0

0

1 1

1 1

2 2

2 2

3 3

3 3

4 4

4 4

5 5

5 5

6 6

6 6

7

7

8 8

8 8

9 9

9 9

10 10

10 10

11 11

11 11

12 12

12 12

13 Key Concept Overhead cannot be directly tracked to products and services but must instead be allocated using cost drivers.

13 Key Concept Overhead cannot be directly tracked to products and services but must instead be allocated using cost drivers.

14 14

14 14

15 Key Concept Understanding what causes overhead costs to be incurred (what drives them) is the key to allocating overhead. 15

15 Key Concept Understanding what causes overhead costs to be incurred (what drives them) is the key to allocating overhead. 15

16 16

16 16

17 Key Concept Accuracy in overhead application has become much more important as overhead costs have increased and make up a larger portion of the total costs of products. 17

17 Key Concept Accuracy in overhead application has become much more important as overhead costs have increased and make up a larger portion of the total costs of products. 17

18 Key Concept Using estimates smoothes out or normalizes seasonal and random fluctuations in overhead costs. 18

18 Key Concept Using estimates smoothes out or normalizes seasonal and random fluctuations in overhead costs. 18

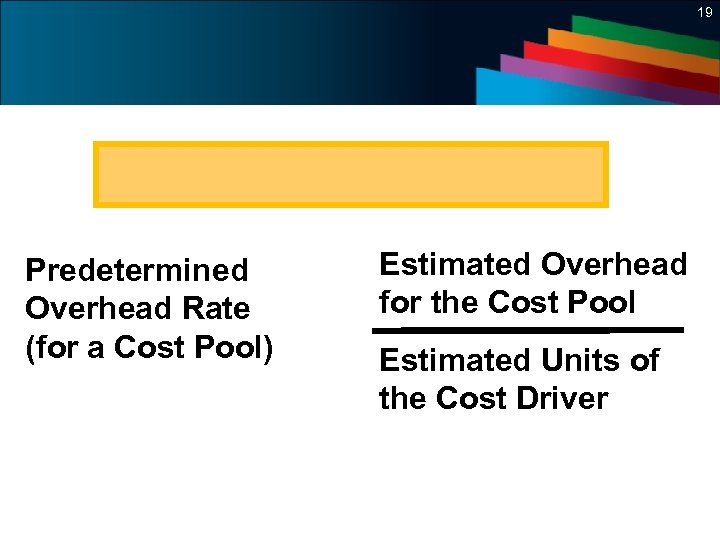

19 Predetermined Overhead Rate (for a Cost Pool) Estimated Overhead for the Cost Pool Estimated Units of the Cost Driver 19

19 Predetermined Overhead Rate (for a Cost Pool) Estimated Overhead for the Cost Pool Estimated Units of the Cost Driver 19

20 20

20 20

21 Key Concept 21

21 Key Concept 21

22 If a job required 22. 4 labor hours, how much overhead would be allocated to that job? 22

22 If a job required 22. 4 labor hours, how much overhead would be allocated to that job? 22

23 Over applied Overhead: Applied overhead is greater than actual overhead 23

23 Over applied Overhead: Applied overhead is greater than actual overhead 23

24 How do we account for the under- or over-applied overhead? Allocate the amount to work in process, finished goods, and cost of goods sold based on the balance in each account. Or, if the amount of the adjustment is small, adjust only the cost of goods sold account. 24

24 How do we account for the under- or over-applied overhead? Allocate the amount to work in process, finished goods, and cost of goods sold based on the balance in each account. Or, if the amount of the adjustment is small, adjust only the cost of goods sold account. 24

25 25

25 25

26 Multiple WIP accounts are used: one for every process. As products are moved from one process to another, the costs of the previous process are transferred to the next process. Example: Blending and pouring paint 26

26 Multiple WIP accounts are used: one for every process. As products are moved from one process to another, the costs of the previous process are transferred to the next process. Example: Blending and pouring paint 26

27 27

27 27

28 28

28 28