94f93fd04a9e427a8e868375d7daf18c.ppt

- Количество слайдов: 47

第十單元: Determining Optimal Level of Product Availability Optimal Matching of Supply and Demand (III) 蔣明晃教授 1 【 著 作 除 另 有 註 明 外 , 取 創 用 CC「 名 標 本 採 姓 示 - 非 商 業 性 - 相 同 方 式 分 享 」 灣 3. 0版 授 台 權釋出 】

Pull Postponement: EX. 2 Flickr_kennethkonica 2 Wikipedia

Pull Postponement ► Basic Elements: 》The process steps must be sequenced so that the less differentiating steps are performed at prior to the decoupling point. 》After the decoupling point, the process steps can be performed flexible and fast. 》Accurate order capture for BTO. > Example: National Bicycle, Benetton. 3

延遲差異化 ►延遲差異化 (Postponement Differentiation)之意義 》 此種延遲主要是運用在最終產品的需求未確定時, 先生產一些通用或產品族共通的部分,等到特定的 產品需求確定後再進行生產或製造,以減少不確定 性。 4

延遲差異化的做法 ►作業程序的重排序 (Resequencing) 》例子 : Benetton, postpone dyeing until after assembled. Cost: 10% more expensive, new machine purchased and employee retrained. 》例子 : US disk drive manufacturing. Insert generic circuit board into assembly, complete much of the testing, remove the generic circuit board, and add customer-specific boards later. 5

延遲差異化的做法 ►產品的共通性 (Commonality) 》利用產品線或產品族的重新設計來達成 》例子 : Printer manufacturing, redesign the new and old products to share a common circuit board and printhead such that final process can be delayed. 本作品轉載自hp (http: //h 10010. www 1. hp. com/wwpc/au/en/sm/WF 06 c/A 112771 -64209 -64548 -26997 -14820. html ),依據著 作權法第 46、52、65條合理使用。 6

延遲差異化的做法 ►模組化 (Modularity): 》 模組化產品設計:將功能採模組化,使各個模組 能夠簡易且以較低成本的添加到產品上。例子: HP Laser Jet 》模組化製程設計:製程應設計盡 量獨立的生產模組,容易因應不 同的要求進行彈性的調整。例子: print-andpigment mixture, Levis jeans 本作品轉載自Microsoft Office 2007多媒體藝 廊,依據Microsoft服務合約及著作權法第 46、 52、65條合理使用。 7 本作品轉載自Microsoft Office 2007多媒體 藝廊,依據Microsoft服務合約及著作權法第 46、52、65條合理使用。 本作品轉載自Microsoft Office 2007多媒體 藝廊,依據Microsoft服務合約及著作權法 第 46、52、65條合理使用。

延遲差異化的做法 ►標準化 (Standardization): 》建立數種顧客所需的標準化產品之選擇 ►機動敏捷的供應網路 (Agile Supply Networks) 》某些網路節點存放基本的產品 , 並在收 到顧客訂單時進行客製化的最後作業. 8 .

Concurrent and Parallel Processing ► Concurrent and parallel processing involves modifying the manufacturing process so that steps that were previously performed in a sequence can be completed at the same time. 》 reduce lead time 》 reduce inventory cost ► A key is the concept of modularity or decoupling 9

延遲差異化施行的考量 ►重新排序或延遲時所需資本投入之考量。 ►重新排序或延遲時所需技術與能力之考量。 ►延遲的結果可能使存貨成本提高。 ►在國際運籌作業中,各進出口國對原物料, 零組件或在製品的關稅考量。 10

Logistics Postponement ► Meaning: 》 Redesign the tasks in the SC so that some of the customization steps can be performed downstream closer to the customers. WIKIPEDIA 11 本作品轉載自Cool. CLIPS網站 (http: //dir. coolclips. com/Food/Vegeta bles/Vegetable_groups/bamboo, _woo dcut_style_vc 001509. html), Free 150 pixel Jpeg Image,瀏覽日期 2012/03/16。按著作權法第 52、65 條合理使用。 本作品轉載自Microsoft Office 2007多媒體 藝廊,依據Microsoft服務合約及著作權法第 46、52、65條合理使用。

Requirements for logistics postponement ► can not lead to quality degradation. ► downstream sites have capability to perform the task without excessive cost and time. ► potentially to procure the necessary components or modules for the customization. ► the engineering team is able and willing to design products and processes to defer the steps effectively. 12

Form Postponement ► Meaning: 》postponement is achieved through the change in the form of the product structure by standardizing some of the process steps or components. ► Example: HP Laser Printer. 本作品轉載自hp (http: //h 10010. www 1. hp. com/wwpc/au/en/sm/WF 06 c/A 1 -12771 -64209 -64548 -26997 -14820. html ),依 據著作權法第 46、52、65條合理使用。 13

Postponement Enablers ► Products or processes should be modular in structure. ► Design engineer should be aware of the importance of SCM to pursuit design for postponement opportunity. ► Must involve multiple functions or organization in collaboration. ► Quantify the costs and benefits to determine the best point for postponement 14

The Value of Postponement ► Improve matching of supply and demand: need to qualify the benefit with additional cost ► Increase profitability: differentiate after receiving customer order so that inventories can be reduced ► Valuable for selling a large variety of products with demand that is independent and comparable in size 15

Value of Postponement: Benetton ◈ For each color 本作品轉載自Benetton Group (http: //www. benettongroup. com/ ),依據 著作權法第 46、52、65條合理使用。 》 Mean demand = 1, 000; SD = 500 ◈ For each garment 》 Sale price = $50 》 Salvage value = $10 》 Production cost using option 1 (thread are dyed and the garment was knitted) with long lead time = $20 》 Production cost using option 2 (dying was postponed until after the garment was knitted) = $22 ►What is the value of postponement? 16

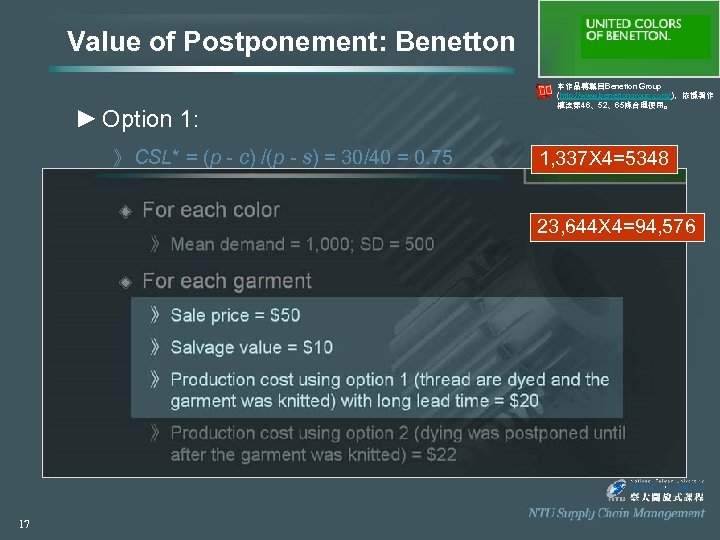

Value of Postponement: Benetton ► Option 1: 》 CSL* = (p - c) /(p - s) = 30/40 = 0. 75 本作品轉載自Benetton Group (http: //www. benettongroup. com/ ),依據著作 權法第 46、52、65條合理使用。 1, 337 X 4=5348 》 O* = NORMINV(0. 75, 1000, 500) = 1, 337 units of each color 》 Expected profits from each color = $23, 644 X 4=94, 576 》 Expected overstock for each color = 412 》 Expected understock for each color = 75 》 5348 sweaters are produced, expected profit of $94, 576 with an average of 1, 648 sweaters sold on clearance and 300 customers turns away for lack of sweaters 17

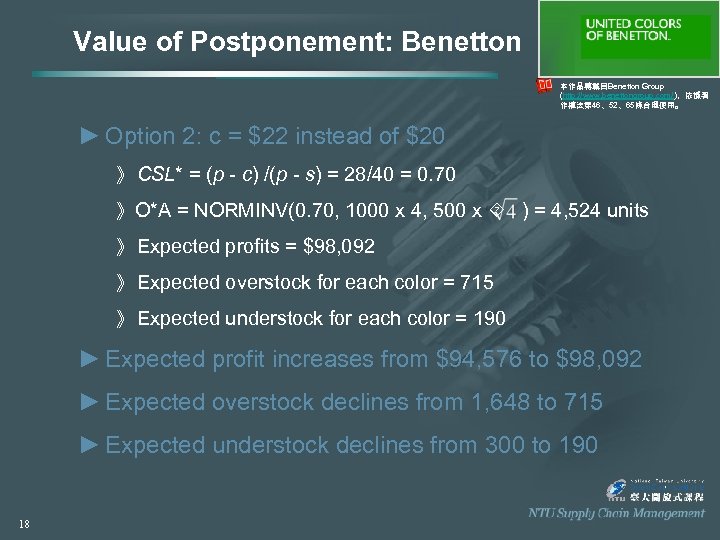

Value of Postponement: Benetton 本作品轉載自Benetton Group (http: //www. benettongroup. com/ ),依據著 作權法第 46、52、65條合理使用。 ► Option 2: c = $22 instead of $20 》 CSL* = (p - c) /(p - s) = 28/40 = 0. 70 》O*A = NORMINV(0. 70, 1000 x 4, 500 x ) = 4, 524 units. 》 Expected profits = $98, 092 》 Expected overstock for each color = 715 》 Expected understock for each color = 190 ► Expected profit increases from $94, 576 to $98, 092 ► Expected overstock declines from 1, 648 to 715 ► Expected understock declines from 300 to 190 18

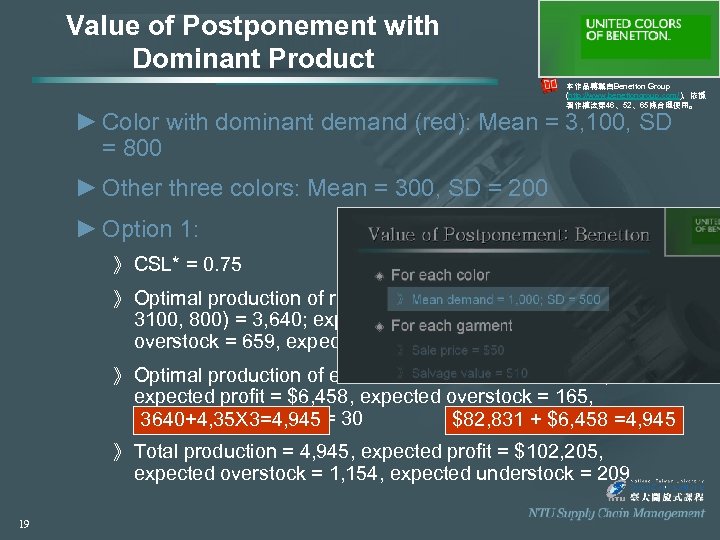

Value of Postponement with Dominant Product 本作品轉載自Benetton Group (http: //www. benettongroup. com/ ),依據 著作權法第 46、52、65條合理使用。 ► Color with dominant demand (red): Mean = 3, 100, SD = 800 ► Other three colors: Mean = 300, SD = 200 ► Option 1: 》 CSL* = 0. 75 》 Optimal production of red sweaters O* = NORMINV(0. 75, 3100, 800) = 3, 640; expected profit = $82, 831, expected overstock = 659, expected understock = 119 》 Optimal production of each other color sweater = 435; expected profit = $6, 458, expected overstock = 165, expected understock = 30 3640+4, 35 X 3=4, 945 $82, 831 + $6, 458 =4, 945 》 Total production = 4, 945, expected profit = $102, 205, expected overstock = 1, 154, expected understock = 209 19

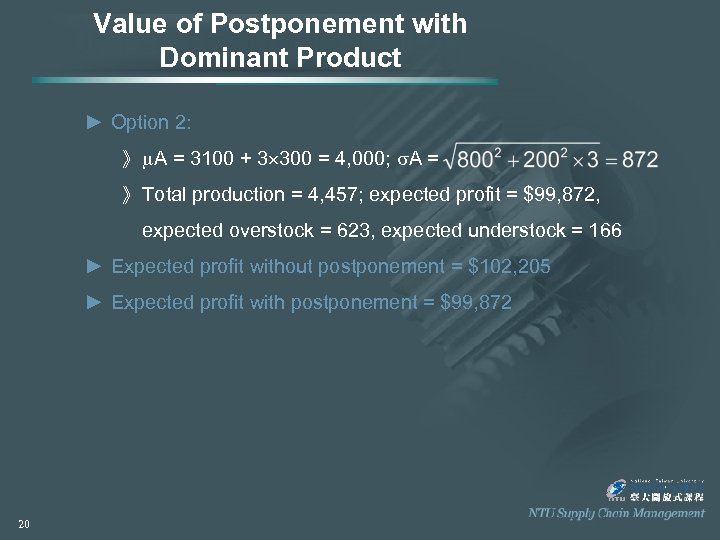

Value of Postponement with Dominant Product ► Option 2: 》 A = 3100 + 3 300 = 4, 000; A = 》 Total production = 4, 457; expected profit = $99, 872, expected overstock = 623, expected understock = 166 ► Expected profit without postponement = $102, 205 ► Expected profit with postponement = $99, 872 20

Meaning of Pure Postponement ► Postponement may reduce overall profit for a firm if a single product contributes the majority of the demand, since the increased manufacturing expense due to postponement outweighs the small benefit from aggregation 21

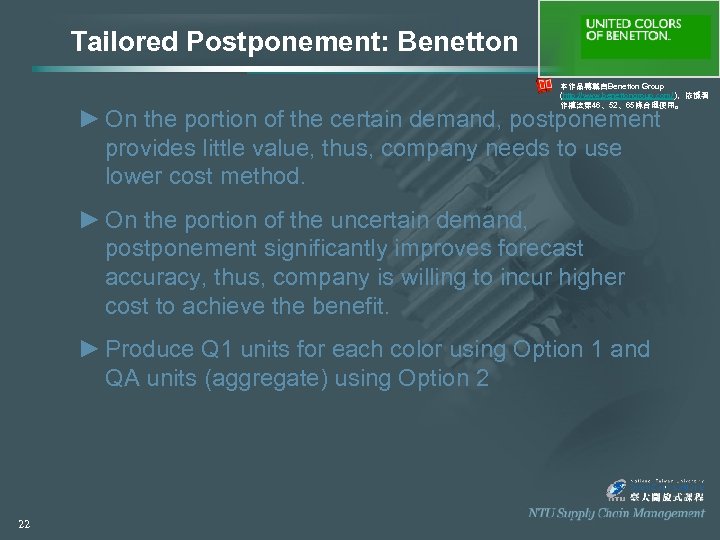

Tailored Postponement: Benetton 本作品轉載自Benetton Group (http: //www. benettongroup. com/ ),依據著 作權法第 46、52、65條合理使用。 ► On the portion of the certain demand, postponement provides little value, thus, company needs to use lower cost method. ► On the portion of the uncertain demand, postponement significantly improves forecast accuracy, thus, company is willing to incur higher cost to achieve the benefit. ► Produce Q 1 units for each color using Option 1 and QA units (aggregate) using Option 2 22

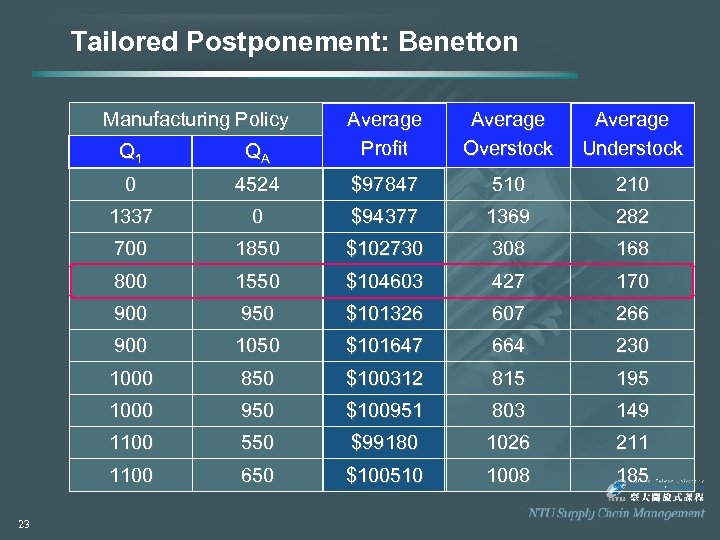

Tailored Postponement: Benetton Manufacturing Policy Q 1 0 4524 $97847 510 210 1337 0 $94377 1369 282 700 1850 $102730 308 168 800 1550 $104603 427 170 900 950 $101326 607 266 900 1050 $101647 664 230 1000 850 $100312 815 195 1000 950 $100951 803 149 1100 550 $99180 1026 211 1100 23 QA Average Profit Average Overstock Average Understock 650 $100510 1008 185

The Benefit of Tailored Postponement ► Tailored postponement allows a firm to increase its profitability by postponing only the uncertain part of the demand producing the predictable part at a lower cost without postponement 24

The Meaning of Tailored Sourcing ► A combination of two supply sources: one focusing on cost but unable to handle uncertainty well, and the other focusing on flexibility to handle uncertainty but a higher cost ► A backup policy ► Disadvantage: increasing complexity of implementation 25

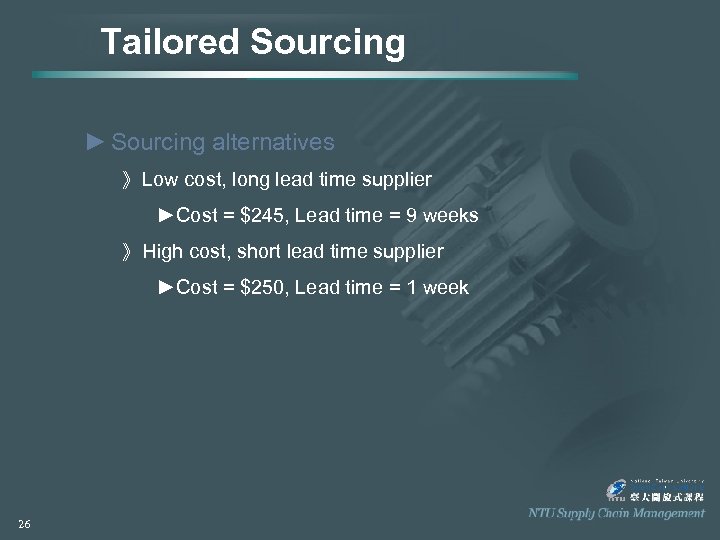

Tailored Sourcing ► Sourcing alternatives 》 Low cost, long lead time supplier ►Cost = $245, Lead time = 9 weeks 》 High cost, short lead time supplier ►Cost = $250, Lead time = 1 week 26

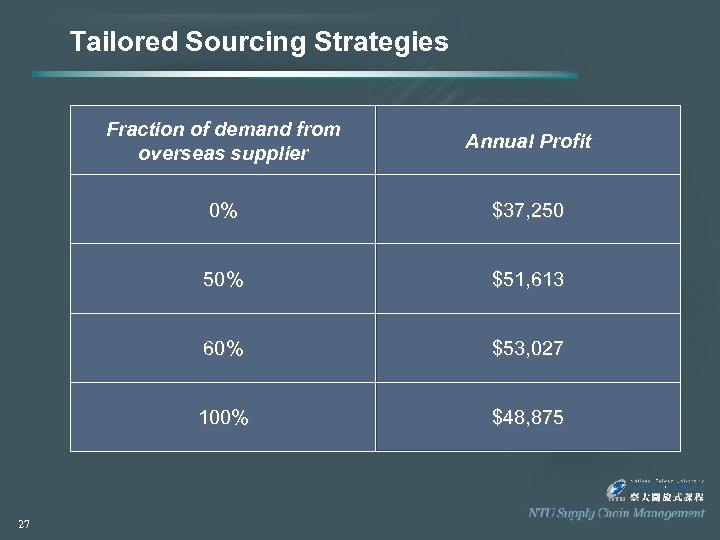

Tailored Sourcing Strategies Fraction of demand from overseas supplier 0% $37, 250 50% $51, 613 60% $53, 027 100% 27 Annual Profit $48, 875

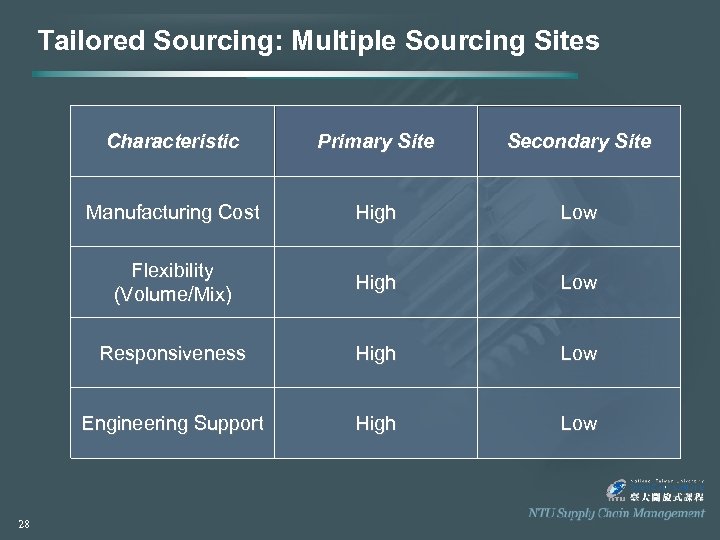

Tailored Sourcing: Multiple Sourcing Sites Characteristic Secondary Site Manufacturing Cost High Low Flexibility (Volume/Mix) High Low Responsiveness High Low Engineering Support 28 Primary Site High Low

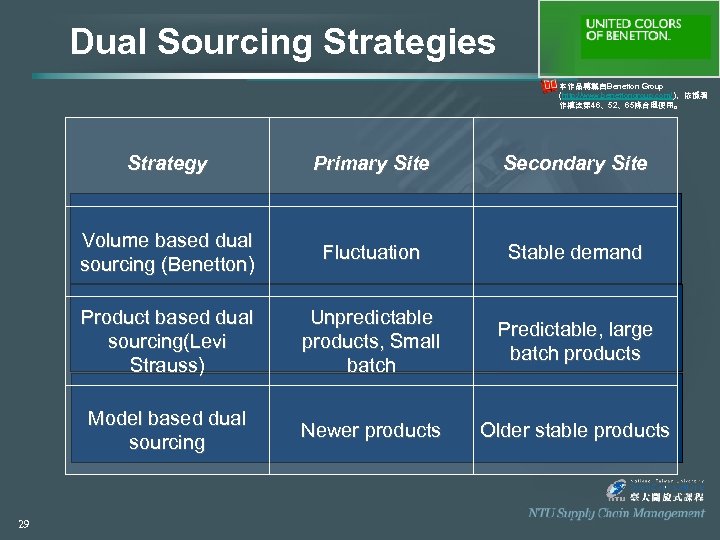

Dual Sourcing Strategies 本作品轉載自Benetton Group (http: //www. benettongroup. com/ ),依據著 作權法第 46、52、65條合理使用。 Strategy Secondary Site Volume based dual sourcing (Benetton) Fluctuation Stable demand Product based dual sourcing(Levi Strauss) Unpredictable products, Small batch Predictable, large batch products Model based dual sourcing 29 Primary Site Newer products Older stable products

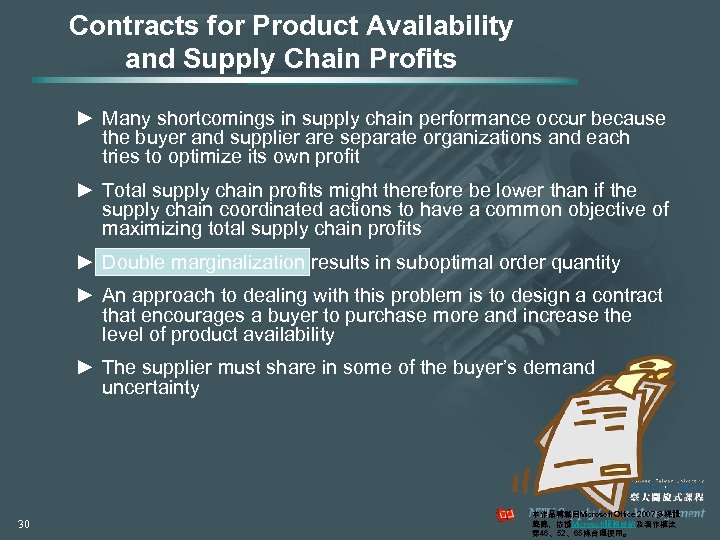

Contracts for Product Availability and Supply Chain Profits ► Many shortcomings in supply chain performance occur because the buyer and supplier are separate organizations and each tries to optimize its own profit ► Total supply chain profits might therefore be lower than if the supply chain coordinated actions to have a common objective of maximizing total supply chain profits ► Double marginalization results in suboptimal order quantity ► An approach to dealing with this problem is to design a contract that encourages a buyer to purchase more and increase the level of product availability ► The supplier must share in some of the buyer’s demand uncertainty 30 本作品轉載自Microsoft Office 2007多媒體 藝廊,依據Microsoft服務合約及著作權法 第 46、52、65條合理使用。

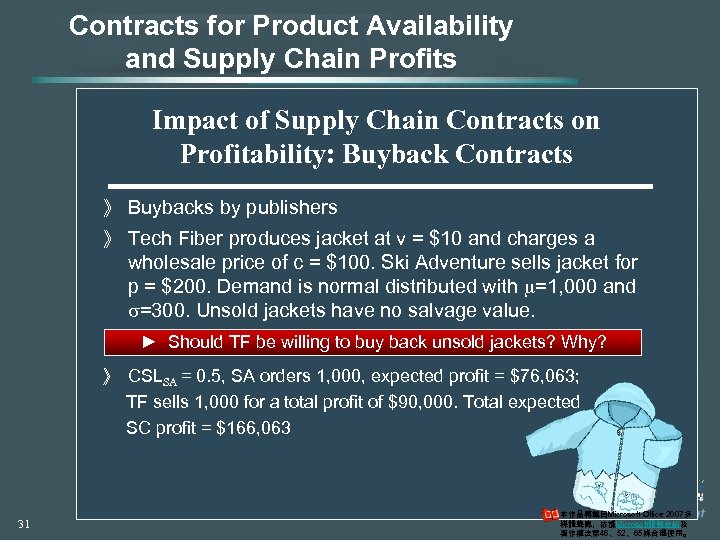

Contracts for Product Availability and Supply Chain Profits ► Many Impact of Supply chain performance occur because shortcomings in supply Chain Contracts on the buyer and supplier are separate organizations and each Profitability: Buyback Contracts tries to optimize its own profit ► Total supply chain profits might therefore be lower than if the 》 Buybacks coordinated actions to have a common objective of supply chain by publishers maximizing total supply jacket at v = 》 Tech Fiber produces chain profits $10 and charges a ► Double marginalization = $100. in suboptimal order quantity wholesale price of c results Ski Adventure sells jacket for ► An p = $200. Demand is with thisdistributed with =1, 000 and approach to dealing normal problem is to design a contract =300. Unsold buyer have no salvage and increase that encourages a jacketsto purchase more value. level► Should TF be willing to buy back unsold jackets? Why? of product availability ► 》 CSL = 0. 5, SA orders 1, 000, expected profit = $76, 063; The supplier must share in some of the buyer’s demand SA uncertainty TF sells 1, 000 for a total profit of $90, 000. Total expected SC profit = $166, 063 31 本作品轉載自Microsoft Office 2007多 媒體藝廊,依據Microsoft服務合約及 著作權法第 46、52、65條合理使用。

Contracts for Product Availability and Supply Chain Profits ► Many shortcomings in supply chain performance occur because the buyer and supplier are separate organizations and each tries to optimize its own profit ► Total supply chain profits might therefore be lower than if the supply chain coordinated actions to have a common objective of maximizing total supply chain profits ► Double marginalization results in suboptimal order quantity ► An approach to dealing with this problem is to design a contract that encourages a buyer to purchase more and increase the level of product availability ► The supplier must share in some of the buyer’s demand uncertainty 32 本作品轉載自Microsoft Office 2007多媒體藝 廊,依據Microsoft服務合約及著作權法第 46、 52、65條合理使用。

The Categories of Supply Contract ► Horizon Length ► Pricing: linear (proportional) or non-linear (two-part tariff); buyback, holding cost subsidies, payment for inability to supply ► Periodicity of ordering: fixed or random ► Quantity commitment: 》 Total minimum commitment: quantity or dollar value 》 Periodical commitment 》 Demand commitment 》 Capacity commitment 33

The Categories of Supply Contract ► Flexibility: 》 Magnitude or frequency of adjustments ► Delivery commitment: 》 Lead time 》 Shipment policy ► Quality: defect rates, specifications ► Information sharing 34

Supplier Selection and Contracts ► Contracts for Product Availability and Supply Chain Profits 》 Buyback Contracts 》 Revenue-Sharing Contracts 》 Quantity Flexibility Contracts ► Contracts to Coordinate Supply Chain Costs ► Contracts to Increase Agent Effort ► Contracts to Induce Performance Improvement 35

Supplier Selection and Contracts Impact of Supply Chain Contracts on ► Contracts for Product Availability and Supply Chain Profits Profitability: Buyback Contracts 》 Buybacks by publishers 》 Revenue-Sharing Contracts 》 Tech Fiber produces jacket at v = $10 and charges a 》 Quantity Flexibility Contracts Ski Adventure sells jacket for wholesale price of c = $100. p = $200. Demand is normal distributed with =1, 000 and ► Contracts. Unsold jackets have no salvage value. =300. to Coordinate Supply Chain Costs ► Should Increase to buy Effort ► Contracts to TF be willing. Agentback unsold jackets? Why? 》 CSLSA = ► Contracts 0. 5, Induce Performance profit = $76, 063; to SA orders 1, 000, expected Improvement TF sells 1, 000 for a total profit of $90, 000. Total expected SC profit = $166, 063 36 本作品轉載自Microsoft Office 2007多媒體藝 廊,依據Microsoft服務合約及著作權法第 46、 52、65條合理使用。

Supplier Selection and Contracts Impact of Supply Chain Contracts on ► Contracts for Product Availability and Supply Chain Profits Profitability: Buyback Contracts 》For entire SC, SC makes $190 for each jacket sold, and 》 Revenue-Sharing Contracts of understocking is $190, and only loses $10. Thus, the cost Flexibility Contracts 》 Quantity of overstock is $10. 》The optimal CSL for entire SC is 0. 95 and Costs ► Contracts to Coordinate Supply Chain produce 1, 493 jackets. Total SC profit is $183, 812. ► Contracts to Increase Agent Effort ► Contracts to Induce Performance Improvement 本作品轉載自Microsoft Office 2007多 媒體藝廊,依據Microsoft服務合約及 著作權法第 46、52、65條合理使用。 37

Return Policy : Buyback contracts ► Issue of Double Marginalization ► Wholesale price c ► Buyback price b ► Manufacturing salvage value $s. M ► The salvage value for retailer is s=b ► Optimal order quantity O* ► Expected manufacturing profit = O*(c-v) – b expected overstock at retailer v: 生產一單位的變動成本 38

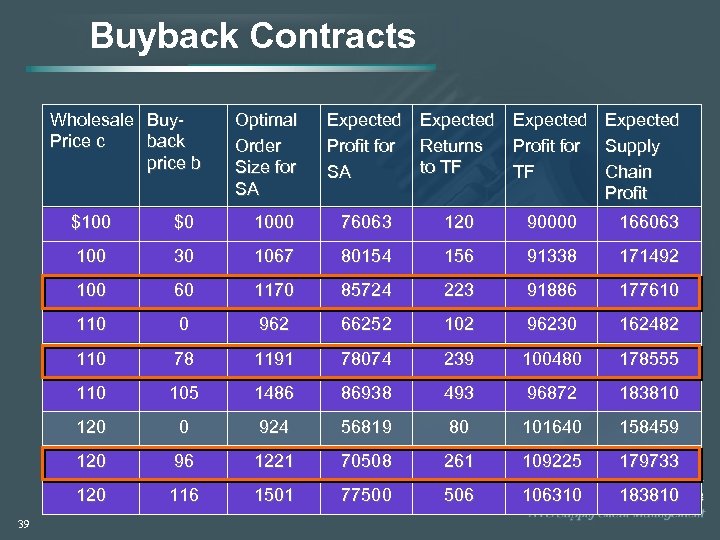

Buyback Contracts Wholesale Buy. Price c back price b Optimal Order Size for SA Expected Profit for SA Expected Returns to TF Expected Profit for TF Expected Supply Chain Profit $100 1000 76063 120 90000 166063 100 30 1067 80154 156 91338 171492 100 60 1170 85724 223 91886 177610 110 0 962 66252 102 96230 162482 110 78 1191 78074 239 100480 178555 110 105 1486 86938 493 96872 183810 120 0 924 56819 80 101640 158459 120 96 1221 70508 261 109225 179733 120 39 $0 116 1501 77500 506 106310 183810

Buyback Contracts ► Manufactures can use buyback contracts to increase their own profit as well as total supply chain profits. Buyback contract also encourage retailers increase product availability ► Manufactures need to consider the cost associated with a return ► As the cost associated with a return increases, buyback contracts become less attractive. ► Applications: (1) bookstores return the cover of the book to reduce the cost of return; (2) manufactures use holding cost subsidies. 40 本作品轉載自Microsoft Office 2007多 媒體藝廊,依據Microsoft服務合約及著 作權法第 46、52、65條合理使用。 本作品轉載自Microsoft Office 2007多媒 體藝廊,依據Microsoft服務合約及著作 權法第 46、52、65條合理使用。

Contracts for Product Availability and Supply Chain Profits: Buyback Contracts ► Allows a retailer to return unsold inventory up to a specified amount at an agreed upon price ► Increases the optimal order quantity for the retailer, resulting in higher product availability and higher profits for both the retailer and the supplier ► Most effective for products with low variable cost, such as music, software, books, magazines, and newspapers ► High tech industry provides price support for retailers due to price drop rapidly 41

Contracts for Product Availability and Supply Chain Profits: Buyback Contracts ► Downside: 》 Results in surplus inventory that must be disposed of, which increases supply chain costs 》 Lead the retailer to exert less effort to sell 》 May increase information distortion through the supply chain because the supply chain reacts to retail orders, not actual customer demand 42

Revenue Sharing Contracts ► Manufacture charges the retailer a low wholesale price and shares a fraction of the revenue generated by the retailer. ► The retailer cost will be decreased due to lower overstock cost, thus, retailer will increase the level of product availability resulting higher profits for both manufacturer and retailer. 43

EX: BLOCKBUSTER Basher Eyre _Geograph 44

版權聲明 頁碼 2 2 作品 授權條件 作者 /來源 Flickr,作者:kennethkonica。 (http: //www. flickr. com/photos/littlebiglens/6878901153/sizes/l/in/pool 60201846@N 00/) , 瀏覽日期: 2012/02/20。該網站採取創用CC「姓名標示-禁止改作」 3. 0版授權釋出。 本作品轉載自WIKIPEDIA (http: //en. wikipedia. org/wiki/File: Mc. Donald%27 s_Golden_Arches. svg ),瀏覽 日期 2012/03/23 。 6, 13 7 本作品轉載自Microsoft Office 2007多媒體藝廊,依據Microsoft服務合約 及著作權法第 46、52、65條合理使用。 7 45 本作品轉載自hp (http: //h 10010. www 1. hp. com/wwpc/au/en/sm/WF 06 c/A 112771 -64209 -64548 -26997 -14820. html),依據著作權法第 46、52、 65條合理使用。 本作品轉載自Microsoft Office 2007多媒體藝廊,依據Microsoft服務合約 及著作權法第 46、52、65條合理使用。 16 -19, 22, 29 本作品轉載自Benetton Group (http: //www. benettongroup. com/),依據著 作權法第 46、52、65條合理使用。

版權聲明 頁碼 作品 授權條件 作者 /來源 11 本作品轉載自Microsoft Office 2007多媒體藝廊,依據Microsoft服務合約 及著作權法第 46、52、65條合理使用。 11 本作品轉載自Cool. CLIPS網站 (http: //dir. coolclips. com/Food/Vegetables/Vegetable_groups/bamboo, _woodcut_s tyle_vc 001509. html), Free 150 pixel Jpeg Image,瀏覽日期 2012/03/16。按著 作權法第 52、65條合理使用。 11 本作品轉載自WIKIPEDIA (http: //en. wikipedia. org/wiki/File: Coca. Cola_logo. svg),瀏覽日期 2012/02/24 。 30, 32 31, 36, 37 本作品轉載自Microsoft Office 2007多媒體藝廊,依據Microsoft服務合約 及著作權法第 46、52、65條合理使用。 40 46 本作品轉載自Microsoft Office 2007多媒體藝廊,依據Microsoft服務合約 及著作權法第 46、52、65條合理使用。

版權聲明 頁碼 44 47 作品 授權條件 作者 /來源 Geograph,作者:Basher Eyre。(http: //www. geograph. org. uk/photo/834743 ) , 瀏覽日期: 2012/02/24。該網站採取創用CC「姓名標示-相同方式分享 」2. 0版授權釋出。

94f93fd04a9e427a8e868375d7daf18c.ppt