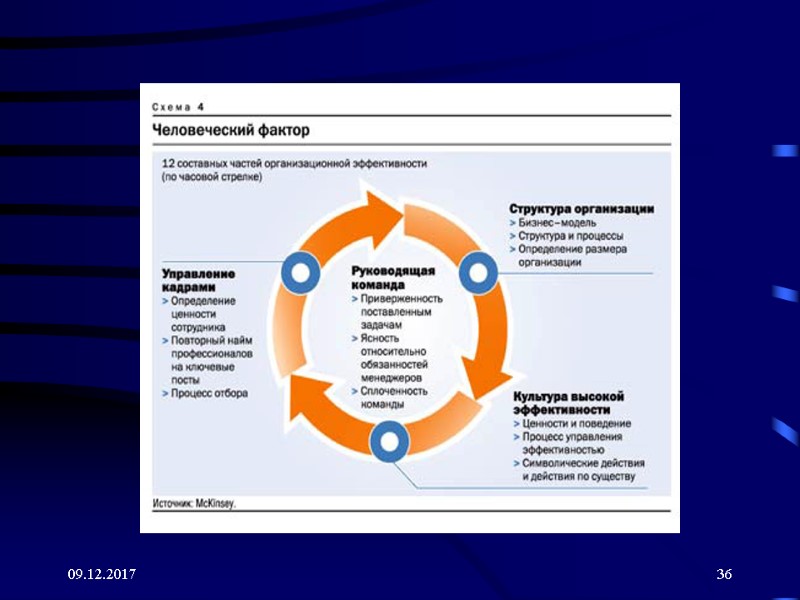

09.12.2017 35 Organizational efficiency Forming the management team Developing the adequate structure Development and nursing the favourable organisational culture Development the staff competences

09.12.2017 35 Organizational efficiency Forming the management team Developing the adequate structure Development and nursing the favourable organisational culture Development the staff competences

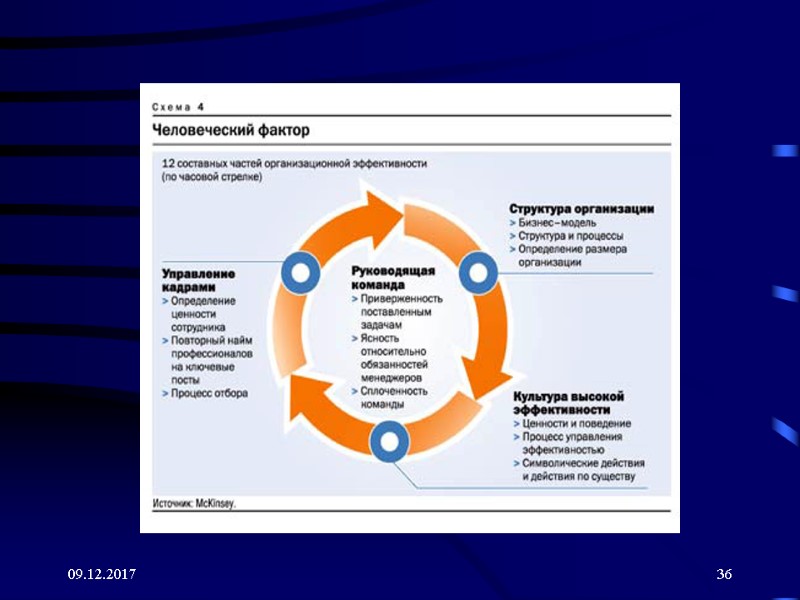

09.12.2017 36

09.12.2017 36

09.12.2017 37 Key decisions Plan of the merger? Who will lead? How to make changes?

09.12.2017 37 Key decisions Plan of the merger? Who will lead? How to make changes?

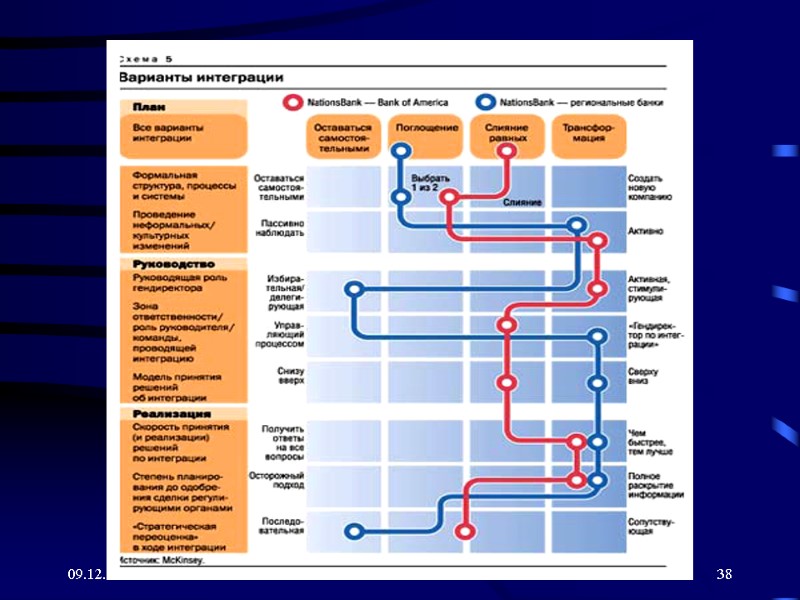

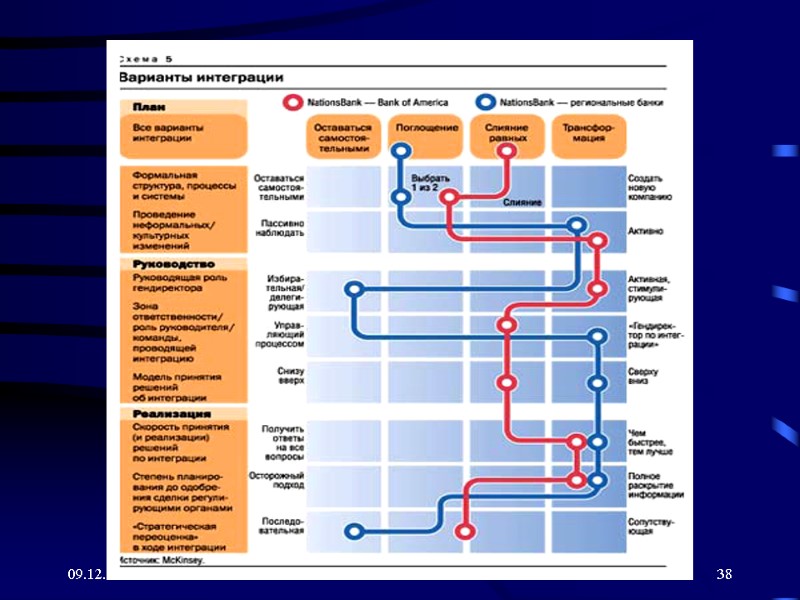

09.12.2017 38

09.12.2017 38

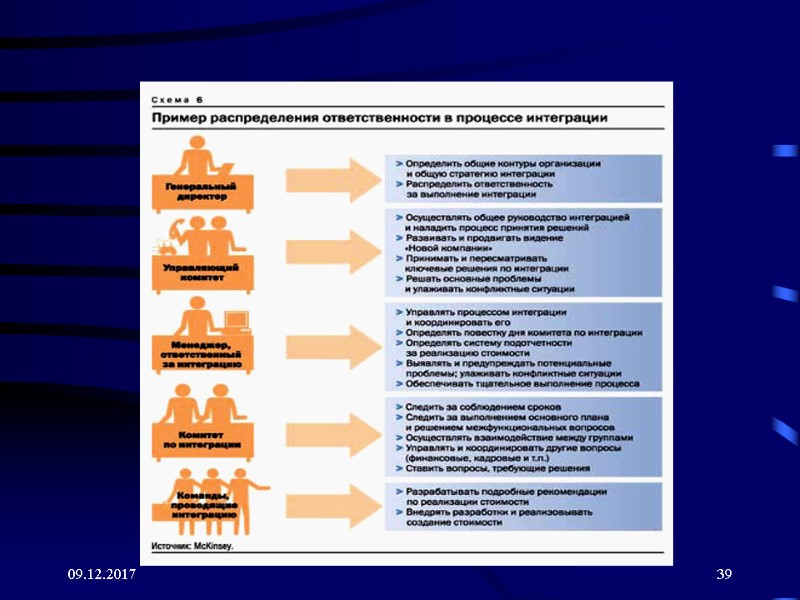

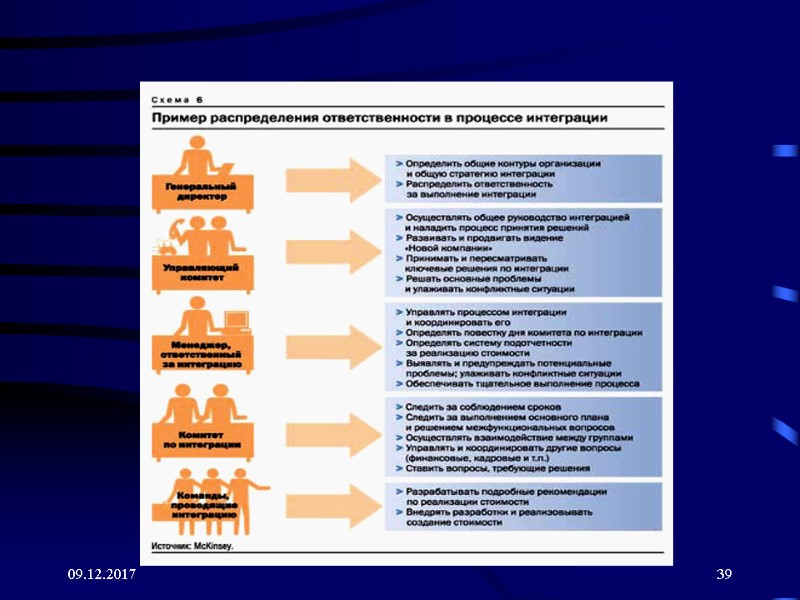

09.12.2017 39

09.12.2017 39

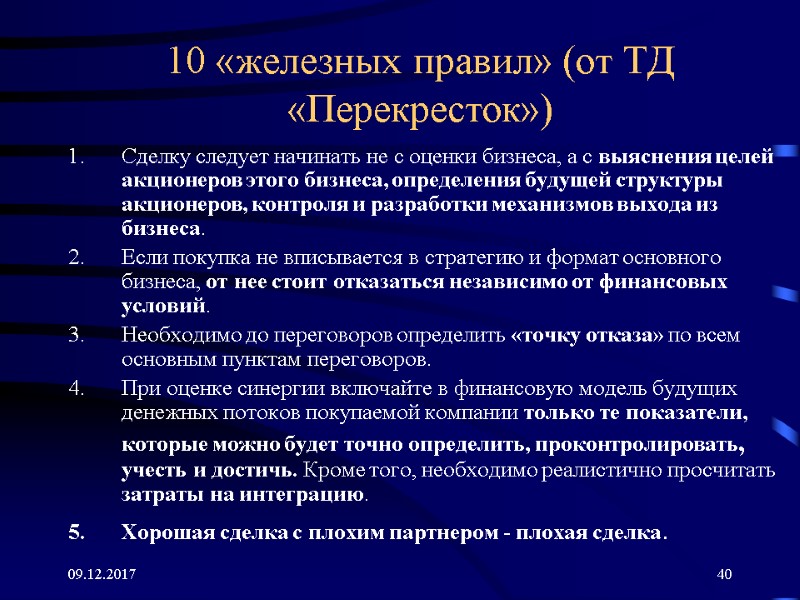

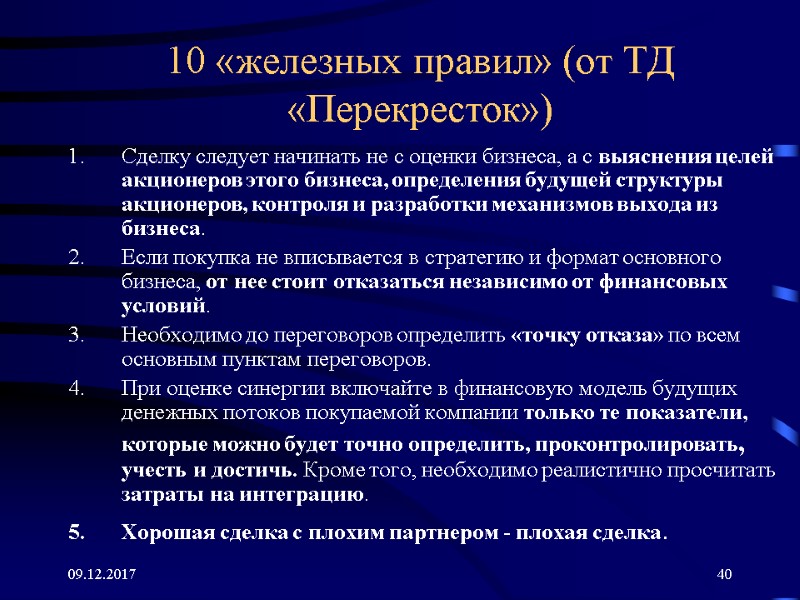

09.12.2017 40 10 «железных правил» (от ТД «Перекресток») Сделку следует начинать не с оценки бизнеса, а с выяснения целей акционеров этого бизнеса, определения будущей структуры акционеров, контроля и разработки механизмов выхода из бизнеса. Если покупка не вписывается в стратегию и формат основного бизнеса, от нее стоит отказаться независимо от финансовых условий. Необходимо до переговоров определить «точку отказа» по всем основным пунктам переговоров. При оценке синергии включайте в финансовую модель будущих денежных потоков покупаемой компании только те показатели, которые можно будет точно определить, проконтролировать, учесть и достичь. Кроме того, необходимо реалистично просчитать затраты на интеграцию. Хорошая сделка с плохим партнером - плохая сделка.

09.12.2017 40 10 «железных правил» (от ТД «Перекресток») Сделку следует начинать не с оценки бизнеса, а с выяснения целей акционеров этого бизнеса, определения будущей структуры акционеров, контроля и разработки механизмов выхода из бизнеса. Если покупка не вписывается в стратегию и формат основного бизнеса, от нее стоит отказаться независимо от финансовых условий. Необходимо до переговоров определить «точку отказа» по всем основным пунктам переговоров. При оценке синергии включайте в финансовую модель будущих денежных потоков покупаемой компании только те показатели, которые можно будет точно определить, проконтролировать, учесть и достичь. Кроме того, необходимо реалистично просчитать затраты на интеграцию. Хорошая сделка с плохим партнером - плохая сделка.

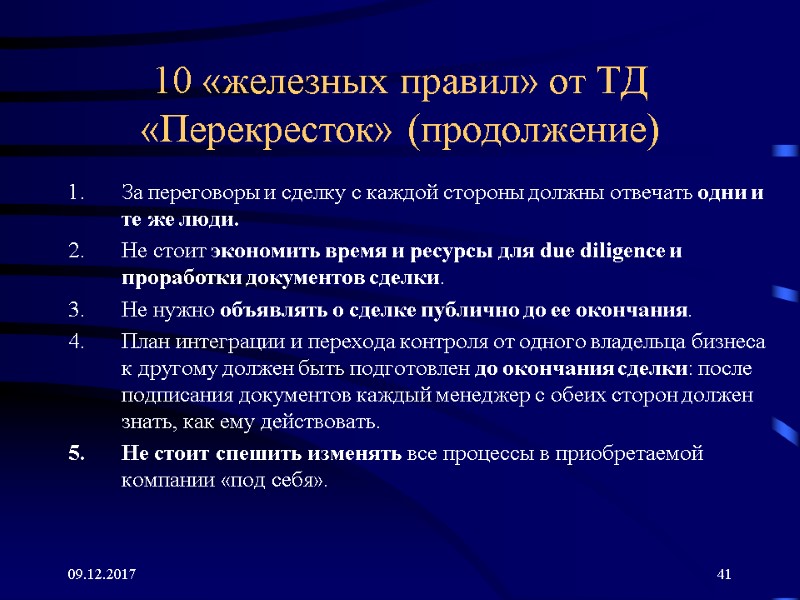

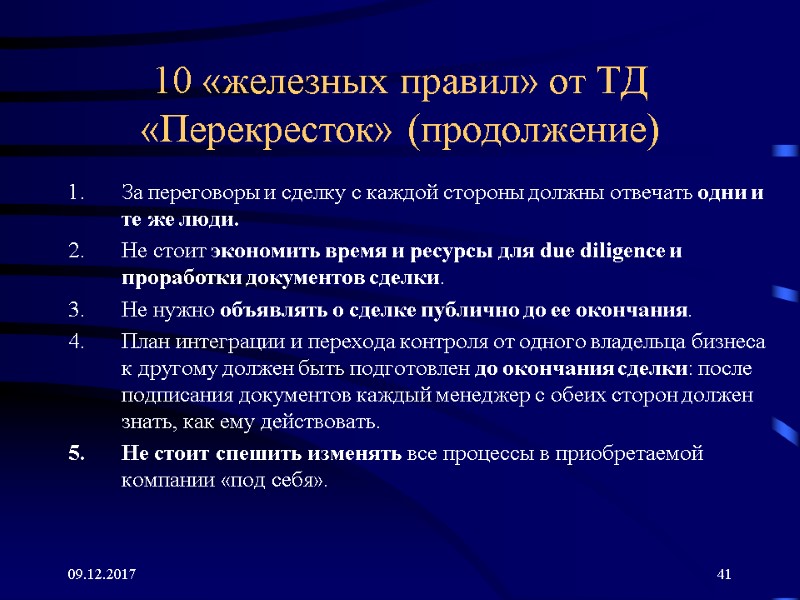

09.12.2017 41 10 «железных правил» от ТД «Перекресток» (продолжение) За переговоры и сделку с каждой стороны должны отвечать одни и те же люди. Не стоит экономить время и ресурсы для due diligence и проработки документов сделки. Не нужно объявлять о сделке публично до ее окончания. План интеграции и перехода контроля от одного владельца бизнеса к другому должен быть подготовлен до окончания сделки: после подписания документов каждый менеджер с обеих сторон должен знать, как ему действовать. Не стоит спешить изменять все процессы в приобретаемой компании «под себя».

09.12.2017 41 10 «железных правил» от ТД «Перекресток» (продолжение) За переговоры и сделку с каждой стороны должны отвечать одни и те же люди. Не стоит экономить время и ресурсы для due diligence и проработки документов сделки. Не нужно объявлять о сделке публично до ее окончания. План интеграции и перехода контроля от одного владельца бизнеса к другому должен быть подготовлен до окончания сделки: после подписания документов каждый менеджер с обеих сторон должен знать, как ему действовать. Не стоит спешить изменять все процессы в приобретаемой компании «под себя».