1dff8a7308b6e1e28d2bb6ecb1baa16b.ppt

- Количество слайдов: 32

0

Safe Harbour This presentation contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements appear in a number of places in this presentation and include statements regarding the intent, belief or current expectations of the customer base, estimates regarding future growth in the different business lines and the global business, market share, financial results and other aspects of the activities and situation relating to the Company. Such forward looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward looking statements as a result of various factors. Analysts are cautioned not to place undue reliance on those forward looking statements, which speak only as of the date of this presentation. Telefónica undertakes no obligation to release publicly the results of any revisions to these forward looking statements which may be made to reflect events and circumstances after the date of this presentation, including, without limitation, changes in Telefónica´s business or acquisition strategy or to reflect the occurrence of unanticipated events. Analysts and investors are encouraged to consult the Company´s Annual Report on Form 20 -F as well as periodic filings made on Form 6 -K, which are on file with the United States Securities and Exchange Commission. Investor Conference March 2001, Rio de Janeiro 1

A value growth company: Delivering results Investors Conference March 2001, Rio de Janeiro

WE ARE CONFIDENT THAT BY BUILDING ON OUR FUNDAMENTALS WE WILL DELIVER ON PROFITABILITY AND GROWTH Profitability: Strengthen focus on earnings Strong emphasis on efficiency and execution Growth: Multiple growth dimensions Building business models that are profitable and sustainable AS A CONSEQUENCE, OUR COMPANY’S VALUE WILL INCREASE Investor Conference March 2001, Rio de Janeiro 3

DELIVERING RESULTS: PROFITABILITY AND GROWTH We will capture opportunities based on our strong strategic position and fundamentals We manage key performance metrics Management priorities to crystallize value Our Group model enables delivery Investor Conference March 2001, Rio de Janeiro 4

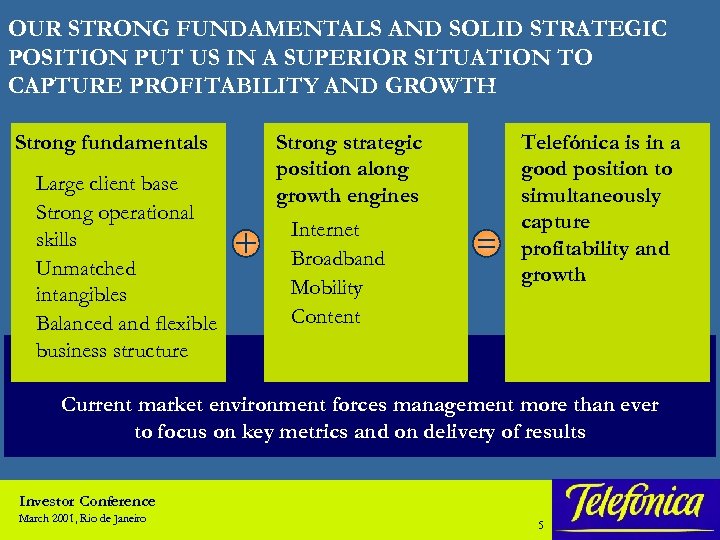

OUR STRONG FUNDAMENTALS AND SOLID STRATEGIC POSITION PUT US IN A SUPERIOR SITUATION TO CAPTURE PROFITABILITY AND GROWTH Strong fundamentals Large client base Strong operational skills Unmatched intangibles Balanced and flexible business structure Strong strategic position along growth engines Internet Broadband Mobility Content Telefónica is in a good position to simultaneously capture profitability and growth Current market environment forces management more than ever to focus on key metrics and on delivery of results Investor Conference March 2001, Rio de Janeiro 5

DELIVERING RESULTS: PROFITABILITY AND GROWTH We will capture opportunities based on our strong strategic position and fundamentals We manage key performance metrics Management priorities to crystallize value Our Group model enables delivery Investor Conference March 2001, Rio de Janeiro 6

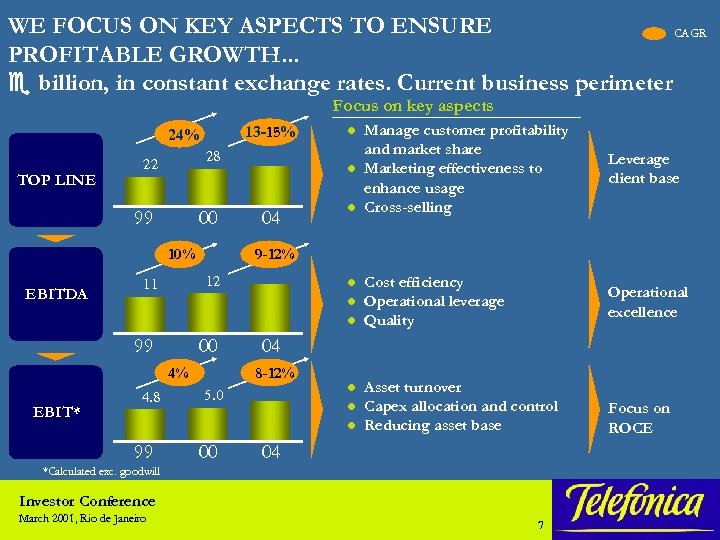

WE FOCUS ON KEY ASPECTS TO ENSURE CAGR PROFITABLE GROWTH. . . billion, in constant exchange rates. Current business perimeter Focus on key aspects 13 -15% 24% TOP LINE 28 22 99 00 10% EBITDA l 04 l l 99 00 4% EBIT* 4. 8 Leverage client base Cost efficiency Operational leverage Quality Operational excellence 04 8 -12% 5. 0 l l l 99 Manage customer profitability and market share Marketing effectiveness to enhance usage Cross-selling 9 -12% 12 11 l 00 Asset turnover Capex allocation and control Reducing asset base 04 *Calculated exc. goodwill Investor Conference March 2001, Rio de Janeiro 7 Focus on ROCE

WE FOCUS ON LEVERAGING OUR CLIENT BASE, . . . We have a growing client base. . . …which we expect to expand. . . >100 million …and leverage to extract its full potential l Manage client profitability and market share 25% l Accelerate marketing initiatives and effectiveness 65 52 1999 l Push cross-selling across the Group’s businesses 2000 2004 Investor Conference March 2001, Rio de Janeiro 8

…ON RAISING OUR OPERATIONAL PERFORMANCE. . . This is already …but it is an ona clear strength. . . going priority. . . …and we will raise our performance by: Cost efficiency* 18, 6 1999 53, 9 Operational leverage** 1999 Accelerate e-business implementation l Tighten performance parameters l Monitor improvements with further developed cost accounting tools l -7% 16, 8 12, 6 2000 2004 -4% 47, 5 2000 70 -75% <40 Turn fixed costs into variable l Externalize functions, transparency l Outsourcing of non-core functions l 2004 90 -95% Monitor quality with customer centric perspective l Reduce cost of non-quality l Quality*** 1999 2000 2004 *Personal expenses (exc. Atento)/revenues **Fixed cost/total cost (estimates) ***Residential + business satisfaction index in Td. E Investor Conference March 2001, Rio de Janeiro 9

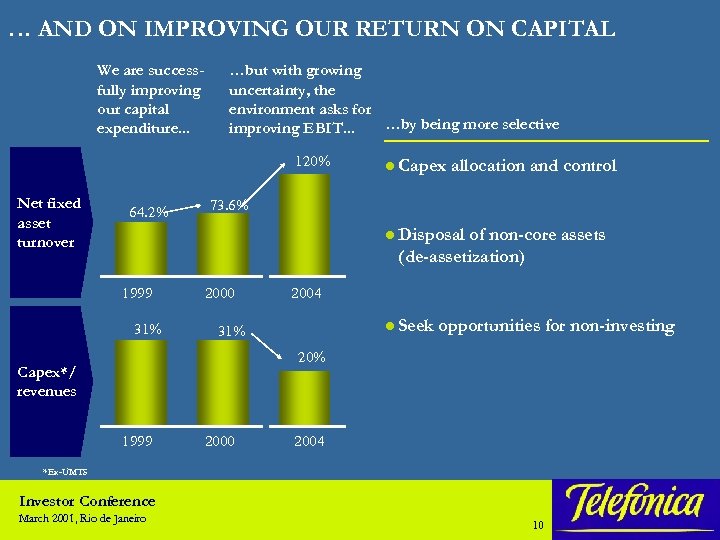

… AND ON IMPROVING OUR RETURN ON CAPITAL We are successfully improving our capital expenditure. . . …but with growing uncertainty, the environment asks for …by being more selective improving EBIT. . . 120% Net fixed asset turnover 64. 2% l Capex allocation and control 73. 6% l Disposal of non-core assets (de-assetization) 1999 31% 2000 2004 l Seek 31% opportunities for non-investing 20% Capex*/ revenues 1999 2000 2004 *Ex-UMTS Investor Conference March 2001, Rio de Janeiro 10

DELIVERING RESULTS: PROFITABILITY AND GROWTH We will capture opportunities based on our strong strategic position and fundamentals We manage key performance metrics Management priorities to crystallize value Our Group model enables delivery Investor Conference March 2001, Rio de Janeiro 11

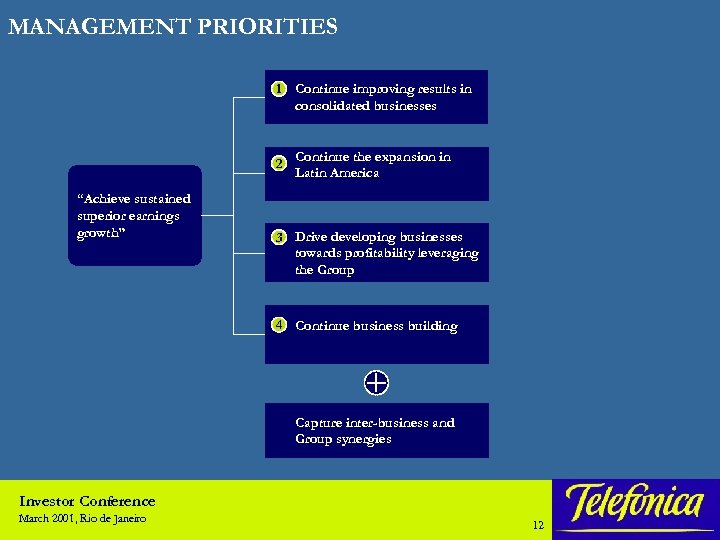

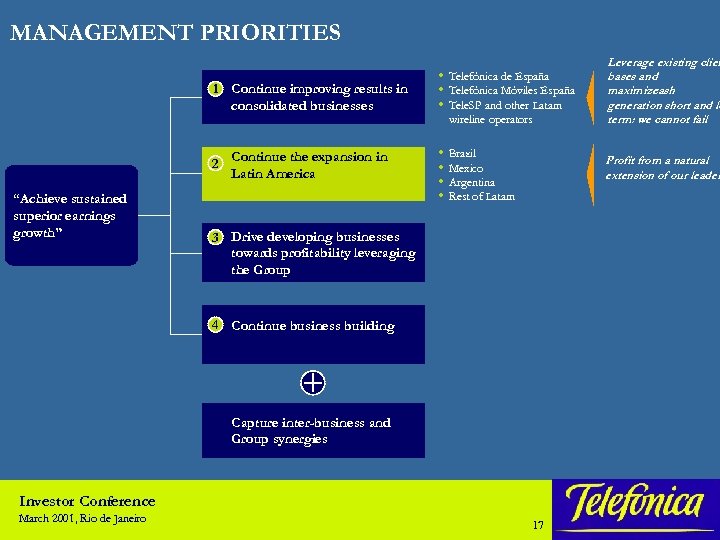

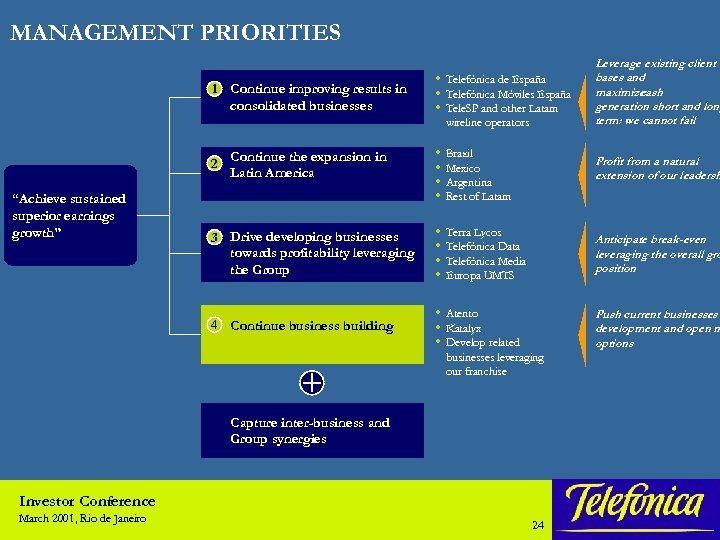

MANAGEMENT PRIORITIES 1 Continue improving results in consolidated businesses 2 “Achieve sustained superior earnings growth” Continue the expansion in Latin America 3 Drive developing businesses towards profitability leveraging the Group 4 Continue business building Capture inter-business and Group synergies Investor Conference March 2001, Rio de Janeiro 12

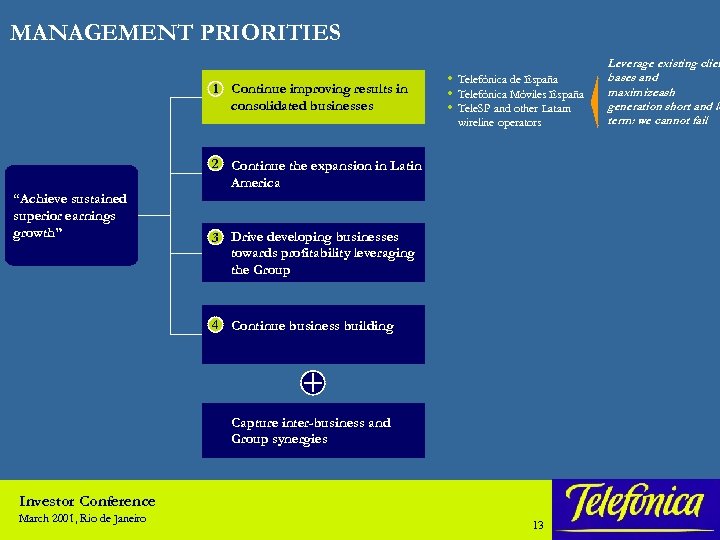

MANAGEMENT PRIORITIES 1 Continue improving results in consolidated businesses Telefónica de España Telefónica Móviles España Tele. SP and other Latam wireline operators 2 Continue the expansion in Latin America “Achieve sustained superior earnings growth” 3 Drive developing businesses towards profitability leveraging the Group 4 Continue business building Capture inter-business and Group synergies Investor Conference March 2001, Rio de Janeiro 13 Leverage existing clien bases and maximize cash generation short and lo term: we cannot fail

TELEFONICA DE ESPAÑA Winning the broadband battle • Push ADSL deployment • Deepen customer segmentation More cash-flow More stable Continuing to increase efficiency More business opportunities • Transform into e-business for Td. E and rest of the • Control/manage capex intensity Group • Quality improvement Investor Conference March 2001, Rio de Janeiro 14

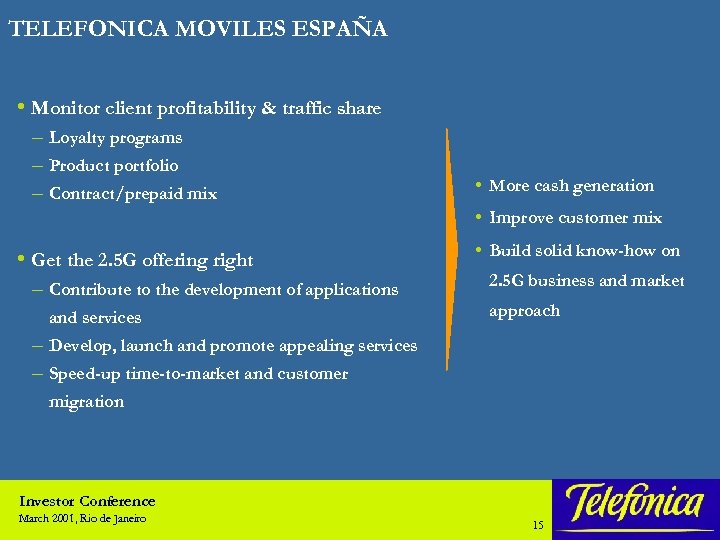

TELEFONICA MOVILES ESPAÑA • Monitor client profitability & traffic share – Loyalty programs – Product portfolio – Contract/prepaid mix More cash generation Improve customer mix • Get the 2. 5 G offering right – Contribute to the development of applications and services Build solid know-how on 2. 5 G business and market approach – Develop, launch and promote appealing services – Speed-up time-to-market and customer migration Investor Conference March 2001, Rio de Janeiro 15

TELESP Accelerate “Metas” accomplishment Key for roll-out to Brazilian telecom market Continue to build on solid operational fundamentals 1. Ensure additional capex meets strict return criteria 2. Tighten metrics and bring efficiency to the next level 3. Sharpen the marketing approach and broaden product catalogue More cash flow, exceeding organic growth needs Maintain outstanding competitive position Platform to leverage Telefonica’s Brazilian opportunity Investor Conference March 2001, Rio de Janeiro 16

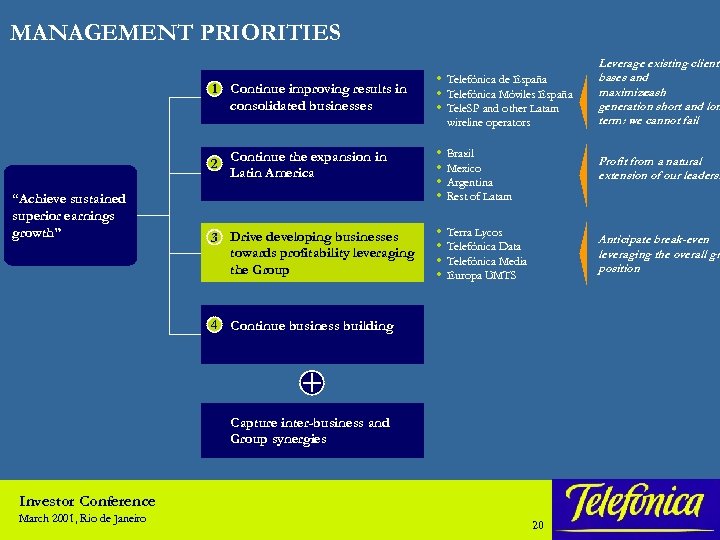

MANAGEMENT PRIORITIES 1 Continue improving results in consolidated businesses 2 Continue the expansion in Latin America “Achieve sustained superior earnings growth” Telefónica de España Telefónica Móviles España Tele. SP and other Latam wireline operators Brazil Mexico Argentina Rest of Latam Profit from a natural extension of our leader 3 Drive developing businesses towards profitability leveraging the Group 4 Continue business building Capture inter-business and Group synergies Investor Conference March 2001, Rio de Janeiro Leverage existing clien bases and maximize cash generation short and lo term: we cannot fail 17

EXPANSION IN LATIN AMERICA 1. Launch Brazilian wireline operations outside Sao Paulo in 2002 (“Brazil 2002”) 2. Consolidate TEM-PT JV as the #1 player in Brazilian mobile markets 3. Successfully develop recently entered markets, e. g. , northern Argentina, Mexico 4. Complete the Latin-American portfolio profiting from a natural extension of our leadership Investor Conference March 2001, Rio de Janeiro 18

BRAZIL CONTINUES TO BE A BIG OPPORTUNITY Brazil 2002 as a first priority project Integrated offering of voice and data services for large businesses Long distance national and international services Transport (carriers’ carrier) TEM-PT JV to lead the Brazilian mobile market 9. 3 million controlled customers, and potential market over 93 million POPs 60% of average market share and single player operating in Sao Paulo & Rio de Janeiro Leadership in 4 of 5 wealthiest areas in Brazil Investor Conference March 2001, Rio de Janeiro 19

MANAGEMENT PRIORITIES 1 Continue improving results in consolidated businesses 2 “Achieve sustained superior earnings growth” Continue the expansion in Latin America 3 Drive developing businesses towards profitability leveraging the Group Telefónica de España Telefónica Móviles España Tele. SP and other Latam wireline operators Brazil Mexico Argentina Rest of Latam Terra Lycos Telefónica Data Telefónica Media Europa UMTS Profit from a natural extension of our leadersh Anticipate break-even leveraging the overall gro position 4 Continue business building Capture inter-business and Group synergies Investor Conference March 2001, Rio de Janeiro Leverage existing client bases and maximize cash generation short and lon term: we cannot fail 20

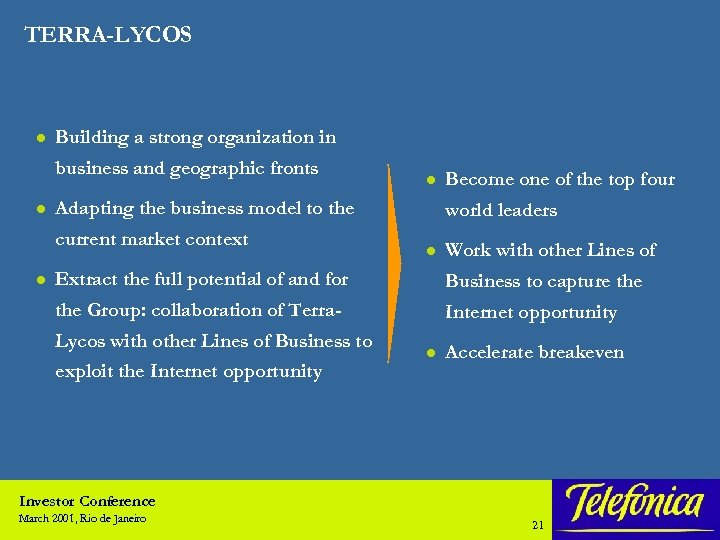

TERRA-LYCOS l Building a strong organization in business and geographic fronts l l Adapting the business model to the current market context Become one of the top four world leaders l Work with other Lines of Extract the full potential of and for Business to capture the Group: collaboration of Terra- l Internet opportunity Lycos with other Lines of Business to exploit the Internet opportunity l Accelerate breakeven Investor Conference March 2001, Rio de Janeiro 21

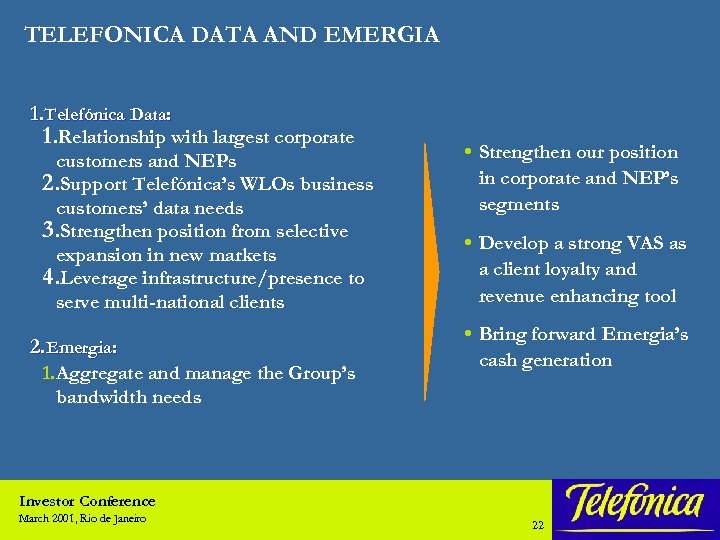

TELEFONICA DATA AND EMERGIA 1. Telefónica Data: 1. Relationship with largest corporate customers and NEPs 2. Support Telefónica’s WLOs business customers’ data needs 3. Strengthen position from selective expansion in new markets 4. Leverage infrastructure/presence to serve multi-national clients 2. Emergia: 1. Aggregate and manage the Group’s bandwidth needs Strengthen our position in corporate and NEP’s segments Develop a strong VAS as a client loyalty and revenue enhancing tool Bring forward Emergia’s cash generation Investor Conference March 2001, Rio de Janeiro 22

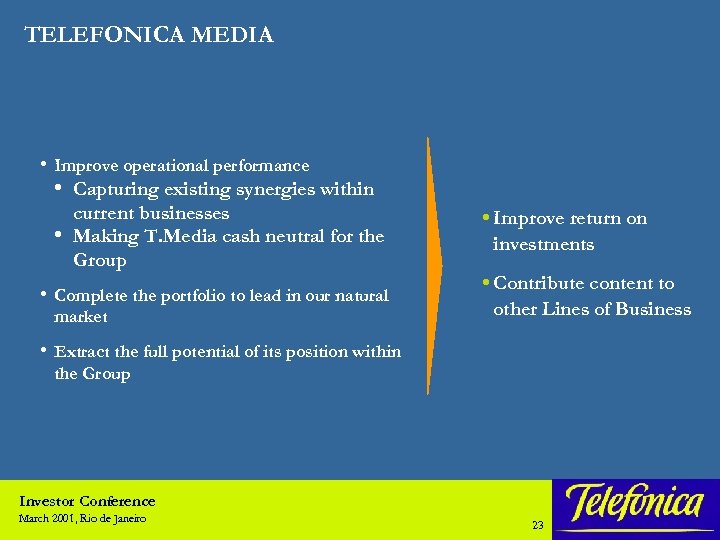

TELEFONICA MEDIA • Improve operational performance • Capturing existing synergies within • current businesses Making T. Media cash neutral for the Group • Complete the portfolio to lead in our natural market Improve return on investments Contribute content to other Lines of Business • Extract the full potential of its position within the Group Investor Conference March 2001, Rio de Janeiro 23

MANAGEMENT PRIORITIES 1 Continue improving results in consolidated businesses 2 “Achieve sustained superior earnings growth” Continue the expansion in Latin America 3 Drive developing businesses towards profitability leveraging the Group 4 Continue business building Telefónica de España Telefónica Móviles España Tele. SP and other Latam wireline operators Brazil Mexico Argentina Rest of Latam Terra Lycos Telefónica Data Telefónica Media Europa UMTS Profit from a natural extension of our leadersh Anticipate break-even leveraging the overall gro position Atento Katalyx Develop related businesses leveraging our franchise Capture inter-business and Group synergies Investor Conference March 2001, Rio de Janeiro Leverage existing client bases and maximize cash generation short and long term: we cannot fail 24 Push current businesses development and open ne options

CONTINUE BUSINESS BUILDING l We have launched several initiatives: eg. , Atento, Katalyx – Clear progress – Still improvements/adjustments to make – Focus on performance and clear value potential with a flexible approach l We will continue to develop opportunities and build new businesses: – Leveraging our customer base and franchise – Creating a competitive advantage by building on our strengths and intangibles – Adjacent businesses with low asset intensity and short pay-backs Investor Conference March 2001, Rio de Janeiro 25

DELIVERING RESULTS: PROFITABILITY AND GROWTH We will capture opportunities based on our strong strategic position and fundamentals We manage key performance metrics Management priorities to crystallize value Our Group model enables delivery Investor Conference March 2001, Rio de Janeiro 26

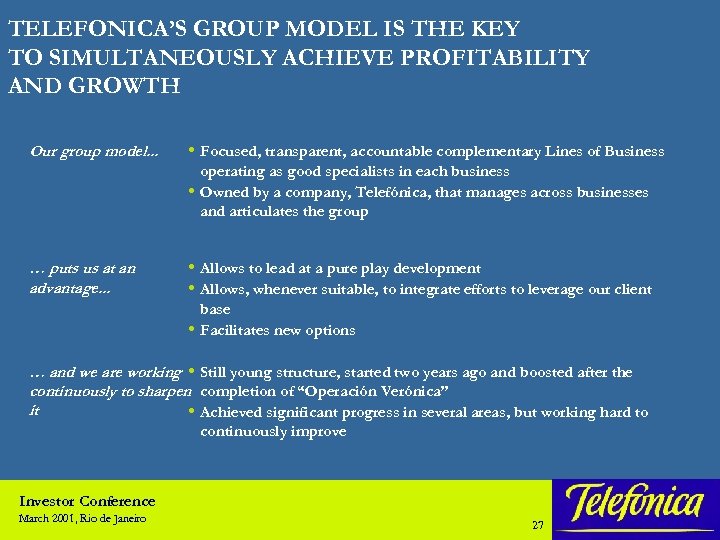

TELEFONICA’S GROUP MODEL IS THE KEY TO SIMULTANEOUSLY ACHIEVE PROFITABILITY AND GROWTH Our group model. . . Focused, transparent, accountable complementary Lines of Business operating as good specialists in each business Owned by a company, Telefónica, that manages across businesses and articulates the group … puts us at an advantage. . . Allows to lead at a pure play development Allows, whenever suitable, to integrate efforts to leverage our client base Facilitates new options … and we are working Still young structure, started two years ago and boosted after the continuously to sharpen completion of “Operación Verónica” it Achieved significant progress in several areas, but working hard to continuously improve Investor Conference March 2001, Rio de Janeiro 27

IN THIS MODEL, HIGH VALUE ADDING ACTIVITIES ARE PERFORMED AT GROUP LEVEL Manage across businesses Assist to and demand strong business performance Achieve functional articulation for effectiveness and efficiency Shape the development of the group Investor Conference March 2001, Rio de Janeiro 28

WE HAVE PROGRESSED SIGNIFICANTLY IN SEVERAL ACTIVITIES TO BE PERFORMED AT GROUP LEVEL AND ARE WORKING HARD TO ADVANCE ON THE REST Examples Manage across businesses Assist to and demand strong business performance Achieve functional articulation for effectiveness and efficiency Architect and shape the development of the group l Plan Futurnet to extract maximum potential of broadband across businesses l Shared distribution channels l. . . l Strategic reviews and budgeting process l Common management information systems l Coherent reward schemes l. . . l Lowest cost of funding through centralized management of cash and finance l Strong brand management l Development of Shared Service Centers l. . . Adaptiveness in partnerships/alliances Launch of dedicated Real Estate Management Unit . . . Investor Conference March 2001, Rio de Janeiro 29 A process of continuous development and improvement

WHAT WE’VE SAID SO FAR Telefónica’s performance is based on solid, lasting business fundamentals This fundamentals underpin our financial results Building on our fundamentals and our solid financial position, we are confident that we will deliver on profitability and growth We focus on four management priorities to crystallize our value Our group model is a key enabler that puts us at an advantage to deliver value and growth Investor Conference March 2001, Rio de Janeiro 30

31

1dff8a7308b6e1e28d2bb6ecb1baa16b.ppt