a744cdff765ec3e478d7a8d37e45067d.ppt

- Количество слайдов: 34

08 THE PRICE LEVEL AND INFLATION

08 THE PRICE LEVEL AND INFLATION

Previously • Unemployment rate – The percentage of the labor force that would like to work who are unemployed • Labor for participation rate – Percent of overall population in the labor force

Previously • Unemployment rate – The percentage of the labor force that would like to work who are unemployed • Labor for participation rate – Percent of overall population in the labor force

Big Questions 1. How is inflation measured? 2. What problems does inflation bring?

Big Questions 1. How is inflation measured? 2. What problems does inflation bring?

Inflation • Inflation – Continuing rise in the general price level – Deflation: opposite of inflation. . . price level falls • Biggest problem of inflation? – Uncertainty about price changes creates problems for firms and workers

Inflation • Inflation – Continuing rise in the general price level – Deflation: opposite of inflation. . . price level falls • Biggest problem of inflation? – Uncertainty about price changes creates problems for firms and workers

Consumer Price Index • Consumer Price Index (CPI) – A measure of the price level based on the consumption pattern of a typical consumer • Bureau of Labor statistics – The government agency that reports inflation and unemployment data

Consumer Price Index • Consumer Price Index (CPI) – A measure of the price level based on the consumption pattern of a typical consumer • Bureau of Labor statistics – The government agency that reports inflation and unemployment data

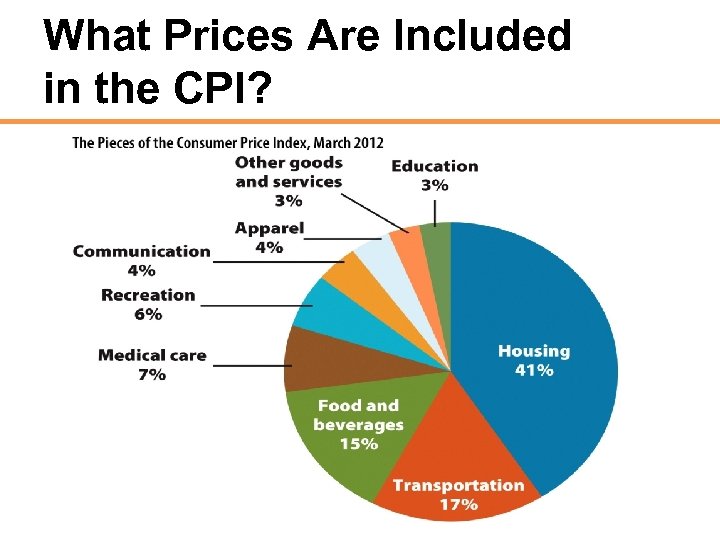

What Prices Are Included in the CPI?

What Prices Are Included in the CPI?

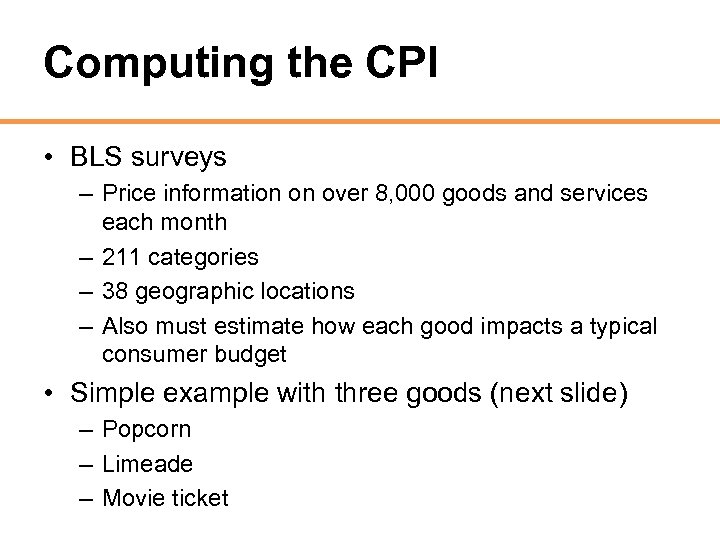

Computing the CPI • BLS surveys – Price information on over 8, 000 goods and services each month – 211 categories – 38 geographic locations – Also must estimate how each good impacts a typical consumer budget • Simple example with three goods (next slide) – Popcorn – Limeade – Movie ticket

Computing the CPI • BLS surveys – Price information on over 8, 000 goods and services each month – 211 categories – 38 geographic locations – Also must estimate how each good impacts a typical consumer budget • Simple example with three goods (next slide) – Popcorn – Limeade – Movie ticket

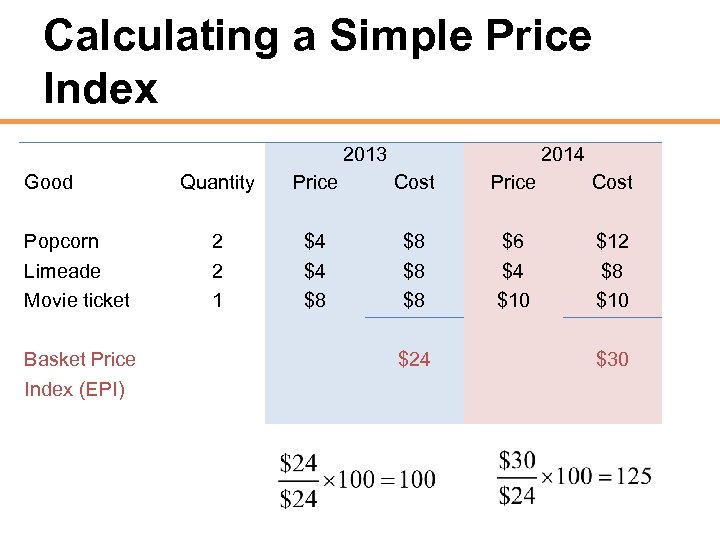

Calculating a Simple Price Index 2013 Good Popcorn Limeade Movie ticket Basket Price Index (EPI) 2014 Quantity Price Cost 2 2 1 $4 $4 $8 $8 $6 $4 $10 $12 $8 $10 $24 $30

Calculating a Simple Price Index 2013 Good Popcorn Limeade Movie ticket Basket Price Index (EPI) 2014 Quantity Price Cost 2 2 1 $4 $4 $8 $8 $6 $4 $10 $12 $8 $10 $24 $30

Inflation • Finding the price index • Having found the price levels, we can find inflation by using a percentage change formula – Inflation rates are measured over the course of a year • In the previous example, inflation is 25%

Inflation • Finding the price index • Having found the price levels, we can find inflation by using a percentage change formula – Inflation rates are measured over the course of a year • In the previous example, inflation is 25%

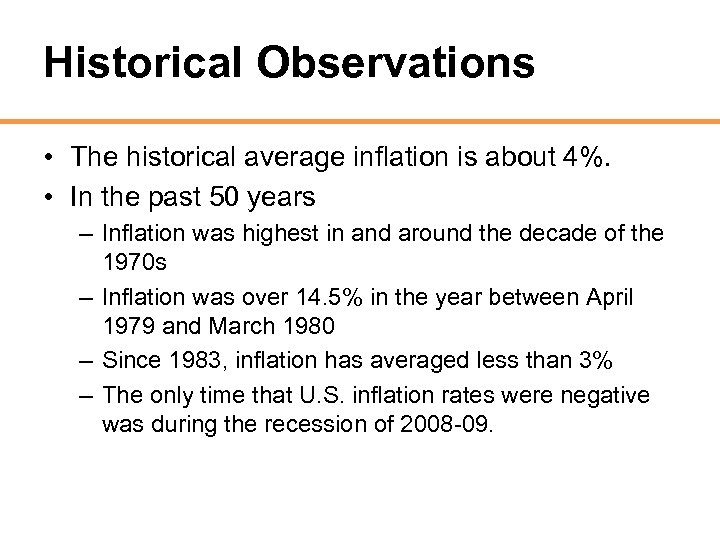

Historical Observations • The historical average inflation is about 4%. • In the past 50 years – Inflation was highest in and around the decade of the 1970 s – Inflation was over 14. 5% in the year between April 1979 and March 1980 – Since 1983, inflation has averaged less than 3% – The only time that U. S. inflation rates were negative was during the recession of 2008 -09.

Historical Observations • The historical average inflation is about 4%. • In the past 50 years – Inflation was highest in and around the decade of the 1970 s – Inflation was over 14. 5% in the year between April 1979 and March 1980 – Since 1983, inflation has averaged less than 3% – The only time that U. S. inflation rates were negative was during the recession of 2008 -09.

Prices Don’t All Move Together • Clearly, most prices rise over time (see the previous figure) – Travel – Education – Health care • However, some prices fall over time – Consumer electronics – Usually due to a result of great technological advancements – Flat panel TV, 1997: $7, 000 – Flat panel TV 2012: $500

Prices Don’t All Move Together • Clearly, most prices rise over time (see the previous figure) – Travel – Education – Health care • However, some prices fall over time – Consumer electronics – Usually due to a result of great technological advancements – Flat panel TV, 1997: $7, 000 – Flat panel TV 2012: $500

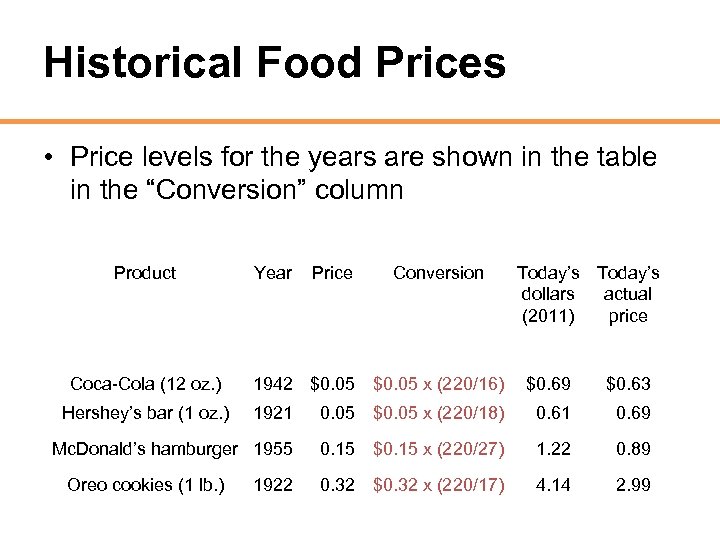

Historical Food Prices • Price levels for the years are shown in the table in the “Conversion” column Product Coca-Cola (12 oz. ) Hershey’s bar (1 oz. ) Year Price Conversion 1942 $0. 05 x (220/16) Today’s dollars actual (2011) price $0. 69 $0. 63 1921 0. 05 $0. 05 x (220/18) 0. 61 0. 69 Mc. Donald’s hamburger 1955 0. 15 $0. 15 x (220/27) 1. 22 0. 89 0. 32 $0. 32 x (220/17) 4. 14 2. 99 Oreo cookies (1 lb. ) 1922

Historical Food Prices • Price levels for the years are shown in the table in the “Conversion” column Product Coca-Cola (12 oz. ) Hershey’s bar (1 oz. ) Year Price Conversion 1942 $0. 05 x (220/16) Today’s dollars actual (2011) price $0. 69 $0. 63 1921 0. 05 $0. 05 x (220/18) 0. 61 0. 69 Mc. Donald’s hamburger 1955 0. 15 $0. 15 x (220/27) 1. 22 0. 89 0. 32 $0. 32 x (220/17) 4. 14 2. 99 Oreo cookies (1 lb. ) 1922

Concerns about CPI Accuracy • Most common concern is that CPI overstates true inflation (upward bias)—three possible reasons: – Substitution – Changes in quality – New products and locations • Substitution – Microeconomics: when the price of A rises, we buy more B

Concerns about CPI Accuracy • Most common concern is that CPI overstates true inflation (upward bias)—three possible reasons: – Substitution – Changes in quality – New products and locations • Substitution – Microeconomics: when the price of A rises, we buy more B

Concerns about CPI Accuracy • Quality changes – Prices may rise because the quality is better – Example: flat-screen HD TVs (compared to what existed in early 1990 s)

Concerns about CPI Accuracy • Quality changes – Prices may rise because the quality is better – Example: flat-screen HD TVs (compared to what existed in early 1990 s)

Concerns about CPI Accuracy • New goods, services, and locations – Electronics, such as flash drives and i. Pads

Concerns about CPI Accuracy • New goods, services, and locations – Electronics, such as flash drives and i. Pads

The Costs of Inflation • Future price level uncertainty – Uncertain inflation makes long-term contracts riskier – Workers: fear of getting underpaid next year – Lenders: fear of lending out money today and getting paid back in less-valuable dollars next year – If long-term contracts don’t transpire, GDP growth is slowed

The Costs of Inflation • Future price level uncertainty – Uncertain inflation makes long-term contracts riskier – Workers: fear of getting underpaid next year – Lenders: fear of lending out money today and getting paid back in less-valuable dollars next year – If long-term contracts don’t transpire, GDP growth is slowed

Pennies, Inflation, and Copper • With inflation, currency loses real value. That is, a given amount of currency won’t buy as many goods or services. • Can this make small denominations of currency not worth having? Remember that it still takes resources to mint currency!

Pennies, Inflation, and Copper • With inflation, currency loses real value. That is, a given amount of currency won’t buy as many goods or services. • Can this make small denominations of currency not worth having? Remember that it still takes resources to mint currency!

Costs of Inflation • Shoe-leather costs – Shoe-leather costs are resources that are wasted when people change behavior to avoid holding money • Money Illusion – People interpreting nominal wage or price changes as real changes – If prices and wages all go up by 2%, there is no real change in your purchasing power. People with money illusion think they are richer in this case.

Costs of Inflation • Shoe-leather costs – Shoe-leather costs are resources that are wasted when people change behavior to avoid holding money • Money Illusion – People interpreting nominal wage or price changes as real changes – If prices and wages all go up by 2%, there is no real change in your purchasing power. People with money illusion think they are richer in this case.

Costs of Inflation • Nominal wage – The wage in current dollars, analogous to nominal GDP • Real wage – Nominal wage adjusted for inflation (changes in the price level) • Another money illusion example: – If nominal wages go up by 3%, but prices go up by 5%, money illusion may cause you to think of yourself as wealthier, but your real wages have actually decreased!

Costs of Inflation • Nominal wage – The wage in current dollars, analogous to nominal GDP • Real wage – Nominal wage adjusted for inflation (changes in the price level) • Another money illusion example: – If nominal wages go up by 3%, but prices go up by 5%, money illusion may cause you to think of yourself as wealthier, but your real wages have actually decreased!

Costs of Inflation • Menu costs – The costs of changing prices – Example: a restaurant will have to print new menus for all price changes • Uncertainty about future price levels – Firms may have to borrow today and pay back the money later. – Uncertainty about prices may make borrowing riskier.

Costs of Inflation • Menu costs – The costs of changing prices – Example: a restaurant will have to print new menus for all price changes • Uncertainty about future price levels – Firms may have to borrow today and pay back the money later. – Uncertainty about prices may make borrowing riskier.

Costs of Inflation • Wealth redistribution – Wealth can be redistributed between borrowers and lenders • Example: – You borrow $50, 000, and expect to pay back $60, 000 in five years • If unexpected inflation occurs – You are better off, bank is worse off • If the inflation was expected – The bank would have required more in return for the loan (you’d have to repay $75, 000 in five years)

Costs of Inflation • Wealth redistribution – Wealth can be redistributed between borrowers and lenders • Example: – You borrow $50, 000, and expect to pay back $60, 000 in five years • If unexpected inflation occurs – You are better off, bank is worse off • If the inflation was expected – The bank would have required more in return for the loan (you’d have to repay $75, 000 in five years)

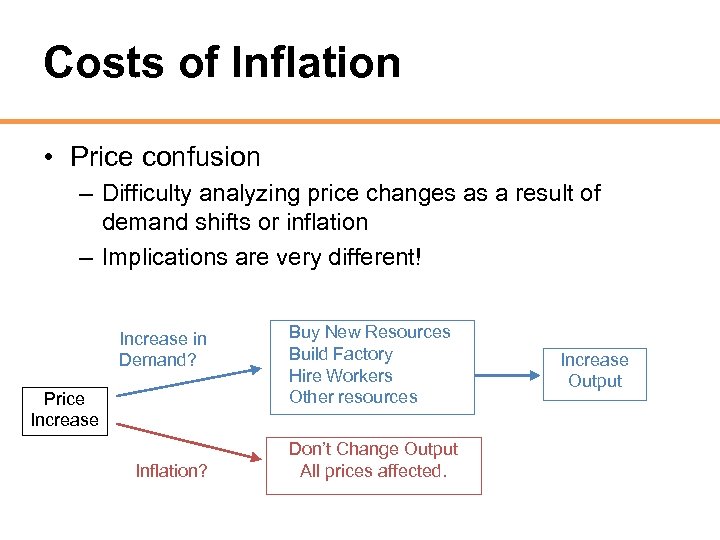

Costs of Inflation • Price confusion – Difficulty analyzing price changes as a result of demand shifts or inflation – Implications are very different! Increase in Demand? Price Increase Inflation? Buy New Resources Build Factory Hire Workers Other resources Don’t Change Output All prices affected. Increase Output

Costs of Inflation • Price confusion – Difficulty analyzing price changes as a result of demand shifts or inflation – Implications are very different! Increase in Demand? Price Increase Inflation? Buy New Resources Build Factory Hire Workers Other resources Don’t Change Output All prices affected. Increase Output

Costs of Inflation • Tax distortions – Capital gains taxes are taxes on the gains realized by selling an asset for more than its purchase price – Problem: often, the price rises due to inflation rather than an increase in the value of the good • Example – Buy a house in 1980 for $80, 000 – Sell the house in 2012 for $230, 000 for a $150, 000 capital gain. You have to pay taxes on this $150, 000. – However, the CPI rose from 80 to 230 in those years, so the real value of the house is the same!

Costs of Inflation • Tax distortions – Capital gains taxes are taxes on the gains realized by selling an asset for more than its purchase price – Problem: often, the price rises due to inflation rather than an increase in the value of the good • Example – Buy a house in 1980 for $80, 000 – Sell the house in 2012 for $230, 000 for a $150, 000 capital gain. You have to pay taxes on this $150, 000. – However, the CPI rose from 80 to 230 in those years, so the real value of the house is the same!

Costs of Inflation

Costs of Inflation

The Cause of Inflation • No debate on the cause of inflation – Inflation caused expansions in the nation’s money supply – Milton Friedman: “inflation is always and everywhere a monetary phenomenon”

The Cause of Inflation • No debate on the cause of inflation – Inflation caused expansions in the nation’s money supply – Milton Friedman: “inflation is always and everywhere a monetary phenomenon”

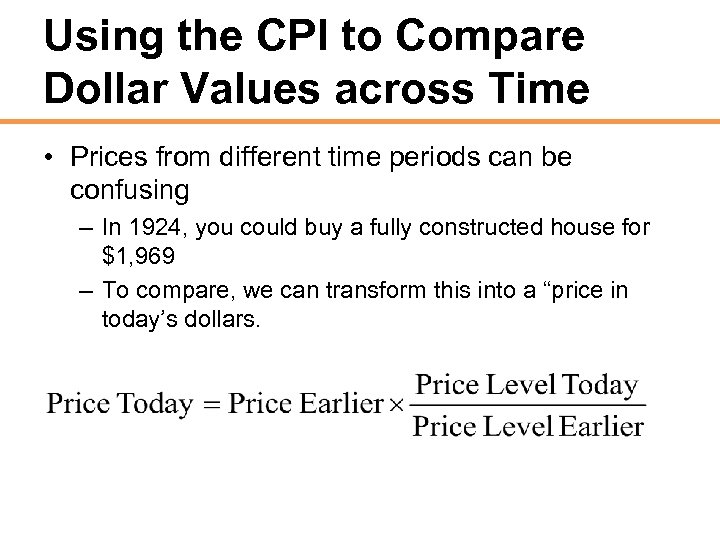

Using the CPI to Compare Dollar Values across Time • Prices from different time periods can be confusing – In 1924, you could buy a fully constructed house for $1, 969 – To compare, we can transform this into a “price in today’s dollars.

Using the CPI to Compare Dollar Values across Time • Prices from different time periods can be confusing – In 1924, you could buy a fully constructed house for $1, 969 – To compare, we can transform this into a “price in today’s dollars.

Economics in Duck. Tales • Duck. Tales (1989) – Episode “Dough Ray Me” – Gyro invents a ray gun which duplicates objects. The boys use it to start duplicating money. Will this cause a problem?

Economics in Duck. Tales • Duck. Tales (1989) – Episode “Dough Ray Me” – Gyro invents a ray gun which duplicates objects. The boys use it to start duplicating money. Will this cause a problem?

Conclusion • CPI computation can be difficult because the typical “basket” of consumer goods changes over time. The BLS tries to adjust for this • The macroeconomic costs of continued price rises include future price level uncertainty, signal extraction problems, menu costs, and money illusion • Inflation is often misunderstood by the general public

Conclusion • CPI computation can be difficult because the typical “basket” of consumer goods changes over time. The BLS tries to adjust for this • The macroeconomic costs of continued price rises include future price level uncertainty, signal extraction problems, menu costs, and money illusion • Inflation is often misunderstood by the general public

Summary • The CPI is the primary measure of the general price level in the United States – Computed using prices from a basket of goods formed by the spending habits of the typical consumer • Forming the basket of goods is no simple task, especially given that the basket changes over time – Consumers substitute goods based upon relative price changes and quality changes – New goods and retail options change consumers’ buying habits – The BLS attempts to account for all of these changes

Summary • The CPI is the primary measure of the general price level in the United States – Computed using prices from a basket of goods formed by the spending habits of the typical consumer • Forming the basket of goods is no simple task, especially given that the basket changes over time – Consumers substitute goods based upon relative price changes and quality changes – New goods and retail options change consumers’ buying habits – The BLS attempts to account for all of these changes

Practice What You Know Which of the following spending categories makes up the largest portion of the CPI market basket? A. B. C. D. Travel (includes paying for gas) Housing Entertainment Food

Practice What You Know Which of the following spending categories makes up the largest portion of the CPI market basket? A. B. C. D. Travel (includes paying for gas) Housing Entertainment Food

Practice What You Know If inflation is a general rise in the price level, why have consumer electronic prices fell over time? A. The demand for electronics has decreased B. Electronics are not counted in the CPI C. Electronics are getting smaller in size so the price is falling as well D. Increases in technology have greatly reduced production costs for these goods

Practice What You Know If inflation is a general rise in the price level, why have consumer electronic prices fell over time? A. The demand for electronics has decreased B. Electronics are not counted in the CPI C. Electronics are getting smaller in size so the price is falling as well D. Increases in technology have greatly reduced production costs for these goods

Practice What You Know Suppose that prices and wages both double next year. What is true about next year compared to this year? A. Nominal wages are higher and real wages remained constant B. Nominal wages and real wages are both higher C. Nominal wages are higher and real wages are lower D. Nominal wages increased and real wages decreased

Practice What You Know Suppose that prices and wages both double next year. What is true about next year compared to this year? A. Nominal wages are higher and real wages remained constant B. Nominal wages and real wages are both higher C. Nominal wages are higher and real wages are lower D. Nominal wages increased and real wages decreased

Practice What You Know In 2012, John takes out a 30 -year bank mortgage loan at a fixed interest rate. He buys a house with the loan. In 2014 to 2018, there is a large amount of inflation. Who is hurt and helped by this inflation, ceteris paribus? A. John is helped and the bank is hurt B. The bank is helped and John is hurt C. John and the bank are both hurt D. John and the bank are both helped

Practice What You Know In 2012, John takes out a 30 -year bank mortgage loan at a fixed interest rate. He buys a house with the loan. In 2014 to 2018, there is a large amount of inflation. Who is hurt and helped by this inflation, ceteris paribus? A. John is helped and the bank is hurt B. The bank is helped and John is hurt C. John and the bank are both hurt D. John and the bank are both helped

Practice What You Know Suppose that Felix gets a 1% raise this year, but prices have also risen by 1%. Felix feels richer due to his raise and attempts to change his spending habits. Felix is suffering from A. B. C. D. Irrational exuberance Macroeconomics Money illusion Inflation pricing

Practice What You Know Suppose that Felix gets a 1% raise this year, but prices have also risen by 1%. Felix feels richer due to his raise and attempts to change his spending habits. Felix is suffering from A. B. C. D. Irrational exuberance Macroeconomics Money illusion Inflation pricing